Does top executives’US experience matter?Evidence from US-listed Chinese firms

Jingjing Li,Minghi Wei,Bingxun Lin

aSchool of Business,Sun Yat-sen University,China

bCollege of Business Administration,University of Rhode Island,USA

Does top executives’US experience matter?Evidence from US-listed Chinese firms

Jingjing Lia,*,Minghai Weia,Bingxuan Linb

aSchool of Business,Sun Yat-sen University,China

bCollege of Business Administration,University of Rhode Island,USA

ARTICLEINFO

Article history:

Received 8 October 2014

Accepted 2 November 2015

Available online 17 March 2016

US-listed Chinese firms Top executives’US experience Analysts following Institutional holdings

Foreign firms face enormous obstacles in attracting investors and analysts when issuing securities in the United States.We use US-listed Chinese firms as our research sample and find that firms that hire top executives(i.e.,Chief Executive Officer[CEO]or Chief Financial Officer[CFO])with work experience in the US or educational qualif i cations from the US attract more US institutional investors and analysts.Further,we find that CFOs’US experience dominates the results.Corroborating our results,we further find that firms with US-experienced CFOs are more likely to hold conference calls and voluntarily issue management forecasts,which suggests that CFOs with a US background are better at communicating with US investors and analysts and acting in alignment with US norms compared with Chinese CFOs.Collectively,our results suggest that hiring a CFO with a US background could facilitate cross-listed foreign firms to lower US investors’and analysts’information disadvantage.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Foreign firms that trade their equity on US stock exchanges face serious obstacles in attracting US investors and analysts due to the linguistic,procedural,and institutional dif f erences between their home country and the United States(Lundholm et al.,2014).This paper examines the favorable effects of top executives’US background in attracting US institutional investors and analysts using data from US-listed Chinese firms. We predict that US-listed Chinese firms whose top executives have experience in working in the US attract more US institutional investors and analysts.First,we conjecture that executives with a US background perform better in communicating with US institutional investors and analysts.Due to their US experience,they generally have an advantage in understanding US business culture and interacting with US business people.More importantly,they may have a better understanding of what US investors and analysts expect,and tend to act in alignment with US norms.Second,Beatty et al.(2013) fi nd that the likelihood of fi nancial fraud in US-listed Chinese fi rms is signi fi cantly lower if the Chief Executive Officer(CEO)was educated in North America.Based on this evidence,we argue that hiring top executives with a US background can potentially serve as a kind of reputational insurance mechanism.Executives who have worked in the US should better understand the stringent regulations and pay more attention to their reputations in the US market than Chinese executives.Therefore, fi rms that hire top executives with a US background may build an image of a wellbonded corporation,and thus US institutional investors and analysts prefer to follow them.Third,hiring executives with a US background could reduce the‘‘psychological distance”between US investors and foreign fi rms.Grinblatt and Keloharju(2001) fi nd that investors in Finland prefer to hold and trade with fi rms with CEOs of a similar cultural origin.We argue that top executives with a US background can reduce US investors’psychological distance,and thus are expected to attract more US institutional investors.Based on at least these three factors,we predict that US institutional investors and analysts exhibit a preference for US-listed Chinese firms with top executives with US work experience.

Using US-listed Chinese firms as our research sample,we find that firms with top executives(i.e.,CEO or Chief Financial Officer[CFO])who have work experience in the US attract more US institutional investors and analysts than firms with Chinese top executives.Further,we find that CFOs with US experience dominate the results.To eliminate the endogenous innate ability argument,we control for CFO innate ability following Giannetti et al.(2014)and the results remain consistent.We also use the two-stage Heckman method to eliminate selection bias and the results remain consistent.We acknowledge,nevertheless,that we cannot totally resolve the endogenous f i rm-executive matching problem.As supporting evidence,we find that the disclosure practices of CFOs with US experience dif f er from those of Chinese CFOs,with the former more likely to hold conference calls and voluntarily issue management forecasts.The findings suggest that CFOs with a US background are better at communicating with US investors and analysts,and act in ways that are more consistent with US norms.

Our study contributes to the literature in several ways.To the best of our knowledge,this is the first study to examine the ef f ect of executives’US experience on disclosure practices,and consequently analyst following and institutional holdings,using the setting of US-listed Chinese firms.Our results suggest that hiring top executives with a US background can facilitate US-listed Chinese firms to mitigate home bias and obtain US investment.The results lead to a deeper understanding of the mechanisms that can help Chinese firms to obtain international resources and may well be generalizable to all cross-listed foreign firms on US exchanges.

This paper also extends the literature that examines managerial characteristics or traits(Bertrand and Schoar,2003;Bamber et al.,2010;Dyreng et al.,2010;Malmendier et al.,2011;Cronqvist et al.,2012,among others).The upper echelons theory from the management literature argues that top managers often face complex situations that do not have calculable solutions.As such,managers are more likely to make strategic choices based on their personal experiences and backgrounds(Hambrick and Finkelstein,1987;Hambrick, 2007).We observe a meaningful managerial characteristic in the context of US-listed Chinese firms,namely CFOs with a US background,and find that it has a favorable influence in attracting US institutional investors and analysts beyond the previously documented f i rm-level determinants.

The remainder of the paper proceeds as follows.Section 2 provides the literature review and hypothesis development.Section 3 explains our sample selection and descriptive statistics.Section 4 contains our research design and main results,while Section 5 shows robustness and additional tests.Section 6 concludes the paper.

2.Literature review and hypothesis development

Foreign firms that trade their equity on US stock exchanges face serious obstacles in attracting US investors and analysts.Lundholm et al.(2014)find that foreign firms that provide clearer disclosure have more US institutional ownership,whereas Lundholm et al.(2014)consider reporting quality,we document that foreignfi rms can attract more US institutional investors by hiring top executives with a US background.There are three potential reasons,as follows.

First,top executives of foreign firms,especially CFOs,who have work experience in the US may perform better in communicating with US investors and analysts.Due to their US experience,they generally have an advantage in understanding US business culture and how to interact with US business people.More importantly,they are more familiar with what US investors expect and more likely to act in alignment with US norms.Therefore,we argue that CFOs with US experience are better at communicating with US investors and analysts.

Second,we argue that hiring top executives with a US background can potentially serve as a kind of reputational insurance mechanism.Top executives who have worked or are currently working in the US should better understand the stringent regulations and pay more attention to their reputations in the US market than those who work in the Chinese market.Therefore,firms that hire top executives with a US background may build an image of well-bonded corporations,and thus US institutional investors will prefer to invest in those firms.Consistent with our reputational bonding argument,Beatty et al.(2013)find that the likelihood of f i nancial fraud in US-listed Chinese firms is signif i cantly lower if the CEO was educated in North America.

Third,top executives’US background may reduce the‘‘psychological distance”between Americans and foreign firms.Grinblatt and Keloharju(2001)use the unique setting of Finland where there are two cultural origins and find that investors prefer to hold and trade with firms whose CEO is of a similar cultural origin. Consequently,top executives with a US background may increase US investors’familiarity with foreign firms and reduce their psychological distance,and hence these firms are expected to attract more institutional investors.Based on the above analyses,we predict that US institutional investors and analysts exhibit a preference for US-listed Chinese firms with top executives with US work experience.

We use US-listed Chinese firms1Based on the closing price on 19 Sep 2014,the overall market value of Chinese firms’trading equities in the US is more than 1.4 trillion dollars,which is higher than Spain’s total GDP for the whole of 2013(i.e.,1.36 trillion dollars).as our research sample.China is geographically and culturally distant from the US.China’s legal system originated from Roman Civil Law and dif f ers from US Common Law. Allen et al.(2005)compare overall investor protection in mainland China with the countries included in La Porta et al.(1998).They find that mainland China is rated one of the worst and the US one of the best f i nancial markets in terms of investor protection.Therefore,there is a signif i cant gap between China and the US, and Chinese fi rms may face considerable difficulty in attracting US investors and analysts.We use US-listed Chinese fi rms as our research sample to examine whether hiring executives with US experience could help fi rms to attract US investors and analysts.

Based on the above analysis,we state our hypotheses as follows:

H1:US-listed Chinese firms with top executives who have worked in the US attract more institutional ownership.

H2:US-listed Chinese firms with top executives who have worked in the US attract higher analyst following.

3.Sample selection and descriptive statistics

Our sample period is 2006-2012.We compile a sample of US-listed Chinese firms from various sources:(1) Wind database,(2)Bank of New York,which provides a list of ADRs on its website,(3)Sina Finance website, and(4)Compustat.We exclude firms that are headquartered outside mainland China by reviewing the corporate pro fi les.We also exclude fi nancial fi rms.As a result,our fi nal sample comprises 213 US-listed Chinese fi rms.

Generally,the CFO,Investor Relations Officer or Vice President of Investor Relations takes charge of investor relations development and mostly communicates with analysts and institutional investors.We hand collect the pro fi les of all of the top executives from fi rms’annual reports and proxy statements and fi nd thatfew of the firms in our sample specif i cally disclose information on the Investor Relations Officer or Vice President of Investor Relations.Therefore,we mainly focus on two top executives:(1)the CFO,who is in charge of information disclosure and communicating with analysts and institutional investors;and(2)the CEO,who takes overall charge of corporate management.We manually extract information on the CEOs’and CFOs’work experience and educational background from SEC f i lings,such as annual reports and proxy statements.

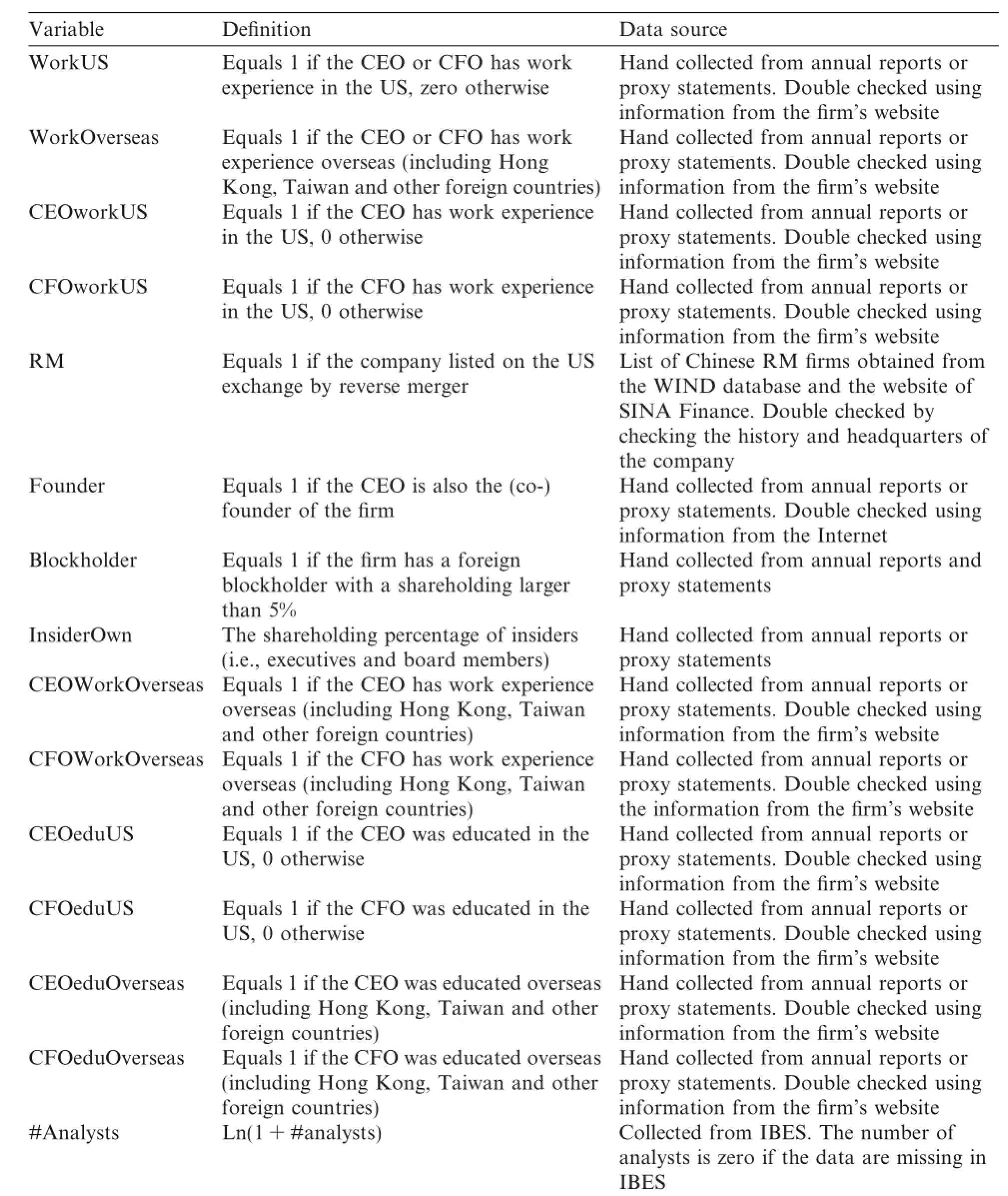

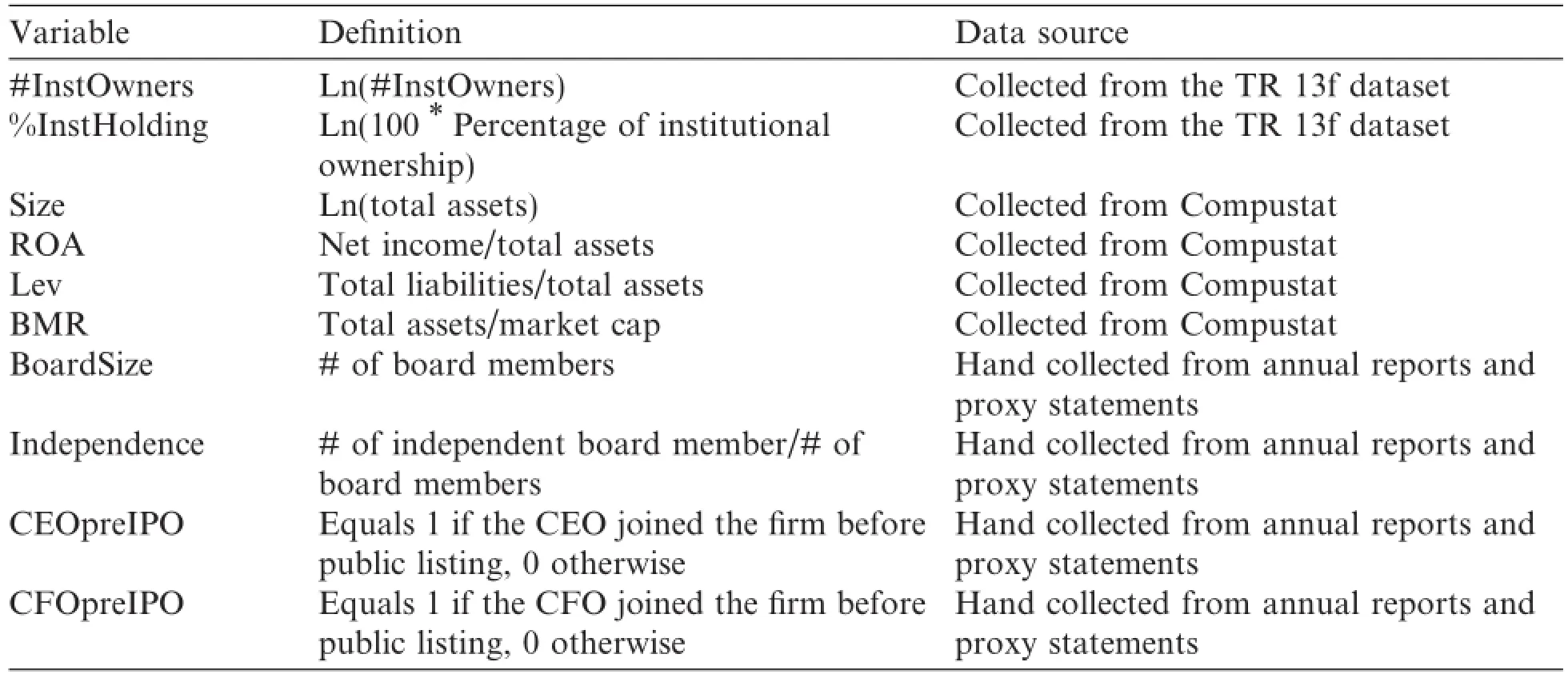

Financial data are extracted from Compustat.Analyst data are obtained from Institutional Broker’s Estimate System(IBES).Institutional investor data are taken from TR 13f.We hand collect all of the required information from 10-Ks,20-Fs,and proxy statements f i led by Chinese firms during the sample period, including insider ownership(holdings by the firms’officers and directors),foreigner blockholders(non-Chinese owners with 5%ownership or higher),board characteristics(board size,board independence),and whether the CEO is the founder of the f i rm.We also hand collect the conference call and management forecast data from current reports(i.e.,8 k,6 k).The variable def i nitions are summarized in Appendix A.

Table 1 Panel A describes the distribution of f i rm-year observations by year.It shows that approximately 40%of CEOs or CFOs have worked in the US.Panel B shows the distribution of f i rm-year observations by Fama-French industry categories.It shows that US-listed Chinese firms are concentrated in the manufacturing and business equipment industries,with 28(13%)and 77(36%)of firms,respectively.Panel C describes the distribution of sample firms by listing method.In our sample,88 firms are listed on exchanges via reverse mergers and 125 through the IPO process,and among the latter,101 firms are listed by issuing American Depositary Receipts(ADRs).

Table 1Distribution of observations.

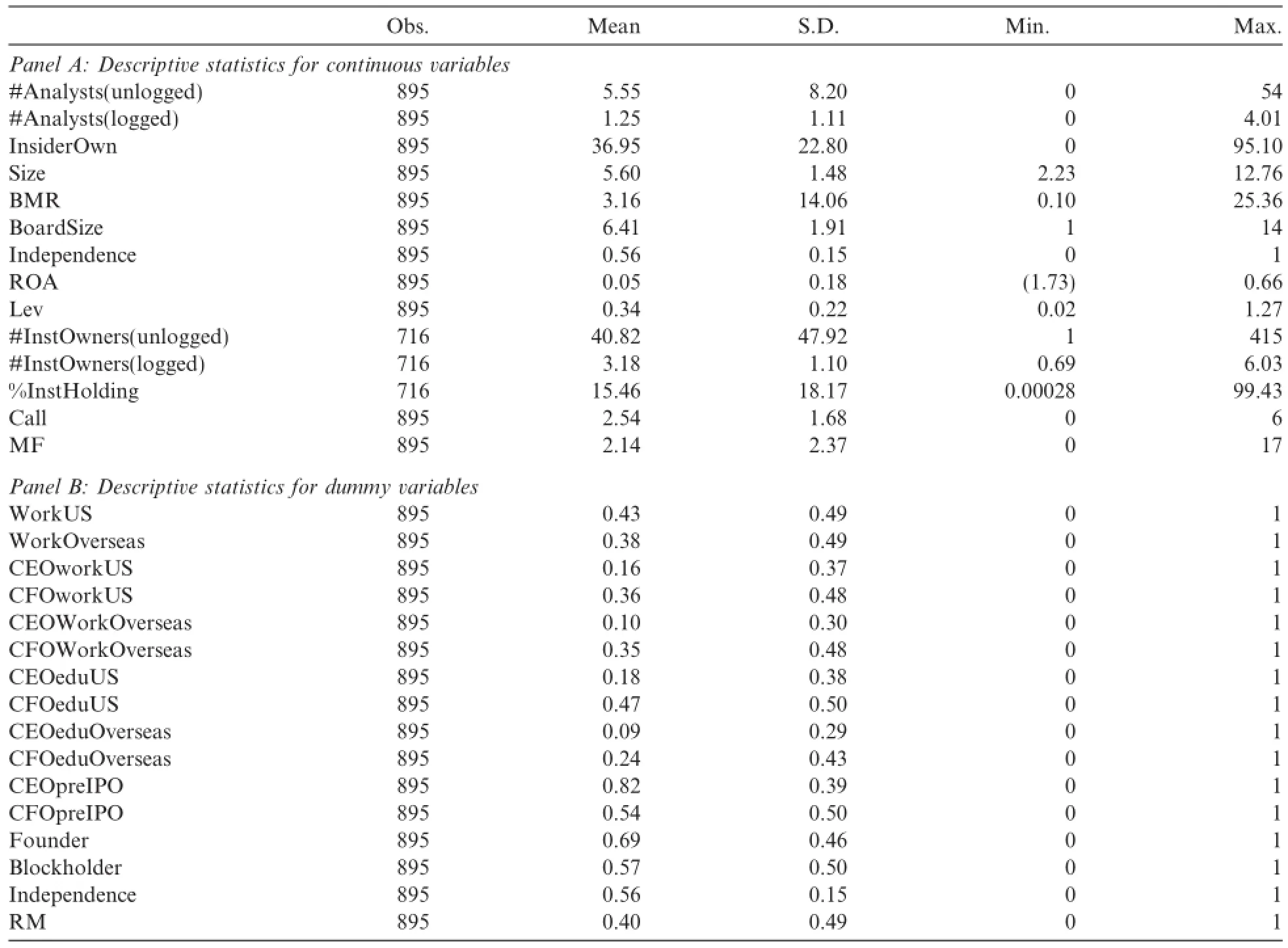

Table 2 Panel A provides the descriptive statistics of the continuous variables.The means for analyst coverage(#Analysts)and number of institutional investors(#InstOwners)are 5.55 and 40.82,respectively,and the maximum values for Analysts and#InstOwners are 54 and 415,respectively.The mean of institutional ownership(%InstHolding)is 15.46%and the maximum value is 99.43%.We also provide the statistics for f i rm size(Size),board size(BoardSize),insider ownership(InsiderOwn),the proportion of independent directors on the board(Independence),and f i nancial indicators such as return on assets(ROA),leverage(Lev)and the book-to-market ratio(BMR).

Table 2 Panel B provides the descriptive statistics for the discrete variables.We construct a dummy variable,WorkUS,to capture top executives’work experience in the US,which equals 1 if the CEO or CFO has worked in the US,and otherwise 0.We construct another dummy variable,WorkOverseas,to capture executives’work experience outside mainland China,excluding the US.WorkOverseas equals 1 if the CEO or CFO has worked overseas excluding the US,and otherwise 0.

Panel B shows that 43%of observations have CEOs or CFOs who have worked in the US,and 38%of observations have CEOs or CFOs who have worked in other countries or regions outside mainland China, excluding the US.Overall,this means that 80%of f i rm-year observations have top executives who have worked overseas,and 20%of f i rm-year observations have top executives who have worked only in China mainland.

We construct two variables,CEOworkUS and CFOworkUS,to explicitly capture CEOs’and CFOs’work experience in the US,respectively.Correspondingly,we construct another two variables,CEOWorkOverseasand CFOWorkOverseas,to explicitly capture CEOs’and CFOs’work experience overseas excluding the US, respectively.Panel B shows that 16%of the CEOs and 36%of the CFOs in our sample have worked in the US, and 10%of CEOs and 35%of CFOs have worked overseas but not in the US.This means that the percentages of CEOs and CFOs in our sample who have worked only in mainland China are 73%and 29%,respectively. We also extract the investment banking experience of CEOs and CFOs in their early careers and find that 12.96%of CFOs have worked in an investment bank,while the percentage for CEOs is only 1.45%.

Table 2Descriptive statistics.

We use the abovementioned variables as primary indicators in our main tests.As a robustness check,we construct another series of variables to capture CEOs’and CFOs’US or overseas experience based on their educational background rather than their career path.First,we construct the variables CEOeduUS and CFOeduUS to capture whether the CEO and the CFO were educated in the US.Then,we construct another two variables,CEOeduOverseas and CFOeduOverseas,to capture whether the CEOs and CFOs were educated abroad but excluding the US.The percentages of CEOs who were educated in the US and other foreign countries or regions are 18%and 9%,respectively.Correspondingly,the percentages for CFOs are 47%and 24%,respectively.This means that 73%of CEOs and less than one-third of CFOs had their education in mainland China.The CFOs are clearly more internationalized than the CEOs in our sample.

We also manually collect data on CFOs’undergraduate universities or institutions.In summary,15.53%of CFOs graduated from universities or colleges that are not included in the‘‘211 program”in China;30.28%of CFOs graduated from universities that are members of the‘‘211 program”but not the‘‘985 program”;18.66% of CFOs graduated from the top tier universities that are members of the‘‘985 program”;and 35.53%of CFOs graduated from universities or institutions overseas.

We also summarize the highest educational qualif i cations of CEOs and CFOs.A signif i cantly higher percentage of CFOs(40%)than CEOs(15.76%)received an MBA degree,whereas 13%of CEOs received a Ph.D. compared with 2.09%of CFOs.

We also construct two variables to measure whether the CEO or CFO joined the f i rm before the IPO,CEO-preIPO and CFOpreIPO,respectively.We find that 82%of the CEOs in our sample joined their firms before the IPO;69%of CEOs were the founder or co-founder of their firms;and 54%of CFOs joined before the IPO.

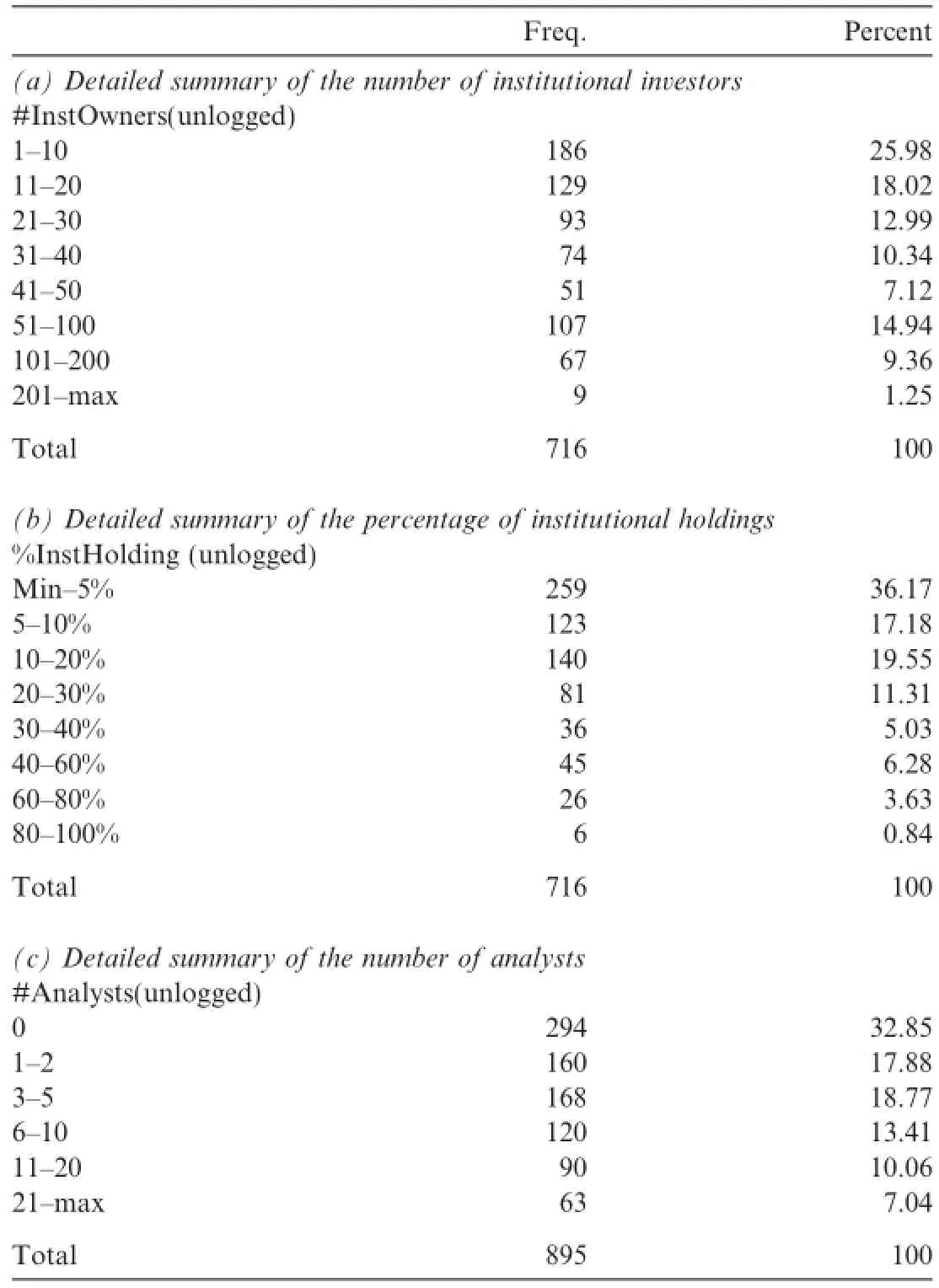

In Table 3,we describe the main dependent variables in our research.We collect institutional ownership positions from Thomson Financial’s 13-F f i lings database.We measure institutional holdings using the most recent data prior to the end month of f i scal year.2If we set the missing institutional holdings data to zero,the results for institutional ownership remain consistent but the result for the number of institutional investors disappears.

The mean of#InstOwners is 40.82.Approximately 26%of observations have less than 10 institutional investors,including 78 firms listed through reverse mergers;48.5%of observations have between 11 and 50 institutional investors;15%of observations have between 50 and 100 institutional investors;9.4%of observations have between 100 and 200 institutional investors;and 1.2%of observations have more than 200 institutional investors.

The mean institutional ownership is 15.46%;approximately 36%of observations have less than 5%institutional ownership,of which 15%of observations were listed through reverse mergers;approximately half of the observations have between 5%and 30%institutional ownership;and the remaining 15%of observations have more than 30%institutional ownership.

We also provide a detailed distribution of the analyst coverage variable.We collect analysts’data from the IBES database.We measure analyst following using the most recent data prior to the last month of the f i scal year and set missing analyst data to zero.The data for analyst coverage are left-censored at 0.Approximately 18%of observations have up to two analysts following the f i rm;32%of observations have between 3 and 10 analysts;and approximately 17%of observations have more than 10 analysts.The maximum number of analysts following a f i rm in our sample is 54.This is generally consistent with our previous argument that it is difficult to attract analysts for foreign firms issuing securities on US exchanges.

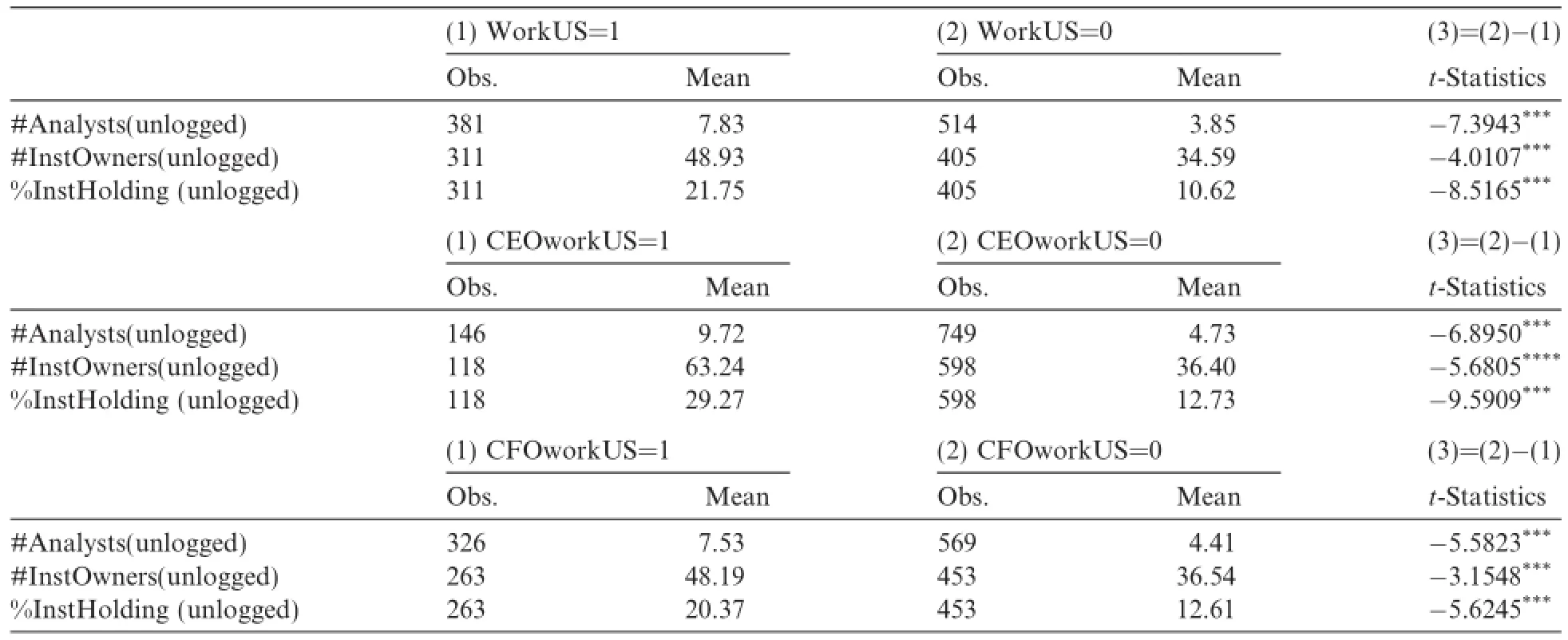

Table 4 summarizes the results of the univariate analysis.The mean analyst coverage is 7.83 for the group in which WorkUS equals 1 and 3.85 for the group in which WorkUS equals 0.The t-test results show that the

dif f erences between the means of the two groups are signif i cant for analyst coverage and institutional ownership.The results are similar if we replace WorkUS with CEOworkUS or CFOworkUS.

Table 3Detailed summary of dependent variables.

Table 4Univariate analysis.

4.Research design and main results

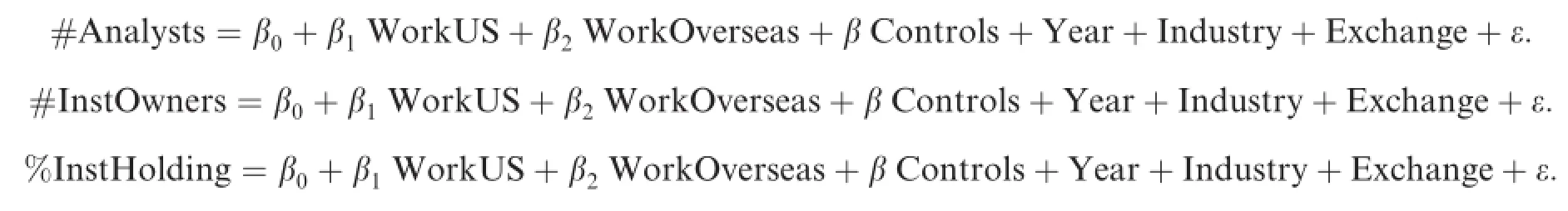

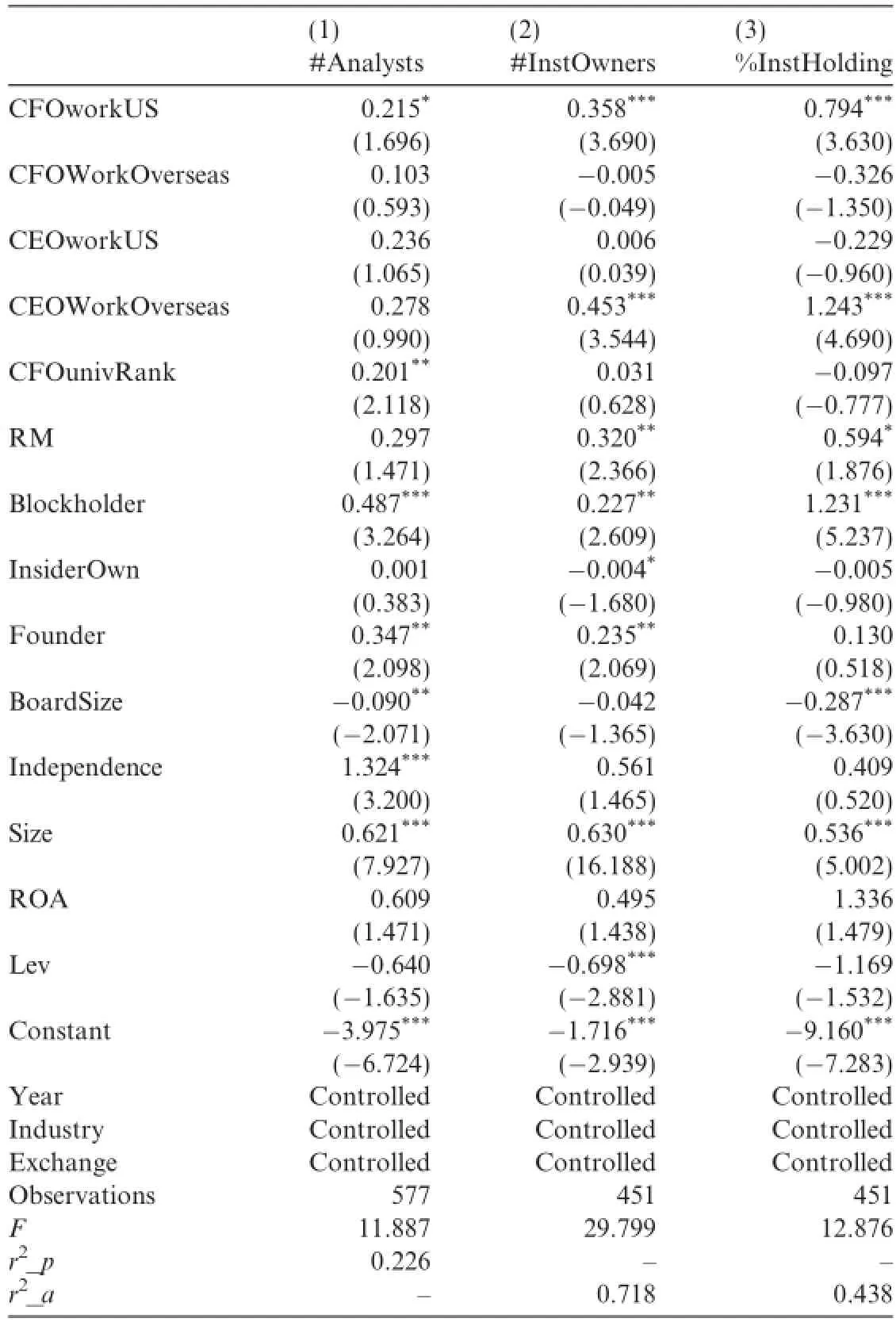

We examine the ef f ect of top executives’US experience on analyst following and institutional investors using the following models:

We control for top executives’other overseas experience to ensure the results are cleanly measuring the ef f ect of US experience.As the literature documents that corporate governance can affect analyst coverage and institutional investor following,we use three proxies for corporate governance and control for them in the regressions.We first control for listing method(RM)to capture the quality of corporate governance.Chen et al.(2013)suggest that for Chinese firms that have low bonding incentives and poor governance,the reverse merger process provides an opportunity to access the US capital markets.We also control for common corporate governance features:board characteristics and ownership structure. Our second proxy for corporate governance is board independence.Corporate boards of directors monitor top executives and make decisions about top managers’compensation and retention.Board independence has been widely used as a proxy of the board’s aggressive ability to curb opportunistic managerial behavior in the presence of agency problems(e.g.,Klein,2002;Ahmed and Duellman,2007).Our third proxy for corporate governance is the existence of foreign institutional blockholders.We use an indicator of whether the f i rm has one or more foreign block institutional investors(non-Chinese institutional owners with 5%ownership or higher)to capture the quality of corporate governance,following previous studies that suggest that institutional investors play an important monitoring role in reducing agency costs.

We also include the following control variables:(1)InsiderOwn,which captures the holdings by the officers and directors;(2)BoardSize,which measures the size of the board;(3)Founder,which captures whether the CEO is the founder of the f i rm;(4)and Size,which equals the log of total assets,and several f i nancial indicators including the book-to-market ratio,return on assets,and leverage.

The main results are shown in Table 5.We report robust t-statistics based on standard errors adjusted for clustering at the f i rm level.Column 1 shows that the coefficient of WorkUS is positive and signif i cant at the 0.05 signif i cance level,which means that top executives’work experience in the US has a signif i cant positive ef f ect on analyst following.The coefficient of WorkOverseas is insignif i cant,which suggests that executives’work experience in other countries or regions does not benef i t the firms by attracting analysts in the US market.Consistent with our expectation,the coefficients of Blockholder,Independence,Founder,Size,and ROA are positive and signif i cant.Columns 2 and 3 show that the coefficients of WorkUS are positive and signif i cant at the 0.01 signif i cance level,which means that top executives’work experience in the US has a positive ef f ect on both the number of institutional investors and their level of ownership.

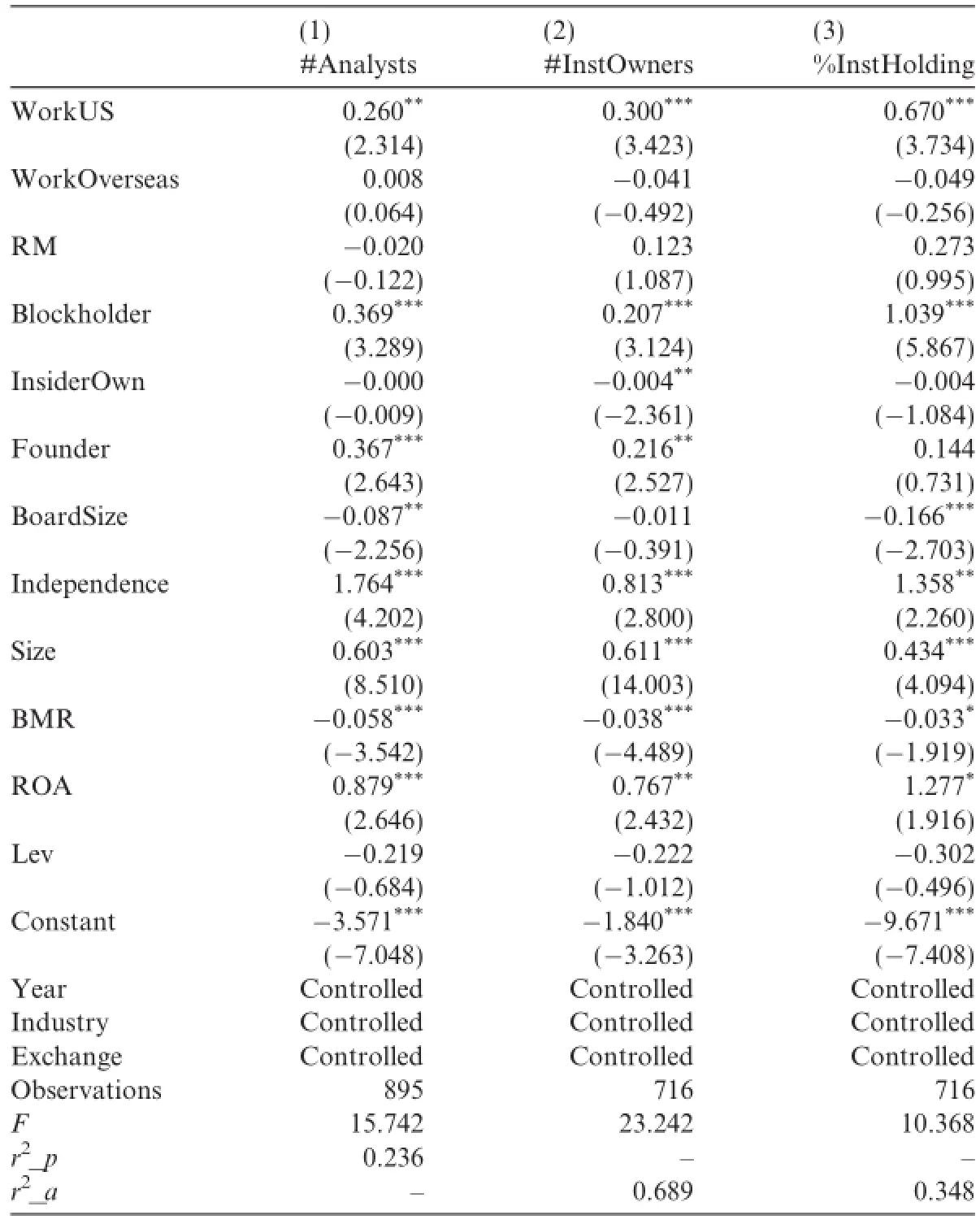

Next,to examine whether executives’US work experience dominates the results,we construct two new variables to separately capture CEOs’and CFOs’work experience in the US.Correspondingly,we construct two variables to explicitly capture CEOs’and CFOs’work experience in other countries or regions outside the Chinese mainland,but excluding the US.We predict that CFOs’US experience is relatively inf l uential in our research,because CFOs normally take charge of information disclosure and communication with analysts and institutional owners.Table 6 shows that,consistent with our prediction,CFOs’US experience dominates the results.

Table 5Ef f ect of executives’US experience on analysts and institutional investors.

5.Robustness checks and additional tests

5.1.Controlling for discretionary accruals

We further control for discretionary accruals to capture earnings quality in the robustness analysis and the results remain unchanged.3The result is untabulated.Please request it from the authors if needed.We use the modif i ed Jones model to calculate discretionary accruals.We do not control for discretionary accrual based earnings quality in the main test to avoid further sample reduction.

Table 6Ef f ect of CFOs’US experience on analysts and institutional investors.

5.2.Innate ability explanation

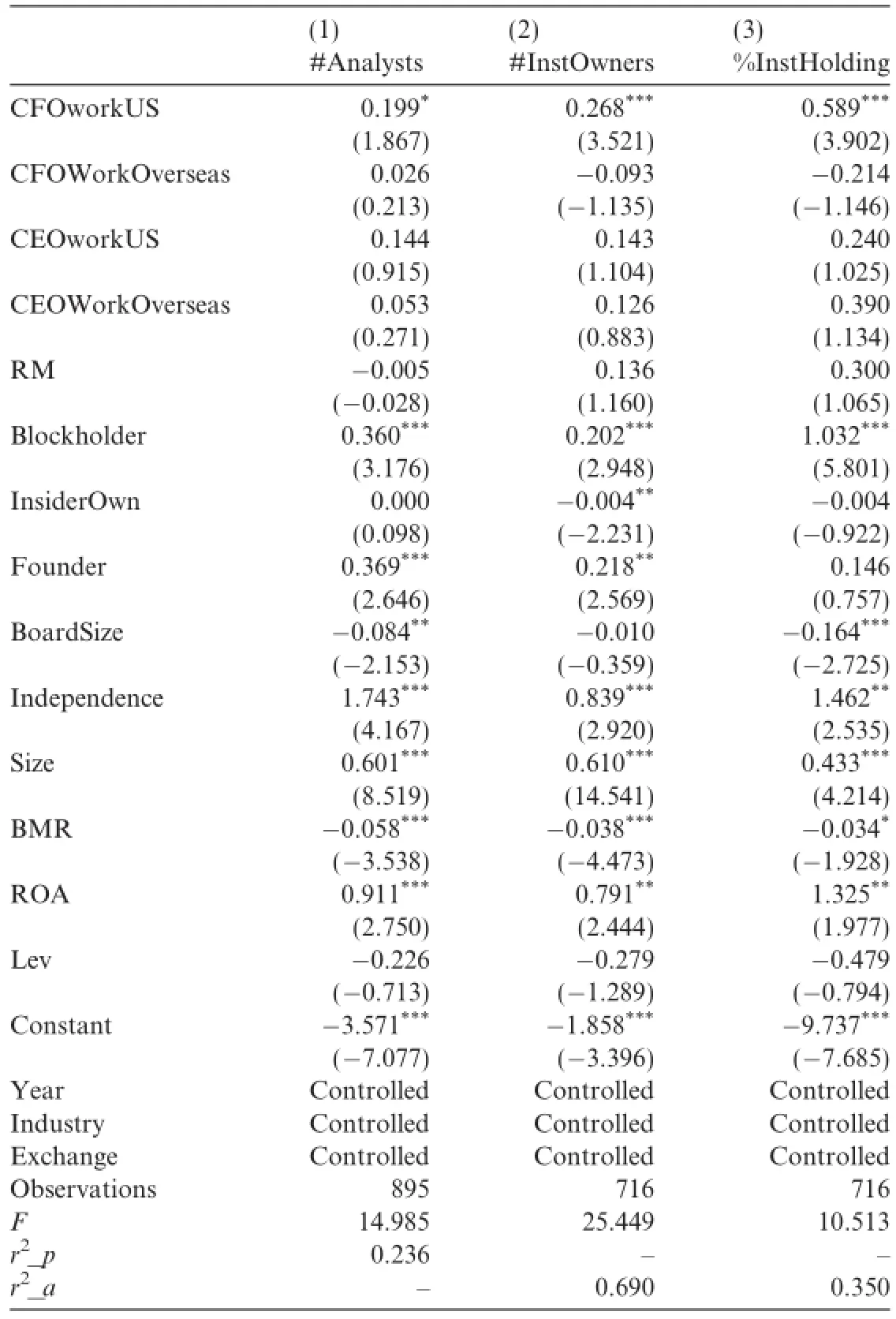

So far,we have shown that CFOs with US experience have a positive ef f ect on analyst following and institutional holdings.It could be argued that these benef i ts may be due to CFOs’exceptional ability,rather than their US experience.To rule out this alternative explanation,we provide some evidence suggesting that US experience may matter,beyond the executives’ability.Most of the CFOs in our sample obtained their undergraduate degrees in China.Following Giannetti et al.(2014),we measure CFO ability using the rankings of their Chinese universities.We sort the universities into top tier,second tier,and third tier.As the results in Table 7 show,the coefficient of CFOworkUS is signif i cantly positive after controlling for university ranking, which suggests that CFOs’US experience matters beyond their innate ability.

Table 7Alternative explanation:CFOs’innate ability.

5.3.Self-selection problem

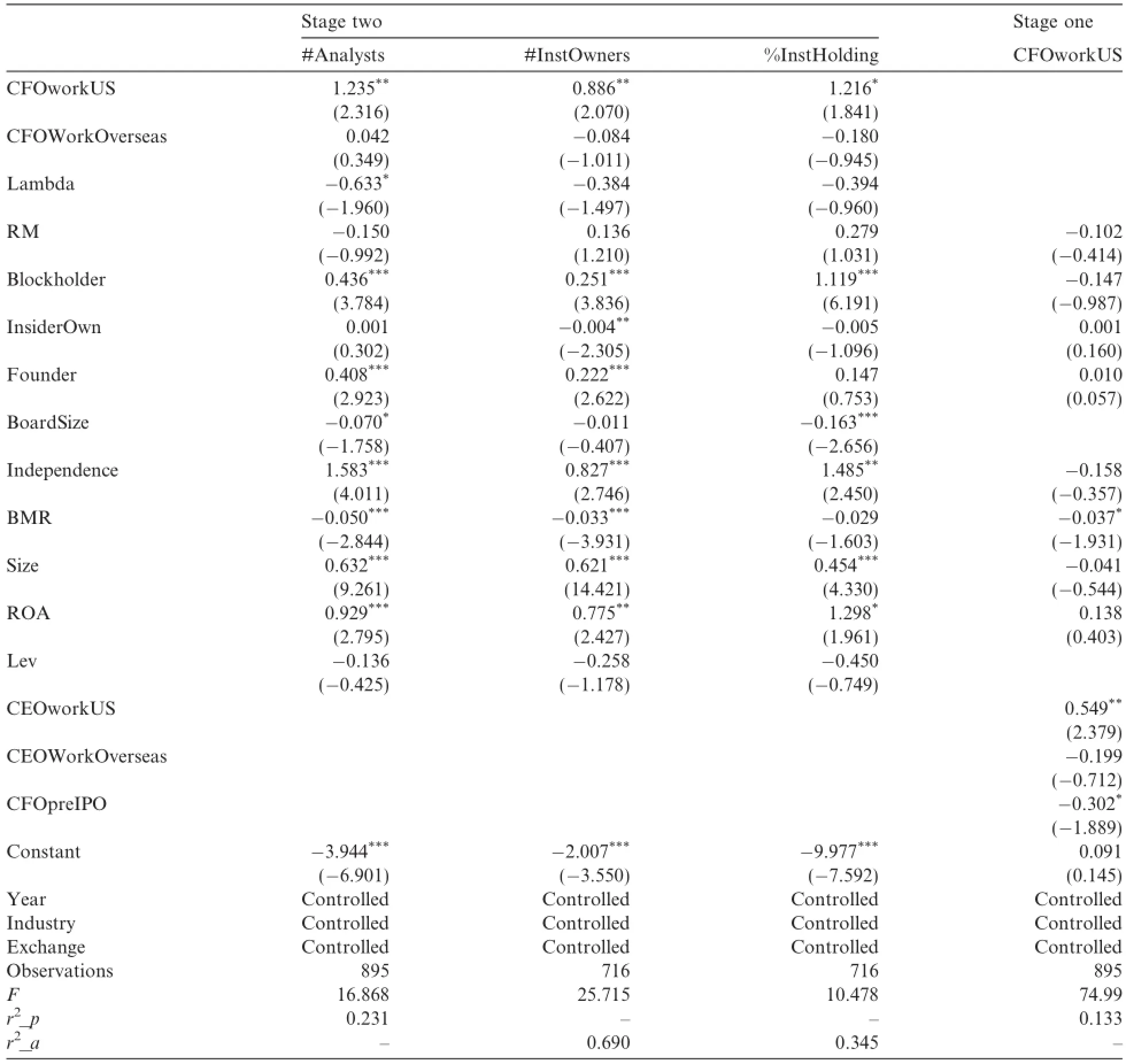

The choice of hiring a CFO with US experience may be determined by corporate governance,the existence of foreign large blockholders,and the CEO’s characteristics.We use the Heckman two-stage method to control for this potential self-selection issue.In the first stage,we design a model to examine the possibility of a f i rm hiring a CFO with US experience.We use CFOpreIPO as an instrumental variable.Column 4 of Table 8 shows the results of the first stage.The results are consistent with the previous main results after controlling for lambda in the second-stage regressions(Columns 1–3 of Table 8).

Table 8Results of the Heckman two-stage regression.

5.4.Global investment banking experience

We test whether executives’global investment banking experience has an additional ef f ect on the number of analysts and institutional investors following the f i rm.We find that CFOs’global investment bank experience has an additional positive ef f ect on analyst coverage.4The results are untabulated.Please request them from the authors if needed.

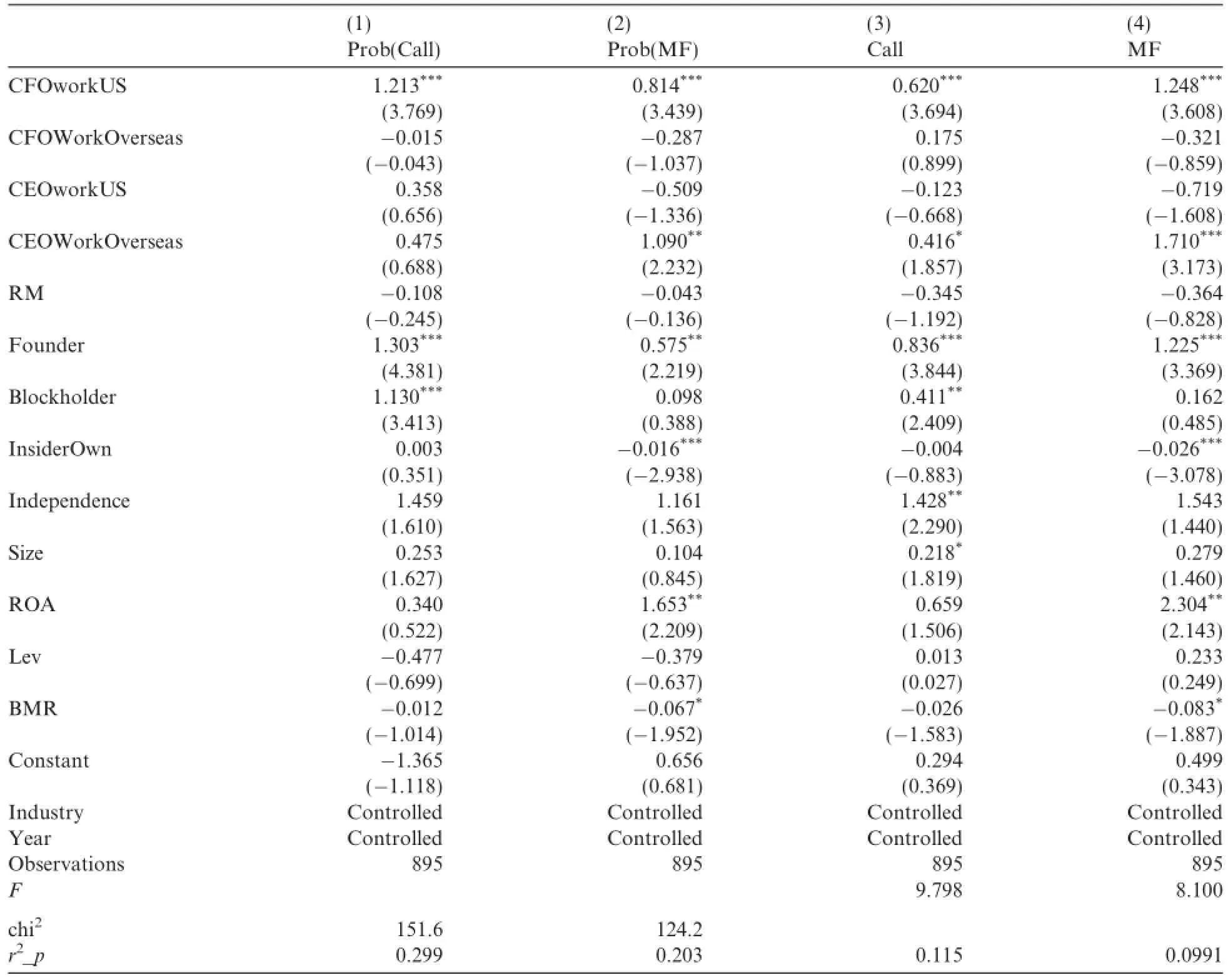

Table 9Ef f ect of CFOs’US experience on conference call and management forecast frequency.

5.5.Alternative measure of US background

We also use another measure to capture executives’US background.We extract the executives’educational background from their biographies and construct the CEOeduUS and CFOeduUS variables to indicate whether they were educated in the US.The results are similar to the main results.5The results are untabulated.Please request them from the authors if needed.

5.6.Other top executives’US background

Generally,the board secretary is in charge of investor relations in Chinese listed firms.It is possible that US-listed Chinese firms follow this custom and the board secretary functions as an IR specialist to communicate with investors and analysts.Therefore,we also test whether the board secretary’s US experience hasan ef f ect on the number of analysts and institutional investors following the f i rm.However,the results show no support for this ef f ect,which implies that CFOs play a critical role in communicating with analysts and investors in US-listed Chinese firms.

5.7.Are CFOs with US experience more likely to hold conference calls?

There is evidence to suggest that CFOs have a signif i cant influence on companies’f i nancial reporting(e.g., Geiger and North,2006;Ge et al.,2010).We argue that CFOs with US experience may act more in alignment with US norms in disclosure practices,such as holding conference calls,and thus may attract more US institutional investors and analysts(e.g.,Kimbrough,2005).Consistent with our expectation,we find that(1)firms with US experienced CFOs are more likely to hold conference calls,and(2)the frequency of conference calls is signif i cantly higher for firms with US-experienced CFOs.Columns 1 and 3 of Table 9 report the results,which provide direct evidence of how CFOs with US experience are able to help US-listed Chinese firms to attract more US investors and analysts.

5.8.Do CFOs with US experience voluntarily disclose more management forecasts?

Given that releasing management earnings forecasts is normal practice in the US,CFOs with US experience may act more similarly to domestic US managers in terms of their disclosure activities,such as voluntarily disclosing earnings forecasts,and thus attract more US institutional investors and analysts. Consistent with our argument,we find that(1)firms with US-experienced CFOs are more likely to voluntarily issue management forecasts,and(2)the frequency of management forecasts is signi fi cantly higher for fi rms with US-experienced CFOs.Columns 2 and 4 of Table 9 report the results,which provide direct evidence of how CFOs with US experience are able to help US-listed Chinese fi rms to attract more US investors and analysts.

6.Conclusion

We use US-listed Chinese firms as our research sample and find that firms that hire top executives(i.e., CEOs or CFOs)with work experience in the US or educational qualif i cations from the US attract more analysts and institutional investors.Further,we find that CFOs’US experience dominates the results.To eliminate the innate ability argument,we control for CFO innate ability by following Giannetti et al.(2014)and the results remain consistent.We use the two-stage Heckman method to eliminate selection bias and the results again remain consistent.Nevertheless,we acknowledge that we cannot totally resolve the f i rm–executive matching endogeneity problem.

As supporting evidence,we find that firms with US-experienced executives tend to hold more conference calls and voluntarily issue more management forecasts.This complements previous studies documenting the ef f ect of information disclosure on analysts’and institutional investors’activities by looking beyond the outcomes and identifying the core management drivers.Our results suggest that foreign firms attempt to lower investors’and analysts’information disadvantage or psychological distance by hiring top executives with US experience.

Our findings provide a deeper understanding of the mechanisms that facilitate US-listed Chinese firms to obtain international capital or resources and the results may be generalizable to other foreign firms cross-listed on US exchanges.

Acknowledgments

The authors owe many thanks to Prof.Zhen Li for his enlightening advice and other participants at the CJAR special issue conference in November 2014.We appreciate the f i nancial support from the National Natural Science Foundation of China(No.71272202).

Appendix A.Variable def i nitions

Appendix A(continued)

Ahmed,A.,Duellman,S.,2007.Accounting conservatism and board of director characteristics:an empirical analysis.J.Acc.Econ.43, 411–437.

Allen,F.,Qian,J.,Qian,M.,2005.Law,f i nance,and economic growth in China.J.Financ.Econ.77,57–116.

Bamber,L.,Jiang,J.,Wang,I.,2010.What’s my style?The influence of top managers and their personal backgrounds on voluntary corporate f i nancial disclosure.Acc.Rev.85,1131–1162.

Beatty,R.,Lu,H.,Luo,W.,2013.The market for lemon:a study of quality uncertainty and the market mechanism for Chinese firms listed in the US.Working paper.

Bertrand,M.,Schoar,A.,2003.Managing with style:the ef f ect of managers on f i rm policies.Quart.J.Econ.68,1169–1208.

Chen,K.C.,Cheng,Q.Lin,Y.C.,Lin,Y.C.,Xiao,X.,2013.Financial reporting quality of Chinese reverse merger firms:The reverse merger ef f ect or the China Ef f ect?Working paper.Singapore Management University.

Cronqvist,H.,Makhija,A.K.,Yonker,S.E.,2012.Behavioral consistency in corporate f i nance.CEO personal and corporate leverage.J. Financ.Econ.103,20–40.

Dyreng,S.,Hanlon,M.,Maydew,E.,2010.The ef f ect of executives on corporate tax avoidance.Acc.Rev.85,1163–1189.

Ge,W.,Matsumoto,D.,Zhang,J.,2010.Do CFOs have styles of their own?An empirical investigation of the e ff ect of individual CFOs on fi nancial reporting practices.Working paper.University of Washington.

Geiger,M.A.,North,D.S.,2006.Does hiring a new CFO change things?An investigation of changes in discretionary accruals.Acc.Rev. 81(4),781–809.

Giannetti,M.,Liao,G.,Yu,X.Y.,2014.The brain of corporate boards:evidence from China.J.Fin.70(4),1629–1682.

Grinblatt,M.,Keloharju,M.,2001.How distance,language and culture in fl uence stockholdings and trades.J.Fin.56(3),1053–1073.

Hambrick,D.C.,2007.Upper echelons theory:an update.Acad.Manag.Rev.32(2),334–343.

Hambrick,D.C.,Finkelstein,S.,1987.Managerial discretion:a bridge between polar views of organizational outcomes.Res.Org.Behav. 9,369–406.

Kimbrough,M.,2005.The e ff ect of conference calls on analyst and market under reaction to earnings announcements.Acc.Rev.80(1), 189–219.

Klein,A.,2002.Audit committee,board of director characteristics,and earnings management.J.Acc.Econ.33(3),375–400.

La Porta,R.,Lopez-de-Silanes,F.,Shleifer,A.,Vishny,R.W.,1998.Law and fi nance.J.Polit.Econ.106(6),1113–1155.

Lundholm,R.,Rogo,R.,Zhang,J.L.,2014.Restoring the tower of Babel:how foreign fi rms communicate with US investors.Acc.Rev. 89(4),1453–1485.

Malmendier,U.,Tate,G.,Yan,J.,2011.Overcon fi dence and early-life experiences:the e ff ect of managerial traits on corporate fi nancial policies.J.Fin.66(5),1687–1733.

*Corresponding author.

E-mail addresses:ljingjing3-c@my.cityu.edu.hk(J.Li),mnswmh@mail.sysu.edu.cn(M.Wei),blin@uri.edu(B.Lin).

http://dx.doi.org/10.1016/j.cjar.2015.11.002

1755-3091/©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).