Technical efficiency of hybrid maize growers: A stochastic frontier model approach

lmad Ali, HUO Xue-xi, lmran Khan, Hashmat Ali, Khan Baz, Sufyan Ullah Khan

1 College of Economics and Management, Northwest A&F University, Yangling 712100, P.R.China

2 School of Economics, Dongbei University of Finance and Economics, Dalian 116025, P.R.China

3 School of Economics and Management, China University of Geosciences, Wuhan 430074, P.R.China

Abstract This study investigated the effect of credit constraints and credit unconstraints on the technical efficiency of hybrid maize growers in the Khyber Pakhtunkhwa Province (KPK) of Pakistan. The primary data were collected by a direct elicitation method from 510 maize growers of KPK Province. Stochastic frontier model techniques were used for technical efficiency analyses. The results revealed that the mean technical efficiency difference between the two groups was 10.2%. The results of technical inefficiency effect modeling demonstrated that education of the household head, family size, number of married family members, off-farm income, farming experience, tractor drill, water irrigation through a lined course, certified seed, extension services, household saving variables, and a credit size variable had positive effects on technical efficiency for both credit constrained farmers (CCFs) and credit unconstrained farmers (UCCFs). In addition, age of household head and fragmented land values had negative effects on technical efficiency for both groups. However, the interest rate had positive and negative impacts on the technical efficiency of CCFs and UCCFs, respectively. Our results have significant implications for policies related to land use, interest rate, and banking sector expansion in the rural areas of Pakistan.

Keywords: stochastic frontier analysis, maize growers, technical efficiency, credit rationing and credit markets in Pakistan

1. lntroduction

Pakistan’s agricultural sector is a cornerstone of the national economy and has abundant rural labor capital.It contributes 19% to the overall gross domestic product(GDP) and employs 42% of the country’s total labor force;however, approximately 62-64% of the total population live in the rural areas and are engaged either directly or indirectly in agricultural activities (GOP 2016). This sector plays a vital role in poverty alleviation, food security, and boosting economic growth. A dynamic, profitable, and improved agricultural sector can uplift the life styles of the rural communities (GOP 2016). In Pakistan, maize plantings rank the third in terms of cultivation area, after wheat and rice crops; approximately 99% of the country’s maize production is from the Punjab and Khyber Pakhtunkhwa(KPK) provinces. The share of maize production is 2.7%of agriculture GDP and 0.5% of total country GDP (GOP 2016). The real rural development strategy depends totally upon sufficient accessibility of financial resources, and a better link is needed between financial institutions and rural household farmers (Dicken 2007; Zhao and Barry 2014). If farm households do not have the problem of financial restriction and can easily avail of the credit option,then, according to production theory, production efficiency increases, and the agriculture segment can play a key role in developing the country’s economy. Farm household ability could be enhanced by providing an optimal level of inputs while cash liquidity influences the technical efficiency of farm household agricultural production in Pakistan (Mehmood 2017). However, global financial analysts are focusing on the sustainable development agenda by introducing subsidized rural credit programs; significant impacts of their policies on farming communities have been limited so far .

The financial position of farm households and the operation of financial markets in rural areas in Pakistan are very similar to those in other developing countries. In Pakistan, most rural farmers are facing extreme financial problems. Currently, the financial markets in rural areas of Pakistan are showing spreading deficiency linked with factors including credit quantity restrictions, the effect of private moneylenders, and asymmetry of information. The borrowers are bound due to a complicated system of loan acquisitions, and the system involves too much formality,such as legal and non-legal agreements based on their net worth, loan size, and associated documentation for loan acquisitions (Bashir and Azeem 2008; Mehmood et al. 2012). The laborious lending situation for farm households has had an adverse effect on the efficiency of crop production.

At present, the available limited studies on credit constraints and farm household technical efficiency in Pakistan reveal several deficiencies. To date, some studies have focused on external credit constraints embodied by financial institutions, while ignoring the impact of farm household internal credit constraints (Ayaz and Hussain 2011). Moreover, the previous studies have ignored the impacts of farm income, technological adaption, and the many factors associated with financial institutions (Akram et al. 2013). To fill the existing gaps, this study analyzed the supply side and demand side credit constraints and the farm households’ technical efficiency. According to the methods employed by Komicha and Öhlmer (2008) and Cabrera et al.(2010), we determined the impact of independent variables on technical efficiency by using stochastic frontier analysis(SFA). Our findings can contribute to the existing literature,and they may have broader implications from a policy perspective. In addition, our study might provide suitable plans for policy discourse specialists and could encourage financial associations to offer their facilities in the required rural areas of our study. Considering the problem in hand,our study addressed the following three specific questions:1) Whether credit constrained and credit unconstrained influence the technical efficiency of hybrid maize growers?2) Does off-farm income influence the technical efficiency of maize growers? 3) Does the interest rate have any impact on the technical efficiency of maize production?

2. Theoretical framework of the study

The idea of credit constraints and their causes, such as price rationing, operation cost rationing, risk rationing, and quantity rationing, have been discussed extensively in the literature(Boucher et al. 2009; Fletschner et al. 2010; Verteramo Chiu et al. 2014). Fig. 1 describes the general concept of credit constrained farmers (CCFs) and credit unconstrained farmers (UCCFs) growing maize in our study area. The problem of credit constraints arises from both demand side and supply side. The demand side credit constraints occur,due to factors such as insufficient household income, bad credit record, lack of collateral and lack of guarantor etc.,whereas the supply side credit constraints occur when the lenders provide an inadequate amount of credit to household farmers (Mehmood et al. 2017). When the lender realizes that the farmers are unable to repay either the interest or the loan, the applications may be rejected. These specific conditions dominate either when the financial markets are unsatisfactory or when the interest rate is very high (Juriová 2016). Additionally, our identification of credit constraint is under the mechanism of non-price restricting. On the other hand, our study hypothesized that CCFs have sufficient cash and capital for the inputs and can achieve a high level of production.

First, we designed our theoretical model for the perfect identification of CCFs and UCCFs in our field survey for data collection. The maize farmers are considered to be UCCFs, if they received a sufficient (100%) amount of credit,and CCFs if they did not receive a sufficient (i.e., below 100%) amount of credit. Therefore, we hypothesized that the farmers who have received a sufficient amount of credit can gain access to maximum inputs for production, leading to higher production efficiency. On the other hand, maize farmers who did not receive a sufficient amount of credit cannot gain access to the maximum inputs for production,and, therefore, their production efficiency will be low.

Fig. 1 further reveals that the respondent maize growers surveyed are divided into two categories: (1) farmers who do not need credit because they have a sufficient amount of assets and (2) farmers who need credit. This group can be classified into two categories further: (1) farmers who did not apply for credit and (2) farmers who applied for credit.The farmers who did not apply for credit have many reasons,such as risk restriction and cost operation rationing due to farmers’ risk reluctance behavior or several other reasons(Fletschner et al. 2010; Zhao and Barry 2014). However,from the bank side, quantity restricting, cost of transaction,and risk rationing are recognized as related reasons in the current credit marketplace literature (e.g., Feder 1985;Foltz 2004).

Fig. 1 Theoretical framework of credit constrained farmers (CCFs) and credit unconstrained farmers (UCCFs). Source: author’s observation during data collection.

The maize growers who submit their applications for credit are classified into three categories: (i) farmers who applied for credit and their application are approved for 100% credit because they fulfill all the requirements and receive a sufficient amount of credit as there is no quantity rationing from both the demand side and the supply side,these farmers are considered UCCFs; (ii) farmers whose applications are not approved for a sufficient amount of credit(i.e., below 100%) and some of whose application forms are rejected; (iii) farmers who apply directly for credit through contacting with private lenders and most of whom receive the loan, though some farmers did not receive the loan.The situation of quantity rationing generally arises due to information asymmetries or moral hazards (Zhao and Barry 2014). In the current study, there are three groups of farmers:(i) credit constraint group, (ii) credit unconstraint group, and(iii) the farmers who do not apply for credit, or apply for credit but do not receive it; this last group were disqualified and discarded from our data set. Several studies, e.g., Feder et al.(1990), Fletschner et al. (2010), Zhao et al. (2014), and Zhao and Barry (2014), have revealed that credit constraints can influence resource distribution, risk performance, and choice of production technology, which may lead to minimum output of CCFs compared to UCCFs.

3. Data and methodology

3.1. Data and sample techniques

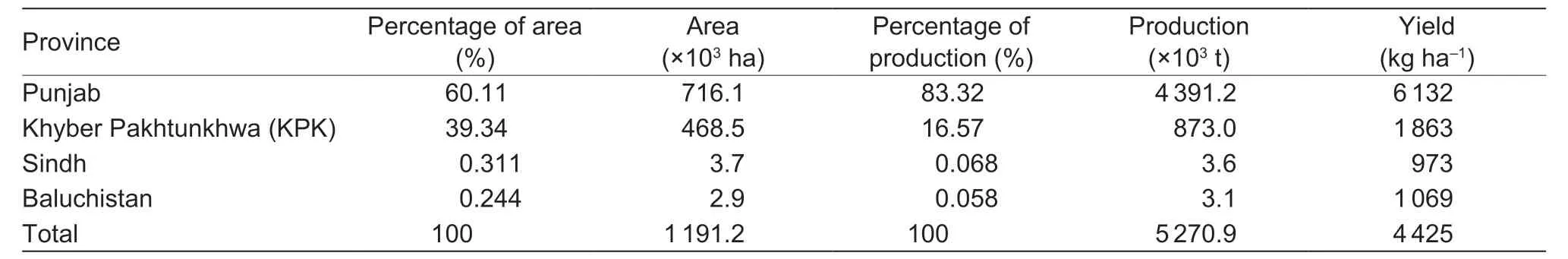

Table 1 demonstrates the total area, total production, and yield per hectare of maize crops in Pakistan. It shows that the total area under maize crop cultivation in Pakistan is 1 191.2×103ha. Due to the soil fertility and suitable climatic conditions for maize cultivation, Punjab and KPK provinces are the major growing areas. Of the total area under maize cultivation the shares of Punjab and KPK are 716.1×103and 468.5×103ha, respectively, and their yield is 6 132 and 1 863 kg ha-1, respectively. In KPK, maize is the second crop after wheat, but the production level is not satisfactory,unlike the case in Punjab Province. It is documented that the production level needs improvement, which may be achieved by providing better input factors at subsidized rates and proper times (Dorward and Chirwa 2011). The small household farmers need financial support, agricultural education awareness, subsidies for input factors, and easy market accessibility (Rapsomanikis 2015).

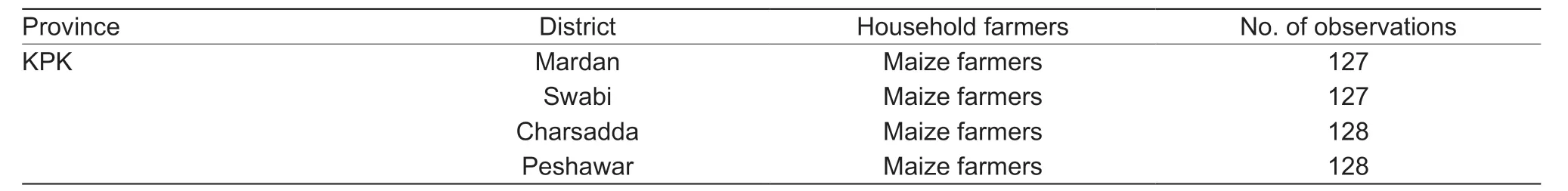

The random sampling technique was used to collect the primary data from small household farming societies in four major districts of KPK, namely, Mardan, Swabi,Charsadda, and Peshawar during 2018, as shown in Table 2.Furthermore, a direct elicitation technique was employed for data collection regarding the credit constraint rationing position of the maize growers in the study area. All four districts are naturally suitable for hybrid maize production.Farmers mostly cultivate hybrid maize in these areas. The total data are collected from 510 CCFs and UCCFs in these four districts. The literature reveals that the aforementioned technique is suitable for investigating credit restricting of farmers’ positions (Barham et al. 1996; Boucher el al. 2009;Fletschner et al. 2010).

3.2. Analytical framework

The previous literature illustrates that evaluation of technical efficiency employs two methods: a parametric approach and a non-parametric approach. The parametric approach enables the use of econometric techniques, but the nonparametric approach is based entirely on mathematical techniques data envelopment analysis (DEA). Previous studies have discussed and explained the advantages and shortcomings of both the approaches (e.g., Battese and Hassan 1999; Coelli and Perelman 1999; Bravo-Ureta and Pinheiro 1997) .

The econometric technique is stochastic, and it splits the impact of random error from the inefficiency effect.The non-parametric techniques, which combines the errors and, hence, is known as combination inefficiency. The econometric technique is parametric and controls the impact of misspecification of practical form through inefficiency. The non-parametric technique is non-parametric and is not so liable to this description error.

However, the literature reveals that the econometric technique is used commonly to assess the technical efficiency of firms (Hassan and Ahmad 2005; Tchale 2009;Gbigbi 2011). Accordingly, the econometric techniques were used in our study for SFA.

3.3. Stochastic frontier analysis

SFA, which is also known as a composed error model, was developed initially by Aigner et al. (1977) and Meeusen and Broeck (1977). Supposing an appropriate production equation, we described the stochastic production frontier equation as below:

where Yi, yield produced by ith maize grower; Xi, inputs for the maize by ith growers; βi, parameters of study;collected unsystematic errors; εi=νi-μi, νiis symmetric (-∞<νi<∞) and shows those random errors, such as climate change orother natural disasters, which are out of the farmer’s control.

Table 1 Area, production, and yield per hectare of maize crop (2015/2016)

Table 2 Details of maize growers’ observation in the four districts of Khyber Pakhtunkhwa (KPK)

It is expected that viis identically and independently distributed as N(0, σ2v) (Gujarati 2003). Farm specific technical inefficiency is denoted by μi. On the other hand,it shows the gap of output (Yi) and its maximum possible output assumed by the SFA [f(Xij, β)+νi] (Aigner et al. 1977).μiarises from N(0, σ2u) and is half normally distributed below 0 (Kumbhakar and Lovell 2003). The terms νiand μiare always independent for the input factors Xi.

3.4. Stochastic frontier model specification

The SFA model was used to estimate the technical efficiency of maize production. This technique specifies the effect of technical inefficiency that cannot be controlled by maize growers. The Cobb-Douglas Production function is suitable for estimating technical efficiency in our study, due to its advantages of easing interpretation and estimation. In addition, the elastic functional form solves the difficulty of multi-collinearity. We can express the SFA equation for the analysis as below:

where Yi, yield of maize in kilograms per acre; X1, land used for maize crop in acres; X2, seed rate used in kilograms per acre; X3, tractor ploughing hours per acre; X4, animal ploughing hours per acre; X5, number of family laborers for maize cultivation; X6, fertilizer, such as urea, potash, and DAP, applied in kilograms per acre; X7, irrigation, in average number of applications for maize per season; X8, pesticide,in number of applications; εi, error (composed error term);ln, natural logarithm; β0, Intercept of the model; βi, equation parameters.

3.5. Estimation of the stochastic frontier model

The maximum likelihood estimation (MLE) technique was employed to estimation the SFA (Greene 1980). The basic idea of the maximum likelihood principle is to choose the parameter estimates (β, σ2ε) to maximize the probability of obtaining the data:

The MLEs of β, γ, and σ2ε at which the value of the likelihood function is the maximum were obtained by setting the first order partial derivatives with respect to β, γ, and σ2ε as equal to zero and solving these non-linear equations simultaneously. It can be estimated by using a non-linear optimization algorithm to find the optimal values of the parameters.

3.6. Equation of technical inefficiency estimation

In the model specification of technical efficiency estimation,it is expected that random viis normally distributed as N (0,whereas μiis half normally distributed as N (0, σ2u).

where μidenotes the specific technical inefficiency of maize yield; δo-δ19are the parameters to be estimated; ωiis the random normally distributed error term.

Z1ito Z19iare the inefficient variable factors. 1)Demographic and socio-economic factors: Z1, age of household head (years); Z2, education of household (years);Z3, family size of household (numbers); Z4, married members in family (numbers); Z5, dependent family members(numbers); Z6, off-farm income, is dummy variable if Yes=1,otherwise 0; Z7, farming experience in years; Z8, mobile phone use is dummy variable if Yes=1, otherwise 0; Z9,certified seed used is dummy variable if Yes=1, otherwise 0;Z10, tractor drill use is dummy variable if Yes=1, otherwise 0;Z11, live stock holding is dummy variable if Yes=1, otherwise 0; Z12, water irrigation through line is dummy variable if Yes=1, otherwise 0; Z13, land fragmented is dummy variable if Yes=1, otherwise 0; 2) Institution factors: Z14, extension services is dummy variable if Yes=1, otherwise 0; Z15,household saving per year in PKR (×103); Z16, interest rate on principle amount in PKR; Z17, credit size received by farmers in PKR; Z18, distance to lenders in kilometers; Z19,credit availability to all farmers; if so, then Yes=1.

3.7. Estimation of technical efficiency and technical inefficiency of individual maize growers

The following formula is applied to estimate the technical efficiency (TE) of maize growers:

where Yi, observed yield of ith maize grower;frontiers yield of ith maize grower that is obtained; TEi, technical efficiency of ith maize grower in the range of 0 to 1.

To obtain the result of technical inefficiency (TI) of individual maize growers, the formula below was employed.

4. Results and discussion

4.1. Summary statistics of variables in the SFA model

Table 3 reveals the summary statistics of variables in the SFA model for four districts of KPK Province, Pakistan. The household farmers were divided into two groups: CCFs and UCCFs. The mean value of maize was 1 431.8 and 1 495.556 kg acre-1for CCFs and UCCFs, respectively,with a t-ratio value of 5.612. The mean values of land in acres for CCFs and UCCFs were 3.955 and 5.033 acres,respectively (1 hectare=2.47 acres). The amount of seed used was 7.188 and 8.511 kg acre-1for CCFs and UCCFs,respectively. The mean values of tractor ploughing for CCFs and UCCFs were 4.004 and 4.15 h acre-1, respectively.The average values for family labor in terms of number working were 2.282 and 2.366 acre-1for CCFs and UCCFs,respectively. The mean values of fertilizer application were 153.082 and 184.333 kg acre-1for CCFs and UCCFs,respectively. The pesticides and water irrigation inputs are usually considered in application frequency. The application frequency of water irrigation for CCFs and UCCFs was 5 and 5.005, respectively.

Table 4 shows the descriptive statistics’ summary of independent variables used in the inefficiency effect model.The average ages of household heads of CCFs and UCCFs were 40.378 and 39.39.4 years, respectively. The mean values of education for CCFs and UCCFs household heads were 5.848 and 7.072 years, respectively. The average value of family size for CCFs was 7.009, with a standard deviation value of 1.404, and the average value for UCCFs was 8.2, with a standard deviation value of 1.399. The married family members and dependent family members of both groups are represented in the inefficiency effect model, and the t-ratios of both groups are significant at the 10% level. The off-farm income mean value of the CCFs group is 0.278 and that of the UCCFs group is 0.316, which indicates that the UCCFs group likes off-farm activity. In the survey area, most household farmers had many years’experience of and connection with agricultural activities;the mean values for CCFs and UCCFs were 18.996 and 19.477 years, respectively.

In the inefficiency effect model, the dummy variables used are mobile phone use, tractor drill, certified seed, live stock holding, and water irrigation though a lined course. If the household farmers have used these, the individual use is represented by Yes=1; otherwise, the value is No=0. The mean values of these five dummy variables in the UCCFs group are greater than those in the CCFs group. The term land fragmented represents the extent to which household farmers use the land in their plots for maize cultivation. The average values of land fragmented for CCFs and UCCFs were 0.539 and 0.6, respectively. Institutional factors related to farmers are shown in Table 4 in the last part of the inefficiency effect model. The mean values of the dummy variable of extension services for CCFs and UCCFs are 0.501 and 0.533, respectively. The household saving per year is a very important variable factor for household farmers’ input production; if the production is high, farmers will earn more and be able to save money for future needs.The average value of household savings for CCFs was 60.419×103PKR (Pakistani rupees), with a standard deviation value of 11.463, and the average value for UCCFs was 121.895×103PKR, with a standard deviation of 38.882,which have a difference of 60.297×103PKR. The interest rate on principal amount for CCFs and UCCFs groups are3.718 and 11.138 with standard deviations 1.277 and 1.723,respectively. The mean value between the groups was 7.42,which shows that the UCCFs group was willing to pay a high interest rate. The average values of the loan received variable were 118.157×103and 336.7×103PKR for CCFs and UCCFs groups, respectively. However, the standard deviation values for CCFs and UCCFs groups were 25.663 and 101.560, respectively. The final dummy variable used in the model was credit availability; both groups of household farmers availed of credit.

Table 3 Descriptive statistic of dependent and independent variables for the stochastic frontier analysis (SFA) model1)

Table 4 Descriptive statistics of independent variables used in the inefficiency effect model1)

Table 4 shows that all the farmers had access to credit,with some farmers having received a sufficient amount of credit (100%) and others having received an insufficient amount of credit (<100%). The credit availability may either directly or indirectly influence the production level and technical efficiency of the maize growers in the study area. However, the UCCFs group can have an optimum level of inputs due to the availability of a sufficient amount of credit, which might help them achieve an optimal level of output. On the other hand, the CCFs group did not have sufficient inputs, thus having below average production.Consequently, there were considerable differences in both production and technical efficiency of the groups. Credit availability presents the farmers with many advantages,such as influencing the distribution of input resources that are bound by cash constraints and helping famers to purchase improved new technologies (Lee and Chambers 1986; Färe et al. 1990; Barry and Robison 2001; Blancard et al. 2006; Petrick 2005). However, the empirical literature focusing on credit availability and its impact on technical efficiency is inadequate, especially for developing countries like Pakistan.

4.2. Technical efficiency parameters of the maximum likelihood estimation (MLE) model

Table 5 shows the results from the MLE model that the land variable coefficient value for the CCFs group was 0.158,with negative significant influence at the 1% level on maize production. The possible reasons for this are imperfection in the labor market, cropping system used, land soil fertility, and high prices of input endowment. This result is in line with that of Komicha and Öhlmer (2008). The seed parameter value was highly significant for the UCCFs group, at the 5% level of significance, with a coefficient of 0.499. One possible reason for this is that the CCFs group purchased good quality seed (Mehmood et al. 2017). The variable tractor use was 0.156 h, significant at 10%, for the CCFs group and 0.166 h, significant at 5%, for the UCCFs group. The use of more technology on the land is in direct proportion to crop production (Sekhon et al. 2010). The coefficient value of animal worked was 0.347 h for the UCCFs group, significant at the 5% level in its influence on maize production. A big reason for this degree of impact is that UCCFs used oxen to plough the land, which could increase production if the farmers used good quality seed and fertilizers.

The coefficient for family labor was 0.018, indicating significance for the CCFs group at the 5% level of significance. The average labor force for CCFs group was significant at the 5% level because this group did not have either much machinery or large capital input and had to provide more effort in the form of labor. The coefficient values of fertilizer application for the CCFs and UCCFs groups were significant at the 5 and 1% levels,respectively. It has been shown that both groups used high quality fertilizers and purchased them at a suitable subsidy rate (Mehmood et al. 2017). The coefficient of irrigation applications for the UCCFs group was 0.06, which was highly significant at 1% level of significance. This may be because the UCCFs group had its own tube well, thus having no water irrigation problem in the survey area. The result is in line with that of Mehmood et al. (2017). The pesticide application variable for the CCFs and UCCFs groups was significant at 5 and 1% levels, respectively with coefficient values of 0.138 and 0.067, respectively.

It has been documented that pesticide use had a significant effect on maize production (Dut 2014). In the UCCFs group, the seed variable had the greatest influenceon maize output elasticity, whereas, in the CCFs group, the pesticide application variable had the greatest impact on maize output elasticity. Moreover, the scale elasticity, i.e.,the sum of all output elasticities in our model, indicated the existence of a decreasing return to scale, which revealed that, for maize growers in the study area, there was no proportional association between farm inputs and the level of production. From the estimated result, it is concluded that maize farmers did not use the optimal level of input for maize production; this may be because the farmers need to adopt more advanced farming technology. However,our study shows that credit constraint, whether from the demand side or the supply side, is a considerable cause of decreasing return of scale in maize production. A recent study by Mehmood et al. (2017) suggested that, advanced technology and financial institution are the preliminary for agricultural advancement.

Table 5 Maximum likelihood estimate frontier production1)

4.3. Ranges of technical efficiency

Table 6 demonstrates the frequency distribution of the farm households’ productive efficiency for both CCFs and UCCFs groups. The results showed that the technical efficiency varied significantly between the two groups of maize growers. Our results further indicate that the mean technical efficiencies for the CCFs and UCCFs groups were 79.2 and 89.4%, respectively. The mean technical efficiency of UCCFs growers was 10.2% higher than that of CCFs, indicating a considerable gap between the two groups. According to the findings of Mehmood et al. (2017)and Komicha and Öhlmer (2008); the UCCFs growers have,respectively, 9 and 12% higher technical efficiency than do the CCFs growers. This might be due to the differences in their economic level that can be overcome by providing access to credit. Our findings suggest that by utilizing the existing level of input factors, the CCFs and UCCFs can increase the maize yield by 20.8 and 10.6%, respectively.Moreover, the result indicates that 79.43% of the UCCFs group and 23.32% of the CCFs group have attained a technical efficiency score above 85%, indicating a significant difference between the two groups. Furthermore, the nonsignificant value of Breusch-Pagan-Godfrey confirms the absence of white heteroscedasticity. To devise appropriate policies, policymakers are often interested in ranking farms/firms in terms of their technical efficiencies.

For both the CCFs and UCCFs groups, not only the technical efficiencies but also the distributions of the estimated technical efficiencies were different. In the CCFs group of farm households, the minimum technical efficiency score was 24.7%, whereas that of the UCCFs group was 35.4%. Similarly, the maximum technical efficiency score for both the CCFs and UCCFs groups of farm households was 99%. Moreover, the mean technical efficiency score of the CCFs group was 79.2% (almost 80%), and approximately 64% of the CCFs and 9% of the UCCFs groups had technical efficiency scores of lower than 80%, indicating more loss inpotential production of the CCFs group than in the UCCFs group. Fig. 2 demonstrates the cumulative distribution of the efficiency scores for the two groups. The technical efficiency scores of the CCFs group were skewed towards the lower efficiency scores, i.e., the CCFs graph was concave to the origin, whereas those of the UCCFs group were skewed towards the highest efficiency scores, i.e., the UCCFs graph was convex to the origin. The graph revealed that most of the CCFs group - 64% - had lower technical efficiencies.Some other factors can also influence the technical efficiencies of the farm households, as discussed below.

Table 6 Frequency distribution of efficiency estimates for credit constrained farmers (CCFs), credit unconstrained farmers (UCCFs),and the full sample

4.4. Estimation of technical inefficiency effect model

Table 7 highlights the parameter estimates of the relationship between technical inefficiency and respondents’ socioeconomic, demographic, and institutional factors. Following Mehmood et al. (2017) and Cabrera et al. (2010), the results of parameter estimates regarding technical efficiency have been interpreted. Eq. (8) shows that, when the technical inefficiency of a farm household is negative means that it has a positive effect on technical efficiency. To draw comparison with previous studies, this method of depiction is common practice in the available literature.

The estimated variables specified that the age of farmers was significant and negative for both CCFs and UCCFs groups, with co-efficient of 0.007 and 0.033, respectively,indicating that the older farmers are less efficient than younger famers, the possible reason is that young farmers are more energetic and technically efficient than old farmers(Mehmood et al. 2017). The coefficients of education parameter for both groups had positive and significant impacts on technical efficiency, however, the level of significance in the UCCFs group was higher than that in the CCFs group, indicating that education can improve skills and play a key role in the acquisition of loans, etc. It has been documented that education of both CCFs and UCCFs has a positive effect on production (Akram et al. 2013).For both groups, the family household size parameter had positive and significant impacts on the technical efficiency of maize production, indicating that large family size does not constrain labor. The household family size had a significant impact on crop production (Rahman and Umar 2009). Furthermore, the coefficient values of married family members were positive and significant at the 1% level in the UCCFs group. The analysis indicates that the labor force in a family increases when famers marry, with a resultant increase in production efficiency.

Fig. 2 Ranges of technical efficiency scores. CCFs, credit constrained farmers; UCCFs, credit unconstrained farmers.

Table 7 Parameter estimates of the inefficiency effect model1)

Among the farm households, the diversification of income sources is a norm related to pull and push effects (Escobal 2001). Our analysis shows that off-farm income for both CCFs and UCCFs had positive and significant effects on maize production at the 1 and 10% levels, respectively,showing that these famers had enough capital for inputs’production. Our results are in line with the findings of Tipi et al. (2009) and Mehmood et al. (2017). The coefficient of farm experience for both the CCFs and the UCCFs had positive and significant effects on production at the 5 and 1% levels of significance, respectively. Most household members had a long connection with agricultural activities and their considerable experience had a positive and significant effect on crop production (Mango et al. 2015).

In our study, the parameter of certified seed (hybrid)showed a positive and significant effect at the 5% level on the UCCFs group of maize growers. Our results are in line with the findings of Musaba and Bwacha (2014). The tractor drill coefficient value of the UCCFs group had a positive and significant effect at the 10% level on maize production efficiency. In the survey area, most farmers used a tractor drill for ploughing because it makes the land suitable for weeding and easy to irrigate, thereby increasing production efficiency. The coefficient value of livestock holding had a positive and significant effect at the 5% level of significance on the UCCFs group; the result is in line with Mehmood et al. (2017). The dummy variable coefficient value of water irrigation through a lined course for the UCCFs group was 1.637, and it had a positive and significant influence at the 5% level on maize production. The farmers in the survey area better know the irrigation style because the canal system was developed there. The coefficient values for land fragmented were 0.018 and 0.824 for CCFs and UCCFs,respectively, and this variable had negative and significant impacts on maize production for both groups. One possible explanation for this is that the production on fragmented land is lower than that in a non-fragmented plot because fragmented land cannot be managed properly.

The last phase of the technical inefficiency model included institutional factors, which are very important for household farmers in obtaining loans. The extension services variable had a positive and significant impact at the 5% level on UCCFs group. Our results contradict the findings of Alene and Hassan (2006), who reported that poor communication skills of extension services and weak links with the local farmers, resulting in a decline in the number of farmers receiving loans. The coefficients of the household saving values were 0.047 and 0.006 for both groups that have positive and significant impact on technical efficiency of maize productivity, it might because farmers with savings can easily purchase the input of production and may achieve the optimum level of output (Mehmood et al. 2017).

The credit size had a positive and significant impact at the 5% level on the technical efficiency of both the CCFs and UCCFs. There are two possible reasons for this: first,if farmers received a large amount in the form of a loan they could use advanced technology and provide suitable production factors easily; second, a large loan being issued to farmers indicates that the interest rate is low because the volume of loan can decrease the per unit contract cost.The results are in line with the study of Hassan and Ahmad(2005) and Mehmood et al. (2017).

Credit availability is a dummy variable used in our study because both groups of farmers had access to credit;therefore, in our study, we analyzed the full sample for the effect of technical efficiency on maize yield. The coefficient for credit availability had a positive and significant effect on all maize growers at the 5% level of significance. In line with the findings of Ayaz and Hussain (2011) and Mehmood (2017), although in contrast with the hypotheses of financial analysts, our findings suggest that financial organizations do not provide considerable support to raise the levels of livelihood of rural communities. However, it is crucial to minimize the risk reluctant mechanisms at the households level by providing subsidies insurance premiums as suggested by Arshad et al. (2016) and Mehmood et al.(2017).

5. Conclusion and recommendation

This study analyzed the effects of credit constraint and credit unconstraint on the technical efficiency of maize growers in the four districts of Khyber Pakhtunkhwa Province of Pakistan. Primary data were collected from households of maize growers through the direct elicitation method, and the famers were divided into two groups: credit constrained(CCFs) and credit unconstrained (UCCFs) farmers. For the data analysis, we used a stochastic frontier model with a parametric approach to assess the technical efficiency for both CCFs and UCCFs groups. The mean technical efficiency scores were 79.2 and 89.4 for the CCFs and UCCFs groups, respectively. The mean difference in technical efficiency between the two groups was 10.2,indicating that, due to inefficiency, there was a considerable potential loss in output. Moreover, the findings suggest that,in the study area, the CCFs and UCCFs groups of maize growers need to increase their production levels by 20.8 and 10.8%, respectively, using the existing level of inputs’ supply to reach the optimum level of output efficiency.

The technical inefficiency factors model revealed that the efficiency of both groups was positively and significantly influenced by demographic and institutional factors, such as education of household head, family size, married family members, off-farm income, farm experience, certified seed, tractor drill, water irrigation through a lined course,household saving, credit size, and credit availability. The age of household head and land fragmentation had negative and significant impacts on the technical efficiency of both groups of maize growers. Dependent family members and interest rate had positive impacts on the technical efficiency of the CCFs group but negative impacts on the technical efficiency of the UCCFs group. The variables of mobile phone, livestock holding, extension services, and credit distance had negative impacts on the technical efficiency of the CCFs group of maize growers and positive impacts on the technical efficiency of the UCCFs group.

The credit availability positively and significantly influenced the technical efficiency of maize production.However, the problem is still unsolved, and the questions can be raised as to why imperfection still exists in the local financial market and why there has been no impact on poverty alleviation in rural farming communities in lessdeveloped countries like Pakistan.

The results suggest that easy access to formal credit may reduce the credit-restricting position of rural farm household communities in Pakistan. Government financial organizations and private lenders’ institutions need either rehabilitation or, possibly, to make changes in their policies regarding credit supply and credit demand rationing for farm household communities. The financial institutions need to consider some social awareness campaigns and revise their policies regarding issuing credit to secure loans and encourage borrowers. The interest rate plays a vital role in the technical efficiency of maize production, as a high interest rate may restrict borrowers’ ability to gain accessing to credit. Therefore, the state bank of Pakistan needs to focus on this problem and make appropriate solutions so that every household farmer can obtain easy access to loans. As the prices of inputs increases every year due to inflation, the state bank of Pakistan needs to concentrate on a per acre loan policy to cope with the imbalanced situation. To facilitate the rural farm communities, the government of Pakistan should increase the branches of financial institutions.

Acknowledgements

The authors extends heartfelt thanks to editorial board and the two anonymous reviewers for their valuable suggestions.This research was sponsored by the National Natural Social Science Foundation of China (71573211).

Journal of Integrative Agriculture2019年10期

Journal of Integrative Agriculture2019年10期

- Journal of Integrative Agriculture的其它文章

- Application of virus-induced gene silencing for identification of FHB resistant genes

- Dynamic changes of root proteome reveal diverse responsive proteins in maize subjected to cadmium stress

- Strategies to enhance cottonseed oil contents and reshape fatty acid profile employing different breeding and genetic engineering approaches

- Maize/peanut intercropping increases photosynthetic characteristics,13C-photosynthate distribution, and grain yield of summer maize

- Rhizosphere soil bacterial community composition in soybean genotypes and feedback to soil P availability

- Effect of biochar on grain yield and leaf photosynthetic physiology of soybean cultivars with different phosphorus efficiencies