Vertical Integration and Reverse Engineering of Agricultural Enterprises

Gang WU,Yong DU

School of Economics and Management,Southwest University,Chongqing 400715,China

1 Introduction

Agricultural integration,also known as the industrialization of agriculture,is the combination of agricultural producers(farmers,farms,etc.)and other related sectors(industrial,commercial,service,financial,etc.)economically and organizationally,to achieve a certain kind of collaboration and unification,and seek common development[1].China has implemented the development strategy of agricultural integration for more than 10 years,which largely promotes the transition of traditional agriculture in China to modern agriculture.The practice proves that the agricultural integration can break through the smallholder bottleneck constraints,and rule out the traditional institutional barriers,becoming the inherent power and effective way to enhance market agricultural development[2].

The vertical integration of agricultural enterprises is an important way of agricultural integration.For a long time,a lot of literature has studied and explored the vertical integration.Spengler(1950)analyzed the vertical integration process of upstream and downstream enterprises,and believed that the vertical integration can increase profits,reduce the final product price,and eliminate the double marginalization effect[3].Stigler(1951)developed the life cycle theory of vertical integration,and believed that vertical integration is related to the life cycle of industry[4].From the point of view of uncertainty,Arrow(1975)pointed out that when there was asymmetric information in the perfectly competitive market,the downstream enterprises can draw on the backward vertical integration,and enhance the market price forecasts,in order to avoid the production efficiency loss caused by the lack of information[5].Williamson(1971,1985)expanded Coase's theory of transaction cost,and portray the vertical integration from asset specificity,transaction uncertainty and transaction frequency[6-7].

The Chinese scholars Zhang Disheng and Chen Hongmin(2001)used the game theory and differential analysis technique to analyze the motivation and externality of vertical integration under the general assumption[8].Based on the upstream enterprises engaged in R&D investment,the downstream enterprises engaged in R&D investment,and the upstream and downstream firms engaged in R&D investment at the same time,Huo Peijun and Xuan Guoliang(2000,2001,2002)analyzed the vertical integration cooperation and non-cooperation effects,indicating that the vertical R&D cooperation was conducive to promoting the corporate R&D activities,and increasing the yield of the final product,which will help improve the industry profits and social welfare,and verify the positive effects of vertical R&D cooperation[9-11].Jing Hui and Xun Zhijian(2007)thought that the vertical integration enterprises can reduce their costs,but it will increase the cost of enterprises which are not integrated,leading to unfair competition,ultimately not conducive to industrial development[12].Vertical integration will produce the market foreclosure effect,that is,the monopolistic sellers or buyers effectively use their monopoly power,to exclude competitors or reduce competition between competitors,and achieve the purpose of increasing monopoly profits.

These extremely rich and profound researches provide the theoretical reference and logical starting point for this article.This paper argues that in the duopoly structure,when the downstream enterprises carry out innovation,the upstream suppliers can decide whether to invest in reverse engineering,so that they can decipher the relevant information of customers(downstream enterprise),but the suppliers after vertical integration can obtain the information on their subsidiaries at no cost.Whether it is the information obtained from reverse engineering or subsidiaries,the suppliers can sell it to other downstream enterprises for profits.

Moreover,after one supplier is vertically integrated with one downstream enterprise,if the independent downstream enterprise chooses this integrated enterprise as its supplier,it will make its products likely to be copied.The market foreclosure arising from vertical integration reduces the independent downstream enterprises'innovation investment and profits,but increases the integrated enterprises'innovation investment and profits.

2 Hypotheses and model

Assuming that one system consists of the upstream market and the downstream market;two upstream enterprises(enterprise UAand enterprise UB)produce the homogeneous intermediate products;two downstream enterprises produce(enterprise D1and enterprise D2)use these products to produce the final products.

Assuming that the marginal cost of upstream and downstream enterprises is always zero,and the upstream suppliers provide the intermediate products for the downstream enterprises at total cost T.

The downstream enterprises can increase the profits through innovation,and when one enterprise carries out innovation,the relative advantage makes them increases profits.However,when both of the enterprises carry out innovation,the competition makes part of the profits disappear and each enterprise obtains additional profits.

Assuming that the profit is zero when the enterprises do not innovate;each downstream enterprise Di decides its own level of innovation investment;the probability of innovation is ρi[0,1];the input cost is C(ρi).

Assuming that C(ρi)is quadratic differentiable convex function and it meets C″(·)>Δ-δ.

Repeated game is as follows:

(i)Time period 1(t=1).In phase 1,D1and D2select their own level of innovation investment at the same time,the probability of innovation isρ1andρ2,and the innovation success or failure is visible for all enterprises.

In phase 2,UAand UBprovide the intermediate products to the downstream enterprises at the same time.D1and D2choose their own suppliers.

Phase 2 can also be changed to:vertical integration between UAand D1.For D2,there will be a risk:when it chooses UAas the supplier,its innovation may be copied by D1.If so,we useθ>0 to represent the probability of imitation.

Suppliers finally decide whether to invest in reverse engineering at cost of A,and the suppliers investing in reverse engineering can decipher customer information,but the integrated supplier can obtain the information on its subsidiaries at no cost.Whether it is the information obtained from reverse engineering or subsidiaries,the suppliers can sell it to other downstream enterprises at the cost of δ.

(ii)Time period 2(t=2).There are two phases same as above.

3 Vertical integration and reverse engineering

Before vertical integration,assuming A>δ,the cost A does not bring any additional profit,and the suppliers will not invest in reverse engineering,therefore,for the two vertically separated suppliers,the only equilibrium is the case,and no one invests in reverse engineering.

In contrast,the integrated enterprises may find that it is profitable investment,conducive to preventing the resulting market foreclosure effect(Hart&Tirole,1990)[13].

Assuming that UAand D1are vertically integrated into UAD1,we need to first consider the game in Time period 2(t=2).Even if the integrated enterprises have invested in reverse engineering,they will protect their subsidiaries;the independent enterprises never invest in reverse engineering.

If D2thinks that UAdoes not invest in reverse engineering in Time period 1(UAis expected to never invest in Time period 2),then the upstream competition is still symmetrical,so the suppliers set price,the innovation probability of downstream enterprises in Time period 2 and expected profit based on the cost.

If D2believes that UApreviously invested in reverse engineering,the asymmetrical upstream competition will make the intermediate product price of UBgreater than zero,that is,the vertical integration results in the rising intermediate product price,and the market foreclosure is generated("partial foreclosure").

Now we consider the game in Time period 1,and assume that the discount factor is β.When both of the downstream enterprises carry out innovation,or neither of them innovates,the upstream competition is symmetric,making the suppliers set price based on cost,and the two downstream enterprises obtain δ or 0.In both cases,there are no suppliers investing in reverse engineering.

If the innovator is D1,UAcan not benefit from reverse engineering,because even if UAwants to sell the innovation of its subsidiary business,it can be easily obtained from D1.

If the innovator is D2,the net loss for UAto invest in reverse engineering is A-θδ,but the integrated enterprises'profit is increased byin Time period 2.

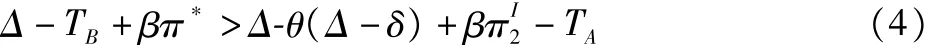

Therefore,it meets the following condition:

UA-D1is selected as supplier,and it will invest in reverse engineering.UAis willing to provide intermediate products at the cost of TA.

In contrast,UBis willing to provide intermediate products at the cost of TB:

Proposition 1:When A>β(ΠI-ΠS)-θ(Δ-2δ),there will be no enterprises investing inreverse engineering,but in Time period 1(t=1),there will be market foreclosure;when A<β(ΠI-ΠS)-θ(Δ-2δ),the integrated enterprises invest in reverse engineering,and in Time period 2(t=2),there is market foreclosure

When A>β(ΠI-ΠS)-θ(Δ-2δ),we can get:

UBwins in the competition,and the integrated enterprises do not invest in reverse engineering.Since TB>TA,it means that thevertical integration raises the prices of intermediate goods,unfavorable to the downstream independent enterprises,and the market foreclosure is generated("partial foreclosure").

When A<β(ΠI-ΠS)-θ(Δ-2δ),UAwins in the competition in Time period 1(t=1),and there is no market foreclosure,but as long as formula(1)is valid,the integrated enterprises find it profitable to invest in reverse engineering.We can see from the preceding discussion that since TB>TA,there is market foreclosure("partial foreclosure")in Time period 2(t=2).

4 Repeated game

Assuming that some suppliers must spend A>δto use customer information(for example,by investing in reverse engineering),while some suppliers can attain this at zero cost.The former is known as"good"type,while the latter is known as"bad"type.

To simplify the model,we assume that only the supplier UAtype is uncertain,that is,the probability of"good"is p(0<p<1),and the probability of"bad"is 1-p.The probability of"good"in UBis1.To simplify the model,we assume that θ=1,δ=0.Even if the profit is negligible,"bad"suppliers still choose to use customer information.

4.1Game in Time period 2 Sinceδ=0,the profit can be only earned by one enterprise Di.Now Diis assumed to be independent,and UAis selected as the supplier.

Since the income stemming from the utilization of information on Diis zero,only when UAis"bad"type can this be done.This also means that regardless of the type,UAobtains the same profit"zero",and the upstream price competition then reaches a standard asymmetric Bertrand game TA=0,TB=(1-p)Δ.

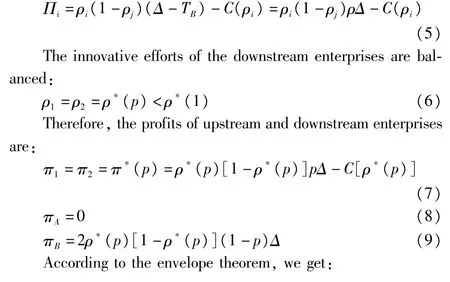

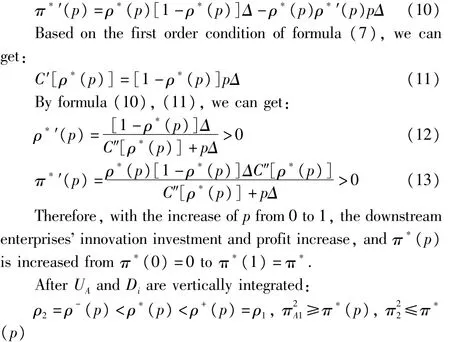

Proposition 2:When t=2,before vertical integration,the downstream enterprises'innovation investment and profits increase along with the increase in p;after vertical integration,the independent downstream enterprises'innovation investment and profits decline,while the integrated enterprises'innovation investment and profits increase.

Before being vertically integrated,the expected profit of independent enterprise Diis:

whereρ-(p)andρ+(p)signify the innovation probability of the independent downstream enterprises and the integrated enterprises respectively;π22andπ2A1signify the profit of the independent downstream enterprises and the integrated enterprises in Time period 2,respectively.

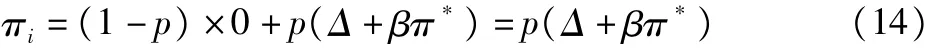

4.2Game in Time period 1 Proposition 3:When t=1,before vertical integration,the downstream enterprises actively invest in innovation and achieve positive expected profits;after vertical integration,if),the integrated enterprises fully foreclose the independent downstream enterprises.

Before vertical integration,is assumed to be the only innovator,and is selected as the supplier.will always get zero profit in the future,and total profit of is as follows:

UAis vertically integrated with D1,and UAwill protect the innovation of its subsidiaries.D2is assumed to be the only successful innovator,and UAis selected as the supplier.

If UAis"bad"type,it copies the innovation of D2and benefits in the game of Time period 2.

If UAis"good"type,it does not copy the innovation and obtains profit in the game of Time period 2.

The imitation and uncertainty of the type make the integrated enterprises getIf the following condition is met:

Regardless of the type of UA,UAwill always use information on D2,because the market foreclosure benefits exceed the costs of reverse engineering.Therefore,when A<A(p),D2should not trade with UA-D1,which causes the expected total income of D2to beθδ+(1-θ)Δ=0.The value of innovation of D2completely disappears due to imitation,and UAwill get in comeθδ=0 by imitation.

UAwill provide the intermediate goods at the price of TA=-θδ=0.So,D2chooses UBas the supplier,and the net profit of D2is as follows:

By formula(16),we can find that whenθ=1 andδ=0,TB=Δ,that is,UBcan extract the full value from the innovation of D2("complete foreclosure").

5 Conclusions

Based on repeated game,this article considers the"good"or"bad"type of enterprises,and studies the impact of vertical integration between one upstream enterprise and one downstream enterprise on the independent downstream enterprises in a duopoly market.Meanwhile the suppliers can invest in reverse engineering,which will also affect the downstream enterprises'innovation and profits.

The study results show that when the cost is higher than the threshold valueβ(ΠI-ΠS)θ(Δ-2δ),there will be no enterprise investing in reverse engineering;when the cost is lower than the threshold value,the integrated enterprises will invest in reverse engineering;in the game of Time period 2,the downstream enterprises'innovation investment and profits increase with the increase in the"good"probability of suppliers before vertical integration;after vertical integration,the independent downstream enterprises'innovation investment and profits decline,but the integrated enterprises'innovation investment and profits increase;in the game of Time period 1,the vertical integration makes the independent downstream enterprises"totally foreclosed".

[1]XIA Y,NIURF.Agricultural industrial integration and international experience[J].Issues in Agricultural Economy,1996,12:2-7.(in Chinese).

[2]NIU RF.Study on agricultural industrial integrated operation[J].Issues in Agricultural Economy,1997(2):18-24.(in Chinese).

[3]Spengler JJ.Vertical integration and antitrust policy[J].The Journal of Political Economy,1950,58(4):347-352.

[4]Stigler GJ.The division of labor is limited by the extent of the market[J].The Journal of Political Economy,1951,59(3):185-193.

[5]Arrow KJ.Vertical integration and communication[J].The Bell Journal of Economics,1975:173-183.

[6]Williamson OE.The vertical integration of production:market failure considerations[J].The American Economic Review,1971,61(2):112-123.

[7]Riordan MH,Williamson OE.Asset specificity and economic organization[J].International Journal of Industrial Organization,1985,3(4):365-378.

[8]ZHANG DS,CHEN HM.Analysis on effects of vertical integration[J].Journal of Systems Engineering,2001,16(6):425-449.(in Chinese).

[9]HUO PJ,XUAN GL.Vertical integration with research and development(R&D)investment[J].Journal of Shanghai Jiaotong University,2000,34(11):1562-1565.(in Chinese).

[10]HUO PJ,XUANGL.Comparisons of the upstream R&D expenditures between vertical integration and non integration[J].Journal of Systems Engineering,2001,16(1):36-38.(in Chinese).

[11]HUO PJ,XUANGL.The effect of vertical integration on R&D expenditure of the downstream firm[J].Journal of Industrial Engineering and Engineering Management,2002,16(1):44-46.(in Chinese).

[12]JING H,XUAN ZJ.Endogenous vertical integration of successive oligopolists[J].Journal of Industrial Engineering and Engineering Management,2007,21(2):10-14.(in Chinese).

[13]HartO,Tirole J,Carlton DW,etal.Vertical integration and market foreclosure[J].Brookings Papers on Economic Activity.Microeconomics,1990:205-286.

Asian Agricultural Research2014年2期

Asian Agricultural Research2014年2期

- Asian Agricultural Research的其它文章

- Training and Recommendations on the Lower Limbs Exp losive Force of Juvenile Amateur M en Sprinters

- Efficiency Evaluation of Vegetable Specialized Cooperatives Based on Data of Chongqing Municipality

- Effects of Soil C/N Ratio on Apple Grow th and Nitrogen Utilization,Residue and Loss

- Drought and Waterlogging Characteristics during the Grow th Period of Summer Maize in Luxi Plain Areas

- Model for Predicting Climatic Yield of Sugarcane in Nanning City

- Assessment of Cultivation M ethod for Energy Beet Based on LCA Method