Short sellers’accusations against Chinese reverse mergers:Information analytics or guilt by association?☆

Hongqi Liu,Nan Xu,Jianming Ye

aSouthwestern University of Finance and Economics,Sichuan,China

bBaruch College,City University of New York,NY,USA

cXiamen University,China

Short sellers’accusations against Chinese reverse mergers:Information analytics or guilt by association?☆

Hongqi Liua,b,Nan Xua,*,Jianming Yeb,c

aSouthwestern University of Finance and Economics,Sichuan,China

bBaruch College,City University of New York,NY,USA

cXiamen University,China

A R T I C L EI N F O

Article history:

Accepted 16 February 2015

Available online 20 March 2015

Chinese reverse mergers

Fraud accusation

Guilt by association

Information analytics

Short sellers

This paper studies short sellers’trading strategies and their effects on the financial market by examining their accusations of fraud against Chinese reverse merger firms(CRMs)in the US.We find that short sellers rely on firms’fundamental information,especially relative financial indicators,to locate their“prey.”Specifically,they compare a target firm’s financial indicators (e.g.,growth and receivables)with both the industry average and the firm’s history.We find no evidence that short sellers accuse CRMs simply because of their reverse merger label.Additionally,we test the accuracy of short sellers’accusations in the long run and find that accused firms are more likely to delist and less likely to recover from price plunges.Our results also indicate that CRMs’high exposure to short sellers’accusations stem from adverse selection problems:firms with high litigation risk are more likely to choose reverse mergers to access the US capital market.Overall,our results support the view that short sellers are sophisticated investors and shed some light on their decision processes.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

The effect that short sellers have on the financial market is a topic of great debate.On the one hand,advocates argue that short sellers are informed investors who are able to identify overpriced stocks and businessmisconduct,and thus their participation improves market efficiency(Miller,1977;Jones and Lamont,2002; Lamont and Stein,2004).On the other hand,dissenters argue that short sellers use abusive trading strategies, dampen investor confidence in the financial market and decrease market liquidity(Cox,2008).In this debate, although many papers have suggested that short-sellers are“smart guys”who can unearth overpriced companies and contribute to the efficiency of the stock market,their strategies for locating overvalued firms and their decision processes are still unknown.

We disentangle this debate by analyzing short sellers’motivations for accusing many US Chinese reverse merger firms(CRMs)of financial fraud.Between 2010 and 2011,short sellers accused 62 CRMs of fraud, leading to an almost 50%reduction in the CRMs’equity value.Short sellers clearly acted as crucial“fraud detectors”in the process,because most of these scandals started with short sellers’reports that questioned the credibility of the firms’financial reports.However,the real motivation behind short sellers’accusations against CRMs remains unknown.How do short sellers locate their prey?Do they base their accusations on information analytics or guilt by association?What kind of information do they use in their decision processes?This paper fills this gap in the literature.

We find no evidence that short sellers accuse CRMs simply because of their association with other ill-reputed CRMs(referred to as guilt by association).Specifically,we find that short sellers pay attention to unusually high growth in profitability and accounts receivables.In particular,they identify targets by comparing financial indicators with the industry average or with firms’histories.Firms with poor internal control,a small proportion of outside directors,a low level of managerial shareholdings and low-quality audit reports are more likely to be targets of short sellers.We further check the long-term performance of accused firms to test the accuracy of short sellers’accusations.Accused firms are more likely to delist from exchanges and less likely to recover from price plunges following short-sellers’accusations.Our results also suggest that CRMs’high exposure to short sellers’accusations stems from adverse selection problems:firms with high litigation risk are more likely to choose reverse mergers to access the US capital market.

Two competing hypotheses attempt to explain the strategies behind short sellers’fraud accusations.The information analytics hypothesis regards short sellers’research reports as reliable outputs produced by careful analysis.Therefore,their intensive attacks against CRMs are well-founded:firms targeted by short sellers are indeed inferior to their counterparts in terms of information disclosure.Many papers provide corroborating evidence of the informativeness of short sellers’actions.They argue that short sellers are able to identify stock overpricing and firm misconduct(e.g.,Jones and Lamont,2002;Christophe et al.,2004,2009;Diether et al., 2009;Karpoff and Lou,2010).At the same time,many argue that it is not necessarily true that short sellers are betting against information.Short sellers could take advantage of investors’negative perception of the CRM society and indiscriminately accuse any member of the society of“guilt by association.”As an example, Dennis E.Nixon,the Chairman of Bancshares,claimed that his bank was attacked by short sellers who viewed it as guilty because of its association with banks in crisis and their troubles.Moreover,former SEC Chairman Christopher Cox(2008)noted that even“far-better”financial companies,such as JPMorgan Chase,could be vulnerable to guilt by association.We refer to this view as the“guilt by association hypothesis.”

To empirically test the two hypotheses,we collect data on all US-listed Chinese firms,including IPO firms (CIPO)and CRMs,and short sellers’reports accusing Chinese firms of fraud.We test the two hypotheses in two phases.In the first phase,we directly test whether a CRM is more likely to be attacked by short sellers after controlling forother factors andstudy theinformation they use in their decision process.In thesecondphase,we examinethepost-accusationperformanceofaccusedfirmstofurthertestthevalidityofshortsellers’accusations.

In the first phase,we use a dummy variable indicating the identity(CRM or CIPO)of a Chinese firm and conventional factors that are known to affect the occurrence of firm misconduct to explain a firm’s probability of being accused.Because the factors affecting the probability of financial misstatement may also decide a firm’s choice between reverse merger and IPO in the first place,we use two-stage IV approaches and propensity score matching to mitigate the endogeneity problem.We find no evidence that short sellers are more likely to accuse CRMs,after controlling for other factors.We document that short sellers target firms that have abnormally high growth in profitability and a higher proportion of accounts receivables relative to the industry average or firms’histories.Short sellers also pay attention to firms with weak fundamentals.These results indicate that CRMs’high exposure to short sellers’accusations stems from firms’adverse selection at the initial stage.

In the second phase,we study the post-accusation performance of accused firms.First,using a probit model, we show that accused firms are generally more likely to delist than other firms.To ensure that the delisting is not simply caused by the feedback effects of short sellers’accusations,we then conduct a longitudinal data analysis. Goldstein and Guembel(2008)argue that short selling may cause a price decline even when short sellers are not informed at all.A short seller can establish a short position on the stock and the selling pressure will drive the price down.The price decline will subsequently lead to cancelation of real investment projects and a reduction in the real value of the firm.If feedback effects were indeed at work,firms’survival times would be uncorrelated with short sellers’accusations.However,we find that non-accused firms generally stay in the market for longer than accused firms.This result suggests that such delisting is caused by ex-ante deterioration in firm fundamentals.Next,we examine the price performance of accused firms(both delisted firms and active firms)after the releaseofshortsellers’researchreports.Ifshortsellers’accusationsaregroundlessandmisleading,investorswill eventually realize this and the stock prices of implicated firms should rebound to their fair values.In contrast,if the price drops are caused by accusations that are informative about the poor quality of the firms,their stock prices are unlikely to recover.The summary statistics show that Chinese firms subsequently exhibit poor price performance and none of them are able to recover their stock prices to the pre-accusation level.Specifically, 63.7%of firms experienced a further price drop and only four firms recovered to more than 70%of their preaccusation price.The results indicate that accused Chinese firms were generally overvalued before accusations and support the view that short sellers’are informed investors who are able to identify“bad apples.”

This paper contributes to the literature in the following ways.First,we contribute to the literature on short sellers’decision processes.Although many papers have suggested that short sellers are“smart guys”who can unearth overvalued companies and contribute to efficient stock prices,only a handful of papers have examined their decision processes.Dechow et al.(2001),for example,show that short sellers particularly target firms that have a low fundamental(book value,earnings and cash flow)to price ratio.Desai et al.(2002)suggest that short selling is related to suspect financial reporting.However,no previous study,to the best of our knowledge,has examined the possibility that short sellers may also be taking advantage of the guilt by association fallacy.Indeed,industry has made a strong argument that short sellers sometimes simply indiscriminately attack firms associated with an ill-fated label,such as“banks”during the financial crisis period or CRMs at times when many such firms were exposed as fraudulent.This paper fills this gap.We find no evidence that short sellers are making use of the guilt by association fallacy.Second,we further analyze the information set short sellers use.We find that financial information and corporate governance are important considerations,especially relative financial indicators.Thus,our paper also contributes to the literature on firm fraud. Third,our paper also contributes to the literature debating the adverse selection and credibility of CRMs.We provide evidence that corroborates the findings of several working papers that have recently studied this issue by conducting fundamental analysis of CRMs(Lee et al.,2013).Finally,we contribute to the debate over the effects that short sellers have on the financial market.

The remainder of our paper is organized as follows.Section 2 provides the literature review and hypothesis development;Section 3 describes the data and sample selection;Section 4 discusses the research design and empirical results;Section 5 reports the robustness checks;and Section 6 concludes.

2.Literature review and hypothesis development

2.1.Short sellers’strategies

2.1.1.“Information analytics”hypothesis

Studies that examine the association between short selling and stock overpricing provide corroborating evidence about short sellers’information analytics.A large body of the literature finds that short sale activities preceding either unfavorable news or analyst downgrades are significantly and positively correlated with the extent of subsequent stock price declines(e.g.,Christophe et al.,2004,2009;Liu et al.,2008;Diether et al., 2009).For example,Christophe et al.(2009)find abnormal short-selling activity before analyst downgrades. Diether et al.(2009)find that short sellers increase their trading following positive returns and correctly predict future negative abnormal returns.Those results are consistent with the view that short sellers trade on the short-term overreaction of stock prices.

Moreover,some studies imply that short sellers are sophisticated investors who can identify overpriced stocks and business misconduct.Miller(1977)was the first to point out that the constraint on short selling leads to stock over-pricing.Subsequent studies support this prediction.Lamont and Stein(2004)and Jones and Lamont(2002)find that stocks that are costly to short have very low abnormal returns in the subsequent year.Karpoff and Lou(2010)study the short interest in stocks that are proven ex-post to be overvalued.They find that abnormal short interest increases steadily in the 19 months before the negative information is publicly revealed,particularly when the misconduct is severe.These results indicate that short sellers are proficient at analyzing information and are able to uncover financial misconduct.Relevant studies that directly examine the accounting quality of CRMs also provide evidence of short sellers’sophistication. Chen et al.(2012)argue that CRMs exhibit lower financial reporting quality than US RM firms.

Based on the reasoning above,we develop the information analytics hypothesis:

Hypothesis 1a.All else being equal,CRMs are no more likely to be accused by short sellers than their CIPO counterparties.

2.1.2.Guilt by association hypothesis

A contradictory view suggests that short sellers do not always bet against information.Rather,short sellers may simply be motivated by investors’negative perception of the CRM society and indiscriminately accuse its members of guilt by association.We refer to this view as the“guilt by association hypothesis.”

The guilt by association fallacy is widely documented in the psychological literature.It refers to the unpleasant and often emotional assumption that an individual will have committed a crime if other individuals with the same social label have committed that crime.A typical example of such a fallacy is that“Simon,Karl, Jared and Brett are all petty criminals,and they are all friends of Josh.Therefore,Josh is a petty criminal.”The stock market is conducive to such misperceptions because investors often value stocks based on the performance of the industry,region or any other peer group to which the firm belongs.Darrough et al.(2012)find that the high exposure of Chinese firms to fraud accusations affects not only the stock prices of accused firms, but also those of seemingly quite legitimate Chinese firms.Lee et al.(2013)examine the initial financial health and subsequent performance of reverse mergers and find that Chinese RMs are generally healthier and fare better than both their US RM counterparts and a group of industry-,size-and date-matched publicly traded firms from the same exchange.An implication is that given the huge negative perception about“made in China”and the prevalence of the guilt by association fallacy,it is possible that many accused Chinese firms are merely victims of their association with truly fraudulent firms.

Several studies have examined the strategies that influential players use to spread rumors to make a profit. The basic idea is that informed traders sometimes send false signals to their followers,then if the followers act on the false signal and move the price in the wrong direction,the informed trader can make a profit.Bommel (2003),for example,models that an informed investor with limited capital can spread imprecise rumors to followers,convince them to trade excessively and then make a profit from the subsequent price overshoots: she first trades when she receives private information and then when she knows the price to be overshooting. Fishman and Hagerty(1992)argue that corporate insiders who are required to disclose their trades can profit by signaling to their followers that they are trading on information,when in fact they are not.Of course,investors only believe in the rumors that they find plausible.The claim that a particular CRM firm is fraudulent is certainly a potentially plausible rumor because many other CRMs are fraudulent and investors are subject to the behavioral bias of committing the guilt by association fallacy.Aware of this phenomenon,short sellers can accuse CRMs and benefit from the resulting stock price drop and ruined reputation of the accused firm.

The guilt by association fallacy has been witnessed many times in the real world.The dot-com bubble is obviously a good illustration of such a fallacy,in a positive way.Another example is the International Bancshares Corporation.Dennis E.Nixon,the Chairman of Bancshares,claimed that his bank was attacked by short sellers who viewed it as guilty simply because of its association with the major banks and their troubles.

Based on the reasoning above,we develop the following hypothesis:

Hypothesis 1b.Short sellers’reports are based on the guilt by association fallacy.All else being equal,CRMs are more likely to be accused by short sellers than their non-CRM counterparts.

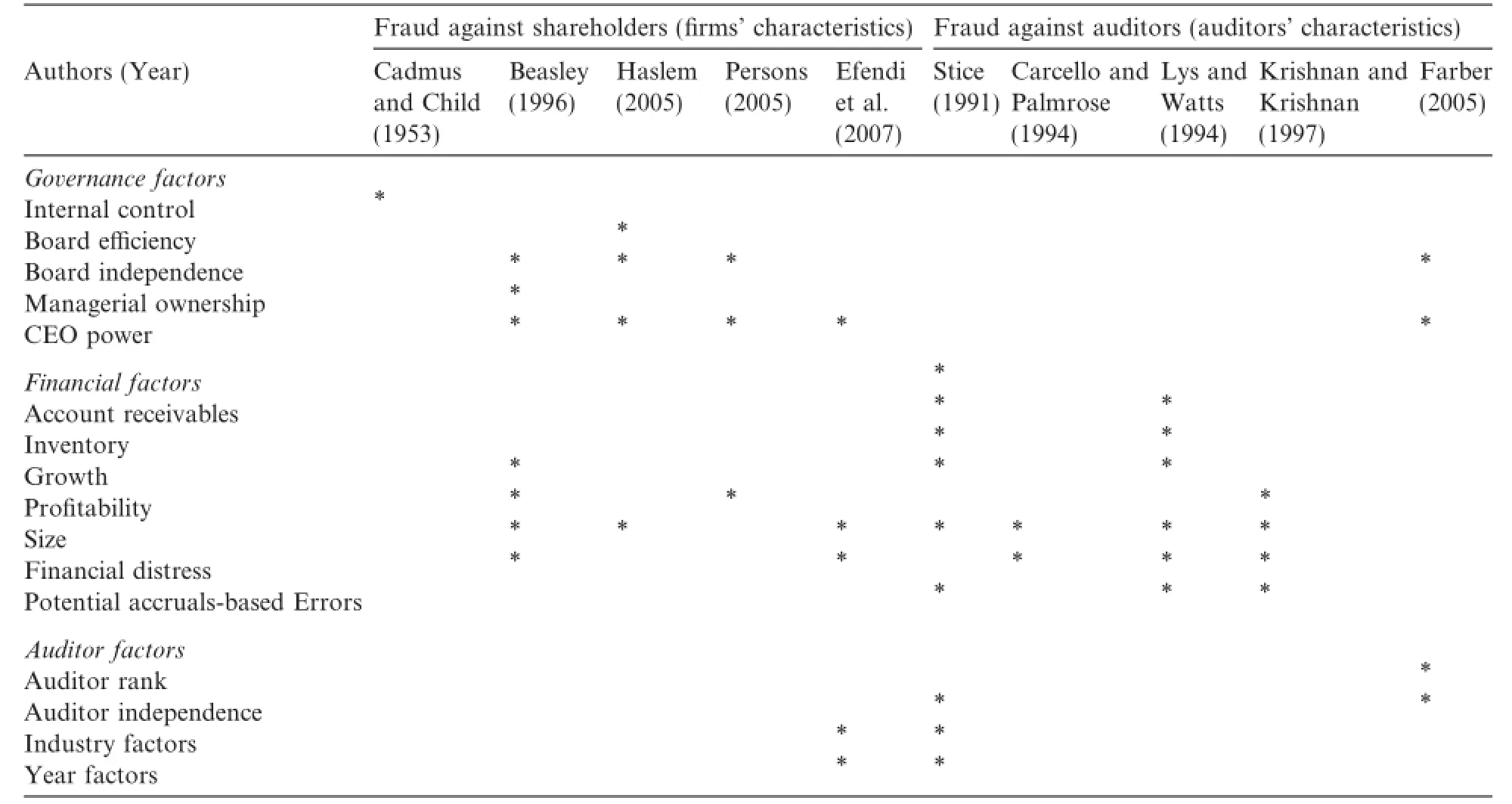

Table 1 Summary of factors influencing fraud-related litigation documented in prior studies.

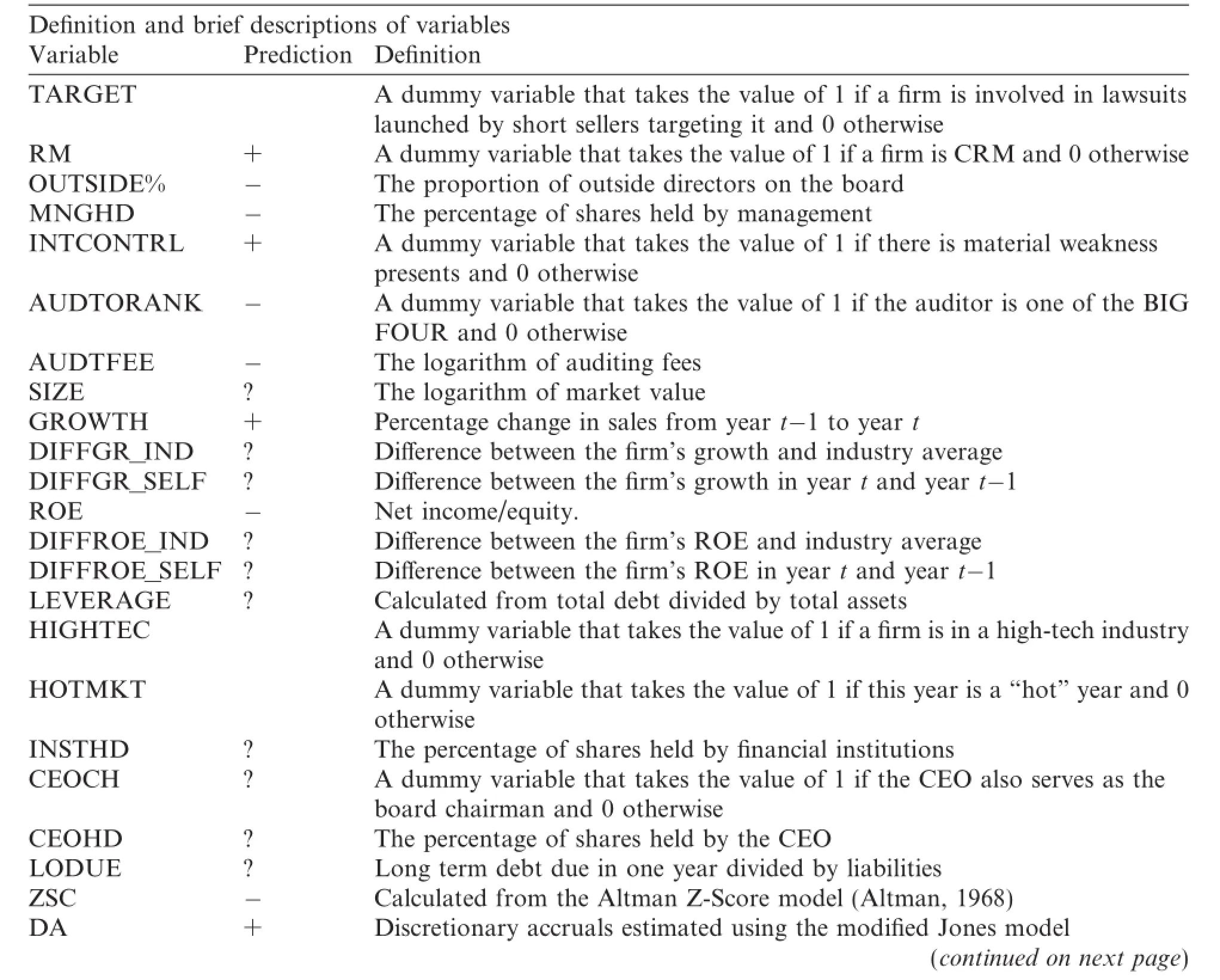

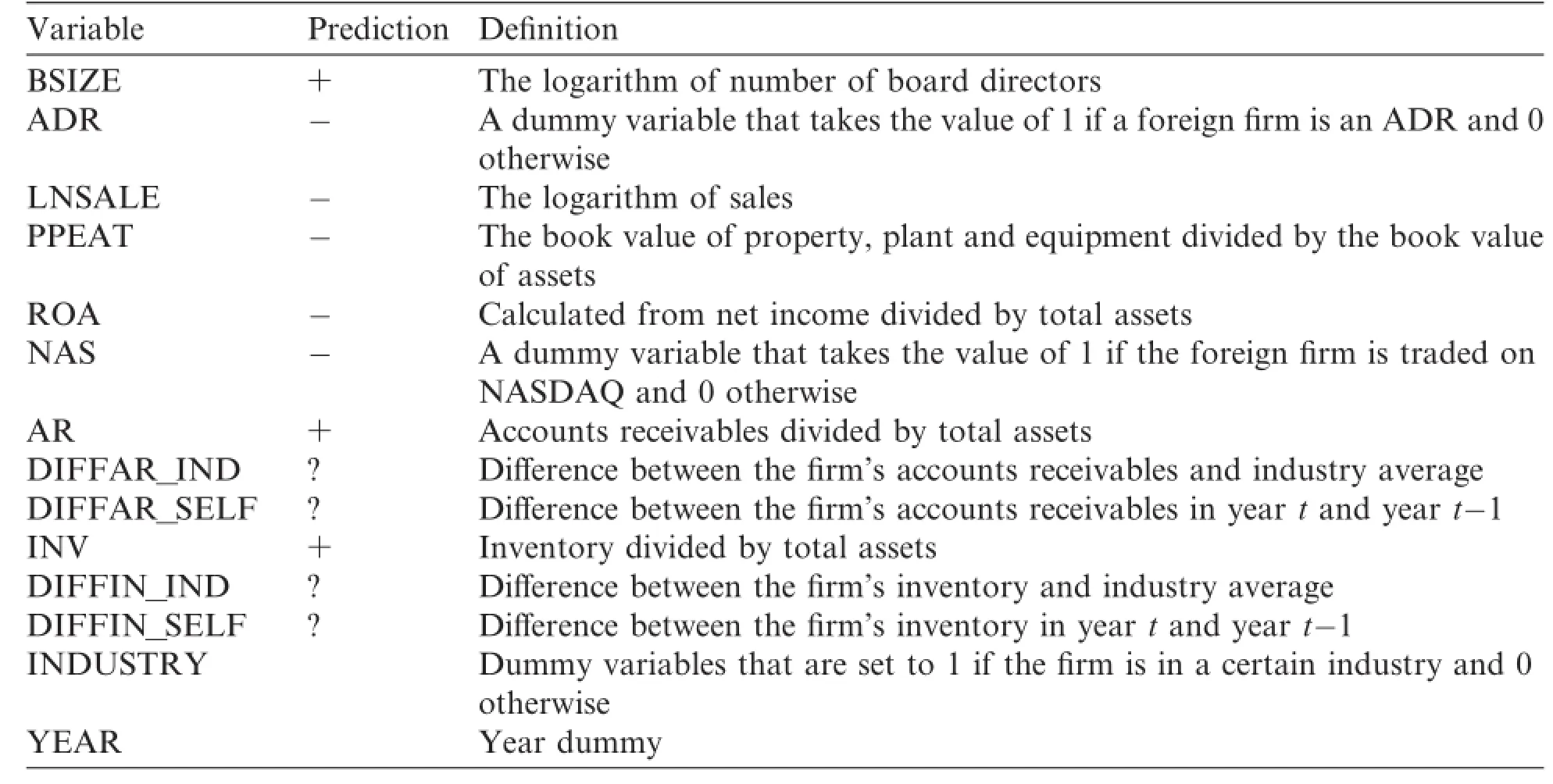

2.2.Information used by short sellers

Karpoff and Lou(2010)suggest that short sellers are good at identifying fraudulent firms.If short sellers are indeed sophisticated investors,what kind of information do they rely on?A number of studies on fraud firms have shed light on this question(e.g.,Cadmus and Child,1953;Beasley,1996;Haslem,2005;Persons, 2005;Dechow et al.,2001)by identifying the factors that affect the probability of fraud.We summarize these factors in Table 1.Beasley(1996)argues that having a larger proportion of outside members on the board of directors significantly reduces the likelihood of financial statement fraud.Efendi et al.(2007)find that misstatements are more likely to occur in firms in which the CEO has sizable holdings of in-the-money stock options.Overall,these papers suggest that solid financial status and good corporate governance can efficiently reduce the occurrence of misconduct.More direct evidence,such as that provided by Dechow et al.(2001), shows that short sellers use financial information,such as the fundamental to valuation ratio,to assess whether a stock is overpriced.

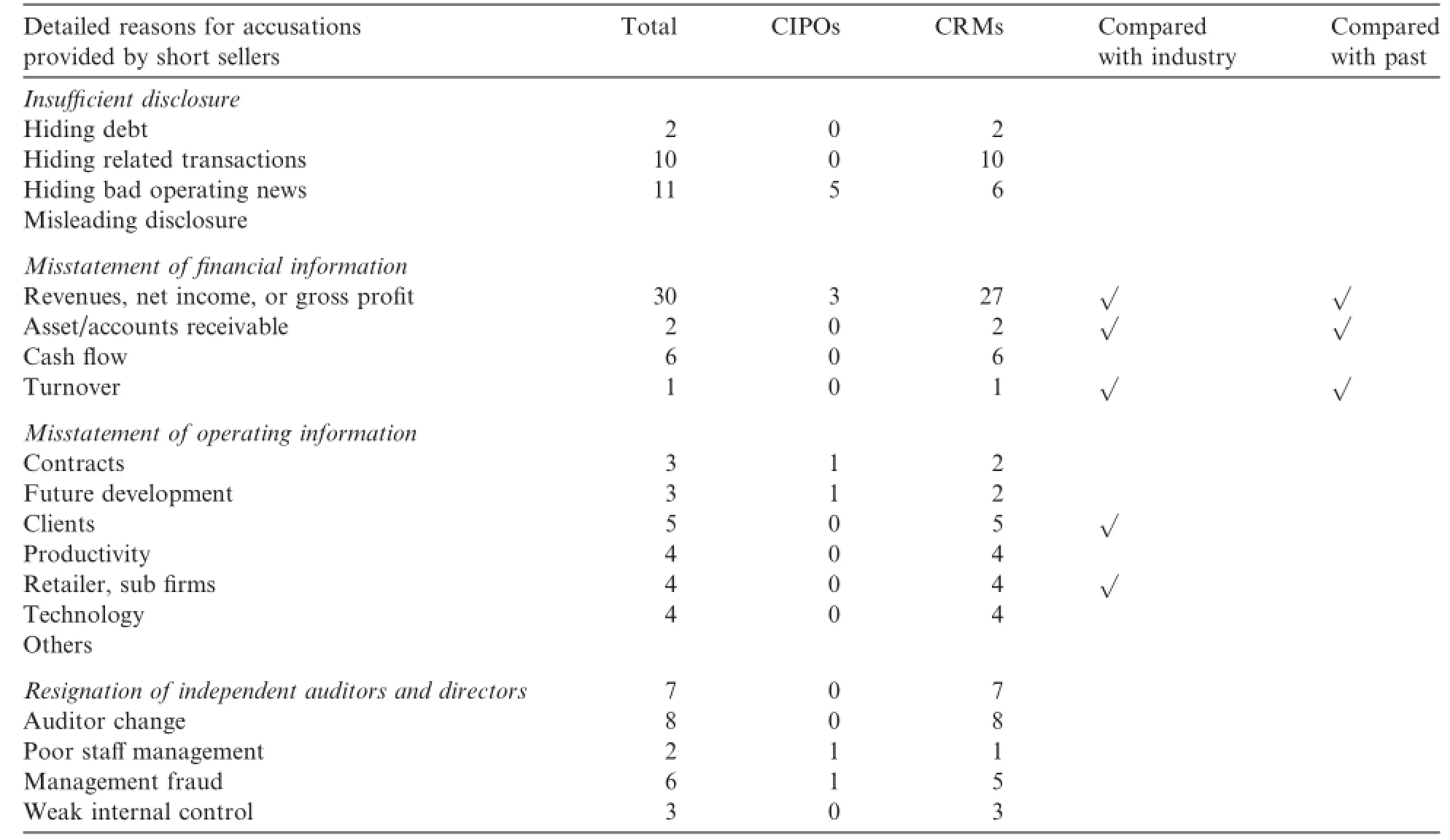

We read the short sellers’reports and summarize the disclosed reasons for their accusations against CRMs. These statistics are reported in Table 2.1The total number of firms under all categories exceeds the number of firms that were sued because firms were usually sued for multiple reasons.Of the 37 accusations,overstatement of profitability(operating revenue,net income and gross profit margin)and misleading operating information(forged contracts,false clients,false branches or false technologies)are the two leading reasons for accusations.More importantly,the reports indicate that short sellers value relative financial information.In the last two columns,we highlight the indicators that are usually compared with the industry average and firm history.For example,Muddy Water’sresearch report against China Media Express Holdings(CCME)2This report was published on February 3,2011,on Muddy Water’s website:http://www.muddywatersresearch.com/research/ccme/ initiating-coverage-ccme/.stresses the comparison between CCME’s income and that of its peers:“We note that FMCN had a 2009 net income margin of 9%.AMCN and VISN both lost money that year.”

Table 2 Reasons for accusations by short sellers.

Based on the above reasoning,we develop the second hypothesis:

Hypothesis 2.If the information analytics hypothesis is correct,financial information,especially relative financial indicators,plays a crucial role in short sellers’decisions.

2.3.Accuracy of short sellers’accusations

Revealing the strategies or information sources that short sellers use does not necessarily speak to the validity of their accusations against CRMs.Whether short sellers’accusations are accurate requires further investigation.

Firms’survival status provides a means to examine whether short sellers’accusations are accurate.The dynamics of the stock market(i.e.,firms entering and exiting)lead to the efficient reallocation of productive resources from non-surviving to surviving firms(Baker and Kennedy,2002).Consequently,a good firm attracts resource inflows and manages to stay in the market.In contrast,the market reveals the intrinsic value of bad firms and expels them.Therefore,we conjuncture that if short sellers can uncover the quality of firms, then the performance of these target firms will be weaker,indicated either by their subsequent delisting or price recovery.

Based on this reasoning,we develop the following hypothesis:

Hypothesis 3.Firms that are targeted by short sellers are more likely to be delisted from the capital market or are unlikely to recover from the price drop caused by the accusation.

3.Data

3.1.Data source and sample construction

Our sample consists of 253 Chinese firms that went public on the US stock market between 2000 and 2011. We first extract company names from the CSMAR database and tickers from the Bloomberg website,then use information from the mass media in China and the COMPUSTAT database to supplement the sample and verify the data integrity.3We check our list with Chinese-localized media such as finance.sina.com and imeigu.com to make sure all US listed Chinese firms are included.We further require firms to have non-missing financial and proxy statements. Annual accounting and auditor data are from the COMPUSTAT database and the AUDIT ANALYTICS database.Annual corporate governance information is from financial statements(10-K or 20-F)in the SEC’s EDGAR database.Finally,we refine our sample to 253 Chinese firms(1038 firm-year observations), with 108 CRMs and 145 CIPOs.

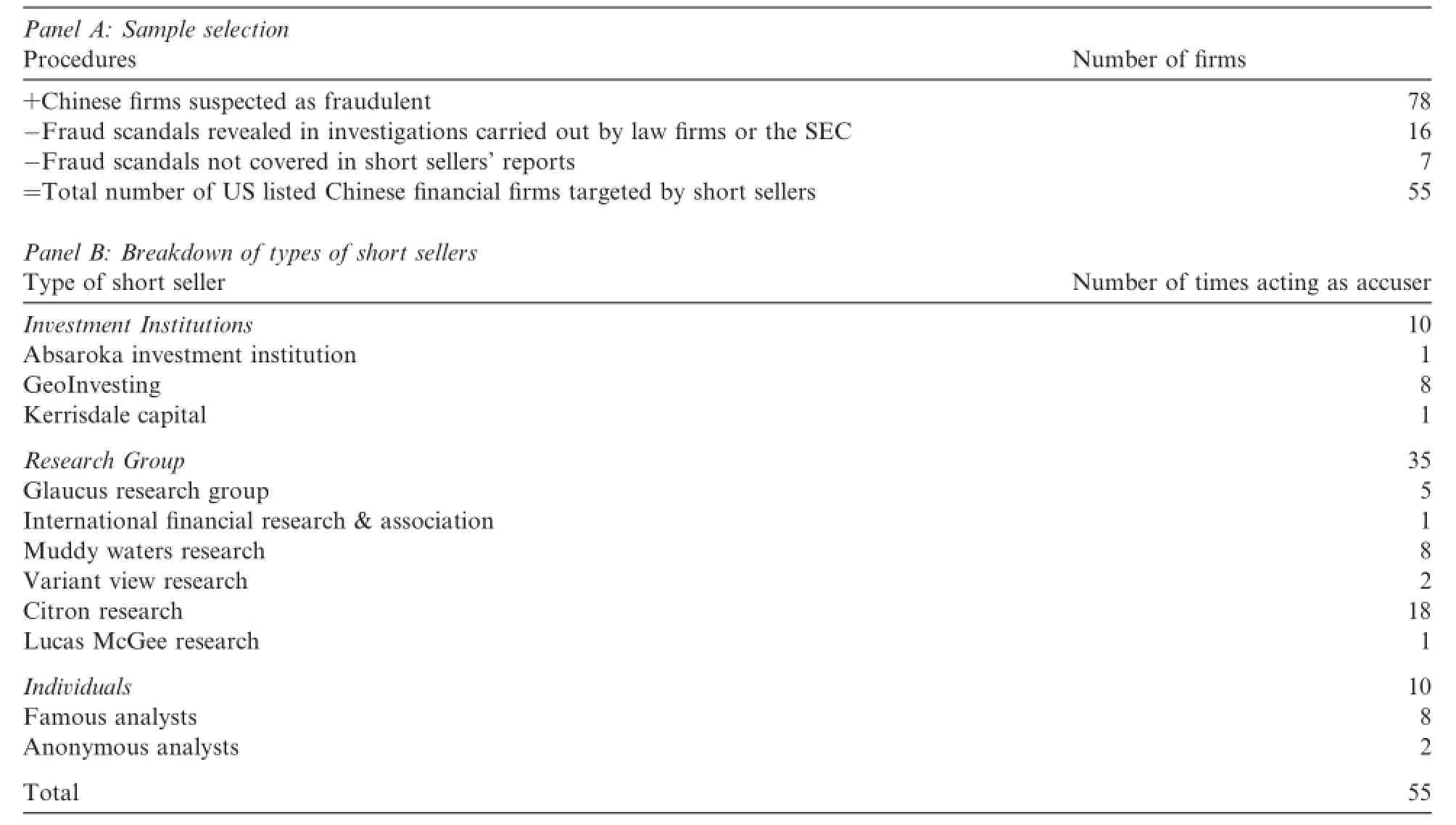

We apply the following procedure to identify the Chinese firms that were accused of fraud by short sellers. First,we identify Chinese firms that were once suspected of“fraud”if(1)they were sued by law firms4We also document these law firms’leading cases against Chinese firms:Neda Zaman Law Office,Milberg LLP,Rosen Law Firm, Shuman Law Office,Kessler Topaz Meltzer&Check,Glancy Binkow&Goldberg LLP,Izard Nobel LLP,Pomerantz Law,CMS,PLLC, Lieff Cabraser Heimann&Bernstein LLP,Federman&Sherwood,Law Offices of Howard G.Smith,and Bronstein,Gewirtz&Grossman LLC.or(2) their financial reports were questioned in news reports in the major financial press.This procedure identifies 78 firms.Second,we trace these suspected firms to decide whether short sellers initiated those suspicions.A fraud is considered to have been“uncovered”by short sellers if(1)research reports are available on the websites of major short sellers or(2)a short seller’s name is identified in investment reports on the websites of major American stock market analysts.5For example,the website“Seeking Alpha”provides sophisticated individual short sellers such as Ian Bezek,Alfred and Little Axler and research groups such as Glaucus Research Group with a platform for publishing their investment research reports.The sample selection procedure is summarized in Panel A of Table 3. Panel B of Table 3 presents a breakdown of the types of short sellers behind the accusations:10 firms were accused by investment institutions,35 by research groups and the remaining 10 by individual short sellers.

3.2.Status quo of lawsuits against Chinese firms

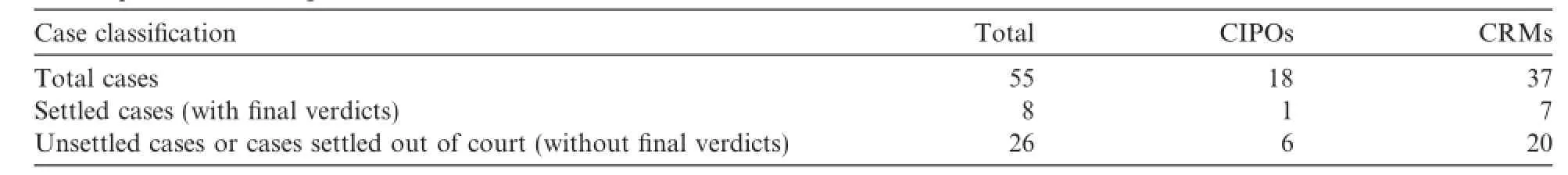

We summarize the status quo of lawsuits against Chinese firms as of December 30,2011,in Table 4.As many as 26 accused firms had not obtained final verdicts by that date and only 8 had obtained final verdicts and closed their cases.Relying on settlement data may therefore not be a feasible method of evaluating the credibility of short sellers’accusations.Twenty of the 26 unsettled cases were against CRMs.

4.Empirical analysis

We present our empirical analysis in two subsections.In Section 4.1,we analyze short sellers’strategies and focus on the information they use in their decision-making process.In Section 4.2,we analyze the firms’postaccusation performance.

4.1.Tests of Hypotheses 1 and 2

4.1.1.Model specification and control variables

Previous studies have evaluated short sellers’role by focusing on their trading patterns rather than directly testing their strategies,largely because the latter is difficult to achieve in the absence of their privateinformation data.Fortunately,short sellers’frequent accusations against US Chinese firms allow us to directly test their strategies.

Table 3 Sample selection:US listed Chinese firms targeted by short sellers.

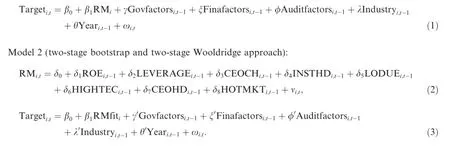

We use both probit regression and instrument variable regression(two-stage bootstrap and Wooldridge two-stage)to analyze short sellers’strategies.In the probit regression,we regress the accusation indicator dummy on the CRM indicator dummy and conventional factors that are documented to affect the occurrence of firm misconduct.For the two-stage bootstrap regression,we first predict the fitted values of the CRM indicator dummy.We then use the predicted value in the second stage regression and bootstrap the system 100 times to obtain a robust estimation.The Wooldridge two-stage approach first follows the same procedure as the two-stage bootstrap,then we use the predicted value as the instrument to conduct the standard twostage least squares procedure.The models are as follows:

Model 1(probit approach):

Table 4 Status quo of lawsuits against accused Chinese firms.

TARGETi,tis an indicator variable that equals 1 if firm i in year t was accused by short sellers,and 0 otherwise.The RM(reverse merger)dummy equals 1 if a firm is a CRM and 0 otherwise.If the guilt by association hypothesis holds,we expect a significant positive relationship between the CRM dummy and a firm’s probability of being accused.Otherwise,if the financial information analytics hypothesis holds,we expect an insignificant relationship.

Govfactorsi,t-1is a set of governance factors in year t-1,comprising material weakness of internal control (INTCONTRLt-1),proportion of outside directors(OUTSIDE%t-1),CEO duality(CEOCHt-1),proportion of CEO holdings(CEOHDt-1),managerial ownership(MNGHDt-1)and number of directors(BDSIZEt-1).

Finafactorsi,t-1is a set of financial factors in year t-1 including firm size(SIZEt-1),Zscore(ZSCt-1),which measures firms’financial distress following Zmijewski(1984),sales growth(GROWTHt-1),return on equity (ROEt-1),accounts receivable(ARt-1),leverage ratio(LEVERAGEt-1)and the difference between the firms’financial characteristics(sales growth,ROE,inventory and accounts receivable)and the industry averageoritsownpastaverage(DIFFGR_INDt-1,DIFFROE_INDt-1,DIFFINV_INDt-1, DIFFAR_INDt-1,DIFFGR_SELFt-1,DIFFROE_SELFt-1,DIFFINV_SELFt-1,DIFFAR_SELFt-1).

Auditfactorsi,t-1is a set of audit factors in year t-1,comprising an indicator variable of whether the auditor is a member of the Big 4(ADTRANKt-1),the natural logarithm of audit fee(AUDTFEEt-1)and the ratio of discretionary accruals to total assets(DAt-1).

We choose the control variables that influence the likelihood of financial misstatement,as documented in the literature,and list them in Table 1.Weak corporate governance is believed to offer a powerful explanation for firms’misleading reports.Material weakness of internal control is expected to increase the likelihood of financial misstatement because the lack of an oversight mechanism may aggravate the agency problem (Cadmus and Child,1953).Following Doyle et al.(2007),we use a dummy variable(INTCONTRLt-1)that specifies whether a firm has material weakness of internal control to proxy for the quality of internal control systems.We also include board size and board independence.Studies show that including more outside directors on the board reduces financial misstatement because outsiders are more likely to question and challenge management’s proposals(Beasley,1996;Haslem,20056Instead of the proportion of outsiders on a board,Haslem(2005)use an opposite proxy:the percentage of inside directors on the board.;Efendi et al.,2007;Farber,2005).In addition, Haslem(2005)finds that firms with higher managerial options are more likely to settle their litigations,suggesting that a high level of managerial holdings decreases the misalignment between shareholders and managers’incentives,and thus reduces the incidence of misleading financial reports.We measure managerial ownership as the proportion of managerial shareholdings(MNGHDt-1).Because manipulations are expected to be more likely when CEOs are able to dominate the board,we also include CEO duality(CEOCHt-1)and the proportion of CEO holdings(CEOHDt-1)as proxies for CEO power.

Several factors are included to capture firm financial characteristics,including sales growth,profitability, size,financial distress,potential accruals-based errors,accounts receivables and inventory.Stice(1991),Lys and Watts(1994),and Beasley(1996)find that firm growth is positively associated with litigation,which may be because fast-growing firms have a high turnover of inventory or receivables,and thus have a high risk of audit detection.We measure growth by the percentage change in sales between the current and previous year(GROWTHt-1).Additionally,financial statements are more likely to be over-reported in firms with low profitability and a strong incentive to window dress.Similarly,four studies show that financial distress is significantly correlated with misstatement,but with mixed conclusions.Stice(1991)and Krishnan and Krishnan(1997)find a positive relationship between financial distress and misstatement,whereas Carcelloand Palmrose(1994)and Lys and Watts(1994)find a negative relationship.In our test,financial distress is measured by Zscore and leverage.We include firm size(logarithm of total assets)to address the size effect,according to the literature(Carcello and Palmrose,1994;Lys and Watts,1994;Beasley,1996;Krishnan and Krishnan, 1997;Haslem,2005;Efendi et al.,2007).Moreover,according to Hypothesis 2,we include the difference between a firm’s financial characteristics and the industry average level or the firm’own historical average to capture abnormal reported growth in financial characteristics(e.g.,sales growth,ROE and inventory).

The effect of the auditor is controlled by two factors:auditor independence and auditor rank.Farber(2005) find that financial fraud is less likely in firms audited by Big 4 auditors.Auditors’proclivity to disclose discovered errors is also closely related to the incidence of misstatement:the more independent the auditor, the less likely they are to collude with their clients(Stice,1991;Krishnan and Krishnan,1997;Farber, 2005).We include the dummy(ADTRANKt-1)to indicate whether the auditor is a member of the Big 4 and the logarithm of audit fees(AUDTFEEt-1)as proxies for auditor independence.The potential accruals-based error,proxied by the ratio of discretionary accruals to total assets,is also included.It is expected to have a positive effect on the likelihood of fraud litigation because it is a proxy for accruals manipulation(Stice,1991;Lys and Watts,1994;Krishnan and Krishnan,1997).We present more detailed definitions and the predicted signs of the effects of the control variables in Appendix A.

4.1.2.Empirical results

In this section,we present the estimation of our models.We use probit regressions to estimate model 1 and the two-stage bootstrap and Woodridge two-stage methods to estimate models 2 and 3.

The key independent variable in the probit model is the RM dummy.The key independent variable in the two-stage bootstrap and two-stage Woodridge methods is the fitted value of the RM dummy(RMfit)from the first stage.In each specification,we report both the coefficients and the marginal effects that are computed at the mean values of the other variables.We also report the p values of the F tests for each group of variables: governance,auditor and financial factors.The F test allows us to examine the overall effect of each group of factors on the likelihood of firms being targeted by short sellers.Year and industry fixed effects are included in all three models.We cluster standard errors by firm to control for cross-sectional heteroskedasticity and within-firm serial correlation.

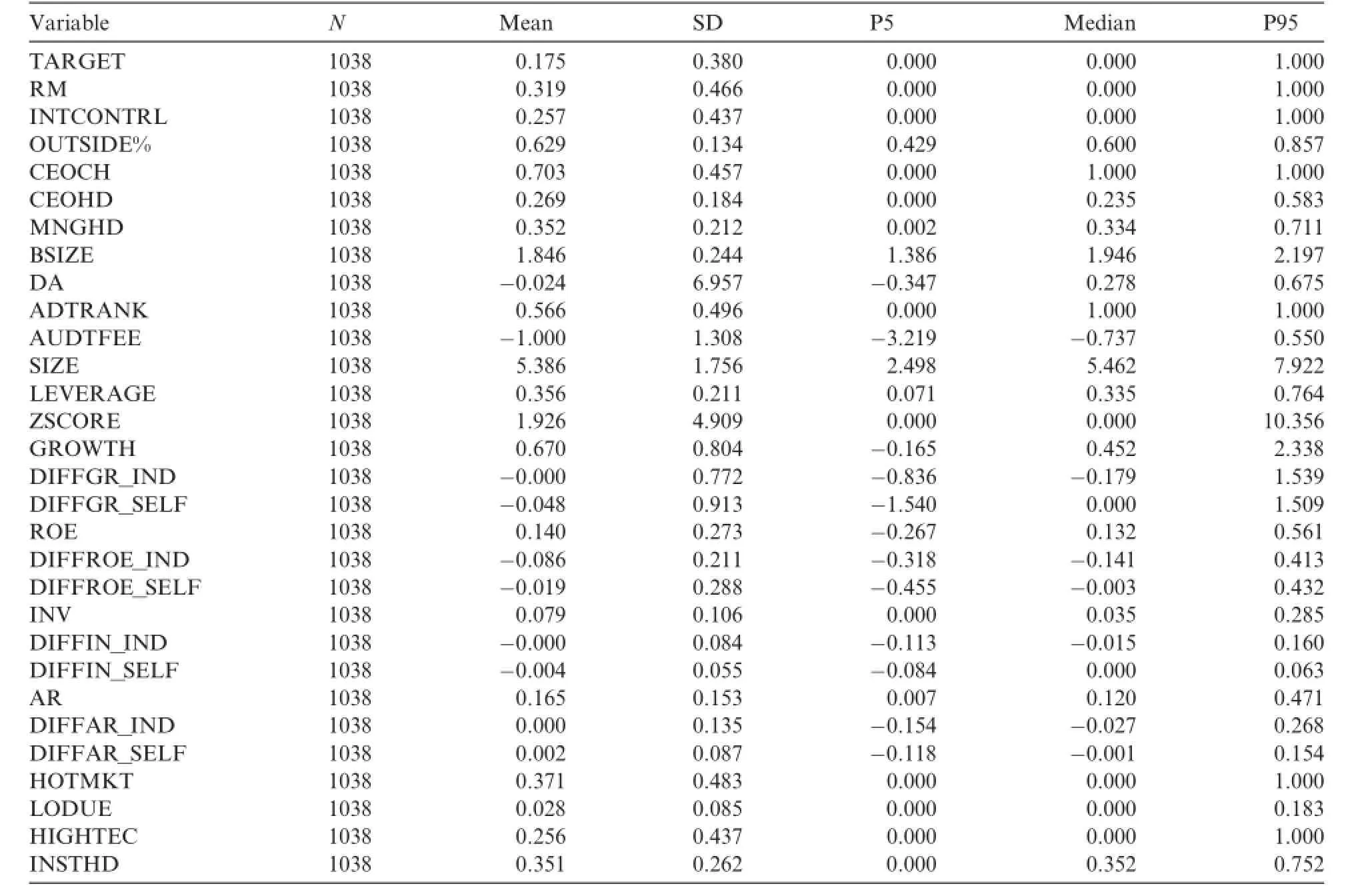

We report the descriptive statistics in Table 5.The mean value of RM indicates that CRMs account for 31.9%of the entire sample.The average value of SIZE is 5.38,equivalent to$217.02 million(=e5.38).

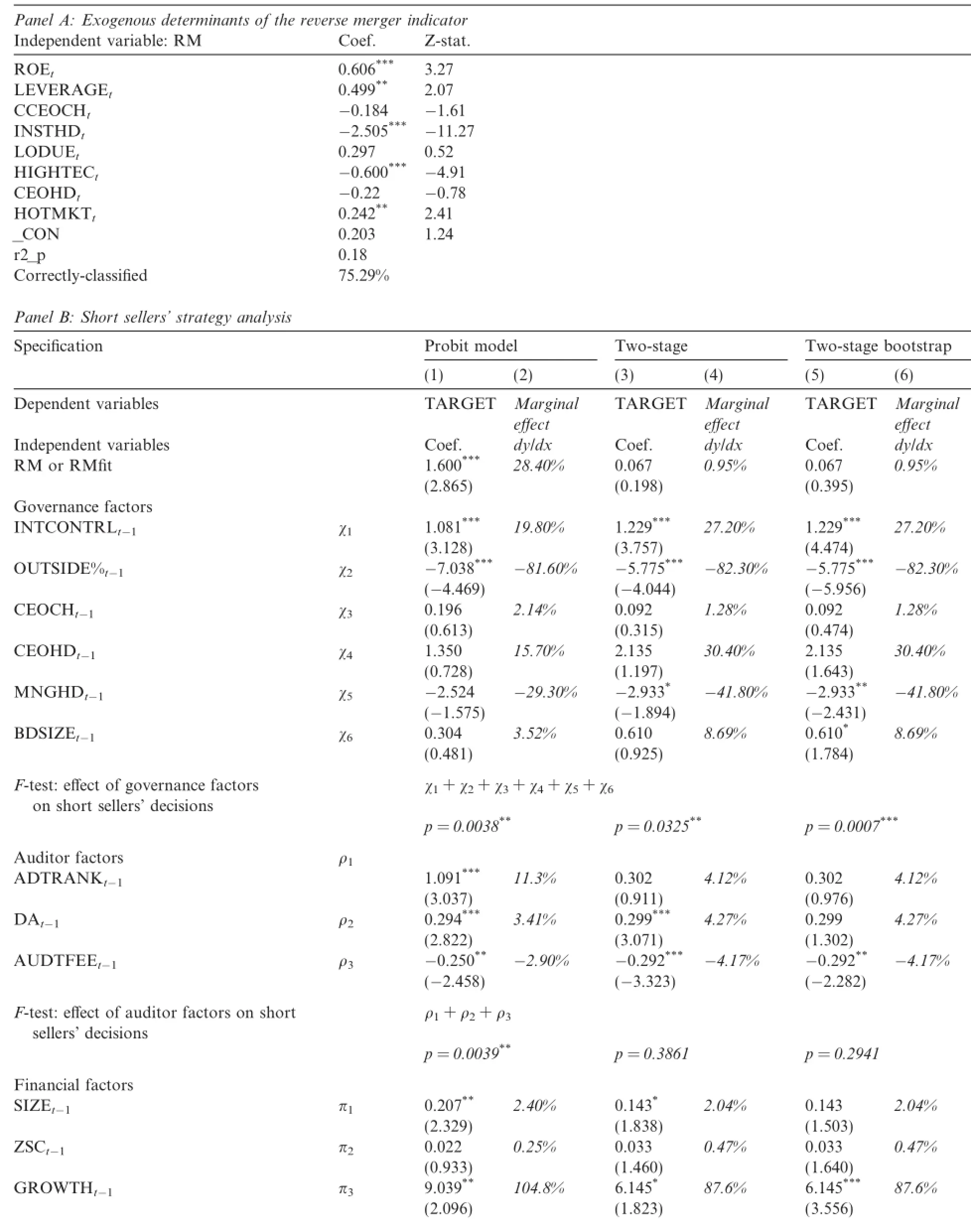

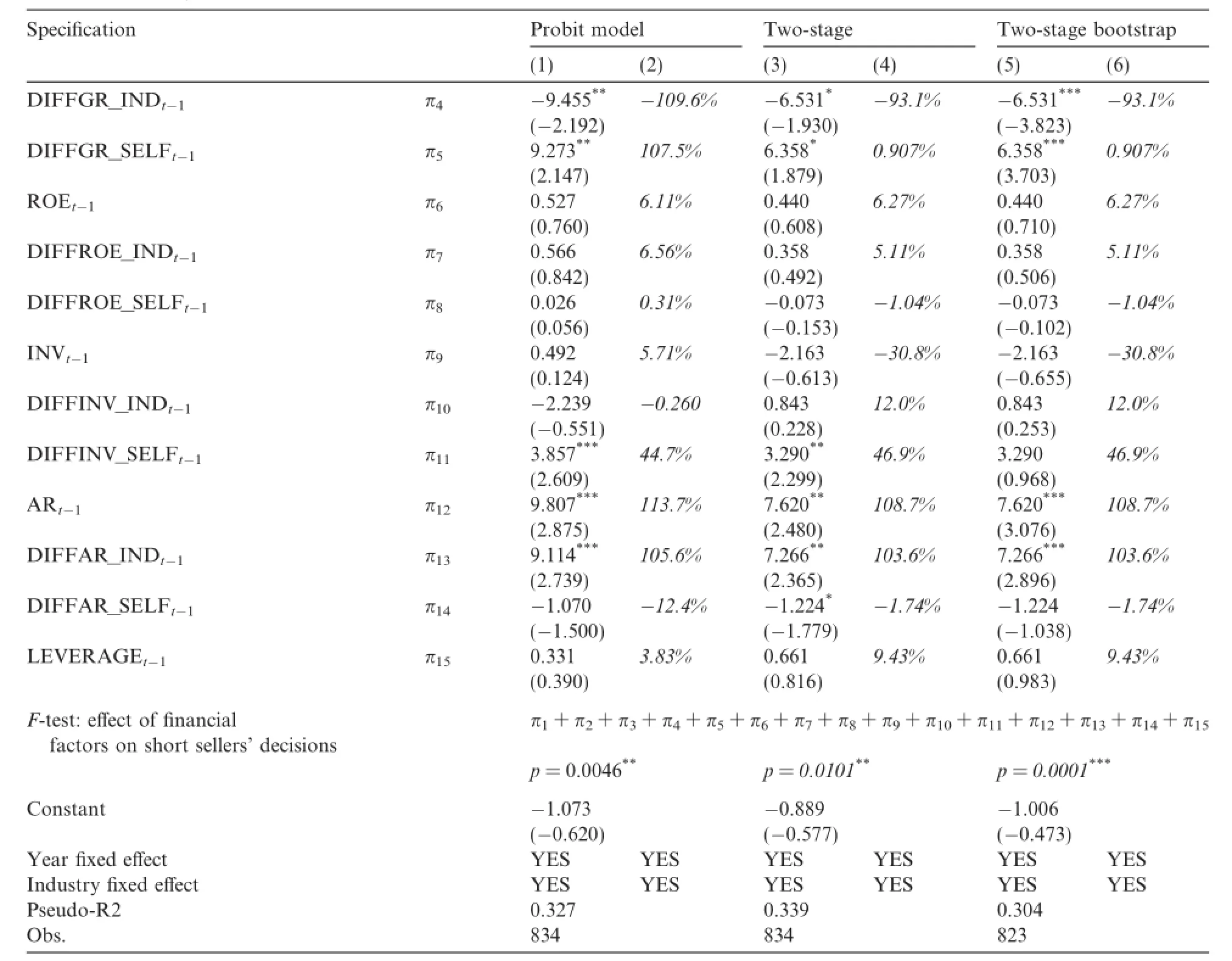

Table 6 reports the main results.In Panel A of Table 6,we present the first stage of both the two-stage bootstrap and two-stage Wooldridge procedures.In particular,we regress firms’choice between reverse merger and IPO on a series of exogenous factors to obtain the fitted value.Exogenous factors include market timing,high-tech industry and a range of financial characteristics.First,market factors play a crucial role when firms make their listing choice.Brau et al.(2003)find that IPOs and reverse mergers occur in waves that are negatively correlated,suggesting that market timing,also referred to as the“IPO period,”is a key factor for firms to consider.Second,Ray(2008)documents that firms’listing choices are also influenced by high tech industries and high tech bubbles,as both are associated with higher IPO discount rates.Therefore,we include an indicator dummy to control for the high tech industry.We also include financial factors that correlate with the listing choice,including ROE,ROA,leverage and total assets(Gleason et al.,2005;Jindra et al.,2012). The results reported in Table 6 are consistent with previous findings.We find that firms with higher profitability,lower levels of institutional holdings and higher leverage ratios are more likely to go public through reverse mergers,especially during non-tech bubble periods.We then use the fitted value from the first stage to explain firms’probability of being targeted by short sellers.

We report the structural regression results in Panel B of Table 6.In the probit model,the coefficient on RM is 1.6 and significant at the 1%level.The marginal effect is 28.4%,showing that,ceteris paribus,an RM firm is 28.4%more likely to be accused by short sellers.In the two-stage bootstrap and Wooldridge two stage models, the coefficients on RMfit are both 0.067,but neither is significant.The results show that once the adverse selection problem is taken into consideration at the initial stage,the plausible relationship between RM firms and the probability of being accused by short sellers disappears.The reason we see a positive effect of RM on the probability of short seller accusation in the probit model is that firms that choose to go public via reverse mergers are more likely to be associated with misconduct in the first place.

Table 5 Descriptive statistics.

Because the simple probit model is subject to the endogeneity problem,our conclusions are based on the two-stage model and the two-stage bootstrap model,which generally produce the same results.

A few audit factors also play an important role in determining short sellers’targets.For example,audit fee (AUDFEEt-1)plays an important role in short sellers’decision-making process.The negative coefficient on audit fee indicates that a higher audit fee can effectively increase the quality of financial reports and thus lower the probability of accusation.However,the joint significance test shows that auditor traits may not draw much attention from short sellers.The p-value of the F-test is 0.294 in the Wooldridge two-stage model.

For governance factors,the coefficient on internal control(proportion of outside directors)is significantly positive(negative),suggesting that the presence of material weakness(more outside directors)increases (decreases)a firm’s probability of being accused.The results are consistent with the view that good corporate governance can effectively monitor managers and reduce the occurrence of firm misconduct.Firms with higher manager shareholdings(MNGHDt-1)are less likely to be accused by short sellers,suggesting that greater alignment between managers’and shareholders’interests can effectively curb misconduct.The F-tests suggest that corporate governance factors are critical considerations for short sellers when choosing their targets.

Among the financial factors,the positive and significant coefficient on sales growth suggests that firms with high sales growth are more likely to be accused by short sellers.There are two possible explanations.First, fast-growing firms have a high turnover of inventory or receivables and thus have a high risk of audit detection.Second,financial fraud often involves inflation of earnings.Therefore,unusually high growth in sales might reflect manager manipulation.When a firm’s growth rate is higher than the industry average,it is more likely to be accused by short sellers,suggesting that an abnormal increase in sales is likely to be associated with accounting manipulation.However,when the firm’s growth rate is higher than its average growth rate,the probability is lowered.We also find that firms with high growth in accounts receivables are more likely tobe accused.Accounts receivables are therefore also likely to be perceived as components that are susceptible to managerial manipulation.The joint significance of all of the financial factors also suggests that relative financial factors are critical considerations in short sellers’decision process,which supports Hypothesis 2.

Table 6 Multivariate analysis of short sellers’strategies.

Table 6(continued)

4.2.Test of Hypothesis 3:post-accusation performance analysis

In this section,we further investigate the economic consequences of short sellers’accusations in two steps. First,we test the relationship between firms’survival rate(time)and the incidence of accusations by short sellers.Second,we summarize the price recovery process of accused firms.

4.2.1.Survival status analysis

The dynamics of the stock market(i.e.,firms entering and exiting)lead to the reallocation of productive resources from non-surviving to surviving firms(Baker and Kennedy,2002).Whether a given company delists or survives is greatly affected by substantial fundamental change.Thus,firms’survival status provides a means to examine whether short sellers’accusations are information-based.If the short sellers’reports carry credible information,then we would expect accused firms to have a higher delisting rate than other firms.Otherwise, the delisting rate should be the same.

To test the effect of short sellers’accusations on firm survival rates,we use the two-stage bootstrap and Woodridge two-stage methods to estimate model 5.The first stage regression is the same as model 1,and model 5 is

where:

Delisti,tis a dummy variable that equals 1 if firm i was delisted in year t and 0 otherwise.

Targeti,tis a dummy variable that equals 1 if firm i was targeted in year t by short sellers and 0 otherwise.

RMiis a dummy variable that equals 1 if firm i was a reverse merger firm and 0 otherwise.

Controli,t-1is a series of lagged controls that other studies have included.Following Baker and Kennedy (2002),we include firms’profitability measured by the natural logarithm of sales and ROA;the proportion of collateral measured by the proportion of fixed assets;and other financial characteristics such as leverage and size.We also include an ADR dummy,US market returns and a NASDAQ dummy.Chaplinsky and Ramchand(2007)argue that ADRs are more likely to delist than their US counterparts due to the stricter regulations introduced by the SOX act.The NASDAQ market has witnessed a higher incidence of foreign firms delisting due to the simplified delisting process.7As Chaplinsky and Ramchand(2007)document,“the NYSE requires that a firm gain the approval of its audit committee and Board of Directors before delisting,while NASDAQ simply requires a letter stating the reasons for delisting.In neither case is shareholder approval required.”We also control for market condition measured by US stock market return and firms’financial characteristics,such as ROA and firm size.

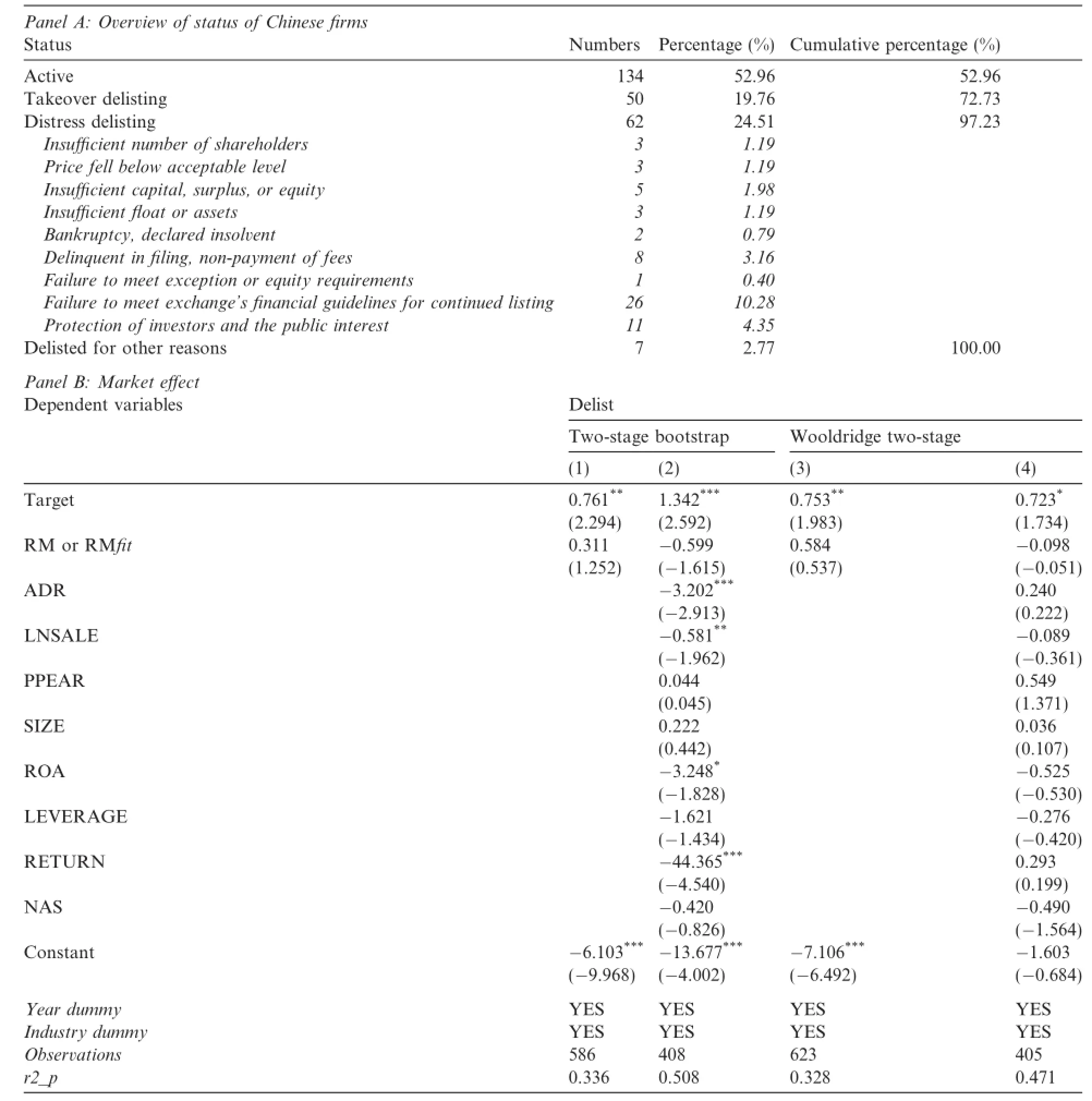

Panel A of Table 7 presents an overview of Chinese firms’trading status as of December 31,2012.Among 253 Chinese firms,only 134(52.96%)firms remained active and 119(47.04%)firms had delisted.Fifty(19.76%) firms were acquired by other firms and 62(24.51%)firms had delisted due to distress.Those that had delisted due to distress can be further classified into nine categories.The leading cause(26 cases,10.28%)is failure to meet the exchange’s financial guidelines for continued listing,followed by delinquency in filing and non-payment of fees(8 cases).We report the empirical results of the delisting model 5 in columns 1–4 in Panel B of Table 7.The results are generally consistent with our predictions.We find that firms accused by short sellers (Target)bear a higher risk of delisting in the future,even after controlling for other factors.When we use the two-stage bootstrap specification,the coefficient of Target is significant at the 1–5%level in columns 1–3.In columns 4–6,we use the Wooldridge two-stage specification and the result remains the same.Those results support the view that firms that are targeted by short sellers are more likely to delist from the capital market. With the control variables,we find that companies are less likely to delist when they are profitable and when the market condition is optimistic,which is consistent with Baker and Kennedy(2002).

Table 7 Post-accusation performance analysis.

4.2.2.Price performance analysis

In an efficient market,stock prices incorporate a rich information set on a timely basis.Therefore,we further test the credibility of short sellers’accusations by investigating firms’stock price patterns in the subsequent period.If short sellers’accusations are groundless and misleading,investors will eventually realize this and the stock prices of implicated firms should rebound to their fair values.Otherwise,the stock prices are unlikely to recover after the accusations because the resulting price drops are informative about the poor quality of those firms.

We measure firms’price recovery rate as the percentage change in the stock price between the first release date of the short sellers’report and the delisting date if the firm is inactive,or December 31,2012,if the firm is still active.

where Precoverydenotes the percentage of price recovery,Ptrepresents the closing price on December 31,2012 if the firm is still trading,Pdelistequals the delisting price if the firm is delisted and Pdelistis the stock price at the first release date of the short sellers’report.

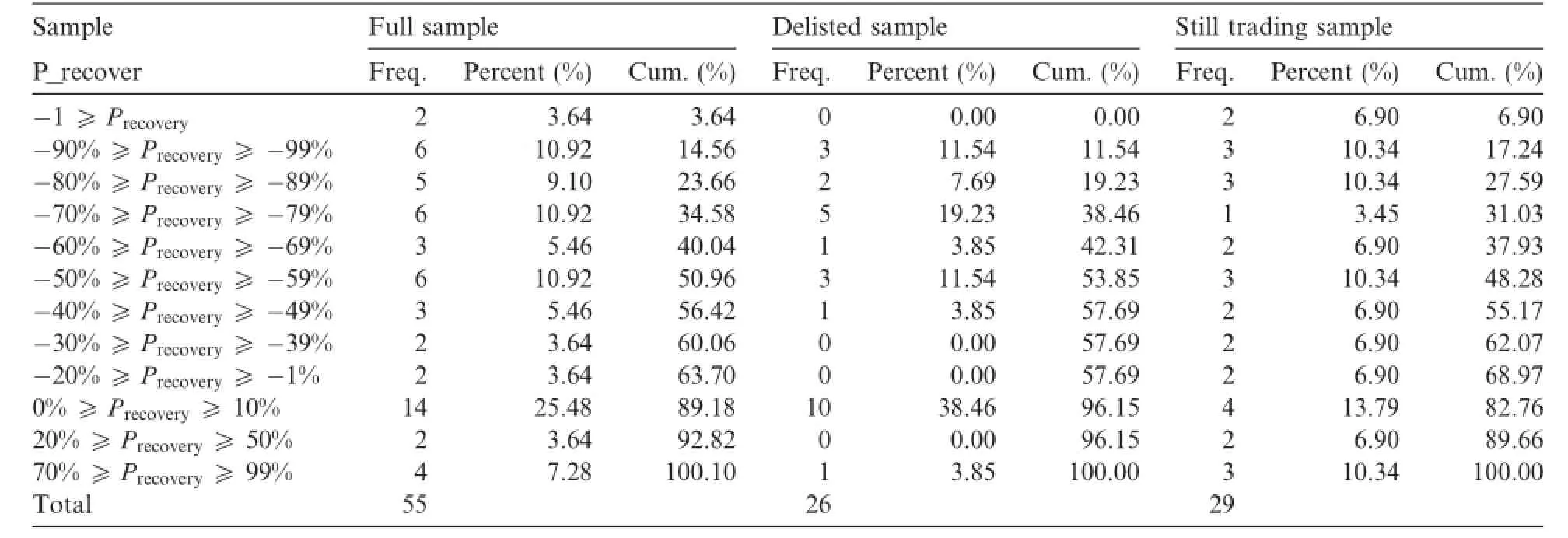

We summarize the price recovery pattern in Table 8.Consistent with the information analytics hypothesis, none of the accused firms are able to recover their price to the original level(Precovery≥1).As many as 63.7% of firms(Precovery≤0)never push their stock price back up and only 4 firms(7.28%)recover more than 70%of their price to the pre-accusation level.To better understand the distribution of the price recovery rate,we further classify accused firms into a delisted group and an active group.

5.Robustness tests

5.1.Robustness test for Hypothesis 1

In this section,we apply a propensity score matching approach as the robustness test,based on two considerations.First,in cases where the probit model contains a binary endogenous explanatory variable,it is difficult to obtain a consistent estimation through the regular IV procedure because in the second stage estimation we cannot pass the expected value through a nonlinear model.Even the modified procedure can only mitigate,rather than fully address,this problem.However,as Wooldridge(2002)suggests,the propensity score matching approach is attractive because there is no need to model the expected value of the independent variable.Second,propensity score matching,as a nonparametric method,can exclude the possibility of violations of other classic assumptions,which can be a potential problem with the two-stage bootstrap and Wooldridge two-stage procedures.

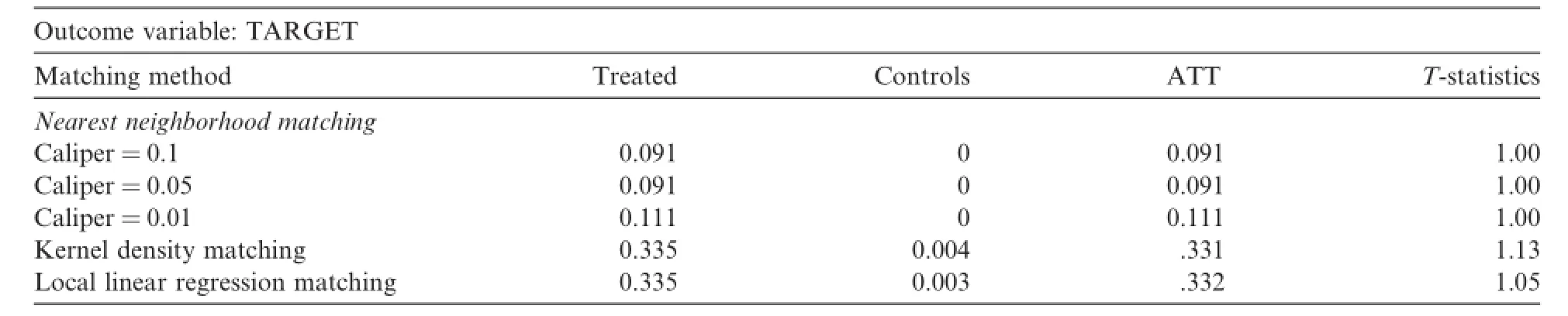

The results are reported in Table 9.The average treatment effect(ATT)is 0.091 and significant at the 1%level.This result shows that the ATT between the two groups is significant if we use nearest neighborhood matching,kernel density matching or local linear regression matching.The interpretation is that in terms of the probability of choosing a reverse merger when going public,there are two similar groups: the first group goes public through reverse mergers but the other group does not.However,there is almost no difference between the two groups in terms of the incidence of firms being accused of financial fraud by short sellers.Short sellers’judgments of financial fraud therefore do not rely on a firm’s identity(CRM or CIPO).

5.2.Robustness test for Hypothesis 3

It can be argued that the positive relationship between the delisting likelihood and short seller accusations is driven by the feedback effects of short sellers’accusations,rather than firms’fundamentals.If this were true, we would expect firms’survival times to be uncorrelated with short sellers’accusations:firms will get delisted

Table 8 Price performance analysis.

if firms are delisted,

where Precoverydenotes the percentage of price recovery;Paccuserepresents the stock price on the first release date of the short seller’s report;Ptrepresents the closing price on December 31,2012 if the firm is still trading;Pdelistequals the delisting price if the firms is delisted; and Paccuseis the original price at the first release date of the short seller’s report. whenever they are attacked by short sellers.We test this alternative explanation by applying a longitudinal data analysis.We collect each firm’s survival time and apply a Cox proportional hazard model.The Cox proportional hazard model allows us to use all available information,to deal with omitted between-firm variation and to loosen the assumptions on the data’s distributional properties.

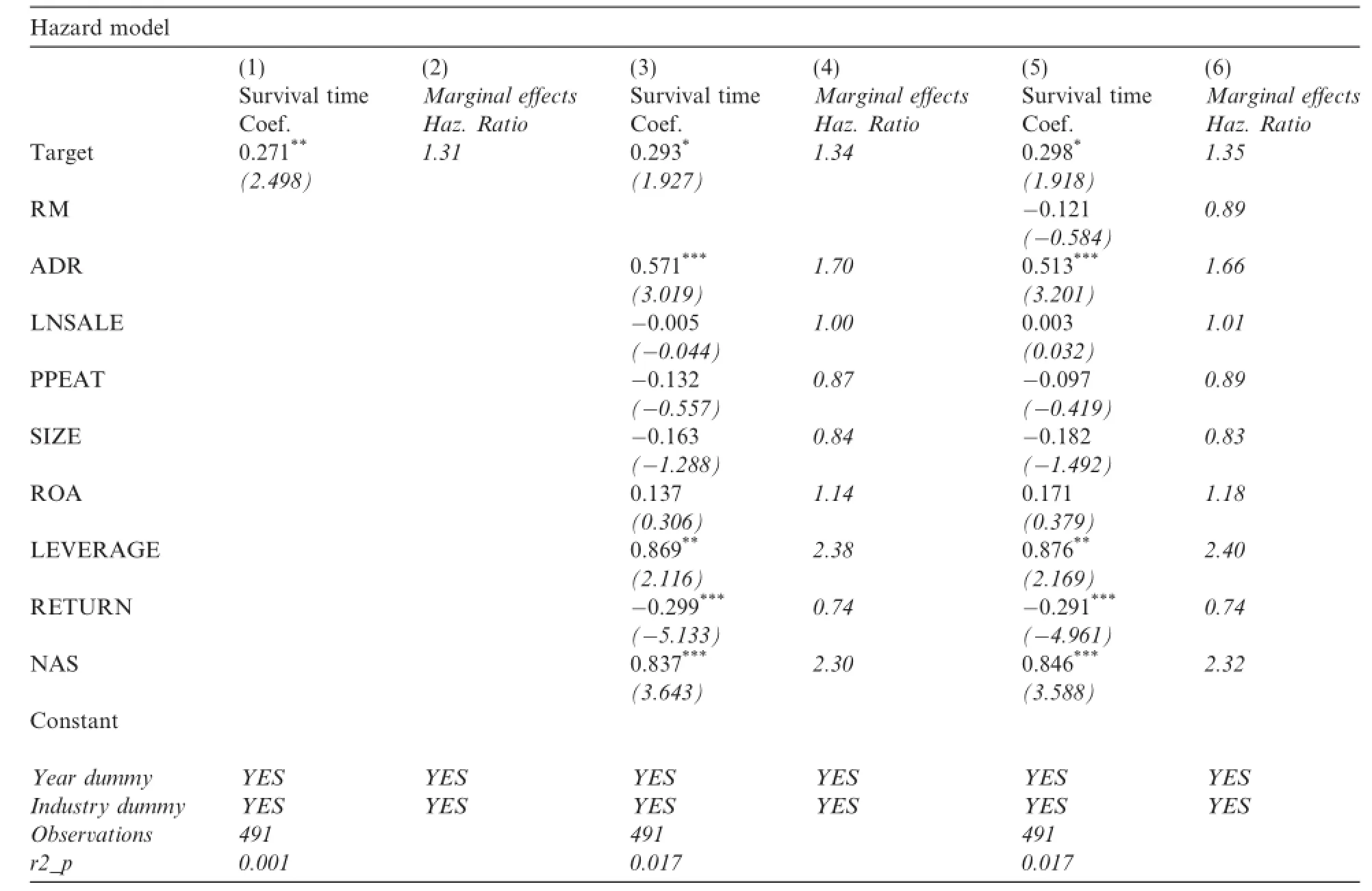

We present the results in columns 1–6 of Table 10.Because the Cox proportional hazard model transforms the dependent variable into a hazard rate,the hazard ratio coefficients are interpreted as a survival time scalingfactor:a hazard ratio greater than 1 accelerates failure(reduces survival time),whereas a hazard ratio less than 1 decelerates failure(increases survival time).Generally,the hazard rate for accused firms(Target)is 31–35% higher than for non-accused firms,from the models with or without control variables.This result indicates that short sellers are good at identifying fraudulent Chinese firms and forcing them out of the market. Consistent with Chaplinsky and Ramchand(2007),we find that the hazard rate is 113%higher for NASDAQ firms(NAS)and 70%higher for ADR firms(ADR).The coefficients on the other control variables are consistent with the findings obtained from the probit model.

Table 9 Robustness test of Hypothesis 1:propensity score approach.

Table 10 Robustness test of Hypothesis 3:hazard model approach.

6.Conclusion

The effect that short sellers have on the financial market has long been debated.Proponents argue that short sellers are sophisticated investors who can identify over-priced stocks and improve price efficiency. Dissenters,conversely,argue that short sellers use abusive trading strategies,dampen investor confidence in financial markets and decrease market liquidity.

In this paper,we contribute to the debate by directly testing short sellers’strategies in accusing Chinese reverse merger firms of financial fraud.Between 2010 and 2011,62 CRMs were accused of fraud by shortsellers,leading to a reduction of almost 50%in the CRMs’equity value.We test two hypotheses regarding short sellers’strategies.One hypothesis is that short sellers’accusations against Chinese reverse merger firms are based on information analytics.The other hypothesis is that short sellers indiscriminately accuse Chinese reverse merger firms because of their association with other guilty Chinese reverse merger firms. We find little evidence that short sellers base their strategies on firms’reverse merger identity.In the long run,the accused firms are more likely to delist or fail to recover from the price drop following short sellers’accusations.The short sellers’decision process involves comparing the target firms’financial indicators (e.g.,growth and receivables)with both the industry average and the firms’histories to locate“bad apples.”Fundamentals such as the quality of corporate governance are also crucial determinants in short sellers’decision process.Firms that have poor internal control,a small proportion of outside directors,a low level of managerial shareholdings and low-quality audit reports are more likely to be targets of short sellers.Our results suggest that CRMs’high exposure to short sellers’accusations stems from firms’adverse selection:firms with a high litigation risk are more likely to choose a reverse merger to access the US capital market.

Appendix A.Variable definitions

Appendix A(continued)

References

Altman,E.I.,1968.Financial ratios,discriminant analysis and the prediction of corporate bankruptcy.J.Finance 23,589–609.

Baker,G.,Kennedy,R.E.,2002.Survivorship and the economic grim reaper.J Law Econ Organ 18(2),324–361.

Beasley,M.S.,1996.An empirical analysis of the relation between the board of director composition and financial statement fraud.Acc. Rev.71,443–465.

Bommel,J.V.,2003.Rumors.J.Finance 58,1499–1519.

Brau,J.,Francis,B.,Kohers,N.,2003.The choice of IPO versus takeover:empirical evidence.J.Bus.76(4),582–612.

Cadmus,B.,Child,A.J.E.,1953.Internal Control Against Fraud and Waste.Prentice-Hall,New York.

Carcello,J.V.,Palmrose,Z.,1994.Auditor litigation and modified reporting on bankrupt clients.J.Acc.Res.32,1–30.

Chang,X.,Dasgupta,S.,Hilary,G.,2009.The effect of auditor quality on financing decisions.Acc.Rev.84(July),1085–1117.

Chaplinsky,S.,Ramchand,L.,2007.From Listing to Delisting:Foreign Firms’Entry and Exit From the U.S.University of Virginia Working Paper.

Chen,K.,Chen,Q.,Lin,Y.C.,Lin,Y.C.,Liu,X.,2012.Do Foreign Firms’Shortcut to Wall Street Cut Short Their Financial Reporting Quality?Evidence from Chinese Reverse Mergers.Working Paper.

Christophe,S.E.,Ferri,M.G.,Angel,J.J.,2004.Short-selling prior to earnings announcements.J.Finance 59,1845–1876.

Christophe,S.E.,Ferri,M.G.,Hsieh,J.,2009.Informed trading before analyst downgrades:evidence from short sellers.J.Financ.Econ. 95,85–106.

Cox,C.,2008.Statements of SEC Chairman Christopher Cox and Enforcement Division Director Linda Thomsen Regarding Immediate Commission Actions to Combat Market Manipulation[EB/OL].

Darrough,M.,Huang,R.,Zhao,S.,2012.The Spillover Effect of Chinese Reverse Merger Frauds:Chinese or Reverse Merger?Working Paper.

Dechow,P.M.,Hutton,A.P.,Meulbroek,L.,Sloan,R.G.,2001.Short-sellers,fundamental analysis,and stock returns.J.Financ.Econ. 61,77–106.

Desai,H.,Ramesh,K.,Thiagarajan,S.R.,Balachandran,B.V.,2002.An investigation of the information role of short interest in the Nasdaq market.J.Finance 57,2263–2287.

Diether,B.K.,Lee,K.H.,Werner,I.M.,2009.Short sale strategies and return predictability.Rev.Financial Stud.22,575–607.

Doyle,J.,Ge,W.,McVay,S.,2007.Determinants of weaknesses in internal control over financial reporting.J.Acc.Econ.44,193–223.

Efendi,J.,Srivastava,A.,Swanson,E.P.,2007.Why do corporate managers misstate financial statements?The role of option compensation and other factors.J.Financ.Econ.85,667–708.

Farber,D.B.,2005.Restoring trust after fraud:does corporate governance matter?Acc.Rev.80,539–561.

Fishman,M.,Hagerty,K.,1992.Insider trading and the efficiency of stock prices.Rand J.Econ.23,106–122.

Gleason,K.C.,Jain,R.,Rosenthal,L,2005.Alternatives for Going Public:Evidence from Takeovers,Self-underwritten IPOs,and Traditional IPOs.Working Paper.

Goldstein,I.,Guembel,A.,2008.Manipulation and the allocational role of prices.Rev.Econ.Stud.75,133–164.

Haslem,B.,2005.Managerial opportunism during corporate litigation.J.Finance 60,2013–2041.

Jindra J.,Voetmann,T.,Walking,R.A.,2012.Reverse Mergers:Yhe Chinese Experience.Working Paper.

Jones,C.M.,Lamont,O.A.,2002.Short sale constraints and stock returns.J.Financ.Econ.66,207–239.

Karpoff,J.M.,Lou,X.,2010.Short sellers and financial misconduct.J.Finance 65,1879–1913.

Krishnan,J.,Krishnan,J.,1997.Litigation risk and auditor resignations.Acc.Rev.72,539–560.

Lamont,O.,Stein,J.,2004.Aggregate Short Interest and Market Valuations,NBER Working Paper.

Lee,C.M.C.,Li,K.K.,Zhang,R.,2013.Shell Games:Are Chinese Reverse Merger Firms Inherently Toxic?Working Paper.

Liu,M.,Ma,T.,Zhang,Y.,2008.Are Short Sellers Informed?New Evidence from Short Sales on Financial Firms During the Recent Subprime Mortgage Crisis.Binghamton University–SUNY Working Paper.

Lys,T.,Watts,R.L.,1994.Lawsuits against auditors.J.Acc.Res.32,65–93.

Miller,E.M.,1977.Risk,uncertainty and divergence of opinion.J.Finance 9(32),1151–1168.

Persons,O.S.,2005.The relation between the new corporate governance rules and the likelihood of financial statement fraud.Rev.Acc. Finance 4(2),125–148.

Ray,S.,2008.IPO Discounts and Fraction of the Firm Sold:Theory and Evidence.Working Paper.

Stice,J.D.,1991.Using financial and market information to identify pre-engagement factors associated with lawsuits against auditors. Acc.Rev.66,516–533.

Wooldridge,J.M.,2002.Econometric Analysis of Cross-section and Panel Data.MIT Press,Cambridge,MA.

Zmijewski,M.E.,1984.Methodological issues related to the estimation of financial distress prediction models.J.Accounting Res.22,59–82.

6 August 2014

.Tel.:+86 13880900676.

E-mail addresses:Hongqi.Liu@baruch.cuny.edu(H.Liu),sara870515@hotmail.com(N.Xu),Jianmng.Ye@baruch.cuny.edu(J.Ye).

☆Our project was supported by the China Scholarship Council.

http://dx.doi.org/10.1016/j.cjar.2015.02.002

1755-3091/©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

China Journal of Accounting Research2015年2期

China Journal of Accounting Research2015年2期

- China Journal of Accounting Research的其它文章

- Management earnings forecasts and analyst forecasts: Evidence from mandatory disclosure system

- Monetary policy and dynamic adjustment of corporate investment:A policy transmission channel perspective

- The effect of stock market pressure on the tradeoff between corporate and shareholders’tax benefits

- Guidelines for Manuscripts Submitted to The China Journal of Accounting Research