The Relation between Age Structure of Population and Resident Consumption Based on Endogenous Growth Theory

, ,

1. School of Public Affairs, University of Science and Technology of China, Hefei 230026, China; 2. Department of Health Management, Bengbu Medical College, Bengbu 233004, China; 3. School of Management, University of Science and Technology of China, Hefei 230026, China

1 Introduction and literature review

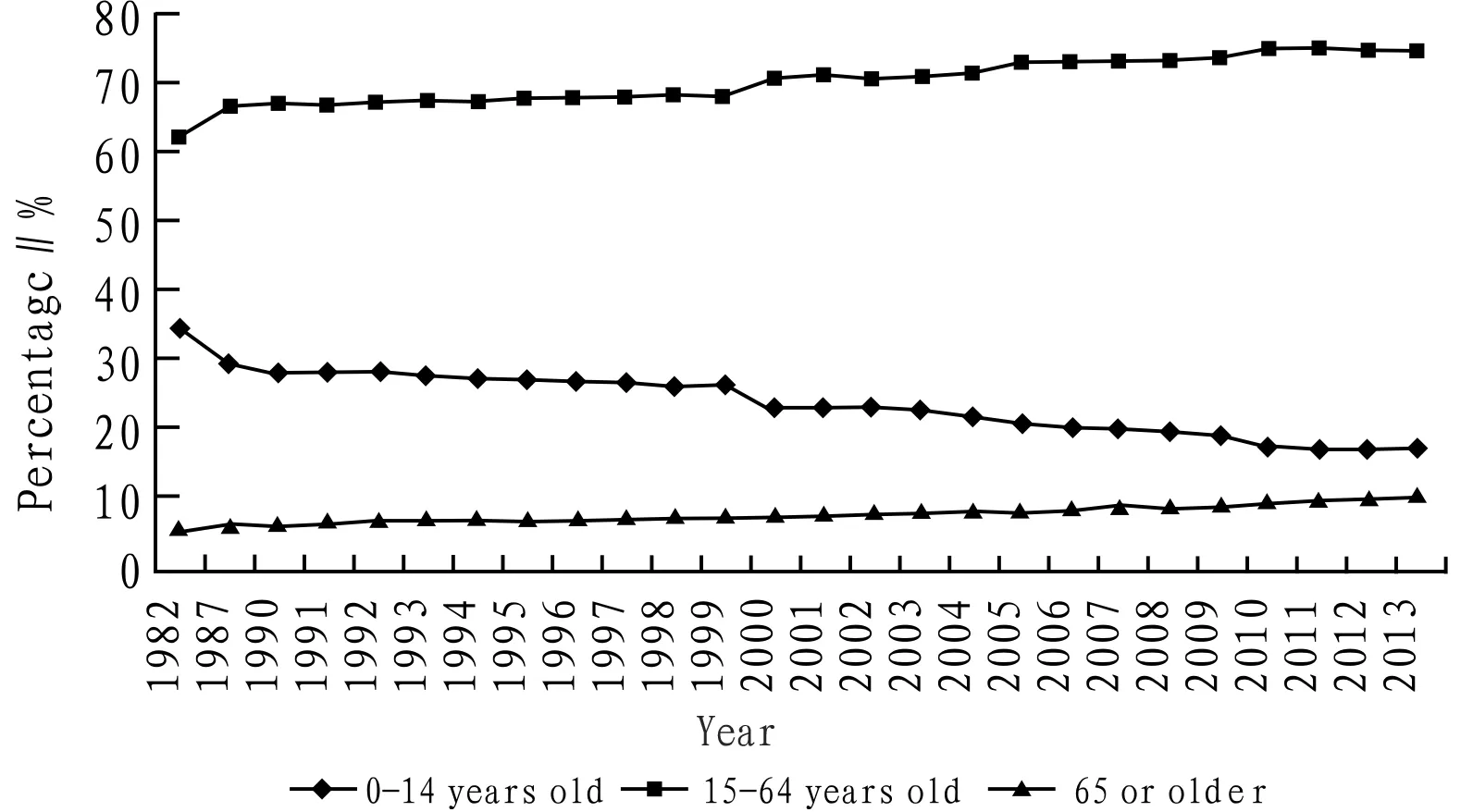

Due to the strict family planning policy in the past three decades, the fertility rate of China keeps falling. The percentage of 0-14 years old population constantly declines, while the percentage of the population older than 65 continues to rise, which deteriorates the problem of aging, as shown in Fig. 1. China’s population has entered the new normal state with accelerated aging and extremely low fertility rate. Although China still wears the hat of "largest population in the world", great changes have taken place in the population structure.CommuniqueoftheThirdPlenarySessionofthe18thCentralCommitteeoftheCommunistPartyofChinaofficially approved the second child policy, thus, it will be of great realistic significance to study issues related to the age structure of population. Theories connecting the age structure of population and resident savings include: (i) life cycle hypothesis introduced by Modigliani and Brumberg[1], and (ii) household saving demand model developed by Samuelson[2]and Nether[3]. According to Modigliani and Brumberg, there exists positive correlation between the age structure of population and the resident savings, while there is negative correlation between child and elderly population and savings. In the opinions of Samuelson and Nether, the number of child in a family plays a decisive role in savings. In other words, if a family has more children, this family will have to reduce savings for endowment and increase current consumption; otherwise, the family will reduce consumption. Foreign scholars discussed the relation between age structure of population and resident consumption mainly from the macro and micro perspectives. In macro national total data, typical researches are as follows: Modigliani[4], using transnational cross-sectional data, made an empirical study on the relation between the age structure of population and savings, and found there exists significant negative correlation between child and elderly population and rate of savings; also using transnational cross-sectional data, Leff[5]studied and found there exists negative correlation between both child dependency coefficient and rate of savings and between elderly dependency coefficient and rate of savings, and he further verified results of Modigliani. In micro household survey data, there are following typical studies. Demery and Duck[6]studied the household data of the England in 1969-1998 and found that if the sample selection bias was corrected and certain adjustment was made to the endowment from household income, there was positive correlation between labor age population and savings, and such conclusion is close to life cycle hypothesis; Kraay[7], on the basis of household survey panel data of resident savings in different provinces of China in 1978-1989, using two stage OLS method, studied the effect of age structure of population on savings, and found the effect of dependency coefficient on resident savings is not statistically significant; Horioka and Wan[8], using household survey panel data in different provinces of China in 1995-2004, with the aid of dynamic panel GMM estimation method, studied the effect of age structure of population on savings, and obtained conclusions similar to Kraay.

Many domestic scholars also studied the effect of age structure of population (child dependency coefficient and elderly dependency coefficient) on resident consumption. Results of studies are quite varied. Here, we just list some typical ones. Li Wenxing and Xu Changsheng[9]made an empirical study on panel data of 29 provinces in 1989-2004, and concluded that there is negative correlation between child dependency coefficient and resident consumption rate, while there is insignificant positive correlation between elderly dependency coefficient and resident consumption rate. Fang Fuqian[10], on the basis of panel data of 30 provinces in 1995-2005, found there exists negative correlation between child dependency coefficient and urban resident consumption and rural resident consumption, while there is positive correlation between elderly dependency coefficient and urban resident consumption and rural resident consumption. In the empirical study of panel data of 29 provinces in 1993-2008, Chen Chong[11]obtained the result of negative correlation between child and elderly dependency coefficient and rural resident consumption. In their study of panel data of 31 provinces in 1996-2010, Mao Zhonggen and Sun Wufu[12]found positive correlation between child dependency coefficient and urban and rural resident consumption, and negative correlation between elderly dependency coefficient and urban resident consumption, while its effect on rural resident is weaker. According to results of Fu Bohang and Fang Qiyun[13], the decline in child dependency coefficient reduces China’s resident consumption rate, while the rise of elderly dependency coefficient impairs rise of China’s resident consumption rate. Gai Xiaomin and Geng Jun[15]obtained positive correlation between child dependency coefficient and consumption level, and negative correlation between elderly coefficient and consumption level.

Fig.1Changesinagestructureofpopulationin1982-2013

In sum, most studies focus on empirical researches, while few touch on theories. Besides, most domestic studies are based on provincial panel data, few studies focus on the resident consumption level of a specific province. Finally, most studies concentrate on the effect of age structure of population on resident consumption, few studies introduce cross terms to determine the effect of age structure of population on resident consumption, and few studies elaborate internal action mechanism. In view of these, we try to make up for the shortage of the above studies. Firstly, within the framework of endogenous growth theory, through building Hamiltonian function, we derived the explicit relation between age structure of population and resident consumption, to provide theoretical support for empirical study. Secondly, our empirical study was based on the data of a province. Finally, apart from studying the effect of age structure of population and resident consumption, we also introduced urbanization level, social expenditure, child dependency coefficient and elderly dependency coefficient to elaborate the effect of age structure of population and resident consumption and their internal action mechanism.

2 Theoretical model

2.1ProductionfunctionA typical household serves as manufacture to conduct production. Assume production function consists of two parts: physical capitalKand laborL. For simplicity, production function satisfied the requirements of Cobb-Douglas production function:

Y=AKαL1-α

(1)

whereAis constant technical coefficient.

Equation (1) is neoclassical production function. At this time, the production function is:

y=Akα

(2)

The marginal value of capital and labor in manufacturer balanced condition is:

r=Aαka-1,w=A(1-α)kα

(3)

2.2ConsumerbehaviorSetuas total utility of discount, isu(c) is instantaneous utility function of welfare, c denotes per capita consumption level of typical household in period t.ρdenotes time preference rate and is constant. Unlimited life consumers maximize their lifelong utility, then the maximum utility function will be:

(4)

where,u(c)=logc.

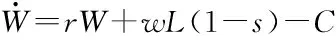

Assume total assets of household in periodtisW, the return on capital isr, then the income of household assets in periodtwill berW. At the same time, assume the household can provide laborLfor the society and obtain the wage returnwL. According to opinion of Chen Chong that the household income should deduct the dependency coefficient of child growth period and retirement endowment period, the household income after deducting dependency coefficient will bewL(1-s). The budget constraint of household can be expressed as:

whereCis household consumption in periodt.

Assume per capita wealtha=W/L, and per capita consumptionc=C/L. In the beginning, wealth of resident is 0,i.e.a(0) = 0; when it reaches the periodT, the residual wealth level could barely support average per capita consumption levelc0of the year, namely,a(T) =c0. Accordingly, the accumulated equation for per capita wealth will be:

(5)

2.3SolutionofthecompetitiveequilibriumIn sum, the decision making of typical household on the basis of per capita consumption level c is a dynamic optimization process, and the specific optimization growth can be expressed as follows:

(6)

Building Hamiltonian function for equation (6):

H=logc+λ[ra+w(1-s)-c]

(7)

whereλis Hamilton multiplier, and its optimum first order is:

(8)

Combining equations (3), (5) and (8), we can get the resident consumption function:

(9)

Calculate the first-order partial derivative of s for equation (9), we obtain:

According to equation (9), long-term consumption level is function of dependency coefficient, and they take on negative correlation. Thus, we have established basic theoretical framework and logical ideas for dependency coefficient acting on resident consumption level. In this study, we focus on the effect of changes in the age structure of population on resident consumption level. The dependency coefficient of resident includes child dependency and elderly support. In the empirical study, we divide the dependency coefficient into child dependency coefficient and elderly dependency coefficient, and discuss the effect of respective dependency coefficient, urbanization level, social expenditure and cross term of dependency coefficient on resident consumption level.

3 Empirical study

3.1BuildingofeconometricmodelTo verify accuracy of theoretical analysis results, we take real per capita resident consumption as dependent variable, child dependency coefficient and elderly dependency coefficient as independent variables, and introduce some control variables to the regression equation. The specific econometric model is as follows:

consit=α0+α1cdrit+α2odrit+α3cityit+α4socit+α5cdrit*cityit+α6odrit*cityit+α7cdrit*socit+α8odr*socit+α9rpcgdpit+a10gapit+α11fgit+εit

whereiandtdenote province and year respectively;αi(i=1,2,3…11) denotes regression coefficient;εitis disturbance term.

Description of variable selection: real per capita resident consumption (cons) and real per capita GDP (rpcgdp) are real values excluding the inflation effect; child dependency coefficient (cdr) is calculated using the ratio of population of 0-14 years old to population of 15-64 years old; elderly dependency coefficient (odr) is calculated using the ratio of population older than 65 to the population of 15-64 years old; urbanization level (city) is measured using urban population to total population; social expenditure (soc) is expressed in the ratio of social expenditure to total financial expenditure, and social expenditure mainly includes expenditure in science, education, culture and hygiene, as well as social security; urban and rural income gap (gap) can be calculated using the ratio of per capita net income of rural residents to per capita disposable income of urban residents. Financial expenditure scale (fg) is the value of total expenditure scale of each province and city divided by GDP of the province. Here, the introduction of cross term is to study the effect of urbanization level and social expenditure on child dependency coefficient and elderly dependency coefficient, and their relation with resident consumption.

3.2DatasourceandempiricalresultsThe data of variables were selected fromStatisticalYearbookofChina, National Database, and MacroChina DataBase. The sample interval is 2000-2013, and total samples are 434.

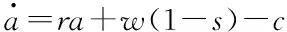

Since the panel data were used, it is firstly necessary to identify the model, to determine whether the fixed effect model or random effect model is suitable. From Table 1, in Hausman test of equations (1), (2) and (4),Pvalue is lower than 5%, so it rejects original hypothesis (random effect model), then we adopt fixed effect model to estimate the above equations; however, in Hausman test of equation (3),Pvalue is greater than 10%, so it accepts the original hypothesis (random effect model), then we adopt random effect model to estimate the above equation. Meanwhile, at the 10% significance level, except the government expenditure scale in equation (1) and the cross term coefficient of social expenditure and child dependency coefficient in equation (3), other coefficients pass the significance test, andPvalue ofFstatistics is lower than 10% of significance level, indicating the regression model is also significant. The regression results are listed in Table 1.

From Table 1, we can see: (i) There exists negative correlation between child dependency coefficient and resident consumption. Possible reasons are as follows. Firstly, due to the influence of traditional culture of "hoping children to succeed", most residents would rather economize on food and clothing and reduce current consumption expenditure than cultivate and educate their children. Secondly, current family planning policy leads to decline of children number, but residents will increase human investment in children to improve overall quality of their children due to the thought of "raising children to support them in their old age". Besides, transformation of such thought to socialized endowment promotes residents to increase savings. When the increase in current dependent care expenses is lower than the increase in savings due to decline in children number, resident consumption level will decline. (ii) There is positive correlation between elderly dependency coefficient and resident consumption. This is similar to conclusion of Wang Xia[14]. Possible reasons are as follows. Firstly, with the growth of age, the elderly will not create wealth any more, but they still need consumer goods such as foods and medical care provided by the society, and they need caring to enjoy their remaining years. Modigliani stated that marginal consumption tendency of the elderly is very high. Secondly, China remains at the early period of aging, and China is a country of valuing the filial love. With deterioration of aging, dependency expenditure in the elderly will exceed the savings, then there will be growth of resident consumption.

Table1Resultsofeffectofagestructureofpopulationonresidentconsumption

IndependentvariableDependentvariable:realpercapitaresidentconsumptionEquation(1)Equation(2)Equation(3)Equation(4)rpcgdp0.3157***(32.043)0.3173***(30.962)0.3141***(16.794)0.2796***(22.967)fg0.0359(0.481)0.0545*(1.705)0.1300*(1.752)gap-0.5283***(-3.025)-0.5375***(-3.128)-0.5130***(-3.775)city0.2753***(3.176)1.0190***(3.326)0.2720***(3.458)2.5763***(5.307)soc0.4278**(2.224)0.2881*(1.883)1.3525***(4.013)0.2344(0.427)cdr-0.0065(-0.604)-0.1908*(-1.813)-0.0468(-1.458)-0.1349**(-2.271)odr0.6878*(1.823)3.3648**(2.549)3.5776***(2.757)8.3136***(3.446)city*cdr-0.0040*(-1.892)-0.0364***(-5.595)city*odr0.0578**(-2.171)0.1164***(-3.486)soc*cdr-0.0012(-1.631)-0.0445***(-5.338)soc*odr0.0771**(2.288)0.0591*(1.716)Numberofsamples434434434434Adj-R20.930.930.930.93F153.20152.18145.75152.23P(F)0.000.000.000.00Hausman16.0416.7914.0921.13P(H)0.020.030.120.03

Note:*,**and***denote significant at 10%, 5% and 1% respectively, value in parenthesis istvalue.

The cross term coefficient of social expenditure and child dependency coefficient is positive, while the cross term coefficient of social expenditure and elderly dependency coefficient is negative and it is significant at 10% level. This means that the social expenditure weakens the negative effect of child dependency coefficient on resident consumption, but it intensifies positive effect of elderly dependency coefficient on resident consumption. Possible reasons are as follows. Social expenditure includes expenditure in science, education, culture and hygiene, and social security. When government increases input in science, education, culture and hygiene, resident will reduce such expenditure, but increase consumption in other aspects, thus the social expenditure will weaken the negative effect of child dependency coefficient on resident consumption; with increase in social expenditure, government provides higher quality public services, which will reduce burden of residents in endowment and then increase resident consumption, accordingly it intensifies the positive effect of elderly dependency coefficient on resident consumption. (iv) Other control variables are also essential factors influencing resident consumption. There is significant positive correlation between economic growth and resident consumption level. Government scale takes on positive correlation with resident consumption level. The significance is varied. Besides, there is significant negative correlation between urban and rural income gap and resident consumption. Social expenditure takes on significant positive correlation with resident consumption, and urbanization level also takes on significant positive correlation with resident consumption.

Table2Resultsofeffectofagestructureofpopulationoneconomicgrowth

IndependentvariableDependentvariable:grpcgdpEquation(5)Equation(6)Equation(7)cons0.0373***(11.475)0.0380***(11.936)0.0383***(11.194)city0.0393***(3.693)0.0408***(3.906)0.0413***(3.764)soc0.1658***(7.621)0.1302***(5.628)0.1279***(5.223)fg-0.0556***(-6.832)-0.0394***(-4.402)-0.0385***(-4.160)cdr-0.0002(-0.121)-0.0012*(-1.736)odr-0.1790***(-3.962)-0.1893***(-4.230)Numberofsamples434434434Adj-R20.510.530.53F14.1015.1114.70P(F)0.000.000.00Hausman68.4198.3194.45P(H)0.000.000.00

Note:*,**and***denote significant at 10%, 5% and 1% respectively, value in parenthesis istvalue. grpcgdp denotes economic growth rate. In this study, the average real per capita GDP growth rate of the current year and following three years is used as indicator for measuring the economic growth.

Current population structure of China (decline in children) is favorable for growth of resident consumption demand, but is such aging population structure favorable for economic growth Now we carry out test for this. Since the panel data were used, it is firstly necessary to identify the model, to determine whether the fixed effect model or random effect model is suitable. From Table 2, thePvalue corresponding to Hausman test of equations (5), (6) and (7) is lower than 5%, indicating it rejects original hypothesis (random effect model), so we employ fixed effect model to make estimation. The results are listed in Table 2. According to Table 2, child dependency coefficient exerts negative effect on economic growth, while elderly dependency coefficient exerts significant negative effect on economic growth, thus in such aging population structure, economic development may lose the demographic dividends. At present, child population constantly declines, while elderly population constantly rises. In future, labor age population will gradually decrease. Thus, the negative effect of age structure of population on economic growth will last for a long time.

4 Conclusions and recommendations

4.1ConclusionsWithin the framework of endogenous growth theory, we studied the dynamic relation between age structure of population and resident consumption, and obtained explicit relation between resident consumption and dependency coefficient through Hamiltonian function method. Then, using panel data of 31 provinces in 2000-2013, we made an empirical study and came up with following conclusions. There is negative correlation between child dependency coefficient and resident consumption and there is positive correlation between elderly dependency coefficient and resident consumption; urbanization level weakens the negative effect of child dependency coefficient on resident consumption but it increases the positive effect of elderly dependency coefficient on resident consumption; social expenditure weakens the negative effect of child dependency coefficient on resident consumption, but it intensifies positive effect of elderly dependency coefficient on resident consumption; economic growth and resident consumption level take on significant positive correlation. Government scale takes on positive correlation with resident consumption level. The significance is varied. Besides, there is significant negative correlation between urban and rural income gap and resident consumption. Social expenditure takes on significant positive correlation with resident consumption, and urbanization level also takes on significant positive correlation with resident consumption.

4.2Recommendations(i) Properly controlling age structure of population. There is negative correlation between child dependency coefficient and resident consumption and there is positive correlation between elderly dependency coefficient and resident consumption. Therefore, government should properly control age structure of population and pay attention to the effect of population structure on resident consumption and economic growth. (ii) Promoting benign development of urbanization. Since urbanization level weakens the negative effect of child dependency coefficient on resident consumption, but it intensifies positive effect of elderly dependency coefficient on resident consumption, urbanization level is favorable for promoting resident consumption. In the process of urbanization, it is recommended to stick to the principle of coordinated development of large, medium and small sized cities, make effort to guarantee rights and benefits of migrant workers and urban households with financial difficulties, and promote equalized basic public services, to make contribution for expanding domestic demands. (iii) Optimizing public expenditure structure. Empirical study indicates that social expenditure exerts significant positive effect on resident consumption, so the increase in social expenditure will promote improvement in resident consumption level. In this situation, optimizing public expenditure structure and properly increasing the percentage of social expenditure are of great significance for lifting resident consumption level. (iv) Developing elderly industry and cultivating and developing elderly consumption market. This not only solves problems of the elderly in foods, medical care and other consumer goods, but also expands consumption market, promotes domestic demands, and accordingly realizes stable and healthy economic growth.

[1] MODIGLIANI F, BRUMBERG R. Utility analysis and the consumption function: An interpretation of the cross section data[M]. In Kurihara K.K.(ed): Post-Keynesian Economics. New Brunswick, NJ: Rutgers University Press, 1954: 388-436.

[2] SAMUELSON RA. An exact consumption loan model of interest with or without the social contrivance of money[J]. Journal of Political Economy, 1958, 66(6): 467-482.

[3] NEHER PA. Peasants, procreation, and pensions[J]. The American Economic Review, 1971, 61(3): 380-389.

[4] MODIGLIANI F. The life cycle hypothesis of savings, the demand for wealth, and the supply of capital[J]. Social Research, 1966, 33(2): 160-217.

[5] LEFF NH. Dependency rates and savings rates[J]. The American Economic Review, 1969, 59(5): 886- 896.

[6] DEMERY D, DUCK NW. Savings-age profiles in the UK[J]. Journal of Population Economics, 2006, 19(5): 521-541.

[7] KRAAY A. Household saving in China[J]. World Bank Economic Review, 2000, 14(3):545-570.

[8] HORIOKA CY, WAN J. The determinants of household saving in China: A dynamic panel analysis of provincial data[J]. Journal of Money, Credit and Banking,2007,39(8): 2077-2096.

[9] LI WX, XU CS, AI CR. The impacts of population age structure on household consumption in China: 1989-2004[J]. Economic Research Journal, 2008(7):118-129.(in Chinese).

[10] FANG FQ. An inquiry into the causes of inadequate household consumption in China——An analysis based on provincial data of urban and rural China[J]. Social Sciences in China,2009(2):68-82.(in Chinese).

[11] CHEN C. Population structural change and consumption of rural residents——Theoretical design and empirical test based on life cycle hypothesis[J].Journal of Agrotechnical Economics,2011(4):25-32.(in Chinese).

[12] MAO ZG, SUN WF, HONG T. Comparative analysis on the relationship between population age structure and household consumption in China[J]. Population Research,2013(3):82-92.(in Chinese).

[13] FU BH, FANG QY, SONG DY. Urbanization, population age composition and resident consumption: Empirical research based on provincial dynamic panel data[J]. China Population Resources and Environment, 2013, 23(11): 108-114. (in Chinese).

[14] WANG X. Population age composition, economic growth and Chinese resident consumption[J]. Zhejiang Social Sciences, 2011,(10):20-25.(in Chinese).

[15] GAI XM, GENG J. Consumption level, consumption choice and change of population age structure[J]. Reform, 2014(12):127-134.(in Chinese).

Asian Agricultural Research2016年9期

Asian Agricultural Research2016年9期

- Asian Agricultural Research的其它文章

- Empirical Study on the Relationship between Organizational Flexibility and Performance of Agricultural Enterprise

- Correlation between Employment Quality and Skill Training of Land-expropriated Farmers

- A Study on Spatial Distribution of Commercial Housing Prices in Xiangtan City

- Design and Experiment of Fluid Dynamic Ultrasonic Water Aerator

- Effect of Different Pretreatments on Explosion Puffing Drying of Hami Melon at Modified Temperature and Pressure in Xinjiang

- Design and Implementation of National Meteorological Service Platform