Earnings management,corporate governance and expense stickiness

Shuang Xue,Yun Hong

aInstitute of Accounting and Finance,School of Accountancy,Shanghai University of Finance and Economics,China

bBusiness School of Hunan University,China

Earnings management,corporate governance and expense stickiness

Shuang Xuea,*,Yun Hongb

aInstitute of Accounting and Finance,School of Accountancy,Shanghai University of Finance and Economics,China

bBusiness School of Hunan University,China

A R T I C L EI N F O

Article history:

Accepted 5 February 2015

Available online 11 March 2015

Earnings management

Corporate governance

Expense stickiness

Interaction effect

Cost and expense stickiness is an important issue in accounting and economics research,and the literature has shown that cost stickiness cannot be separated from managers'motivations.In this paper,we examine the effects that earnings management has on expense stickiness.Defining small positive profits or small earnings increases as earnings management,we observe significant expense stickiness in the non-earnings-management sub-sample,compared with the earnings-management sub-sample.When we divide expenses into R&D,advertising and other general expenses,we find that managers control expenses mainly by decreasing general expenses.We further examine corporate governance's effect on expense stickiness.Using factor analysis,we extract eight main factors and find that good corporate governance reduces expense stickiness.Finally,we investigate the interaction effects of earnings management and corporate governance on expense stickiness.The empirical results show that good corporate governance can further reduce cost stickiness,although its effect is not as strong as that of earnings management.

©2015 Sun Yat-sen University.Production and hosting by B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons. org/licenses/by-nc-nd/4.0/).

1.Introduction

The term expense‘‘stickiness”captures an asymmetric expense behavior response to the direction of a change in activities;that is,expenses increase more quickly with an increasing activity level than they decease with a declining activity level(e.g.,Noreen and Soderstrom,(1997),Cooper and Kaplan(1998),and Anderson et al.(2003)).Because it is an important issue in both accounting and economic researches,expense stickiness,to some degree,reflects the operating efficiency of corporate assets(Gong et al.(2010)).

Compared with the classic linear cost behavior model described by traditional management accounting,expense stickiness fits better with the management decision of resource adjustment in practice.The existence of expense stickiness is strongly connected to management's active behavior(e.g.,Anderson et al.(2003)and Banker et al.(2011)).Thus,to truly understand stickiness,it is essential to investigate the reasons why management deliberately adjusts resources.

Most previous studies have investigated expense stickiness based on either adjustment costs or management expectations.Some have suggested that the adjustment cost of reducing input under declining activities is higher than that of raising input under increasing activities(e.g.,Jaramillo et al.(1993),Pfann and Palm(1993,1997),Goux et al.(2001),and Cooper and Haltiwanger(2006)).This,in turn,makes it less likely to reduce the input level(i.e.,stickiness)because it is more expensive to do so.Other scholars have suggested that managers tend to be optimistic about future revenue because most firms'future revenues increase,making them reluctant to reduce expenses.

When considering the wide-spread nature of agency problems in modern enterprises(Jensen and Mecking,1976),it is unlikely that management would behave as expected in an ideal world(i.e.,adjustment cost and expectation considerations).There are conflicts between self-interested managers and other stakeholders,of which earnings management behavior under compensation contracts is the most obvious.Healy(1985)found that managers adjust earnings in order to receive higher compensation.While under pressure to avoid breaching debt covenants,managers are also likely to choose between accounting policies(Sweeney(1994)). Moreover,previous studies have indicated an increase in earnings management due to the incentives of meeting or beating last year's earnings,avoiding reporting losses,and meeting or beating consensus analysts' forecasts(e.g.,Burgstahler and Dichev(1997)and Degeorge(1999)).

In the earnings management literature,few studies have explored earnings management's effect on expense stickiness.Chen(2008)investigated the relationship between managerial empire building and expense stickiness.Dierynck and Renders(2009)observed the stickiness of labor costs in firms that reported small positive ROAs and slightly increased earnings.Kama and Weiss(2010)provided evidence that firms reduced the stickiness of operating costs to avoid losses or earnings decreases.Compared with the cost of sales,expense is a different type of cost.In this paper,we shed light on the relationship between expense stickiness and earnings management incentives.

We begin by investigating earnings management's effect on expense stickiness.We define the incentive to avoid losses or earnings decreases as upward earnings management,and divide the sample into two parts. Significant expense stickiness is observed in the non-earnings-management sample,compared with the earnings-management sample,indicating that managers,under pressure to report sound earnings,prefer to reduce expenses when sales decline.

Whether expense reduction indicates increased operating efficiency or short-sighted and dysfunctional managerial behavior remains an interesting question.To answer this question,we further divide expenses into R&D,advertising,and other general expenses.1We appreciate the helpful comments of the referee.The results show that the stickiness reduction difference between the earnings-management and non-earnings-management sub-samples is much more significant in other general expenses than in R&D or advertising expenses.Facing the pressure of upward earnings management makes managers more likely to reduce expenses in a discriminate way for their firms'long-term development.

Next,we analyze what influence corporate governance has over expense stickiness.Taken as an essential part of the management operation environment,corporate governance studies have generated conflicting evidence.Some attribute the chaos to the difficulty of setting up a reliable and effective evaluation system on corporate governance.Drawing from the work of Larcker et al.(2007),we choose the method of factor analysis to produce a comprehensive and objective description of corporate governance.After extracting eight main factors from the summarized corporate governance indices,we find that good corporate governance has a negative effect on expense stickiness.

Then,we check the interaction effect of earnings management and corporate governance.Our results show that the interaction works to further reduce expense stickiness,indicating that self-interest upward earningsmanagement incentives influence the ways in which firms control expenses with the help of good corporate governance.The results imply that compared with corporate governance,earnings management incentives have a more significant effect on reducing stickiness.We attribute this to the fact that earnings management,as taken by managers,has a direct influence on current expenditure decisions,whereas corporate governance works indirectly.

Finally,we subdivide the expenses and find that the above interaction effect is more significant for reducing the stickiness of other general expenses than R&D or advertising expenses.Moreover,the results show that the earnings management mechanism only works in the poor corporate governance sub-sample for R&D expenses,whereas it works in both the good and poor corporate governance sub-samples for other general expenses. This result proves that good corporate governance benefits firms by constructing a disciplined environment and restricting management opportunism.

This paper's contributions are as follows.First,our study is among the first to investigate the relation between earnings management and expense stickiness,and thus it extends the domestic and international literature on those issues.Second,we subdivide the expenses and find that the reductions in other general expense stickiness have efficient characteristics,which provides insights into management behavioral under pressure.Third,compared with previous studies that have used an individual proxy to investigate the effect of corporate governance,we conduct factor analysis and extract the main factors to see the comprehensive influence of corporate governance on expense stickiness.Fourth,instead of using a dichotomy to consider the nature of earnings management,we find that opportunistic earnings management has an active role in controlling costs.Thus,we provide new evidence of the bright side of earnings management from the stickiness aspect to enrich the existing research.Fifth,this paper checks the individual and interaction effects of corporate governance and earnings management on expenses stickiness to provide a true understanding of the stickiness phenomenon.Finally,our evidence helps investors better understand changes in firm expenses,so that they can more accurately forecast firms'future earnings or cash flows.

The remainder of the paper proceeds as follows.We discuss the literature and pose our hypotheses in Section 2 and present our research design in Section 3.We introduce our sample and data in Section 4.We report our empirical findings in Section 5 and additional robustness tests in Section 6.Section 7 concludes the paper.

2.Related literature and hypotheses development

There are two main views about the existence of expense stickiness:rational decision-making and motivational.The rational decision-making view treats expense stickiness as a consequence of management rationally choosing between alternatives after comprehensively weighting costs and benefits.Some studies have been guided by this view in providing detailed explanations of the following specific aspects.It has been suggested that the adjustment cost of reducing input under declining activities is higher than that of raising input under increasing activities(e.g.,Jaramillo et al.(1993),Pfann and Palm(1993,1997),Goux et al.(2001),Cooper and Haltiwanger(2006),Balakrishnan et al.(2004),Banker and Chen(2006),and Balakrishnan and Gruca(2008)). Due to the above consideration,even facing declining demand,managers are less likely to reduce input resources and related expenses,which,in turn,leads to expense stickiness.Banker et al.(2011)analyzed relevant data and concluded that management commonly expect a sales increase in the following year.Thus,even under declining activities,it is rare for management to reduce input.

The second view is motivation-based and relates expense stickiness to managerial incentives,suggesting that managers are not expected to behave as if they were in an ideal world.Among their dysfunctional behavior,perks and earnings management reflecting different contracting stimulations are often observed.Chen et al.(2008)investigated the relationship between empire building and perks,which revealed that higher expense stickiness accompanied stronger managerial incentives for empire building.There is a large body of literature studying different earnings management incentives,such as compensation(Healy,1985),debt covenants(Sweeney,1994),meeting or beating last year's earnings,avoiding reporting losses,and meeting or beating consensus analysts'forecasts(e.g.,Burgstahler and Dichev(1997)and Degeorge et al.(1999)). However,studies on earnings management's effect on expense stickiness have been rare.Dierynck and Renders(2009)found a small stickiness of labor costs in firms with small positive profit or small earningsincrease,whereas Kama and Weiss(2010)revealed that companies with earnings management exhibited less stickiness of operating costs.

Compared with the studies on cost stickiness,there is no literature investigating whether a similar principle fits the explanation of expense stickiness.Although production costs(both variable and fixed)are unavoidable inputs for production,the occurrence of major parts of expenses,such as those for advertising and R&D,is likely to be decided by managers.Thus,we expect earnings management incentives to affect expense stickiness. When holding the upward earnings management incentive,managers are more likely to reduce expenses in response to a declining demand,which in turn decreases expense stickiness.

Therefore we develop the following hypothesis:

H1.Upward earnings management significantly decreases expense stickiness.

Because managers increase earnings in different ways,it is necessary to investigate whether their methods are efficient.When referring to efficiency,we mean that managers either reduce expenses by flattening the hierarchy and improving administrative efficiency,or by tightly controlling expenses through perk reduction and waste avoidance.However,choosing to cut R&D or advertising expenses for upward earnings management is seen as an inefficient way to pursue short-term goals at the expense of long-term development(Eberhart et al.(2004)).

To further test efficiency,we divide expenses into R&D,advertising,and other general expenses.We define other general expenses as those outside of R&D or advertising.Managers choosing to reduce R&D or advertising expenses to increase earnings is regarded as inefficient because it sacrifices the enterprise's long-term development.Managers choosing to reduce other general expenses is regarded as an efficient way of controlling expenses.

Thus,to further investigate whether managers choose an efficient way to manage earnings,we develop the following competing hypotheses:

H2a.Under the pressure of realizing upward earnings,managers typically reduce R&D or advertising expenses.

H2b.Under the pressure of realizing upward earnings,managers typically reduce other general expenses.

Corporate governance refers to the set of mechanisms that monitor or motivate managers when there is a separation of ownership and control.Some of these mechanisms are the board of directors,institutional shareholders,and market operations for corporate control(Larcker et al.,2007).These mechanisms are designed to solve the widespread agency problem.Based on institutional economics theory,motivating and monitoring are the main ways to solve the agency problem(Yuan,2005).When motivating,good corporate governance can,to some degree,support goal congruence between managers and enterprises so that the former will try to maximize firm value.Moreover,when managers make decisions that are in the best interests of the business,their goals are achieved more efficiently thanks to good corporate governance.In contrast,the monitoring role is more important because good corporate governance reduces management opportunism while protecting principals'interests.

Sometimes,the self-interested behavior of managers leads to expense stickiness(Chen et al.,2008).In its monitoring role(Wan and Wang,2011),good corporate governance should,to some degree,reduce expense stickiness.When managers try to improve cost control,good corporate governance is expected to facilitate the process and reduce expense stickiness.

Calleja et al.(2006)showed that costs are stickier for French and German firms than for US and UK firms,and they attributed this to the differences in corporate governance,as French and German firms are subject to code-law governance systems in addition to being historically less subject to the pressure of a market for corporate control.Firms in the US and the UK are arguably subject to more rigorous external scrutiny and their corporate objective of shareholder maximization tends to produce lower levels of cost stickiness.Chen(2008)suggested that firms with larger boards of directors or more independent boards(the separation of Chairman and CEO,more external independent directors),and those with directors who hold larger shareholdings have a lower level of expense stickiness.Furthermore,the above mentioned corporate governance mechanisms work better in reducing expense stickiness when managers hold an empire building incentive.Similarconclusions,based on the study of China's manufacturing industry,were reached by Wan and Wang(2011). The only difference in result was that the larger board size impeded the control of free cash flow,which increased expense stickiness.

Although Calleja et al.(2006)explained the cross-country differences in costs,they did not provide direct evidence.Although Chen et al.(2008)raised direct evidence of the relationship between corporate governance and expense stickiness,their measures of corporate governance were incomplete.A comprehensive system of corporate governance is expected to comprise both internal(e.g.,board independence,board working schedule,structure of shareholding,etc.)and external(e.g.,institutional shareholders and creditor monitoring,regulation,auditing,etc.)mechanisms.Given a comprehensive picture of corporate governance,we develop the following hypothesis:

H3.Good corporate governance significantly decreases expense stickiness.

According to the first and third hypotheses,both upward earnings management and good corporate governance may help to reduce expense stickiness.Thus,it seems reasonable to consider their separate and interactive effects.Warfield et al.(1995)and Klein(2002)suggest that good corporate governance can restrict earnings management.The literature usually takes earnings management as evidence of management opportunism.Here,we consider not only the disadvantages of earnings management,but also its benefits.In addition to being evidence of management opportunism,upward earnings management can simultaneously improve firms'cost control.For example,Roychowdhury(2006)and Cohen et al.(2008)found that firms decreased their current year costs for upward earnings management.Thus,from a cost control perspective,upward earnings management is value-adding for the enterprise.

As mentioned,good corporate governance can play both motivating and monitoring roles.On the one hand,good corporate governance can restrict managers'self-interest behavior,which may decrease shareholder wealth.On the other hand,when managers are motivated to maximize firm value,good corporate governance can contribute to the success of management decisions.Here,under upward earnings management,while managers are trying to control costs and expenses,good corporate governance is likely to be beneficial. Thus,expense stickiness is expected to decline.Thus,we develop the following hypothesis:

H4.The interaction effect of good corporate governance and the motivation supplied by upward earnings management can further reduce expense stickiness.

When raising the second hypothesis,we know that managers can reduce expense stickiness either efficiently or at the expense of their firms'long-term benefits.The former(achieved by reducing other general expenses)reflects management's effort to maximize shareholder wealth,whereas the latter(achieved by reducing R&D or advertising expenses)indicates managers'self-interest behavior.If good corporate governance does restrict managers'self-interest behavior,managers are expected to prefer efficient methods to reduce expense stickiness.If corporate governance does not help control expenses,managers are expected to prefer inefficient methods.Based on whether good corporate governance restricts managers'self-interest behavior,we develop the following competing hypotheses:

H5a.The interaction effect between good corporate governance and upward earnings management motivation can significantly reduce the stickiness of other general expenses,relative to R&D or advertising.

H5b.The interaction effect between good corporate governance and upward earnings management motivation can significantly reduce the stickiness of R&D or advertising expenses,relative to other general expenses.

3.Research design

3.1.Measurement of expense stickiness

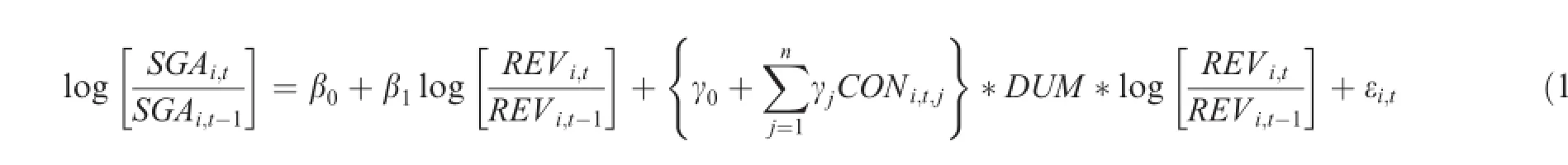

Consistent with the literature(Anderson et al.,2003;Subramaniam and Weidenmier,2003),we use the following logarithmic model to measure expense stickiness:)

here

SGA=natural log of total administration and operation expenses;

REV=natural log of revenue;

DUM=a dummy variable with a value of 1 if the current year REV decreases( REVi,t/REVi,t-1<1),and 0

otherwise;

CON=control variables.Here,we mainly use CAPR and TOBQ as control variables because most of the

variables used by existing studies have already been considered in relation to corporate governance.The

details of CAPR and TOBQ are as follows:

CAPR=capital intensity,measured as the net value of fixed assets scaled by operating revenue;

TOBQ=growth rate,measured as Tobin's Q(i indicates firm and t indicates year).

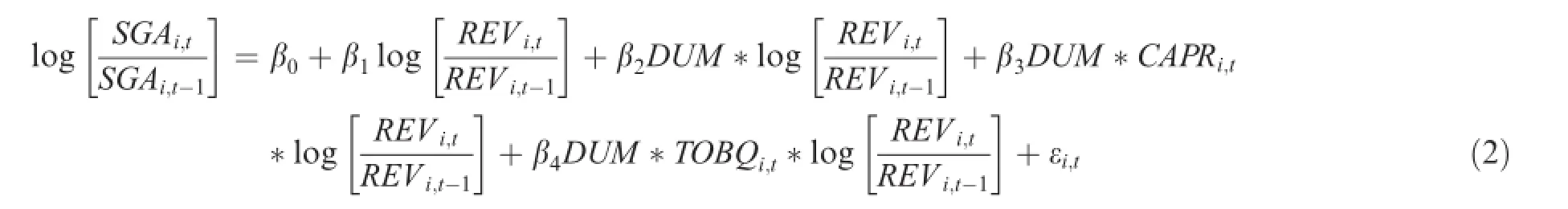

Hence,we restate model(1)as follows:

According to the definition of expense stickiness,a significant negative sign of β2in model(2)indicates the existence of expense stickiness.

3.2.Earnings management and expense stickiness

The literature consistently indicates that earnings management allows avoiding reporting losses or earnings decreases,meeting or beating consensus analysts'forecasts,reducing taxation,and decreasing the probability of debt covenant default.Burgstahler and Dichev(1997)and Degeorge et al.(1999)found that earnings management helps in the avoidance of reporting small losses and earnings decreases.Roychowdhury(2006)and Cohen et al.(2008)further suggested that management reduces costs to avoid reporting losses or earnings decreases.Based on the method used by Roychowdhury(2006)and Cohen et al.(2008),we include two categories of data in the upward earnings management subsample.The data in the first category report a small positive profit,which indicates incentives for avoiding reporting losses.The data in the second category report a small increase in ROA,which indicates incentives for avoiding reporting earnings decreases.

In this study,we define those firm-year observations whose ROA is 0-1.5%as the small positive profit sub-sample,and those whose earnings change scaled by total assets is 0-1%as the small earnings increase sub-sample.Together,they make up the sub-sample of upward earnings management.We use EAMG as an indicator whose value equals 1 if the observation belongs to the earnings-management sub-sample and 0 otherwise.

To test H1,we regress model(2)with the earnings-management and non-earnings-management subsamples,separately.As H1 indicates,we expect a lower level of expense stickiness in the earnings-management sub-sample.Thus,we expect β2in the earnings-management sub-sample to be significantly higher than in the non-earnings-management sub-sample.The sign of β2in the non-earnings-management sub-sample should be significantly negative due to the existence of expense stickiness.

3.3.Efficiency of reducing expense stickiness

To investigate whether the reduction of expense stickiness reflects efficient behavior,we further divide expenses(SGA)into R&D,advertising(ADV),and other general expenses(GSGA).H2a indicates that managers reduce expense stickiness at the expense of firms'long-term benefits,whereas H2b indicates that managers use an efficient way to reduce expenses.

To test H2a and H2b,we replace SGA with either R&D,ADV,or GSGA in model used to test H1.If H2a holds,because managers choose to mainly reduce R&D or advertising expense to increase earnings,β2in the earnings-management sub-sample should be significantly higher than in the non-earnings-management subsample,and the sign of β2in the non-earnings-management sub-sample should be significantly negative when using R&D and ADV instead of SGA.The inter-sample difference of β2is not expected to be significant when using GSGA instead of SGA.However,if H2b holds,the above expected results should be opposite.

3.4.Corporate governance and expense stickiness

Most of the previous studies have measured corporate governance with single or aggregative indices,which are obviously arbitrary.Furthermore,the empirical results of those studies are conflicting.Larcker et al.(2007)suspected that part of the explanation for these mixed results is that the measures used in the empirical analyses exhibit a modest level of reliability and construct validity.For example,when using a single indicator(e.g.,percentage of independent directors)to represent a complex construct(e.g.,board independence),measurement error is likely to result in inconsistent regression coefficients.Similar problems arise if a set of indicators are naively summed to form some type of governance index(e.g.,the‘‘G-score”used by Gompers et al.(2003)).The use of multiple indicators can alleviate the measurement error associated with a single indicator.However,unless the individual indicators are measuring the same underlying governance construct,the resulting index is difficult to interpret and likely to contain substantial measurement error. Larcker et al.(2007)suggested that factor analysis be applied to extract main factors from the multiple indicators of corporate governance.The benefits of using factor analysis are worth noting.First,it avoids the measurement error introduced by a single index.Second,it reduces the arbitrary nature of using an aggregative index formed by a set of naive indicators.Third,it eliminates the influence of collinearity and improves the accuracy of parameter estimation and hypothesis testing.Finally,compared with using principal component analysis(PCA),factor analysis can raise a much more clear result thanks to the process of factor rotation,which can effectively identify the interaction effect of the same index on different principal components.

Given the advantages of using factor analysis,we develop our method based on the work of Larcker et al.(2007).We use PCA to identify the main dimensions of corporate governance and the relations between its factors.Eight factors with characteristic values greater than 1 are retained.We run orthogonal and oblique rotation in sequence and get the corresponding factor scores.We use the orthogonal rotation process to get consistent final results and the oblique rotation process to increase the explanation power.

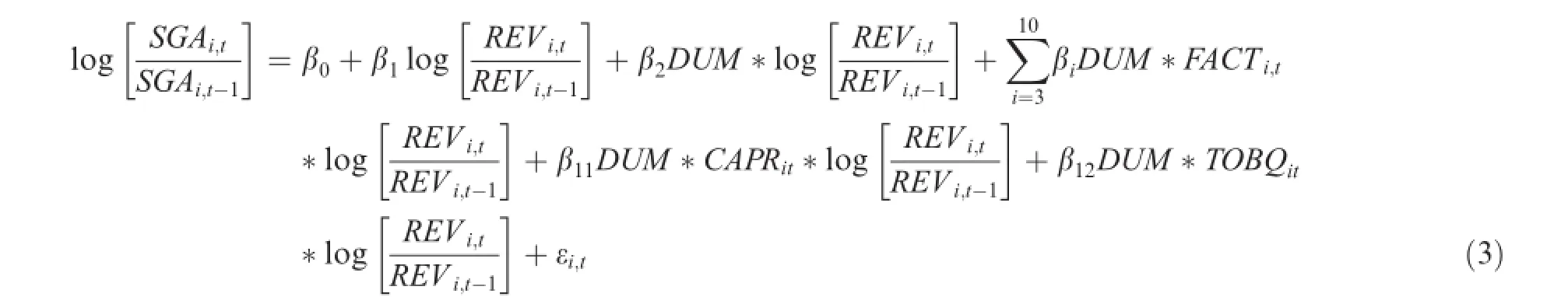

We develop the following model:

FACTi(i=3,...,10)represents the eight factors of corporate governance and the other variables are defined as in model(2).We first test the individual effect of each factor by sequentially integrating them into model(3). The sign of β2is expected to be significantly negative due to expense stickiness.If H3 holds,the sign of βi(i=3,...,10)is expected to be significantly positive because good corporate governance can decrease expense stickiness.Likewise,we expect to find a similar result when integrating all of the factors into model(3).

3.5.Management incentives and corporate governance

To test H4,we run model(2)on four sub-samples.We first raise the following equation to get each firm-year's corporate governance score:

where

CGSC=the corporate governance score;

FACTi=the score of each corporate governance factor;and

EIGNi=each factor's characteristic value produced by conversion with the symbol of economic significance.

A higher amount of CGSC indicates better corporate governance of the observation.However,we rank the CGSC from lowest to highest.CGID equals 1 when CGSC is greater than the median(which represents good corporate governance)and 0 otherwise.We further divide the sample into two sub-samples(CGID=1 and 0),giving four sub-samples when using both EAMG and CGID as classification standards.Represented by the form of(EAMG/CGID),these four sub-samples are(0/0),(0/1),(1/0),and(1/1).

If H4 holds,because the interaction effect between good corporate governance and upward earnings management motivation can further reduce expense stickiness,we expect β2in the(1/1)sub-sample to be significantly higher than in the other three sub-samples.

We replace SGA with R&D,ADV,and GSGA and use the same model(2)to test H5.If H5a holds,when using R&D or ADV instead of GSGA,upward earnings management is expected to significantly reduce expense stickiness only in the CGID=0 subsample.However,if H5b holds,the stickiness of R&D or ADV is expected to decrease with upward earnings management in both the CGID=0 and CGID=1 subsamples.

4.Sample and data

4.1.Data source and sample selection

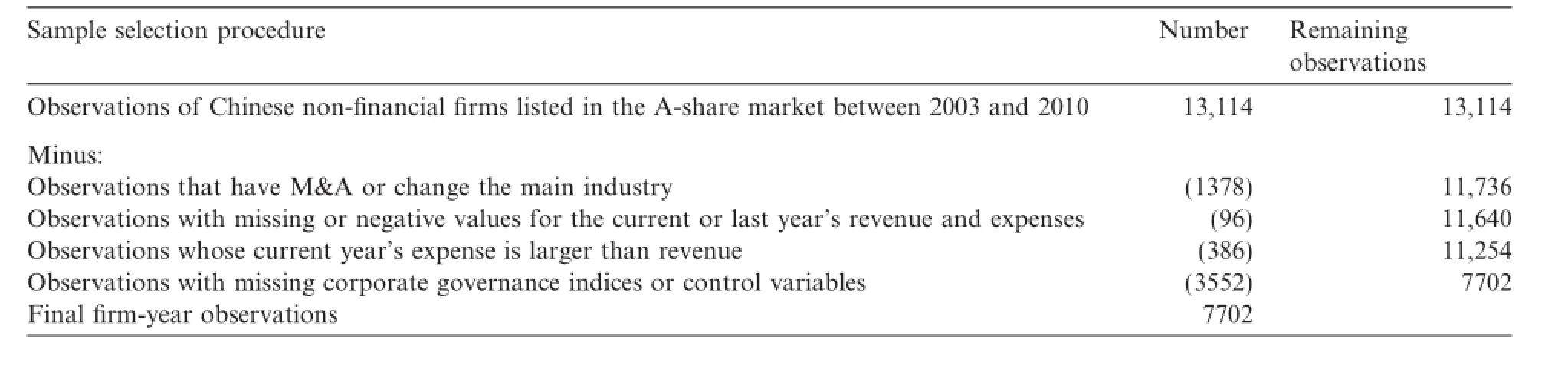

We begin with all Chinese non-financial firms listed in the A-share market between 2003 and 2010.This period is selected mainly due to the availability of some corporate governance indices.We then remove observations that have M&A or change the main industry,that have missing or negative values of the current or prior year's revenue and expenses,whose current year's expenses are larger than revenue,and those with missing corporate governance indices or control variables.This leaves us with a final sample size of 7702 firm-year observations.Table 1 indicates this sample selection process.The financial data and corporate governance indicators are obtained from the CSMAR and RESSET databases.Data on the ultimate controlling shareholder is collected from the CCER database and we double-check it using the WIND database.We manually collect R&D and ADV from the annual reports of listed firms.These data are usually reported in the note‘‘Other cash paid related to operating activities.”R&D includes items such as research,development,and consulting costs.ADV consists of expenses related to advertising and marketing activities.

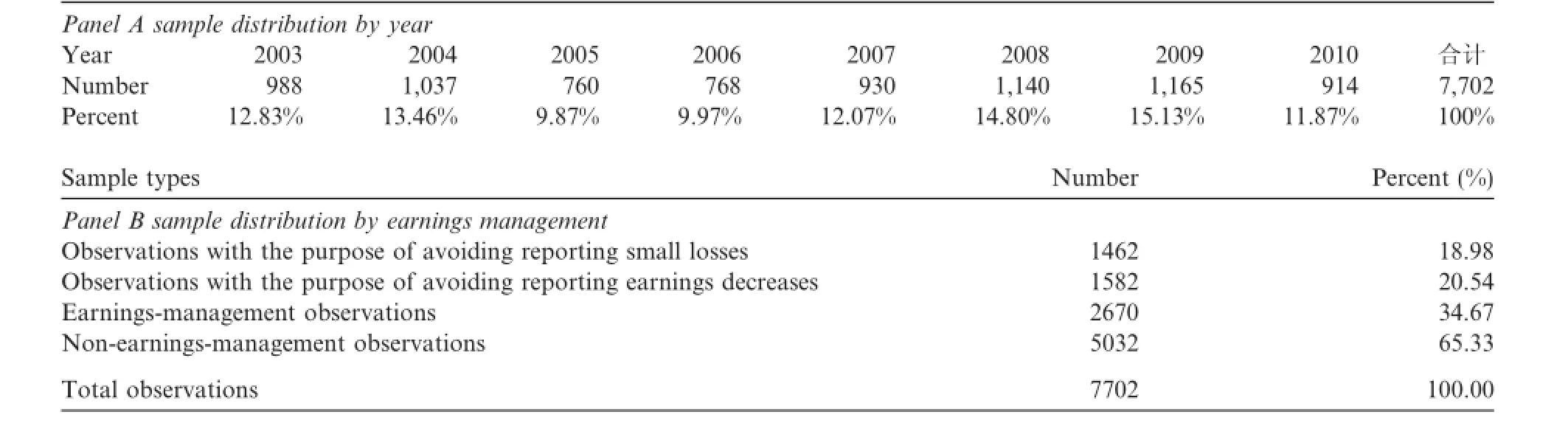

Panel A of Table 2 lists the distribution of the sample observations by year,which shows no great change in observation numbers in different years.Panel B provides a distribution picture of the different earnings management incentives sub-samples.Specifically,1462 firm-years,or 18.92%of total observations indicate an incentive to avoid reporting small losses,while a similar amount of 1582(20.54%)observations indicate an incentive to avoid reporting small earnings decreases.Because there are firm years with both of the above mentioned incentives,the total amount of observations with upward earnings management incentives are 2670—more than a third of the whole sample.

4.2.Descriptive statistics

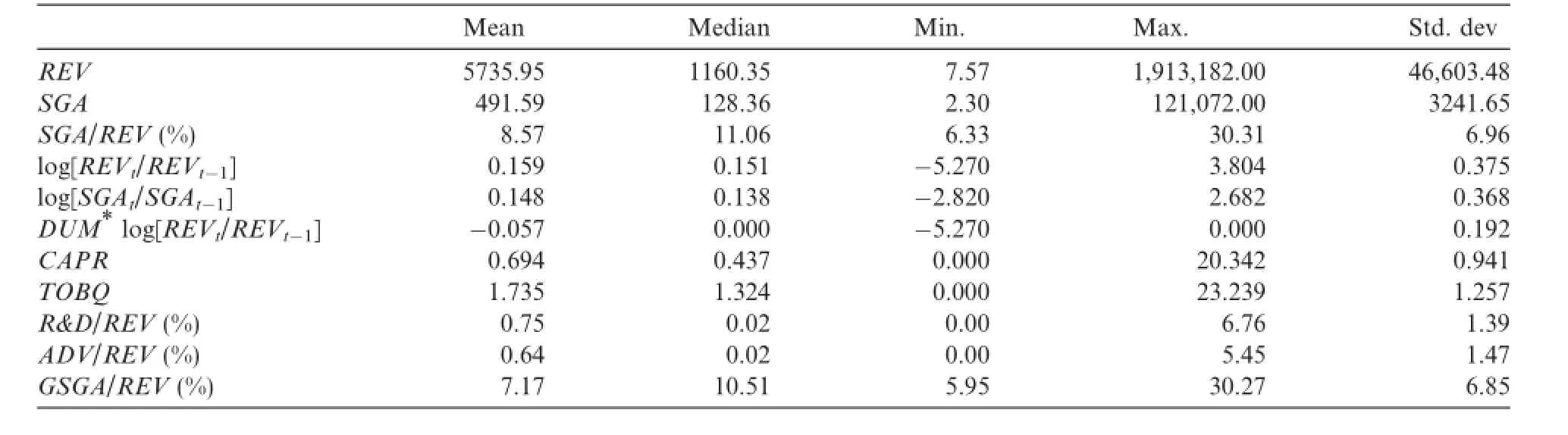

Table 3 reports the summary statistics of the main variables used in testing the hypotheses.We do not include the description of corporate governance variables in Table 3 because they are shown in the subsequent factor analysis process.

Table 1Sample selection process.

Table 2Sample distribution.

Table 3Descriptive statistics.

Table 3 shows that the mean(median)values of REV and SGA are 5736(1160)and 492(128).Both variables are right-skewed and it is reasonable to take the natural log of the initial amount in the subsequent regression. The standard deviations of REV and SGA are 46,603 and 3242,respectively,significantly larger than their means,which indicates that there is large variation in these variables.We report a mean(median)SGA/REV of 8.57%(11.06%),which is smaller than the value of 26.41%(17.79%)reported in the work of Anderson et al.(2003).Here,we suggest that this may be due to the difference between Chinese Accounting Standards and U.S.GAAP.

On average,firm revenues and expenses increase during the sample period due to the positive values of log[REVt/REVt-1]and log[SGAt/SGAt-1].The mean(median)of log[REVt/REVt-1]and log[SGAt/SGAt-1]are 0.159(0.151)and 0.148(0.138),respectively.However,log[REVt/REVt-1]has a minimum of-5.27(indicatingthat some firms have a significant decrease in revenue),a maximum of 3.804(indicating that some firms have large growth in revenue),and a standard deviation of 0.375(indicating that the annual changes in firm revenues are quite different).The same characteristics are found in log[SGAt/SGAt-1](with a minimum of -2.82,a maximum of 2.682,and a standard deviation of 0.368).The mean(median)of DUM*log[REVt/ REVt-1]is-0.057(0)and it is therefore left-skewed.It has a minimum of-5.27,a maximum of 0,and a standard deviation of 0.196,indicating that the annual variances in revenues for decreasing firms are also quite large.

The mean(median)values of CAPR and TOBQ are 0.694(0.437)and 1.735(1.324),and their standard deviations are 0.941 and 1.257,respectively,which indicates significant cross-sample variance.

After further dividing SGA into R&D,ADV,and GSGA,we find that the mean(median)values of(R&D/ REV)and(ADV/REV)are 0.75%(0.02%)and 0.64%(0.02%),respectively.Given that(GSGA/REV)has a mean(median)value of 7.17%(10.51%),on average,other general expenses comprise the majority of total expenses.

5.Main empirical results

5.1.The existence of expense stickiness

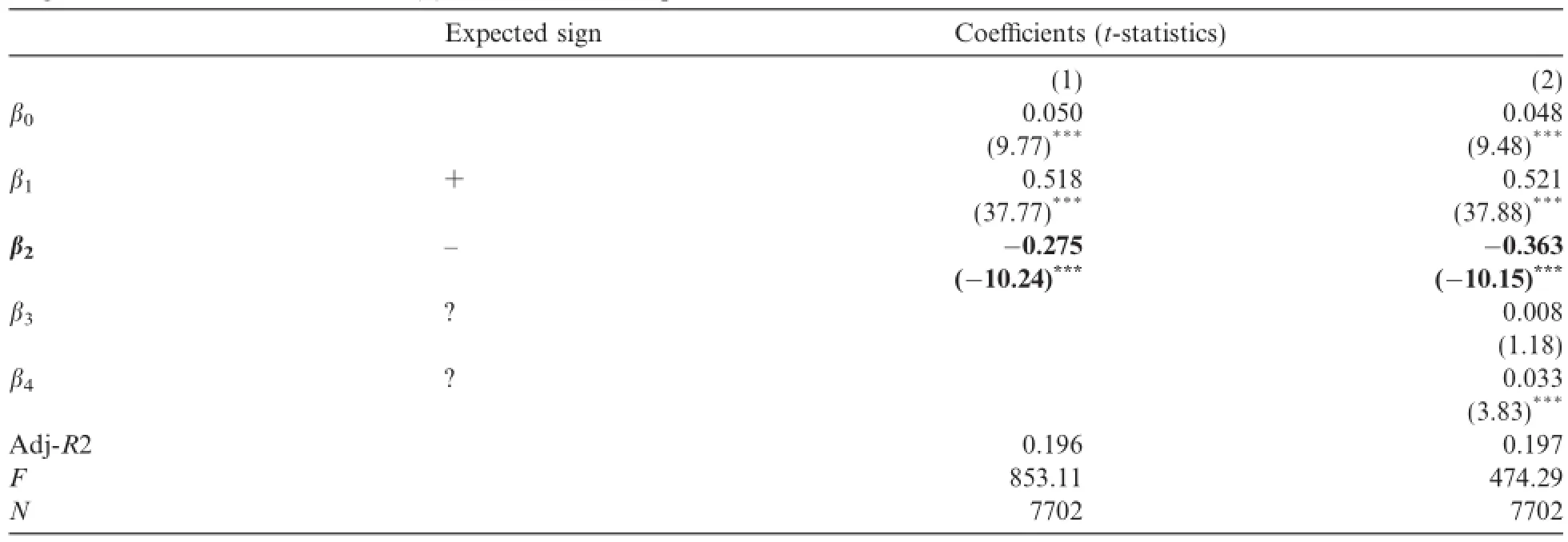

The results of the OLS regression based on model(2)are shown in Table 4.Compared with the results in Column(1),Column(2)adds control variables.Based on results in Column(1),β1is 0.518 and significantly positive at the 1%level.The value of β1is consistent with our expectation that expenses increase with growing revenue but at a lower speed.β2is-0.275 and significantly negative at the 1%level,which indicates the existence of expense stickiness,as expected.When putting additional control variables into the estimation,we find similar results.Here,β2is-0.363,which is lower than that in Column(1)and suggests a larger level of expense stickiness.β3is positive but not statistically significant and β4is significantly positive,indicating a lower level of expense stickiness in fast-growing firms.In summary,the results reported in Table 4 indicate expense stickiness in Chinese firms listed in A-share markets,which is consistent with previous research findings(e.g.,Kong et al.(2007)and Gong et al.(2010)).

5.2.Earnings management and expense stickiness(H1)

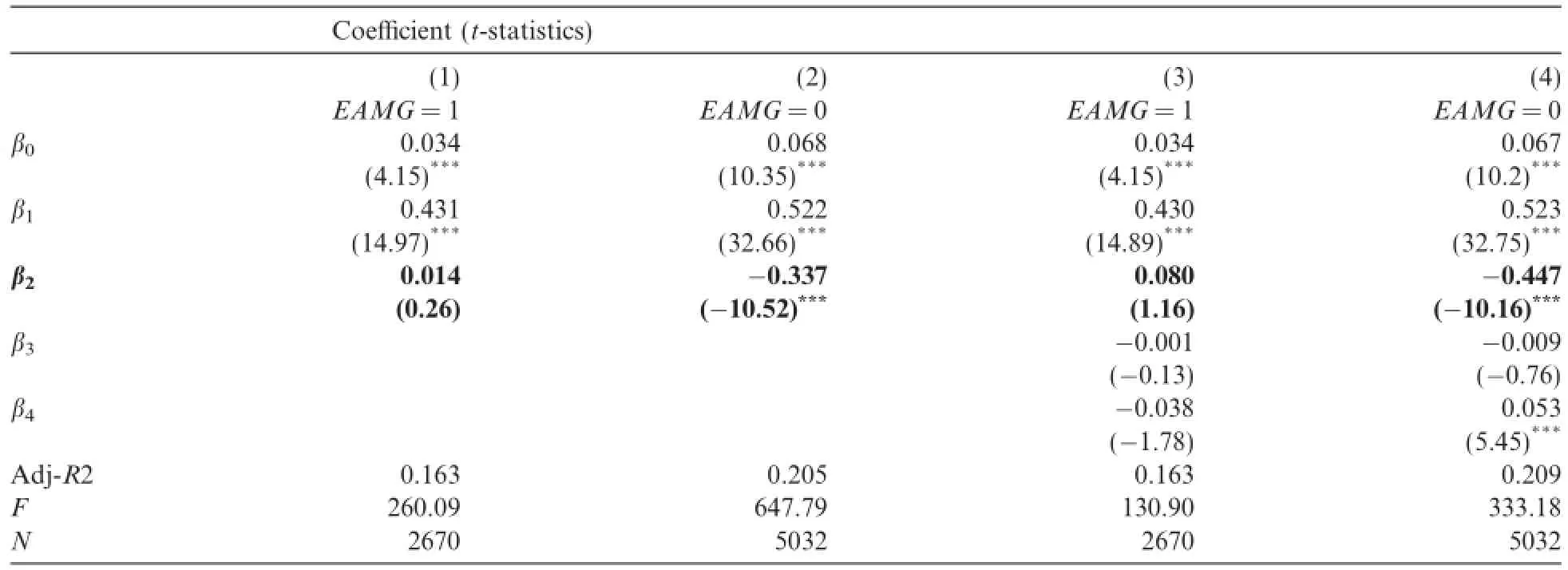

The regression results of upward earnings management on expense stickiness are reported in Table 5. Compared with the results in Columns(1)and(2),Columns(3)and(4)add CAPR and TOBQ.

Table 4Regression results based on model(2)for the whole sample.

As Table 5 shows,β2in Column(1)is positive and not statistically significant,indicating that upward earnings management decreases expense stickiness.The value of β2is lower in Column(2)than that reported in Table 4(results of the whole sample),which suggests that expense stickiness is mainly explained by the observations in the non-earnings-management sub-sample.Similar results are found after estimating with additional control variables and the value of β2in Column(4),-0.447,is lower than that in Column(2),-0.337,revealing a higher level of expense stickiness after controlling for other variables.

To summarize,the results in Table 5 provide evidence that expense stickiness is mainly found in the nonearnings-management sub-sample.Moreover,the value of β2in the earnings-management sub-sample is larger than that in the non-earnings-management sub-sample and the difference(not tabulated)is statistically significant at the 1%level(χ2test=22.37).Thus,consistent with H1,the evidence suggests that upward earnings management significantly decreases expense stickiness.

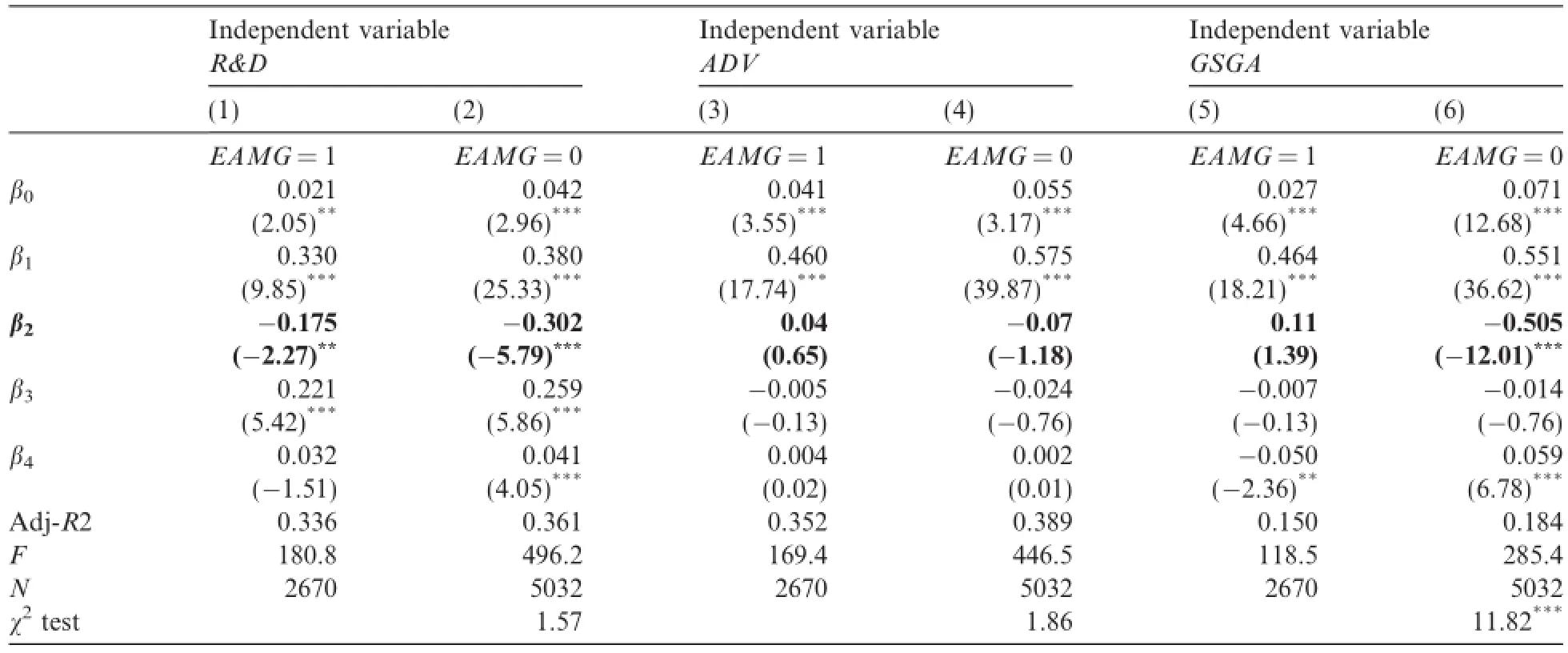

5.3.Efficiency of expense stickiness reduction(H2)

What expense types do managers tend to reduce under earnings pressure?The results are reported in Table 6.The results of R&D are shown in Columns(1)and(2)of Table 6.The values of β2in both columns are negative and statistically significant,indicating the existence of expense stickiness in both samples.In the earnings-management sub-sample,R&D decreases 0.155%(0.330-0.175%)with every 1%of revenue,and 0.078%(0.38-0.302%)in the non-earnings-management sub-sample.The results suggest that R&D in both sub-samples is sticky.Although the amount of R&D reduction is greater in the earnings-management subsample than in the non-earnings-management sub-sample,the difference between these two sub-samples is not statistically significant(χ2test=1.57).The results in Columns(3)and(4)provide evidence that there is little stickiness of ADV in either sub-sample.The results of GSGA are represented in Columns(5)and(6). The value of β2in Column(6)is-0.505 and statistically significant at the 1%level and that in Column(5)is 0.11 and not statistically significant,indicating that upward earnings management significantly reduces the stickiness of GSGA.

The results in Table 6 imply that when facing the pressure of upward earnings management,managers may reduce R&D(which may be seen as a way to pursue a short-term target at the expense of long-term benefits),but it is more likely that managers choose to decrease other general expenses that lead to a lower level of expense stickiness.Thus,the evidence suggests that the ways in which managers reduce expense stickiness are efficient when they hold an upward earnings management incentive.

Table 5Regression results of earnings management incentive on expense stickiness.

Table 6Efficiency of reducing expense stickiness.

5.4.Corporate governance and expense stickiness(H3)

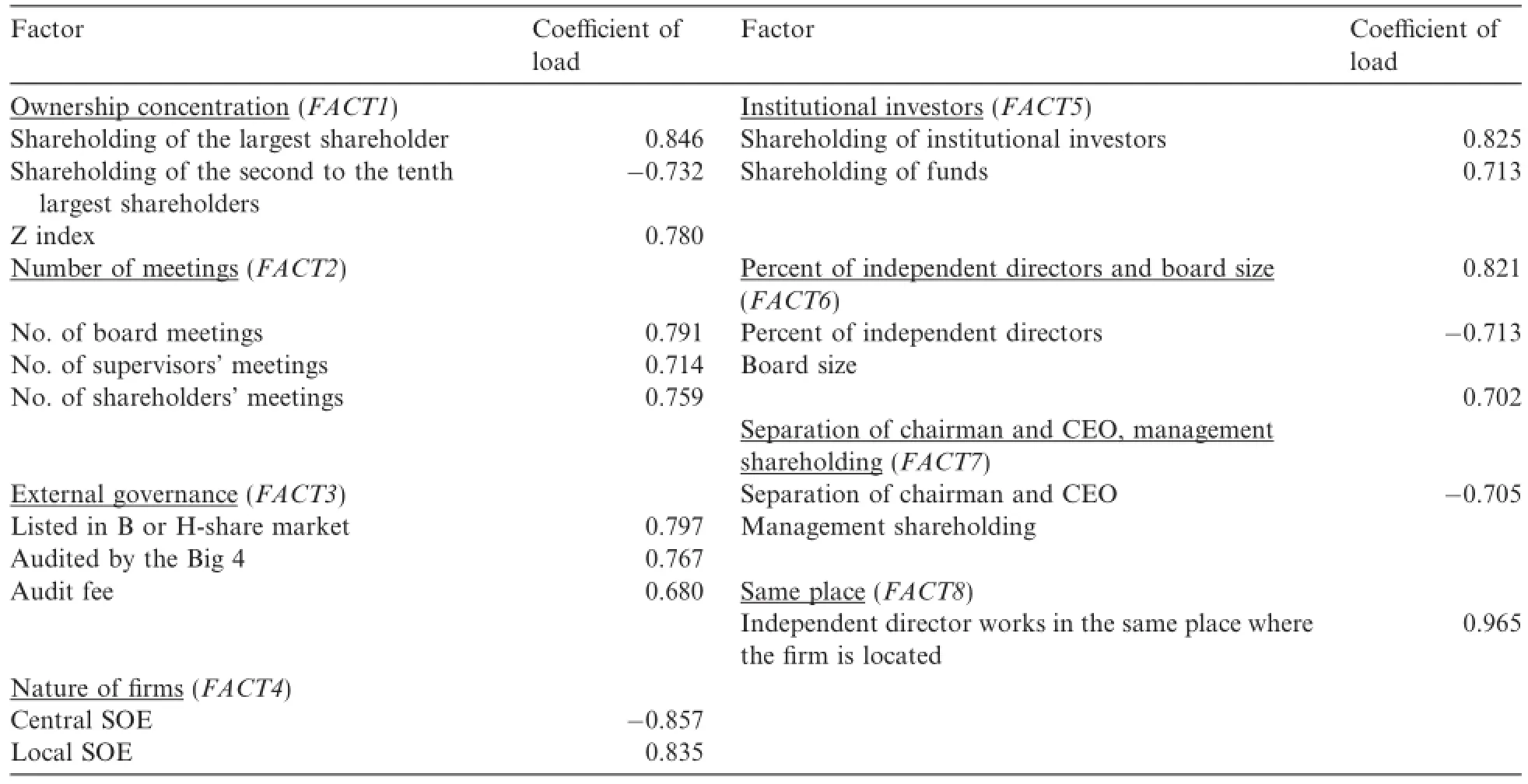

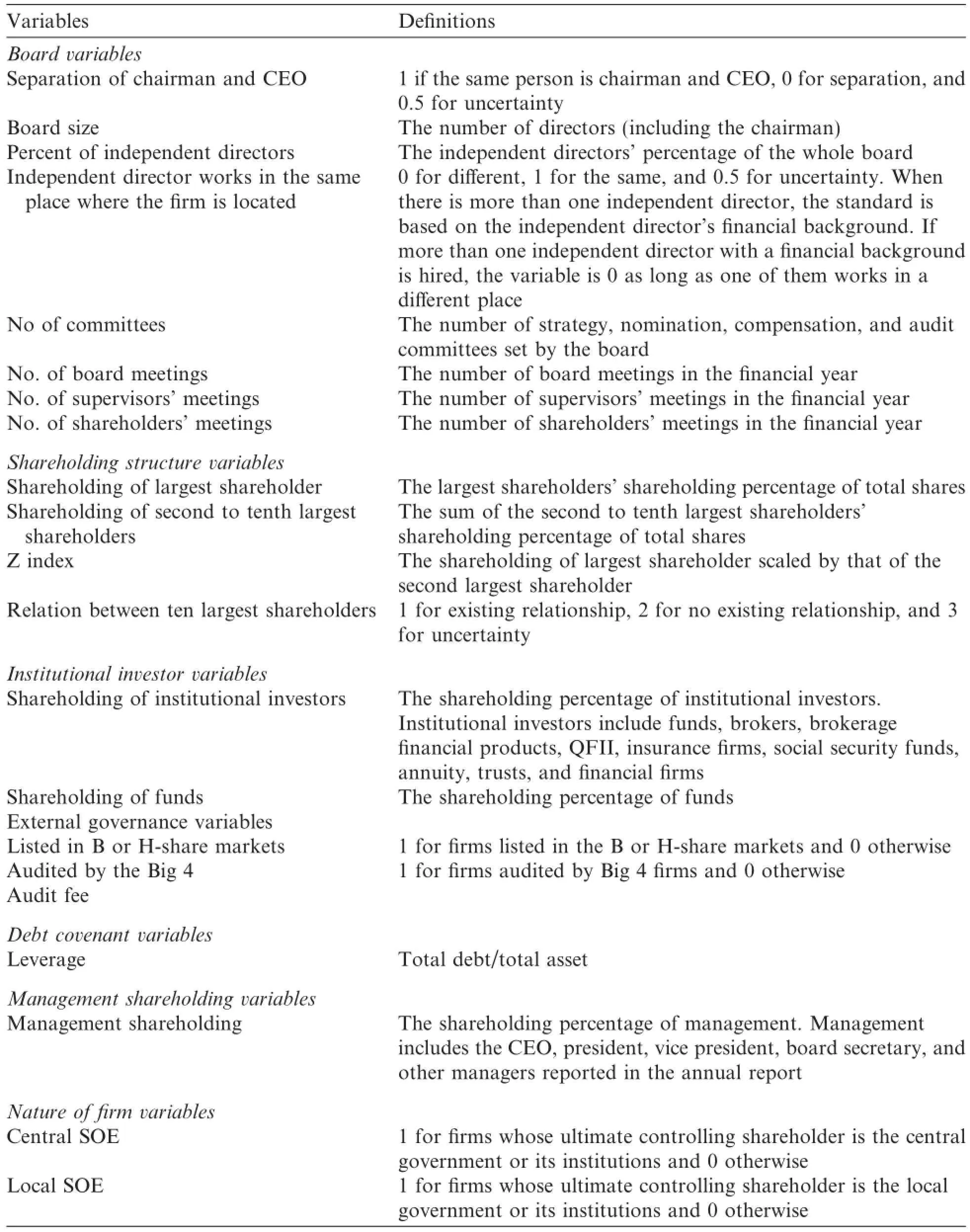

The detailed descriptions of the corporate governance variables are listed in the Appendix.Because the results in the literature(e.g.,Larcker et al.(2007),Jin and Yuan(2007),Gao et al.(2006),and Bai et al.(2005))can be conveniently reached and Armstrong et al.(2010)provided a comprehensive overview of the studies on this issue,to be parsimonious we only present the variables without detailing the reasoning behind their selection.

Table 7 reports the results of our corporate governance factor analysis.We extract eight factors with characteristic values greater than one,and which explain about 60%of the raw data variance,similar to the results of Larcker et al.(2007),who obtained 61.7%explanatory power.The first factor(FACT1)represents ownership concentration,including‘‘shareholding of largest shareholders,”‘‘shareholding of second to tenth shareholders,”and‘‘Z index.”The score of FACT1 increases with growing ownership concentration.The‘‘numbers of board meetings,supervisors'meetings and shareholders'meetings”make up the second factor(FACT2),which reflects the number of meetings,with a higher score indicating a larger number of meetings.FACT3,which reflects external governance,is made up of‘‘listed in B or H-share market,”‘‘audited by the Big 4,”and‘‘audit fee,”which are interrelated because firms listed in markets other than A-share markets have more demand for the assurance service supplied by reputable auditors and correspondingly are charged higher audit fees. FACT4,which reflects the nature of firms,includes two indicators—‘‘central”and‘‘local”SOE—with private firms receiving higher scores.FACT5,which reflects‘‘shareholding of institutional investors”and‘‘shareholding of funds,”representsinstitutional investors and its score increases with institutional investors'shareholding. FACT6,including‘‘percent of independent directors”and‘‘board size,”is assigned a higher score with a larger percent of independent directors or a smaller board size.Given a fixed number of independent directors,a smaller board size indicates a larger percent of independent directors.‘‘Separation of chairman and CEO”and‘‘management shareholding”constitute the seventh factor(FACT7),with a higher score assigned to firms that separate chairman and CEO,or have more management shareholdings(the higher the level of management's shareholding,the more goal-congruence between management and shareholders).FACT8 reflects the‘‘same place,”with a higher score if independent directors work at the same place where the firm is located.

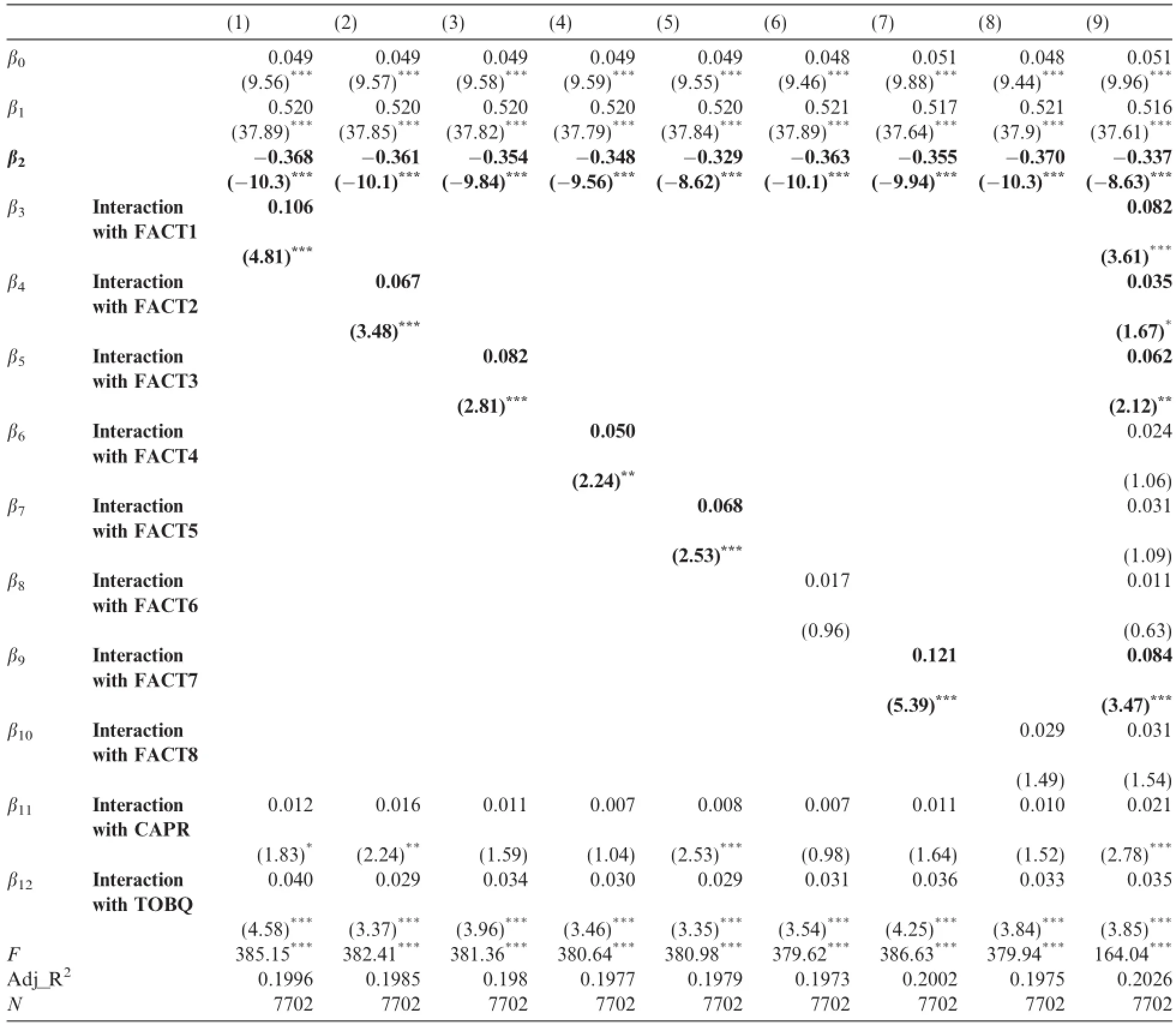

The regression results of corporate governance on expense stickiness are shown in Table 8.We present the results of integrating each factor into estimating model(3),one at a time,from Columns(1)to(8).The estimation result including all of the factors is shown in Column(9).The value of β2in all of the columns issignificantly negative,with a minimum of-0.37 and a maximum of-0.329,indicating the existence of expense stickiness.In Column(1),β3is positive and statistically significant,suggesting that the concentration of shareholding can decrease expense stickiness.A high ownership concentration may represent the concentration of management authority,which in turn promotes the success of managers'cost control processes.From Column(2),we find that more meetings benefit the reduction in expense stickiness,as β4is significantly positive.This result may be because a higher number of meetings indicates a more transparent governance environment and convenient communication between different firm levels,prompting the widespread pursuit of cost control targets by firms.β5in Column(5)is positive and statistically significant,suggesting that firms that list in B or H-share markets and are audited by reputable auditors have a lower level of expense stickiness,indicating that good external governance can help managers to better control costs.The value of β6is significantly positive in Column(4),suggesting that firms other than central SOEs have a lower level of expense stickiness.We provide evidence of the ways in which institutional shareholders benefit from the cost control aspect because β7in Column(5)is positive and statistically significant,suggesting that an increase in institutional investors' shareholding can help reduce expense stickiness.β8in Column(6)is positive but not statistically significant. Although the effect is not statistically significant,it still indicates that an increase in the percentage of independent directors may,to some degree,reduce expense stickiness.The significantly positive sign of β9in Column(7)shows that separating the chairman and CEO or increasing management shareholdings can help reduce expense stickiness.When independent directors work in the same place where a firm is located,it has a limited effect on reducing expense stickiness because β9is positive but not statistically significant in Column(8).When all of the factors are considered,we find similar results in Column(9),with a little weaker statistical significance of some coefficients.To summarize,the results reported in Table 8 provide evidence that good corporate governance(especially high ownership concentration,hardworking boards,good external governance,separation of chairman and CEO,and management shareholdings)can significantly decrease expense stickiness,which is consistent with H3.

Table 7Corporate governance factors.

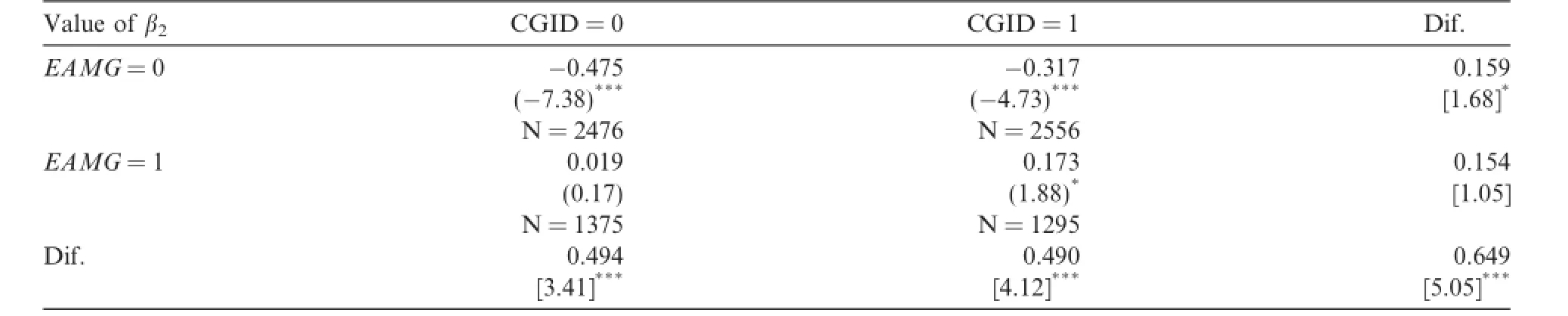

5.5.Interaction effect between earnings management and corporate governance(H4)

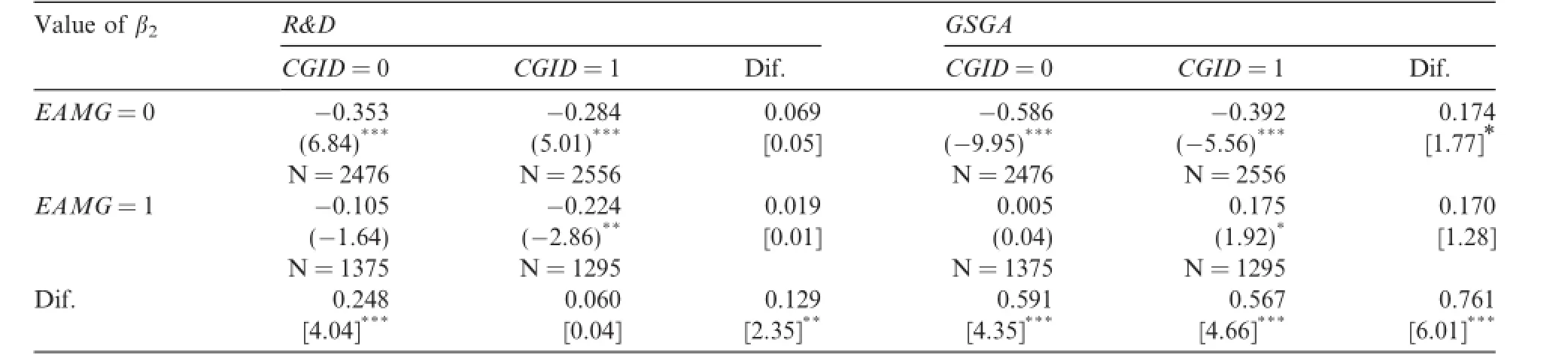

The regression results,based on sub-samples divided by earnings management and corporate governance,are listed in Table 9.As noted,EAMG=0(1)indicates the sub-sample without(with)earnings managementincentives and CGID=0(1)indicates the sub-sample with relatively bad(good)corporate governance.The corresponding coefficient differences for each column(row)and their t values(based on the Chow test using dummy variables)are listed in the last row(column).The coefficient differences between groups(1/1)and(0/0)and their t values are listed in the lower-right corner.

As Table 9 shows,the value of β2is 0.173 and statistically significant at the 10%level in the(1/1)subsample,indicating anti-stickiness(e.g.,Balakrishnan et al.(2004)and Weiss(2010)).2The concept of anti-stickiness was first raised by Balakrishnan et al.(2004).Costs are deemed anti-sticky if they increase less when activity rises than they decrease when activity falls by an equivalent amount.For more information,refer to Section II of Balakrishnan et al.(2004)and the graph description or explanation of Weiss(2010).Therefore,the stickiness of expenses in the(1/1)sub-sample is at a lower level than in the other sub-samples.The difference in β2between(1/1)and(0/0)is 0.649 and is statistically significant at the 1%level,as is the difference between(1/1)and(0/1),which is 0.49 and also significant at the 1%level.Although the difference between(1/1)and(1/0)is not statistically significant,it is still positive and consistent with our expectations.Thus,the above results support H4,which suggests that the interaction effect of upward earnings management and good corporate governance can further reduce expense stickiness.

Table 8Corporate governance and expense stickiness.

From Table 9,we further find that upward earnings management increases the value of β2to 0.494(0.490)in the bad(good)corporate governance sub-sample,which is statistically significant at the 1%level,indicating that upward earnings management has a great effect on reducing expense stickiness.Although the increased difference in β2by good corporate governance is 0.159(0.154)in the non-earnings-management(earningsmanagement)sub-sample,only the amount in the non-earnings-management sub-sample is statistically significant at the 10%level.Compared with corporate governance,upward earnings management has a greater influence on reducing the level of expense stickiness because the differences due to earnings management are not only larger,but also more significant than those due to corporate governance.Earnings management,as taken by managers,has a direct influence on current expenditure decisions,whereas corporate governance works indirectly.

Table 9Interaction effect of EM and CG on expense stickiness.

5.6.Effects of corporate governance and earnings management on different expenses(H5)

Table 10 reports the results of testing H5.We do not list the regression results on ADV in Table 10 as they are not statistically significant.The effect of earnings management on reducing R&D stickiness is onlysignificant in the bad corporate governance sub-sample,indicating that good corporate governance can restrict managers'discretional behavior of pursuing short-term targets at the expense of long-term benefits. In both good and bad corporate governance sub-samples,upward earnings management can significantly decrease the stickiness of GSGA.Thus,the results in Table 10 suggest that managers mainly choose to reduce other general expenses to meet earnings targets,which is consistent with H5a.

Table 10Regression results of different expenses.

6.Robustness tests

To examine the consistency of our results,we run the following robustness tests.As Subramaniam and Weidenmier(2003)and Kong et al.(2007)suggest,there are different driving factors on stickiness in different industries.Thus,we add dummy variables to our regressions to control for industry fixed effects. Due to the changing economic environment,the driving factors for expense stickiness may change over time.To control for time effects,we add year dummy variables to our regression.We run the regressions based on different earnings-management definitions,including firm-years whose ROA are 0-1%,0-1.8%,and 0-2%as the observations with the purpose of avoiding reporting small losses,and firm-years whose changes in earnings scaled by total asset are 0-0.5%,0-0.8%,0-1.3%,and 0-1.5%as observations with the purpose of avoiding reporting earnings decreases.In addition to regressing based on the whole earningsmanagement sub-sample,we regress based on the sub-samples of avoiding reporting small losses and earnings decreases separately.Different methods are used to extract corporate governance factors,including PCA,iterative PCA,and factor analysis based on non-weighted least squares.To summarize,the results are similar to those shown in the main empirical section and thus our conclusions are robust to the above mentioned tests.

7.Conclusion

Cost and expense stickiness is an important issue in accounting and economics research.The literature has shown that cost stickiness cannot be separated from managers'motivations.Based on the literature,we first study the influence of earnings management on expense stickiness.Defining small positive profits or small earnings increases as earnings management,we find that there is significantly more expense stickiness in our non-earnings-management sub-sample than in our earnings-management sub-sample,which indicates that managers prefer to reduce more expenses under the pressure of reporting sound earnings. To check whether the expense reduction indicates better operating efficiency or managers'dysfunctional short-sighted behavior,we further divide expenses into R&D,advertising,and other general expenses. The results show that the difference in the reduction in stickiness between the earnings-management and non-earnings-management sub-samples is much more significant in other general expenses than in R&D or advertising expenses.We also analyze the influence of corporate governance on the stickiness of expenses.Based on Larcker et al.(2007),we extract eight main factors from the summarized corporate governance indices and find that good corporate governance has a negative effect on expense stickiness. We finally check the interaction effect between earnings management and corporate governance and find that the interaction further reduces expense stickiness.Our results imply that earnings management incentives have a more significant effect on reducing the stickiness than corporate governance,and that firms benefit from good corporate governance,as it restricts management opportunism,especially under earnings pressure.

Acknowledgments

This research is funded by a National Natural Science Grant(No.71172143),a Key Socia1 Science Research Institute Grant of the Ministry of Education(No.12JJD790037)and the Program for New Century Excellent Talents in University(NCET-13-0893).

Appendix A.Selection of corporate governance variables

References

Anderson,M.,Banker,R.,Janakiraman,S.,2003.Are selling,general,and administrative costs‘sticky'?J.Acc.Res.41,47-63.

Armstrong,C.,Guay,W.,Weber,G.,2010.The role of information and financial reporting in corporate governance and contracting.J. Acc.Econ.50,179-234.

Bai,C.,Liu,Q.,Lu,Z.,Song,M.,Zhang,J.,2005.An empirical study on Chinese Listed Firms'Corporate Governance.Econ.Res.J.02,81-91(in Chinese).

Balakrishnan,R.,Gruca,T.,2008.Cost stickiness and core competency:a note.Contemp.Acc.Res.25,993-1006.

Balakrishnan,R.,Petersen,M.,Soderstrom,N.,2004.Does capacity utilization affect the‘‘stickiness”of cost?J.Acc.,Audit.Finance 19,283-299.

Banker,R.,Chen,L.2006,Labor Market Characteristics and Cross-country Differences in Cost Stickiness.Working Paper,The University of Iowa.

Banker,R.,Byzalov,D.,Plehn-Dujowich,J.2011,Sticky Cost Behavior:Theory and Evidence.Working Paper,Fox School of Business Temple University.

Burgstahler,D.,Dichev,I.,1997.Earnings management to avoid losses and earnings decreases.J.Acc.Econ.24,99-126.

Calleja,K.,Steliaros,M.,Thomas,D.,2006.A note on cost stickiness:some international comparisons.Manage.Acc.Res.17,127-140.

Chen,C.,Lu,H.,Sougiannis,T.2008,Managerial Empire Building,Corporate Governance,and the Asymmetrical Behavior of Selling,General,and Administrative Costs.Working Paper,University of Illinois at Urbana-Champaign.

Cohen,D.,Dey,A.,Lys,T.,2008.Real and accrual-based earnings management in the pre-and post-sarbanes oxley periods.Acc.Rev.82,757-787.

Cooper,R.,Haltiwanger,J.,2006.On the nature of capital adjustment costs.Rev.Econ.Stud.73,611-633.

Cooper,R.,Kaplan,R.,1998.The Design of Cost Management Systems:Text,Cases,and Readings.Prentice-Hall,Upper Saddle River,NJ.

Degeorge,F.,Patel,J.,Zeckhauser,R.,1999.Earnings management to exceed thresholds.J.Bus.72,1-33.

Dierynck,B.,Renders,A.2009.The Influence of Earnings Management Incentives on the Asymmetric Behavior of Labor Costs:Evidence from a Non-US Setting.Working Paper,Katholieke Universitet Leuven.

Eberhart,A.,Maxwell,W.,Siddique,A.,2004.An examination of long-term abnormal stock returns and operating performance following R&D increase.J.Finance 59(2),623-650.

Gao,L.,He,S.,Huang,Z.,2006.Corporate Governance and Tunneling,China.Econ.Quart.04,1158-1177(in Chinese).

Gompers,P.,Ishii,J.,Metrick,A.,2003.Corporate governance and equity prices.Quart.J.Econ.118,107-155.

Gong,Q.,Liu,H.,Shen,H.,2010.The development of regional factor market,state holding and cost stickiness.China Acc.Rev.04,431-446(in Chinese).

Goux,D.,Maurin,E.,Pauchet,M.,2001.Fixed-term contracts and the dynamics of labor demand.Eur.Econ.Rev.45,533-552.

Healy,H.,1985.The effect of bonus schemes on accounting decision.J.Acc.Econ.7,85-107.

Jaramillo,F.,Schiantarelli,F.,Sembenelli,A.,1993.Are adjustment costs for labor asymmetric?An econometric test on panel data for Italy.Rev.Econ.Stat.74,640-648.

Jensen,M.C.,Mecking,W.H.,1976.Theory of the firm:managerial behavior,agency costs and ownership structure.J.Financial Econ.3,305-360.

Jin,Q.,Yuan,H.,2007.Corporate governance and the determinants of the compensation ratio in the splitting-share reform.China Econ. Quart.01,249-270(in Chinese).

Kama,I.,Weiss D.2010.Do Managers'Deliberate Decisions Induce Sticky Costs?Working Paper,Tel Aviv University.

Klein,A.,2002.Audit committee,board of director characteristics,and earnings management.J.Acc.Econ.33,375-400.

Kong,Y.,Zhu,N.,Kong,Q.,2007.Study on cost stickiness.Acc.Res.11,58-65(in Chinese).

Larcker,D.,Richardson,S.,Tuna,I.,2007.Corporate governance,accounting outcomes,and organizational performance.Acc.Rev.82,963-1008.

Noreen,E.,Soderstrom,N.,1997.The accuracy of proportional cost models:evidence from hospital service departments.Rev.Acc.Stud. 2,89-114.

Pfann,G.,Palm,F.,1993.Asymmetric adjustment costs in non-linear labour demand models for the Netherlands and UK manufacturing sectors.Rev.Econ.Stud.60,397-412.

Pfann,G.,Palm,F.,1997.Sources of asymmetry in production factor dynamics.J.Econ.82,361-392.

Roychowdhury,S.,2006.Earnings management through real activities manipulation.J.Acc.Econ.41,335-370.

Subramaniam,C.,Weidenmier,M.2003.Additional Evidence on the Sticky Behavior of Costs.Working Paper,Texas Christian University.

Sweeney,1994.Debt-covenant violation and manager's accounting and economics.J.Acc.Econ.17,281-308.

Wan,S.,Wang,H.,2011.Managerial self-interest,board governance and cost stickiness.Econ.Manage.05,26-32(in Chinese).

Warfield,T.D.,Wild,J.J.,Wild,K.L.,1995.Managerial ownership,accounting choices,and informativeness of earnings.J.Acc.Econ.20,61-91.

Weiss,D.,2010.Cost behavior and analysts'earnings forecasts.Acc.Rev.85,1441-1471.

Yuan,Q.,2005.New Institutional Economics.China Development Press,Beijing(in Chinese).

9 March 2012

at:School of Accountancy,Shanghai University of Finance and Economics,777 Guoding Rd,Shanghai 200433,China.Tel.:+86 021 65903910,+86 13681801599.

E-mail address:xuesh@mail.shufe.edu.cn(S.Xue).

China Journal of Accounting Research2016年1期

China Journal of Accounting Research2016年1期

- China Journal of Accounting Research的其它文章

- Do business groups affect corporate cash holdings?Evidence from a transition economy☆

- Executive compensation in business groups:Evidence from China☆

- Government governance,executive networks and enterprise R&D Expenditure

- Guidelines for Manuscripts Submitted to The China Journal of Accounting Research