Women on boards of directors and corporate philanthropic disaster response

Ming Ji,Zhe Zhng

aNorthwestern Polytechnical University,China

bXi’an Jiaotong University,China

Women on boards of directors and corporate philanthropic disaster response

Ming Jiaa,Zhe Zhangb,*

aNorthwestern Polytechnical University,China

bXi’an Jiaotong University,China

A R T I C L EI N F O

Article history:

Accepted 6 December 2011

Available online 5 May 2012

JEL classification:

G34

M14

Women on boards of directors

Political connections

Marketization

Corporate philanthropic disaster

response

Inthisstudyweconductfirm-levelanalysisoftheimpactofwomenintheboardroom on corporate philanthropic disaster response(CPDR).We propose that CPDR contains agency costs and that female directors are more likely to restrain the associated agency costs of CPDR.We predict a negative relationship between the ratio of women on boards of directors(WoBs)and philanthropic contribution,which is weaker in firms with political connections and stronger in firms with better-developed institutional environments.Data was collected from the philanthropic responses to the Wenchuan earthquake on May 12,2008 of privately-owned listed Chinese firms.The results support the hypothesized negative relationship,which is found to be weaker in firms with political connections.However,marketization-related factors do not signif icantly moderate this relationship.These results indicate that CPDR contains agency costs and that female directors do not facilitate the corporate donation process,butratherevaluatethebenefitsandrestraintheassociatedagencycosts.

ⓒ2012 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

In recent years,considerable attention has been paid to the ability of firms to devote their resources to addressing natural disasters,with arguments made based on the scale of the resources that firms possess,the competencies they may have,or the specific goods or services they can deliver(Hess et al.,2002;Margolis and Walsh,2003;Muller and Kra¨ussl,2011).The impact of natural disasters on corporate business has dramatically strengthened in recent years due to a number of high-profile events,such as the South Asian tsunami in 2004,Hurricane Katrina and the Kashmiri earthquake in 2005,the Californian wildfires of 2007(Muller and Kra¨ussl,2011)and China’s Wenchuan earthquake in 2008.Thus far,however,organizational research has not explored why and when a firm might execute a corporate philanthropic disaster response(CPDR), which has attracted a great deal of attention given its great importance to society.

Previous research has shown that women are generally more responsive to crisis situations and more likely to engage in giving than men(Williams,2003).There is some anecdotal evidence that the number of women serving on a corporate board exerts an influence on the level of activities related to corporate social responsibility (CSR)(Wang and Coffey,1992;Stanwick and Stanwick,1998).It has also been observed that women are more likely than men to desire updates on how their charitable donations are being used because they view charity as a means of securing additional relationships and a greater involvement in the community(Marx,2000).

Does the presence of women on boards of directors(WoBs)facilitate corporate philanthropic disaster response,generally referred to as corporate social responsibility(CSR)?Understanding the effects of increasing the voice of women is even more important given the recent and upcoming changes in workforce demographics(Richard et al.,2006).In fact,Ely and Padavic(2007)note that the issue of how WoB operate in most organizations is still a“black box”.

While Hillman and Cannella(2007)propose that increasing the number of WoB would alter inter-group relations among directors and affect organizational strategy,the empirical literature on the relationship between WoB and CSR has produced few studies that systematically theorize and test women’s influence at the corporate level(Terjesen et al.,2009).Williams(2003)studies this relationship based on the corporate charitable giving stated in annual reports and confirms that the underlying motives for why women are more charitable than men remain unclear.Furthermore,no previous studies have employed constructs and variables that are specifically germane to a CPDR evaluation perspective(Muller and Kra¨ussl,2011),especially in a transitional economy such as China where corporate social practices are too underdeveloped to establish a well-formed CSR culture.

Our empirical test offers a thorough examination of the firm-level effects of WoB,beginning with the general question that opened this article and moving to address whether and how WoB influence corporate philanthropic strategy and the disbursal of corporate resources through participation in and contribution to corporate disaster response.In particular,we investigate how female directors evaluate CPDR and highlight a different aspect of the relationship between WoB and CSR.Specifically,we emphasize that the role of female directors is to evaluate rather than facilitate CPDR.

Our first goal is to explore the effect of WoB on CPDR by integrating agency costs theory and a knowledgebased view to suggest a negative relationship between WoB and CPDR.Theoretically,the most relevant theories for explaining women’s effects on corporate issues in China are agency costs and knowledge-based theory.Agency costs theory captures the essence of CPDR in China and asks for regulatory methods to increase governance efficiency and restrain agency costs.The knowledge-based view of firms suggests that increased communication,coordination and collaboration among organizational members are the keys to efficient organizational decisions because they allow for knowledge integration through the pooling of group resources (Bantel and Jackson,1989;Pelled et al.,1999).These theories complement our investigation of the relationship between WoB and CPDR in China.

Our second goal is to explore the managerial motivation for CPDR.Previous studies have not considered what motivates female directors in CPDR situations,i.e.whether they restrain agency costs for the benefit of investors or whether they serve their own self interest by targeting private managerial benefits.Godfrey et al. (2008)find that the insurance effect of CSR that protects investors’wealth holds for the CSR targeting of afirm’s secondary stakeholders,but does not hold for the social initiatives targeting of a firm’s primary stakeholders.We still do not know the CPDR target that motivates directors and whether it has potential benefits for investors.

Furthermore,it is important to understand the conditions under which female directors exert the ability to evaluate the benefits and restrain the agency costs of CPDR.Although strategic scholars have identified the external environment as the key contingency factor in the relationship between organizational processes andcorporate strategy(Richard et al.,2006),no systematic study has examined the roles that contingent factors play in the relationship between WoB and CPDR.We call for an integration of the organizational behavior and strategy literature and posit that women’s behavior and group processes in specific environmental contexts must be considered,along with the association between these processes and the context in which they occur. Therefore,it is important to consider the varying impact that WoB have on CPDR under different types of conditions.Thus,our third goal is to examine contingent effects on the relationship between WoB and CPDRs.

This study makes the following contributions.First,we extend the literature by integrating agency costs and knowledge-based theories and propose an evaluation function for female directors to emphasize the negative impact that WoB have on CPDR.Second,we examine the moderating effects of marketization and political connections-typical characteristics of transitional economies,especially China-on the relationship between WoB and CPDR.Third,we use a unique database gathered from Chinese privately-owned listed firms’donation announcements after the Wenchuan earthquake of 2008,and the empirical results support our hypotheses.

The remainder of this article proceeds as follows.The next section describes the theoretical model and presents hypotheses for empirical testing.The third section outlines the empirical method used to investigate the hypotheses.The fourth section presents the results.The fifth and concluding section discusses the implications of the findings and the limitations of the study.

2.Theory and hypothesis development

In this section we discuss why CPDR contains considerable agency costs,especially in China.We then consider how WoB affect the organizational evaluation of CPDR before philanthropic contribution decisions are made.In addition,we outline two contingency factors that might mitigate female directors’ability to properly evaluate CPDR:the marketization factor,which influences whether female directors are empowered with the rights to evaluate CPDR and the political connection factor,which determines the extent to which female directors hold the rights to alter CPDR.

2.1.Corporate philanthropic disaster response and agency costs

Margolis and Walsh(2001)review almost 100 studies attempting to quantify a relationship between CSR and corporate financial performance,but they fail to produce a conclusive result.The motivation behind CSR is quite complex and changes within different contexts,making it difficult to rely on a single theory to explain all of the resulting relationships.We propose that CPDR can be classified as a kind of agency cost in China that is based on exchanges between firms and the government.

2.1.1.Exchanges between firms and government in China

“CSR activities targeting primary stakeholders should produce exchange capital among groups-the potential to create more advantageous exchanges between the firm and its primary stakeholders.Such CSR activities,however,are less likely to produce moral capital;indeed,precisely because these actions can be viewed through a power-exchange lens they may be viewed as merely self-serving,rather than other-regarding,behaviors”(Godfrey et al.,2008,p.5).

As one of the largest transitional economies in the world,China has undergone dramatic changes since 1978.The government has played a very important role in economic development and continues to exert great influence on corporate operations(Nee et al.,2007;He and Tian,2008).Government bureaus at all levels are powerful groups in that they are the most important stakeholders of business firms(He and Tian,2008).

Even with China’s current economic transition,a large number of firms still depend on the government for resources such as capital,land,favorable policies and other assistance.A Chinese firm must use some government-oriented strategies to cultivate its relationship with the government.Chinese political institutions do not legitimize corporate political rent-seeking such as campaign contributions or corporate lobbying,so it becomes necessary to find other ways to obtain rents.In China,firms use philanthropic contributions for rent-seeking more frequently than firms in other countries.Corporate involvement in government-proposed social and charitable activities is a very helpful conduit because firms achieve moral legitimacy when thegovernment judges their activities to be acceptable and proper.For example,after the Wenchuan earthquake in 2008,the government encouraged firms to engage in disaster relief.Because corporate donations were motivated in this way,CPDR helped firms to cultivate a beneficial relationship with the government,which in turn created favorable policies.This kind of donation is similar to the political lobbying that prompts cash-preferential policy exchanges between firms and the government.

2.1.2.Agency cost perspective

It remains a concern that corporate responses to disaster in the form of cash donations to the government are not altruistic.In such cases state-owned listed firms should donate more generously than privately-owned listedfirms because the former represent the government’s efforts to assume social responsibility and deliver disaster relief.However,Zhang et al.(2009)find that state-owned listed firms donated less than privately-owned listedfirms in response to the Wenchuan earthquake.Furthermore,disaster victims typically need vital emergency materials such as food,water and medicine,and it can be difficult to apply cash in solving such resource limitation problems in atimely manner.A firm’s choice to donate cash ismainlydriven by the knowledge thatdoing so might grab stakeholders’attention without the responsibilities of providing the necessities of disaster relief.

Consistent with a political contribution perspective on CPDR,managerial opportunism is an additional motive behind corporate disaster donations.A manager may contribute corporate resources to achieve a higher social status,gain favor with board members by contributing to their favorite causes or further their own ideological preferences(Barnard,1997).Boatsman and Gupta(1996)and Helland and Smith(2003)provide evidence that managers and board members exert significant influence over corporate giving.Previous studies on the antecedents of CSR show that agency cost-related variables such as managerial shareholdings, board composition and the number of board members significantly influence corporate donations(e.g.,Brown et al.,2006;Helland and Smith,2003).Giving programs may enable managers and directors to support favorite charities at shareholders’expense.

Although managers may use CPDR to build up a relationship(guanxi)with the government and simultaneously purchase personal benefits,many empirical studies show that the practice is not necessarily beneficial for investors.

2.1.3.Empirical studies on CPDR

Several empirical studies support our conclusion that CPDR is not related to altruism.Muller and Whiteman(2008)collect data on donations related to the South Asian tsunami,Hurricane Katrina and the Kashmiri earthquake from Fortune Global 500 firms located in North America,Europe and Asia.Their results reveal inter-regional differences in the overall likelihood of donations and their cash value,providing evidence of a home-region effect on CPDR,whereby firms pay more attention to disasters that are close to home or in locations where they have a local presence.Shan et al.(2008)study the economic motivation for corporate donations based on Chinese firms’responses to the Wenchuan earthquake and find that firms with products directly related to consumers’daily lives generally donated 50%more than other firms.

It could be argued that if CPDR is certain to be beneficial to a firm,its investors would respond positively to corporate donation announcements.However,empirical results from previous studies do not support this conclusion.Muller and Kra¨ussl(2011)investigate stock market reactions to corporate donation announcements based on the corporate response to Hurricane Katrina.Their results show that CPDR is not linked to specifically positive or negative abnormal returns overall.They further argue that in such cases the donatingfirm gains no“moral capital”because although the cause(the CPDR)is considered positive,the firm’s intentions are not perceived as genuine.

Taken together,both the exchanges between firms and government and the agency cost perspective suggest that CPDR which targets the Chinese government generates private benefits for managers,and that this kind of corporate donation is similar to an agency cost that does not definitively provide benefits for investors.

2.2.Women on boards of directors and corporate philanthropic disaster response

CPDR contains agency costs and is not necessarily consistent with investors’values.Although directors can expropriate private benefits from CPDR,female directors have significantly different motivations from theirmale counterparts when it comes to such benefits.Female directors mainly evaluate the benefits of CPDR for corporate efficiency and the consideration of investors.International comparisons show that countries with more women in their governments also have a lower level of corruption(Swamy et al.,2001;Dollar et al., 2001;Cheung and Herna´ndez-Julia´n,2007).Eckel and Grossman(2001)find women to be less selfish in dictator game experiments and Schubert et al.(1999)find them to be more risk-averse in their financial decisionmaking.Levi et al.(2008)show that the bid premium over pre-announcement target share prices is statistically and economically smaller if the CEO of the bidding firm is a woman.These studies suggest that women would be less likely to participate in the selfish,risky activities of corruption and more likely to use creative measures to discover value and correct the tendency to overpay,if it exists.

The effect of female directors in boardrooms on buffering the conflicts of interest that arise between male directors and investors during CPDR,from an agency costs and knowledge-based perspective,suggests a negative relationship between WoB and CPDR.The knowledge-based view of the firm suggests that although knowledge is developed by individuals,the organization plays a critical role in articulating and applying it through integration and coordination efforts(Grant,1996).WoB have a positive effect on corporate governance efficiency(Francoeur et al.,2007;Adams and Ferreira,2009).On male-dominated corporate boards, female directors promote a better understanding of the marketplace,increase organizational creativity and innovation,exercise effective problem solving,promote corporate monitoring,decrease the private benefits of managerial control,enhance the effectiveness of corporate leadership,display a better understanding of the complexities of the environment,promote more effective global relationships and encourage cultural sensitivity among corporate leaders(Robinson and Dechant,1997;Carter et al.,2003;Richard et al.,2007). The potential agency costs of CPDR stimulate female directors to make decisions in opposition to those of their male counterparts,preventing the chance that CPDR will be initiated by selfish behavior.

Based on the preceding logic,because CPDR contains considerable agency costs it is reasonable to propose that WoB increase corporate governance efficiency and female directors evaluate the benefits of CPDR for shareholders,restrain the agency costs of CPDR and,consequently,respond negatively to CPDR.Hence, we assert:

Hypothesis 1.Women on boards of directors have a negative association with corporate philanthropic contributions to disaster relief.

2.3.Moderating roles of political connections and marketization

Contingency theory states that an organizational process must fit its context(Drazin and Van de Ven, 1985).It hypothesizes that no one method of management can be optimally effective in all situations,and research should explore the context in which various resources will have the best influence(Miller and Shamsie,1996;Richard et al.,2007).

Given that it is the largest transitional economy in the world,China has only recently built up an efficient institutional separation between business and government.Firms,governments and wide societal elements collectively shape market regulations conducted through consultation and accommodation,resulting in incremental and ongoing rather than episodic and radical policy change(Detomasi,2008).Therefore, relationships with the government help firms to obtain rent-seeking benefits.Detomasi(2008)argues that the institutional characteristics of a political environment have the potential to determine whether and howfirms might pursue CSR.We propose that political connections with the government and marketization levels have a significant influence on the relationship between WoB and CPDR in China.

2.3.1.The moderating role of political connections

Political connections are a kind of relational wealth whereby managers’personal connections with the government(or government officials)affect not only corporate performance but also decisions regarding issues such as philanthropic contributions.A number of studies examine corporate political connections within different countries(see,e.g.,Fisman(2001)for Indonesia,Johnson and Mitton(2003)for Malaysia,Ferguson and Voth(2008)for Germany and Agrawal and Knoeber(2001)for a sample of outside directors in theUS).Several recent studies also provide cross-country evidence of the impact of political connections on firm value(Faccio,2007).Taken together,these findings suggest that politically connected firms should benefit from their connections,particularly in countries with higher levels of corruption.If CPDR facilitates the development and maintenance of relationships with the government,then political connections should promote the effects of corporate philanthropic decisions beyond any constraints,such as female directors’negative impact on CPDR-ultimately facilitating firm-government exchanges.

In politically connected firms,female directors encounter strong pressure exerted by politically connected managersandafirm-connectedgovernment,whichmightmakethemlesslikelytovoteagainstCPDR.Thiscreates an environment in which female directors are less likely to challenge a political intervention initiated by the government that interrupts the regular organizational decision-making process.Based on this logic,we hypothesize:

Hypothesis 2.Political connections weaken the effect of female directors in such a way that the negative relationship between women on boards of directors and corporate philanthropic contributions to disasters will be less salient for listed firms with political connections.

2.3.2.The moderating role of marketization

Market development means market-based transactions and a free economy.In an environment with a high level of marketization,capital markets tend to be broad,deep and active,providing venture capital for start-ups and disciplining poor performing firms to produce returns and increase their value for shareholders(Murtha and Lenway,1994).The process of organizational decision making in this type of environment is normative andfollowsmarket principles.Professionalwomenareselected andpromotedtovariousboardsbasedonmerit. Female directors are less likely to encounter a glass ceiling when they seek promotion and are empowered based on their board seats.This empowerment strengthens their ability to oppose their male counterparts regarding CPDR,which contains considerable agency costs.In addition,an efficient market that yields insignificant positive returns after CPDR(Muller and Kra¨ussl,2011)validates the rejection of CPDR by female directors.

However,if firms are operating under an environment with a low level of marketization that does not allow for promoting women onto boards of directors,they will not have the motivation to invite professional women capable of hampering the male-dominant board culture to serve on their boards.Furthermore,female directors will be more likely to be punished for their contrary suggestions/decisions than their male counterparts. Westphal and Stern(2007)use survey data from 760 outside directors at large and medium-sized US firms and find that women are rewarded less than their male counterparts in the director labor market for engaging in a given level of advice-giving or ingratiatory behavior.In other words,women are less likely to improve their chances of receiving a board appointment by engaging in this behavior.They are also punished more frequently for engaging in monitoring and controlling behavior.In these situations,female directors are compelled to agree with their male counterparts rather than vote against them.Following this logic,we posit:

Hypothesis 3.The negative relationship between women on boards of directors and corporate philanthropic contributions to disasters will be more salient for listed firms operating in an environment with a higher level of marketization than those operating in an environment with a lower level of marketization.

3.Methodology

3.1.Sample

The May 12,2008 Wenchuan earthquake resulted in more than 68,858 deaths and losses in the hundreds of billions of Yuan as of May 30,2008.These numbers will undoubtedly continue to increase as more information becomes available about the extent of the event(Wang,2008).After the earthquake,many publicly tradedfirms listed on the Shanghai and Shenzhen stock exchanges disclosed philanthropic contribution plans.Our sample consists of all privately-owned firms listed before 2006,a total of 519 firms.

We do not include state-owned listed firms in our study for the following reasons.First,the legitimacy of state-owned listed firms’donations of corporate resources to the government is still debatable.The regulatory agencies with jurisdiction over SOEs have raised concerns that such donations could undermine the value ofstate-owned assets and seriously control corporate donations.1In November 2009,the Chinese State-owned Assets Supervision Admission Committee established a regulation on charitable giving by SOEs that are under central government control.Please refer to the website:http://www.gov.cn/gzdt/2009-12/16/content_1488862.htm.Second,the motivation behind the donations of SOEs is complex.Wang and Qian(2010)study the relationship between corporate donation and performance in China and find that state-owned firms do not receive benefits from corporate donations.An SOE’s donation of corporate resources is more likely to be motivated by other political factors,regardless of the economic returns.Third,there are generally fewer women serving on the corporate boards of state-owned listedfirms than on the boards of privately-owned listed firms.Based on our collected data,the ratio of WoB is only 9%in SOEs,comparatively less than the ratio of WoB in privately-owned firms.However,studies on women’s ability to alter corporate decision making emphasizes that only one or two women usually serve in the boardroom,and they are treated as tokens whose contributions are dismissed or devalued by their male counterparts (e.g.,Konrad et al.,2008;Torchia et al.,2011).Consequently,the effect of women on corporate governance is quite limited in SOEs.Furthermore,in a robustness test,we analyze a sample of SOEs and find the relationship between the ratio of WoB and corporate donations is not significant.

Consistent with previous research(e.g.,Muller and Whiteman,2008)our investigation is based on firm selfreporting and draws from information disseminated through the official information disclosure website appointed by the China Securities Regulatory Commission(CSRC),2The website is http://www.cninfo.com.cn/default.htm.corporate websites and press releases.3The information published on http://www.finance.sina.com.cn/blank/zzqyxd.shtml also provides corporate giving data.To obtain charitable donation data,we match these firms with data provided in corporate disclosures after the earthquake.The disclosures include information on cash contributions by firms.A total of 121 listed firms made charitable donations.We also use financial data from these firms’annual reports for 2006.As a result of missing data,the sample varies between 468 and 476 listed firms.

3.2.Measures and analytical approach

3.2.1.Dependent measures

In line with Brown et al.(2006),we introduce three dependent variables:donation,the ratio of giving to assets and the ratio of giving to profits.We use the dummy variable donation to measure whether a firm demonstrated a philanthropic disaster response.If the firm responded to the disaster,donation is coded 1,otherwise 0.The ratio of giving is defined as the amount the firm identified as its cash contribution to disaster relief. We use two ratios of giving measures proposed by Brown et al.(2006),where the ratio of giving to assets equals the log-transformed(ratio of RMB value of company donations to total assets*100+1)and ratio of giving to profit equals the log-transformed(ratio of RMB value of company donations to net profits+1).

3.2.2.Independent variable

We use the ratio of women on boards of directors as the measure of WoB.This treatment is consistent with previous studies(Adams and Ferreira,2009;Harrison and Klein,2007;Campell and Mı´nguez-Vera,2007).

3.2.3.Moderating variables

Next,we include three moderating variables.Following Faccio(2007)and Fan and Wong(2007)we define political connection as the CEO being connected to current or former government bureaucrats or a member of the Peoples’Congress.We measure the marketization of different regions that listed firms are registered in China based on Fan and Wang(2010).We decompose the index of marketization into marketization level and law enforcement level as proposed by Fan and Wang(2010).Based on whether the marketization and law enforcement level values are larger than the mean,we construct two dummy variables and code marketization and law enforcement levels as 1 and 0,respectively.

3.2.4.Control

A number of controls are included in the analysis.The ratio of debt to assets is measured to control for capital structure.Net profit is specified in the model as a control variable because it has been found to havea direct effect on corporate philanthropic contributions due to the influence of economic scale and market power(Brown et al.,2006).In addition,we introduce listed years,the number of years between the year in which the firm was listed in 2008,to control for the effect of corporate familiarity because firms that have been listed for a long time tend to make large philanthropic contributions(Godfrey,2005).We also control for the geographic location effect with geographic distance,which is calculated based on the geographic distance between the registered region of the listed firm and the earthquake center as drawn from Google Maps data. Finally,we introduce market type to control for industry effects.If a firm’s industry is classified as not being related to the basic necessities of life such as clothing,food,shelter and transportation,the market type is coded 1,otherwise 0.

3.3.Correction for endogeneity

Although we anticipate that WoB influence corporate donations to disasters,it is possible that corporate characteristics influence the presence of women on corporate boards.Brown et al.(2006)propose that firms introduce women onto their boards symbolically.If sufficient women serve on the board of supervisors,which is coordinated with the board of directors,the firm will also provide more seats on the board for women,to disperse any concerns about discrimination.Furthermore,if the chairman,CEO or board secretary is a woman,then the firm will have more women on the board of directors in accordance with a preference for gender similarity(Adams and Ferreira,2009).Adams and Ferreira(2009)show that the ratio of WoB is smaller in large firms.Keeping the requirement of efficient instrumental variables in mind,to control for potential endogeneity we introduce number of female directors on monitoring board,chairman or CEO is a woman,board secretary is a woman and corporate asset scale as instrumental variables.

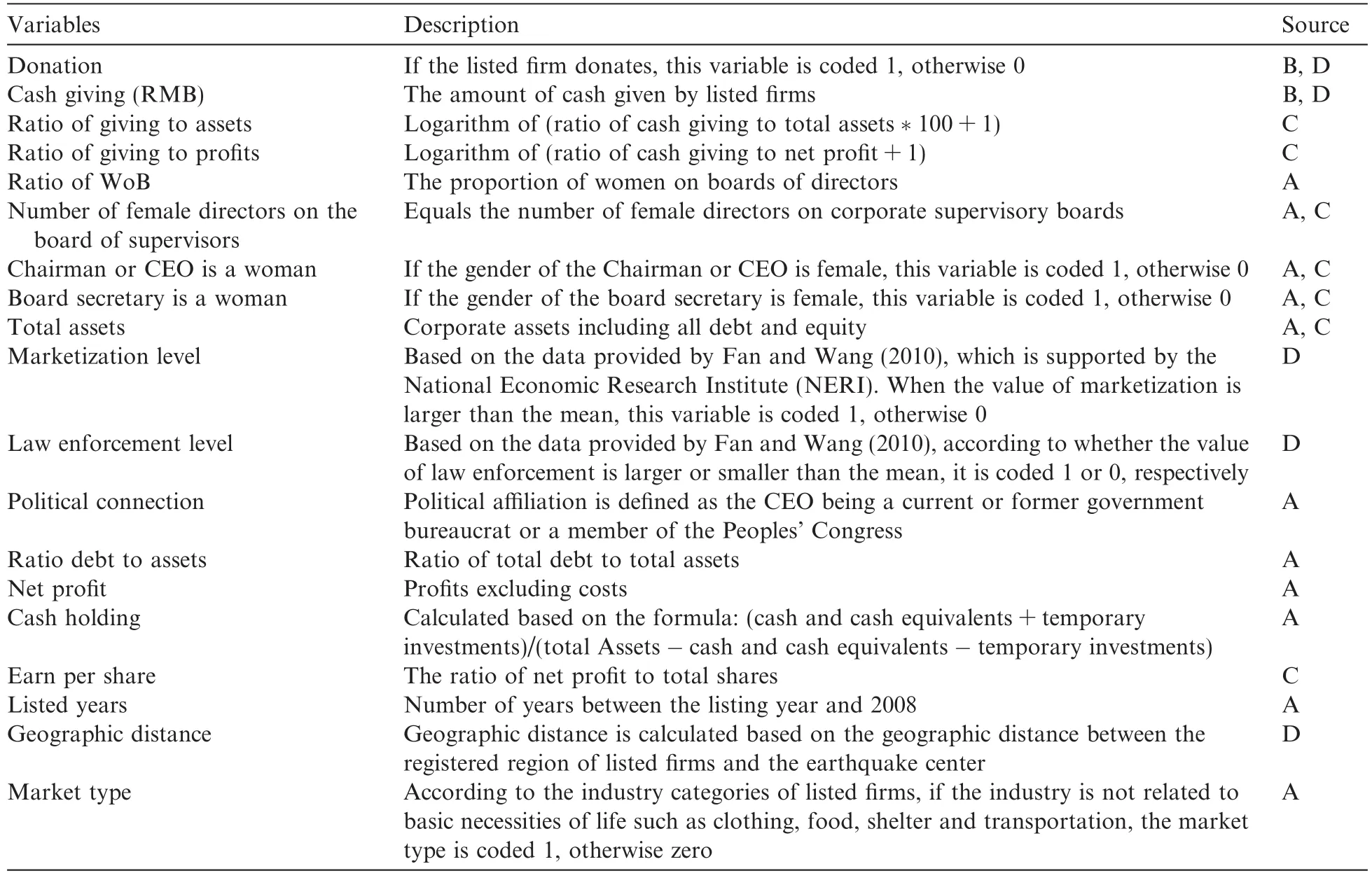

Table 1Variable definitions.This table reports and describes the variables used in our regression analysis.Data sources:A=annual reports; B=listed firms temporary disclosure;C=data stream(http://www.gtarsc.com/)and D=news reports on the Internet or in books.

?

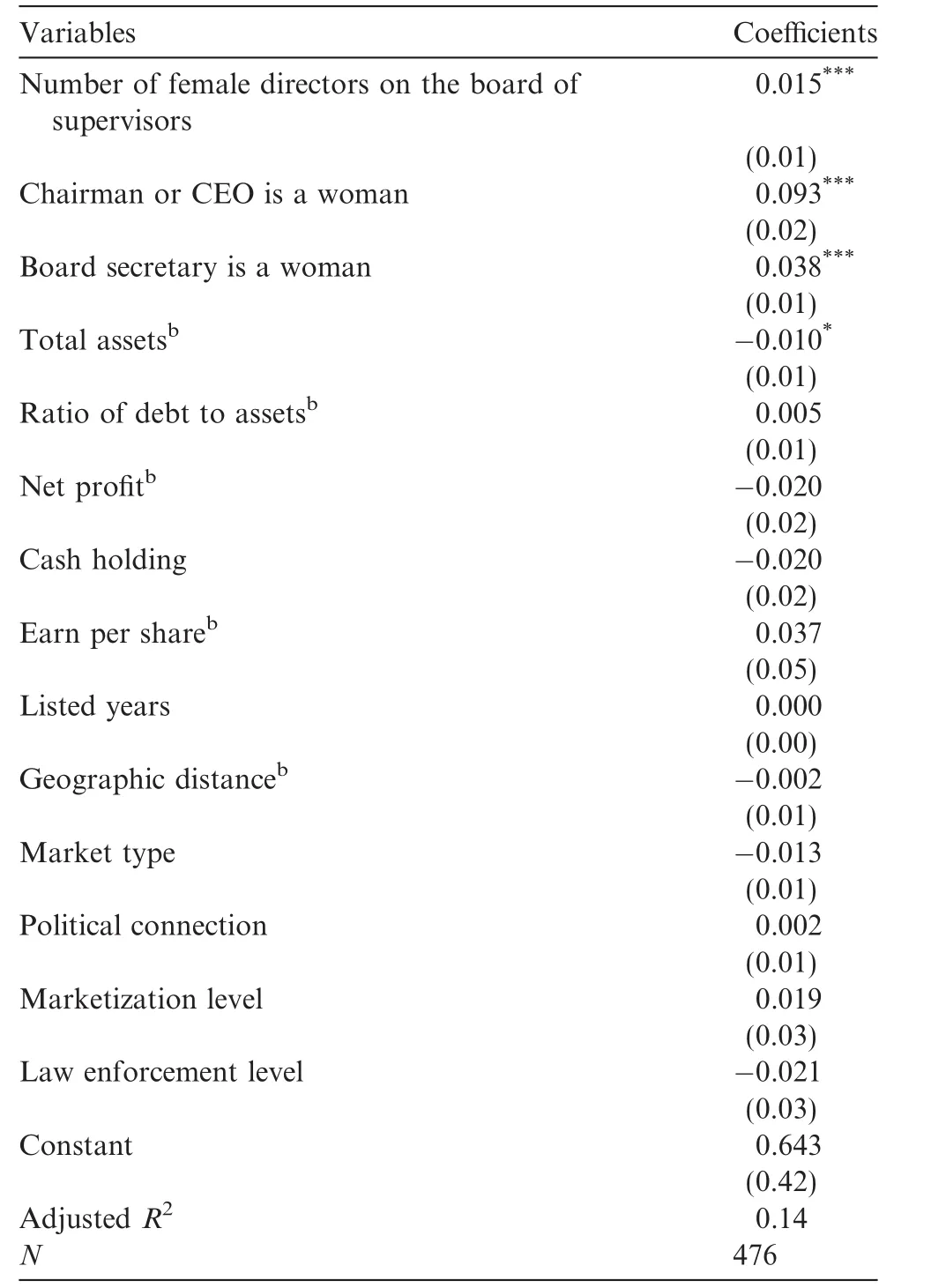

Table 3First-stage regression analysis for the ratio of women on boards of directors.a

The analysis is conducted in two stages.In the first stage we use ordinary regressions to model the influence of instrumental variables on the ratio of WoB.In the second stage we include the endogeneity correction variable and use a binomial logistic regression to model the likelihood that a given firm is expected to donate.We analyze the ratios of giving amounts using Tobit regression models.Because a large number of values for the dependent variable‘Giving’are 0,the censorship regression model is appropriate.Table 1 presents the def initions and sources of the data.

4.Results

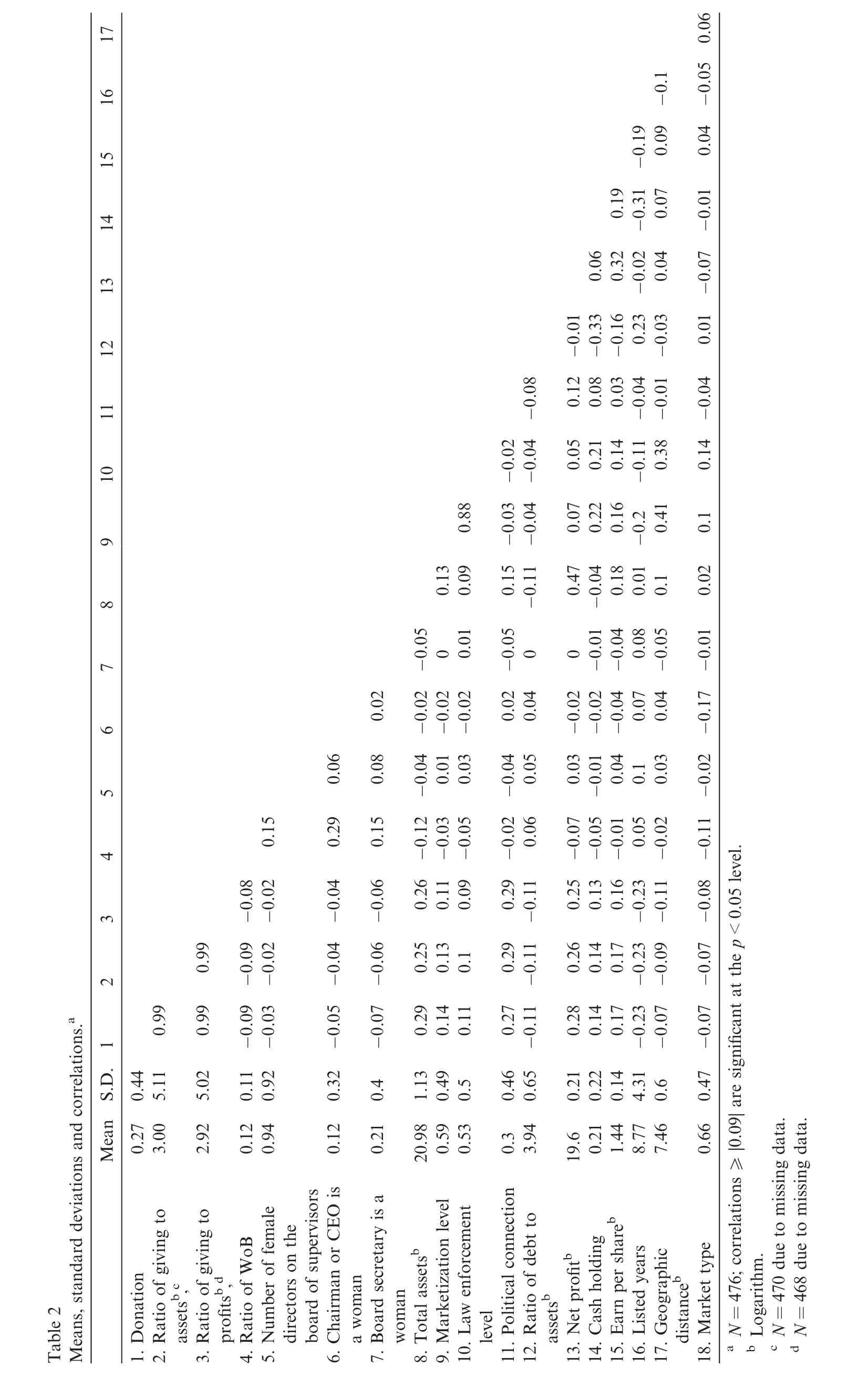

The results are reported in Tables 2,3 and 4a-4c.Table 2 reports the descriptive statistics of our variables. The correlations between the variables do not suggest any potential for serious multicollinearity in the regression analysis.

Table 3 reports the regression results and effectiveness of the instrumental variables.As predicted,all of the instrumental variables are significantly related to the ratio of WoB.Following the methods described in ourtwo-stage regression to control for endogeneity,we create a variable to measure the residual of the ratio of female directors on the board and include it in the following regression models.

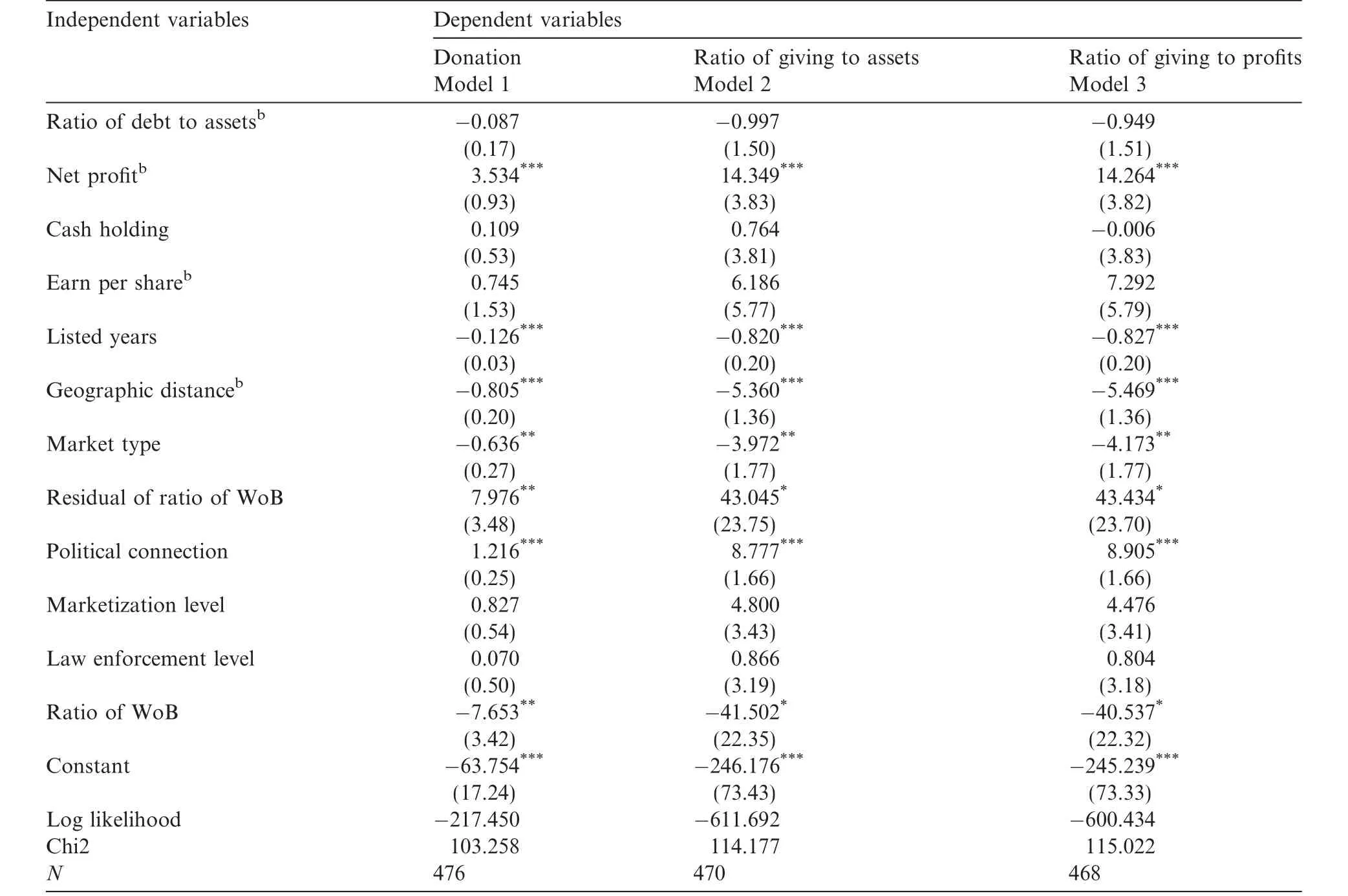

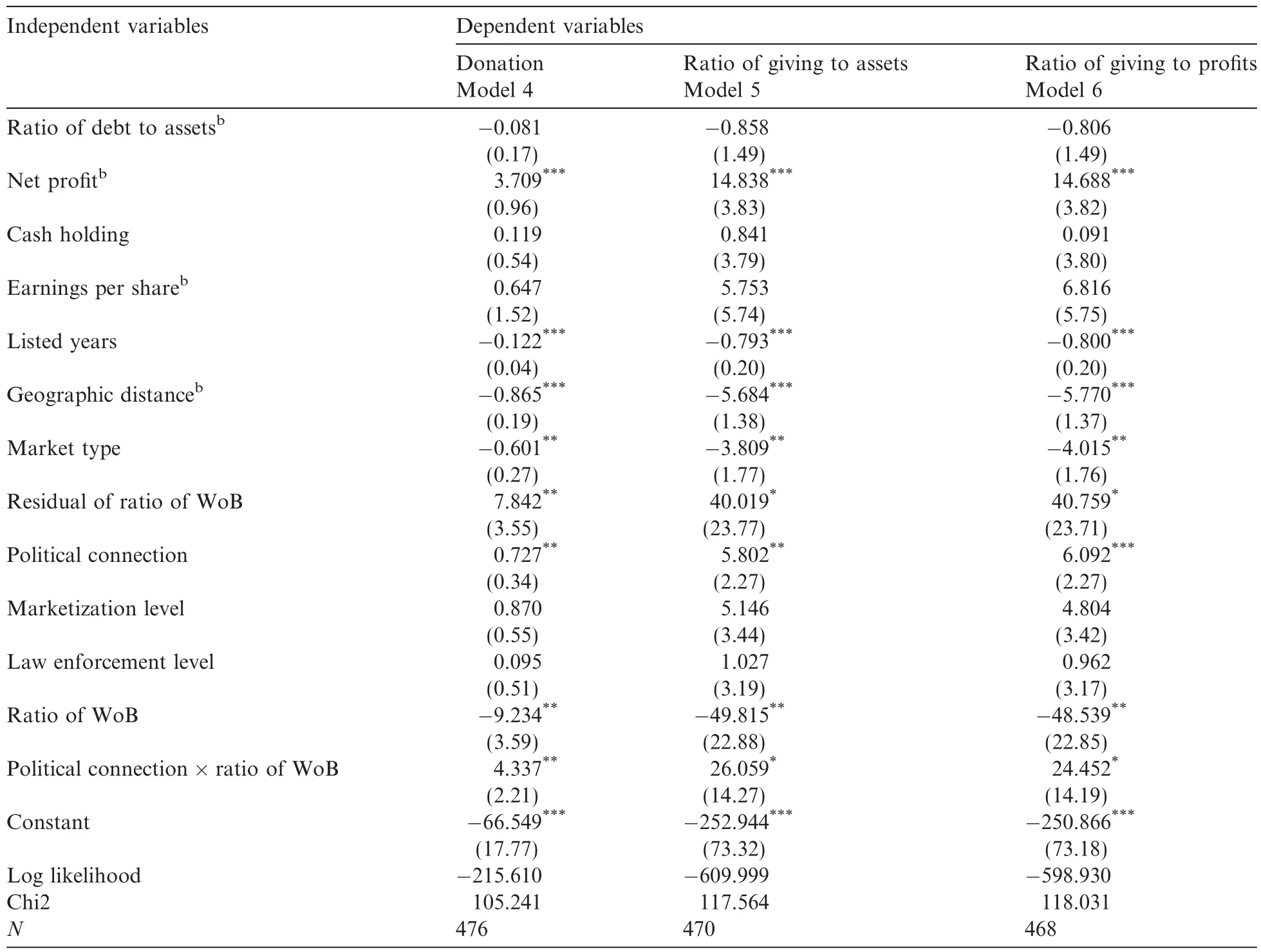

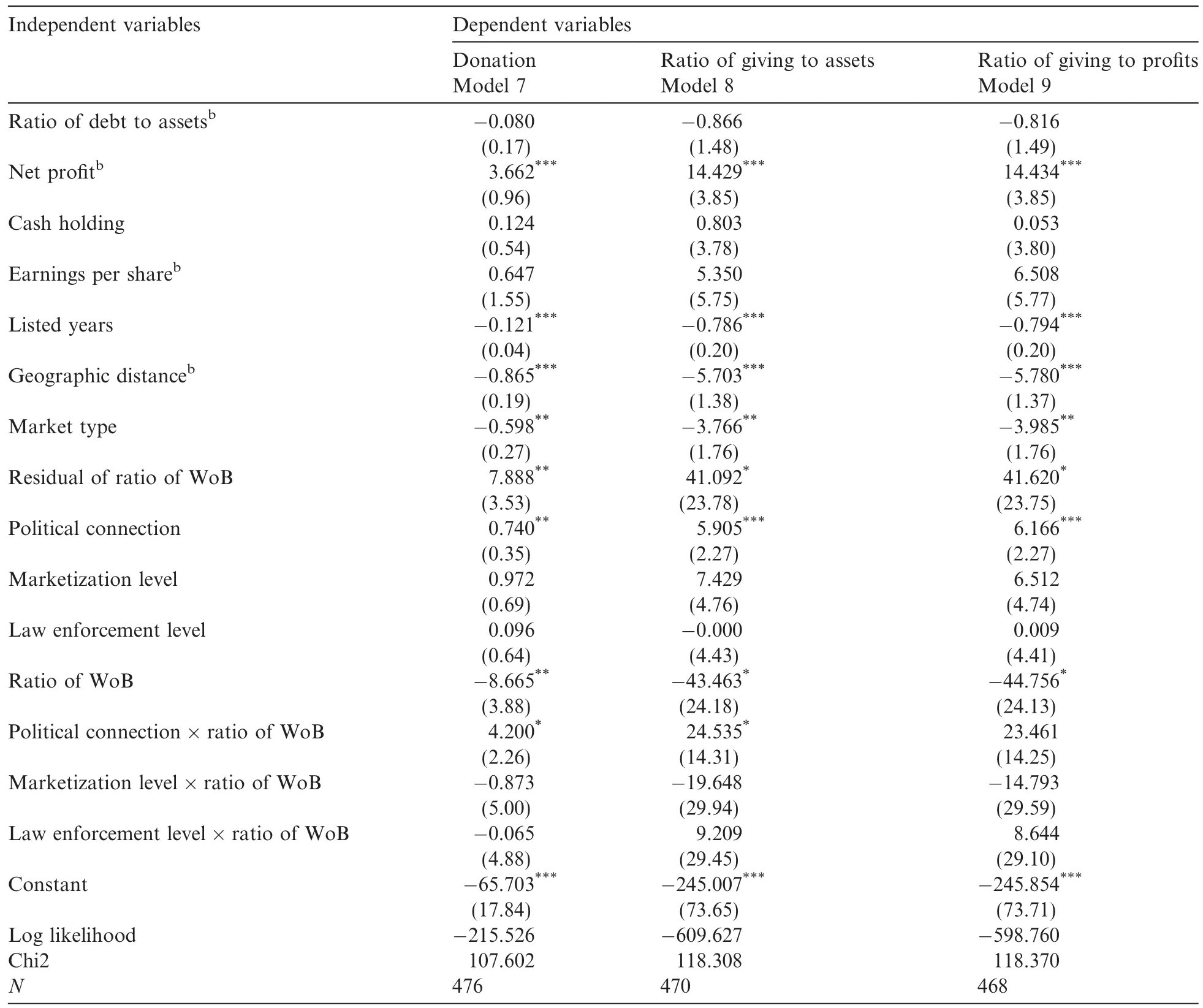

Tables 4a-4creport theregressionmodelforCPDR.The significantcoefficientsontheresidualofthe ratioof WoB confirm the endogeneity problem for WoB and the effectiveness of introducing the two-stage regression method to correct for it.To test whether political connections,marketization level and law enforcement level are significant moderators of the relationship between WoB and CPDR,we introduce a hierarchical regression analysis.Step1includesmodels1,2and3.Thecontrolandmaineffectvariablesareincludedwiththedependent variables donation,ratio of giving to assets and ratio of giving to profits,respectively.When model 1 predicts CPDR probability,the coefficient for the ratio of WoB(β=-7.653,p<0.05)is significant.Similarly,when models 2 and 3 predict the giving ratio,the coefficients for the ratio of WoB in model 2(β=-41.502, p<0.10)and model 3(β=-40.537,p<0.10)are also significant.These results support Hypothesis 1.

Step 2 includes models 4,5 and 6.We include the product term of political connection×ratio of WoB to signify the interaction between political connections and WoB.When model 4 predicts CPDR probability,the interaction effect between political connections and the ratio of WoB is significant(β=4.337,p<0.05).When models 5 and 6 are used to predict the ratio of giving to assets and the ratio of giving to profits,the interaction effects are also significant in model 5(β=26.059,p<0.10)and model 6(β=24.452,p<0.10),which support Hypothesis 2.

Table 4aSecond-stage regression results predicting the relationship between corporate donations and women on boards of directors.a

Table 4bSecond-stage regression results predicting the relationship between corporate donations and women on boards of directors,including the moderator of political connections.a

Step 3 includes models 7,8 and 9.We include interaction terms between political connections,marketization and political intervention with the ratio of WoB.The interaction terms between political connection and the ratio of WoB are positive and significant in models 7 and 8.However,the interaction terms between the marketization-related variables and the ratio of WoB are not significant in all three models.These results confirm Hypothesis 2,but not Hypothesis 3.

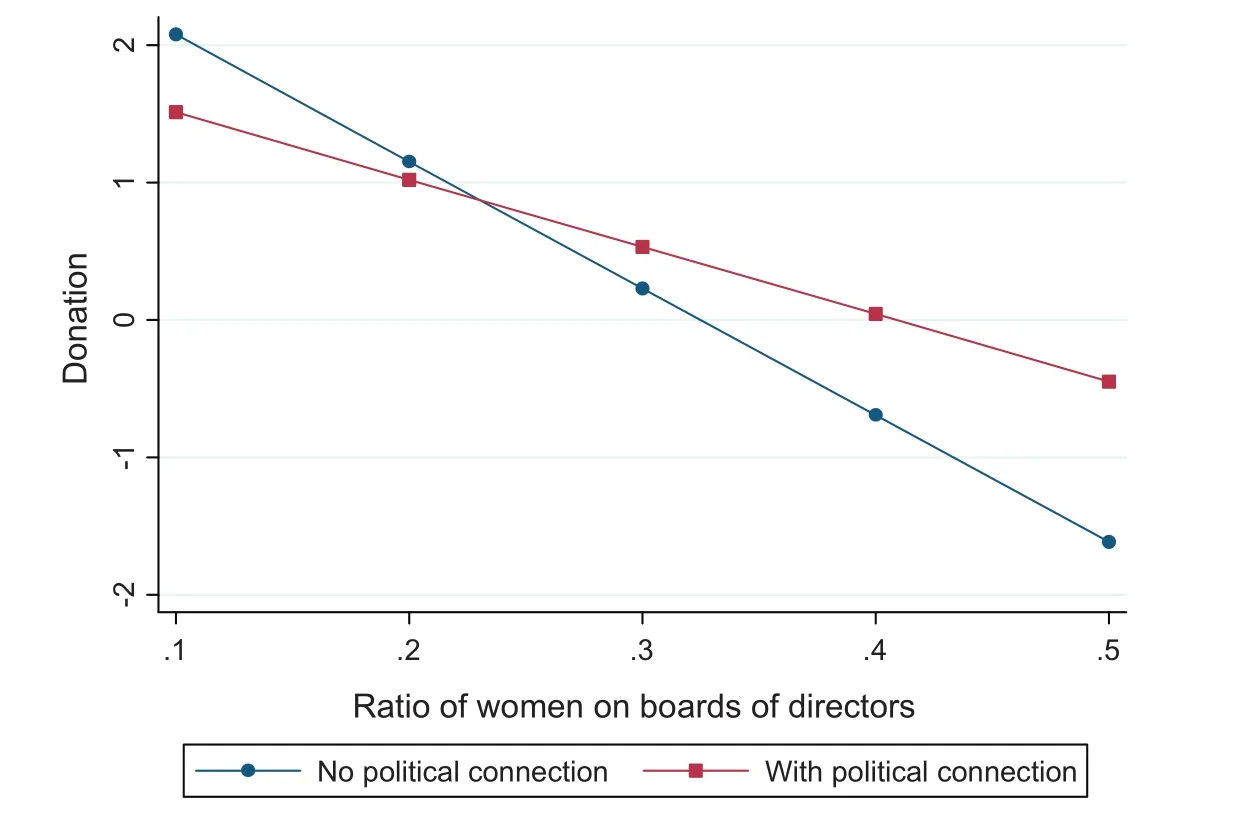

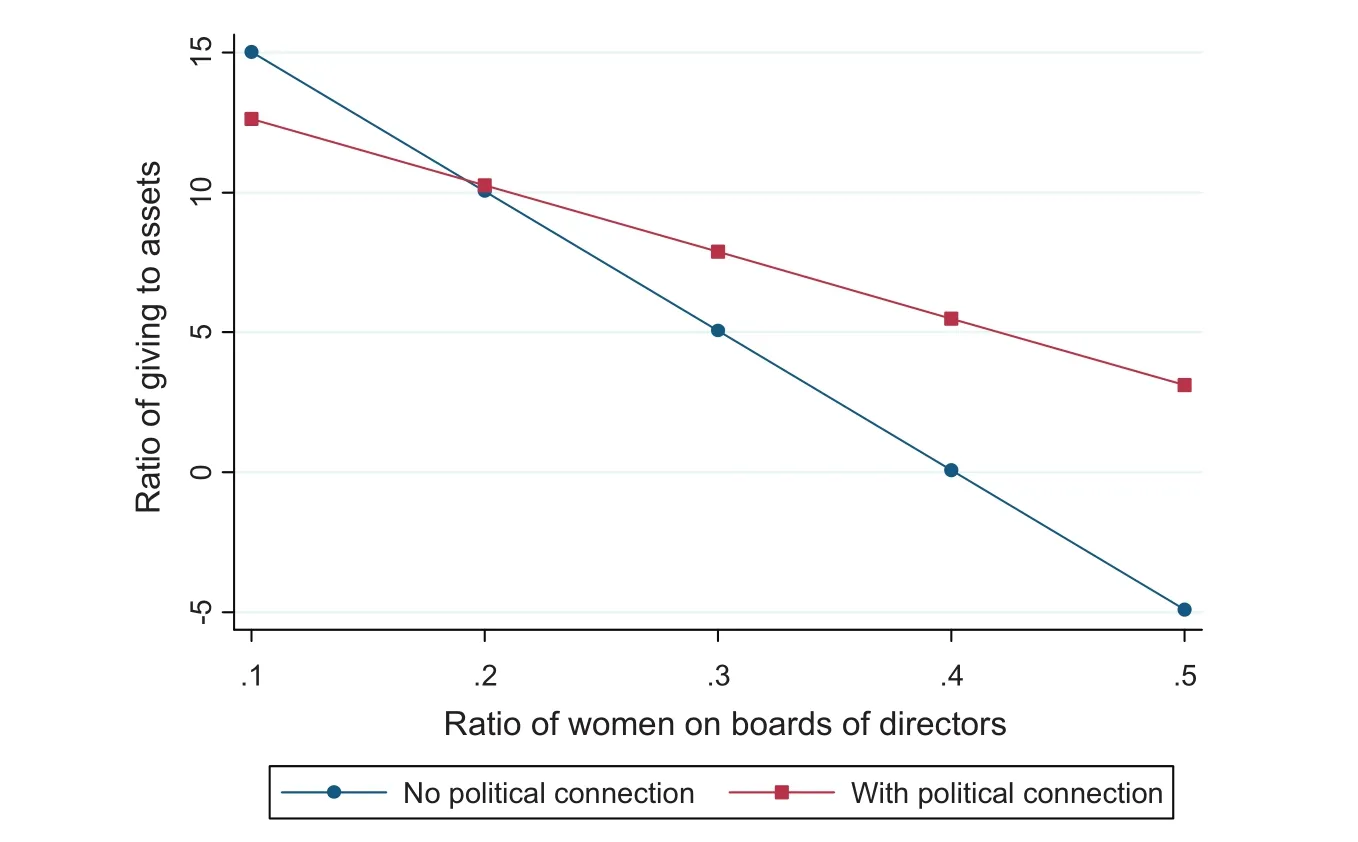

To visualize the relationship outlined in Hypothesis 2,Figs.1a and 1b show the plot of the significant interaction(Aiken and West,1991)between political connections and the ratio of WoB.The CPDR probability and giving ratio are negatively related to WoB,and the relationship is more salient within firms without political connections than with political connections.

5.Discussion

Previous CSR research has not studied the relationship between WoB and CPDR or considered the ways in which institutional environments moderate it.Using unique data collected from privately-owned listed firms’philanthropic disaster responses after China’s Wenchuan earthquake in 2008,this study provides convincing evidence that CPDR is negatively related to the ratio of WoB,and that political connections positively moderate the relationship between WoB and CPDR.However,our results do not support the theory that marketization-related factors,such as marketization level and law enforcement level,also moderate this relationship.

Table 4cSecond-stage regression results predicting the relationship between corporate donations and women on boards of directors,including the three moderators.a

5.1.Theoretical implications

This study makes the following theoretical contributions.First,it extends the CSR literature to show that women in boardrooms influence corporate social practice.Our comprehensive model also explores a distinctive type of CSR,namely corporate philanthropic disaster response(CPDR).In addition,we use a previouslyunstudied context,CPDR,and incorporate political connections along with marketization and law enforcement levels as moderators.Thus,this study not only contributes to the ongoing exploration of the relationship between WoB and CPDR,but also promotes an increased understanding of the impact that corporate ties with government and institutional environments have on this relationship.

Second,the study advances our understanding of female directors’function as evaluators of the agency costs of CPDR,which challenges the notion that women are more“giving”than men in times of crisis.Previous studies on the relationship between WoB and CSR emphasize the emotional perspective that female directors are generally more responsive to acts of giving than their male counterparts in crisis situations (e.g.,Williams,2003).This study overturns previous views of female directors,presenting instead a professional and rational perspective that emphasizes the effects of their evaluations when making corporate contribution decisions after natural disasters.

Fig.1a.The moderating effect of political connections on the relationship between women on boards of directors and corporate donation probability.

Fig.1b.The moderating effect of political connections on the relationship between women on boards of directors and corporate giving ratio.

We find that in a transitional economy where corporate social activities act as a kind of exchange between firms and the government they include significant agency costs and female directors play a very important evaluation role that constrains the irrational waste of corporate resources and protects investor value.

Third,our results provide insights into the moderating role of firm relationships with government and the institutional environment in the relationship between WoB and CPDR.In particular,this study illustrates how the negative effect that female directors have on CPDR might be undermined in different conditions,especially in a transitional economy like that of China.This analysis helps to paint a more complete picture of the relationship between WoB and CPDR.

5.2.Managerial implications

Our results also have practical implications for listed firms.CSR is thought to be essential to corporate survival and growth,yet very little research has clarified how a firm should initiate and utilize CSR,particularly regarding how firms should respond to natural disasters.Based on our results,we advise that WoB help listedfirms to evaluate the benefits of CPDR and restrain the wasteful donation of corporate resources.Furthermore,we also suggest that political connections in fl uence the impact that female directors have on CPDR. In a transitional economy like China,the chairman or CEO’s political status determines the empowerment of female directors,and they are well empowered to vote against CPDR in firms that are not politically connected.

5.3.Limitations and future research

This study has the strength of employing both the knowledge-based view of the firm and agency costs theory to study the relationship between WoB and CPDR.However,it also has limitations.First,our findings are contrary to the conventional wisdom that WoB tend to vote for CPDR,and we do not study the conditions under which women prefer CSR.Second,we define CPDR as a kind of agency cost that does not benefit investors,but we do not examine the relationship between CPDR and corporate performance or investor reaction to directly test this proposition.Third,the moderating factors of the relationship between WoB and CPDR have some limitations.Specifically,female directors’backgrounds,such as their beliefs and personal relationships with disaster areas,also influence their decisions,but we do not control for such factors.Fourth,our data is from a single source,which might generate omitted variable bias given that an endogenous event would influence both dependent and independent variables that we do consider.In addition,the sample selection method may be biased because we only include listed firms,but many other types of firms,such as non-listed and multinational firms,also contribute to disaster relief.

Future research should be pursued in three directions.First,it should explore the relationship between WoB and CPDR in different contexts.Comparative studies of firms responding to disasters that have happened in different countries would be very informative.Second,women are becoming increasingly important in corporate governance and it is essential to determine how best to empower them to maximize the benefits generated from their service on corporate boards.Third,further studies that examine other moderators of the relationship between WoB and CPDR would be very useful.

5.4.Conclusion

Our results reveal that female directors do not always respond positively to CSR initiatives.They do increase a firm’s rationality with regard to joining disaster relief efforts and respond negatively to CPDR. However,political connections positively moderate the relationship between WoB and CPDR.

Our primary goal in this study is to inspire further research that expands our understanding of this special phenomenon of CPDR and to provide a more intense study of the effects of gender on corporate governance and management.Our findings strongly support the importance of the link between WoB and CPDR.We demonstrate that there is considerable value in drawing on CSR,especially CPDR,to understand whether and how to initiate a CPDR to increase an organization’s success.

Acknowledgments

This study was funded by grants from the National Natural Science Foundation of China(Nos.71002049 and 70902066)and the New Teacher Fund of the Chinese Ministry of Education(Nos.20106102120055 and 20090201120038).We would like to thank the Social Science Promotion Program at Northwestern Polytechnical University and the New Teacher Support Program and President’s Fund at Xi’an Jiaotong University. The authors express their appreciation to the CJAR Summer Research Workshop 2011 on 16-17 July 2011 and its participants at City University of Hong Kong,and to the editor and anonymous reviewers for their suggestions and comments.However,the authors are responsible for all errors in the paper.

Adams,R.B.,Ferreira,D.,2009.Women in the boardroom and their impact on governance and performance.Journal of Financial Economics 94,291-309.

Agrawal,A.,Knoeber,C.,2001.Do some outside directors play a political role?Journal of Law and Economics 44,179-198.

Aiken,L.S.,West,S.C.,1991.Multiple Regression Testing and Interpreting Interactions.Sage,Newbury Park,CA.

Bantel,K.A.,Jackson,S.E.,1989.Top management and innovations in banking:does the composition of the top team make a difference? Strategic Management Journal,Summer Special Issue 10,107-124.

Barnard,J.,1997.Corporate philanthropy,executives’pet charities and the agency problem.New York Law School Review 41,1147-1178.

Boatsman,J.R.,Gupta,S.,1996.Taxes and corporate charity:empirical evidence from micro-level panel data.National Tax Journal 49 (n2),193-213.

Brown,W.,Helland,E.,Smith,J.K.,2006.Corporate philanthropic practices.Journal of Corporate Finance 12,855-877.

Campell,K.,Mı´nguez-Vera,A.,2007.Gender diversity in the boardroom and firm financial performance.Journal of Business Ethics 83, 435-451.

Carter,D.A.,Simkins,B.J.,Simpson,W.G.,2003.Corporate governance,board diversity,and firm value.The Financial Review 38,33-53.

Cheung,A.,Herna´ndez-Julia´n,R.,2007.Gender and Corruption:A Panel Data Analysis.Department of Economics,University of Rochester(working paper).

Detomasi,D.,2008.The political roots of corporate social responsibility.Journal of Business Ethics 82,807-819.

Dollar,D.R.,Fisman,R.,Gatti,R.,2001.Are women really the‘fairer’sex?Corruption and women in government.Journal of Economic Behavior&Organization 46,423-429.

Drazin,R.,Van de Ven,A.,1985.Alternative forms of fit in contingency theory.Administrative Science Quarterly 30(4),514-539.

Eckel,C.,Grossman,P.J.,2001.Chivalry and solidarity in ultimatum games.Economic Inquiry 39(2),171-188.

Ely,R.,Padavic,I.,2007.A feminist analysis of organizational research on sex differences.Academy of Management Review 32(4),1121-1143.

Faccio,M.,2007.Politically connected firms.American Economic Review 96(1),369-386.

Fan,G.,Wang,X.,2010.The Report on the Relative Process of Marketization of Each Region in China.The Economic Science Press(in Chinese).

Fan,P.H.,Wong,T.J.,2007.Politically-connected CEOs,corporate governance and post-IPO performance of China’s newly partially privatized firms.Journal of Financial Economics 84(2),330-357.

Ferguson,T.,Voth,H.,2008.Betting on Hitler-the value of political connections in Nazi Germany.Quarterly Journal of Economics 123 (1),101-137.

Fisman,R.,2001.Estimating the value of political connections.American Economic Review 91,1095-1102.

Francoeur,C.,Labelle,R.,Sinclair-Desgagne´,B.,2007.Gender diversity in corporate governance and top management.Journal of Business Ethics 81,83-95.

Godfrey,P.,2005.The relationship between corporate philanthropy and shareholder wealth:a risk management perspective.Academy of Management Review 30(4),454-479.

Godfrey,P.C.,Merrill,C.B.,Hansen,J.M.,2008.The relationship between corporate social responsibility and shareholder value:an empirical test of the risk management hypothesis.Strategic Management Journal.http://dx.doi.org/10.1002/smj.750.

Grant,R.M.,1996.Toward a knowledge-based theory of the firm.Strategic Management Journal 18(7),583-591.

Harrison,D.A.,Klein,K.J.,2007.What’s the difference?Diversity constructs as separation,variety,or disparity in organizations. Academy of Management Review 32(4),1199-1228.

He,Y.Q.,Tian,Z.L.,2008.Government-oriented corporate public relation strategies in transitional China.Management and Organization Review 4(3),367-391.

Helland,E.,Smith,J.,2003.Corporate Philanthropy(working paper).<http://ssrn.com/abstract=472161〉.

Hess,D.,Rogovsky,N.,Dunfee,T.W.,2002.The next wave of corporate community involvement:corporate social initiatives.California Management Review 44(2),110-125.

Hillman,A.J.,Cannella Jr.,A.A.,2007.Organizational predictors of women on corporate boards.Academy of Management Journal 50 (4),941-952.

Johnson,S.,Mitton,T.,2003.Cronyism and capital controls:evidence from Malaysia.Journal of Financial Economics 67,351-382.

Konrad,A.M.,Kramer,V.W.,Erkut,S.,2008.Critical mass:the impact of three or more women on corporate boards.Organizational Dynamics 37(2),145-164.

Levi,M.,Li,K.,Zhang,F.,2008.Mergers and Acquisitions:The Role of Gender.Sauder School of Business,University of British Columbia(working paper).

Margolis,J.D.,Walsh,J.P.,2001.People and Profits:The Search for a Link between a Company’s Social and Financial Performance. Lawrence Erlbaum,Mahweh,NJ.

Margolis,J.D.,Walsh,J.P.,2003.Misery loves companies:rethinking social initiatives by business.Administrative Science Quarterly 48, 268-305.

Marx,J.D.,2000.Women and human services giving.Social Work 31,66-84.

Miller,D.,Shamsie,J.,1996.The resource-based view of the firm in two environments:the Hollywood film studios from 1936-1965. Academy of Management Journal 39,519-543.

Muller,A.,Kra¨ussl,R.,2011.Doing good deeds in times of need:a strategic perspective on corporate disaster donations.Strategic Management Journal 32,911-929.

Muller,A.,Whiteman,G.,2008.Exploring the geography of corporate philanthropic disaster response:a study of Fortune Global 500firms.Journal of Business Ethics.http://dx.doi.org/10.1007/s10551-008-9710-7.

Murtha,T.,Lenway,S.,1994.Country capabilities and the strategic state:how national political institutions affect multinational corporations’strategies.Strategic Management Journal 15,113-129.

Nee,V.,Opper,S.,Wong,S.,2007.Developmental state and corporate governance in China.Management and Organization Review 3, 19-53.

Pelled,L.H.,Eisenhardt,K.M.,Xin,K.R.,1999.Exploring the black box:an analysis of work group diversity conflict,and performance. Administrative Science Quarterly 44,1-28.

Richard,O.,Ford,D.L.,Ismail,K.M.,2006.Exploring the performance effects of visible attribute diversity:the moderating role of span of control and organizational life cycle.International Journal of Human Resource Management 17(12),2091-2109.

Richard,O.C.,Murthi,B.P.S.,Ismail,K.,2007.The impact of racial diversity on intermediate and long-term performance:the moderating role of environmental context.Strategic Management Journal 28,1213-1233.

Robinson,G.,Dechant,K.,1997.Building a business case for diversity.Academy of Management Executive 11,21-30.

Schubert,R.,Brown,M.,Gysler,M.,Brachinger,H.W.,1999.Financial decision-making:are women really more risk-averse?American Economic Review 89(2),381-385.

Shan,L.,Gan,L.,Zheng,T.,2008.Corporate donations and economic incentives:an empirical study based on corporate donations following the 5.12 earthquake in China.Economic Research Journal 11,51-60(in Chinese).

Stanwick,P.A.,Stanwick,S.D.,1998.The determinants of corporate social performance:an empirical examination.American Business Review 16,86-93.

Swamy,A.,Azfar,O.,Knack,S.,Lee,Y.,2001.Gender and corruption.Journal of Development Economics 64,25-55.

Terjesen,S.,Sealy,R.,Singh,V.,2009.Women directors on corporate boards:a review and research agenda.Corporate Governance:An International Review 17(3),320-337.

Torchia,M.,Calabro`,A.,Huse,M.,2011.Women directors on corporate boards:from tokenism to critical mass.Journal of Business Ethics.http://dx.doi.org/10.1007/s10551-011-0815-z.

Wang,Z.,2008.A preliminary report on the great Wenchuan earthquake.Earthquake Engineering and Engineering Vibration 7(2),225-234.

Wang,J.,Coffey,B.S.,1992.Boards composition and corporate philanthropy.Journal of Business Ethics 10,540-577.

Wang,H.,Qian,C.,2010.Corporate philanthropy and corporate financial performance:the roles of stakeholders’responses and political access.Academy of Management Journal(published online first).

Westphal,J.D.,Stern,I.,2007.Flattery will get you everywhere(especially if you are a male Caucasian):how ingratiation,boardroom behavior,and demographic minority status affect additional board appointments at US companies.Academy of Management Journal 50(2),267-288.

Williams,R.J.,2003.Women on corporate boards of directors and their influence on corporate philanthropy.Journal of Business Ethics 42(1),1-10.

Zhang,R.,Rezaee,Z.,Zhu,J.G.,2009.Corporate philanthropic disaster response and ownership type:evidence from Chinese firms’response to the Sichuan earthquake.Journal of Business Ethics.http://dx.doi.org/10.1007/s10551-009-0067-3.

27 April 2011

*Corresponding author.

E-mail address:mingazhe@yahoo.com.cn(Z.Zhang).

China Journal of Accounting Research2012年1期

China Journal of Accounting Research2012年1期

- China Journal of Accounting Research的其它文章

- Overemployment,executive pay-for-performance sensitivity and economic consequences:Evidence from China

- Accounting standard changes and foreign analyst behavior: Evidence from China

- Controller changes and auditor changes

- Enforcement actions and their effectiveness in securities regulation:Empirical evidence from management earnings forecasts