具有随机波动率的美式期权定价

李 萍,李建辉

(1.西安工程大学理学院,陕西西安 710048;2.西京学院应用统计与理学系,陕西西安 710123)

具有随机波动率的美式期权定价

李 萍1,李建辉2

(1.西安工程大学理学院,陕西西安 710048;2.西京学院应用统计与理学系,陕西西安 710123)

为了更好地解决期权定价中存在的问题,研究了带有Heston随机波动率模型的期权定价问题,对美式期权的最佳实施边界及其提前执行的条件进行了分析和讨论。鉴于美式期权不存在解析定价公式,通过离散化参数空间将带有Heston随机波动率的美式期权价格所满足的随机偏微分方程转化为相应的差分方程,进而采用高阶紧式有限差分方法进行求解,得到了期权价格的数值解。通过数值实验对理论结果进行验证和模拟,对带有常数波动率和随机波动率条件下的两种最佳实施边界进行比较,发现最佳实施边界也具有随机波动性;在设定参数下对波动率的行为和性质进行分析,模拟出波动率曲线,并对高阶紧差分方法的计算结果进行比较,得到了期权的数值解,验证了算法的有效性。此方法对解决随机波动率下的期权定价其他问题,如:随机波动率下的多标的资产期权定价、障碍期权定价的研究具有借鉴价值。

金融市场;随机分析;美式期权;随机波动率;自由边界;有限差分法

期权是一种重要金融衍生工具,具有良好的规避风险的功能。金融市场风险管理领域应用较为广泛的是Black-Scholes期权定价模型[1-2]。美式期权是金融市场上受欢迎的期权之一,具有在到期日之前的任何时刻均可执行的特点。其收益取决于标的股票价格的变动,属路径依赖期权。要得到其精确解析定价公式是非常困难的,甚至是不可能的。近年来,国内外学者在该领域的研究,一方面主要致力于美式期权定价的数值解法研究,另一方面对Black-Scholes模型做深刻的研究,寻求更加精确的模型用以刻画随机波动率、利率等参数。文献[3]在传统的Black-Scholes模型的基础上,给出了具有离散红利的美式期权的数值计算方法。文献[4-6]分别给出了一些求解美式期权定价问题的有限差分方法和蒙特卡洛模拟方法,得到了期权价格。文献[7]用GARCH模型做了标的股票的波动率预测,给出了一种模糊系统波动率预测方法。文献[8—9]给出了一些参数依赖期权定价问题解法。文献[10—16]研究了求解美式期权的定价模型的移动边界逼法、牛顿法及布谷鸟搜索算法等。同时许多学者当前的研究主要是基于随机波动率的期权定价问题[17—21],为更加精确的求得期权价格打下基础。

本研究在文献[4,8,10,16—18]研究的基础上,考虑Heston模型随机波动率之下的美式期权定价问题,将期权价格满足的随机偏微分方程及其对应的边界条件和终止条件进行变量变化和离散化,并采用一种基于均匀网格的高阶紧差分方法求解,得到了期权价格的数值解,同时对波动率和美式期权的最佳实施边界做了数值模拟。

1 随机波动率下的期权定价

以K,S,q,r,T和t分别表示期权的敲定价格、标的股票价格、红利率、无风险利息率、到期日和当前时间,则τ=T-t表示当前时间距到期日的时间,K和S的单位均为$;T,t和τ的单位均为年。

(1)

(2)

而且对于看跌期权,满足如下的初始条件和边界条件:

2 美式期权的最佳实施边界

美式期权的持有人有权在敲定期日之前的任意时刻执行期权,是否提前执行取决于当前的股票价格是否低于最佳实施边界b(τ,v)。最佳实施边界将资产价格空间分为终止区域S和继续持有区域C。在区域C中有:max{K-S,0}-P<0,在区域S中有:max{K-S,0}-P=0。

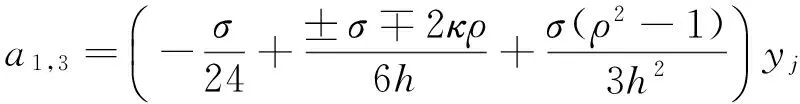

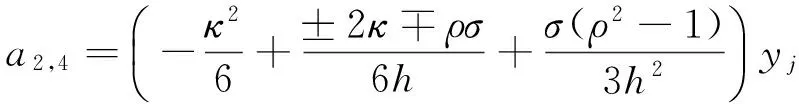

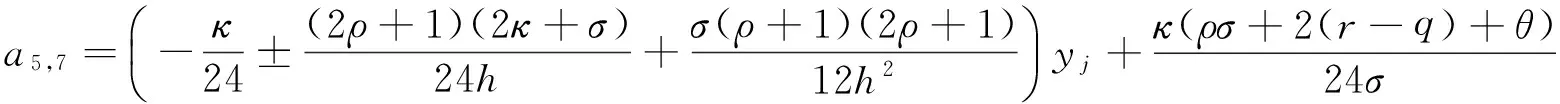

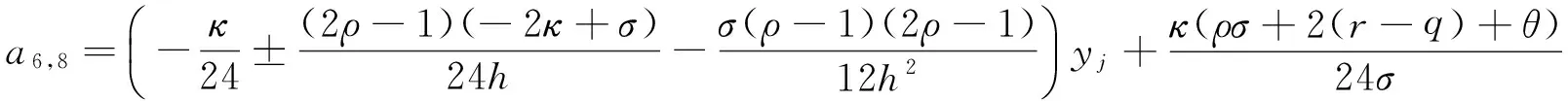

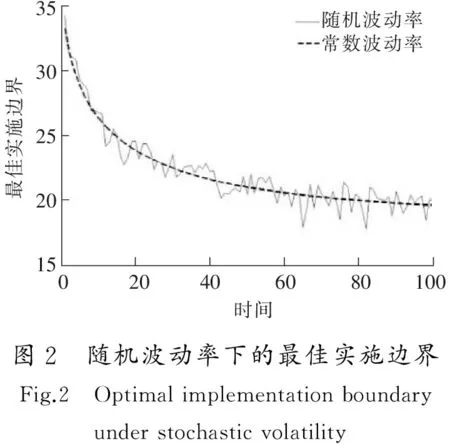

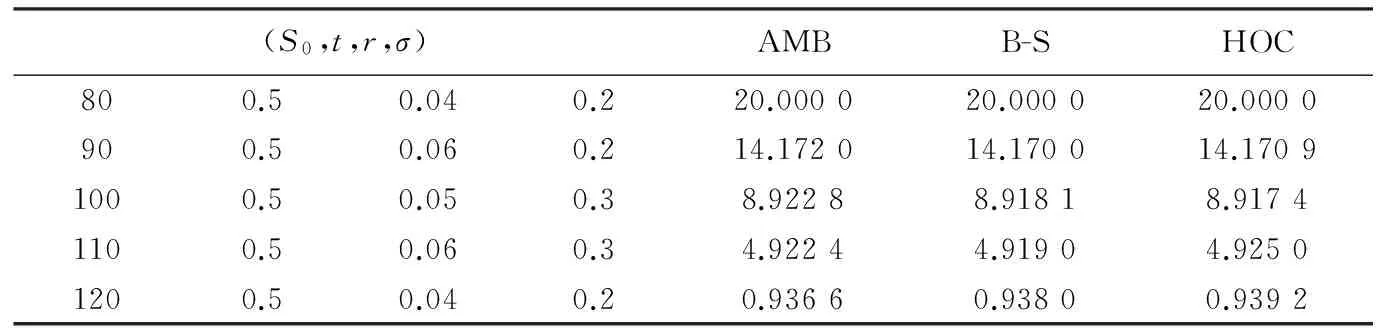

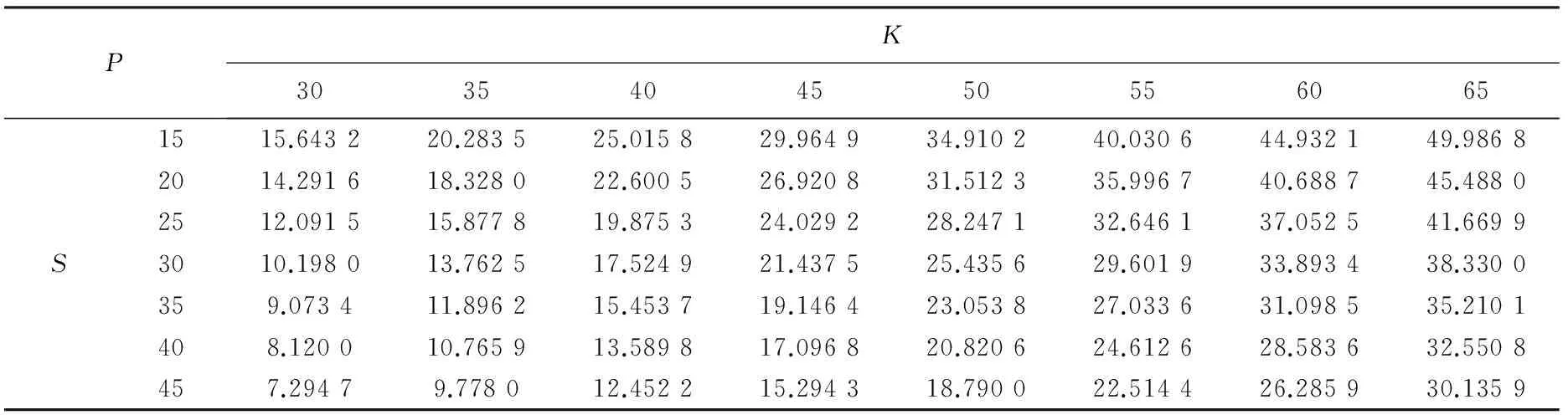

美式期权具有终止条件,P(S,v,0)=(K-S)+, 0 考虑到期权是否提前执行,则有以下2种情形: Ⅰ)期权不提前执行,有边界条件: 此时的美式期权类似于欧式期权,仅在到期日当天进行交易,或根据到期日当天的标的资产价格计算收益,以判断是否放弃执行期权,如此以来将在很大程度上回避风险。 Ⅱ)期权提前执行,有边界条件: 对∀b(v,τ) 对方程(5)作如下变换: 则方程(5)变为 而且对x∈R,v>0,τ>0满足如下初始条件和边界条件: 对上述问题离散化,对于时间的离散化,{Δτ,2(Δτ),…,N(Δτ)},对于空间的离散化,用[-R1,R1]和[0,R2]分别代替R和R+,R1,R2>0。为方便起见,考虑均匀网格: {xi∈[-R1,R1]|xi=ih1},i=-n,…,n, {yj∈[0,R2]|yj=jh2},j=0,…,m, 形成了(2n+1)×(m+1)个网格点,R1=nh1,R2=mh2,空间步长为R1和R2,时间步长为Δτ。则关于方程(7)的标准中心差分近似为 方程(7)两边分别求x和y的混合偏导数,可得: 方程(7)两边分别求x和y的二阶导数,再将两式相加得: 由式(6)—式(11)可得: 这里的ul,l=0,…,8,包括格点(i,j)与其相邻的8个格点为 式(12)中的系数al和bl可以由参数κ,σ,ρ,θ,r,q,h计算得到: u(-R1,y,τ)=u(-R1,y,0),τ∈[0,T],y∈[0,R2]。 边界条件x=R1,对应S=Smax,其中Smax满足人工边界Pv(Smax,v,t)=0,PSv(Smax,v,t)=0,PSS(Smax,v,t)=0且Pvv(Smax,v,t)=0。将这些边界条件带入式(5)得到:Pt-rP=0。边界条件y=R2,x∉{-R1,R1},对应v=vmin,S∉{Smin,Smax}。由式(12)-式(18)对点u-1,j,j=0,…,m,用外推公式: u-1,j=4u0,j-6u1,j+4u2,j-u3,j+O(h4)ui,m,i=-n,…,n, 以上给出了求解带有随机波动率的美式期权价格的一种数值方法——高阶紧差分(HOC)方法。在Matlab软件中编写算法程序,实现算法。 图1 a)中曲线呈“中间低”、“两边高”形态,这种波动率与敲定价格之间的关系在金融学中称之为波动率微笑。由图1 b)-c)对比可以看出:当ρ>0时,波动率随敲定价格K增大呈上升趋势;当ρ<0时,执行价格随敲定价格K增大呈下降趋势。波动率在某时间段上高,而在另外某时间段上低,说明波动率存在聚类行为。 试验2设定参数κ=2,θ=0.01,r=0.03,q=0.015,v0=0.2,K=20$,α=0.3,σ=0.2,Δτ=0.01,ρ=1,模拟出了一条随机波动率下的最佳实施边界,如图2所示。波动率为常数时,最佳实施边界为一条平滑的曲线,而随机波动对应的最佳实施边界呈现随机波动的趋势。实际上,在计算期权价格时,需要在做大量的模拟的基础上确定最佳实施边界,分析和研究其统计规律性。 试验4求满足参数κ=2,θ=0.01,r=0.03,q=0.015,α=0.3,σ=0.2,T=3,ρ=0.5的随机波动率下的美式看跌期权的价格。使用HOC方法计算出期权价格,见表2。 表1 计算结果的比较 表2 具有随机波动率的美式期权的价格 本研究考虑Heston模型随机波动率之下的美式期权定价问题,采用高阶紧差分方法求解期权价格满足的随机偏微分方程,并对其进行数值试验,验证了算法的有效性,最后得到了期权的数值解。然而,随机波动率之下的期权定价问题不限于此,如随机波动率下的多标的资产期权定价、障碍期权定价等仍有待研究。 / [1] BLACK F, SCHOLES M. The pricing of options and corporate liabilities [J]. Journal of Political Economy, 1973, 81(3): 637-654. [2] COHEN J B,BLACK F, SCHOLES M. The valuation of option contracts and a test of market efficiency [J]. Journal of Finance, 2012, 27(2): 399-417. [3] BATTAUZ A, PRATELLI M. Optimal stopping and American options with discrete dividends and exogenous risk [J]. Insurance Mathematics and Economics, 2004, 35(2): 255-265. [4] ZHAO J, DAVISON M, CORLESS R M. Compact finite difference method for American option pricing [J]. Journal of Computational and Applied Mathematics, 2007, 206(1): 306-321. [5] TANGMAN D Y, GOPAUL A, BHURUTH M. A fast high-order finite difference algorithm for pricing American options [J]. Journal of Computational and Applied Mathematics, 2008, 222(1): 17-29. [6] RAYMOND H C, WONG C Y,YEUNG K M. Pricing multi-asset American-style options by memory reduction Monte Carlo methods [J]. Applied Mathematics and Computation, 2006, 179(2): 535-544. [7] HUNG J C. Applying a combined fuzzy systems and GARCH model to adaptively forecast stock market volatility [J]. Applied Soft Computing, 2011, 11(5): 3938-3945. [8 ] 孙玉东,师义民,吴敏.参数依赖股票价格情形下的障碍期权定价[J].数学物理学报,2013,33 (5): 912-925. SUN Yudong SHI Yimin WU Min. Barrier option pricing when parameters dependent on stock price [J]. Acta Mathematica Scientia, 2013, 33(5): 912-925. [9] HESTON S L. A closed-form solution for options with stochastic volatility with applications to bond and currency options [J]. Review of Financial Studies, 1993, 6(2): 327-343. [10] CHOCKALINGAM A, MUTHURAMAN K. An approximate moving boundary method for American option pricing [J]. European Journal of Operational Research, 2015 , 240 (2) :431-438. [11] JEUNESSE M, JOURDAIN B. Regularity of the American Put option in the Black-Scholes model with general discrete dividends[J]. Stochastic Processes & Their Applications, 2012, 122(9):3101-3125. [12] HOUT K I, TOIVANEN J. Application of operator splitting methods in finance[J]. Ima Journal of Numerical Analysis, 2015, 203(5):1173-1184. [13] DURIS K,TAN S H,LAI C H,et al. Comparison of the analytical approximation formula and Newton's method for solving a class of nonlinear Black-Scholes parabolic equations[J]. Computational Methods in Applied Mathematics, 2016, 16 (1) :35-50. [14] DATE P, ISLYAEV S. A fast calibrating volatility model for option pricing[J]. European Journal of Operational Research, 2015, 243(2):599-606. [15] AL-HAGYAN M, MISIRAN M, OMAR Z. Content analysis of stochastic volatility model in discrete and continuous time setting[J]. Research Journal of Applied Sciences Engineering & Technology, 2015, 10(10):1185-1191. [16] NWOZO C R, FADUGBA S E. On two transform methods for the valuation of contingent claims[J]. Journal of Mathematical Finance, 2015, 5(2):88-112. [17] HARING S, HOCHREITER R. Efficient and robust calibration of the Heston option pricing model for American options using an improved Cuckoo Search Algorithm[J]. Computer Science, 2015, 89(1):797-803. [18] RUCKDESCHEL P, SAYER T, SZIMAYER A. Pricing American options in the Heston model: A close look on incorporating correlation[J]. Social Science Electronic Publishing, 2013,20(3):9-29. [19] TINNE H, KAREL J, In't Hout ADI schemes for pricing American options under the heston model[J]. Applied Mathematical Finance, 2015, 22(3):207-237. [20] BATTAUZ A, DONNO M D, SBUELZ A. The put-call symmetry for American options in the heston stochastic volatility model[J]. Analele Universitatii Din Oradea Fascicula Biology, 2014,80(2):857-864. [21] NAGASHIMA K, CHUNG T K, TANAKA K. Asymptotic expansion formula of option price under multifactor Heston model[J]. Asia-Pacific Financial Markets, 2014, 21(4):351-396. American option pricing with stochastic volatility processes LI Ping1, LI Jianhui2 (1. School of Science, Xi’an Polytechnic University, Xi’an, Shaanxi 710048, China; 2. Department of Applied Statistics and Science, Xijing University, Xi’an, Shaanxi 710123, China) In order to solve the problem of option pricing more perfectly, the option pricing problem with Heston stochastic volatility model is considered. The optimal implementation boundary of American option and the conditions for its early execution are analyzed and discussed. In view of the fact that there is no analytical American option pricing formula, through the space discretization parameters, the stochastic partial differential equation satisfied by American options with Heston stochastic volatility is transformed into the corresponding differential equations, and then using high order compact finite difference method, numerical solutions are obtained for the option price. The numerical experiments are carried out to verify the theoretical results and simulation. The two kinds of optimal exercise boundaries under the conditions of the constant volatility and the stochastic volatility are compared, and the results show that the optimal exercise boundary also has stochastic volatility. Under the setting of parameters, the behavior and the nature of volatility are analyzed, the volatility curve is simulated, the calculation results of high order compact difference method are compared, and the numerical option solution is obtained, so that the method is verified. The research result provides reference for solving the problems of option pricing under stochastic volatility such as multiple underlying asset option pricing and barrier option pricing. finance markets; stochastic analysis; American option; stochastic volatility; free boundary; finite difference method 1008-1542(2017)06-0542-06 10.7535/hbkd.2017yx06006 O211.9MSC(2010)主题分类91B24 A 2016-12-28; 2017-09-10;责任编辑:张 军 陕西省自然科学基金(2016JM1009);陕西省教育厅专项科研计划基金(15JK2183,15JK2134) 李 萍(1981—),女,陕西咸阳人,工程师,硕士,主要从事应用数学方面的研究。 E-mail:13379220399@163.com 李 萍,李建辉.具有随机波动率的美式期权定价 [J].河北科技大学学报,2017,38(6):542-547. LI Ping, LI Jianhui.American option pricing with stochastic volatility processes[J].Journal of Hebei University of Science and Technology,2017,38(6):542-547.

3 高阶紧差分格式

4 数值试验

5 结 语