英文摘要

SCHEME

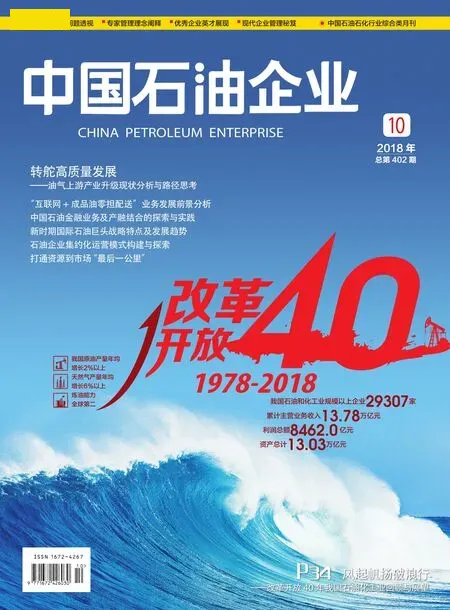

The Blueprint It Is Drawn, The Giant Ship It Is Sailed— Review of China's Petrochemical Industry in the Past 40 Years of Reform and Opening Up

In the past four decades, the Chinese people, in the sprit of diligence, courage, and solidarity, have written the magnificent epic of national development with both hands. In 2017,China’s GDP was equivalent to US$12.2 trillion, and the gap with the US economy, the world’s largest economy, is rapidly shrinking. If we continue to grow for 10 years in the growth rate of 6%, China is expected to become the world’s largest economy. This process will profoundly change the political and economic structure and governance map in the globe.

The magnificent reform and opening up has also driven the rapid development of China’s petrochemical industry. According to the Statistics from the National Bureau of Statistics, it shows that from 1979 to 2017, China’s crude oil output increased by an average of more than 2% per year, which is much higher than the average growth rate of 0.8% of global crude oil production in the same period. The average annual growth rate of natural gas production was more than 6%, which was as 2.2 times as the global average growth rate; The refining capacity continues to increase, china becoming the world’s second largest oil refining country after the United States. By the end of 2017, there were 29,307 enterprises above designated size in China’s petroleum and chemical industry, with a cumulative main business income of 13.78 trillion yuan, an increase of 15.7% over the previous year,total profit of 846.20 billion yuan, an increase of 51.9% year-on-year, which separately accounts for 11.8% and 11.3% of total revenue and total profit in the national scale of the main industry; with an assets totaled 13.03 trillion yuan, an increase of 5.4%, accounting for 11.6% of the total industrial assets of the country. In terms of job creation, the three major state-owned oil companies created 2.29 million jobs directly in 2017, which is 15 times than that of BAT in job creation. In terms of tax contribution, taking CNPC and Sinopec as examples, the annual tax payment exceeds 700 billion,accounting for 7% of the national total fiscal revenue.

The wind is strong and the wave is turbulent, China’s petrochemical industry has been steadily moving forward in the face of difficulties and obstacles, which paves the way of the revitalization of national industry and fulfill the “Chinese Dream”

SPECIAL MANUSCRIPT

Steering to High Quality Development Model— Analysis and Path Analysis of the Industry Upgrade of Oil and Gas Upstream Industry

On September 27, President Xi Jinping inspected Liaoyang Petrochemical in his investigation in Liaoning,who fully affirmed Liaoyang Petrochemical’s remarkable achievements in the project of Russian crude oil processing optimization and efficiency transformation, which includes but not limited project construction and production, technological innovation, supply-side structural reform, turning losses into profit, promoting the spirit of petroleum, team building and other aspects, President Xi is full of cordial care for millions of oil people, and his expectation to China’s oil industry becomes a great incentive and encouragement to the industry.

China’s economy has shifted from a high-speed growth stage to a high-quality development stage, which places higher demands on the high-quality development of the petroleum industry.

The foresight of oil people should be based on long-term development model and focus on quality. They shall promote the industry into a high-quality development model and focus on high-quality supply, and promote the upgrading of the industrial chain. Millions of oil people are taking the spirit of the President Xi’s speech as a guide to bring together the powerful forces that promote a high-quality development model.

FORUM

Analysis on Exploration and Practice of China Petroleum Financial Business and Industry and Finance Combination

In accordance with the principle of service main business, market-oriented development, standardized operation, coordinated development, and strict risk control,CNPC has established Finance Company, Bank of Kunlun, Kunlun Trust, Kunlun Leasing, Exclusive Insurance, Generali China, Generali China Insurance. Financial institutions such as Shengbao, Jingsheng Public Valuation, and Tianjin Emissions Exchange, which played an important role in fund security, risk management, and reduction of financial expenses, and helped build a comprehensive international energy company. At present, China’s petroleum financial service system has basically taken shape with characteristics of the energy industry.

SCHEME

Analysis on the Development Prospect of “Internet + Refined Oil Breakbulk Distribution” Business

The sale of refined oil is a transaction of bulk goods, the business is mainly between refineries and oil wholesale enterprises. It’s a B2B business model and cannot carry out BtoC business between large-scale refinery and end customers through the Internet. The main obstacle is that the issue of distribution and refilling cannot be solved between refinery and end customers. How to realize the breakbulk distribution of refined oil from refinery to end consumers is the key to solving the large-scale e-commerce breakbulk distribution of vehicle fuel.