Government governance,executive networks and enterprise R&D Expenditure

Xin Jin,Gungyong Lei,Junli Yu

aCollege of Business and Administration,Zhejiang University of Technology,China

bBusiness School,University of International Business and Economics,China

cLixin Accounting Research Institute,Shanghai Lixin University of Commerce,China

Government governance,executive networks and enterprise R&D Expenditure

Xin Jina,Guangyong Leib,Junli Yuc,*

aCollege of Business and Administration,Zhejiang University of Technology,China

bBusiness School,University of International Business and Economics,China

cLixin Accounting Research Institute,Shanghai Lixin University of Commerce,China

A R T I C L EI N F O

Article history:

Accepted 11 September 2015

JEL classification:

G39

M41

Government governance

Executive networks

R&D investment

State-owned enterprises

The increasingly competitive market environment makes independent innovation the core of the enterprise's and evens the country's competitiveness.In order to solve the problem of its own limited R&D resources,firms need to find access to outside resources.Since the government mainly provides policy and financial support,the information diffusion and learning effects of executive networks can effectively compensate for the shortage of formal institutional arrangements.In view of this,we manually collect data on R&D expenditures and executive networks having common management members in China A-share listed companies from 2007 to 2010.Combined with corporate governance and government governance data,this paper empirically tests the influence of government governance and executive networks on enterprise innovation.The empirical results reveal that the governance efficiency of the government where the enterprise is located determines the efficiency of resource allocation firms are faced with,which provides institutional constraints on corporate R&D intensity,and that the establishment and scale of executive networks do contribute to R&D decisions.Further testing shows that compared with non-state-owned enterprises,state-owned enterprises are faced with relatively weaker restraints and pressures in terms of policy,finance,technology and competition.Thus,they show no obvious reliance on government governance quality and the information diffusion of executive networks.The findings of this study help us to understand the role of informal systems in social economics,such as relationship networks and social capital,in the context of China's economic development,and provide relevant evidence and enrich macro and micro studies of‘‘government and market”and‘‘market and enterprise”relationships.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Enterprise R&D activities enable them to make innovations in products,technologies and procedures,which determine companies'competitive advantages and growth in the future(Scherer,1984;Ettlie,1998). The process of innovation not only promotes technological progress,but also becomes the main impetus of endogenous economic growth.In spite of China's economy growing miraculously,the sustainability of economic growth is still worrying;therefore,it is imperative to transfer the mode of economic growth,and encourage independent innovation by enterprises.As a result,the state has put forward the strategic objective of building an innovation-oriented country,1July 1,2008,the new revision of

According to the‘‘China Statistical Yearbook on Science and Technology”,from 1995 to 2009,the average annual growth rate of national R&D expenditures was up to 20.12%,much higher than GDP growth over the same period and showing an upward trend.The statistical report of the Ministry of Science and Technology in 20112http://www.sts.org.cn/sjkl/kjtjdt/data2011/science and technology statistical data 2011.pdf.also shows that,71.7%of R&D funds in 2010 are derived from enterprises,and 73.4%of R&D operating departments are also in enterprises.But the Global Competitiveness Report(2011-2012)reveals that the firm-level technology absorption capacity of Chinese mainland enterprises ranks only 61st3World Economic Forum,2011,The Global Competitiveness Report 2011-2012,pp.491.in 142 countries and regions,indicating that the technological innovation of Chinese mainland enterprises is still not competitive on a global scale.This mismatch of inputs and outputs is subject to the country's overall level of technology development,government investment intensity and selection of investment objects.It is also influenced by their own resource constraints and strategic decisions.

Meanwhile,enterprises have to confront increasingly intense global competition in the new economic environment characterized by knowledge and information.On the one hand,in order to maintain continual motivation to develop and endure competitive strength in an increasingly keen competitive environment,most enterprises have deeply realized that independent innovation is their impulsion for survival and development.On the other hand,with the current guidance to build an innovation-oriented country,a series of preferential policies and security mechanisms to avoid R&D risk have stimulated enterprises'enthusiasm to innovation.Under both internal and external stimulus,innovation undoubtedly becomes the driving force of firms'development and progress,while investment in R&D is inevitably an important corporate expenditure.

‘‘Fiscal Federalism”in China's transition process and performance-driven‘‘Official Promotion System”,strongly stimulate local government to progress economic development.The differences in historical conditions and natural resource endowments result in diverse institutional constraints on economic development and in government efficiency in different areas.Under the pressure of horizontal competition,local government essentially becomes the regulating subject for the regional economy,playing the role of quasi-market subject,and directly or indirectly joining in enterprises'operating activities.Therefore,governance as a formal arrangement can be either the supporter of the sustainable development of enterprises,or the taker of corporate value.That is,efficiency of governance is often an important factor influencing thedegree of government intervention in enterprises'activities.Insufficient government investment enforces enterprises to actively apply the limited resources supplied by the formal institutional arrangement,while at the same time actively seeking informal institutional arrangements(such as networking)for themselves to obtain actual or potential resources(Nahapiet and Ghoshal,1998).

Wang(2005)considers that social networks play a prominent role in social operations and resource allocation in China.For enterprises,social networks include not only the financial and family relations among management members and their common social relations(Hwang and Kim,2009),but also political relations between top management and government officials(Fan et al.,2007).These networks provide more opportunities for enterprises'development and growth,which reduces the transaction costs of enterprises in the development process and information asymmetry,as well as increasing the channels for enterprises to obtain more resources by expanding social networks and avoiding the irregular behavior of industry and local government.To sum up,research and development investment decisions are usually the result of formal institutional arrangements under the background of government intervention and informal institutional arrangements embedded in enterprise social networks.

We manually collect data on R&D expenditure and the size of commercial networks constituted by common members of management in listed companies from 2007 to 2010.Combined with firm financial and governance data and an index of government governance,this paper examines the impact of government governance on R&D expenditure as a formal institutional arrangement and explores the mechanism of executive networks as an informal arrangement.

The contributions of this paper are as follows:first,it enriches the existing literature on the internal motivation of enterprise innovation and tests whether informal institutional arrangements and formal institutional arrangements interact with each other in R&D activities;second,from the micro and macro perspectives,this paper examines whether informal institutional arrangements(social network),an effective complementary mechanism for imperfect market systems,help companies acquire technical resources,promote the upgrade of their core value,and thus encourage macroeconomic growth and improve the competitive strength of national science and technology;third,it emphasizes that in the transitioning Chinese market,the absence of paths and mechanisms to obtain resources with formal institutional arrangements makes firms utilize social capital embedded in business networks as a sub-optimal choice.

The remainders of this paper are organized as following:theory and research questions are outlined in Section 2;research design is in Section 3;data analysis and discussion of the empirical results is in Section 4;conclusions are in Section 5.

2.Theory and research questions

Recent research on R&D investment covers two aspects-influence factors and economic effects. Influencing factors contain market and industry characteristics(Rogers,2002;An et al.,2006;Zhu,2006),equity nature and structure(Hill and Snell,1988;Baysinger et al.,1991;Wahal and McConnell,2000),and corporate financial variables(Baysinger et al.,1991;Bhagat and Welch,1995).Economic effects include enterprise growth(Mansfield,1962;Mowery,1983),productivity and performance(Griliches,1986;Wu,2006).However,these studies pay little attention to enterprise R&D activities and their influencing factors from the perspective of institutional arrangements.This paper covers the perspectives of governance,executive networks,and their interaction with each other and enterprise heterogeneity.

2.1.Policy resources for R&D-government governance

Many studies(La Porta et al.,1999;Easterly,2001;Acemoglu et al.,2001,2002;Easterly and Levine,2003;Rodrik et al.,2004;Rose-Ackerman and Kornai,2004)indicate that governance and its efficiency have an important influence on economic growth and social development.Easterly(2001)even states that in a variety of institutional factors affecting economic growth,governance plays a vital role.Government incompetence,corruption,inefficiency and lack of reactive capacity are fatal for economic growth.

A major feature of the Chinese transition economy is that large numbers of resources are still controlled by the government.The government can intervene in company activities through policies and administrativeinstructions.Sometimes the interventions can be distorted,delayed and even corrupted(Mauro,1995;Treisman,2000).In the process of economic transformation,‘federalism with Chinese style'(Qian and Weingast,1997;Qian and Roland,1998;Jin et al.,2005)becomes a strong incentive to economic development for local governments.Fierce competition between regions is the new reality faced by local governments.They transform from plan executors under the planning system to political entrepreneurs and do everything possible to integrate the economic and political resources under their control,make appropriate industrial development strategy and rely on product and technological innovation to achieve beyond the average performance of the market.Thus,there is close cooperation between the local government and the entrepreneurs in the area.That is,local officials provide policies and resources,and enterprises provide the required performance,employment and taxes,and even personal benefits.

Local economic development faces different resource constraints due to historical conditions and resource endowment,which causes the heterogeneity in the efficiency of local governments.In order to maintain the sustainability of local economic development,local governments with rich resources will provide the company's technological innovation activities with policy and financial support,and enact and implement relevant policies so as to encourage it to make contributions to local competitive advantages.These efficient interventions,which are viewed as effective governance,help enterprises to improve their core values and create favorable conditions for local competitiveness.On the other hand,local governments with poor resources barely support the innovation activities of companies.But since political achievements are still needed,local officials will make the companies perform some social duties by occupying their resources. Meanwhile,the high risk of innovation activities discourages local governments with low efficiency from supporting the companies.They take resources from the people but do not use them for the people and tend to breed corruption.As the enterprise development process is not only embedded in their own social network,but also deeply rooted in the governance background with regional differences,therefore the efficiency of local governments will undoubtedly have a direct impact on policy formulation,implementation efficiency and resource constraints,which will indirectly affect the R&D decisions of companies.

H1.The higher the efficiency of regional governance,the higher R&D expenditures will be.

2.2.Enterprise R&D investment strategic resources-executive networks

Social capital based on relationship networks and trust affects the economic development of a country or region and plays a decisive role in the enterprises'sustainable development(Guiso et al.,2004).Social relationship networks owned by enterprises,especially by executives,can improve information access and delivery speed significantly,helping executives make effective decisions,conduct valid monitoring and improve the effectiveness of corporate governance in order to enhance company value(Ellison and Fudenberg,1993;Maman,1999;Cohen et al.,2010).Executive networks can also improve the speed and efficiency of a company's access to resources,restrain investment behavior and thereby affect business growth(Uzzi,1996,1999;Uzzi and Gillespie,2002;Khwaja and Mian,2008;Khanna and Thomas,2009).At the same time,network externality makes the decision behavior of network members show the advantages of convergence. The higher concentration of the company's position in the social network,the lower the level of heterogeneity of its investment strategies,and the value of the network enables companies with larger network scale achieve better operating performance.As an informal institutional arrangement,social relationship networks not only provide a competitive advantage for the company in influencing the decision making progress,but also play a role in limiting existing competitors and the exclusion of other potential competitors(Hochberg et al.,2007),which is undoubtedly an important strategic resource to help the company maintain its core competitiveness.

Although corporate governance in China is in a transition period from relationship governance to rulebased governance,traditional culture leaves relationship governance in a dominant position.Executive social networks can be seen as an effective complement to the internal resources of a company.In particular in the cultural context of Chinese collectivism,company value is not only assessed by its own competitiveness and contribution to society,but also decided by the scale of the social network it links to.Studies based on the Chinese context(Keister,1998;Ren et al.,2007;Li and Zhang,2007;Li et al.,2008)found that executive relationship networks have a significant effect on company performance.Peng and Liao(2008)analyzedthe intrinsic mechanism of interlocking directorships'impact on corporate governance by discussing the interlocking directorship network,board of directors and the personal behavior of the interlocking directors,and found that the embedded ability of the interlocking directorships has a significant positive impact on a company's governance performance.Lu et al.(2006)and Lu and Chen(2009)found the company could get vital resources through interlocking director enterprises and the organizational function of interlocking directorships in the listed company is to promote inter-firm coordination and information transmission. Chen and Xie(2011)argued that in the interlocking independent directorship network of Chinese listed companies,independent directors with a higher degree of network-concentration are more motivated and also better able to monitor managers'investment decision behavior and therefore curb the inefficient investment behavior of managers with an opportunistic motivation to gain personal profits.Moreover,they can provide more accurate and timely information and knowledge on investment opportunities for business decisions through recommendation functions in order to reduce over-investment and under-investment and improve investment efficiency.With the increasing complexity and risk of innovation and the dramatic changes of the market environment,companies can hardly complete innovation activities effectively on their own and external resources have therefore become an effective source of technological innovation.As government investment in company innovation is policy selective,companies have to look for other ways to seek the core strategic resources for their technological innovations.Companies are always limited by finance,human resources and risks in innovation.A close network connection will assure the timeliness and accuracy of the companies'information,and by learning or acquiring key resources from network members,companies can shape their own core competitiveness.Rogers(1995)found that new innovations are often spread in the informal interpersonal channels and the structure of the diffusion network will affect the speed of adoption of new innovations.Therefore,constructing the social network can help communication,share resources and decrease information asymmetry,thus facilitating companies'R&D activities.

H2.The bigger the executive network,the higher R&D expenditures will be.

2.3.Government governance and executive networks:intersection or parallel

When executive networks provide valid information to help executives make decisions,the disparity of the external environment(government governance)could have a significant impact on corporate risk dispersion and uncertainties decrease.On the one hand,efficient local governments have advantages in policy-making and system-perfection,so listed companies will get the necessary resources and technologies in R&D activities easily,anddonotneedtorelysomuchonexecutivesocialnetworks.Forlistedcompaniesfrom regions withless governanceefficiency,theymaynotbeabletogeteffectivesupportforR&Dactivitiesfromthelocalgovernment through formal institutional arrangements,forcing them to rely more on executive networks,which compensates for the weakness of regional policy support.However,there might be an alternative relationship between the social network scale and governance efficiency in the promotion of R&D investment.Efficient governments will reduce improper intervention in companies,and provide support for information exchange for network members from different regions,which will further promote R&D activities,while less efficient governments may intervene too much in order to protect their own interests,worrying that companies will reveal a handful of actual or potential competitive advantages through their own social networks,especially through regional networks,and ultimately form institutional barriers for R&D activities.There lies a‘‘Matthew Effect”in the executive network and government governance in the promotion of companies'R&D activities.

However,what companies obtain through executive networks is decision-making information related to R&D,which may cause the companies to imitate the network members in making R&D investment decisions. While local governments tend to provide policy and financial support,and companies restrained by governments will adjust their R&D strategies and become a community of interest with the government. Therefore,executive networks and government governance may have completely different effect mechanisms on the R&D activities of companies and there is no intersection in their pathways.

H3a.There is an interaction effect between the efficiency of governance and the effect of executive network scale on R&D expenditures.

H3b.There is no interaction effect between the efficiency of governance and the effect of executive network scale on R&D expenditures.

2.4.Firm heterogeneity:nature of property rights

Chinese state-owned enterprises take on more social responsibilities and correspondingly get more help regarding budget constraints,financing facilities and government backing(Li and Xia,2008).Due to long-standing monopolies and scale advantages,state-owned enterprises'technological innovations stem mostly from internal motivation and self-reliance and their emphasis on external environment and network relationships is significantly weaker than private enterprises.Additionally,agency costs between private shareholders and management are relatively smaller in private enterprises.Shareholders show stronger control ability.External dependence and linkages are more close and important,which reflects the correlation effect of government,networks and corporate behavior,while state-owned enterprises show the opposite relationships.

H4.Compared to non-state-controlled enterprises,government governance(executive networks)has a weaker effect on the R&D expenditure of state-owned enterprises.

3.Research design

3.1.Sample and data

The original sample includes all A-share listed companies from 2007 to 2010.4According to the processing of R&D expenditures in the Accounting Standard for Business Enterprises No.6-Intangible assets issued in 2006,firms should divide R&D process into research stage and development stage.Expensing the expenditures in research stage and capitalizing the expenditures in development stage if they meet the conditions.Therefore,listed companies adjusted the disclosure of R&D expenditures in their financial statements from 2007,and the sample interval in this paper is 2007-2010.We exclude the following:(1)firms in the Finance and Insurance industry.Characteristics of relevant financial data in this industry significantly differ from those of other industries;(2)firms with an unknown ultimate controller,which refers to the ultimate shareholder with the largest equity ratio.This information is needed to determine whether the listed companies are ultimately controlled by the government or not,and therefore we exclude companies with opaque ultimate controller information;(3)firms with missing data;and(4)firms which are ST or PT that year.The final sample includes 5899 firm-year observations from 1701 firms.Among them,there are 3505 firm-year observations of state-owned enterprises and 2394 firm-year observations of non-state-owned enterprises.

We collect data about executive networks and R&D expenditure manually on the basis of relevant information disclosed in annual reports.Particularly,information about R&D expenditures of the main board listed companies is obtained from‘‘development expenditure”,‘‘G&A(general&administrative)expense”or‘‘other cash paid relating to operating activities”which are announced in‘‘Notes to Financial Statements”. The subject‘‘development expenditure”contains spending on research and development,and the item‘‘G&A expense”only discloses period research spending which is an expense.The subject‘‘other cash paid relating to operating activities”offers information about R&D expenditure paid by cash.Therefore,in order to provide an accurate reflection of real R&D expenditure,we refer to‘‘development expenditure”first,and choose the other two subjects if‘‘development expenditure”is not disclosed.We also get information for firms on the SME(small and medium-sized enterprises)board from‘‘Report of the directorates”.Through the above data collection process,we find 1958 companies with specific annual R&D data.In regard to other companies without R&D data,we define its R&D expenditure as zero.Data for the ultimate controller are sourced from the CSMAR database,corporate governance and financial data are from the CSMAR database and data about government governance are from the Report on Market Process(Fan et al.,2011).Main continuous variables are winsorized at the 1%and 99%levels to eliminate the influence of extreme values.

Table 1Definitions of variables.

3.2.Model and variables

Sample companies whose annual R&D expenditure data are unavailable do not necessarily carry out no R&D activities and investment at all.Therefore,in order to ensure the unbiasedness and consistency of regression results of such censored observations,we employ a Tobit model5Tobit model,also known as limited dependent variable model,is mainly used to verify dependent variables with the following characteristics:variables whose values can be observed are scored higher than 0,while those cannot be observed in the sample are scored 0. Because data regarding listed company's R&D expenditure can only be obtained through their annual reports,we score R&D expenditure of companies without annual disclosure of it as 0.But that does not mean these companies'actual R&D expenditure is 0,so this paper uses Tobit model to test the hypotheses.In response to the reviewer's request of OLS regression testing,we find that the results remain unchanged.to test the research questions. Based on the existing literature(Bhagat and Welch,1995;Huang and Chen,2011)and our research hypotheses,this paper tests variables such as government governance and executive networks and studies their interaction.Variables and their definitions are shown in Table 1.

3.2.1.Dependent variables

R&D expenditure directly reflects the technological innovation ability of enterprises.Considering the large differences in absolute expenditure among listed companies in different industries,this paper adopts a comparative index-R&D intensity,which is the ratio of R&D expenditure to total assets(Nam et al.,2003;Liu and Liu,2007;Ren,2010).

3.2.2.Independent variables

3.2.2.1.Government governance.Government governance is based on Market Process Index(Fan et al.,2011). Since it is only available till 2009,this paper adopts data from 2006 to 2009.

Figure 1.Schematic diagram for executive networks.

3.2.2.2.Executive networks.Size of executive networks evaluates the ability of an enterprise to acquire technological innovation resources from business networks,including the scale of interlocking executives(CS)and the number of interlocking listed companies(FNET).Referring to Mintz and Schwartz(1985)and Stokman et al.(1985),the specific calculation is the number of executives(including directors,senior managers and supervisors)who take executive positions directly in other listed companies(including A-share,B-share and GEM listed companies)and the number of listed companies as a result of management tenure.As illustrated in Fig.1,Firm A has five interlocking executives and three interlocking listed companies.

3.2.3.Moderating variables

Nature of property rights(STATE).Existing research discovered(Li and Xia,2008;Feng and Wen,2008)that the technological innovation ability and R&D intensity of non-state-owned(mainly private-holding)listed companies are considerably higher than those of state-owned enterprises.The government taking both the positions of the judge and the player will often interfere with the decisions of state-owned enterprises because of multiple goals of developing the local economy,employment and social stability.As a result,state-owned enterprises will abandon some of their R&D activities,which need a large amount of money input and help raise enterprise value in the long run in order to undertake these social functions for the government.

3.2.4.Control variables

Referring to the existing literature(Bhagat and Welch,1995;Helfat,1997;Bah and Dumontier,2001;Ahuja and Lampert,2001;Nam et al.,2003;Feng and Wen,2008;Ren,2010;Huang and Chen,2011),this paper selects the following control variables:(1)Firm age(Age),which refers to the time span from the establishment of the company to the observation year;(2)Financial leverage(LEV),which reflects the company's existing capital structure;(3)The growth of enterprises(MB),which is represented by the market to book value ratio;(4)Profitability(ROA),which reflects the enterprise's resource accumulation ability;(5)Counterbalance Degree of Shareholders(SHRZ),which represents large shareholders'constraint of controlling shareholders;(6)The Proportion of Institutional Ownership(IIS);(7)Firm size(Size);(8)Corporate governance structure(DCEO),which is evaluated by a dummy variable for CEO duality;(9)Year dummies(Year),which are used to control for annual differences in R&D activities;(10)Industry dummies(Industry),which are used to control for the impact of industries on Enterprise R&D investment.According to‘‘Guidelines on the Industry Classification of Listed Companies”enacted by the China Securities Regulatory Commission in 2001,listed companies in China are divided into 13 industries,among which manufacturing has 10 sub-classes.Therefore the Industry variable is set by the 10 sub-classes under manufacturing and the other 11 industries,excluding finance and insurance.

4.Empirical analysis

4.1.Descriptive statistics

4.1.1.Characteristics of executive networks

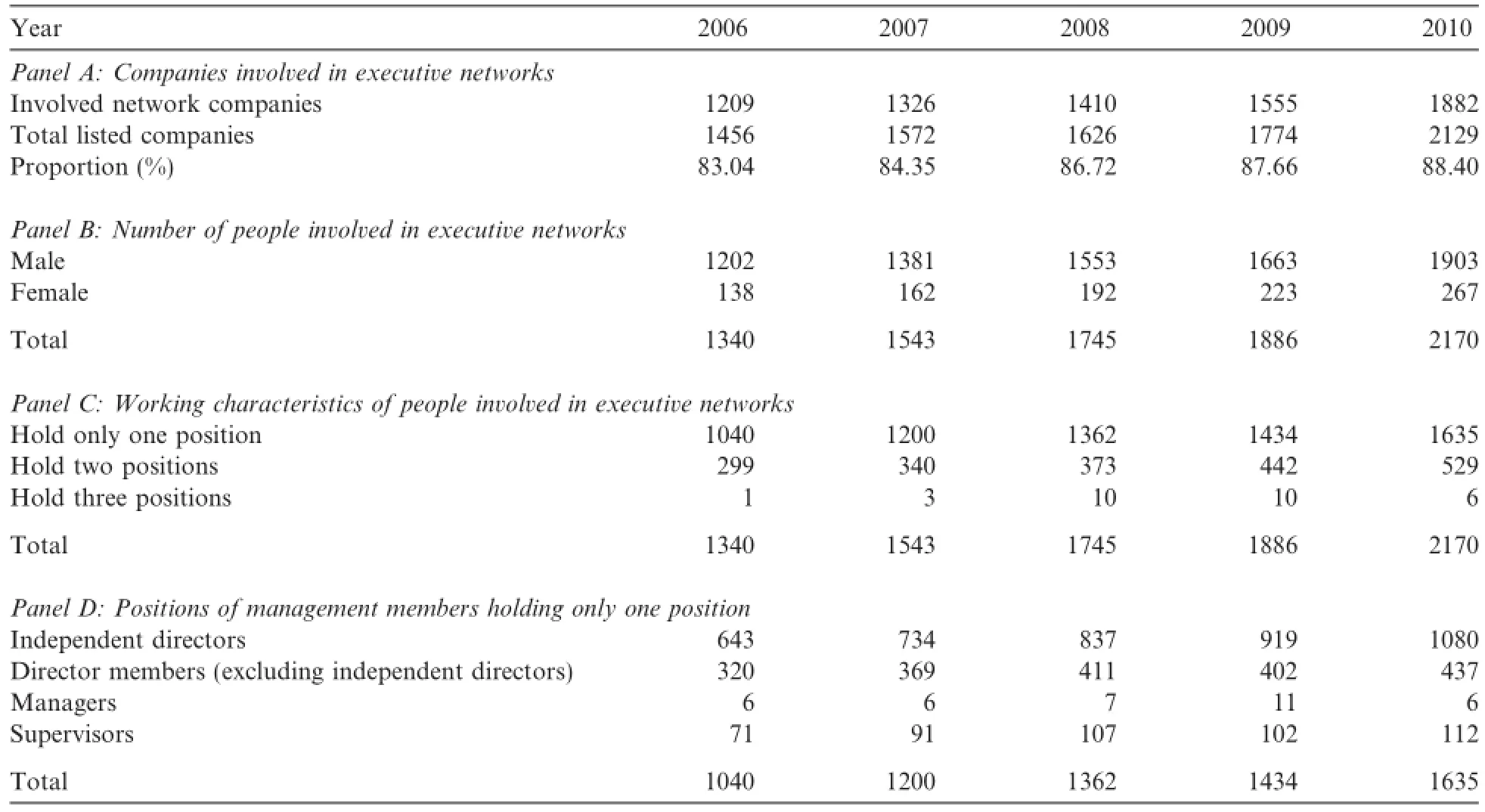

Table 2 refers to manually collected statistics of executive networks in all the China A-share listed companies.According to Table 2,a high proportion of listed companies are involved in executive networks,and it presents an increasing trend.This means that during the transition period,Chinese local governments with low efficiency of resource allocation induce companies,especially listed companies to effectively obtain resources through their own social networks,which has become an effective way of making up for governance deficiencies.In Table 2,management staff involved in executive networks of listed companies also increases year by year,but there is a relatively small proportion of female staff,with an average number around 11% each year.In this paper,positions of management staff involved in executive networks are divided into four categories,i.e.independent directors,board members(except independent directors),6If board members serve as managers simultaneously within the same company,they are regarded as board members in statistics.members of the Supervisory Board and managers(including president,general manager,department manager and general director who are disclosed in Annual Reports).Panel C in Table 2 shows that most interlocking managers in executive networks hold only one position in the network,while Panel D7Part D in Table 2 categorizes all of the positions interlocking managers hold in different listed companies according to four management positions.illustrates most interlocking managers taking only one type of position are independent directors.

Table 2Annual statistics of executive networks.

4.1.2.Summary statistics

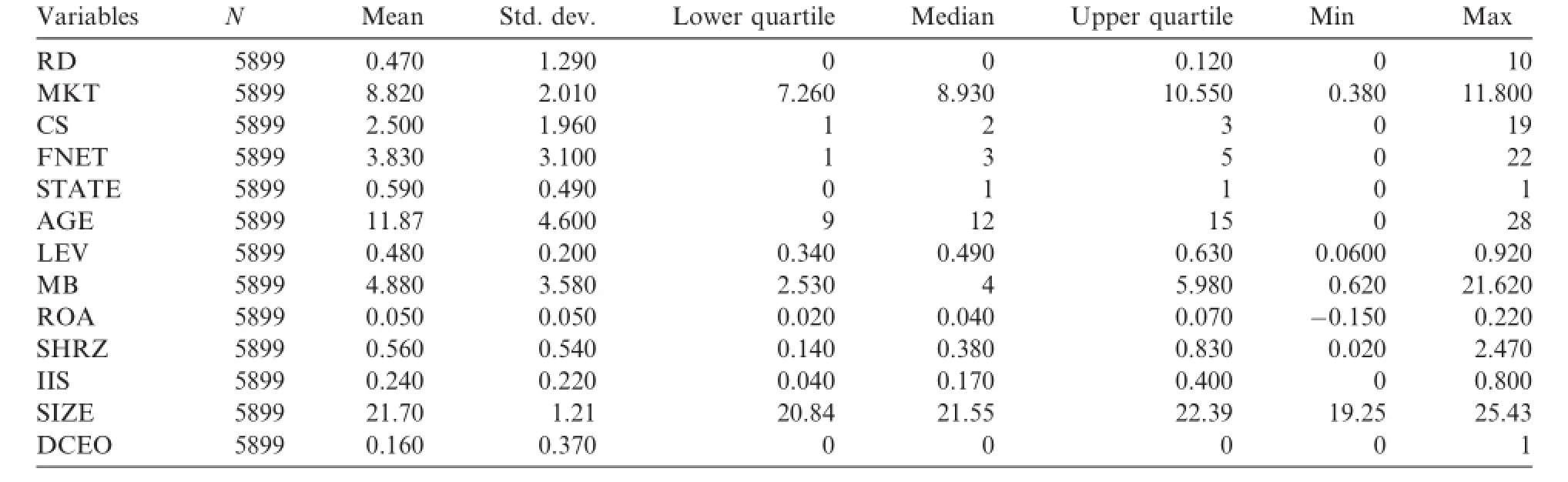

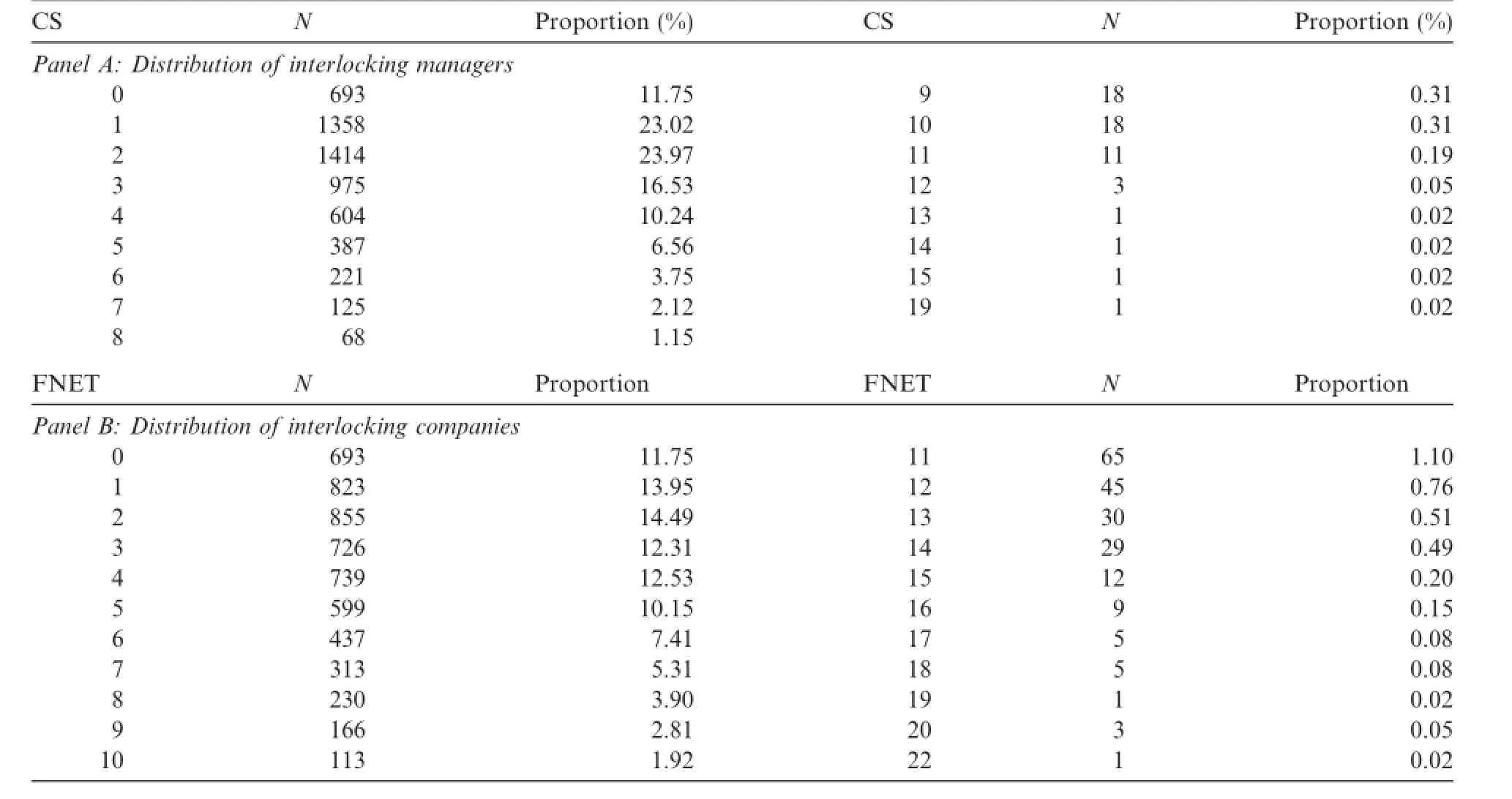

Table 3 shows the descriptive statistics of all the variables except year and industry dummy variables.In the sub-sample(1958 firm-year observations)with R&D data from annual reports,mean(median)R&D intensity is 1.41%(0.77%),which indicates that Chinese listed companies'investment in R&D is generally low.And the gap between its minimum(0.000058%)and maximum(65.35%)value reflects some major differences among the firms.In Table 4,not only the number of companies investing in R&D but also the amounts and intensity of R&D increase year by year,which implies that companies pay more attention to technological innovation and view enhancement of core competitiveness as the key strategy.Table 5 by industry illustrates that companies with higher R&D expenditures are mostly concentrated in the manufacturing and IT industries,which means industrial characteristics is an important determinant of corporate R&D investment.Thereare only 693 firms without executive networks in the full sample(5899),which demonstrates the commonness of executive networks in listed companies(distribution structure of executive networks is shown in Table 6).

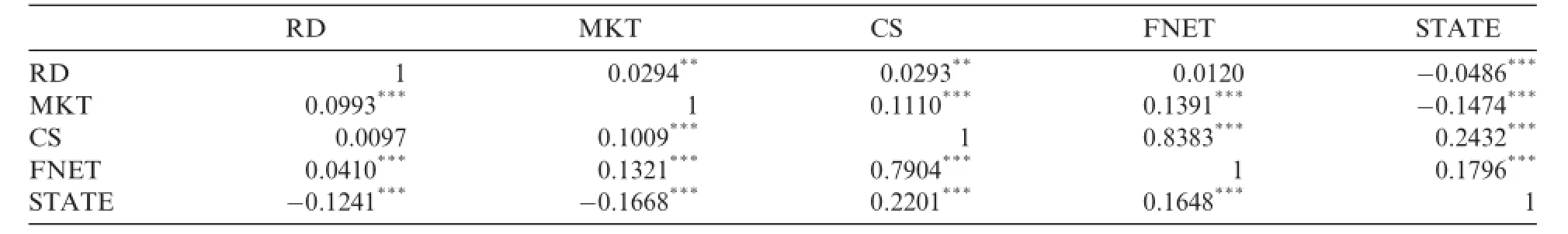

Table 7 presents correlation analysis between the major variables.There is a significant positive correlation between R&D intensity(RD)and executive networks(CS,FNET),which means establishment of this network will encourage enterprises to increase investment in R&D.Also,there is a significant positive correlation between R&D intensity(RD)and the efficiency of government governance(MKT),which means that government institutional arrangements and the effectiveness of governance have an important impact on R&D decision-making and create a favorable external institutional environment for enterprises'R&Dactivities.The fact that R&D intensity(RD)and the nature of property rights(STATE)are significantly negatively correlated means that the R&D intensity of non-state-owned enterprises is higher than that of state-owned enterprises,and compared with state-owned enterprises,and non-state-owned enterprises without protective policy advantages are more motivated to enhance their own core competitiveness through increased research and development investment.

Table 3Descriptive statistics.

Table 4R&D investment:annual statistics.

Table 5R&D intensity:statistics by industry.

Table 6Structure of executive networks.

Table 7Correlation coefficients between the main variables.

4.2.Empirical results

4.2.1.Tests of governance and executive networks on R&D

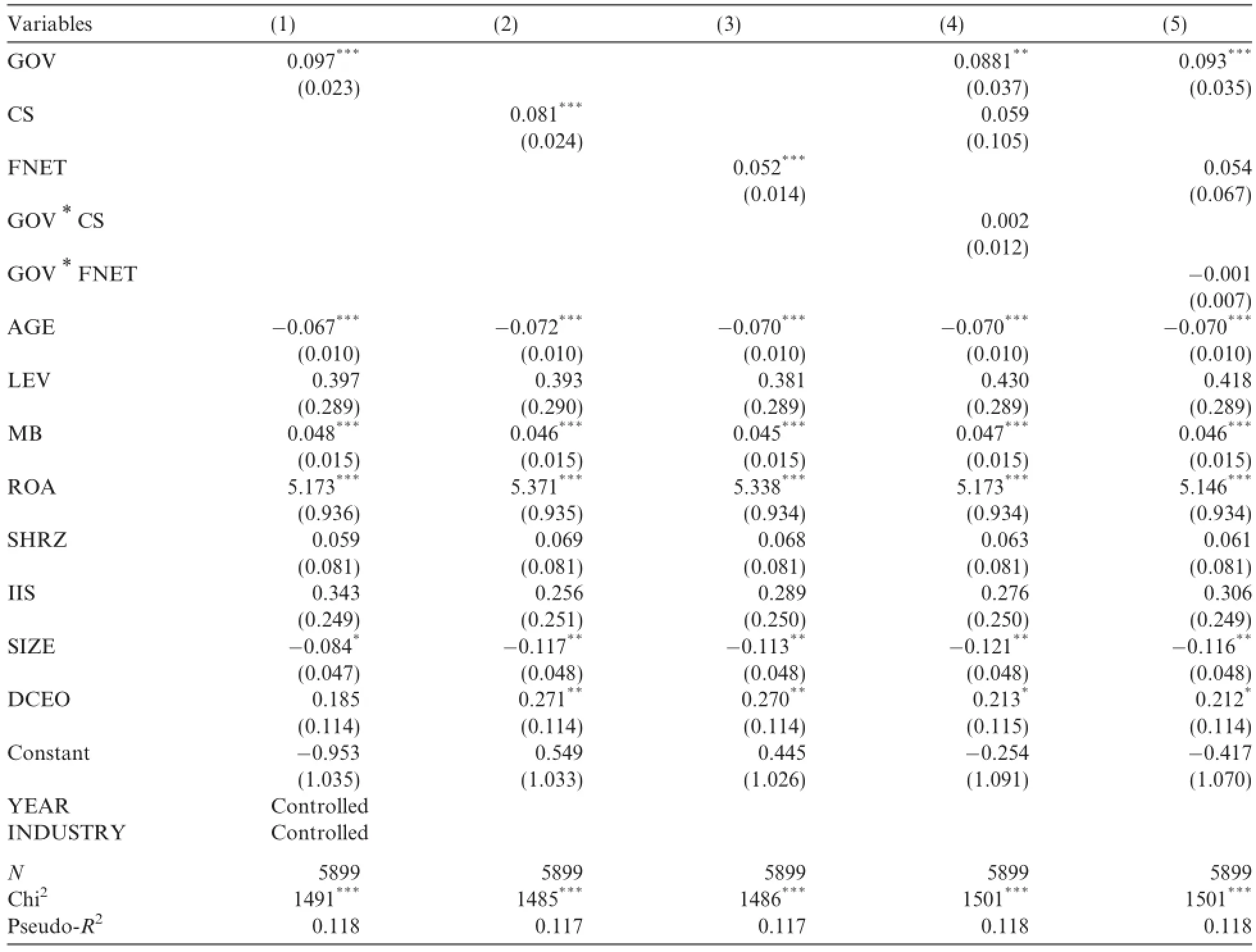

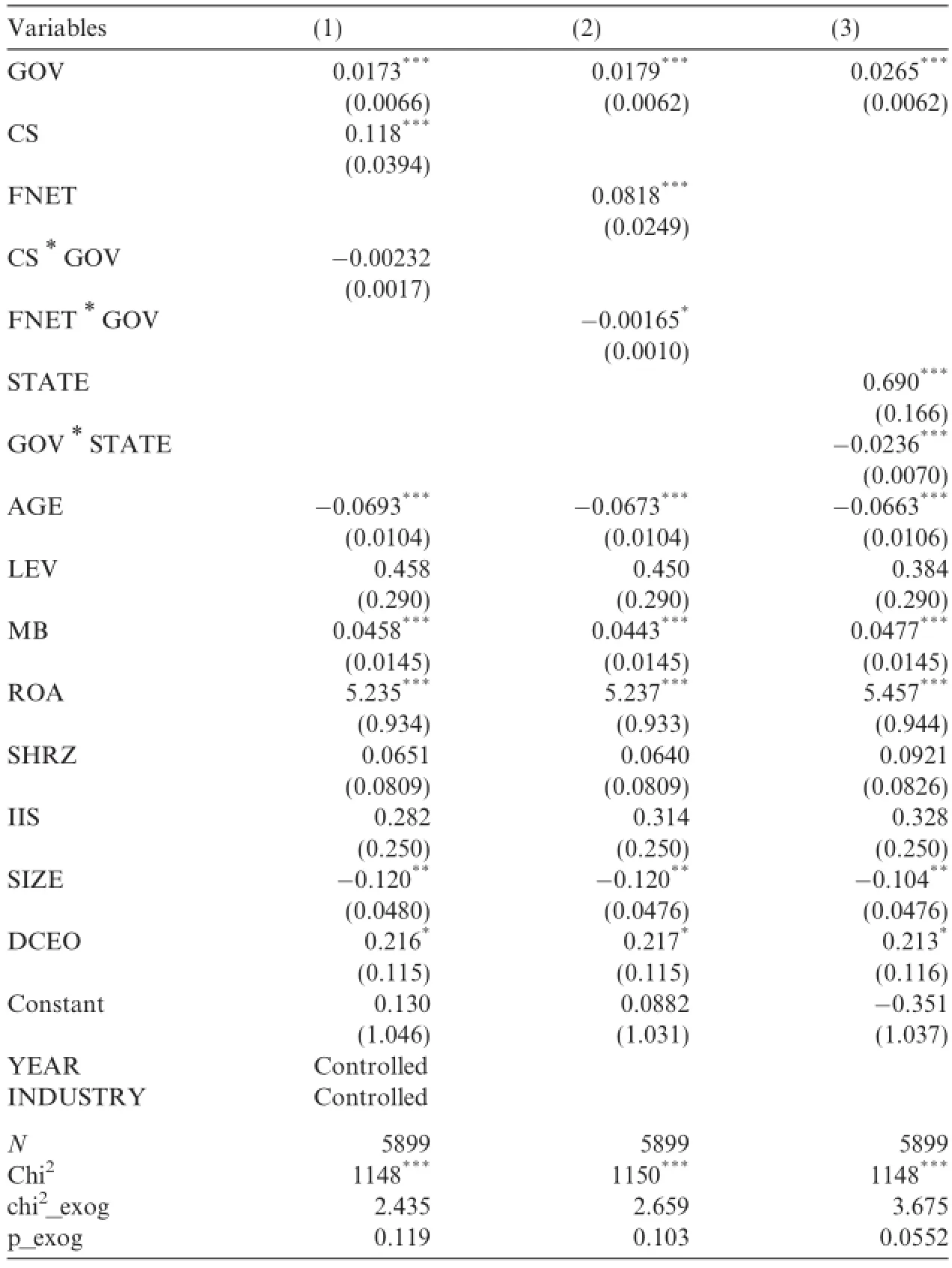

Table 8 shows regression results between R&D intensity and size of executive networks and governance efficiency respectively.8Innovation expenditures disclosed in items‘‘development expenditure”,‘‘management expense”and‘‘other cash paid relating to operating activities”in‘‘Notes to Financial Statements”have different emphases and refer to different R&D expenses.We test with all these three types of data and find the results remain unchanged.In Column 1,governance efficiency has a significant positive effect on R&D intensityat the level of 1%,i.e.companies located in areas with more efficient governance do invest more in R&D activities.The relatively weak innovation capacity during China's economic transition and the support of government policy pose constraints to enterprises'self-innovation.In order to encourage their selfinnovation enthusiasm and promote regional economic growth,local governments provide preferential tax and subsidy policies.Regions with more efficient governance generally possess more resources and more effective policy formulation and execution to support enterprises'R&D.Therefore,their economic strength and core competitiveness are effectively enhanced.In Column 2,R&D intensity has a significant positive relationship with executive networks at the level of 1%,i.e.the larger the listed companies'executive networks are,the stronger its R&D intensity.This demonstrates that social networks via executives'external positions do provide more abundant resources,which helps the company reduce transaction costs,optimize resource allocation and enhance core competitiveness.As China is currently experiencing economic transition and has not yet formed a relatively perfect market and institutional environment,the overall social technological innovation ability still lags behind developed countries and R&D capacity remains the bottleneck for the sustainable development of enterprises.Therefore,active and independent innovation and effective access to technological resources are still essential for enterprises to pursue long-term value,growth and sustainability.This executive network opens up new opportunities to listed companies,not only arousing theirenthusiasm but also offering diversified access to resources and it is especially crucial for listed companies lacking technological innovation ability to enhance their core value.Columns 4 and 5 show that there are no significant relationships between the interaction of these two influencing factors and R&D intensity. Therefore,informal and formal institutional arrangements affect R&D activities with their own unique mechanism,which means the two mechanisms are parallel.

Table 8Regression results.

All regression results show that enterprise Age and R&D intensity have a significant negative correlation at the level of 1%,namely the younger the enterprise is,the stronger the R&D intensity will be,which is consistent with Ahuja and Lampert(2001).Older enterprises tend to rely on their existing growth opportunities and rest on their laurels;thus,they fall into the trap of innovation restriction and gradually lose their adaptability to their unpredictable competitive environment.MB and R&D intensity have significant positive correlations at the level of 1%,implying that high-growth companies are more motivated in R&D investment to advance their core values and promotefast development.ROA and R&D intensity have a significant positive correlationat the level of 1%,which means higher profitability provides strong financial support for R&D investment. SHRZ and R&D intensity have a significant positive correlation.Companies with CEO duality have higher R&D intensity,which implies that the CEO taking the position as chairman will exercise more influence and control over the enterprise,gain more resources and autonomy for innovation,which prompts him to exert his talent and entrepreneurship.Meanwhile,it facilitates the communication between management and shareholders to better formulate and implement its R&D strategy.This conclusion also provides new empirical evidence to‘‘modern stewardship theory”.

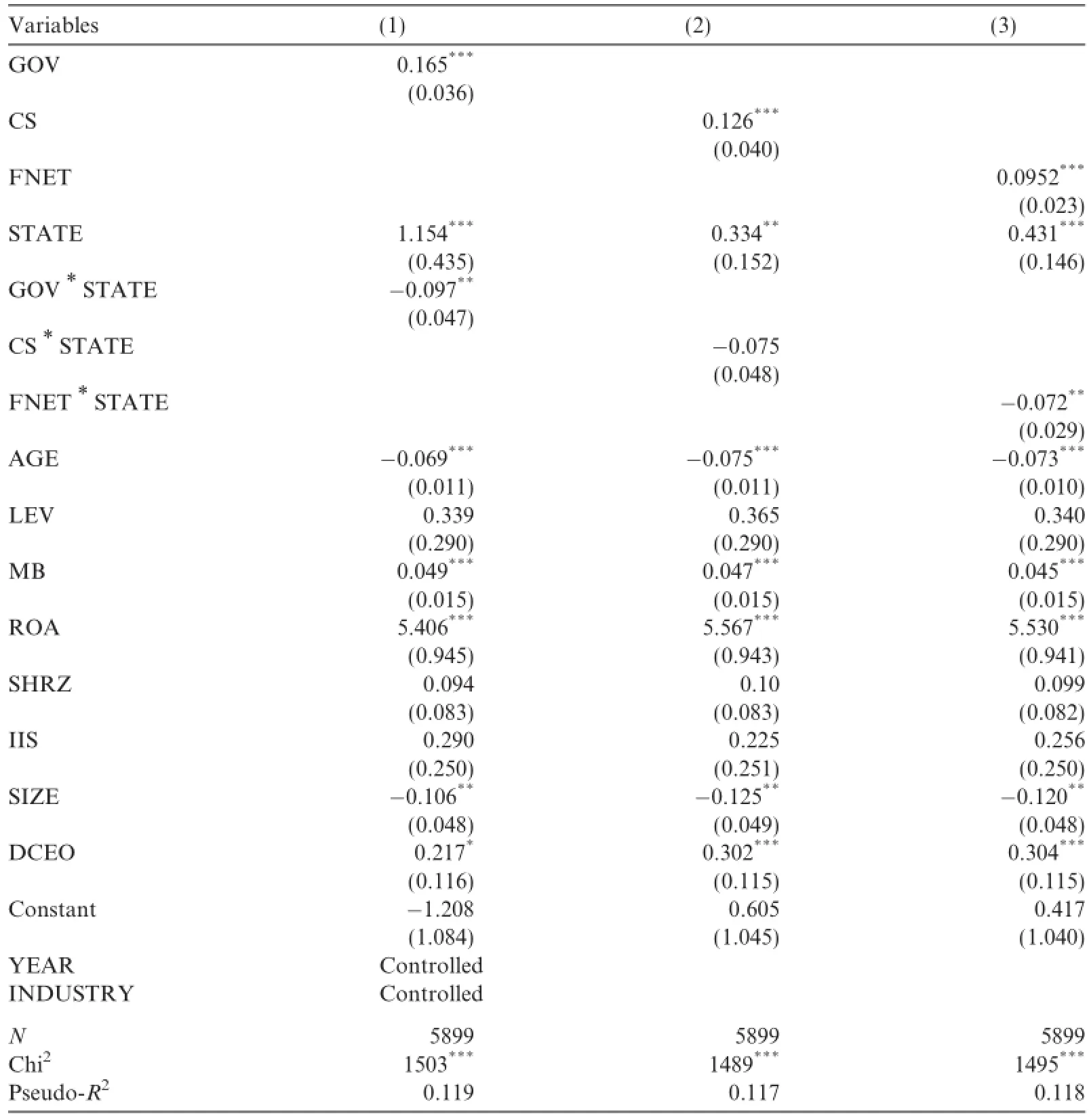

Table 9Regression results based on the nature of property rights.

Table 10Two-stage regressions using instrumental variables.

4.2.2.Regressions based on ownership classification

Based on the results in Table 8,this paper tests the interaction effects of government governance,executive networks and property rights respectively,which are shown in Table 9.In column 1,the interaction coefficient of government governance and property rights is significantly negative at the level of 5%,indicating that compared to state-owned enterprises,governance efficiency exerts greater impact on R&D investment in non-state-owned enterprises.As allocation of government resources between SOEs and non-SOEs is sequential,improvement of governance efficiency can effectively protect fairness,and its impact on corporate R&D investment in the non-state-owned enterprises is more obvious.Column 3 shows the interaction coefficient of executive networks and property rights is significantly negative at the level of 5%,i.e.comparedto state-owned enterprises,non-state-owned enterprises'executive networks have a more prominent impact on enhancing R&D investment,which suggests that non-state-owned enterprises with relatively scarcer resources will actively use informal institutional arrangements to ease pressure on resource constraints when resources cannot be effectively obtained through formal institutional arrangements.

4.3.Robustness tests

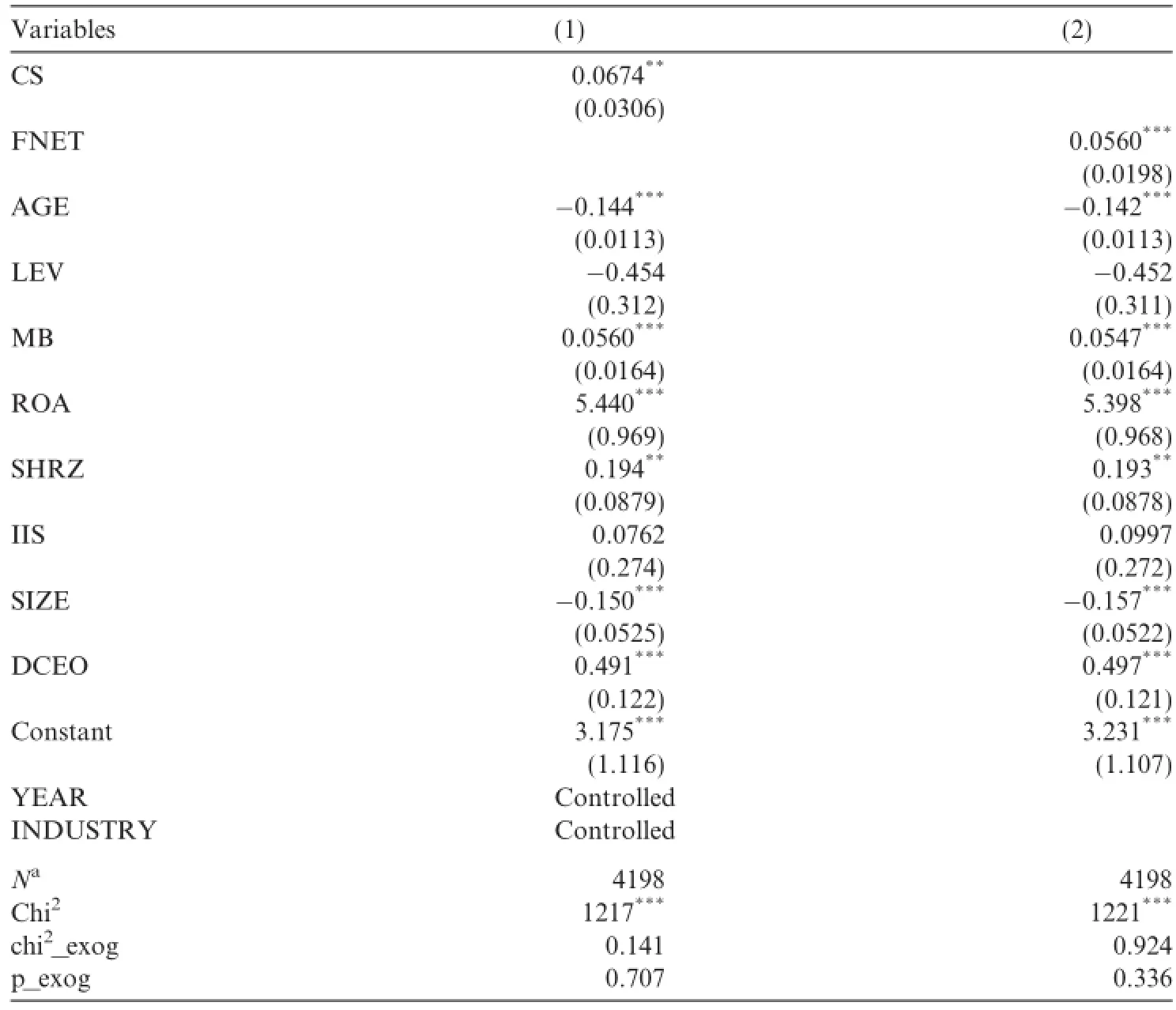

5.5.1.Endogenous executive networks

Companies'R&D expenditure is affected by information diffusion,and the role of information is usually hard to observe and quantify,so we deal with it as a noise.Moreover,enterprises with stronger technological innovation abilities and better external images are deemed to have more qualified management members,whoare more apt to be employed in other listed companies,leading to the formation of executive networks.For these reasons,there is inevitably an endogenous relationship between the random disturbance variables and the executive network variables.Therefore,in order to eliminate the impact of endogeneity,this paper selects the lagged data of executive networks(CSt-1,FNETt-1),companies cross-listed as B-shares or H-shares(CROSSLIST,cross-listed is valued 1,0 otherwise)and the scale of executives in listed companies(NM)as instrumental variables,and uses Tobit models to conduct two-stage regressions.The regression results are consistent with the above ones,and the indicator detecting endogeneity chi2_exog9In STATA software,the null hypothesis of indicator‘‘chi2_exog”is:instrumental variables are exogenous,‘‘p_exog”refers to‘‘pvalue”of this indicator.does not reject the null hypothesis.Namely,the instrumental variables effectively eliminate endogeneity(Table 10).

Table 11Alternative government governance variables.

Table 12Indirect effect of monopoly and bankruptcy risk.

Table 13Regression results after excluding monopoly companies.

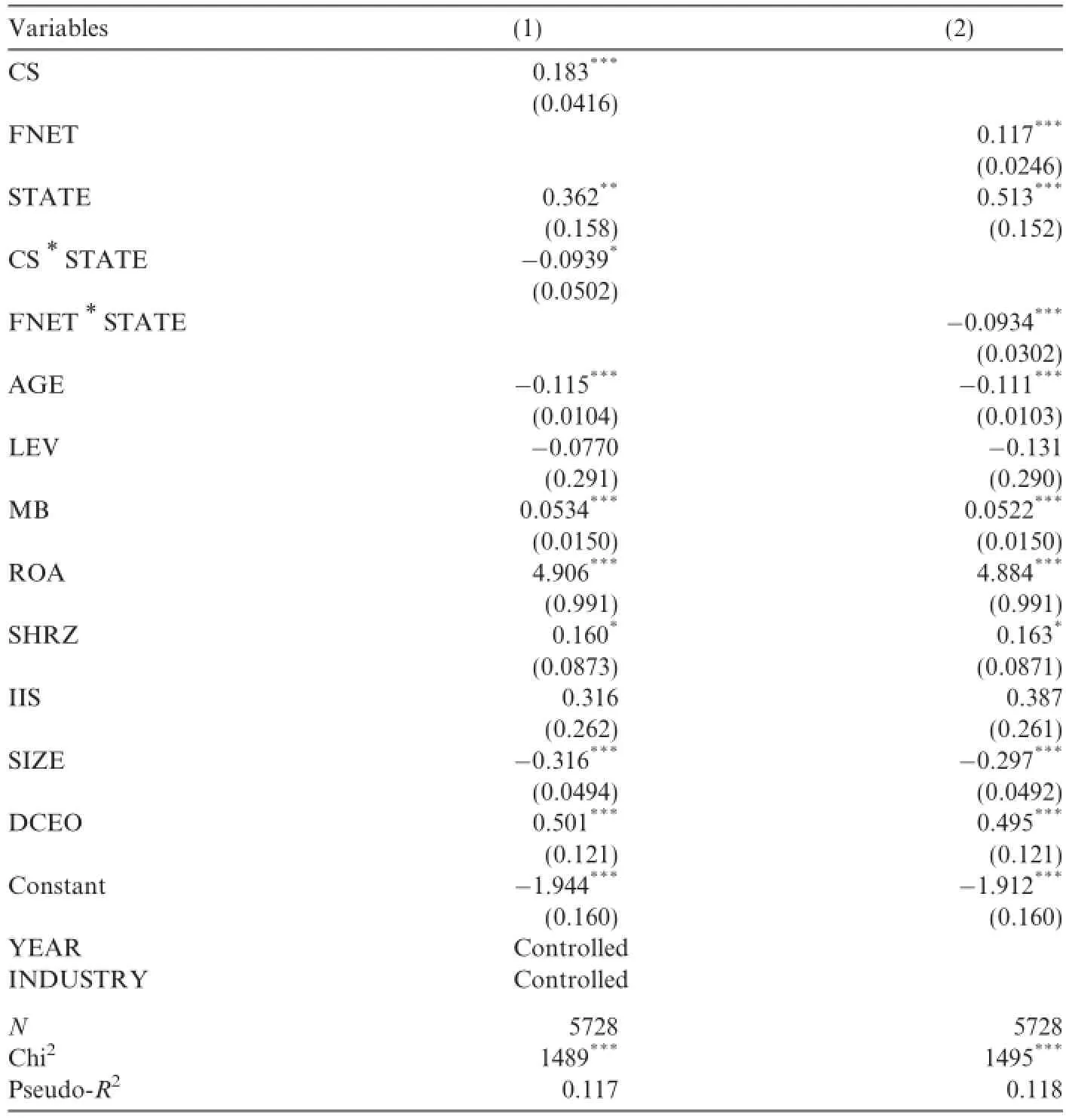

4.3.2.Alternative variables and sample segments

Given a large quantity of indicators of local governance level and efficiency,this paper attempts to introduce two sub-indexes‘‘1 relationship between government and the market”and‘‘1c reducing government intervention in companies”as proxy variables for the levels of governance(see Table 11).The basic conclusions are not affected.

State-owned enterprises have a relatively small bankruptcy risk and can survive without innovation;therefore,they lack the motivation for technological innovation.Among them,consensus on correlation between monopolized industries and technological innovation has not been reached yet and is to be tested. Therefore,Tables 12 and 13 test the relationship from perspectives of the nature of corporate monopoly and bankruptcy risk.Referring to Qiu et al.'s(2010)definition,we add a dummy variable‘‘monopoly or not(Monopoly)”to the regression model and take into consideration the impact of CS*Monopoly(FNET*Monopoly).Regarding bankruptcy risk,although this article has excluded observations labeled with ST or PT that year,to be safe,we refer to Altman's(1968)definition on‘‘bankruptcy Z value”and add a dummy variable‘‘bankruptcy or not(Bankruptcy)”to the regression model and take into consideration the interaction effect(CS*Bankruptcy,FNET*Bankruptcy).The results show that there is no significantcorrelation between executive networks and Monopoly or executive networks and Bankruptcy,indicating that monopoly industries and bankruptcy risk have no effect on the network.Thus,the basic conclusions remain unaffected.

Moreover,considering the relatively high R&D expenditure of high-tech innovation enterprises,Table 14 identifies‘‘high-tech innovation enterprises”according to RESSET database's definition standards10In RESSET database,enterprises are divided into seven categories:1.High-tech enterprises;2.Tech enterprises;3.Torch Plan;4.863 plan;5.Agricultural industrialized key state enterprises;6.Innovative enterprise;7.Key software enterprises within state planning.This paper identifies all these types as high-tech innovative enterprises except category 5.and then introduces a dummy variable‘‘Innovative”in the regression as a control variable(high-tech innovation enterprises are valued 1,0 otherwise).The conclusions remain consistent.

Regions with high efficiency are often economically developed and local governments tend to provide more financial support for technological innovation of enterprises.Therefore,in order to testify that the positiveimpact on enterprises'technological innovation activities originates from local governance efficiency rather than financial support,we introduce annual S&T financial expenditure data of provincial governments from the Zhonghong Database(FISCAL)as an instrumental variable of government governance.The test results remain robust(see Table 15).

Table 14Test of control variables in high-tech innovative companies.

Table 15Instrumental variables of government's science and technology expenditure.

4.3.3.Alternative regression methods

In order to avoid sample selection bias,we use a Tobit model in our empirical testing and regard corporate R&D expenditure as zero when there is no relevant data disclosure.However,the number of observations available accounts for about 1/3 of the total sample number,so when doing the robustness test,we consider applying OLS regression models to test this sub-sample.The test results are shown in Table 16.Size of executive networks and R&D intensity are significantly positively correlated at the level of 1%,which is consistentwith our previous conclusions;governance quality and R&D intensity are significantly positively correlated at the level of 5%.Thus,the conclusions still support the above hypotheses.

Table 16OLS regression results.

5.Conclusion

In the competitive context of accelerated integration of the global economy,enterprises increasingly rely on innovation ability to survive and develop.R&D as a crucial form of firm innovation is critical in continuously improving and maintaining the enterprises'and even the country's competitive advantage.However,R&D activity is full of uncertainty and risk.On the one hand,the huge R&D investment and the high uncertainty of the market and technology are formidable.On the other hand,enterprises have to invest in R&D to gain market opportunities and high profits under the pressure of competition.Therefore,it is necessary to acquire resources to provide funds for corporate R&D activities and effectively reduce the risk.Based on the institutional arrangements perspective,this paper uses listed companies'data from 2007 to 2010 and finds that both informal and formal institutional arrangements can supply resources to corporate R&D activities,thereby verifying that executive network size and the efficiency of government governance are vital factorsinfluencing R&D decision-making.Informal institutional arrangements are an effective supplement for an imperfect formal system.They can improve the ineffectiveness of an imperfect formal system.The difference is that companies get more technical information through executive networks,but more policy and funding support from government.

Meanwhile,further research also shows that,compared to non-state-owned enterprises,government governance and executive networks have a weaker effect on the R&D expenditures of state-owned enterprises. Compared to non-board-listed companies,government governance(executive networks)has a stronger(weaker)effect on the R&D expenditures of board-listed enterprises.The findings show that long-standing monopoly and scale advantages have formed state-owned enterprises'technical dominance to a certain extent;thus,they place less emphasis on the external environment and external networks than private enterprises. Similarly,due to its size,industry characteristics and other factors,enterprises in small and medium sectors are subject to stricter management by regulatory agencies,and therefore their motivation for building an executive network is more intense.

The limitations of this paper lie in the data and market process index.The workload of data collection and selection is enormous,and updating of the data is still continuing.In 2012,our country embarked on a comprehensive and deepening national reform,which may have an impact on our original data.But given the timing effect,our results suffered limited impact.Of course,influenced by reform,changes and impacts of future government governance and executive networks should be more interesting topics.Meanwhile,there lies a certain degree of error in employing the overall market process index as a proxy for local governance efficiency.So we chose many more alternative indicators to substitute for this proxy,but pinning down a relatively precise indicator of local government governance remains a key issue.

Acknowledgments

This study was sponsored by Humanity and Social Science Youth foundation of Ministry of Education of China(15YJC790137),Innovation Program of China Shanghai Municipal Education Commission(13YS117). National Natural Science Foundation of China for Young Scholars(71402169).Social Science Fund of China ZhejiangProvince(14NDJC166YB).NaturalScienceFoundationofChinaZhejiangProvince(LQ14G020009).

References

Acemoglu,D.,Johnson,S.,Robinson,J.A.,2001.The colonial origins of comparative development:an empirical investigation.Am.Econ. Rev.91(5),1369-1401.

Acemoglu,D.,Johnson,S.,Robinson,J.A.,2002.Reversal of fortune:geography and institutions in the making of the modern world income distribution.Quart.J.Econ.107(4),1231-1294.

Ahuja,G.,Lampert,C.M.,2001.Entrepreneurship in the large corporation:a longitudinal study of how established firms create breakthrough inventions.Strateg.Manage.J.22(6-7),521-543.

Altman,E.,1968.Financial Ratios,Discriminant Analysis and the Prediction of Corporate Bankruptcy.J.Finance.23(4),589-609.

An,Tongliang,Shi,Hao,Ludovico,A.,2006.An observation and empirical study of R&D behavior of Chinese manufacturing firms: based on a survey of the manufacturing firms in Jiangsu province.Econ.Res.J.41(2),21-30,56.

Bah,R.,Dumontier,P.,2001.R&D intensityand corporatefinancial policy:some international evidence.J.Bus.Financ.Account.28(5-6),671-692.

Baysinger,D.,Kosnik,R.D.,Turk,T.A.,1991.Effects of board and ownership structure on corporate R&D strategy.Acad.Manage.J.34(1),205-214.

Bhagat,S.,Welch,I.,1995.Corporate research&development investments,international comparisons.J.Account.Econ.19(2-3),443-470.

Chen,Yunseng,Xie,Deren,2011.Network position,independent director governance and investment efficiency.Manage.World 7,113-127.

Cohen,L.,Frazzini,A.,Malloy,C.,2010.Sell side school ties.J.Financ.65(4),1409-1437.

Easterly,W.,Levine,R.,2003.Tropics,germs,and crops:how endowments influence economic development.J.Monetary Econ.50(1),3-39.

Easterly,W.,2001.The Elusive Quest for Growth:Economists'Adventures and Misadventures in the Tropics.The MIT Press,Cambridge,MA.

Ellison,G.,Fudenberg,D.,1993.Rules of thumb for social learning.J.Polit.Econ.101(4),612-643.

Ettlie,J.E.,1998.R&D and global manufacturing performance.Manage.Sci.44(1),1-11.

Fan,Gang,Wang,Xiaolu,Zhu,Hengpeng,2011.Chinese Marketization Index.Economic Science Press,Beijing.

Fan,J.P.H.,Wong,T.J.,Zhang,T.,2007.Politically connected CEOs,corporate governance and Post-IPO performance of China's newly partially privatized firms.J.Financ.Econ.84(2),330-357

Feng,Genfu,Wen,Jun,2008.An empirical analysis of the relation between China listing corporation governance and enterprise technology innovation.China Ind.Econ.(7),91-101

Griliches,Z.,1986.Productivity,R&D and basic research at firm level in the 1970s.Am.Econ.Rev.76(1),141-154.

Guiso,L.,Sapienza,P.,Zingales,L.,2004.The role of social capital in financial development.Am.Econ.Rev.94(3),526-556.

Helfat,C.E.,1997.Know-how and asset complementarity and dynamic capability accumulation:the case of R&D.Strateg.Manage.J.18(5),339-360.

Hill,C.,Snell,S.,1988.External control,corporate strategy,and firm performance in research-intensive industries.Strateg.Manage.J.9(6),577-590.

Hochberg,Y.V.,Ljungqvist,A.,Lu,Y.,2007.Whom you know matters:venture capital networks and investment performance.J.Financ. 62(1),251-301.

Hwang,B.H.,Kim,S.,2009.It pays to have friends.J.Financ.Econ.93(1),138-158.

Jin,H.,Qian,Y.,Weingast,B.,2005.Regional decentralization and fiscal incentives:federalism,Chinese style.J.Public Econ.89(9-10),1719-1742.

Keister,L.A.,1998.Engineering growth:business group structure and firm performance in China's transition economy.Am.J.Sociol.104(2),404-440.

Khanna,T.,Thomas,C.,2009.Synchronicity and firm interlocks in an emerging market.J.Financ.Econ.92(2),182-204.

Khwaja,A.I.,Mian,A.,2008.Tracing the impact of bank liquidity shocks:evidence from an emerging market.Am.Econ.Rev.98(4),1413-1442.

Huang,Jun,Chen,Xinyuan,2011.Management by grouping of enterprises and enterprise R&D investment-based on the analysis from the perspective of knowledge spillover and internal capital market.Econ.Res.J.6,80-92.

La Porta,R.,Lopez-de-Silanes,F.,Shleifer,A.,Vishny,R.,1999.The quality of government.J.Law Econ.Organ.15(1),222-279.

Li,Danmeng,Xia,Lijun,2008.The nature of equity,the institutional environment and the R&D intensity of the listing corporation.J. Financ.Econ.34(4),93-104(in Chinese).

Li,H.,Zhang,Y.,2007.The role of managers'political networking and functional experience in new venture performance:evidence from China's transition economy.Strateg.Manage.J.28(8),791-804.

Li,J.J.,Poppo,L.,Zhou,K.Z.,2008.Do managerial ties in China always produce value?Competition,uncertainty,and domestic vs. foreign firms.Strateg.Manage.J.29(4),383-400.

Liu,Yunguo,Liu,Wen,2007.The senior executive tenure and R&D spending in China's listing corporation.Manage.World 1,128-136.

Lu,Changchong,Chen,Shihua,Joachim,S.,2006.The theory of interlocking directorates:from the empirical test of Chinese enterprises. China Ind.Econ.1,113-119.

Lu,Changchong,Chen,Shihua,2009.The reconstruction of fracture connection:interlocking directorates and its organization function. Manage.World 5,152-165.

Maman,D.,1999.Research note:interlocking ties within business groups in Israel-a longitudinal analysis,1974-1987.Organ.Stud.20(2),323-339.

Mansfield,E.,1962.Entry,Gibrat's law,innovation and the growth of firms.Am.Econ.Rev.52(5),1023-1051.

Mauro,P.,1995.Corruption and growth.Q.J.Econ.110(3),681-712.

Mintz,B.,Schwartz,M.,1985.The Power Structure of American Business.University of Chicago Press,Chicago.

Mowery,D.C.,1983.Industrial research and firm size,survival,and growth in American manufacturing,1921-1946:an assessment.J. Econ.Hist.43(4),953-980.

Nahapiet,J.,Ghoshal,S.,1998.Social capital,intellectual capital,and the organizational advantage.Acad.Manage.Rev.23(2),242-266.

Nam,J.,Ottoo,R.E.,Thornton Jr.,J.H.,2003.The effect of managerial incentives to bear risk on corporate capital structure and R&D investment.Financ.Rev.38(1),77-101.

Peng,Zhengyin,Liao,Tianye,2008.An empirical study on the governance effect of interlocking directorates:based on an analysis of the inherent mechanism.Nankai Bus.Rev.11(1),99-105.

Qian,Y.,Roland,G.,1998.Federalism and the soft budget constraint.Am.Econ.Rev.88(5),1143-1162.

Qian,Y.,Weingast,B.,1997.Federalism as a commitment to preserving market incentives.J.Econ.Perspect.11(4),83-92.

Qiu,Yueming,Li,Shi,Sicular,T.,2010.Exploring the issue on the high income of monopolized industry.Soc.Sci.China 3,77-93.

Ren,Bing,Qu,Yunhui,Peng,Weigang,2007.Interlocking directorates and firm performance:an empirical study in China.Nankai Bus. Rev.10(1),8-15.

Ren,Haiyun,2010.Relationship between ownership structure and R&D inputs:evidence from listed manufacturing companies in China. China Soft Sci.5,126-135.

Rodrik,D.,Subramanian,A.,Trebbi,F.,2004.Institutions rule:the primacy of institutions over geography and integration in economic development.J.Econ.Growth 9(2),131-165.

Rogers,M.,1995.Diffusion of Innovations,fourth ed.The Free Press,NY.

Rogers,M.,2002.The influence of diversification and market structure on the R&D intensity of large Australian firms.Aust.Econ.Rev. 35(2),155-172.

Rose-Ackerman,S.,Kornai,J.,2004.Building a Trustworthy State in Post-socialist Transition.Palgrave Macmillan,New York.

Scherer,F.M.,1984.Innovation and Growth:Schumpeterian Perspectives.MIT Press,Mass,Cambridge.

Treisman,D.,2000.The causes of corruption:a cross-national study.J.Public Econ.76,399-457.

Stokman,F.,Ziegler,R.,Scott,J.,1985.Networks of Corporate Power:An Analysis of Ten Countries.Polity Press,Cambridge.

Uzzi,B.,Gillespie,J.J.,2002.Knowledge spillover in corporate financing networks:embeddedness and the firm's debt performance. Strateg.Manage.J.23(7),595-618.

Uzzi,B.,1996.The sources and consequences of embeddedness for the economic performance of organizations:the network effect.Am. Sociol.Rev.61(4),674-698.

Uzzi,B.,1999.Embeddedness in the making of financial capital:how social relations and networks benefit firms seeking financing.Am. Sociol.Rev.64(4),481-505.

Wahal,S.,McConnell,J.J.,2000.Do institutional investors exacerbate managerial myopia?J.Corp.Financ.6(3),307-329.

Wang,Yonqin,2005.Reputation,Commitment and Organizational Forms.Shanghai People's Publishing House,Shanghai.

Wu,Yanbing,2006.R&D and productivity:an empirical study on Chinese manufacturing Industry.Econ.Res.J.41(11),60-71.

Zhu,Hengpeng.,2006.Firm size,market power,and the R&D behavior of non-government enterprises.J.World Econ.29(12),41-52.

15 May 2014

.

E-mail addresses:jxgudong@zjut.edu.cn(X.Jin),guangyonglei@126.com(G.Lei),jlyuchina@gmail.com(J.Yu).

China Journal of Accounting Research2016年1期

China Journal of Accounting Research2016年1期

- China Journal of Accounting Research的其它文章

- Do business groups affect corporate cash holdings?Evidence from a transition economy☆

- Executive compensation in business groups:Evidence from China☆

- Earnings management,corporate governance and expense stickiness

- Guidelines for Manuscripts Submitted to The China Journal of Accounting Research