Religion and stock price crash risk:Evidence from China

Wenfei Li,Guilong Cai

Sun Yat-sen Business School,Sun Yat-sen University,China

Religion and stock price crash risk:Evidence from China

Wenfei Li,Guilong Cai*

Sun Yat-sen Business School,Sun Yat-sen University,China

A R T I C L EI N F O

Article history:

Accepted 21 April 2016

Available online 20 May 2016

Religious environment

Stock price crash risk

Informal institution

Corporate governance

This paper investigates whether religious traditions influence firm-specific crash risk in China.Using a sample of A-share listed firms from 2003 to 2013,we provide evidence that the more intense the religious environment,the lower the stock price crash risk,implying that religion plays an important role in Chinese corporate governance.Further,we find that(1)religion affects stock price crash risk by reducing earnings management and the management perk problem;(2)different religions have different effects,and Taoism,in particular,is unrelated to crash risk;and(3)the effects of religion are more pronounced with higher quality corporate governance and a stronger legal environment.Religion constrains the management agency problem,thus reducing stock price crash risk in China.Our paper enriches the literature on stock price crash risk and religion,and on new economic geography.

©2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

The global financial crisis of 2008 stimulated scholars'interest in stock price crash risk.However,the current literature mainly focuses on the relationship between formal institutions,such as corporate governance,and stock price crash risk.Relatively few studies explore the effect of informal institutions such as religion.In China,an emerging and transitioning country,formal institutions such as investor protection systems,corporate governance and accounting standards are less developed(Allen et al.,2005),listed firms'opaqueness is high and agency problems are severe.The Chinese stock market has therefore been experiencing big bubbles and crashes(Piotroski and Wong,2012).Unfortunately,many formal mechanisms that can effectively reduce stock price crash risk in mature capital markets fail to work in the Chinese capital market.When formal institutions cannot effectively reduce stock price crash risk,it is worth examining whether informal institutions can play an alternative governance role.As Wei(2002)states,it is of great practical significance to explore the moral and ethical basis of the market economy from the perspective of informal institutions.

The role of informal institutions in corporate governance in China cannot be ignored and may even play a more important role than previously thought(Chen et al.,2013).Religion,an important part of the informal institutional environment,has a long history in China and greatly influences people's behavior.When it comes to the dramatically fluctuating Chinese stock market,whether religion can reduce stock price crash risk is an open question.Callen and Fang(2015)were the first to study the effect of religion on stock price crash risk in the United States.However,the Chinese religious environment is very different from that of America.First,the religious faith of Chinese people does not necessarily identify belief,rather‘‘belonging”(gui shu)and‘‘participation”(can yu),unlike Western Christianity,which requires‘‘conversion”(gui yi)and‘‘commitment”(wei sheng)(Zhang,2015).Second,although Western religions are strongly doctrinaire,Chinese religions are more secular.Chinese believers pay more attention to the function of the religion they participate in and the choice of religion has a certain randomness;there is not such a great distinction between different sects,such as the difference between Catholicism and other types of Christianity.Third,Christianity,including Catholicism,is a foreign religion,and Chinese believers'religious attitudes may differ from those of believers in the United States.As the differences in the religious environments of China and Western countries are great,it is meaningful to examine the influence of religion on stock price crash risk in China.

Therefore,we hand-collect details of 552 religious sites in 23 provinces and use China's A-share listed companies during 2003-2013 as our research sample.We investigate the relationship between religion and stock price crash risk,and find that religion can effectively reduce stock price crash risk even after controlling for other factors that influence the risk.In addition,we explore the following three questions:What is the channel through which religion acts on crash risk?Do different types of religions have different effects on crash risk?Is there any variation in religion's effect on crash risk at different levels of corporate governance?

The results show that(1)The mechanisms of religion's influence on stock price crash risk are through reducing earnings management and managers'perk consumption.(2)Different types of religions have different effects on stock price crash risk.Specifically,Taoism has no influence on stock price crash risk whereas Buddhism,Christianity,Catholicism and Islam have significant effects.These differences can be attributed to the unique religious environment in China and Chinese people's attitude toward religion.(3)The effect of religion on stock price crash risk depends on the institutional environment.Specifically,only when the quality of corporate governance and the legal environment is high does religion significantly influence stock price crash risk.These results show that the governance role of religion is conditional on higher quality corporate governance and a strong external legal environment.

Our study contributes to the literature in several ways.First,there has been little research examining stock price crash risk from the perspective of informal institutions;we examine the influence of religion on stock price crash risk in the Chinese capital market,thus filling that void.The current literature studies the factors affecting stock price crash risk mainly from the perspective of formal institutions(e.g.,Xu et al.,2013a,b;Chen et al.,forthcoming).As formal institutions are weak in China,it is not reasonable to ignore the role of informal institutions in corporate governance.Therefore,we explore whether religion can reduce stock price crash risk in China.Our results show that religion plays an important role in constraining management opportunism in China,which reduces stock price crash risk.We provide some evidence in support of Weber's(1905)contention that religion plays an important role in the development of modern secular culture in the context of stock price crash risk.

Second,we further examine the mechanisms of religion's effect on stock price crash risk,to deepen our understanding of how religion affects stock price crash risk.The closest study to ours is that of Callen and Fang(2015),who find that religion can reduce stock price crash risk;however,they do not show how religion exerts its effect.To fill this gap,we explore the mechanism of religion's influence on stock price crash risk,and find that religion reduces stock price crash risk by mitigating management agency problems.

Third,our study also contributes to the literature on religion.Most studies of religion take Christianity as their main research focus(e.g.,Callen and Fang,2015),and only a few papers examine the role of Buddhism and/or Taoism in the context of China(Chen et al.,2013;Du,2013,2015;Du et al.,2014).These studies do not analyze the different effects of different kinds of religion comprehensively.China's culture ofnon-excludability and inclusive religious beliefs lead to the existence of multiple religions.This gives us an opportunity to study the effects of different religions.Jiang et al.(2015)compare the influence of Western and Eastern religions on risk-taking.In this paper,we first comprehensively study the effect of different types of religion on stock price crash risk.In particular,we provide evidence that foreign religions(e.g.,Christianity and Catholicism)can constrain opportunistic management behavior and reduce stock price crash risk in China.

Fourth,the new economic geography literature emphasizes the importance of geography on managers'and investors'decision-making.Examples include how corporate location can affect firms'financial decisionmaking(Almazan et al.,2010;Arena and Michael,2012),mergers and acquisitions(Kang and Kim,2008;Kedia et al.,2008)and dividend policies(John et al.,2011).We find that management decision-making is more likely to be influenced in firms located in areas with higher levels of religiosity,and the crash risk of such firms is lower.Therefore,our research also enriches the literature on new economic geography with the finding that geographical location affects stock price crash risk.

The remainder of our paper is organized as follows.Section 2 introduces the institutional background of religion in China,and reviews the literature and theoretical analysis.Section 3 describes the sample,variable measurement and research design.Section 4 presents the empirical results and robustness checks.Section 5 further explores the relationship between religion and stock price crash risk and Section 6 concludes the paper.

2.Institutional background,literature and theoretical analysis

2.1.Religion in China

The proportion of the population identifying as religious adherents has reached as high as 84%worldwide by 2010,and is expected to increase in the next four decades(Pew Research Center,2015).The role that religion plays in the social,political and economic fields is gradually being confirmed,and research on Chinese religion is just getting started(Jin and Qiu,2008).In particular,the economic consequences of religion remain largely unexplored in the financial accounting research.In fact,religions including Buddhism,Taoism,Christianity and Islam,as well as folk religions,have a long history in China.Buddhism was introduced in the Han Dynasty over 2000 years ago,Taoism originated in China more than 1700 years ago,Islam has a history of more than 1300 years in China,and Christianity,including Catholicism,came to China in the early nineteenth century.

A paradoxical view,the so-called‘‘Chinese religion of no importance theory”believes that China as a nation lacks religious belief,as religion does not play an important role or have an essential position in Chinese society.However,Yang(1961)notes that:

The under-evaluation of the place of religion in Chinese society did not find much support from reality.

There was not one corner in the vast land of China where one did not find temples,shrines,altars and other places of worship.The temples and shrines dotting the entire landscape were a visible indication of the strong and pervasive influence of religion in Chinese society,for they stood as symbols of a social reality.

Unlike Western institutional religion,which has a system of theology,rituals and organization of its own,independent of other secular social institutions,Chinese religions are diffused(Yang,1961),that is,their faith,rituals and religious activities are merged with daily life and have become a part of everyday life.As a result of the combining of religious doctrine and daily life,China's diffused religion does not have a systematic scripture or well organized church institution;at its core is worship of heaven,respect of forefathers and polytheism. The weakness of formally organized religion in China does not imply the absence of an important function played by religious structural systems in Chinese society and culture(He,2007).A Chinese person with faith in religion does not necessarily identify as being a religious adherent,but rather as a believer in Buddhism or Taoism,going into a temple‘‘to pilgrimage,”where what is required is not formal religious ceremony,but‘‘a sincere heart that can work wonders”and‘‘doing good deeds unto others.”

Even during the ten years of the Cultural Revolution in China,when the government adopted a policy of eradicating religions,the embers of Chinese religion were never extinguished.After the Cultural Revolution,especially since the reform and opening up in 1978,thanks to the policy of freedom of religious belief,religious activities have been restored and people's right to freedom of religious belief is respected and protected by law(Du,2010).As a result,religion has been re-flourishing and affecting people's behavior in the following ways.

First,more and more people believe in religion.Religion is gradually being recognized as a cultural phenomenon reflecting a kind of culture or core value of civilization,rather than a symbol of ignorance or backwardness as in the past(Du,2010).By 2012,there were over 10 million Chinese religious adherents,more than 139,000 religious activity sites,more than 360,000 religious workers,and at least 5500 religious groups in China(Li,2013).Second,the influence of religion on entrepreneurs or managers is increasingly important. Religious belief provides people with emotional support(Idler,1987).With globalization of economies and consequent increasing competition,entrepreneurs and managers facing a growing level of anxiety turn to religion for spiritual relaxation,comfort and peace of mind.For example,a large number of elite businesspeople have joined the Beijing International Christian Fellowship,and in Wenzhou,Zhejiang province,entrepreneurs are called‘‘religious boss”for their faith in Christianity(Chen,2005).Thirdly,religious activity sites have been rehabilitated.Religious temples,as scenic tourism spots in China,are often refurbished by local governments on the grounds of‘‘protecting cultural relics and maintaining tourist attractions”(Du,2013). In addition,adherents and entrepreneurs donate to construct or repair temples,as in the case of Wang Jianlin,the chairman of the board of Dalian Wanda Group Co.,Ltd.,who donated 1 billion yuan indirectly to Da Bao'en Temple through the Nanjing municipal government.The improvement of religious activity sites and their surrounding infrastructure has greatly contributed to the dissemination and development of a religious spirit in China.

2.2.Literature review and hypothesis development

Stock price crash risk arises when managers withhold bad news.When the accumulated negative information reaches a tipping point,as the Chinese proverb says,‘‘truth will come to light sooner or later.”The information will be suddenly released to the stock market and the stock price will fall sharply,i.e.,a stock price crash.The lower a company's transparency,the higher the information asymmetry between managers and outside investors,so managers will be likely to hide negative information,resulting in an abrupt decline in stock price.The current literature has supported this view on the basis of agency theory.Kim et al.(2011a)provide evidence that when managers are using corporate tax avoidance as a resource transfer vehicle(‘‘tunneling”),concealing unfavorable information and masking the firm performance excessively,the accumulated negative information will lead to a stock price crash.Also based on agency theory,Kim et al.(2011b)find that granting managers,especially the CFO,options will lead to stock price crash risk.Scholars also find that firms'real earnings management(Francis et al.,2014),manager overconfidence(Kim et al.,forthcoming),perk consumption(Xu et al.,2014),political promotions(Piotroski et al.,2015)and mandatory IFRS adoption(DeFond et al.,2011)will increase stock price crash risk.However,female managers(Li and Liu,2012),tax enforcement(Jiang,2013),accounting conservatism(Kim and Zhang,2016),higher corporate transparency(Hutton et al.,2009),higher quality internal controls(Ye et al.,2015;Chen et al.,forthcoming),auditor industry specialization(Jiang and Yi,2013),corporate social responsibility(Kim et al.,2014),good corporate governance(Andreou et al.,forthcoming)and the proportion held by block shareholders(Wang et al.,2015)will reduce stock price crash risk.In short,managerial opportunism will enable managers to hide bad news,and when the accumulated negative information reaches a critical threshold,it will suddenly be released to the stock market all at once,leading to a crash.However,the effect of governance on stock price crash risk varies across institutional environments.

Institutional constructions are still weak in China,which is a transitional economy.External corporate governance mechanisms that can effectively reduce stock price crash risk in developed countries,such as the presence of financial analysts and institutional investors,exacerbate rather than reduce stock price crash risk in China's capital market(Xu et al.,2013a,b).When institutional mechanisms fail to reduce stock price crash risk,can religion,as one of the informal institutions,play a role in constraining management opportunism?Iannaccone(1998)points out that religion shapes personal values and beliefs,and has an important effect on people's economic behavior and decision-making.Recent studies also confirm that religion has an effect on information disclosure(Riahi-Belkaoui,2004;Dyreng et al.,2012),a firm's risk-taking or riskexposure(Jiang et al.,2015;Hilary and Hui,2009),owner-manager agency costs(Du,2013),equity pricing(EI Ghoul et al.,2012),financial reporting irregularities or earnings management(McGuire et al.,2012;Chen et al.,2013),corporate philanthropic giving(Du et al.,2014),entrepreneurship(Nunziata and Rocco,2011;Ruan et al.,2014)and tunneling(Du,2015).The paper most relevant to our research is Callen and Fang(2015),which reports that firms headquartered in countries with higher levels of religiosity exhibit lower levels of future stock price crash risk.

From the literature review,we can see that on the one hand,the main reason for stock price crash risk is the agency problem;the literature provides evidence mainly from the perspective of formal rather than informal institutions.On the other hand,the literature provides preliminary evidence that religion can influence the behavior of managers and investors.This paper argues that religion can alleviate principal-agent problems,thus reducing stock price crash risk.

First,religion can reduce stock price crash risk by alleviating earnings management behavior.Although different religions have different doctrines,they all emphasize moral and ethical standards,requesting honest and trustworthy behavior,upholding human needs and breaking the pursuit of secular,material and sensual pleasures.For example,as a basic moral principle,Buddhism demands‘‘do not be evil,pursue the public good and self purification”and takes the‘‘Five Precepts”as its basic ethical standard(Zhang,2007).Christianity requires that Christians must‘‘not give false testimony”(they should be honest),and must not be greedy(they should not do anything unethically for personal gain).Burckhardt(1979)points out that‘‘religion is the most important link to maintain the human society,because only it can be qualified to act as a guardian of a particular moral state.”By reducing a firm's information opacity,self-interested managers often try to manipulate the firm's stock price.People who have religious beliefs tend to hold traditional views on moral issues and have conservative moral standards(Barnett et al.,1996),and constrain their own manipulative behavior.People who have religious beliefs are often risk-averse(Miller,2000;Diaz,2000).Once the manipulation of bad news is discovered,managers will be exposed to the risk of litigation(McGuire et al.,2012).Therefore,to reduce the risk of being sued,religious managers will engage in less earnings manipulation,which will lead to lower stock price crash risk.

Second,religion can reduce stock price crash risk by inhibiting managers'self-interested behavior. Religious managers will reduce their desires and greed through inner practice and abstinence,thus alleviating the agency problem.Companies in China,especially state-owned enterprises,have compensation regulations. Therefore,managers generally have a strong incentive to pursue excessive perks to make up their loss in compensation.As a result,pursuing perks is a serious agency problem in Chinese companies.Xu et al.(2014)find that to get more perks,managers may conceal bad news by portraying inappropriate resource consumption as effective resource utilization,and to achieve the purpose of empire building,managers will make short-sighted over-investment disguised as valuable investment.These actions will lead to the continuous accumulation of bad news and thus ultimately to a stock price crash.Du(2013)notes that religion can reduce managers'pursuit of perks.Therefore,religion can reduce stock price crash risk by alleviating the agency problem of managers'perk consumption.

In summary,religion plays an important role in mitigating agency problems,especially in the case of weak external supervision mechanisms(McGuire et al.,2012).We therefore believe that the stronger the religious atmosphere where listed companies are located,the lower the future stock price crash risk,because agency problems are likely to be suppressed.

3.Research design

3.1.Sample selection and data sources

Our initial sample consists of all Chinese A-share listed companies from 2003 to 2013.Following previous studies,we screen the sample and exclude(1)financial firms,(2)firms with fewer than 30 trading weeks of stock return data in a fiscal year(Jin and Myers,2006),(3)firms whose transaction status is special treatment(ST)or particular transfer(PT),and(4)observations with incomplete financial data.To mitigate the effects of outliers,we winsorize continuous variables at the 1%level in both tails.Our financial data is obtained from theChina Stock Market and Accounting Research(CSMAR)database.The study's final sample consists of 11,171 firm-year observations.

Following Chen et al.(2013),we collect data on 552 religious sites in 23 provinces in China as follows:(1)148 provincial key temples mentioned in the Report by the Religious Affairs Bureau under the State Council about Determining Buddhism and Taoism National Key Temples in the Han Nationality Area;and(2)venues for religious activities that were awarded‘‘The First National Advanced Collectives and Individuals in Establishing Harmonious Temples”by the China State Administration of Religious Affairs in 2010.1We combine the two reports to reflect the overall effect of temples in China and to analyze whether different kinds of religion have different effects on Chinese enterprises.In addition,we follow Chen et al.(2013)and only use the 148 provincial key temples;the results are the same(untabulated).

3.2.Variable measurement

3.2.1.Measuring firm-specific crash risk

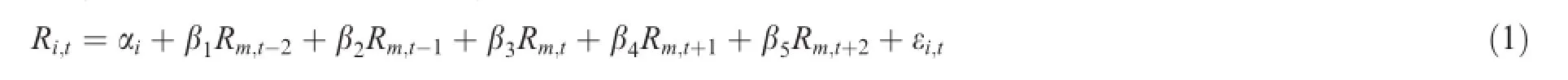

Following Kim et al.(2011a,b),we use two measures of stock price crash risk.We first estimate firm-specific weekly returns,denoted Wi,t,as the natural log of one plus the residual return from the expanded market model regression for each firm and year:

where Ri,tis the return that considers the yields on cash dividend reinvestment on stock i in week t and Rm,tis the value-weighted market return in week t.The firm-specific weekly returns for firm i in week t are measured by Wi,t=Ln(1+εi,t),where εi,tis the residual in Eq.(1).

Second,we construct the following two variables based on Wi,t:

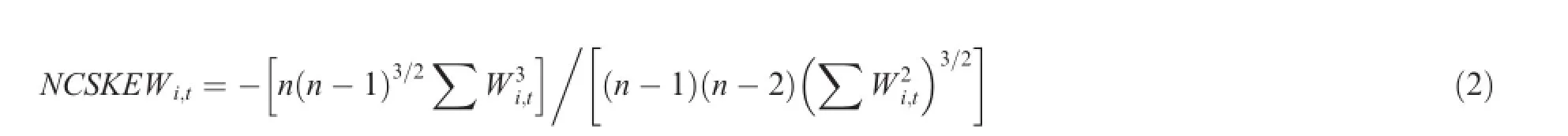

(1)The negative coefficient of skewness,NCSKEW

where n is the number of trading weeks of stock i in year t.A higher value of NCSKEW means a higher skewness coefficient,corresponding to a greater stock crash risk.

(2)The down-to-up volatility,DUVOL

where nuand ndare the number of up and down weeks in year t,respectively.A higher value of DUVOL indicates a more left-skewed distribution,which means a stock has a greater crash risk.

3.2.2.Measuring religion

The managers of firms registered in areas with higher levels of religiosity(i.e.,a more pronounced religious atmosphere)will be more likely to participate in religious activities than managers in areas with lower levels of religiosity,and thus these managers will be more easily influenced by religion.

Following Du(2013)and Du et al.(2014),we calculate the distance between the registered address of the listed company and the site of religious activity to measure the degree to which managers are affected by religion.The detailed procedure is as follows.2A more direct measure of the effect of religion on corporate executives is the distance between the birthplace of top executives and religious temples.However,due to issues of personal privacy,it is very difficult to acquire data about the birthplaces of the executives. Therefore,following Du(2013)and Du et al.(2014),we calculate the distance between the registered address of the listed company and the religious activities site to measure the degree to which managers are affected by religion.

First,using Google Earth,we obtain the longitude and latitude of every firm-year observation in our sample according to its registered address.Similarly,we check the geographic location of every religious activities site in our sample and obtain its longitude and latitude.

Second,we calculate the distance between each firm and the religious activities sites according to their respective longitudes and latitudes,equaling the length of the minor arc across the surface of the earth.RELIGION is the number of famous temples within a 200 km radius of the firm's registered address.The higher the value,the stronger the effect of managers influenced by religion.We also use the number of temples within a 100 km and a 300 km radius around the firm to proxy for religion for robust results.The formulae are as follows:

where d is the distance between the registered address of each firm and a temple.We define the longitude and latitude of a temple(a firm)as lonrand latr(lonfand latf),respectively.

3.2.3.Control variables

We control for several factors shown to influence crash likelihood(Chen et al.,2001;Kim et al.,2011a,b). First,we control for the lag value of crash risk to account for the potential serial correlation of NCSKEW and DUVOL.Stocks with higher volatility are more likely to experience a crash in the future,so we control for weekly return volatility(SIGMA).Hutton et al.(2009)show that firms with earnings management are more prone to suffer from a future crash,so we include the absolute value of abnormal accruals(ABACC),measured as the previous three year's moving sum of the absolute value of discretionary accruals,where discretionary accruals are estimated by the modified Jones model.We control for the de-trended share turnover(TURNOVER),calculated as the average monthly share turnover in year t minus the average monthly share turnover in year t-1.As past returns can help to forecast crash risk,we control for past returns(RET)measured as the mean of firm-specific weekly returns over the fiscal year.Similarly,we control for the market-tobook ratio(MB)because those firms with higher MB are also predicted to have a higher crash risk.To control for the size effect,we include firm size(SIZE),calculated as the natural log of the book value of total assets. We also control for leverage(LEV),calculated as debt divided by total assets,and profitability measured by return on assets(ROA).As the quality of auditors and property rights will affect a firm's transparency,we also control for audit quality(BIG4)which is equal to one if the firm engages a Big4 audit firm and zero otherwise,and the ownership of the firm(SOE)which is equal to one if the firm is a state-owned enterprise and zero otherwise.

3.3.The empirical model To test whether religion will reduce stock price crash risk,we design the empirical model as follows:

We include industry and year dummies to control for industry and year fixed effects in all regressions.We report t-values based on robust standard errors clustered by firm.A significant negative coefficient of α1indicates that religion can reduce stock price crash risk.

4.Empirical results

4.1.Descriptive statistics

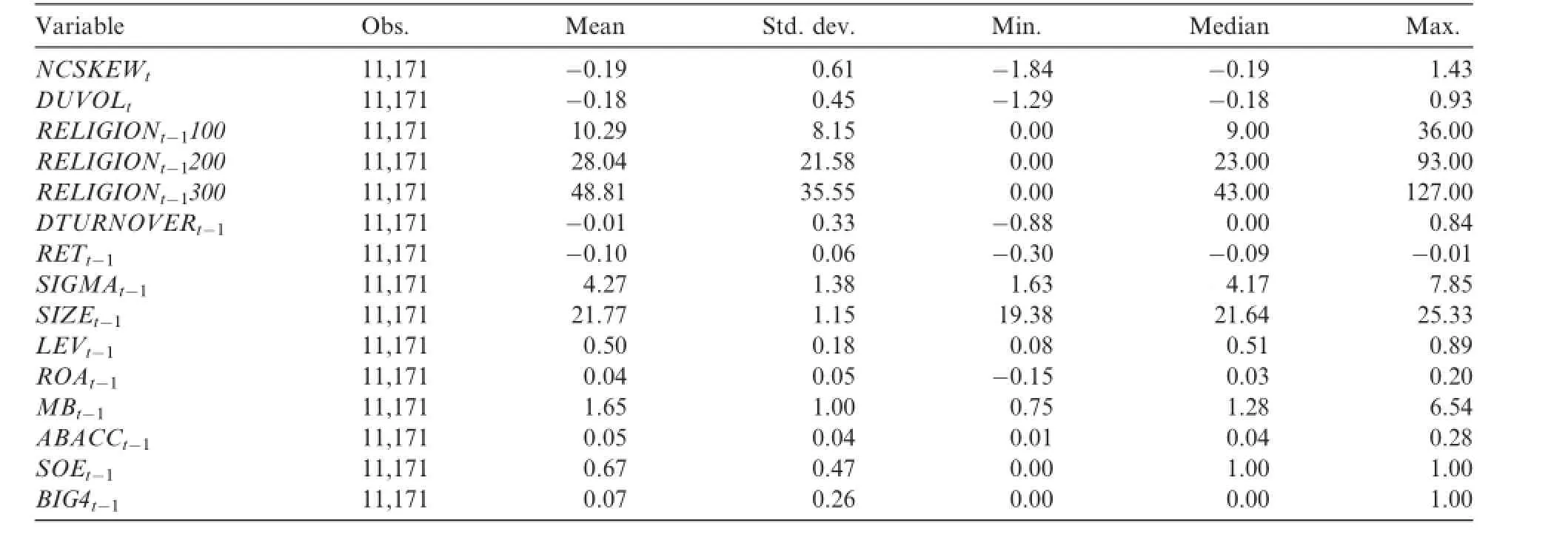

Table 1 presents the descriptive statistics for the main variables.The mean values of NCSKEWtand DUVOLtare-0.19 and-0.18,respectively.The mean value of NCSKEWtis similar to the estimates in Chen et al.(forthcoming).The respective standard deviations of NCSKEWtand DUVOLtare 0.61 and0.45,which means that the two crash risk variables have large differences in our sample.The mean value for RELIGIONt-1200 is 28.04,meaning that there are on average 28 temples within a 200 km radius of the firm's registered address.

Panel A of Table 2 shows the location distribution of religious temples and the listed companies.There are no religious temples within 100 km of 10.69%of the listed companies,and the percentage of firms with no religious sites within the radius declines gradually with distance.Panel B reports the results of the univariate tests.We distinguish between firms affected by high and low degrees of religion;a value higher than the median indicates a high degree of religious influence,and a value lower than the median indicates a low degree of religious influence.We can see that whether NCSKEWtor DUVOLtis used to measure stock price crash risk,there is a significant difference between a high and low degree of religion,implying that firms registered in areas with higher levels of religiosity are less prone to crashes,providing preliminary support for our conjecture.

Table 1Descriptive statistics.

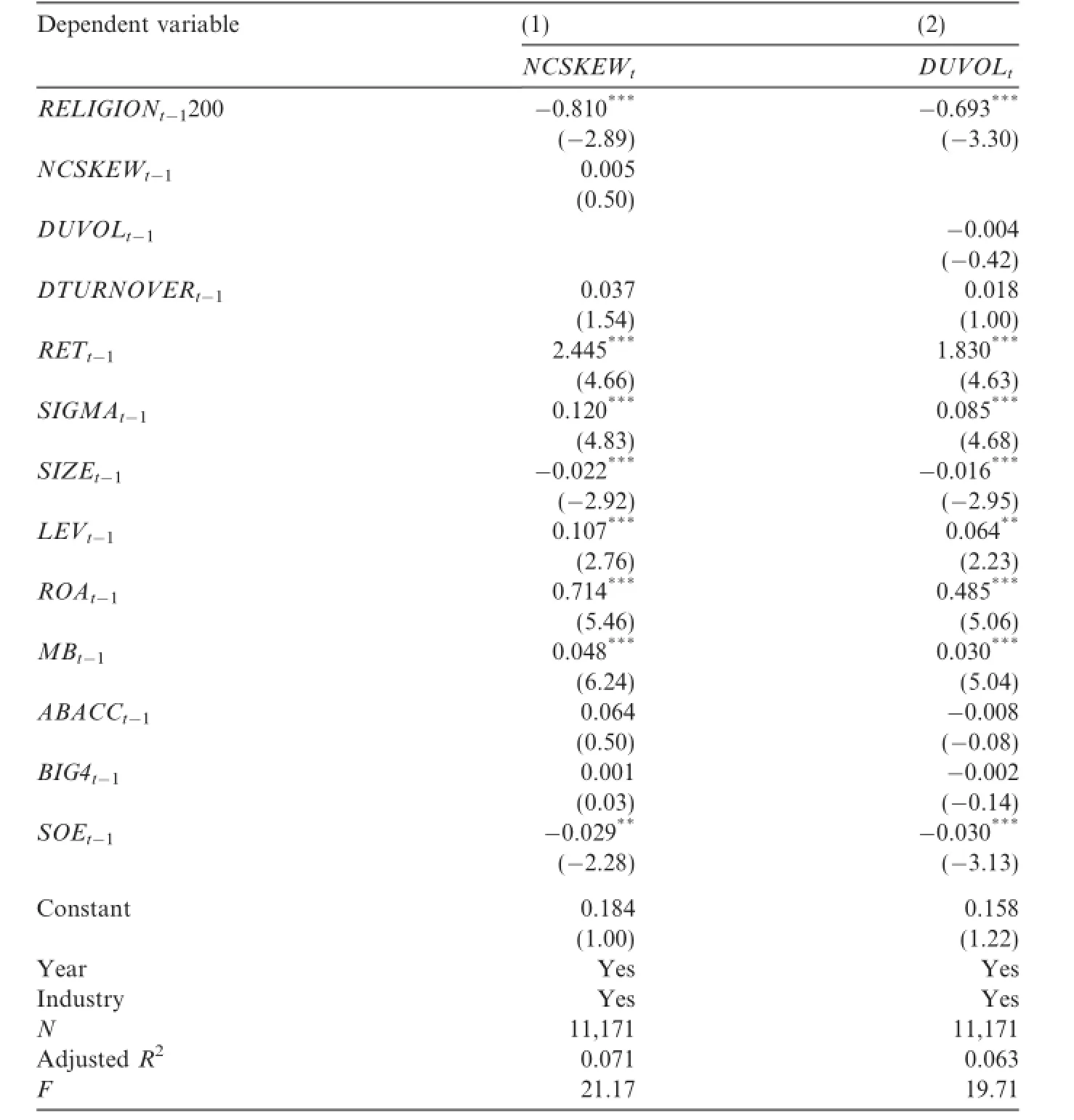

4.2.The effect of religion on crash risk

Table 3 presents the results of our regression analysis of the relation between religion and future firmspecific stock price crash risk after controlling for other potential factors that influence crash risk.We can see that whether the future firm-specific crash risk is measured as NCSKEWtor DUVOLt,the estimated coefficients of RELIGIONt-1200 are both significantly negative at the 1%level(t-values=-2.89 and-3.30).This finding supports our hypothesis;that is,the more religious the environment where a listed firm is located,the lower the future firm-specific crash risk,which is consistent with the view that religion can play a positive rolein corporate governance.As China's religious policy opens up,religious activities are booming,more and more people are becoming religious adherents and the influence of religion will gradually become more important.Overall,our results offer some evidence that religion can constrain managerial opportunism,mitigate the adverse effect of a sudden release of bad news and thus reduce firm-specific crash risk.

Table 2Location distribution of temples and listed firms and univariate tests.

The coefficients of the control variables are generally consistent with prior research.First,the coefficients of RETt-1,SIGMAt-1and MBt-1are significantly positive at the 1%level,which is consistent with Chen et al.(2001)and Jiang and Yi(2013).Second,the coefficients of ABACCt-1and DTURNOVERt-1are both insignificant,which is also consistent with studies of stock price crash risk based on Chinese data(e.g.,Xu et al.,2012).

Table 3Regression analysis on the effect of religion on crash risk.

4.3.Robustness checks

Our result is robust to a battery of sensitivity tests as follows(untabulated).

4.3.1.Alternative proxy for religion

We calculate the number of religious activity sites within a 100 km and 300 km radius around the firm's registered address as two alternative proxies for the religious variable and then re-estimate Eq.(7).Our results still holdusingthesetwoalternativemeasurements.Whetherthereligiousvariableismeasuredasthenumberoftemples within 100 km,200 km or 300 km,the coefficients of RELIGIONt-1are all significantly negative.In addition,the absolute value of the religious coefficient decreases with distance,suggesting that firms closer to religiousactivitysitesarelesspronetocrashes.Theresultsforothercontrolvariablesareconsistentwiththeprevious findings.

4.3.2.The influence of analysts and institutional investors

Xu et al.(2013a,b)find that financial analysts and institutional investors can also affect firm-specific crash risk.To alleviate the effect of omitted variables,we include ANALYSTt-1and INSTIt-1in the model.The results show that the coefficient of RELIGIONt-1200 is still significantly negative at the 1%level after controlling for financial analysts and institutional investors.Consistent with Xu et al.(2013a,b),ANALYSTt-1and INSTIt-1are associated with positive stock price crash risk.These findings indicate that in terms of stock price crash risk,external governance mechanisms in the Chinese capital market fail to work effectively;instead,they increase the volatility of the stock market.

5.Further research

5.1.The mechanisms of religion's effect on firm-specific crash risk

According to the above theoretical analyses,religion will weaken principal-agent problems and thus reduce stock price crash risk.Specifically,religion can reduce stock price crash risk by mitigating earnings management and perk consumption.To test the pathways via which religion acts on stock price crash risk,we use the Sobel intermediary factor test method(Baron and Kenny,1986)to analyze the intermediary effect.Taking the earnings management intermediary effect as an example,we design the following models:

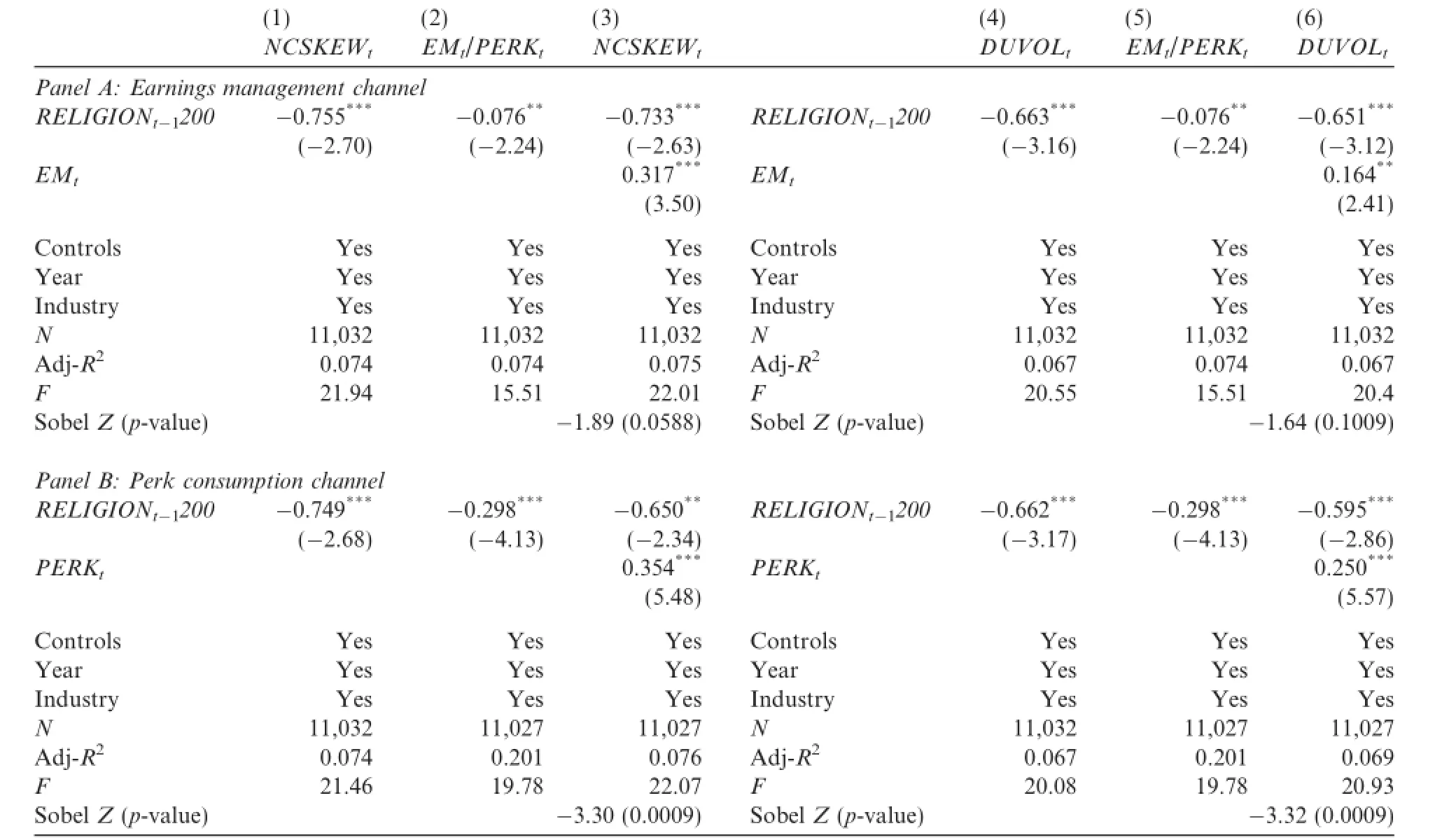

Table 4 presents the intermediary effects of regression testing.Panel A shows the results for whether religion reduces firm-specific crash risk by reducing earnings management.We use discretionary accruals to measure earnings management.In Column(1),the coefficient of RELIGIONt-1is-0.755,and significant at 1%level,which is consistent with previous findings suggesting that religion reduces stock price crash risk.In Column(2),the coefficient of RELIGIONt-1is also significantly negative,indicating that religion can reduce the earnings management problem,consistent with Chen et al.(2013).When we add the intermediary factor EMtinto model(1),the absolute value of the coefficient decreases from 0.755 to 0.733,and is still significantly negative at the 1%level.The Sobel Z value is-1.89,which is significant at the 10%level,suggesting that there is apartial mediation effect of earnings management.The ratio of the indirect effect to the direct effect is 3.28%.3The indirect effect of earnings management is-0.024(-0.076×0.317),whereas the direct effect is-0.733,so the value of the indirect effect accounted for by the direct effect is 3.28%.Overall,Columns(1)-(3)show that religion does reduce firm-specific crash risk by reducing earnings management.

Panel B of Table 4 shows whether religion reduces stock price crash risk by means of moderating the problem of perk consumption.We use management fees to measure managers'perk consumption(Ang et al.,2000).4We also use sales management expense ratio to measure perk consumption;the result is consistent.In Column(2),the coefficient of RELIGIONt-1is significantly negative at the 1%level,indicating that religion can reduce managers'perk consumption significantly,which is consistent with Du(2013).In Column(1),the coefficient of RELIGIONt-1is significantly negative at the 1%level.However,when we add the intermediary factor of PERKtinto model(1),the absolute value of the coefficient of RELIGIONt-1decreases from 0.749 to 0.650,and both are significantly negative at the 5%level.The Sobel Z value is-3.30 and significant at the 1%level,showing that there is a partial mediation effect of perk consumption.The ratio of the indirect effect to the direct effect is 15.01%.

The results in Table 4 show that religion reduces firm-specific crash risk by reducing agency problems such as earnings management and perk consumption.

Table 4Mechanisms of religion's influence on crash risk.

5.2.The effect of different types of religion on crash risk

Previous studies on the economic consequences of religion have only rarely examined the effect of different types of religion,thus failing to fully reflect the effect of different religions.Fortunately,the uniqueness of China's religious policy and environment give us the opportunity to study the role different religions played in corporate governance.

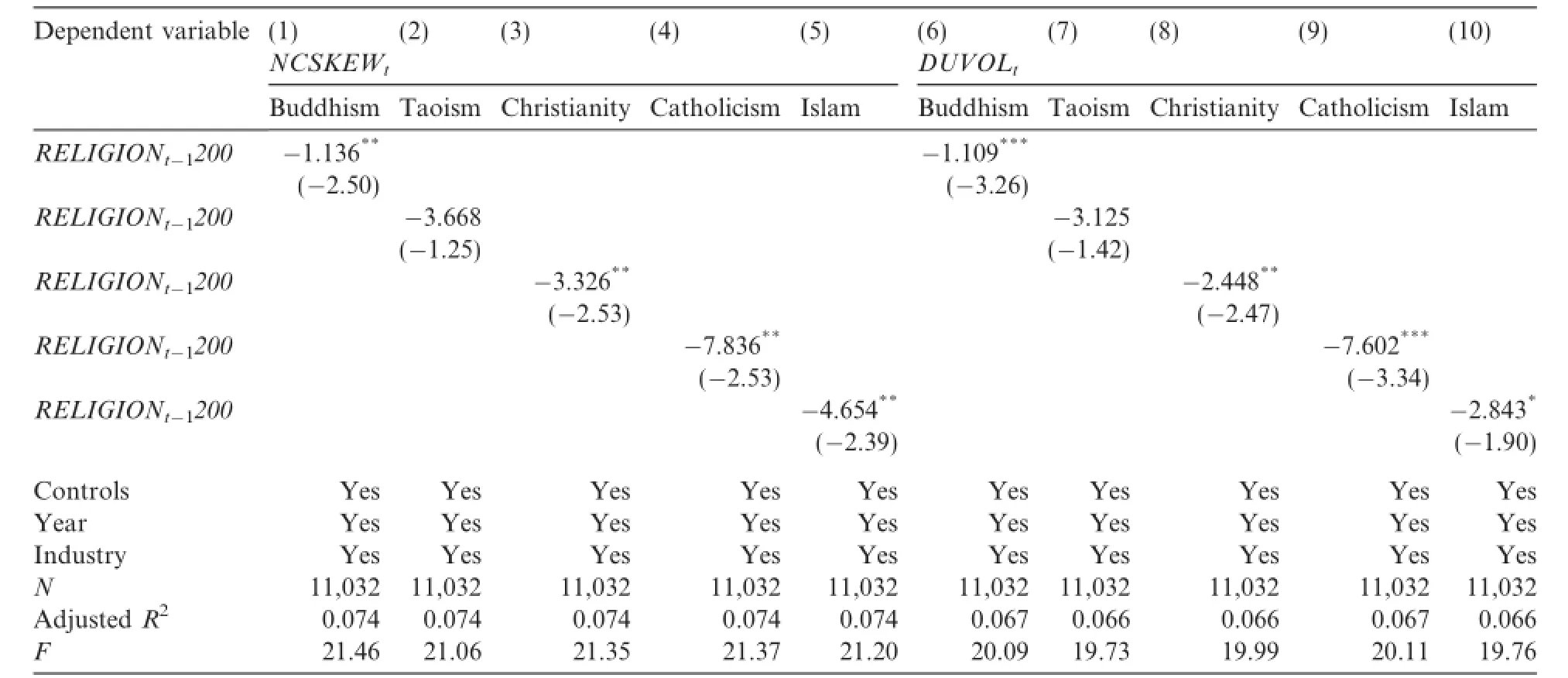

In America,Christianity is dominant,whereas China is a country of religious diversity,with the five major religions being Buddhism,Taoism,Catholicism,Christianity and Islam.To further study the different effects of different kinds of religions on corporate governance in China we divide the sample into five subsamples—Buddhism,Taoism,Catholicism,Christianity and Islam—and then regress them respectively.Table 5 reports the effects of these different religions on crash risk.We can see that the coefficients of the religion variable are all significantly negative except for that of Taoism,which implies that Buddhism,Catholicism,Christianity and Islam reduce firm-specific crash risk whereas Taoism does not.Our findings are consistent with Du(2013),who compares the influence of Buddhism and Taoism on agency costs and finds that only Buddhism can significantly reduce a company's agency costs.We can also see that foreign religions such as Christianity can significantly reduce stock price crash risk.Callen and Fang(2015)find that Christianity can significantly reduce stock price crash risk in the United States.Columns(3)and(8)of Table 5 are consistent with the result of Callen and Fang(2015).The results show that the dissemination of Christianity into China can effectively restrain managers'hiding of negative news,as well as reducing firm-specific crash risk.Prior to research studying Western religions finds that the governance role that religion plays comes predominantly from Protestantism rather than from Catholicism(EI Ghoul et al.,2012).Our results show that both Catholicism and Christianity can play a significant role in corporate governance to reduce stock price crash risk.This is mainly due to the unique Chinese religious environment and the differences between American and Chinese attitudes to religion.In China,religious adherents do not strictly distinguish between religious sects,instead,they pay more attention to the function of religion,and are even blind to worship and faith in god(Liang,2002).Therefore,foreign religions,whether Protestant Christianity or Catholicism,can both have a governing effect on the managers of listed companies in China.

Table 5Influence of different types of religion on crash risk.

5.3.The effect of religion on crash risk in different governance environments:supplementary or substitution?

There is a debate over whether the effect of formal and informal institutions on managers'behavior is supplementary or one of substitution.On the one hand,from the perspective of corporate governance,if the quality of corporate governance is low,managerial opportunism may be extreme.It is doubtful that religion can constrain managers to hide bad news in companies with lower-quality governance.However,Callen and Fang(2015)find that the negative relationship between religion and future crash risk is stronger for firms with weaker corporate governance in the United States,which implies that there is a substitutable relationship between religion and corporate governance working on firm-specific crash risk.On the other hand,from the perspective of external governance mechanisms,because religion is part of the social rather than the legal culture,whether people abide by religious doctrines depends on their moral self-discipline rather than the law. There is theoretically a supplementary or substitutional relationship between religion and institutional governance mechanisms.Based on China's institutional background,Chen et al.(2013)point out that religion influences actors'utility functions and risk attitudes,and people are willing to pay a higher cost to achieve a higher standard.Therefore,they argue that the relationship between religion and corporate governance is more complementary than substitutional,and their empirical results support this idea.

To comprehensively reflect the relationship between religion and governance mechanisms in terms of crash risk,we analyze the two aspects of internal governance and external governance.However,there may be an endogeneity problem because religion can also affect corporate governance(Chen et al.,2013).To avoid this problem,we do not use conventional variables to measure corporate governance.5We also use traditional corporate governance variables such as the duality of the CEO and chairman of the board(Kim et al.,2014)and separation of ownership and control to measure corporate governance;the results are consistent.

The Chinese government mandated IFRS adoption in 2007;the non-tradable shares reform ended in the same year and the‘‘New Company Law”had been in force for one year.As a result,the quality of Chinese listed firms'corporate governance has greatly increased since 2007.Therefore,we use the external shock in 2007 to separate the subsample of high-quality corporate governance(after 2007)from the subsample of low quality governance(before 2007).The advantage of using this measure is that the change of corporate governance is an exogenous shock,and therefore not influenced by religion.Following Chen et al.(2013),we use the legal environment where the firm is located to measure the quality of external governance.6Variables are defined as follows:we use the mean of Fang Gang index in provinces to measure the development of the legal environment from 2001 to 2009.When the provincial legal development level is higher than the median,then LAW=1,otherwise LAW=0.LAW equal to 1 indicates that the company's external governance is better.

Table 6 presents the results of the cross-sectional analyses.Column(2)in Panel A and Column(8)in Panel B show that in the high-quality corporate governance group,the coefficients of religion are significantly negative at the 1%level,but in the low-quality corporate governance group(Column(1)in Panel A and Column(7)in Panel B),the coefficients of religion are insignificant.These results suggest that in China,there is a complementary relationship between religion and internal governance,which is inconsistent with the finding reported in Callen and Fang(2015).The reason may be that the overall corporate governance level is higher in America and the quality of internal corporate governance is relatively low in China.In this case,it is difficult for religion to play a governance role.In terms of external governance,Column(4)in Panel A and Column(10)in Panel B show that in the strong legal environment group,the coefficients of religion are significantly negative at the 5%level(NCSKEWt)or 1%level(DUVOLt),but in the weak legal environment group,the coefficients of religion are insignificant(Column(3)in Panel A and Column(9)in Panel B).The results suggest that the relationship between religion and external governance is supplementary,which is also consistent with Chen et al.(2013).

Whether religion can effectively reduce firm-specific crash risk depends on the quality of the governance environment.Specifically,religion can effectively play a governance role only in firms with high-quality internal governance in a strong legal environment.These results imply that religion cannot completely replace internal governance and a strong legal system;when internal corporate governance and the legal environment are of high enough quality,they create a situation in which religion can exert an effect.

Table 6Cross-sectional analyses of governance environments.

6.Conclusion

The past decade has seen increasing attention given to stock price crash risk around the world,because such crashes can be highly detrimental to a country's economy and the capital market.However,the current literature on crash risk mainly considers formal institutions such as corporate governance,and few studies have examined whether informal institutions can influence firm-specific crash risk.In this paper,we investigate the relationship between religion and stock price crash risk in terms of an informal institution,which enriches the literature on stock price crash risk and religion,and also contributes to the field of new economic geography.

Our results show that firms in a more religious environment have lower firm-specific crash risk in China. We also find the following:

(1)Earnings management and perk consumption have partial intermediary effects on religion and stock price crash risk.Religion's effects on crash risk are enacted through the channel of reducing the agency problems of earnings management and managers'perk consumption.

(2)Different types of religions have different effects on crash risk in China.In particular,Taoism has no association with crash risk whereas the foreign religions of Catholicism and Christianity both significantly reduce stock price crash risk.

(3)The effect of religion on stock crash risk depends on the quality of the governance environment.Specifically,the negative relationship between religion and crash risk is more pronounced when the quality of corporate governance and the legal environment is higher,suggesting that there is a complementary relationship between religion and formal governance mechanisms.

In summary,to the best of our knowledge,this study is the first to demonstrate that religion plays a governance role in relieving management opportunism problems and thus reducing firm-specific crash riskin the transformation of socialist China.Our findings have implications for how to recognize and effectively improve the positive role of religion in corporate governance in weak governance environments.It is of vital importance to note that religion can work well only when the quality of corporate governance and the legal environment are improved.

Acknowledgments

The authors thank the executive editor and anonymous referees for their helpful suggestions.This study was supported by the National Natural Science Foundation of China(Project Nos.71372151;71502040;7157020419;71332004).

References

Andreou,P.C.,Antoniou,C.,Horton,J.,Louca,C.,2016.Corporate governance and firm-specific stock price crashes.Eur.Financ. Manage.(forthcoming).

Ang,J.S.,Cole,R.A.,Lin,J.W.,2000.Agency cost and ownership structure.J.Finance 55(1),81-106.

Allen,F.,Qian,J.,Qian,M.,2005.Law,finance and economic growth in China.J.Financ.Econ.77(1),57-116.

Almazan,A.,Motta,A.D.,Titman,S.,Uysal,V.,2010.Financial structure,acquisition opportunities and firm locations.J.Finance 65(2),529-563.

Arena,M.P.,Michael,D.,2012.Firm location and corporate debt.J.Bank.Finance 36(4),1079-1092.

Barnett,T.,Bass,K.,Brown,G.,1996.Religiosity,ethical ideology and intentions to report a peer's wrong doing.J.Bus.Ethics 15(11),1161-1175.

Baron,R.M.,Kenny,D.A.,1986.The moderator-mediator variable distinction in social psychological research:conceptual,strategic,and statistical considerations.J.Pers.Soc.Psychol.51,1173-1182.

Burckhardt,J.,1979.Reflections on History.Liberty Classics,Indianapolis.

Callen,J.L.,Fang,X.,2015.Religion and stock price crash risk.J.Financ.Quant.Anal.50(1/2),169-195.

Chen,C.,2005.Christianity in China during the Transition Period:A Case Study of Christianity in Zhejiang.Oriental Press,Beijing(in Chinese).

Chen,D.,Hu,X.,Liang,S.,Xin,F.,2013.Religious tradition and corporate governance.Econ.Res.J.9,71-84(in Chinese).

Chen,J.,Chan,K.C.,Dong,W.,Zhang,F.,2016.Internal control and stock price crash risk:evidence from China.Eur.Acc.Rev.(forthcoming).

Chen,J.,Hong,H.,Stein,J.C.,2001.Forecasting crashes:trading volume,past returns,and conditional skewness in stock prices.J. Financ.Econ.61(3),345-381.

DeFond,M.,Hu,X.,Hung,M.,Li,S.,2011.The impact of mandatory IFRS adoption on foreign mutual fund ownership:the role of comparability.J.Acc.Econ.51(3),240-258.

Diaz,J.,2000.Religion and gambling in sin-city:a statistical analysis of the relationship between religion and gambling patterns in Las Vegas residents.Soc.Sci.J.37,453-458.

Du,X.,2013.Does religion matter to owner-manager agency costs?Evidence from China.J.Bus.Ethics 118(2),319-347.

Du,X.,2015.Does Confucianism reduce minority shareholder expropriation?Evidence from China.J.Bus.Ethics 132(4),661-716.

Du,X.,Jian,W.,Du,Y.J.,Feng,W.,Zeng,Q.,2014.Religion,the nature of ultimate owner,and corporate philanthropic giving:evidence from China.J.Bus.Ethics 123(2),235-256.

Du,Y.,2010.Current situation and development trend of religions in contemporary China.J.Central Inst.Social.5,77-88(in Chinese).

Dyreng,S.,Mayew,W.,Williams,C.,2012.Religious social norms and corporate financial reporting.J.Bus.Financ.Acc.39,845-875.

EI Ghoul,S.,Guedhami,O.,Ni,Y.,Pittman,J.,Saadi,S.,2012.Does religion matter to equity pricing?J.Bus.Ethics 111(4),491-518.

Francis,B.,Hasan,I.,Li,L.X.,2014.Abnormal real operations,real earnings management,and subsequent crashes in stock prices.Rev. Quant.Financ.Acc.46(2),217-260.

He,Y.,2007.Cultural Studies on Contemporary Chinese Religion.Northeast Normal University.Doctoral thesis(in Chinese).

Hilary,G.,Hui,K.W.,2009.Does religion matter in corporate decision making in America?J.Financ.Econ.93(3),455-473.

Hutton,A.P.,Marcus,A.J.,Tehranian,H.,2009.Opaque financial reports,R2,and crash risk.J.Financ.Econ.94(1),67-86.

Iannaccone,L.R.,1998.Introduction to the economics of religion.J.Econ.Lit.36(3),1465-1495.

Idler,E.,1987.Religious involvement and the health of the elderly:some hypotheses and an initial test.Soc.Forces 66(1),226-238.

Jiang,F.,Jiang,Z.,Kim,K.A.,Zhang,M.,2015.Family-firm risk-taking:does religion matter?J.Corp.Financ.33,260-278.

Jiang,X.,2013.Tax enforcement,tax aggressiveness and stock price crash risk.Nankai Bus.Rev.5,152-160(in Chinese).

Jiang,X.,Yi,Z.,2013.Auditor industry specialization and stock price crash risk.China Acc.Rev.11(2),133-150(in Chinese).

Jin,L.,Myers,S.,2006.R2 around the world:new theory and new tests.J.Financ.Econ.79(2),257-292.

Jin,Z.,Qiu,Y.,2008.Chinese Religious Report.Social Science Literature Press,Beijing(in Chinese).

John,K.,Knyazeva,A.,Knyazeva,D.,2011.Does geography matter?Firm location and corporate payout policy.J.Financ.Econ.101(3),533-551.

Kang,J.K.,Kim,J.M.,2008.The geography of block acquisitions.J.Finance 63(6),2817-2858.

Kedia,S.,Panchapagesan,V.,Uysal,V.,2008.Geography and acquirer returns.J.Financ.Intermed.17(2),256-275.

Kim,J.B.,Li,Y.,Zhang,L.,2011a.Corporate tax avoidance and stock price crash risk:firm-level analysis.J.Financ.Econ.100(3),639-662.

Kim,J.B.,Li,Y.,Zhang,L.,2011b.CEO versus CFO:equity incentives and crashes.J.Financ.Econ.101(3),713-730.

Kim,J.B.,Wang,Z.,Zhang,L.,2016.CEO overconfidence and stock price crash risk.Contemp.Acc.Res.(forthcoming).

Kim,J.B.,Zhang,L.,2016.Accounting conservatism and stock price crash risk:firm-level evidence.Contemp.Acc.Res.33(1),412-441.

Kim,Y.,Li,H.,Li,S.,2014.Corporate social responsibility and stock price crash risk.J.Bank.Finance 43,1-13.

Li,F.,2013.A preliminary study on the trust of religious organizations based on data from Shanghai.Chin.J.Sociol.33(2),85-110(in Chinese).

Li,X.,Liu,H.,2012.CEO vs CFO:gender and stock price crash risk.J.World Econ.12,102-129(in Chinese).

Liang,L.,2002.The religious view of Chinese traditional society and religious faith.Acad.J.Zhongzhou 6,104-108(in Chinese).

McGuire,S.T.,Omer,T.C.,Sharp,N.Y.,2012.The impact of religion on financial reporting irregularities.Acc.Rev.87(2),645-673.

Miller,A.S.,2000.Going to hell in Asia:the relationship between risk and religion in a cross culture setting.Rev.Relig.Res.42(1),5-18.

Nunziata,L.,Rocco,L.,2011.The Implications of Cultural Background on Labor Market Choices:The Case of Religion and Entrepreneurship.IZA Working Paper.

Pew Research Center,2015.The Future of World Religions:Population Growth Projections,2010-2050,2th April.〈http://www. pewforum.org/2015/04/02/religious-projections-2010-2050/〉.

Piotroski,J.D.,Wong,T.J.,2012.Institutions and information environment of Chinese listed firms.In:Capitalizing China.University of Chicago Press,Chicago,pp.242-246.

Piotroski,J.D.,Wong,T.J.,Zhang,T.,2015.Political incentives to suppress negative information:evidence from Chinese listed firms.J. Acc.Res.53(2),405-409.

Riahi-Belkaoui,A.,2004.Law,religiosity and earnings opacity internationally.J.Acc.Audit.Perform.Eval.1(4),493-502.

Ruan,R.,Zheng,F.,Liu,L.,2014.The power of religious believing:does religion influence entrepreneurship?Econ.Res.J.3,171-184(in Chinese).

Sobel,M.E.,1982.Asymptotic confidence intervals for indirect effects in structural equation models.Sociol.Methodol.13,290-312.

Wang,H.,Cao,F.,Ye,K.T.,2015.Monitoring or tunneling?The proportion of the proportion held by the big shareholders and the risk of the crash of the stock price.Manage.World 2,45-57(in Chinese).

Weber,M.,1905.The Protestant Ethic and the Spirit of Capitalism.Allen and Unwin,London.

Wei,S.,2002.Economics and Ethics:Exploring the Ethical Dimensions of Market Economy and the Moral Foundation.Shanghai People's Press,Shanghai(in Chinese).

Xu,N.,Jiang,X.,Chan,K.C.,Yi,Z.,2013a.Analyst coverage,optimism,and stock price crash risk:evidence from China.Pac.-Basin Finance J.25(11),217-239.

Xu,N.,Jiang,X.,Yi,Z.,Xu,X.,2012.Conflicts of interest,analyst optimism and stock price crash risk.Econ.Res.J.7,127-140(in Chinese).

Xu,N.,Li,X.,Yuan,Q.,Chan,K.C.,2014.Excess perks and stock price crash risk:evidence from China.J.Corp.Finance 25(4),419-434.

Xu,N.,Yu,S.,Yi,Z.,2013b.Herding behavior of institutional investors and stock price crash risk.Manage.World 7,31-43(in Chinese).

Yang,C.K.,1961.Religion in Chinese Society:A Study of Contemporary Social Functions of Religion and Some of their Historical Factors.University of California Press,Berkeley and Los Angeles.

Ye,K.,Cao,F.,Wang,H.,2015.Can internal control information disclosure reduce stock price crash risk.J.Financ.Res.2,192-206(in Chinese).

Zhang,L.,2015.Three characteristics of Chinese religious tradition.China Relig.4,60-61.

Zhang,Z.,2007.The positive role of religious ethics for building a harmonious society.Theor.Explor.4,32-34(in Chinese).

11 September 2014

.Tel.:+86 15017566664;fax:+86(20)84036924.

E-mail addresses:liwenfei21@126.com(W.Li),caiglong@mail2.sysu.edu.cn(G.Cai).

China Journal of Accounting Research2016年3期

China Journal of Accounting Research2016年3期

- China Journal of Accounting Research的其它文章

- Bank equity connections,intellectual property protection and enterprise innovation-A bank ownership perspective

- Disclosure of government financial information and thecostoflocalgovernment'sdebtfinancing—Empirical evidence from provincial investment bonds for urban construction☆

- Income smoothing and the cost of debt