Market reaction to tender offers: Insights from China

WANG Yuchen, QIAN Yuanchen

1. International Institute of Finance, School of Management, University of Science and Technology of China, Hefei 230601, China;2. Department of Statistics and Finance, School of Management, University of Science and Technology of China, Hefei 230026, China

Abstract: This article studies the tender offers of Chinese A-share listed companies. We apply the nonparametric method and the piecewise-linear regression model to indicate that the pricing of offers has an anchoring effect. We find that the historical returns positively affect the post-offer price premium. Besides, We use the logistic regression model to find that historical returns significantly influence the success rate of the acquisition. We adopt the event study methods to show that the abnormal return and the abnormal trading volume reach their peaks on the announcement day, revealing the possible existence of informed traders in tender offers.

Keywords: anchoring effect; announcement effect; acquisition premium; corporate finance; Chinese market; tender offer

1 Introduction

1.1 Background

China promulgated theInterimRegulationsontheAdministrationofStockIssuanceandTradingin 1993, which is the first rule about the tender offer. Subsequently, theSecuritiesLawofthePeople’sRepublicofChina(referred to as theSecuritiesLaw) promulgated in 1998 is a further supplement and improvement to those regulations. To promote theSecuritiesLaw, enhance the tender offer details and push forward substantial corporate restructuring in China’s securities market, theRegulationsonTakeoversofListedCompanies(RTLC) in October 2002 andtheNoticeonRelevantIssuesConcerningtheListingandTradingConditionsoftheAcquiredcompany’sSharesInvolvedinaTenderOfferin May 2003 have been issued successively. In order to regulate the acquisition of listed companies and changes in equity, the China Securities Regulatory Commission (CSRC) made several amendments in subsequent years. The promulgation of these supporting regulations not only perfect the regulatory system for Chinese listed companies’ tender offers but also importantly solved many obstacles that restricted the listed company’s tender offers. Chinese first tender offer report was issued on April 9, 2003. Nan Gang United issued a tender offer to Nan Gang shares in accordance with the law. Since then, there have been successive tender offer events. What are the inherent reasons for the tender offer of listed companies? Whether the rights and interests of small and medium shareholders are protected and whether investors can benefit from it. A series of questions are worth exploring.

The tender offer system was established earlier in developed countries and scholars have studied it in a mature way[1,2]. We do not choose to compare the differences of markets from an institutional perspective. We prepare to apply empirical research methods to study tender offers in the Chinese market. We hope that our results can provide reasonable references for the target companies, acquirers and investors.

1.2 Literature review

In a tender offer, the acquirers propose a per-share price to the target’s shareholders. Then target firms have the choice of whether or not to sell at the offer price. Bradley[3]examines 161 tender offers in the U.S. and finds that the average pre-offer price premium paid by an acquirer was 49% of the pre-transaction share prices of a target. After that, the existed researches use the target’s share price during 20 to 40 trading days prior to the announcement day as the pre-offer share price to remove the effect of pre-offer runup of share prices due to the information leakage[4,5].The most obvious is that they help to explain the offer price premium in a novel and economically meaningful way. The impact of trading success and market reaction on reference points is also somewhat unique. Genesove and Mayer[6]find that the owners’ cost base significantly influences the negotiation and outcome of real estate transactions. Subsequently, Baker et al[7]study the relationship between the target’s recent peak prices and several aspects of merger and acquisition including offer prices, deal success, market reaction, and merger waves. They find that offer prices are biased toward the target’s recent peak prices although such prices are economically unremarkable. George et al.[8]suggest that an important contributing factor to the post earnings announcement drift is investors anchoring their beliefs about fundamental value on the 52-week high, which restrains price reactions to earnings news. Ma et al.[9]propose that using the 52-week stock price peak as an investment strategy reference, generates a significant value-weighted monthlyαof 1.13%. Jetter and Walker[10]analyse of 12596 daily games and suggest that anchoring effects can play an important role in financial decisions under pressure. Ma et al.[11]propose that acquirers earn higher (lower) announcement-period returns when their pre-announcement stock prices are well below (near) their 52-week highs.In this article, we follow the idea of Ma et al.[11]and use the highest stock price from 30 days to one year before the indicative report announcement day as the historical stock price reference point. Then we calculate the difference between the reference point and the 90% of volume-weighted average price of the 30 days before the announcement day(30VWAP).

The economic applications of anchoring effect are plentiful. Neale and Bazerman[12]consider the setting of union negotiation and review strategies on wages, which seemed to take advantage of anchoring. Loughran and Ritter[13]propose that reference point preference and mental accounting can help explain IPO underpricing. Diamond and Vartiainen[14]generally suppose the reference point effect in organizational economics. Hart and Moore[15]develop contracting theory based on the parties’ use of anchoring and psychological reference points. Baker and Xuan[16]find that the price when the CEO joins the company is the reference point for raising new equity. We apply this “52-week high” premium to reflect the anchoring effect of bid price and find that the acquirers indeed anchor the price[注]Anchoring effect means that when people make a quantitative estimation of an event, they will use certain specific values as the starting value. And the starting value will restrict the estimated value like an anchor. When making decisions, they will unconsciously pay attention to the initial information..

In addition, Dodd and Ruback[17]analyze the 172 tender offer events that occurred between 1958 and 1976. They confirm that whether the tender offer is successful or not, the target company can obtain a positive abnormal return in the month of the announcement. The results indicate that tender offers can be profitable, but most of the proceeds go to the shareholders of the target company. Fowler and Schmidt[18]find that the post-acquisition financial performance of the target improved significantly. Dann et al.[19]document positive earnings surprises and equity systematic risk reduction following tender offers. Hutson[20]analyze the volatility of stock prices after the acquisition. Branch and Yang[21]argue that acquirers can obtain potential arbitrage after a tender offer. We analyze the potential for post-tender arbitrage in the Chinese market and list the factors that affect the premium.

Under existing federal and state law, Easterbrook and Fischel[22]find that a corporation’s managers can resist and often defeat a premium tender offer without liability to either the corporation’s shareholders or unsuccessful acquirers. Jensen and Ruback[23]report that the excess return of the target company’s stock can be achieved. The target company can obtain a significantly positive excess return from the announcement date until the completion of the acquisition in a successful tender offer. Walkling[24]uses logistic analysis to find the factors that influence the success of the tender offer. He concludes that the bid premium, shares acquired, percentage of shares controlled by the bidders, etc., can significantly affect the success of the offer. Walkling and Edmister[25]further study the factors that determine the offer premium. They find that the debt-to-asset ratio, market value, and controlled shares determine the bid premium. Hsieh and Walkling[26]indicate that the change in arbitrage holdings is greater in successful offers. Afsharipour[27]conclude that the longer the interval period, the likelihood of a deal being completed decreases. Butler and Sauska[28]show that termination fees lead to increased deal completion. We calculate the post-offer price premium and find that the premium is affected by historical returns and more significant in a full offer.

Some studies examine 128 tender offer bids from 1980 to 1987 in America and find that the target has significant abnormal earnings on the announcement day[29,30]. Bradley et al.[31]test the effectiveness and credibility of analysts’ recommendations by looking at their behaviour around announcements of takeover offers. However, Heinen[32]argue that domestic Euro area acquirers show insignificant positive abnormal returns while cross-border Euro area acquirer show insignificant negative abnormal returns. Kwon and Song[33]research the announcement effect of public tender offer process in Korea and conclude that companies exempt from preferential negotiations showed significant negative effects on abnormal returns. Lee and Chung[34]analyze how stock market liquidity affects the abnormal return to target firms in mergers and tender offers. Yaghoubi et al.[35]find that long-term abnormal earnings of target companies have diversity in different industries. We calculate the abnormal return and find that there are obvious positive abnormal returns on the tender offer announcement date.

In order to distinguish the influence of different acquisition methods on the effect of tender offer, we further divide samples into partial offers and full offers. An academic literature has long identified numerous factors influencing the choice of acquisition methods, but the exact mechanisms through which these factors determine the form of the deal are still not well understood[36,37]. Dong et al.[38]find that undervalued firms are more likely to be acquired via a tender than a merger. Cain et al[39]argue that the volatility of the target’s stock returns is a proxy for the uncertainty of future cash flows, and consequently may reveal the target’s preference for a fast close of the deal. Offenberg and Pirinsky[40]analyze that how do acquirers choose between mergers and tender offers. Tender offers provide the advantage of substantially faster completion time than mergers. However, a tender offer signals to the target higher demand for its shares and raises its reservation price. We extend the idea to examines the difference between a full offer and a partial offer. We conclude that there are differences between the two offer methods in the offer price, order ratio, abnormal returns, etc.

Our research contributes to the literature in the following aspects. First, this paper is one of the few empirical studies on tender offers in the Chinese market. It provides empirical evidence for some important prior theories on tender offers for the first time. In particular, our findings are consistent with the results in Baker et al.[7]that the pricing has an anchoring effect. Moreover, the threshold of marginal effect in 52-week high in China is higher than American market and anchoring effect is significant in partial offers. Second, our methodology is in similar to Offenberg and Pirinsky[40]by analogy, and we compare the method used to study M&A to a full offer and a partial offer. We find the differences between those two methods in aspects of the completion ratio, the offer price premium, and the post-offer premium. Full offers is lower than partial offer in terms of the offer price premium and the completion ratio. But the offered shares in full offers are more than that in partial offers. But the offered shares ratio is more than those in partial offers. Third, we extend the model of Butler and Sauska[28]and add variables such as historical earnings, tender intervals, etc.. We find that historical returns positively affect the success rate of acquisitions. Finally, we calculate the abnormal returns and abnormal trading volumes of tender offers and conclude that the announcement effect is significant in tender offers. Besides, we expose that there are potential informed traders in tender offers.

The rest of the paper is organized as follows. In Section 2, we describe data sources, methodology, and variables related to target companies. In Section 3, we show the factors that affect the offer price, the post-acquisition premium, and the success of offer. We conclude in Section 4.

2 Data

2.1 Data sources

We collect the sample of A-share targets acquired between December 2003 and December 2018 mainly from the CSMAR and WIND databases, the official websites of Shanghai Stock Exchange and Shenzhen Stock Exchange, and the remaining cases are collected manually. We focus on the post-2002 period because the first offer event was occurred in April 2003. Samples occurred between April 2003 and November 2003 are mandatory offers, and the target company has been delisted from the market after the offer. We eliminate these samples.

We require all the target companies to be listed on Chinese A-shares so that Chinese takeover law applies to the deal. Besides, the acquirers should meet the same criteria to avoid complications arising from different foreign tax and legal regimes. To accurately measure the price changes, all deals must have been completed. What’s more, all target companies should have financial information in CRSC during the offer periods. The initial sample had 110 offer events, and we excluded the firms being delisted after the offer and the B-shares. The final sample size is 77, of which 40 partial offers and 37 full offers.

An indicative offer report is issued and revealed to the public before the tender offer event. Therefore, we use the date of indicative report announcement as the benchmark. We obtain the offer price and the mean of the daily volume-weighted average price of the past 30 trading days before the filing date of the indicative report(30VWAP). Then we use 90% of the 30VWAP as the base price, since the CSRC requires the offer price cannot be much lower than 30VWAP. We calculate the offer price premium as the offer price minus the base price, then divide it by the base price. Similarly, the 52-week high is the 52-week high stock price over the 365 calendar days ending 30 trading days prior to the announcement date expressed as a percentage difference from the base price. The purpose of choosing 30 trading days lagged price as the scaling factor is to attenuate any upward rumors or new information effect on the offer premium.

Regarding the composition of the acquirers, there are parent companies of listed companies, individuals, foreign-funded enterprises, and state-owned enterprises. Most of them are subsidiary acquisitions and very few are foreign companies making offers to listed companies. In terms of trading attitude, there are 40 offers in agreed offers and 37 for hostile offers[注]An agreed offer refers to an act of acquisition reached by the acquirers and the acquired board on the basis of consensus. A hostile offer is the acquisition by the acquirers in the capital market without the permission of the target’s board of directors, regardless of whether the other board agrees or not. The number of offers with different attitudes is the same as the partial offers and full offers, but the correspondence is not equal. We use trading attitude as a dummy variable in later tests.. In all tender offer events, the control of 12 target companies has been transferred. Therefore, we apply transfer of control as the control variable.

In addition, from the announcement date of the indicative offer report to the start of the tender offer, the longest interval is 876 days, the shortest interval is one day, and the average interval is 118 days. The maximum period from the start of the official offer to the end of the offer is 60 days, the shortest is 28 days, and the average is 32 days. The difference in the interval of the offer may mean that the acquirer and the target have more time to manipulate the stock price. Meanwhile, interval may determine the success of the offer, and we explain these in the following part.

2.2 Summary statistics

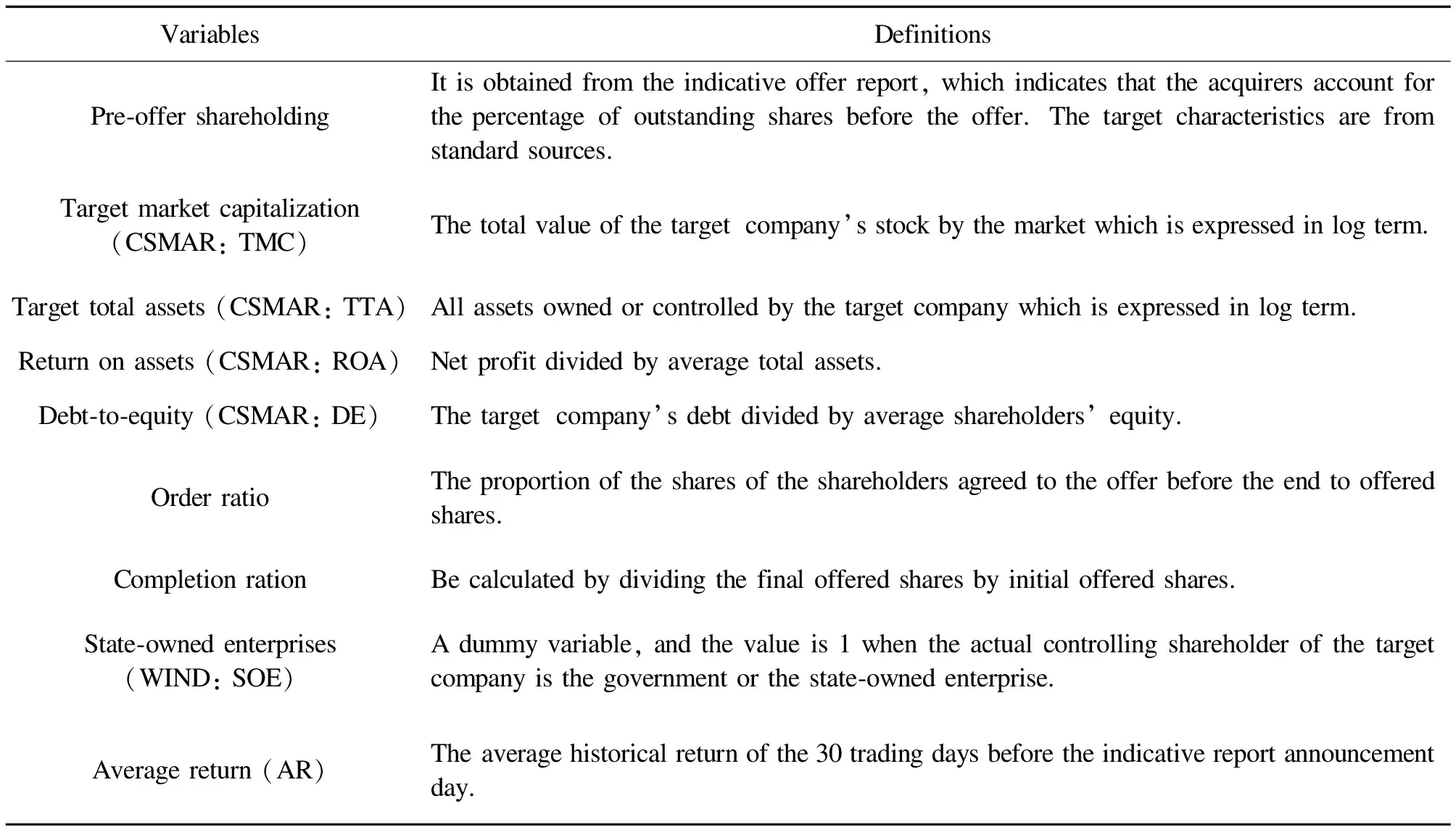

Table 1 includes detailed definitions of variables. Table 2 reports the summary statistics of our sample, which include means, standard deviations, medians, maximums, minimums of control variables, independent variables, and dependent variables. Regarding prices, the average offer price premium of the partial offer is 35.00%, but the mean price of the full offer is 17.06%. Because bidders are voluntary and motivated in the partial offer, and the bid price is high to meet their acquisition purpose. We record the financial indicators of the target company for the quarter of the indicative report announcement day. Key indicators include the characteristic of the target company and the outcome of the offer.

For the company’s financial indicators such as TTA, TMC, ROA and ROE, there are few differences between partial offers and full offers. We explain the differences in the following part.

2.3 Partial offer and full offer

From Table 2, there are differences in some aspects between the partial offer and the full offer. The mean of pre-offer shareholding in partial offers is 27.72%, which is also lower than that in full offers. Simultaneously, the average value of offered shares in partial offers is 13.25%, which is also lower than that in full offers. Before the full offer, the acquirer generally signs an acquisition agreement with the target company. The amount of shares acquired by the agreement is high enough to make sure that the acquirer owns 30% of the target company’s shares, triggering a mandatory offer. In that case the acquirer has to offer all the remaining shares of the target company. Therefore, before the offer, the acquirer holds more shares of the target company in a full offer than that in a partial offer.

Table 1. The definitions of the variables.

Table 2. Summary statistics, 2003-12-2018-12.

In addition, the mean of completion ratio in partial offers is 80.57%, which is higher than that in full offers. The legislative intent of tender offer is to protect the interests of small shareholders and to give them the right to withdraw from the target company. The investment decision is based on the current situation of the control of the target company. If the control is transferred, the small shareholders will lose the original basis for investing. Since small shareholders cannot influence the transfer of control, at least they should have a fair chance to withdraw their investment. But if small shareholders sell shares in the market together, they will make the stock price plummet and suffer losses inevitably. As a result, the law compels the acquirers to issue a public tender offer, so that shareholders have the opportunity to sell their shares at a fair price. In this regard, the law of partial offers gives the minority shareholders part of the right to withdraw from the company, while the rule of full offers provides them with the chance to opt out completely. Therefore, shareholders are more willing to sell their shares in partial offers.

In Table 3, we list the differences in the offer price premium, offered shares, and completion ratio between partial offers and full offers. At the same time, the mean and median of the two sets for each variable are tested. We use the t-test and the Wilcoxon rank-sum to test mean and median. The t-value and chi-square value of the test are listed in the last column of Table 3 in parentheses. The mean of offer price premium in the partial offer is 21.50%, which is 16.15% high than that in full offers. The median of offer price premium has a similar result. The purchasers are active and initiative to choose a partial offer to increase shareholding. Therefore, the bidders are willing to pay a higher price to achieve the purpose of the acquisition. However, the full offer is compulsory, and the acquirers are forced to purchase the additional shares because it will increase the cost of the acquisition. The acquirers try to keep the offer price as low as possible without violating the regulations. For Panel B, the mean of offered shares in partial offers is 13.25%, which is 29.44% lower than that in full offers.

Table 3. Tests of two offer methods.

Due to the mandatory offer requirements, the acquirers have to make an offer to all the shareholders except those related to the agreement acquisition. For this reason, the bidders offer more shares in full offers. For Panel C, the mean of the completion ratio in partial offers is 80.57%, which is 77.73% high than that in full offers. The difference in median is much larger. The completion ratio is defined as the percentage of shares that finally acquired to the offered shares after the offer. The completion ratio of the full offer is only 2.84%, which is significantly lower than the partial offer. Because the full offer may lead to the delisting and the acquisition is uncertain and risky, shareholders are forced to sell their shares. But they stay on the sidelines and wait for the stock price to increase.

3 Results

3.1 Pricing

Similar to Baker et al.[7], we begin by documenting the effect of past peak prices on offer prices. Figure 1(a) illustrates the histogram of the difference between offer price and the 52-week high. This plot clearly shows a spike at the 52-week high, which indicate that bidders commonly bid at the recent peak price. To be clear, the peak price is not much related to the offer price, because the 52-week high is measured 30 trading days before the indicative report’s announcement day. Most of the bidders offer below the 52-week high. This could reflect the bidders’ anticipation of the difficult negotiation and the preservation of a psychological option value of being able to cross a salient threshold as a “concession” in later rounds[7].

Certainly, the majority of offer prices do not equal to the 52-week high. We study the overall shape of the relationship between these prices in a nonparametric way in Figure 1(b). We estimate Gaussian kernel regressions of the model.

Offerit=a+b·52WkHii,t-30+eit

(1)

with varying bandwidths and estimation points. Here 52WkHi represents 52-week high.

Gaussian kernel regressions of the offer premium on the target’s 52-week high price. (a) displays the histogram of the difference between the offer price and the target’s 52-week high price. (b) describes the kernel regression that has a bandwidth of 10 and has 48 estimation points. The regression limits the sample to situations where the 52-week high is less than 1.75 times the base price. Figure 1. Non-linear effects.

Figure 1(b) limits the sample to the case where the 52-week high is less than 75% high than the base price and the bandwidth is 20. We can see that with the increase of 52-week high, the offer premium has increased significantly and this effect is not obvious at the right tail. In a quasi-rational argument, targets that have fallen substantially from their 52-week high may fail to persuade the bidders.

The first column of Table 4 report the least-squares estimation of Equation(1). Considering the nonlinearity of Figure 1(b), we make piecewise linear regression as follows.

Offerit=a+b1min(52WkHii,t-30,75)+

b2max(0,min(52WkHii,t-30-75,50))+

b3max(0,52WkHii,t-30-125) +eit

(2)

with standard errors are clustered by month. This specification allows for a marginal effect ofb1for 52-week high premium up to 75%,b2for premia between 75% and 125%, andb3for premia above 125%.

We scale up the 30-day lagging price to reduce heteroskedasticity. But to an extent, investors and the board of directors don’t consider the offer price from the perspective of 30-day lagging prices. This approach will also cause a measurement error, leading to a possible false positive correlation. Consequently, we use the 30-day lagging price as a variable to reduce this error.

Column 1 of Panel A in Table 4 reports the year fixed effect regression, which shows that offer price increase about 1% for every 15.5% rise in the 52-week high. This is statistically significant but not large. The piecewise linear regression shows that when the 52-week high reference price is lower than 75%, the offer price rises by 1.9% with every 10% increment of 52-week high. However, it exerts an opposite influence, decreasing 1.6% for each additional 10% increase in the 52-week high between 75% and 125%. Beyond 125%, the effect is approximately 1.6%. This pattern is consistent with marginal utility, which implies that the effect of the increase in the offer price becomes less significant with the increase of 52-week high. As for why the second-stage coefficient is negative, the purchasers are skeptical of the excessively high maximum price and fear the failure of the transaction. Therefore, the acquirers are forced to offer a higher price to withstand the risk. 52-week high price is much higher than the benchmark price in the third-stage, it indicates that the company has a potential value-added space. The acquirer is willing to pay a high offer price to obtain handsome profits.

The remainder of Table 4 is mainly to divide the sample into partial offers and full offers respectively in order to study differences impact of the offer price between them. We find that in partial offers, the 52-week high has no significant impact on the offer price. Because the bidders are voluntary and motivated, the target company’s peak price has little impact on their buy-out confidence. And they are willing to pay a higher price to make the acquisition successful. The full offer has the opposite conclusion since the peak price is the most valuable reference. When the bidders are forced, they will refer to the peak price to make a reasonable decision. It reflects the anchoring effect of the acquirers in pricing.

We add some standardized financial indicators and characteristics of the target company as control variables to the regression, and the conclusion does not change obviously. In addition, we note that ROE may be a factor considered by the acquirers, as the good financial situation attracts the investors to pay a higher price.

3.2 Post-offer price premium

Figure 2 shows that there is a significant price premium for tender offers[注]Most of the target companies that are offered will suspend trading before the indicative report announcement, some as long as several months, and some as short as a few days. Therefore, we use the target company’s trading day data. In addition, the time interval from the indicative report announcement to the official start of the offer is also very different, the shortest is only a few days, the longest is even more than half a year.. The acquirers may obtain short-term benefits from the acquisition no matter what kind of offer. However, there exist evident differences in the post-offer returns between partial offers and full offers. Next, we use the regression with year fixed effect to study the factors that affect the post-offer price premium.

Campbell and Thompson[41]find that historical stock returns have a significant effect on the future stock price. Therefore, we use the average stock returns for 30 trading days (AR) before the indicative report’s announcement day as an independent variable. We set a vacancy period of 30 trading days before the announcement day to avoid the existence of informed traders who may manipulate the stock price. Besides, this measurement can take into account the reaction of the internal acquisition of the target company.

Table 4. The pricing of tender offers.

Table 5 shows the results of multiple regression. In the whole sample, AR significantly affects the post-offer price premium, and it increases by 4.8% for every 10% increase in AR. Results are even more significant in full offers. For every 10% increase in returns, there is a 5.8% increase in the post-acquisition premium. Barclay and Holderness[42]reveal that the control premium is a part of the post-offer premium. We confirm this conclusion as negotiated acquisitions make the acquirers get the effective control of the company in full offers. However, partial offers have no similar conclusions. Since the full offer is a mandatory offer, the acquirers are forced to buy additional shares at a higher price, so they bid at the lowest possible price. The result leads to an increase in the post-offer premium, and small shareholders cannot obtain a control premium from the acquisition. The acquirers are optimistic about the future of the target company. The good performance of historical stock returns made them more determined in the acquisition decision. Meanwhile, the target’s financial situation have been improved after the completion of the acquisition. However, the bidders of the partial offers are optimistic about the target’s prospects. They have to raise the offer price to satisfy their expected premium. Hence, the tender offer only causes the transfer of shares, while the control of the target is not transferred.

We illustrate that the debt-to-equity(DE) has a significantly positive impact on the post-offer premium. Table 2 reveals that most of the target companies have poor management or financial problems in full offers, so the debt ratio is extremely high. The post-offer premium increases as the debt ratio increases. The high debt ratio makes the target company need cash flow to change its financial situation. For the partial offer, the target companies rarely have those problems. From Column 3 of Table 5, we observe that state-owned enterprises have lower premiums after tender offers. This is because in China, state-owned enterprises may receive government support and have abundant funds. The acquisition and reorganization of state-owned enterprises are subject to the supervision and regulation of government departments. It is difficult for informed traders to arbitrage from target companies. Therefore, SOE is not very significant in the whole sample.

3.3 Success of offer

Inspired by the method of Walkling[24], we use the logistic regression to study the factors that affect the offer’s success rate. In a tender offer, shareholders expect to sell their shares at a higher price, but acquirers are willing to achieve their acquisition purpose at the lowest price as possible. We add several variables used in the literature, such as the pre-offer shareholding, the trading attitude and the offer price premium.

Because there exists a certain interval from the indicative report announcement date to the beginning of the offer. During this vacancy period, shareholders think about whether to accept the offer. In addition, the characteristic of the target company may also determine the success rate, because state-owned companies have advantages in innovation resources and the government’s subsidies. Non-state-owned companies have strong motivation for more corporate interests and better firm performance. Whether the control of the target company will be transferred after the end of the offer is also a factor considered by shareholders. Moreover, historical returns affect shareholders’ decisions. For companies with better returns, shareholders are forced to sell their shares in hopes of getting more returns. Based on the above reasons, we add variables such as Interval, SOE, Control transfer and AR. The detailed definition and calculation of these variables are shown in Table 6. We use the following regression equation.

(3)

Then do a logistic transformation ofp, we get

(4)

wherep=P(Y=1|X1,…,XN),Ymeans the offer is successful when the final accepted shares are more than or equal to the reserved shares, the value is 1. Otherwise, the value is 0.Xirepresents variable such as SOE, trading attitude, control transfer. We scale all independent variables with the mean value of 0, and the variance of 1.

Table 5. Multiple OLS regression of post-offer price premium.

Table 6 displays the regression and the results reveal that trading attitude, whether the control is transferred, and the interval of the transaction hardly predict the success rate. But we can get useful information from their coefficients. State-owned background and a friendly attitude to the deal will help complete the offer. Because state-owned enterprises enjoy more government financial support and policy encouragement in China. Shareholders are willing to sell their shares. Hostile trading attitudes and the transfer of control may cause the delisting of the target company, which will lead to the failure of the offer. The coefficient of AR is negatively significant. When the target company’s recent earnings are positive, the likelihood of success of offer will decrease. This is because the target company can bring positive returns to shareholders, and shareholders will maintain a wait-and-see attitude. The tender offer event promotes the stock price to rise, which further discourages them from the idea of immediate action unless the acquirers offer a higher price to meet their premium demand. It just verifies that when the offer price premium is positive, the likelihood of successful offer will increase. The coefficient of the offer price premium is higher than the coefficient of AR. When the premium is higher than historical returns, the probability of achieving the acquisition objective will increase. In other words, when the premium reaches the shareholders’ expected increase in returns, the shareholders are willing to sell their shares. Besides, we find that if the acquirers hold a large number of target shares before the offer, the likelihood of the success will decrease. Because shareholders are worried that the acquirers may use the offer to manipulate the stock price, or the company may be delisted due to the majority of the shares holding by the acquirers.

About the reliability of the model, the last four rows of Table 6 report the percentage of concordant and discordant using the pairing method[注]In the sample, the number of successful offers is 26, and the number of non-successful offers is 51. We get a total of 1326 pairs in final.. The consistent percentage is as high as 89.3%. Hence, acquirers can use the conclusions of this model to meet their goals, whether they want to make a successful acquisition or not. For bidders who intend to facilitate the acquisition in a partial offer, they should appropriately increase the offer price to exceed the expected demand of shareholders. The expected demand can be measured by the average value of the target company’s historical returns. For those acquirers who have to choose a full offer,they can reduce the offer price as much as possible to dispel the idea of shareholders selling their shares on condition that the rules are not violated. In this way, the acquirers can avoid having to pay additional funds to acquire shares that they do not need due to the mandatory regulation.

Table 6. Logistic regression of success rate.

3.4 Abnormal returns of the announcement

In order to further explore the return during the tender offer, we apply event study to calculate the abnormal around tender offer announcement day. First, financial markets are efficient according to the efficient markets hypothesis (EMH). Stock prices reflect all known public information. Second, the studied events are unexpected by the market. Therefore, abnormal returns can measure the degree of the target company’s reaction to an event or information disclosure. Third, there is no mixed effect of other events during the window of the events. Similar to the method of Brown and Warner[43], we use the market model to calculate abnormal returns. Our model is as follows:

(5)

whereRitis the return of the target company,Rmtis the market return,ARitis the abnormal return,T0is the indicative report announcement date andhis the interval window. We set the normal intervals from 120 trading days to 30 trading days before the indicative report announcement day. We use CSI300 index return as the market return.

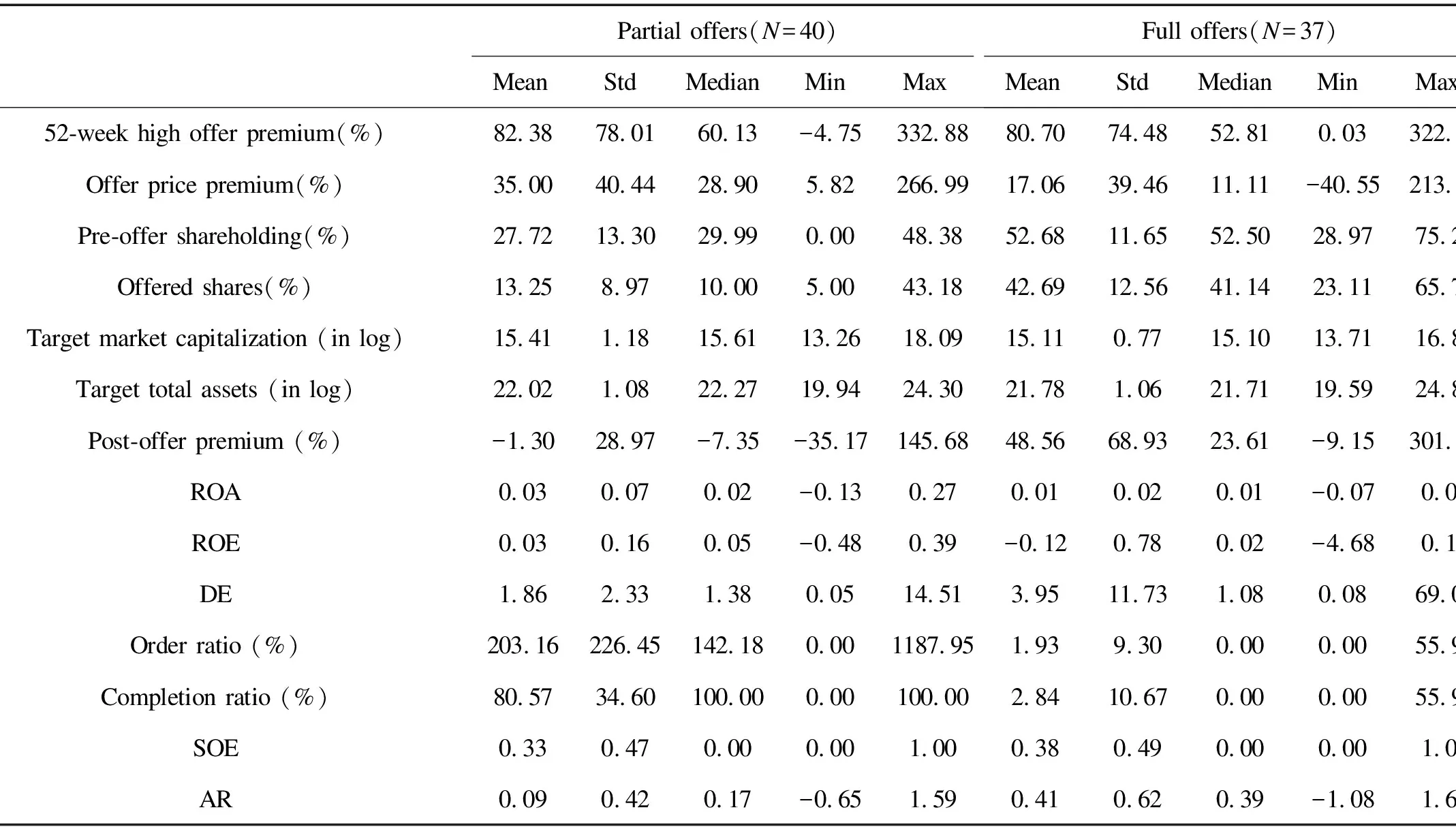

This figure shows the abnormal returns of the tender offer. T0 indicates the indicative report announcement day. The estimation window period is from T0-120 to T0-30 and the event window start from T0-20 to T0+20. The average of the target company AR at each moment is the average abnormal return(AAR). We divide the sample into two parts.Figure 3. Abnormal returns.

Figure 3 shows the change in the average abnormal return (AAR) of the tender offer. We can see that on the announcement dayT0, the abnormal return has a peak, and the change is relatively not so steep before and afterT0. Simultaneously, we observe that the duration of peak for full offers is a bit longer compared with partial offers, and there are very few negative abnormal returns. In partial offers, abnormal returns only increase significantly on the day before the announcement, while appear in the 3 to 5 days before the announcement for full offers. This situation may reflect that there exist informed traders in full offers. They use information obtained in advance to purchase a large number of shares and generate the arbitrage opportunity. We verify this argument in the section of abnormal trading volumes. Overall, the tender offer brings significant positive abnormal returns to the target company, which is profitable for investors.

This figure shows the CARs of the offer. T0 indicates the indicative report announcement day. The estimation window period is from T0-120 to T0-30 and the event window starts from T0-20 to T0+20. Figure 4. Cumulative abnormal returns.

In addition, cumulative abnormal returns (CAR) of the target company are shown in Figure 4. We can see that cumulative returns of the target company are positive in the entire evaluation period, and it continues increasing over time. Besides, after the announcement day, the growth in cumulative abnormal returns has become leveled off. This also further illustrates the significant increase in returns brought by the acquisition announcement to the target company, and the change is no longer obvious after the announcement day.

In Table 7, we divide the sample into full offers and partial offers to research a series of factors that affect CARs. In Table 8, we test the differences in CARs on the 3rd, 7th and 20th day before and after the announcement day. In terms of short-term and long-term CARs, the full offer is significantly higher than the partial offer, which is almost doubled. This is consistent with the conclusion observed from Figure 4. There is not much difference between those two in terms of CARs in the medium term.

No matter what kind of tender offer, there are positive abnormal returns. We consider the factors that affect the abnormal returns of tender offers in the whole sample. Table 7 shows the result of the regression with year fixed effect. Offer price premium, way of the tender offer and the debt-to-equity ratio of the target company significantly affect CARs. The higher the offer price premium, the greater the cumulative abnormal returns. Approximately every 1% increase in the offer price premium, the abnormal returns will increase by 70%. This means that the acquirers may already know that they can get higher returns before the acquisition, so they are willing to pay a higher premium to meet their goals. In other words, the bidders may be a potential informed trader, which damages the rights and interests of small shareholders. Besides, the way of an offer is also a factor determining abnormal returns. The full offer has more CARs, which provides an opportunity for investors. Holding shares may be a good strategy for small and medium shareholders. As for the debt-to-equity ratio positively affects CARs, the possible reasons are as follows. On the date of the announcement, investors believe that the offer is profitable and will invest in the target company. The financial situation of the target company has been improved, which will lead to higher returns. What’s more, the interest payment to creditors is a fixed expenditure that has nothing to do with the level of profitability of the company. The company’s income will increase to a greater extent when the company’s capital profit rate is higher than the debt capital cost, which is the financial leverage effect. At the same time, the company can use its own funds saved from the debt to create new profits. Therefore, a certain degree of the debt management plays an important role in improving returns.

Table 7. Multiple OLS regression of cumulative abnormal returns.

Table 8. Tests on CAR of two offer methods.

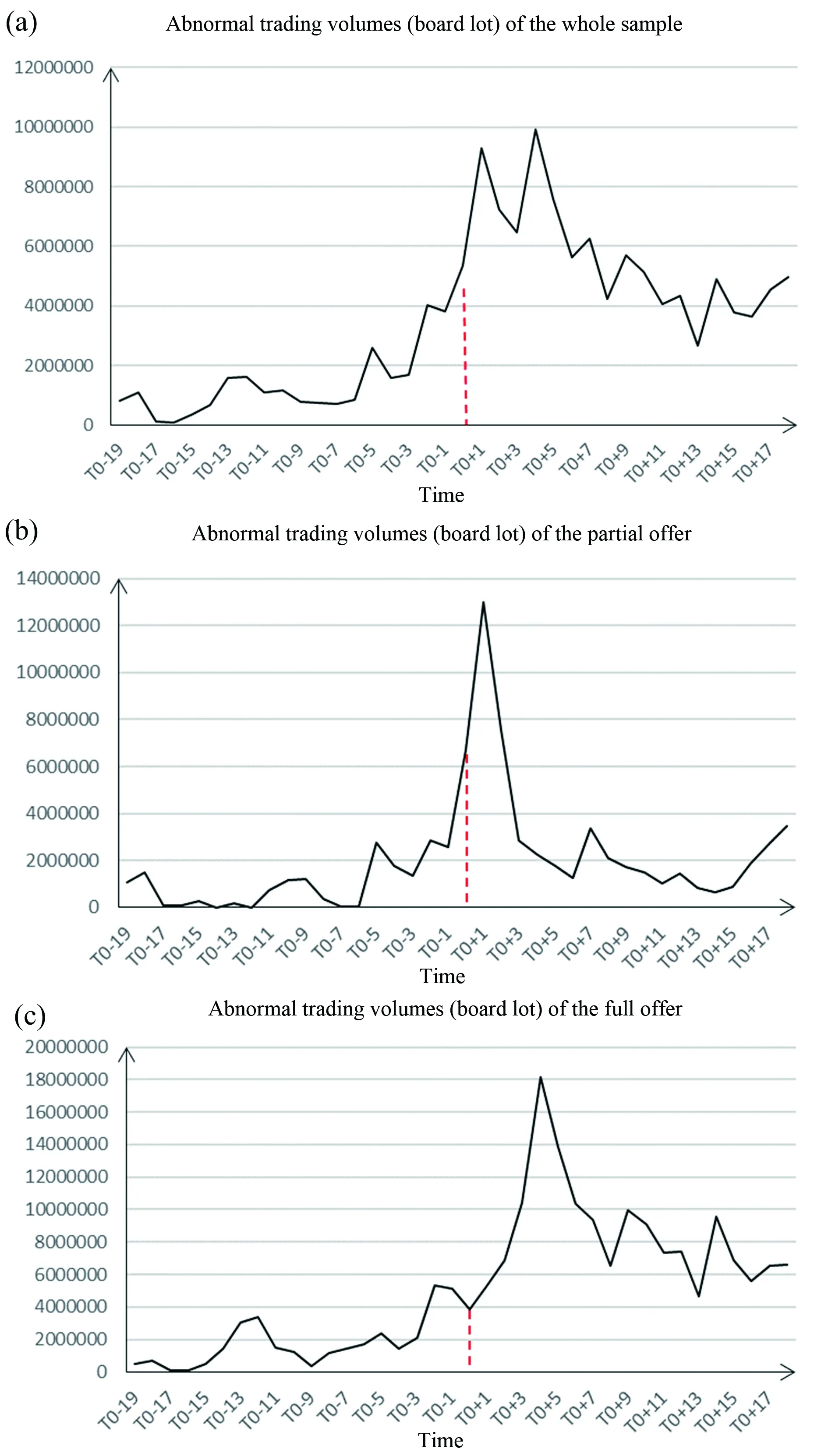

3.5 Abnormal trading volume

In the previous section, we mentioned that there may exist informed traders in the tender offer. In this section, we use the abnormal trading volumes to test this assumption. We apply the estimation method used by Bris[44]to calculate the abnormal trading volume. We regard the 120 trading days to 30 trading days before the announcement day as the normal trading period. Then we calculate the mean and standard deviation of the trading volume during the normal period. The period from 20 trading days before the announcement day to 20 trading days after the announcement day is regarded as the period to be assessed. During the estimation period, if the trading volume is greater than the average of the normal trading volume plus twice the standard deviation, we consider this to be abnormal. Then we define the abnormal trading volume as today’s trading volume minus the average of normal trading volume, else that is 0.

fort∈[T-120,T-30],

NTv=average(Tvt)

std=std(Tvt)

fort∈[T-20,T+20],

if Tvt>NTv + 2std,

ATv= NTv - Tvt

else ATv=0

(6)

We use the following method to calculate abnormal trading volumes. We set the normal trading intervals from 30 trading days to 120 trading days before the indicative report announcement. The intervals we choose to be evaluated are 20 trading days before the announcement to 20 trading days after the announcement. If the trading volume in the evaluation period exceeds the average trading volume in the normal period plus twice the standard deviation, We define it as abnormal trading volumes. Then let the trading volume minus the average trading volume in the normal period, which is the abnormal trading volume.Figure 5. Abnormal trading volumes.

Here Tv means the trading volume, NTv represents the normal trading volume, ATv stands for abnormal trading volume,Tis the indicative report announcement day. Figure 5 shows the changes in abnormal trading volumes around the announcement day. We can see that abnormal trading volumes in the full offer are more than that in the partial offer before the announcement. We also report the difference by using t-test in Table 9. Those results indicate that there may be informed traders in the full offer, who buy a large number of stocks before the announcement date. After the announcement date, the trading volumes in the partial offer drop rapidly except for a short transaction peak and a large number of transactions last for a period of time in the full offer. It shows that external investors are more optimistic about the benefits of the full offer, which is consistent with the previous conclusions. Overall the tender offer is beneficial for the market.

3.6 Changes in operating conditions

In order to study the impact of the tender offer on the financial status of the target company, we collect financial data before and after the tender offer. Return on assets (ROA) is one of the most widely used indicators to measure the profitability of a company in the industry[45]. We calculate ROA as net profit after tax divided by total assets. The higher the indicator, the better the effect of corporate asset utilization, indicating that the company has achieved good results in increasing revenue and saving funds. Therefore, we choose ROA as a measure of corporate finance.

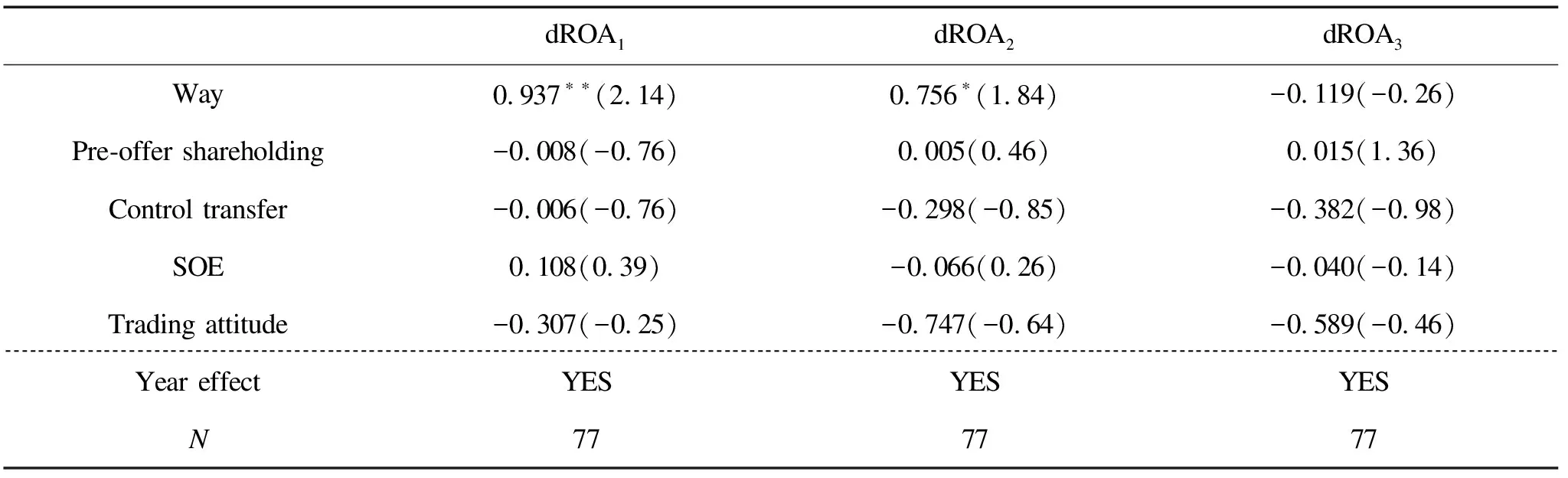

Similar to the idea of difference-in-differences, we collected the ROA data of the target company before, during, and after the offer. We define dROA1as the ROA of the quarter in which the offer is announced, minus the ROA of the quarter before the announcement. Then we calculate dROA2as the ROA of the next quarter after the offer completion minus the ROA of the quarter on the announcement date. Finally, We define dROA3as dROA2minus dROA1, which represents the unique change brought by the tender offer to the target company.

Table 9. Tests on abnormal trading volumes.

(7)

whereTrepresents the quarter of the indicative report announcement date. Table 10 shows the results of ordinary least squares regression. We find that through a full offer, the target company’s ROA has been significantly improved. But this is only for the issuance of the tender offer announcement. After the offer is completed, the return on assets of the target company in the full offer will also increase. However, we find that no matter what kind of offer it is, it does not have much impact on the changes in ROA. It shows that under short-term changes, the impact of the two bidding methods on the target company is not much different.

4 Conclusions

This article studies the tender offer events of Chinese A-share listed companies since the end of 2003. As far as we know, this paper is one of the few empirical studies on the tender offer in China. Due to the low frequency of tender offer in the Chinese market, our sample size is not large despite we include all the tender offers launched over the past 12 years. We contribute to a comprehensive analysis of the offer events. Similar to Offenberg and Pirinsky[40], we divide the offers into partial offers and full offers. Moreover, we expand the research on the factors affecting the success of the offer and apply the market model to reveal the announcement date effect of the offer. We find that in the Chinese acquisition market, the psychology of acquirers has an anchoring effect, and that it is more significant in the full offer. The acquirers have to make a full offer due to policy pressure when they want to acquire more shares, and the historical stock price is even more important. The shareholders of the target company are not very active in accepting the full offer. After all, their offer price premium is too low. In addition, the historical returns of the target company significantly affect the tender offer premium. The effect in the full offer is more significant, because there is a negotiated acquisition before the offer and the cash flow of the target company has been greatly improved. Furthermore, historical returns, bidders’ pre-offer shareholdings, and offer price premium affect the success rate of the acquisition. The shareholders of the target company decide whether to keep the shares in their hands based on historical returns.

Table 10. Changes in the target’s operating capabilities before and after the tender offer.

They worry that they may fall into a trap as the acquirers probably manipulate the stock price. Certainly, the effect of the announcement date is very obvious in a tender offer. On the day when the target company issued the announcement, the abnormal return and abnormal trading volume reach their peak. This shows that the tender offer is good news for the market and external investors are willing to hold more shares in the target company. The abnormal trading volumes before the announcement prove that there may exist informed traders in the tender offer. For the target company’s financial situation, the company that accepts the full offer has a short-term improvement.

This article is limited by the number of samples, and may not be able to fully explain how internal information leaked in the tender offer and the reasons for the purchaser’s motivation. This is the direction we will continue to study. The number of subsequent Chinese market offers continues to increase, and our research issues have also become diversified. This article serves as a stepping stone for the future research.

Acknowledgments

This work is supported by the Provincial Natural Science Foundation of Anhui (1908085QG299).

Conflictofinterest

The authors declare no conflict of interest.

Authorinformation

WANGYuchenreceived her PhD degree in Business (Finance) from Singapore Management University. She is currently a Non-tenured Associate Professor at the International Institute of Finance, University of Science and Technology of China. Her research mainly focuses on empirical asset pricing, corporate finance and institutional investment.

QIANYuanchen(corresponding author) is currently a Master student at the Department of Statistics and Finance, University of Science and Technology of China. His major is Statistics and his interests include statistical applications and corporate finance.

- 中国科学技术大学学报的其它文章

- A robust homogeneity pursuit algorithm for varying coefficient models with longitudinal data

- New product launching: The effect of firm-generated content on purchase intention

- Statistical test for high order stochastic dominance under the density ratio model

- The generating fields of two twisted Kloosterman sums

- Lin-Lu-Yau curvature and diameter of amply regular graphs