Do business groups affect corporate cash holdings?Evidence from a transition economy☆

Weixing Ci,Cheng(Colin)Zeng,Edwrd Lee,Neslihn Ozkn

aDongling School of Economics and Management,University of Science and Technology Beijing,China

bAlliance Manchester Business School,University of Manchester,United Kingdom

cSchool of Economics,Finance and Management,University of Bristol,United Kingdom

Do business groups affect corporate cash holdings?Evidence from a transition economy☆

Weixing Caia,Cheng(Colin)Zengb,*,Edward Leeb,Neslihan Ozkanc

aDongling School of Economics and Management,University of Science and Technology Beijing,China

bAlliance Manchester Business School,University of Manchester,United Kingdom

cSchool of Economics,Finance and Management,University of Bristol,United Kingdom

A R T I C L EI N F O

Article history:

Accepted 28 October 2015

Available online 19 January 2016

JEL classification:

G32

G34

G38

Business groups

Cash holdings

China

State ownership

Monetary policy

We examine whether business groups'influence on cash holdings depends on ownership.Group affiliation can increase firms'agency costs or benefit firms by providing an internal capital market,especially in transition economies characterized by weak investor protection and difficult external capital acquisition.A hand-collected dataset of Chinese firms reveals that group affiliation decreases cash holdings,alleviating the free-cash-flow problem of agency costs. State ownership and control of listed firms moderate this benefit,which is more pronounced when the financial market is less liquid.Group affiliation facilitates related-party transactions,increases debt capacity and decreases investmentcash-flow sensitivity and overinvestment.In transitional economies,privately controlled firms are more likely to benefit from group affiliation than statecontrolled firms propped up by the government.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

This paper investigates the effect of business groups on firms'cash policies and whether it depends on ownership structure.A business group is a set of legally independent firms bound together by formal and informal ties(for an overview of business groups,see Khanna and Yafeh,2007).This unique organizational form is internationally widespread,especially in transition economies.For instance,Claessens et al.(2002)find that in eight of the nine Asian countries they study,the top fifteen family groups control more than 20%of the listed corporate assets.In particular,up to the end of 2006,Chinese business groups contributed above 60%of the nation's industrial output(Sutherland,2009).Despite their significant contribution to national economies,the general understanding of business groups in emerging countries has thus far been inadequate.

The literature suggests two competing explanations of how business groups affect corporate cash holdings. A predominant view in corporate finance is based on the free-cash-flow hypothesis,which posits that in the presence of agency costs of managerial discretion,management has incentives to hold excess cash for its own objectives at shareholders'expense(Jensen,1986).The complicated ownership and organizational structure of business groups result in a higher level of information asymmetry than seen in standalone firms,which inevitably exacerbates the agency conflicts between managers and shareholders.Alternatively,business group affiliation benefits firms by forming an internal capital market.The precautionary motive hypothesis put forth by Keynes(1936)suggests that in the presence of an internal capital market,business group affiliates tend to hold less cash due to a lower level of financial constraints(Schiantarelli and Sembenelli,2000).Taken together,the net effect of business groups on cash holdings depends on which role of the business group dominates the other.This study explores business groups in China and aims to contribute to the current debate over their role in emerging economies.

Transition economies like China offer a suitable research setting in which to study the costs and benefits of business groups for two reasons.First,China is characterized by the coexistence of tremendous economic achievements and an underdeveloped institutional environment.As the largest emerging economy,China has experienced unprecedented economic growth during the past three decades.However,the country's investor protection is among the worst worldwide.Allen et al.(2005)suggest that China ranks the lowest in terms of investor protection among the countries included in a study by La Porta et al.(1998).External financing in the country can be very costly or even unavailable(Ayyagari et al.,2010).In such a context,business groups may serve extensive governance functions by creating an internal capital market(He et al.,2013)and enhancing intra-group guarantees and financing flexibility(Chang and Hong,2000).Second,despite its transition from a centrally planned economy to a market-oriented economy,China has maintained a state-dominated financial system in which the government has substantial influence over the allocation of financial resources(Cai et al.,2014).The state-dominated financial system usually favors state-owned enterprises(SOEs)by providing them financial support in the forms of preferential loans,state subsidies,IPO/SEO opportunities and so forth.As opposed to their SOE counterparts,non-SOEs(NSOEs)face greater difficulties accessing external finance.Thus,a business group is likely to serve as an internal capital market to mitigate the financial constraints facing NSOEs.

Our empirical findings are as follows.Using a panel of 6633 Chinese listed non-financial firms covering 2008-2011,we find that group-affiliated firms hold significantly less cash than their unaffiliated counterparts. This finding is consistent with the view that the precautionary motive of affiliated firms to hold cash is weaker due to the lower level of constraints imposed by the internal capital market.In addition,we examine whether the effects of business groups on cash holdings differ between SOEs and NSOEs.The results show that the role of business groups in decreasing cash reserves is economically and statistically more prominent among NSOEs.In subsequent analysis,we exploit an exogenous shock to the credit supply as a result of tight monetary policy during 2010-2011.As expected,we find strong evidence that the decrease in credit supply due to the monetary policy change strengthens the relationship between business groups and cash holdings and that this relationship is more pronounced among NSOEs.

We perform several additional analyses to shed light on the mechanisms through which business groups can mitigate capital constraints.First,we examine whether group affiliates are involved in more related-party transactions.Consistent with Jia et al.(2013),we find a positive relationship between business groups and the amount of related-party transactions,providing direct evidence of the internal capital market mechanismthrough which business groups mitigate the precautionary motive of affiliated firms to hold cash.We also find that group-affiliated firms have a higher debt capacity than their unaffiliated peers,suggesting that business groups help affiliated firms to obtain external financing.Next,we examine whether group affiliates face fewer financial constraints than unaffiliated firms.The results show that the former exhibit a lower level of investment-cash-flow sensitivity than the latter.Finally,further analysis indicates that group affiliation decreases the level of overinvestment.This effect is more pronounced among NSOEs,suggesting that business groups contribute to decreasing the free-cash-flow problem.1We acknowledge the referee for raising this point.

Our study contributes to the business group and cash policy literature.We provide evidence based on a transition economy,which offers an interesting institutional setting in which to compare the cost and benefit effects of group affiliation.He et al.(2013)analyze the relationship between business groups and investment-cash-flow sensitivity but do not examine the effect of group affiliation on cash holdings,which is a more direct measure of the agency problem associated with free cash flow.In addition,the sample used by He et al.(2013)only goes up to 2006.Given the significant effect of China's split share structure reform(SSSR)on corporate cash holdings,our study exclusively focuses on the post-reform period(i.e.,2008-2011).2Chen et al.(2012)investigate the sensitivity of cash holdings to the split share structure reform using a sample covering 2000-2008. They find that by 2008 more than 79%firms had completed the conversion of non-tradable shares to tradable shares.Moreover,unlike prior studies of business groups in China(e.g.,Keister,1998;Fan et al.,2008;Carney et al.,2009),which may suffer from the problem of small-sample bias,we consider all of the publicly traded group affiliates in China.The rich data of the listed firms yield relatively unbiased results(He et al.,2013).Our findings suggest that in transition economies like China,firms propped up to a lesser extent by the government are more likely to benefit from business group affiliation.The policy implication stemming from our evidence is that group affiliation for SOEs may be less justified given that the underlying agency cost may not be offset by capital acquisition benefits.

The remainder of this paper is organized as follows.Section 2 briefly introduces China's business groups and institutional factors.Section 3 provides the literature review and hypothesis development.Section 4 discusses the research design and sample.Section 5 presents the empirical results.Section 6 discusses the results of additional analyses.The final section concludes the paper.

2.Institutional background

2.1.Business groups in China

A key aspect of the economic reform generating China's unprecedented growth is the establishment of business groups,known as qiyejituan in Chinese.To facilitate China's economic transition from a centrally planned economy to a market-oriented economy without causing the chaos seen in other ex-communist economies such as Russia,business groups have been introduced as intermediary institutions and economic engines for economic development(Keister,1998;Yiu et al.,2005).In the mid-1980s,business groups increased rapidly with the encouragement and assistance of the state.It is widely believed that such groups can develop new technology,deliver superior financial performance and achieve economies of scale.In one decade,business groups in China went from non-existent to numbering more than 7000 by the early 1990s.As of 1995,the state-owned business groups were valued at 1.12 trillion yuan(USD$135.7 billion),one quarter of the nation's total state-owned assets(Kan,1996).

Through the establishment of two stock exchanges in the early 1990s,some business groups began to include both publicly traded firms and SOEs in their portfolios of affiliated firms.As the listed group affiliates are independent legal entities that are required to disclose their financial and non-financial information regularly,we can clearly identify affiliated firms by their corporate structures.In addition,the financial information pertaining to these firms yields rich data for our large-sample analysis.Fig.1 demonstrates the complexity of a business group in China.Founded in 1969,Wanxiang Group includes four listed affiliated firms,including one in Shanghai and three in Shenzhen.3Consistent with He et al.(2013),we do not include firms with shares traded in non-domestic markets such as Hong Kong and the United States.

Figure 1.Structure of Wanxiang Group.Source:2008 Annual Report of Relevant Firms.

Consistent with China's transition to a market economy,continued efforts have been made to let the state sector concentrate on strategic and‘‘life-blood”industries in the national economy.As a result,the number of business groups has declined in recent years and their economic significance has improved.For instance,although the number of business groups at various levels fell to 2767 in 1999,their value now accounts for more than 50%of the assets of all SOEs and NSOEs(Ma,2005).

Many scholars consider business groups an organizational response to the underdeveloped institutions of emerging economies(e.g.,Chang and Hong,2000;Khanna and Palepu,2000a,b;Jian and Wong,2010).Thus,firms in emerging countries may be better off as parts of business groups due to higher transaction costs and because such groups can act as intermediaries between economic actors and imperfect markets by filling institutional voids.In contrast,the relatively lower transaction costs in developed economies with more efficient capital markets,stronger legal protection and better financial intermediaries decrease the need for an internal capital market and the broad diversification offered by business groups.

Business group structures vary across countries,exhibiting differences in both formal links(such as ownership structure)and informal ties(such as family,kinship and friendship)(Morck et al.,2005).Chinese business groups are most similar to those in Japan and Korea,partly because Chinese officials have been observing and learning about Japanese keiretsu and Korean chaebol for years(Ma,2005).However,Chinese business groups differ from keiretsu and chaebol in the following two ways.First,Korean chaebols are characterized by private ownership with limited bank involvement,and Japanese keiretsus have multiple corporate owners,typically centered on a main bank(Gedajlovic and Shapiro,2002).However,Chinese business groups involve considerable government intervention.Second,Chinese business groups are more focused,although somewhat more diversified,than keiretsus and chaebols.This is particularly true for state-owned business groups,as the government requires them to act as the leading players or national champions in their sectors.As such,China offers an ideal laboratory in which to analyze the effect of ownership structure on the role of business groups.

2.2.Ownership structure of Chinese listed firms

A distinct feature of China's stock markets is the dominant role of state ownership in Chinese listed firms. For example,nearly two thirds of Chinese listed firms are currently still under state control.Compared with their NSOE counterparts,SOEs usually have multiple objectives,including not only profit maximization but also social aims such as the creation of job opportunities and maintenance of social stability.In return,thegovernments at various levels often provide SOEs with perks such as business contracts and financial assistance.For instance,stock market regulators always treat SOEs preferentially by offering them listing privileges(Aharony et al.,2000).In addition,SOEs have greater access to equity offerings for capital needs(Gordon and Li,2003),debt financing(Sapienza,2004;Jia,2009)and state subsidies,particularly when they face financial distress(Chen et al.,2008;Lee et al.,2014).Consequently,SOEs are expected to be associated with less financial constraints and bankruptcy risk than NSOEs.

It was not until 2005,when China underwent the SSSR,that state and legal person shares became freely tradable on the stock exchanges.Before the reform,such shares could be exchanged only under special circumstances at a negotiated price and with government approval.The reform required non-tradable shares to become tradable after the end of a lock-up period.For most firms,the lock-up period ended in 2007/2008,after which the shareholders were able to sell up to 50%of their shares in the following six months(Chen et al.,2009).As a major policy change,the SSSR has had a significant effect on the financing activities of Chinese listed firms in areas such as cash policy(Chen et al.,2012)and leverage decisions(Liu and Tian,2012).To parse out the potential confounding effect of the SSSR on cash holdings,we focus exclusively on the postreform period(i.e.,2008-2011)in the present study.We believe that doing so allows us to better answer our research question about the link between business groups and cash holdings.

2.3.China's monetary policy during 2008-2011

Firms'cash-holding incentives are likely to be affected by external factors such as financial market liquidity. The recent financial crisis has had a profound influence around the world.All of the major economies suffered from a sudden contraction of liquidity and China was no exception.The main concern of China's monetary policy before the crisis was controlling inflation,as its consumer price index was far above 3%.However,as the unexpected crisis hit China's economy,the government promptly switched its monetary policy from preventing the economy from overheating to stimulating the economy by expanding domestic demand to offset a slump in exports resulting from the financial crisis.To achieve this,the Chinese government loosened the once-tight monetary policy in 2008,with China's central bank,the People's Bank of China(PBC),slashing benchmark interest rates by a factor of five and the deposit requirement ratio by a factor of four.Moreover,during 2008-2009,the government put a 4-trillion-yuan(USD$586 billion)stimulus package in place to bolster economic expansion and help sustain global growth.The central bank further loosened credit controls in 2009,which spurred a surge in new bank loans of 9.6 trillion yuan,up from 4.9 trillion yuan in 2008.

China's monetary policy entered into a tightening cycle in 2010 for two reasons.First,China's domestic economy experienced a strong recovery as a result of the loose monetary policy and proactive fiscal policy in 2008-2009.Second,China was facing rising inflation and the threat of hot money inflows expected from the quantitative easing policy of the U.S.In an effort to counteract these effects,China's stance gradually swung from‘‘loose”to‘‘appropriately tight.”For instance,the PBC had raised interest rates five times and the deposit requirement ratio nine times by August 2011.

Studies have used the broad definition of money to measure China's monetary policy based on the PBC officially defining its intermediate target as M2 in 1996(Xie,2000).Fig.2 presents the targeted and actually realized growth rates of M2 for the period 2005-2011.As expected,the actual growth rate peaked at 28.4 in 2009 and then declined to 17.3 by 2011.Given the preceding discussions,we define the loose(tight)monetary policy period as 2008-2009(2010-2011)in this study.

3.Literature review and hypothesis development

3.1.Literature related to business groups

The past two decades have witnessed a surge in research related to business groups.Most of this literature focuses on emerging economies(Khanna and Palepu,2000a,b;Khanna and Rivkin,2001),based on the argument that business groups are more common in countries with poor legal and regulatory institutions(Granovetter,2005).Studies have examined the effect of business groups through a wide array of indicators such as market valuation(e.g.,Bae and Jeong,2007;Bae et al.,2008),financial constraints(e.g.,Shin andPark,1999;Bena and Ortiz-Molina,2013;He et al.,2013),risk sharing(e.g.,Khanna and Yafeh,2005;He et al.,2013),financial performance(e.g.,Khanna and Palepu,2000b;Khanna and Rivkin,2001;Carney et al.,2011)and tunneling(e.g.,Bae et al.,2002;Baek et al.,2006).In contrast,limited empirical evidence has been produced to show the effect of business groups on cash holdings.Without making a strict distinction between affiliates and non-affiliates,Pinkowitz et al.(2006)examine the effect of bank power on cash holdings and find that Japanese keiretsu members hold less cash than other firms.A recent study by Locorotondo et al.(2014)documents a negative relationship between business group affiliation and cash holdings based on a sample of Belgian firms.

Figure 2.Targeted and actual growth rates of M2 2005-2011.

3.2.Literature related to corporate cash holdings

Neoclassic economics theory suggests that a firm's optimal cash holdings should be at a level such that the marginal benefit of the cash holdings is equal to their marginal cost.A vast number of studies have correspondingly focused on the determinants and motives of cash holdings in different contexts,such as the U. S.(e.g.,Kim et al.,1998;Opler et al.,1999;Bates et al.,2009),the U.K.(e.g.,Ozkan and Ozkan,2004),Italy(e.g.,Bigelli and Sa´nchez-Vidal,2012)and other countries(e.g.,Campello et al.,2012;Dittmar et al.,2003;Pinkowitz et al.,2006).However,studies of cash holdings in China remain scant,with the exceptions of those by Wu et al.(2012)and Chen et al.(2012).Wu et al.(2012)examine the effect of financial deepening on the relationship between trade credit and cash holdings.They find that firms in regions of higher financial development hold less cash for payables and substitute more receivables for cash.Chen et al.(2012)suggest that there is a negative relationship between the SSSR and the cash holdings of Chinese listed firms.Our study extends and complements these papers by focusing on the group-cash relationship,in which business groups appear to capture liquidity demand,beyond the factors examined in previous studies.

3.3.Hypothesis development

The precautionary motive proposes that cash is held as a buffer to guard against unexpected contingencies or cash deficiencies(Keynes,1936;Hill et al.,2014).Opler et al.(1999)suggest that firms with strong growth opportunities,riskier cash flows and less access to capital markets hold more cash.Extending a study by Opler et al.(1999),Han and Qiu(2007)find a positive relationship between cash holdings and cash flow volatility among financially constrained firms.Acharya et al.(2007)provide theoretical and empirical evidence showing that firms with greater hedging needs hold more cash.In a subsequent study,Bates et al.(2009)also document a positive relationship between cash holdings and cash flow volatility.They indicate that the precautionary motive dominates agency conflicts in explaining the increase in cash holdings.A recent study by Hill et al.(2014)finds that firms with political connections hold less cash due to decreased concerns about liquidity shortages.

As cash is held for precautionary purposes to counteract future cash flow shocks,business groups may alter firms'liquidity strategies by decreasing the uncertainty of future cash flows in several ways.First,business groups allow the formation of internal capital markets,which can partially replace the external markets in meeting the financial needs of affiliated firms.A group pools funds from its affiliated members and reallocates them to the most profitable projects.As such,business groups can be seen as a more efficient channel for allocating capital and managerial resources among affiliated firms.This is especially the case when external markets are underdeveloped.In addition,business groups can benefit affiliated firms by facilitating risk sharing(Khanna and Yafeh,2005).This is done mainly through the transfer of resources from well-performing affiliates to poorly performing ones,particularly during times of financial difficulty.For instance,Prowse(1992)provides evidence that group affiliates assist member firms that are suffering from financial distress so as to ensure the long-term survival of the group.This is corroborated by Friedman et al.(2003),who find that group controllers tend to prop up affiliated firms during a crisis using their private funds or group-wide savings.Given intra-group coordination and internal transactions,business groups can decrease the bankruptcy probabilities of affiliated firms(Lincoln et al.,1996),which may in turn decrease the precautionary motive for holding cash.

In addition to providing internal capital markets,business groups may help affiliated firms to obtain external financing.Group affiliation can improve the debt-bearing capacity of member firms by linking the member firms to one another.Group reputation enables affiliates to gain access to external credit(Chang and Hong,2000;Schiantarelli and Sembenelli,2000).In addition,intra-group guarantees help affiliated firms to gain financing through bank loans and corporate bonds,as the assets of one group firm can serve as collateral for other member firms(Shin and Park,1999;Verschueren and Deloof,2006).

Overall,business group affiliations are expected to yield improved access to finance and an ability to generate more stable future cash flows,in turn decreasing the precautionary motives of affiliated firms to hold cash.As long as this effect dominates the potential agency problem often associated with business groups(La Porta et al.,1999;Bae et al.,2002;Morck et al.,2005;Jiang et al.,2010),we expect a negative association between group affiliation and cash holdings.These arguments lead to our first hypothesis.

H1.Business-group-affiliated firms hold less cash than their unaffiliated counterparts.

Studies have suggested that political connections play a dominant role in firms'cash policies.Faccio et al.(2006)document that politically connected firms are more likely to be bailed out by the government in times of distress than non-connected peers.This implicit guarantee in turn disincentivizes firms from retaining excess cash.Political connections appear to be more explicit in China than in Western economies and are reflected in the form of state ownership.As discussed in Section 2.2,China's state-dominated financial system favors SOEs.Compared with their NSOE counterparts,SOEs are more likely to exhibit the soft budget constraint formulated by Kornai(1980).According to soft budget constraint theory,an organization with a budget constraint can always depend on a supporting organization to bail it out when its budget constraint is breached. In China,SOEs have better access to external financing through either the banking sector or the equity markets than NSOEs(e.g.,Chen et al.,2012;Megginson and Wei,2013).Furthermore,SOEs are more likely to receive financial assistance when facing financial distress(Cull and Xu,2000).Therefore,the marginal effect of business groups in terms of mitigating financial constraints and decreasing cash holdings driven by precautionary motives should be greater among NSOEs than SOEs.Hence,we posit the following hypothesis.

H2.The inverse relationship between business groups and cash holdings is more pronounced among NSOEs than among SOEs.

In addition to micro-level firm characteristics,macroeconomic factors such as monetary policy affect firms' cash-holding decisions(Faulkender and Wang,2006;Zaman,2011;Harford et al.,2012).The monetary transmission mechanism is particularly important for firms.Whenever monetary policy changes,market interest rates such as mortgage and bank deposit rates change accordingly.These changes in turn affect the investment and financing behavior of firms in the economy.For example,other things being equal,higher interest rates resulting from tight monetary policy tend to encourage firms to hold more liquidity rather than make investments.In such circumstances,bank borrowing may become very expensive or even unavailable,making financially constrained firms more vulnerable than others and thereby having a significant bearing on their cash orliquidity management decisions.As bank financing is a dominant financing channel for Chinese firms(Allen et al.,2005),the sensitivity of this form of financing to monetary policy changes can be highly significant.As discussed previously,business groups are likely to decrease firms'cash holdings through the channels of both internal and external financing.We expect that the effect of business groups on cash holdings is more prominent in times of tight monetary policy.Furthermore,compared with their SOE counterparts,NSOEs suffer from a higher level of capital constraints,as explained in Section 2.2.Therefore,we expect that the interaction effect of monetary policy and business groups on cash holdings is more pronounced among NSOEs than SOEs.Hence,we put forward the following hypotheses.

H3a.Group-affiliated firms hold even less cash than unaffiliated firms in times of tight monetary policy than they do in times of loose monetary policy.

H3b.The relationship in H3a is more pronounced for NSOEs than for SOEs.

Figure 3.Percentage of group-affiliated firms.

4.Research design

4.1.Sample and data

We base our sample selection on all of the firms listed on the Shanghai and Shenzhen Stock Exchanges during 2008-2011.As explained earlier,we restrict our sample to begin in 2008 to circumvent the influence of the SSSR on cash holdings(Chen et al.,2012).We collect the business affiliation data manually from the annual reports of the listed firms.Following He et al.(2013),we identify a firm's group affiliation in each year based on whether its ultimate controller has more than one listed firm in that year.4We define business groups as having at least two listed firms.Business groups in China were originally encouraged to publically list their strongest son firms.As a result,almost all Chinese listed firms are affiliated with a business group(Jiang et al.,2010;Jia et al.,2013). Our classification is likely to bias the results against finding a negative association between group affiliation and cash holdings because internal capital markets may also exist in our non-group sample.In other words,our results may become stronger if we restrict business groups to have at least one listed company.Fig.3 demonstrates the proportion of group-affiliated firms over our sample period.On average,group-affiliated firms account for 50%of all of the listed firms.This proportion is higher than that in a study by He et al.(2013),who find it to be slightly above 30%in 2006.The difference arises mainly due to the acceleration of mergers and acquisitions in China in recent years,which has resulted in a growing number of group affiliates.In addition,as shown in Fig.3,there is a dramatic decrease in the proportion of group-affiliated firms in 2011,although the number of affiliated firms stays almost the same as that in previous years.This drop is driven by a sharp increase in the number of listed firms following the launch of China's Growth Enterprise Board.

Our analyses call for a separation of SOEs and NSOEs.We identify an SOE(NSOE)based on whether its ultimate controller is a state asset management bureau or other government-related unit.We retrieve the information related to ultimate controllers from the CCER Sinofin Database.Finally,we download the financial and accounting data used in our analyses from the China Security Markets and Accounting Research(CSMAR)database.

Table 1 Panel A summarizes the sample selection process.Of the 8629 initial firm-year observations,we remove 651 observations that are listed for less than 1 year.In addition,we eliminate 147 firm-year observa-tions from the financial sector and 1198 firm-year observations with insufficient data for our study.The final sample consists of 6633 firm-year observations.

Table 1Sample selection and distribution.

Table 1 Panel B presents the yearly distribution of the sample.The numbers of both group-affiliated and unaffiliated firms increase gradually across the years.In particular,a significant increase is observed in the number of unaffiliated firms,from 789 in 2010 to 1089 in 2011.This further explains why the proportion of affiliated firms decreases significantly in 2011,as demonstrated in Fig.3.

Table 1 Panel C presents the industry distribution of observations,where the industries are based on the classifications of the China Securities Regulatory Commission(CSRC).Equipment manufacturing constitutes the largest share with 1121 observations,581 of which are affiliated with business groups.Other manufacturing is the smallest sector with 34 observations,only 4 of which are group affiliated.

4.2.Model specification

We examine the association between cash and business groups based on the framework implemented by Opler et al.(1999),variants of which have been used to test several issues related to cash holdings(e.g.,Ozkan and Ozkan,2004;Fritz Foley et al.,2007;Harford et al.,2008).We estimate the following equation:

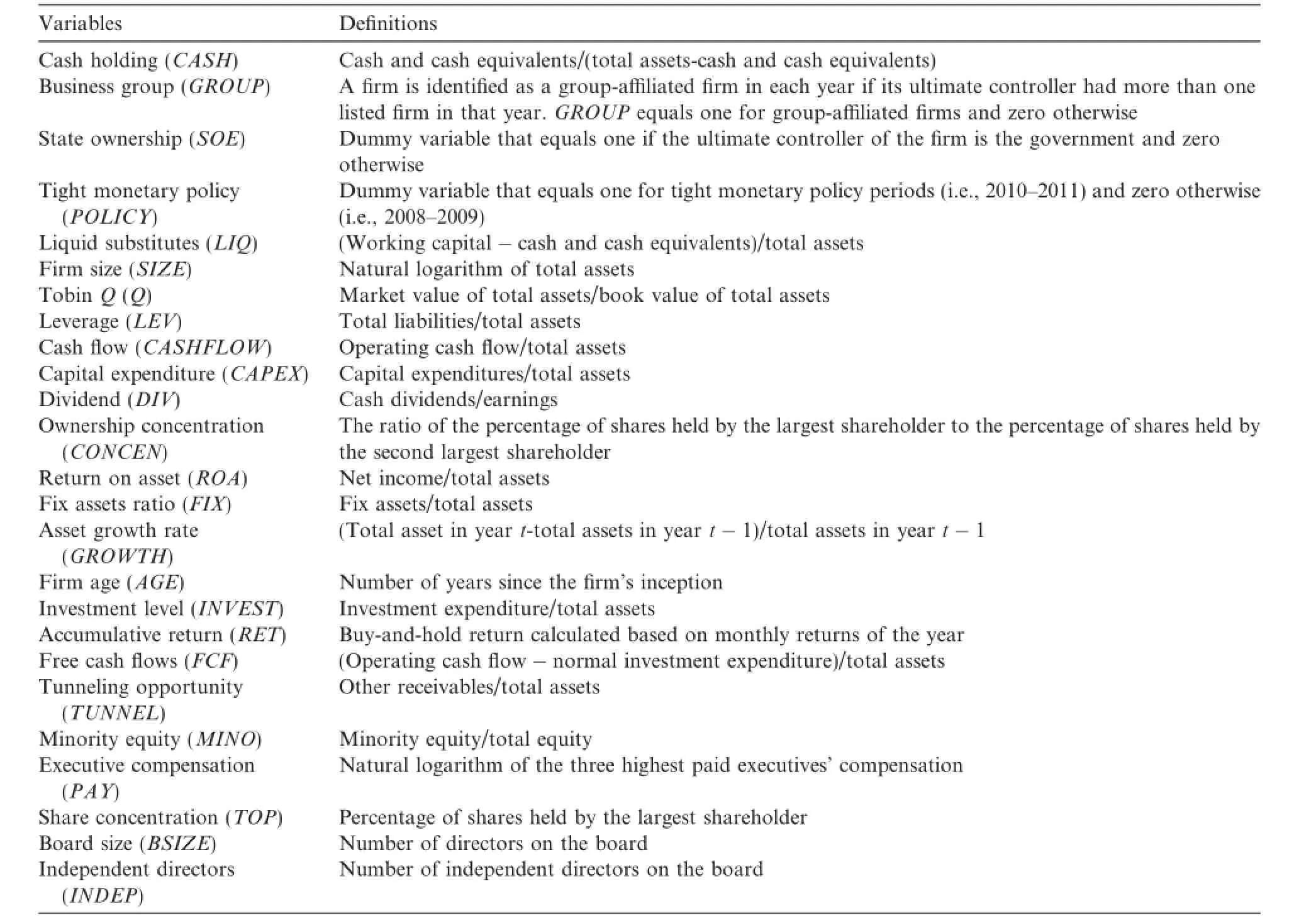

where for firm i in year t CASH refers to cash and cash equivalents divided by net assets,i.e.,total assets minus cash and cash equivalents;GROUP is a dummy variable that equals one if the firm is group affiliated and zero otherwise;LIQ refers to working capital minus cash and cash equivalents divided by total assets;SIZE is the natural logarithm of total assets;Q is the market value of total assets divided by the book value of total assets;LEV refers to total liabilities divided by total assets;CF refers to operating cash flow scaled by total assets;CAPEX refers to capital expenditure divided by total assets;DIV is the ratio of cash dividends to earnings;and CONCEN is the share proportion of the largest shareholder divided by the share proportion of the second largest shareholder.If H1 is supported and business group affiliates hold less cash than unaffiliated firms,then we should observe that α1is significantly negative.Table 2 presents the variable definitions.

To test H2,which states that the effect of business groups on cash holdings is more pronounced for NSOEs than for SOEs,we estimate Eq.(1)for the NSOE and SOE subsamples,respectively.If H2 is true,then we expect that the coefficient of GROUP is greater for the NSOE subsample.In addition,we test whether the difference between the GROUP coefficients for the two groups is statistically significant.

To test whether the relationship between group affiliation and cash is amplified in times of tight monetary policy as hypothesized in H3a,we adopt a difference-in-difference approach by including a policy dummy(POLICY)and an interaction term between POLICY and GROUP in Eq.(1).The regression model is thus expressed as follows:

where POLICY is an indicator variable equal to one if the observation occurs during a period of tight monetary policy(i.e.,2010-2011)and zero otherwise(i.e.,2008-2009).H3a is supported if β3is significantly negative.To further test H3b,we estimate Eq.(2)separately for the NSOE and SOE subsamples.We expect that β3is significantly more negative for NSOEs.

5.Empirical findings

5.1.Summary statistics

Table 3 reports the descriptive statistics and univariate test results for both the unaffiliated(in Panel A)and affiliated(in Panel B)firms.All of the variables except the dummy variables are winsorized at the 1st and 99th percentiles.The average cash-to-assets ratios of the unaffiliated and affiliated samples are 0.300 and 0.221,respectively,which are higher than the respective values of 0.145 and 0.176 found by He et al.(2013).The difference arises partly due to the different sample periods we examine.5The sample period in the study by He et al.(2013)is 1998-2006.Another important observation is that unaffiliated firms hold greater cash reserves on their balance sheets than their affiliated peers at both the mean and median levels,lending initial support to H1.This pattern is more evident during the period of tight monetary policy(i.e.,2010-2011).As seen in Panel C,the difference in CASH between the two subsamples is statistically significant at the 1%level over 2010-2011 but insignificant over 2008-2009.This finding is consistent with H3a.

Turning to the statistics for the control variables,on average,group-affiliated firms have higher levels of size,leverage,cash flow,capital expenditure,dividend payments and ownership concentration and lower liquidity and Tobin's Q than unaffiliated firms.However,the significance of the differences varies across the years.

Table 2Variable definitions.

5.2.Pearson correlations

Table 3 Descriptive statisticsfor the mainvariables.Thistable presencashtsdescriptive statisticsfor the f i rm-levelcharacteristics ofthe unaff i liatedand aff i liatedassamples for the periodcash2008-2011.The variables are def i ned asIZfollows:CASHiscalculatedastoand casheqisuivalents/(totalassetset-cash and cashequivalents).LIQe ofiscalculated(workingcapitaland casheqCAuivalents)/totalopofassets.SE isthe natural logarithm ofistal assets.Qdef i ned asthe markividvalue oftotal assets/book valutotal assets.LEVs toistoearntal liabgs.Cilities/toCEowtal assets.e SHFLOWiserating cashf l owareh/totalassets.CAPEXcapital expendnditures/totalarehassets.Dend(DIV)ismeasuredasmeanthe ratio ofcashdividendbsaminONshN isthshvaluare proportionthe eqe largest shofolder/share proportionofthe secor thlargest sholder.Dif f shows the dif f erenceins between the two suples.P-values the pesoftests for thualitymeans.All ofthe variables exceptfoe dummy variables are winsorizedatthe 1%and 99%levels.PeriodObs.CASHLIQ SIZEQ LEV CASHFLOWCAPEX DIV CONCENMeanMedianMeanMedianMeanMedianMeanMedianMeanMedianMeanMedianMeanMedianMeanMedianMeanMedianPanel A:Unaff i liatedsample(GROUP=0)20086840.1930.116-0.086 -0.03621.06820.9931.567 1.244 0.510 0.495 0.048 0.046 0.050 0.036 0.287 00 9.867 3.468 20097240.2440.146-0.080 -0.02421.17621.0952.724 2.104 0.505 0.494 0.059 0.056 0.034 0.033 0.232 9.345 4.011 20107890.3320.177-0.040 0.005 21.28621.2092.958 2.298 0.479 0.475 0.039 0.044 0.048 0.038 0.206 0.063 9.346 4.100 201110890.382 0.197 0.042 0.078 21.37421.2491.980 1.476 0.404 0.386 0.019 0.022 0.065 0.054 0.302 0.148 7.925 3.501 Total 32860.300 0.161-0.031 0.014 21.24521.1462.293 1.685 0.467 0.464 0.039 0.040 0.051 0.042 0.261 0.059 8.982 3.743 Panel B:Aff i liatedsample(GROUP=1)0.085 20087730.1890.131--0.08721.85421.6931.278 1.081 0.528 0.537 0.050 0.048 0.059 0.041 0.390 0.045 15.2188.244 20098200.2320.152-0.079 -0.07221.98521.8022.202 1.827 0.529 0.547 0.063 0.058 0.050 0.034 0.253 0.074 15.9718.608 20108610.2290.144-0.058 -0.05022.17022.0042.305 1.805 0.532 0.549 0.043 0.043 0.051 0.037 0.215 0.086 15.5758.065 20118930.2320.140-0.050 -0.03922.32122.1821.622 1.307 0.534 0.543 0.032 0.033 0.056 0.041 0.271 0.123 15.3517.659 Total 33470.221 0.142-0.068 -0.06122.09221.9211.861 1.448 0.531 0.544 0.047 0.045 0.054 0.038 0.280 0.094 15.5308.095 PeriodObs.Dif f P-value Dif f P-value Dif f P-value Dif f P-value Dif f P-value Dif f P-value Dif f P-value Dif f P-value Dif f P-value Panel C:Comparisonoff i rmcharacteristics between unaff i liatedand aff i liated0.289 f i rms 200814570.004 0.3671-0.0010.4876-0.7860.00000.0000-0.0180.0493-0.0020.3306-0.0090.0068-0.1030.0028-5.3510.0000200915440.012 0.2230-0.0010.4714-0.8090.00000.522 0.0000-0.0230.0151-0.0040.2019-0.0150.0275-0.0210.1987-6.6260.0000201016500.103 0.00000.018 0.0924-0.8840.00000.653 0.0000-0.0520.0000-0.0040.1532-0.0030.2954-0.0090.3234-6.2290.0000201119820.150 0.00000.092 0.0000-0.9460.00000.358 0.0000-0.1300.0000-0.0130.0003-0.0040.23110.031 0.0878-7.4260.0000Total 66330.079 0.00000.037 0.0000-0.8470.00000.432 0.0000-0.0640.0000-0.0080.0001-0.0030.1617-0.0190.0732-6.5480.0000

Table 4 presents the Pearson correlation matrix.As expected,GROUP is significantly negatively correlated with CASH,suggesting that group-affiliated firms tend to hold less cash than their unaffiliated counterparts. This is once again consistent with H1.In addition,CASH is significantly positively correlated with liquidity,Tobin's Q,cash flow and dividends,and negatively correlated with firm size,leverage,capital expenditure and ownership concentration.This indicates that these control variables are important in explaining a firm's cash policy and should therefore be included in multivariate analyses.Finally,the correlation coefficients of the main variables are less than 0.7,suggesting that multicollinearity should not be a concern in this study(Lind et al.,2002).

5.3.Test of H1

Table 5 presents pooled OLS regressions to determine the effect of business groups on cash holdings in the first two columns.As reported in column(1),the coefficient of GROUP is significantly negative(-0.0536,t-stat=-6.65).In terms of economic interpretation,a one-standard-deviation increase in the likelihood of being group affiliated precedes a roughly 5%decrease in the cash ratio.The result is not sensitive to the inclusion of a variety of control variables(-0.0166,t-stat=-2.25)as shown in column(2).This suggests a substantial weakening in the demand for cash from affiliated firms,consistent with H1.

All of the control variables except for Tobin's Q significantly explain firms'cash levels.For instance,the non-cash liquidity substitute(LIQ)has a negative effect on cash.The results also show that larger firms hold larger amounts of cash,which does not lend support to the view that larger firms hold less cash because such firms are less capital constrained and more diversified.This finding suggests that other factors may explain the effect of size on cash holdings(Ozkan and Ozkan,2004).In addition,more leveraged(LEV)firms hold significantly less cash,a finding in line with the notion that firms with a higher level of leverage incur higher opportunity costs of holding cash(Baskin,1987)and/or have greater access to external finance(Ferreira and Vilela,2004).Furthermore,firms with a higher level of cash flow(CASHFLOW)tend to hold more cash,as internally generated funds are critical drivers of cash.Consistent with other studies(e.g.,Hill et al.,2014;Locorotondo et al.,2014),the coefficient of capital expenditure(CAPEX)is negative and that of dividends(DIV)is positive.Finally,ownership concentration(CONCEN)is negatively associated with cash holdings,a finding consistent with the view that the presence of strong controllers may lead to a reduction in agency costs,which in turn implies that firms with strong controllers have lower cash reserves.

The preceding results estimated from the OLS regressions provide support for H1,which states that groupaffiliated firms hold less cash than their unaffiliated peers.However,as suggested by Khanna(2000),OLS regressions may suffer from severe self-selection bias in this case,as group affiliation may be endogenously selected based on unobserved firm characteristics,leading to a bias in the coefficient estimates.In an effort to address the potential selection bias issue,we implement a variant of the Heckman two-stage approach: the treatment effect model.6Although the dependent variable is only observed for a subset of sample participants in the Heckman two-stage model,it is observed for both the treated and untreated subsamples in the treatment effect model(Guo and Fraser,2010).In our study,both affiliated and unaffiliated samples are observable.In such cases,the treatment effect model is more appropriate than the Heckman two-stage model for capturing potential self-selection bias.In the first stage,we estimate a logit model for group affiliation on a bunch of variables that are likely to influence a firm's decision to become affiliated with a given group.Apart from the control variables in the preceding OLS regressions,we include some other variables in the first-stage regression:fixed asset ratio(FIX),return on assets(ROA),asset growth rate(GROWTH),lagged affiliation status(L_GROUP)and firm age(AGE).We then include the hazard ratio(HAZARD)based on the logistic regression in the first stage with CASH as the dependent variable.Controlling for potential selection bias does not weaken our main results,as shown in column(4).For instance,the coefficient of GROUP remains negative and statistically significant(-0.019,t-stat=-2.33).Furthermore,the coefficient of the hazard ratio(HAZARD)is positive but insignificant(0.006,t-stat=0.82),implying that selection bias may not be a concern in our study.7Untabulated results suggest that our main findings also remain unaffected when a propensity score matching approach is adopted.

5.4.Test of H2

s:llowtalistoENfod zero1.0000les are def i ned asanNCp aff i liatede ofvalud(DIV)les e variabetividenthCOAll of1.0000e mark0.0075(0.5409)variabisgroutholder.arehassets.DDIV hele.Tthe f i rmsampe ifisdef i ned asitures/totallargest shX 1.0000PE0.0749(0.0000)onlltal assets.Qe fuualsCAndr theqthate secoOWcapital expendaracteristics fothoftoisFL1.00000.18070.03380.0023leEXortiones. SH(0.0000)y variabm of(0.0059)(0.8500)-0.0267(0.0299)chmmgarithAPare propparentheses are p-valua du-levelral loassets.CCA/totalolder/sh1.0000-0.1290(0.0000)-0.1136(0.0000)0.0577(0.0000)e f i rmise natuf l owarehV LEr thUPthROE isinfoassets.Suivalents).GIZg cashn matrixeratine largest shrted1.0000(0.0000)-0.1556(0.0000)0.0534opthers repoW isQ ofrrelatioeqortionmbe nun cod cashLOHFTh1.0000-0.4737(0.0000)(0.0000)-0.0669(0.0000)0.21890.0553(0.0000)(0.0000)-0.1804(0.0000)0.1618(0.0000)-0.0975(0.0000)0.1136(0.0000)-0.0822(0.0000)0.1147e Pearso-cash anuivalents)/totalASare propeqe shSIZEththtsassetsd cashd 99%levels.table presenantal assets.CN is1.00000.10280.1178(0.0000)-0.2340(0.0000)(0.0000)0.0744(0.0000)e 1%cashThtal liabgs.Cthistoearnuivalents/(totaleqONilities/toCEanLIQ capitalinatles.P 1.00000.3183(0.0000)(0.0000)-0.5631(0.0000)0.1449(0.0002)-0.1155(0.0000)0.04470.0121(0.3234)0.0178(0.1463)(0.0000)-0.0038(0.7568)0.1557variaborkingisEVs toOUGRe mainanasd cash(wtal assets.Ldividendcashles are winsorized1.0000(0.0001)-0.0638(0.0000)0.0482(0.0000)-0.1326(0.0000)0.17170.1327(0.0000)0.0374(0.0023)for thcashasLIQ ise ofcalculatedtoy variabSHn matrixcalculatedk value ratio ofthe dummCAmeasuredforrelatioisise.ooasr thOWTable 4P -0.1136(0.0000)FLX -0.1250(0.0000)EN-0.0846(0.0000)CoSHCAotherwassets/bexceptSHCAOUGRLIQ SIZE-0.1822(0.0000)V -0.3960(0.0000)SHPENCQ LECACADIV CO

Table 6 presents the results of subsample analyses of the group-cash relationship.The results in column(2)pertain to the NSOE subsample,and column(3)reports the results for the SOE subsample.The coefficient ofGROUP is negative and significant at the 5%level among NSOEs(-0.0326,t-stat=-2.19),but significantly positive among SOEs(0.0206,t-stat=1.92).The results provide evidence that the former firms are being propped up to a lesser extent by government support and therefore have a greater precautionary motive than the latter firms.In other words,the benefits of affiliating with a business group appear to be greater for NSOEs.Meanwhile,group affiliation magnifies the free-cash-flow problem for SOEs,in which managers'private interests diverge from the interests of the firms they manage.

Further comparison of the coefficient of GROUP suggests a significant difference between the two groups(p-value=0.001).Taken together,these results support H2,suggesting that although group affiliation significantly decreases the cash holdings of firms with greater precautionary motives,the effect is moderated by the state ownership of listed firms.

Table 5Effect of business groups on cash holdings.This table presents regression results of the effect of business groups on cash holdings for the full sample.The variables are defined as follows:CASH is calculated as cash and cash equivalents/(total assets-cash and cash equivalents).GROUP is a dummy variable that equals one if the firm is group affiliated and zero otherwise.LIQ is calculated as(working capital-cash and cash equivalents)/total assets.SIZE is the natural logarithm of total assets.Q is defined as the market value of total assets/book value of total assets.LEV is total liabilities/total assets.CASHFLOW is operating cash flow/total assets.CAPEX is capital expenditures/total assets.DIV is measured as the ratio of cash dividends to earnings.CONCEN is the share proportion of the largest shareholder/share proportion of the second largest shareholder.FIX is measured as fixed assets/total assets.ROA is measured as net income/total assets.GROWTH is measured as the growth rate of total assets.AGE is the number of years since the firm's inception. L_GROUP is the lagged term of GROUP.HAZARD is the hazard ratio calculated from the first stage.All of the variables except for the dummy variables are winsorized at the 1%and 99%levels.The numbers reported in parentheses are heteroskedasticity corrected t-statistics.

5.5.Test of H3a and H3b

Table 7 presents the results for the effect of monetary policy on the association between group affiliation and cash balances.To perform a difference-in-difference estimation,we estimate Eq.(2),in which POLICYis a dummy variable equal to one if the observation occurs during a period of tight monetary policy(i.e.,2010-2011)and zero otherwise(i.e.,2008-2009).The coefficient of interest is the interaction between group affiliation and tight monetary policy(GROUP*POLICY).Supporting H3a,column(1)shows that the grouppolicy interaction is negative and significant at the 1%level,indicating that the moderating role of the group on cash reserves is more noticeable during a period of tight monetary policy.Columns(2)and(3)report the relationships for NSOEs and SOEs,respectively.In line with our expectation as stated in H3b,we find that the coefficient of GROUP*POLICY is negative and significant at the 5%level for NSOEs(-0.0716,t-stat= -2.50)but insignificant for SOEs(-0.0275,t-stat=-1.36).The difference is also statistically significant(p-value=0.008).This indicates that the effect of group affiliation on cash balances during periods of tight monetary policy is confined to firms with an innate disadvantage in acquiring external financing.Another important observation is that during periods of relatively loose monetary policy,group-affiliated SOEs(0.034,t-stat=2.74)tend to hold economically and statistically more cash than affiliated NSOEs(0.0059,t-stat=0.27).The difference in the coefficient of GROUP is significant at the 5%level.The results suggest that SOEs suffer from more severe agency problems than NSOEs,which causes the corporate cash holdings of the former firms to deviate from the level needed for operational and investment purposes(Chen et al.,2012).

Table 6Effect of business groups and state ownership on cash holdings.This table presents regression results of the effect of business groups on cash holdings for the non-state-owned(NSOE)and state-owned(SOE)subsamples,respectively.The variables are defined as follows: CASH is calculated as cash and cash equivalents/(total assets-cash and cash equivalents).GROUP is a dummy variable that equals one if the firm is group affiliated and zero otherwise.LIQ is calculated as(working capital-cash and cash equivalents)/total assets.SIZE is the natural logarithm of total assets.Q is defined as the market value of total assets/book value of total assets.LEV is total liabilities/total assets.CASHFLOW is operating cash flow/total assets.CAPEX is capital expenditures/total assets.DIV is measured as the ratio of cash dividends to earnings.CONCEN is the share proportion of the largest shareholder/share proportion of the second largest shareholder.All of the variables except for the dummy variables are winsorized at the 1%and 99%levels.The numbers reported in parentheses are heteroskedasticity corrected t-statistics.The numbers reported in brackets are p-values comparing the coefficients between the two subsamples.

6.Further analyses

The preceding results show that business group affiliates hold lower cash reserves than their unaffiliated peers.Our interpretation of these results is that group affiliation can improve affiliates'access to both internal and external capital markets,consistent with the precautionary motive explanation for holding cash.To gain further insight into the mechanism by which group affiliations alleviate the capital constraints of affiliates,weconduct several additional analyses of the role of group affiliations in facilitating internal financing(relatedparty transactions)and external financing(debt capacity)and lowering financial constraints(investment-cashflow sensitivity).In addition,we examine whether business groups help to decrease the investment inefficiency induced by the free-cash-flow problem.

Table 7Effect of tight monetary policy on the group-cash relation.This table shows how the effect of business groups and state ownership on the cash holdings is influenced by exogenous monetary policy.The variables are defined as follows:CASH is calculated as cash and cash equivalents/(total assets-cash and cash equivalents).GROUP is a dummy variable that equals one if the firm is group affiliated and zero otherwise.POLICY is a dummy variable that equals one if the firm is under a tight monetary policy(i.e.,2010-2011)and zero otherwise. LIQ is calculated as(working capital-cash and cash equivalents)/total assets.SIZE is the natural logarithm of total assets.Q is defined as the market value of total assets/book value of total assets.LEV is total liabilities/total assets.CASHFLOW is operating cash flow/total assets.CAPEX is capital expenditures/total assets.DIV is measured as the ratio of cash dividends to earnings.CONCEN is the share proportion of the largest shareholder/share proportion of the second largest shareholder.All of the variables except for the dummy variables are winsorized at the 1%and 99%levels.The numbers reported in parentheses are heteroskedasticity corrected t-statistics.The numbers reported in brackets are p-values comparing the coefficients between SOEs and NSOEs.

6.1.Business group and related-party transactions

Drawing on internal market theory(Leff,1978),business groups benefit affiliated firms by forming efficient group-wide internal labor and capital markets.To provide direct evidence of the veracity of this argument,we examine the association between group affiliation and internal financing while paying particular attention to related-party transactions(RPT),which are prevalent in China(e.g.,Keister,1998).The CSRC mandates that all Chinese listed firms disclose such transactions in their financial reporting,which enables us to investigate the internal resource flows within a business group.These transactions mainly include inter-corporate lending and loan guarantees;internal purchases and sales of goods or assets;and leases.To capture the intra-group related-party transactions,we exclude those not occurring between members of the same business group.We employ a Tobit regression as follows:

where for firm i and year t RPT is the value of intra-group related-party transactions divided by total assets,GROUP is a dummy variable that equals one if the firm is affiliated with a group and zero otherwise,SIZE isthe natural logarithm of total assets,LEV refers to total liabilities divided by total assets and GROWTH is the growth rate of total assets.We also control for year and industry fixed effects.

Table 8 presents the results.Consistent with Jia et al.(2013),we document a positive and significant association between GROUP and RPT(0.043,t-stat=17.32).According to an economic interpretation,a onestandard-deviation increase in group affiliation results in a 4.3%increase in the amount of related-party transactions within a group.Turning to split-sample analysis,as reported in columns(2)and(3),the effect of group affiliation on related-party transactions is more pronounced for NSOEs(0.031,t-stat=6.40)than for SOEs(0.021,t-stat=5.94).The coefficient of GROUP differs significantly between the two groups(p-value=0.000).This lends further support to our main finding that business groups play a greater role in decreasing cash balances for NSOEs.

6.2.Business groups and debt capacity

In addition to facilitating the internal capital markets,business groups can improve the debt-bearing capacity of affiliates(e.g.,Chang and Hong,2000;Manos et al.,2007).To confirm our conjecture,we estimate the following pooled OLS regression:

where for firm i and year t LEV is a proxy for debt capacity.To enhance the robustness of our analysis,we use two measures for LEV:LEV1,which is calculated as total liabilities(i.e.,short-term loans plus long-term loans)divided by the book value of total assets,and LEV2,which is calculated as total liabilities divided by the market value of total assets.All of the other variables are as defined previously expect for TA,which refers to tangible assets divided by total assets.Table 9 presents the results.

As shown in column(1),the coefficient of GROUP is positive and significant at the 1%level(0.0223,t-stat=4.39).This indicates that a one-standard-deviation increase in group affiliation leads to a 2.23% increase in loans from debt markets.When it comes to split-sample analysis,as shown in columns(2)and(3),the positive effect of group affiliation on debt capacity occurs for NSOEs(0.030,t-stat=2.79)but notfor SOEs(-0.007,t-stat=-0.91).As expected,the difference in the GROUP coefficient is significant at the 5%level(p-value=0.033).The results are not sensitive to the use of the alternative measure for the dependent variable,as observed in columns(4)-(6).The results offer an extra explanation of the positive association between business groups and corporate cash holdings.

Table 8Do affiliated firms have more related party transactions within the groups?This table presents Tobit regression results of the effect of business groups on related party transactions within the groups.The dependent variable is related party transactions,measured by the amount of related party transactions within a group divided by total assets.The other variables are defined as follows:GROUP is a dummy variable that equals one if the firm is group affiliated and zero otherwise.SIZE is the natural logarithm of total assets.LEV is total liabilities/total assets.GROWTH is the growth rate of total assets.All of the variables except for the dummy variables are winsorized at the 1%and 99%levels.The numbers reported in parentheses are heteroskedasticity corrected t-statistics.The numbers reported in brackets are p-values comparing the coefficients between SOEs and NSOEs.

t endependassets. largest rrected t-*(32.44)37320.5187hend0.0051(0.81)*(-7.55)-0.7241***(-12.88)les are def i ned asassets/totale secocoasticity0.0859**0.0488***(2.60)capacity.T-0.0000(-0.72)0.0077(1.46)e other variablethofed(6)EsSO-1.5856***(-25.70)YY debttangibortionskonA is2901ps*(4.85)*(3.27)*(-9.46)0.3636grouare prop0.0210**(2.34)sinessPanel B.Th0.1170**0.0005**e intal assets.Ts -0.0046(-0.97)toolder/shparentheses are heteroOE0.0550***(12.09)-0.9220**buarehin(5)NSYY e eff ect ofvaluetmofgarithrted*(5.48)*(6.05)13.65)-0.4491**66330.4739d markPanel A anthral loe largest shofmbthers repoV2*(-LElts ofle0.0230**0.0748***(29.47)0.0917**-0.5883**0.0001(1.25)e nu*(-th22.85)e natus.(4)llresuisortionThOEPanel B:samp-1.3821**0.0011(0.32)S regressione in. valuFuYY okise.SIZEare propd NSanEs-0.3770**(-bootherwe sh3732d 99%levels.S regression.. *(3.48)S regressionthS regression*(13.91)*(-14.14)OLin*(3.27)*(-2.67)0.2808OLOL0.0391**OLtsare calculatedd zeroN isantable presen0.0772**CEe 1%een SO-0.0070(-0.91)[0.033]**[0.076]* 2.34)-0.7478***(-9.74)-1.0077**-0.0002**0.0171**attsan(3)EsONthbetwSOYY lts are based onlts are based onlts are based onThiseff i ciens?e cop aff i liated2901e resuf i rmtotal assetsgrou*(2.79)tal assets.C*(5.49)0.2160the resue resuaff i liatedhereisoftog thrateofles are winsorizedarinllll0.0301**0.0085(1.39)0.1836**-0.0004(-0.07)mp0.2631*(1.95)y variabs 0.0004**(2.34)All ofththofe f i rmcothOE).eduntal assets,wthes(2)NSYY -sidantoone ifo-sided).Ao-sided).Ath(twoualsthmme growcapacityare p-valu*(4.39)eqH ise du*(9.17)6633WTr th*(6.90)*(-16.01)0.2407atlevel(twlevel(twleRObracketsthV1fodebtLEle0.0223**0.0283**0.1354**-0.8872**ilities divided by-0.0000(-0.45)Panel A:-0.1922(-1.22)e 10%levelthththe 1%atatatera highe 5%Futal liables exceptcecece0.0074*(1.75)tommy variabYY dif f eren(1)llsamptest]s haveasindif f erenmeasureda dutotal assets.Gers repoe variabrteddif f erenf i rmP isonthrnmbifi cante retuifi cantualityifi cantAll ofOUeqnuofsignTable 9 aff i liatedinles:GRllowA isthfoROarehP older.heTHstatistics.TENt -valuevariabRY*IndOUAOWNC*IndInINYEicate signGRicate signshDo[PSIZETAROGRCOtercepSTDUARs.Ob2R**Indicate**

6.3.Business group and investment-cash-flow sensitivity

The previous results consistently suggest that group affiliations decrease a firm's reliance on precautionary cash holdings.The question that naturally arises is whether group-affiliated firms face less financial constraints than their unaffiliated peers.He et al.(2013)find a negative association between group affiliation and financial constraints,proxied by investment-cash-flow sensitivity.However,their study focuses on an earlier period than ours(i.e.,1998-2006).Given the rapid development of China's economy and the structural change in the stock markets following the SSSR,a further investigation of the effect of business groups on financial constraints in recent years is merited.Following Almeida and Campello(2007),we estimate the following equation:

where all of the variables are as defined previously.The main variable of interest is GROUP*CASHFLOW. The results for the full sample are shown in columns(1)and(2)of Table 10.Without considering the variation between the group-affiliated and unaffiliated firms,Chinese listed firms exhibit a high level of financial constraints on average,as the coefficient of CASHFLOW is positive and significant at the 1%level.When we include the business group variable(GROUP)and an interaction term between GROUP and CASHFLOW,we find that group-affiliated firms have a lower level of capital constraints than the unaffiliated firms.For example,the coefficient of GROUP*CASHFLOW is significantly negative(-0.111,t-stat=-1.83).Thiscorroborates the results of He et al.(2013),who find that the coefficient of GROUP*CASHFLOW is-0.1313(column[1]of Table 3 Panel B).Taken together,our findings suggest that,on average,group affiliations help to decrease the financial constraints facing listed firms.

Table 10Do affiliated firms suffer less from capital constraints?This table presents OLS regression results of the effect of business groups on investment-cash flow sensitivity.The variables are defined as follows:CAPEX is capital expenditures/total assets.CASHFLOW is operating cash flow/total assets.GROUP is a dummy variable that equals one if the firm is group affiliated and zero otherwise.SIZE is the natural logarithm of total assets.Q is defined as the market value of total assets/book value of total assets.LEV is total liabilities/total assets.ROA is measured as net income/total assets.All of the variables except for the dummy variables are winsorized at the 1%and 99% levels.The numbers reported in brackets are p-values comparing the coefficients between SOEs and NSOEs.The numbers reported in parentheses are heteroskedasticity corrected t-statistics.

Columns(3)and(4)report the subsample analysis results.The coefficient of GROUP*CASHFLOW is significantly negative for NSOEs(-0.228,t-stat=-2.78)but insignificant for SOEs(0.033,t-stat=1.25).The difference in the coefficient is also significant at the 1%level(p-value=0.000).The results support the view that the marginal effect of group affiliation is greater for firms that have more difficulty acquiring external financing.

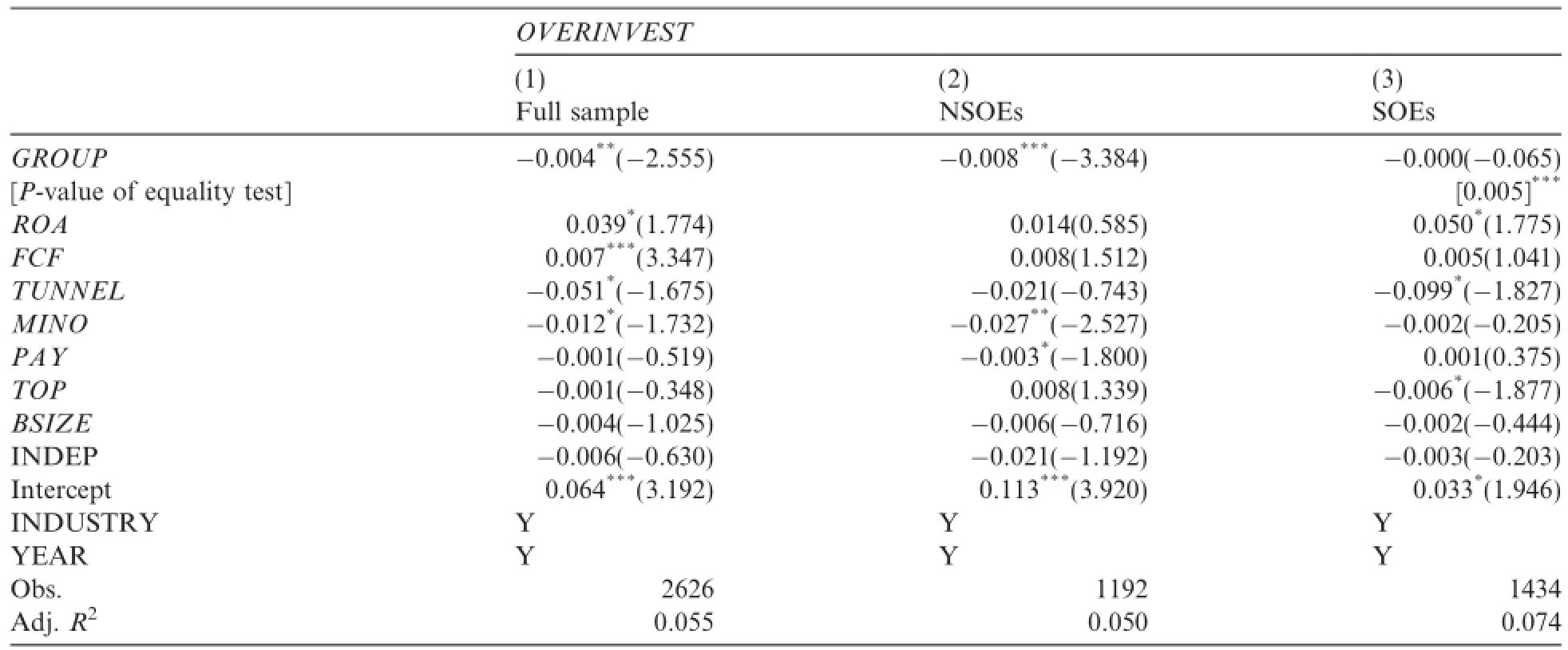

6.4.Business groups and overinvestment

Thus far it is apparent that group affiliates hold less cash due to the existence of an internal capital market. A more intriguing question is whether business groups mitigate or exacerbate the free-cash-flow problem.In this section,we examine the effect of group affiliation on overinvestment,which is the most likely consequence of retaining free cash flows(e.g.,Lang and Litzenberger,1989;Richardson,2006).

We estimate the following equation based on the framework adopted by Richardson(2006):

where INVEST is measured as investment expenditure divided by total assets.RET is the accumulative return,calculated based on monthly returns of the year.The fitted value of Eq.(6)is the normal level of investment and the residual is the abnormal investment estimate.Positive residuals correspond with overinvestment(OVERINVEST).

Table 11Do group affiliations decrease overinvestment?This table presents OLS regression results of the effect of business groups on overinvestment.The variables are defined as follows:OVERINVEST is the positive residual estimated from Eq.(6).GROUP is a dummy variable that equals one if the firm is group affiliated and zero otherwise.ROA is measured as net income/total assets.FCF refers to free cash flow,calculated as(operating cash flow-normal investment expenditure)/total assets.TUNNEL refers to other receivables divided by total assets.MINO is minority equity/total equity.PAY is the natural log of the sum of the three highest paid executives' compensations.TOP is the percentage of shares held by the largest shareholder.BSIZE is the number of directors on the board.INDEP is the number of independent directors on the board.All of the variables except for the dummy variables are winsorized at the 1%and 99% levels.The numbers reported in parentheses are heteroskedasticity corrected t-statistics.The numbers reported in brackets are p-values comparing the coefficients between SOEs and NSOEs.

In the second stage,we estimate the following equation to test the influence of business groups on overinvestment:

where FCF is free cash flow,calculated as operating cash flow minus the normal investment expenditure divided by total assets.TUNNEL refers to other receivables divided by total assets.MINO is calculated as minority equity divided by total equity.PAY is the natural log of executive pay,measured as the sum of the three highest paid executives'compensation.TOP is measured as the percentage of shares held by the largest shareholder.BSIZE is the number of directors on the board.INDEP is the number of independent directors on the board.

As Table 11 shows,group affiliation decreases overinvestment on average.Moreover,this effect is more conspicuousamongNSOEs(coefficient=-0.008,t-stat=-3.384)thanSOEs(coefficient=-0.000,t-stat=-0.065).These results suggest that business groups have a positive role in decreasing the freecash-flow problem,especially for those who experience a greater reduction in cash holdings due to moderated precautionary motives.

7.Conclusion

Although considerable attention has been paid to the question of why business groups exist,focusing solely on either the‘‘tunneling”or‘‘propping up”functions of business groups fails to fully capture the complexity and nuance of the question.This study seeks to achieve a better understanding of the role of business groups by investigating the relationship between group affiliation and cash holdings in a transitional economy characterized by weak investor protection and difficulties in obtaining external financing.

Theresultsshow that group affiliationsignificantly decreasescash holdings.Thissupportsthe‘‘proppingup”explanation that business groups allow the formation of internal capital markets,which alleviates the free-cashflow problem associated with the tunneling function.However,this benefit is moderated by state ownership,which is associated with higher agency costs.In addition,the effect is more prominent when the financial market isless liquidas aresult oftight monetarypolicy.Finally,in exploringthemannerin which business groups affect firms'decisions to hold cash,we find that group affiliation facilitates related-party transactions,improves debt capacity and decreases investment-cash-flow sensitivity and overinvestment.Furthermore,the effects are more pronounced among NSOEs,which are propped up by the government to a lesser extent.

This study bridges the business group and cash holding literatures.However,additional research is warranted to explore areas such as the dynamic cash holdings of group-affiliated and unaffiliated firms.In particular,studies must determine how SOEs adjust their cash policies when they are privatized.Furthermore,a growing literature shows that the cash holdings of unaffiliated firms serve as a buffer against underinvestment associated with financing frictions.Whether the internal capital market can prevent group affiliates from underinvesting is another topic for future research.Finally,the comparison of the group-cash relationship across countries may also yield new insights.

References

Acharya,V.,Almeida,H.,Campello,M.,2007.Is cash negative debt?A hedging perspective on corporate financial policies.J.Financ. Intermed.16(4),515-554.

Aharony,J.,Lee,C.W.J.,Wong,T.J.,2000.Financial packaging of IPO firms in China.J.Account.Res.38(1),103-126.

Allen,F.,Qian,J.,Qian,M.,2005.Law,finance,and economic growth in China.J.Financ.Econ.77(1),57-116.

Almeida,H.,Campello,M.,2007.Financial constraints,asset tangibility and corporate investment.Rev.Financ.Stud.20,1429-1460.

Ayyagari,M.,Demirgu¨c¸-Kunt,A.,Maksimovic,V.,2010.Formal versus informal finance:evidence from China.Rev.Financ.Stud.23(8),3048-3097.

Bae,K.H.,Jeong,S.W.,2007.The value relevance of earnings and book value,ownership structure,and business group affiliation: evidence from Korean business groups.J.Bus.Financ.Account.34(5-6),740-766.

Bae,K.H.,Kang,J.K.,Kim,J.M.,2002.Tunneling or value added?Evidence from mergers by Korean business groups.J.Financ.57(6),2695-2740.

Bae,G.S.,Cheon,Y.S.,Kang,J.K.,2008.Intragroup propping:evidence from the stock-price effects of earnings announcements by Korean business groups.Rev.Financ.Stud.21(5),2015-2060.

Baek,J.S.,Kang,J.K.,Lee,I.,2006.Business groups and tunneling:evidence from private securities offerings by Korean chaebols.J. Financ.61(5),2415-2449.

Baskin,J.,1987.Corporate liquidity in games of monopoly power.Rev.Econ.Statist.69,312-319.

Bates,T.W.,Kahle,K.M.,Stulz,R.M.,2009.Why do US firms hold so much more cash than they used to?J.Financ.64(5),1985-2021. Bena,J.,Ortiz-Molina,H.,2013.Pyramidal ownership and the creation of new firms.J.Financ.Econ.108(3),798-821.

Bigelli,M.,Sa´nchez-Vidal,J.,2012.Cash holdings in private firms.J.Banking Financ.36(1),26-35.

Cai,W.,Xu,F.,Zeng,C.,2014.Regional Political Pressure and Excessive Credit Growth.Working paper,University of Bristol.

Campello,M.,Giambona,E.,Graham,J.R.,Harvey,C.R.,2012.Access to liquidity and corporate investment in Europe during the financial crisis.Rev.Financ.16(2),323-346.

Carney,M.,Shapiro,D.,Tang,Y.,2009.Business group performance in China:ownership and temporal considerations.Manage.Org. Rev.5(2),167-193.

Carney,M.,Gedajlovic,E.R.,Heugens,P.P.,Van Essen,M.,Van Oosterhout,J.H.,2011.Business group affiliation,performance,context,and strategy:a meta-analysis.Acad.Manage.J.54(3),437-460.

Chang,S.J.,Hong,J.,2000.Economic performance of group-affiliated companies in Korea:intragroup resource sharing and internal business transactions.Acad.Manage.J.43(3),429-448.

Chen,X.,Lee,C.W.J.,Li,J.,2008.Government assisted earnings management in China.J.Account.Public Policy 27(3),262-274.

Chen,G.,Firth,M.,Xu,L.,2009.Does the type of ownership control matter?Evidence from China's listed companies.J.Banking Financ. 33(1),171-181.

Chen,Q.,Chen,X.,Schipper,K.,Xu,Y.,Xue,J.,2012.The sensitivity of corporate cash holdings to corporate governance.Rev.Financ. Stud.25(12),3610-3644.

Claessens,S.,Djankov,S.,Fan,J.P.,Lang,L.H.,2002.Disentangling the incentive and entrenchment effects of large shareholdings.J. Financ.57(6),2741-2771.

Cull,R.,Xu,L.C.,2000.Bureaucrats,state banks,and the efficiency of credit allocation:the experience of Chinese state-owned enterprises.J.Comp.Econ.28(1),1-31.

Dittmar,A.,Mahrt-Smith,J.,Servaes,H.,2003.International corporate governance and corporate cash holdings.J.Financ.Quant.Anal. 38(1),111-133.

Faccio,M.,Masulis,R.W.,McConnell,J.,2006.Political connections and corporate bailouts.J.Financ.61(6),2597-2635.

Fan,J.P.,Jin,L.,Zheng,G.,2008.Internal Capital Market in Emerging Markets:Expropriation and Mitigating Financing Constraints. Working paper,The Chinese University of Hong Kong.

Faulkender,M.,Wang,R.,2006.Corporate financial policy and the value of cash.J.Financ.61(4),1957-1990.

Ferreira,M.A.,Vilela,A.S.,2004.Why do firms hold cash?Evidence from EMU countries.Eur.Financ.Manage.10,295-319.

Friedman,E.,Johnson,S.,Mitton,T.,2003.Propping and tunneling.J.Comp.Econ.31(4),732-750.

Fritz Foley,C.,Hartzell,J.C.,Titman,S.,Twite,G.,2007.Why do firms hold so much cash?A tax-based explanation.J.Financ.Econ.86(3),579-607.

Gedajlovic,E.,Shapiro,D.M.,2002.Ownership structure and firm profitability in Japan.Acad.Manage.J.45(3),565-575.

Gordon,R.H.,Li,W.,2003.Government as a discriminating monopolist in the financial market:the case of China.J.Public Econ.87(2),283-312.

Granovetter,M.,2005.The impact of social structure on economic outcomes.J.Econ.Perspect.19(1),33-50.

Guo,S.,Fraser,M.W.,2010.Propensity Score Analysis:Statistical Methods and Applications.Sage,Los Angeles.

Han,S.,Qiu,J.,2007.Corporate precautionary cash holdings.J.Corp.Financ.13(1),43-57.

Harford,J.,Mansi,S.A.,Maxwell,W.F.,2008.Corporate governance and firm cash holdings in the US.J.Financ.Econ.87(3),535-555. Harford,J.,Kecske´s,A.,Mansi,S.,2012.Investor Horizons and Corporate Cash Holdings.Available at SSRN 2000226.

He,J.,Rui,O.M.,Zha,X.,2013.Business groups in China.J.Corp.Financ.22,166-192.

Hill,M.D.,Fuller,K.P.,Kelly,G.W.,Washam,J.O.,2014.Corporate cash holdings and political connections.Rev.Quant.Financ.Acc. 42(1),123-142.

Jensen,M.C.,1986.Agency costs of free cash flow,corporate finance,and takeovers.Am.Econ.Rev.,323-329

Jia,C.,2009.The effect of ownership on the prudential behavior of banks-the case of China.J.Banking Financ.33(1),77-87.

Jia,N.,Shi,J.,Wang,Y.,2013.Coinsurance within business groups:evidence from related party transactions in an emerging market. Manage.Sci.59(10),2295-2313.

Jian,M.,Wong,T.J.,2010.Propping through related party transactions.Rev.Acc.Stud.15(1),70-105.

Jiang,G.,Lee,C.,Yue,H.,2010.Tunneling through intercorporate loans:the China experience.J.Financ.Econ.98(1),1-20.

Kan,R.,1996.Finance Firms Seek Role.Springer.April 29.

Keister,L.A.,1998.Engineering growth:business group structure and firm performance in China's transition economy.Am.J.Sociol.104(2),404-440.

Keynes,J.M.,1936.The General Theory of Interest,Employment and money.

Khanna,T.,2000.Business groups and social welfare in emerging markets:existing evidence and unanswered questions.Eur.Econ.Rev. 44,748-761.

Khanna,T.,Palepu,K.,2000a.Is group affiliation profitable in emerging markets?An analysis of diversified Indian business groups.J. Financ.55(2),867-891.

Khanna,T.,Palepu,K.,2000b.The future of business groups in emerging markets:long-run evidence from Chile.Acad.Manage.J.43(3),268-285.

Khanna,T.,Rivkin,J.W.,2001.Estimating the performance effects of business groups in emerging markets.Strateg.Manage.J.22(1),45-74.

Khanna,T.,Yafeh,Y.,2005.Business groups and risk sharing around the world.J.Bus.78(1),301-340.

Khanna,T.,Yafeh,Y.,2007.Business groups in emerging markets:paragons or parasites?J.Econ.Lit.,331-372

Kim,C.S.,Mauer,D.C.,Sherman,A.E.,1998.The determinants of corporate liquidity:theory and evidence.J.Financ.Quant.Anal.33(3),335-359.

Kornai,J.,1980.Economics of Shortage,vol.A and B.North Holland.

La Porta,Rafael,Lopez de Silanes,Florencio,Shleifer,Andrei,Vishny,Robert,1998.Law and finance.J.Polit.Econ.106(6),1113-1155.

La Porta,R.,Lopez-de-Silanes,F.,Shleifer,A.,1999.Ownership structures around the world.J.Financ.54(2),471-517.

Lang,L.H.,Litzenberger,R.H.,1989.Dividend announcements:cash flow signaling vs.free cash flow hypothesis?J.Financ.Econ.24(1),181-191.

Lee,E.,Walker,M.,Zeng,C.,2014.Do Chinese government subsidies affect firm value?Account.Org.Soc.39,149-169.

Leff,N.,1978.Industrial organization and entrepreneurship in the developing countries:The economic groups.Econ.Devel.Cult.Change 26(4),661-675.

Lincoln,J.R.,Gerlach,M.L.,Ahmadjian,C.L.,1996.Keiretsu networks and corporate performance in Japan.Am.Sociol.Rev.,67-88 Lind,D.A.,Marchal,W.G.,Mason,R.D.,2002.Statistical Techniques in Business and Economics.McGraw-Hill,Irwin.

Liu,Q.,Tian,G.,2012.Controlling shareholder,expropriations and firm's leverage decision:evidence from Chinese non-tradable share reform.J.Corp.Financ.18(4),782-803.

Locorotondo,R.,Dewaelheyns,N.,Van Hulle,C.,2014.Cash holdings and business group membership.J.Bus.Res.67(3),316-323.

Ma,X.F.,2005.The Critical Role of Business Groups in China.

Manos,R.,Murinde,V.,Green,C.,2007.Leverage and business groups:Evidence from Indian firms.J.Econ.Business 59(5),443-465.

Megginson,W.I.,Wei,Z.B.,2013.State Ownership,Soft-budget Constraint and Cash Holdings:Evidence from China's Privatized Firms. Working Paper.

Morck,R.,Danie,W.,Bernard,Y.,2005.Corporate governance,economic entrenchment,and growth.J.Econ.Lit.43(3),655-720.

Opler,T.,Pinkowitz,L.,Stulz,R.,Williamson,R.,1999.The determinants and implications of corporate cash holdings.J.Financ.Econ. 52(1),3-46.

Ozkan,A.,Ozkan,N.,2004.Corporate cash holdings:an empirical investigation of UK companies.J.Banking Financ.28(9),2103-2134.

Pinkowitz,L.,Stulz,R.,Williamson,R.,2006.Does the contribution of corporate cash holdings and dividends to firm value depend on governance?A cross-country analysis.J.Financ.61(6),2725-2751.

Prowse,S.D.,1992.The structure of corporate ownership in Japan.J.Financ.47(3),1121-1140.

Richardson,S.,2006.Over-investment of free cash flow.Rev.Acc.Stud.11(2-3),159-189.

Sapienza,P.,2004.The effects of government ownership on bank lending.J.Financ.Econ.72(2),357-384.

Schiantarelli,F.,Sembenelli,A.,2000.Form of ownership and financial constraints:panel data evidence from flow of funds and investment equations.Empirica 27(2),175-192.

Shin,H.H.,Park,Y.S.,1999.Financing constraints and internal capital markets:evidence from Korean chaebols.J.Corp.Financ.5(2),169-191.

Sutherland,D.,2009.Do China's‘national team'business groups undertake strategic-asset-seeking OFDI?Chin.Manage.Stud.3(1),11-24.

Verschueren,I.,Deloof,M.,2006.How does intragroup financing affect leverage?Belgian evidence.J.Account.Auditing Financ.21(1),83-108.

Wu,W.,Rui,O.M.,Wu,C.,2012.Trade credit,cash holdings,and financial deepening:evidence from a transitional economy.J.Banking Financ.36(11),2868-2883.

Xie,D.,2000.The conduct of the open market operations and the shift of monetary policy instruments.Econ.Res.J.5,31-38(in Chinese).

Yiu,D.,Bruton,G.D.,Lu,Y.,2005.Understanding business group performance in an emerging economy:acquiring resources and capabilities in order to prosper.J.Manage.Stud.42(1),183-206.

Zaman,A.A.,2011.Cash Holdings,Market Frictions and Monetary Policy:An Investigation of Increase in Cash Holdings.Working Paper,Saint Mary's University.

14 May 2015

.

E-mail addresses:caiwx@ustb.edu.cn(W.Cai),cheng.zeng@mbs.ac.uk(Cheng(Colin)Zeng),edward.lee@mbs.ac.uk(E.Lee),n.ozkan@bristol.ac.uk(N.Ozkan).