Audit Judgment Performance:The Effect of Performance Incentives,Obedience Pressures and Ethical Perceptions

Trinandari P.Nugrahanti,Adi Susilo Jahja

Perbanas Institute,Jl.Perbanas.Karet Kuningan,Setiabudi,Jakarta 12940,Indonesia

Keywords Performance incentives Obedience pressures Ethical perception Audit judgment

Abstract This study aims to analyze the influence of performance incentives,obedience pressures and ethical perceptions to audit judgment in auditors’professional activities.Data collection was conducted by distributing questionnaires to auditors from public accounting firms in Indonesia.The result showed that the performance incentives increase the performance of audit judgment.The obedience pressures of auditors profoundly influenced the performance of audit judgment performance of auditors whereas the ethical perception has no effect on audit judgment.This study suggests that auditors should pay attention to auditing standards and professional codes of ethics,encourage auditors to be able to overcome the pressures and behave by the professional ethical standards.Therefore audit firms should provide performance incentives.Finally,the study shows that the Institute of Public Accountants Indonesia(IAPI)is expected to always conduct continuous professional education(PPL)for the audit profession in order to implement the audit standards and professional code of ethics.

1 Introduction

Auditors should exercise professional judgment in planning and auditing financial statements according to the standards of the Professional Standard of the Public Accountant(SPAP,2014;IAASB,2014).In this matter,professional judgment in conducting an audit is very important as mentioned by SPAP(2014)audit standard in section 100.Unprofessional audit judgment can lead to a misstatement of financial audit(Arens et al.,2014;Wyatt,2014).

Auditors’professional judgment is influenced by three groups of factors namely task factors,environmental factors and personal factors(Meyer,2001;Bonner and Sprinkle,2002).The task factors consist of the composition of information,the relevance of information and the complexity of the tasks.Environmental factors consist of pressures,feedback,regulations and standards while personal factors consist of knowledge,skills,abilities,gender,culture and moral development(Bonner and Sprinkle,2002;Iskandar and Sanusi,2011;Aswathi and Pratt,1990;Baeley et al.,1998).

Professional judgment is the result of a collective assessment in all phases of audit activities which include audit planning,gathering,evaluating of audit evidence,and reporting of the audit opinion.In conducting audit judgment,auditors are required to identify the audit objective,analysis of material level,evaluate the audit risk that is related to audit planning and makes the appropriate audit opinion.The quality of judgment and decision made will determine the auditors’work quality(Watkins et al.,2004).

According to Bonner and Sprinkle(2002),and Sanusi and Iskandar(2007),performance incentive is a kind of environment variable that could affect individual efforts and audit judgment performance.Performance incentives are employees’ financial incentive in the form of bonuses,commissions as rewards for employee performance(Watkins et al.,2004).Therefore the performance incentive can be treated as an environment variable that could influence the performance of the audit judgment.Several studies are in line with the statement on incentive and effort which could determine the influence of performance incentive on the auditors’performance quality(Bonner and Spilker,2002;Aswathi and Pratt,1990;Bonner and Spilker,2002;Baeley et al.,1998).However,Libby and Lipe(1992),Aswathi and Pratt(1990)and Libby et al.(1992)showed that financial incentives have no significant effect on audit judgment.

Obedience pressure is an increasing social influence pressure on the individuals who receive a direct order from other parties(Brehm and Kassin,1990;Lord and DeZoort,2001).Previous studies(Lord and DeZoort,2001 and DeZoort and Lord,1994)stated that obedience pressure influence significantly the auditors’professionalism in making the judgment.However,several studies(Putri and Laksito,2013;Hartanto and Kusuma,2002)revealed that obedience pressure has no significant effect on audit judgment.In other researches,Tielman(2012),Praditaningrum and Januarti(2012)showed that obedience pressure has a negative and significant impact on audit judgment.Pressure from a superior or client can also exert bad influences such as loss of professionalism,loss of public confidence and social credibility.

Auditors from the public accounting firms should pay attention to ethics in performing their duties.Ethics the issue is important to convince clients and external users about the quality of the audit performed(Espinosa and Barrainkua,2016;Arifuddin,2014;Nugrahanti,2012;Sweeney and Roberts,1997).Hence,public confidence in the quality of professional services will increase as the auditing profession fosters high standards of performance and ethics(IESBA,2014;Arens et al.,2014;SPAP,2014).Recently,there are increasing numbers of studies about the influence of these factors towards audit judgment performance and also more accounting practitioners are interested in investigating individual behaviour behind audit judgement(Espinosa and Barrainkua,2016).

Based on the above explanation,the research issue is whether there are influences of performance incentives,obedience pressures and ethical perceptions toward audit judgment performance.Thus,the objectives of this study are to test empirically and analyze the influence of performance incentives,obedience pressures and ethical perceptions toward audit judgment performance.

2 Literature review and hypotheses development

2.1 Audit judgment performance

Audit judgment is an audit procedure performed by the auditor to make consideration and evaluation for the fairness of the financial statements(Bonner,1999;DeZoort et al.,1994;Hogarth,1992).An auditor is required to collect valid evidence of data and information of the corporation’s financial statements to create a relevant,reliable and independent auditor’s professional judgment(Hogarth,1992;Bonner,1999;DeZoort et al.,1994).In the audit works,the auditor’s professional judgment would determine the audit judgment(Gibbins,1984).The quality of judgment and the decision made are the reflections of the auditor’s work quality(Watkins et al.,2004).

2.2 Performance incentives

Audit firms often use performance incentives to improve the performance of auditors as a whole.The most commonly used performance incentives are financial and non financial incentives(Iskandar dan Sanusi,2012).Financial incentives can drive people to seek the skills they need to perform tasks so their future performance and consequently their compensation will be better(Sanusi and Iskandar,2007;Bonner and Sprinkle,2002).Earlier studies stated that financial incentives(for example,commission,bonuses)and non financial incentives(for example,facilities,promotions)could improve auditor performance in auditing financial statements(Aswathi and Pratt,1990;Bonner and Spilker,2002;Baeley et al.,1998;Sanusi and Iskandar,2007).Bonner and Spilker(2002)mentioned the importance of performance incentives to motivate auditors in conducting audit judgment.The incentives are based on the cost of living and the income level of the auditors(Bonner,1999).

According to Ashton et al.(2002), financial incentives could improve performance tasks and audit judgment performance as well.Similarly,Sanusi and Iskandar(2007)agree that audit judgment performance is influenced by performance incentives.The feedback information about performance and efficiency can also improve the performance of audit judgement as revealed by some studies(Earley,1990;Ashton,1990;Iskandar dan Sanusi,2012).Therefore,the following hypothesis was proposed:

H1:Performance incentives influence audit judgment.

2.3 Obedience pressures

The theory of obedience states that the individual who has power is a source of influence to others due to the existence of authority or legitimate power towards a subordinate because of the organizational hierarchy(Brehm and Kassin,1990;Lord and DeZoort,2001).Milgram(1974)has developed power obedience paradigm which stated that subordinates will experience a psychological change because of their superior’s pressure.Lord and DeZoort(2001)and DeZoort and Lord(1994)found that normal people can commit destructive actions when faced with enormous pressure from legitimate authorities.These findings are consistent with the studies conducted by Brehm and Kassin(1990),Lord and DeZoort(2001),DeZoort and Lord(1994).They stated that the greater the pressure faced by auditors,the greater the dilemma faced and ultimately judgment mistakes may occur,whether intentional or not.This finding is reinforced by those of DeZoort and Lord(1994)who saw the effects of superior pressures were costly consequences such as lawsuits,the loss of professionalism,the loss of public confidence and social credibility.

The findings above proved that the performance of auditors in conducting audit judgment is affected by the pressure of obedience.In another previous research showed that obedience pressure in the form of the superior commands and the demand of the client to deviate from the professional standard will tend to encourage auditors to violate the professional standard(Lord and DeZoort,2001;DeZoort and Lord,1994).Thus,it can be concluded that obedience pressures affect audit performance in making audit judgment.Therefore,the following hypothesis is was proposed:

H2:Obedience Pressure is influential in making audit judgment.

2.4 Ethical perceptions

Ethics as a moral teaching is not written but for a professional organization,ethics are outlined in a written code called code of ethics.Code of ethics is a system of moral principles that is established by a group of professionals(Arens et al.,2014;Wyatt,2004).The auditor’s code of ethics is made to serve as a rule of ethical conduct for professional members aimed at maintaining the reputation and trust in the community(IESBA,2014;SPAP,2014).

Indonesia Accountant Association(IAI)has a code of conduct that binds its members.In order to become a public accountant that can be trusted by the community;accounting profession practices must adhere to the ethical principles as contained in the Code of Ethics of Public Accounting Professional Indonesia(SPAP)in section 100(2014),covering(1)Responsibility of the profession,(2)Public interest,(3)Integrity,(4)Objectivity,(5)Competence,precision and precautions,(6)Confidentiality,(7)Professional Behavior and(8)Technical Standards.The results of research conducted by Sweeney and Roberts(1997);Nugrahanti(2012),Arifuddin(2014)and Espinosa and Barrainkua(2016)concluded that ethical perceptions affect the professional judgment of auditors.Thus,the following hypothesis was proposed:

H3:Ethical perceptions have an effect on the creation of an audit judgment.

3 Methods

The population in this study are the auditors who work in public accounting firms or Kantor Akuntan Publik(KAP)in Indonesia,the accounting firms from the big four and non-big four of small and medium size,or accounting firms in collaboration with foreign parties.The auditors who participated in this research are at any of the following levels of auditor partner;auditor manager,auditor supervisor or senior auditor whose responsibility is to conduct the audit.Sampling technique used was purposive sampling,whereby samples were obtained at any time on condition that the sample was suitable to specific criteria.

The type of data used in this study is the primary data and the survey method was used to collect data.A total of 178 survey questionnaires were distributed to auditors of KAP selected randomly from a list of KAP registration in the Institute of Accountants Public Indonesia.The number of completed questionnaires were 77 and 70 questionnaires were used for the analysis.

The limitations of this study are:(1)when distributing the questionnaires,it was found that many respondents were out of town on duty which limits the number of completed or returned questionnaires,(2)the external validity of this study is limited since the casein the questionnaire contains less information than the actual state of the audit environment.In an actual audit situation,richer information will influence audit judgment performance.

The measurement of audit judgment performance is conducted through the number of correct responses compared with standard criteria.The evaluation of audit judgment performance is based on the number of correct substantive and compliance tests listed.The respondents need to identify substantive tests of transactions that are likely to uncover the misstatements created in the audit case.The quality of work was appraised by the correct responses from each audit task in the questionnaire and the more correct responses given by the auditors shall be interpreted that the auditors’work would be more qualified(Bonner,1999;DeZoort et al.,1994;Gibbins,1984,Hogarth,1992;Watkins et al.,2004).

The measurement of the independent variable;performance incentive was by the number of bonuses,commissions,promotions and grant facilities that the auditors received from the employer and the level of incentives given in auditing the financial statements(Sanusi and Iskandar,2007;Bonner and Spilker,2002;Aswathi and Pratt,1990;Bailey et al.,1998;Iskandar and Sanusi,2012).

The independent variable;pressure obedience from a senior auditor,a superior or to a junior auditor,and the pressure that from the client were examined to identify deviations against predetermined standards by DeZoort and Lord(1994),Brehm and Kassin(1990),and Lord and DeZoort(2001).The obedience pressure was measured by an instrument consisting of nine-question items.The measurement scale used was a five-point Likert scale ranging from strongly disagree(5)to strongly agree(1).

The independent variable;the ethical perception was measured by the ethical principles that auditors must exhibit in auditing judgment which includes professional responsibilities,public interest,integrity,objectivity,competence,precision,prudence,con fidentiality,professional behaviour and technical standards(SPAP,2014;Sweeney and Roberts,1997;Espinosa and Barrainkua,2016;Arifuddin,2014;Nugrahanti, 2012).The pressure of obedience was measured by an instrument consisting of twenty one-question items.Respondents indicated their degree of agreement or disagreement with each statement using a five-point Likert scale.

The results were statistically analyzed using multiple regression analysis.The model is formulated as follows:

whereY is audit judgment performance,a is the value ofintercept(constant),b1-b3is the regression coefficient,X1is performance incentives,X2is pressure obedience,X3is the ethical perception,ande is an error.The significance level used is 1%or 5%or 10%(Ghozali,2013).

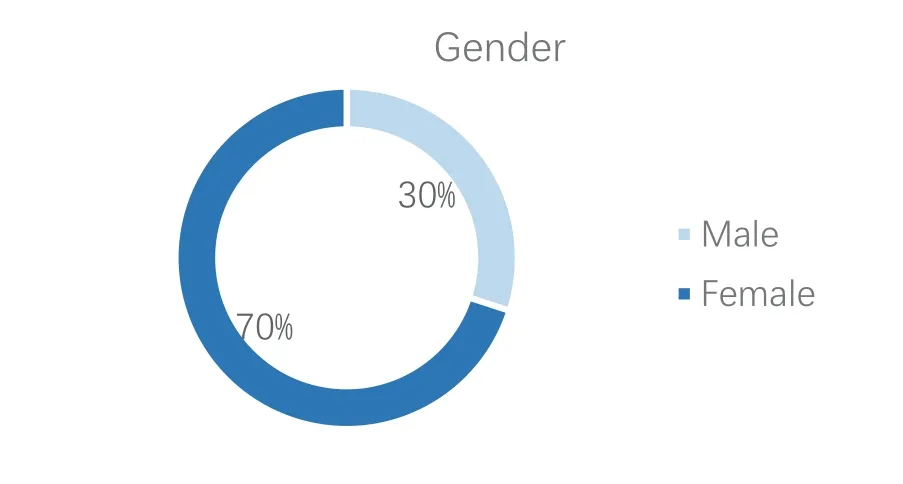

Fig.1 Gender of Respondents.

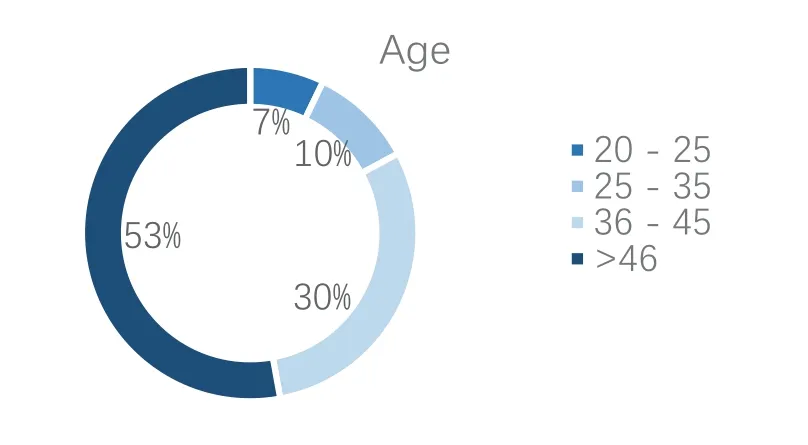

Fig.2 Age of Respondents(Years).

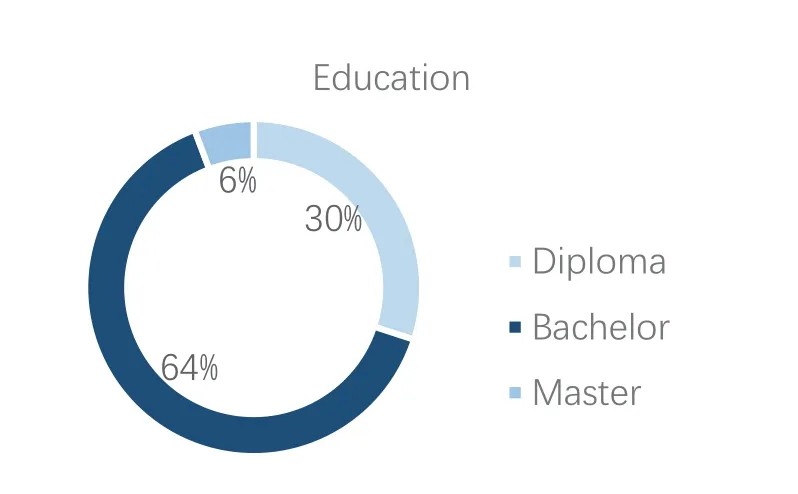

Fig.3 Tertiary Education of Respondents.

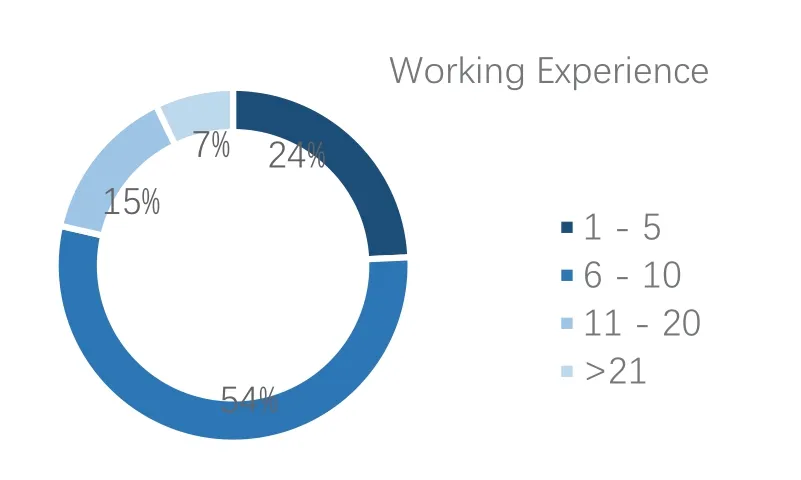

Fig.4 Period of Working Experience(Years).

Fig.5 Status of Respondents.

4 Results

4.1 Demographics of respondents

The demography of the 70 respondents consisted of 21 males(30%)and 49 females(70%)with a majority between 36 years old and 45 years old(35%).The tertiary education of 45 respondents(64%)is mostly with a bachelor degree.The longest period of working experience in audit works is between 6 to 10 years(54%)and 15 respondents(22%)are holding a position as an auditor partner.

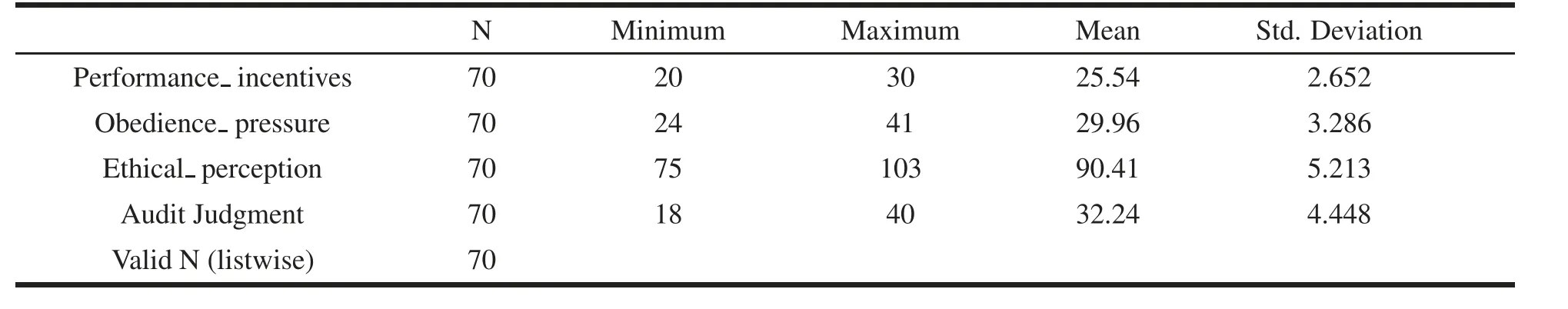

The descriptive statistics of this study in Table 1 shows that the minimum value for the performance incentive variable is 20 and the maximum is 30 with an average total of 25.54 and a standard deviation of 2.652.As to the minimum values for obedience,the pressure variable is 24 and the maximum is 41 with the average total of 29.96 and the standard deviation of 3.286.With the ethical perception variable,the minimum value is75 and the maximum is 103 with a mean total of 90.41 and standard deviation of 5.213,while the audit judgment variable minimum value is 18 and maximum 40 with an average total 32.24 and standard deviation equals to 4.448.

Table 1 Descriptive statistics.

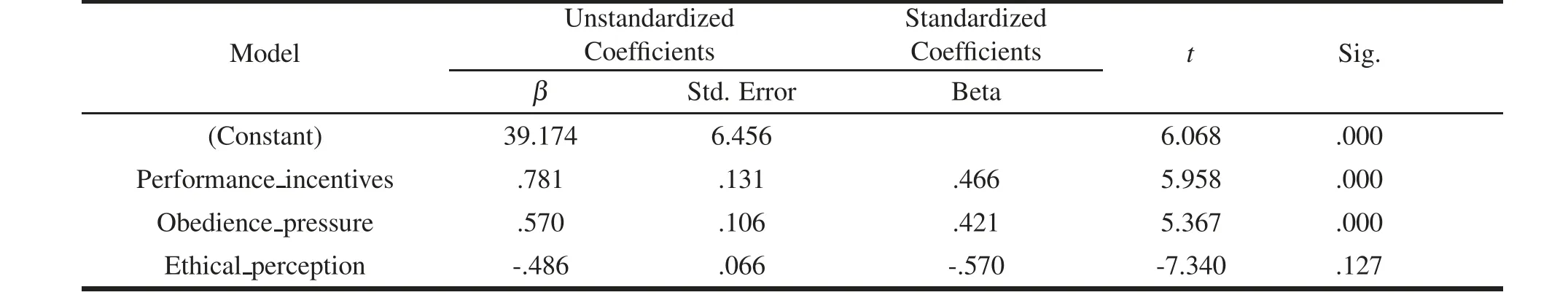

Table 2 Test Result of Multiple Linear Regression Model.

4.2 Validity and reliability test results data

All indicators used to measure all variables in this data are valid.The validity of test results for each of the variables have a correlation coefficient greater than r-table for n=70 is 0.2352,so all the indicators for these variables are valid(Ghozali,2005).Internal consistency of the items related questions to the variables in this study is indicated by Cronbach’s alpha coefficient greater than 0.7.It means that all questions from each of the variables were reliable(Ghozali,2005).

4.3 Classical test assumptions

Testing normality of data was done using the Kolmogorov test;where the value of Kolmogorov-Smirnov of 0.978 and not significant at 0.05 or above were 0.05(p=0.978 for>than 0.05).So we cannot reject H0,which means that the residuals were normally distributed.Test results multicollinearity data shows that all independent variables had tolerance values above 0.10 and VIF values were under 10.It means that the regression model is free of multicollinearity problems.Heteroscedasticity test results obtained with the scatter plot that there are points that spread the field scatter.It means that the model of regression in this model does not contain a problem of heteroscedasticity.

4.4 Hypotheses testing

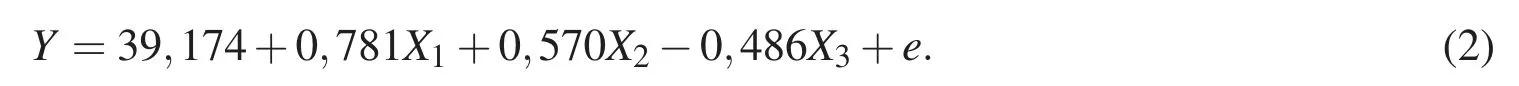

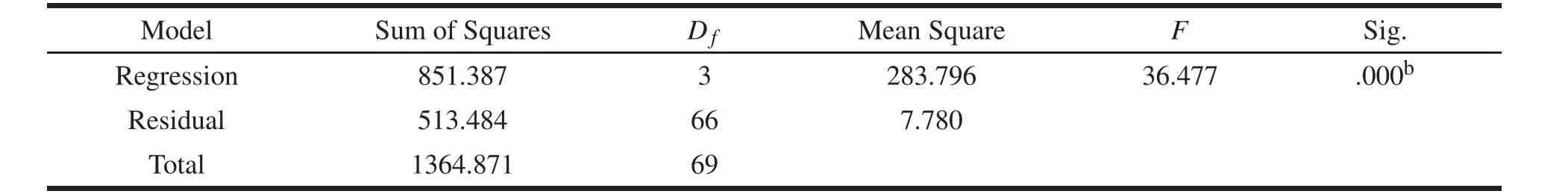

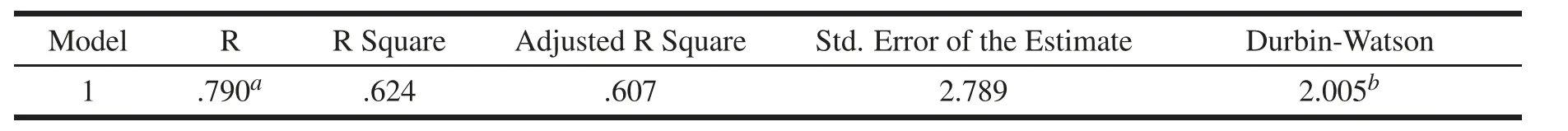

Table 2 shows the regression analysis results of performance incentives,ethical perceptions and obedience pressures on audit judgment performance.Regression equation model was based on Moderated Regression Analysis(MRA).The result of the research model is as follows:

Table 2 shows the audit judgment variable has a constant value of 39.174 with a positive result.The result means that the constant value was not affected by performance incentive,obedience pressure or ethical perception variables.The table also shows thatβ1performance incentives have a coefficient value of 0.781 with a positive sign and this means that performance incentives have a positive effect on audit judgment.In other words,any addition of performance incentives obtained by the auditors will raise the quality of audit judgment.

Table 3 Statistical test results t.

Table 4 Statistical Test Results FANOVAa.

Table 5 Coefficient of Determination(R2).

β2obedience pressure has a coefficient of 0.570 with a positive sign which means that the obedience pressures has a positive effect on audit judgment.The positive sign indicates that each addition of an obedience pressure to the auditors will further improve the quality of audit judgment.

β3ethical perception has a coefficient of 0.486 with a negative sign indicating that ethical perception has a negative effect on audit judgment and that any decrease in an ethical perception toward the auditors will further decrease the quality of audit judgment.

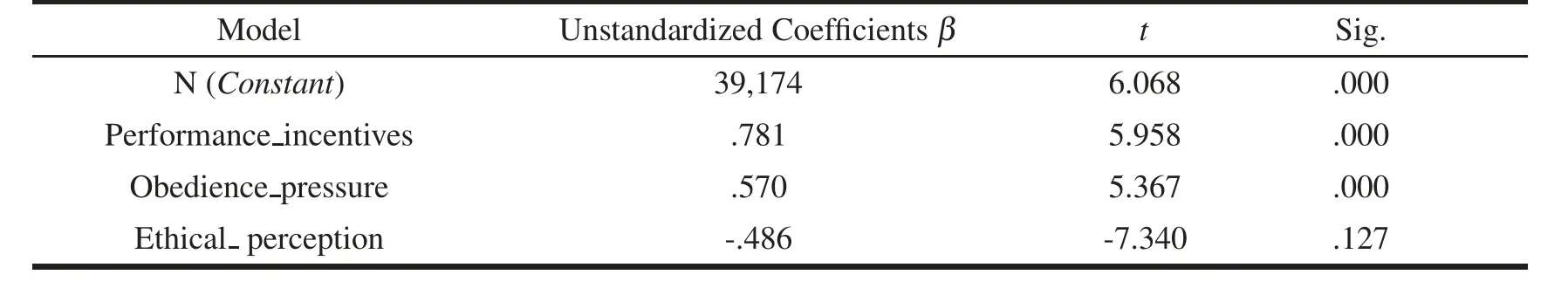

As indicated in Table 3,the criterion for t-test(partial)is if its probability(significant)=0.01 or=0.05 and or=0.1 Hais rejected and its reversal if probability(significance)>0.01,>0.05 and>0.1 then Hais accepted.

The first hypothesis(H1),referring to the t-test above shows the performance incentives(X1)variable on audit judgment performance(Y)has a significance value of 0.000 that which is smaller than 0.01(0.000<0.01)with coefficients(β)0.78.The result means Hois rejected and Hais accepted and that conclude H1is accepted.It means that performance incentives have a significant positive impact on audit performance.With this result,it is concluded that auditors who received performance incentives will be motivated to produce audit judgment performance better than auditors who do not receive performance incentives(Bonner and Sprinkle,2002;Iskandar and Sanusi,2012).

As for the second hypothesis(H2),the result of testing the influence of obedience pressures(X2)on audit judgment performance(Y)has shown a significant value of 0.000,that is smaller than 0.01(0.000<0.01)with the coefficient(β)0.570.This result indicates that Hois rejected and Hais accepted,and it can be concluded that H2is accepted which means that obedience pressure has a significant positive impact on audit judgment performance.This result means that the higher the obedience pressures faced by the auditors from both the employer and the client,the further it will improve the quality of the audit judgment performance presented by the auditor(Brehm and Kassin,1990;DeZoort and Lord,1994;Lord and DeZoort,2001).

The third hypothesis(H3)indicates the ethical perception(X3)effect on audit judgment performance(Y).The result of data processing shows the regression coefficient on ethical perception relationship and audit judgment performance is equal to-0.486 has significance value equal to 0.127 that is bigger than 0.10(0.127>0.10)with coefficient showing the direction is opposite to audit judgment performance that is ethical perception.The result indicated Hois accepted and Hais rejected.It can be concluded that H3is rejected.Ethical perception has no significant effect on the negative direction of audit judgment performance.It shows that the low ethical perceptions possessed by the auditors do not affect the audit judgment.This study revealed that ethical perceptions have no significant effect on audit judgment which is in line with previous studies(Putri and Laksito,2013;Hartanto and Kusuma,2002).

Based on Table 4,results of testing the overall model F-test obtained with the F value of 36.477 with a significance of 0.000.Thus,testing a model using the variables of performance incentives,obedience pressures and ethical perceptions can be demonstrated as significant to the audit model judgment performance.Based on Table 5,the magnitude of the influence of the three independent variables are indicated with an adjusted coefficient of determination R2value of 62.4%per cent of audit judgment performance which can be explained by the variables of performance incentives,obedience pressures and ethical perceptions as the remaining 37.6%of audit judgment performance explained by other variables not included in this model.

5 Discussions

5.1 The influence of performance incentives on the professional audit judgment

Performance incentives can increase auditors’productivity and determine the audit judgment.It indicates that the auditors who obtain financial incentives from the KAP will produce better judgments resulting in more responsible auditors carrying out their audit duties.The result is in line with studies conducted by Aswathi and Pratt(1990),Bonner and Sprinkle(2002),Sanusi and Iskandar(2007)and Baeley et al.(1998).They stated that performance incentives are a form of financial rewards of bonuses,commissions for employees’performance.Thus,performance incentive is a variable that can affect individual performance and audit judgment.

5.2 The influence of obedience pressure on the professional audit judgment

Auditors with high obedience pressures will have a high sense of responsibility in accomplishing their duties.The high sense of responsibility for the implementation of these tasks encourage the auditors to cope well with the pressures of compliance and have an effect on the quality of audit professional judgment.Consequently,auditors can make quality audit judgment.These results support the research by DeZoort and Lord(1994),Brehm and Kassin(1990)and Lord and DeZoort(2001)that the auditors under superior orders and pressures from clients who do not deviate from professional standards tend to cause junior auditors to obey the command.

5.3 The influence of ethical perceptions on the professional audit judgment

The personal factor of the auditor’s ethical perception affects the auditor’s professional judgment.High ethical perceptions would encourage an auditor to behave by ethical standards thereby increasing the professional judgment.On the contrary,the findings of this research indicated that low ethical perceptions do not influence in reducing the quality of audit professional judgment(Putri and Laksito,2013;Hartanto and Kusuma,2002).This is due to differences in the competence and professional responsibilities of the male and female auditors in interpreting and understanding the ethical perceptions about existing practices of the cultural values of the country.

Public trust in the quality of audit services will increase when the public accounting profession encourages high performance and ethical standards to all auditors so that a good ethical perception will be able to positively influence auditors’professional judgment(Bonner and Spilker,2002;Sanusi and Iskandar,2007;Aswathi and Pratt,1990;Bailey et al.,1998).

6 Conclusion

Hypothesis test results indicated that performance incentive is one of the variables that can affect individual performance and audit judgment performance.This study shows that Indonesian auditors who received performance incentives from public accounting firm(KAP)will be able to improve audit judgment performance better than auditors who do not receive incentives.Furthermore,the higher obedience pressure faced by auditors both from the pressure of the superior and the client,the further it will improve the quality of audit judgment performance.However,the ethical perception has no significant negative effect on the audit judgment performance which means that low ethical perceptions by the auditors do not result in a decrease of the quality of audit judgment in their professional activity.This study will provide the following benefits:(1)Auditors can improve their performance in carrying out audit tasks and need to pay attention to auditing standards and professional codes of ethics;(2)Public accounting firm(KAP)could improve audit quality by providing performance incentives for employee achievement,encouraging auditors to overcome the pressure and always behave in accordance with the professional ethical standards;(3)Institute of Public Accountants Indonesia(IAPI)is expected to always socialize the implementation of audit standards and apply the professional code of ethics through Continuing Professional Education(PPL).Future studies are recommended to develop research models by adding some variables,such as gender aspects,experience,knowledge,profession,responsibility,ability,independence and task complexity.

Journal of Environmental Accounting and Management2018年3期

Journal of Environmental Accounting and Management2018年3期

- Journal of Environmental Accounting and Management的其它文章

- Impact of Climate Change Disclosure on Financial Performance:An Analysis of Indian Firms

- Estimates of the Effectiveness for Urban Energy Conservation and Carbon Abatement Policies:The Case of Beijing City,China

- The Evaluation of Forest Cultural Value Based on WTP:A Case Study in Diebu County of Gansu Province in China

- A Simulation Approach to Understanding The Effect of Mimicry on Prey’s Flourishing When Predators Decline Due to Environmental Disturbance

- Optimization of the Gram Staining Method Based on Superparamagnetic Magnetic Nanobeads

- Modeling of a Small Scale Wind Turbine for Water Pumping Process:Case Study