Face Masks Become China’s New Market Sensation

Wang Jixing

China information Center of daily Chemical industry, China

Overview

Looking across the global skin care market, the face mask is probably one of the few categories where China dominates. Ever since becoming a market sensation nearly 10 years ago, face masks have grown remarkably quickly in China. China’s face mask market is growing at an impressive rate, according to global market intelligence agency Mintel. The face mask market in China is by far the largest market–valued at RMB 19.1 billion in 2017, up from RMB 18.1 billion in 2016, and representing 47.6% of the total global market. Figure 1 shows the market size of face mask by country in 2016. In comparison, the overall growth rate of China’s beauty and personal care market stood at 8% in 2017. The market share of face mask products accounted for 10.0% of the skincare products. The growing use of face masks in China is largely because of the item’s ability to offer consumers different skincare benefits in a convenient manner and short turnaround time.

Its research shows the market has had a compound annual growth rate (CAGR) of 29% in value between 2011 and 2017. Mintel estimates China’s face mask market will grow at a CAGR of 15.8% in value over the next five years and expects to reach RMB 31,746 million by 2021.

Figure 1. Face mask market size by country ($ Mil.), 2016

The mid-end products prices range from RMB 50 yuan to RMB 100 yuan and mid-to-high end products priced at RMB 100 yuan and over are the chief product segments, together making up 80% of the market share.

As yet, there does not seem to be any strong brand loyalty in the face masks category. Mintel’s research shows that there is similar interest to try out premium masks and new brands. Of female face mask buyers in urban China,54% spent RMB 30 or more a sheet in the six months to January 2017. Also, 52% had tried out new brands during the same period.

In China, sheet mask accounts for over 70% of the market, enjoying the biggest buyer base with faster growth, and masks with a long-lasting moisturizing /cooling effect are still in high demand among Chinese consumers. The popularity of sheet masks is attributable to the convenience, hydration function and product innovation in materials. At present, the face masks market worldwide is being primarily driven by increasing consumer demand for anti-ageing formula, which in turn is influencing the purchasing patterns of consumers. In the future, besides the traditional moisture & whitening products, consumers expect to pay for more targeted function masks to treat their specific skin conditions, such as pore refining, after-sun repair, etc.

The size of the face mask market in China increased over the years and proved that the mask has become more and more important in skincare market, China face mask market is relatively has entered the maturity stage. Figure 2 shows the market size of face mask in China from 2010 to 2017.

Figure 2. Market size of face masks in China, 2010~2017(RMB Bil.)

Competition increases

At the same time, the face mask brands are facing another problem: fierce competition. In only 2 years, there have been over 300 brands available in front of Chinese face mask users, which has been increased by about 4 times. With 300 competitors, it’s very difficult for the low level players to make a real profit. And the selection of the market will push more and more low competitive brands out of the market. However, the competition in other sectors in cosmetics market can easily dwarf that in face mask market.

Not only in quantity, but also in quality, the competitors are increasing. In fact, since 3 years ago, cosmetics tycoons have already turned attention to the players in face mask market. L’Oreal Group has purchased the leader MG and another brand “Carina Lau” has also been merged by digital domain on the last day of 2014. Meanwhile, there are also more and more brands get investment. With strong financial support, those brands can acquire more resources to push harder in the distribution channels and campaigns at a larger scale.

Chinese brands dominate the top face mask brands

Few years ago, most of the top beauty brands in China were Western brands. They have been losing ground,however, to their Asia-Pacific competitors. China’s local brands have been manufacturing high quality beauty products and marketed aggressively through media and Korean beauty brands has gained popularity with Hallyu(Korean Wave).

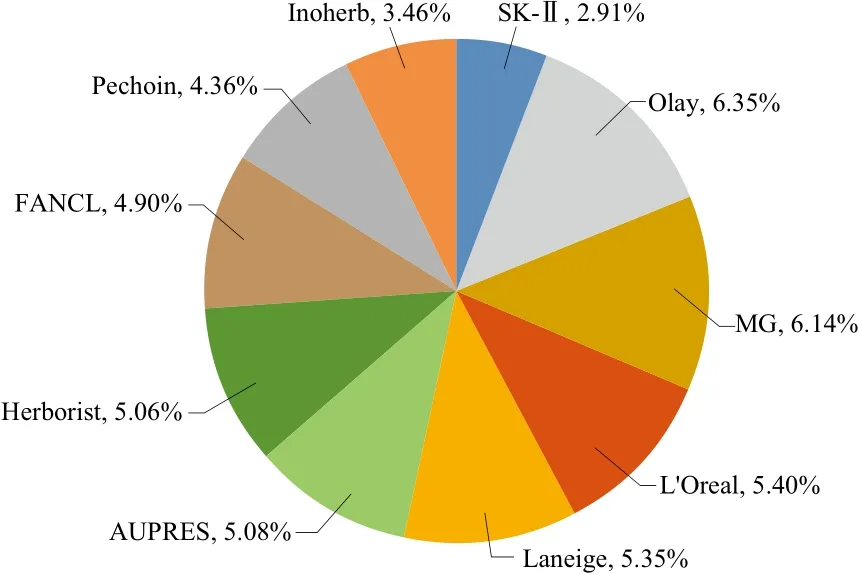

At present, there are two kinds of face masks brands:full range of cosmetics brands (i.e.Olay, L'Oreal, Fancl,Herborist; brands engaged in production of face mask (i.e.MG, My Beauty Diary, Cortry). Different brands choose to compete in different market segments according to their positioning and target consumer.

According to the China National Commercial Information Center, among the face mask sales of top ten brands,Olay brand achieved the highest sales of 6.35%, followed by MG (6.14%) and L'Oreal (5.4%) (Figure 3).

Figure 3. The market share of the top 10 face mask brands in China(%)

However, according to the Syntun data, One Leaf is the biggest online brand of face mask in 2017, about 7.1%.The second is Mask Family, about 6.8%(Figure 4).

Figure 4. The market share of the best selling face mask brands online in China (%)

From the above data shows that there is no monopoly brand leader in Chinese face mask market, and consumer brand loyalty is relatively low, and Chinese face mask market has more room for growth.

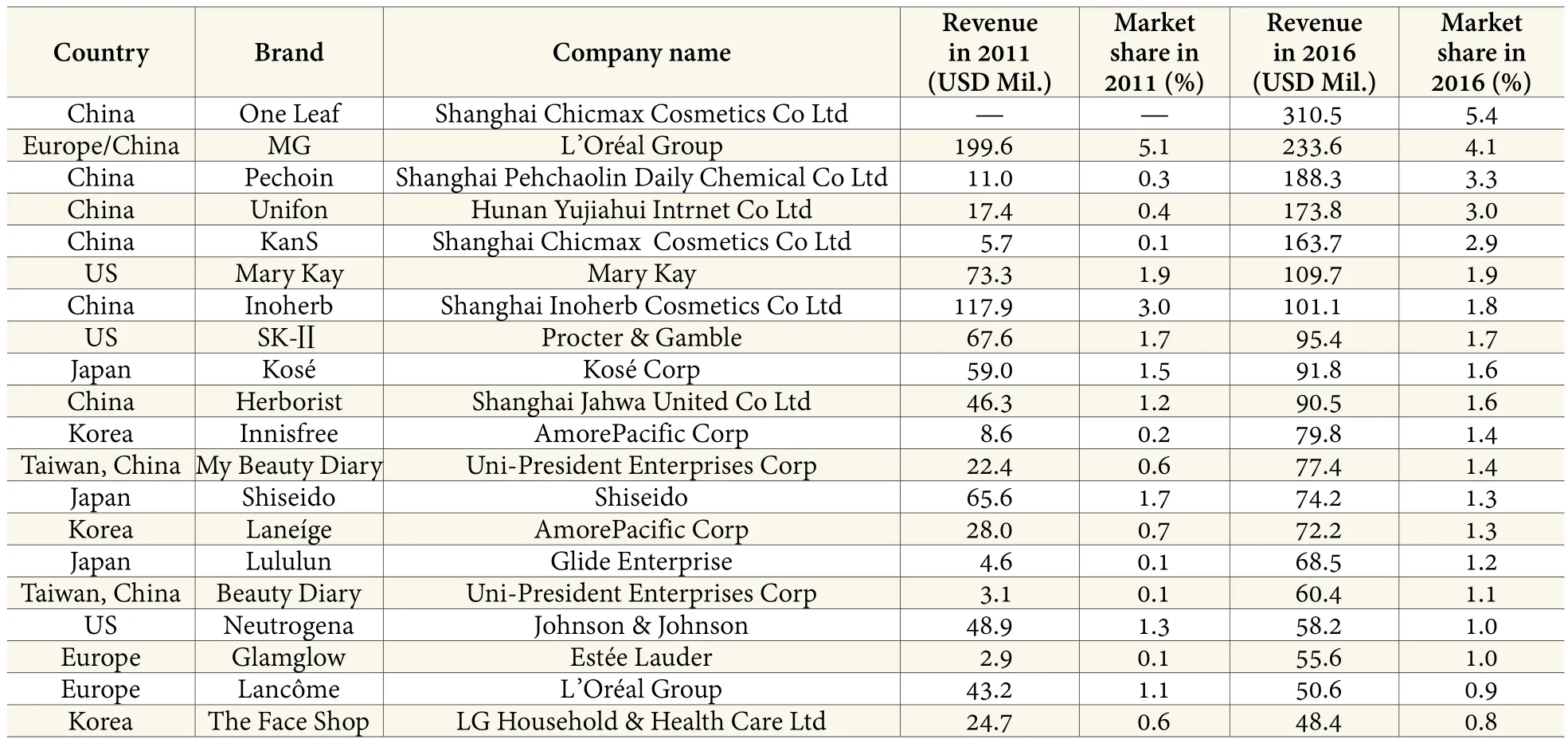

Table 1 shows the burgeoning growth and the success of Chinese brands in the face mask market from 2011 to 2017. The top-five brands excluding MG (acquired by L’Oréal), One Leaf, Unifon, KanS, and Pechoin–collectively had less than a 1% market share in 2011. These four brands saw rapid expansion in the five-year period from 2011 to 2017, capturing 17.6% share of the total market in 2017. The top brand, One Leaf, was started in 2014 and grew to generate revenues of more than US $300 million in 2016.

Apart from L’Oréal, international brands have failed to compete with emerging local Chinese brands that have grown to capture the majority of the market.

table 1. Market share and revenue of face mask brands in China

Marketing strategies of successful Chinese brands

Brands from China have been remarkably successful in capturing the opportunity in this product category. Part of their success can been attributable to their marketing strategies. In the following section, we analyze two case studies: One Leaf and My Beauty Diary.

One Leaf

The brand One Leaf, owned by Shanghai Chicmax Cosmetics Co, emerged in 2014 and reached US $310.5 million in sales, or a 7.1% market share in 2017, at the expense of Western and Japanese brands (Figure 5).The success of One Leaf can be primarily attributed to spending on TV commercials and sponsorship of popular reality shows.

Figure 5. Global market share of the top face mask brands (%), 2014~2016

According to 36Kr Media, a Chinese technology media company, the brand’s ad spending to promote its face masks reached over RMB 1 billion (US $150 million)during the two years between 2015 and 2016. Based on data from Euromonitor International, the ad spending over those two years translates into 28% of the brand’s revenues over the same period of time, which is a very high portion when compared to its peers. For example,Shiseido and Kosé Corp spend roughly 6%~7% of their revenues on advertising expenses for all beauty products.Given its substantial ad spend, One Leaf has become a prominent sponsor of popular reality shows and television series.

In addition, One Leaf integrated a reality show and e-commerce to promote its brand in China. JD.com and Alibaba, the largest e-commerce players in China,organized a one-day shopping festival on June 18, 2016. One Leaf leveraged the popular Chinese variety music show Come Sing With Me to promote its brand. Cooperating with Tmall, the leading e-commerce platform in China,consumers could interact with the show by shaking their phones to get a free trial of One Leaf face masks on that day. The brand gained popularity following the innovative marketing campaign. In 2016, One Leaf’s sales on Tmall surpassed US $45 million, and in 2017, one-day sales on June 18 reached US $4.5 million.

My Beauty Diary

In contrast with One Leaf’s tremendous ad spend and marketing effort, My Beauty Diary, owned by Uni-President Enterprises, has minimal ad spending or marketing budget.However, the brand has also experienced strong growth over the past decade, expanding its sales from US $7.2 million in 2007 to US $77.4 million in 2016 (Figure 6).

Figure 6. Sales and market share of My Beauty Daiary,2007~2016

The brand’s low-price strategy is the recipe behind its strong growth. Uni-President Enterprises saw that consumers wanted to wear masks more often, but as brands were mostly focusing on face masks at premium pricing, the choices for face masks for the mass market were limited. Therefore, the company developed face masks for the mass market at lower pricing, targeting the younger generation, aged 15~29.

Rather than using substantial ad spend to promote the brand, My Beauty Diary reaches its target customers through social media and video platforms. Millennials are attracted by the high-quality, low-price face masks and they share the products among their friends and on social media.According to Mintel, some of the strongest motivations for users to try new products include good word of mouth and natural ingredients. My Beauty Diary’s high-quality,low-price offering has allowed it to promote the brand to its target customers without incurring substantial ad spend costs, which has helped it to grow market share significantly in the face mask market.

Beauty brands search for novel natural ingredients with unique skin care functions for new product development.My Beauty Diary applied Tahitian pearl– which contains vitamins, minerals and amino acid to improve skin tone–in one of its new face mask products. The face mask launch was a great success, achieving total sales of 120 million packets over the four years to 2016.

Consumers are becoming professional

53% of Chinese females agree that face masks are the best first-aid skincare products. Face masks popularity is not limited to specific ages. There are 95% women tier 1-2 cities are using face masks. Kantar Worldpanel Usage reports a steady increase of mask penetration in all generations.Across the top 27 cities in China, 79% of women aged 20~50 use masks every week, indicating mask wide acceptance.But young females remain still the main consumers–over the last two years, mask increased its penetration by 3.3 points amongst females aged 20~35, with weekly usage penetration growing from 16% to 19%. This important demographic group represents 67% of the mask users.

More than half Chinese girls living in cities are used to face mask. And they are not loyal to one brand; in fact, they are very open to new brands. Thus, the number of brands in the market has increased from 70 to 300 in only 2 years.

Consumers are always dazzled by endless array of face mask brands. After trying many times, they are becoming more professional and on the other side, primitive promotion methods such as discount bombarding is facing a big problem of low efficiency.

Mintel findings show that income has not stopped urban Chinese women from using face masks, as research shows there is no significant difference in the use of sheet masks across income levels, income has limited consumers’pursuit of niche types of face masks as high earners are more likely to use a greater variety of the product.

According to Mintel, females in China, today, are increasingly accepting of the idea of premium face masks,as Mintel research reveals just over half (54%) of female face mask users surveyed in urban China have purchased a face mask priced RMB 30 or above (per sheet) in the six months to January 2017. Additionally, a similar proportion (52%) of these face masks consumers have tried out new brands during the same time period.

In 2016, the proportion of face mask online sales within RMB 50 yuan decreased to 18.1%, and the sales proportion of mask sales of RMB 50~200 yuan reached 69.0% (Figure 7).

Figure 7. Online price distribution of face mask (%)

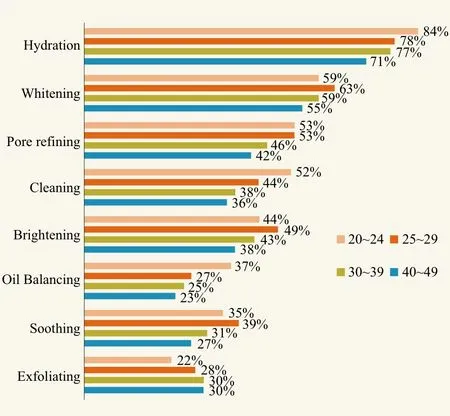

Among the younger generation, healthy, radiant skin that glows has become the new definition of beauty. This derives brightening and whitening claims (Figure 8).

Figure 8. Different needs for face masks of people at different age in China

Men’s face mask market has unlimited potential

In today’s modern and equal societies, beauty is no longer only meant for women. There’s a gold rush for men among brands in China. An increasing number of Chinese men become more aware about how they could be in line with their ideal appearances. In this context, with the aim of enhancing and maintaining desirable looks, men tend to be no longer hesitating to strategically select and utilize cosmetics. The male’s cosmetics sector exhibits strong growth, in particular skincare products for men.

In recent years, the proportion of men’s investment in skincare consumption has increased year by year, with data showing that men spend 25% of their consumption on skin-whitening products in 2016.

In China, male consumers born in the 1990s are the driving force behind the countries male beauty market and are considered just as important as their female counterparts. Much like consumers in the West, they’ve grown up with the internet, social media and consider their appearance just as important as indulgences such as designer clothes, luxury travel, and technology.

China’s male face skincare market is expected to garner over RMB 11.498 billion yuan by 2020, with a CAGR of 9.6% between 2015 and 2020, according to a Mintel Research report.

At present, many Chinese young men are very keen to apply face masks after shaving. The survey finds that Chinese male consumers have a growing awareness about skincare products and benefit-based product segmentation. Products respondents use regularly or on as-required basis include face mask (28%), sunscreen /sunblock (19%), and lip balm (16%) (Figure 9).

Figure 9. Male skincare products used on as-required basis

Despite there is an increasing demand for skin care by men, most brands didn’t pay enough attention to this market.

In addition to the big three for men–L 'Oreal, Nevia and Mentholatum, there are only a few men’s skin care brands to offer mask exclusively dedicated to men, such as Gf and JVR.

The trends

Mintel estimates China’s face mask segment to grow at a CAGR of 15.8% in value over the next five years,reaching RMB 27,900 million yuan by 2021(Figure 10).

Figure 10. Forecast retail sales of China face mask market(RMB Bil.), 2018~2023

1) In the next few years, China’s face mask market will continue to growth at a fast speed. The low unit price and immediate hydration have made face masks an essential beauty routine for most Chinese women. Considering the high levels of usage, the next step in market development will be product premiumisation and product extension.

2) As the maturity of the Chinese mask market,people demand for comfort and efficacy of the mask improves continuingly. In the future, the mask market is further branching out, and getting more sophisticated.More body specific masks for the chest, arms and breasts are expected. Trending masks will target specific problem solution needs as well as ageing issues.

There is room for sheet/mask face care brands to offer more premium innovations that are focused on multiple benefits (e.g. anti-ageing, anti-acne), using standout and unique ingredients and novel colors and designs.

3) The face mask market for male is booming. Along with increasing female users, there is also a rise in male grooming. This in turn is forcing manufacturers to develop and innovate more products with promotional offers in order to satisfy male consumer demands.

New brand development of male face mask market is also a wise choice. As the female market grows saturated,the luxury industry is looking to affluent men for growth.The male population has also been gaining a major share of the face masks market worldwide, apart from female population. Male consumers are paying greater attention to their skin and have also become beauty conscious.

4) As the face mask sector becomes more segmented,new products are more specific in terms of application occasions and target groups, in an attempt to differentiate themselves from the others.

5) Along with various claims, the substrates are also starting to diversify in terms of material sources,structures and shapes. Silk mask and bio-cellulose mask will become mainstream.

Bio-cellulose mask fabrics provide skin-tight dermal adhesion, allowing them to transfer cosmetic ingredients very efficiently. The texture of a bio-cellulose mask feels like a cool, moist gel but its underlying structure is incredibly strong and resilient. Bio-cellulose masks do not dry out during application.

During the forecast period, bio- cellulose sheet face masks are expected to show highest growth due to the increasing awareness about the usage of chemical free and organic products. This is followed by hydrogel sheet masks which give multiple benefits to users such as hydration,whitening, and glow. Manufacturers are focusing on developing these products at cost competitive costs.

Such new substrates can not only facilitate brands’environmentally-friendly and sustainable positioning,but also offer tangible skin care benefits by carrying more lotions, and therefore more actives, to the skin in comparison to synthetic or cotton-based nonwovens. And more actives usually enhance the user’s experience. But substrates can impart a feel-good factor. For example,ultra-thin light and transparent sheets can deliver a feeling of comfort even as they fit tightly to the contours of the face.

From bio-cellulose to silk, collagen gel and cotton lace,the Chinese market is innovating fast. Design has become the best way to create differences among competitors;such as 3D masks with a parted line in the center in order to create face volume.

6) Medium- and high-end face masks dominate the market. It is a consumption trend to buy decent, highquality and differentiated products currently. Consumers,especially high income earners, have shown their appetite for high-end products.

China Detergent & Cosmetics2018年2期

China Detergent & Cosmetics2018年2期

- China Detergent & Cosmetics的其它文章

- New Chinese Laundry Pods Standard to Launch

- L’Oréal Tops Most Valuable Personal Care brand List

- Alibaba Encourages Canadian SME Growth in China

- Meet Our New Editorial Board Member:Richard Leroux

- Sensory Evaluation of Hydroxy Ethyl Cellulose (HEC) in Facial Mask

- Beiersdorf Grows E-commerce Presence in China