Empirical Study on the Relationship between Organizational Flexibility and Performance of Agricultural Enterprise

, ,

College of Economics and Management, Huazhong Agricultural University, Wuhan 430070, China

1 Introduction

Agricultural modernization is always the attention focus and research topic of domestic and foreign scholars. To realize China’s agricultural modernization, it should value the developments of agricultural enterprises in China. When the developments of agricultural enterprises reach modernization level, the development of agricultural economy could realize the modernization development. However, the development of China society is just at deepening stage of reform, and the development of agricultural enterprise faces complex environment of system and market dual transformation. To maintain development advantage and market competitive strength of the enterprise in complex environment, agricultural enterprise should maintain flexibility(suitability)development. Therefore, it has important theoretic value and actual significance to study the relationship between organizational flexibility and performance of agricultural enterprise in China. At present, some domestic researchers studied agricultural enterprises. For example, Xia Yingetal. studied the development roads of state owned agricultural enterprises, and thought that state owned agricultural enterprises should innovate the development mode. Chen Xiaohongetal. studied the development strategies of small and medium sized agricultural enterprises, and thought that agricultural enterprise should take the road of industrialization and science. Cao Junjieetal. studied the restraining factors of agricultural enterprise development. Liu Liangcanetal. studied the performance problem of agricultural enterprise development. But there is nearly no the research about how agricultural enterprise adapt to rapid changes of internal and external environments and make scientific decision(namely flexibility development). For that reason, based on the existing theory about flexibility, the relationships between organizational flexibility and performance of different types of agricultural enterprises are explored. In this paper, several problems will be solved. Firstly, state owned and private agricultural enterprises are studied to analyze the difference of organizational flexibility among different types of agricultural enterprises. Secondly, the relationship between organizational flexibility and performance of agricultural enterprise is studied to analyze if the influences of organizational flexibilities of different types of agricultural enterprises on performance are different. Finally, according to the research results, countermeasures and suggestions adapting to the developments of different types of enterprises are proposed.

2 Research design

2.1DefinitionoforganizationalflexibilityconceptThe flexibility was firstly proposed by Lavington in 1921. To the 1930s, economist Hart AGetal. studied the influence of economic cycle oscillation on enterprise and the theory of flexibility management[1]. Mandelbaum thought that flexibility was a kind of response ability of enterprise to environmental change, namely strain and buffering capacities to the environment[2]. John Millimanetal. thought that flexibility was a kind of human resource management ability, which was used to quickly respond to change demand of enterprise interior or environment[3]. Tan thought that flexibility was related to agility, and flexibility indicated adaptability and multi-functionality[4]. Upton defined the flexibility as that it spent very little time, vigor, cost and performance to generate the ability to change[5]. Gong Daihuaetal. defined the flexibility as an integrated ability, which contained mutation management adaptation ability, coordination ability and anti realistic ability[6]. Chowdhary defined the flexibility as the ability to respond to the environment or system change[7]. Wan Lunlaietal. thought that modern enterprise had the abilities of continuous learning and innovation, and organizational flexibility was enterprise’s ability of responding to environmental change by integrating internal and external resources[8]. Dreyeretal. thought that flexibility was the enterprise’s ability of adapting to environmental change and finding chance[9]. Yao Gang thought that flexible organization indicated the self adjustment if organization was continuously conducted under the environment of dynamic competition, thereby adapting to organizational environment[10]. He Chengetal. thought that organizational flexibility was a kind of ability of organization. When organization environment changed, organization would spend the least cost (time, energy and loss) to adjust or counterattack[11]. The existing researches on flexibility’s definition are not unified, but almost think that organizational flexibility is a kind of ability to respond to internal and external environmental changes. In this paper, the authors also define organizational flexibility, and think that organizational flexibility indicates a kind of ability to adapt to internal and external environmental changes and find market chance. It includes some adaptive adjustments in internal management process, some adaptabilities to enterprise strategy and target when external environmental changes, and some adaptive behaviors when trading with different customs.

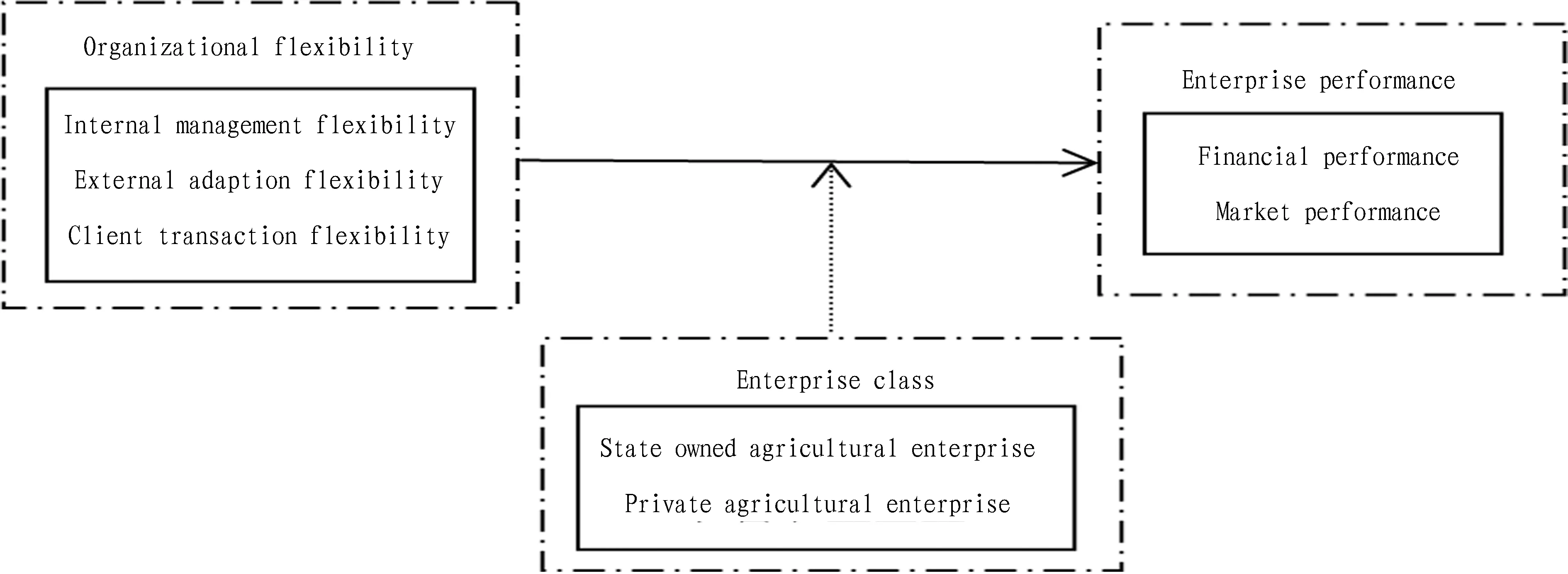

2.2ResearchframeworkAccording to treatment theory of modern enterprise, the related problems in agricultural enterprise are studied, and the relationships between organizational flexibility and performance of different types of agricultural enterprises are explored. The existing researchers deeply studied organizational flexibility and carried out dimension division. For example, Ansoff divided enterprise flexibility into internal and external flexibilities[12]. The European Commission pointed out that both internal and external flexibilities promoted economy growth. Zhao Bofu divided organizational flexibility into four dimensions, including the distribution of power, business process optimization, organization renewal and flexibility selection. Liu Yan divided organizational flexibility into six dimensions: structure, personnel, process, innovation, resource and culture. Mujde Erol Genevoisetal. defined the flexibility as the ability to adapt to client, internal or external processes, supplier, law or environment itself, which had uncertainty[13]. Sushil divided the flexibility into strategy flexibility, organization flexibility, function flexibility and information system flexibility[14]. According to the researches of Ansoffetal., the authors divide organizational flexibility of enterprise into three dimensions: internal management flexibility, external adaption flexibility and client transaction flexibility. For the evaluation of enterprise performance, there were more evaluation methods in the existing researches. For example, Kaplanetal. evaluated enterprise performance from four aspects: financial index, customer index, internal business process index and employee growth learning index. Walletal. studied subjective data of enterprise performance, and thought that there was not significant difference when using subjective and objective data to assess enterprise. Nie Huiping used human resource performance and financial performance to evaluate enterprise performance. Chen Guoquanetal. studied enterprise performance by using enterprise client, internal business learning and development and financial condition. Liu Weixing used financial performance and market performance to measure enterprise performance. Yang Ying used explicit and hidden performances to measure enterprise performance. In this paper, by referring to prior experience, financial performance and market performance are used to measure enterprise performance. In the existing researches, some scholars studied the relationship between enterprise flexibility and performance and obtained some conclusions. Paik thought that strategy flexibility had positive effect on the performance[15]. Ranjan V. N. Karri proved that organizational flexibility of enterprise could promote strategy and financial performances of the enterprise by empirical research[16]. The research results of Fred Phillips showed that the larger the organizational flexibility of enterprise, the better the performance, and organizational flexibility of enterprise had positive effect on performance[17]. Xie Weihongetal. thought that high performance of enterprise was largely related to flexibility, and the better the flexibility, the better the enterprise performance[18]. Qi Pengju studied organizational flexibility of enterprise, and thought that enterprise flexibility had significantly positive effect on performance. Tang Wenping studied the manufacturing enterprise, and thought that development strategy performance of enterprise had positive effect on performance. Wang Tienanetal. thought that the stronger the enterprise’s independent learning ability, the higher the enterprise flexibility, and ability flexibility had significant effect on enterprise performance[19]. Jiang Zhuetal. thought that organizational flexibility had significantly positive effect on enterprise performance[20]. Wu Beilei thought that flexible human resource management could significantly promote organizational performance of enterprise[21]. Based on the existing researches, the relationships between organizational flexibility and performance from state owned and private agricultural enterprises are contrasted. Internal management flexibility, external adaption flexibility and client transaction flexibility are used to measure organizational flexibility, while financial performance and market performance are used to measure enterprise performance, and concrete research model is shown as Fig.1.

2.3Theoreticalhypothesis

2.3.1Influence of internal management flexibility on financial performance. Internal management of enterprise promotes enterprise development, and flexible internal management could make enterprise better adapt to internal environmental change of enterprise. Ashok Abbott thought that enterprise flexibility had positive effect on financial performance[22]. Xu Meixin thought that flexible management could make enterprise maintain competitive advantage and promote performance[23]. From this, two kinds of hypotheses are proposed. Hypothesis 1-1: internal management flexibility of state owned agricultural enterprise had positive correlation effect on financial performance; hypothesis 1-2: internal management flexibility of private agricultural enterprise had positive correlation effect on financial performance.

2.3.2Influence of external adaption flexibility on financial performance. Enterprise could adapt to external environmental change well, avoid loss and enhance its own competitiveness, thereby promoting enterprise’s economic benefit. Ranjan V. N. Karri proved that organizational flexibility of enterprise could promote strategy and financial performances of enterprise by empirical research. Ashok Abbott thought that enterprise flexibility had positive effect on enterprise’s financial performance. The European Commission pointed out that both external and internal flexibilities had very important effects on economic growth, competitiveness and employment, which had very important relationships with economic growth, competitiveness and employment. Therefore, two kinds of hypotheses are proposed. Hypothesis 2-1:external adaption flexibility of state owned agricultural enterprise has positive correlation effect on financial performance; hypothesis 2-2: external adaption flexibility of private agricultural enterprise has positive correlation effect on financial performance.

Fig.1Theoreticalmodelofresearch

2.3.3Influence of client transaction flexibility on financial performance. Enterprise could accurately and conveniently trade with clients, which could promote the enterprise product or service sale, thereby promoting enterprise’s economic benefit, and it has great impact on financial performance of enterprise. Paik thought that flexibility had positive effect on performance. Therefore, there are two kinds of hypotheses. Hypothesis 3-1:client transaction flexibility of state owned agricultural enterprise has positive correlation effect on financial performance; hypothesis 3-2:client transaction flexibility of private agricultural enterprise has positive correlation effect on financial performance.

2.3.4Influence of internal management flexibility on market performance. Internal management flexibility of enterprise has great impact on the promotion of whole enterprise benefit, which could not only promote enterprise’s financial performance but also market share and product competitiveness. The ILO thought that enterprise was flexible protagonist. When they were forced to adapt to new market, technology, organizational form and employment form, productivity and competitiveness could be maintained by flexible manner to provide specious work. Therefore, there are two kinds of hypotheses. Hypothesis 4-1:internal management flexibility of state owned agricultural enterprise has positive correlation effect on market performance; hypothesis 4-2:internal management flexibility of private agricultural enterprise has positive correlation effect on market performance.

2.3.5Influence of external adaption flexibility on market performance. When possessing external environmental adaption flexibility, enterprise could timely respond to environmental change and find chance, thereby expanding market share of enterprise. Dreyerandetal. thought that flexibility was the ability of enterprise adapting to environmental change and finding chance. The research of Hao Cheng showed that external environmental adaption of enterprise had significant impact on enterprise performance. Wang Yu thought that external environmental adaption had significant impact on non financial performance of enterprise[24]. Therefore, there are two kinds of hypotheses. Hypothesis 5-1:external adaption flexibility of state owned agricultural enterprise has positive correlation effect on market performance; hypothesis 5-2:external adaption flexibility of private agricultural enterprise has positive correlation effect on market performance.

2.3.6Influence of client transaction flexibility on market performance. Client transaction flexibility of enterprise could make that enterprise maintain good relationship with dealer, thereby promoting the sale of enterprise product, increasing market share of enterprise, and promoting market performance of enterprise. Enterprise possess good client transaction flexibility, which has important promoting role in enterprise’s production or product sale, which could promote enterprise’s economic benefit and also has great impact on financial performance. Yasmeen Ansari thought that when maintaining flexibility, enterprise could establish good cooperation relationship with client, which makes product or service sale convenient and quick, thereby promoting product or service sale. Therefore, there are two kinds of hypotheses. Hypothesis 6-1:client transaction flexibility of state owned agricultural enterprise has positive correlation effect on market performance; hypothesis 6-2:client transaction flexibility of private agricultural enterprise has positive correlation effect on market performance.

3 Data source and variable illustration

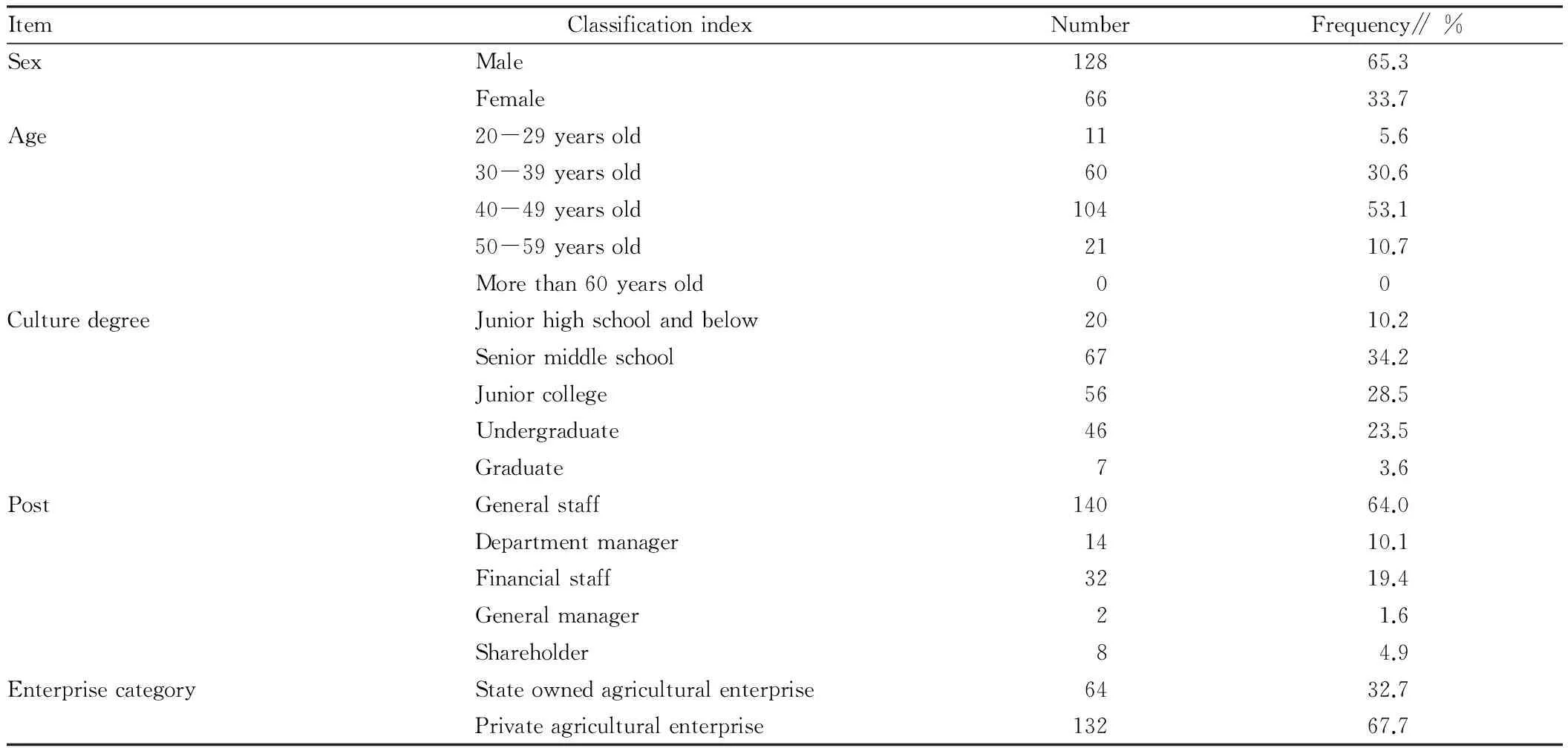

3.1SampleanddatacollectionBy investigating concrete situations of many agricultural enterprises, the data are obtained. Enterprise distribution includes more than 10 provinces, such as Hubei, Hunan and Jiangsu, and the investigated agricultural enterprises include grain and oil industry, aquatic products industry, fruit and vegetable industry, poultry, egg and meat industry, forestry industry, feed industry, flower industry and seed industry. There are 210 questionnaires in total, and 196 effective questionnaires are recovered finally, with 93.33% of effective rate. Basic characteristics of sample include sex, age, culture degree, post of the investigated staff and enterprise category (Table 1).

Table1Basiccharacteristicsofsamples

ItemClassificationindexNumberFrequency∥%SexMale12865.3Female6633.7Age20-29yearsold115.630-39yearsold6030.640-49yearsold10453.150-59yearsold2110.7Morethan60yearsold00CulturedegreeJuniorhighschoolandbelow2010.2Seniormiddleschool6734.2Juniorcollege5628.5Undergraduate4623.5Graduate73.6PostGeneralstaff14064.0Departmentmanager1410.1Financialstaff3219.4Generalmanager21.6Shareholder84.9EnterprisecategoryStateownedagriculturalenterprise6432.7Privateagriculturalenterprise13267.7

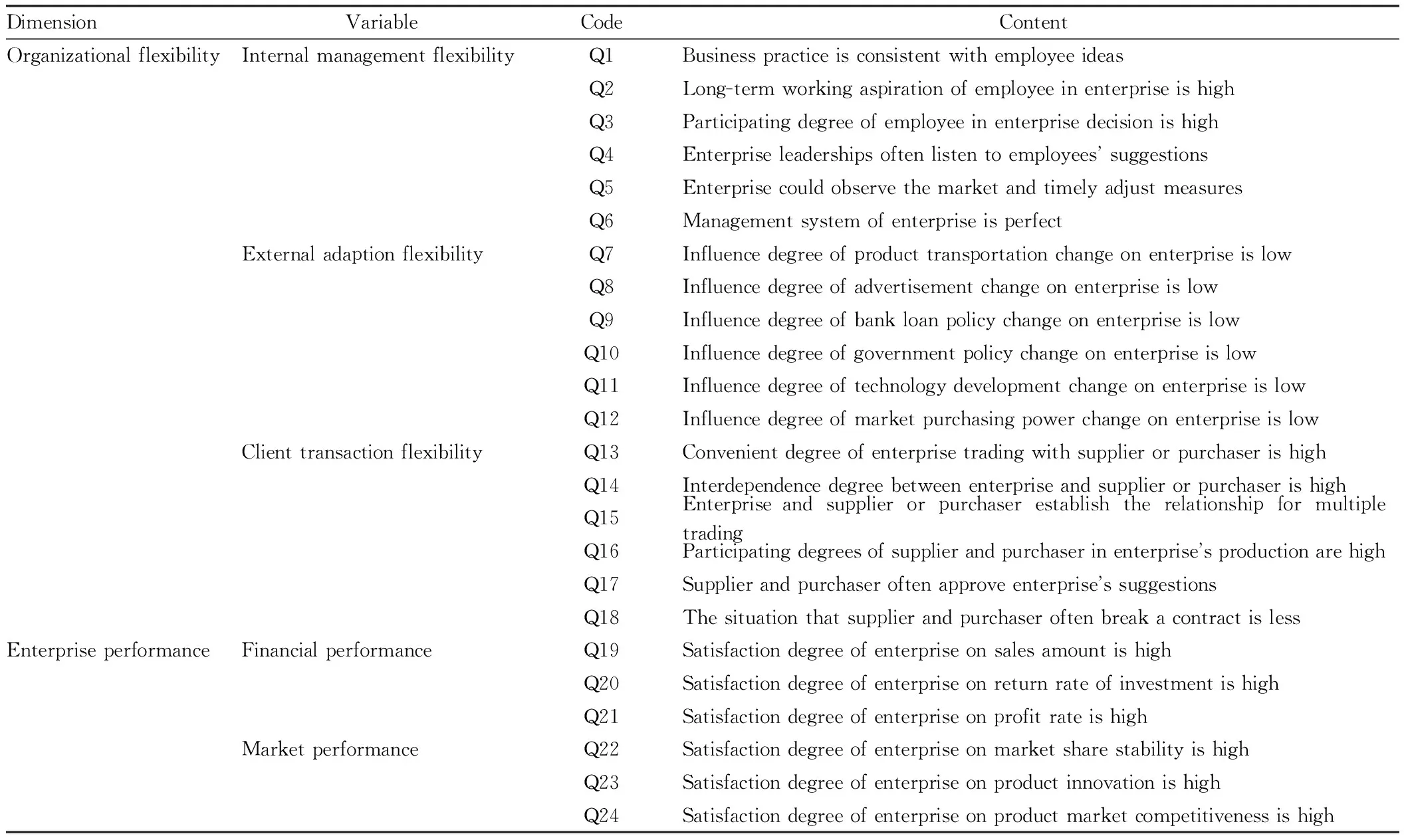

3.2VariableandmeasurementFor the measurement of variable, based on prior theories, organizational flexibility of agricultural enterprise is divided into three dimensions in this paper: internal management flexibility, external adaption flexibility and client transaction flexibility, and each variable designs 6 measurement indexes. Performance of agricultural enterprise is divided into two dimensions: financial performance and market performance, and each variable designs 3 measurement indexes. Each item all uses Likert 1-7(1 represents very disagree, and 7 represents very agree)to measure. Concrete item and code of each variable are shown as Table 2.

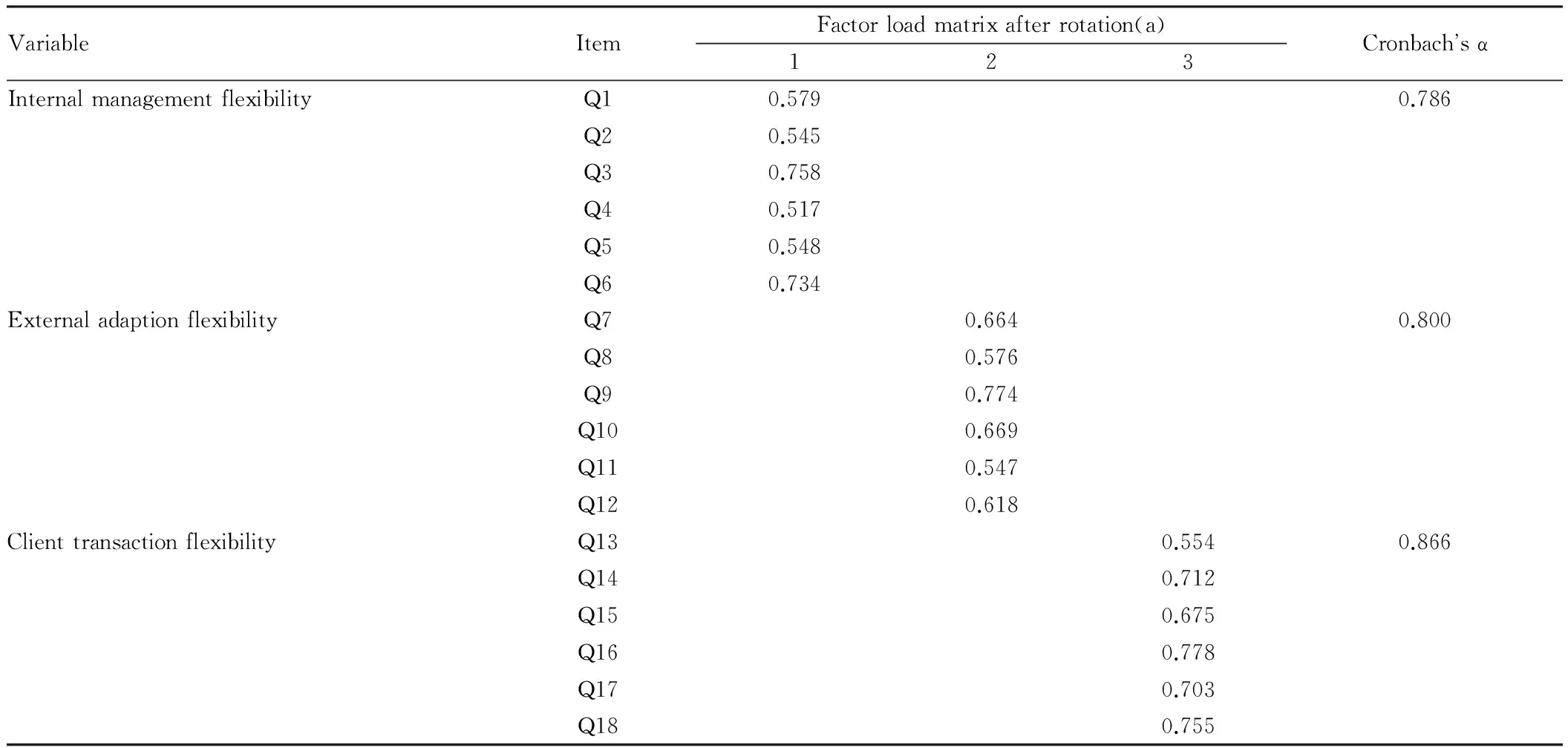

3.3ReliabilityandvaliditytestData reliability is tested by using Cronbach’s α value referring to internal consistency. According to test results, Cronbach’s α of each variable is almost more than 0.7 of level suggested by Nunnally. Here, reliability of internal management flexibility of variable is 0.786, while reliability of external adaption flexibility of variable is 0.800, and reliability of client transaction flexibility of variable is 0.866, which shows that each variable has good reliability. In data research process, the authors also use principal component analysis of maximum variance rotation for exploratory factor analysis. Seen from research results, KMO value of sample data is 0.922, and variance explanation rate is 55.559%, and factor loading value of each item at the related variable is all more than 0.5. According to research results, the measured tool is effective and reliable, and results are shown as Table 3.

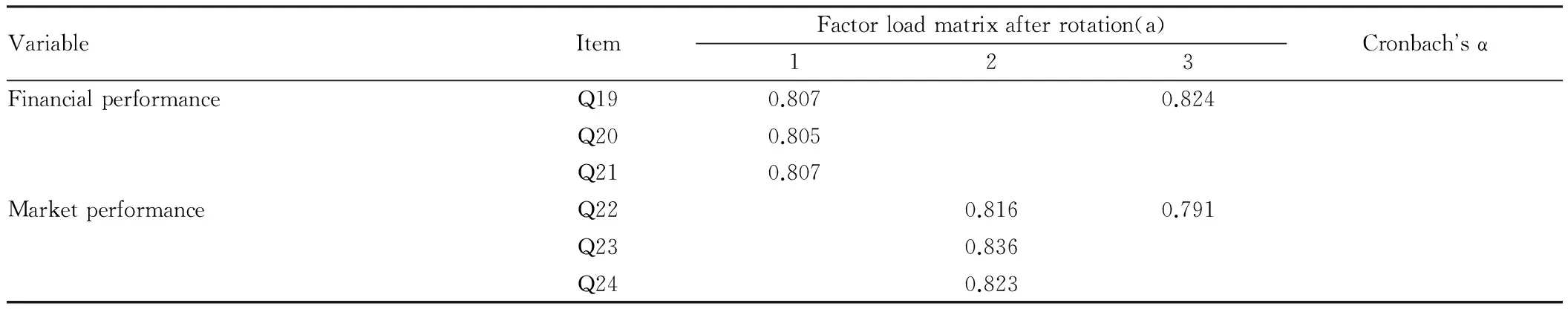

Seen from test results, reliability of financial performance is 0.791, while reliability of market performance is 0.824, showing that each variable has good reliability. In data research process, the authors also use principal component analysis of maximum variance rotation for exploratory factor analysis. Seen from research results, KMO value of sample data is 0.931, and variance explanation rate is 72.406%, and factor loading value of each item at the related variable is all more than 0.5. According to research results, the measured tool is effective and reliable, and results are shown as Table 4.

4 Empirical analysis and results

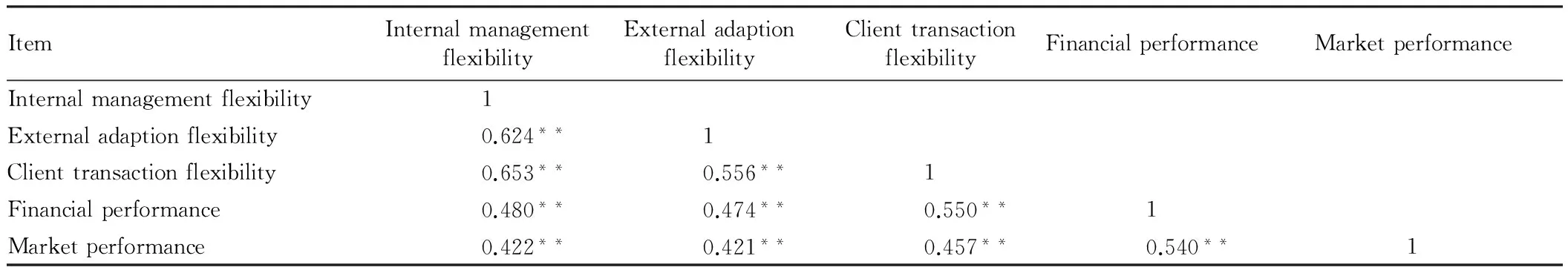

4.1CorrelationanalysisAccording to the existing researches, in the results of correlation analysis, when |r|<0.7, it illustrates that there is not stronger linear correlation among variables. In this paper, the authors use correlation analysis method to test the relationship among data to verify data reliability. Seen from correlation analysis results, each variable in this research shows significantly positive correlation relationship, that is to say, under the confidence level ofP<0.05, correlation coefficient among each variable is all less than 0.7. It illustrates that each research variable does not have multiple co-linearity. Seen from correlation analysis results, data in the research are authentic and reliable, and research results are shown as Table 5.

Table2Operationaldefinitionofvariable

DimensionVariableCodeContentOrganizationalflexibilityInternalmanagementflexibilityQ1BusinesspracticeisconsistentwithemployeeideasQ2Long-termworkingaspirationofemployeeinenterpriseishighQ3ParticipatingdegreeofemployeeinenterprisedecisionishighQ4EnterpriseleadershipsoftenlistentoemployeessuggestionsQ5EnterprisecouldobservethemarketandtimelyadjustmeasuresQ6ManagementsystemofenterpriseisperfectExternaladaptionflexibilityQ7InfluencedegreeofproducttransportationchangeonenterpriseislowQ8InfluencedegreeofadvertisementchangeonenterpriseislowQ9InfluencedegreeofbankloanpolicychangeonenterpriseislowQ10InfluencedegreeofgovernmentpolicychangeonenterpriseislowQ11InfluencedegreeoftechnologydevelopmentchangeonenterpriseislowQ12InfluencedegreeofmarketpurchasingpowerchangeonenterpriseislowClienttransactionflexibilityQ13ConvenientdegreeofenterprisetradingwithsupplierorpurchaserishighQ14InterdependencedegreebetweenenterpriseandsupplierorpurchaserishighQ15EnterpriseandsupplierorpurchaserestablishtherelationshipformultipletradingQ16ParticipatingdegreesofsupplierandpurchaserinenterprisesproductionarehighQ17SupplierandpurchaseroftenapproveenterprisessuggestionsQ18ThesituationthatsupplierandpurchaseroftenbreakacontractislessEnterpriseperformanceFinancialperformanceQ19SatisfactiondegreeofenterpriseonsalesamountishighQ20SatisfactiondegreeofenterpriseonreturnrateofinvestmentishighQ21SatisfactiondegreeofenterpriseonprofitrateishighMarketperformanceQ22SatisfactiondegreeofenterpriseonmarketsharestabilityishighQ23SatisfactiondegreeofenterpriseonproductinnovationishighQ24Satisfactiondegreeofenterpriseonproductmarketcompetitivenessishigh

Table3Factoranalysisandreliabilitytestofenterpriseorganizationalflexibility

VariableItemFactorloadmatrixafterrotation(a)123CronbachsαInternalmanagementflexibilityQ10.5790.786Q20.545Q30.758Q40.517Q50.548Q60.734ExternaladaptionflexibilityQ70.6640.800Q80.576Q90.774Q100.669Q110.547Q120.618ClienttransactionflexibilityQ130.5540.866Q140.712Q150.675Q160.778Q170.703Q180.755

4.2RegressionanalysisIn this paper, performance of agricultural enterprise uses two dimensions to measure: financial performance and market performance. Moreover, classification of agricultural enterprise is taken as control variable to study the influence of organizational flexibility of agricultural enterprise on enterprise performance. In this paper, regression analysis method is used to analyze research content, and concrete analysis results are as below.

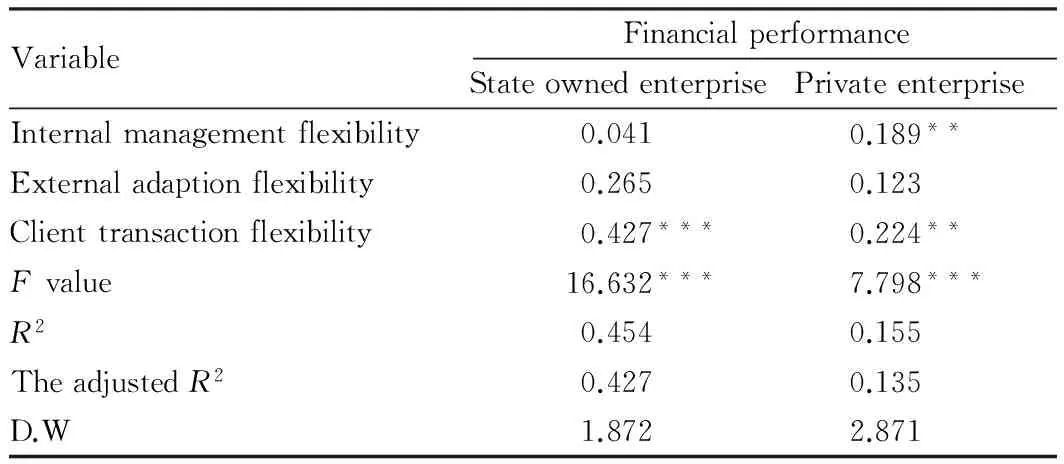

4.2.1Influence of organizational flexibility on financial performance. Regression analysis results between organizational flexibility of agricultural enterprise and enterprise financial performance are shown as Table 6. Seen fromFvalue,Pvalue is all less than 0.01, illustrating that in different properties of agricultural enterprises, regression model between organizational flexibility and enterprise performance is very significant. The adjustedR2are respectively 0.454 and 0.135, illustrating that regression model has very strong explanatory power. D.W values are 1.872 and 2.871 respectively, illustrating that there does not exist obvious self correlation among variables.

Table4Factoranalysisandreliabilitytestofenterpriseperformance

VariableItemFactorloadmatrixafterrotation(a)123CronbachsαFinancialperformanceQ190.8070.824Q200.805Q210.807MarketperformanceQ220.8160.791Q230.836Q240.823

Table5Pearsoncorrelationcoefficientofvariablefactors

ItemInternalmanagementflexibilityExternaladaptionflexibilityClienttransactionflexibilityFinancialperformanceMarketperformanceInternalmanagementflexibility1Externaladaptionflexibility0.624**1Clienttransactionflexibility0.653**0.556**1Financialperformance0.480**0.474**0.550**1Marketperformance0.422**0.421**0.457**0.540**1

Note:***shows significant level ofP<0.01, while**shows significant level ofP<0.05, and*shows significant level ofP<0.1.

Table6Regressionanalysisoforganizationalflexibilityonfinancialperformance

VariableFinancialperformanceStateownedenterprisePrivateenterpriseInternalmanagementflexibility0.0410.189**Externaladaptionflexibility0.2650.123Clienttransactionflexibility0.427***0.224**Fvalue16.632***7.798***R20.4540.155TheadjustedR20.4270.135D.W1.8722.871

Note:***shows significant level ofP<0.01, while**shows significant level ofP<0.05, and*shows significant level ofP<0.1.

In state owned agricultural enterprises, regression coefficients of internal management flexibility and external adaption flexibility on financial performance of enterprise are respectively 0.041 and 0.265. It illustrates that both internal management flexibility and external adaption flexibility have positive influence on financial performance of enterprise, but the influence is insignificant, and hypotheses 1-1 and 2-1 are verified. Client transaction flexibility has significantly positive correlation with financial performance of enterprise, and regression coefficient is 0.628. It illustrates that it could effectively promote financial performance by enhancing client transaction flexibility, and hypothesis 3-1 is verified. In private agricultural enterprise, both internal management flexibility and client transaction flexibility have significantly positive correlations with financial performance, and their regression coefficients are 0.189 and 0.224 respectively, but the influence of client transaction flexibility is more significant. It illustrates that it could effectively promote financial performance by enhancing internal management flexibility and client transaction flexibility, and the influence of client transaction flexibility is the largest, followed by internal management flexibility, and hypotheses 1-2 and 3-2 are verified. External adaption flexibility has positive influence on financial performance, but the influence is not significant, and hypothesis 2-2 is verified. Overall, in state owned and private agricultural enterprises, three dimensions of organizational flexibility all have positive influences on financial performance, but the influence effects are different. Here, internal management flexibility has significantly positive correlation with financial performance of private agricultural enterprise, while it has positive influence on state owned agricultural enterprise but the influence is insignificant. External adaption flexibility has positive influence on financial performances of state owned and private agricultural enterprises but the influence is insignificant. Client transaction flexibility has significantly positive correlation with financial performances of state owned and private agricultural enterprises.

4.2.2Influence of organization flexibility on market performance. Regression analysis results of organizational flexibility of agricultural enterprise on market performance are shown as Table 7. Seen fromFvalue,Pvalues are all less than 0.01, illustrating that regression models between organizational flexibility and market performance in different properties of agricultural enterprises are all very significant. The adjustedR2are respectively 0.490, 0.440 and 0.113, illustrating that regression model has very strong explanatory power. D.W values are 1.885, 2.426 and 2.136 respectively, illustrating that there does not exist obvious self correlation among variables.

Table7Regressionanalysisoforganizationalflexibilityonmarketperformance

VariableMarketperformanceStateownedenterprisePrivateenterpriseInternalmanagementflexibility0.1890.127*Externaladaptionflexibility0.1230.076Clienttransactionflexibility0.224**0.200**Fvalue7.798***4.082***R20.1550.087TheadjustedR20.1350.066D.W1.8712.074

Note:***shows significant level ofP<0.01, while**shows significant level ofP<0.05, and*shows significant level ofP<0.1.

In state owned agricultural enterprise, regression coefficients of internal management flexibility and external adaption flexibility on market performance are respectively 0.189 and 0.123. It illustrates that both internal management flexibility and external adaption flexibility have positive influences on market performance, but the influence is insignificant, and hypotheses 4-1 and 5-1 are verified. Client transaction flexibility has significantly positive correlation with market performance, and regression coefficient is 0.506. It illustrates that it could effectively promote market performance by enhancing client transaction flexibility, and hypothesis 6-1 is verified. In private agricultural enterprise, both internal management flexibility and client transaction flexibility have significantly positive correlations with market performance, and their regression coefficients are 0.127 and 0.200 respectively, but the influence of client transaction flexibility is more significant. It illustrates that it could effectively promote market performance by enhancing internal management flexibility and client transaction flexibility, and the influence of client transaction flexibility is the largest, followed by internal management flexibility, and hypotheses 4-2 and 6-2 are verified. External adaption flexibility has positive influence on market performance, but the influence is insignificant, and hypothesis 5-2 is verified. Overall, in state owned and private agricultural enterprises, three dimensions of organizational flexibility all have positive influences on market performance, but the influence effects are different. Here, internal management flexibility has significantly positive correlation with market performance of private agricultural enterprise, and insignificantly positive influence on market performance of state owned agricultural enterprise. External adaption flexibility has insignificantly positive influence on market performances of state owned and private agricultural enterprises. Client transaction flexibility has significantly positive correlation with market performances of state owned and private agricultural enterprises.

5 Conclusions

Taking internal management flexibility, external adaption flexibility and client transaction flexibility as three dimensions of organizational flexibility, the relationship between organizational flexibility and performance of enterprise is studied in this paper. Taking enterprise class as control variable, corresponding theoretic model is established, and the conclusions are obtained via empirical analysis. Firstly, internal management flexibility of enterprise has positive influence on financial and market performances of different categories of agricultural enterprises, and the influence is insignificant in state owned agricultural enterprise and extremely significant in private agricultural enterprise. Internal management of state owned agricultural enterprise is more normative but lacks flexibility, and internal management of enterprise should develop toward flexibility to promote enterprise performance. Private enterprise has good internal management flexibility, and should use internal flexibility to develop toward innovative strategy, thereby promoting whole competitiveness of enterprise. Secondly, external adaption flexibility of enterprise has positive influence on financial and market performances of state owned and private agricultural enterprises, but the influence is insignificant. In state owned and private agricultural enterprises, it should value suitability of enterprise to external environment to effectively respond to the influence brought by social or market environment change on the enterprise, thereby promoting sustainable development of enterprise. Thirdly, client transaction flexibility of enterprise has significantly positive influence on financial and market performances of state owned and private agricultural enterprises. In state owned and private agricultural enterprises, enterprise should maintain flexible transaction relationship and environment with supplier or purchaser to increase enterprise’s product or serve sale, thereby promoting enterprise performance. Under increasingly complex internal and external environments, to quickly respond to environmental change and make scientific decision, enterprise should take rational flexible strategy according to actual situation. Flexible development of enterprise could make the enterprise adapt to environment change and uncertainty, promote integrated strength of enterprise and maintain sustainable development of enterprise.

[1] HART A. Anticipation, business planning and the cycle [J]. The Quarterly Journal of Economics, 1937, 51(2): 273-297.

[2] MANDELBAUM M. Flexibility and decision making [J]. European Journal of Operational Research, 2009, 44(6): 17-27.

[3] JOHN M, MARY A, VON G,etal. Organizational life cycles and strategic international human resource management in multinational companies: Implications for congruence theory [J]. Academy of Management Review, 1991, 16(2): 318-339.

[4] TAN JJ. Perceived environment, strategic orientation, ownership effect and performance implications in a transition economy: An empirical study in the People’s Republic of China [D]. Ph.D.Virginia Polytechnic Institute and State University, 1993.

[5] UPTON DM. Flexibility as process mobility: The management of plant capabilities for quick response manufacturing [J]. Journal of Operations Management, 1995(12): 205-224.

[6] GONG DH, CHEN RQ. Some problems in the study of the flexibility of enterprises [J]. Journal of Industrial Engineering and Engineering Management,1999(l):73-75. (in Chinese).

[7] CHOWDARY BV. Flexibility and related issues in evaluation and selection of technological systems [J]. Global Journal of Flexible SystemsManagement, 2001(2): 11-20.

[8] WAN LL, DA QL. Nature of flexibility about enterprises and the strategy for constructing the flexibility of enterprises [J]. Journal of Management Sciences in China,2003,6(2):89-94. (in Chinese).

[9] DREYER B, GRONHAUG. Uncertainty flexibility and sustained competitive advantage [J]. Journal of Business Research, 2004, 57(5): 484-494.

[10] YAO G. Discussion on the flexibility organization management of modern enterprises [J].Enterprise Economy,2005(6):56-60. (in Chinese).

[11] HE C, BAI SJ, LI Q. Research on the framework of flexible organization based on the management by project [J].Modern Manufacturing Engineering,2009(9):14-17. (in Chinese).

[12] ANSOFF HI. Corporate strategy [J]. New York: McGraw Hill, 1965,60(7):11-16.

[13] MUJDE EG, UGUR G. Managing supply chain flexibility [C]. Proceedings of the Multidisciplinary Academic Conference, 2015: 1-8.

[14] SUSHIL. Enterprise performance management and flexibility: A case study of Indian upstream oil industry [Z]. Proceedings of GLOGIFT 09, 2009.

[15] PAIK YS. The impact of strategic flexibility on business performance in the international business environment [J]. The Requirement for the Degree of Doctor of Philosophy, 1991, 20(3):60-71.

[16] RANJAN VN. Strategic flexibility and performance [J]. The Requirement for the Degree of Doctor of Philosophy, 1999, 4(2):39-41.

[17] FRED P, SUGANDHA DT. Measuring organizational flexibility: An exploration and general model [J]. Technological Forecasting and Social Change, 2000(164): 23-28.

[18] XIE WH, ZHANG ZX, ZHU GL,etal. An empirical study on the relationship between enterprise flexibility and firm performance based on the angle of organizational boundary [J].Reformation & Strategy,2007(7):28-31. (in Chinese).

[19] WANG TN, CHEN T, JIA RX. On influence of organizational learning and strategic flexibility on enterprise performance: An empirical study [J].Journal of Management Sciences in China,2010(7):42-59. (in Chinese).

[20] JIANG Z, ZHANG YC, LIU Y. Research on relationship between organizational flexibility and enterprise performance:Taking the level of servitization as a mediative variable [J].Science & Technology Progress and Policy,2014(14):80-84. (in Chinese).

[21] WU BL. An empirical study on the effect of flexible human resources management on organizational performance of enterprises [J].Statistics and Decision,2016(2):183-185. (in Chinese).

[22] ASHOK A, KUNAL B. Strategic flexibility and firm performance: The case of US based transnational corporations [J]. Global Journal of Flexible Systems Management, 2003, 4(6):1-8.

[23] XU MX. The evolution framework of relationships among human resource management, corporate strategy and performance in the dynamic environment:Based on the change of corporations’ environment [J].Journal of East China University of Science and Technology:Social Science Edition,2012(1):48-56. (in Chinese).

[24] WANG Y. Effect of strategic change means and the adaptation of external environmental characteristics on firm performance [J].Statistics and Decision,2009(20):170-173. (in Chinese)

Asian Agricultural Research2016年9期

Asian Agricultural Research2016年9期

- Asian Agricultural Research的其它文章

- Correlation between Employment Quality and Skill Training of Land-expropriated Farmers

- A Study on Spatial Distribution of Commercial Housing Prices in Xiangtan City

- Design and Experiment of Fluid Dynamic Ultrasonic Water Aerator

- The Relation between Age Structure of Population and Resident Consumption Based on Endogenous Growth Theory

- Effect of Different Pretreatments on Explosion Puffing Drying of Hami Melon at Modified Temperature and Pressure in Xinjiang

- Design and Implementation of National Meteorological Service Platform