The effect of stock market pressure on the tradeoff between corporate and shareholders’tax benefits

Ming-Chin Chen

Department of Accounting,College of Commerce,National Chengchi University,Taiwan

The effect of stock market pressure on the tradeoff between corporate and shareholders’tax benefits

Ming-Chin Chen*

Department of Accounting,College of Commerce,National Chengchi University,Taiwan

A R T I C L EI N F O

Article history:

Accepted 30 December 2014

Available online 24 March 2015

Corporate tax planning

Shareholder tax benefits

Stock market pressure

Financial reporting costs

Earnings persistence

The Taiwanese government offers firms that invest in qualified projects in emerging high-tech industries two mutually exclusive tax incentives—a corporate 5-year tax exemption or shareholder investment tax credits.This study examines whether corporate managers take shareholder tax benefits into account in their corporate tax planning.The results show that privately held firms are more likely than listed firms to choose shareholder investment tax credits and forego corporate tax benefits.Listed firms with relatively high earnings response coefficients tend to choose a corporate 5-year tax exemption,as it can enhance reported after-tax earnings.Further,in the 5-year period following their choice of a particular tax incentive,firms choosing a corporate 5-year tax exemption exhibit significantly lower earnings persistence than those choosing shareholder investment tax credits.Taken together,these results suggest that stock market pressure has a significant effect on firms’choices between corporate and shareholder tax benefits,and that the choice of tax incentives has an effect on future earnings quality.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

To promote technological advancement,the Taiwanese government provides two mutually exclusive tax incentives to stimulate investment in qualified high-tech industries.1Companies that invest in the qualified industries can select either a 5-year exemption from corporate income tax on income derived from those investments or they can pass the tax incentive to their shareholders by granting shareholders investment tax credits of up to 20%(for corporate shareholders)or 10%(for individual shareholders)of the qualifiedinvestment amount.2The credit rate depends on the type of shareholder.The credit rate is 20%for corporate shareholders and 10%for individual shareholders.Firms that choose a corporate 5-year tax exemption must relinquish the application for shareholder investment tax credits, and vice versa,with no alteration being allowed after the choice is made.As only one of the two alternatives can be selected,the choice of tax incentive is an important tax planning decision as to whether firms should keep the tax benefit at the corporate level or pass it to their shareholders.In Taiwan,the overall tax revenue losses resulting from these two tax incentives during the 1999–2005 period amounted to about US$3.6 billion.3Financial Data Center,Ministry of Finance(Taiwan),Statistics on Tax Revenues of Profit-Seeking Enterprise Income Tax(1999–2005).The magnitude of the tax-savings from the two tax incentives is so significant that the choice between the two alternatives is generally regarded as one of the most important tax planning decisions made by managers in Taiwan.

The choice between shareholder tax benefits and corporate tax exemptions offered to managers of Taiwanese firms provides researchers with an opportunity to examine whether firms take shareholder taxes into account when making corporate tax planning decisions.Prior studies have addressed the role of capital market incentives in firms’tax planning concerns(Cloyd et al.,1996;Klassen,1997;Armstrong et al.,2012; Graham et al.,2014).These studies,however,focus on the trade-off between corporate tax benefits and financial reporting costs.They have not addressed if and how capital market incentives affect a firm’s choice between corporate and shareholder tax benefits.This study empirically investigates whether firms consider shareholder tax benefits when making corporate tax planning decisions in the presence of capital market pressure.

Scholes et al.(2015)emphasize in their classic textbook Taxes and Business Strategy:A Planning Approach that effective tax planning should take“all parties”into consideration.The Taiwanese context,in which firms choose either a corporate 5-year tax exemption or shareholder investment tax credits,constitutes a rare opportunity to empirically investigate how firms make the trade-off between corporate and shareholder tax benefits in tax planning.

Maximizing the overall tax benefits for a firm and its stockholders is contingent upon accurate forecasts of the firm’s profitability in the 5-year period following the qualified investment.Ex-ante,if the projected tax-savings from a corporate 5-year tax exemption exceed those of shareholder investment tax credits,firms should choose a corporate 5-year tax exemption.Conversely,if the aggregate amount of shareholder investment tax credits exceeds the tax-savings of a corporate 5-year tax exemption,then the firm should choose shareholder investment tax credits and thereby shift the tax benefits directly to its stockholders.

Consider,as an example,an investment of$100 million in a qualified project.If the firm chooses shareholder investment tax credits,its shareholders may directly obtain tax credits of up to$20 million(for corporate shareholders)or$10 million(for individual shareholders).Conversely,if the firm chooses a corporate 5-year tax exemption,assuming that the rate of return on the project is a constant 20%per annum and the corresponding corporate tax rate is 25%,4Taiwan’s corporate income tax rate is essentially a flat rate of 25%for taxable income above NT$100,000.the firm’s overall tax savings during the 5-year period will be(undiscounted)$25 million in total.In the latter case,the shareholders pay the associated incremental individual income taxes,while the company distributes the tax-exempt earnings in the form of dividends.Thus,the optimal decision is based on the trade-off between corporate and shareholder tax savings.

In addition to creating tax savings for either firms or shareholders,the choice between the two tax incentives may also affect firms’reported earnings.Firms that choose a corporate 5-year tax exemption can directly reduce their corporate income tax expenses,whereas firms that pass investment tax credits to their shareholders still have to pay corporate income tax.Thus,ceteris paribus,firms choosing a corporate 5-year tax exemption will report greater after-tax earnings in their financial statements than firms choosing shareholder investment tax credits.Consequently,when choosing a tax incentive,firms are also making a trade-off between corporate financial reporting costs and shareholder tax benefits.

This study conducts empirical tests in the following two ways.First,I compare the tax planning decisions of privately held and listed firms.5Privately held firms’stocks are not listed on either of the two stock exchanges.Hence,privately held firms are not subject to stock price pressure from the capital market.Compared with listed firms,privately held firms,which do not have stock price pressure from the capital market,are more likely to choose shareholder investment tax credits,thereby givingtax benefits directly to their shareholders.I examine whether the difference in stock price pressure between the two types of firms affects their choice between a corporate 5-year tax exemption and shareholder investment tax credits.

Second,I examine how tax planning decisions within listed firms vary with different levels of capital market pressure.As listed firms may differ in their level of stock price pressure,the incentive for them to increase reported earnings may also vary with the pressure from the capital market.For instance,listed firms with relatively high earnings response coefficients(ERCs),whose stock returns exhibit a high degree of covariation with reported earnings,are more likely than firms with low ERCs to have strong incentives to increase reported earnings to reduce their financial reporting costs.Accordingly,firms with high ERCs are more likely to choose a corporate 5-year tax exemption than firms with low ERCs.Hence,I use ERCs as a direct proxy for the degree of stock price pressure on listed firms and examine whether differences in listed firms’stock price pressure affect their choice of a corporate 5-year tax exemption or shareholder investment tax credits.6Unlike the US,Taiwan does not have sophisticated analyst-following data.Only a few well-known companies are followed by foreign analysts.Most Taiwanese companies do not have available data on analyst following or earnings forecasts.Therefore,I use ERCs as a proxy for stock price pressure.

To analyze the economic consequences of the choice of tax incentive,I further examine whether financial reporting incentives are different in firms that choose different types of tax incentives.For firms that choose shareholder investment credits,the total tax benefits of shareholders are determined by the qualified investment amount and are thus independent of firms’future earnings.In contrast,for firms choosing a corporate 5-year exemption,the total corporate tax benefits depend on the firms’future earnings during the 5-year exemption period.Thus,compared with firms that choose shareholders tax benefits,firms that choose a corporate 5-year exemption are likely to have a greater incentive to maximize their earnings during the exemption period,resulting in lower levels of earnings persistence.

The results of this study show that privately held firms are more likely than listed firms to choose shareholder investment tax credits.Additionally,listed firms with relatively high ERCs tend to choose a corporate 5-year tax exemption that increases their reported after-tax earnings.Further,in the 5-year period following their choice of a tax incentive,firms choosing a corporate 5-year tax exemption exhibit significantly lower earnings persistence than those choosing shareholder investment tax credits.Together,these results suggest that stock price pressure has a significant effect on firms’choices of corporate or shareholder tax benefits, and that the type of tax incentive affects future earnings quality,as proxied by earnings persistence.The results of this study extend the findings of previous studies(Cloyd et al.,1996;Klassen,1997;Armstrong et al.,2012; Graham et al.,2014)by providing evidence that firms’tax planning decisions involve a trade-off between shareholder-level tax benefits and corporate reported earnings.

The remainder of this paper is organized as follows.Section 2 discusses previous empirical research on corporate tax planning.Section 3 develops the research hypotheses and describes the empirical procedures and sample used to test the hypotheses.Section 4 presents and discusses the empirical findings,and Section 5 concludes the paper with a discussion of the research results and their implications.

2.Related research

Tax planning plays an important role in business operations,yet few empirical studies have investigated the tax planning behavior of firms,as firms’tax planning data are confidential.Ke(2001)investigates the effect of the 1993 increase in the personal tax rate relative to the corporate tax rate on managerial compensation in privately held insurance companies.He finds that after 1993,in response to the changes in the relative rate schedules for individual and corporate income taxes,management-owned insurance companies pay their shareholders/managers less tax-deductible compensation than a control sample of non-management-owned counterparts.This result implies that when designing optimal shareholder/manager compensation,firms attempt to minimize the overall tax costs of both firms and shareholders.

The tax rate reduction of the 1986 Tax Reform Act(TRA 86)provides an experimental setting for examining firms’motivations to shift income from corporations to shareholders.As the TRA 86 reduces the toppersonal tax rate to 28%,which is lower than the top corporate tax rate of 34%,C corporations,which unlike S corporations are subject to double taxation,have the incentive to shift income from corporations to shareholders,and,as a result,yield a lower pretax rate of returns.Using a sample of 6839 privately held C and S corporations from the motor carrier industry from the 1984–1992 period,Enis and Ke(2003)examine the effect of the TRA 86 on income shifting from corporations to shareholders.They estimate that during the sample period C corporations shifted an average of$130,587 of taxable income each year to shareholders after the TRA 86 was enacted.

Ke(2001)and Enis and Ke(2003)show that contingent upon the relative corporate and individual tax rates,managers do engage in strategic shifting of corporate taxable income to shareholders to minimize the overall tax burden for both firms and shareholders.This is consistent with the conclusion of Scholes et al. (2015)that an effective tax planning framework considers all stakeholders.By analyzing changes in reported earnings and other financial variables corresponding to changes in tax policies(e.g.,TRA 86),these studies provide indirect evidence that firms seek to minimize the overall tax burden of their stakeholders in their strategic tax planning.In summary,previous studies support a broader hypothesis that rational firms will attempt to maximize the overall tax and nontax benefits of their stakeholders by making effective tax planning decisions.In contrast,this study directly observes firms’selection of specific alternative incentives that offer tax savings to either the firm or to its shareholders.Thus it provides a natural experiment to directly examine the factors associated with firms’specific tax planning decisions.

An alternative hypothesis to firms seeking to minimize the overall tax burden of stakeholders is that they balance this aim with the need to minimize financial reporting costs.Financial reporting costs(or capital market pressure,Klassen(1997))are non-tax costs,such as debt covenant violation,reduced executive compensation and the perceived negative stock market consequences associated with reductions in reported earnings(Cloyd et al.,1996;Klassen,1997;Armstrong et al.,2012;Graham et al.,2014).In a survey of financial executives of large and medium-sized public and private manufacturing firms,Cloyd et al.(1996)show that public firms with higher financial reporting costs are less inclined than private firms with lower financial reporting costs to choose financial accounting methods that conform to an aggressive tax position. Consequently,private firms are more likely to choose accounting methods that are less optimistic but are likely to increase the probability of successfully defending their tax positions if challenged by the IRS. These results suggest that in defending an aggressive tax position,managers face a trade-off between financial reporting costs and corporate tax benefits.

Using the concentration of inside ownership as a proxy for capital market pressure,7Klassen argues that firms with greater concentration of inside ownership experience less pressure from the capital market,whereas the opposite is true.Klassen(1997)finds that in the trade-off between financial and tax reporting,firms with greater inside ownership concentration tend to favor corporate tax benefits,whereas those with lower inside ownership concentration tend to favor financial reporting costs.

Using proprietary data on the incentive compensation of tax directors of public companies,Armstrong et al.(2012)find a strong negative relationship between the incentive compensation of tax directors and the GAAP effective tax rate,but little relationship between the incentive compensation of tax directors and other tax attributes.These results indicate that tax directors of public companies are provided with incentives to reduce the level of tax expense reported in financial statements.

Analyzing survey responses from nearly 600 corporate tax executives,Graham et al.(2014)find that financial accounting incentives play an important role in tax planning—84%of surveyed publicly traded firms responded that the top management at their company cares at least as much about the GAAP ETR as they do about cash taxes paid.In addition,their regression results show that the primary driver for determining the relative importance of financial concerns is capital market incentives,as proxied by being publicly traded,having a high analyst following or having high institutional ownership.

Prior research indicates that public companies have strong incentives for considering financial reporting concerns in tax planning decisions(Klassen,1997;Armstrong et al.,2012;Graham et al.,2014).These studies, however,do not examine the trade-off between corporate financial reporting costs and shareholder taxbenefits:a potential trade-off may exist under the principle that effective tax planning should take into account all parties(Scholes et al.,2015).Thus,this study extends the literature by examining how firms make the choice between corporate and shareholder tax benefits.Further,instead of using survey data,this study uses firms’actual choices of tax incentives to analyze the determinants of the trade-off between corporate and shareholder tax benefits.

3.Research hypotheses and research methods

3.1.Research hypotheses

First,I consider the effect of stock market pressure on the choice between a corporate 5-year tax exemption and shareholder investment tax credits.For listed firms,the perceived stock market consequences of reported earnings are directly associated with the selected tax treatment.To increase reported after-tax earnings,listed firms are more likely to choose a corporate 5-year tax exemption.Conversely,privately held firms do not experience stock price pressure from the capital market and are accordingly more likely than their listed counterparts to choose shareholder investment tax credits and thereby directly pass tax benefits to their shareholders.Hence,the first hypothesis for this study is as follows.

H1.Privately held firms are more likely than listed firms to choose shareholder investment tax credits.

Second,I consider the effect of market pressure on the choice between a corporate 5-year tax exemption and shareholder investment tax credits.The measure of particular interest is the perceived capital market consequences of the reported net income associated with the selected tax treatment.I capture market pressure using firms’ERCs,which exhibit the levels of covariation between unexpected earnings and stock returns.Hence, changes in earnings will have a greater effect on listed firms with high ERCs than on those with low ERCs. Consequently,when trading off between financial reporting costs and shareholder tax benefits,listed firms with high ERCs are more likely to choose a corporate 5-year tax exemption,as it will increase the reported after-tax earnings in financial statements.Accordingly,the second hypothesis for this study is as follows.

H2.Listed firms with relatively high ERCs are more likely to choose a corporate 5-year tax exemption than listed firms with relatively low ERCs.

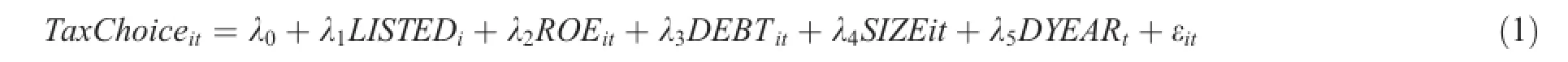

3.2.Regression model

3.2.1.Effect of stock price pressure on listed and privately held firms’choices of tax incentives

The sample for the examination of the effect of stock market pressure on the trade-off between corporate reported earnings and shareholder tax benefits includes both listed and privately held firms.As the dependent variable is the choice of one of the two tax incentives,I use a dummy variable(TaxChoice)to represent the choice decision and use a logistic regression estimation to analyze the tax planning decision.TaxChoice is set to one if the firm chooses shareholder investment tax credits and set to zero if it chooses a corporate 5-year tax exemption.The logistic regression model is as follows.

where the subscript i represents the individual firm and t is the sample year.The definitions of the independent variables are as follows(expected signs on regression coefficients are in brackets).

LISTED(–)A dummy variable for firms with stocks listed on the stock market.LISTED is set to 1 if the firm is a listed firm,and set to 0 if it is a privately held company

ROE(–)Return on common stockholders’equity,measured by(net income–preferred stock dividends)÷common stockholders’equity

DEBT(–)Debt ratio,measured as long-term liabilities÷total assets

SIZE(?)Firm size,measured by the natural log value of net sales

DYEAR(+)A dummy variable for the sample period after the implementation of the Imputation System in Taiwan.Taiwan implemented the Imputation System in 1998;hence,DYEAR is set to 1 if the sample year is 1998 or later,and 0 otherwise

In Model(1),stock market pressure is represented by the coefficient on LISTED,an indicator variable for listed firms.According to the first hypothesis,in the presence of stock price pressure from the capital market, listed firms are more likely than privately held firms to choose a corporate 5-year tax exemption to increase reported after-tax earnings in financial statements.Hence,the coefficient on LISTED is expected to be negative.

ROE and DEBT are included in the regression model to control for the effect of firms’profitability and financial obligations on their choice of tax incentive.ROE is return on common stockholders’equity. Shareholders are more willing to preserve cash flows within firms if the firms have higher ROEs.Thus,firms with higher ROEs are more likely to choose a corporate 5-year tax exemption to reduce income tax payable at the corporate level and enable them to preserve more after-tax cash flows.DEBT is measured by long-term debt divided by total assets.To avoid violating debt covenants,firms with higher debt ratios have a greater need to preserve cash flows to pay off interest and debt that is due(Begley,1990;DeFond and Jiambalvo, 1994).Accordingly,they may be more inclined to choose a corporate 5-year tax exemption to reduce the amount of cash needed to pay for corporate income tax.

SIZE is the natural log value of net sales and is used to control for the potential size effect on the propensity of firms to choose between the two tax incentives.SIZE is related to unobservable firm characteristics,such as diversification in ownership,growth opportunities,and economies of scales that may produce different propensities in tax planning(Mills et al.,1998).There is no predicted sign on the coefficient of SIZE.

DYEAR is a dummy variable for the period after the implementation of the Imputation System in Taiwan. Taiwan implemented the Imputation System in 1998.The Imputation System grants income tax that is paid at the corporate level as imputation tax credits(ITCs)to individual shareholders and allows individual shareholders to offset their income taxes with ITCs.If the individual income tax payable by a shareholder is less than the received ITCs,the shareholder can claim tax refunds for the excess of the received ITCs over his or her income tax payable.Hence,from a shareholder’s perspective,income tax paid at the corporate level can offset income tax payable when filing individual tax returns and thus will not cause an increase in overall tax costs under the Imputation System.Accordingly,I expect that in the period after the implementation of the Imputation System,firms have fewer incentives to reduce income tax at the corporate level and more incentives to directly reduce taxes at the shareholder level.

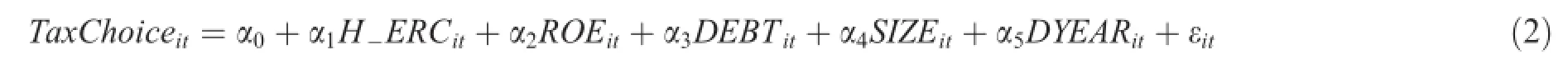

3.2.2.Effect of stock price pressure on listed firms’choices of tax incentives

The second research hypothesis concerns the effect of differences in ERCs on listed firms’choices of tax incentives.To capture the market pressure caused by the relative values of firms’ERCs,H_ERC replaces LISTED in the regression model.H_ERC is an indicator variable for listed firms with relatively high ERCs.H_ERC is set to 1 if the firm’s ERC is greater than the median ERC of all of the listed firms,and 0 otherwise.The regression model is as follows:

The definitions and measures of DYEAR,ROE,SIZE and DEBT in Model(2)are the same as in Model (1).

Following Collins and Kothari(1989)and Ali and Zarowin(1992),the estimation of ERCs proceeds as follows:

where the subscript i represents the individual firm and T is the estimation period that spans the 20 quarters preceding the year in which the sample firm chooses a tax incentive.Q represents the four quarters of a year by setting Q=1 to 4.Model(3)is estimated separately for each sample firm.The individual firm’s ERC isobtained by the estimated regression coefficient^b on(ΔX/P).In each firm’s regression estimation,the sample period covers 20 quarters.8To obtain stable regression estimates,firms with data from less than 10 of the 20 quarters are excluded from the sample.The definitions and measures of the dependent and independent variables in Model(3)are as follows.

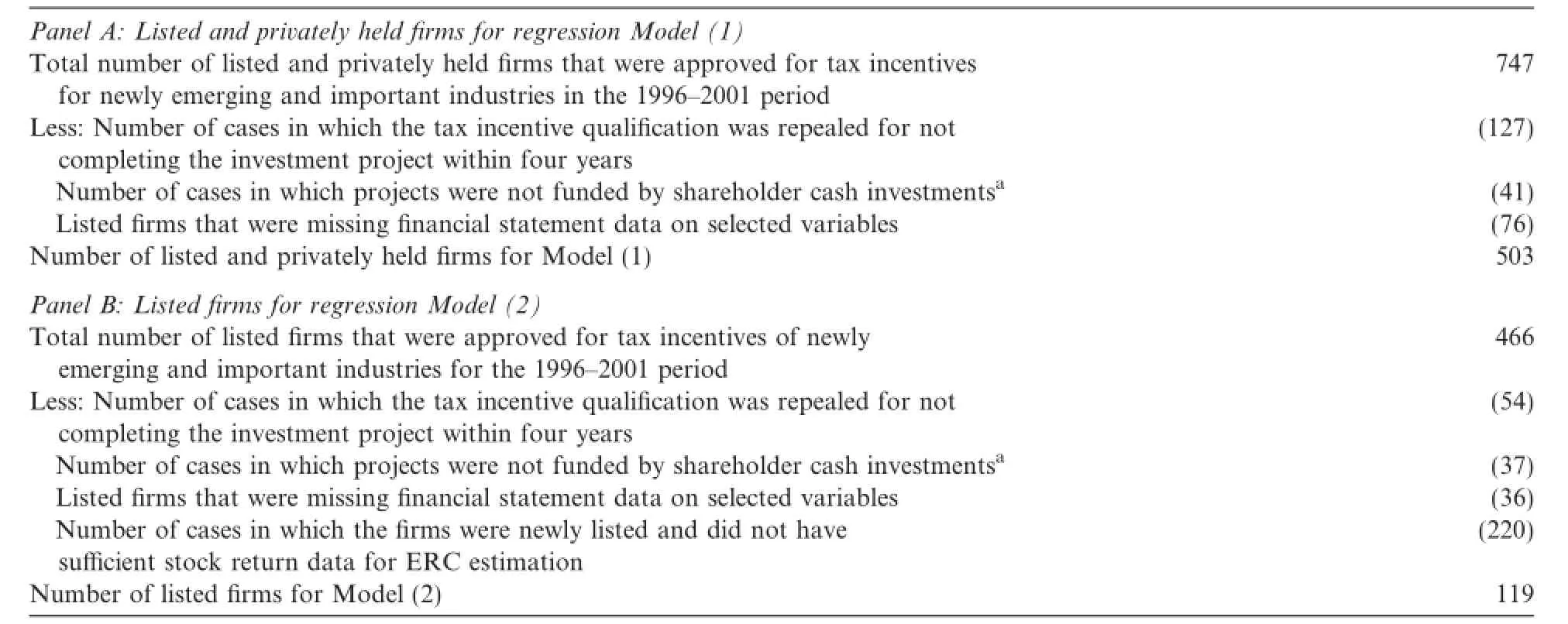

Table 1 Sample selection procedures.

RetIndividual firm i’s stock returns over the quarter QT

ΔXUnexpected earnings,ΔXQT=XQT–XQ(T-1).To account for seasonal fluctuations in quarterly data,unexpected quarterly earnings are calculated by subtracting the current quarter’s earnings from the same quarter earnings in the previous year

PClosing stock price at the end of the quarter QT

RetMktRate of return of the market portfolio over the quarter QT

RetRFRisk-free interest rate for quarter QT,measured by the deposit interest rate of the Bank of Taiwan (the government-owned bank)

3.3.Data and sample selection

Panels A and B of Table 1 outline the sample selection procedures for regression Models(1)and(2), respectively.The sample consists of firms that applied to the Ministry of Finance(Taiwan)for approval of qualified investments in emerging high-tech industries between 1996 and 2001.According to the Statue of Upgrading Industries(Taiwan),to claim the tax incentives,approved investment projects have to be completed within four years of the government’s approval.The choice between the two tax incentives is made when the firms complete their planned investment projects.Hence,I collect data on each firm’s choice of tax incentive when the firm finishes its investment plan.The annual financial statement data used in the regression models are from the year when the firm makes its tax incentive decision.

8Quarterly data are used to estimate ERCs because Taiwanese companies have a relatively short history compared with U.S. corporations.Using yearly data results in a significant reduction in sample size.

Panel A of Table 1 shows the initial sample of 747 cases of investment projects approved for tax incentives. The qualification for tax incentives was repealed in 127 cases due to failure to complete the investment projects within four years.The 41 firms with projects that were not funded by shareholder cash investments did not qualify for shareholder investment tax credits and could only apply for the corporate 5-year tax exemption; thus,they are excluded from the sample.Seventy-six firms are excluded for missing financial statement data on selected variables.Hence,the final sample for Model(1)consists of 503 firms.Similar selection procedures are applied to the sample for Model(2),as detailed in Panel B of Table 1.The final sample for Model(2)consists of 119 listed firms.

4.Results

4.1.Effect of capital market pressure on the choice of tax incentives—listed and privately held firms

4.1.1.Descriptive statistics and univariate analysis

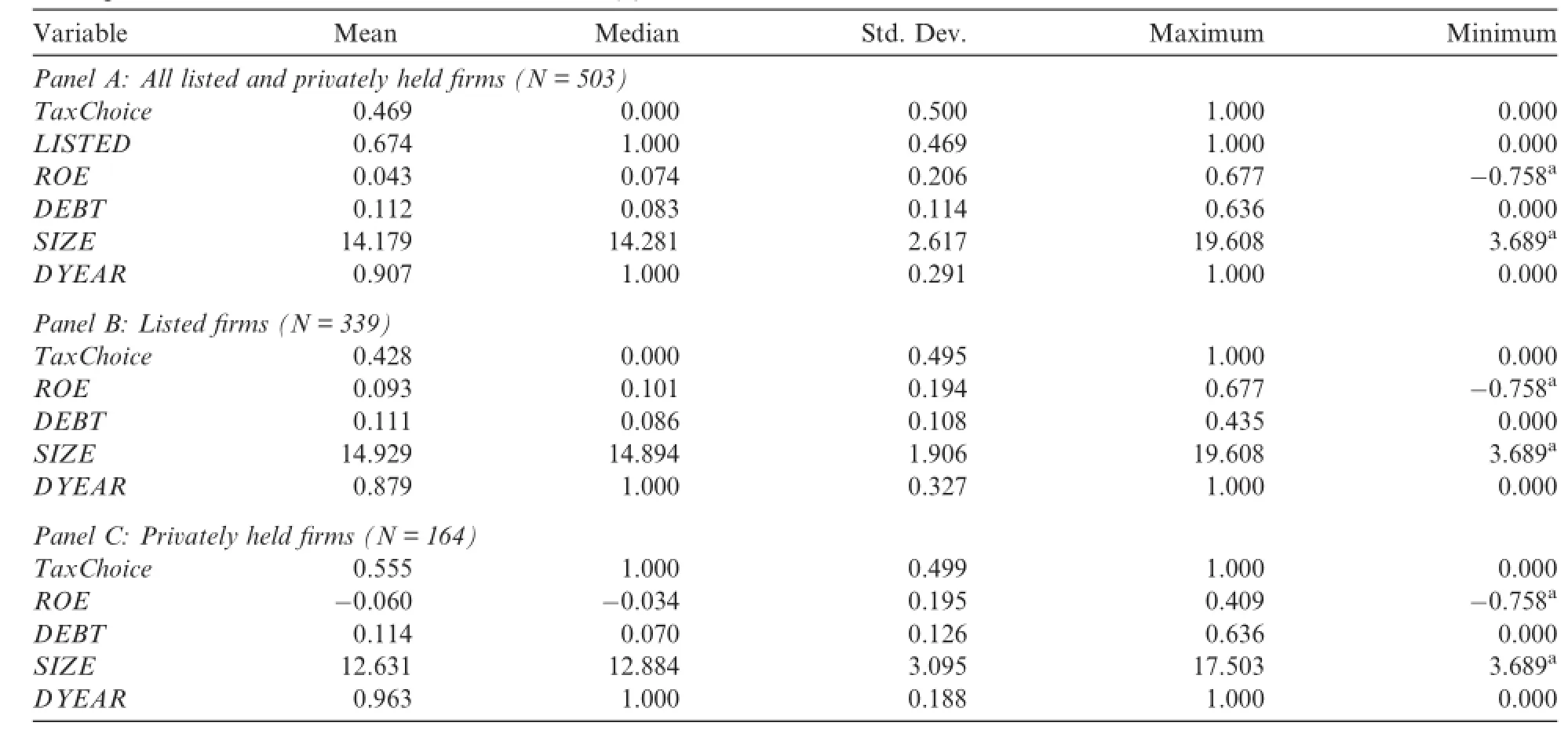

Panels A,B,and C of Table 2 provide descriptive statistics of selected variables for the full sample,listed companies and privately held companies,respectively.The mean value of TaxChoice for privately held companies(0.555)is higher than that of listed companies(0.428),suggesting that privately held companies are more likely to choose shareholder investment tax credits.The mean values of SIZE and ROE in listed companies are greater than in the privately held companies,indicating that listed companies are usually larger in size and more profitable.

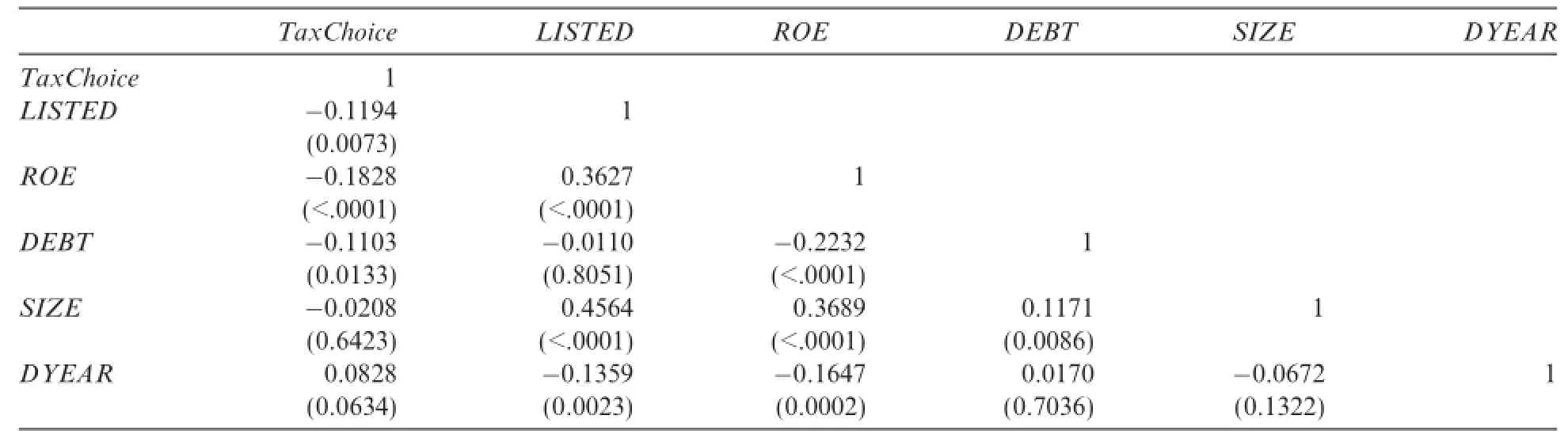

Table 3 shows the results of the correlation analysis of the dependent and independent variables.LISTED is significantly negatively related to TaxChoice,which is consistent with H1 in that listed firms are more likely to choose tax incentives that enhance reported corporate earnings.In addition,ROE is significantly negativelycorrelated with TaxChoice,suggesting that firms with greater ROEs are more likely to choose a corporate 5-year tax exemption.

Table 2 Descriptive statistics for selected variables—Model(1).

Table 3 Correlation analysis of selected variables—Model(1).

4.1.2.Logistic regression results

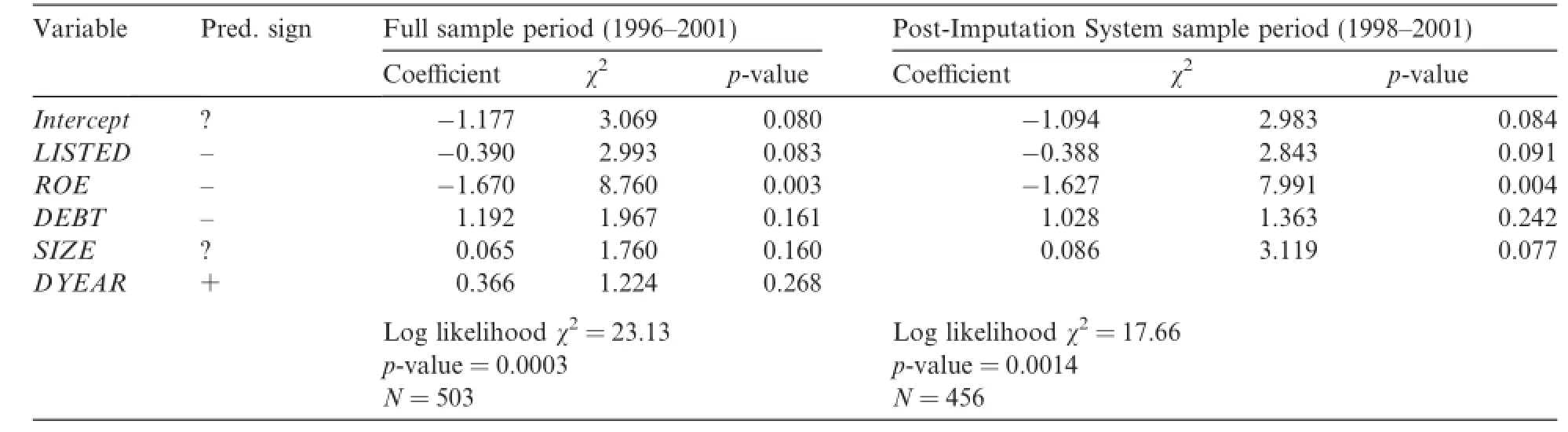

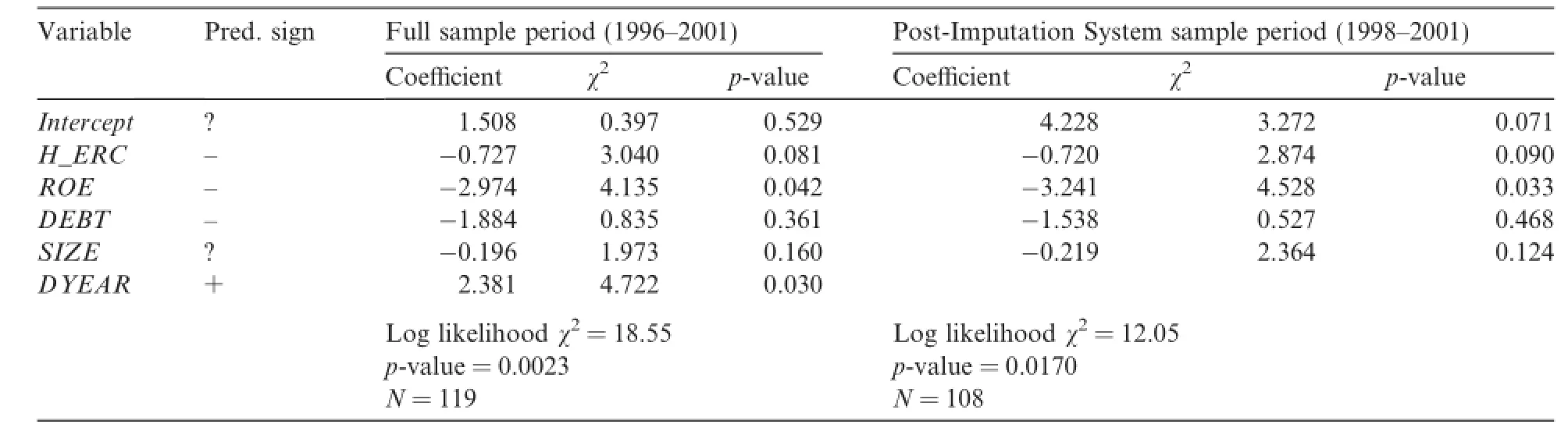

The left panel of Table 4 presents the logistic regression results for the full sample.The model’s log likelihood χ2is 24.34 and its p-value is 0.0002,suggesting that the regression model has overall good explanatory power.

In the regression results for the full sample period,the coefficient on LISTED is significantly negative,with a p-value equal to 0.074.This result is consistent with H1 in that listed firms in the presence of stock price pressure tend to choose a corporate 5-year tax exemption to reduce financial reporting costs,whereas privately held firms that do not have stock price pressure from the capital market are more likely to choose shareholder investment tax credits and thereby directly pass tax benefits to their shareholders.

The coefficient on ROE is significantly negative with a p-value of 0.005.This is consistent with the prediction that firms with higher return on equity are able to make more efficient use of funds and thus tend to choose a corporate 5-year tax exemption to retain more after-tax cash flows within firms.

4.1.3.Additional analysis

Since Taiwan implemented the Imputation System in 1998,income tax paid at the corporate level is imputed as tax credits at the individual shareholder level.Transformations in the tax system may result in structural changes to firms’tax planning propensity,as the motivation to minimize corporate income tax may be less strong under new tax systems.Hence,I further modify the sample to examine whether differences in stock price pressure faced by listed companies continue to affect their choices of tax incentives under the Imputation System.

The right panel of Table 4 reports the regression results for the 1998–2001 sample period.The results show that the coefficient on LISTED remains significantly negative with a p-value of 0.081.The coefficients and significance levels of the other variables are not significantly different from those for the full sample period.This result suggests that under the Imputation System the effect of capital market pressure remains pronounced for listed firms when there is a trade-off between reported corporate earnings and shareholder tax benefits.

Table 4 Logistic regression results for Model(1).

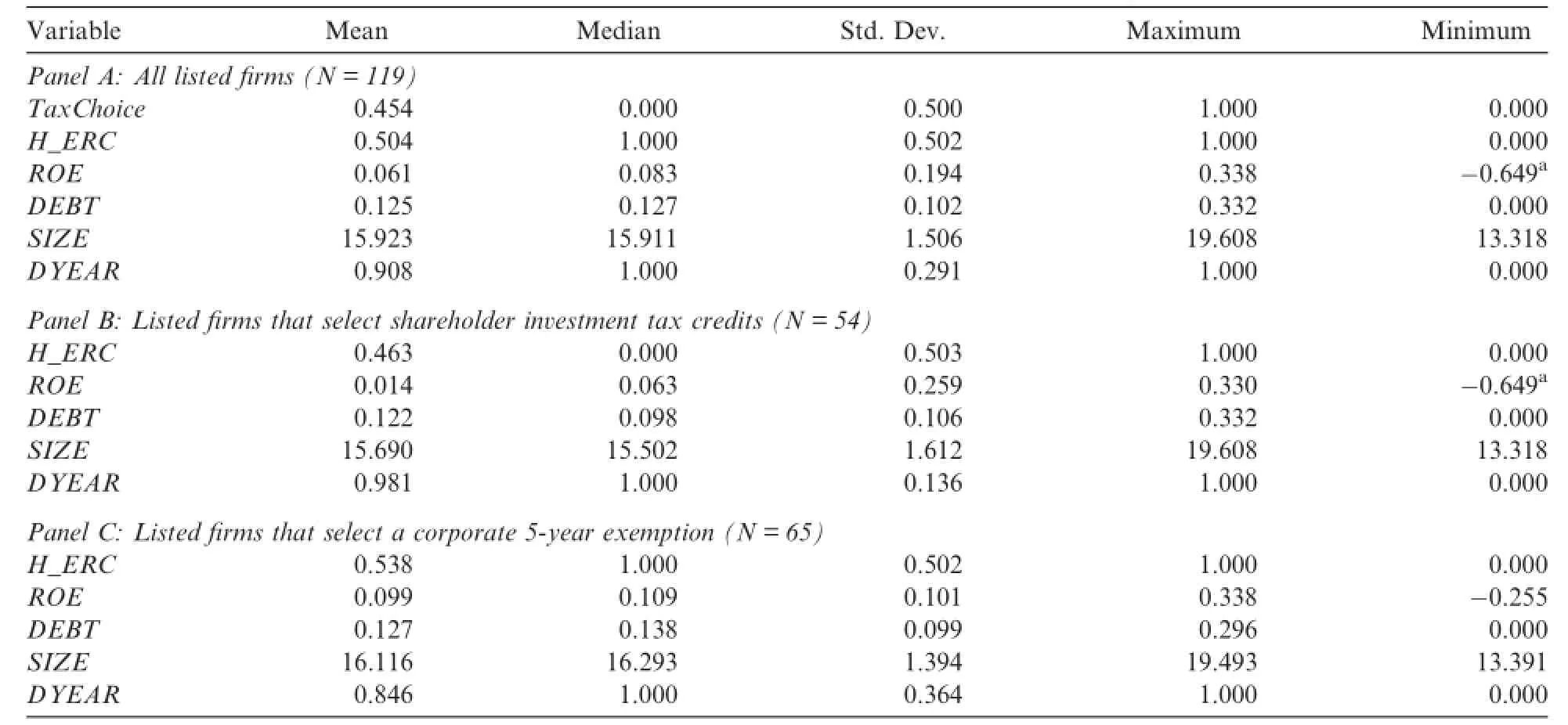

Table 5 Descriptive statistics for selected variables—Model(2).

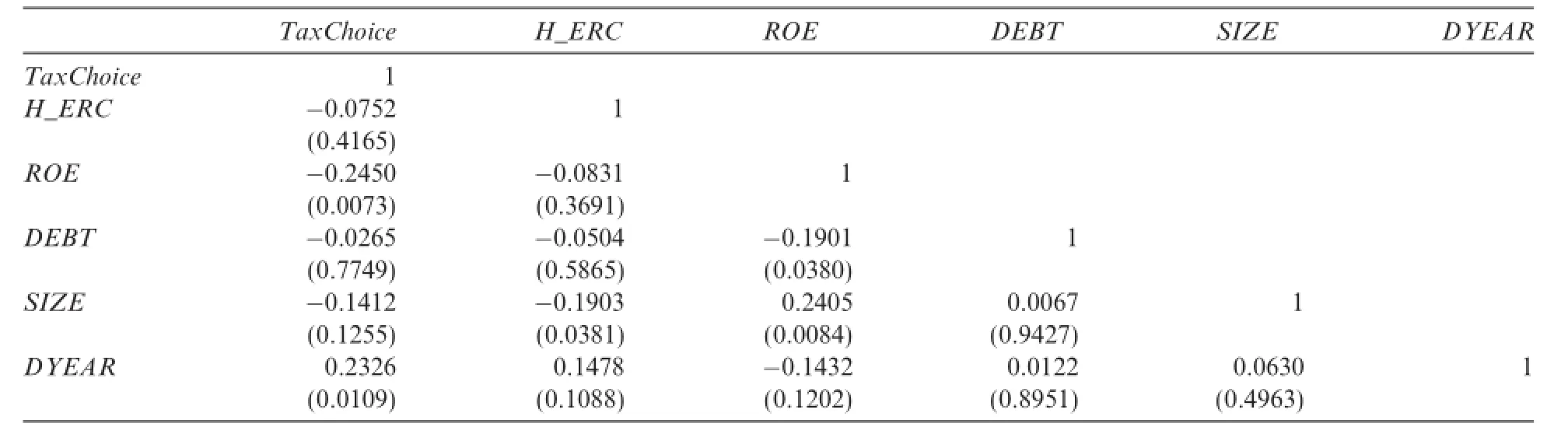

Table 6 Correlation analysis of selected variables—Model(2)(N=119).

4.2.Effect of stock price pressure on listed firms’choices of tax incentives

4.2.1.Descriptive statistics and univariate analysis

To enhance the validity of the research findings,the sample is further modified to examine whether differences in ERCs produce differential effects on listed firms’choices of tax incentives.Panel A of Table 5 presents the descriptive statistics of selected variables for the sample of listed firms.Panels B and C of Table 5 list the descriptive statistics for listed firms that select shareholder investment tax credits and those that choose a corporate 5-year tax exemption,respectively.Consistent with expectations,the mean H_ERC of firms that choose a corporate 5-year exemption(0.538)is greater than that of firms that choose shareholder investment tax credits(0.463).The mean ROE of firms that choose a corporate 5-year exemption(0.099)is also higher than that of firms that choose shareholder investment tax credits(0.005).Table 6 presents the results of the correlation analysis for the dependent and independent variables.Similar to the results for the full sample,ROE is significantly negatively related to TaxChoice,suggesting that listed firms with greater ROEs are more likely to choose a corporate 5-year tax exemption.

4.2.2.Logistic regression results

Table 7 presents the logistic regression results for listed companies.The model’s log likelihood χ2is 18.65 and its p-value is 0.0022.In addition,the correct ratio of predicted decisions based on a cutoff probability of 0.5 is about 70.7%.

The left and right panels of Table 7 present the results for the full sample period and the 1998-2001 sample period,respectively.The coefficients on H_ERC in both panels are negative and significant at 0.1,lending support to H2 in that listed companies with relatively higher ERCs,i.e.have a higher correlation between reported earnings and stock prices,tend to choose a corporate 5-year tax exemption to increase their aftertax earnings in financial statements.Both of the stock market pressure variables,LISTED and H_ERC, are significantly negative in Tables 4 and 7.However,the coefficients on DEBT are insignificant in Tables 4 and 7,suggesting that stock market pressure is a greater financial reporting incentive than debt covenant restrictions in firms choosing between the two types of tax benefits.

The coefficients on ROE in both of the regression results are negative and significant,consistent with the prediction that firms with higher return on equity tend to choose a corporate 5-year tax exemption to retain more after-tax cash flows within firms.Profitable firms are able to make more efficient use of funds and,as aresult,their shareholders are willing to retain cash flows within firms.Finally,consistent with expectations,the coefficient on DYEAR in the full sample regression results is positive and significant,suggesting that since the implementation of the Imputation System,firms prefer shareholder investment tax credits that directly reduce taxes payable at the shareholder level.

Table 7 Logistic regression results for Model(2).

The financial statement data used in Models(1)and(2)are from the year in which the firm makes its decision.I also conduct robustness tests using financial statement data from the year before the firm makes its decision.The untabulated results are qualitatively similar to those shown in Tables 4 and 7.

4.2.3.Additional analysis

In choosing a tax incentive,a company is also deciding whether to transfer resources out of the firm to its shareholders.A controlling shareholder may influence a company’s decision.Therefore,I further control for the effect of controlling shareholders’stake by adding the percentage of shares held by the top five shareholders(TOP5)to Model(2).The untabulated regression results show that the coefficient on TOP5 is positive but insignificant,perhaps because tax benefits passing directly to shareholders are proportional to the percentage of shares they own if the company chooses shareholder investment credits,thereby reducing the potential conflict of interest between controlling and minority shareholders.Nevertheless,after controlling for the percentage of shares held by controlling shareholders,the coefficients on H_ERC remain negative and significant at 0.1,consistent with H2.In addition,the coefficients and significance levels of the other variables are not significantly different from those displayed in Table 7.

4.3.Effect of tax incentive choice on earnings persistence

In addition to the trade-off between tax benefits and financial reporting costs,the choice between a corporate five-year tax exemption and shareholder investment tax credits is likely to affect a firm’s future earnings planning.For firms choosing shareholder investment tax credits,the total credit amount of their shareholder tax benefit is determined by the amount of the qualified investment approved by the government.Therefore, their shareholder tax benefits are independent of the firms’future earnings.

In contrast,for firms choosing a corporate five-year exemption,the total amount of their corporate tax benefit depends on the firms’earnings during the five-year tax-exemption period.To maximize corporate tax benefits it is necessary to increase the firms’earnings during the five-year tax-exemption period that follows the approval of the tax incentive.As a consequence,firms engaging in maximizing their earnings during thefive-year tax exemption period may have lower earnings persistence.To examine the possible economic consequences of different tax incentives,I further test whether firms choosing a corporate five-year exemption are likely to have lower earnings persistence than those choosing shareholder investment tax credits during the five-year exemption period.

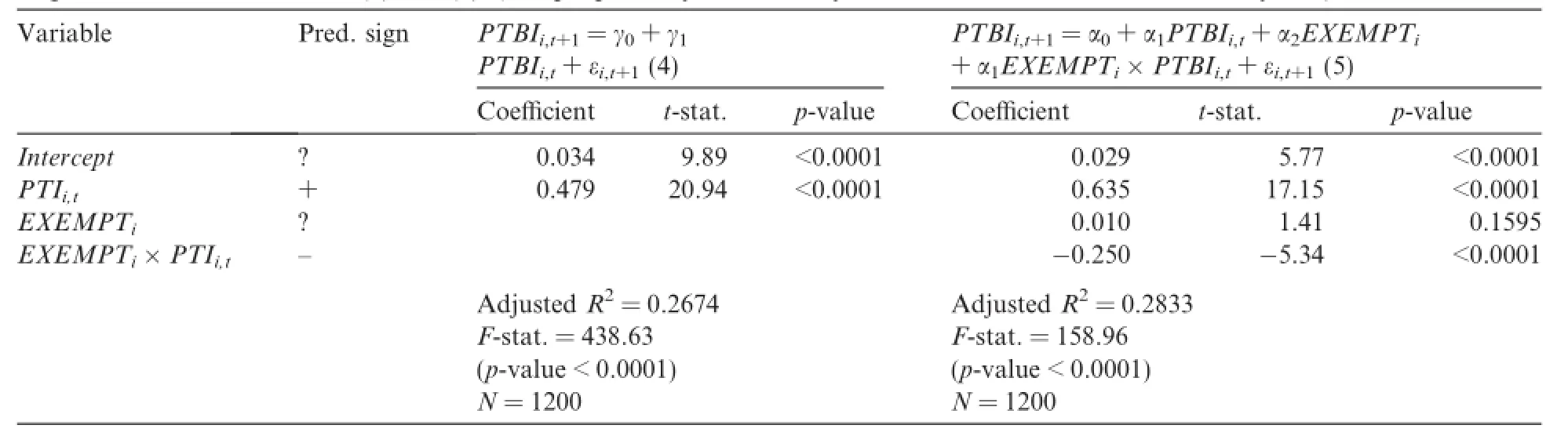

Following Hanlon(2005)and Blaylock et al.(2012),I construct the following two earnings persistence equations as Models(4)and(5)to examine whether firms choosing a corporate five-year exemption tend to have lower earnings persistence.

where PTBI is pretax accounting income scaled by average total assets for cross-sectional comparability, and the coefficients γ1and α1are estimates of the mapping of current-period pretax earnings into future (one-period)earnings,referred to as the persistence parameter(Blaylock et al.,2012).EXEMPT is a dummy variable set to 1 if the firm chooses a corporate 5-year tax exemption,and 0 if it chooses shareholder investment tax credits.EXEMPT×PTI is the interaction term of EXEMPT and PTI.EXEMPT×PTI captures the effect of a 5-year exemption on earnings persistence.

Model(4)is the baseline model that forms the basis of earnings persistence tests in Hanlon(2005)and Blaylock et al.(2012).I add EXEMPT and EXEMPT×PTBI to Model(5)to test whether the choice of a corporate five-year exemption has a negative effect on firms’earnings persistence.I expect α3,the coefficient on EXEMPT×PTBI,to be negative if the choice of a corporate 5-year exemption results in a lower persistence of current-period pretax earnings into future earnings.

The left and right panels of Table 8 present the results of Models(4)and(5)respectively,using the five years following the year the firm makes the choice of tax incentive as the sample period.9Firms without five years of consecutive annual data are deleted,reducing the number of firms to 240 and the sample to 1200 firm-year observations(240 firms×5 years).The results show that both γ1and α1are positive and significant.However,as expected,α3is negative and significant,suggesting that firms choosing a corporate 5-year tax exemption have lower earnings persistence during the five years following the year they make their choice.Further,the coefficient γ1represents the average earnings persistence of the sample without controlling for the difference between the two types of tax incentives,and the coefficient α1is the average earnings persistence after controlling for this difference.The coefficient γ1(0.479)is noticeably lower than the coefficient α1(0.635),suggesting that the average earnings persistence of the sample is significantly reduced by firms choosing a corporate 5-year tax exemption.The results of Model(4)show that the average earnings persistence of firms choosing shareholder investment tax credits is about 0.635,whereas the average earnings persistence for firms choosing a corporate 5-year exemption is about 0.385,10=the coefficient α1(0.635)–the coefficient α3(-0.250).nearly 40%11=1–0.385/0.645.lower.

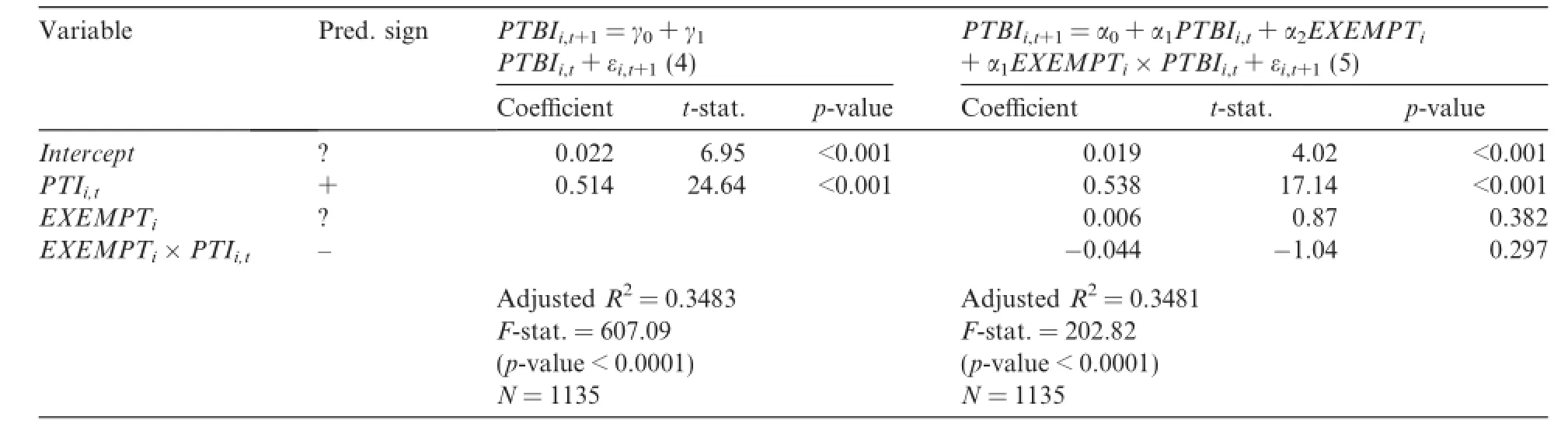

To exclude the possibility that the lower earnings persistence of firms choosing a corporate 5-year tax exemption is due to firm heterogeneity rather than firms strategically engaging in maximizing earnings behavior,I further conduct regression analysis for Models(4)and(5)using the five years following the fifth year after the firm makes its choice of tax incentive as the sample period.If the significant difference in earnings persistence between firms choosing the two types of tax incentives shown in Table 8 is due to firm heterogeneity,the difference should remain pronounced after the 5-year exemption period.

The left and right panels of Table 9 present the results of Models(4)and(5)respectively,for the sample period of the five years following the fifth year after the firm makes its choice of tax incentive.12The sample consists of 1135 firm-year observations.The results show that both γ1and α1remain positive and significant in Table 9.However,α3becomes insignificant,as shown in Table 9,suggesting that the differences between firms that choose the two types of tax incentives disappear after the 5-year exemption period.In addition,the coefficient γ1is 0.514 and the coefficient α1is 0.538 in Table 9.The difference in the two earnings persistence coefficients does not appear to be noticeable whether or not the type of tax incentive is controlled for.The results provide evidence that the choice of taxincentive has an effect on firms’earnings persistence during the 5-year exemption period.Firms choosing a corporate 5-year tax exemption are more likely to have lower earnings persistence during the five-year exemption period than those choosing shareholder investment tax credits.

Table 8 Regression results for Models(4)and(5).(Sample period:year t+1 to year t+5;choice of tax incentives at year t).

Table 9 Regression results for Models(4)and(5).(Sample period:year t+6 to year t+10;the choice of tax incentives at year t).

5.Conclusions and limitations

This study investigates the role of stock market pressure in the trade-off between corporate and shareholder tax benefits.The direct examination of firm managers’choice of two mutually exclusive alternative tax incentives indicates that privately held firms are more likely than listed firms to choose shareholder investment tax credits and forego corporate tax benefits.Listed firms with high ERCs are more likely than listed firms with low ERCs to choose a corporate 5-year tax exemption,as it can enhance reported after-tax earnings.This study further examines the consequences of different types of tax incentives on financial reporting quality. The results show that in the 5-year period following their choice of tax incentives,firms choosing a corporate 5-year tax exemption exhibit significantly lower earnings persistence than those choosing shareholder investment tax credits.The results suggest that stock market pressure has a significant effect on firms’choice of tax incentive and that the choice of tax incentive affects future earnings quality,as proxied by earnings persistence.

The results of this study extend previous research(Cloyd et al.,1996;Klassen,1997;Armstrong et al.,2012; Graham et al.,2014)by providing direct evidence that firms making effective tax planning decisions considerthe trade-offs for all parties(corporations and shareholders)and all costs(tax costs and financial reporting costs).Further,this study provides evidence of the financial reporting consequences of two tax incentives. This demonstrates the complexity of the interaction between firms’tax and financial decisions(Scholes et al.,2015).The findings of this study also have important tax policy implications for countries that use imputation systems.Under imputation systems,firms are deemed to have fewer incentives to reduce corporate tax that is payable at the corporate level,because reducing taxes paid at the corporate level also reduces imputation credits attributable to shareholders.However,the results of this study suggest that non-tax costs such as financial reporting costs associated with corporate after-tax earnings remain a pronounced factor in firms’choices between corporate and shareholder tax benefits under imputation systems.

There are several limitations and caveats to this study.First,to focus on the effect of capital market incentives on corporate tax planning,the empirical models in this study may omit variables that are potentially correlated with firms’tax planning decisions,e.g.,corporate governance,ownership structure,management compensation and the capital market efficiency hypothesis.To the extent that these omitted variables may be correlated with stock market pressure,they could confound the results.However,including more variables in the empirical models eliminates firms from the sample,which may cause other limitations.Second,the two types of tax incentives have been criticized for being over-abundant and may cause firms to over-invest in particular industries.This study does not address whether the tax incentives cause a loss of efficiency or distortions in resources allocation.The focus of this study is firms’tax planning behavior at the micro-level,which may inhibit the generalization of its findings for broader tax policy implications.

References

Ali,A.,Zarowin,P.,1992.Permanent versus transitory components of annual earnings and estimation error in earnings response coefficients.J.Acc.Econ.15,249–264.

Armstrong,C.S.,Blouin,J.L.,Larcker,D.F.,2012.The incentives for tax planning.J.Acc.Econ.53,391–411.

Begley,J.,1990.Debt covenants and accounting choice.J.Acc.Econ.12,125–139.

Blaylock,B.,Shevlin,T.,Wilson,R.,2012.Tax avoidance,large positive temporary book-tax differences,and earnings persistence.Acc. Rev.87(1),91–120.

Cloyd,C.B.,Pratt,J.,Stock,T.,1996.The use of financial accounting choice to support aggressive tax positions:public and private firms. J.Acc.Res.34(Spring),23–43.

Collins,D.,Kothari,S.P.,1989.An analysis of intertemporal and cross-sectional determinants of earnings response coefficients.J.Acc. Econ.11,143–181.

DeFond,M.,Jiambalvo,J.,1994.Debt covenant violation and manipulation of accruals.J.Acc.Econ.17,145–176.

Enis,C.R.,Ke,B.,2003.The impact of the 1986 Tax Reform Act on income shifting from corporate to shareholder tax bases:evidence from the motor carrier industry.J.Acc.Res.41(1),65–88.

Graham,J.R.,Hanlon,M.,Shevlin,T.,Shroff,N.,2014.Incentives for tax planning and avoidance:evidence from the field.Acc.Rev.89 (3),991–1023.

Hanlon,M.,2005.The persistence and pricing of earnings,accruals,and cash flows when firms have large book-tax differences.Acc.Rev. 80(1),137–167.

Ke,B.,2001.Taxes as a determinant of managerial compensation in privately-held insurance companies.Acc.Rev.76,655–674.

Klassen,K.,1997.The impact of inside ownership concentration on the trade-off between financial and tax reporting.Acc.Rev.72(3), 455–474.

Mills,L.,Erickson,M.M.,Maydew,E.L.,1998.Investments in tax planning.J.Am.Taxat.Assoc.20(1),1–20.

Scholes,M.S.,Wolfson,M.A.,Erickson,M.,Hanlon,M.,Maydew,E.L.,Shevlin,T.,2015.Taxes and Business Strategy:A Planning Approach,fifth ed.Pearson Education Inc,Upper Saddle River,NJ.

16 July 2013

*Address:Department of Accounting,National Chengchi University,64,Sec.2,Chih-Nan Rd.,Taipei 116,Taiwan.

E-mail address:mingchin@nccu.edu.tw

1The qualified emerging hi-tech industries are regarded as strategically important to Taiwan’s technological advancement and are specified in Articles 8 and 9 of the Statute for Upgrading Industries(Taiwan).

http://dx.doi.org/10.1016/j.cjar.2014.12.001

1755-3091/©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

China Journal of Accounting Research2015年2期

China Journal of Accounting Research2015年2期

- China Journal of Accounting Research的其它文章

- Management earnings forecasts and analyst forecasts: Evidence from mandatory disclosure system

- Short sellers’accusations against Chinese reverse mergers:Information analytics or guilt by association?☆

- Monetary policy and dynamic adjustment of corporate investment:A policy transmission channel perspective

- Guidelines for Manuscripts Submitted to The China Journal of Accounting Research