Li Ka-shing’s Three Principles

By Wang Shuo

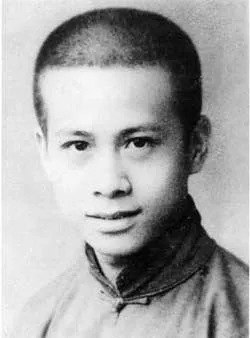

童年时代的李嘉诚Li Ka-shing in his childhood

I interviewed Li Ka-shing in 2013, when he had just begun preparing for retirement. I was recently granted another opportunity to interview him; and on the day I met him at his 70th floor office in Cheung Kong Center, the entire building was enshrouded by an ethereal cover of mist. Here I was,back at the very same place I’d interviewed him the first time,and visions of those past events and stories that happened at Victoria Harbor danced in front of my eyes.

As it turns out, his retirement went off without a hitch. As the old saying goes, “Every project has a beginning, but not many have an ending.” But for Li Ka-shing,the beginning and the ending were both equally triumphant. He made sure that every project not only made a promising start but came to a roaring conclusion. And so, he is truly deserving of the title he has been bestowed with by the adoring throngs of Hongkongers:“The Superman of Business.” And his every word and deed have never betrayed his reputation as the “most philanthropic billionaire on Hong Kong island.”

As a successful businessman, a guardian of business and a happy family man, Li Ka-shing left his flourishing business empire at the height of its power to his worthy heir, just as it was flushed with cash, had consistently exemplary performance, and had attained global reach. His distinguished life and career culminated in a climax and ended in calmness.

It was during this interview that he imparted me his three principles that had sustained him throughout his career and life.

The first is constant study. At the age of twelve, Li Ka-shing dropped out of school and had to work for a living. I once asked him, which book had impressed him most; the answer was a second-hand book he had once purchased from a street vendor,whose theme was how to treat patients with tuberculosis (TB).He got the disease from his father,and at that time there was no effective treatment for TB. Yet,using the methodology provided in the book, Li Ka-shing saved his father and himself by his own power. Since then, buying second-hand books from street vendors has become something of a curious addiction, and he has become a hardcore book lover.

“Knowledge is power.” This is the saying that he mentioned three times in the conversation.Li, a teenage boy stricken with TB who worked diurnally and read nocturnally, woke up every morning with a book lying on his chest. Then one day the secretary at the company he worked for resigned, and the manager asked the grunt workers at the bottom rung of the ladder who was good at pen-and-paper writing–Li’s name was mentioned unanimously. Li’s manager asked him whether he was familiar with the abacus, to which he replied yes. He was then asked whether he knew accounting, to which he replied in the affirmative. This resulted in him being promoted to the position of accountant, where his salary doubled.

李嘉诚三个要诀

文/王烁

2013年专访李嘉诚,那时他的退休计划刚开始执行,从长江中心70层办公室看出去,云雾缭绕。近日再度专访,退休计划完美收官,从同一位置看去,维港风物历历在目。

靡不有初,鲜克有终。李嘉诚有始有终,不负“超人”之名。多年来,人们心目中的香港首富总是非他莫属。

赚得了钱,守得住业,管得住家,李嘉诚把现金充沛、业务稳健、全球布局的商业帝国,金瓯无缺地交给下一代。达至巅峰后,他平静下山。

李嘉诚对我讲了三个要诀。

第一,始终学习。为生计,李嘉诚12岁即辍学打工,但不曾放下过书本。我问他印象最深的是哪本书,回答是儿时淘来的一本二手书,讲如何护理肺结核患者。当时肺结核并无有效疗法,父亲将此疾传染给他,他根据书中教授的方法照顾父亲并自理,幸而得愈。后来他学会用废品价格买二手书,从此手不释卷。

“知识改变命运。”李嘉诚对我讲了不下三次。

痨病少年日间打工,夜里读书,醒来发现书压在胸口。直到有一天秘书离职,老板问工友谁能代笔写信,一屋人指着李嘉诚。一试称职后,老板又问:珠算你懂不懂?回答:懂。再问:会计你懂不懂?再答:懂。于是他成了会计,工资涨了一倍。

第二,做没有天花板的事。很快,李嘉诚决定不做会计而做销售员。他认为,会计工资高但前途有限;销售员起薪低,又辛苦,但空间无限。做销售的第一年,李嘉诚业绩比第二名高出7倍。

几年后,李嘉诚决定单干。30岁之前,他已经挣够“一生所需要的钱”。

第三,多元化。在同级香港富豪中,唯有李嘉诚做到了全球布局,也就是地域多元化,业务遍布50多个国家。在香港地产价格高企的时候,多元化使李嘉诚的名义资产一度低于其他专一于香港地产的富豪,但事实证明,多元化才是屹立的基石。

多元化还有另一层含义。今天长江集团旗下资产中,50%以上已是形形色色的收租型资产,带来稳定的现金流。这些基业交给大儿子李泽钜管理。二儿子李泽楷敢想敢为,李嘉诚给他现金支持,任他放飞。而“第三个儿子”——李嘉诚基金会专注慈善,间接持有多项风险投资。在三个“儿子”之间,李嘉诚顺势做杠铃式配置:最安全资产与最冒险投资各在一头,各安其位。

(摘自《财新周刊》2018年第12期)

The second principle is choosing a career with great prospects. Later, Li decided not to be an accountant and became a salesperson instead. For what reason? He reckoned that being an accountant earned more, but that there was a glass ceiling in the profession. A salesperson may receive a lower salary, but the skills built and networking opportunities give the trade limitless potential. In the first year as a salesperson, Li Ka-shing sold seven times more than the second-place salesperson in the company. A few years later, Li again decided to start his own business. Before he was thirty he had earned “more money than he could spend in a lifetime.”

The third principle is to never put one’s eggs in one basket,meaning to diversify one’s interests. Among his wealthy cohorts, Li Ka-shing was the only one who had expanded to a global level. Li’s business empire had penetrated markets in over fifty countries and regions. At a time when Hong Kong’s real-estate prices were rising exponentially, it was diversification that made Li’s nominal wealth seem lower than those rich who focused business in Hong Kong, yet, as evidenced by the continued growth of his businesses, it was diversification that allowed Li’s enterprises to have such staying power.

Yet there was something else about diversification that has another revelation. More than fifty percent of the revenues in Cheung Kong Holdings come from rental units, which have led to consistent and stable capital inflows. These rental properties are now under the direction of Li Ka-shing’s elder son, Victor Li Tzar-kuoi, who has shown himself to be a responsible and astute businessman. As for Li Ka-shing’s second son, Richard Li Tzar-kai,his creativity and pragmatism have been greatly appreciated by his father, who decided to provide him with financial support for his own career. Finally, Li Kashing’s “third son,” namely, the Li Ka Shing Foundation, was set up solely for philanthropic causes,while indirectly holding some sources of venture capital.

In mentoring his two children and guiding his third, Li Kashing never forgot to strike a balance between diversification and specialization: putting the safest capital on one side, and the riskiest on the other side. Through smart business moves and wise management, Li Ka-shing managed to realize both durability and profitability in all his business ventures, which is precisely why he has achieved the sage-like status of the likes of Bill Gates or Warren Buffet in Hong Kong.

(From Caixin Weekly, Issue 12,2018. Translation: Gary Chen)