Are all investment decisions to subscribe to new stocks mindless?

Zhe Li,Fang Wang,Xiaohong Dong

aSchool of Business,Renmin University of China,China

bSchool of Management,China Women’s University,China

cBusiness Institute,Anhui University of Finance&Economics,China

Are all investment decisions to subscribe to new stocks mindless?

Zhe Lia,*,Fang Wangb,Xiaohong Dongc

aSchool of Business,Renmin University of China,China

bSchool of Management,China Women’s University,China

cBusiness Institute,Anhui University of Finance&Economics,China

Investor heterogeneity and behavior in the process of subscribing to new stocks

ARTICLEINFO

Article history:

Received 1 March 2015

Accepted 13 September 2016

Available online 20 October 2016

Corporate governance information Institutional investors Historical performance New stock subscriptions

The IPO process is a way for companies to improve their corporate governance and for investors to assess company quality.This paper posits that investor choices vary with dif f erences in investment ability and experience.Three groups of investors with large holdings,namely individual investors,bluechip institutional investors and underperforming institutional investors,are compared by their use of three types of corporate governance information: board characteristics,equity structure and affiliated relationships.Overall, institutional investors make greater use of corporate governance information than individual investors,with blue-chip institutional investors making the greatest use.Further,bull-bear markets exert a signif i cant influence on the behavior of both individual and underperforming institutional investors.These results enrich the IPO literature and contribute to optimal social fund allocation in the stock market.

©2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Although the mispricing of new shares is diminishing with the evolution of China’s initial public of f ering (IPO)supervisory policy,the investment behavior induced by the new share concept remains the subject of considerable research interest.The IPO process not only improves corporate governance,but also provides investors with information on company quality.IPO firms have to provide the public with a large amountof information,including information on corporate governance,which has to be of high quality.The corporate governance information required is objective,and thus difficult to manipulate.It also serves to guarantee the reliability of other information.Here,we focus on two main questions.Are there any dif f erences in the degree of information absorption among different types of investors during new share selection?Does the market sentiment caused by the bull-bear market cycle affect investors’information absorption?This paper reports the results of an empirical investigation of these questions using data on the corporation governance information of IPO firms and investor behavior in China.

Historical experience in developed capital markets suggests that institutional investors,who are the main driving force behind the marketization of the global f i nancial system,play a positive role in ex ante stock selection and ex post supervision by virtue of their economies of scale and professional advantages.The prior literature focuses primarily on the economic consequences of the participation of certain types of investors, institutional investors in particular,largely ignoring the subject of stock selection,IPO stock selection in particular.Although institutional investors can take part in corporate governance by voting with their feet, engaging in public opposition or private lobbying and/or exposing management entrenchment(Gillan and Starks,2003),these ef f orts are costly and may ultimately be in vain.In fact,governance-sensitive institutional investors display a preference for firms with sound internal governance(Bushee et al.,2014).Therefore,we believe that competent,experienced investors are likelier to select rather than forgo quality stocks.

This paper contributes to the literature in four ways.First,it enriches the literature on new share selection. It reports the first systematic study investigating whether different types of investors make different uses of the governance information disclosed in preliminary prospectuses and listing announcements when bulk-buying a target corporation.Few studies in China have focused on how the corporation governance mechanism affects the new share selection decisions of institutional investors or even examined institutional investor behavior in such selection.The likely reasons for this research gap are the difficulties in the information acquisition and application processes and the inability to draw conclusions concerning IPO issues from Western studies on stock selection strategies that use such f i nancial indicators as the growth rate of operating revenue and the P/B ratio.When investors lack relevant historical performance information,it is wise to focus on corporate governance information.The empirical evidence also shows that distinguishing worthy from worthless stocks with reference to such information improves the efficiency of new share selection,thus implying that the government should place greater emphasis on standardizing and supervising the disclosure of governance information by IPO firms and carry out audits of their prospectuses and listing announcements.

Second,the paper ref i nes the quantif i cation of corporate governance information in the IPO context.One challenge in comprehensively examining the use of such information by investors making new share selection decisions is the selection of indicators.In consideration of the availability of governance information and the quantif i ability of indicators,we choose board characteristics,ownership characteristics,affiliated relationships and auditing position to represent internal and external governance,and hence to describe firms’governance situation at the time of their IPOs.In addition,we also adopt the methods of principal component analysis (PCA)and categorical principal component analysis(CATPCA),which take information quantity as a weight, to extract dummy-variable principal components and continuous-variable principal components from our nine corporate governance variables.This method of extracting classif i ed principal components is suitable for studies on corporate governance,and can be extended to sequential studies.

Third,the paper reclassif i es investors based on historical investment performance and overweighting experience.Most studies classify investors as individual investors or institutional investors and then further classify the latter by economic laws and regulations.To avoid bias from mindless investors,we focus on the information processing of investors with large holdings,who can be assumed to be professional and capable.In addition,as noted,we classify investors by historical investment performance and overweighting experience rather than by economic laws and regulations.This approach allows us to identify dif f erences in the information absorption of different types of investors,thus rendering the study more pertinent than others.We demonstrate that institutional investors with excellent historical investment performance and rich overweighting experience pay greater attention to the governance situation in IPO firms than other investors.

Finally,the paper investigates the moderating ef f ect of market sentiment on new share selection.More specif i cally,it examines whether investors’new share selection strategies are influenced by the bull-bear market cycle.We divide our sample into two groups based on the market circumstances at the time of firms’IPOs,andfi nd that the cycle does exert a signif i cant moderating ef f ect on the new share selection strategies of investors with large holdings.Relative to their individual counterparts,institutional investors are unperturbed by market sentiment and capable of using governance information ef f ectively in a bull market.

The remainder of the paper is structured as follows.Section 2 reviews the domestic and overseas literatures and proposes the study’s hypotheses.Section 3 introduces the research design,including data selection and research methods.Section 4 outlines and discusses the empirical results,and Section 5 reports the results of additional analysis using other classif i cation approaches for investors with large holdings.Section 6 concludes the paper with a discussion of the research implications.

2.Literature review and research hypotheses

2.1.Corporate governance information and dif f erences in new stock subscription decisions among heterogeneous investors with large holdings

Corporate governance information allows investors to determine company quality(Shleifer and Vishny, 1986).A high-quality external corporate governance environment can reduce listed firms’operating risks and improve their ability to deal with crises.This corporate governance premium ensures that companies operate smoothly over the long term,and ultimately results in high returns for investors.Accordingly,institutional investors tend to favor companies with good corporate governance(Falkenstein,1996;Eakins et al., 1998;Grinstein and Michaely,2005;Xin and Xu,2007;Song and Li,2009;Li and Li,2008;Ye et al.,2009).It can thus be concluded that corporate governance affects both the value of IPO firms and the interests of investors.Investors with large holdings are constrained by limited f i nancial resources and strong prof i t pressure. Therefore,their investment decisions tend to be relatively cautious.Under pressure to gain a prof i t,they dig out as much information as possible to determine whether a new stock is really a black horse and to protect their own interests,paying particularly close attention to the f i rm’s corporate governance information. The better the governance structure of an IPO f i rm,the larger institutional investors’holdings in it are likely to be because these investors are good at making use of information.However,investors are heterogeneous, and their degree of sensitivity to corporate governance information also dif f ers.Hence,we investigate the differences in the strategies of different groups of investors with large holdings,namely institutional investors and individual investors,when they make new stock subscription decisions.

Securities investments account for only a small proportion of individual investors’portfolios.These investors also struggle with complex operations such as short selling.Therefore,in the face of numerous investment possibilities,individual investors are prone to the‘‘search problem.”Kumar and Lee(2006)find little variety in the securities in which individual investors invest and a high degree of correlation in their investment behavior.In addition,individual investors display obvious myopia,often making investment decisions on the basis of past price change patterns.Field and Lowry(2009)show that individual investors generally ignore information on the characteristics of IPO companies in their decision-making process and do not even consider those companies’pre-IPO earnings conditions.In addition,they find that a considerable proportion of such investors make large investments in IPO companies with poor f i nancial performance.Individual investors are also more easily affected by hearsay and tend toward impulse investments,showing themselves to be behaviorally motivated(Shefrin and Statman,1985).Barber and Odean(2004)find that many individual investors are net buyers of‘‘eye-catching”stocks,that is,those with a news media focus,high turnover rate or high daily returns.In summary,individual investors depend on noise in making transaction decisions,and find it difficult to make full use of corporate governance information on IPO firms.

Institutional investors clearly have a number of advantages over individual investors,including teamwork, knowledge accumulation and practical experience.They are better able to judge market conditions and identify high-quality stocks,and hence are likelier to achieve returns higher than the market average(Grinblatt and Titman,1989,1992;Nofsinger and Sias,1999;Wermers,2000).Institutional investors have been found to identify firms that beat market benchmarks over a one-quarter horizon and to avoid firms that exhibit poor performance over the long run(Field and Lowry,2009),and thus to have a strong ability to screen companies at the IPO stage.Using a dataset of bid information on every IPO auction in Taiwan from 1995 to 2000, Chiang et al.(2012)find that the bids of institutional investors are relatively consistent with those of informedbidders in IPO auction theory,whereas those of individual investors are not.1In price bids for IPO firms,institutional investors’information superiority allows them to win at a relatively low price,and their bids are generally consistent with IPO auction theory.In contrast,the information inferiority of individual investors means that they generally overbid,and hence their bids dif f er from those predicted by auction theory.As a matter of fact,returns are higher when more institutional investors take part in the auction.The trading strategies of institutional investors are also more diverse than those of individual investors,and they are more adept at using the short-selling strategy prof i tably(Barber and Odean,2008).Therefore,institutional investors create more portfolios in the process of subscribing to IPOs.Although public information is the main information source tapped by institutional investors,these investors have a stronger motivation than their individual counterparts to dig for additional information under the dual pressure of supervision and agency costs.They are thus choosier when selecting securities,and keep a vigilant eye on corporate governance information(Giannetti and Simonov,2006;Russell Reynolds Associates,1998;Chiu and Monin,2003;Schnatterly and Johnson,2014; Li et al.,2015).

To sum up,compared with individual investors,institutional investors have advantages in knowledge and capital reserves,information processing and industry specialization,among other advantages.They are good at exploiting the governance information publicly disclosed by IPO companies,and adjust their investment portfolios using a discretionary approach.These investors can also bear a higher level of investment volatility than their individual counterparts.Therefore,we believe that institutional investors have advantages in the use of public information on IPO firms,and thus put forward Hypothesis 1a.

Hypothesis 1a.Compared with individual investors,institutional investors with large holdings pay more attention to the corporate governance conditions of IPO firms when subscribing to new stocks.

Although there is a clear boundary between individual and institutional investors,a large degree of heterogeneity exists within the latter group.Because there is a lack of historical transaction data for IPO stocks, investors’decisions about whether to buy them can be based only on the publicly disclosed information in their prospectuses.Accordingly,we believe that different types of institutional investors have dif f ering degrees of ability to grasp governance information on IPO firms.Del Guerciu(1996),Bushee and Noe(2000)and Bushee et al.(2014)all posit that due to signif i cant variations in information sources,data analysis,professional knowledge and investment experience among institutional investors,their sensitivity to and utilization of corporate governance information also dif f er.Therefore,we divide institutional investors into two groups, blue-chip investors and underperforming investors,based on their historical investment ability and experience.

The historical investment performance of investors has some predictive power for future performance (Fung and Hsieh,2000).Blue-chip institutions achieved higher than market average returns in the past,which suggests that they have the ability to select high-quality stocks.In the process of forming their own investment style,institutional investors also acquire information interpretation and application skills that give them the ability to grasp a comprehensive body of information.They also subject IPO companies to quality screening. Therefore,we believe that among investors with large new stock holdings,those whose historical performance is good(blue-chip institutional investors)have a stronger motivation and ability to make use of corporate governance information on IPO corporations than those whose historical performance is poor(underperforming institutional investors),which leads us to propose Hypothesis 1b.

Hypothesis 1b.Institutional investors with good rather than poor historical performance pay more attention to corporate governance information on IPO companies before making a large investment.

2.2.Moderating effects of bull-bear cycle on new stock subscription strategies of investors with large holdings

different external market environments lead to signif i cant dif f erences in investors’decision-making behavior.Daniel et al.(1998)construct a theoretical model of cognitive and emotional bias based on the behavioral pricing context.Bagozzi et al.(1999)and Statman et al.(2003)find that rising market sentiment prompts some investors to assess future securities performance in an overly optimistic fashion and to have conf i dence in their predictive ability concerning securities.Using Chinese data,You(2010)shows that the market is likely tooverreact(underreact)when market sentiment is bullish(bearish).Hong and Stein(1999,2007)further emphasize the importance of investor heterogeneity.Although all types of investors display behavioral bias,the extent to which they do so dif f ers.In China’s securities market,individual investors are more sensitive to market sentiment than institutional investors,and tend to buy securities in a herd when such sentiment is positive (Li et al.,2015).The pattern of new stock subscription decisions is similarly affected by the external market environment.

During the up phase of a composite index,a highly speculative atmosphere is likely to make some investors overly optimistic,thereby dampening demand for information on new shares.In this situation,the motivations of both individual and underperforming institutional investors to use corporate governance information are likely to weaken.Mature investors,in contrast,are more capable of maintaining a stable investment style and identifying potential investment targets calmly and objectively in the up phase of a stock index.Therefore, during bull market periods,the ability of individual and underperforming institutional investors to interpret IPO governance information is reduced,whereas that of their blue-chip counterparts holds steady.

In the down phase of a composite index,in contrast,the resulting stock market recession forces investors to be more cautious in their selection.Individual investors and blue-chip and underperforming institutional investors alike are forced to exploit the investment signals contained in corporate governance information due to the smaller prof i t space.Therefore,in these circumstances,the motivations of both individual and underperforming institutional investors to make use of corporate governance information are enhanced.

To summarize,the bull-bear market cycle is an important factor in investors’new stock subscription behavior.An external environment characterized by a composite index in an up phase weakens the ability of less sophisticated investors(individual investors and underperforming institutional investors)to make use of corporate governance information on IPO firms.This discussion brings us to our f i nal hypothesis.

Hypothesis 2a.Compared with institutional investors,individual investors’motivation and ability to make use of corporate governance information on IPO companies is weakened during the up phase of a composite index.

Hypothesis 2b.Compared with blue-chip institutional investors,underperforming institutional investors’motivation and ability to make use of corporate governance information on IPO companies is weakened during the up phase of a composite index.

3.Research design

3.1.Sample selection and data sources

To investigate how the corporate governance of IPO companies influences the new stock subscription decisions of different types of investors,we collect corporate governance data on all Chinese IPO companies listed between 20 May 2002(when the market value allotment system started in full)and 31 December 2014.The sample is then divided into stages based on the IPO bull-bear market cycle.The sample is also cleaned as follows.First,observations with incomplete information disclosure,such as a lack of f i nancial information for the three years before the listing date,market information on new shares and corporate governance information,are excluded.Second,the agent variables are calculated according to the original data;that is,extreme values are winsorized at 1%.Investor information is collected from the first post-listing quarterly reports of the sample IPO firms,and corporate governance information is collected manually from IPO prospectuses and listed company statements.Data on the control variables are collected from the CSMAR,RESSET and CNINFO databases,and information on underwriter reputation from the official Web site of the China Securities Industry Association(CSIA).All data are double-checked for discrepancies.After data-processing,the fi nal sample includes 1516 observations.

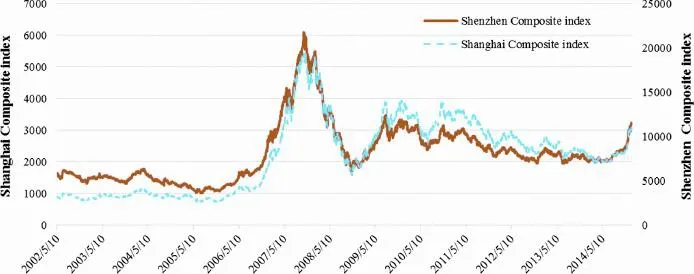

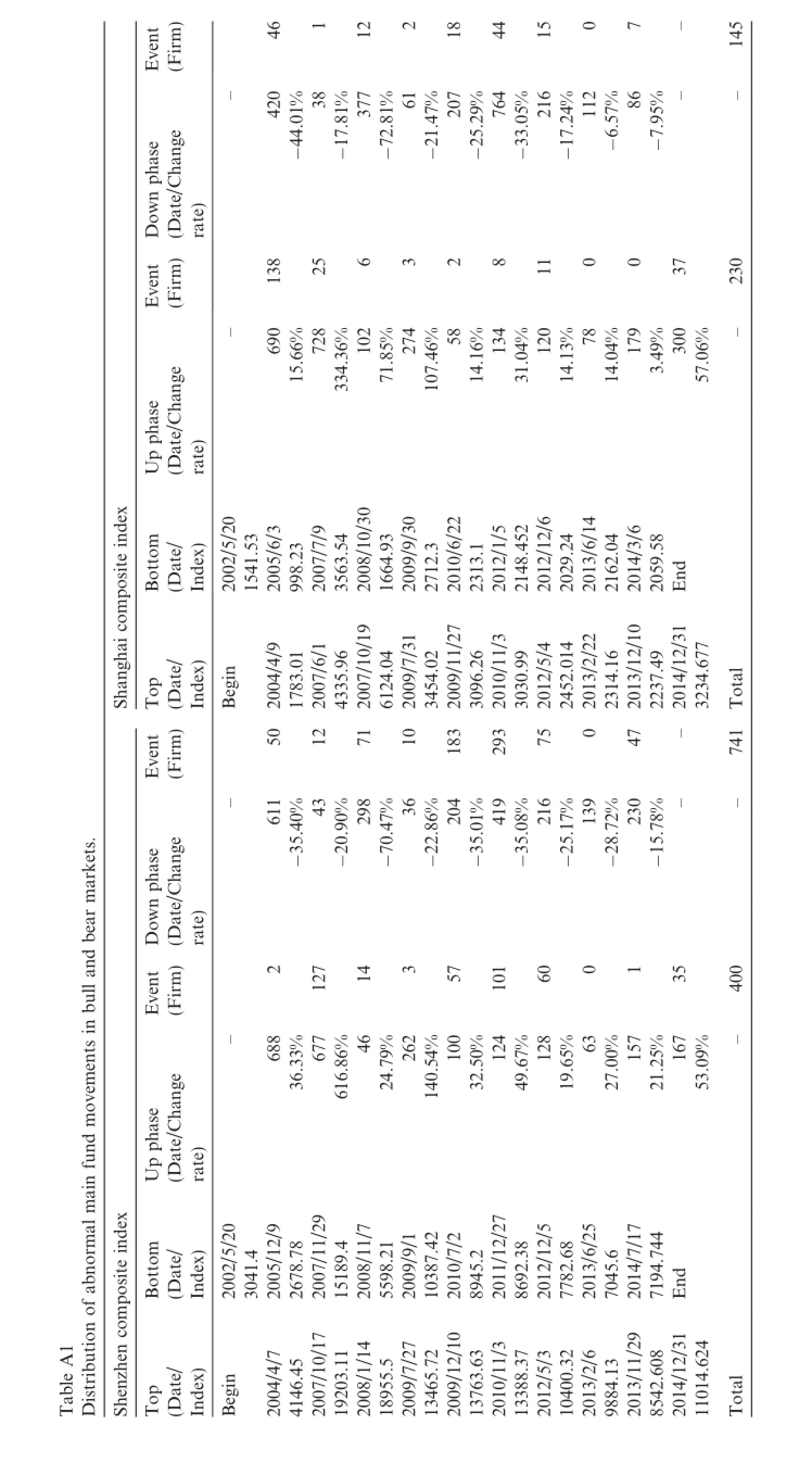

Fig.1 shows the time series of the Shanghai and Shenzhen Composite Indexes,which are further divided into up and down periods in Appendix A in accordance with the Elliott Wave Principle.The Shanghai and Shenzhen stock markets experienced 10 up cycles and nine down cycles between May 2002 and December 2014.The cycles in both directions lasted from one month to approximately two years,although the averagecycle is about 251 days.More importantly,the distribution of new stocks in the overall bull-bear cycle depicted in Fig.1 shows,in general,that there is a signif i cant dif f erence in the distributions of the 1516 sample IPO firms in bull and bear periods.

Figure 1.External investment environment at the time of new stock listings(time series of the Shanghai and Shenzhen Composite Indexes).

3.2.Independent variable:division of investor heterogeneity

Most scholars distinguish between different types of institutional investors by economic laws and regulations,although institutional investors’affiliated background and investment style are increasingly being taken into consideration.However,the heterogeneity of these investors is rarely considered from the perspective of large-holding experience.Yang et al.(2012)conclude that most researchers are concerned purely with the study of securities investment funds,with only a few studies comparing such funds with securities companies or social insurance funds,a few comparing them with securities companies and the Qualif i ed Foreign Institutional Investor(QFII)scheme,and a few comparing securities investment funds,securities companies,the QFII scheme and trust companies.We argue that these classif i cations are inadequate.Because IPO stock subscription decisions have a strong degree of specif i city,and the experience of institutional investors diverges widely(Bushee et al.,2014),it is necessary to make a more meaningful division of the institutional investor group.

To measure the investment capacity of institutional investors,we reclassify those who buy large holdings in new stocks.Based on their past investment performance,we divide institutional investors into blue-chip and underperforming investors and carry out a comparative study of the two using rational factors to ref l ect their institutional experience and ability.Distinguishing the investment ability of heterogeneous institutional investors who subscribe to new stocks allows us to characterize,for example,the age of the institution,historical investment return pattern and historical number of investments.However,because the ef f ect of institutional age is difficult to distinguish,it is not considered in this study.Historical investment returns ref l ect past investment performance,which is used as a classif i cation criterion in our main model.The historical number of investments reflects the investment experience of institutional investors,and it is thus used as the classif i cation criterion in our extended analysis.

Gillan and Starks(2000)posit that the shareholding ratio reflects investors’degree of participation.We first divide investors into institutional and individual investors,whose shareholdings are noted as P_INST and P_INDI,respectively,and then further divide institutional investors by their investment performance in the previous year.The shareholding ratios of blue-chip and underperforming institutional investors are noted as P_WINNER and P_LOSER,respectively.

Because of the limited rationality of investors,there are cognitive dif f erences in the perception of corporate governance information,which results in dif f ering patterns of new stock subscription behavior.Owing to the limited resources available in the process of competing for new stocks,investors necessarily shoot their arrows at the target to gain higher returns.2For example,when setting up new stock products,many funds commit themselves to increasing the probability of obtaining prof i table new stocks.Accordingly,rational investors tend to screen IPO companies and select those of high quality to ensure higher returns rather than aimlessly investing or casting a wide net.Investors who invest heavily in new stocks put a lot of money into particular IPO corporations,resulting in a huge degree of prof i t pressure.Then,by making use of their investment experience and analytical capacity,these investors have a strong motivation to dig out hidden content in the information they collect to identify the best new stocks.We believe that under the three drivers of experience, ability and pressure,heavily investing investors can exploit various types of information to capture the details hidden therein3The detailed descriptions of investment strategies and regular disclosure of investment lists on the Web sites of the main securities investment funds provide some corporate governance information,such as board characteristics,ownership structure,company affiliation and audit condition.to maximize their prof i ts and purchase new stocks preferentially.Therefore,the research object in this paper is investors who invest heavily in new stocks.

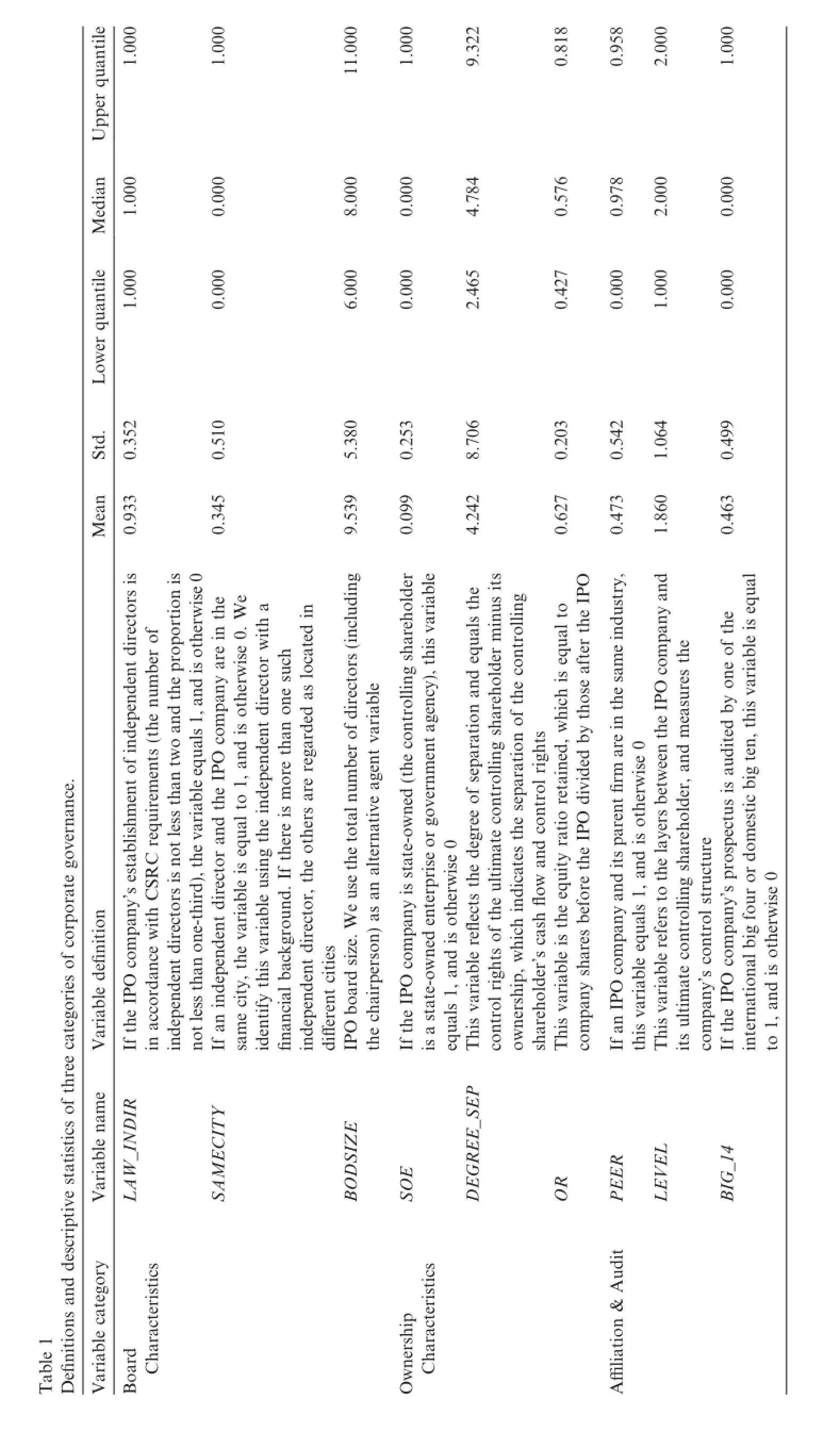

3.3.Main observation variables:extraction of principal components of corporate governance

Following Xu et al.(2006),who extract an operating performance index as a reference,we use PCA to calculate the principal components of comprehensive corporate governance,which are then used as the standard in the following analysis.We extract three representative variables featuring board characteristic information and three featuring equity structure information,two dimensions ref l ecting affiliation information,and one variable featuring audit information on IPO prospectuses.These variables are sourced from the annual reports issued one year before the IPOs,and act as representative indicators.The def i nitions of the variables and their descriptive statistics are presented in Table 1.

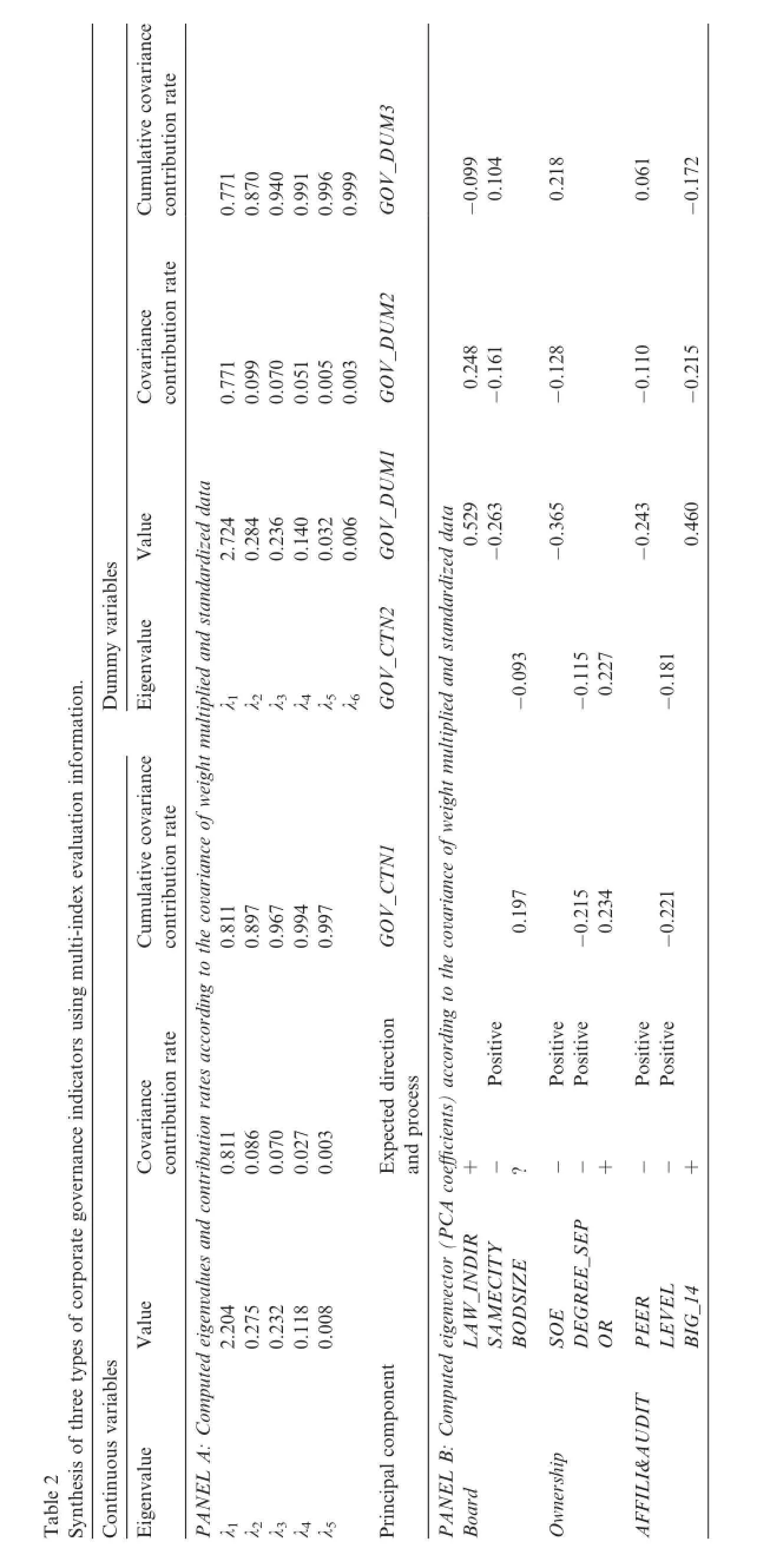

We ref i ne the nine explanatory variables on corporate governance information to construct a principal component factor that shows the overall corporate governance conditions of new shares.For continuous variables such as BODSIZE,DEGREE_SEP,OR and LEVEL,we use conventional PCA to extract the principal components.For the f i ve other categorical variables,the PCA precondition that the variables to be extracted are in a multivariate normal distribution is difficult to meet.Therefore,the researchers perform data classif ication using CATPCA instead.That method can play the same function as ordinary PCA(Zhang et al.,2004). In addition,it can not only eliminate any interaction between evaluation indexes,but also simplif i es the index synthesis steps and then brief l y shows the relationship between corporate governance and investment strategy. The synthesis process is illustrated in Table 2.

First,Panel A of Table 2 shows that the first eigenvalue’s cumulative contribution rate to the continuous and categorical variables,respectively,interprets 81.11%and 77.09%of the represented variables.Hence,it can be used to express the optimal linear combination of the nine variables.Second,the variance contribution rate is taken as a weight to construct the eigenvector,and the first principal component of continuous variable GOV_CTN1 and first principal component of categorical variable GOV_DUM1 derived from PCA can be identif i ed as a comprehensive indicator of the corporate governance level.

The loading coefficients(factor loadings)of GOV_CTN1 to the continuous variables are BODSIZE(0.197), DEGREE_SEP(-0.215),OR(0.234)and LEVEL(-0.221),and those of GOV_DUM1 to the categorical variables are LAW_INDIR(0.529),SAMECITY(-0.263),SOE(-0.365),PEER(-0.243)and BIG_14 (0.460).

Panel B of Table 2 shows the directions of the coefficients corresponding to the positive and standardized nine governance information variables to be consistent with expectations.Therefore,we take the first principal component factor scores of the corporate governance continuous(GOV_CTN1)and-categorical(GOV_DUM1)variables as agent variables of corporate governance,and enter them in the selection model.

3.4.Model test and variable connotation

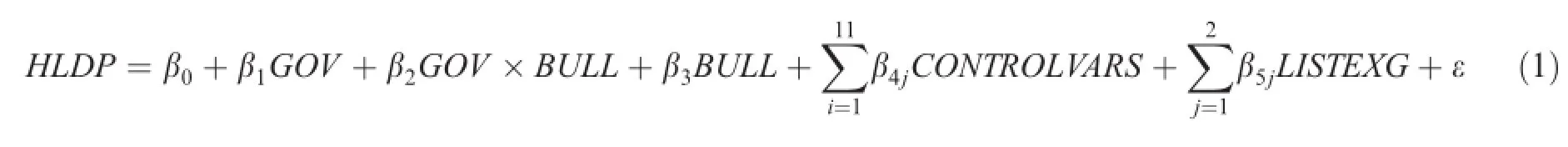

After extracting the three types of principal components of the corporate governance information of IPO corporations(GOVi),we regress the three indexes to the shareholding ratios of heterogeneous investors,the listing exchange of new stocks and the bull-bear market cycle,as shown in Eq.(1).

In Eq.(1),the dependent variable HLDP represents the shareholding ratios of different types of investors.The independent variable GOV represents both the first principal component of the continuous corporate governance variable(GOV_DUM1)and that of the categorical corporate governance variable(GOV_CTN1). Hypothesis 1 predicts the regression coefficients of the GOV variables to be signif i cantly positive for the shareholding ratio of institutional investors(blue-chip investors in particular);that is,β1should be signif i cantly positive.Further,to examine the ef f ect of the bull-bear market cycle on the relationship between the corporate governance of IPO firms and institutional investors’holding decisions,we include the principal components of the two variables of corporate governance(GOV_DUM1 and GOV_CTN1)and the bull-bear cycle(BULL).If the composite index of the host exchange(Shanghai or Shenzhen)is in an upward cycle when new stocks are issued,then BULL equals 1;if it is in a downward phase,BULL equals 0.Hypothesis 2 predicts the coefficient of the product to be signif i cantly positive for the shareholding ratio of institutional investors(particularly blue-chip investors);that is,β2should be signif i cantly positive.

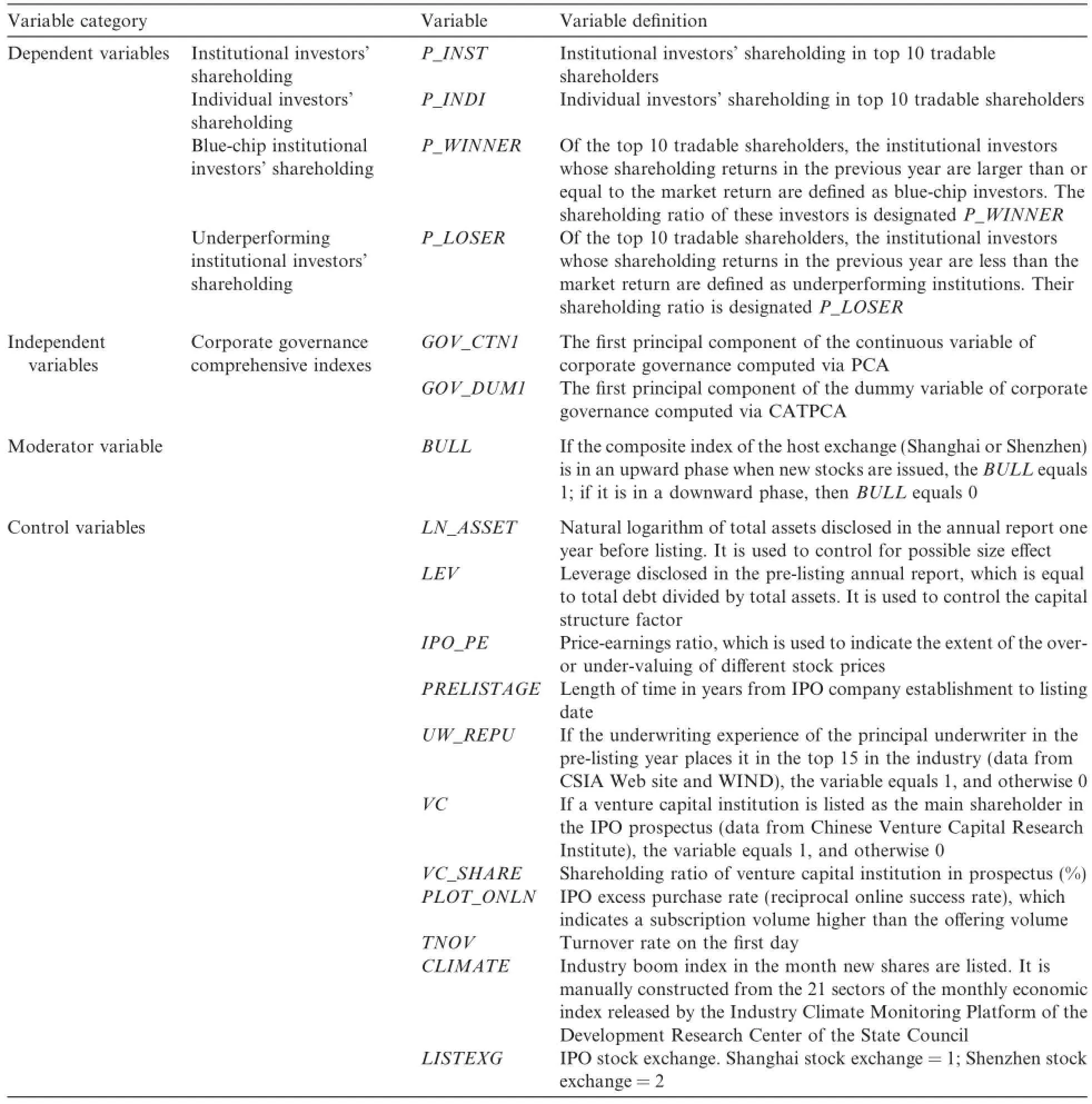

The def i nitions of the variables used in this research are presented in Table 3.

The control variables(CONTROL VARS)in Eq.(1)are chosen with reference to previous research and China’s institutional background.They include IPO f i nancial information,which is directly related to the investment decision(i.e.,company size,capital structure and performance indicators),basic information (i.e.,company age before listing,reputation of underwriters and venture capital institution,and participation of venture capital institution)and market information(i.e.,excess subscription of new shares,first-day turnover rate and industry boom index in new share listing month).In addition to these three categories of control variables,we also control for f i xed effects(i.e.,the stock exchange on which new shares are listed).

First,with regard to the aforementioned f i nancial information,the scale of a company’s assets suggests the scale of its economy,which has a positive ef f ect on rational investors(Shefrin and Statman,1994;Lakonishok et al.,1994),who are more willing to hold shares in large companies(Gompers and Metrick,2001).In addition,the capital structure,namely,the debt level,reveals the extent of a f i rm’s f i nancial risk and f i nancial distress(Ohlson,1980).Although the indicator of liabilities to assets has many defects,it is often used by rational investors to select stock(Bushee,2001)because the earnings response coefficient of highly leveraged companies is signif i cantly lower than that of less-leveraged firms(Dhaliwal et al.,1991).The issuing price-to-earnings ratio constitutes internal information used to estimate the IPO stock price,and therefore provides a pricing channel.It plays an important role in guiding investment decisions.Prior studies have found that stocks in public corporations with high prof i t and growth levels are likely to be held by institutional investors with large shareholdings(Gompers and Metrick,2001).

Second,with regard to the basic information,the length of time between an IPO company’s establishment and its listing date constitutes a special signal.Company age can affect the future excess returns of IPO companies.For those in mature industries,the longer the length of establishment before the listing,the higher the level of market awareness.For IPO firms in industries such as Internet and new media,e-commerce,and new energy or other emerging industries,however,growing rapidly and quickly passing the China Securities Regulatory Commission’s(CSRC)listing criteria are suggestive of a strong development tendency.Investors can judge the information disclosed by the company’sage after considering its industry.Underwriter reputation is an important factor that influences the success and performance of IPO companies(Carter and Manaster, 1990;Megginson and Weiss,1991;Cooney et al.,2003).We select underwriter performance to measure underwriter reputation.Data on the amount of underwriting undertaken by a principal underwriter in the year before an IPO are obtained from the CSIA Web site.If that amount puts him or her into the top 15 in the given industry,then he or she is regarded as having a strong reputation,and UW_REPU=1.The participationand shareholding ratio of venture capital(VC)institutions are also considered.The IPO process is affected by the behavior and reputation of VC investors to varying degrees(Zhang and Liao,2011;Chen et al.,2011;Cai et al.,2013).We adopt the approach of Coakley et al.(2007)and Chen et al.(2011).If VC institutions are listed among the main shareholders in an IPO prospectus,we believe that VC investors participate in the f i rm.

Table 3Def i nitions of main research variables.

Finally,with regard to the market information,the IPO excess purchase rate is indicative of online subscription success,as it refers to the subscription volume being higher than the of f ering volume.The firstday turnover rate indicates the presence of strong institutions,which has implications for assessing stock price volatility.We also control for dif f erences in industry boom.With reference to the CSRC’s 2001‘‘ListingCorporation Industry Classif i cation Guidelines,”we obtain the industry boom index for each IPO company in its listing month.We also add the stock listing exchange(LISTEXG)to our model as a f i xed-ef f ect variable to ref l ect dif f erences between the Shenzhen and Shanghai trading markets.

4.Empirical results

4.1.Descriptive statistics

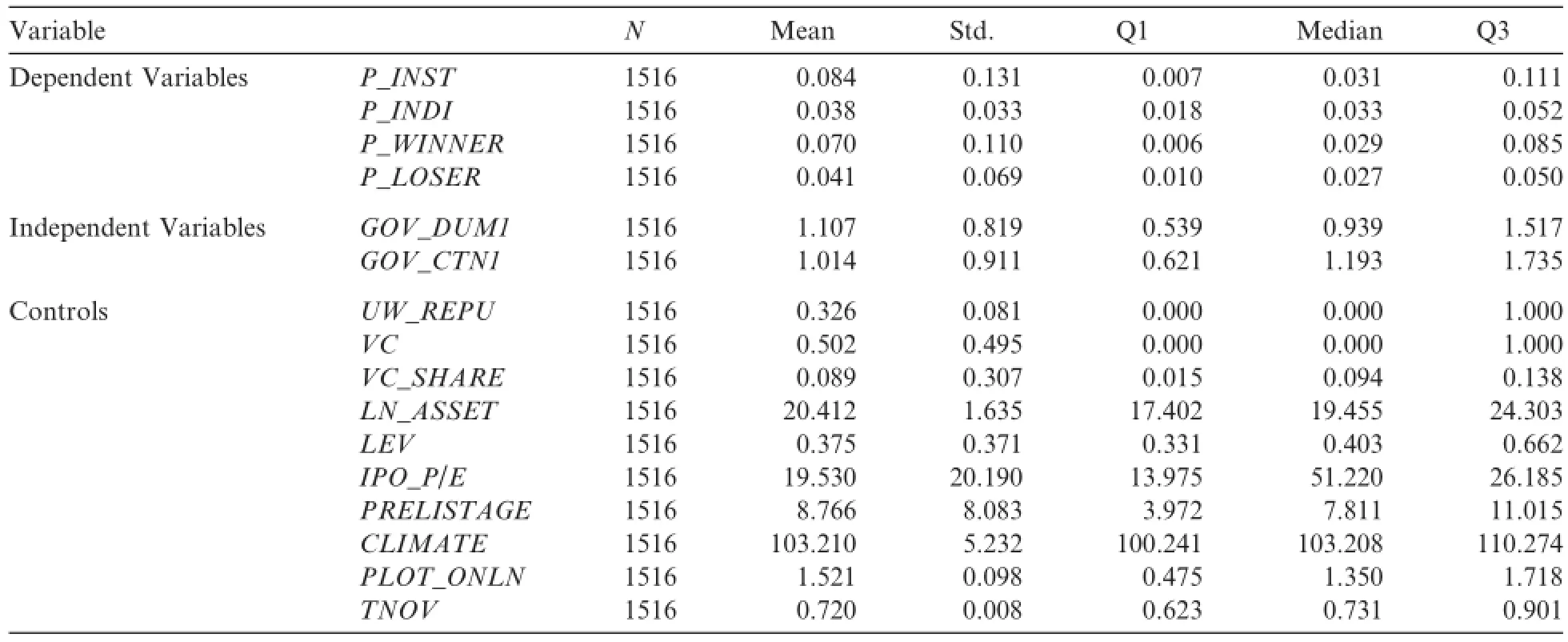

Table 4 tabulates summary statistics for the variables used in our main analysis.Judging from the list of investors who take a large holding in new stocks,institutional investors tend to have a larger ownership stake than individual investors,averaging around 4.61%in our sample.Moreover,within the institutional investor group,blue-chip investors have a larger ownership stake than their underperforming counterparts,which is consistent with our expectations.

Descriptive statistics for the control variables are also presented in the table.The mean value of underwriter reputation(UW_REPU)is 0.326,indicating that 32.62%of the sample firms recruit highly reputable underwriters.The mean values of VC and VC_SHARE are 0.502 and 0.089,respectively,suggesting that VC institutions subscribe to only a few new stocks.Their holdings are 8.91%on average.The new firms in our sample tend to have low f i nancial leverage ratios,averaging around 0.375.The mean value of CLIMATE is 103.210, which is expected as new firms always list in a bull market.The other variables are within normal ranges.

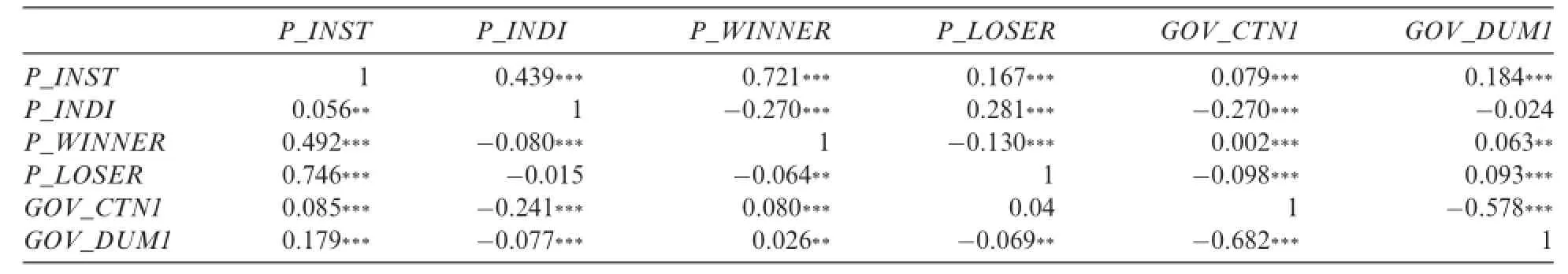

Table 5 reports the correlations between the ownership stakes of the two institutional investor groups and the explanatory variable,i.e.,corporate governance.The Pearson correlations are on the bottom left,and the Spearman correlations in the upper right.Consistent with our hypothesis,the ownership stakes of institutional investors and blue-chip investors,P_INST and P_WINNER,are strongly and positively correlated with the two proxies for corporate governance.In contrast,P_INDI is negatively correlated with both independent variables,and the correlation between P_LOSER and GOV_CTN1(GOV_DUM1)is unstable,providing preliminary support for our hypothesis that underperforming institutional investors do not make ef f ective use of corporate governance information.

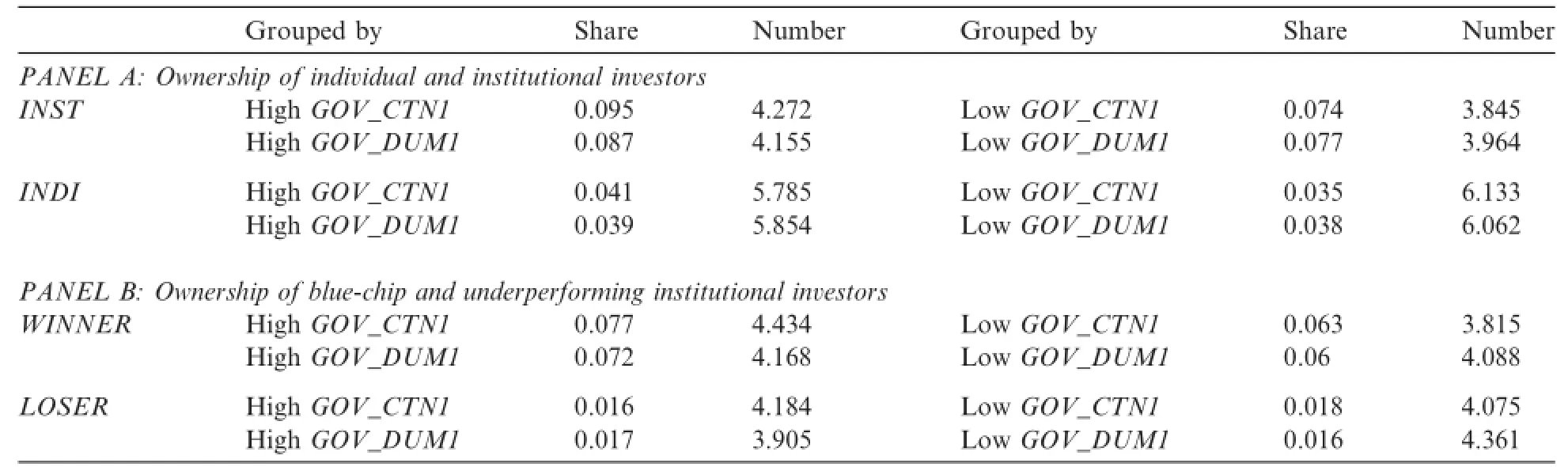

4.2.Group testing of investor heterogeneity and new stock subscription behavior

Panel A of Table 6 divides the full sample into two groups by both the value of corporate governance and investor heterogeneity.The horizontal axis distinguishes the sample by the median of GOV_CTN1 andGOV_DUM1,and the vertical by whether the investors are institutions or individuals.The values of P_INST descend a signif i cant 2.11%from high GOV_CTN1 to low GOV_CTN1,indicating a positive relationship between corporate governance and investors’decisions.In contrast,the change in the mean values of the P_INDI measure from high to low governance is not signif i cant,which is consistent with Hypothesis 1a. We repeat the group testing using the first principal component of the dummy variable GOV_DUM1,and the results are basically consistent with the foregoing conclusion.

Table 4Descriptive statistics of the main variables.

Table 5Correlation matrices.

Furthermore,we also compare the two types of institutional investors,as shown in Panel B of Table 6.It can be seen that blue-chip investors hold more stock in newly listed firms with high GOV_CTN1 and GOV_DUM1 values than their underperforming counterparts and tend to avoid new firms with low such values,which is consistent with Hypothesis 1b.

4.3.Multivariate analyses

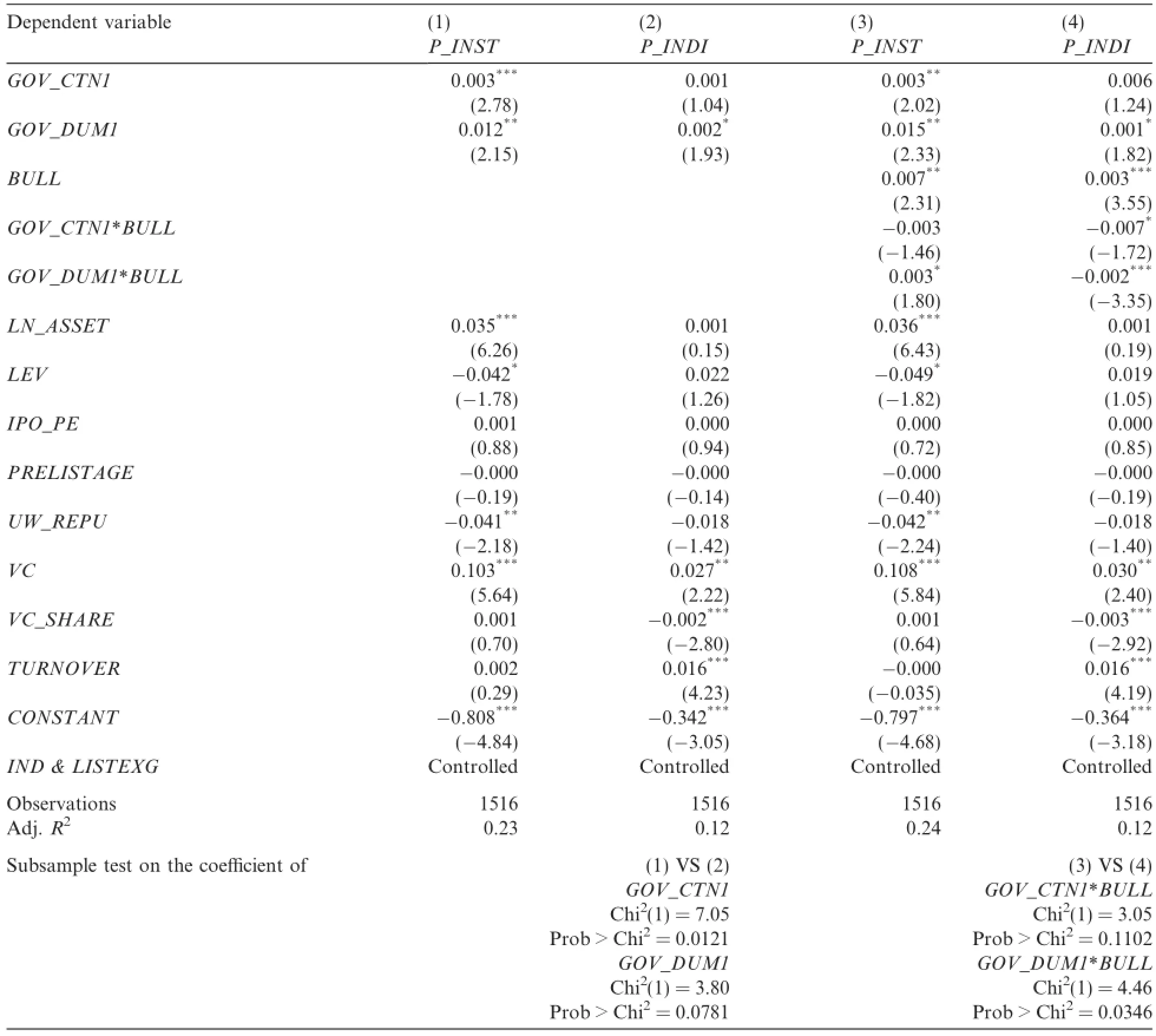

Table 7 reports the empirical results for Hypothesis 1.The dependent variable in Columns(1)and(3)is P_INST,whereas that in Columns(2)and(4)is P_INDI.The explanatory variables are GOV_CTN1 and GOV_DUM1,respectively.

Without considering the ef f ect of bull and bear cycles,the estimated coefficients on GOV_CTN1 and GOV_DUM1 are signif i cantly positive in the first model in Table 7,indicating that newly listed firms with better corporate governance tend to attract more institutional investors.In the second model considering the shareholding of individual investors,however,the coefficient of GOV_CTN1 lacks signif i cance and that of GOV_DUM1 is positive only at the 10%signif i cance level.These results are in line with our expectation and support Hypothesis 1a.

We next include the interaction item for market cycle and the two principal components of corporate governance.For institutional investors,the coefficient of GOV_CTN1*BULL in column(3)lacks signif i cance and that of GOV_DUM1*BULL is positive only at the 10%signif i cance level,indicating that institutional investorsprefer well-governed new firms even in an environment of feverish speculation.However,the picture is different when it comes to individual investors.As shown in column(4),the coefficients of GOV_CTN1*BULL and GOV_DUM1*BULL are-0.007 and-0.002 at signif i cance levels of 10%and 1%,respectively,thus conf i rming Hypothesis 1b.

Table 6Shareholdings of heterogeneous investors in new firms with different levels of corporate governance.

The results for the control variables are also consistent with our expectations.For instance,the estimated coefficients on LN_ASSET are signif i cantly positive,which indicates that large firms supported by VC are better received by institutional investors because of those firms’reputational capital.The coefficients on LEV are not consistent in the different models,indicating that the influence of leverage may be conditional.

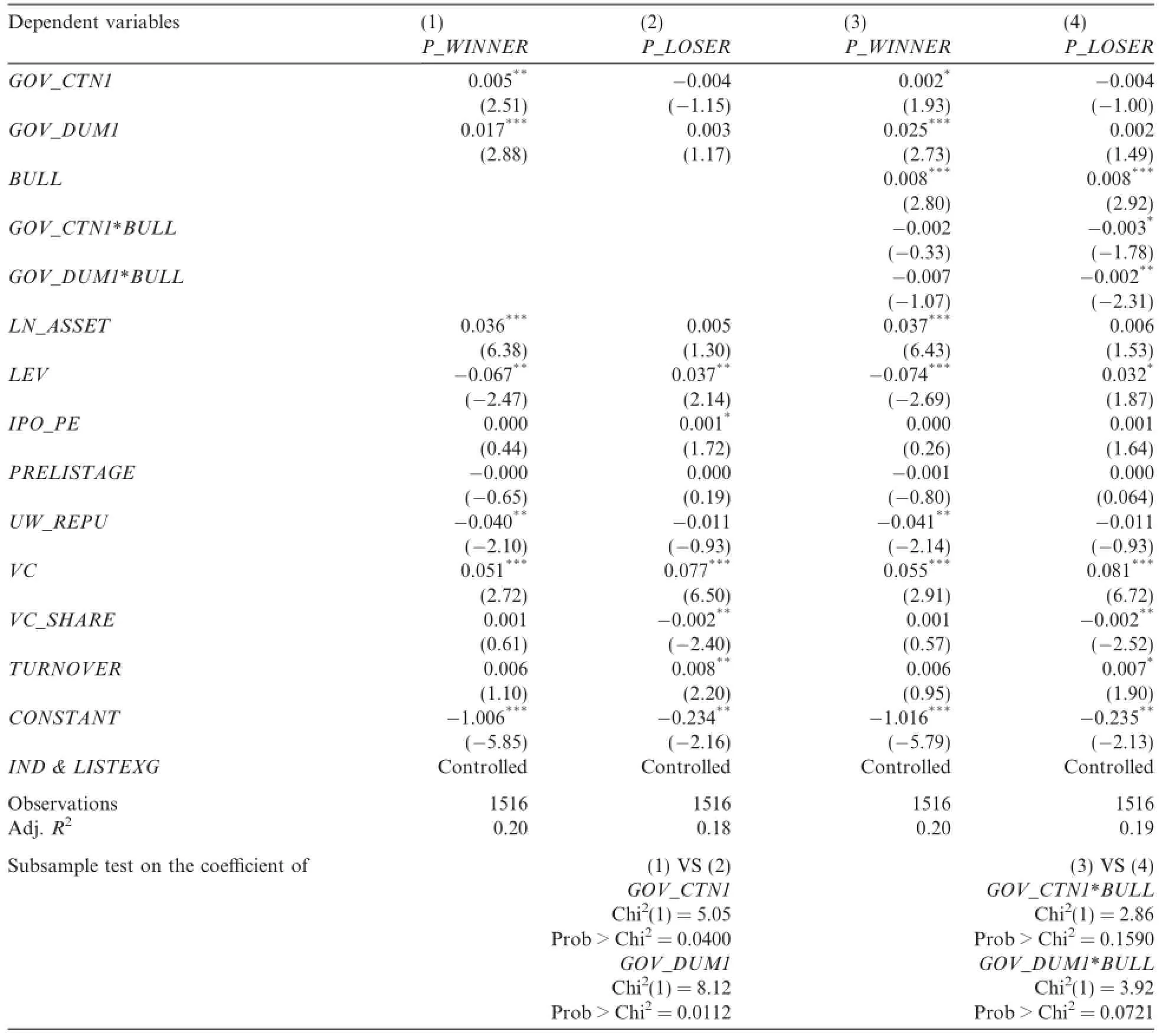

We now seek to explain the relationship between corporate governance and the behavior of investors with different historical performance records.Table 8 presents the regression estimates of those investors proxied byP_WINNER and P_LOSER.The results in columns(1)and(2)show the coefficients on GOV_CTN1 and GOV_DUM1 to be signif i cantly positive below 5%and 1%,respectively(t-statistics=2.51 and 2.88, respectively).

Table 7The influence of corporate governance on new stock selection.

Table 8influence of corporate governance on investors with different levels of investment performance.

After controlling for bull and bear cycles,we observe the influence of the market environment on investor behavior.Both GOV_CTN1*BULL and GOV_CTN1*BULL are more signif i cantly negative in column(4) than in column(3),indicating that the market environment is negatively associated with the rationality of underperforming institutional investors relative to their blue-chip counterparts,which is consistent with Hypothesis 2b.

In sum,the results in Tables 7 and 8 suggest that compared with individual investors,institutional investors with large holdings make more ef f ective use of corporate governance information.Similarly,compared with their underperforming counterparts,blue-chip institutional investors also make better use of such information.Furthermore,bull and bear markets exert a signif i cant influence on the behavior of both individual investors and underperforming institutional investors.

5.Extended research

The dif f erences between individual and institutional investors are obvious,but the classif i cations of institutional investors dif f er.In expanded testing,we change the classif i cation criteria for the ability of institutional investors.We first consider large holding experience instead of historical investment performance,and we thenreclassify institutional investors in accordance with economic laws and regulations to determine whether the main regression conclusions hold.

Table 9effects of corporate governance on institutional investors with large holding experience when they make large investment decisions about IPO stocks.

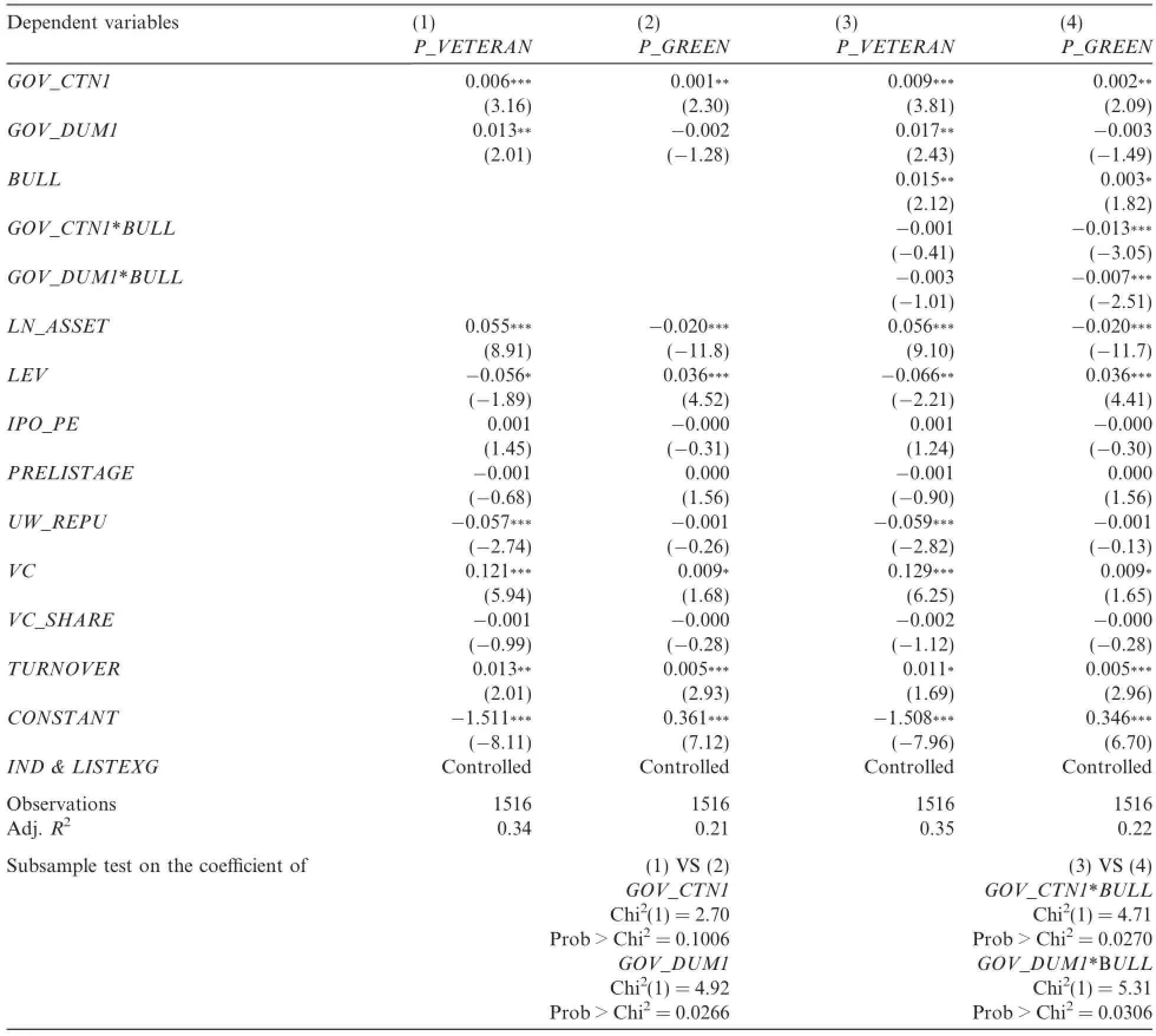

5.1.Reclassifying institutional investors according to large holding experience

We first compare the top 10 tradable shareholders of IPO companies with those of the companies a year before their IPO.We then sort the listed companies held by institutions with large holdings who invest heavily in new stocks,ranking them from high to low.Next,we choose the top 10%as‘‘institutions with rich large holding experience”(VETERAN)and the bottom 10%as‘‘institutions lacking large holding experience”(GREEN).Finally,using this new classif i cation method,we reexamine the ability of different types of institutional investors to make use of corporate governance information.The results are presented in Table 9.

As can be seen in columns(1)and(2)of Table 9,the higher the level of corporate governance,the larger the shareholding of institutions with rich experience.Columns(3)and(4)show that when the bull-bear cycle variable and its cross term with the corporate governance variables are added,the regression coefficients of the cross terms between the corporate governance principal components(GOV_CTN1,GOV_DUM1)and BULL are signif i cantly negative in the group with a lack of large holding experience.The implication is that investors with little such experience make little use of corporate governance information on IPO corporations in a bull market environment,thus further highlighting the informational advantage of institutional investors with considerable large holding experience in the IPO context,particularly in the up phase of a stock market index.

To further test the robustness of the regression results,the classif i cation standards are adjusted in two ways. First,we relax the classif i cation criteria.More specif i cally,we quarter the number of listed companies in which institutions were once heavily invested,and then take the median(MEDIAN=once held large shares of three other listed companies)and upper quartile(P75=once held large shares of at least four other listed companies)as the classif i cation standard for‘‘institutional investors with rich large holding experience.”Second,we tighten the classif i cation standard.More specif i cally,we rank the listed companies once heavily held by institutions from high to low,and then take the top 5%(P95=once held large shares of at least seven other listed companies)as the classif i cation standard.The results are basically consistent with those discussed above.

5.2.Reclassifying institutional investors by economic laws and regulations

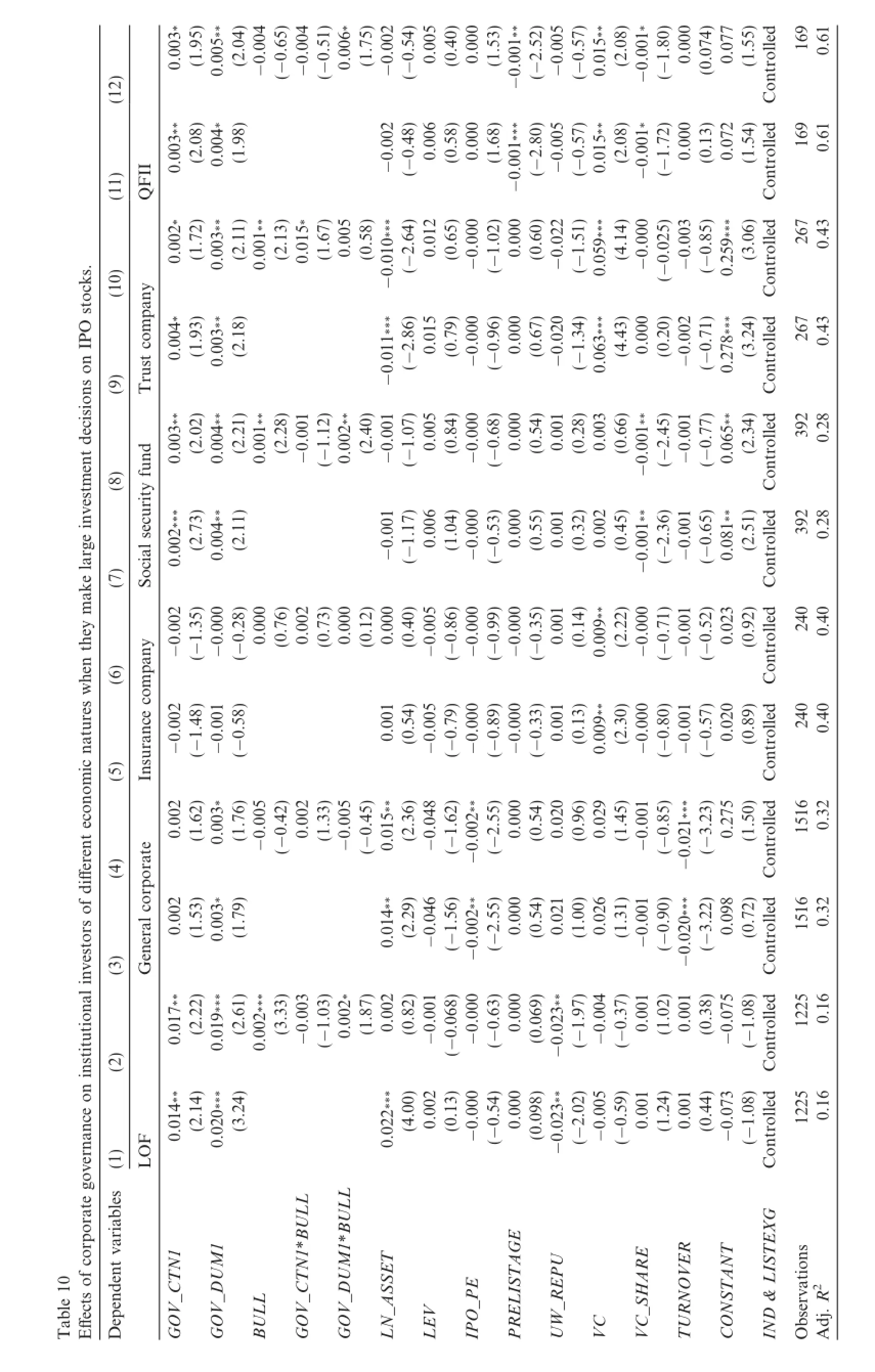

Most studies classify institutional investors by economic laws and regulations and are concerned purely with the study of securities investment funds,although a few studies compare such funds with securities companies or social insurance funds or with securities companies and the QFII scheme,and there are also a few comparing securities investment funds,securities companies,the QFII scheme and trust companies.In extended testing,we investigate the application of governance information on IPO corporations by different institutional investors classif i ed on the basis of economic laws and regulations.

Table 10 presents the results of testing the relationship between the shareholding ratios of institutional investors classif i ed by economic laws and regulations and accounting information quality.Restricted by the law and investment environment,the number of samples in each column dif f ers.Except for securities investment funds and common legal institutions,the holdings of listed companies by other institutional investors are limited.The test results are as follows.(1)According to the two principal component variables of corporate governance (GOV_CTN1,GOV_DUM1),the shareholdings of securities investment funds,social insurance funds,trust companies and QFII firms are all signif i cantly positively correlated with the corporate governance variables. In contrast,the positive relationship between those variables and the shareholding of common legal institutions is relatively weak,probably because the trading strategies of such institutions are stable and they keep in close contact with IPO companies.The shareholding of insurance companies is negatively correlated with the corporate governance variables,probably because these companies often have business affiliations with the target companies.(2)From the cross terms of the two principal component variables of corporate governance with the bull-bear cycle(GOV_CTN1*BULL,GOV_DUM1*BULL),it can be seen that the relationship between institutional investors’shareholding and the corporate governance variables is not negatively affectedby a bull market cycle.The implication is that institutional investors pay close attention to corporate governance information even in the upward phase of a stock index,which is quite consistent with the results in Table 7.

6.Conclusions and implications

An IPO is not only a process that improves a f i rm’s corporate governance level;it is also a process that provides investors with useful information.It is generally believed that a boom in new stock investment possibilities renders it difficult for the market to ascertain the real value of IPO companies,and thus triggers irrational investor behavior.The consequences are ref l ected in capital investment behavior,with investors often overestimating the initial returns on new stocks.However,there is a great deal of heterogeneity in investor capacity and performance.Do all investors really choose new stocks irrationally?Does mindless investment exist in the IPO market?The theoretical analyses and empirical tests described in this paper are carried out to find answers to these questions.

Our study sample incudes all IPO companies in China that went public between 20 May 2002 and 31 December 2014.We use the PCA method to extract corporate governance characteristics,and compare the use of corporate governance information by diverse investors with large holding experience when they subscribe to new stocks.The empirical results show the following.First,compared with individual investors,institutional investors make greater use of corporate governance information.Second,there are signif i cant variations in the use of such information by institutional investors.Compared with underperforming institutional investors,blue-chip institutional investors make more ef f ective use of corporate governance information.Third,in the up phase of a stock index,the use of such information by both individual investors and underperforming institutional investors declines signif i cantly.However,the bull-bear cycle exerts little influence on the use of corporate governance information by blue-chip institutional investors.

This paper enriches the literature on China’s IPO market.The findings help us to better understand the behavioral characteristics of investors in the process of selecting new stocks,and shed light on how to optimize the allocation of social funds in the capital market,both of which are of theoretical and practical signif i cance. The paper can serve as a reference for China’s reform of its IPO issuance and supervision system,and provide suggestions for IPO firms seeking long-term development.It can also provide support for investors looking to take advantage of corporate governance information to improve the efficiency of their new stock subscription activities.IPO companies need to be aware of the importance of such information in the capital markets,and improve their governance structures accordingly.To attract more institutional investors with large holdings, thereby supporting their long-term development,these firms need to establish a reasonable board structure, hire an accounting f i rm with an international reputation,optimize their ownership structure and develop an internal control system.In terms of theory,this study shows the value of focusing on investors with large holdings and investigating the relationship between external behavior and internal decision-making in the new stock subscription process.

Acknowledgments

We thank Professor Liping Xu from Sun Yat-sen University,the anonymous reviewers and the participants of the Special Issue Symposium for the China Journal of Accounting Research held in April 2015 for their helpful comments and suggestions.We are fully responsible for the contents of this paper.The work presented herein is sponsored by the National Natural Science Foundation of China(Nos.71272152 and 71172180).

Appendix A

See Table A1.

Bagozzi,R.P.,Gopinath,M.,Nyer,P.U.,1999.The role of emotions in marketing.J.Acad.Mark.Sci.27,184–206.

Bushee,B.,Noe,C.,2000.Corporate disclosure practices,institutional investors,and stock return volatility.Journal of Accounting Research 38(Supplement),171–202.

Bushee,B.J.,2001.Do institutional investors prefer near-term earnings over long-run value?Contemp.Acc.Res.18(2),207–246.

Bushee,B.J.,Carter,M.E.,Gerakos,J.,2014.Institutional investor preferences for corporate governance mechanisms.J.Manage.Acc. Res.26(2),123–149.

Cai,W.X.,Hu,Z.Y.,He,F.,2013.Political connections,venture capital investments and IPO opportunities:evidence from start-ups in China.J.Finance Econ.5,51–61(in Chinese).

Carter,R.,Manaster,S.,1990.Initial public of f erings and underwriter reputation.J.Finance 45(4),1045–1067.

Chen,G.M.,Yu,X.,Kou,X.H.,2011.The underpricing of venture capital backed IPOs:evidence from Chinese firms listed on different stock markets.Econ.Res.J.5,51–61(in Chinese).

Chiang,Y.-M.,Qian,Y.,Sherman,A.E.,2012.Endogenous entry and partial adjustment in IPO auctions:are institutional investors better informed?Rev.Financ.Stud.23(3),1200–1230.

Chiu,P.,Monin,J.,2003.Ef f ective corporate governance:from the perspective of New Zealand fund managers.Corp.Gov.:Int.Rev.11 (2),123–131.

Cooney,J.W.,Kato,H.K.,Schallheim,J.S.,2003.Underwriter certif i cation and Japanese seasoned equity issues.Rev.Financ.Stud.16 (3),949–982.

Daniel,K.,Subrahmanyam,A.,Hirshleifer,D.,1998.Investor psychology and security market under and overreactions.J.Finance 53(6), 1839–1885.

Del Guerciu,D.,1996.The distorting ef f ect of the prudent-man laws of institutional equity investment.J.Financ.Econ.40(1),31–62.

Dhaliwal,D.S.,Lee,K.J.,Fargher,N.L.,1991.The association between unexpected earnings and abnormal security returns in the presence of f i nancial leverage.Contemp.Acc.Res.8(1),20–41.

Eakins,S.,Stanley,R.,Paul,E.,1998.Institutional portfolio composition:an examination of the prudent investment hypothesis.Quart. Rev.Econ.Finance 38(1),93–109.

Falkenstein,E.G.,1996.Preferences for stock characteristics as revealed by mutual fund portfolio holdings.J.Finance 51(1),111–135.

Field,L.C.,Lowry,M.,2009.Institutional versus individual investment in IPOs:the importance of f i rm fundamentals.J.Financ.Quant. Anal.44(3),489–516.

Giannetti,M.,Simonov,A.,2006.Which investors fear expropriation?Evidence from investors’portfolio choices.J.Finance 61(3),1507–1547.

Gillan,S.L.,Starks,L.T.,2000.Corporate governance proposals and shareholder activism:the role of institutional investors.J.Financ. Econ.57(2),275–305.

Gompers,P.A.,Metrick,A.,2001.Institutional investors and equity prices.Quart.J.Econ.116(1),229–259.

Grinblatt,M.,Titman,S.,1989.Mutual fund performance:an analysis of quarterly portfolio holdings.J.Bus.62(3),393–416.

Grinblatt,M.,Titman,S.,1992.The persistence of mutual fund performance.J.Finance 47(5),1977–1984.

Grinstein,Y.,Michaely,R.,2005.Institutional holdings and payout policy.J.Finance 60(3),1389–1426.

Hong,H.,Stein,J.C.,1999.A unif i ed theory of under reaction,momentum trading and overreaction in asset markets.J.Finance 54(6), 2143–2184.

Hong,H.,Stein,J.C.,2007.Disagreement and the stock market.J.Econ.Perspect.21(2),109–128.

Kumar,A.,Lee,C.,2006.Retail investor sentiment and return co-movements.J.Finance 61(5),2451–2486.

Lakonishok,J.,Shleifer,A.,Vishny,R.W.,1994.Contrarian investment,extrapolation,and risk.J.Finance 49(5),1541–1578.

Li,W.,Wang,S.S.,Rhee,G.,2015.Dif f erences in herding:individual vs.institutional investors.In:Asian Finance Association(AsianFA) 2015 Conference Paper.

Li,W.A.,Li,B.,2008.An empirical study on the ef f ect of institutional investors participating in corporate governance:based on the data of 2004–2006 CCGINK.Nankai Bus.Rev.1,4–14(in Chinese).

Megginson,W.L.,Weiss,K.A.,1991.Venture capitalist certif i cation in initial public of f erings.J.Finance 46(3),879–903.

Nofsinger,J.R.,Sias,R.W.,1999.Herding and feedback trading by institutional and individual investors.J.Finance 54(6),2263–2295.

Ohlson,J.A.,1980.Financial ratios and the probabilistic prediction of bankruptcy.J.Acc.Res.18(1),109–131.

Russell Reynolds Associates,1998.Setting new standards for corporate governance:1997 US survey on institutional investors.Corp. Gov.:Int.Rev.6(1),67–68.

Schnatterly,K.,Johnson,S.G.,2014.Independent boards and the institutional investors that prefer them:drivers of institutional investor heterogeneity in governance preferences.Strateg.Manage.J.35(10),1552–1563.

Shefrin,H.,Statman,M.,1985.The disposition to sell winners too early and ride losers too long:theory and evidence.J.Finance 40(3), 777–790.

Shefrin,H.,Statman,M.,1994.Making sense of beta,size and book-to-market.J.Portfolio Manage.21(2),26–34.

Shleifer,A.,Vishny,R.W.,1986.Large shareholders and corporate control.J.Polit.Econ.94(3),461–468.

Song,Y.,Li,Z.,2009.The relevance between institutional ownership and companies’information on listed companies in China:empirical evidence from listed companies in China.Nankai Bus.Rev.5,55–64(in Chinese).

Statman,M.,Thorley,S.,Vorkink,K.,2003.Investor overconf i dence and trading volume.Soc.Sci.Electron.Publ.19(1),1531–1565.

Wermers,R.,2000.Mutual fund performance:an empirical decomposition into stock-picking talent,style,transactions costs,and expenses.J.Finance 55(4),1655–1703.

Xin,Y.,Xu,L.P.,2007.Governance environments and consideration in share reform:an investor protection perspective.Econ.Res.J.9, 121–133(in Chinese).

Xu,L.P.,Xin,Y.,Chen,G.M.,2006.Ownership concentration,outside block holders,and operating performance:evidence from China’s listed companies.Econ.Res.J.1,90–100(in Chinese).

Yang,H.Y.,Sun,J.,Wei,D.H.,2012.The ef f ect of independence of institutional investors on agency costs.Secur.Market Herald 1,25–30 (in Chinese).

Ye,J.F.,Li,D.M.,Ding,Q.,2009.Study on institutional investors.Share-holding and corporate transparency in a real environment:an analysis on endogenous test of omitted variables and simultaneous causality.J.Finance Econ.1,49–60(in Chinese).

You,J.X.,2010.Heterogeneity and market irrationality.Econ.Manage.4,138–146(in Chinese).

Zhang,W.T.,Zhu,L.M.,Bao,P.F.,2004.The application of principal component analysis method in analysis of multiple choices.China J.Public Health 1,124–125(in Chinese).

Zhang,X.Y.,Liao,L.,2011.VC background,IPO underpricing and post-IPO performance.Econ.Res.J.6,118–132(in Chinese).

*Corresponding author.

E-mail addresses:lizhewenbei@ruc.edu.cn(Z.Li),wf536@ruc.edu.cn(F.Wang),Dongxh45@126.com(X.Dong).

http://dx.doi.org/10.1016/j.cjar.2016.09.002

1755-3091/©2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

China Journal of Accounting Research2016年4期

China Journal of Accounting Research2016年4期

- China Journal of Accounting Research的其它文章

- How does auditors’work stress affect audit quality? Empirical evidence from the Chinese stock market

- Does top executives’US experience matter?Evidence from US-listed Chinese firms

- Accounting information quality,governance efficiency and capital investment choice