Ecuador Export Potential Agricultural Products to China

Alvarez Alex, Wang Du-chun, and Wang Pan-pan

College of Economics and Management, Northeast Agricultural University, Harbin 150030, China

Introduction

Latin America seeks to take advantage of the opening Chinese market, not only the energy supply market and oil related products, but also in agricultural products and services. This has been the case of countries, such as Brazil, Chile, Peru and Argentina,which opened their markets taking advantage of the bilateral agreements that has been maintained for several decades with the Asian country. While trade into China by ALC (ALC Latin America Countries)has been mainly in energy market, the government puts efforts in balancing the supply increasing the share in agricultural products and services. For these reasons, Ecuador needs to promote their exports and attract foreign investments to these sectors. The economic strategy of China in Ecuador is expressed by the positive evolution of the economic-commercial exchange, flows of non-oil trade in 2008 range between US 42 million in exports and imports at US 1.455 million (Villagrán; Molina;Hidalgo, 2011), focus sales on agricultural products,minerals, textiles and manufacturing industry. On the other hand, China exports machinery, capital goods, consumer goods and services. This study aims to determine the Ecuadorian agricultural products with export potential to China, according to the current market conditions, tariff and non-tariff requirements considering the competitive and comparative competition with other countries in Latin America.

Trade Latin America-China

Agricultural products represent a small share of total imports. However, Latin American countries have great expectations on entering to such niche markets with a perspective of economic growth. Latin America has become an important trading and investing partner in the Asian country, and maintained in 2010 trade of US 183.067 million, being Brazil, Chile, Mexico and Argentina the countries with the largest share. China presents a negative trade balance with some countries in the region mainly due imports of raw materials and oil. Meanwhile, Ecuador has shown a trade def i cit of US 989 million and occupies the 11th position among Latin American countries trading with China(Table 1).

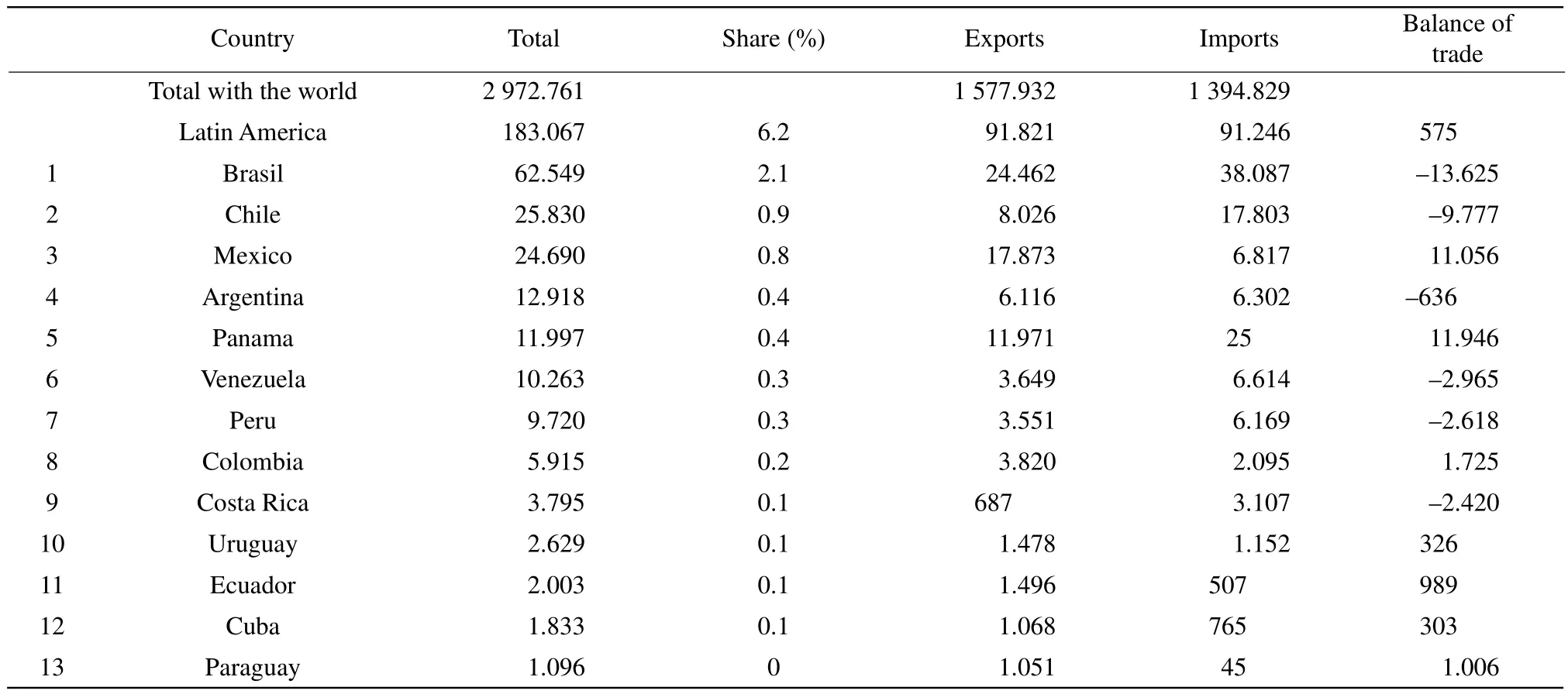

Table 1 China's main ALC commercial partners in 2010 (US millions)

Ecuador agricultural export supply

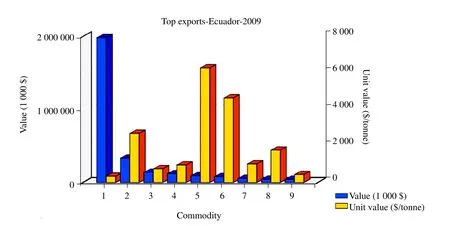

The main agricultural products exported by Ecuador to the world are shown in volume and production capacity (Fig. 1).

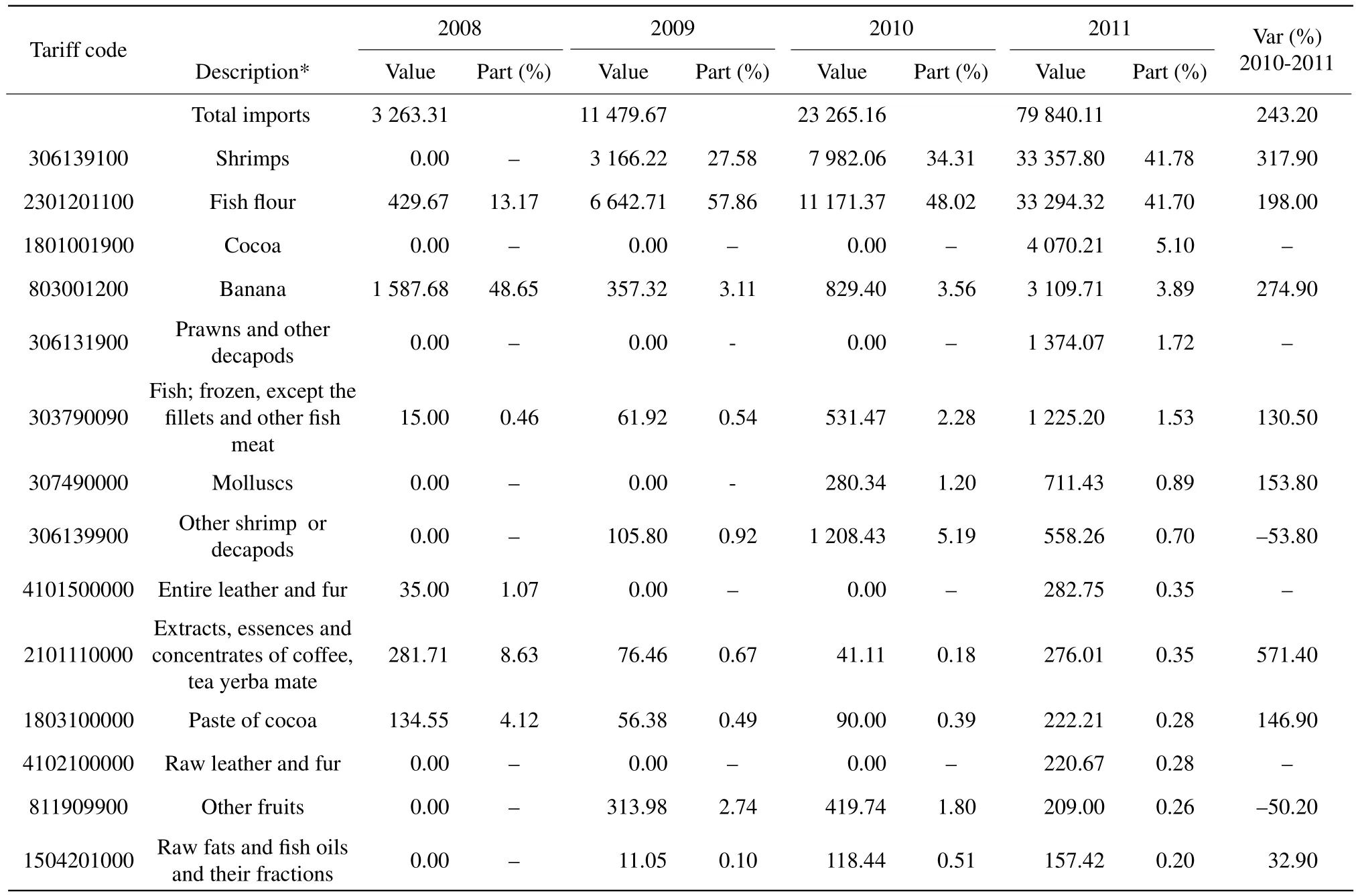

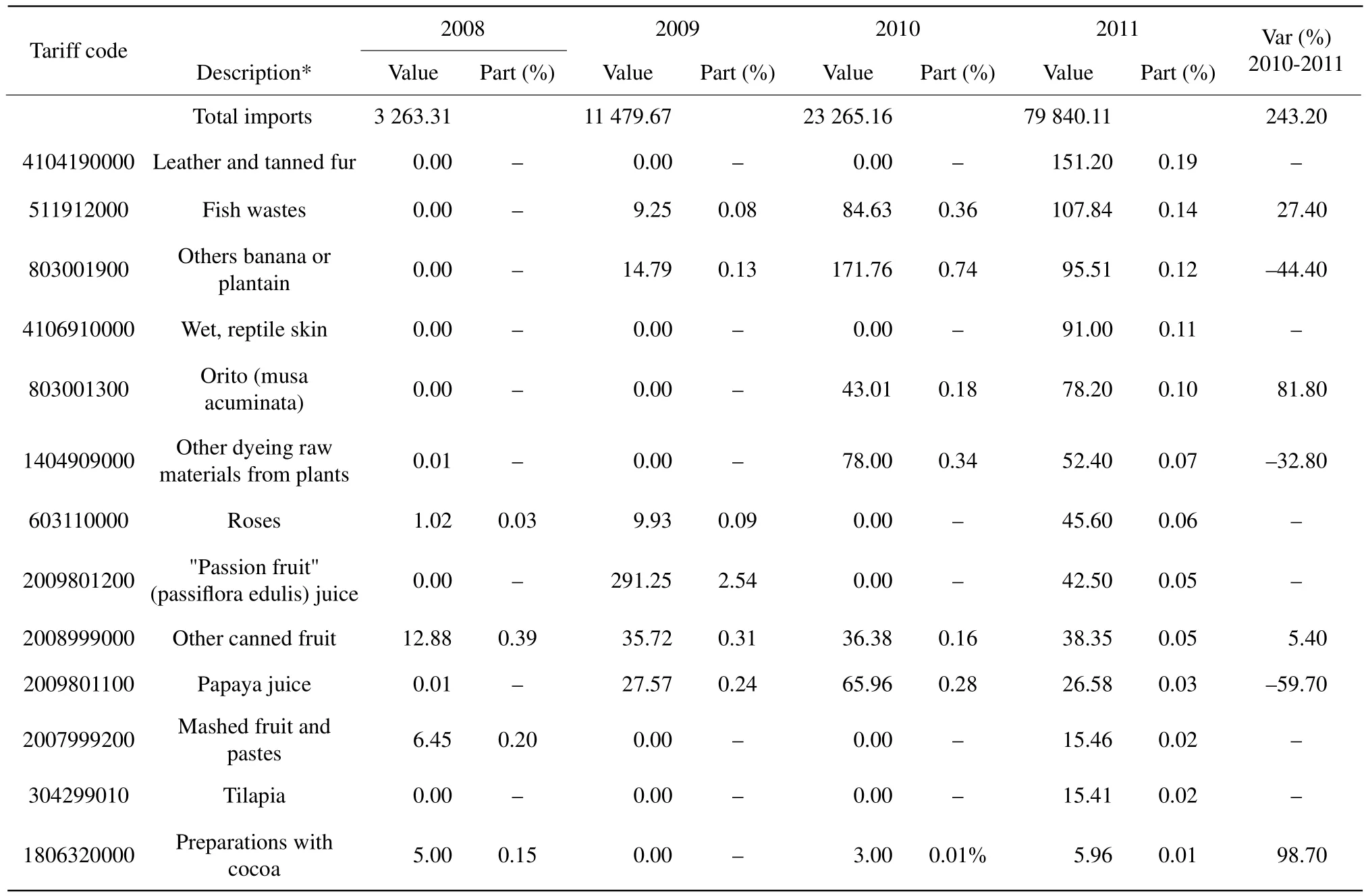

Ecuador re fl ects a high level of exports dependence on agricultural products such as bananas, shrimp,and cocoa beans. Agricultural products represent approximately 11% of Ecuador total exports to China,mainly distribut in four tariff chapters as shrimp,fi sh meal, cocoa beans, and bananas (Table 2). However, there is a huge de fi cit in trade balance with China and must be analyzed the Ecuadorian products with greater competitiveness and advantage in new markets to tighten the trading gap between these two countries.

Despite the low trade volume, some products like fi sh fl our, shrimps and cocoa have shown a signi fi cant growth in the past three years, products closely related to Chinese daily diet basis and consumption preferences trends.

Methods

According to IICA, 2008, the methodology for the identif i cation of agricultural business opportunities is as the followings:

Main agricultural exported products

The analyzed agricultural commodities are those chapters found in the harmonized system tariffs(HS), plus some specific sub chapters. From these agricultural products, using the latest year with available information tariffs at 6-digit level, the sharing of each agricultural export to China was determined. For that, estimated their relative share values from the total agricultural exports in dollars.Once determined the relative share of each agricultural item exported from total agricultural exports fl ow, the items that have greater participation in agricultural exports were selected. Data from Central Bank of Ecuador and United Nations, and 2012 online data base was used.

Fig. 1 Ecuador agricultural top export 2009

Table 2 Agricultural trade of China imports from Ecuador (FOB US thousands)

Continued

Revealed comparative advantage indicator(IVCR)of main agricultural export products

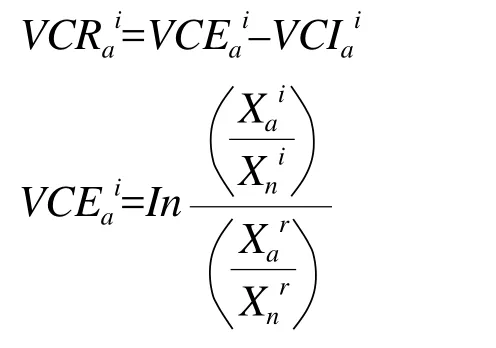

The IVCR is an indicator used to measure the products in which the trade flows of goods (imports and exports)reveal an advantage or disadvantage for the country on analysis. Index of revealed comparative advantage of (Vollrath, 1991)is used for the calculation of this indicator.

Where, VCE is the comparative advantage revealed by exports.

In which, X=value of the exports; i=country discussed; r=world less the country on analysis (given that the indicator is calculated by the assumption of bilateral trade); a=the value of the commodity analyzed; n= total trade value less than that of the analyzed good "a".

If the VCR is positive, trade fl ows reveal an advantage in the export of the good "a". On the contrary,if the VCR is negative, which indicates that there is an advantage in the import of the good "a". The calculation of the VCR indicator is generated from(United Nations, 2012)trade six digits data tariffs in the structure of the analyzed country's trade. With the aim of determining the trend that has followed his advantage or comparative disadvantage revealed in recent years. The greater the value of the VCR, the greater is the comparative disadvantage degree for the good "a" respect to the total number of products traded by the country "i".

Occurrence time a country of interest imports the product that Ecuador exports to the world

Where, Mpcj=imports carried out by a specific country; Xij=exports carried out by Ecuador to the world.

This indicator measures the level of complementarity of a tariff between Ecuador and the country under study, determining the potential market size that Ecuador could cover with their exports (Maldonado,2009). The higher the indicator, the larger of the good market which could be covered by Ecuador supply(Table 3).

Statistical identif i cation of products exported by Latin American competitors

Other supplementary information was obtained through the identif i cation of products already exported by Ecuador Latin American "competitors" countries to the Chinese market, the chosen country was Peru because of its similarity on supply of exportable products, trade channels, and its progress on bilateral agreements with the Asian country (Heredia; Huarachi,2009). Current exports from the selected country that could be potential markets for the Ecuadorian supply were selected.

Discussion

Indicators comparison

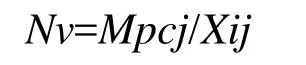

The products were selected in two categories, growth potential commodities that Ecuador currently exports and potential of new trade flow creating. In order to sharpen up the analysis, proceeded disaggregate to 10 digits the list of products identified as greater export potential.

Table 3 Opportunities in current exports to China (FOB US thousands)

The analysis shows that 15 items could generate exports by US 1 400 million; under the condition that exports reach higher levels in the coming years. In the case of banana, despite the increase in exports, the competitiveness has declined by the years 2010-2011,therefore the IVCR and the occurence time indicator showed values lower than 0.5, that may be due to the lack of market openness compared to other products.Products such as fish flour, fish meat, shrimps,shellfish reflected a high increase in exports for the year 2011. Similarly IVCR reveals a high export viability showing high rates in the case of fish flour,fish meat and mollusks. Other products of the low trade volume, but with opportunities to increase their exports include the skins of cattle and horses, paste of cocoa, fruits, fish waste, skins of reptiles, especially the skins of cattle is considered as an opportunity of market expansion due to its high demand, and China had imported worldwide approximately 1 400 million in 2011. This analysis does not include differentiation over unit pricing and other comparisons on tariff and non-tariff advantages with other competitor countries,it only establishes guidelines according to market trends in China (García, 2007). Countries considered as competitors countries with Ecuador in products with potential creation of new trade flows are Colombia,Peru, Chile and those countries that form the Central American common market. Peru was chosen in the analysis because of its successful trade relations with China in recent years and its exportable agricultural supply similarities with Ecuador (Promperu, 2010).As the result, the products with high expectance in the agricultural sector are HS chapters from 1 to 24,specifically traditional products, such as fish viscera,mixtures of vegetables, plants and seeds used in perfumery, seaweed, beans, fl our of aquatic invertebrates.Including the chapters 41-51 with the items related to leather and fi ne hair of alpaca.

Banco Central del Ecuador. 2012. Trade statistics database. http://www.portal.bce.f i n.ec/vto_bueno/ComercioExterior.jsp.

FAO. 2012. Statistics of agricultural products database. http://faostat.fao.org/site/342/default.aspx.

García S. 2007. Estudio de oportunidades comerciales para Ecuador en países de Europa y Asia Central: Ucrania, Kazajstán y Azerbaiyan.Aladi Dapmder, 15(7): 100-107.

Heredia J, Huarachi J. 2009. ESAN. In: The revealed competitiveness index comparison between Peru and main world exporters, the case of Lambayeque Region. Peru. pp. 37-38

IICA. 2008. Indicadores Macro y Socioeconómicos. Comuniica Special Edition, 4(2): 109-116.

Maldonado L. 2009. Competitividad de las exportaciones ecuatorianas en Corea del Sur. CEAP, 3(2): 10-21.

Odarda O, Santa Cruz G. 2011. Consejería Agrícola (MAGyP). In:Análisis del comercio Agrícola chino en 2010. Embajada Argentina en la República Popular China, Beijing. pp. 7-8.

Promperu. 2010. Comisión de Promoción del Perú para la Exportación y el Turismo. http://www.siicex.gob.pe/promperustat/pr_pais_part.asp.

United Nations. 2012. Comtrade. Statistic database. http://comtrade.un.org/.

Villagrán H, Molina M, Hidalgo J. 2011. Pro Ecuador. In: Guía comercial de la República popular de China. Quito. pp. 20-24.

Vollrath T. 1991. A theoretical evaluation of alternative trade intensity measures of revealed comparative advantage. Weltwirtschaftliches A,127(2): 264-280.

Journal of Northeast Agricultural University(English Edition)2013年1期

Journal of Northeast Agricultural University(English Edition)2013年1期

- Journal of Northeast Agricultural University(English Edition)的其它文章

- Effects of Sub-chronic Aluminum Exposure on Renal Pathologic Structure in Rats

- Effects of Low-temperature and Herbicide on Membrane Stability,Antioxidant Capacity, and Product of Metabolism in Barley Seedlings

- SWOT Analysis and Development Strategies of Maize Industry in Heilongjiang Province

- Research on DSP-Based Automatic Excitation Regulator in Small Rural Hydropower Station

- Expression of a Lysine-rich Gene in Bacillus subtilis 168

- Isolation, Purif i cation and Cryopreservation of Cells from Neonatal Bovine Testis