Bank equity connections,intellectual property protection and enterprise innovation-A bank ownership perspective

Xing Liu,Shuiquan Jiang

School of Economics and Business Administration,Chongqing University,China

Bank equity connections,intellectual property protection and enterprise innovation-A bank ownership perspective

Xing Liu1,Shuiquan Jiang*

School of Economics and Business Administration,Chongqing University,China

A R T I C L EI N F O

Article history:

Accepted 21 April 2016

Available online 20 May 2016

Bank equity connections

Intellectual property protection

Corporate innovation

Innovation performance

This study investigates the effects of bank equity connections and intellectual property protection on enterprises'innovation behavior,and the regulating effect of intellectual property protection on the relationship between bank equity connections and innovation.In general,bank equity connections and intellectual property protection not only significantly increase innovation input,but also improve innovation performance.However,the efficiency of bank equity connections is influenced by the heterogeneity of enterprises and the value orientation of the subjects.Bank equity connections have a more significantly positive effect on innovation in private and central enterprises,whereas the principal-agent problem and government intervention may weaken the marginal contribution of bank equity connections to the innovation of local state-owned enterprises.Bank equity connections and intellectual property protection are complementary in promoting enterprise innovation. Not only are the combined effects of bank equity connections and intellectual property protection greater than the individual effects,but when the latter is relatively weak,the former's positive effect on innovation is obviously weakened and may even crowd out innovation.

©2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Since the beginning of its economic reforms in 1978,China's market-orientation and property rights have created a‘‘growth miracle.”However,this growth has excessively relied on high input,high consumption and high emissions.The lack of independent innovation and technological progress has limited the intensive and efficient use of resources and sustainable economic growth(Wu and Mi,2011;Chen and Hu,2011).The rapid increase in labor costs,the increase in resource environment pressure and shrinking external demand have resulted in increasingly negative externalities in this low-end economic growth pattern.Therefore,strengthening technological progress,changing the mode of economic growth,and improving the ability to innovate and gradually shift from factor-driven economic growth to innovation-driven economic growth are urgent tasks. In fact,increasing innovation and building an innovative country were emphasized in China's 12th 5-year plan.But the current outlook for innovation development is not optimistic.Although the ratio of R&D expenses to sales revenue in large-and medium-sized industrial enterprises increased from 0.48%in 1996 to about 0.93%in 2010,the level of innovation input still fell behind that of developed countries.According to Hall and Oriani(2006),the ratio of R&D expenses to sales revenue in the United States,Britain,Germany and France is 4.9%,2.9%,4.5%and 4.2%,respectively.In 1992,R&D expenses reached 1.97%of GDP,a record;however,the ratio has reached 2.66%,1.86%,2.40%and 2.16%,respectively,in the United States,Britain,Germany and France,since the end of the 20th century.2Source:China Statistical Yearbook(1996-2013).Before 2011,this yearbook separately disclosed the R&D expenses and sales income of China's large-and medium-sized industrial enterprises.In 2011,the large and medium-sized industrial enterprises were grouped into the category of above-scale enterprises;this yearbook did not separate large-and middle-scale enterprises,nor did the financial reports reveal information about scientific or technological innovations.Therefore,the data are only for the fiscal year that ended in 2010.Furthermore,the conversion rate for scientific and technological achievements in developed countries is more than 80%,whereas in China,the conversion rate is very low,only 20%,and the authentic industrialization rate is less than 5%(Xiao and Wang,2014).

Accordingly,understanding why investment in innovation and the effects of such investment are so low in Chinese enterprises,and how to promote innovation are important issues both theoretically and practically. Enterprise innovation can be easily restricted by financing limitations due to its high risk,long incubation period and information asymmetry.Access to a steady stream of financial support may be a key factor in innovation decisions.Enterprises'financing channels include internal financing and external financing.Although internal financing provides higher autonomy and less risk,using internal financing to fund an innovation project may be difficult,not only due to the constraints imposed by corporate earnings and business fluctuations,but also because of ownership structure,management incentives,investor risk appetite,institutional investors governance,product market competition and so on(Lin et al.,2011a,2011b,2011c;Aghion et al.,2005,2013;Li and Song,2010;Becker-Blease,2011;O'Connor and Rafferty,2012;Lu and Dang,2014;Sapra et al.,2014;Tian and Wang,2014).Therefore,access to external capital is of paramount importance to ease the risk of investing in innovation.In fact,there are several studies of the relationship between external financing and innovation in China.Using an innovation resource acquisition research perspective,Brown et al.(2013),Chemmanur et al.(2014)and Cornaggia et al.(2015)investigate the relationships of enterprise innovation with stock financing,corporate venture capital and credit financing,respectively.Hsu et al.(2014)use the data of 32 developed countries and emerging markets and examine the effect of the securities and credit markets on enterprise innovation at the national level.Domestic scholars Xie and Fang(2011)find that banking reform and regional financial development promote investment in innovation in Chinese enterprises by expanding financing channels.Using the World Bank's survey data of more than 12,000 Chinese enterprises,Ma et al.(2014)find that the acquisition of bank credit can increase the probability of R&D and the intensity of innovation by 8.6%and 0.24%,respectively.

Although these scholars reveal the transmission mechanisms that transform external financing into enterprise innovation,these studies are mainly based on institutional environments in developed countries,such as the USA and Britain,and their basic assumptions and logical deductions may not be effectively migrated to emerging markets such as China.Therefore,their findings may not reasonably explain,forecast or guide innovation behavior in China.For instance,although with the rapid development of China's capital market,securities financing and credit financing have become the two most important external financing channels forlisted corporations,due to China's bank-dominated financial system,external financing of enterprises,even listed enterprises,is still dominated by credit financing.This greatly weakens the ability of securities financing to promote enterprise innovation.3Unlike some regions such as Europe and the Americas,the centerpiece of China's financial system is credit financing,and securities financing is underdeveloped.According to the executive report of China's central bank on monetary policy disclosure,from 2006 to 2012 foreign currency loans,entrustment loans,trust loans,no discount bank draft,corporate bonds and stock financing were,respectively,65.82%,7.01%,6.44%,7.86%,9.46%and 3.42%of the capital that the real economy obtained from the financial system.Because political interference in private enterprises often results in low levels of corporate transparency and greater business risk,etc.,private enterprises have remained marginalized in the stock and bond markets(Zhu and Lu,2011).Therefore,their dependence on bank credit may be larger. The data from the China Stock Market,Accounting Research and Wind Information Co.,Ltd.databases show that from 2006 to 2013,many more Chinese listed companies were financed with bank credit than with equity financing.Specifically,despite IPO financing,the external financing of China's listed companies is still primarily bank loans.Thus compared to other nations and areas,equity financing in China plays a limited role in promoting innovation.

Furthermore,in existing studies,enterprises are viewed as passive recipients in an external financing environment;thus,these studies ignore the innovative behavior of enterprises facing external difficulties,the transmission channels of innovation and the effect of the external environment on micro transmission mechanisms. During economic transfers,the imperfections in China's capital market and institutional arrangement distort the factor market and resource mismatch problems(Xu,2011;Zhu and Lu,2011,2012).The low efficiency of both the market and government also encourages enterprises to invest in social capital,such as building political connections,hiring executives with financial backgrounds and so on,to obtain resource allocation advantages(Liu et al.,2013;Cull et al.,2015).However,compared to these indirect associations,the equity connections established by holding bank ownership are a much more direct association;this strategy has been widely used in emerging markets,but has not received attention from scholars(Khanna and Yafeh,2007;Chen and Chen,2012).According to statistics collected by the author,approximately 14.79%of Chinese manufacturing listed companies hold more than 2%of the total ownership of a bank.In recent years,to strengthen our economy and compete with foreign rivals,our government,learning from the development experiences of neighboring countries,has issued a series of realization measures and preferential policies,4For example,in 1999 The People's Bank of China issued interim provisions on financial institutions.In 2004,the China Banking Regulatory Commission formally published the‘‘Management approach of the related transactions between commercial banks and insiders or shareholders.”In 2011,China issued‘‘Several opinions of the State Council on encouraging and guiding the healthy development of private investment.”that encourage and guide non-financial capital into the financial sector.These measures will undoubtedly further highlight the effect of bank equity connections on the economy.Unfortunately,this phenomenon has not been examined in academic circles;few studies have analyzed the mechanisms and economic consequences of bank equity connections from an innovation perspective.This is also important because the mechanisms through which bank equity connections affect enterprises'financial decisions are also affected by corporate governance mechanisms and the external institutional environment.

After a series of substantial structural reforms,such as the‘‘State retreats and private advances”reform,and the reform of the share system,China's original state-owned enterprises gradually converted into modern joint-stock enterprises through various means,such as spin-off listings,binding listings,holistic listings.But in the current transition period,the influence of ultimate property rights on enterprise innovation still exists and must not be overlooked.Although the government considers innovation as the primary driver of economic transformation,they also have to consider employment,economic growth and multiple other targets when promoting innovation,and they must incorporate these targets into their state-owned enterprises.The government's strategic plans continuously change along with the actual economic situation;funding innovative projects would not only bring numerous risks but would also influence technological innovations in private enterprises.Even more seriously,the current government performance assessment system,which takes GDP as the key measure,makes government officials and state-owned enterprise executives prefer shortterm goals and short-term investment,as they carry less risk over brief and uncertain tenures.This leads to a reduction in innovation investment,which has high risks and a long periodicity.Thus,the resource allocation function of bank equity connections can be easily diverted to the rent-seeking channels of government officials or state-owned enterprise executives.

In addition,due to the characteristics of externality and quasi-public goods,innovation needs a good legal protection environment or a mechanism that reduces the risk of information disclosure of R&D and protects the rights of creative subjects(Lerner,2009).However,due to the absence of intellectual property protection,independent innovation in China is severely suppressed and there is abnormal dependence on social networks;in particular,government connections that can be used to obtain‘‘relationship rents”are preferred over innovation investment(Xiao and Wang,2014).Since the enactment of its patent law in 1992,China has promulgated a series of judicial interpretations,implementation details and administration regulations meant to protect creative subjects,but the difficulties in reporting,investigating and collecting proof,offering testimony,and dealing with the law enforcement process still negatively affect the protection of creative subjects'rights. Under the circumstances,it is doubtful whether the resource allocation advantages of bank equity connections can promote innovation.Today,China is at a critical juncture and the government is promoting structural adjustment of the economy and seeks to enhance the quality of economic development by strengthening autonomous innovation.

This study analyzes the transmission mechanisms of bank equity connections in innovation investment and innovation performance and investigates the different effects of bank equity connections in different enterprises and how the interaction between bank equity connections and intellectual property protection stimulates domestic innovation.This research not only enriches our understanding of relevant topics,it also offers suggestions for increasing innovation.

The rest of this paper is organized as follows.First,this paper discusses the mechanisms and effect of bank equity connections on enterprises'innovative behavior,observes the different effects of bank ownership on different enterprises,and reveals the‘‘black box”between bank equity connections and corporate innovation.It not only explains the reasons why more and more enterprises are inclined to invest in banks,it also contributes to the empirical study of this topic.Second,although previous studies have used the intellectual property protection index to investigate the influences of the institutional evolvement of intellectual property protection on enterprise innovation,we use the distribution density of patent agencies and the scale of technology transfer to describe the knowledge protection environment,which helps to improve the depth and objectivity of our argument.Finally,this paper embeds bank equity connections into the transmission mechanism of intellectual property protection and the value orientation of governing bodies,reveals the connection between enterprises' initiatives and institutional evolution,and establishes a bridge between macroeconomic reforms and the micro behavior of enterprises.Today,China is trying to develop a financial system that is suitable for its special national conditions,and the main questions for this system are how to guide and standardize non-financial capital into the financial sector and how to introduce competitive drivers and property right constraints that will optimize incentives and constraint mechanisms of commercial banks.The conclusions provide a theoretical basis and some empirical support for answers to these questions.

This article is organized as follows.Section 1 is the introduction section,Section 2 presents the theoretical analysis and research hypotheses,Section 3 describes the research sample and model,Section 4 presents the results and analysis,Section 5 is an extended test of the data and the final section contains a discussion of the results and some recommendations.

2.Theoretical analysis and research hypotheses

2.1.Bank equity connections,enterprise heterogeneity and enterprise innovation

In the perfect capital market described in MM theory,enterprises always have access to financing at the same cost as internal funds;the only factor determining whether enterprises innovate is the marginal value of their innovative projects(McLean et al.,2012).In reality,however,the imperfection of the capital market and the lack of institutional arrangements distort the configuration of China's capital market.Information asymmetry,caused by adverse selection and moral hazards,means that innovation investment is a capital investment requiring high investment,high risks and long-periodicity.It is difficult for investors or creditors to appraise the real risk and value of innovation investment,and the external capital market,which uses competition and price mechanisms to allocate resources,is not always effective(Rajan and Zingales,2001;Beck and Levine,2002);this results in the‘‘lemon market”problem(Leland and Pyle,1977).In this environment,innovation investment can reduce an enterprise's ability to mortgage and will have a direct effect on their ability to acquire external resources(Brown et al.,2009).Therefore,to avoid the defects of the market and system,companies have intense motivation to seek alternative financing mechanisms;developing a bank equity connection is a common mechanism in many emerging market countries.We argue that this connection between financial markets and enterprises provides resource support and other synergistic effects through multiple paths.

According to resource-based theory and social capital theory,the network of social relationships formed by a bank equity connection can help to mobilize or secure necessary resources for enterprises'innovations.This can be of critical importance in China's economic transitional context(Allen et al.,2005).First,information asymmetry,and the moral hazard and adverse selection problems caused by information asymmetry,are the key factors in financing.However,partial ownership of a bank can bring financial advantages by improving the exchange of information between lenders and borrowers.A bank equity connection can promote information sharing and business coordination between banks and enterprises through compact and organizational arrangements,and can internalize external financing.This not only reduces the risk of information disclosure of R&D,it also helps to solve the problem of funding innovation through asset replacement,reducing loan restrictions,increasing credit and so on.

The cooperative atmosphere created by bank ownership also helps to improve information collection and the supervision of an enterprise's actions.Haubrich(1989)points out that long and stable business relations encourage information production and the supervision of lenders,and so strengthen governance.Zhai et al.(2014)also find that a bank-enterprise relationship introduces market supervision into enterprises and that‘‘interior market management”promotes the supervision and regulation of the behavior of both large shareholders and management.For this reason,a bank equity connection may cultivate innovation because the‘‘EBC”itself may alleviate the agency problem.A bank equity connection can also function as a reputation authentication or guarantee mechanism that signals corporate financing capacity.Other external borrowers may think that a bank equity connection guarantees the quality of relationship loans,because they believe that the information advantages and the nepotism formed by bank ownership mean that the loans from the relationship banks are implicitly guaranteed,thus reducing information asymmetry and easing financing constraints(Chen and Chen,2012;Lu et al.,2012;Liu and Jiang,2015).

In China,political interference and the low efficiency of commercial banks exacerbate the mismatch between basic resources and the funding risks of innovative projects;as a result,there is a phenomenon of scale and ownership discrimination in the resource allocation process(Song et al.,2011;Zhu and Lu,2011,2012).This means that some quality innovation projects are delayed or shelved and reduce innovation investment.A bank equity connection can partially alleviate such discrimination in the allocation of resources,and thus alleviate the financing constraints of innovative projects.Knowledge and ability also play important roles in financing management;many companies encounter trouble in financing due to a lack of high-quality financial talent,but holding bank ownership can optimize an enterprise's knowledge structure and intellectual capital.The knowledge integration between banks and enterprises can lead to tailor-made innovative financing schemes such as structured financing.

Last but not the least,social networks built through bank equity connections can boost the formation of social capital,such as political connections and relationships.This not only helps with project financing,it also helps to capture other scarce resources such as tax breaks,government subsidies and so on.According to capability-based theory,a bank equity connection not only means that enterprises can obtain abundant resources,they can also enhance the dynamic capability of resource allocation,including absorptive capacity,integration capability and innovation ability(Wang and Ahmed,2007).Absorptive capacity refers to the capacity to identify values and to identify and master external knowledge and embed it in management decisions.It is a capacity based on the awareness,precognition,and assessment and application of an external knowledge source.Enterprises with strong absorptive capacity can sense,acquire and integrate external information and knowledge,and obtain sustainable competitive advantages.Such enterprises emphasize the importance of knowledge and experience.In fact,it is the information sharing and knowledge integration advantage of holding bank ownership that allows a bank equity connection to improve an enterprise's absorptive capacity and promote the value identification,scientific assessment and decision-making optimization of innovation investment.

Integration ability is the ability to identify and seize market opportunities through flexible resource allocation and dynamic management.The flexible allocation of resources and the adjustment of business strategies help to cope with volatility in the external economic environment;that is,integration capacity reflects the inner organizational efficiency of enterprises and the integration between enterprises and the external environment.Bank equity connections improve integration ability in two ways.First,it can set up an internal capital market that includes banks,and thus gets around the financing restrictions of the external market by centralizing management and internal capital market operations.This eases the pressure on capital allocation due to the cash flow characteristics of cross-complementary behavior,cross-subsidization,etc.Second,there is a tremendous amount of prophase investment and infrastructure investment that must occur to turn an idea into a product.In that respect,the effect of bank equity connections on resource conformity and managerial collaboration can provide a solution to the resource dependence of innovation projects.In addition to promoting the application and popularization of new technology,a bank equity connection can also help to establish scale advantage and remove entry barriers,both of which promote the successful hatching of innovation projects and claim the monopoly profits of innovations.Overall,the effect of bank equity connections on innovation capability is a remarkable reflection of its effect on improving the absorption and integrative capacities of enterprises.Based on above analysis,we propose the first hypothesis.

H1.Bank equity connections are positively related to the intensity of innovation investment.

Bank equity connections can independently affect the innovation behavior of enterprises through two paths:cultivating resource supplies and enhancing dynamic configurations.However,the complicated governance mechanisms of listed companies mean these paths are restricted by property right arrangements and the value orientation of the governing body.Given this heterogeneity,the above-mentioned effects may not occur in all enterprises.

Cultivating resource supplies can be challenging,as China is still in an economic transition period,and the distortion of the factors market and the lack of institutional arrangements squeeze out the effect of national commercial banks,state-owned enterprises'soft budget constraints and the shortage of the capital for private companies,which generally face serious credit ration problems(Lin et al.,2010;Song et al.,2011;Li et al.,2012).This situation reduces dependence on the resource advantage of a bank equity connection in national enterprises,local state-owned enterprises and private enterprises.Furthermore,the value orientations of the governing bodies of national enterprises,which are the main levers for adjusting the economy,are important factors in economic and social development;they propel innovative national construction and promote economic structural adjustments and upgrades.Thus,the legal regulation of central government-control enterprises is relatively complete.

However,in the process of transforming‘‘made in China”into‘‘created in China,”these central enterprises are confronting waves of economic globalization,more complicated multilateral cooperation in international relations and more intense competition in international education;these circumstances demand greater innovation intensity and innovation performance.Thus,bank equity connections can obviously have a positive influence on the innovative behavior of central enterprises.For local state-owned enterprises,although they have greater talent development,technical exchanges,implicit state guarantees,technology innovation incentives,etc.,officials prefer fixed asset investment projects that have less risk,more efficiency and high labor absorption capacity,because they also promote employment,social stability,environmental governance,GDP growth or other political achievements,and because currently government officials'performance is assessed by changes in GDP.Furthermore,the executives of local state-owned enterprises are not truly professional managers,but rather administrative officials appointed by the government in some form;thus the agency problem,which is caused by the separation of control rights and ownership,makes the executives of local state-owned enterprises prefer short-term goals and short-term gains with less risk during their relatively short and uncertainty terms.This is a better strategy for meeting the needs of political advancement and other interest demands such as non-pecuniary compensation.

These factors distort the investment behavior of local state-owned enterprises(Chen and Chen,2014). Moreover,Tian(2005),Xin and Lin(2006),and Qian and Yeung(2015)find that in China the governance role of debt is inefficient.First,the government's implicit guarantee of state-owned enterprises encourages financial institutions to provide capital to state-owned enterprises and weakens their motivation to superviseand restrict corporate borrowers.Second,manager's expectations of soft budget constraints and governmental interference in SOE investment lead to rapid expansion based on excessive debt and this distorts the debt governance mechanism in local state-owned enterprises.Therefore,without effective supervision,the strategy of holding bank ownership may be alienated to the channels of managerial interests.Furthermore,bank equity connections may also distort the debt governance in local state-owned enterprises by loosening budget restrictions.In other words,the resource advantage of bank equity connections strengthens the right seeking and tunneling behavior of managers(Zhao et al.,2010;Peng et al.,2011;Li and Ma,2014).

Therefore,the positive effects of bank equity connections on local state-owned enterprises'innovative behavior may not be significant,and may even be negative.But in private enterprises with clear property rights,company executives are often the largest shareholders or agents appointed by the largest shareholders. Accordingly,the principal-agent conflicts of private enterprises are relatively moderate.Moreover,fierce competition in the manager market can standardize and restrict executive behavior.Such managers dedicate greater attention to the long-term interests of enterprises and actively innovate due to the incentives of innovation profits.In such cases,the resource advantage of bank equity connections may be enough to break through their source constraints bottleneck.Accordingly,the potential innovation advantages of bank equity connections are maximized in private enterprises.Based on the above analysis,we propose a second hypothesis.

H2.The intensity of the positive effects of bank equity connections on enterprises'innovative behavior is strongest in private enterprises,moderate in central enterprises and weakest in local state-owned enterprises.

2.2.Bank equity connections,intellectual property protection and enterprise innovation

Scientific and technological innovation have several characteristics;they are non-competitive and nonexclusive and have positive externality.In business,all of the above characteristics create the free-rider problem and enhance market failure(Romer,1986).Survey data suggest that among China's domestic companies,rivals usually begin launching a similar product or substitutes within four to five months of a new product entering the market(Xiao and Wang,2014).As the motivation for innovation investment is profit,the high investment and high risk characteristics of innovation investments mean that enterprises will only invest in innovations when there is the potential for high profits.As intellectual property protection is the most important institutional arrangement for supporting enterprise innovation,its role must not be neglected.First,the protection of intellectual property rights,as a system guarantee,protects the private interest of the right's holder by granting them a legal monopoly.(Of course,such legal rights do not counter-act any other laws,including antimonopoly laws.)This not only helps to compensate innovators for the prophase investment of innovation by guaranteeing monopolistic profit within the statutory time,it also reduces the problem of the pricing of technology transformation caused by the emergence of substitutes.This ensures the economic compensation of innovative investment and establishes a long-term stimulation mechanism(Yi et al.,2013).

Intellectual property protection also plays an essential role in the dissemination and promotion of technological information and the use of technology.For example,a strong patent protection regime can speed up the dissemination of technological information,can greatly cut down on repeated investment,and allow other innovators to stand on the shoulders of giants to develop new technologies and devices.This accelerates technical innovations and strengthens competition in the technology market(Moser,2005,2012).Finally,intellectual property protection can ease the financing constraints on innovative projects.Intellectual property rights protection can reduce the uncertainty of innovation transformation by supporting the profits of an innovation,thus reducing the value evaluation risk and easing the information asymmetry in its financing.

However,the highest degree of intellectual property protection is not always the best.The dual effect of intellectual property means that a lack of adequate intellectual property protection means that innovations are liable to be infringed on and duplicated.This not only reduces interest in innovation,it also has a negative effect on accumulated resources and technology maturity.But a monopoly caused by strong intellectual property protection might hinder market competition and reduce the driving force of innovation.Horii and Iwaisako(2007)find that innovation incentive requires a reasonable degree of intellectual property protection,but blindly strengthening IPR protection may hinder economic growth.Thus,the protection of intellectualproperty rights has to balance between static losses resulting in over-monopolization and dynamic gains over the long term.

China's market,established under a period of economic transformation,is a nascent market that possesses many immature characteristics.Although China has carried out a series of changes and additions so that legislation related to intellectual property protection approaches and reaches the protection level seen in Western countries,problems are still not solved effectively and promptly,especially issues of group infringement,repeat infringement,etc.There are widespread difficulties in reporting,investigating and collecting proof,offering testimony,treating and changing in the process of safeguarding rights.Even worse,in some provinces,the intellectual property protection is weak,owing to uneven regional development in China.Accordingly,in the current situation,strengthening IPR protection levels may have positive effects on enterprises'innovative behavior(Lin et al.,2010).As mentioned above,the distortion of the factor market and the lack of institutional arrangements seriously distort the innovative behavior of Chinese enterprises.This is reflected not only in the restraints on external resources for,from the least to the greatest,private enterprises,local state-owned enterprises and central enterprises,but also in alternative mechanisms of intellectual property protection,such as administrative interference,restrictions on industry entrance or other preferential policies with which the state-owned enterprises and especially the central-owned enterprises could conserve their power and earn profits from innovations.Therefore,the dependence on intellectual property protection is different for enterprises with different property rights.Based on above analysis,we propose a third hypothesis.

H3.Intellectual property protection is positively related to the intensity of innovation investment,and the accelerating effect of intellectual property protection is strongest in private enterprise innovation,moderate in local state-owned enterprise innovation,and weakest in central enterprise innovation.

Both bank equity connections and intellectual property protection can promote business enterprise innovation.A further question is whether there is any relationship between bank equity connections and intellectual property protection in promoting innovation.From the theoretical standpoint,intellectual property protection may affect the relationship between bank equity connections and innovation through two contrary mechanisms.First,both bank equity connections and intellectual property protection can ease resource allocation constraints.Bank equity connections can also help to maintain the legitimate rights of creative subjects by promoting the industrialization of innovation achievements,establishing market power and removing entry barriers,etc.In other words,bank equity connections and intellectual property protection are substitutable to a certain extent.Therefore,bank equity connections may reduce the dependence of innovative companies on intellectual property protection.That is to say,the existence of one mechanism may reduce the dependence on the other mechanism.However,there may also be a complementary relationship between them.The potential interactions are as follows:(1)moderate intellectual property protection is a prerequisite for bank equity connections to effectively promote innovation.When the intellectual property protection is weak,the law is less binding on infringers,and thus piracy,counterfeiting and other violations weaken innovation and reduce the investment returns and enthusiasm of investors.In this case,even with the resource disposal advantage of bank equity connections,enterprises may prefer less risky investments to innovation investment(Zhang et al.,2011;Cull et al.,2015).(2)With the strengthening of intellectual property protection,the excess profits of innovation will also increase;thus,the innovation investment prompted by the bank equity connection can create more value,i.e.,it has a multiplier effect on innovation.Moreover,the distortion of the factor market and the absence of institutional arrangements in China mean that the transmission effect of intellectual property protection needs some complementary mechanisms,such as bank equity connections.Based on above analysis,we propose a competitive hypothesis as follows.

H4a.There is a substitutional relationship between bank equity connections and intellectual property protection in promoting innovation.

H4b.There is a complementary relationship between bank equity connections and intellectual property protection in promoting innovation.

3.Research design

3.1.Data and sample

This study examines the effect of bank equity connections and intellectual property protection on firm innovation,and the interaction between them in this process.The initial sample comprises all of the A-share manufacturing and information technology listed companies for the 2006-2013 period.The final sample is obtained by filtering this sample with the following conditions:(1)newly listed and specially treated companies are removed;(2)observations with missing variables or with abnormal data are dropped;(3)ST companies,and financial and insurance companies are removed;(4)observations with leverage levels that fall outside the outlier leverage levels of[0,1]are excluded;(5)to avoid the consequences of differences in accounting standards,financing environment,supervision mechanisms and so on,companies with stock in the A-share market,B-share market and H-share market at the same time are removed;(6)taking into account the effect of acquisition,mergers and other non-recurrent activities on innovation investment,companies undergoing major asset reorganizations in the 2006-2013 period are removed;and(7)companies with changes in actual controllers are removed.In addition,to avoid the influence of outliers,all of the continuous variables are winsorized at the 1%and 99%levels.After the above procedure,the final sample includes 4475 firm-year observations.

3.2.Definition of main variables

The innovation data,EBC data and intellectual property protection data(IPR data)are manually reconciled.Based on the related regulations in China's accounting standards and other relevant systems,we collect and screen the innovation data from the information disclosure in‘‘management expenses”and‘‘cash payments relating to other financing activities,”which are disclosed in the board reports,annual reports and the notes to financial statements.

The EBC data used in this study are collected from the WIND database,which is a leading integrated financial data service provider in China.We also apply the following treatments when sorting the EBC data:(1)when companies hold many commercial bank shares,only the event with the maximum stake is considered;(2)as a small investment in a bank may not have any material effect on corporate capital allocation,according to the principle of‘‘essence is more important than form,”firms that hold less than 2%of a bank's total ownership or that are not in the list of the 10 largest shareholders for banks are dropped5According to the‘‘Management approach of the related transactions between commercial banks and insiders or shareholders”regulations,the China Banking Regulatory Commission formally published in 2004,associated subjects comprise connected natural persons,legal persons or other organizations,which directly,indirectly and jointly hold 5%+bank ownership shares or voting rights.But according to the‘‘Information Disclosure by Commercial Banks”regulations,in force since 2007,banks are required to disclose which shareholders are in the list of the 10 largest shareholders for banks as these are regarded as large shareholders that can influence bank policies and operation decisions.In fact,according to statistics collected by the author,due to the size and ownership structure of commercial banks,holding 2%+bank ownership shares or voting rights often requires a magnitude of funds and can enter the top ten largest shareholders,and has an important impact on bank policies and operation decisions.Therefore,we choose holding more than 2% of a bank's total ownership and appearing on the list of the 10 largest shareholders for a bank as the definition criterion of‘‘whether the firms have a bank equity connection”.We focus only on non-financial firms when we identify firms holding significant bank ownership.In addition,to ensure the reliability of our empirical results,we also choose 2%,3%and 5%as the definition criterion,respectively.That is,select the subsample of non-financial firms which hold 2%+,3%+,and 5%bank ownership shares and use the propensity score matching of Rosenbaum and Rubin(1985)to find and screen the paired samples to re-examine the hypotheses of this paper.The conclusions are the same as those reported.Due to the limited length of this paper,the manuscript is somewhat abbreviated.;(3)to avoid the‘‘noise”effect of holding other financial institution shares,we eliminate companies that have other financial institutions ownership but do not hold bank ownership.

For the other main explanatory variable,we select the following methods to measure the intensity of China's intellectual property protection(IPP).(1)The technology market trade of different provinces,autonomous regions and municipalities(IPP1).That is,IPP1 is equal to the contract annual turnover of the technology market in different regions divided by the annual gross domestic product in the region.The essenceof technology trade is the transfer of intellectual property,which depends to a large degree on the effective implementation of an intellectual property rights protection mechanism.Moreover,the laws protecting intellectual property in China are mainly enforced locally(Long and Wang,2014).Specifically,as technical contracts can only be reached when people have confidence that the law protects intellectual property,the trade in the technology market can be used to measure the status of intellectual property protection in the region.(2)The distribution density of patent agencies(IPP2).6The data of the technology market trade are collected from the‘‘Yearbook of Science and Technology of China”,published by the State Statistical bureau and the Ministry of Science and Technology.The data of the number of the patent agencies in different regions are collected from the‘‘Annual Survey of patent agencies”,published by the State Intellectual Property Office(‘‘SIPO”).The study did not take into account the impact of the patent department of national defense because of the specialties of their operation.Furthermore,we also dropped the samples in Tibetan regions because of missing data of IPP1 and IPP2.IPP2 is equal to the number of patent agencies in different regions divided by the total population in the area.The greater IPP2,the stronger the competition.Such healthy competition keeps the cost of intellectual property protection low and the service much more comprehensive.Furthermore,the pressure of competition makes the patent agency step up publicity efforts and strengthen public awareness of intellectual property protection.Thus,using the distribution density of patent agencies to measure the status of intellectual property protection is reasonable.These two measurement methods are not only objective,they characterize the propagation mechanism of the protection system for intellectual property rights more carefully and thoroughly than the intellectual property protection index at the national level.

3.3.Model design and definition of other concepts

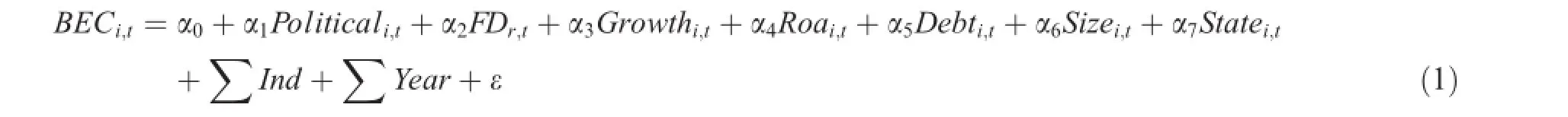

In view of the possible endogenous relationship between bank equity connections and corporate characteristics,we control for selection bias and endogeneity with Heckman's(Winner of Nobel Prize in Economics in 2000)two-stage method and 2SLS.The first phase is a probability type Probit regression,which is used to estimate the probability of a bank equity connection;then,the forecast results are used to estimate the Inverse Mills Ratio(IMR).Subsequently,the IMR is put into the second stage model to control and overcome the effect of self-selection and endogeneity on the empirical analysis.7To control and overcome the effect of self-selection and endogeneity,we also use the propensity score matching of Rosenbaum and Rubin(1985)to find and screen the paired samples.On this foundation,we set a control group that also takes part in the experiment.We use contrastive analysis to assess whether there are differences in the innovation behavior between enterprises with bank equity connections and enterprises without it;the conclusions are consistent with those reported in this paper.Due to limited space,we do not give the details of these tests.

As stated,we run a Probit regression on the above model to estimate the probability of a bank equity connection.To identify the firms with bank equity connections,we use an indicator variable,BEC,which equals one if a firm holds more than 2%of a bank's total ownership and is in the list of 10 largest shareholders,and zero otherwise.Similarly,we identify whether a firm has political connections using an indicator variable,Political,which is equal to one if a firm has a political connection,and zero otherwise.Additionally,based on prior studies(Wu et al.,2012),we include control variables for the financial deepening measure(FD),firm size(Size),financial leverage(Debt),a nature of property right dummy(State),growth opportunities(growth),profitability(ROA)and industry and year dummy variables.Debt is equal to total debt divided by total assets. Size is defined as the natural logarithm of total assets.ROA is return on assets and is equal to net income divided by total assets.Growth is sales growth and is equal to the difference between the sales in this year and the sales in previous years,divided by the sales in the previous year.FD is defined as the ratio of bank loans to GDP in the province in which the firm is located.Industry and year dummy variables are included in the model to account for time-invariant industry heterogeneity and time trends.Industry classification is based on that of the China Securities Regulatory Commission(CSRC),which recognizes 21 industries,with a one-digit code for non-manufacturing industries and a two-digit code for manufacturing industries.

Further,to test H1,we build model(2),based on the estimate of the IMR,to investigate the effect of bank equity connections on investment intensity.

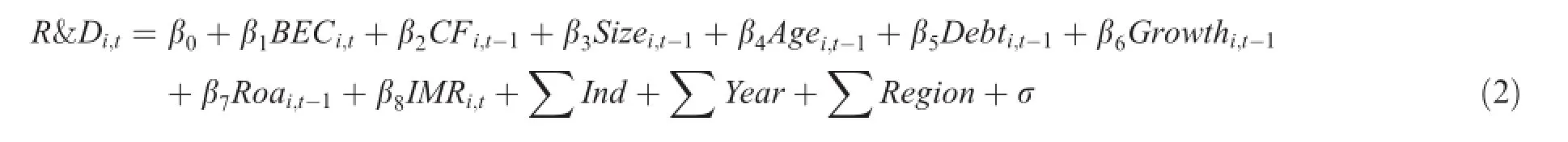

The dependent variable,R&D,captures the intensity of firm innovation,and is equal to R&D expenditure divided by total operating income.The explanatory variable is BEC.According to the theoretical analysis aforesaid,a bank equity connection improves innovation by alleviating the resources stipulation of innovation investment and enhancing dynamic configuration capability.Therefore,we expect that R&D is positively related to BEC.Moreover,in the selection of control variables,based on prior studies(Wu et al.,2012;Fang et al.,2014;Acharya et al.,2014;He and Tian,2013),we include the financial deepening measure(FD),firm size(Size),financial leverage(Debt),cash flow(CF),growth opportunities(growth),the profitability(ROA),a region dummy(Region)and industry and year dummy variables.The cash flow ratio(CF)is defined as net cash flow from operations divided by total assets.The region dummy is added to capture differences in economic development,legal institutions(enforcement and judicial efficiency)and corruption across regions.To test H3,H4a and H4b,using model(2),we introduce variables of the intellectual property protection index(IPP)and the interaction terms between BEC and IPP to test the influence of intellectual property rights protection on technological innovation and the relationship between bank equity connections and innovation.According to the preceding theoretical analysis,whether or not companies have established a bank equity connection,intellectual property protection will help to alleviate the resources stipulation of innovation investment and to promote the value transformation of innovation achievements,and thus will encourage innovation.As such,we anticipate that the regression coefficients of IPP1 and IPP2 to R&D are both significantly positive.8The use of interactive items results in the multi-collinearity problem.To this end,we did the VIF test,to weaken the influence of the multi-collinearity problem.Following Kemp(2003),the data central processing method is used to process the interactive item data.

For context,to observe the different effects of different properties(central enterprises,local state-owned enterprises,private enterprise)on enterprises'innovative behavior,we apply group testing according to property rights.We compare the differences in the regression coefficients between the groups using the Chow test,and judge whether the difference in the groups'regression coefficients is statistically significant(Prob〉chi2).

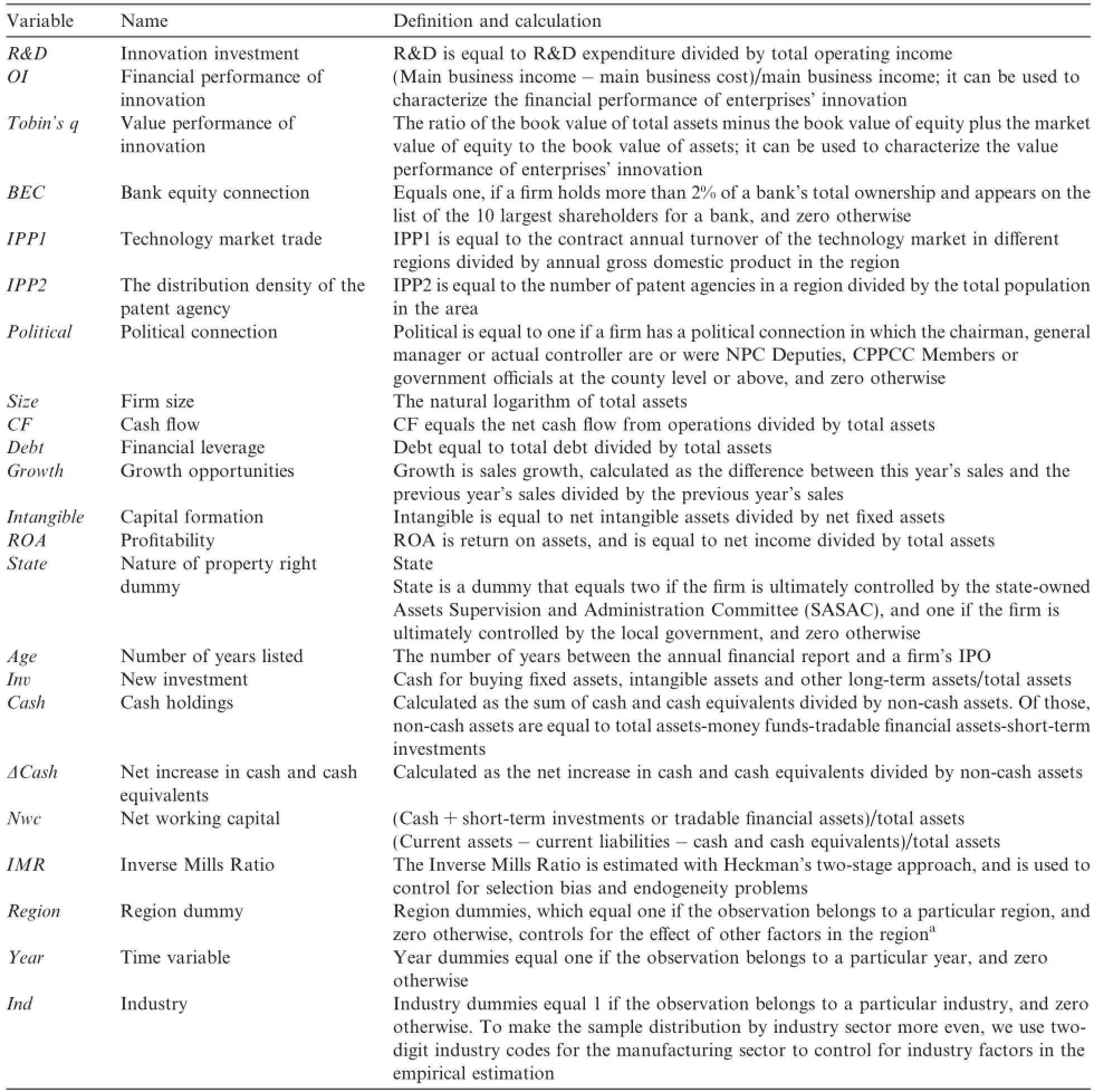

The calculations and definitions of the variables(including the variables that are used in the extended test)are shown in Table 1.

4.Empirical results and analysis

4.1.Descriptive statistics

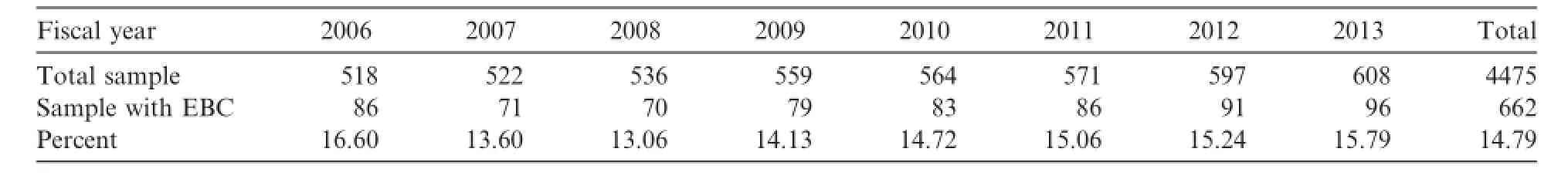

Tables 2 and 3 show the industry distribution of the final sample and the distribution of the bank equity connection sample by industry and year.The sample period is 2006-2013.The sample is composed of 4475 firm-year observations,including 662 firm-years(approximately 14.79%of the firm-years in the full sample)in which firms hold more than 2%of a bank's total ownership and appear on the list of the bank's 10 largest shareholders.Every industry except the wood and furniture industries contain firms with bank equity connections.In addition,296 firm-years hold more than 5%bank ownership stakes.

The distribution by year of the BEC shows that there was a brief fall in the number of enterprises with bank equity connections in 2007 and 2008;this is related to the exposure of related-party guarantees in the Delong Department and the Green Cool scandal.Overall,the increase in the number of enterprises establishing bank equity connections is an obvious trend.Hence,our sample suggests that holding significant ownership inbanks is a very popular strategy in China;this result highlights the academic value and practical significance of this study.

Table 4 shows the number of intellectual property agencies(except for the patent department of national defense),the transaction scale of the regional technology markets and the average value of the intellectual property protection index(IPP)in various provinces,autonomous regions and municipalities between 2006and 2013.As shown in Table 4,in aggregate,the protection of intellectual property in China has continuously increased since 2008.This is primarily due to improvements in IPR protection awareness and the gradual improvement in institutional arrangements.The second session of the Tenth National People's Congress passed a constitution revision bill in March 2004 that modified Article 13 and clearly stipulates that the lawful private property of citizens is inviolable.The lawful private property of citizens includes patents,trademarks,franchises,copyright,goodwill.It provides a legal basis for intellectual property protection at a constitutional level.The State Council issued the‘‘Outline of National Intellectual Property Strategy”in 2008,which further highlights the important position of intellectual property in the national strategy.Of course,it is worth pointing out that although that has been significant progress in the efforts to protect intellectual property rights,the development of intellectual property protection is not quite balanced across all regions of China.The problems,lack of awareness of independent intellectual property rights protection and the lack of relevant resources and talent,are quite severe in many areas.In a word,intellectual property protection in China still has a long way to go.

Table 1Variable definitions.

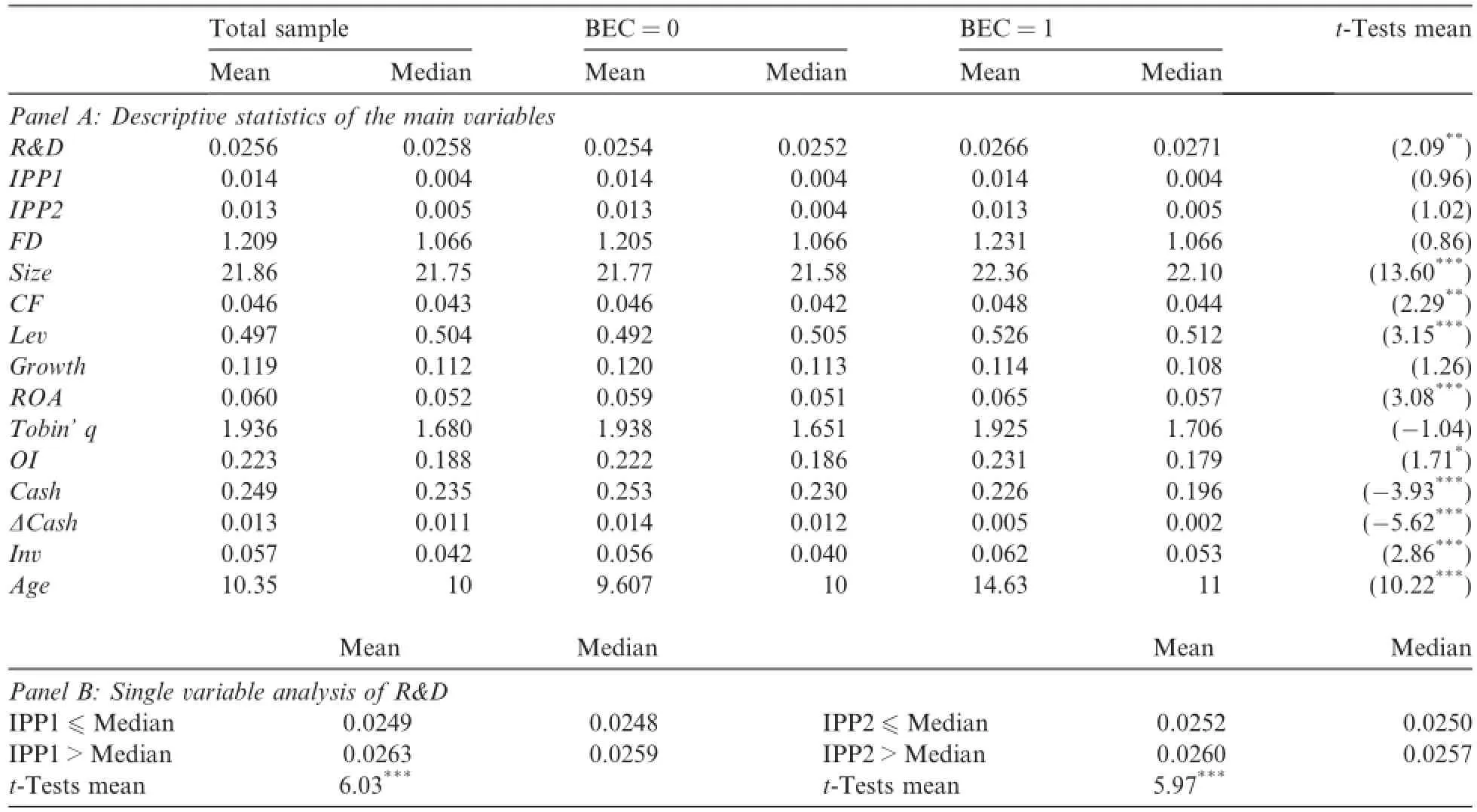

Table 5 provides descriptive statistics of the main variables and the results of the single variable analysis.To avoid the influence of outliers,all of the continuous variables are winsorized at the 1%and 99%levels.As shown in Panel A of Table 5,the mean and median of IPP1 are 0.014 and 0.004,respectively.The mean and median of IPP2 are 0.013 and 0.005.These indicate that there is a significant deviation between the mean and median of IPP1 and IPP2;that is,the development of intellectual property protection is not balanced across different regions and in different years.Actually,taking Beijing's active technology market as anexample,in 2006,there were only 120 intellectual property agencies in Beijing,but this number more than doubled to 254 between 2006 and 2013;however,there were only three intellectual property agencies in Gansu,Ningxia,Qinghai,in 2013.This also reflects the unbalanced nature of regional IPR protection.In addition,based on a univariate comparison,firms with bank equity connections tend to be larger,more profitable,and have more debt,net cash flow and new investment.

Table 2Industry distribution of sample firm-years and the distribution of BEC by industry.

Table 3Distribution of BEC by year.

Table 4Intellectual property protection in China between 2006 and 2013.

To visually display the effect of bank equity connections and intellectual property protection on enterprise innovation,we divide the sample into two groups according to bank equity connections and the median of the IPP index,and conduct a single variable analysis of R&D.As shown in Panel A of Table 5,the innovation investment intensity is higher in firms with a bank equity connection at a level of 5%,which is consistent with our prediction in H1.Similarly,as shown in Panel B of Table 5,whether it is grouped by the median IPP1,or by the median IPP2,innovation investment intensity is higher in the group where the lack of intellectual property protection is lower with significance at the 1%level,which is consistent with H3.All of the above results preliminarily confirm that both bank equity connections and intellectual property protection have a positive effect on innovation.

Table 5Descriptive statistics of the main variables and the results of single variable analysis.

4.2.Bank equity connections,enterprise heterogeneity and enterprise innovation

***** rises 2.00)(2.49)(4.99)(2.94)(2.68)2.90)(1.81)3.76)(1.98)terp(-0.015**0.082**-0.064**(--0.010**(-Private en5 mnluCo* * * rises 2.17)0.001(1.12)(2.63)(2.28)(2.03)2.86)(2.22)-0.005**-0.389**-0.387**(-0.071**0.039**0.040**0.045**0.018**0.012**-0.048**(2.36)0.055**0.058*(-5.91)terp(-0.071**0.067**ned encal state-ow4 mnLoluCo* * * rises -0.221**-0.056**2.90)(1.69)(1.82)(2.06)(2.59)-0.016(-(1.70)0.068* 0.009* 0.012**0.008**1.53)-0.006**(-(-0.029* 3.59)0.016(0.40)terpCentral en3 mnluCo* *** lesamp22.45)(-2.74)(1.74)0.012* 0.076**(2.77)0.042*(1.89)(2.42)(-5.28)(2.78)-0.039**mn0.043**(--0.009**0.028*(1.80)llFuluCo. vationno&Dinle:Rriseterpd enstage t variabengeneity anndSecoDependIntercept -0.269**GrowC SizethDebtCFA ROAge R IMhetero1 mn-0.515*** 3.67)(1.96)(-0.006**BE-0.051* 1.68)(-(5.88)2.39)(-0.241*** 0.295***(12.78)-0.467*** 3.02)(--0.027* 1.88)(-riseluterpCoens,ectionECnnle:Bcot variabTable 6equityenBankFirst stage DependIntercept thPCFDLev GrowSizeA ROState Control 14860.2879e tare thbracketsControl 20600.2631ers inmbe nuthdel,mostage regressionControl 929 0.2948nde secoes;in the z-valuControl 44750.2597are thbracketsers inmbegion e nuth&Rdel,&IndmoYear2s ObregressionitControl 44750.1086Adj-R e Probthwithe 10%level. level.level.e f i rst stage regressionthththe 5%e 1%&Ind2R **SignPseudote:In thes. *SYearObs valuignif i cance atifi cance at*Signif i cance atNo**

Table 6 shows the parameter estimation results of models(1)and(2)after controlling for selection bias and endogeneity using Heckman's correction and 2SLS.The estimation for model(1),shown in column 1 in Table 6,suggests that political connections,financial depth in the region,growth opportunities,profitability,firm size and the nature of ownership affect whether firms establish bank equity connections.The results of estimating model(2)for the full sample are shown in the second column in Table 6.The coefficient of BEC is 0.012(t-value=1.74),suggesting that compared to firms without bank equity connections,those with bank equity connections invest more in innovation.These results are consistent with H1.Furthermore,to testwhether the effect of BEC differs across firms with different properties,we divide the sample into three groups by ownership type and compare the differences in the BEC coefficient across the three groups.Columns 3-5 in Table 6 report the results.In the subsample of central enterprises,the coefficient of BEC is 0.009(tvalue=1.69).Similarly,in the private enterprises group,the coefficient of BEC is 0.015(t-value=2.49). The results presented in column 4 suggest that bank equity connections do not affect the innovation investment of local state-owned enterprises.We also compare the influence of BEC on firms with different properties using the Chow test.As shown in columns 3 and 5 in Table 6,the coefficients of BEC vary from 0.001 to 0.015,and there is a significant difference between the two groups(P〈0.001).These results show that bank equity connections have various effects on innovation in the three types of enterprises.Due to their monopoly advantages and their special role in the national economy,central enterprises easily obtain policy support and exogenous financing.Hence,the innovation advantages of BEC are relatively weak in central enterprises.However,the situation for private enterprises is different;the long-term ownership and scale discrimination in private enterprise financing,financing constraints and policy bias hinder the innovation investment of private enterprises.Therefore,the effect of BEC on resource acquisition and on dynamic configuration capability is strongest in these firms.Local state-owned enterprises probably use the resources advantage of BEC to invest excessively,due to the government's widespread intervention and insufficient oversight of executive power;hence,the effect of bank equity connections on investment is insignificant in local state-owned enterprises. And yet,the regression coefficient of IMR shows that the selection of this instrumental variable is reasonable.

4.3.Bank equity connections,intellectual property protection and enterprise innovation

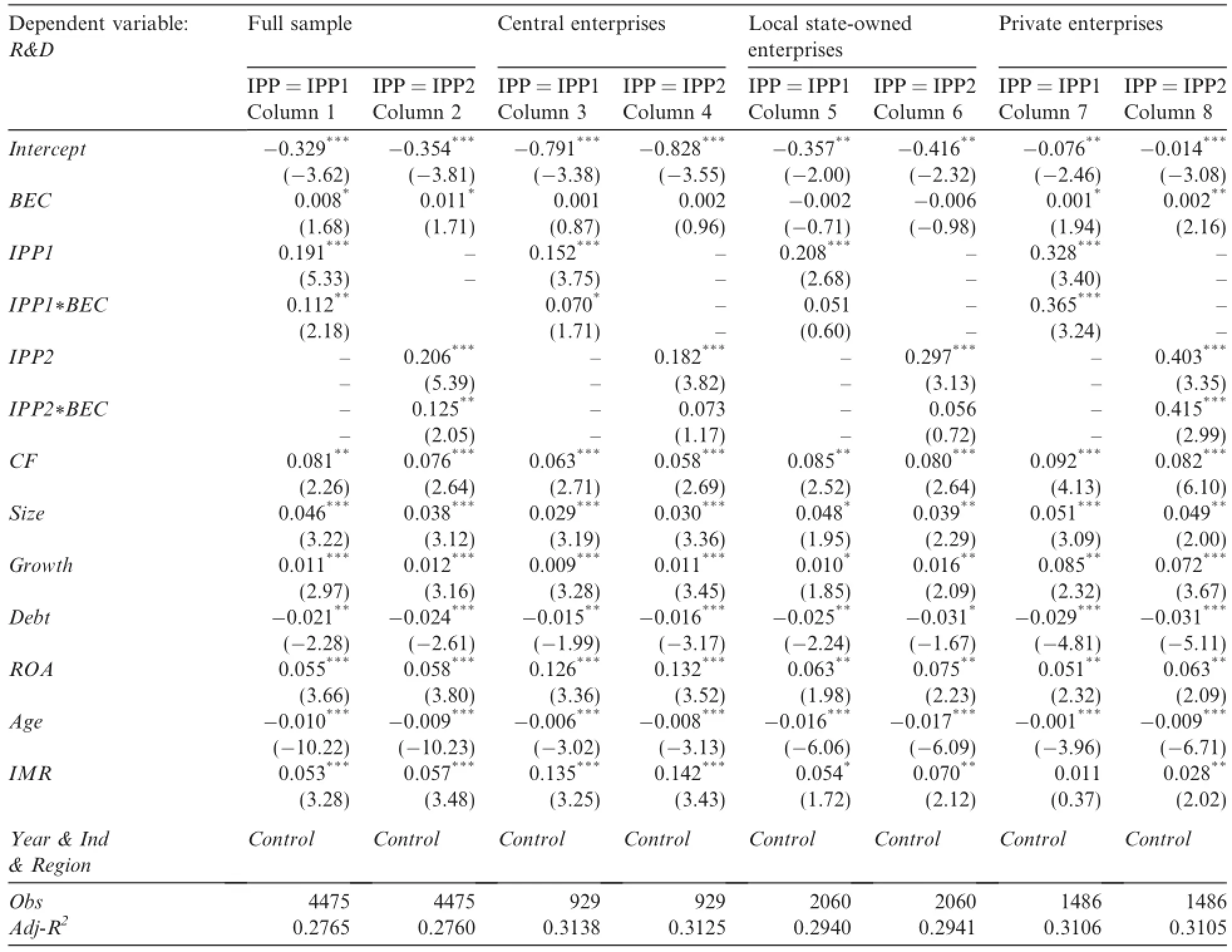

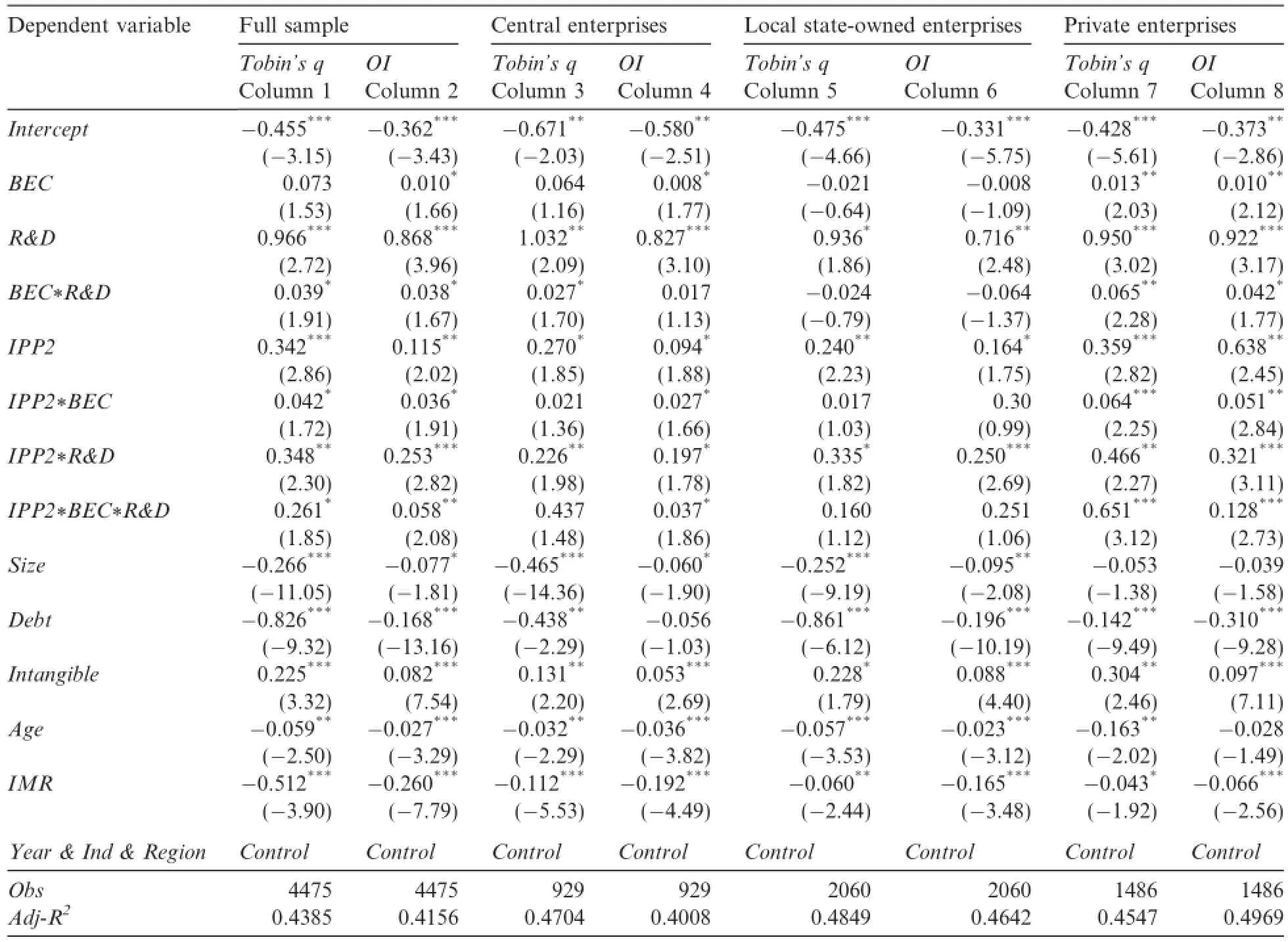

Table 7 shows the effect of intellectual property protection on enterprise innovation,and the interactive relationship between bank equity connections and intellectual property protection in the process of improving innovation.In columns 1-8,IPP1and IPP2 are used to measure the status of intellectual property protection in various regions.We find that the coefficients of IPP1 and IPP2 are all significantly positive across all columns;that is,in the whole sample and in the subsamples,the level of intellectual property protection(IPP)is positive related to the intensity of innovation investment.This is consistent with H3.Moreover,to investigate the interactive relationship between bank equity connections and intellectual property protection in the process of improving innovation,we include the interaction terms of bank equity connections and the intellectual property protection index in the model.The results are reported in columns 1-8 in Table 7.The interaction term between BEC and IPP1,shown in column 1,is significantly positive at a level of 5%,and the interaction term between BEC and IPP2,shown in column 2,is significantly positive at the level of 5%.This supports our hypothesis H4b;intellectual property rights protection can strengthen the enhancement effects of bank equity connections on corporate innovation.The testing of different property rights groups shows that the coefficients of IPP1 and IPP2 are lowest for central enterprises,moderate for local state-owned enterprises and highest for private enterprises and the Chow's test of each pair shows that there are significant differences between column 3 and column 5(P-Value=0.056),between column 5 and column 7(P-Value=0.031),between column 3 and column 7(P-Value=0.006),between column 4 and column 6(P-Value=0.092),between column 6 and column 8(P-Value=0.049)and between column 4 and column 8(P-Value=0.011).All of the tests pass the significant test with at least a 0.01 level.

Therefore,intellectual property protection has a different facilitation effect on different types of enterprises,which is consistent with H3.Intellectual property protection has less effect in enterprises that can safeguard the rights and benefits of innovation with alternative mechanisms,such as administrative intervention.The capacity to pursue their rights through alternative means increases gradually from private enterprises to local state-owned enterprises to central enterprises;as the level of government control increases,the dependence on intellectual property protection becomes weaker.Columns 3 and 4 in Table 7 show that the coefficients of IPP1*BEC and IPP2*BEC are positive,and the coefficient of IPP1*BEC is significant at a level of 10%,indicating that in central enterprises,the interaction between intellectual property rights protection and bank equity connections has a significant effect on innovation.However,in columns 5 and 6,the coefficients of IPP1*BEC and IPP2*BEC are both insignificant,indicating that the interactions do not affect the innovative behavior of local state-owned enterprises,perhaps due to the distortion of the bank equity connection,which severely weakens the moderating effect of intellectual property protection.For private enterprises,columns 7and 8 in Table 7 show that the coefficients of the interaction terms between IPP1 and BEC and between IPP2 and BEC are both significantly positive at the 1%level,and Chow's test shows that there are significant differences between column 5 and column 7(P-Value=0.056),indicating that in private enterprises,the complementary effect of bank equity connections and intellectual property protection is most prominent. Private enterprises probably still struggle to protect their rights with alternative mechanisms,leading to greater dependence on intellectual property protection.These results are consistent with H4b.

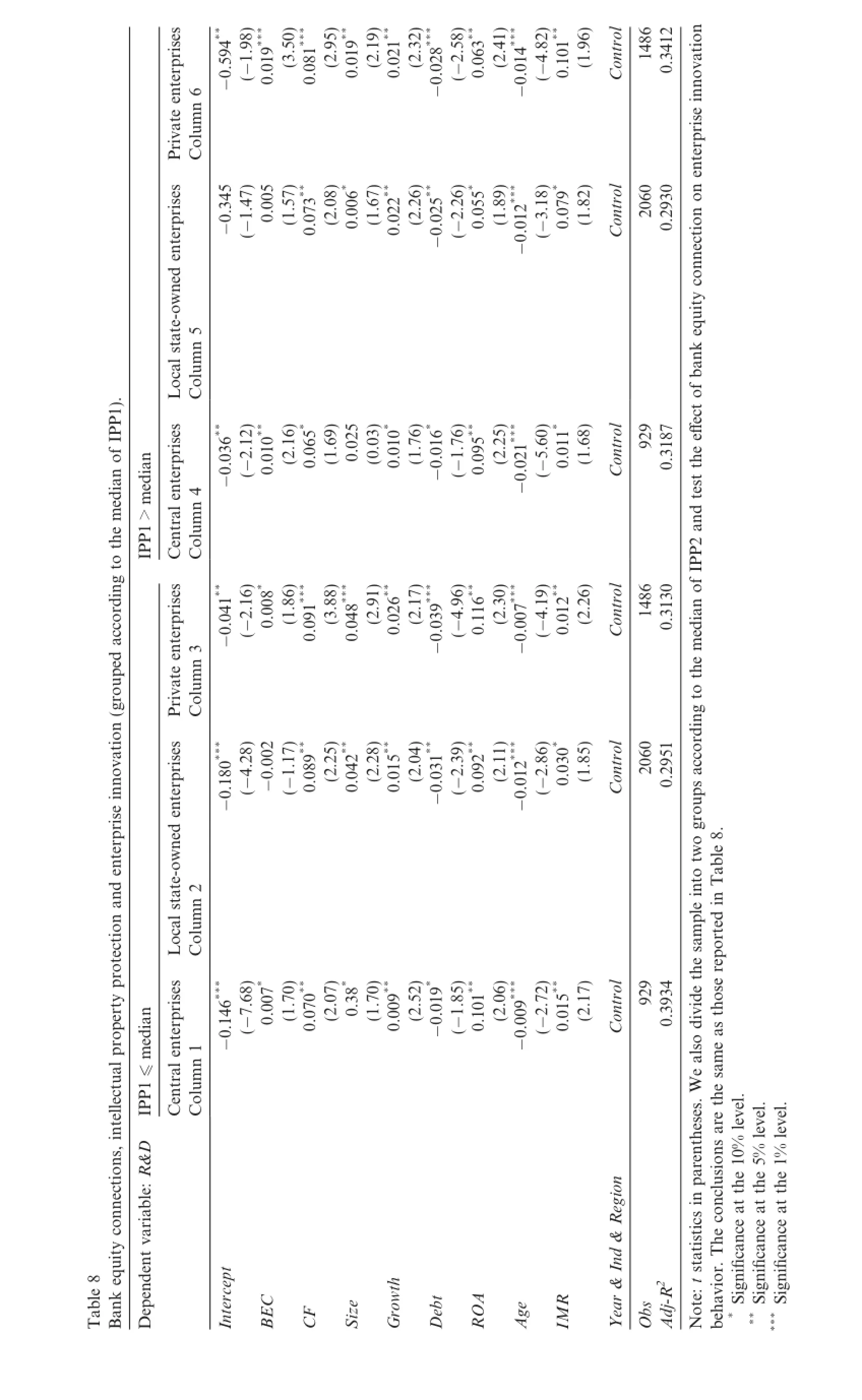

In Table 7,we investigate whether the interaction between intellectual property protection and bank equity connections promotes innovation.In Table 8,we divide the sample into two groups according to the median IPP1 and compare the regression coefficients of bank equity connections.In the higher IPP1 group,intellectual property protection is relatively weak,whereas in the lower IPP1 group,the influence of intellectual property protection is comparatively strong.As shown in columns 1-3 in Table 8,the coefficients of BEC are significantly positive at the 10%level in columns 1 and 3,but the coefficient of BEC is insignificant in the statistical sense,indicating that when IPP1 is below the median,bank equity connections can promote innovation in private enterprises and central enterprises,but might have little effect on innovation in local state-owned enterprises.Similarly,the results shown in columns 4 and 6 show that the coefficients of BEC are as follows:0.010 and 0.019,which are significant at the 1%and 5%levels,respectively.However,in column 5,the coefficient of BEC does not reach the level of statistical significance.Furthermore,the Chow's test shows that there are significant differences between column 1 and column 4(P-Value=0.091)and between column 3 and column 6(P-Value=0.025),indicating that when intellectual property protection is relatively poor,bank equity connections can stimulate innovation in central enterprises and private enterprises,but this effect is relatively weak,especially as bank equity connections do not promote innovation in local state-owned enterprises and may even crowd out innovation investment.These results show the dependence of the transmission mechanism of bank equity connections on intellectual property protection and strongly supports H4b.

Table 7Bank equity connections,intellectual property protection and enterprise innovation.

rises **** terp-0.594**1.98)(3.50)(2.95)0.019**(2.19)(2.32)-0.025**-0.028**(-0.019**0.073**0.081**0.022**0.021**2.58)0.063**(2.41)-0.014**(-4.82)0.101**(1.96)Private en6(-mnluCorises * terp-0.041**-0.036**-0.3451.47)(1.57)(2.08)0.006*(1.67)(2.26)2.26)(1.89)-0.012**(-0.010**0.005(-(-0.079* 3.18)(1.82)ned encal state-ow5 mnluP1).LoCoIP* ofrises 2.12)-0.016* ian terp(-(2.16)0.065*(1.69)0.025(0.03)0.009**0.015**0.026**0.010*(1.76)1.76)5.60)e median(-(1.68)(2.25)ed(-〉mmn-0.021**thP1lug toIPCentral en4 Coin**** rdaccorises terp2.16)(-0.008*(1.86)(3.88)(2.91)(2.17)4.96)(2.30)-0.007**(-4.19)(2.26)up(groed0.042**0.048**mnluCovationPrivate en3 -0.031**-0.039**terp(-norises -0.180***(-4.28)-0.002(-2.39)1.17)2.86)(2.25)(2.28)in(2.04)(-(2.11)-0.012***(-(1.85)terprised enned enan2 0.012**0.011* protectioncal state-owmnLoluCo* * ertyrises propian -0.146**terp7.68)(1.70)(2.07)0.38*(1.70)(2.52)-0.019*(-(2.06)1.85)-0.009**0.007* 0.070**0.089**0.091**(-(2.17)2.72)ed0.101**0.092**0.116**0.095**0.055*(-0.015**0.030* altellectu≤mP1mnIPCentral en1 luCoins,ection&Dnnle:Rcot variabTable 8equityenBankDependIntercept C thBECFSizeGrowDebtA ROAge R IMControl 14860.3412vationnoinriseterpControl 20600.2930enonectionnncouityeqbankControl 929 0.3187e eff ect ofthd testanP2Control IP14860.3130ofe medianthg toinControl 20600.2951rdaccopso groutwtoinleinTable 8.e samprtedControl 929 0.3934thdivideose repothalsoasWee sames are thlevel.level.egion parentheses.innclusione 10%level. thththe 5%e 1%&R&Indstatisticscohe**Signte:tbehavior.T*S2 YearObs Adj-R ignif i cance atifi cance at***Signif i cance atNo

5.Additional analysis:bank equity connections,intellectual property protection and innovation performance

Innovation is the engine of economic reorientation and structural adjustment in an industry and it enhances the quality of economic development.In the long term,investing in innovation is important in sustainable corporation development,but the huge investment and large venture can cause serious uncertainty about short-term performance.Moreover,the public goods characteristic of innovation means that the return from investment in innovation projects is very uncertain.The above research shows that bank equity connections and intellectual property protection can encourage enterprises to increase innovation,but it is unclear whether they improve innovation performance.In the following sections,we examine the influence of bank equity connections and intellectual property protection on innovation performance.To this end,we construct the following models.

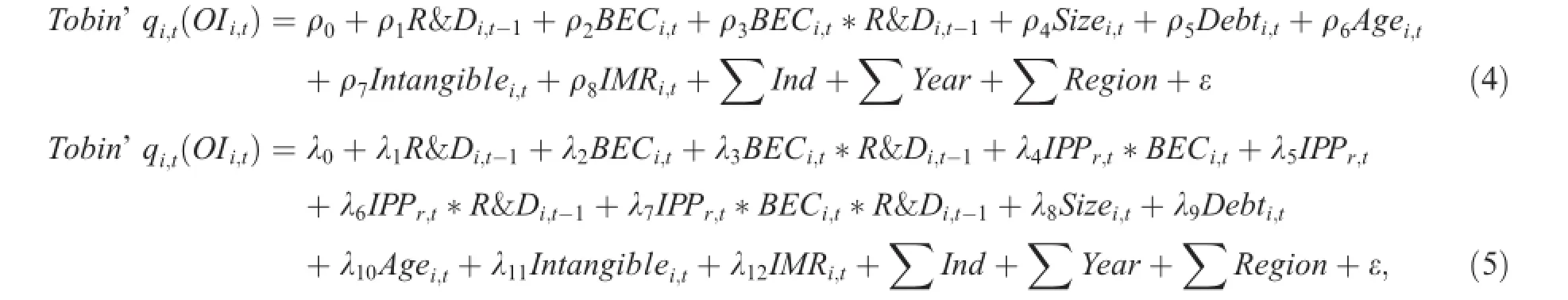

where OI and Tobin's q represent the financial performance and value performance of enterprises'innovations,respectively.We choose gross margins as an alternative variable for innovation performance,as not only can innovation improve enterprise performance by either increasing output or reducing costs or a mixture of the two,but there may also be the problem of earnings management.Thus OI is a comparatively ideal variable to measure innovation performance.To investigate the influence of bank equity connections and intellectual property protection on innovation performance and the relationship between them in this process,we include BEC,IPP,and the interactive terms between BEC and R&D,between IPP and R&D,between IPP and BEC,and the three-way interaction term between IPP,BEC and R&D.In addition to these variables,we also include Size,Debt,Intangible,Age,IMR and other factors to control for their effect on innovation.

5.1.Bank equity connections and innovation performance

Table 9 presents the test results of model(5).As shown in columns 1 and 2 of Table 9,the coefficient of the interaction terms between BEC and R&D is 0.056 and 0.048,respectively,which are both significant at the 1% level;that is,on average,for all types of firms,holding significant bank ownership is helpful for transforming innovation achievements into value.Columns 3-8 of Table 9 show the results of the estimation of model(5)using the subsamples.In the group testing of property rights,the coefficients of BEC*R&D are significantly positive for central enterprises and private enterprises,and the coefficients are bigger in the subsample that only includes private enterprises.However,in columns 5 and 6,the coefficients of BEC*R&D are both insignificant,indicating that bank equity connections have no significant effect on innovation performance in local state-owned enterprises.Furthermore,Chow's test of the subsample of private enterprises and central enterprises shows that there are significant differences between column 3 and column 7(P-Value=0.032)andbetween column 4 and column 8(P-Value=0.086);the differences are significant at the 10%level.In other words,in different enterprises,bank equity connections have different facilitation effects on innovation performance,and the intensity of the effect is greatest in private enterprises,moderate in central enterprises and weakest in local state-owned enterprises,perhaps because the internal control systems and many other institutional arrangements are better in central enterprises than in local state-owned enterprises.Therefore,bank equity connections are positively related to innovation performance.However,due to soft budget constraints,a monopolistic market structure and the imperfect financial supervision system,this effect is stronger in private enterprises.For local state-owned enterprises,the short-term interest appeals of local government officials and the self-interested behavior of corporate executives are likely to distort the capital investment of local stateowned enterprises and make the resource disposal advantage of bank equity connections a less efficient tool for increasing profits.This results in less investment in innovation overall,and bank equity connections may even have a slightly negative effect on innovation performance in local state-owned enterprises.

Table 9Bank equity connections,enterprise heterogeneity and innovation performance.

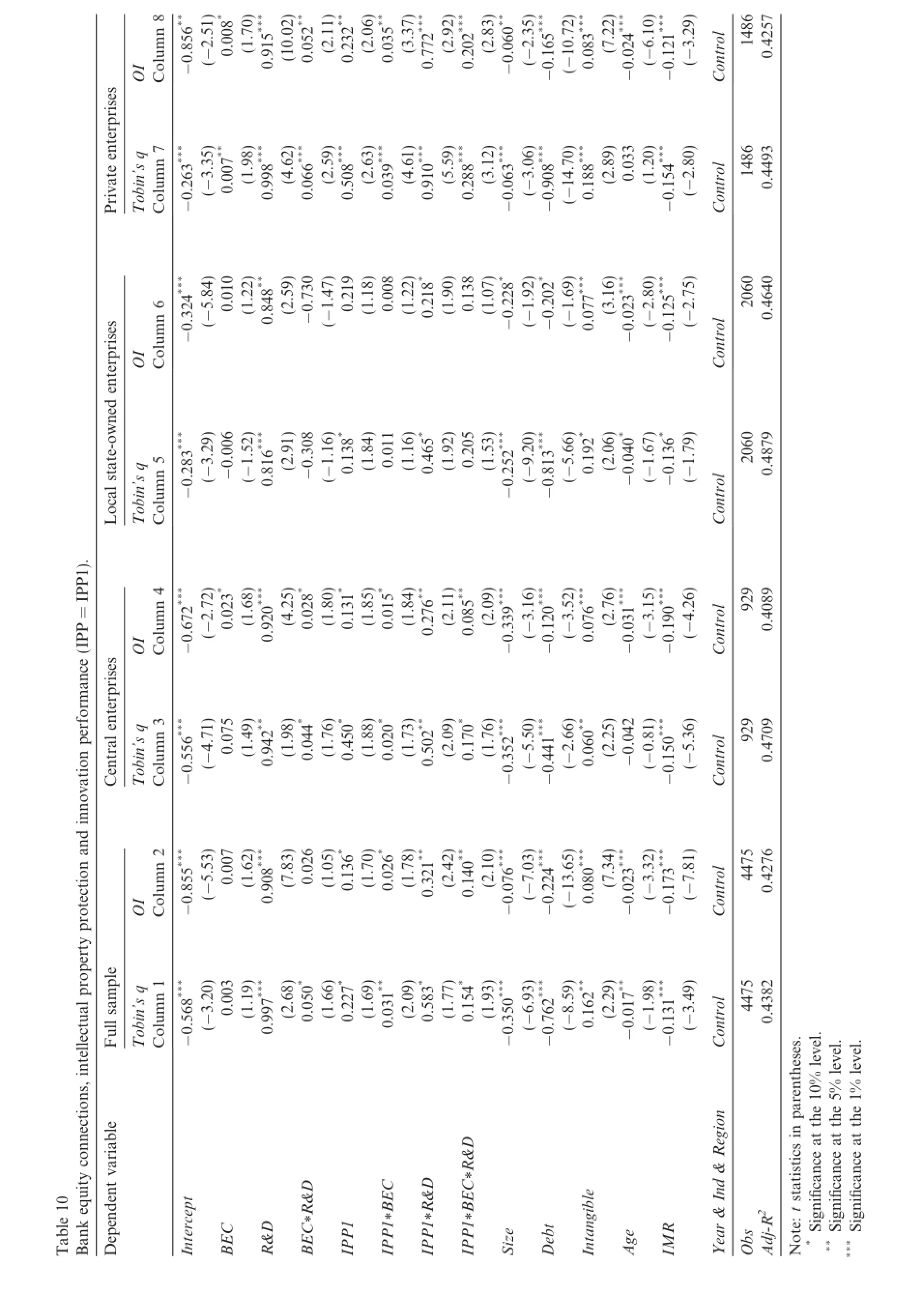

5.2.Bank equity connections,intellectual property protection and innovation performance

8 * ****** mnlu-0.856**2.51)(-(1.70)0.915**(10.02)0.052**(2.11)0.232**(2.06)0.035**(3.37)0.772**(2.92)0.202**(2.83)-0.060**2.35)(-10.72)(7.22)-0.024**3.29)14860.007**0.008*(-OI-0.165**(-(-0.083**6.10)0.4257rises Co-0.121**Control terpPrivate enTobin's q7********* 14.70)-0.263***(1.98)lumn3.35)0.848**0.998**(4.62)0.066**(2.59)0.508**(2.63)0.039**(4.61)0.910**(5.59)0.288**(3.12)-0.063**3.06)-0.908***(2.89)0.033(1.20)2.80)1486Co(-(-(-0.188**-0.154**(-Control 0.44936 mn-0.730(-5.84)1.92)0.010(1.22)(2.59)-0.202*(-(1.18)0.008 2.80)(1.22)0.219 2.75)0.218*(1.90)0.138 2060(1.07)-0.228*(-rises (-(3.16)1.47)1.69)(-0.077***(--0.023*** -0.125*** 0.4640terpluOICoControl -0.324*** cal state-owned enmn-0.283*** Tobin's q5(-3.29)-0.0061.52)(-(2.91)-0.3080.816*** 1.16)(-0.138*(1.84)0.011(1.16)(1.92)(1.53)-0.252*** 9.20)(--0.813*** 0.321**0.502**0.276**0.465* 0.085**0.205 5.66)(-0.192*(2.06)-0.040* 1.67)(--0.136* 1.79)(-20600.4879LoluCoControl P1).IP4** ***** P=929 -0.672**(-(1.68)mn2.72)(4.25)(1.80)(1.85)(1.84)(2.11)(2.09)3.16)3.52)(2.76)3.15)4.26)performance(IP0.023* 0.028* 0.131* 0.015*(-(-(-(-0.4089rises OIluCo-0.339**-0.120**-0.031**-0.190**Control terp* * -0.352**Central enTobin's q3 -0.556**4.71)-0.042929(1.49)mn0.942**0.920**vation(1.98)lu0.044* 0.075(1.76)0.450*(1.88)0.020*(1.73)(2.09)0.140**0.170*(1.76)5.50)* -0.441**(2.25)(-0.81)2.66)(--0.150*** Co(-0.060**0.076**(-5.36)(-Control 0.4709nod inanprotection2 mn-0.855*** lu5.53)(-0.007(1.62)(7.83)0.026(1.05)(1.70)(1.78)(2.42)(2.10)-0.076*** 0.908*** 0.136* 0.031**0.026* 7.03)(7.34)3.32)(-4475(-OI13.65)(-Co-0.224***(--0.017**-0.023*** Control -0.173*** 7.81)0.4276propertyle*** -0.350**sampTobin's q1 -0.568***(-altellectullmnlu3.20)0.003(1.19)0.997**(2.68)0.050*(1.66)0.227*(1.69)(2.09)0.583*(1.77)0.154*(1.93)6.93)*8.59)(2.29)1.98)3.49)4475FuCo(-(-0.162**0.080***(-(--0.762**Control -0.131**0.4382ins,level.level.ectionparentheses.e 10%level. thththleegion e 1%&DnnincoTable 10uityt variabe 5%&ReqenD EC&DEC*Rstatistics**SignDependBankIntercept C*R&P1*BP1*RP1*BIntangible&Indte:t*S2 ifi cance atC D P1SizeDebtAge R YearObs Adj-R ignif i cance at*Signif i cance atBER&BEIPIPIPIPIMNo**

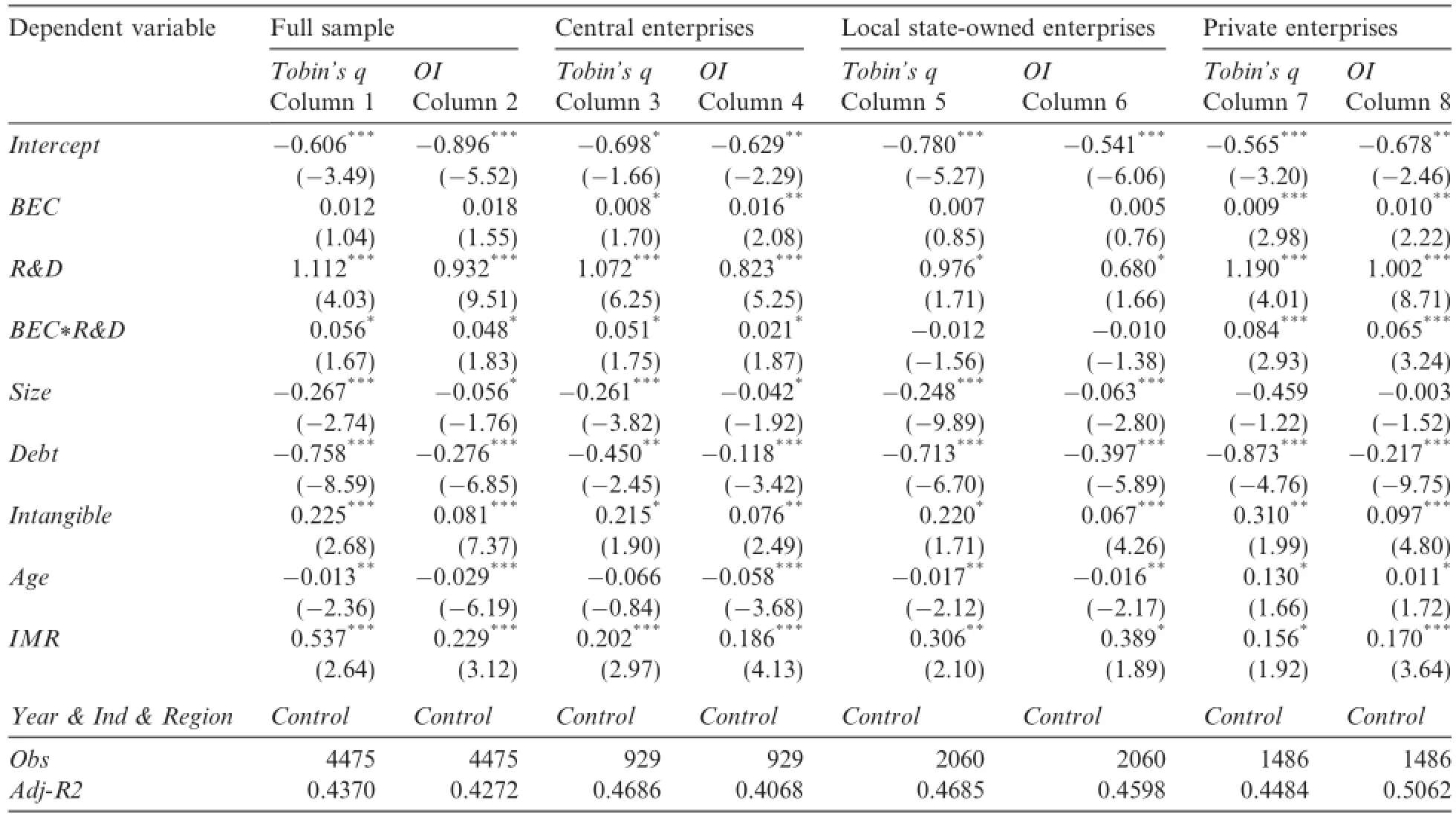

Taking IPP1 as the proxy variable for intellectual property protection,we investigate the individual influence of intellectual property protection on innovation performance,and the interaction between intellectual property protection and bank equity connections.As shown in columns 1 and 2 of Table 10,the coefficients of IPP1*R&D are significantly positive at 10%and 5%levels,respectively.Moreover,the coefficients of IPP1* BEC*R&D are 0.154 and 0.140,respectively,and are both significant.These results indicate that for all firms,intellectual property protection not only improves innovation performance,it can positively moderate the relation between bank equity connections and innovation performance.In addition,as shown in columns 3-8 of Table 10,we find that for central enterprises,local state-owned enterprises and private enterprises,the coefficients of IPP1*R&D are significantly positive and that the coefficient is lowest for central enterprises and highest in private enterprises.Moreover,Chow's test shows that there are significant differences between each pair.These results suggest that the positive effect of intellectual property protection on innovation performance is strongest in private enterprises and weakest in central enterprises,which is consistent with H3. One explanation might simply be,similar to Table 7,that the capacity to pursue rights through alternative means increases gradually with increases in government control level,so the dependence on intellectual property protection becomes weaker.To analyze the relationship between intellectual property protection and bank equity connections,we include the three-way interaction term among IPP1,R&D and the BEC dummy. We focus on the coefficient of IPP1*BEC*R&D.As shown in columns 3-8 of Table 10,the coefficients of I PP1*BEC*R&D are all significantly positive,except in the subsample of local state-owned enterprises;the coefficient of IPP1*BEC*R&D is greater in the subsample of private enterprises than in the subsample of central enterprises.Furthermore,Chow's test shows that there are significant differences between columns 3 and 7(P-Value=0.056)and between columns 4 and 8(P-Value=0.071).This indicates that the interactive effect between bank equity connections and intellectual property protection makes the strongest improvements in innovation performance in private enterprises,and the least improvement in local state-owned enterprises,perhaps because the short-term interests of local government officials and the self-interested behavior ofcorporate executives are likely to distort the capital investment of local state-owned enterprises and make the resources disposal advantage of a bank equity connection an inefficient tool for extracting profits.This would result in less investment in innovation,so in this case,bank equity connections do not improve innovative performance even if reinforced with the protection of intellectual property rights.

Table 11Bank equity connections,intellectual property protection and innovation performance(IPP=IPP2).

In Table 11 we use IPP2 as the proxy variable for intellectual property protection.The results in columns 1-8 show that the coefficients of IPP2 and IPP2*R&D are all significantly positive.This suggests that intellectual property protection reduces the cost of innovation,enhances corporate value and improves innovation performance,whether in the whole sample regression or in the subsamples grouped by type of property rights. As shown in columns 2-8 of Table 10,the coefficient of IPP2*R&D is largest in the private enterprises subsample,and smallest in the central enterprises subsample.Furthermore,Chow's test shows that there are significant differences between each pair,indicating that the positive effect of intellectual property protection gradually increases from the central enterprises,through state-owned enterprises to private enterprises.Here,we focus on the coefficient of IPP2*BEC*R&D.As shown in columns 1-2 of Table 10,the coefficients of I PP2*BEC*R&D are all significantly positive.This suggests that intellectual property protection and bank equity connections complement each other.Furthermore,we find that when the dependent variable is measured by Tobin's q,the coefficients of IPP2*BEC*R&D are insignificant in columns 3 and 5,but significantly positive in column 7,indicating that the complementary effect of intellectual property protection and bank equity connections has the most influence on private enterprises,and has little influence on the other two types of enterprises.In the same way,when the dependent variable is OI,the coefficient of IPP2*BEC*R&D is positive but not significant in the subsample of private enterprises,whereas in column 4,the subsample of central enterprises,and in column 8,the subsample of private enterprises,the coefficients are both significantly positive,but greater for private enterprises.Chow's test shows that there are significant differences between column 4 and column 8(P=0.061).These results suggest that the positive moderating effect of intellectual property protection on the relationship between bank equity connections and innovation performance is the strongest in private enterprises and weakest in local state-owned enterprises.

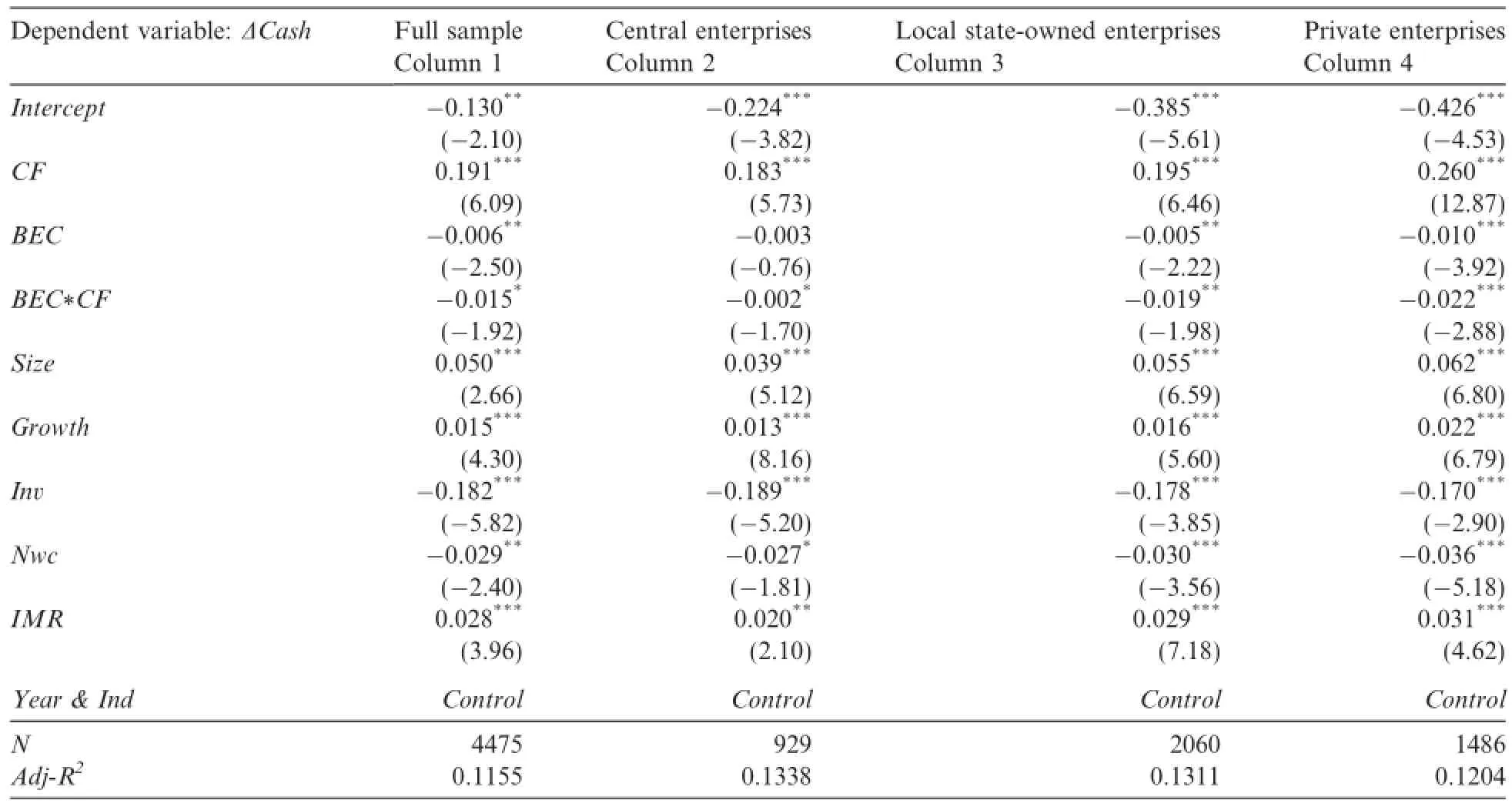

Table 12Bank equity connections,enterprise heterogeneity and financing constraints.

5.3.Robustness tests for whether bank equity connections can ease financing constraints