Monetary policy and dynamic adjustment of corporate investment:A policy transmission channel perspective

Qiang Fu,Xing Liu

School of Economics and Business Administration,Chongqing University,China

Monetary policy and dynamic adjustment of corporate investment:A policy transmission channel perspective

Qiang Fu,Xing Liu*

School of Economics and Business Administration,Chongqing University,China

A R T I C L EI N F O

Article history:

Accepted 25 March 2015

Available online 15 April 2015

JEL classification:

G31

E52

Monetary policy

Transmission channels

Asymmetric effect

Corporate investment

Dynamic adjustment

We investigate monetary policy effects on corporate investment adjustment, using a sample of China’s A-share listed firms(2005–2012),under an asymmetic framework and from a monetary policy transmission channel perspective.We find that corporate investment adjustment is faster in expansionary than contractionary monetary policy periods.Monetary policy has a significant effect on adjustment speed through monetary and credit channels.An increase in the growth rate of money supply or credit accelerates adjustment. Both effects are significantly greater during tightening than expansionary periods.The monetary channel has significant asymmetry,whereas the credit channel has none.Leverage moderates the relationship between monetary policy and adjustment,with a greater effect in expansionary periods.This study enriches the corporate investment behavior literature and can help governments develop and optimize macro-control policies.

©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

Investment decisions are one of the three main financial decisions made by corporations.Modigliani and Miller(1958)propose that corporate investment decisions are independent of financing decisions under a series of strict assumptions.Subsequently,researchers have relaxed the strict hypothesis of the Modigliani–Miller theorem and developed the theory of investment cash flow sensitivities,based on the perspective of financing constraints caused by asymmetric information,and the theory of free cash flow over-investment,based on the perspective of agency conflicts.These theories argue that the appearance of imperfect markets and agencyconflicts affects the scale and cost of enterprise financing,thereby affecting the decisions and efficiency of corporate investment.

The macroeconomic policy environment affects corporate investment decisions.Management science research has recently focused on overcoming the micro–macro divide in the field,expanding research methods and theoretical innovation and bridging the science-practice gap(Aguinis et al.,2011).Studies on the decisionmaking behavior of micro-enterprises that consider macro policies are increasingly common(Fan et al.,2014; Jiang and Rao,2011;Rao et al.,2013).Studies based on the monetary policy perspective mainly focus on the influence of monetary policy on capital structure dynamic adjustment(Cook and Tang,2010;Luo and Nie, 2012;Ma and Hu,2012;Su and Zeng,2009),the policy of cash holdings(Baum et al.,2006,2008;Zhu and Lu, 2009)and credit financing(Li and Wang,2011;Rao and Jiang,2013a,b).Few studies focus on investment decisions.

Monetary policy is an important macro external variable that affects the investment decisions of enterprises.There is a body of literature focusing on the effect of monetary policy on corporate investment.Jing et al.(2012)find that loose monetary policy reduces the financing constraints of private enterprises. However,the financing redundancy resulting from loose monetary policy leads to inefficient investments by private enterprises with poor or general investment opportunities.In contrast,a good financing environment enables a company to take advantage of more investment opportunities,enhancing the efficiency of capital allocation when the company faces better investment opportunities.Xuan(2012)finds that a company can improve its ability to obtain loans and its investment level during tight monetary policies if it follows an ongoing conservative debt financial policy during expansionary monetary policies.Companies that follow a conservative debt financial policy are able to respond to monetary policy shocks and weaken their effects. Liu et al.(2013)find that internal capital markets in business groups buffer the effect of monetary policy on corporate investment.

The studies on monetary policy and corporate investment behavior mainly focus on under-and overinvestment caused by credit financing constraints.Few studies explore the influence of monetary policies and transmission channels on the direction and speed of investment dynamic adjustment,especially from an asymmetric perspective.By clarifying these issues,we can reveal monetary policy transmission mechanisms at the micro level and examine their effects.Therefore,this paper uses Richardson’s(2006)estimation model of expected investment and Flannery and Rangan’s(2006)partial adjustment model to study the influence of monetary policy states and transmission channels on the direction and speed of investment dynamic adjustment.

Our results indicate that corporate investment adjustment is faster during expansionary monetary policy periods than contraction periods.The effect of the money supply on the corporate investment adjustment speed is significantly greater in tight monetary policy periods than in loose periods.This effect is significantly asymmetric.An increase in the growth rate of the credit scale accelerates corporate investment adjustment. This channel does not have a significant asymmetric effect.Leverage has a greater effect on corporate investment in expansionary monetary policy periods.

The contribution of this paper is as follows.First,the estimation model of the dynamic adjustment of corporate investment is designed by integrating the investment efficiency and partial adjustment models.This model provides the basis for studying the effect of monetary policy on the dynamic adjustment of corporate investment.Second,we study the effect of monetary policy transmission channels on corporate investment behavior through detailed microscopic transmission channels of monetary policy.Third,we examine whether monetary policy and its transmission channels have an asymmetric effect on the adjustment of corporate investment.Finally,the literature mainly focuses on the influence of financing constraints on investment, due to the credit channel of monetary policy.We simultaneously pay attention to the effect of the monetary channels of monetary policy on investment opportunities.

This study provides valuable policy implications for monetary authorities and managers.First,policymakers should consider the effects of different policy instruments.Money supply and credit policy are effective tools for influencing corporate investment adjustment during contractionary monetary policy.Interest rates are an effective tool during expansionary monetary policy.Leverage has a greater effect on corporate financing ability during expansionary monetary policy than contractionary monetary policy.Monetary authoritiesshould pay more attention to firms with high leverage during loose monetary policies to detect financing difficulties.

Second,policy-makers should focus on optimizing the corporate investment scale and improving corporate investment efficiency to avoid over-investment and the resulting overcapacity.Company decision-makers need to pre-judge the influence of different policy instruments implemented by monetary authorities on corporate finance and investment opportunities.They should adopt an effective response in advance to ensure that the level of corporate investment can maximize returns.

The rest of the paper is organized as follows.In Section 2,we provide an overview of the macro policies in the institutional background of China and refine the research questions.Section 3 presents the model design, key concepts and definitions.Section 4 shows the sample selection and data sources.In Section 5,the empirical results are reported and robustness tests are conducted.Section 6 presents the discussion and Section 7 summarizes the main conclusions.

2.Institutional background analysis and research question refinement

Before 1978,a single planned economic system was implemented in China.The government relied on administration and planning to manage the economy,to poor effect and economic fluctuation.After the reform and opening up,especially in the mid-1980s,a market-oriented reform model was established.The Chinese economic environment and conditions were changing.In 1993,the Communist Party of China clearly proclaimed that establishing a socialist market economic system was the goal of its economic reform at its fourteenth conference.Since then,China has begun to gradually transform from a planned economy to a market economy.The government has gradually shifted its macroeconomic management from relying mainly on planning and executive orders to using market-based instruments,such as fiscal and monetary policies,in accordance with the market-oriented reform.

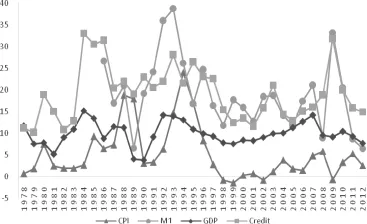

The main objective of macroeconomic regulation and control is the pursuit of stable economic growth with a reasonable level of the Consumer Price Index(CPI).The government’s macroeconomic control focuses on adjusting the aggregate equilibrium with short-term,counter-cyclical,discretionary characteristics.Since 1997, economic growth has been steady and the CPI has fluctuated in a reasonable interval,as shown in Fig.1.This shows enhanced macro-control ability and the effectiveness of market-based measures.As can be seen from the M1(a narrow measure of the money supply including currency and demand deposit)and credit scale growth rates,the discretionary monetary policy mainly uses counter-cyclical measures to achieve steady economic growth with a reasonable level of CPI.

China used to mainly use quantity-oriented monetary policy tools such as adjusting the statutory deposit reserve ratio,open market operations and credit scale control.Price-based monetary policy tools based on interest rates were used at a lower frequency.On 19 July 2013,approved by the State Council,the People’s Bank of China decided to stop controlling the lending rates offered by financial institutions,which was an important step in market-based interest rate reform.1Approved by the State Council,the People’s Bank of China decided to remove controls on the lending interest rates offered by financial institutions to their clients from 20 July 2013.The loan interest rates of financial institutions are now determined autonomously by the financial institutions according to business principles.On 11 March 2014,Zhou Xiaochuan,the central bank governor,stated at a Chinese People’s Political Consultative Conference that“deposit interest rate liberalization is certainly in the plan and probably can be realized within one or two years.”Under this reform,economic stimulus policies are no longer able to depend on liquidity injections.The price adjustment mechanism in the market of credit supply and demand is now active.This mechanism can optimize the allocation of credit resources and will have a profound effect on monetary policy transmission channels,mechanisms and effects.

How do macroeconomic policies affect a real economy?Do macro policies play their expected role?What are their transmission mechanisms?To answer these questions,we need to analyze and test the mechanisms and policy effects of macroeconomic policies at the micro level.Previous studies mainly focus on monetary policies’transmission channels,mechanisms and consequences from a macro perspective.We analyze the microscopic effect of monetary policy transmission channels on corporate investment behavior.

Figure 1.GDP growth,CPI growth and monetary policy from 1978 to 2012.

2.1.Asymmetric effects of monetary policy on corporate investment

For decades,macroeconomists have debated whether monetary policy has the same effect on real output during economic recessions and expansions.Before the 1920s,most economists believed that contractionary and expansionary monetary policies had symmetric effects,suggesting a linear relationship between money supply and output.After the 1920s,economists gradually realized that a“tightening monetary policy can effectively restrain[an]overheated economy,but the effect of[a]loose monetary policy in promoting economic growth is not obvious,which implies the effect of monetary policy is asymmetric.”In the 1930s,Keynes argued with Pigou over whether monetary policies had less or no effect on output during a severe economic downturn. The limited effectiveness of an expansionary monetary policy was partially explained when the concept of a“liquidity trap”was introduced.In a liquidity trap,interest rates are so low that people believe that they cannot drop further.The monetary policy then fails(Keynes,1936).

At the beginning of the 1990s,studies that empirically test the asymmetric effects of monetary policy gradually began appearing.Cover(1992)examines quarterly US post-war data from 1951 to 1987 and concludes that positive money supply shocks have no effect on output,whereas negative shocks reduce output. Karras(1996)examines 18 European countries from the 1953–1990 period and finds that negative money supply shocks have a statistically significant effect on output,whereas positive shocks have a statistically insignificant effect.Karras and Stokes(1999)find that the effects of money supply on prices and output of private consumption are symmetric,whereas the response of fixed investment is characterized by asymmetries,very similar to those that affect output.

The evidence from China for asymmetrical monetary shock effects is mixed.Huang and Deng(2000)use Chinese quarterly data from 1980 to 1997 and find the effects of monetary policies to be very different between China and Western countries.They find that the M1money supply shock has symmetric effects,whereas the M2(a broad measure of the money supply including currency,demand deposit and savings deposits)money supply shock has asymmetric effects.This asymmetry is opposite to that in Western countries:a positive money supply shock significantly affects output,whereas a negative money supply shock does not. However,Liu(2002)examines China’s monthly data from 1990 to 2001 and suggests that the decelerating effect of a tight monetary policy is greater than the accelerating effect of an expansionary monetary policy. Chen et al.(2003)and Chen(2006)reach a similar conclusion to Liu after examining China’s quarterly data from 1993–2002 and 1993–2005,respectively.Thus,due to differences in methods and sample windows,studies on the asymmetry of monetary policy effects at the macro-level do not reach consistent conclusions.

Does monetary policy have an asymmetrical effect on enterprise at the micro-level?Based on enterprise micro data,Gong and Meng(2012),Jing et al.(2012)and Qian(2013)find that expansionary and contractionary monetary policies have asymmetrical effects on corporate investment.However,the asymmetry is opposite to that found at the macro-level:expansionary monetary policy significantly alleviates financial constraints and promotes corporate investment,whereas contractionary monetary policy does not significantlyreduce corporate investment.The investment scale is sticky when adjusting downward due to investment inertia and sustainability.The transmission of monetary policy also has a lag effect,between a policy’s implementation and managers in investment decision-making perceiving the implications of the policy.

Our first concern is therefore how different types of monetary policies affect the adjustment of corporate investment and whether expansionary and contractionary monetary policies have asymmetric effects on corporate investment.

2.2.Monetary policy transmission channels and the dynamic adjustment of investment in micro enterprises

Macroeconomic monetary policies have many relatively clear microscopic transmission channels,such as the money channel(which includes interest rates,exchange rates and the asset prices approach)and general credit channel of transmission(Bernanke and Blinder,1992;Bernanke and Gertler,1995).According to neoclassical economics,monetary policymakers use their leverage over short-term interest rates to influence the cost of capital and,consequently,spending on durable goods,such as fixed investment,housing,inventories and consumer durables.In turn,changes in aggregate demand affect the level of corporate investment.When the central bank raises interest rates,there is a corresponding increase in the cost of debt financing and the external financing constraints of companies(Luo and Nie,2012).Companies become more dependent on internal financing or reduce current investment to dynamically adjust their scale of investment.

Since 1990,monetary economists,such as Benanke,Gertler,Kashyap and Stein,have proposed the theory of credit transmission of monetary policy when they study the role of micro-level enterprises in the monetary policy transmission process.Credit transmission theory suggests that monetary policy affects the availability of financing mainly through increasing or decreasing the supply of bank loans,thereby affecting the supply of corporate investment(Bernanke and Gertler,1995;Oliner and Rudebusch,1996).The credit rationing policy, which is used as an important monetary policy instrument in China2On 1 January 1998,the People’s Bank of China abolished the control of the size of loans by state-owned commercial banks,which had been practiced for nearly five decades.At the end of 2007,to effectively control the high inflation rate,the central bank enabled credit size control again.,imposes a total credit limit.The total amount of new loans issued by all commercial banks every year cannot exceed the annual credit stipulated by the People’s Bank of China in principle(Su and Zeng,2009).Through the bank lending channel,a tight monetary policy reduces bank reserves and forces banks to shrink their loans,which reduces the commercial bank loans available to enterprises(Kashyap et al.,1993).In addition,due to economic structural adjustments,transformation and upgrading,banks are encouraged to issue loans to enterprises in the advanced manufacturing and strategic emerging industries.In contrast,loans to high energy consumption,high emission industries and overcapacity industries are strictly controlled,which strengthens bank credit financing constraints for some enterprises.

Researchers are interested in the effect of monetary policies on corporate investment behavior through the different transmission channels.Bernanke and Gertler(1995)note that monetary policy has a significant effect on long-term investment and find that monetary policy influences corporate investment through both the interest rate channel and the level of financing constraints.Chatelain and Tiomo(2003)suggest that monetary policy influences corporate investment through the interest rate channel,which can adjust the cost of capital, and through the credit channel,which can adjust external financing constraints.Zulkhibri(2013)finds that monetary policy significantly affects firms’access to external finance when interest rates are increasing. Bank-dependent firms are the most vulnerable to this effect.Internal finance is more important for high leverage firms during tight liquidity conditions.

Studies on Chinese companies draw similar conclusions.Zhang et al.(2012)study the dual effects of monetary policy on corporate investment supply and demand.They find that changes in monetary policy change investment opportunities,affect a company’s willingness to invest through monetary channels,change the company’s ability to raise funds and the supply of investment funds through the credit channel and ultimately affect the company’s investment decisions.Monetary policies also affect corporate investment in companies with different financing constraints through different transmission channels.The monetary channel has a larger effect on low financing constraints companies,whereas the credit channel has a larger effect on highfinancing constraints companies.Huang et al.(2012)find that quantity-oriented and price-based monetary policies have heterogeneous effects on corporate investment behavior.The influence of monetary policies is constrained by the liquidity,inventory,size and asset–liability ratio of a firm.Firms with higher liquidity, lower inventory levels and lower asset–liability ratios are less sensitive to the effects of the two kinds of monetary policies.The larger a firm is,the less it is affected by quantity-oriented monetary policies,but the more sensitive it is to price-based monetary policies.

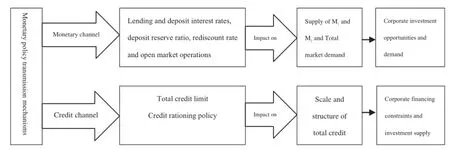

Fig.2 presents the transmission channels and mechanisms by which monetary policy influences corporate investment behavior.When monetary policy changes(for example,from easing to tightening),it affects corporate investment opportunities and external financing constraints through the credit and monetary channels,respectively.Rational decision-makers in enterprises therefore actively consider adjusting their investment plans and scale to respond to these changes.From the perspective of credit financing constraints caused by the credit transmission channel,during a monetary policy contraction,corporate credit financing constraints and the opportunity cost of investment increase as the credit supply decreases.According to the net present value(NPV)rule and the theory of maximizing profit,the enterprise will reduce its investment projects to adjust its investment scale.During a loose monetary policy,external financing constraints and the cost of capital decline as the credit supply increases.According to the NPV rule,many projects with original negative NPV become profitable,so enterprises will expand their scale of investment to maximize profit.

From the perspective of the monetary transmission channel,during expansionary monetary policy,the total market demand increases as the base money supply increases.Enterprises expand production and increase their scale of investment due to the increase in investment opportunities.During tight monetary policy,the total market demand decreases and the cost of capital rises as the money supply decreases.Companies reduce their scale of investment as the reduction in investment opportunities causes investment demand to decrease.

Is there a linear relationship between the changes in monetary policy and corporate investment?Is there an asymmetric effect?Do different monetary policy transmission channels and tools have the same effect on the adjustment speed of corporate investment?All of these questions require in-depth empirical research.

Leverage plays an important moderating role in the effect of monetary policy on corporate investment. Lang et al.(1996)show that the effect of monetary policy changes on firms with high levels of leverage is larger than on those with low levels of leverage.There is a negative relationship between leverage and future growth at the firm level.Hu(1999)finds that monetary contractions reduce the growth of investment more in highly leveraged firms than in less leveraged firms.The results suggest that a broad credit channel for monetary policy exists and that it can operate through leverage,as adverse monetary shocks aggravate real debt burdens and raise the effective costs of investment.

Based on the above analysis,we empirically examine the effects of different monetary policy channels on the speed of corporate investment adjustment and whether there is an asymmetric effect.We test the role of leverage in the effect of monetary policy on corporate investment.

Figure 2.The transmission channels and mechanisms of monetary policy and its influence on investment behavior.

3.Model design and definition of key concepts

3.1.Dynamic adjustment model of corporate investment

We design the dynamic adjustment model of corporate investment with the effect of monetary policy by integrating Richardson’s(2006)investment efficiency model and Flannery and Rangan’s(2006)partial adjustment model.The model is derived as follows.

Step 1:Estimated model of expected investment.

According to Richardson(2006),there is an optimal scale of corporate investment.It depends on the last operating conditions of a company in a given external environment.We set the estimated model of expected corporate investment as follows:

Step 2:Standard partial adjustment model.

In a frictionless world,firms quickly move back to their target level,which is the level they choose in the absence of any adjustment costs.However,in the presence of adjustment costs,firms may partially adjust back to their expected level of investment over multiple periods.We use Flannery and Rangan’s(2006)standard partial adjustment model to estimate the speed of the adjustment of corporate investment to the next period target level.

The standard partial adjustment model of corporate investment is as follows:

where Ii,tand Ii,t-1represent the actual investment level for firm i in periods t and t-1 and λ represents the adjustment speed of corporate investment to the target level from period t-1 to period t.The larger the value of λ,the faster the adjustment speed.λ=1 indicates that firms fully adjust for any deviation away from their target investment level.We expect λ to be less than 1 in the presence of adjustment costs.

Step 3:Integrated partial adjustment model.

Following Flannery and Rangan,we substitute(1)into(2)and rearrange.The model of integrated corporate investment partial adjustment model is:

Step 4:Dynamic adjustment model of investment with monetary policy effects.

Relaxing the assumption of a fixed external economic policy,we argue that a manager develops investment plans at the beginning of each year according to the operating conditions in the previous year and dynamically adjusts them according to this year’s changes in macroeconomic policies.To investigate the effects of monetary policy and its transmission channels on the adjustment speed of corporate investment,we develop an extended integrated partial adjustment model.We add the interaction term between the variables for the current monetary policy period and the lagged variable of investment(MCt*Ii,t-1)in the right of model(3),as follows:

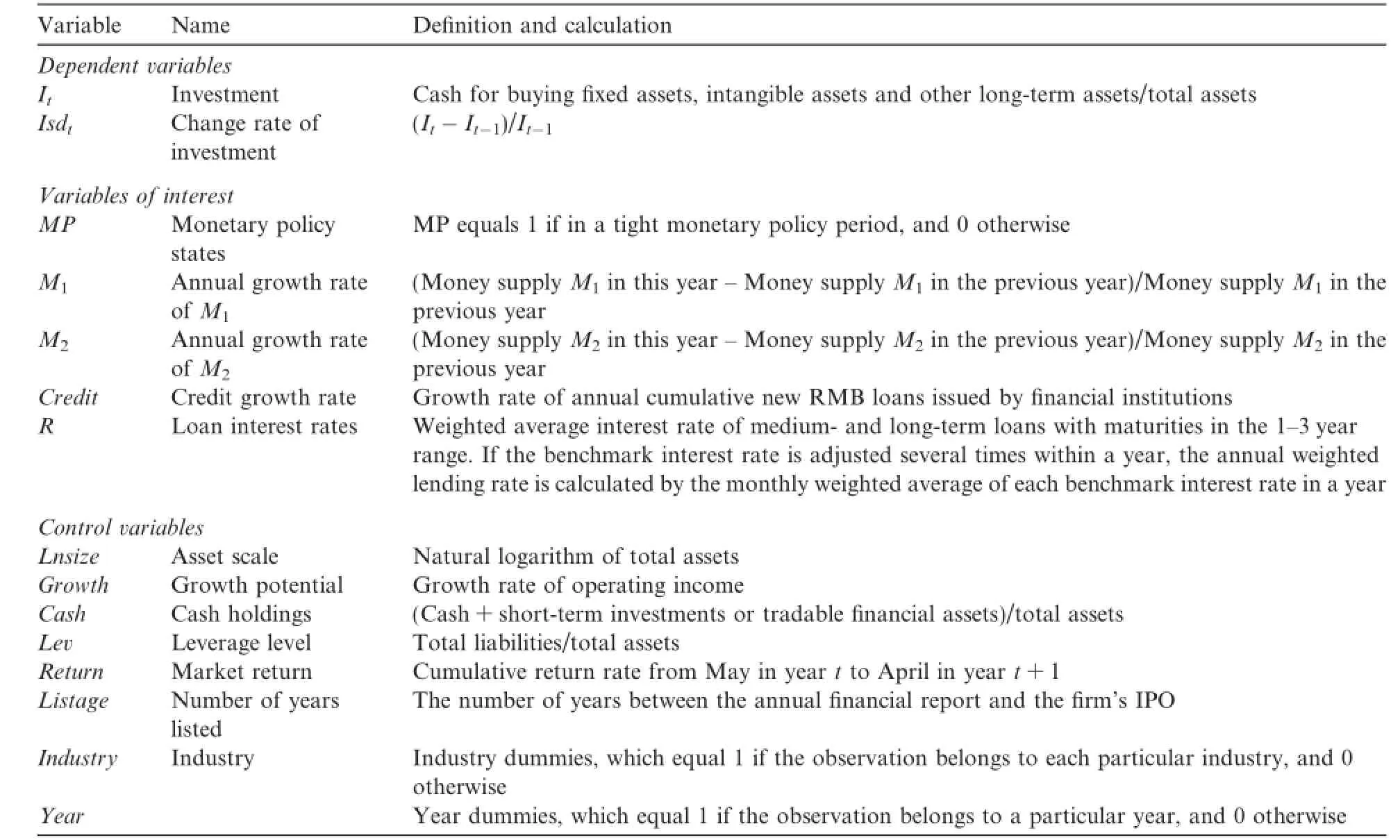

where MCtrepresents monetary policy variables,proxied by the M1and M2growth rates and loan interest rates in the monetary channel and credit growth rates in the credit channel.The adjustment speed of corporate investment becomes λ′=λ-η*MCt.As MCtis generally positive,when the coefficient on the interaction item is significantly negative,the adjustment speed of corporate investment increases with an increase in the monetary policy variables,and vice versa.The calculations and definitions of the variables are shown in Table 1.

Table 1 Variable definitions.

3.2.Definition and determinants of corporate investment

According to Richardson’s(2006)definition,total investment expenditure can then be split into(i)required investment expenditure to maintain assets in place and(ii)investment expenditure on new projects.We define corporate investment as new investment with a proxy using cash expenditure for buying fixed assets,intangible assets and other long-term assets and standardizing with total assets to eliminate the influence of size differences.

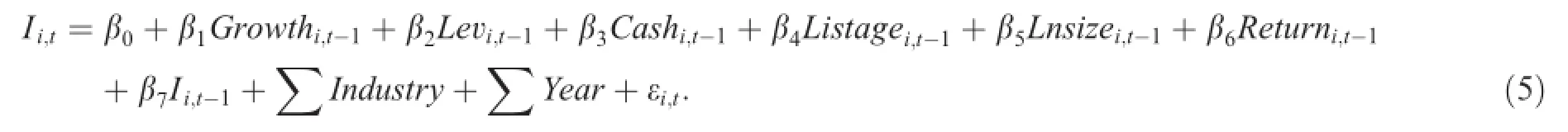

Following Richardson(2006),we estimate expected investment according to the following regression specification:

The determinants of investment decisions include measures of growth opportunities,leverage,the level of cash,firm age,firm size,past stock returns,prior level of firm investment,industry fixed effects and annual fixed effects.

3.3.Definition of monetary policy states and transmission channels

3.3.1.Definition of monetary policy states

The government often describes three monetary policy states:active or expansionary monetary policy,prudent monetary policy and tight monetary policy.However,monetary policy is often divided into tightening and expansionary monetary policies,based on different indicators in the academic literature.

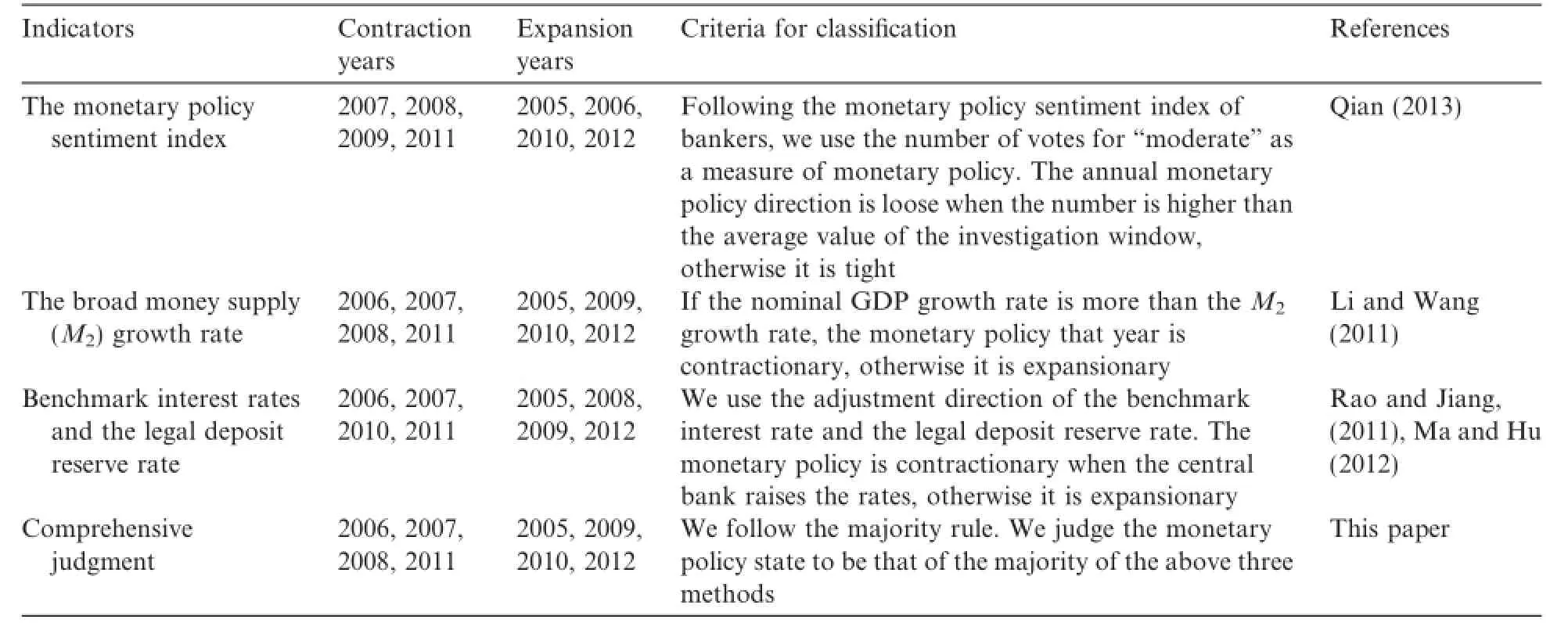

Indicators commonly used to determine the annual monetary policy direction in the literature are listed below:

(1)Monetary policy sentiment index of bankers

Zhu and Lu(2009)and Ye and Zhu(2009)measure the degree of tightening monetary policy using the monetary policy sentiment index from the bankers’survey carried out by the People’s Bank of China and the National Bureau of Statistics of China.The survey records bankers’assessments of monetary policy as too loose,partially loose,moderate,tight,too tight and unknown.They use“too tight”to measure the degree of monetary policy tightening.The higher the ratio of bankers who believe that a monetary policy is too tight, the tighter monetary policy is.Qian(2013)use“moderate”as a measure of monetary policy.They judge the annual monetary policy direction as loose when the number of votes for“moderate”is higher than the average value of the investigation window,and otherwise judge the direction to be easing.As only votes for“moderate”are available for recent years,we use Qian’s method to judge the monetary policy direction.

(2)The broad money supply(M2)growth rate

Mayer et al.(1996)show a close relationship between money supply and nominal GDP in developed countries.In the major countries,the stock of money and GDP both grow in the same direction.Shirakawa(2001) suggests that nominal GDP makes a nearly consistent growth with money supply(M2+CDs(large time deposits,institutional money-market fund balances))in Japan.Jing et al.(2012)use the annual broad money supply(M2)growth rate as a measure of monetary policy.

Li and Wang(2011)use the difference between the nominal GDP growth rate and M2growth rate to measure the monetary policy state.The nominal GDP growth in the general sense represents the demand for currency for economic development,whereas the M2growth rate reflects the money supply level.If the difference between the two is positive,there is a money supply gap and the government implements contractionary monetary policy.If the difference is negative,then the money supply exceeds the demand of economic development and the government implements expansionary monetary policy.

(3)Benchmark interest rates and the legal deposit reserve rate

Li and Wang(2011)also use one-year lending interest rates as a measure of monetary policy.Rao and Jiang (2011)and Ma and Hu(2012)judge the monetary policy state according to the adjustment direction of the benchmark interest rate and the legal deposit reserve rate implemented by the central bank.

As shown in Table 2,2006 and 2008–2010 are classified differently by the above three mainstream methods of determining the direction of the monetary policy.According to majority rule,we judge 2006 and 2008 to be tight monetary policy years and 2009 and 2010 to be loose monetary policy years.We divide the sample window into contraction years(2006,2007,2008 and 2011)and expansion years(2005,2009, 2010 and 2012).

3.3.2.Definition of monetary policy transmission channels

Monetary policy transmission channels generally include the monetary channel(including interest rates, exchange rates and asset prices)and credit channel.The monetary channel influences M1and M2supply to achieve policy goals through monetary policy tools,such as interest rates,exchange rates,deposit reserves,open market operations and standing lending facilities.3In January 2013,the People’s Bank of China set up standing loan facilities which provide liquidity support for financial institutions.As M1reflects the real purchasing power in an economy,which represents the market demand and reflects investment opportunities,we use the M1growth rate as the main proxy variable of the monetary channel.We use the M2growth rate and weighted average loan interest rate of loans with maturity in the one to three year range as robustness test variables.

Table 2 Definition of the annual monetary policy direction.

The credit channel generally refers to monetary policy tools that the central bank uses to adjust the credit financing supply to achieve a policy goal.The monetary policy tools of the credit channel are the total credit limit and credit rationing,which affect the scale and structure of total credit.New loans by financial institutions reflect the total credit supply,which affects the degree of external financing constraints that enterprises experience.We use the annual cumulative new RMB loans growth rate of financial institutions as the proxy variable for monetary policy through the credit channel.

4.Sample selection and data sources

The initial sample includes all A-share listed companies from 2005 to 2012.The final sample is obtained by filtering with the following conditions.(1)Observations with missing variables are dropped.(2)Financial and insurance companies are removed.(3)Observations with leverage levels that fall outside the outlier leverage levels of[0,1]or investment rates equal to 0 are excluded.(4)Newly listed and specially treated companies are removed.

To meet the availability of the lag variable,we use a balanced panel data set of 1157 listed companies over the eight-year period.The final sample includes 9256 firm-year observations.Financial data of the listed companies are sourced from the China Stock Market and Accounting Research and Wind Information Co.,Ltd. databases.Monetary policy variables are collected from the website of the People’s Bank of China and the National Bureau of Standards of China.The money and credit supplies are taken from the Monetary Policy Implementation Report and the monetary policy sentiment index of bankers is taken from the Chinese Bankers Survey Report.

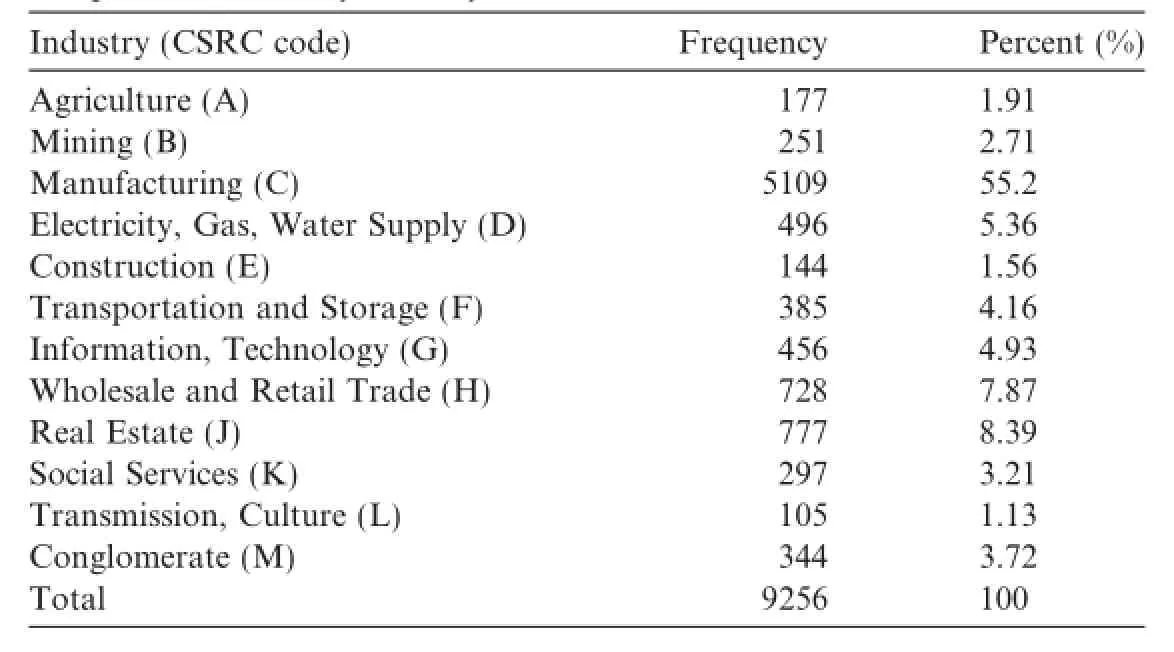

Table 3 shows the sample by industry sector.The industry classification is based on the Industrial Distribution of Listed Companies index issued by the China Securities Regulatory Commission(CSRC). The manufacturing sector accounts for 55.2%of the sample.To make the sample distribution by industry sector more even,we use two-digit industry codes for the manufacturing sector to control for industry factors in the empirical estimation.

5.Model estimation and empirical analysis

5.1.Descriptive statistics

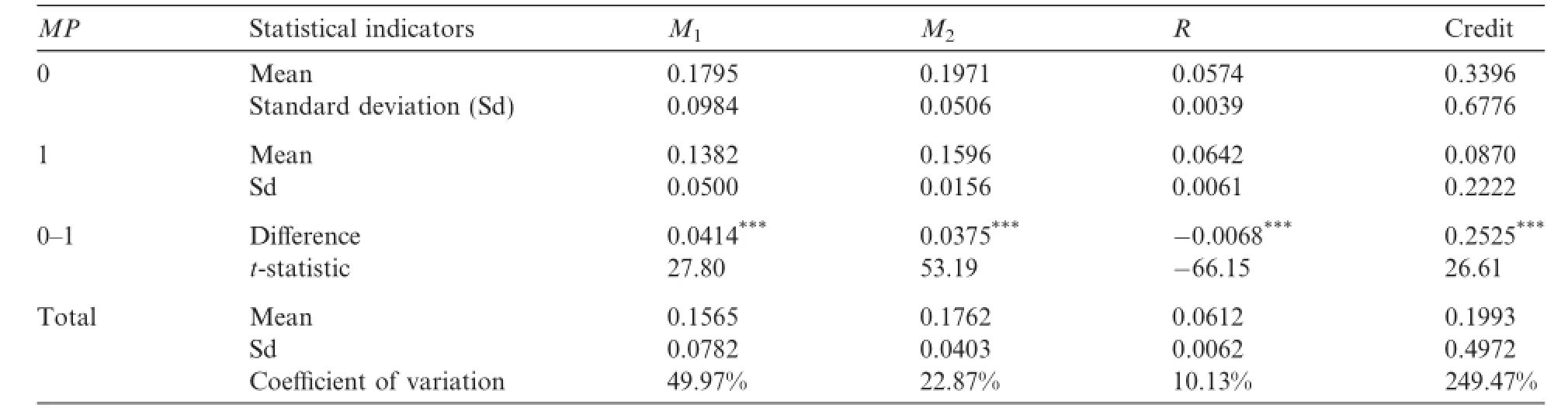

Table 4 provides descriptive statistics of the monetary policy variables.It demonstrates four proxy variables for the monetary policy transmission channels of the monetary policy states.There is a significant differencebetween the monetary policy states in every proxy variable,which indicates that the definition of the monetary policy states is reasonable.From the coefficient of variation,monetary policy is mainly implemented through quantitative tools in the monetary channels to adjust the money supply.The price instrument with interest rates as the core has a small variation.The coefficient of variation of the credit growth rate is 249.47%,which suggests that monetary policy is mainly implemented through credit scale control.

Table 3 Sample distribution by industry sector.

Table 4 Descriptive statistics of the monetary policy variables.

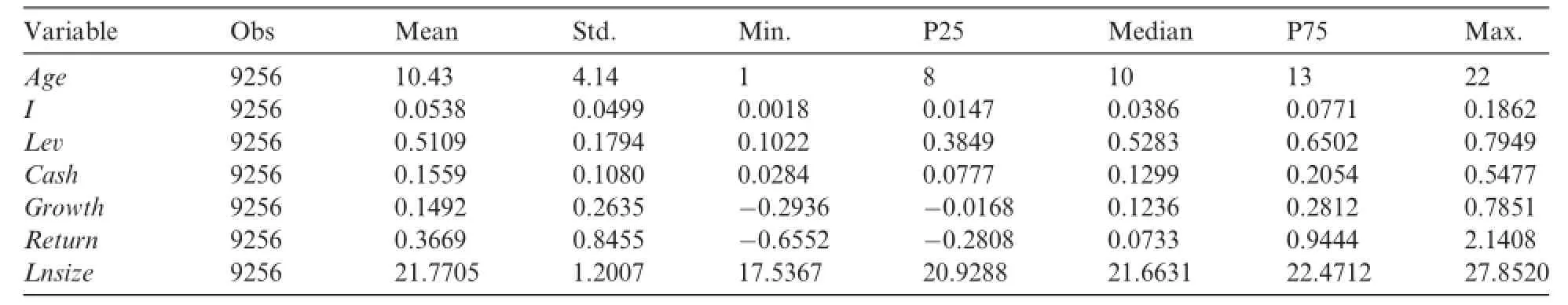

Table 5 provides descriptive statistics for the main corporate variables.To avoid the influence of outliers, all of the continuous variables are winsorized at the 1%and 99%levels.As shown in Table 5,the average company in the sample has a listed age of 10.4,investment rate of 5.38%,leverage of 51.09%,cash holdings ratio of 15.59%,annual operating income growth of 14.92%and annual market return of 36.69%.

Table 5 Descriptive statistics of the main corporate variables.

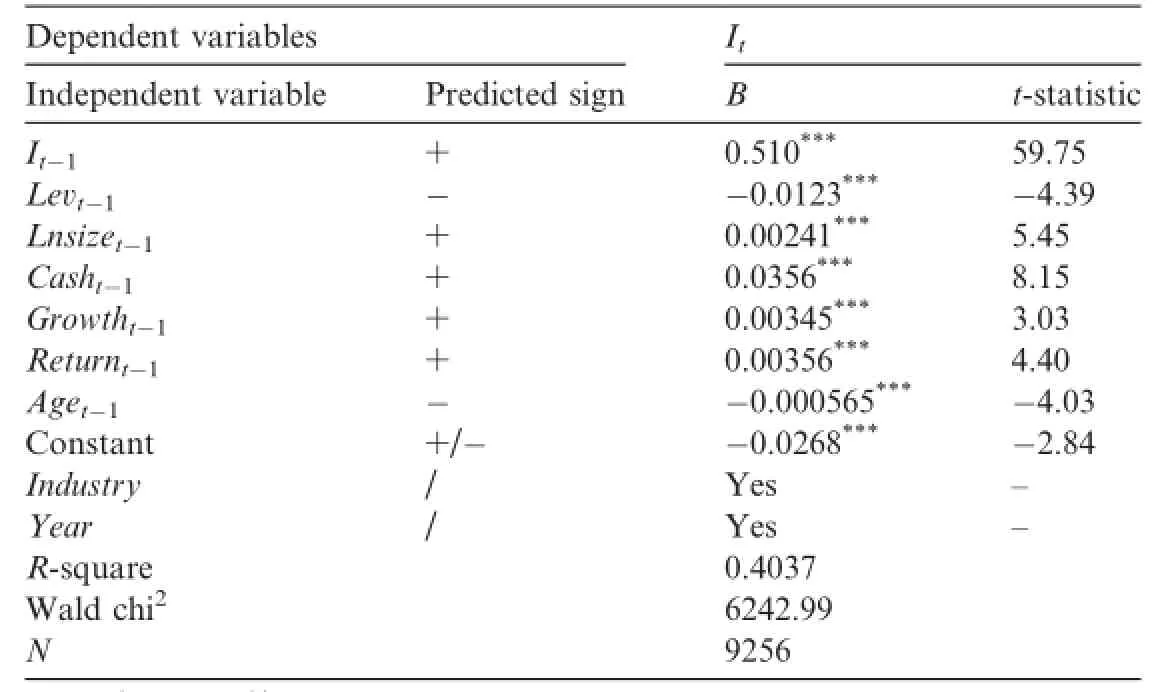

Table 6 Estimating expected corporate investment.

5.2.Empirical results

5.2.1.Estimating the expected level of capital investment

Adjustment model(4)internalizes the estimate of expected corporate investment.The premise of this internalization is that the target level of corporate investment can be appropriately fitted by the firm characteristic variables.We must therefore test and discuss the fitting effect of the expected corporate investment estimation model(5).

Table 6 reports the estimates of expected corporate investment.The sign of the coefficient is consistent with theoretical expectations and similar studies(e.g.,Richardson,2006).The estimates of all of the parameters are significant at the 1%level.The goodness of fit(0.4)is high.We therefore believe that model(5)is suitable for estimating the expected investment level with the selected firm characteristic variables.

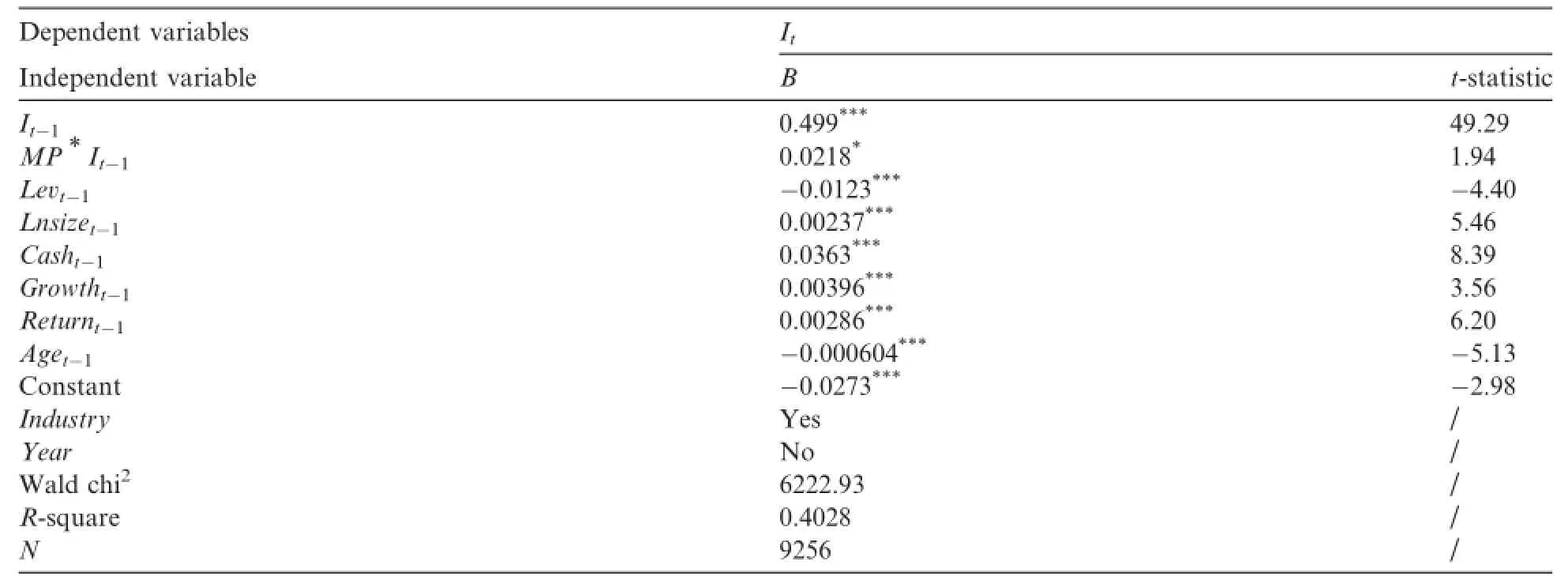

5.2.2.Monetary policy states and dynamic adjustment of corporate investment

Table 7 reports the estimates of the effect of the monetary policy states on the adjustment speed of corporate investment.The regression results show that the coefficient of It-1is 0.499 and the coefficient of MP*It-1is0.0218.Accordingtotheeconomicsignificanceofthemodel,theadjustmentspeedis λ′=0.501-0.0218*MP.The results show that corporate investment adjusts back to the target level faster during loose monetary policies than tight policies.Monetary policy has asymmetric effects on corporate investment in expansionary and tight periods.A typical firm closes about 50.1%of the gap between the actual and target investment levels in one year of loose monetary policy,with an adjustment HALF-LIFE4The adjustment HALF-LIFE is(ln2)/λ,where λ is the adjustment speed.of 1.38 years. In contrast,it can only correct about 47.92%of the gap between the actual and target investment levels in a year of tight monetary policy,with an adjustment HALF-LIFE of 1.45 years.

5.2.3.Monetary transmission channels and the dynamic adjustment of corporate investment

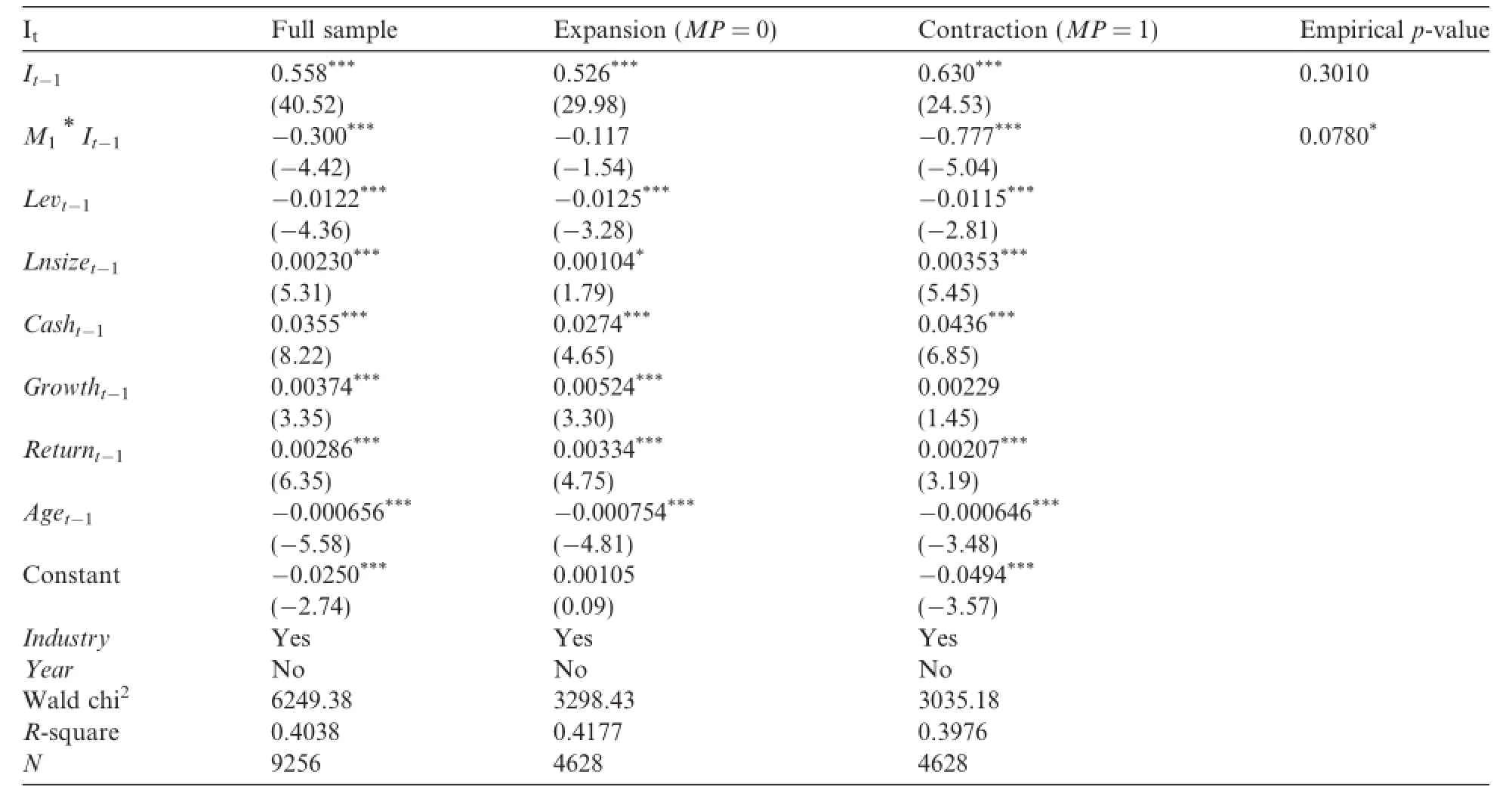

To test whether monetary policy transmission channels have an asymmetric effect on the adjustment speed during different monetary policy states,we use simulation evidence to determine the significance of the observed differences in the coefficient estimates reported in the literature(Cleary,1999;Islam and Mozumdar,2007;Lian et al.,2010).A bootstrapping procedure is used to calculate empirical p-values that estimate the likelihood of obtaining the observed differences in coefficient estimates if the true coefficients are,in fact,equal.

Table 7 Estimating the effect of monetary policy states on the adjustment speed of corporate investment.

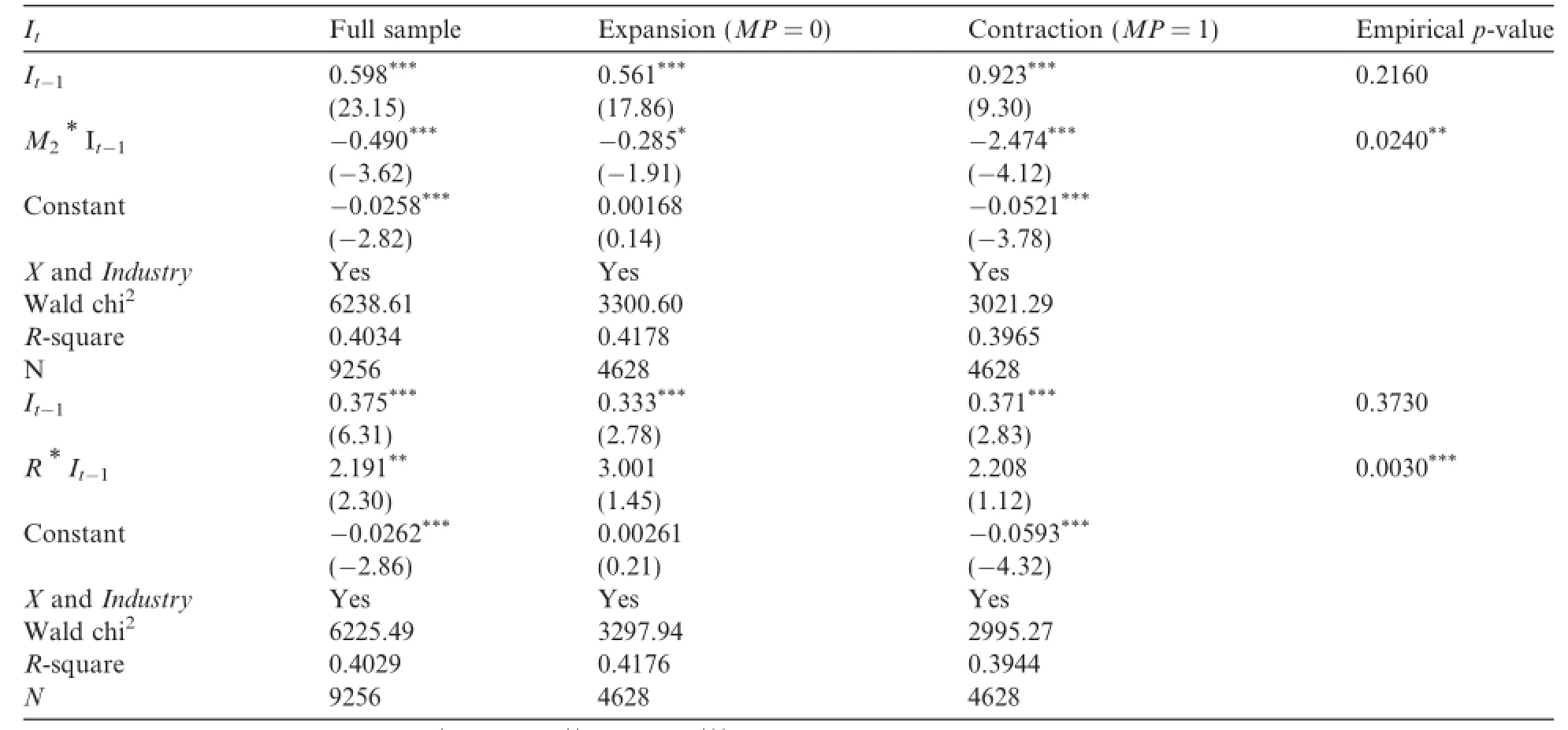

Table 8 Estimating the effect of the monetary channel on the adjustment speed of corporate investment.

Table 8 reports the estimates of the effect of the monetary channel on the adjustment speed of corporate investment.The results show that the coefficient of It-1is 0.558 and the coefficient of M1*It-1is-0.300 when we use the M1growth rate as the proxy variable of the monetary channel.According to the economic significance of the model,the adjustment speed is λ′=0.442+0.3*M1.In our sample interval,a typical firm closesabout 46.147%of the gap between the actual and target investment levels in 2012,which has the lowest M1growth rate of 6.49%,corresponding to an adjustment HALF-LIFE of 1.50 years.In contrast,it closes about 53.905%of the gap between the actual and target levels in 2009,which has the highest M1growth rate of 32.35%,corresponding to an adjustment HALF-LIFE of 1.29 years.The results show that expanding the monetary policy by increasing the growth rate of M1can speed up the adjustment of corporate investment. The change in the M1supply has a greater effect on the adjustment speed of corporate investment in tight monetary policy periods than in loose monetary policy periods.The observed differences in the coefficient estimates indicate that monetary policy has an asymmetric effect on corporate investment in the monetary channel,at the 10%significance level.We can conclude that changing the money supply through monetary channels has a significant effect on corporate investment adjustment in tight monetary policy periods,but a non-significant effect in loose monetary policy periods.

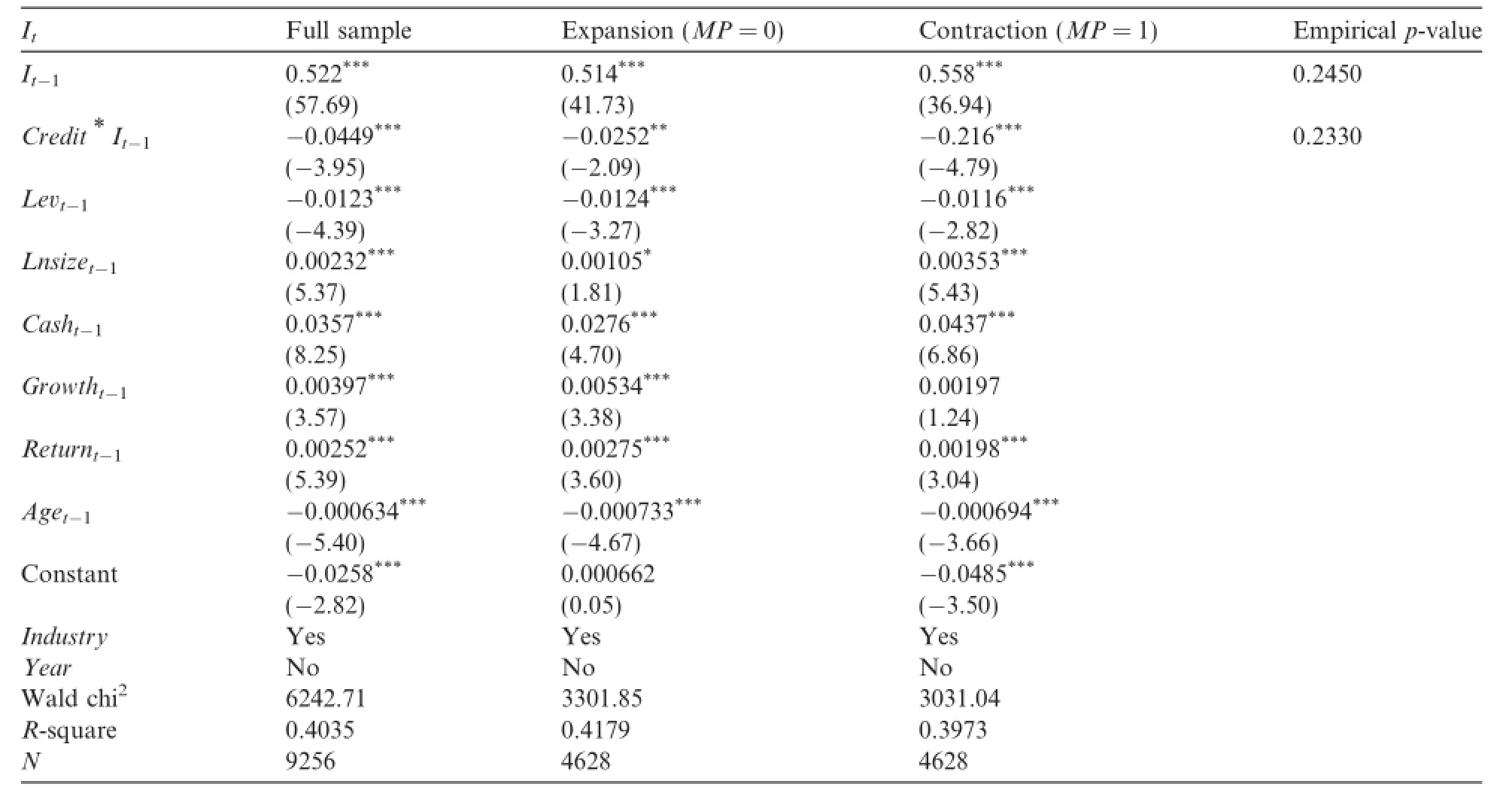

5.2.4.Credit channel and dynamic adjustment of corporate investment

Table 9 reports the estimates of the effects of the credit channel on the speed of corporate investment adjustment.The results show that the coefficient of It-1is 0.522 and the coefficient of Credit*It-1is-0.0449 when we use credit growth rate as the proxy variable of the credit channel.According to the economic significance of the model,the adjustment speed is λ′=0.478+0.0449*Credit.In our sample interval,a typical firm closes about 46.5%of the gap between the actual and target investment levels in 2010,which has the lowest credit growth rate of-28.90%,corresponding to an adjustment HALF-LIFE of 1.49 years.In contrast,it corrects about 54.45%of the gap between the actual and target levels in 2009,which has the highest credit growth rate of 148.13%,corresponding to an adjustment HALF-LIFE of 1.27 years.The results show that loose monetary policy can speed up corporate investment adjustment by increasing the credit supply.A change in credit supply has a greater effect on the speed of corporate investment adjustment in tight monetary policy periods than in loose monetary policy periods.The observed differences in the coefficient estimates indicate that the credit channel does not have an asymmetric effect,at the 10%significance level.

Table 9 Estimating the effect of the credit channel on the adjustment speed of corporate investment.

5.2.5.Robustness tests

We test the robustness of our results on the asymmetric effect in the monetary channel by repeating the test process using the M2growth rate and lending interest rates as proxies for the monetary channel of monetary policy.The results of the two tests,shown in Table 10,indicate that the differences in the coefficient estimates of the interaction term are significant at the 5%level.The results are therefore robust.

The results show that the coefficient of It-1is 0.598 and the coefficient of M2*It-1is-0.490 when we use the M2growth rate as the proxy variable of the monetary channel.The adjustment speed is then λ′=0.402+0.49*M2.In our sample interval,a typical firm closes about 46.87%of the gap between the actual and target investment levels in 2011,which has the lowest M2growth rate of 13.61%,corresponding to an adjustment HALF-LIFE of 1.48 years.In contrast,it corrects about 53.76%of the gap between the actual and target levels in 2009,which has the highest M2growth rate of 27.68%,corresponding to an adjustment HALF-LIFE of 1.29 years.The results show that expanding monetary policy to increase the growth rate of M2can speed up the adjustment of corporate investment.The effect of the change in M2supply on the adjustment speed of corporate investment is significantly greater in tight monetary policy periods than in loose monetary policy periods.

The results show that the coefficient of It-1is 0.375 and the coefficient of R*It-1is 2.191 when we use lendingratesastheproxyvariableofthemonetarychannel.Theadjustmentspeedisthen λ′=0.625-2.191*R.In our sample interval,a typical firm closes about 50.67%of the gap between the actual and target investment levels in 2009,which has the lowest lending rates of 5.40%,corresponding to an adjustment HALF-LIFE of 1.37 years.In contrast,it corrects about 46.57%of the gap between the actual and target levels in 2008,which has the highest lending rates of 7.27%,corresponding to an adjustment HALF-LIFE of 1.49 years.The results show that contracting monetary policy by raising lending rates can slow down the adjustment of corporate investment.The effect of the change in lending rates on the adjustment speed of corporate investment is non-significantly greater in loose monetary policy periods than in tight monetary policy periods.

Table 10 Robustness test results.

6.Further discussion

6.1.Monetary policy and dynamic adjustment of corporate investment:role of leverage

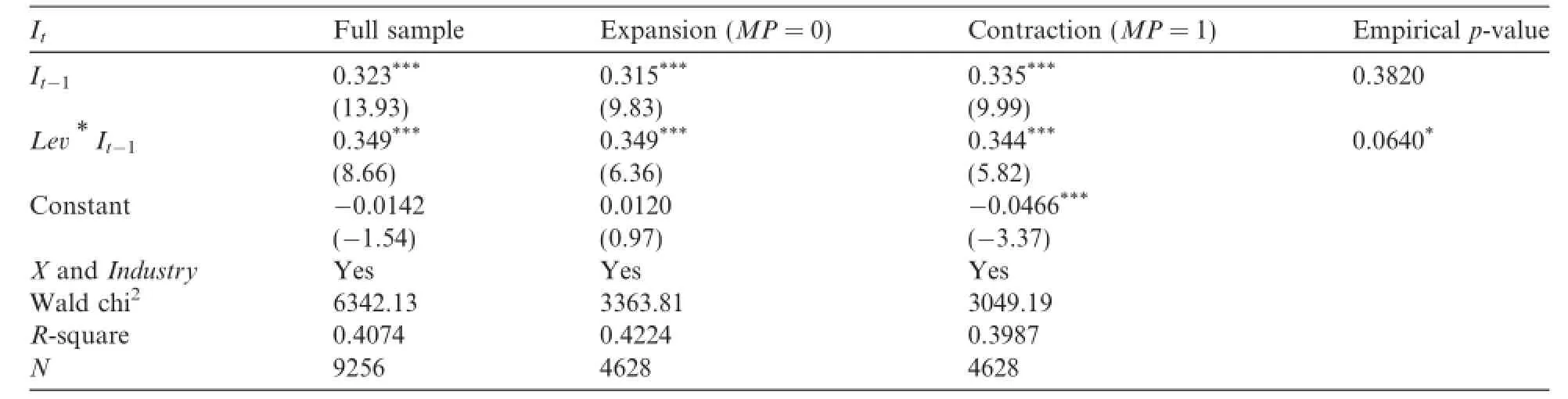

The literature shows that the leverage level plays an important moderating role in the effect of monetary policy on the adjustment of corporate investment.We examine the effect of the leverage level on the relationship between the adjustment of corporate investment and monetary policy in different states.The results are shown in Table 11.

The results show that the coefficient of It-1is 0.323 and the coefficient of Lev*It-1is 0.349.According to the economic significance of the model,the adjustment speed is λ′=0.677-0.349*Lev.A typical firm in our sample closes about 64.13%of the gap between the actual and target investment levels in one year when leverage is at its lowest level of 10.219%,corresponding to an adjustment HALF-LIFE of 1.08 years.In contrast,it corrects about 39.96%of the gap between the actual and target levels when leverage is at its highest level of 79.486%,corresponding to an adjustment HALF-LIFE of 1.73 years.The results show that the higher the leverage,the slower the adjustment speed of corporate investment.This result is due to the financing constraints that reduce the external financing supply for corporate investment.Leverage has a greater effect on the adjustment speed of corporate investment in loose monetary policy periods than in tight monetary policy periods.The observed differences in the coefficient estimates indicate that there is an asymmetric effect at the 10%significance level.The implication for policy-makers is that monetary authorities should pay more attention to firms with high leverage during loose monetary policy periods to solve their financing difficulties.

6.2.Differences between the relative and absolute speed of corporate investment adjustment

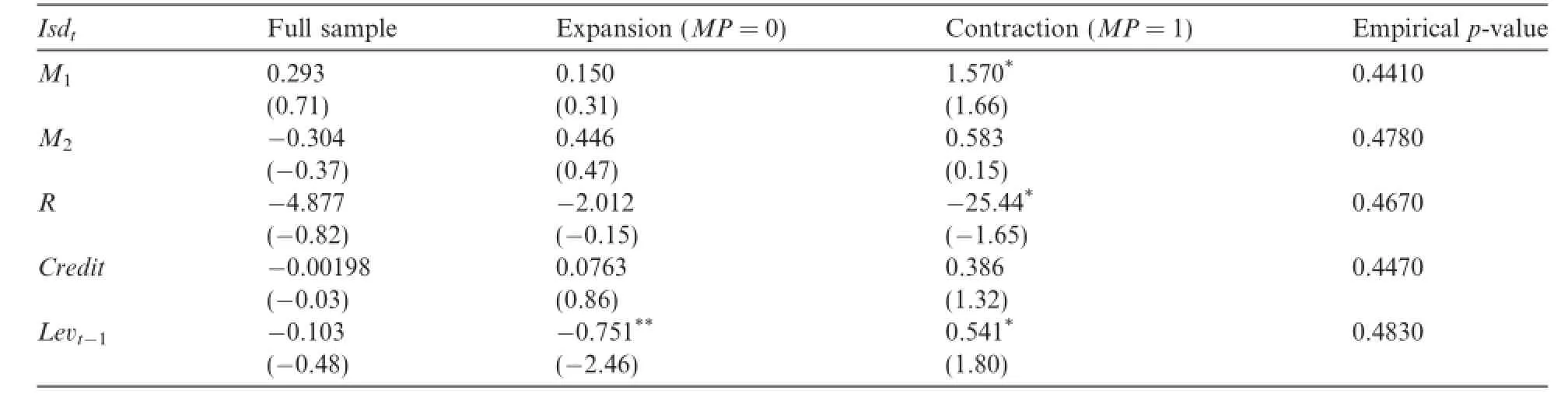

The empirical investigation above reports the effect of monetary policy on the relative speed of adjustment to the optimal level of investment.However,the effect of monetary policy on the absolute speed of adjustment of corporate investment is a more intuitive measure,which is the rate of change in the level of investment from one year to another.We repeat the empirical estimates using the absolute adjustment speed and compare the results.The empirical results of model(6)are shown in Table 12.

The results show that the effects of monetary policy variables on the absolute speed of adjustment of corporate investment are not significant,except for the effects of M1and lending rates R in tight monetary policy periods.However,lending rates have a greater effect on the absolute adjustment speed of corporate investment in tight monetary policy periods than in loose monetary policy periods,which is inconsistent with the resultsfound using the relative speed of adjustment.All of the empirical p-values are larger than 10%,indicating no asymmetric effects on the absolute speed of adjustment of corporate investment under different monetary policy states.

Table 11 Estimating the effect of leverage on the adjustment speed of corporate investment.

Table 12 Estimating the effect of monetary policy on the absolute speed of adjustment of corporate investment.

The differences in the estimation results using relative and absolute adjustment speeds of corporate investment may be caused by the measure perspective of the two kinds of speed.The relative speed of adjustment adjusts to the optimal investment level,which takes into account the effects of over-or under-investment.The absolute speed of adjustment is based only on the rate of change in corporate investment.Therefore,we argue that the relative speed of adjustment is suitable for choosing monetary policy to optimize the investment scale. For example,in response to the international financial crisis of 2007,the Chinese government implemented an expansionary monetary policy and proactive fiscal policy with a 4 trillion investment plan from 2008. Although these measures played a short-term role in economic recovery,over-investment has resulted in overcapacity and redundant construction,which is harmful to the long-term development of the economy.

7.Conclusions and implications

Based on China’s A-share listed firms from 2005 to 2012,we investigate the effects of monetary policy on the direction and speed of corporate investment adjustment.The results show that the adjustment speed of corporate investment is faster in expansionary monetary policy periods than in contractionary monetary policy periods.The monetary channel,proxied by M1,M2and loan interest rates,has a significant effect on the adjustment of corporate investment.This effect is asymmetric across different monetary policy states.The credit channel,proxied by credit scale,has a significant,but not asymmetric effect on the adjustment of corporate investment.Leverage is an important factor for restricting the adjustment of corporate investment.The higher the leverage,the slower the adjustment speed of corporate investment.

Monetary authorities should pay attention to the effect of monetary policy on the adjustment of corporate investment.Expansionary monetary policy more effectively adjusts corporate investment than tightening policy.A change in the growth rate of M1or M2has a significantly greater effect on the adjustment of corporate investment during tight monetary policies.Leverage has a greater effect on financing capacity in loose monetary policy periods than in tight periods.Monetary authorities should pay more attention to firms with high leverage during loose monetary policy periods.

Acknowledgements

We acknowledge the helpful comments and suggestions provided by Professor George YONG YANG from the Chinese University of Hong Kong,the anonymous reviewers and the participants of the SummerResearch Workshop of the China Journal of Accounting Research in July 2014.We are completely responsible for the content of this paper.

This study was supported by a Major Project Grant of the National Natural Science Foundation of China (No.71232004)and two General Projects Grant of the National Natural Science Foundation of China(No. 71172082;71372137).

References

Aguinis,H.,Boyd,B.K.,Pierce,C.A.,Short,J.C.,2011.Walking new avenues in management research methods and theories:bridging micro and macro domains.J.Manage.37(2),395–403.

Baum,C.F.,Caglayan,M.,Ozkan,N.,Talavera,O.,2006.The impact of macroeconomic uncertainty on non-financial firms’demand for liquidity.Rev.Financ.Econ.15(4),289–304.

Baum,C.F.,Caglayan,M.,Stephan,A.,Talavera,O.,2008.Uncertainty determinants of corporate liquidity.Econ.Model.25(5),833–849.

Bernanke,B.,Blinder,A.S.,1992.The federal funds rate and the channels of monetary transmission.Am.Econ.Rev.82(4),901–921.

Bernanke,B.S.,Gertler,M.,1995.Inside the black box:the credit channel of monetary policy transmission.J.Econ.Perspect.9(4),27–48.

Chatelain,J.-B.,Tiomo,A.,2003.Monetary policy and corporate investment in France.In:Angeloni,I.,Kashyap,A.K.,Mojon,B. (Eds.),Monetary Policy Transmission in the Euro Area:A Study by the Eurosystem Monetary Transmission Network.Cambridge University Press,Cambridge,UK,pp.187–197.

Chen,J.B.,2006.The policy direction,business cycles and asymmetry of the effects of monetary policies.Manage.World 9,6–12(in Chinese).

Chen,D.W.,Xu,Q.,Sun,Q.Q.,2003.The positive analysis on the asymmetry of effect of China’s monetary policy.Quant.Tech.Econ.5, 19–22(in Chinese).

Cleary,S.,1999.The relationship between firm investment and financial status.J.Finance 54(2),673–692.

Cook,D.O.,Tang,T.,2010.Macroeconomic conditions and capital structure adjustment speed.J.Corp.Finance 16(1),73–87.

Cover,J.P.,1992.Asymmetric effects of positive and negative money-supply shocks.Quart.J.Econ.107(4),1261–1282.

Fan,C.L.,Liang,S.K.,Wang,Y.W.,Chen,D.H.,Jiang,G.H.,2014.Broaden the research of macroeconomic policies and corporate behavior:a summary of the second session of academic seminar.Econ.Res.J.49(1),186–190(in Chinese).

Flannery,M.J.,Rangan,K.P.,2006.Partial adjustment toward target capital structures.J.Financ.Econ.79(3),469–506.

Gong,G.M.,Meng,S.,2012.Monetary policy,financing constraints and corporate investment.Res.Econ.Manage.11,95–104(in Chinese).

Hu,C.X.,1999.Leverage,monetary policy,and firm investment.Econ.Rev.2(2),32–39.

Huang,X.K.,Deng,S.H.,2000.On the empirical studies of monetary policies neutrality and asymmetry.J.Manage.Sci.China 3(2),34–41(in Chinese).

Huang,Y.S.,Song,F.M.,Wang,Y.,2012.Monetary policy and corporate investment:evidence from Chinese micro data.China World Econ.20(5),1–20.

Islam,S.S.,Mozumdar,A.,2007.Financial market development and the importance of internal cash:evidence from international data.J. Bank.Finance 31(3),641–658.

Jiang,G.H.,Rao,P.G.,2011.Macroeconomic policies and corporate behavior:broaden accounting and corporate finance research horizon.Account.Res.3,9–18(in Chinese).

Jing,Q.L.,Kong,X.,Hou,Q.C.,2012.Monetary policy,investment efficiency and equity value.Econ.Res.J.47(5),96–106(in Chinese).

Karras,G.,1996.Are the output effects of monetary policy asymmetric?Evidence from a sample of European countries.Oxford Bull. Econ.Stat.58(2),267–278.

Karras,G.,Stokes,H.H.,1999.Why are the effects of money-supply shocks asymmetric?Evidence from prices,consumption,and investment.J.Macroecon.21(4),713–727.

Kashyap,A.K.,Stein,J.C.,Wilcox,D.W.,1993.Monetary policy and credit conditions:evidence from the composition of external finance.Am.Econ.Rev.83(1),78–98.

Keynes,J.M.,1936.General Theory of Employment,Interest and Money.Macmillan,London.

Lang,L.,Ofek,E.,Stulz,R.,1996.Leverage,investment,and firm growth.J.Financ.Econ.40(1),3–29.

Li,Z.J.,Wang,S.P.,2011.Monetary policy,information disclosure quality and corporate debt financing.Account.Res.10,56–63(in Chinese).

Lian,Y.J.,Peng,F.P.,Su,Z.,2010.Financing constraints and liquidity management behavior.J.Financ.Res.10,158–171(in Chinese).

Liu,J.Q.,2002.Studies of the effectiveness and asymmetry of monetary policy in China’s economy.Manage.World(03),43–51(59–153,in Chinese).

Liu,X.,Ji,F.,Fu,Q.,2013.Monetary policy,group’s internal capital market and capital investment.Econ.Sci.3,18–33(in Chinese).

Luo,M.,Nie,W.Z.,2012.Fiscal policy,monetary policy and dynamic adjustment of corporate capital structure:empirical evidence based on listed firms in China.Econ.Sci.5,18–32(in Chinese).

Ma,W.C.,Hu,S.Y.,2012.Monetary policy,credit channel and capital structure.Account.Res.(11),39–48(94–95,in Chinese).

Mayer,T.,Duesenberry,J.S.,Aliber,R.Z.,1996.Money,Banking,and the Economy.WW Norton,New York.

Modigliani,F.,Miller,M.H.,1958.The cost of capital,corporation finance and the theory of investment.Am.Econ.Rev.48(3),261–297.

Oliner,S.D.,Rudebusch,G.D.,1996.Is there a broad credit channel for monetary policy?Econ.Rev.1,3–13.

Qian,Y.,2013.A study on monetary policy and corporate investment:based on firm-level dynamic panel data.Econ.Manage.01,37–43 (in Chinese).

Rao,P.G.,Jiang,G.H.,2011.Monetary policy fluctuation,bank credit and accounting conservatism.J.Financ.Res.03,51–71(in Chinese).

Rao,P.G.,Jiang,G.H.,2013a.Monetary policy,credit resources allocation and the firm performance.Manage.World(3),12–22(47,in Chinese).

Rao,P.G.,Jiang,G.H.,2013b.The impact of monetary policy on the relationship between bank loans and business credit.Econ.Res.J.48 (1),68–82(in Chinese).

Rao,P.G.,Si,M.Q.,Jiang,G.H.,Chen,D.H.,2013.Research on the relationship between macroeconomic policies and corporate behavior:a summary of the first session of academic seminar.Econ.Res.J.48(2),150–154(in Chinese).

Richardson,S.,2006.Over-investment of free cash flow.Rev.Acc.Stud.11(2–3),159–189.

Shirakawa,M.,2001.Monetary policy under the zero interest rate constraint and balance sheet adjustment.Int.Finance 4(3),463–489.

Su,D.W.,Zeng,H.J.,2009.Macroeconomic conditions and corporate capital structure:evidence from publicly-listed firms in China during 1994 and 2007.Econ.Res.J.44(12),52–65(in Chinese).

Xuan,Y.,2012.Monetary policy shock,debt conservatism,corporate financing and investment abilities.South China J.Econ.10,102–114(in Chinese).

Ye,K.T.,Zhu,J.G.,2009.Between short money supply and the allocation of credit resources.Manage.World(1),22–28(188,in Chinese).

Zhang,X.Z.,Liu,Z.Y.,Wang,J.,2012.Dual effects of monetary policy on corporate investment.J.Manage.Sci.5,108–119(in Chinese).

Zhu,J.G.,Lu,Z.F.,2009.Monetary policies,enterprise’s growth,and the change in the level of cash-holding.Manage.World(3),152–158 (188,in Chinese).

Zulkhibri,M.,2013.Corporate investment behaviour and monetary policy:evidence from firm-level data for Malaysia.Glob.Econ.Rev. 42(3),269–290.

16 May 2014

.

E-mail addresses:fuqiang853@163.com(Q.Fu),liuxing@cqu.edu.cn(X.Liu).

http://dx.doi.org/10.1016/j.cjar.2015.03.001

1755-3091/©2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

China Journal of Accounting Research2015年2期

China Journal of Accounting Research2015年2期

- China Journal of Accounting Research的其它文章

- Management earnings forecasts and analyst forecasts: Evidence from mandatory disclosure system

- Short sellers’accusations against Chinese reverse mergers:Information analytics or guilt by association?☆

- The effect of stock market pressure on the tradeoff between corporate and shareholders’tax benefits

- Guidelines for Manuscripts Submitted to The China Journal of Accounting Research