Accounting standard changes and foreign analyst behavior: Evidence from China

Yutao Wang,Yu Hou,Xiaolin Chen

aSchool of Accountancy,Central University of Finance and Economics,China

bRotman School of Management,University of Toronto,Toronto,Canada

cSchool of Accounting,Jiujiang University,China

Accounting standard changes and foreign analyst behavior: Evidence from China

Yutao Wanga,*,Yu Houb,Xiaolin Chenc

aSchool of Accountancy,Central University of Finance and Economics,China

bRotman School of Management,University of Toronto,Toronto,Canada

cSchool of Accounting,Jiujiang University,China

A R T I C L EI N F O

Article history:

Accepted 9 September 2010

Available online 30 April 2012

JEL classification:

G14

G20

M41

This study investigates changes in foreign analyst behavior before and after Chinese New Accounting Standards was implemented during 2007.The empirical results show that after the new accounting standards were implemented, forecast error among foreign analysts decreased in both absolute and relative terms in comparison with domestic analysts,and foreign analysts forecast earnings more frequently than they did before the new accounting standards. These results imply that the implementation of new accounting standards in the Chinese capital market helped mitigate both information asymmetry between listed firms in China and foreign investors,and the“home bias”of foreign analysts.It also increased the attractiveness of listed firms and facilitated international communication and cooperation.This study also has significant implications for how resource allocation efficiency in the Chinese capital market can be raised and how the“introducing in”policy should be assessed.

ⓒ2012 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

This paper explores the effect of IFRS adoption in the Chinese stock market on foreign investors by examining its impact on foreign analyst behavior.The new accounting standards issued on January 1,2007represent a significant systematic reform of accounting standards and were a major measure by which the“bringing in,going out”enterprise strategy1The“bringing in,going out”strategy is mentioned in an important speech on accounting changes delivered by Jin Renqing,Minister of Finance,when the new accounting standard and new auditing standard were issued.He noted that the new accounting and auditing standards were significant measures to optimize the Chinese market economy and assist enterprises in implementing the“bringing in, going out”strategy(see also“Index for Accounting Standards for Business Enterprises,”2008).We believe that“bringing in”refers to assisting foreign investors(including foreign analysts)to understand Chinese financial reports,and that“going out”refers to assisting local enterprises to understand the financial reports of foreign companies.was put into practice.This reform was intended to enhance the comparability of accounting standards,to assist Chinese enterprises in going abroad,and to facilitate overseas financing and international exchange and cooperation.Most prior research on the effect of the new standards focuses on the local capital market from perspectives such as earnings management and value relevance.Given that the behavior and preferences of foreign investors are largely reflected in the behavior of foreign analysts,this paper uses foreign analysts as the treatment sample compared with the control sample of local analysts.We are interested in the impact of the information contained in financial reports issued under the old and new accounting standards on the earnings forecasts of foreign analysts,2We do not emphasize the effect of the new standard on accounting information quality.The fall in forecast error among foreign analysts does not necessarily demonstrate improved accounting information quality alone,but could also be due to reduced information collecting and processing costs.and further examine the outcomes of adopting the“bringing in”strategy.

Foreign analysts are generally more familiar with IFRS than local analysts.3Not all foreign analysts are located in countries that adopt IFRS,an example being US analysts.We cannot distinguish among these countries due to data limitations.However,even for analysts in countries that do not follow IFRS,we do not expect them to know less about IFRS than local analysts do.Therefore,the new standards are unlikely to have increased the information costs of these analysts,and including them in the tests would introduce a bias against our results.Following implementation of the new Chinese accounting standards,which converge local standards with IFRS,we expect that the costs foreign analysts face in collecting public information from financial reports prepared under the new accounting standards to have been significantly reduced.As a result,foreign analysts are likely to make more accurate earnings forecasts than they did before the new accounting standards took effect.In this paper,we test the predicted relationship between foreign analyst earnings forecasts and the new accounting standards.With a comprehensive set of controls for the individual characteristics of analysts,we find that after the new standards were implemented,the forecast errors of foreign analysts fell substantially in terms of both their raw and relative values(using local analysts as the control sample).Furthermore,the number of foreign analysts following Chinese listed companies has increased significantly since the new standards were introduced.If foreign analysts and foreign investors share the same information set,these results imply that IFRS convergence has lowered the information costs of foreign investors,which will ultimately help Chinese listed firms communicate and coordinate more effectively in the international arena.They also suggest that having more participants in the analyst sector also improves the efficiency with which resources are allocated in the capital market.

This study makes the following contributions to the literature.First,it provides results of practical significance to market participants and policymakers.The primary purpose of implementing the new accounting standards was to enhance the international comparability of financial reports,which would both attract more foreign investors to participate in the Chinese capital market and improve the allocation efficiency and competitiveness of the market.However,to the best of our knowledge,few studies have investigated whether the new standards have achieved this goal.Despite difficulties in directly observing the behavior and preferences of foreign investors,we argue that they are reflected to a great extent in the behavior of foreign analysts.We thus focus on the effects of the new Chinese accounting standards on the behavior of foreign analysts,enabling us to infer how the new standards have impacted foreign investors.Second,this study reports important empirical evidence on the effect of the changes made by the new accounting standards.Unlike other studies on the impact of IFRS adoption,this paper concentrates on the Chinese setting.Because it is compulsory to comply with IFRS in China,we can dismiss the self-selection issue,i.e.,the bias caused by voluntary adoption in previous research(e.g.,Leuz and Verrecchia,2000)have to deal with this issue in their study of voluntary IFRS adopters in Germany).While some recent studies have also investigated the impact ofmandatory IFRS adoption(e.g.,Armstrong et al.,2010;Tan et al.,2009),our Chinese setting provides three advantages.First,it is not subject to the omitted variables issue introduced by institutional differences,an issue usually found in international studies.Second,the rapidly growing analyst industry in China can be employed as the control sample,which further helps rule out the impact of other potential confounding effects. Third,in comparison with other Chinese studies on the effect of changes in accounting standards,this paper reveals evidence from a new perspective:that of foreign analysts(foreign investors).Most previous studies on new accounting standards-such as analysis of market reactions(Wang et al.,2009a)and management behavior(Wang et al.,2009b;Ye et al.,2009)-examine the local investor context.Although these studies provide some evidence on the impact of the new standards,they suffer from a number of limitations:in terms of information costs,although local investors(or analysts)are already fairly familiar with the old standards,they must learn and digest the new standards when they are released.Therefore,due to the time and effort local investors(or analysts)need to expend in learning the new standards,their information costs are likely to go up rather than down.Consequently,it is unclear what impact the new standards are likely to have on local investors(or analysts),and the increase in their information costs may result in earnings management and changes in local analyst behavior,which would confound the analysis of this issue.In contrast,foreign analysts provide us with a cleaner research environment to examine the issues at hand,because a reduction in information costs is more likely to be reflected in their behavior due to their limited understanding of the previous accounting standards.Hence,analyzing the cohort of foreign analysts is likely to reveal a clearer picture of the significant role the new accounting standards have played in reducing information costs.

2.Research hypotheses and empirical models

2.1.Background of Chinese accounting standard changes

The changes(including those made most recently)made to the Chinese accounting standards system,since the Basic Standard was enacted in 1992 and the first specific accounting standard(Disclosure of Related Party Relationships and Transactions)was introduced in 1997,can generally be divided into three stages.In the first stage(1992-2000),10 specific accounting standards and the general principle of freedom were brought into effect.Provided the enterprise gave full disclosure,any accounting treatment leading to an increase or decrease in profit was acceptable(Liu et al.,2004).Substantial changes were made in the second stage(2001-2006),the key ones being an increase in the number of specific accounting standards to 15 and the elimination of fair value;additional limitations on items that could be taken into account in calculating profit,as reflected by many items such as gains on debt restructuring no longer being included in profit calculations and being moved to capital reserves instead;requiring listed companies to set aside provisions for diminution in asset values and write-offs of organization costs as a lump sum rather than by installments;and a cap on profits from related party transactions.The third stage starting from 2007 includes the recent accounting standard changes.The new accounting standards issued in 2007 introduced substantial changes,and together constitute an integrated system of Chinese accounting standards.In particular,these changes include revision of the Basic Standard and the enactment of 38 specific accounting standards aimed at converging Chinese accounting practices with International Financial Reporting Standards(IFRS);more freedom in choosing the guiding philosophy in comparison with that available in the second stage,with some items which used to be disregarded in calculating profit(e.g.,gains on debt restructuring)again being allowed to appear in the income statement;widespread introduction of the fair value model and giving more accounting treatment choices to enterprises.The two key reforms made during these three stages were the changes made to accounting standards in 2001 and 2007.This paper focuses on the latter set of changes implemented via the new accounting standards issued in 2007.

In the second stage starting from 2001,the overall guiding philosophy of Chinese accounting standards was still generally affected by the old Basic Standard,and a large emphasis was placed on the fiduciary function of accounting.Subsequently,specific accounting standards were introduced to do everything possible to impose restrictions on earnings manipulating activities among listed companies and required them to include proceeds from unavoidable economic items such as gains on debt restructuring into shareholders’equity to limit the opportunity for management to window-dress profits.It was during this stage that efforts were made toestablish accounting standards systems with Chinese characteristics.Moreover,to help enterprises adopt the“bringing in,going out”strategy,the changes made to accounting standards in 2007 resulted in a substantial degree of convergence with IFRS,with an emphasis on the accounting functions of facilitating useful decisions and providing information,the active introduction of fair value models and giving enterprises more choices in accounting treatments.Therefore,while there were substantial differences between Chinese accounting standards and IFRS before 2007 in terms of both the guiding philosophy and the number of accounting standards in place,these differences have been reduced since 2007 due to the ongoing pattern of IFRS convergence in China,a trend certain to have far-reaching implications for China’s economy,society and capital market.4Although the new accounting standards have resulted in convergence with IFRS,they still have Chinese characteristics,such as in statements forbidding the reversal of impairment losses on assets and the recognition of related parties,both of which are different from IFRS.Hence,this paper investigates the effect on foreign analysts of the new accounting standards implemented at the turning point of 2007,and examines the outcomes of implementing the“bringing in”strategy.

2.2.Research hypotheses

The convergence of Chinese accounting standards with IFRS is part of the international trend of accounting harmonization.Despite the widespread implementation of IFRS in many countries,there are still disputes in academia about whether international accounting harmonization can improve the quality of financial reporting and the information environment.Supporters of accounting harmonization believe that IFRS can enhance the comparability of financial reports in different countries and thereby restrict earnings management.Moreover,introduction of the fair value model enhances the connection between financial figures and intrinsic value.Barth et al.(2008)document improved accounting quality following the implementation of IFRS,including less earnings management,more timely recognition of losses and a closer connection betweenfinancial figures and intrinsic value.In terms of overall accounting quality,Beuselinck et al.(2009)find that the implementation of IFRS improves the information environment and increases the transparency of accounting information.These empirical results show that the international convergence of accounting standards does indeed improve the accounting information environment and reduce the information asymmetry faced by investors,both of which help enhance the efficiency of capital markets and resource allocation.

However,opponents of accounting harmonization believe that because institutional backgrounds,cultures, history and other characteristics determine a country’s accounting standards system,a harmonized set of accounting standards is unlikely to facilitate improvements in the quality of financial reporting and the local information environment.Consequently,a unified system of accounting standards does not always benefit every country and the compulsory implementation of IFRS could lead to huge transition costs.Daske (2006)examines the economic effect of IFRS implementation through the lens of the expected cost of equity capital,finding the cost of equity capital rises rather than falls during the transition period,thus revealing that the compulsory implementation of IFRS could bring substantial transition costs.In terms of earnings management,Van Tendeloo and Vanstraelen(2005)provide empirical evidence supporting the view that the introduction of IFRS seems to increase the likelihood of earnings management.These empirical studies show that the international convergence of accounting standards neither limits opportunistic activities among managers nor improves the information environment or reduces the information asymmetry faced by investors.

Chinese empirical research concerning accounting harmonization does not reveal a consensus either.Some researchers find that the change to IFRS helps raise the quality of accounting information and boosts the connection between financial figures and intrinsic value(Jin,2010;Luo et al.,2008;Wang et al.,2009a),whereas others conclude that the change weakens the connection between financial figures and intrinsic value(Zhu et al.,2009)and increases the likelihood of earnings management(Ye et al.,2009).

The preceding review of the literature illustrates two points.First,academics hold diverging opinions on the effect of IFRS implementation,leading to a limited comprehension of the current effect of implementing new accounting standards.Second,researchers in China generally investigate the effect of accounting harmonization from the perspective of local financial report users.Research examining the effect of accounting standard changes through the eyes of foreign investors is scarce.This study is aimed at filling this gap by providing newempirical evidence of the effect of implementing accounting standard changes through investigating the behavior of a special group of capital market participants-foreign analysts.The relationship between the behavior of foreign analysts and accounting standards can be attributed to many factors.First,many studies find that accounting standards exert substantial effects on foreign analyst behavior.Ashbaugh and Pincus(2001)find that the larger the difference between local accounting standards and IFRS,the lower the accuracy of analyst forecasts,and that their accuracy improves after IFRS reforms.Hope(2003a)finds a positive correlation between the level of disclosure of accounting policy and the accuracy of earnings forecasts.Furthermore, Hope(2003b)also finds a positive correlation between the effectiveness with which accounting standards are implemented and the accuracy of analyst forecasts.Basu et al.(1998)show that forecast accuracy is lower in countries with less accrual-based accounting,more market-based accounting and fewer accounting treatment choices.Guan et al.(2006)discuss the effect of the extent of similarity between local accounting standards and US GAAP on analyst forecasts,and find the smaller the difference,the higher the accuracy of forecasts.Second,the convergence of IFRS and local GAAP reduces the information asymmetry faced by foreign analysts.Because such analysts are more familiar with IFRS,and accounting harmonization in China reduces differences between standards in China and those in their own country,it is more convenient for them to gather and process public information and thus alleviate information asymmetry,which in turn enables them to make more effective forecasts through private information gathering.Bae et al.(2008)find in an international study that the smaller the differences among accounting standards in various countries,the more foreign analysts will follow companies in such countries and the higher the accuracy of their forecasts.These studies show that the international convergence of accounting standards reduces the difference between Chinese accounting standards and the standards of countries where analysts are domiciled,lowers the cost of gathering and processing information,and ultimately leads to changes in both the number of followers and forecast accuracy.

This study focuses on the effect of accounting harmonization on changes in the behavior of foreign analysts. In doing so,we may uncover more precise empirical evidence for the debate on accounting harmonization. IFRS implementation is aimed at enhancing the comparability of accounting standards,improving the accounting information environment and reducing information asymmetry between firms and investors.Given that foreign investors face higher costs in gathering and processing information,we are likely to observe whether the goal of accounting harmonization has been achieved from changes in the behavior of foreign investors.Bae et al.(2008)examine the effect of various accounting standards on foreign analysts,finding the larger the differences between accounting standards in the countries where analysts are domiciled and those in the home country of the company being followed,the smaller the number of foreign analysts following the company and the lower the accuracy of their forecasts.Their study thus shows that prior to accounting harmonization,foreign analysts face higher information asymmetry and information processing costs.Tan et al.(2009) further examine whether accounting harmonization has raised the level of accuracy of foreign analyst forecasts,finding less forecast error after the adoption of IFRS.This study also examines the effect of IFRS convergence in China on foreign analysts,but differs from that of Tan et al.(2009)in the following respects:(1)this paper focuses on the Chinese market,which is not subject to omitted variable issues that often emerge in international studies;and(2)the rapidly growing local analyst market in China provides a natural control sample and helps in carefully examining the effect of IFRS on foreign analysts.Foreign analysts have their strengths and weaknesses in comparison with local analysts.On the one hand,they have the advantage of greater familiarity with IFRS.5There were substantial differences between Chinese accounting standards and IFRS before 2007.Therefore,in comparison with local analysts,foreign analysts are relatively familiar with IFRS.On the other hand,they lack knowledge of the Chinese capital market and incur higher information costs.These characteristics explain why foreign analysts rely heavily on financial reports to make earnings forecasts.The new accounting standards issued in 2007 put IFRS convergence into practice,thus enabling foreign analysts to take full advantage of one of their strengths by reducing information costs through their familiarity with IFRS.This induces them to invest more resources or to profit more from the same resources,a benefit bound to attract more foreign analysts to follow Chinese listed companies and enhance the efficiency of their forecasts.Based on the above discussion,we now put forward our two hypotheses:

H1.Forecast error among foreign analysts of Chinese listed companies decreases after the implementation of IFRS in China.

H2.The number of foreign analysts following Chinese listed companies increases after the implementation of IFRS in China.

2.3.Empirical model

The focus of this study is on whether changes made to Chinese accounting standards have affected the behavior of foreign analysts.However,other factors might also have affected their forecast accuracy.For example,forecast error is likely to have fallen to an extent corresponding to the level of improvement in information disclosure(Lang and Lundholm,1996).It would be quite difficult to continue our examination if these factors have had effects flowing in the same direction as those of the accounting standard changes.We therefore employ local analysts as our control sample to eliminate factors with similar effects on Chinese and foreign analysts and thus derive more persuasive results.We use the following two models to test our hypotheses:

Based on Model(1),Model(2)includes the additional dummy variables Forana(1 for foreign analysts and 0 otherwise)and Forana_Post to enable local analysts to be used as a control sample.

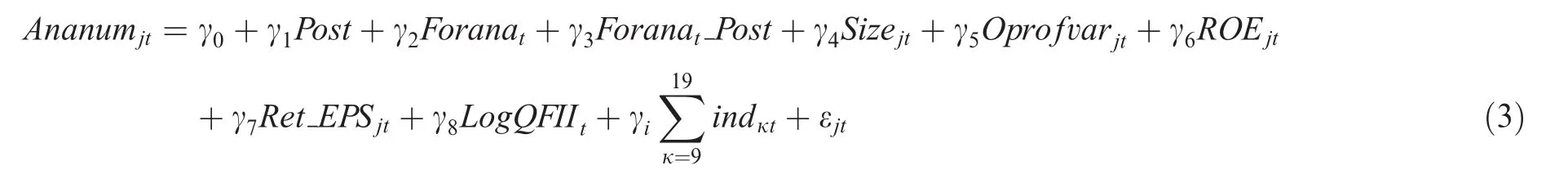

The following model is used to measure fluctuations in the number of analysts following local listed companies before and after the implementation of new accounting standards:

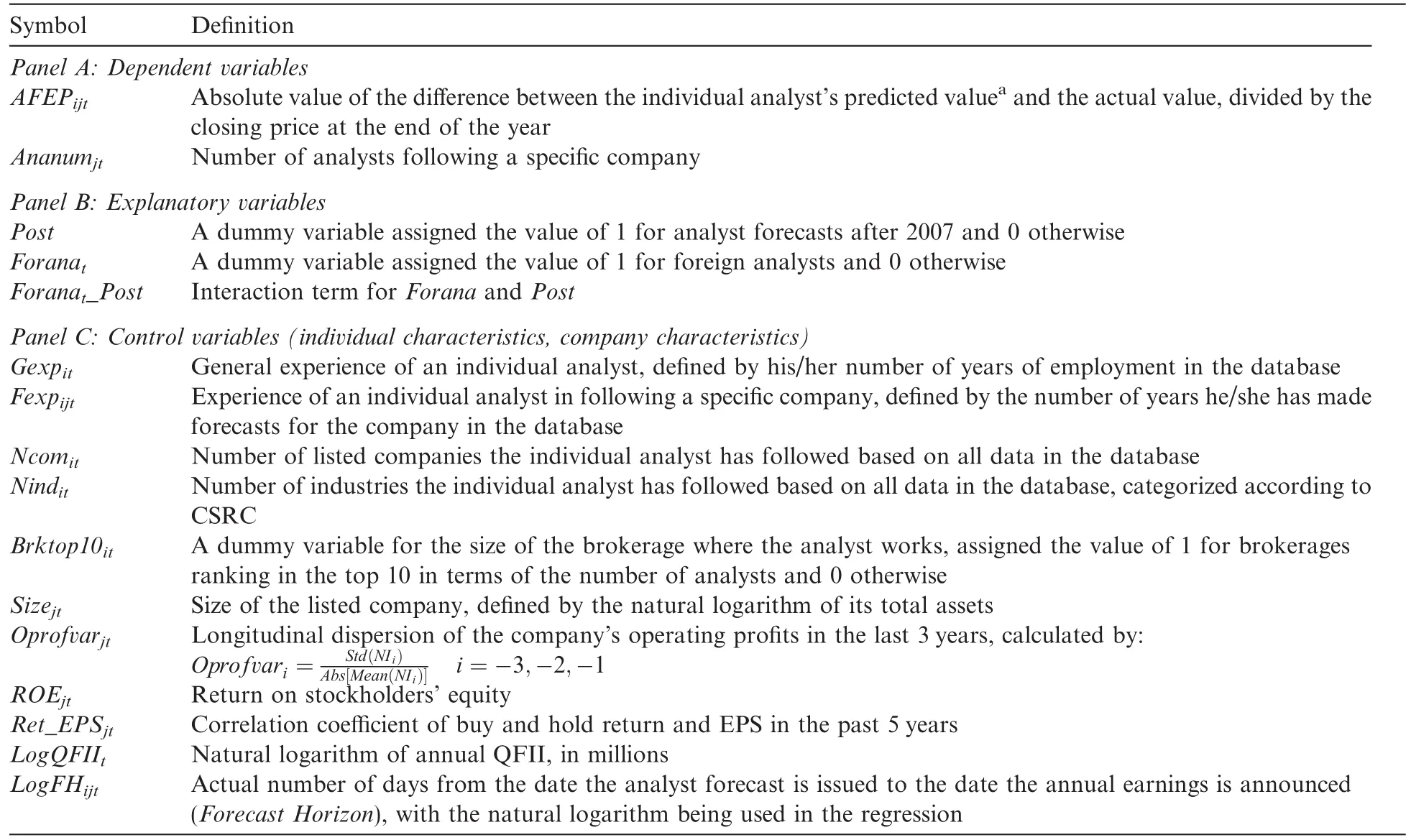

In the models above,the variable subscripts i/j/t refer to analyst i,company j and time t,respectively.We expect that α1<0(for foreign analysts),β3<0 and γ1〉0.In calculating the forecast error variable AFEP,analysts’earnings forecasts are measured from the 2nd quarter earnings announcement date to the annual earnings announcement date,while actual earnings are drawn from the relevant database(described in more detail below).6This approach is adopted in this study to avoid the complication of having the two different definitions of profits used by the two databases from which our data is drawn.We thank the referee for this suggestion.We control for three sets of factors affecting forecast error in Model(1)and Model(2).The first set of factors are individual analyst characteristics,including the work experience of the analyst(Gexpit),their experience following a specific company(Fexpijt),the number of companies the analyst has followed(Ncomit), the number of industries the analyst has followed(Nindit),the size of the brokerage where the analyst works (Brktop10it)and the actual number of days from the date the analyst forecast is issued to the date the annual earnings is announced,which is calculated by adding 1 and taking the natural logarithm(LogFHijt).The second set of factors are company characteristics based on measures such as Ananumjt,Sizejt,Oprofvarjt,ROEjtand Ret_EPSjt.The third set of factors are macro variables based on factors such as the level of QFII investment,which is calculated as its natural logarithm(LogQFIIt),and industry dummy variables.Table 1 defines the variables employed in the models in detail.

Table 1Variable definitions.

3.Empirical analysis

3.1.Sample collection and descriptive statistics

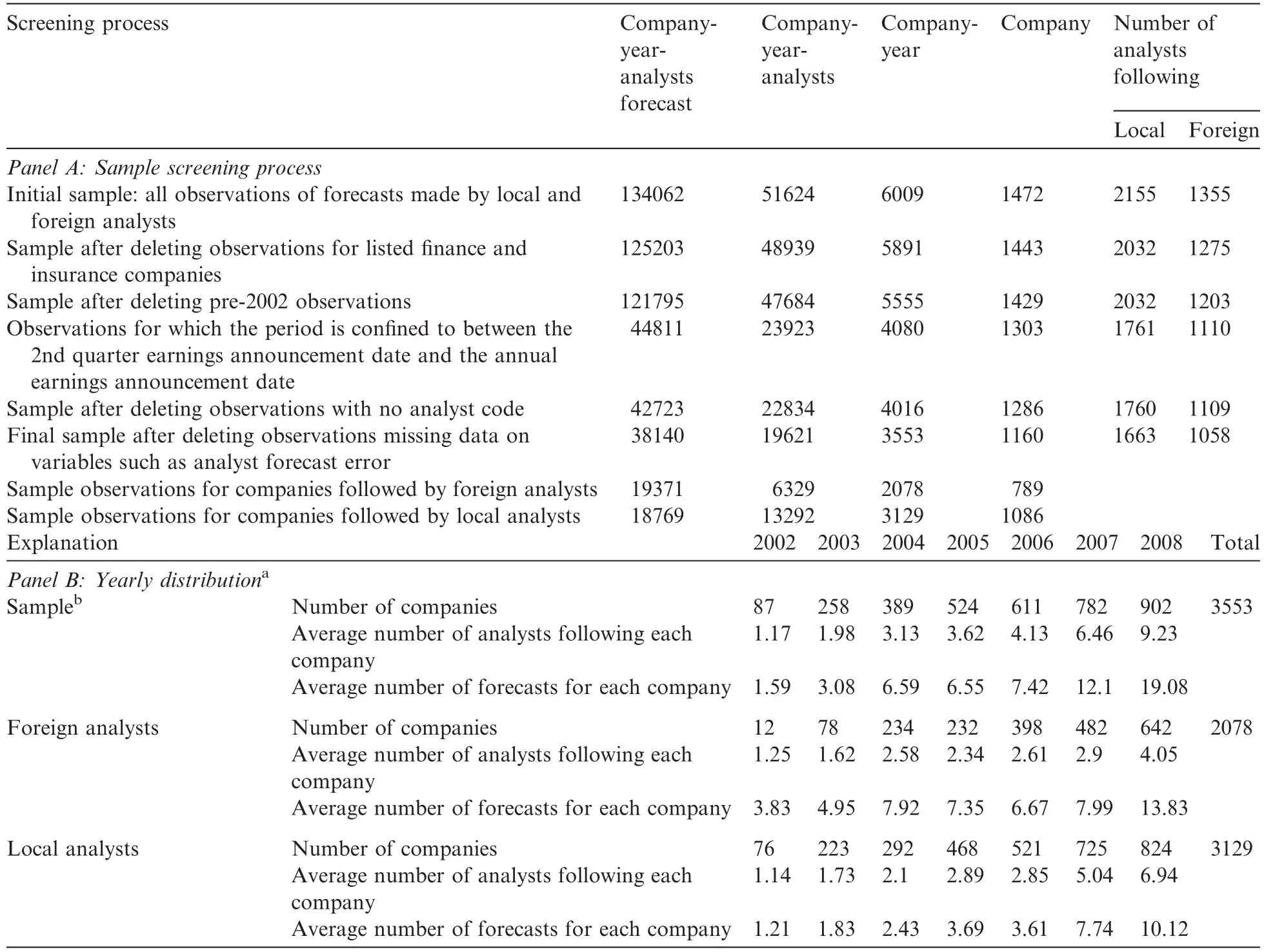

This study draws on an initial sample c7All A-share and B-share companies are included.Because no local analysts follow B-share companies,we examine only A-share companies in tests involving local analysts.However,we adopt B-share companies as our control sample in robustness tests.omprising 134,062 observations(company-year-estimated observations by analysts)of all listed companiesfollowed by both Chinese and foreign analysts prior to the 2008financial year(inclusive).On this basis,we delete 8859 observations for finance and insurance companies,leaving 125,203 in the sampl8Another reason for deleting pre-2002 observations from the sample is because 2001 is the year in which key changes were made to Chinese accounting standards.There was no change in the philosophy underlying Chinese accounting standards from 2002 to 2006(Liu et al.,2004).e.Furthermore,due to missing data on domestic analysts before 2002,we also delete pre-2002 company datato enable better comparisons between Chinese and foreign analysts’performance, leaving 121,795 observations.Third,we omit sample observations for which the period is confined to between the 2nd quarter earnings announcement date and the annual earnings announcement date,leaving 44,811 observations.We then delete observations that have no analyst code or lack correlated variables,yielding afinal sample of 38,140 observations.The data on Chinese analysts and financial data employed in this study come from the CSMAR database maintained by GTA Information Technology Co.,Ltd.The data on foreign analysts come from I/B/E/S.Values for the QFII control variable are sourced from the CEIC database. Details of the sample screening process are provided in Panel A of Table 2.The table reports the following: company-year-analyst sample observations,company-year,company and the number of analysts followingthe company.Differences between company-year-analyst sample observations and company-year analyst forecasts are due to multiple forecasts being made by some analysts during the sample period.Panel B of Table 2 reports the number of companies followed by analysts and the distribution of forecasts from year to year, showing a significant increase in the number of companies followed by foreign analysts since 2007(from 398 in 2006 to 482 in 2007 and 642 in 2008),as well as an increase in the average number of analysts following each company,from 2.61 in 2006 to 4.05 in 2008,jumping by more than 50%.To some extent,these figures demonstrate that the new accounting standards have attracted more foreign analysts to follow Chinese listed companies,while the growth in the average number of analysts following these companies is even more substantial,rising from 2.85 in 2006 to 5.04 in 2007 and 6.94 in 2008.Furthermore,in terms of the number of years each company is followed by an individual analyst,fluctuations among foreign analysts are less marked than those among Chinese analysts,possibly owing to new local analysts entering the market after 2006.

Table 2Sample screening process and yearly distribution.

3.2.Effect of accounting standard changes on the accuracy of foreign analyst forecasts

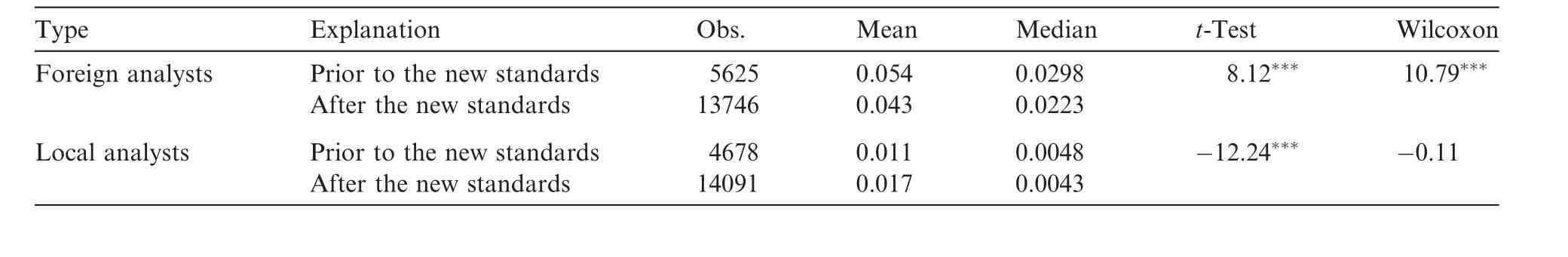

This study starts with univariate analysis designed to test Hypothesis 1.The results shown in Table 3 illustrate the variation in forecast error among local and foreign analysts prior to and after the new accountingstandards were enacted.The number of forecasts made by both of these groups increased significantly from 5625 to 13,746 among foreign analysts and from 4678 to 14,091 among local analysts.Moreover,forecast error among foreign analysts after the new accounting standards were implemented fell dramatically:the mean dropped from 0.054 to 0.043 and the median from 0.0298 to 0.0223,both of which are statistically significant results.In contrast,mean forecast error among local analysts rose from 0.011 to 0.017.These findings are consistent with H1,implying that the new accounting standards have made foreign analysts more familiar with Chinese accounting standards and reduced the uncertainty of future profit forecasts based on information in financial reports,which is helpful in improving the accuracy of forecasting(Zhang,2006).

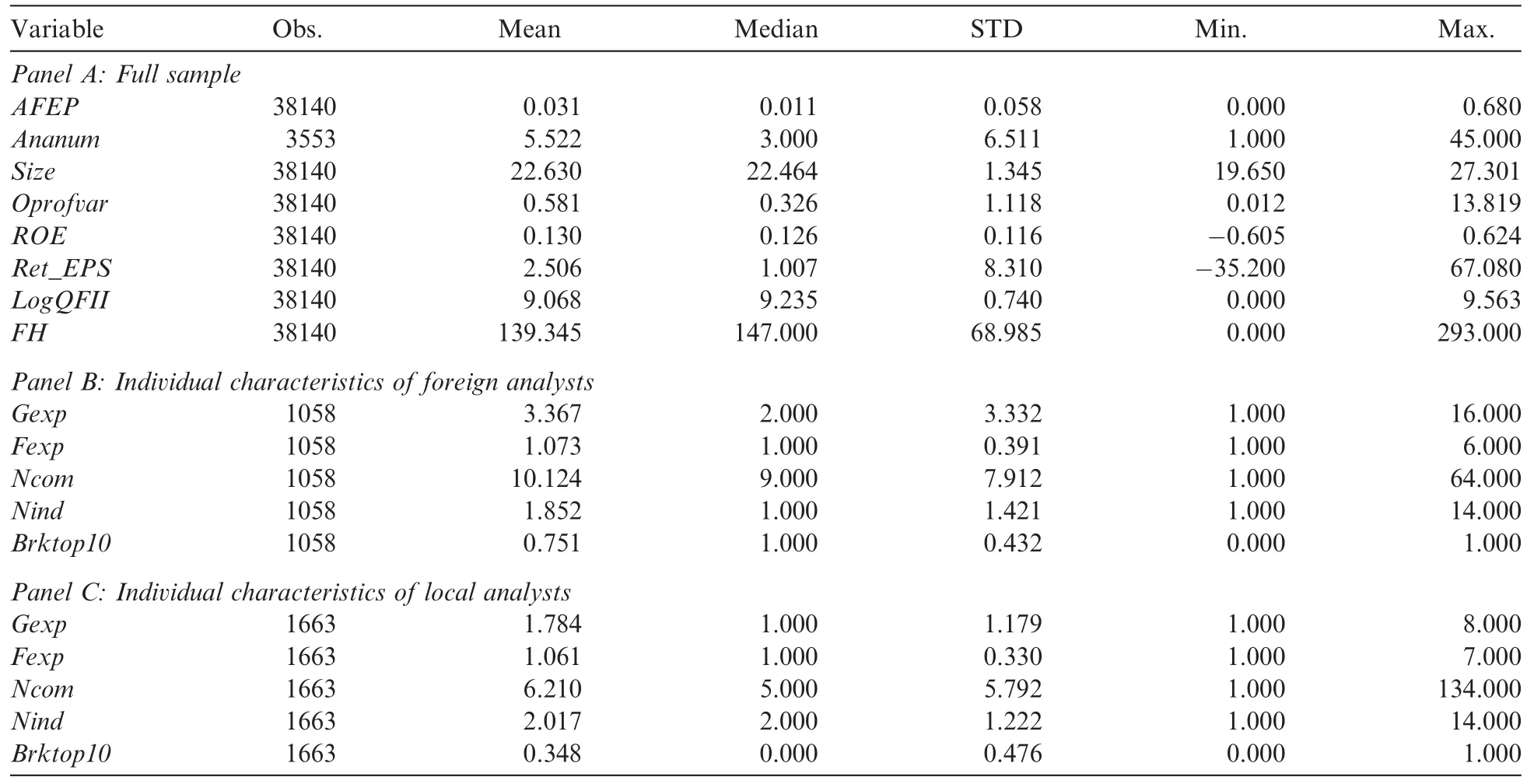

Table 4 reports descriptive statistics for the full sample examined in this paper and for the individual characteristics of the two types of analysts.Panel A shows statistics for all variables other than analysts’individual characteristics.With the exception of the Ananum variable,for which data is gathered on the basis of a company-year sample,the other variables are all based on a company-year-analyst forecast sample(comprising 38,140 observations in total).Panel B and Panel C show statistics for analysts’individual characteristics and a sample based on individual analysts(1058 foreign analyst observations and 1663 local analyst observations,respectively).Panel A demonstrates that the average forecast error among analysts represents 3.1%of the stock price,the average number of analysts following the company is about six,and the average actual number of days between the analyst forecast issuance date and the earnings announcement date is about 140(FH).A comparison between Panel B and Panel C shows that the average work experience of foreign analysts following Chinese listed companies is 3.367 years(Gexp),higher than that of local analysts(1.784);theaverage number of years foreign analysts have followed this specific company is 1.073(Fexp),close to that of local analysts;the average number of companies followed by each foreign analyst is 10(Ncom),higher than that of local analysts(6.21);the average number of industries followed by each foreign analyst is 1.852(Nind), close to that of local analysts;and 75%of foreign analysts work for big brokerages,higher than the proportion of local analysts(35%).These results indicate that foreign analysts are more sophisticated than their local peers,i.e.,foreign analysts follow more Chinese listed companies and work for bigger brokerages than local analysts.

Table 3Forecast error differences between local and foreign analysts prior to and after the enactment of new accounting standards.

Table 4Descriptive statistics.

?

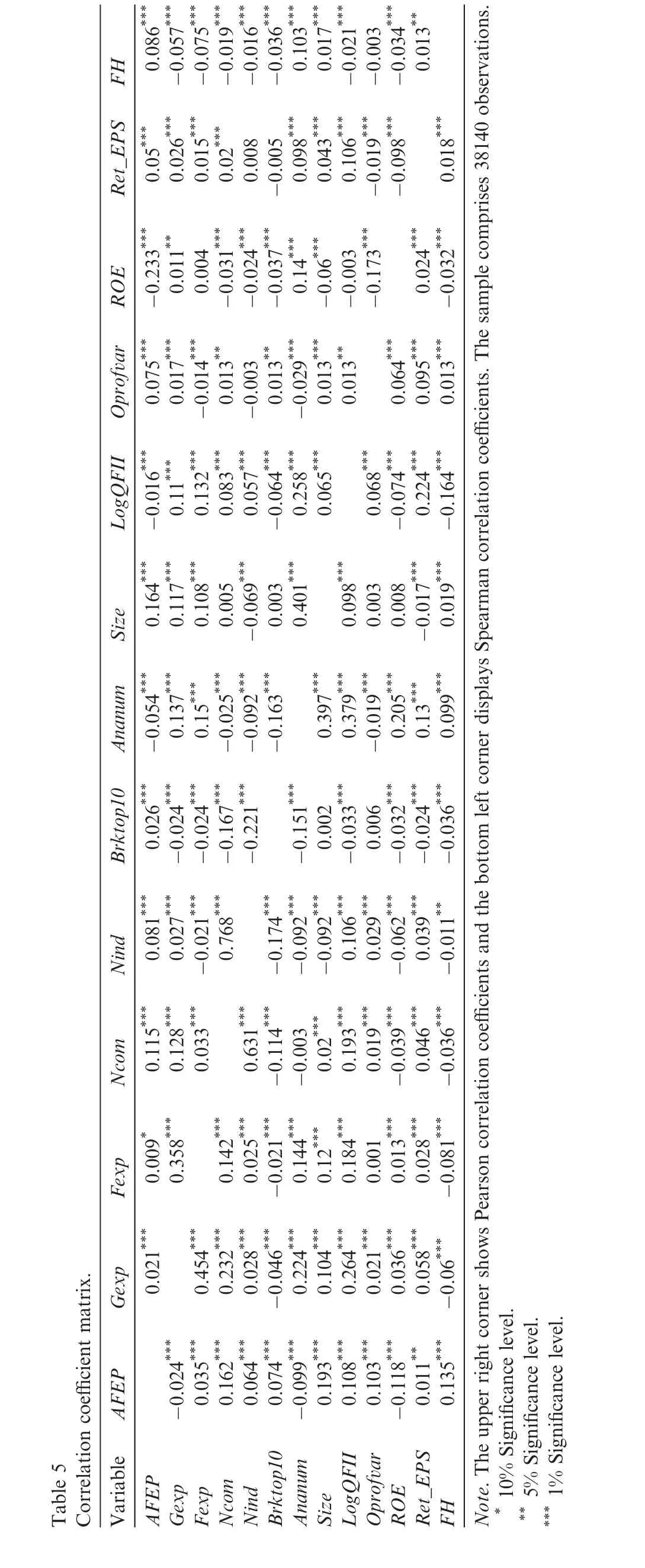

The correlation matrix is displayed in Table 5.It shows a significant negative correlation between AFEP and Gexp and significant positive correlations between AFEP and both Ncom and Nind,implying the less experienced the analyst,the more companies and industries they follow and the higher the level of forecasterror.In addition,the significant positive correlations between AFEP and both Fexp and Brktop10 indicate that contrary to our expectations,the longer the analyst has followed the company,the bigger the brokerage they work for and the higher the level of forecast error.

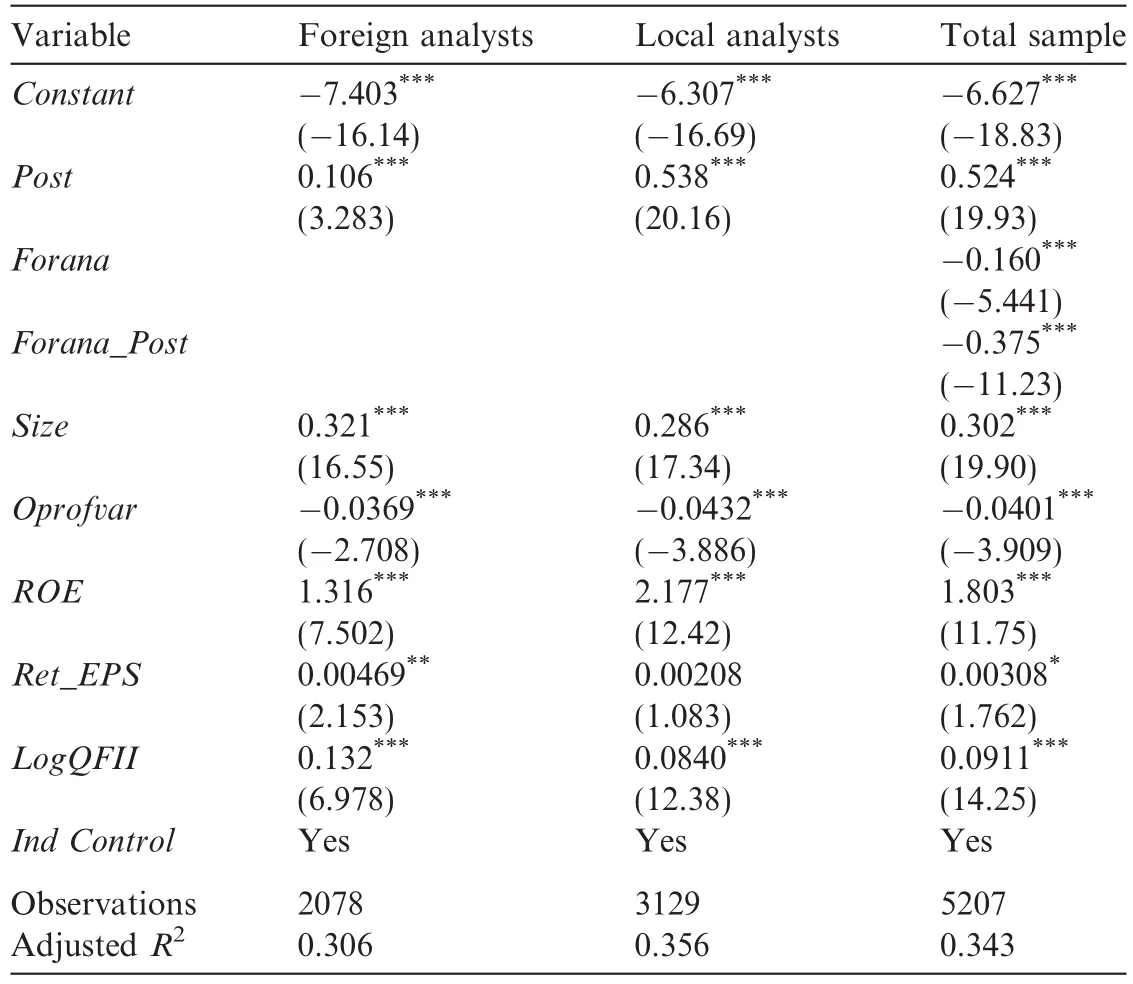

Table 6Regression analysis of forecast error among foreign and local analysts before and after implementation of new standards.

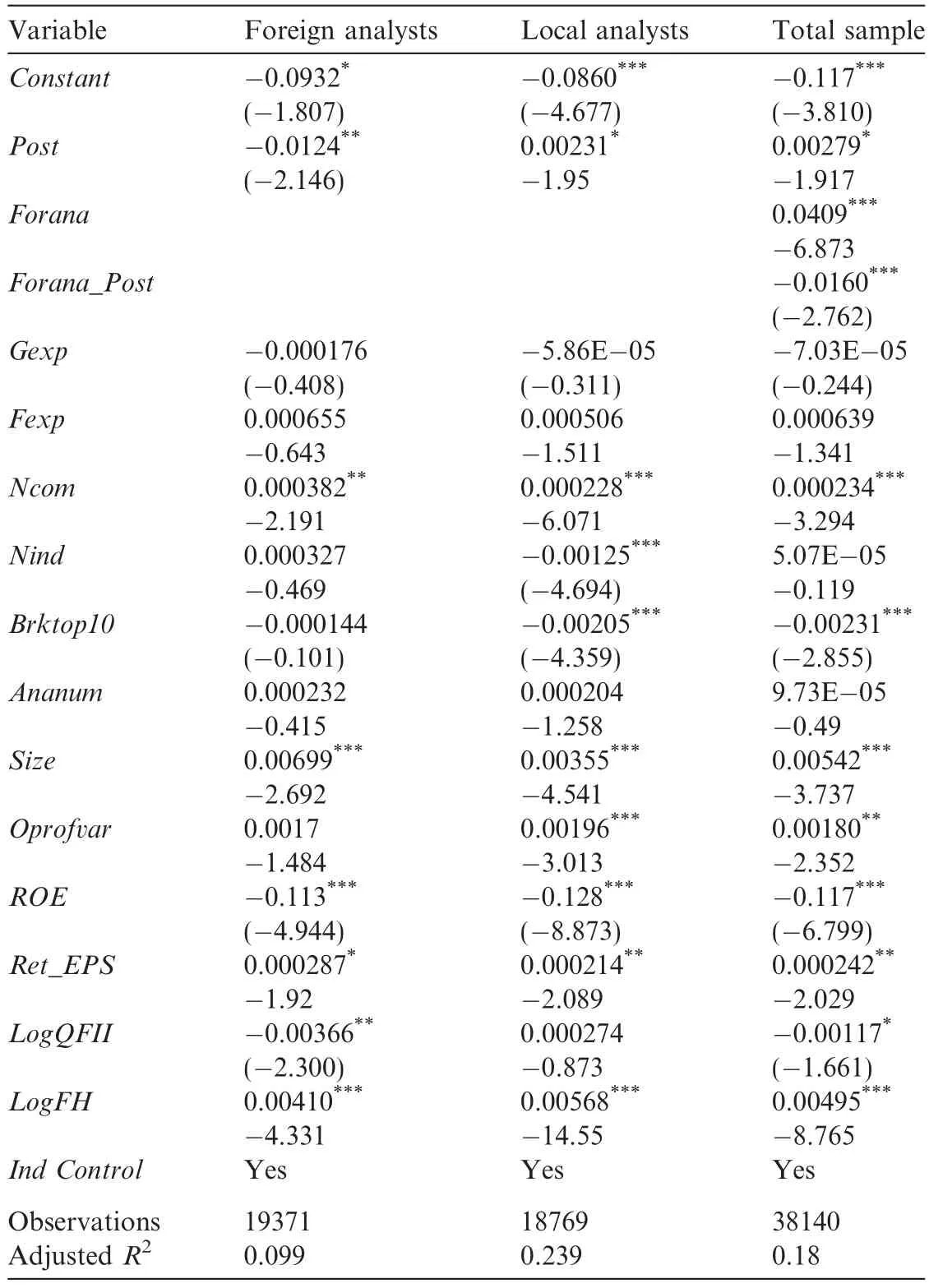

The results of regressions based on Model(1)and Model(2)are displayed in Table 6.The first two columns report the results of separate regressions for foreign analysts and local analysts,respectively.The last column shows the results of a regression for the two groups of analysts combined.In unreported analysis,we examine the VIFs of various variables,all of which are below 5 and thus indicate the absence of significant multicollinearity.In Table 6,following the implementation of accounting standard changes,Post is significantly negative for foreign analysts and significantly positive for local analysts,thus demonstrating an improvement in forecast error among foreign analysts and a deterioration in forecast error among local analysts.We integrate the two types of analysts into the regression model in the last column to explore the relative reduction in forecast error among foreign analysts.The interaction term Forana_Post is significantly negative,revealing a reduction in forecast error among foreign analysts relative to local analysts following the implementation of the new standards.In summary,these results point to a significant reduction in the forecast error of foreign analysts after the accounting standard changes,a result not affected by fluctuations in the analyst industry as a whole.This evidence is consistent with H1.

Turning to the control variables,the insignificance of the results for the individual analyst characteristics variables Gexp,Fexp and Nind and the significant positive coefficient on Ncom demonstrate that the more companies an analyst follows,the higher the level of forecast error,a finding consistent with that of Clement (1999).However,the significant negative result for Brktop10 is inconsistent with our expectations,and is more prominent in the local analysts group than in the foreign analysts group.Furthermore,we find the larger the company(Size),the larger the variation in profits(Oprofvar),the longer the horizon between the forecast issuance date and the annual earnings announcement date(LogFH)and the worse the company’s performance, the larger the forecast error among analysts,all of which are consistent with our predictions.Moreover, the higher the annual QFII,the lower the level of forecast error among foreign analysts,a result not repeated for the local analysts group(for which we find an insignificant coefficient on LogQFII).Together with the results shown in Table 8,we find that QFII investment in the Chinese capital market is an important factor contributing to improved forecast quality and a higher number of foreign analysts following Chinese companies.Above all,the results for the control variables are consistent with those reported in prior research.

3.3.Effect of accounting standard changes on the number of foreign analysts following Chinese companies

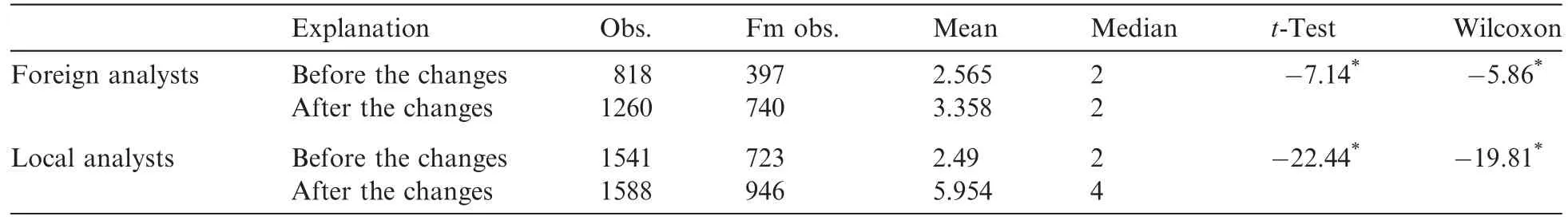

After the new standards were implemented,the information costs of foreign analysts declined owing to their familiarity with IFRS,leading to a rational expectation they would increase the number of forecasts they made on Chinese listed companies.We restrict our sample on a company-year basis to examine the effect of the new standards on the number of foreign analysts following Chinese companies.If in 1 year there are two types of analysts following one company,then two observations exist;otherwise,only one observation exists. This gives us a total of 5207 observations,including 2078 observations of companies followed by foreign analysts each year and 3129 observations of companies followed by local analysts each year(the details are given in Panel A of Table 2).We first look into differences in the number of analysts following each company and whether such differences are significant before and after the accounting standard changes.The results shown in Table 7 indicate that following the accounting standard changes,the average number of foreign analysts following Chinese listed companies increased substantially(fifth column)from 2.565 prior to their implementation to 3.358 post-implementation,with a 1%level of significance.Moreover,the number of local analysts following these companies also rose substantially from 2.490 pre-implementation to 5.954 post-implementation,an increase larger than that among foreign analysts.

Table 7 shows statistics on changes in the number of listed companies followed by Chinese and foreign analysts.The third column(Obs.)shows the annual number of listed companies followed by foreign analysts,with the total of 2078 including 818 observations before the standards were changed and 1260 after the new standards were implemented.It also reports the annual number of listed companies followed by local analysts,the total of 3129 including 1541 observations before the new standards were implemented and 1588 afterwards. The fourth column lists the number of companies followed by local and foreign analysts prior to and afterthe accounting standard changes,9We ignore the effect of various years before and after the accounting standard changes.For example,if company A was followed by any foreign analyst in 2003 and 2004,i.e.prior to the accounting standard changes,we treat it as a single company.The approach taken in other circumstances is similar.showing 397 companies were followed by foreign analysts before the changes and 740 after the changes,an increase of nearly 100%,while the corresponding number of companies followed by local analysts increased less markedly from 723 to 946.

Table 8 provides regression results based on Model(3),among which the result for Post is positive for both the local analysts group and the foreign analysts group,the latter indicating a significant rise in the number of foreign analysts following Chinese listed companies after the changes and supporting Hypothesis 2.However, we also find that the corresponding number of local analysts rose proportionally more than that of foreign analysts(derived from the interaction variable for the full sample result for Forana_Post).The increase in the number of local analysts is substantially larger than that of foreign analysts,probably due to the ongoing prosperity of the Chinese capital market and more analysts joining the industry.

Turning again to the control variables,Size,ROE and LogQFII are all significantly positive in the three groups,and Oprofvar is significantly negative,indicating that the larger the company,the better its performance and the higher the level of QFII investment,the more analysts following the company.However,larger fl uctuations in performance(Oprofvar)reduce the number of analysts following the company.These results are also consistent with those of previous research.

Table 7Comparison of number of companies followed by foreign and local analysts.

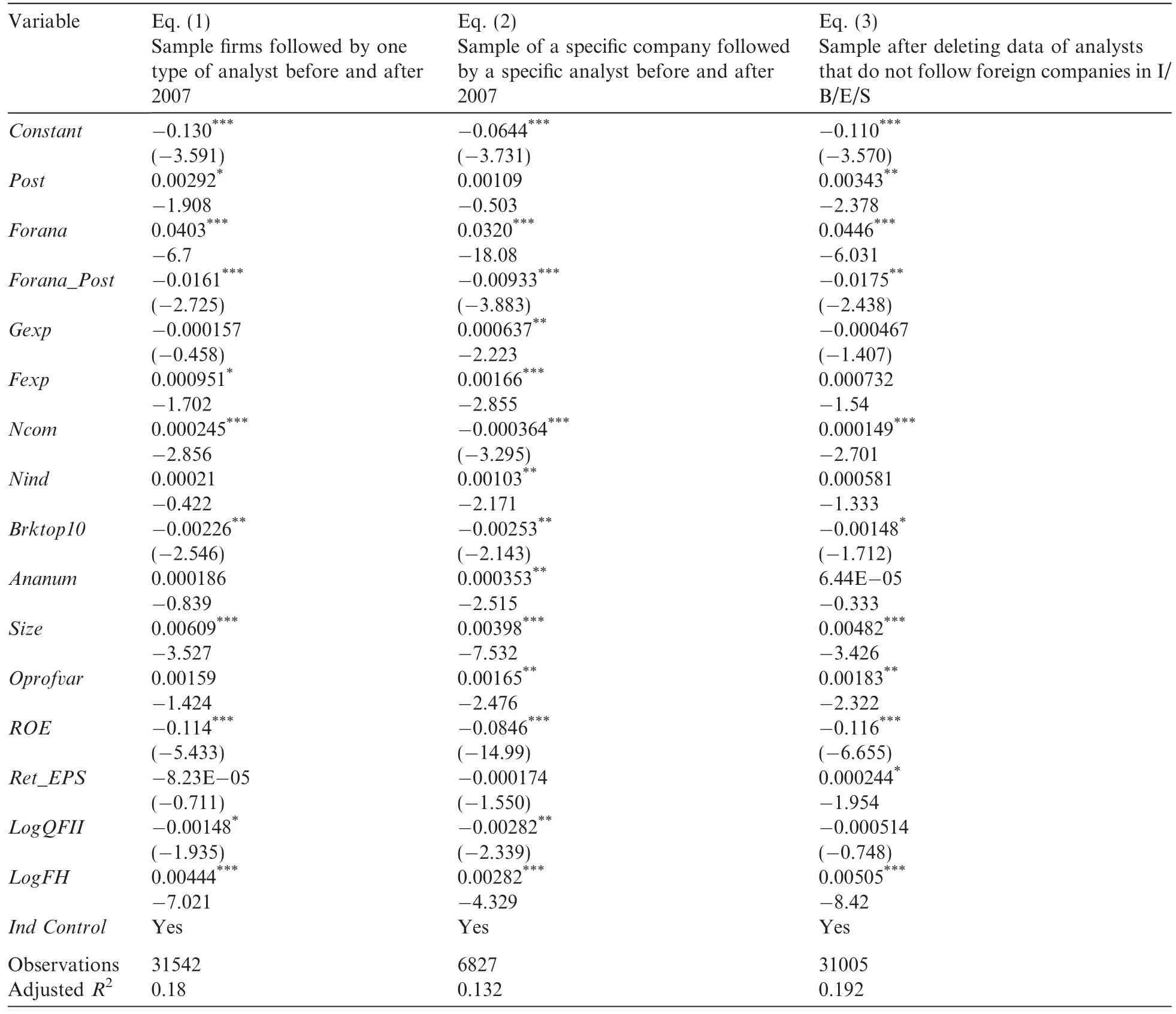

3.4.Robustness tests

We conduct a series of four robustness tests to confirm the validity of our results.First,the main test includes all companies followed by local and foreign analysts to mitigate sample selection bias.If foreign analysts followed a company only before the accounting standard changes were implemented or entered the industry only after the changes were made,then the reduction in forecast error might not have been caused by the accounting standard changes,but may instead be attributable to other changes in macro factors.Therefore,to enhance the reliability of our results,we restrict the sample further by requiring each type of analyst to have followed the company both before and after the accounting standard changes,thus omitting observations with only one type of follower before or after the accounting standard changes.This criterion results in a sample comprising 31,542 observations.On a similar basis,limitations are also placed on the individual characteristics of analysts and companies and on the effect of the macro environment.The results based on Model(2)are displayed in the first column(Eq.(1))of Table 9.They are consistent with those presented in Table 6 and provide additional support for our hypotheses.

Second,while the robustness test above(Table 9,Eq.(1))requires each type of analyst to have followed the company both before and after the accounting changes were made,our next test imposes a more restrictive requirement that an individual analyst(local or foreign)has to have followed Chinese listed companies both before and after the accounting standard changes,which reduces the number of observations sharply to 6827. Based on this and the previous limitations on individual factors,company characteristics and macro factors, the second column(Eq.(2)of Table 9 lists the results obtained using Model(2),which conform to those reported in Table 6.

Table 8Analysis of number of analysts following companies.

Third,the main test differentiates between foreign analysts and local analysts according to the database employed,with information on the former group being drawn from the I/B/E/S database and information on the latter from the CSMAR database.An important problem,however,is whether the I/B/E/S data include predictions made by local analysts.To enhance the robustness of our main results,we limit the data on foreign analysts to data on those following both foreign and Chinese listed firms.This approach adds to the robustness of our results,but leaves us with fewer observations for foreign analysts.After applying this restriction, we obtain a total of 12,236 observations representing 63.17%of the full sample.The results based on Model (2)are shown in the third column(Eq.(3))of Table 9 and are similar to the findings reported in Table 6.

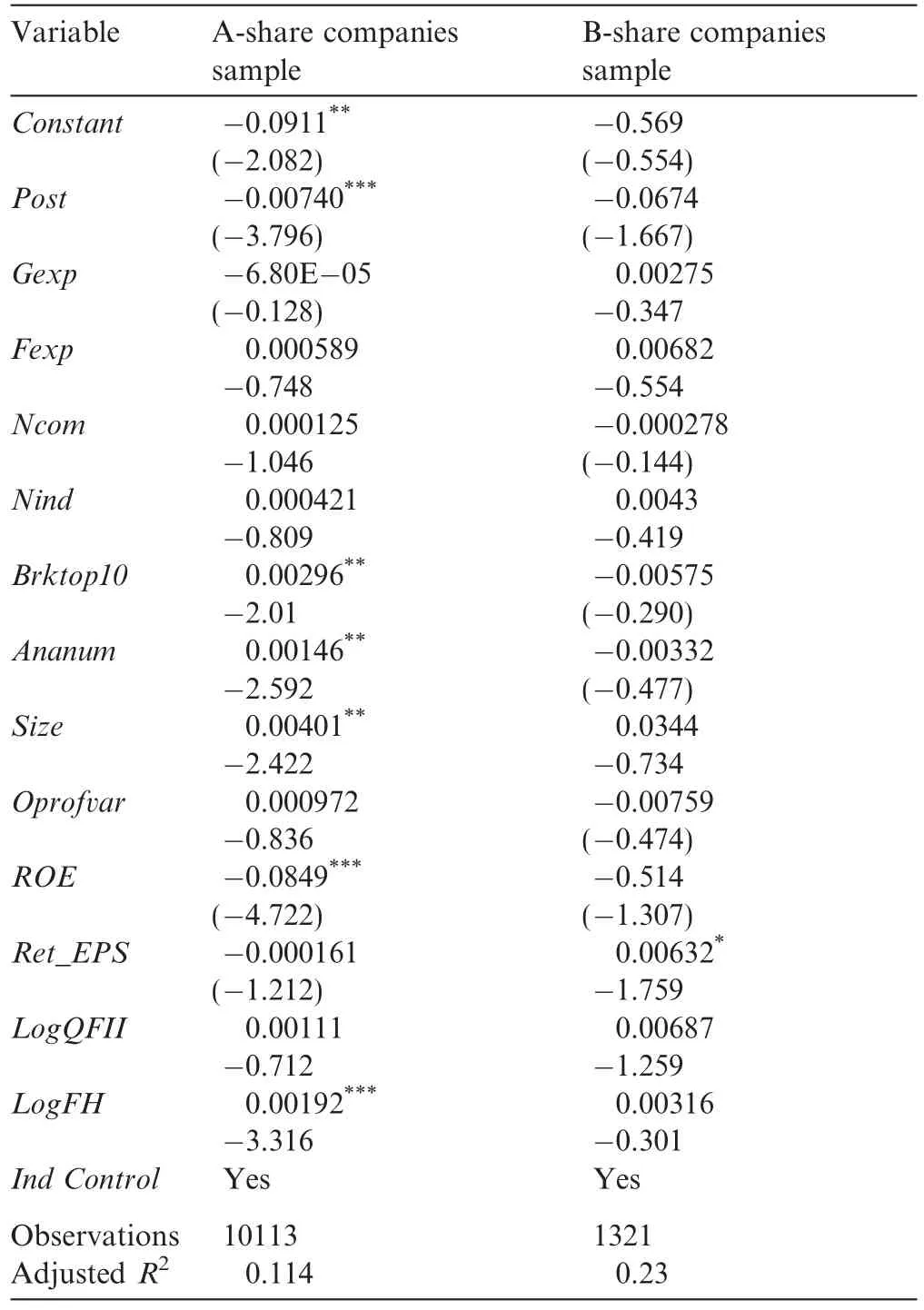

Finally,in the main regression analysis,we use local analysts as our control sample to examine the effect of accounting standard changes on foreign analysts.Yet B-share companies could also be used as a control sample,as they have been required to conform to IFRS throughout the sample period.Therefore,if our expectations still hold using B-share companies as our control sample,we should observe a change in the level of forecast error among foreign analysts of A-share companies and no change in the level of forecast error among foreign analysts of B-share companies.The results of this robustness test are shown in Table 10,where foreign analysts are our treatment sample and are required to have followed the company both before and after the accounting standard changes.The results show a significant drop in foreign analyst forecast error for A-share companies(at the 1%level of significance)and an insignificant change in foreign analyst forecast error for B-share companies.It should be noted,however,that the coefficient on Post in the B-share companies group is close to being significant(t=1.667)and is larger than that on Post in the A-share companies group.10We thank the anonymous referee for this suggestion.Considering the smaller sample of B-share companies11Statistically,there are only 32 B-share companies followed by foreign analysts.This small control sample implies a possibility of onesided evidence.and the smaller t-value obtained,the result is unstable and should be interpreted with caution.

Table 9Results of robustness tests.

4.Conclusion

This study examines the effect of Chinese accounting standard changes on foreign analysts’behavior and shows the influences international convergence toward IFRS might have had on the behavior of foreign investors.We believe that the accounting standard changes made in 2007,which were aimed at IFRS convergence, affected the behavior of foreign analysts in two ways.First,they reduced forecast error by improving the quality of information in financial reports and lowering information uncertainty.Second,due to the familiarity of foreign analysts with IFRS,the accounting standard changes attracted more analysts to follow Chinese listed companies and enhanced the accuracy of their forecasts.Our empirical evidence confirms the expectations reflected in our two hypotheses.In designing this study,we decided to adopt local analysts as our controlsample to highlight the incremental effect of the accounting standard changes on foreign analyst forecasts.Wefind the changes attracted more foreign analysts to follow Chinese listed companies and that forecast error among foreign analysts fell after the new standards were implemented,with the extent of the fall being significantly larger than that seen among local analysts.These results indicate that IFRS convergence has enhanced the familiarity of foreign analysts with Chinese accounting standards,has boosted their enthusiasm to follow Chinese listed companies,has improved the accuracy of their forecasts,has contributed to reducing the information costs of foreign investors and has improved the efficiency of resource allocation.Our results give us a clearer understanding of the effect of Chinese accounting standard changes on foreign investors(or foreign analysts)and are of value to both policymakers and practitioners in facilitating sound economic decisions.

Table 10Results based on sample of foreign analysts only.

Acknowledgements

The authors thank the anonymous referees,Prof.Ding Yuan,Prof.Su Xijia and participants at the“Summer Research Workshop 2010(CJAR)”.This study was supported by Grants from the National NaturalScience Foundation of China for“An Investigation on the Valuation and Behavioral Effects of New Accounting Standards”(Project No.70872056),“Research on Effects of Information Environment Changes on Behavior and Difference of Local and Foreign Analysts”(Project No.71102124),and“Earnings Management,Risk Mark and Audit Opinion Decision-Making”(Project No.70972139),Grants from the Beijing Municipal Commission of Education“Joint Construction Project”and the“Project 211”(Phase-3) Fund of the Central University of Finance and Economics,China.

Armstrong,C.S.,Barth,M.E.,Jagolinzer,A.D.,Riedl,E.J.,2010.Market reaction to the adoption of IFRS in Europe.The Accounting Review 85(1),31-61.

Ashbaugh,H.,Pincus,M.,2001.Domestic accounting standards,international accounting standards,and the predictability of earnings. Journal of Accounting Research 39(3),417-434.

Bae,K.,Tan,H.,Welker,M.,2008.International GAAP differences:the impact on foreign analysts.The Accounting Review 83(3),593-628.

Barth,M.E.,Landsman,W.R.,Lang,M.H.,2008.International accounting standards and accounting quality.Journal of Accounting Research 46(3),467-498.

Basu,S.,Hwang,L.,Jan,C.,1998.International variation in accounting measurement rules and analysts’earnings forecast errors.Journal of Business Finance and Accounting 25(9-10),1207-1247.

Beuselinck,C.,Joos,P.,Khurana,I.,Meulen,V.D.S.,2009.Mandatory Adoption of IFRS and Stock Price Informativeness.Tilburg University,Working paper.

Clement,M.B.,1999.Analyst forecast accuracy:do ability,resources,and portfolio complexity matter?Journal of Accounting and Economics 27(3),285-303.

Daske,H.,2006.Economic benefits of adopting IFRS or US-GAAP-have the expected costs of equity capital really decreased?Journal of Business Finance and Accounting 33(3),329-373.

Guan,Y.,Hopeb,O.,Kang,T.,2006.Does similarity of local GAAP to US GAAP explain analysts’forecast accuracy?Journal of Contemporary Accounting and Economics 2(2),151-169.

Hope,O.K.,2003a.Accounting policy disclosures and analysts’forecasts.Contemporary Accounting Research 20(2),295-321.

Hope,O.K.,2003b.Disclosure practices,enforcement of accounting standards,and analysts’forecast accuracy:an international study. Journal of Accounting Research 41(2),235-272.

Lang,M.H.,Lundholm,R.J.,1996.Corporate disclosure policy and analyst behavior.The Accounting Review 71(4),467-492.

Leuz,C.,Verrecchia,R.E.,2000.The economic consequences of increased disclosure.Journal of Accounting Research 38(3),91-124.

Tan,H.,Wang,S.,Welker,M.,2009.Foreign Analyst Following and Forecast Accuracy around IFRS Adoptions.University of Waterloo,Working paper.

Van Tendeloo,B.,Vanstraelen,A.,2005.Earnings management under German GAAP versus IFRS.European Accounting Review 14(1), 155-180.

Zhang,X.F.,2006.Information uncertainty and analyst forecast behavior.Contemporary Accounting Research 23(2),565-590.

Jin,Z.,2010.New accounting standard,accounting information quality,and the synchronism of stock prices.Accounting Research 07, 19-26(in Chinese).

Liu,F.,Wu,F.,Zhong,R.Q.,2004.Can accounting standards enhance accounting information quality?Preliminary evidence from the Chinese stock market.Accounting Research 05,8-19(in Chinese).

Luo,T.,Xue,J.,Zhang,H.Y.,2008.Analysis of effects of the new accounting standard on the relevance of accounting information value. China Accounting Review 02,129-140(in Chinese).

Wang,Y.T.,Xue,J.,Chen,X.,2009a.Shall the market distinguish different information after the implementation of the new accounting standard?Journal of Financial Research 01,136-150(in Chinese).

Wang,Y.T.,Xue,J.,Chen,X.,2009b.Choices of accounting policy and earnings management of enterprises-research based on changes in the accounting standards.China Accounting Review 03,255-270(in Chinese).

Ye,J.F.,Zhou,L.,Li,D.M.,Guo,L.,2009.Motives of the management,choices of accounting policy and earnings managementempirical research based on classifications of financial assets of listed companies after the issuance of the new accounting standard. Accounting Research 03,25-30(in Chinese).

Zhu,K.,Zhao,X.Y.,Sun,H.,2009.Accounting standards changes,information accuracy and value relevance-empirical evidence based on Chinese accounting standards changes.Management World 04,47-54(in Chinese).

4 May 2010

*Corresponding author.

E-mail address:wangyutao@cufe.edu.cn(Y.Wang).

New accounting standards

Analyst forecasts

Forecast error

China Journal of Accounting Research2012年1期

China Journal of Accounting Research2012年1期

- China Journal of Accounting Research的其它文章

- Overemployment,executive pay-for-performance sensitivity and economic consequences:Evidence from China

- Controller changes and auditor changes

- Enforcement actions and their effectiveness in securities regulation:Empirical evidence from management earnings forecasts

- Women on boards of directors and corporate philanthropic disaster response