Impact of Climate Change Disclosure on Financial Performance:An Analysis of Indian Firms

Praveen Kumar,Mohammad Firoz

Department of Business Administration,National Institute of Technology,Kurukshetra,136119 India

Keywords Climate change disclosure Carbon disclosure project(CDP)Return on equity(ROE)Return on assets(ROA)India

Abstract This paper investigated the relationship between the climate change disclosure and the firms’ financial performance in the Indiancontext.The climate change disclosure scores assigned by the Carbon Disclosure Project(CDP)survey to 44 participating Indian firms during 2011 to 2015 is being used to determine the extent of climate change disclosure.Further,Return on Equity(ROE)and Return on Assets(ROA)are being used to proxy the sample firms’ financial performance.After controlling for industry-and firm-specific variables, we observed that the ROE will be higher for companies having higher environmental disclosure scores comparatively the companies having low environmental disclosure scores.Moreover,the results of the regression analysis revealed that the market perceives the voluntary climate change disclosure as a positive corporate initiative,leading to significant positive regression coefficient.However,this study did not find any evidence to supports that the climate change disclosure affects ROA.These findings are crucial for managers and the investors to assess the economic consequences of voluntary environmental disclosures by the firms operating in emerging economies.

1 Introduction

Climate change and global warming are the de fining challenge of our age.International and national efforts have been made to mitigate the same.In order to reduce emissions of six greenhouse gases(GHGs)by 5.2 per cent from the 1990 level,the UNFCCC(United Nations Framework Convention on Climate Change)adopted an international environmental treaty in 1997,which is popularly known as Kyoto Protocol.It comes into existence on 16th February 2005.Further,India,the world’s fourth-largest GHGs emitters as of 2015,has also announced National Action Plan on climate mitigation with the aim to reduce emission intensity by 20 per cent to 25 per cent by 2020 compared to 2005 levels in line with India’s Copenhagen pledge,which elucidated eight bottom ‘national missions’running through 2017.Moreover,in the climate change regime the firms are also facing internal,economic,regulatory, financial market and social pressure from different stakeholders to report on their climate change actions(Luo et al.,2013).The literature on the effect of climate change disclosure on the firms financial performance have become a matter of interest for the governments of different countries,policymakers,society,investors,business community and academicians as well.Keeping in view all these,the Carbon Disclosure Project(CDP)in 2000 has been launched.Its resultant firms are encouragingly responding to measure,report and manage their climate change actions and integrate this into their assessment of the financial performance as well as long-term prospects of their business.As environmental performance and disclosure influence a firm’s financial performance in the capital market(Freedman and Jaggi,1982;Dye,1985;Ullmann,1985;Dowell et al.,2000;King and Lenox,2001;Konar and Cohen,2001;Al-Tuwaijri et al.,2004;Luo et al.,2012;Saka and Oshika,2014;Flammer,2015;Qiu et al.,2016),resultant, firms with better climate change disclosure have a less environmental risk exposure,a good reputation,better financial performance in the market and customer loyalty(Jacobs et al.,2010).

A few of important studies have attempted to provide a better understanding of firms’climate change management practices and its impact on a firm’s financial performance(Palmer et al.,1995;Blacconiere and Northcut,1997;Bae and Sami,2005;Stern,2007;Kim and Lyon,2011;Fisher-Vanden and Thorburn,2011;Hsu and Wang,2012;Griffin et al.,2012;Saka and Oshika,2014;Matsumura et al.,2014)in developed countries.However,very few researchers have studied the relationship between the environmental disclosure and firms’performance in developing countries,particularly those in Asian countries(Lee et al.,2015).So,motivated with this research gap,the present analysis contributes to the literature in several ways.The study is the first to examine the relationship between climate change disclosure and financial performance in the Indian context.Second,lots of work have been done to examine the relationship between environmental disclosure and the financial performance.However,previous studies have produced mixed results for the effects of climate change disclosure on corporate financial performance.Some studies have found a positive correlation between the two variables(i.e.:Hai et al.,1998;Stanwick and Stanwick,2000;Gozali et al.,2002;Al-Tuwaijri et al.,2004).Cohen et al.(1995)found a positive relationship between environmental disclosure and corporate financial performance.The study reported that the firms which can reduce social and environmental problems such as natural pollution may able to increase and improve their effective production,reputation and competitive advantages.Similarly,Nakao et al.(2007)in their study also reported that environmental performance can positively influence the corporate financial performance.On the other hand,some researchers found no correlation between environmental disclosure and financial performance(Haslinda et al.,2002;Connelly and Limpaphayom,2004;Ruslaina et al.,2006;Cormier and Magnan,2007;Fisher-Vanden and Thorburn,2011).Haslinda et al.,(2002)conducted a study on 40 Malaysian companies listed on KLSE.The study revealed that the relationship between reporting and performance is still inconclusive since only 2 out the 19 items of environmental information examined showed a positive correlation with the profitability of the reporting companies.Similarly,Zauwiyah et al.,(2003)reported that the decision to disclose environmental information is negatively correlated with companies’financial leverage.More importantly,Kim and Lyon(2011)also found no association between firm value and carbon information disclosure.So,this study provides a further evidence on the relationship between environmental disclosure and financial performance.Third,the majority of previous studies used market-based criteria of a firm’s financial performance e.g.stock price(Blacconiere and Northcut,1997;Kim and Lyon,2011;Hsu and Wang,2012;Griffin et al.,2012;Lee et al.,2015),a very few studies have taken accounting-based criteria of a firm’s performance like ROE and ROA.This research also fills this gap in the literature.Fourth,the study provides managers with meaningful implications in terms of making environmental disclosure decisions in the best interests of a firm’s financial performance in the market.

The rest of this paper proceeds as follows:The next section provides a brief review of the related literature on the relationship between the climate change disclosures and the financial performance.The data and methodology section describes the research method and variables which are being used in this study.We then present the results of the empirical analysis.Finally,we discussed the implications of the study and a few concluding remarks.

2 Literature review

Existing literature exhibits a positive relationship between the climate change disclosures and a firm’s financial performance(e.g.:Palmer et al.,1995;Blacconiere and Northcut,1997;Bae and Sami,2005;Stern,2007;Beatty and Shimshack,2010;Fisher-Vanden and Thorburn,2011;Hsu and Wang,2012).Hai et al.(1998)conducted a study with the help of a sample of publicly listed companies in Singapore in order to know the relationship between the environmental disclosure and financial performance.This study reported that the firms which produce environmental disclosure have better financial performance than those that do not.Subsequently,King and Lenox(2001)investigated the relationship between corporate environmental and financial performance.An analysis of longitudinal information and factual techniques found that the firms in cleaner ventures have a higher Tobin’s q,however,the study can’t preclude conceivable perplexing impacts from fixed firm traits.

Murphy(2002),in his review demonstrated that positive environmental performance,in terms of less carbon emission into the atmosphere and their proper disclosure in books of accounts,improve company’s financial performance,in terms of profits,revenue and market value and negative environmental performance have their negative impact,in terms of decreased profits and market value.On the other hand,low-carbon technologies investment,proper emission disclosure and compliance with environmental regulations,produces a favourable return on equity(ROE)and return on assets(ROA)and have a more positive return on their stock.Similarly,Gozali et al.(2002)found that companies with positive environmental disclosures performed significantly better in the market than the companies that disclosed negative environmental information.In the same line,Al-Tuwaijri et al.(2004)also reported that good environmental performance is significantly associated with good economic performance.In addition,Clarkson et al.(2008)revealed in their review study that good environmental performing firms enjoy the benefits to over compliance(“green goodwill”,cost advantages due to process innovation,and raising rivals’costs)while poor environmental performing firms do not enjoy these benefits but instead face obligations to incur future abatement expenditures with no incremental return to shareholders as emission standards get.

Salama(2005)con firmed that there is a positive connection amongst corporate environmental performance and a firm’s financial performance.Moreover,the study further explored that this positive relationship is more grounded when median regression is used.Similarly,Murray et al.(2006)revealed a positive relation between the level of environmental/social disclosure and the consistency of financial returns.Most importantly,Peloza(2009)depicted that there is a little,however positive connection between corporate social performance and an organisation’s financial performance.Later,Clarkson et al.(2011)in their research also showed that firms with superior environmental performance have a favourable financial performance in the market.Whereas,a few studies revealed no relationship between climate change disclosures and a firm’s financial performance.For instance,Trebucq and Henri(2002)found no association between corporate social performance and financial performance.In the context of emerging economies,Verma and Singh(2016)also reported no correlation between a firm’s profitability and corporate social disclosure(CSD).

Moreover,Albertini(2013)in his review of 52 studies over a 35-year time frame affirms a positive connection between environmental performance and financial performance.Griffin and Sun(2013)also documents that shareholders respond positively to a firm’s voluntary green disclosure.In the same vein,Hsu and Wang(2013)examined a sample of firms with news cover again Wall Street Journal(WSJ)during the period 1989-2008.Using event study the results show that firms with more negative words on climate change have significantly positive wealth effects.This study finds that market reaction is less positive in environmentally sensitive industries and in firms with poor environmental performance,though the effect for poor performance is insignificant.

More recently,Lee et al.(2015)reported that the market is likely to respond negatively to firms’carbon information disclosure,implying that investors tend to perceive carbon disclosure as bad news and thus are concerned about potential costs facing firms for addressing climate change.Moreover,a firm can mitigate negative market reaction from its carbon disclosure by releasing its carbon news periodically through the media in advance of its carbon disclosure.The above discussions indicate a positive association between corporate climate change disclosure and firms financial performance.Taking these discussions together leads this research to the following hypothesis:

H1:Corporate climate change disclosures are positively related to a firm’s ROE.

H2:Corporate climate change disclosures are positively related to a firm’s ROA.

3 The carbon disclosure project(CDP)

As stated in the begging, firms increasingly are pressurised to report the impact of their corporate actions on climate change.One major initiative is the Carbon Disclosure Project(CDP),the world’s largest non-profit organisation which covers 35 institutions with US$4 trillion assets and wanted to see firms reporting reliable,comprehensive information about climate change risks and opportunities(CDP India,2015).Every year the CDP has sent leading global corporations a questionnaire on the risks and opportunities from climate change,greenhouse gas emissions,emission reduction plans,targets,and strategies,emission intensity,and corporate governance.By publishing the responses with assigned scores on the basis of disclosed environmental aspects associated with a firm,the CDP is working to facilitate active communication between companies and investors.We utilised extent of climate change disclosure on the CDP as a proxy for climate change disclosure by the Indian firms.It is a voluntary self-reporting project initiated to allow for companies to address the issue of climate change and investors to address the risks involved with their investments.The CDP uses measurement and disclosure to advance the managing of environmental threats and through leveraging investors,customers and authorities,it has been able to give incentives to organisations across the largest global economies to report and measure their environmental data.Moreover,the CDP also helps firms to handle the potential risk of information asymmetric due to lack of environmental reporting standards.Otherwise,lack of publicly available information for all investors causes expectations of a higher rate of return on their investment.Consequently,this can negatively influence the earnings of a firm(Easley and O’Hara,2004).

4 Data and methodology

4.1 Research objective

The main aim of the study is to assess the impact of voluntary climate change disclosure on the firms financial performance.The ROE and ROA are the two financial performance parameters on which the effect of different variables is being assessed.

4.2 Data source and sample selection

We extracted the data needed to measure ROE,ROA and other control variables like size,beta,R&D and leverage of each sample firm from the Prowess Centre for Monitoring Indian Economy(CMIE)Database.Furthermore,climate change disclosure scores were obtained from the Carbon Disclosure Project(CDP)which is the most preferred platform for climate change disclosure by firms throughout the world and are being used in numerous of studies related to voluntary climate change disclosure(e.g.:Reid and Toffel,2009;Matisoff et al.,2012;Li et al.,2014;Saka and Oshika,2014;Doda et al.,2015).The CDP India reports can easily get from the website of the CDP(https://www.cdp.net/en).

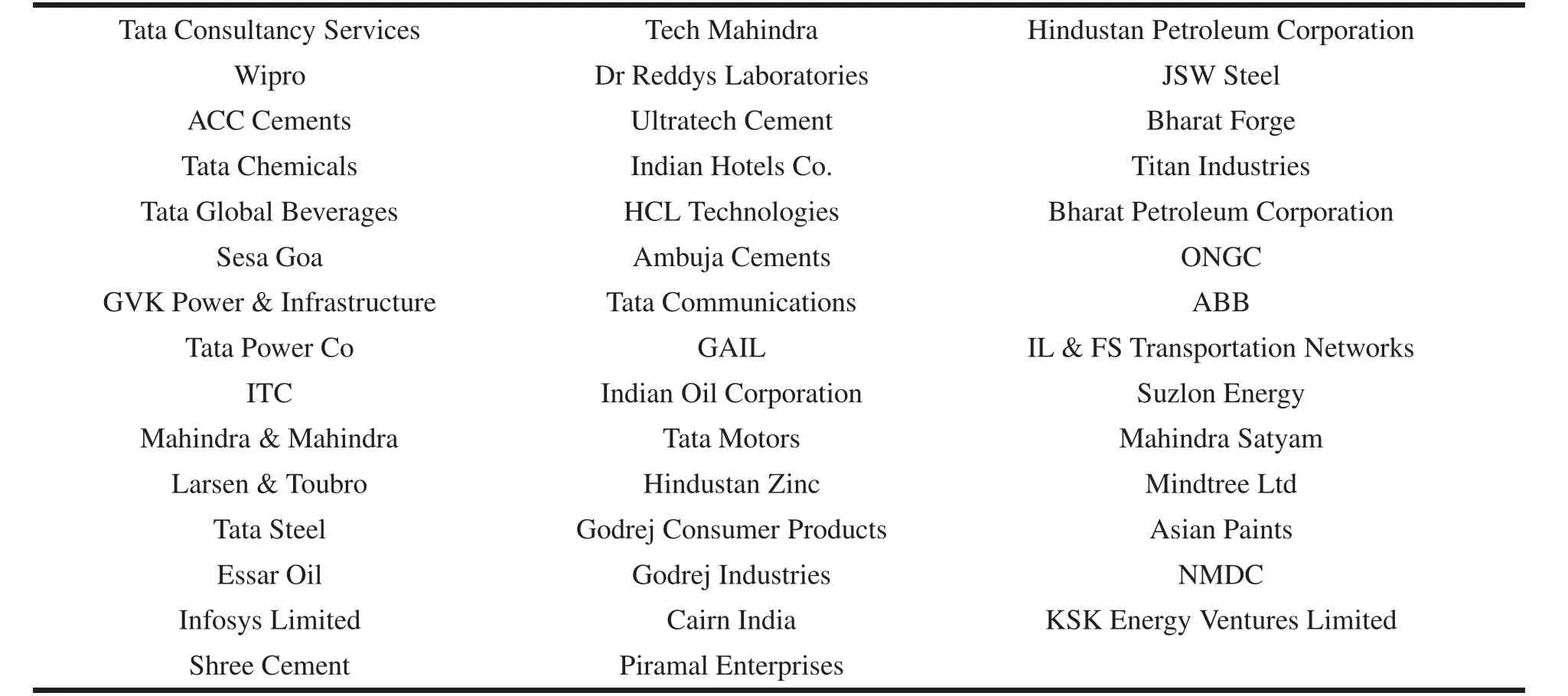

The initial sample population chosen for this study included all firms which disclose their climate change data on the CDP.We excluded nine firms from financial sectors because the regulatory structure or business activities of financial sector firms differ from other industry sectors firms like manufacturing,materials,utilities and industrial firms and they have different reporting procedures,consequently,these companies are not quite comparable(Hossain et al.,1995).Moreover,three firms were not available on Prowess Centre for Monitoring Indian Economy(CMIE)Database.Finally,a sample of 44 firms was formulated(Table 1)and data was selectedfor the years 2011-2015.

Table 1 List of companies under study.

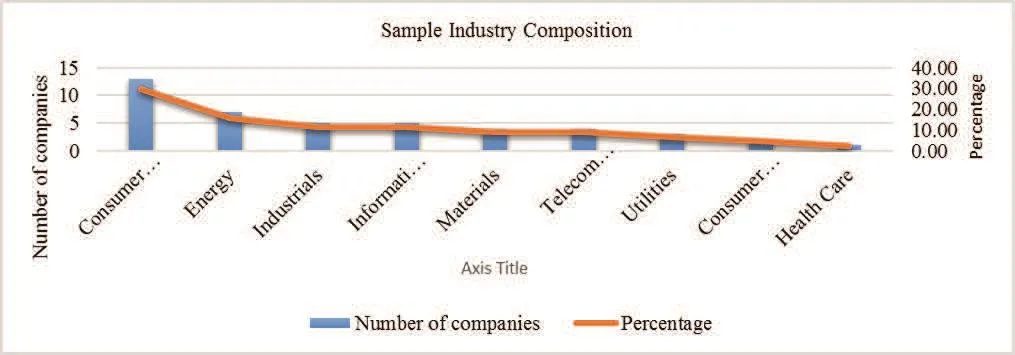

Fig.1 The sample industry composition.

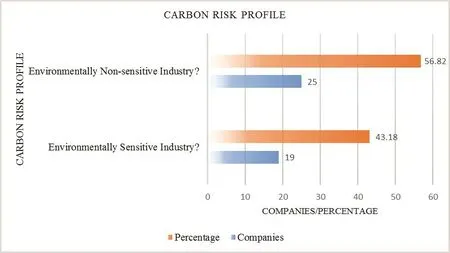

Fig.2 Carbon risk profile of firms.

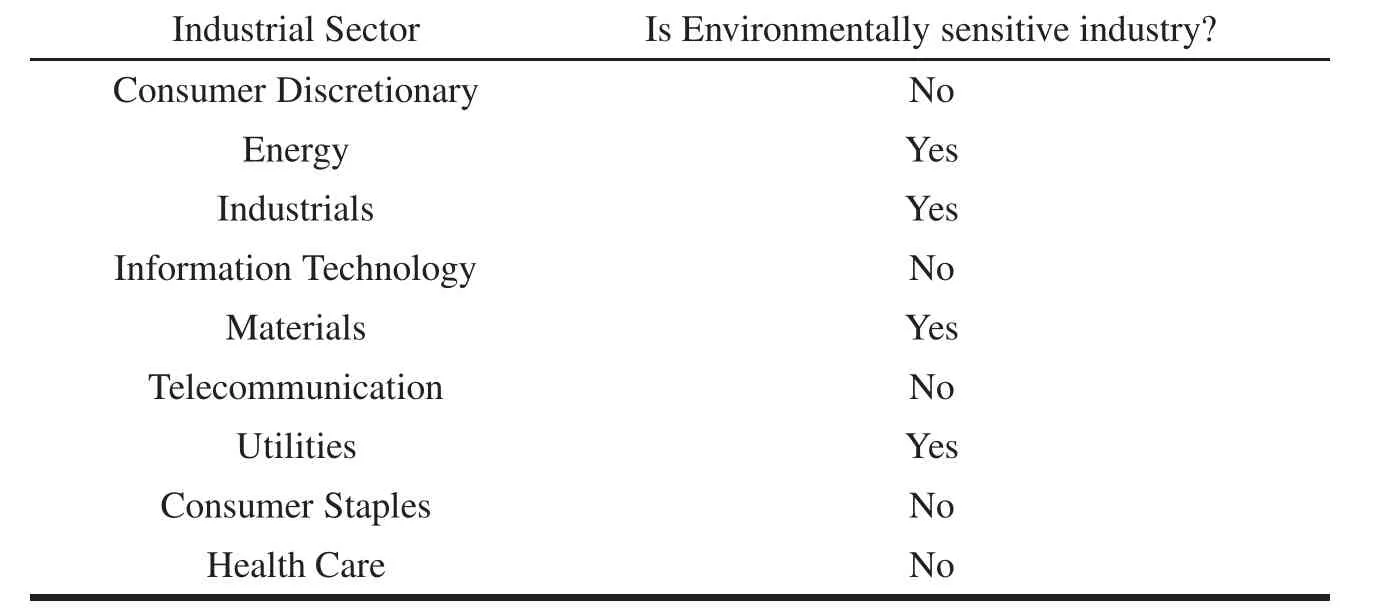

Table 2 Sample industry composition and carbon risk profile.

The activity sectors covered under this study(as shown in Figure 1)were Consumer Discretionary(13 firms covered the highest proportion 29.55 percent of total sample),Energy(7),Industrials(5),Information Technology(5),Materials(4),Telecommunication(4),Utilities(3),Consumer Staples(2)and Health Care(1 firm covered the lowest proportion only 2.27 percent of total sample).Out of 44 sample firms,19 firms(43.18 percent)belongs to environment sensitive industries and 25 firms(56.82 percent)belongs to environment nonsensitive industries(Figure 2).

4.3 Financial Performance Measures

4.3.1 Return on equity(ROE)

Consistent with the prior studies(Hart and Ahuja,1996;Russo and Fouts,1997;Haniffa and Cooke,2005;Shen and Chang,2009)this research is also used Return on Equity(ROE)as a proxy for firms’ financial performance.The ROE is an accounting-based criterion of financial performance which measures the rate of return that the owners of common stock of a company receive on their shareholdings.Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders.The formula for ROE is

Return on Equity=Net Income/Shareholder’s Equity. (1)

Note:Netincome is for the full fiscal year(before dividends paid to common stock holders but after dividends to preferred stock)and Shareholder’s equity does not include preferred shares.

4.3.2 Return on assets(ROA)

Return on assets(ROA)is an indicator of how profitable a company is relative to its total assets.The ROA gives an idea as to how efficient management is at using its assets to generate earnings.It is calculated by dividing a company’s annual earnings by its total assets and shown as a percentage.Consistent with the prior studies(Hart and Ahuja,1996;Russo and Fouts,1997;Shen and Chang,2009)we have calculated ROA as follows:

Return on assets=Pro fit after tax(PAT)/Total Assets. (2)

Note:Total assets are a sum total of Net Block,Work in Progress and Total Current Assets.

4.4 Methodology and variables of the study

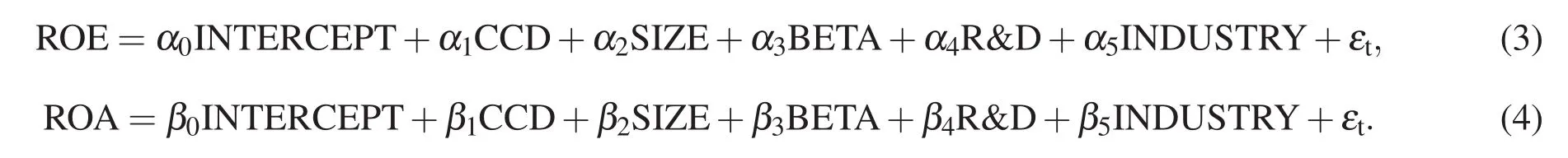

This section describes the econometric and the statistical model used to test the hypotheses.In order to examine the links between voluntary climate change disclosure and a firm’s financial performance,two econometricmodels are being developed.The general form of the econometric models we used to test our hypotheses are as follows:

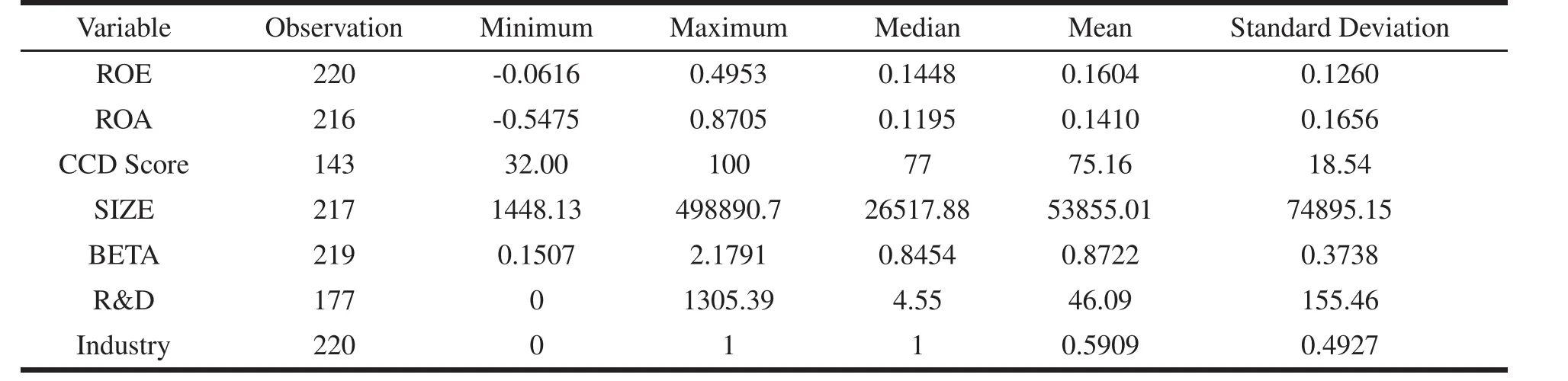

Table 3 Descriptive statistics of the sample firms.

The present study used two explanatory variables such as ROE and ROA as a proxy for firms’ financial performance and five control variables like climate change disclosure,size,beta,R&D and leverage were also used.Where INTERCEPT is the intercept.CCD is the corporate climate change disclosures.The corporate climate change disclosure is a measure of the extent of climate change information disclosed in the CDP India reports.We used the climate change disclose scores assigned by the CDP to the sample firms based on the disclosure on different parameters like GHG emissions data,energy conservation,reduction targets etc.

Moreover,consistent with existing literature(e.g.:Waddock and Graves,1997;Hai et al.,1998;McWilliams and Siegel,2000;Al-Tuwaijri et al.,2004;Salama,2005),this study also control for firm size;systematic risk;R&D intensity and industry effects.Size is the natural logarithm of total assets which is used to control firm size(Hackston and Milne,1996).Larger firms tend to have better financial performance than smaller firms.The coefficient of size(α2)is expected to be positive.Beta was amongst one of the important control variables which measure the systematic risk associated with the industry.This paper predicts coefficient of Beta is positively correlated with ROE and ROA.The R&D is the investment on research and development.INDUSTRY is an industry sector in which sample a firm is operating.Consistent with prior studies(Reid and Toffel,2009;Hrasky,2011;Chapple et al.,2013),this study also operationalized IND as a dichotomous variable;taking a score of one if the firm belongs to an environment sensitive industry;and zero,otherwise(Table 2).It is used to control industry effect on the CDP disclosure.

5 Results and analysis

5.1 Descriptive statistics

Descriptive statistics of the sample firms are reported in the Table 3.The financial performances in this study are measured by using ROE and ROA,which are the dependent variables of this study.The mean of ROE is 16.04 per cent which indicates that sample firms are profitable and having a good return on their investment whereas the standard deviation of ROE is 0.1260.The maximum and minimum value of ROE are 49.53 per cent and-0.06.16 per cent which portrays that some sample firms having a quite high return on their investment and some are not able to generate an adequate return on their investment.Furthermore,the second dependent variable used in this study to measure the financial performance is ROA which the mean value of this variable is 14.10 per cent.The maximum and minimum value of ROA are 87.05 per cent and-0.54.75 per cent which is significantly different from each other.These statistics indicate that sample firms consisted some firms withvery good financial performance in the market and some of the having a negative return on their assets.The standard deviation for this variable is 16.56 whereas the medium value is 11.95.

The mean value for climate change disclosure(CCD)which is one of the important independent variables of this study is 75.16 which indicates that voluntary climate change disclosure on the CDP during the sample period is getting an overwhelming response from the sample firm.The minimum value of CCD is 32 which shows that few companies disclosed low environmental information on the CDP.Besides,the maximum value is 100 which shows that some sample companies disclosed on all the parameters asked by the CDP.The firms voluntarily disclose more on environmental aspects in order to legitimise their operations(Gray et al.,1995;Deegan and Rankin,1996;Brown and Deegan,1998;Deegan,2002;Campbell,2003;Chu et al.,2012).The descriptive statistics also provided for standard deviation value of CCD is 18.54 which denote the low dispersion in observations.The median and mean of the beta portrayed in Table 3 are 0.8454 and 0.8722,respectively,which are very high and depict that the sample firms used in the study bear high operating risks.The mean and median values of R&D are 46.09 and 4.55,respectively.In brief,descriptive statistics for independent variables indicate that the sample firms used in this study are large cap,profitable and risky.

5.2 Correlation among variables

A prior condition to apply regression analysis is to test the multicollinearity among independent variables.The correlation matrix amongst variable of the study is presented in Table 4.Climate change disclosure is positively and significantly correlated to ROE at 10 percent level which indicates that firms with better environmental disclosure quality have positive financial performance in the market.Size is positively and significantly correlated with ROE and ROA of sample firms which show that larger firms have better financial performance than smaller firms.Further,Climate change disclosure is negatively and positively correlated with industry which depicts the environmental friendly firms disclose more on the CDP than firms operating in high environmental sensitive industries.Moreover,beta is also negatively and significantly correlated with ROE and ROA of sample firms which indicate that financial risk associated with a firm can influence its financial performance in the market.A severe multicollinearity may produce misleading coefficient.Researchers throughout the world suggested different measure handle the problem of multicollinearity.Some important studies(e.g.:Hair et al.,2006)suggested that correlation coefficients below 0.9 may not cause serious multicollinearity problem,while Kennedy(1985)argued the value below 0.8 shows no severe multicollinearity.The correlation matrix(Table 4)portrayed that the correlated coefficient values are below this value,so there is no problem of multicollinearity amongst the variables under study.

5.3 Impact of climate change disclosure on ROE

We used multiple regression analysis to examine the impact of climate change disclosure on firms’ financial performance.Moreover,both fixed and random effect models were employed and the Hausman test is used tochoose between the two models having the null hypothesis of using random effect model results.The Table 5 reports the results of the impact of climate change disclosure on ROE using regression analysis.

Table 5 Regression analysis of the estimated impact of climate change disclosure on the return on equity(ROE).

The results of Model(I)and(II)in the Table 5 portrayed that climate change disclosure is positively and significantly related with ROE at the five per cent and 10 per cent levels(p-value<0.05 and p<0.10).These findings con firmed our H1 that firms’climate change disclosure affects ROE in the market.These outcomes are consistent with the prior environmental disclosure studies(i.e.:Hai et al.,1998;Stanwick and Stanwick,2000;Gozali et al.,2002;Al-Tuwaijri et al.,2004).

Empirical results for control variables that are related to the firms’ financial performance are also reported in the Table 5.The result of Models(I)and(II)shows that the coefficient for the firms’size is positively and statistically significantly associated with ROE at the one per cent levels(p-value<0.01).In other words,the climate change disclosure quality produces a favourable ROE and ROA for sample firms(Murphy,2002).The coefficient of size in Model(I)and(II)were found to be positively and significantly related to ROE at the one per cent levels(p-value).

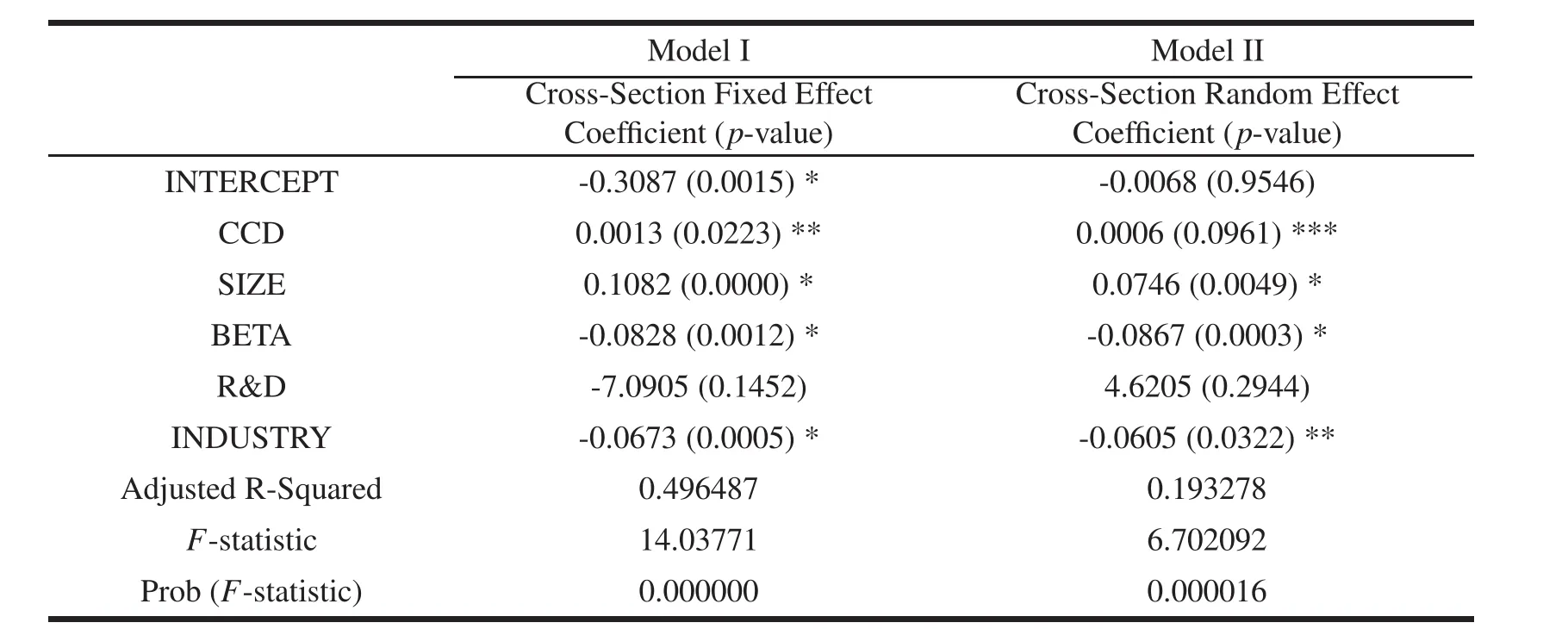

5.4 Impact of climate change disclosure on ROA

This section provides the detailed results and the analysis of the impact of climate change disclosure on ROA.Models(I)and(II)of the Table 6 depicts the results for H2.The outcomes of Model(I)and(II)in the Table 6 shows that there is no significant relationship between climate change disclosure and ROA.Contrary to the existing literature(i.e.:Hai et al.,1998;Stanwick and Stanwick,2000;Gozali et al.,2002;Al-Tuwaijri et al.,2004), findings of the study revealed that the voluntary climate change disclosure is an immaterial decision.Moreover,results of regression model rejected our null hypothesis that corporate climate change disclosure is positively related to firms ROA.

In addition,outcomes for independent variables that are related with the firms’ROA are also reported in the Table 6.The result of Model(I)and(II)shows that the coefficient for the firms’size is positively and statistically significantly associated with ROA at the one and five per cent levels(p-value<0.01 and p-value<0.05),respectively.These results indicate that larger firms have better ROA than smaller firms.Furthermore,the coefficient for beta is negatively and significantly related to ROA in Model(I)and(II)at the 10 per cent levels(p-value<0.10),which is consistent with the fact that the firms with the high financial leverage have lower ROA.Moreover,industry is also negatively and statistically significantly related to ROA in the Models I at 10 percent level(p-value<0.10).These results are consistent with the argument that firms operating in high environmental sensitive industries have lower ROA than firms operating in the low environmental sensitive industry sector.However,this paper does not find any evidence to support that sample firms’R&D affects ROA of the sample firms.

Table 6 Regression Analysis of the estimated impact of climate change disclosure on the Return on Assets(ROA).

6 Conclusion

This paper investigates the impact of the climate change disclosure on firms financial performance.The question raised was whether ROE and ROA will be affected by the voluntary environmental disclosure under the CDP.The present study has revealed mixed results for the effects of climate change disclosure on the firms’financial performance.Our results indicate that there is a significant positive relationship between the corporate climate change disclosure and Return on Equity(ROE).The study further explores that ROE will be higher for companies having higher environmental disclosure scores comparatively the companies having low environmental disclosure scores.However,no significant relationship is detected between the corporate climate change disclosures and Return on Assets(ROA).

Climate change has become a debating issue at national and international level.The corporate houses also recognised the phenomenon,resultant,they voluntarily started to disclose more on the environmental aspects in order to legitimise their operations(Gray et al.,1995;Deegan and Rankin,1996;Brown and Deegan,1998;Deegan, 2002;Campbell,2003;Chu et al.,2012)and to avoid the potential risk of information asymmetric for all investors(Easley and O’Hara,2004).Along with these lines, financial implications of the voluntary environmental disclosure are getting more public exposure and important in the value creation processes of the firms,but reporting standards are almost silent in this regard.Consequently,stakeholders need to rely on voluntary climate change disclosure on the CDP in order to better assess the environmental implications of the firms’operations(Bauer and Hann,2010;Orens et al.,2010;Chaklader and Gulati,2015).So,it is the responsibility of regulators to facilitate the provision of such information disclosure by the firms without comprising the need of various stakeholders e.g.investors.

Journal of Environmental Accounting and Management2018年3期

Journal of Environmental Accounting and Management2018年3期

- Journal of Environmental Accounting and Management的其它文章

- Estimates of the Effectiveness for Urban Energy Conservation and Carbon Abatement Policies:The Case of Beijing City,China

- The Evaluation of Forest Cultural Value Based on WTP:A Case Study in Diebu County of Gansu Province in China

- Audit Judgment Performance:The Effect of Performance Incentives,Obedience Pressures and Ethical Perceptions

- A Simulation Approach to Understanding The Effect of Mimicry on Prey’s Flourishing When Predators Decline Due to Environmental Disturbance

- Optimization of the Gram Staining Method Based on Superparamagnetic Magnetic Nanobeads

- Modeling of a Small Scale Wind Turbine for Water Pumping Process:Case Study