The Development of DTP Pharmacy and Its Impact on Pharmaceutical Enterprises

Shen Manzhu,Zeng Yingying,Yuan Hongmei ,Fu Shuyong

(School of Business Administration,Shenyang Pharmaceutical University,Shenyang 110016,China)

Abstract Objective To summarize the development status of direct to patient (DTP) pharmacy and its impact on pharmaceutical enterprises in China and to provide a reference for the pharmaceutical industry.Methods Literature research method was used to research domestic and foreign journals and magazines.Then,all sorts of data were collected to make a comprehensive comparison.Combined with relevant national policies,the current situation and advantages of the DTP pharmacy were analyzed to study its impact on pharmaceutical enterprises.Results and Conclusion Although DTP pharmacies are in the exploratory stage in China,with the advancement of comprehensive medical and health reforms,several national policies have created a good environment for the development of DTP pharmacies.Therefore,DTP pharmacies are accelerating their construction with better market value.As DTP pharmacies gradually become mature,some pharmaceutical enterprises have deepened cooperation with DTP pharmacies to open new channels for drug management.However,from the perspective of some generic drug enterprises,DTP pharmacies have certain adverse effects on them.

Keywords:DTP pharmacy;prescription outflow;pharmaceutical enterprise;new channel

With the comprehensive reform of China’s pharmaceutical industry,the emerging business model of direct to patient (DTP) pharmacy is in its exploratory stage.Since 2014,the “prescription outflow” policy has prompted retail pharmacies to undertake outpatient pharmacy services for medical institutions.Therefore,many factors have promoted the development of DTP pharmacies in China.This emerging business model has a great impact on pharmaceutical enterprises,bringing the convenience and opportunities in terms of sales and transformation.In the past,research on DTP pharmacies mainly focused on the development process,development reasons,and model extensibility.These studies have reference significance for this article,but they also have some limitations.The influencing factors offered by these studies are not comprehensive.Besides,their research objects are relatively single.Few studies are on the impact of pharmaceutical enterprises.This paper has an in-depth research on the development status of DTP pharmacies by analyzing the policy influences and driving factors of its development,exploring the impact of DTP pharmacies on pharmaceutical enterprises,and making suggestions for the pharmaceutical industry to promote the development of DTP pharmacies and pharmaceuticals transformation.

1 DTP pharmacy status

1.1 Basic concepts of DTP pharmacy

DTP pharmacy,also known as direct patient pharmacy,refers to a drug marketing model in which pharmaceutical enterprises directly transfer drug management rights to drug stores or retail pharmacies,and patients purchase drugs at the pharmacy with prescriptions.DTP pharmacies provide patients with new specific drugs and high-level professional services,including prescription evaluation,medication guidance,tracking and recording medication information,and individualized management of each patient through the establishment of an information system.DTP pharmacy is an important sales channel for high-value drugs as well as patient management and brand marketing[1].

1.2 Characteristics of DTP pharmacy

At present,there are three main operating characteristics of DTP pharmacies in China.The first is the source of the prescription.The outflow of prescriptions is the driving force for the development of DTP pharmacies,and the correct review of prescriptions is the key to the development.The development potential of DTP pharmacies depend on the number of hospitals covered by the business[2].The second is the medical insurance support.The consumer group of DTP pharmacies is self-financed patients,and their overall purchasing power is not strong.With the support of medical insurance,DTP pharmacies can offer service to patients with serious illness or chronic disease,reducing the cost of consumers,which expands the scope of consumer groups.Cities such as Chengdu and Hangzhou have become pilot projects for connecting critical illness medical insurance to DTP pharmacies.The third is the information system and private patient management.The special feature of DTP pharmacy is the “patientbased pharmaceutical service”.DTP pharmacy mainly caters to patients with serious and critical illnesses or chronic diseases.Therefore,DTP pharmacy develops a data system to track patients’ conditions and treatment plans,provide personalized guidance and targeted return visits.Therefore,the accurate information can improve patient compliance with products and recognition of DTP pharmacy services.The operating characteristics of DTP pharmacies conform to market development and the overall policy environment.In the future,DTP pharmacies are expected to become the mainstream in the pharmaceutical market.

2 Related policy influences and driving factors on DTP pharmacy

2.1 Polices impacting on DTP pharmacy

2.1.1 Prescription outflow and medical insurance fee control

The “prescription outflow” policy is the foundation for the development of DTP pharmacies.Since 2014,China has explored the “prescription outflow”.Relevant government documents point out that medical institutions should actively provide prescriptions to patients.They should ensure that prescriptions are issued with the generic name of drugs,and patients can purchase drugs in retail pharmacies with the prescriptions[3].The medical insurance fee control policy further promotes the outflow of prescriptions,which allows the patients to purchase drugs outside the hospital.At the same time,the medical insurance fee control policy has promoted the diagnosis-related groups (DRGs) payment reform,which strictly restricts the increase in medical service costs,causing pressure on brand-name drugs for the treatment of chronic diseases.Therefore,DTP pharmacies with professional services,prescription review guidance and private management have become the best choice for patients with major diseases or chronic diseases.DTP pharmacies become a powerful undertaker of hospital pharmacies.

2.1.2 Public medical institutions reduce the drug proportion to achieve reasonable cost control

In 2017,the government promoted the reform of public medical institutions in an all-round way,clearly requiring that the proportion of drug sales income in public medical institutions should not exceed more than 30% of the total income,and it should be used as a performance evaluation indicator for tertiary hospitals[4].In 2019,the “Opinions on Strengthening the Performance Appraisal of Public Tertiary Hospitals” of the General Office of the State Council mentioned the issue of the proportion of drug expenses in the revenue and cost control.In 2019,the national drug procurement added 70 new varieties with an average drop of 60.7%[5].The restriction on the proportion of drug expenses has broken the interest chain between the enterprises and the service providers.The space for reducing drug prices is limited,and some drugs,especially high-priced new specific drugs,cannot enter the hospitals.Instead,DTP pharmacies are selected as sales channels.It can be seen that the policy of reducing drug proportion and reasonable cost control forces some high-priced drugs to be sold in DTP pharmacies,prompting more patients choose DTP pharmacies to by specific drugs.

2.1.3 Professional policy and industry standards for DTP pharmacy

In the industry,most DTP pharmacies are established by pharmaceutical enterprises,chain pharmacies and drug logistics companies with good resources and equipment.Since the number of DPT pharmacies is small,it needs unified standards and top-level design.In 2018,China Pharmaceutical Business Association issued the “Service Specification for Retail Drugstores Dealing in Specific Drugs”.Relevant experts and representative enterprises were invited to revise the “Service Specification of Chronic Disease Drugs in Retail Drugstores (Trial)” and other normative standards.The association’s representative enterprises were the first to be evaluated as a pilot[6].These two “standards” have been revised many times,including strict requirements for service environment,staffing,pharmacists,professional knowledge training,information management,pharmaceutical care,cold chain management,etc.The construction of professional pharmacy should follow the principle of “government led,industry sponsored,pharmacy voluntary,expert evaluation,dynamic management,and openness and transparency”.Since November 2018,China Pharmaceutical Business Association has started the inspection and evaluation of retail drugstores.The number of qualified pharmacies in the national “Service Specification for Retail Pharmacies Operating Drugs for Special Diseases” has reached 60[7],and the second batch of qualified retail pharmacies in the “special drug standard” has reached 88.By 2020,a total of 148 pharmacies in China had become qualified in the “special drug standard”.According to the “Special Research Report of DTP Pharmacies in 2021”,the basic data of the number and layout of DTP pharmacies in China by 2019 are as follows:Guoda Pharmacy Co.,Ltd,a circulation enterprise,has 306 stores nationwide;China Resources Dexin has 150 stores in 76 cities;The retail chain LBX Pharmacy has 112 stores in China;Sipai Pharmacy,a new upstart,has 70 stores in 54 cities,and Miaoshou has 200 stores in 63 cities.

With the implementation of the pilot and the expansion of the number and layout of DTP pharmacies,more parties will participate in the standard formulation,and gradually form a mature standard system and top-level design.DTP pharmacy is expected to be in line with the classification and hierarchical management of pharmacies being vigorously promoted by the state,which in turn can accelerate the development of DTP pharmacies.

2.2 Driving factors for DTP pharmacies

2.2.1 Drug centralized bidding policy

The policy of drug centralized procurement refers to the competition of pharmaceutical enterprises through bidding,and the hospitals can purchase drugs with reasonable price and excellent quality.However,the traditional bidding policy will cause the large-scale abandonment of the bid and the shortage of some of the winning drugs.Many drugs with large dosage,accurate curative effect,and excellent quality are forced to withdraw from the public hospitals,and the winning rate of drugs in some provinces and cities is even less than 20%[8].The results of drug centralized purchase in 2018 showed that only two foreign enterprises won the bid among 25 varieties.The price of Gefitinib,the original research drug of AstraZeneca,decreased by 77%.In 2019,5 varieties were selected from foreign enterprises in the expanded drug procurement,accounting for 20%,of which the price of irbesartan hydrochlorothiazide and Clopidogrel bisulfate sulfate of Sanofi decreased by 86% and 81%,respectively.In January 2020,four varieties of the second batch of foreign enterprises were selected,accounting for 12.1%,of which the price of Moxifloxacin hydrochloride in Bayer dropped 78%.In August 2020,only 3 foreign-funded pharmaceutical enterprises were selected in the third batch of national centralized procurement,accounting for 5.5%,of which Linezolid,the original Pfizer research drug,was reduced by 90%.It is worth noting that Bayer,the original research drug has an annual sales of more than 3 billion yuan,accounts for 96% of the original drugs in hospitals.However,it did not win the bid in the third batch of centralized procurement.Tianjin Chase Sun and AGCO Pharmaceutical were selected through consistency evaluation.In addition,although the third batch of centralized procurement involved 26 original research drugs of foreign enterprises such as MSD,Novartis,Astra Zeneca and Eli Lilly,many enterprises chose to offer several times higher than the maximum price limit,which meant they just wanted to give up.The data shows that patent drugs and original research drugs are under great pressure in the centralized bidding policy,and DTP pharmacy undoubtedly becomes an important channel for these drugs[9].Thus,the market value of DTP pharmacies will continue to rise.

2.2.2 Unreasonable supply and demand structure of medical terminals

Due to the changes in people’s living standards and habits,rare diseases,chronic diseases,tumors,and cancers have increased.The data show that the death caused by chronic diseases accounts for 88.5%of the total death in China,among which the death rate of cardiovascular and cerebrovascular diseases,cancer and chronic respiratory diseases is 80.7%[10].China’s drug supply is dominated by generic drugs since domestic enterprises do not have first-line patent drugs.The consumption demand of patients has been upgraded from low-end varieties such as antibiotics to high-end varieties such as personalized anti-tumor drugs.As the demand of high clinical value patent drugs continues to increase,the supply cannot match it.Due to the high price of patented drugs and the need for full pharmaceutical service management,traditional public hospitals are difficult to meet the personalized needs.Therefore,DTP pharmacies will help to solve the problem of supply.

The main drugs sold in public hospitals in China are anti-infective drugs,antibiotics,and digestive system drugs.Although the sales of anti-tumor drugs in hospitals have increased since 2019,according to the latest data of global cancer burden in 2020 released by the international agency for research on cancer (IARC),there will be 19.3 million new cancer cases and nearly 10 million deaths worldwide.There are still some problems in drug supply and demand[11].In addition,at present,the global tumor market has reached 138.9 billion US dollars[12],maintaining a rapid growth rate of 15% in the past five years.Chinese market accounts for less than 10%,and the proportion of antitumor drugs in the overall drug market is also low.Therefore,it has broad development space in the future.The increasing demand for new specific drugs has created greater market opportunities for the development of DTP pharmacy.

2.2.3 Balance of personal health insurance account

The mode of “unified account combination”in China’s medical insurance makes many personal accounts surplus.As of 2019,the balance of urban basic medical insurance coordination fund had reached 1 357.379 billion yuan,and the individual account had reached 827.650 billion yuan,which is equivalent to the current annual premium of health insurance[13].Therefore,the high price patent drugs in DTP pharmacy can provide a new channel for the release of individual account balance and improve the efficiency of medical insurance fund.In addition,in 2021,the State Council’s “Guidance on Establishing and Improving the Outpatient Mutual Assistance Security Mechanism of Basic Medical Insurance for Employees” pointed out that broadening the use scope of personal accounts and allowing family members account to be used to pay for the personal expenses while purchasing drugs in designated retail pharmacies.Therefore,one person’s account can be used to pay for the personal expenses of his spouses,parents and children.The policy will be conducive to the outflow of prescription drugs,and DTP pharmacy is suitable for serious diseases and special drugs.

Meanwhile,serious illness insurance has covered urban and rural residents.In 2019,the starting line of serious illness insurance was reduced to 50% of the per capita disposable income of the previous year,the payment proportion of medical expenses within the policy increased to 60%,and the reimbursement proportion of disease insurance of basic medical insurance increased by about 13 percentage.At present,China’s medical payment is mainly based on national medical insurance.Although commercial health insurance accounts for a relatively low proportion,its coverage is also an important driving force for the development of DTP pharmacy.Since 2013,the State Council and the National Development and Reform Commission have also intensively issued policies to encourage employees to purchase commercial insurance with their medical insurance personal account funds.In 2020,the medical insurance bureau repeatedly replied to support the development of commercial health insurance,guiding commercial insurance institutions to participate in serious illness insurance,and giving tax relief and other policies[14]to develop DTP pharmacy.Shenyang,Fuzhou,Shanghai,Chongqing,Nanjing,and other cities have successively introduced policies to encourage people to use their balance of individual medical insurance account to purchase commercial insurance,and the commercial insurance has increased the value of DTP pharmacy[15].

3 The impact of DTP pharmacies on pharmaceutical enterprises

3.1 It opens up new sales channels for pharmaceutical enterprises

DTP pharmacies can promote the sales of new drugs for pharmaceutical enterprises.The promulgation of the drug bidding procurement policy has caused some new drugs and high-priced patent drugs to withdraw from the public hospitals gradually.Since the bidding procurement process is long,and new drugs that have been listed may not be able to enter the hospitals quickly[16].Compared with bidding and purchasing into the hospital,new drugs are sold faster in DTP pharmacies.Some DTP pharmacies with hospital resources can assist pharmaceutical enterprises to have the academic marketing of their products in hospitals,which can accelerate the outflow of prescriptions.For example,Lynparza achieved the first prescription drug delivery on the day it was listed in the market.Aubagio completed the nation’s first prescription sales on the 58th day of the list,setting a record for the sales of domestic rare disease drugs.

3.2 Facilitate the sharing of information by pharmaceutical enterprises

Pharmaceutical enterprises that have established sales channels with DTP pharmacies can eliminate multiple links such as distributors,which help them obtain drug sales data and consumer drug use information easily.Since DTP pharmacies strictly track and record the patient’s physical condition,medication frequency and other information by establishing a good data system to ensure information interconnection,pharmaceutical enterprises can directly obtain various data through DTP pharmacies,and then make corresponding adjustments.For instance,they can obtain drug sales from DTP pharmacies to adjust output.

3.3 Vertical integration of pharmaceutical enterprises

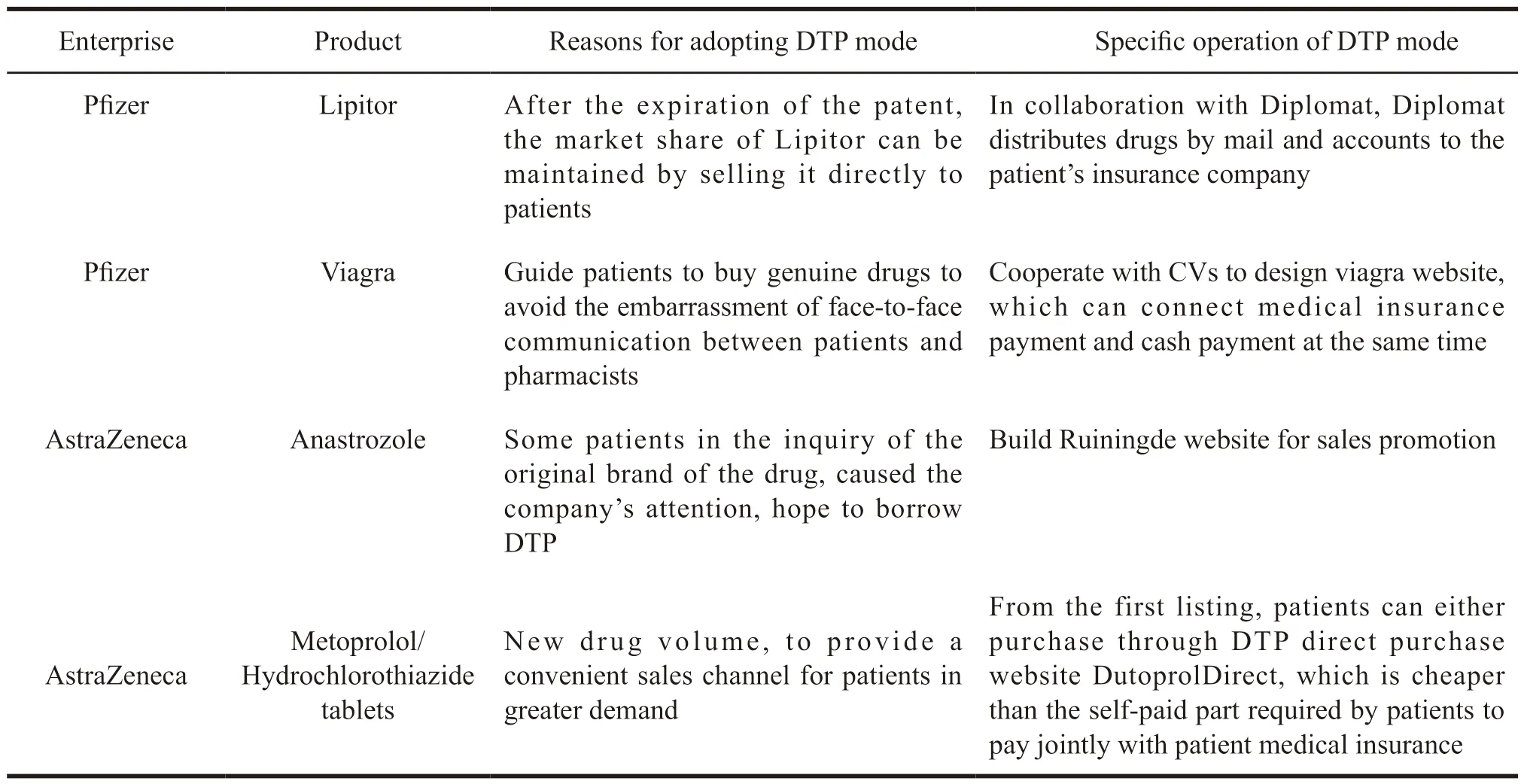

In order to ensure drug sales and reduce losses caused by bidding and procurement,large pharmaceutical enterprises with good resources have begun to develop vertical integration with DTP pharmacies.The realization of vertical integration can maintain the connection with consumers,such as brand loyalty of patients and the sales of medicines.Besides,providing the information of medicines to patients can help construct a direct-toconsumer channel,which is conducive to the sale of medicines.However,according to the current situation of China’s pharmaceutical enterprises,they still have many difficulties for the development of DTP pharmacies.At present,hospitals are the place for selling prescription drugs.Due to the enterprises’high-level strategy and positioning problems,they cannot adjust their existing channels in time,making it difficult to realize the terminal layout of DTP pharmacies.Since the DTP pharmacy model is different from hospital terminals and OTC terminals,domestic pharmaceutical enterprises lacking selfbuilt teams should constantly explore a sales model that suits them in practice.The reasons and operation methods of some well-known pharmaceutical enterprises developing DTP pharmacies are shown in Table 1.

Table 1 Reasons and operation methods of some well-known pharmaceutical enterprises DTP pharmacies

3.4 DTP pharmacy is not conducive to the development of generic drug enterprises

For small pharmaceutical enterprises that only produce generic drugs,their competitiveness is weak,and it is difficult for them to obtain centralized bidding and procurement quotas.Once they lose the hospital market,they must develop new sales models and turn their attention to drug retail terminal.With the rapid development of DTP pharmacies,small generic drug enterprises cannot dominate DTP pharmacies since they do not have corresponding products.Therefore,they cannot enjoy the dividends brought by the development of DTP pharmacies.The development of DTP pharmacies does not bring benefits to every type of pharmaceutical enterprises.If generic drug companies want to adapt to changes,they must adjust to actively conduct research and development of innovative drugs.

4 Suggestions

4.1 Attaching importance to cooperation with DTP pharmacy

National policies have an important impact on the development of China’s pharmaceutical industry.Under the pressure of bidding procurement and medical cost control,new specific drugs and patent drugs of pharmaceutical enterprises cannot enter hospitals or cannot be quickly put on the shelves in hospitals.Therefore,pharmaceutical enterprises must cooperate with DTP pharmacy to sell their patent drugs through the channel of DTP pharmacy,which can reduce the waste of patent protection time,and obtain more profits.The senior management of the enterprise should reform their sales channels d in the future to occupy the market share in time.

4.2 Exploring new sales mode to realize vertical integration

In order to adapt to the changes of policy and obtain more benefits,pharmaceutical enterprises should consider the development of DTP pharmacy.After realizing vertical integration,they can retain the market share through their own sales terminals.Since most of the sales of drugs are still in hospitals,“bidding procurement policy” has brought a serious blow to many pharmaceutical enterprises.How to reduce the losses caused by the policy and gain new market share has become an issue for pharmaceutical enterprises.However,the development of DTP pharmacy needs to strictly follow the industry standards,which requires a lot of cost.Few pharmaceutical enterprises in China can operate DTP pharmacies due to this reason.Therefore,it takes time to build an operation mode to obtain effective solutions to this problem.

4.3 Transformation of pharmaceutical enterprises,increasing investment and developing innovative drugs

Under the pressure of policy and market,many generic drug enterprises withdraw from hospitals and rush to retail terminals.Small generic drug enterprises are in a weak position in the competition,so they cannot maintain the original market share.Therefore,generic pharmaceutical enterprises must make adjustments.On the one hand,they should improve the quality of drugs,reduce production costs,and strive to ensure the market share in public hospitals through bidding.On the other hand,they must increase investment in research and development of innovative drugs,patent drugs or new specific drugs,thus transforming into joint operation pharmaceutical enterprises of innovative drugs and generic drugs.Then,they can carry out close cooperation with DTP pharmacy to occupy the future market.

- 亚洲社会药学杂志的其它文章

- Drug Regulatory Science in EU and Its Enlightenment to China

- A systematic Review of the Safety and Effectiveness of Epidural Analgesia for Labor Analgesia

- Research on the Status of Patent Protection of Prostaglandin Analogues for Glaucoma in China

- Exploration on the Implementation of the Integration of Medical and Preventive Model in China’s Primary Health Care Institutions

- Comparative Analysis of Social Forces Participating in Emergency Management of Public Health Events in China,Australia,Germany and the United States

- The Investigation and Research of the Performance Appraisal of R&D Personnel in R Company