Review on the Development of the Surfactant Industry in China During the “12th Five-year Plan” Period

Zhao Yongjie

China Information Center of Daily Chemical Industry

Overview

2011~2015 was the five-year period of rapid development of the surfactant industry in China, during this period,industrial project construction, industrial integration,technological innovation and product upgrading were scaled up. Based on incomplete statistics, during the “12thFive-year Plan” period, the annual compound growth rate of the surfactant market capacity in China was up to 3.5%.By 2015, the apparent consumption of domestic market exceeded 4.1 million tons, where there were hundreds of product categories. Particularly, there were fundamental changes in the natural oil derived green surfactant product market proportion and variety structure. For example,it was alleged that the proportion of products made of natural green raw materials was more than 50% of the detergent market. There was significant progress in the substitution of traditional risk products in the industrial aid field. Particularly, historic breakthroughs was made in the substitution of traditional alkyl quaternary ammonium salt with esterquat in softeners and substitution of alkylphenol ether with special ethoxylate in textile chemicals.

On the whole, during the “12thFive-year Plan” period,market supply was saturated in the surfactant industry in China, massive over-capacity and unreasonable structures of some products were observed, and upgrading from quantity to quality should be further increased; particularly,solution of high-added-value product development and traditional product application potential development was to be improved. “Product structure adjustment and industrial reform & innovation” would become the main development direction of surfactant industry during the“13thFive-year Plan” period.

Production and market

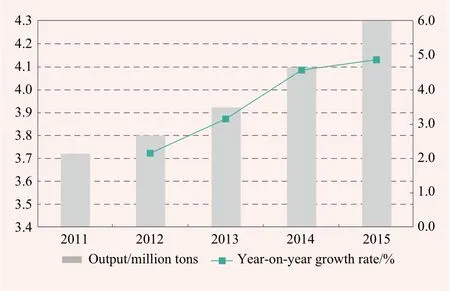

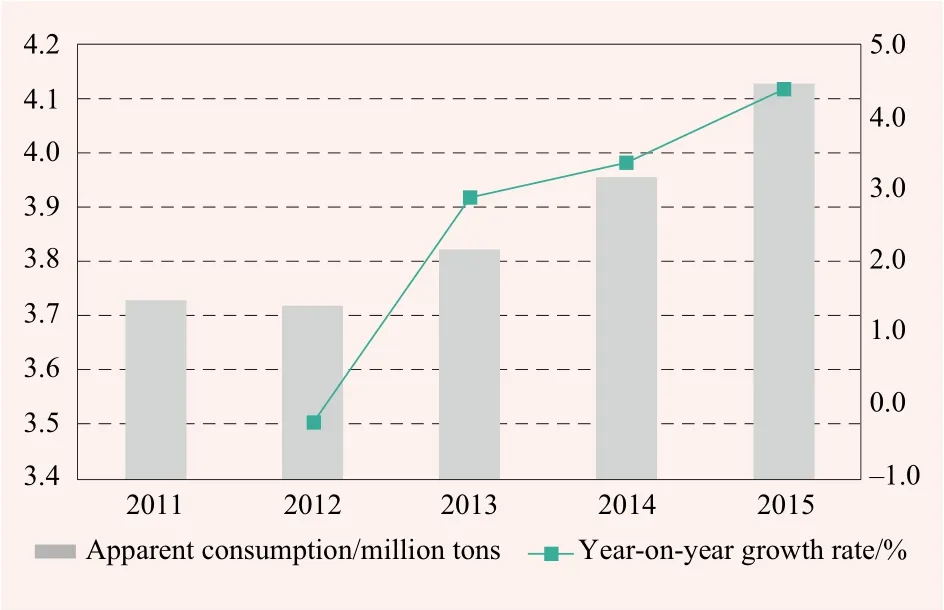

Table 1, Figure 1 and Figure 2 separately show the statistics of Chinese surfactant output, net import volume and market apparent consumption in 2011~2015. With respect to output, the total growth rate in the five years increased by 15%, domestic surfactant output in 2014 exceeded 4 million tons for the first time, while domestic surfactant output in 2015 was even up to 4.3 million tons.During this period, China appeared as an exporter for the first time, with net export volume of 140,000~170,000 tons in the past two years. With respect to the market,apparent market consumption of major surfactants in 2015 was up to 4.12 million tons, with an increase of 10.75% when compared to that in 2011, which was 3.72 million tons.

Table 1. Production and market statistics of Chinese surfactant

During the “12thFive-year Plan” period, the product structure of domestic surfactant industry was still mainly anionic and non-ionic, with total output proportion of more than 85%, while the cationic and other zwitterionic product market proportion was small, less than 15%. The rigid demand of detergents in China revived the industry development during the “12thFive-year Plan” period, while the single product structure limited rapid development of detergent industry; particularly, high-added-value and concentrated detergents were developing slowly.

Based on the product structure, during the “12thFive-year Plan” period, AES, fatty alcohol ether, functional non-ionic products and zwitterionic products were developing rapidly. The output of AES was increased by 64.7% (nearly 300,000 tons); the output of fatty alcohol ether was increased by 31.9% (145,000 tons); the output of other functional non-ionic products (APG,alkanolamide, fatty amine ether and glycerin fatty acid ester) was increased by 93.18%, mainly contributed by APG; the output of zwitterionic and other ionic products was increased by 26.2%. In contrast, the output of alkylphenol ether and alkyl quaternary ammonium salt was slightly reduced; the growth of traditional products represented by alkyl benzene sulfonic acid was steady.

Figure 1. Output statistics of surfactant in China, 2011-2015

Figure 2. Apparent consumption statistics of surfactantt in China, 2011-2015

Figure 3 and Figure 4 show the structural changes in the output structure of major surfactants in China in 2011 and 2015 respectively. The large-scale construction of ethoxylated and sulfonated devices promoted substantial growth of major anionic and non-ionic product output during the “12thFive-year Plan” period; the development of industrial aid substitutes and the growth of demand for functional high-added-value products brought vigor and vitality for zwitterionic and other ionic products. The output of soap products was negatively increased, but still occupying a considerable proportion in the whole industry.

LAS/tons 722,000 846,000171,700

Figure 3. Various surfactant products in China,2011

Figure 4. Various surfactant products in China,2015

Technology and equipment

Chinese surfactant project construction and technology development during the “12thFive-year Plan” period centered on the ethoxylated and sulfonated devices,and some modified alkyl quaternary ammonium salts and functional zwitterionic products were put into industrialized production. With respect to the equipment, during the “12thFive-year Plan” period,the total construction scale of sulfonated products was 153.5 t/h, output of converted LAS was up to 1.1 million t/year, and total construction scale of typical non-ionic ethoxylated devices was up to 2 million t/year, mainly alcohol ethoxylate. In addition, some emerging surfactant projects including APG and esterquat achieved single-set device construction at a scale of 5000 t/year.

Table 3 shows domestic construction of sulfonated,ethoxylated, aminated and APG devices during the“12thFive-year Plan” period. There were more than 36 sets of representative sulfonated devices at the scale of more than 3.0 t/h, and there were 24 sets of ethoxylated devices in new projects, with total capacity of more than 2 million t/year. The total new device construction scale and speed were beyond the development of 30 years before 2011.

The furious burst of construction of major surfactant devices during the “12thFive-year Plan” period brought some problems to the industry, e.g. massive over-capacity of traditional devices,and low annual average operation rate. Some devices became decorations from the start of construction. Unchecked construction was prominent in the industry. Competition between enterprises and market pressure were increased. The profit of major products was in the downward trend. Although the development of AES and AEO made certain achievements, the single daily product structure and low added-value became the main bottlenecks of industrial development.

New product development and application

New product development and industrialized production was the highlight of domestic surfactant industry development during the “12thFive-year Plan” period.Based on incomplete statistics, during the five-year period from 2011 to 2015, there were more than 20 varieties of new surfactants developed and put into production in China,where APG, FMEE, MES, modified alkyl quaternary ammonium salt, esterquat and ethoxylated AEC were most representative.

APG

The domestic early technological development of APG was derived from the key projects of China Research Institute of Daily Chemical Industry during the “8thFiveyear Plan” period and the “9thFive-year Plan” period.Such technology could complete with high-quality product industrialized production by the “one-step method”, with high cost advantage, stable product quality and excellent performance, which could be applied in the industrial and household fields, where the products covered the series products of different carbon chains such as single-carbon or mixed-carbon chains. At the end of the “11thFive-year Plan” period and in the middle of“12thFive-year Plan” period, Shanghai Fine Chemical Co.,Ltd., successfully completed the 15,000 t and subsequently 10,000 t expansion project by virtue of the APG technology of China Research Institute of Daily Chemical Industry,which was successfully put into operation. At present, the products are sold at home and abroad, and the company has become the domestic leading APG supplier.

Next, in 2013~2015, more than 10 domestic enterprises completed the APG project construction by means of technology copy or independent development, with the total capacity of 100,000 t, and at the end of the “12thFive-year Plan” period, the output was up to 70,000 t. At present, the domestic APG industry encounters shortterm over-capacity. The products of different qualities flood the market, causing significant pressure on profit of APG enterprises, market price of major products was decreased from RMB 40,000~50,000/t initially to RMB 15,000/t presently, and the benefit of products per ton was reduced by RMB 20,000~30,000 yuan.

Based on the current international market, the development of APG has huge potential, the downstream application market development and the compatibility technology upgrading have become an effective impetus to promote the sustainable stable growth of APG, and the dealcoholization and bleaching matching technologies will effectively improve the product quality and indicators at present, meeting the high-indicator demand of the cosmetic and other fields. On the whole, APG was a new product of rapid development and mature industrialization during the “12thFive-year Plan” period.

Modified quaternary ammonium cations

Traditional cationic surfactant substitute development &research was the highlight of industry development during the “12thFive-year Plan” period; particularly, historic breakthroughs were made in the development of series products such as esterquat and modified alkyl quaternary ammonium salt. Based on incomplete statistics, during the 12thFive-year Plan” period, Solvay (Zhangjiagang) Fine Chemical Co., Ltd., and Akzo Nobel (Boxing) China Resources Co. Ltd., completed construction of esterquat products at a scale of more than 45,000 t/year. By 2015,the domestic sales volume of esterquat cationic products exceeded 25,000 t, with gradually increasing proportion in the new textile softener and bactericide fields, which, in the long run, would have huge potential, reaching market demand of more than 300,000 t in the future.

Modified alkyl quaternary ammonium salt was another highlight of cationic surfactant development during the “12thFive-year Plan” period, represented by hydroxyethyl alkyl quaternary ammonium salt and dialkyl hydroxyethyl quaternary ammonium salt developed by China Research Institute of Daily Chemical Industry.Compared to traditional alkyl quaternary ammonium salt, such products have such advantages as excellent bactericidal performance, enriched compatibility condition, wide application area and good water solubility. As an important branch of sci-tech key projects of China Research Institute of Daily Chemical Industry during the “12thFive-year Plan” period, such products have achieved hundred-ton scale production, applied in current detergent, bactericidal hand washing and oilfield exploitation fields.

Ethoxylated product upgrading and improvement

X-10 is currently recognized as a surfactant product with excellent detergency and permeability, but it is also an environmental hormone product, and residue in clothing or exposure will cause harm to human bodies and environmental organisms; therefore, development of substitutes has become the key of striving to make technological breakthrough in the ethoxylated products,at present. During the “12thFive-year Plan” period,historic breakthroughs were made in the development of alkylphenol ether series substitutes, including fatty alcohol polyether with narrow range distribution (FAPNRD),isometric alcohol ethoxylate, FMEE and modified oil ethoxylate, which could be used in the surfactant products in the household and industrial fields for industrialized production. Product quality and performance could reach or exceed the traditional product requirements.

During the “12thFive-year Plan” period, isometric alcohol ethoxylate was put into production by virtue of the 60,000 t/year device of Yangzi River-BASF. At present,the large-scale production of C11/C13 isometric alcohol ethoxylate has been achieved, with annual output of about 30,000~40,000 t. In addition, some large-scale ethoxylated devices in China are used to complete the production of isometric alcohol ethoxylate by processing with supplied materials or OEM. At present, the biggest problem with such series products is that the raw material isometric alcohol is basically monopolized by foreign companies at a high market price, so that the popularization and usage in numerous fields are restricted.

FAPNRD is another important branch of sci-tech key projects of China Research Institute of Daily Chemical Industry during the “12thFive-year Plan” period. At present, the catalyst development and the 10,000 t industrialized production have been completed. This technology allows the free fatty alcohol residue of products to be reduced by 7%~10% when compared to the traditional base catalysis technique, where the high-EO polymerization products are significantly reduced and the active matter content of target products are increased,which can effectively improve the technical indicator of downstream sulfonated products, as shown in Table 4.

Figure 4. FAPNRD

FMEE is prepared by the inserted ethoxylated reaction of fatty acid methyl ester with ethylene oxide in the presence of specific catalyst. This product has a series of advantages such as good viscosity reduction effect, quick water solubility, low foaming, small gel phase area, good permeability, strong oil hydrotropy, easy rinsing and good biodegradation. As a substitute of traditional alkylphenol ether, it has huge market potential. Products of Horseman,Lion and Pemex Chemicals have appeared in the domestic market. Sinolight Surfactants Technology Co., Ltd., has completed a 10,000 t industrialized project in Jinshan,Shanghai by virtue of the sci-tech key project technology of China Research Institute of Daily Chemical Industry during the “11thFive-year Plan” period and the “12thFiveyear Plan” period, where the product quality is stable and the catalyst has independent intellectual property rights.

MES

The technological development of MES has been more than 2 decades, but the real industrialized production started from the beginning of the “12thFive-year Plan”period, where the 38,000 t/year device of Guangzhou Keylink Chemical Co., Ltd., and the 30,000 t/year device of Zhejiang Zanyu Technology Group Co., Ltd.,are representatives. The two devices are equipped with product drying systems with proprietary intellectual property rights, which can satisfy the demands of different types of detergents such as laundry powder and liquid detergent for raw materials. Most of other domestic products are liquid, without drying equipment, with active matter content of 30%~70%, mainly used in liquid detergent and some industrial fields.

MES, as a anionic product with low cost and rich raw material source, has revived the domestic detergent industry. However, the product quality and compatibility system should be upgraded. Particularly, detergent stability after compatibility, reduction of detergency caused by too high disodium salt content and other problems should be further solved. In addition, the actual formation development and water solubility of MES should be further improved.

AEC

AEC is a mild, safe and easily biodegradable multifunctional anionic and nonionic compound surfactant.Similar to the structure of soap, due to the ethyoxyl contained in the molecule, it has excellent hard water resistance and strong calcium soap dispersancy; it also has excellent compatibility performance, able to compounded with anionic and cationic surfactants.

Compared to the AEC in the traditional chloroacetic acid preparation, ethoxylated AEC does not contain any chloroacetic acid product harmful to a human body in the technological process, stable in product performance,safe and excellent in biodegradation, which is a very important anionic surfactant with high added-value and wide application prospects. Preparation of AEC catalyst by ethoxylation is of importance, where palladium composite metal loaded activated carbon efficient catalyst is used. Such catalyst has been developed by China Research Institute of Daily Chemical Industry for completely independent proprietary intellectual property rights, which has also been put into the 1000t scale trial production in Shanghai Fine Chemical Co., Ltd., with good market feedback.

Influencing factors

Favorable factors

Industrial policy support will actively promote industrial development. Among fine chemicals, green surfactant is the industry supported by national industrial policy. In the Industrial structure adjustment Guidance Catalog (2005) promulgated by National Development and Reform Commission, surfactant is a specialized fine chemical, included in the industry encouraged for development. In the Outline of Chemical Industry Scientific and Technological Development during the “12thFive-year Plan” Period developed by China Petroleum and Chemical Industry Federation, the fine chemical industry is listed as one of the top priority industries, while surfactants are listed as the key point of technological development industrialization in the fine chemical industry.

Downstream industry demand growth and structure optimization are beneficial to the surfactant demand growth and structure optimization. Surfactants are mainly used in detergents, cosmetics, personal care products, textiles and food industries, downstream industry development which will directly affect the surfactant industry. Based on the development trend in recent years, the downstream industry plays an active promotion role for the surfactant industry growth in the total volume and structure. On one hand, along with economic development and the economic growth mode transformation, surfactant downstream industries as a consumable industry has been continuously growing rapidly, with a constant increase in the demand for surfactants, promoting market capacity expansion of the surfactant industry; on the other hand, along with the improvement of people’s living standards and constant enhancement of environmental and health awareness,the requirements of surfactant downstream industry for product safety, environmental performance and nontoxicity and harmlessness have been constantly increasing,with higher requirements for surfactant production enterprises, promoting the surfactant industry to make product innovation and technological improvements in a timely manner, satisfying the demands of consumer safety, environmental protection and individualization,thus promoting the product structure optimization of the industry.

Fluctuation of raw material prices in the upstream industry also promotes product updating and structure optimization of the surfactant industry. In recent years,the global bulk commodity price has been sharply increased, where there is large fluctuation in the main raw material prices of surfactants such as petroleum and natural oil. While causing cost pressure to the industry,the fluctuation in raw material prices also promotes the improvement of surfactant industry from different points of view. On one hand, the sharp increase in the prices of petroleum and other non-renewable resources causes the traditional surfactants made of alkylbenzene and other petroleum derived chemicals (e.g. LAS) to gradually lose their original price advantage, while the industrialized advantage of green surfactants made of natural oils (e.g.AES and MES) is increasingly apparent. On the other hand, increase in the raw material prices also causes the profit space of numerous small- and mediumsized enterprises, originally without core technology and requisite production conditions, but with low price and low quality to impact the market to be seriously squeezed, while the specialized and scale advantages of few enterprises with advanced equipment, complete process and excellent management are given into full play. This promoted the survival of the fittest and the merger integration in the industry, further increasing market concentration and improving the environment of competition.

Adverse factors

Pressure of rise in raw material and energy prices. The main raw materials required by surfactant production include fatty alcohol, fatty amine, fatty acid and alkylbenzenes, the price of which is largely affected by natural oil and petroleum prices. In recent years,along with the constantly strained relation of supply and demand of global non-renewable energy resources,the petroleum price has been sharply increased and continuously fluctuated. However, natural oil is a renewable energy resource, and long-term planting area expansion, unit output increase and oil chemical industry technology improvement will also increase the supply,but due to the stimulation of petroleum substitution effect, biofuel and other demands, there is significant increase and fluctuation in short-term prices. Therefore,there is a sharp increase in main raw material prices of surfactants, bringing certain cost pressure to surfactant production enterprises, particularly enterprises focusing on production of petroleum-based surfactants.

Environment of competition in the industry should be improved, and the technological level should be also improved. At present, there are more than 2000 enterprises engaging in the surfactant related business;however, most of the enterprises have small scale and low technological level, replying on low-quality and lowprice products to impact the market, and there are few enterprises with scale and technology advantages, without high market shares. The above situation is adverse for the whole industry to increase production efficiency,reduce production cost, reduce energy consumption and pollution, and increase the profit level by reasonably expanding production scale, and is also adverse to the industrialized popularization of new surfactants with high requirements for technological levels and with comprehensive advantages. In the future, the advantage enterprises will utilize specialized and scale advantages to constantly become better and stronger and significantly increase market shares, and comprehensive competition strength in R&D, production and sales will be more fully reflected, thus increasing the technological level and profitability of the whole industry.

Downstream industry is in the face of fierce competition and high cost transfer pressure. The main downstream industry of surfactants includes detergents, cosmetics,textiles and food industries, most of which belong to the daily consumable industry with fierce competition. In the case of rapid capacity expansion and small product differences, price competition between products of different grades is the main competition means; therefore,cost control is the important focus of numerous daily consumable enterprises, which will transfer the cost pressure of downstream products to the surfactant industry of such enterprises to some extent. However,along with the increasing concentration of downstream industry and the diversified choice orientation of consumers,the consumers will pay more and more attention to the product quality, environmental protection and other properties, and the negotiable price of famous brand products will also be significantly increased. Benefiting from this, the surfactant advantage enterprises serving the famous consumable brand enterprises will have more flexible space in the cost transfer pressure.

China Detergent & Cosmetics2018年2期

China Detergent & Cosmetics2018年2期

- China Detergent & Cosmetics的其它文章

- New Chinese Laundry Pods Standard to Launch

- L’Oréal Tops Most Valuable Personal Care brand List

- Alibaba Encourages Canadian SME Growth in China

- Meet Our New Editorial Board Member:Richard Leroux

- Sensory Evaluation of Hydroxy Ethyl Cellulose (HEC) in Facial Mask

- Beiersdorf Grows E-commerce Presence in China