Disclosure of government financial information and thecostoflocalgovernment'sdebtfinancing—Empirical evidence from provincial investment bonds for urban construction☆

Zhiin Chen,Jun Pn,Lingling Wng,*,Xiofeng Shen

aSchool of Economics&Management,Southeast University,China

bSchool of Finance&Economics,Jiangsu University,China

Disclosure of government financial information and thecostoflocalgovernment'sdebtfinancing—Empirical evidence from provincial investment bonds for urban construction☆

Zhibin Chena,Jun Panb,*,Liangliang Wanga,*,Xiaofeng Shenb

aSchool of Economics&Management,Southeast University,China

bSchool of Finance&Economics,Jiangsu University,China

A R T I C L EI N F O

Article history:

Accepted 17 February 2016

Available online 5 April 2016

Local government debt

Cost of debt financing

Government financial

information disclosure

Government intervention

Government audit

China's slowing economic growth and rapid urbanization have made local government debt financing a significant issue.This study uses a sample of China's provincial government data for the 2006-2012 period to examine the effect of the disclosure of financial information by local governments on their debt financing costs.The results show that financial information disclosure is conducive to public supervision and enhances government credibility,leading to a decrease in the cost of debt financing.Furthermore,increased government economic intervention increases the strength of the association between financial information disclosure and the cost of debt financing.Increased government audit prevention function weakens the strength of the association between financial information disclosure and the cost of debt financing.

©2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

In recent years,local government debt has increased.Deputy finance minister Wang Baoan says:‘‘The contradiction between tardiness of financial growth of revenue and strong rigidity of expenditure will further intensify the pressure on local government debt.”A 2013 report by the national government's Audit Department states that the government's direct liability for repayment of debt increased by 62.44%between 2010 and June 2013.As the expansion of debt is often accompanied by an increase in financial risk,the Third Plenary Session of the 18th session of the Central Committee of the Communist Party of China has announced that the relevant departments should establish a reasonable early warning mechanism to control government debt risk and to enhance management.For example,The State Council on Strengthening the Opinions of the Local Government Debt Management was issued by the State Council in 2014.However,a government without debt financing is not a government with no risk.Debt risk,to a large extent,is related to the ability to pay off debt(Liu,2014),and blindness about debt financing combined with ignorance about the lending rate leads to huge risks for governments(Luo and She,2014).

Previous studies of the cost of debt focus on corporate debt,financing scale and risk factors,such as accounting information and debt contracts(Sun et al.,2006;Lu et al.,2008;Deng,2014),information disclosure and debt financing(Hu and Tang,2007;Lu et al.,2013),control of local government debt scale(Azuma and Kurihara,2011),municipal bonds and local government debt risk(Mikesell,2002;Liu and Zhao,2005;Han et al.,2005),government performance and cost of financing(Wilson and Howard,1984).These previous studies,especially those examining financial disclosure,suggest that the cost of debt financing is less for local governments.Therefore,this study uses a sample of urban construction investment bonds1These instruments originated in the Shanghai Pudong construction bonds at the beginning of 1992 and have developed relatively slowly.However,the 2008 financial crisis and the‘‘four trillion plan”launched by the government stimulated their development.Due to concerns about the out of control local financing behavior,since 2013,the Chinese government has begun macro control of bonds.As document No.43[2014]indicates:‘‘local government debt is facing full clear screening,issuing bonds is the only way to raise funds for provincial governments.”issued at the provincial level to explore how financial information transparency affects the cost of local government debt financing.The results show that a high degree of government financial information disclosure is associated with a low cost of local government debt financing.A higher government intervention index and more effective government auditing are also associated with a lower cost of local government debt financing,although these factors also weaken the negative relationship between local government financial information disclosure and government debt financing costs.

The rest of this paper is organized as follows.The second section discusses the institutional background. The third section presents the theoretical analysis and research hypotheses,and the fourth section presents the research design.The fifth section presents the empirical testing and results.The final section discusses the results and presents the conclusions.

2.Institutional background

Since its 1993 reforms of its fiscal and taxation system policy,the Chinese government has allocated more capital to regional infrastructure construction.However,these reforms have caused some problems at the local level,such as the mismatch of government fiscal power and responsibility,leading to a lack of financial resources.To meet the demands of economic development and political competition,local governments have financed their regional investment and financing platforms2According to the 1994 regulations,‘‘The local government shall not issue bonds.”(Mei,2011)through bank loans and by issuing Quasi-municipal bonds(also called urban construction investment bonds,hereinafter referred to as‘‘UCID”).3The local government debt financing may also include forms of trust-financing,finance-leasing and BT-financing,but they are adopted at a very low rate,due to the relatively high cost of financing.Originally,the central government allowed the Shanghai government to issue bonds to raise money for urban construction in the new Pudong area.In 2005,with the support of state policy,the use of UCIDs spread rapidly.In 2008,in response to the global subprime mortgage crisis,the central government implemented the‘‘four trillion plan”to stimulate economic growth,and this provided further opportunities for the development of UCIDs.The issuers of UCIDs are regional investment and financing platforms established by local governments and the aim is to raise money.The buyers are mainly institutional investors,and the money is used to make loan payments,pay for infrastructure construction and provide day-to-dayworking capital.This debt financing source is local fiscal revenues,sales revenue from land leasing and other assets.From the perspective of credit risk and credit promotion measures,these platforms always use accounts receivable,the right of land use or third party professional guarantee agencies as pledges or insurance.

The amount of debt accumulated by local governments in China is constantly increasing,and this has attracted the attention of regulators.In 2010,a number of bad credit events,such as the Sichuan expressway event,Yunnan province energy investment group restructuring,and Shanghai Shenhong,led to a drop in the number of UCIDs issued.Subsequently,the government has begun to standardize the management of financing behavior(i.e.,Guidelines strengthening regulatory risk of local government financing platform loans in 2012 issued by the‘‘China Banking Regulatory Commission”[CBRC]),which has caused a bank credit squeeze.4According to statistics,the proportion of government debt balance accounted for by bank loans decreased from 79%at the end of 2010 to 56.5%in June,2013.Therefore,local government debt capital is now largely financed without bank loans.Given the capital requirements of managing debt and funding projects under construction,UCIDs are important financing channels and the main source of borrowing to both repay existing debt and create new debt.The state council's 2014 Opinion on strengthening the administration of local government debt states that the practice of local governments issuing government bonds and encouraging social capital to participate in public urban infrastructure projects has certain benefits for business investment and operations.It is likely that UCIDs will continue to be used,but the traditional UCIDs will be extended by changes such as a PPP subject for public offering items.According to Wind,the debt-cash of local governments in 2015 is mainly from sales revenue of land leases by local investment and financing platforms,local government fund and bonds replacement,bank loans,trust funds and other financing channels.Therefore,the timely and full disclose of information about funding sources and capital investment plans helps investors to evaluate UCIDs.As the rating of government bonds and interest rates is not only determined by accounting numbers,but also by factors such as the legal environment and information disclosure Wescott(1984),this study discusses the relationship between government financial information disclosure and debt financing costs.

3.Theoretical analysis and research hypotheses

3.1.Government financial information disclosure and the cost of debt financing

Information asymmetry theory(Akerlof,1970)considers the problem of a‘‘lemon market.”Information asymmetry between the public and government creates a strong desire for access to information(Chang,2008).Even internal stakeholders in the government have a strong need for information,which may be greater even than that of external stakeholders(Zhang et al.,2009;Lu,2010).Disclosing government financial information may help the public to understand how public resources are used,reduce the asymmetrical distribution of information,increase social support(Zhang and Zhang,2012)and promote the public fiduciary responsibilities of governments(Chen and Li,2003;Huang et al.,2004).It is well-known that government financial transparency is the key to good financial management;it helps in the supervision and evaluation of government work,improves the operational efficiency of governments and reduces the corruption of government officials(Xiao and Yan,2013;Zhou,2010).Providing the public with accurate government financial information is an essential part of public supervision;it enhances a government's credibility,is a cornerstone of successful government transformation and is a necessary step in the creation of a responsible and serviceoriented government.

Government financial information disclosure allows the general public and stakeholders to understand a government's macro policy and dynamic guidelines,to evaluate the government's resource allocation and to supervise government behavior.More specifically,government financial transparency helps public investors accurately assess government performance and enhances their investment confidence.As a result,investors make better investment decisions and this improves the efficiency of investment.Furthermore,by reducing information asymmetry between the public and the local government,transparency improves a government's image and credibility,which increases investors'trust and thus the government's ability to attract externaldebt and outside investment.When a government is facing debt financing,financial transparency sends positive signals to outside investors.This kind of reputation mechanism facilitates social relations and reduces the perceived risk of breach of contract,which influences financing pricing.As disclosure of government financial information increases the credibility of a government,it reduces the amount of financing revenues that investors require,i.e.,the cost of government debt financing will be lower.Based on the above analysis,this study makes the following hypothesis.

H1.A higher level of government financial information disclosure is associated with a lower cost of local government debt financing.

3.2.Government financial information disclosure,government interference and the cost of debt financing

The structure and period of state debt financing are mainly affected by three factors:the legal system,marketization and government intervention(Demirguc-Kunt and Maksimovic,1999;Giannetti,2003).The government intervention index(a subindex of GDI)is a variable for measuring the degree of government intervention in the market.A high score represents a stronger marketization process and less government intervention(Fan and Wang,2001;Xia and Chen,2007).A low score on the index of government intervention indicates that a company's debt financing period will be longer,and that the debt financing cost will be higher(Sun et al.,2005).Although the fiscal decentralization that occurred between 1950 and 1960 mobilized local governments'participation in economic development,the imbalance between its financial rights and responsibilities aggravates local financial distress and forces local governments to interfere in the market,for example,by influencing financial institutions'credit decisions.This in turn affects local government debt financing. This has been called the‘‘vassal economy”phenomenon(Shen and Dai,1990),‘‘tournament of promotion”behavior(Zhou,2004)and‘‘forced marriage”phenomenon(Xiang,2012).

When a region has a low government intervention index score,the local government has strong control over the financial market and local enterprises and implicitly guarantees listed companies;this compels local stateowned banks to engage in differential loans(Jiang and Li,2006).Due to risk control indicators,state-owned banks tend to have more restrictive conditions when considering giving loans to non-state enterprises;thus,the action is not conducive to the overall reduction of funding cost.However,when there is a high degree of government financial information disclosure,it is easier to break the local government administrative interference phenomenon.As a kind of reputation mechanism,it reduces the cost of local debt financing.When the government intervention index score is high,the level of marketization and rule of law are improved(Zhao,2013),and this effectively reduces or even puts an end to government administrative personnel abusing their power over financial institutions,enterprises,institutions and investors.It also reduces the cost of communication between financial institutions and government officials and improves the efficiency of investment,thus reducing the cost of financing by local governments'investment and financing platforms.In this scenario,government intervention may cause a substitution effect on financial information disclosure,so that the incremental contribution of information disclosure to lower costs will decrease.Based on the above analysis,this study makes the following hypothesis:

H2.Government intervention lowers local governments'debt financing costs and weakens the cost-reduction effect of financial information disclosure on debt financing.

3.3.Government financial information disclosure,government audits and the cost of debt financing

Government audits are an important part of the national governance mechanism of supervision;they promote fiduciary responsibility,and play an‘‘immune system”function(Liu,2012;Liu et al.,2014).Fiscal transparency is part of a local government's economic responsibility,underpins the prevention,reveals and resists functions of government audits.The basic function of auditing is to discover and correct any potential hazards in an enterprise's economic activities.An audit is a kind of external supervision mechanism that can effectively reduce information asymmetry between principals and agents by monitoring the disclosure of information by all kinds of organizations.A strong government audit increases the possibility that a localgovernment has carried out adjustments identified in the audit,and this increases fiscal transparency Li and Liu(2014).Thus,effective audits increase the reliability of accounting information,improve the operational efficiency of a government,protect financial funds and reduce risk(Cai et al.,2009;Wei et al.,2010).The government of a region with greater marketization triggered by a government audit may have a lower debt financing cost(Tang et al.,2012),and a higher quality of audit is favorable for the formation of a good municipal bond market.

A government audit is a reputation mechanism that maintains the safety of financial capital and increases government accountability.Government audits examine financial revenues and expenditures and can improve the authenticity and reliability of government financial information.Therefore,a government audit can reduce the debt risk of local government and effectively reduce the cost of financing.When the government audit mechanism is not sound,the financial information disclosure system is more likely to find weaknesses in the debt financing of local government.The financial information disclosure system is an alternative to the government audit that can effectively prevent debt risk,and thus reduce the cost of debt financing.However,as government audits serve a prevention function,their presence can weaken the governance effect and reputation mechanism of local government financial information disclosure.The more effectively the government audit reduces the cost of debt financing,the higher its substitution effect on financial information disclosure;thus,effective audits weaken the effect of information disclosure on the cost of financing.Based on the above analysis,this study makes the following hypothesis.

H3.Effective government audits lower local governments'debt financing costs and weaken the ability of local government financial information disclosure to lower debt financing costs.

4.Research design

4.1.Sample selection and data sources

This study uses a sample of provincial governments(including provinces,autonomous regions and municipalities directly under the central government)during the 2006-2012 period.The Tibet autonomous region is excluded because of missing debt data.The UCID debt-related data are from the Wind database.The fiscal transparency data are from the Fiscal transparency in China report(2013)by the Finance and Public Policy Research Center of Shanghai University.According to the editor's introduction,the data for 2011 are related to the data from 2010,so this study uses the 2011 data for 2010 and 2012.The government intervention data are from a 2011 report China's marketization index—regional relative progress of marketization by Fan Gang,Wang Xiaolu and Zhu Hengpeng.The data from 2010 are approximated with data from 2009.The government audit data are from the Chinese audit yearbook(2014).The remaining data are from the CSMAR regional economic database.

4.2.Variable definitions and model specification

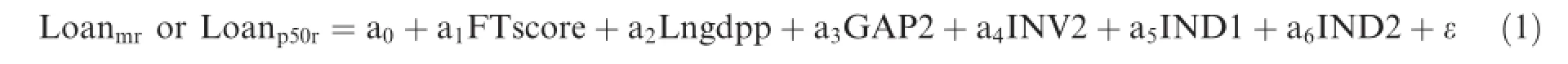

Building on previous research,this study uses the following regression model:

If a1is significantly negative,H1 is supported,which suggests that government financial information disclosure has a negative effect on debt financing cost.

In models(2)and(3),the coefficients of interest are a1and a3.If a1is significantly negative and a3is significantly positive,it suggests that a higher government intervention index score or a more effective government audit prevention function reduces the effect of government financial information disclosure on the cost of local government debt financing,i.e.,H2 and H3 are supported.

In these models,the dependent variable is local government debt financing cost.Each year,many provincial cities issue UCIDs at different interest rates.Therefore,this study uses the mean interest rate(Loan_mr)of all of the UCIDs issued in a year by all provincial governments as a proxy for local government debt financing cost.Given the skewness and kurtosis of bond rates,the median value of all of the debt interest rate values(Loan_p50r)issued by each province is taken as a proxy variable for local government debt financing cost. The explanatory variables are government financial information disclosure(FTscorew),government intervention(GDI)and government audit(ATPre).The study uses the fiscal transparency scores for each province in China,calculated by the Shanghai University of Finance and Economics,as proxy variables for the degree of government financial information disclosure.The government and market index(GDI)is used as a proxy variable for the degree of government intervention in different regions.The government prevention index is represented by the ATPre index.The remaining variables are control variables.All of the variables are winsorized at the 5%and 95%levels.

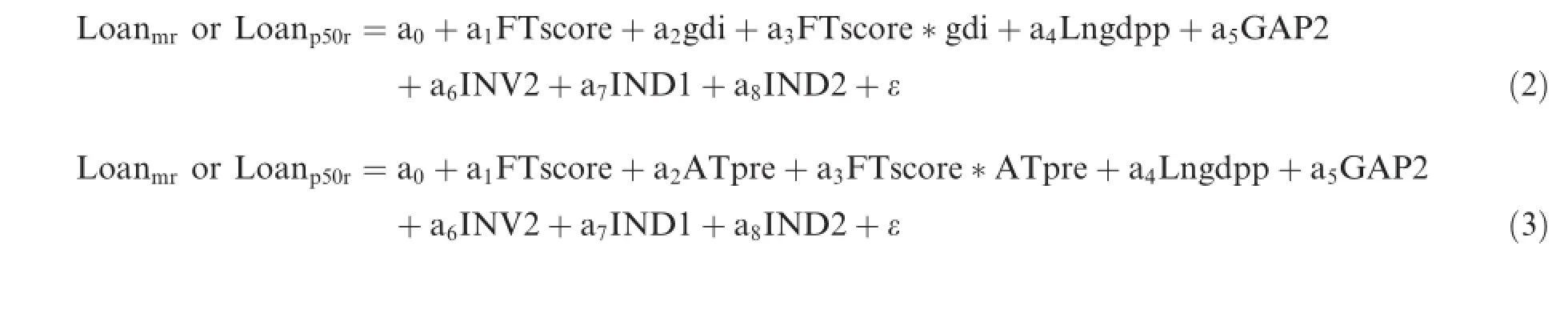

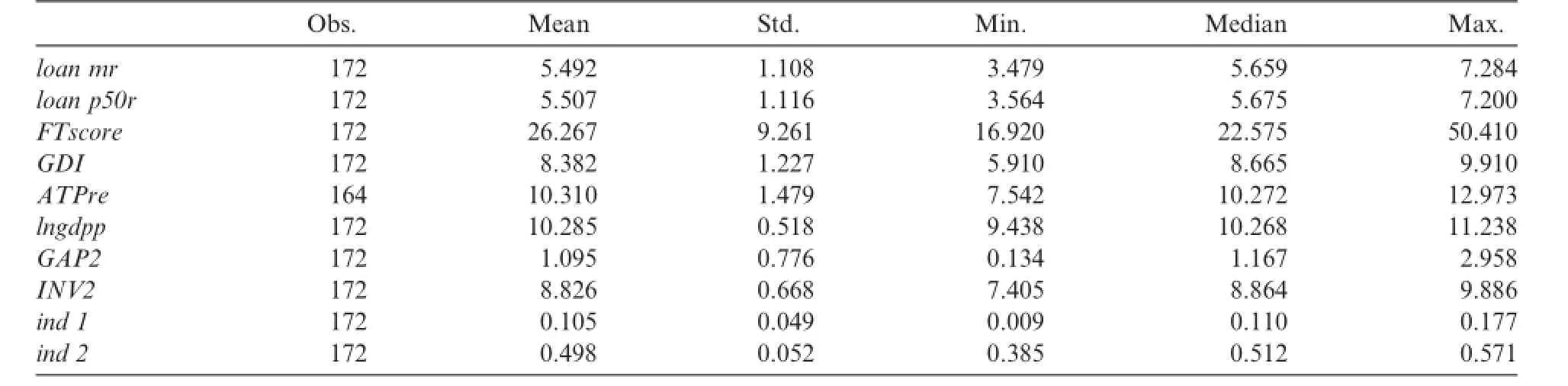

The variable definitions are shown in Table 1.

5.Empirical results

5.1.Descriptive statistics

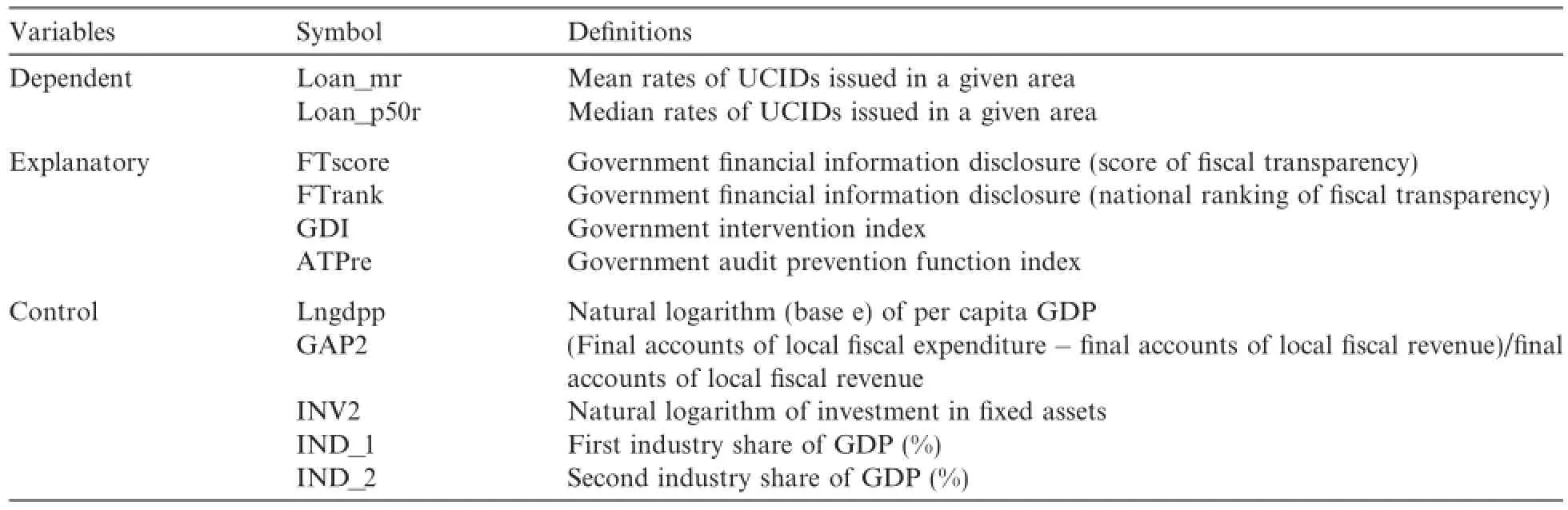

The standard deviation,minimum value and maximum value of the interest rates of each region,presented in Table 2,show there is a large range between regions in the UCID interest rates.The standard deviation for regional fiscal transparency is 9.261,and the minimum and maximum values are 16.920 and 50.410,respectively,illustrating the big difference among regional fiscal transparency.The average score for government financial information disclosure is 26.267 out of 100,illustrating that government finance information disclosure is generally low in China.There is very little difference between regions in terms of regional per capita GDP or fixed assets investment;however,the mean value of the fiscal gap is 1.095,with a maximum value of 2.958,which shows that some regions are experiencing widespread overspending and face capital pressure. There are also some differences in regional industry structures.

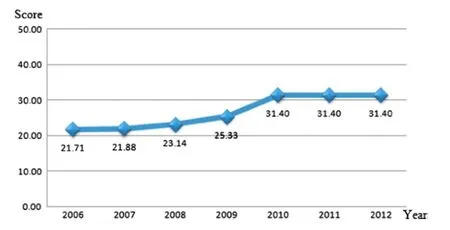

Fig.1 illustrates the trend in the annual average value of fiscal transparency(FTscore).Clearly,the mechanism for local government financial information disclosure is improving.Between 2006 and 2012,31 provinces(autonomous regions and municipalities directly under the central government)increased their fiscal information disclosure by nearly 36%,and the average score rose nearly eight points.

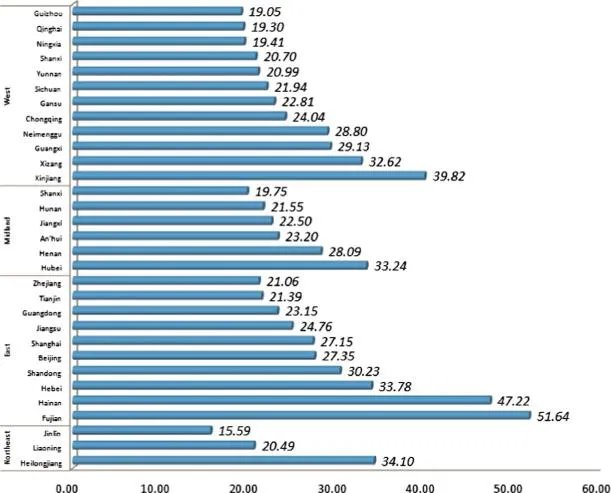

Fig.2 shows the average scores for the fiscal transparency variable(FTscore)by province.The maximum value,51.64,is nearly three times the minimum value of 15.9,indicating the large difference among provinces.The top five provinces for fiscal transparency are Fujian(51.64),Hainan(47.22),Xinjiang(39.82),Hei Longjiang(34.10)and Hebei(33.78).Of the four big economic zones,the fiscal transparency scores in the eastern provinces are all more than 20,and Fujian has the highest value(51.64),illustrating relatively high transparency.

Table 1Definitions of variables.

5.2.Correlation analysis

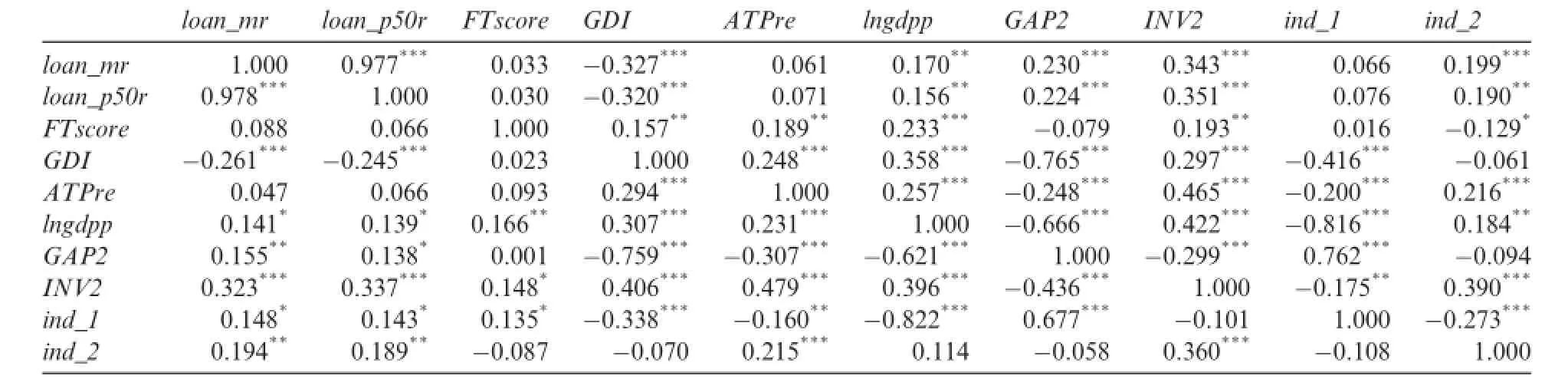

The analysis of the correlation coefficients shows that the interest rates of regional urban construction investment bonds do not strongly correlate with government financial information disclosure,but are generally related to each of the control variables.The analysis of the Pearson correlation coefficients shows that the degree of correlation,from strongest to weakest,ranges from investment in fixed assets,secondary industry share of GDP,fiscal gap,the proportion of primary industry and per capita GDP.The Spearman correlation coefficients produce similar results;the strongest correlation is between fixed asset investment and local government debt interest rate.There are some differences between the two coefficients;compared to the Pearson coefficient,the Spearman coefficients show a stronger correlation between fiscal gap and interest rates than between the proportion of secondary industry and interest rates,and the correlation between the proportion of primary industry and interest rates is weaker.Overall,per capita GDP is correlated with government financial information disclosure,which illustrates that more open and transparent financial disclosure is associated with developments in the economy.At the same time,per capita GDP has a significantly negative correlationwith fiscal gap and the proportion of the primary industry,which implies that in addition to being associated with higher levels of economic development,a smaller fiscal gap is related to less pressure on financial capital,and less dependence on a primary industry(see Table 3).

Table 2Descriptive statistics.

Figure 1.Fiscal transparency over time.Note:The fiscal transparency score has been indexed.Due to missing fiscal transparency data from 2010 and 2012,the study substituted 2011 data for those years.

Figure 2.Fiscal transparency by province.Note:Fiscal transparency scores have been indexed.Due to the missing fiscal transparency data from 2010 and 2012,the study substituted 2011 data for those years.

Table 3Correlation analysis.

5.3.Basic regression results

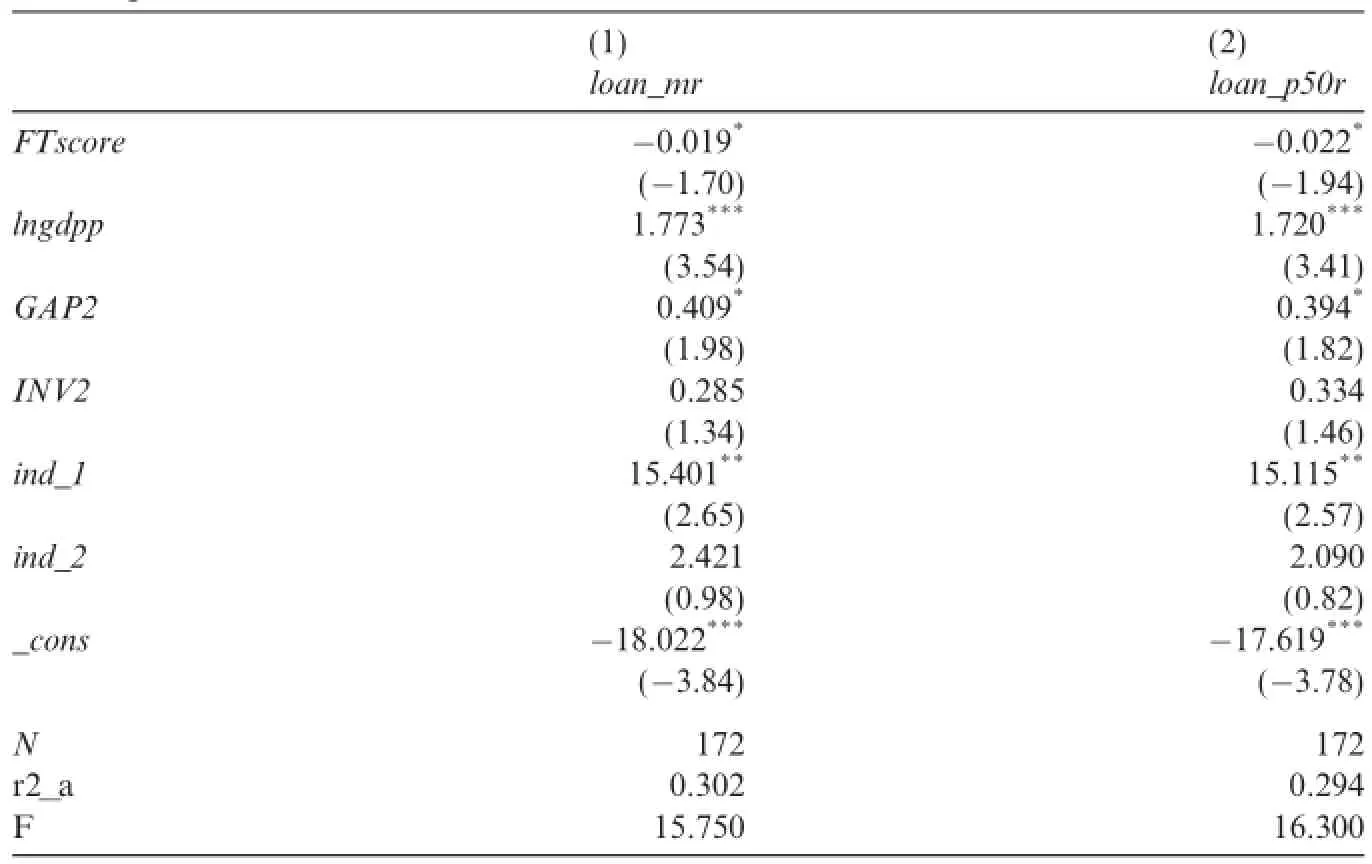

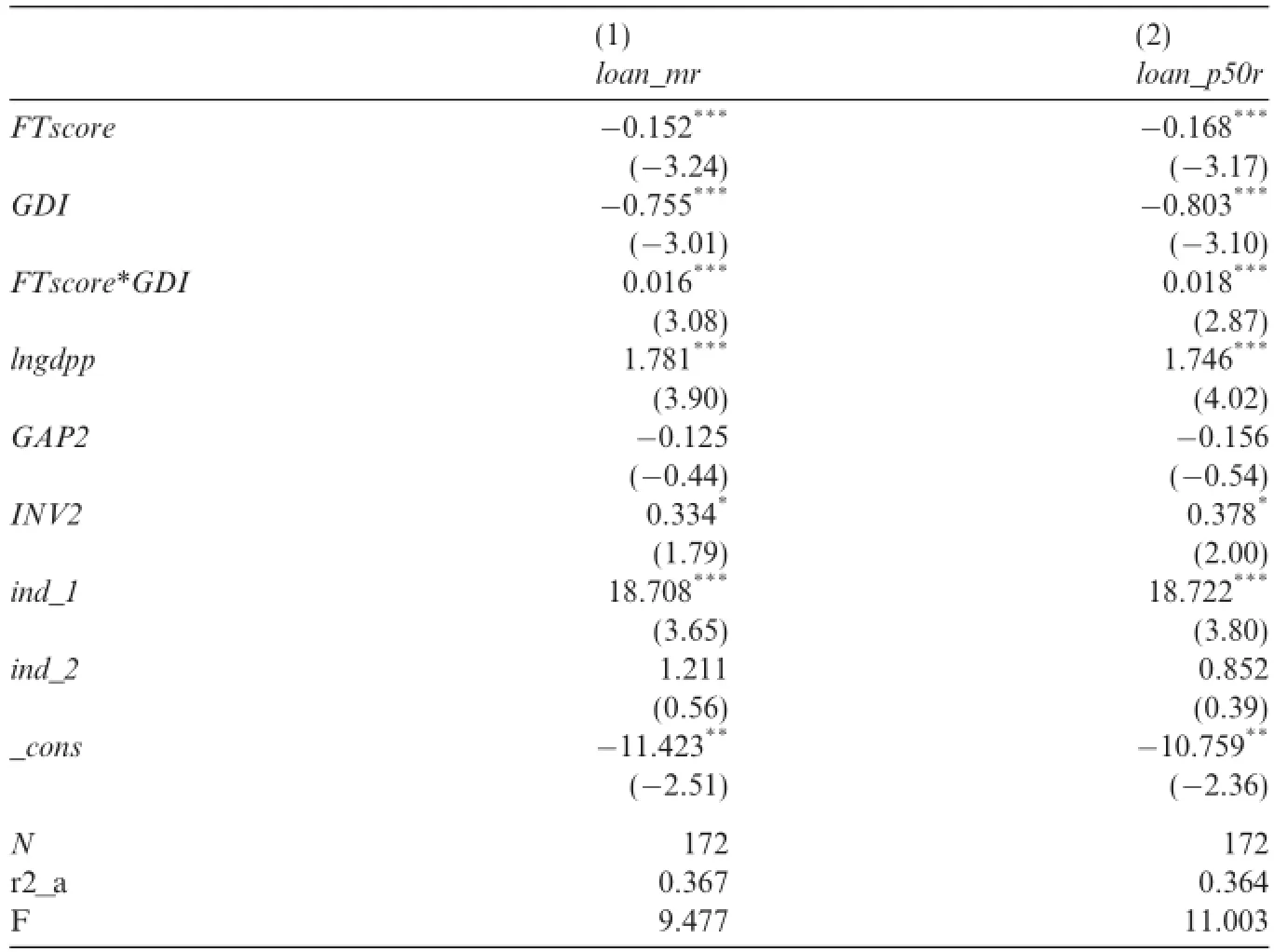

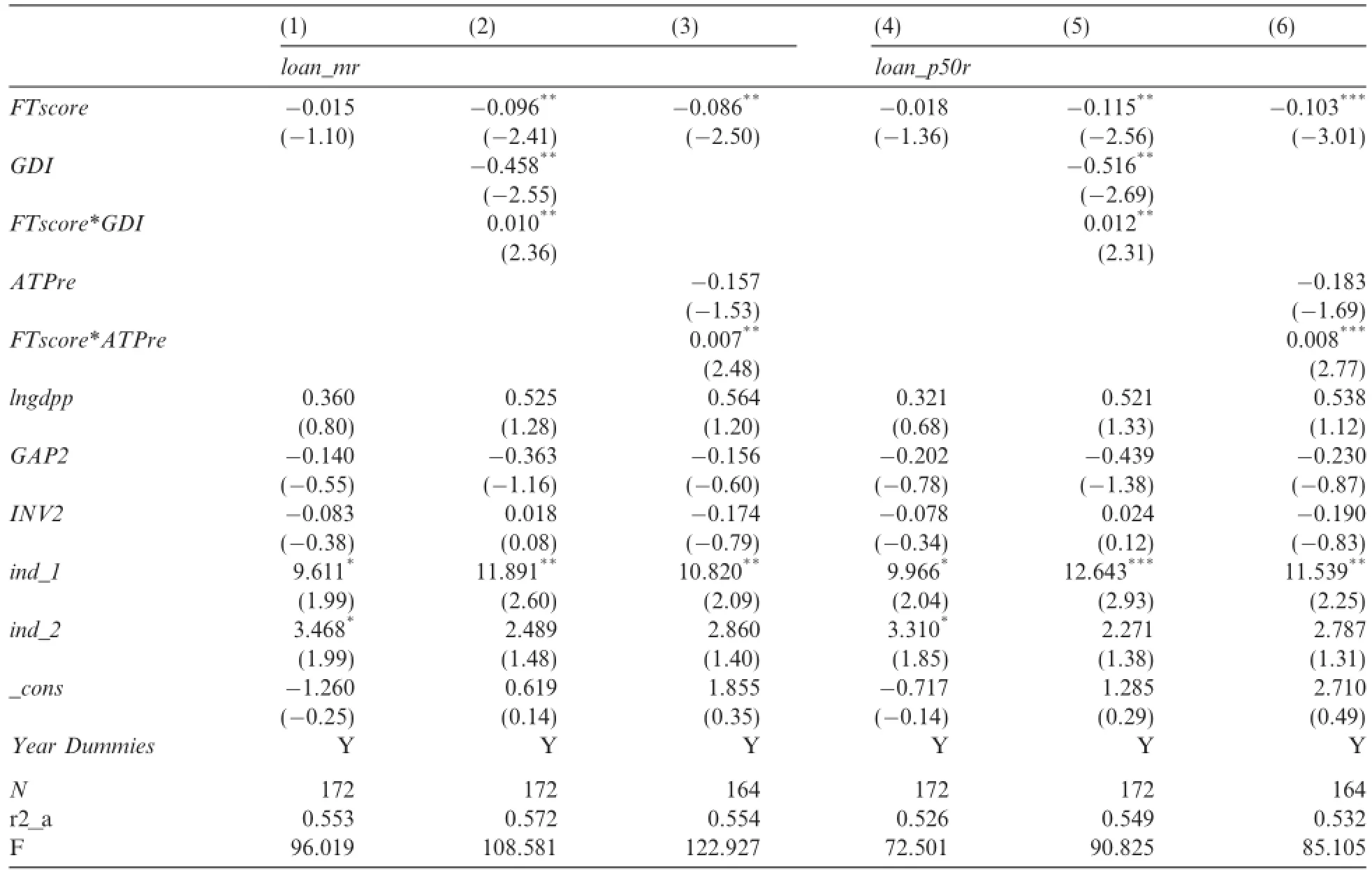

The regression results with average interest rates,loan_mr,and median loan_p50r,as the dependent variables are as follows.The coefficient of government financial information disclosure(FTscore)is significantly negative at the 10%level.This supports H1:a higher degree of government financial information disclosure is associated with a lower issuing rate for UCIDs.In other words,government financial information disclosure reduces the cost of local government debt financing.For the control variables,the correlation coefficient of per capita GDP(lngdpp)is positively significant at the 1%level,i.e.,regions with higher per capita GDP issue UCIDs at higher rates.Generally,a region with advanced economic development may be more able to develop a bond market and may get through the approval process more easily. This would suggest that such regions would issue UCIDs at a lower interest rate;the regression results may show the opposite trend because governments of richer regions may have larger capital demands,and therefore issue UCIDs at a higher interest rate.The coefficient of the proportion of the primary industry(ind_1)is also positively significant at the 5%level illustrating that the issuing rate of UCID increases with an increase in the contribution of a primary industry.These results confirm the study's hypotheses.Regions with relatively low levels of economic development with a larger proportion of GDP from a primary industry have low fiscal revenue,less experience in issuing bonds,and difficulty in examining and approving the issuing of bonds.The coefficient for fiscal gap(GAP2)is positively significant at the 10%level,indicating that higher interest rates for issuing bonds are associated with a large fiscal gap in some areas.It is not hard to understand that such areas often need more cash-capital.The proportion of the secondary industry(ind_2)and investment in fixed assets(INV2)are not significantly associated with local government debt financing costs(see Table 4).

Table 4Relationship between government financial information disclosure and local government debt financing cost.

5.4.The effect of government interference on the relationship between government financial information disclosure and the cost of local government debt financing

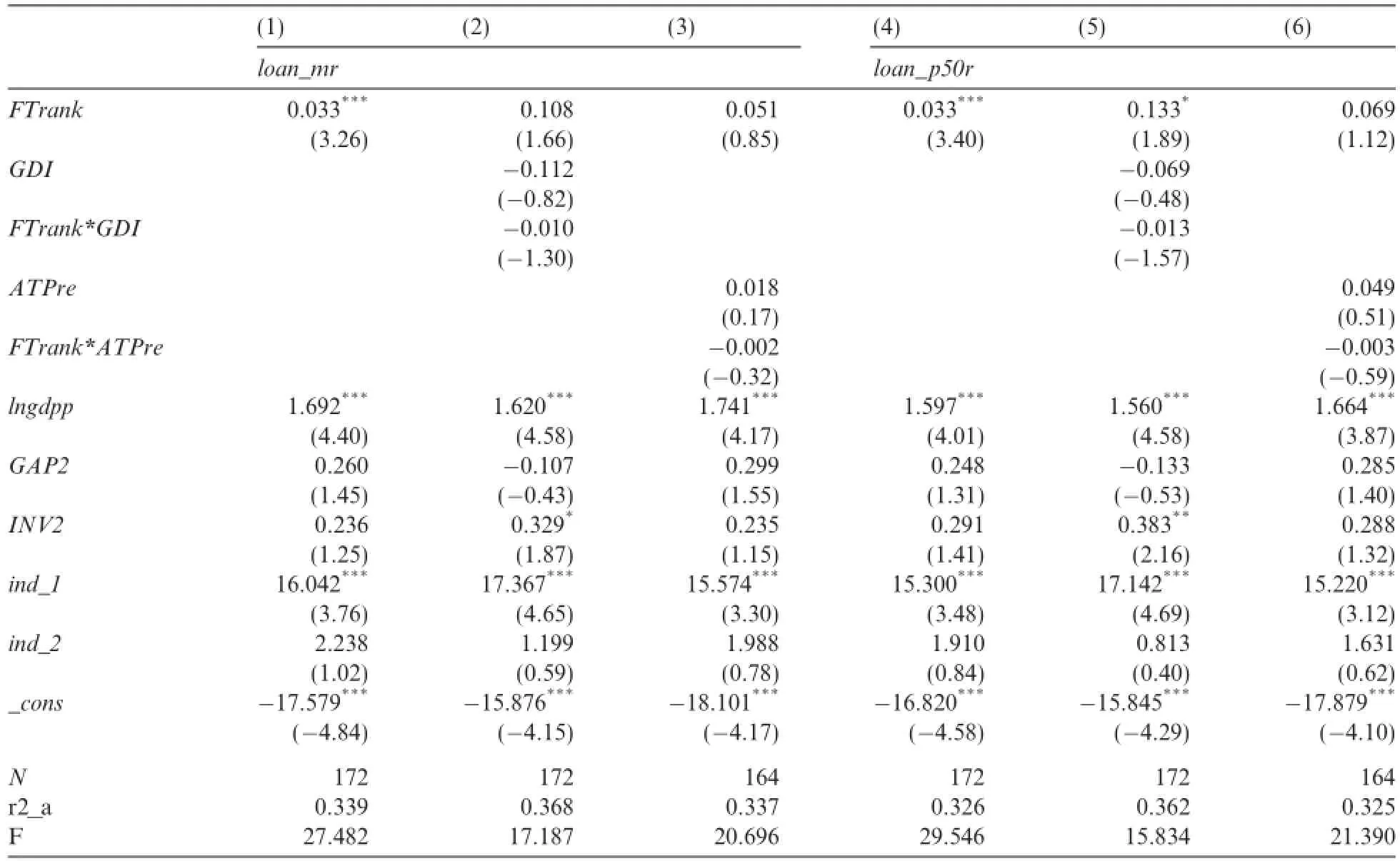

Additional analysis considers the relationship between the government intervention index(GDI)and the interaction of government financial information disclosure and the government intervention index(FTscore*GDI).The coefficient of the government intervention index(GDI)is significantly negative at the 1%level,indicating that a higher value of GDI is associated with a lower UCID interest rate.A higher score on the government intervention index implies that the regional market is advanced,and this will provide a better environment for issuing bonds and reduce the issuing debt interest rates.The coefficient of government financial information disclosure(FTscore)is also significantly negative at the 1%level,but when considered along with the degree of government intervention(GDI),the effect of government financial information disclosure(FTscore)on the issuing rate of UCIDs decreases,i.e.,government intervention reduces the effectiveness of government financial information disclosure on debt financing cost.The interaction term(FTscore*GDI)is significantly positive at the 1%level.The test results for the control variables are nearly the same as in the previous test results.Both per capita GDP(lngdpp)and the proportion of primary industry(ind_1)are significantly positively related to UCID interest rates at the 1%level.Furthermore,investment in fixed assets(INV2)is significantly positively related to UCID interest rates at the 10%level(see Table 5).

5.5.The effect of government audit prevention function on the relationship between government financial information disclosure and the cost of local government debt financing

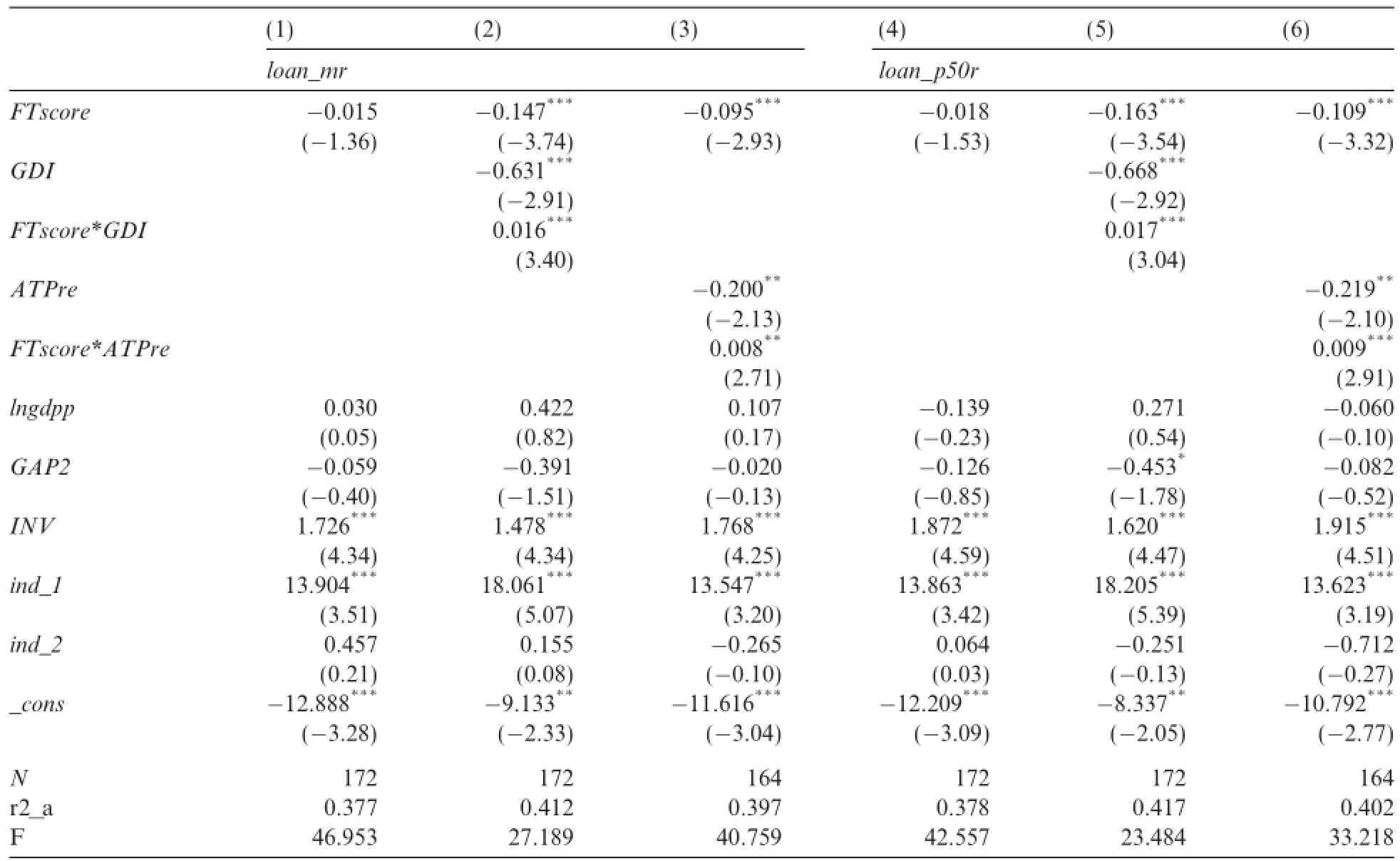

Further analysis examines the relationship between the government audit prevention function index(ATPre)and the interaction of the government financial information disclosure and government auditprevention function index(FTscore*ATPre).The coefficient of the government audit prevention function index is significantly negative at the 5%level,indicating that a higher value of ATPre is associated with a lower UCID interest rate.This supports the above argument that in a sound government audit system,an external audit plays a supervisory role.A sound external audit reduces the fiduciary duties of a local government and improves the government's reputation in the eyes of the public.It strengthens the government's credibility,and this improved reputation reduces the interest rates for issuing debt.The coefficient of government financial information disclosure(FTscore)is significantly negative at the 5%level for loan_mr and 1%level for loan_p50r,nearly the same as in the previous test results.However,when considered together with the degree of government audit prevention function index(ATPre),government financial information disclosure(FTscore)has a less negative effect on the UCID issuing rates,i.e.,a strong government audit prevention function reduces the effect of government financial information disclosure on local government debt financing cost.The interaction term(FTscore*ATPre)is significantly positive at the 5%level.The results for the control variables are almost the same as above.Both per capita GDP(lngdpp)and the proportion of primary industry(ind_1)are significantly positively related to the UCID interest rates at the 1%and 5% level respectively.Furthermore,the fiscal gap(GAP2)is significantly positively related to the UCID interest rate(see Table 6).

Table 5Government financial information disclosure and local government debt financing cost(I).

5.6.Robustness tests

5.6.1.Alternative indicators of government financial information disclosure

In the first robustness test,the national rank of a region's government financial information disclosure(FTrank)is substituted for FTscore.The results show that the national ranking of government financialinformation disclosure(FTrank)is significantly positively related to UCID interest rates,illustrating that less government financial information disclosure is related to higher UCID interest rates.The coefficients of government intervention and government audit are no longer significant,but the positive effective of financial information disclosure(FTrank)on bond issuing rates is somewhat weakened(see Table 7).

Table 6Government financial information disclosure and local government debt financing cost(II).

Table 7Robustness test(I).

5.6.2.Alternative indicators of investment in fixed assets

In a second robustness test,the natural logarithm of fixed assets investment per person(INV)is substituted for the natural logarithm of investment in fixed assets(INV2).The results are as follows.(i)In the first regression,there is no significant correlation between government financial information disclosure and local debt-financing cost.However,when the government intervention variable is added,the relationship between government financial information disclosure and government debt-financing cost is significantly negative at the 1%level,suggesting that government intervention changes the effect of financial information disclosure on the debt-financial cost of UCID.(ii)The results for the test of the effects of government audits are the same.

Investment in fixed assets is selected as a control variable because of its strong effect on interest rates.In particular,as one of the three main driving factors of GNP,investment in fixed assets not only affects the economic forecasts that shape expectations of the benchmark interest rate in the capital market,but also influences the demand for investment-related funds,which further affect interest rates(supply-demand relationship and price of cash in the capital market).However,due to the large difference between regions in the annualinvestments in fixed assets,the results of the analysis,even if natural logarithm of the observations is used,may reflect the characteristics of data distribution and OLS regressions.It is also possible that the population affects the interest rate of funds.Therefore,fixed assets investment and the influence of demographics are considered together.In Table 8,the investment in fixed assets variable is modified with population average processing before being used in the regression.The scale data such as GDP per capita receive the same treatment.

Table 8Robustness test(II).

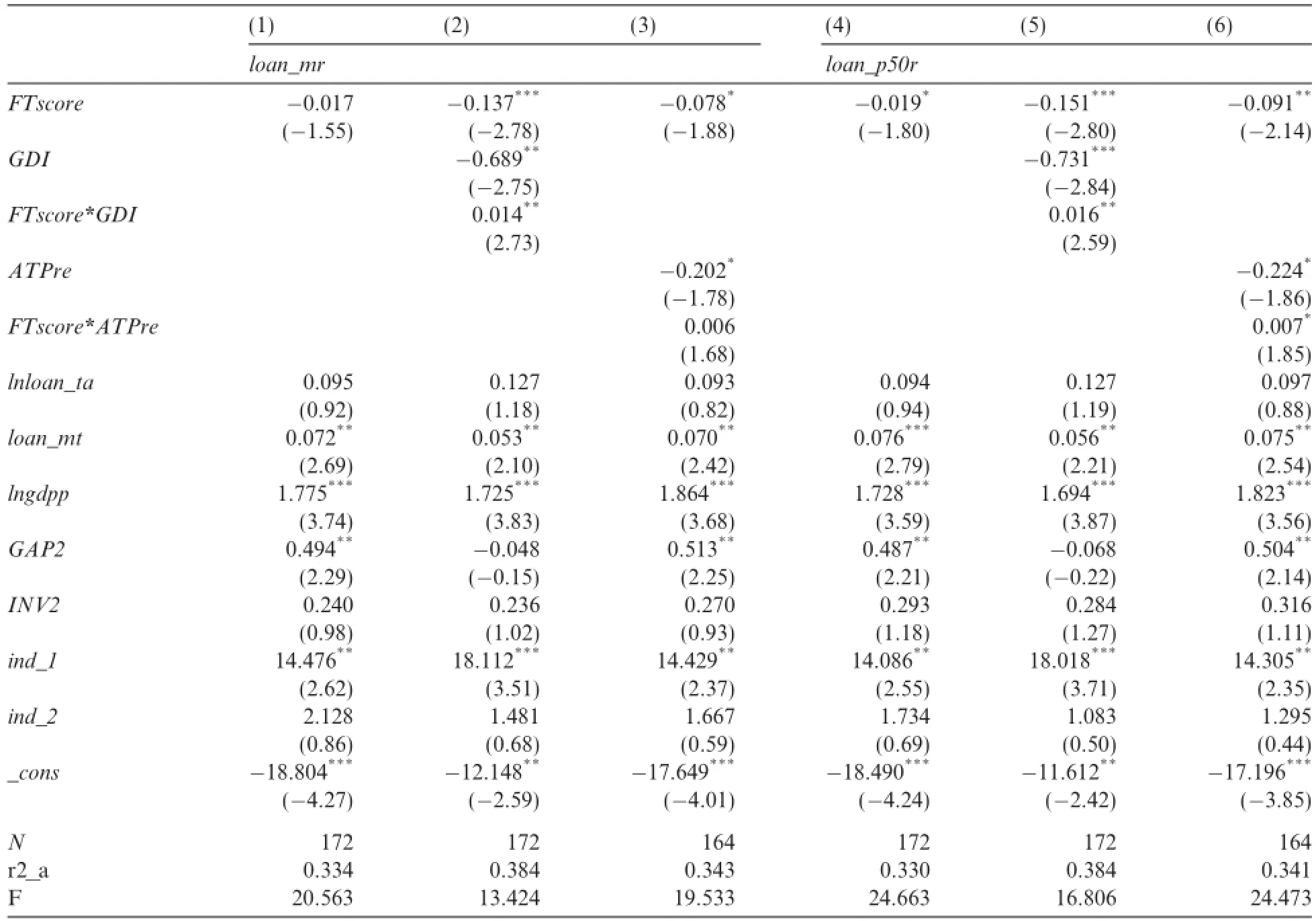

5.6.3.Test results after controlling for the scale and time limit of UCID

To test whether the characteristics of the debt structure affect UCID interest rates,the characteristics of government debt structure are controlled for.A government debt scale variable(i.e.,LnLoan_ta:natural logarithm of annual total issuance of local bonds)and a time limit of UCID variable(i.e.,Loan_mt:annual mean value of local bonds'deadline)are included as structural variables.As shown in Table 9,when the control variables are introduced into the model,there are no substantive changes to the results.

5.6.4.Test results after controlling for the time effect

When Year dummy variables are added to the robustness test,the results are as follows.(1)When the government intervention variable is not added,there is no significant correlation between governmentfinancial information disclosure and local debt-financing cost.However,when government intervention is considered,the relationship between government financial information disclosure and government debt-financing cost is significantly negative at the 5%level,suggesting that government intervention changes the effect of financial information disclosure on the debt-financial cost of UCID.(2)The results for the test of the effects of government audits are the same(see Table 10).

Table 9Robustness test(III).

6.Conclusions and discussion

In China's current social and economic system,the level of financial information disclosure by provincial governments is low.Although overall the degree of information disclosure has been increasing,there is still a large variation between regions in both information disclosure and the cost of government debt financing.The above analyses show that there is a significant and negative relationship between government financial information disclosure and the cost of local government debt financing,i.e.,more government financial information disclosure is associated with lower UCID interest rates.When the government intervention index is used as a regulating variable,the analyses show that with a high score on the government intervention index(GDI),the substitution effect of financial information disclosure is increased,and so the effect of fiscal transparencyon debt financing cost is decreased.When the government audit prevention function index is used as a regulating variable,the analyses show that as the government audits'prevention function strengthens,the effect of fiscal transparency on debt financing cost weakens and vice versa.The results of the robustness tests,which replace FTscore with FTrank and then INV2 with INV,are consistent with the initial conclusions.Of course,this study only examines a few of the many factors that influence local government debt financing.Other factors need to be examined in subsequent studies.In addition,urban construction investment bonds are used to examine the cost of government debt;however,they may not reflect the whole picture of local government debt.As the new‘‘budget law”has implemented strict information disclosure mechanisms and credit evaluation systems for local governments issuing bonds,future research can adopt a more comprehensive perspective.

Table 10Robustness test(IV).

References

Akerlof,G.A.,1970.The market for lemons:quality uncertainty and the market mechanism.Q.J.Econ.84,488-500.

Azuma,Y.,Kurihara,J.,2011.Examining China's local government fiscal dynamics:with a special emphasis on local investment companies(LICs).Politico-Econ.Commentaries 5,1-19.

Cai,C.,Li,J.T.,Liu,G.X.,2009.The basic foundation mechanism and path selection of government audit to maintain national economic security.Auditing Res.4,7-11.

Chang,L.,2008.The new public management,government performance evaluation and improvement of government financial reports. Account.Res.4,19-24.

Chen,L.Q.,Li,J.F.,2003.Review of international government accounting standards and its development.Account.Res.9,49-52.

Demirguc-Kunt,A.,Maksimovic,V.,1999.Institutional,financial markets,and firm debt maturity.J.Financial Econ.54,295-336.

Deng,J.P.,2014.Banking association,accounting information and debt financing-empirical study based on the private enterprises of country.J.Account.Econ.1,3-14.

Fan,G.,Wang,X.L.,2001.The 2000 annual report of various regions'marketization process.J.China Natl.School Administration 3,17-27.

Giannetti,M.,2003.Do better institutional mitigate agency problems?Evidence from corporate finance choices.J.Financial Quant.Anal. 38,185-212.

Han,L.Y.,Mou,H.,Wang,Z.B.,2005.Risk identification and control strategy of municipal bond.Manage.World 3,58-66.

Hu,Y.M.,Tang,S.L.,2007.Audit,information transparency and bank lending rates.Auditing Res.6,74-84.

Huang,S.Z.,Liu,Y.S.,Wang,P.,2004.Difficult issues,hot points and inspiration of American federal government accounting—based on analysis of federal government auditing report.Account.Res.11,13-18.

Jiang,W.,Li,B.,2006.Large shareholders control,asset substitution and capital structure.Working Paper.Accounting Society of China,vol.9,pp.1417-1425.

Li,J.T.,Liu,L.,2014.Discussion on the function of government audit to improve fiscal transparency and guard against financial risks. Finan.Account.Monthly 7,70-73.

Liu,J.Y.,2012.Discussion of national governance and national audit.Soc.Sci.China 6,60-72.

Liu,L.,Cui,Y.,Zhang,X.,2014.Empirical research of national audit maintains the financial security—based on the empirical evidence of provincial panel data.Auditing Res.1,35-42.

Liu,S.X.,2014.Local government debt risk does not come from debt itself.Chin.Cadres Tribune 2,68.

Liu,S.X.,Zhao,X.J.,2005.Risk and prevention of municipal income bonds.Manage.World 3,50-57.

Lu,J.W.,2010.Goals and reform of governmental accounting under perspective of public finance.Contemporary Econ.Manage.1,93-96.

Lu,Z.F.,Zhu,J.G.,Sun,B.X.,2008.Earnings management,accounting information and bank debt contract.Manage.World 3,152-158.

Lu,X.W.,Wang,J.Q.,Dong,D.Y.,2013.Directors'network,information transfer and debt financing cost.Manage.World 3,55-64.

Luo,D.L.,She,G.M.,2014.Official's turnover and local government debt issue.Econ.Res.J.06,131-146.

Mei,J.M.,2011.Problems about the operation of local government's financing platform.Publ.Finan.Res.5,64-66.

Mikesell,J.L.,2002.The threat to state sales taxes from E-commerce:a review of the principal issues.Municipal Finan.J.23,48-61.

Shen,L.R.,Dai,Y.C.,1990.Formation of‘‘vassal economy”in our country,its disadvantages and roots.Econ.Res.J.3,12-19.

Sun,Z.,Liu,F.W.,Li,Z.Q.,2005.Marketization process,government intervention and corporate debt maturity structure.Econ.Res.J.5,52-63.

Sun,Z.,Li,Z.Q.,Wang,J.B.,2006.Property of ownership,accounting information and debt contract—based on experimental evidence from listed company in our country.Manage.World 10,100-107.

Tang,X.S.,Luo,S.,Wang,H.Y.,2012.Marketization and the role of government audit.Auditing Res.3,25-31.

Wei,D.H.,Tan,Z.Y.,Tang,S.Q.,2010.Relationship research of government audits efficiency and financial capital operation security—based on statistics and empirical research of audit's yearbook data.Auditing Res.3,9-14.

Wescott,S.H.,1984.Accounting numbers and socioeconomic variables as predictors of municipal general obligation bond ratings.J. Account.Res.22,412-423.

Wilson,E.R.,Howard,T.P.,1984.The association between municipal market measures and selected financial reporting practices: additional evidence.J.Accounting Res.20,7-29.

Xia,L.J.,Chen,X.Y.,2007.The process of marketization,SOE's reform strategy and endogenous decision of corporate governance structure.Econ.Res.J.7,82-95.

Xiang,Y.,2012.The Formative Mechanism Study of Enterprises Excessive Investment Under Government Intervention.School of Management of Southwestern University of Finance and Economics,Chengdu.

Xiao,P.,Yan,C.,2013.Study of driving factors and choice of path of China's fiscal transparency—based on empirical analysis of the 28 provinces'panel data.Comp.Econ.Soc.Syst.4,199-206.

Zhang,Q.,Zhang,X.Z.,Cheng,X.J.,2009.Choice of government accounting foundation,stakeholders'motives and the influence of institutional environment—based on the inspection from questionnaire data in China.Account.Res.7,35-42.

Zhang,Q.,Zhang,J.,2012.Conflict between supply and demand of information,decision making based on information and government accounting reform-a discussion about paradox of information disclosure in public field of China.Account.Res.7,24-31.

Zhao,Q.,2013.Government invention,rule of law,financial development and excessive investment of listed SOEs.Econ.Survey 30,149-153.

Zhou,L.A.,2004.Motivation and cooperation of government officials come from the promotion game—reason for the long term existence of local protectionism and redundant construction problems in china.Econ.Res.J.6,33-40.

Zhou,H.B.,2010.Fiscal transparency and fiscal supervision.Res.Finan.Account.16,66-67.

6 April 2015

s.

E-mail addresses:panjun7219@163.com(J.Pan),acwangll@126.com(L.Wang).

☆This study was supported by the National Natural Science Foundation of China(Project Nos.71172064;71502033;71572071),National Statistics Research Plan Key Project(Project No.2014LZ58),Universities'Philosophy and Social Science Research Project of Jiangsu Province General Project(Project No.2015SJB836)and the Humanities and Social Sciences Research Youth Fund Project of Ministry of Education of China(Project No.15YJC630096).