知君两件关心事 世上苍生架上书

陈阳

财政篇

可以说,王阳明和黄宗羲的财政税收理论和实践,最能体现浙东学派“经世致用”的学术取向。

题中这两句话,本是南怀瑾先生的患难知己书赠于他的,用来形容王阳明和黄宗羲这两位明清时期“浙东学派”最具代表性的人物,也是贴切不过。

他们关心架上书,在经学史上的成就世人皆知。他们更关心世上苍生,王阳明有很多成功的管理地方财政税收的实践;黄宗羲对土地、财政、国家治理以及它们相互之间的关系有过非常深刻的观察和研究,当代学者根据他的研究提出“黄宗羲定律”是个关系国计民生、王朝兴废的大问题。可以说,他们的财政税收理论和实践,最能体现浙东学派“经世致用”的学术取向。

王阳明:一生事功关民生

正德五年(1510年),王阳明升任庐陵知县(属今江西吉安市)。当时庐陵县百姓正在经受苛捐杂税盘剥之苦。镇守江西的太监王钧摊派巨额银两并征收葛布税,正德四年前只征银100两的税收项目,这一年突然加征,金额翻倍,百姓们更担心这种做法成为定额,遗害无穷;原来每年例行为采办料杉、楠木、炭、牲口等项而征收的税银额度是3498两,这年一下子翻到原来的近3倍。往来的公差对百姓的骚扰剥削日盛一日,再加上天气大旱,还暴发了传染病,庐陵出现了“比巷连村,多至阖门而死”的惨状。侥幸存活的,“弱者逃窜流离,强者群聚为盗,攻劫乡村,日无虚夕”。王阳明在核查实情后,下令“除将原发银两解府转解外”,剩下的亂摊派悉数蠲(juān)免。他表示如果上级追究,甘愿一人承担所有责任,罢官归乡。

正德十一年至十四年(1516年~1519年),王阳明出任都察院左佥都御使,巡抚赣、南、汀、漳等地。他用抚剿结合的方针,仅用一年半的时间,就平定了为患几十年的南赣盗贼之乱。世人都惊叹王阳明杰出的军事指挥才能,殊不知,每一场战争,真正决定胜负的是背后的补养供给和后勤组织工作,战争中无一事不关钱粮。

南赣剿匪,固然有王阳明用兵如神的一面,从另外一个角度看,也是由于当时的政府财政状况,他不得不采取速战速决的办法。南赣平乱期间,王阳明创造了十家牌法,规定每十家为一牌,牌上注明各家的丁口、籍贯、职业,部分人口甚至还有外貌特征。每天一家,轮流巡查。一家隐匿盗贼,其余九家连坐。如有人口变动,需向官府申报,不然会被认定为“黑户”。十家牌法以民治民,盗贼无法隐匿于良民之家,使保甲制度逐渐走向成熟和完善,在有效地改善南赣等地社会治安的同时,并没有给政府和百姓增加经济上的负担,这是他在财政窘迫的情况下所作的巧妙的制度设计。著名的思想家李贽充分认识到这种制度设计所节约的大量财政资金。他说:“十家牌法,今人行之则为扰民生事,先生行之则为富国强兵。所谓人人皆兵,不必借兵狼达;家家皆兵,不患贼盗生发者也。不借兵则无行粮坐粮之费,不患贼则无养兵用兵之费,国以庶富,民以安强,特今人未知耳。”

平乱之后,王阳明着手治理南赣,订立了著名的《南赣乡约》,针对乡村治理中存在的主要问题,从治理实践中的16个方面给予了不同程度的分析和论述,其中财政支出是极为重要的方面。

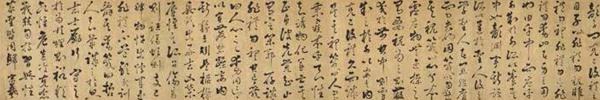

余姚市文物保护管理所藏有一幅王阳明的书法作品——《寓赣州上海日翁书》(又名《寓赣州上海日翁手札》),该手札写于明正德十三年(1518年)四月初十,是王阳明在赣州写给父亲王华的家书。1964年在上海征集到此卷,现为国家一级文物。纸本,纵26.5厘米,横49厘米,前后有自清康熙至现代的15位名家的题跋、题识,钤印共计43枚,反映了这幅手迹自明清、民国直至现代的流传经历,也可见后世名家对王阳明道德、文章、事功、书法的高度推崇。

巡抚赣、南、汀、漳等地任上,王阳明还平定了宁王之乱。正德十四年(1519年)六月十四,封地在南昌的宁王朱宸濠,杀掉江西巡抚孙燧、江西按察副使许逵,号称集结了十万人马,自称皇帝,建伪号“顺德”,公开造反。王阳明得知朱宸濠造反之后,先是故布疑阵拖延朱宸濠的军事行动,然后迅速集结兵马,很快就在地方官的协助下召集了八万平叛的军队,趁着朱宸濠的精锐部队从南昌倾巢而出的时机进攻南昌。朱宸濠害怕南昌有失,赶紧回援,双方在鄱阳湖展开激战。结果仅仅3天,朱宸濠就被王阳明以火攻之计击败,叛军损失惨重,被烧死淹死的多达3万余人,此时距离朱宸濠谋反只有43天。

平乱后,针对地方民生凋敝的现状,为了让农民休养生息、发展生产,王阳明着手对农民问题作了大量安排。在他给朝廷呈递的《处置平复地方以图久安疏》中,他说政府官员的作用极为重要,地方政府要“专力于农”,引导农民“辟其荒芜”“备其旱潦”“通其沟洫”,如果农民“丁力不足”,要想办法让农民“募人耕种”,政府提供“牛具种子”作为回报,农民把“其入三分之一以廪官吏”。除此之外,还要“渐置佃人庐舍”、“岁益增募”等。

他看到了当时社会因自然灾害使民不堪税负,上疏要求减免税收。他先讲了百姓困苦的生活状况(见《征收秋粮稽迟待罪疏》),然后分析减免的缘由,“江西一省之粮税,不过四十万石,今吝四十万石而不肯蠲,异时祸变卒起,即出数百万石,既已无救于难矣”(《乞宽免税粮急救民困以弹灾变疏》)。在他看来,如果不对民减免税收,就会导致“祸变”发生。为了国家的稳定,政府应该考虑减轻税负,以舒民力。在他提出减免税收的建议不被采纳时,他决然以没收宁王地产来抵充税粮。不过,王阳明虽注重民生,也始终认为百姓交纳赋税是天经地义的事,违背义务的就会加以处罚,对于那些拒不听从国家规定纳税的,则毫不姑息(《告渝顽民》)。

嘉靖六年(1527年),广西思恩、田州的民族首领卢苏、王受造反。这两州都是少数民族聚居区,明朝廷采用改土归流政策,实施民族自治,州长官就是当地的土司。但嘉靖一朝,各种矛盾日益激化,加上中央对这些矛盾的处置不当,这一地区成了火药桶,各种暴动屡禁不绝。王阳明以抚代剿,土流并用,不费斗米,不折一卒,招安了反叛的卢苏、王受二人。用当时翰林院掌院学士霍韬的话来说,为朝廷节省了数十万的人力物力。他甚至还利用这两股力量平定了与越南交界的断藤峡和八寨之乱,彻底根除了延续百年的两广边患,平定了明朝的西南边陲。在戡乱的同时,王阳明积极发展当地生产,坚持减税政策,要求中央政府承担官员的生活所需,而不是取之于地方。王阳明的税收政策从来不是单纯的征税,而是从处理税收与生产关系出发,为更长远的增税打下基础。

在任庐陵知县、巡抚南赣汀漳、平定朱宸濠之乱和远征思田的政治事功中,王阳明每一次都不是简单的镇压剿乱,而是一套围绕民生开展的组合拳:赈济灾民、减免税赋、疏通盐法、平息叛乱、设立县治、整顿吏治、兴修桥梁、设立社学、教化民众……他的文录、奏折、公移、碑刻及其与生友的答问中,随处可见诸多民生思想。正如蔡仁厚先生所言:“王阳明的奏疏文字,没有一篇不说到民生疾苦,没有一篇不谈到安定民生。”

黄宗羲:《待访录》里论民生

作为明末清初三大思想家之一,黄宗羲以另一种方式关注民生。他的一生主要在颠沛流离的抗清事业和隐居田园著书立说中度过,没有机会实践他的各项民生措施。但是他在自己影响最大的一本著作——《明夷待访录》中,充分总结了对事关国计民生的田赋、财税制度等的思考。

《明夷待访录》共21篇,3篇论《田制》,3篇论《财计》,占了四分之一强。在《明夷待访录》中,黄宗羲描述了明末赋税沉重的情况,以及税负问题对民生三方面的危害:

一是积累莫返之害。黄宗羲在《田制三》中列举了从唐初租庸调法到晚唐两税法,以及明朝一条鞭法前后的几次并税式改革,一一加以评价,认为这些并税式改革导致税上加税,愈演愈烈,每一次变革都使人民的税负加重。二是所税非所出之害。当时明政府征税用银或用钱。黄宗羲认为谷米是农民田地所产,布帛乃百姓自家所织,却不能直接用于纳税。欠收的年份本身田地所产就不足上供,丰收的年份本来是足以上供的,可是把谷米布帛折换成银子来纳税,银贵谷贱,农民多了一份额外的负担,跟歉收的年份差不多了。三是田土无等第之害。他反对不分土地肥瘠统一征收赋税,建议将肥沃程度不同的土地,按不同的标准计算亩产以定税。

针对上述“三害”,黄宗羲又提出了四方面的对策:一是要按照国家规定的标准征收农业税,不得随意加征。他强调要坚决反对不根据实际的田产而根据政府的开支来征税的做法。二是根据耕地来源的性质不同征收不同的农业税。三是所有的税收都以土地所产征收实物税,减少百姓因为以物易钱而造成的负担。四是将土地分成高低不同九个等级,以最差的土地作为确定赋税的标准。

黄宗羲不会想到,在他去世300年后的20世纪90年代,当代学者们会重新关注他所说的“积累莫返之害”,即历史上各种名目的税赋经过并税式改革得以整编简化,但随后这些名目繁多的税种又重新出现,以致赋税持续攀升。学者们将这一现象概括为公式性规则并称之为“黄宗羲定律”。随后,“黄宗羲定律”这一称谓不胫而走,引起了社会各界对国家财政税收制度的关注,关于“黄宗羲定律”的讨论一度成为学术热点,以及政策研究和公共媒介上的热门话题。

虽然后来更为系统、细致的研究工作发现“黄宗羲定律”所描述的赋税攀升愈演愈烈的历史趋势可能有商榷余地,以黄仁宇为代表的学者根据对明朝赋税制度以及实际运行过程的系统研究得出的结论是,明朝的征税水平不是过高,而是過低,以至于不足以维持基本公共产品的提供。学术讨论还在继续,每一次讨论,我们都能体会到这位“中国思想启蒙之父”心怀天下苍生的拳拳之心。

云山苍苍,江水泱泱。心系苍生,财计为上,先生之风,山高水长。

(本文图片,除署名外均为作者提供)

Scholars of East Zhejiang School: Focus on Economics and Livelihood

By Chen Yang

Wang Yangming and Huang Zongxi, both natives of Yuyao in eastern Zhejiang, were not contemporaries. Wang (1472-1529) lived in the Ming Dynasty (1368-1644) and is widely considered an exemplary scholar even today. Huang Zongxi (1610-1695) was a scholar of the Qing Dynasty (1644-1911).

Wang and Huang are representatives of the scholars of eastern Zhejiang. They were not scholars who knew everything about theories but almost nothing about the real world. Wang Yangming was a successful governor and general who cracked down on armed rebellions fast and solved economic and financial problems almost miraculously and brought law and order to regions under his watch. Huang Zongxi studied economics deeply and came up with wise observations on land, finance, state governance and interwoven relations of the three. Modern scholars consider Huangs studies valuable because he saw how a dynasty could fall apart due to failures.

Wangs career as governor and general is exemplary indeed. In 1510, he served as a county magistrate in Jiangxi Province. A new taxation introduced by the provincial governor smashed the countys economy after a severe drought and a pandemic. As death tolls spiked, refugees organized themselves into gangster groups and plundered villages for survival. Wang investigated the crisis and abolished the taxation policy and brought the county back to law and order.

From 1516 to 1519, Wang was appointed to work as a governor in the south of Jiangxi Province where armed bandits had been a disaster for decades. It took Wang only one and half a year to smash the organized crime. Most people may marvel at Wangs military talent, but the military supplies and logistics Wang put together was a decisive factor of the victory. Wang set up a neighborhood administrative system in the region. The rigorous system effectively cut off the resources of the local bandits, without spending a penny from the government treasury. Li Zhi (1527-1602), a famed scholar of the Ming, pointed out that Wang Yangmings approach was an ingenious design when the government in financial difficulty was not able to fund a large-scale military campaign and that the system might be considered a bad move that would bring harm to people, but some critics were not aware that it worked effectively and efficiently under special circumstances. A look into all the reports and proposals Wang as a government official submitted to the court reveals that all the texts were about people and their welfares.

Huang Zongxi didnt have a chance to work as a government official. In his prime years, he fought the Qing (1644-1911) with the last Ming resisters in southern China and after the defeat retired to a life of scholarly pursuit. He is best known as a historian and the founder of the Eastern Zhejiang School. What made him famous was , the greatest book he wrote in 1663. The book, which critiques despotism and argues for a form of limited government that is built upon laws, political protection of academic freedom, good institutional designs, and separation of governmental powers, was highly recognized in the 1990s in China when scholars reexamined the text and discovered something academically and practically important which is labeled as the Law of Huang Zongxi. The law describes the accumulated damage to a dynastys dynamics when more and more taxes were levied. Huangs study of the taxation history of past dynasties before his time shows that though a newly founded dynasty might reduce taxes by simplifying the taxation code, many other taxes would soon emerge and multiply, which would eventually topple a dynasty. Whether Huang is right or wrong, his study is highly recognized as scholars of today look into the effects of a taxation system on the welfares of a nation. Some scholars have examined the taxes of the Ming Dynasty and discovered that taxes in the Ming were inadequately levied so that the public works were not fully supported. But it doesnt matter whether Huang is incorrect or not. No other books in the history of China were like the one he authored. That is, no other Confucian scholars in the country back then were like him, a scholar who scrutinized the taxation systems of past dynasties and came up with eye-opening observations and discussions.