Research on Incentive Policies for Chinese Innovative Drug R&D -Taking Innovative Anti-tumor Drugs as an Example

Wang Yuejun,Yang Yue,Huang Zhe*

(1.School of Business Administration,Shenyang Pharmaceutical University,Shenyang 110016,China;2.School of Pharmacy,Tsinghua University,Beijing 100084,China)

Abstract Objective To provide reference for improving Chinese innovative drug research and development incentive policies.Methods Based on investigating the incentive policies for innovative drug research and development in clinical research,evaluation and approval in China,anti-tumor drugs were taken as the research object to discuss relevant policies from the perspective of clinical trials and registration approval based on data statistics and current situation analysis.Results and Conclusion Driven by a series of incentive policies for innovative drug R&D,great achievements have been made on anti-tumor drugs.However,there are problems such as concentration of drug targets,homogenization of clinical trials,and gaps in some drugs with large clinical needs.To improve incentive policies for innovative drug R&D,China should adhere to the orientation of clinical value,focusing on basic research and translational research,improving evaluation and approval capabilities,and establishing a sound ecosystem for innovative drugs.

Keywords: innovative drug;innovative anti-tumor drug;incentive policy;policy analysis

In recent years,with the deepening reform of the drug evaluation and approval system,the research and development (R&D) of innovative drugs has become a hot spot in pharmaceutical industry.According to the “World Cancer Report 2020” released by World Health Organization (WHO),the number of new cancer cases in China accounted for more than 23% of the global total,and the death toll accounted for about 30%of the global ones[1].At present,Chinese anti-tumor drug is developing rapidly due to its huge market.However,imported anti-tumor drugs account for a large proportion,and there are huge unmet clinical needs[2].To protect the public health and promote the sustainable development of pharmaceutical industry,China has taken a number of measures to enhance the research and development of innovative anti-tumor drugs.The relevant incentive and regulatory policies have an obvious role in guiding the research and development of innovative drugs.Innovative anti-tumor drugs are the most widely used category of innovative drug,which is a microcosm of the entire innovative drugs.This article takes innovative anti-tumor drugs as an example to review the development of innovative drugs in China during the “13th Five-Year Plan” period.Then we can improve incentive policy system for the research and development of innovative anti-tumor drugs.

1 Overview of incentive policies for Chinese innovative drug R&D

Innovative drugs in different periods have different connotations in China.The innovative drugs in this article refer to drugs that have not been marketed in China or overseas,containing new compounds with well-defined structures and pharmacological effects,and having clinical value.Meanwhile,they also include innovative pharmaceutical products,innovative traditional Chinese medicine and innovative biological products in “Provisions for Drug Registration” of 2020.

Incentive policies for innovative drug R&D refer to various measures formulated by the government to encourage innovative entities to carry out innovative drug R&D.The operating mechanism is a series of dynamic combinations of multiple innovative drug policies with different functions that directly or indirectly affect the innovation subject to have better innovative outcomes.The main participants include the government,enterprises,research institutions,and financial markets[3].

This paper focuses on the two stages: Clinical research and marketing registration.It mainly analyzes the reform measures of clinical trials and evaluation and approval.It takes innovative antitumor drugs as the object to discuss the path of support for independent R&D,which can accelerate the industrialization process in China.

2 Analysis of incentive policies based on innovative anti-tumor drugs R&D

The policy analysis of innovative anti-tumor drugs R&D during the “13th Five-Year Plan” period is as follows.

2.1 Implementation effects and clinical trial policies of innovative anti-tumor drugs

2.1.1 Policy changes for clinical trials of innovative anti-tumor drugs

China has made great progress in reforming the clinical trial management measures[4].On the one hand,clinical trial institutions have changed from the qualification entitled system to the record-keeping management system.In 2017,the National Medical Products Administration (NMPA) established a clinical trial record-keeping platform,which implemented record management for clinical trial institutions that met the requirements of the “Good Clinical Practice”[5].On the other hand,clinical trial applications have changed from the approval system to the implied license system.NMPA shall,within sixty working days from the date of acceptance of a clinical trial application,decide on whether to approve the application and notify the clinical trial sponsor.If the sponsor is not notified within the stipulated period,the application shall be considered approved.It effectively coordinates safety and efficiency to protect the rights and interests of applicants.In addition,NMPA accepts overseas clinical trial data and international multicenter clinical trials,which promotes the simultaneous research and development of innovative drugs at home and abroad and speed up the marketing process in China[6].For innovative anti-tumor drugs,the Center for Drug Evaluation (CDE) of NMPA issued the “Guiding Principle for Clinical Research and Development of Anti-tumor Drugs Oriented to Clinical Value”,emphasizing that it should be clinical valueoriented and patient-centered.The R&D concept means that the regulatory authorities encourage innovation in mechanism and improvement in efficacy,rather than low-level innovation[7].The guiding principle helps enterprises to change the logic of R&D and focus on meeting the clinical needs of patients.

2.1.2 Effects of clinical trial policies for innovative anti-tumor drugs

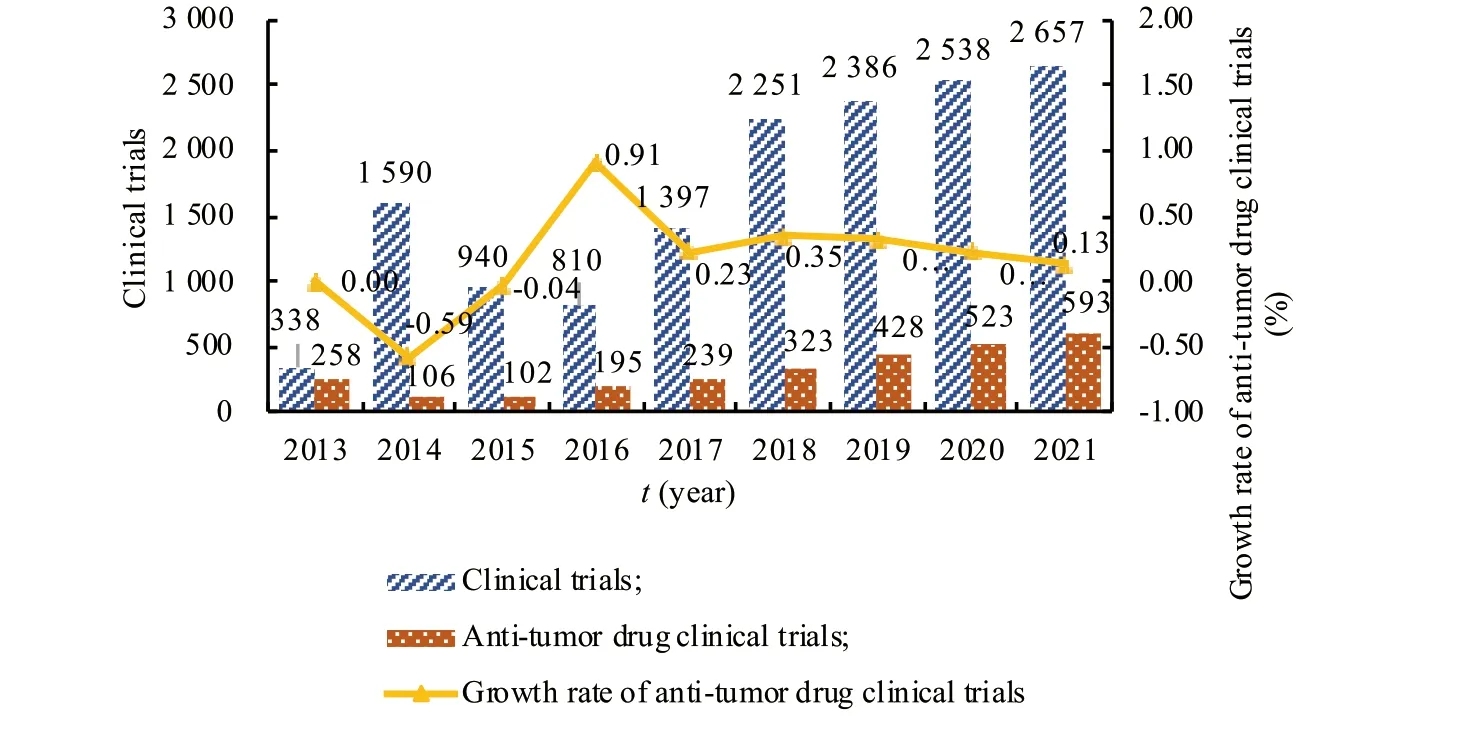

(1) The number of clinical trials of innovative anti-tumor drugs has increased.According to the registration of drug clinical trials and information publicity platform,from January 1,2013,to November 6,2021,a total of 14 907 trials were registered,of which 2 767 anti-tumor drug clinical trials were carried out[8].In recent years,the number of registrations for anti-tumor drugs clinical trials has continued to grow.There were about 100 registrations in 2015.In 2017,the number of registrations rose sharply from 102 to 239.In 2018,after the implied license system for clinical trials application,the increase was even more and the growth rate was stable at 20%-30%.There were 593 clinical trials of antitumor drugs by November 2021,exceeding the total in 2020 (Fig.1).

Fig.1 Changes in the number of anti-tumor drug clinical trials from 2013 to 2021 in China

(2) The homogeneity of clinical trials of innovative anti-tumor drugs is serious.According to CDE’s “Annual Report on Clinical Trials for New Drug Registration in China (2020)”[9],the number of clinical trials of new drugs is higher than that of generic drugs.However,there is serious homogeneity in the distribution of indications and targets.The pursuit of anti-tumor drugs is largely one of the important reasons for the homogenization of the pipeline of innovative drugs in China.

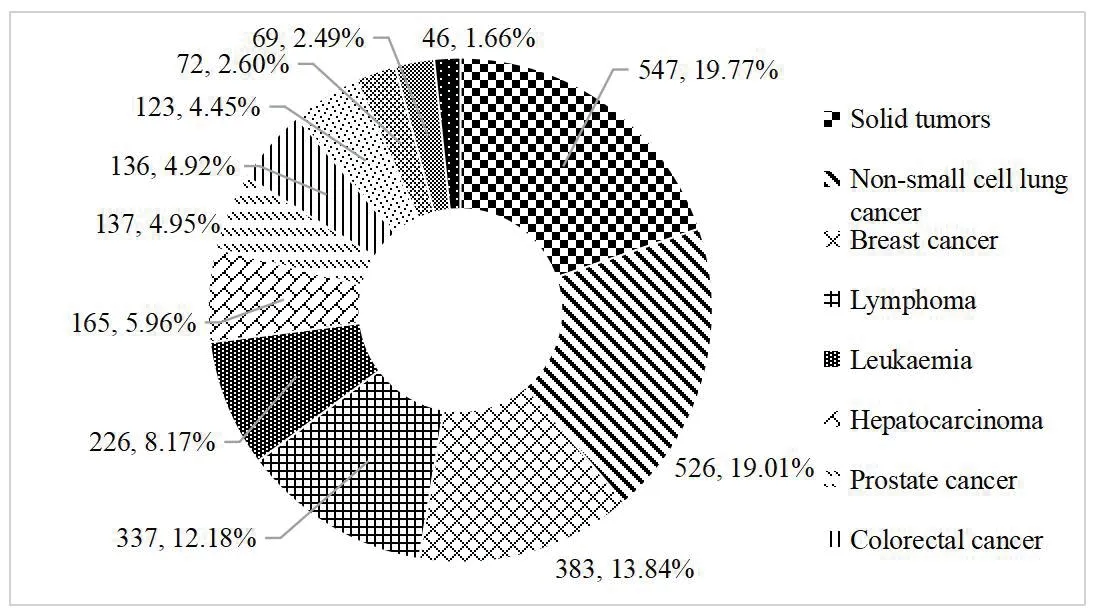

From January 2013 to November 6,2021,among the 2 767 clinical trials of ant i-tumor drugs registered on the platform,clinical trials for common tumors were carried out.Divided by tumor types,the number of solid tumor clinical trial ranked the first (547,accounting for 19.77% of anti-tumor drugs clinical trials),of which 357 drugs were under development for the treatment of solid tumors.Targeted therapy accounted for the largest proportion,followed by non-small cell lung cancer (526,19.01%),breast cancer (383,13.84%),and lymphoma (337,12.18%)(Fig.2).

Fig.2 Distribution of tumor types in anti-tumor drugs clinical trials from 2013 to 2021

As to pharmaceutical products,the number of clinical trials for anti-tumor new drugs was 8 in the top 10 varieties.Apatinib mesylate tablets carried out the most trials with 15,followed by mitoxantrone hydrochloride liposome injection and fluzoparib capsules,both with 10.As to biological products,among the top 10 targets,clinical trials for anti-tumor new drugs had 9,and they were programmed death-1(PD-1),vascular endothelial growth factor receptor(VEGFR),and programmed death-ligand 1 (PD-L1),etc.The targets had the features of the concentration and homogeneity (Fig.3).

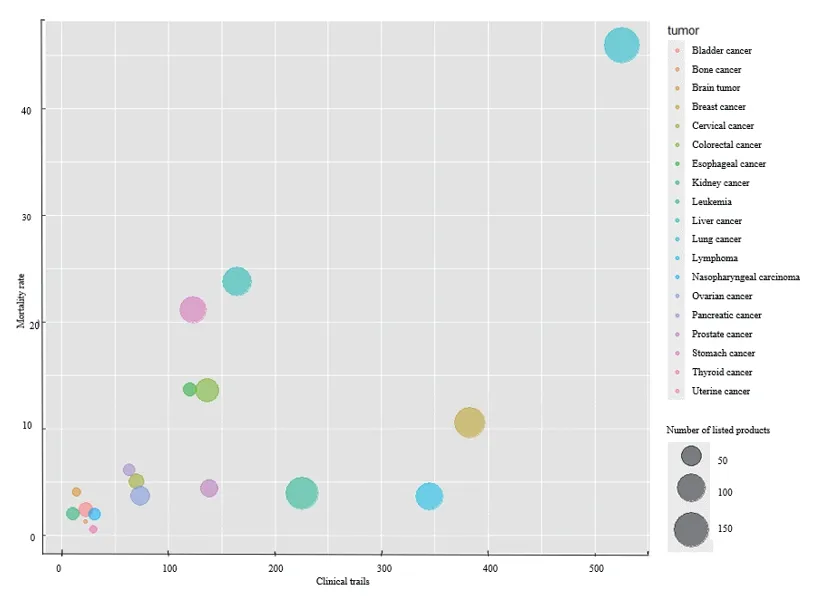

Among 23 solid tumors and 7 hematological tumors,there was a strong correlation between the number of anti-tumor drugs and disease burden in China[10].The top 10 cancer deaths in China in 2020 were: Lung cancer,liver cancer,stomach cancer,esophageal cancer,colorectal cancer,pancreatic cancer,breast cancer,nervous system cancer,leukemia,and cervical cancer,accounting for 83% of the total cancer deaths.Lung cancer had the largest disease burden,with the most corresponding drugs in China.However,some tumor types with heavier disease burden,such as liver cancer,gastric cancer and esophageal cancer,had a high mortality rate.But the number of trials and drugs on the market was relatively small.This means that there is still a gap in the number of drugs for diseases with high clinical needs,such as liver cancer and gastric cancer,possibly due to limited basic research on targets (Fig.4).

Fig.4 The pattern of medicines being developed and marketed for major cancer types in China

2.2 Implementation effects and evaluation and approval policies of innovative anti-tumor drugs

2.2.1 Policy changes for the evaluation and approval of innovative anti-tumor drugs

The “Opinions of the State Council on Reforming the Examination,Evaluation and Approval System for Drugs and Medical Device” in 2015[11]and the “Opinions on Deepening the Reform of the Examination,Evaluation,and Approval System to Encourage the Innovation in Drugs and Medical Device” in 2017[12]defined the development strategy,which was a milestone for the development of medical innovation.The implementation of the new“Drug Administration Law” in 2019 clarified the general direction of encouraging new drugs R&D and supported clinical value-oriented drug innovation.In 2020,the new “Provisions for Drug Registration”stipulated four special approval channels for drug registration,including breakthrough therapy drugs,conditional approval,priority approval and review,and special approval.Therefore,it greatly accelerated the marketing process of innovative drugs,enabling patients to obtain drugs as soon as possible.NMPA actively promoted a series of relevant measures and supporting programs for evaluation and approval.Besides,it effectively practiced the above supporting documents.The authority has also stepped up its drug evaluation capacity by increasing the number of drug evaluators from fewer than 150 to more than 500.In addition,it reorganized the team so that it could adopt an indication-based and a projectmanagement approach from 2015 to 2020.The review team was reorganized,and an expert advisory committee composed of 626 external experts(including 35 academicians) was established[13]to strengthen communication and improve the efficiency of innovative drug review,which played an important role in stimulating innovation to a certain extent.Nevertheless,the relevant rules in the actual implementation of the evaluation and approval policies are still not clear enough.It has been too long since“Special Approval Procedures for Drugs”was issued in 2005.The only way for clinically needed overseas new drugs was guided by the “Announcement on the Evaluation and Approval of Clinically Urgently Needed Overseas New Drugs”issuedin 2018[14].In 2020,“Breakthrough Therapy Drug Procedures(Trial)” “Conditional Approval Procedures (Trial)”and“Working Procedures for Priority Review and approval (Trial)”[15]were released,respectively for the breakthrough therapy drugs to have conditional Approval and priority review and approval.However,only conditional approval has the “Technical Guidelines for Conditional Approval of Drugs (Trial)”[16]as a specific guide.The interpretation of the relevant guidelines is limited,and the release time of the official version is not clear.

2.2.2 Effects of evaluation and approval policies for innovative anti-tumor drugs

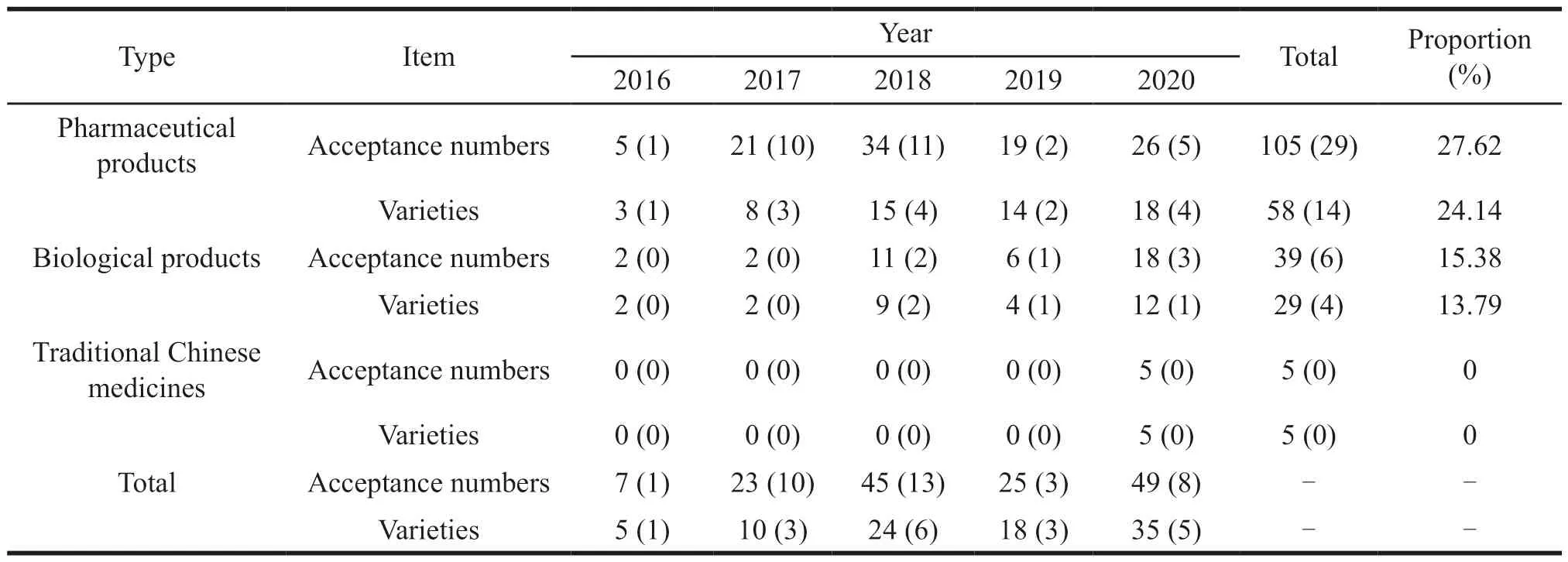

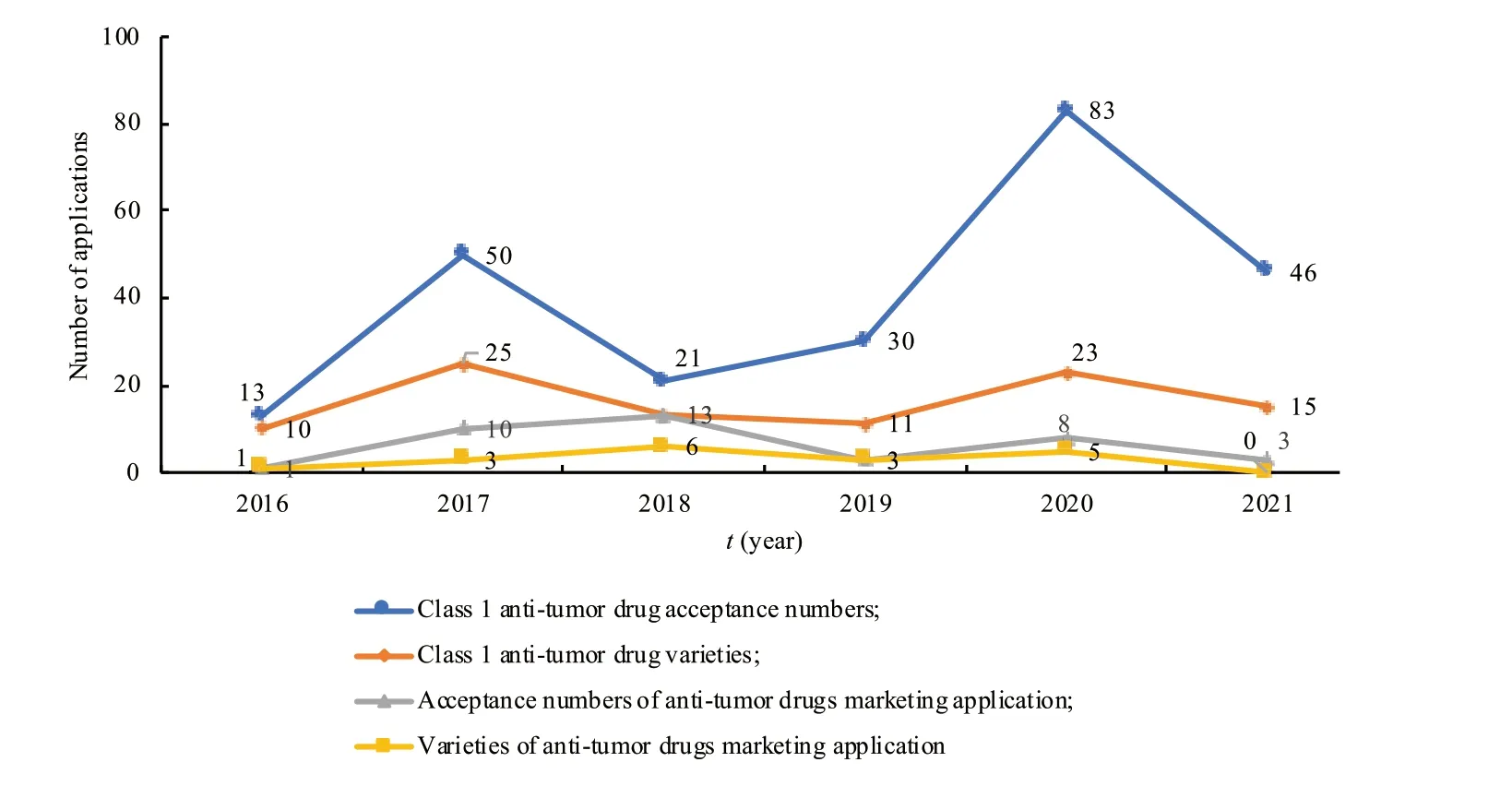

(1) Overview of the acceptance and approval of innovative anti-tumor drugs.According to the NMPA,CDE and Yaozh Database,from 2016 to 2020,CDE accepted a total of 2 690 Class 1 new drug acceptance numbers for 1 374 new drug varieties.Among them,it included 2 536 clinical trial applications for 1 278 varieties,and 149 marketing applications for 92 varieties.New anti-tumor drugs are the most extensive field in the class 1 new drug.There are a total of 197 new anti-tumor drug acceptance numbers for 82 varieties,including 35 marketing applications for 18 varieties.By November 31,2021,there had been 46 new anti-tumor drug acceptance numbers,15 varieties,and 3 applications for marketing (Fig.5).In terms of the types of marketing applications,new anti-tumor pharmaceutical products accounted for 24.14% of the total,biological products accounted for 13.79%,and there were no traditional Chinese medicines (by variety) (Table 1).

Table 1 Marketing application acceptance numbers and varieties for Chinese class 1 new anti-tumor drugs from 2016 to 2020

Fig.5 Number of applications for Class 1 anti-tumor new drugs in China from 2016 to 2021

In terms of the number of approvals,before 2016,only 7 new anti-tumor drugs developed in China were approved,including 5 biological products and 2 pharmaceutical products.They were recombinant human endostatin (Endo,2005),recombinant human adenovirus type 5 (Oncorine,2006),nimotuzumab(Taixinsheng,2008),pegylated recombinant human granulocyte colony stimulating factor for injection (Jinyouli,2011),iodine [131I]metuximab(Licatin,2011),icotinib hydrochloride (Conmana,2011),apatinib mesylate tablets (Aitan,2014),and dalbenamide (Epidaza,2014).

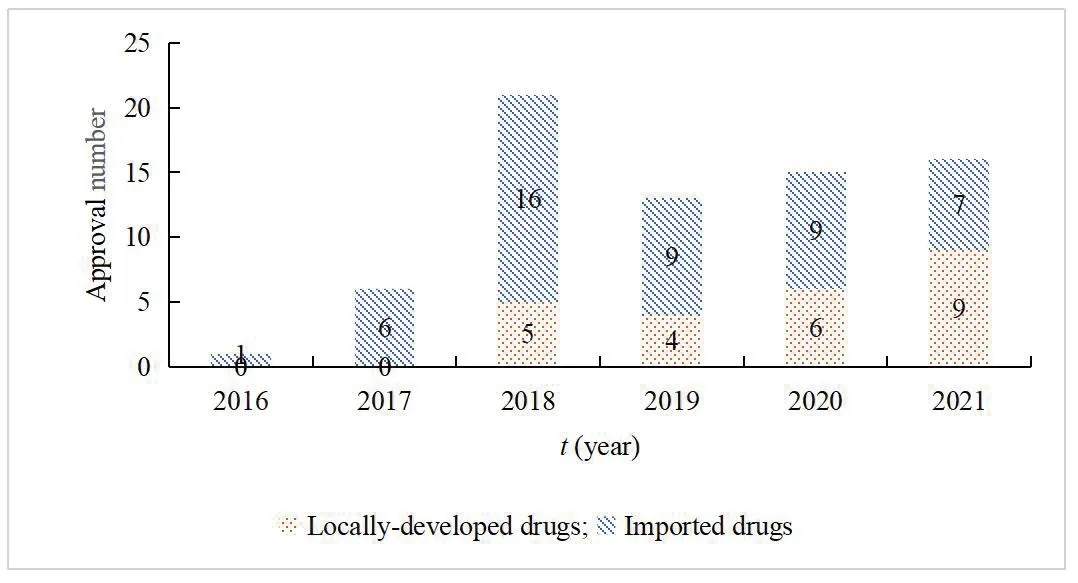

With the continuous development of scientific research and the reform of the policy environment and capital market,the innovative drug R&D has become more active[17].Therefore,the number of new drugs accepted and approved has increased year by year.From 2016 to 2020,China had approved 15 domestically developed innovative drugs and 41 imported original products.A total of 56 innovative anti-tumor drugs covered many tumor types such as lung cancer,breast cancer,colorectal cancer,gastric cancer,liver cancer,leukemia,and lymphoma.In 2018,5 locally developed class 1 innovative antitumor drugs and 16 imported original drugs were approved.In 2019,4 locally developed class 1 innovative anti-tumor drugs and 9 imported original drugs were approved.In 2020,6 locally developed drugs and 9 original drugs were approved.By November 2021,16 new anti-tumor drugs hd been approved,including 9 domestic drugs and 7 imported drugs.For the first time,the number of domestic new drugs approved exceeded imported drugs,and the number of anti-tumor drugs approved for marketing in China increased year by year (Fig.6).

Fig.6 Number of new anti-tumor drugs approved in China from 2016 to 2021

(2) Innovative anti-tumor drugs are widely included in the accelerated channel.From the perspective of the evaluation and approval path,the number of drugs approved for marketing in accordance with the priority evaluation and approval policy had increased from 7 in 2016 to 127 in 2020[18].Before the release of the new “Provisions for Drug Registration”,special approval and priority review were the main accelerated channels for evaluation and approval in China.The vast majority of innovative anti-tumor drugs belong to special approval and priority review varieties,which are also clinically needed drugs.From 2016 to 2020,15 domestically developed innovative antitumor drugs approved in China were all included in the priority evaluation and approval process,including 9 single-arm conditional approvals and 2 random control conditional approvals.Camrelizumab was included in the breakthrough therapy drug (Table 2).

3 Analysis and comparison of US incentive policies for innovative drug R&D

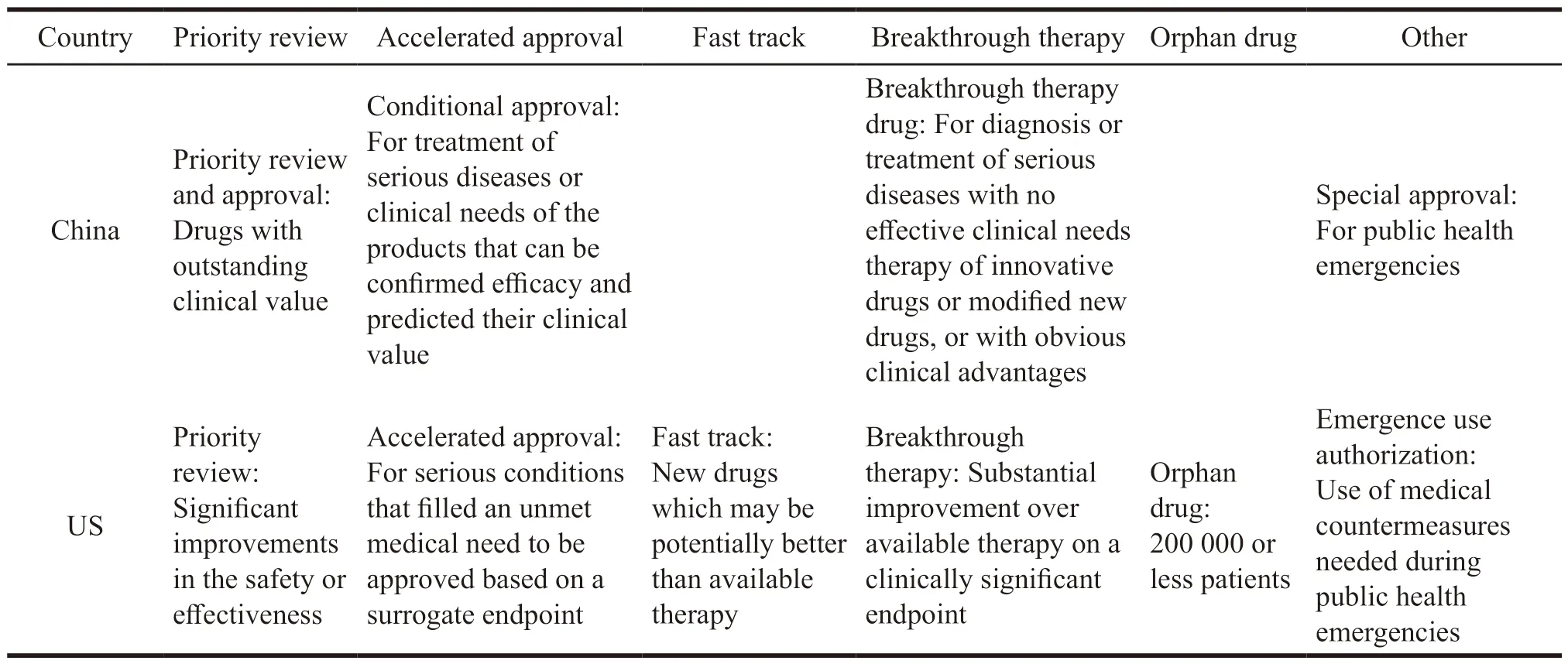

The United States is the most innovative country in the global pharmaceutical industry,and its incentive policies for innovative drug R&D cover the entire life cycle of drugs.In the early stage of R&D,it mainly uses tax incentives to reduce R&D costs and financial support measures to increase capital investment.The more R&D investment an enterprise has,the more preferential it will receive,which has nothing to do with whether the enterprise has successfully developed innovative drugs.In addition,financing policies have an indirect stimulating effect,providing financial allocations,low-interest loans and tax relief to venture capital institutions.It also establishes a risk-sharing mechanism with commercial banks to build a diversified and coordinated market financing environment.In the stage of marketing registration,the Food and Drug Administration (FDA)is not only responsible for review,but also provides guidance and assistance.Its first step is to establish a communication mechanism.During the trial phase,FDA allows applicants to apply for scientific advice,including responses to general technical questions,evaluation of special protocols,and meetings on major scientific issues.In addition to providing research and development guidance for common new drugs,FDA also provides intensive guidance for new drugs with potential clinical advantages for serious or lifethreatening diseases.FDA gives a certain degree of resource preference to highly innovative drugs,including proactive communication plans and multiple formal and informal communications.The second step is to establish special review procedures[19],including priority review,accelerated approval,fast track,and breakthrough therapy compared with Chinese special channel as shown in the Table 3.In general,there are two criteria for entering the special review process.One is that the new drug can meet unmet medical needs,and the other is that the new drug is significantly safer or more effective than existing treatments.

Table 3 Comparison of special review procedures between China and US

The greater the number and variety of innovative drugs on the market,the greater the availability of drugs to patients.According to the data query on FDA and new drug reports over the years,a database was constructed to analyze the number of innovative anti-tumor drugs approved by the FDA from 2016 to 2021 and their proportion to the total number of new drugs (Fig.7)[20].In the sound environment of incentive policy,the number and proportion of new anti-tumor drugs approved in the US is high,accounting for about 20%-30% of new drugs.These innovative anti-tumor drugs have a wide range of indications,covering rare diseases and pediatric drugs.It greatly shortens the time for patients to accept new technologies,new treatments,and new drugs.

Fig.7 Number of innovative anti-tumor drugs approved by FDA from 2016 to 2021

4 Results and conclusion

In recent years,Chinese innovative anti-tumor drugs have experienced a difficult process from imitation to innovation.On the one hand,the reforms,such as the record-keeping management system for institutions,the implied license system for clinical trial applications,and the acceptance of overseas clinical trial data,have considerably improved the efficiency of clinical trials of innovative drugs and increased the number of clinical trials significantly.However,at the same time,the clinical trials of innovative drugs in China are obviously homogenized,and the problem of target clustering is serious.As far as innovative anti-tumor drugs are concerned,there are still a gap in drugs with large clinical needs for liver cancer and gastric cancer due to the limited basic research.On the other hand,the four types of special review procedures are close to the US,which has accelerated the launch of innovative drugs.The innovative antitumor drugs developed in China are all included in the priority review and approval path,but the relevant policy rules are not clear enough.The operating time is limited,and the operating procedures are all trial versions,and it is still unclear when they will be officially released.While being implemented,they should be continuously adjusted according to practice.Breakthrough drug innovation is the only way for China to become a pharmaceutical power.In response to the above problems,this paper puts forward the following three suggestions.

Firstly,it is necessary to clarify the key role and guiding orientation of the government in innovative drugs R&D.Original innovations should meet clinical needs,especially the inadequacy of existing drugs.The government should guide the market to transform high-level repeated research into clinical value-oriented targeted research.At the same time,it will promote the transformation of technological innovation and scientific research accomplishments into R&D pipelines and even new drugs on the market,strengthening quality orientation and application orientation.

Secondly,the evaluation and approval system should be continuously optimized to improve the evaluation and approval capabilities of innovative drugs.Although the risk of innovative drug R&D is relatively high,the return after simultaneous R&D at home and abroad can effectively share the risk.Regulatory authorities should continue to promote the coordination of evaluation and approval concepts,methods,and standards with the international advanced experience,strengthening international collaboration,establishing efficient and smooth processes and decision-making paths,and formulating clear and definite implementation rules.In addition,it should establish and improve drug risk control systems so that innovative drugs can benefit more people.

Finally,a good innovation ecosystem should be built,which can adjust and improve the positioning and tasks of each component of Chinese drug innovation system in the new stage.Therefore,policies related to the production of innovative technologies and the transformation of achievements can truly play an incentive role.The industrialization cooperation mechanism among universities,research institutes,and enterprises in China still needs to be strengthened.It is recommended to formulate relevant laws and regulations as soon as possible to supplement the internal driving force of collaboration,unblock information communication channels,and promote a more stable development of the industry.

- 亚洲社会药学杂志的其它文章

- Research on the Impact of Independent R&D and Collaborative Innovation on Economic Performance in China’s pharmaceutical Industry

- Research on the Effect of R&D lnvestment lntensity and Sales Expense on the Performance of Biomedical Enterprises

- The Status Quo and Enlightenment of the Foreign Extended Clinical Trial System

- Foreign Experience and Enlightenment of Reimbursement Management of Multi-indication Drugs

- Study on Public Health Behavior against the Background of COVID-19 Pandemic -Based on Bandura Reciprocal Determinism

- Current Situation and Prospect of the Application of Real-World Evidence in Health Care