Credit Attitude Differ According to the Social and Demographic Characteristics of People: Findings from the British Social Attitudes Survey

(Chongqing University of Technology, Chongqing 400054, China)

【社会学】

Credit Attitude Differ According to the Social and Demographic Characteristics of People: Findings from the British Social Attitudes Survey

ZHAOYa

(Chongqing University of Technology, Chongqing 400054, China)

Consumer credit forms a major chunk of a country’s credit portfolio and is instrumental in determining the country’s economic prospects and credit worthiness to an extent. It is now more acceptable and easily accessible by the consumers.Therefore, in order to arrive at a more comprehensive understanding of credit, it is necessary to explore differences in the attitudes of different social and demographic group towards credit. This study aims to explore the differences in the attitudes of different social and demographic groups towards personal credit in terms of planning finances and spending.From the analysis, it is clear that age and gender do have a combinative influence on the people’s perception of credit while marital status, ethnicity and religion greatly depend on the extent to which the data is accurate. Moreover, the perception of an individual towards credit could depend on disposable income, household size, resident economy, availability of credit, etc.

credit attitude; social group; demographic group; British social attitudes survey

1 Introduction

Consumer credit forms a major chunk of a country’s credit portfolio and is instrumental in determining the country’s economic prospects and creditworthiness to an extent (Yavas, Bilgin, and Shemwell, 1997). Credit refers to the dealing of borrowing future assets to fund present consumption (Bryant, 1990). Most individuals in modern societies use credit to some extent (Chien and Devaney, 2001). It is now more acceptable and easily accessible by the consumers.Except for the earning from a job, people could access credit available to satisfy their demands in varieties of forms.There has been a dramatically change in the perceived usage of credit. The perception with regards to credit has changed so dramatically in the recent past that it is now perceived as ansubstitute of formal income (Bird, Hagstrom, and Wild 1997). Credit can be defined as a financial management tool which has the capability to benefit the users immensely. However, it must be used wisely. Economic investment theory emphasizes on this aspect of credit usage and suggests that proper use of this tool can help the consumers in maximizing their utilities (Fisher, 1930). However, there have been cases of extreme credit abuses and overuses both at the individual and the family levels and also at the macroeconomic levels which have worried the educators and the financial counselors tremendously.

Numerous research have indicated that the rapidly spread of credit use in recent decades is on account of people’s changing attitude towards credit (Canner and Cyrnak, 1985).The amount of credit that an individual can take up depends on people’s ability to regenerate funds to help pay off the creditor at an agreed upon time and also depends on their individual perspective on credit (Canner and Cyrnak, 1985). Therefore, in order to arrive at a more comprehensive understanding of credit, it is necessary to explore differences in the attitudes of different social and demographic group towards credit. The contribution of this study is to provide further evidence on the differences of individual perception of credit with respect to different social and demographic variables. This study aims to explore the differences in the attitudes of different social and demographic groups towards personal credit in terms of planning finances and spending.

2 Literature Review

2.1CreditAttitude,AgeandOtherDemographicCharacteristics

Various researchers in the past have studied with regards to the relation between the credit attitudes and practices with that of the demographic variables. Although these studies failed to give a consistent result,majority of the studies validated the relation of favorable attitude of credit by younger users (Bloom and Steen, 1987).Modigliani’s(1986) theory of “life-cycle hypothesis of saving” emphasizes the fact that consumers tend to make use of their life resources to maximize their utility and also to help provide for their hassle free consumption throughout their life. This leads younger consumers who have started the income cycle recently to make use of their future incomes, which are relatively higher than their current incometo finance their current consumption needs.

2.1.1AgeandGender

According to Lengnick-Hall, and Lengnick-Hall’s(1988) “family resources management model”, the demographic factors influence the credit attitude and the credit practices directly. The credit attitude and credit practice along with demographic variables plays a major role in granting ‘financial satisfaction’. Numerous studies done in the past have successfully shown the relationship between the credit attitude of the consumers and their age and gender (Bloom and Steen, 1987). It was found that younger people were more flexible in their approach of using a credit card for their expenses than their older counterparts than older group (Awh and Waters, 1974). It is broadly regarded that elder people do not have much time to cover the deficit while youth have much better condition,so that younger people have higher risk tolerances than elders.Moreover, the male consumers had a more favorable attitude towards the adoption of credit card in their credit purchases than the female consumers (Eckel and Grossman, 2002). This may results from that women tend to present more conservative behavior in comparison to their male counterparts (Hinz, McCarthy, and Turner, 1997).

2.1.2MaritalStatus

Grable’s (1997) research about demographic and individual’s risk tolerance explored that marital status is an significant influential factor in differentiating people’s financial tolerance level.Grable (1997) explained that people who have never married have less to lose when they facing financial risk in compare with people who are/were married and have more responsibility of families. Moreover, he assumed that people who are/were married might have more chance to suffer social risk. In order to avoid potential financial loss, people who are/were married tend to have more conservative financial attitude.

2.1.3RaceandReligion

Sung and Hanna (1996) studied that people’s risk attitude also differentiated by race group. Whites tend to have more favorable risk attitude than non-white. This may caused by many minority cultures be fond of accumulating assets from the past and present instead of looking for future. A study conducted by Pinto, Parente, and Mansfield (2005) showed the association between knowledge, religion and the usage behavior of credit cards. It was found that people who have certain religions tend to use cards for convenience purposes.

Generally, we hypothesized that demographic and social factors will differentiate individual’s attitude toward credit.To summarize, an individual’s perception towards credit can depend on a wide array of factors such as age, gender, marital status, ethnicity, religion etc.In view of the existing theories and research, we hypothesized that:

H0 Credit attitude differ according to the social and demographic characteristics of people

H1 Younger people have more favorable attitudes toward credit than older people.

H2 Male has more favorable attitudes toward credit than female.

H3 People who have never married tend to be more favorable towards credit.

H4 Whites have more favorable credit attitude than non-white

H5 People who have non-religion tends to have more favorable credit attitude.

3 Methodology

3.1Design

The present research employed a cross-sectional design involving analyses of secondary data from the British Social Attitudes Survey 2007, which was sponsored by Gatsby Charitable Foundation and conducted by the National Center for Social Research. The survey has been conducted every year since 1983. It gathers information covering: attitudes to health, social welfare, transport, constitution and devolution, education, respect and emotional support. The 2007 BSA was conducted by face-to-face interview and self-completion questionnaires from June 2007 to November 2007. The independent variables of this research were age, gender, marital status, raceand religion, and the dependent variable wereCREDPLAN “credit makes it easier to plan finances” and CREDSPND “credit encourages people to spend too much”.

3.2Participants

The data used in this study is acquired from the UK Data Archives and based upon data obtained from the British Social Attitudes Survey 2007. The surveywas administered among 4124 multistage stratified randomly selected respondents, 2518 of whom answered questions relating to the study variables. Among the respondents, 1996 (48.4%) are male, 2128 (51.6%) are male. And all of these respondents are 18 years old or over.

3.3DependentVariables

In this research, credit attitude was measured by two dependent variables that refer to two specific attitudes: credit planning and credit spending. The reason why to choose these two variables is because they can comprehensively represent the both aspects of credit attitude. The attitude tocredit planning was measured in the 2007 BSA by asking respondents whether “Credit makes it easier to plan finances?” There were five possible responses: (1) agree strongly, (2) agree, (3) neither agree nor disagree, (4) disagree, (5) disagree strongly. People who responded “agree strongly” and “agree” were recoded as having a favorable attitude toward credit, and people who chose “neither agree nor disagree” were recoded as having a neutral attitude, and people who responded “disagree” and “disagree strongly” were recoded as having an unfavorable attitude. The attitude to credit spending was measured by asking respondents whether “credit encourages people to spend too much?” There were five possible responses as well: (1) agree strongly, (2) agree, (3) neither agree nor disagree, (4) disagree, (5) disagree strongly. People who answered “agree strongly” and “agree” were recoded as having an unfavorable attitude toward credit, people who chose “neither agree nor disagree” were recoded as having a neutral attitude, and people who chose “disagree” and “disagree strongly” were recoded as having afavorableattitude. Thus, general attitudes toward credit have been recoded into three categories: favorable attitude, neutral attitude, and unfavorable attitude.

Table 1 Recoding of Independent Variables

3.3.1Age

The original measure of age variable in this survey is continuous, but we recoded the variable into two categories in order to clearly reveal the age difference towards credit attitude. Through observing the frequency of the age variable, we found that the median is 46 years old. According to this, respondents have been divided into two groups, the first group is “young” group which is from 18 years old to 46 years old, the second group is “old” group which is 47 and above. Therefore, respondents are factitiously defined as either young or old. 50.8% of the respondents who answered credit-planning question are in the younger group, 49.2 were in the older group. 50%of the respondents who answered credit-spending question are in the younger group that is equal to the percentage in the older group.

3.3.2Gender

There were 1 216 (48.3%) male individuals answered the credit-planning question,1 304 (51.7%) were female. In terms of people who answered the credit-spending question, 1 222 (47.7%) are male, 1 345 (52,3) were female.

3.3.3Maritalstatus

The original categories of marital status were “married/living as married”, “separate/divorced”, “widowed”, “never married”.According to Grable’s (1997) research, we recode the marital status into two categories “married” and “never married” so as to better observe their different attitude. 2005 (79.6%) of the respondents who answered the credit-planning question are/were married, 214 (20.4%) are never married. 2037 (79.5%) of the respondents who answered the credit-spending question are/were married, 214 (20.5%) are never married.

3.3.4Race

The original breakdown of race was as follows: “blacks of African origin”, “black of Caribbean origin”, “black other origin”, “Asian of Indian origin”, “Asian of Pakistani origin”, “Asian of Bangladeshi origin”, “Asian of Chinese origin”, “Asian of other origin”,“whites of any European origin”, and “white of other origin”, and “mixed origin”. However, in order to explore the different attitudes toward credit between white and non-white people, we recoded the race variable into two categories “white” and “non-white”. 2277 of the Whites answered the planning question in compare with 239 of non-Whites. 2318 white people answered the spending question in compare with 243 non-white.

3.3.5Religion

The summarized categories of religion is as follows:“Church of England/Anglican”, “Roman Catholic”,“other Christian”, “non-Christian, and no religion”.The numbers and percentages of different religion with regard to credit planning and credit-spending are show on the Table 2.

4 Findings

Statistical analyses were conducted by SPSS software. Descriptive statistics were used to analyze the data collected. To explore possible differences in attitude towards credit among these independent variables like age, gender, marital status, race, and religion. Two-way and three-way cross tabulation and Pearson’s Chi-square Test are used to identify the relationshipsof different independent variables on their credit attitude. Chi-Square Test was employed to check the statistical significance among the variables.

1) Descriptive Statistics

Specifically, two-way and three-way cross-tab analysis is performed on the statistical tool IBM SPSS to quantify the effect of the chosen demographic characteristics on respondents’ perception towards credit.

2) Two and Three Way Cross-Tabs and Chi-Square Analysis

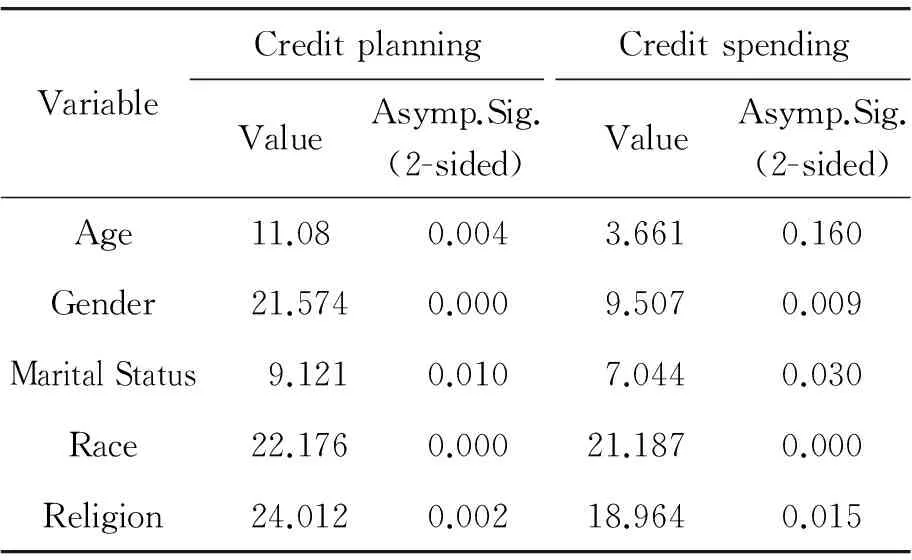

On the first question that credit makes it easier to plan finances, 32.2% or 811 respondents have favorable attitude while 43.7% or 1101 respondents have unfavorable attitude. Upon examining the two-way cross-tab analysis, the chi-square test proved to be valid and the data suggested that there could be a significant relationship between age and attitude towards credit (p=0.004<0.01), with younger people are more likely to agreecredit makes it easier to plan finances (have favorable attitude towards credit).

Table 2 Frequencies and percentages of demographic variables

As for the gender, the chi-square test turned out to be valid and suggested strong correlation between gender and attitude towards creditplanning(p<0.01). However, the cross-tabs data is not entirely indicative of a clear association with the gender with the exception that the difference in the male and female response percentage value is almost 8% tending toward males in the case of those that agree that credit makes it easier to plan finances. Making age the control variable, a three-way cross-tab analysis was performed. The associated chi-square test shows that young respondents’ inputs are not significant enough but those of the old respondents are significant, for credit planningp=0.000<0.01. Specifically, old male respondents are 1.43 times more likely to agree with the argument than the old female respondents, old female are more likely to have a unfavorable attitude.

With respect to marital status, two-way cross-tab analysis shows that there is a statistically significant relationship between marital status and credit planning. In terms of three-way cross-tab, controlling age variable, the chi-square tests are valid but the data suggests that the old respondents’ inputs are insignificant (p=0.154>0.05) while those of young respondents are significant. Specifically, young respondents that were never married are 1.18 times more likely to agree with the argument than the young married respondents.

Table 3 Chi-Square Test Results (Two-Way)

With respect to race, the chi-square test revealed that there is a statistically significant relationship between race and credit attitude (p<0.01), with white people are more like to have unfavorable attitude towards credit than non-white people.If we control the age variable, for credit planning, the associated chi-square test shows that older respondents’ inputs are not significant enough but those of the younger respondents are significant (p<0.01). White young respondents are more likely to have unfavorable attitude, and non-white young tend to have more favorable attitude.

Table 4 Chi-Square Test Results (Three-way)

With respect to religion, the chi-square test was valid and suggested that the young respondents’ inputs are insignificant (p=0.100>0.05) while those of the old respondents are not (p=0.028<0.05). Specifically, old respondents from the Roman Catholic origin are the least likely to agree with the argument, white non-Christian respondents are the most likely by a factor of 2.53 times more than the former respondent group.

However, for the second question that credit encourages people spend too much, 89.8% of these respondents agree (unfavorable attitude), and only 3.6% disagree (favorable attitude). Upon examining the two-way cross-tabs analysis, there is no significant relationship between age and credit spending (p=0.16>0.05). As for the gender, the chi-square test turned out to be valid and suggested strong relationship between gender and credit (p=0.009<0.01). Male respondents tend to have more favorable attitude. Making age the control variable, a three-way cross-tab analysis was performed. The associated chi-square test shows that young respondents’ inputs are not significant enough (p=0.216 > 0.05) but those of the old respondents are significant (p=0.08<0.01). Specifically, old male respondents are 1.9 times more likely to agree with the argument than the old female respondents. Old female respondents tend to have more unfavorable credit attitude.

With respect to marital status, according to the two-way chi-square test, there is a between marital status and credit spending attitude, but the relationship is not statistically significant.Inthe three-way cross-tab analysis, we control age variable, there is no relationship the old respondents and the data suggests that the young respondents’ inputs are insignificant (p=0.068>0.05). With respect to race, the chi-square test revealed that there is a statistically significant relationship between race and attitude towards credit spending. White respondents are the more likely to agree with this argument, which implied that white tend to have more unfavorable attitude. In the three-way cross-tab test, we control age and found that there was more older white people tend to have more unfavorable attitude. In terms of religion, the two-way cross-tab shows that there are statistically significant relationships between religion and credit spending attitude. In the three-way cross-tab test, we found that older people who have certain religion but not Christian have more favorable attitude.

5 Conclusions

The aim of this study is to analyze the differences in the attitudes of various demographic and social groups towards credit, particularly to determine if older people have a more negative attitude and if other demographic variables such as ethnicity, religion and marital status influence this relation. From the analysis, it is clear that age cannot be a stand alone factor to influence perception towards credit. However, in combination with factors such as gender and marital status, it does become a relevant factor particularly in the case of older males and it is clear that the conservative attitude of older people is seen. As younger respondent inputs proved insignificant from a data perspective, older males agreed to the fact the credit helps plan finance better than older females. Ethnicity data suggested issues as the chi-square test output proved invalid while older non-Christian respondents agreed with older males. Moreover, the question whether credit encourages too much spending earned favorable responses from majority older males while variables such as marital status, ethnicity and religion were either insignificant or irrelevant due to invalid chi-square test output. This clearly demonstrates the conservative attitude of older people and their perception towards credit.

Therefore, it can be concluded that age and gender do have a combinative influence on the people’s perception of credit while marital status, ethnicity and religion greatly depend on the extent to which the data is accurate. Moreover, the perception of an individual towards credit could depend on disposable income, household size, resident economy, availability of credit etc. A comprehensive study including these variables with a widened scope of research could give a better idea of the perception of credit from a social and demographic perspective. In terms of widening the scope, aspects such as investment preferences could be chosen.

[1] AWH R Y,WATER D.A Discriminant Analysis Of Economic, Demographic, And Attitudinal Characteristics Of Bank Charge-Card Holders:A Case Study[J].The Journal of Finance,1974,29(3):973-980.

[2] BLOOM D E, STEEN T P.The labor force implications of expanding the child care industry[J].Population Research and Policy Review, 1990,9(1):25-44.

[3] BIRD E J, HAGSTROM P A, WILD R.Credit cards and the poor[M].Madison:Institute for Research on Poverty, University of Wisconsin-Madison, 1997.

[4] BRYANT W K.The Economic Organization of the Household[M].Cambridge:Cambridge University Press, 1990.

[5] CANNER G B, CYRNAK A W.Recent development in credit card holding and use patterns among USA families[J].Journal of Retail Banking,1985, 7(3):63-74.

[6] CHIEN Y.W, DEVANEY S A.The effects of credit attitude and socioeconomic factors on credit card and installment debt[J].Journal of Consumer Affairs, 2001,35(1):162-179.

[7] ECKEL C C, GROSSMAN P J.Sex differences and statistical stereotyping in attitudes toward financial risk[J].Evolution and Human Behavior,2002,23(4):281-295.

[8] FISHER I.The theory of interest[M].New York:Macmillan,1930.

[9] GRABLE J E.Financial risk tolerance and additional factors that affect risk taking in everyday money matters[J].Journal of Business and Psychology,2000,14(4):625-630.

[10]HINZ R P, McCARTHY D D, TURNER J A.Are women conservative investors? Gender differences in participant-directed pension investments[J].Positioning pensions for the twenty-first century, 1997,91:103.

[11]LENGNICK-HALL C A, LENGNICK-HALL M L.Strategic human resources management:A review of the literature and a proposed typology[J].Academy of management Review, 1988, 13(3):454-470.

[12]MODIGLIANI F.Life cycle, individual thrift, and the wealth of nations[J].The American Economic Review, 1986:297-313.

[13]SUNG J, HANNA S.Factors related to risk tolerance[J].Financial Counseling and Planning, 1996,7(1):11-20.

[14]PINTO M B, PARENTE D H, MANSFIELD P M.Information learned from socialization agents:Its relationship to credit card use[J].Family and Consumer Sciences Research Journal,2005,33(4):357-367.

[15]YAVAS U, BILGIN Z, SHEMWELL D J.Service quality in the banking sector in an emerging economy:a consumer survey[J].International Journal of Bank Marketing, 1997,15(6):217-223.

(责任编辑杨梅梅)

不同人口群体、社会群体对贷款在财务规划和消费方面的态度差异性研究——基于英国社会态度调查数据的分析

赵 雅

(重庆理工大学,重庆 400054)

赵雅(1990—),女,硕士,获英国谢菲尔德大学东亚商务研究硕士,获英国布里斯托大学国际关系硕士,研究方向:酒店管理,旅游管理, 国际商务,国际关系(东亚研究)等。

G91

A

1007-7111(2016)12-0175-06

消费贷款是一个国家的信贷投资体系中的重要组成部分,从根本上决定了该国的经济前景和信誉程度,在当今的社会中使用信贷方式已经被广泛接受。因此,研究不同社会群体对个人消费信贷在财务规划和消费方面的态度的差异性,对于研究学者和金融行业来说都具有重要意义。本文从不同社会群体和人口群体视角,分析了不同年龄、种族、宗教、婚姻状况,对于贷款在财务规划和消费方面所呈现出的态度差异,以及各个因素独立和综合的影响程度。从社会和人口的角度扩大了研究范围,包括对这些变量综合的研究,试图可以给出一个更好的结论。研究表明:年龄不能作为一个独立的因素去影响信贷的态度,但是,年龄和性别的综合因素对个人信贷的态度有较大影响,可以观察出老年人对信贷具有明显的保守态度;而婚姻状况、种族和宗教很大程度上取决于数据的准确性。因此,对于信贷的态度也取决于个人可支配收入、家庭规模、居民经济、信贷获得的便捷性等因素。

个人消费信贷;社会群体;人口群体;态度差异性

10.13769/j.cnki.cn50-1011/d.2016.12.056

format:ZHAO Ya.Credit Attitude Differ According to the Social and Demographic Characteristics of People: Findings From the British Social Attitudes Survey[J].The World and Chongqing, 2016(12):175-180.