Overemployment,executive pay-for-performance sensitivity and economic consequences:Evidence from China

Donghua Chen,Yongjian Shen,Fu Xin,Tianqin Zhang

Accounting Department,Research Institution of Accounting and Finance,Nanjing University,China

Overemployment,executive pay-for-performance sensitivity and economic consequences:Evidence from China

Donghua Chen,Yongjian Shen*,Fu Xin,Tianqin Zhang

Accounting Department,Research Institution of Accounting and Finance,Nanjing University,China

A R T I C L EI N F O

Article history:

Accepted 7 December 2011 Available online 8 May 2012

JEL classification:

G38

J31

M48

Government intervention

Surplus labor force

Pay-for-performance sensitivity

Policy burden

Policy gains

Using a sample of state-owned enterprises(SOEs)listed on the Shanghai and Shenzhen Stock Exchanges during the 1999-2009 period,we investigate the effects of overemployment on executives’pay-for-performance sensitivity (PPS)and analyze how the behavior of firms with high/low PPS affects the number of surplus employees.We find the existence of a redundant workforce significantly weakens PPS and the role of accounting measures in performance assessment.In contrast to prior literature,we find that higher PPS is associated with a stronger incentive to lay of fredundant employees and to limit future employee numbers.We also find that weaker government intervention strengthens managerial control over the future size of the workforce.Finally, our findings suggest that a heavier government policy burden on SOEs leads to lower tax rates and more government gains.

ⓒ2012 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

The separation of ownership and control is the main cause of agency problems.Performance-related compensation contracts(pay for performance)can link executives’personal interests with those of the corporation and maximize the benefits for both executives and shareholders.Pay for performance is thus considered one ofthe main mechanisms for coordinating managers’behavior and shareholders’goals(Jensen and Meckling, 1976;Jensen and Murphy,1990).The determination of reasonable compensation contracts thus constitutes a core research subject in corporate governance,especially in the case of China.Such contracts also have a considerable impact on the successful evolution and development of state-owned enterprises(SOEs).

Accounting performance is often used to evaluate executive performance,largely because of the observability and relatively high degree of correlation between accounting performance and managerial effort(Watts and Zimmerman,1986).Numerous studies have concentrated on the relationship between executive compensation and performance(Murphy,1985,1999;Jensen and Murphy,1990;Tosi et al.,2000).Those examining the relationship between executive compensation and the performance of China’s listed companies(Wei,2000;Li, 2000;Liu et al.,2003;Zhang et al.,2003;Du and Zhai,2005;Du and Wang,2007),however,have failed to reach a consistent conclusion.The reason for the lack of consensus could be that,without exception these studies were all based on the same implicit logical premise,that is,that attractive compensation should be strongly related to corporate performance.However,such a premise omits the possible correlation between performance and executive effort.Is maximum accounting performance the only goal of the shareholders of China’s listed firms?Does accounting performance reflect executive effort and the degree of that effort? Is it possible that political targets limit the effectiveness of accounting performance-based compensation contracts among China’s listed companies?What kind of behavior do corporate executives exhibit to maximize personal benefits in the face of different types of government intervention?All of these questions deserve in-depth analysis and the search for their answers provides the motivation for the current study.

During China’s transition from a planned to a market economy,the decentralization of political power increased the residual claims and control of the business operations of local government(including corporations).Such factors as employment,economic development,social stability,fiscal surplus,the loan orientation of state-owned commercial banks,personal career promotion and rent-seeking opportunities all boosted the desire of local governments to maintain influence over local enterprises(Chen,2003).The appointment and regulation of executives reflected local governments’need to maintain the control rights of local SOEs and the aim of such control was often to make these SOEs better serve these governments’political objectives.

Lin and Li(2004)suggests that China’s SOEs bear the policy burdens of social functions,such as limiting layoffs and boosting employee welfare.Regional employment,social harmony and stability remain the main objectives of local government and constitute the promotion criteria for government officials.As a result,local government officials try to boost employment by forcing local enterprises to limit layoffs and hire more personnel.However,as Boycko et al.(1996)point out,privatization has raised the cost of such government intervention so high that the number of redundant,i.e.,superfluous,employees is being reduced in private corporations.Hence,SOEs have become a prime tool by which government attempts to achieve its political goals.One of the results of government intervention has been an increase in redundant manpower in SOEs. The less influence the market has,the more serious the degree of local protectionism and government intervention(Fan and Wang,2010).When subject to government intervention,SOEs face multiple objectives. Accordingly,executive efforts to meet political targets,such as boosting local employment to satisfy local government officials,will not be reflected in accounting performance.In addition,the accounting performance of SOEs usually reflects the financial subsidies given by the government as compensation for the policy-related losses that stem from employing a surplus labor force and is thus not merely the result of executive effort, which reduces the influence of incentives.The existence of multiple endogenous targets for SOEs renders a one-sided emphasis on compensation-related incentives for financial performance inappropriate in many cases (Xin et al.,2007).In other words,SOEs’multiple objectives increase the cost of separating management effort and performance,which may reduce the effectiveness of performance-based compensation contracts.This paper starts from overemployment and explores whether the existence of a large number of redundant employees reduces the pay-for-performance sensitivity(PPS)of state-owned listed companies.It further examines whether executive compensation is sensitive to corporate performance and how the degree of market development influences the future growth of employee numbers.

We find the presence of surplus manpower significantly reduces executive PPS.Firms with greater PPS sensitivity have stronger motivation to control the growth of employee numbers in the future and the interaction between a dummy variable for PPS and present surplus employees is significantly negatively associated with employee growth during time t+1.In addition,compared with their counterparts in regions with a lessdeveloped market,companies in regions with a highly developed market have stronger incentives to control future growth in employee numbers,with the interaction of market index and present surplus employment significantly negatively associated with employee growth during time t+1.

The potential contributions of this paper are as follows.(1)The surplus employment caused by government political intervention weakens our ability to evaluate executive effort and this decrease in PPS increases agency problems to a certain extent.(2)The findings of this study help us to better understand the role played by the Chinese government in the economic transition process and help to deepen our understanding of the country’s institutional background.(3)Assuming that managers have the motivation to maximize their own benefits, closely tying management compensation to corporate performance could serve to control the number of superfluous employees,thereby conflicting with the political goals of local government,a finding that provides a new perspective on the mutual interests of corporate executives and government officials and a fresh explanation for the factors influencing employment in China.

The remainder of the paper is organized as follows.Section 2 presents a review of the literature,including that on the policy burden of SOEs,executive compensation and PPS.Section 3 covers China’s institutional background,theoretical analysis and hypothesis development.Section 4 presents our research design,Section 5 descriptive statistics and Section 6 the results.Section 7 concludes the paper with a summary of our findings and a discussion of the study’s limitations.

2.Literature review

2.1.The policy burden of SOEs

Both domestic and foreign scholars have carried out in-depth research on the policy burden of SOEs. Shleifer and Vishny(1994)posit that the poor performance of these enterprises stems largely from government officials’attempts to achieve political goals through the SOEs under their control,for example,by imposing objectives other than value-maximization,such as the hiring of more employees to win votes.Boycko et al. (1996)and Bai et al.(2000)believe the key factor in the poor performance of SOEs is agency problems,with government officials rather than executives in control and one of the main objectives of the former being to improve employment figures.As long as government officials use SOEs to resolve employment problems,these enterprises will suffer from overemployment.Donahue(1989)shows that,under the same conditions,public corporations hire 20-30%more employees than private companies in the US Frydman et al.(1999)find a decrease in labor productivity to predict an increase in future unemployment among private companies, but they find no such relationship among SOEs,in which political pressure prevents layoffs.Dewenter and Malatesta(2001)find that workforce size,standardized by assets and sales,to be larger in public than private companies and to decrease after privatization.

Researchers have engaged in in-depth research on the economic consequences of overemployment in China. Lin and Tan(1999)and Li and Li(2004),for example,suggest that the existence of a“policy burden”stems from a catch-up strategy that leads to investment in capital-intensive industries or industry sectors that lack comparative advantages and provide fewer employment opportunities.China has an abundant labor force and to mitigate unemployment the government asks SOEs to shoulder the social responsibility,i.e.,policy burden of hiring more employees regardless of actual need.Zeng and Chen(2006)find that overemployment does indeed exist in SOEs and that local SOEs have a greater policy burden than their centralized counterparts.Li and Liang(1998)attribute the main cause of SOE losses to the continued employment of non-productive employees,noting that SOEs do not engage in layoffactions after suffering losses.Xu et al.(2005)find the decision rights of SOE executives with regard to firing to be significantly associated with improved performance. The findings of their study show the labor-related policy costs of SOEs to be particularly high and the decision rights of SOE executives to be particularly important to SOE performance.Zeng and Chen(2006)consider the economic consequences of overemployment,finding that the presence of superfluous employees and high salaries together lead to high labor costs for SOEs.Xue and Bai(2008)demonstrate that the greater the size of the surplus labor force in an SOE,the lower the average wage and the poorer the enterprise’s performance.They also find that SOEs in regions with a higher unemployment rate hire more employees surplus to their requirements and that the government gives more fiscal subsidies to SOEs with a larger excess workforce.

Although considerable research has been carried out on the factors inducing SOEs to hire excess labor and the economic consequences thereof,very few studies have investigated the impact of political interventionbased overemployment on executive incentives and responses to such employment.This gap in the literature motivates this study.

2.2.Executive pay-for-performance sensitivity

Jensen and Murphy(1990)is a classic study on PPS in US listed firms.They find the PPS of these firms to be too low,rendering executive incentives relatively weak.They suggest the constraints of public and private political power as the main reason for the situation.Tosi et al.(2000)and Murphy(1985,1999)subsequently conducted additional research on PPS,finding company size,ordinary employees,unions,consumer groups, and political pressure from Congress and the media to affect the relationship between compensation and performance.

Researchers investigating executive PPS in Chinese listed companies have drawn different conclusions.For example,Wei(2000),Li(2000)and Chen(2003)find no significant correlation between executive compensation and firm performance in these companies.However,more recent research has suggested a significant relationship between the two(Zhang et al.,2003;Du and Zhai,2005;Du and Wang,2007;Xin and Tan,2009).As SOEs have multiple objectives,the higher authorities evaluate the managers of these enterprises not only on the basis of firm performance,but also on their fulfillment of political objectives(Bai et al.,2006;Bai and Xu, 2005).Accordingly,some researchers have shifted their attention to the influence of administrative intervention on executive PPS.Liu et al.(2007),for example,find that the greater the government intervention in business,the smaller the role of accounting measures in performance evaluation and the weaker the correlation between accounting performance and managerial incentives.Xin and Tan(2009)propose the marketization process,degree of industry protection,political background of executives and level of government control as the key factors affecting the effectiveness of executive compensation contracts.Gu et al.(2010)find that stronger government control reduces PPS.Cao et al.(2010)report the cash flow rights ownership of the ultimate controller of SOEs to have a significantly positive impact on executive compensation-accounting performance sensitivity.Wang and Xiao(2011)suggest tunneling through connected transactions as one reason for the decrease in PPS in China.In these more recent studies,1We thank a reviewer for pointing us toward the latest literature.the factors affecting executive PPS are researched at the system level,which is consistent with the overall theme of our research.However,we focus on the multitasking nature of SOEs and propose overemployment as the medium by which government intervention affects PPS.Government intervention and the degree of marketization are relatively abstract concepts.Determining how and through what channels they affect PPS requires further analysis.In this paper,we focus on the specific impacts on an enterprise of government intervention or the degree of marketization,such as the mandatory hiring of superfluous personnel,and analyze how they affect executive PPS.Moreover,in contrast to the prior literature,we consider overemployment as a variable reflecting a preference for government political objectives.

As the PPS of an individual firm is difficult to measure with accuracy,few studies have examined the economic consequences of such sensitivity.Abowd(1990)employs a dummy variable for PPS and finds that if current compensation is sensitive to performance,then executives are encouraged to work hard to improve future performance.Here,we apply Abowd’s(1990)dummy variable method to examine the influence on senior executive behavior of overemployment in enterprises with different degrees of PPS.

3.Institutional background,theoretical analysis and hypothesis development

3.1.Institutional background

Overemployment is associated with planned economies and is a characteristic of the SOEs operating in these economies,which tend to operate a highly centralized employment system.The basic mode of operationis that the government controls the number of jobs and the wage level in SOEs,with neither employers nor employees having any say in the matter.To maintain social stability,the government strictly limits layoffs for economic reasons,thus transferring the policy burden of the social-welfare and financial system from government to business.In the transition from a planned to a market economy,China’s employment system has undergone gradual reform,from uniform distribution under the traditional planned economic system to a market-oriented employment system that adapts to market requirements.However,the size of the workforce in SOEs remains subject to government intervention for a number of reasons.First,the employees of SOEs receive an income that in monetary terms is much less than the value of their labor,with an implicit contract guaranteeing continued employment compensating for the low wages(Chen and Lu,2003).Even if they operate a contract labor system,enterprises cannot freely terminate employees upon contract expiration or if their positions become redundant.Second,corporate downsizing is also limited by a series of government policies. For example,in 1992 an ordinance mandating the transformation of the operating mechanism of state-owned industrial enterprises gave them the right to employ labor,but strictly limited their ability to engage in economic layoffs.The Labor Law of 1994 states that“when the employer is undergoing a period of statutory consolidation before bankruptcy or is experiencing serious production and management difficulties and downsizing is urgently needed,”it should provide“a report to the local labor administrative department concerning its labor reduction program and including the views of the union or all employees,and listen to the views of the labor administrative department.”Such language makes it clear that the ability of SOEs to reduce their labor force is at the discretion of local government(Zeng,2007).

More recent policies do allow SOEs to lay of fstaf fand increase efficiency,and accordingly,excess employment in these enterprises is gradually being reduced.However,the scale and speed of layoffs are still strictly controlled by the government.Enterprises with good returns,even if they have surplus staf f,can rarely obtain permission for layoffs.Their only option is to transfer surplus staf fwithin the enterprise(Chen and Lu,2003). Particularly since the financial crisis of 2008,all levels of government have proposed restrictions on layoffs.For example,in November 2008,the Chongqing State Owned Assets Supervision and Administration Commission (SASAC)stated that layoffs would be strictly controlled in SOEs.2According to a Chongqing Evening News report entitled“State-owned enterprises in Chongqing control layoffs strictly to ensure staffincrease salary 10%in the year”(November 20,2008).In February 2009,the Ministry of Human Resources and Social Security,All-China Federation of Trade Unions and China Enterprise Confederation jointly issued“Guidance on the Response to the Current Economic Situation and Maintain Stable Labor Relations,”which“takes the lead in[ensuring]no layoffs in state-owned enterprises.”It is clear that regardless of changes in the employment system,the inevitable outcome of the government’s emphasis on maintaining a large workforce in SOEs and restricting layoffs is overemployment.Before the reform of the SOE payment structure,executive paywas not linked to corporate performance,but rather was based on arange of non-financial indicators,including the region in which the enterprise operated,industry sector,political level(central or local),firm size and the job type and qualifications of the individual.Following SOE reform,SOEs in Shanghai began to establish an annual salary system,in which managers’salaries comprise a fixed component(base salary)that was paid monthly and linked to the average salary of workers and a changeable component(risk compensation)that was paid at the end of the year and is based on both the basic salary of corporate managers and business performance for the year.Although these enterprises continued to have many non-financial objectives, they began to base their compensation on financial indicators.Following the SASAC’s issuance of“Interim Measures for the Performance Evaluation of Persons in Charge of Central Enterprises”in 2003,in June 2004 it issued“Interim Measures for the Compensation Management of Persons in Charge of Central Enterprises.”The latter document stipulates that salaries in central enterprises consist of a base salary,performance pay and long-term incentive pay,and proposes specific measures to link salaries to performance.

To maximize its own interests,the government has the motivation and ability to intervene in SOEs in a number of respects.First,it has the incentive to carry out administrative interventions,such as mandating employment and avoiding large-scale layoffs,as the regional employment situation is a key indicator by which local government officials are assessed for promotion.Furthermore,a high unemployment rate and large-scale layoffs are thought to bring crime,labor protests and other forms of social unrest,and social stability isbelieved to be the most important factor in economic growth.Investors(particularly foreign investors)are often highly sensitive to social stability.Hence,to maintain social stability,government officials have strong incentives to force SOEs to hire excess labor and/or to prevent them from engaging in widespread layoffs during the restructuring process(Xue and Bai,2008).Second,control of SOEs still lies in the hands of government officials,affording the government the ability to intervene in these enterprises.For example,the government still exerts substantial influence over access to key resources,such as approval for initial public offerings(IPOs)and equity financing,and the appointment of SOE senior executives is still completely under central or local government control(Liu,2001).Therefore,the government still has the ability to force SOEs to internalize its own goals.The foregoing analysis makes it clear that China’s SOEs are forced to bear the policy burden of government-mandated overemployment.Because of regional differences in the promotion of market-oriented reforms,however,local government actions differ by region.

3.2.Hypothesis development

The reform of the executive compensation system has seen greater emphasis gradually placed on the relationship between such compensation and SOE performance,with the SOE sector gradually being introduced to such market-oriented innovations as performance-based pay(Xin,2007).Increasing the sensitivity of performance to salary is considered an important way to resolve agency problems.If both the government as principal and executives as agents pursue utility maximization,then we have reason to believe that the latter will not act according to the interests of the former.Guaranteeing that the two have mutual interests and overcoming the problem of moral hazard requires a proper contract that limits any deviation of the agent’s interests and behavior from those of the principal.In a situation of asymmetric information,the agent’s behavior is unobservable by the principal,which can only see related variables decided by the agent’s actions and other exogenous random factors.Hence,agency theory proposes performance-based compensation contracts,and accordingly,a high degree of PPS may be an effective contractual means of resolving agency problems.If so,then what conditions should the performance measurement standards in these contracts meet?Banker and Datar(1989)suggests that basic performance evaluation should be as sensitive as possible to a manager’s actual actions,which should reflect firm performance as reflected in accounting measures.However,in the case of China’s SOEs,government intervention can reduce the precision and accuracy of accounting-based measures of managerial effort.

SOEs have a similar structure to government agencies and are responsible in large part for carrying out the government’s political tasks.In the political promotion and evaluation system for local government officials, political considerations such as the unemployment rate and regional stability play a vital role in addition to such important economic indicators as gross domestic product(GDP),thus encouraging these officials to consider SOEs an important tool by which to reduce unemployment and ensure stability(Shleifer and Vishny, 1994).As a result,SOEs are forced to retain more surplus labor than their counterparts in the private sector (Zeng and Chen,2006),which increases their operating costs and reduces management flexibility and the input-output ratio,meaning the executives of these firms often get half the results for twice the effort.Given the effect of a largely redundant workforce,it is difficult indeed for SOE executives to improve firm performance through effort alone(Bai et al.,2000;Xue and Bai,2008).The issue of moral hazard may also be relevant here,that is,the rational manager’s chosen production q is always less than optimal production q*, which reduces the extent of his or her effort.Because of information asymmetry,however,the government cannot distinguish the losses that result from the policy burden it imposes on enterprises from those due to managerial ineptitude or moral hazard.Hence,it is very difficult for the government to penalize executives for poor accounting performance.

It is interesting that despite the great policy burden that SOEs bear,we see few collapses or bankruptcies, probably because these enterprises also play a game with the government,fighting for or enjoying a policy“yield.”At the same time the government plays the role of plunderer,it also offers a helping hand(Calomiris et al.,2010;Friedman et al.,2003).Given the policy burden the government places on SOEs for political gain, it would not be in the government’s interest to allow these enterprises to collapse.Accordingly,it also adopts a preferential policy toward SOEs.Xue and Bai(2008)find,for example,that the government gives more financial subsidies to SOEs with a greater excess workforce.Lin’s(2004)research shows that when the policyburden is borne by SOEs,the government finds it necessary to compensate them for the resulting losses to ensure their survival,for example,by offering them protection,financial subsidies or a lower tax rate.Similar to our discussion in the previous paragraph,because of information asymmetry,the government cannot know whether an SOE’s good financial performance is due to executive effort or preferential treatment.Therefore, we posit that accounting-based firm performance is less effective in evaluating the performance of executives in SOEs because of the presence of a largely redundant workforce.Our first hypothesis is thus as follows.

H1.Overemployment reduces executive pay-for-performance sensitivity,all else being equal.

We now turn to a consideration of how rational executives deal with the necessity of maintaining a large surplus workforce.Although implicit incentives exist in Chinese SOEs,such as on-the-job consumption and political promotion opportunities,there are also strong incentives to maximize the monetary compensation of top executives.3Although it is essential to give executives monetary incentives,such implicit incentives as on-the-job consumption and political promotion opportunities influence the effects of monetary incentives.Although they cannot take the place of monetary incentives,they weaken their functions.As market reforms proceed and private enterprises develop more rapidly,SOEs will face increased competition,meaning their political goals may by replaced by economic targets,and the government may place greater weight on these targets in assessing executive performance.In the process,the government may allow greater managerial discretion to boost enterprise efficiency(Xu et al.,2005).

Not all executive compensation in SOEs is insensitive to performance even when overemployment exists.If management believes compensation to bear no relationship to performance,then it has no incentive to improve performance.However,because executives’effort cannot be reflected in enterprise performance, the government cannot judge whether moral hazard exists.The greater the size of an enterprise’s redundant workforce,the more difficult it is for the government to clearly distinguish executive effort and performance outputs and the more obvious the problems of moral hazard and opportunistic behavior become.Thus,to a large extent,overemployment becomes an umbrella to shelter management laziness.If executive compensation and firm performance are closely related,then executives’desire to maximize self-interest will motive them to work hard to improve performance.However,a high percentage of redundant positions in the workforce dilutes executives’input-output ratio.Hence,using their own discretionary power to control employment numbers is the only choice open to executives whose interests are closely aligned with performance.When large numbers of redundant staf fbecome a drag on the maximization of executive self-interest,it is impossible to transform effort into good performance.We thus propose hypothesis H2(a).

H2(a).If executive compensation is sensitive to performance,then the greater the size of the surplus workforce,the greater executives’motivation to control future employment growth.

The decision to lay of fredundant employees is not management’s alone,but also depends on government plans.China’s economic reforms have led to different local governments playing different roles.Governments in regions with a high degree of marketization may create a high-quality environment for enterprises through institutional and technological innovation.In an attempt to reduce the burden on SOEs to absorb a large number of surplus employees,service-oriented local governments may attempt to alleviate unemployment in different ways,such as by creating more jobs to absorb former SOE employees.Moreover,these governments are likely to give executives greater discretionary power in personnel matters.In this way,service-oriented governments not only achieve the political goals of reducing unemployment and creating a stable social environment,but also improve the economic efficiency of SOEs.Governments in regions with a low degree of marketization,in contrast,are more likely to rely on SOEs to absorb the redundant workforce rather than create new jobs.4In Guangdong Province,where the marketization degree is high,for example,to bring in more talent and accelerate the flow of talent, the government forbids enterprises to hire redundant employees,especially since the financial crisis(Chen,2009).In Henan Province,in contrast,where the degree of marketization is lower,the government has taken measures to stabilize employment and avoid large-scale layoffs,such as reducing working hours and salaries and introducing job-sharing.Government and management alike must adjust their behavior according to that of the other side.Management usually wishes to lay offredundant employees to maximize its interests,but such behavior is contrary to government objectives.This discussion leads to our final hypothesis,H2(b).

H2(b).In the case of a large number of surplus employees in the current period,management in regions with a low degree of government intervention will tend to control the growth of employee numbers in the future.

4.Research design

4.1.Data sources

Our financial data and data on executive pay and employee numbers come primarily from the China Stock Market&Accounting Research(CSMAR)and China Center for Economic Research(CCER)databases.As the CSMAR database began publishing employee numbers for listed companies only in 1999,we selected all Shanghai and Shenzhen A-share companies for the 11-year period from 1999 to 2009 as our initial sample.

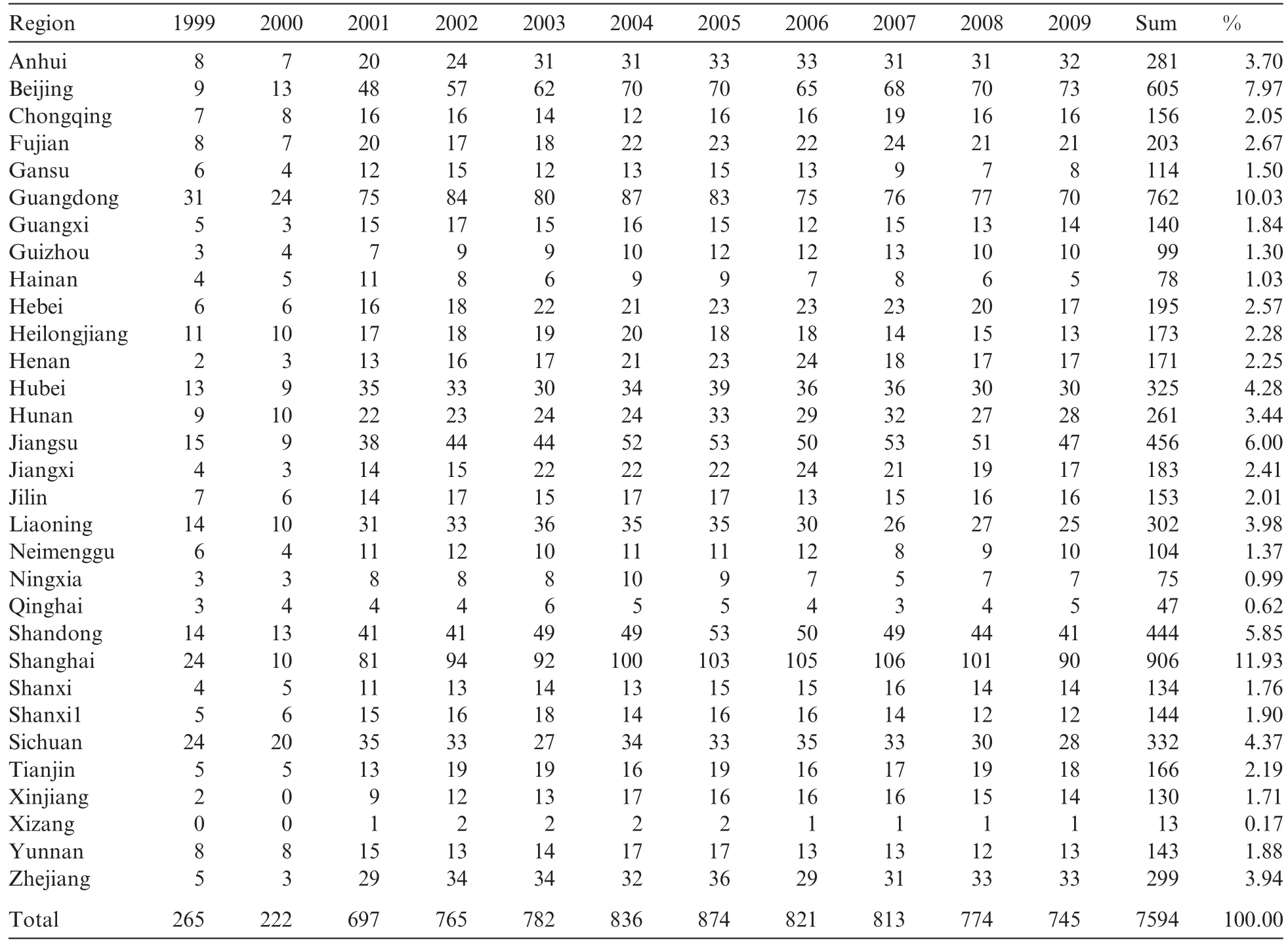

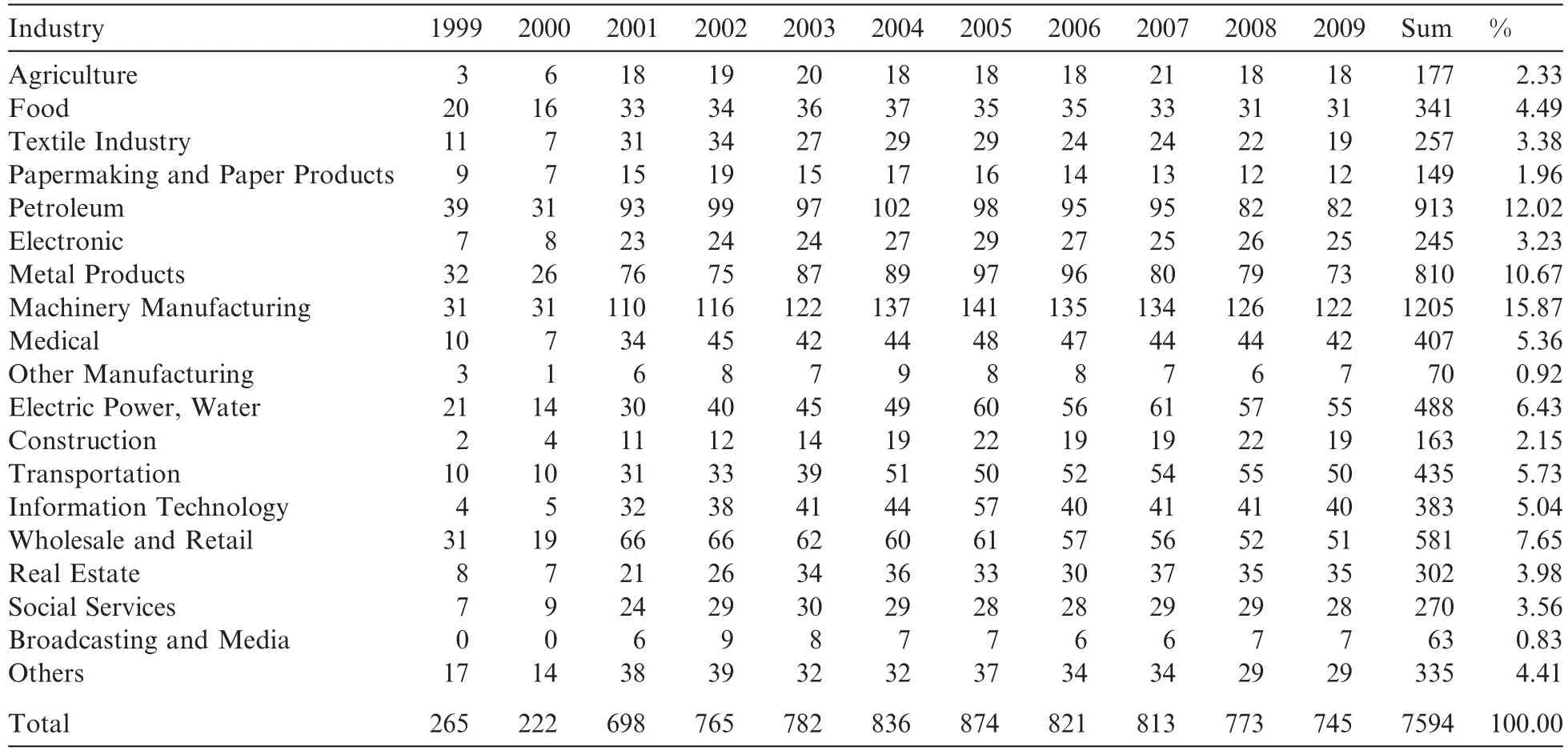

To ensure data quality,we gradually reduced the sample by(1)excluding financial companies;(2)removing companies that did not disclose information on their actual controller;(3)excluding companies whose transaction status was blank,ST or PT;(4)removing small and medium enterprises(SMEs)and Growth Enterprise Market(GEM)listed companies;(5)excluding companies whose ultimate controllers are privately held,foreign-owned or collectively held entities or unidentifiable;and(6)excluding observations with incompletefinancial data or lacking data on executive pay or employee numbers.Following this process of deletions, the study’s final sample includes 7594 firm-yea5Because the non-state enterprise sample for the extractive industry(B)and wood furniture industry(C2)is too small(<20), observations from these industries are omitted.r observations.Its regional distribution is shown in Table 1, and industry and year distribution in Table 2.

4.2.Model specification and variable definitions

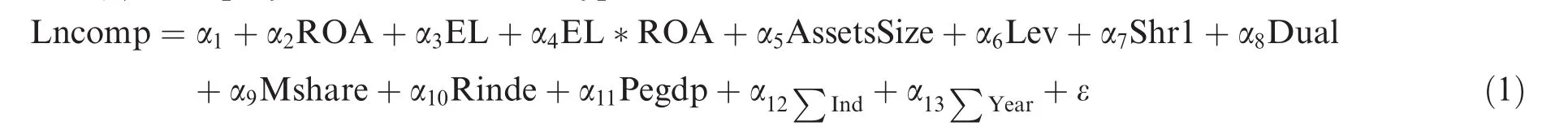

Model(1)is employed to test our first hypothesis.

To test Hypothesis 2,we use the following ordinary least squares(OLSs)multiple regression model.

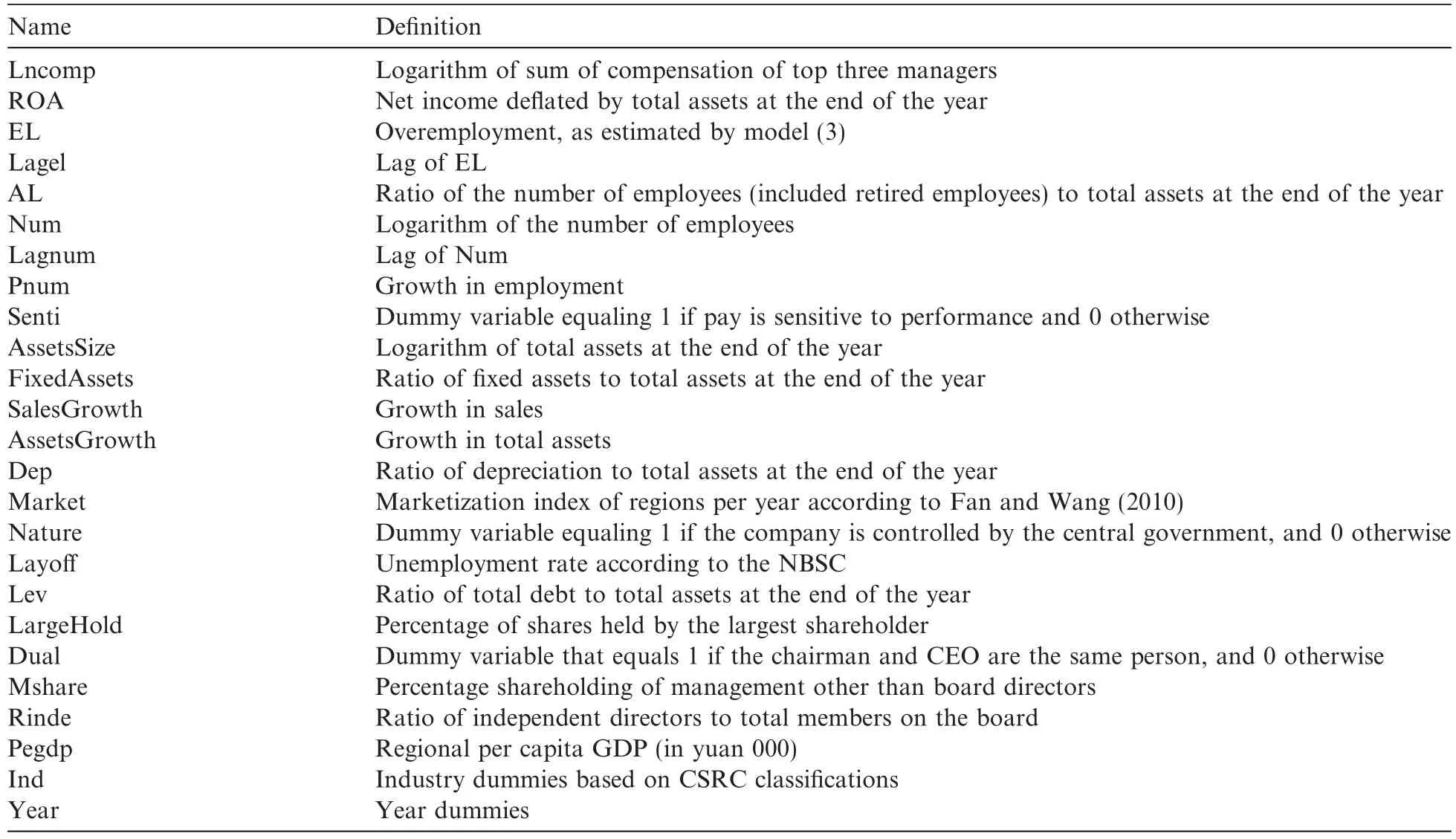

The model variables are defined in Table 3.

We follow Du and Zhai(2005)and Xin et al.(2007)and take the natural logarithm of the total amount of compensation paid to a company’s top three highest-paid senior managers as a proxy6Because equity incentive plans were implemented relatively late in China,it is not very common for the senior management of listed companies to hold stock or stock options(Li,2000;Wei,2000),and hence this study examines executive compensation only in respect of its cash component.for executive pay.Corporate performance is measured by the return on total assets(ROAs).7We do not use market value or other market data as proxies for corporate performance,as China’s capital market development is still in its initial stages and the price signal contains too much noise.It thus lacks reliability and comparability.In addition,Chinese enterprises, particularly SOEs,rarely consider a company’s market value in compensation contracts,rendering such value less important in research on the issues surrounding compensation.Du and Wang(2007)find executive compensation in listed companies to be weakly related to a company’s market value.Xin and Tan(2009)find a stronger relationship between managerial compensation and the stock market returns of state-owned listed companies in regions with a more advanced degree of marketization,but the relationship between the two is still relatively weak.In robustness tests,we also employ such profitability indicators as ROA(Net Profit/End Total Assets),OROA(Operating Profit/End Total Assets),EBIT/End Total Assets and Total Profit/End Total Assets because these indicators are the assessment indicators8For example,in 2005 Guangdong Province issued a“Notice of Interim Measures on Assessing the Performance of the Management of State-owned Enterprise by the Guangdong Provincial Government,”in which it clearly stipulates that the basic indicators of annual performance evaluation include the firm’s total net profit,rate of ROE,gross profit and net asset rate.In 2005,the SASAC of Jiangsu Province promulgated“Interim Measures on the Assessment of the Annual and Three-year Term Performance of the Principals of Provincial Enterprises in Jiangsu Province,”which stipulates that the basic indicators include annual gross profit and net capital gains.adopted by the SASAC at all levels to evaluate the annual performance of SOE principals.

Table 1Sample distribution by region.

Overemployment is measured as the difference between the actual number of employees(AL:the number of employees per million yuan in assets,including serving and retired employees)and expectations of future employee numbers.The non-state sector,which is less affected by government policy burdens,is likely to calculate its personnel needs in accordance with the laws of the market economy and hence to use the factors of production(Chen and Lu,2003).We take private enterprises as a reference for our estimate of the coefficient of superfluous employees to minimize estimation bias.When the amount of labor employed diverges from profit or value maximization goals,non-SOEs can independently adjust that amount.Therefore,in theory, non-SOEs should have no superfluous personnel.

We first regress the sample of non-SOEs by industry to obtain the parameters of our estimated industry expectation employee scale model and then use the difference between the actual SOE employment scale (AL)and the expectations-of-employee-numbers scale(Exp-L)as a proxy for the size of the redundant workforce.According to the research of Zeng and Chen(2006),company size(AssetsSize),capital intensity (FixedAssets),sales growth(SalesGrowth)and industry characteristics(Ind:China Securities Regulatory Commission[CSRC]industry code classifications)are the most important factors in determining the size of a company’s workforce.Based on these authors’work,Xue(2008)employed these four factors combined with asset growth(AssetsGrowth)to measure expectations of employee numbers.In the current study,we employ Xue’s approach and estimate these expectations by industry on the basis of model(3)(see Table 3 for variable definitions).Considering the difference between SOEs and private enterprises in the condition of fixed assets and personnel allocation,we add the variable of accumulated depreciation(Dep)to the four factors in the model:

Table 2Sample distribution by industry.

Table 3Variable definitions.

As noted in Footnote 5,because the number of non-SOE observations in the extractive and wooden furniture industries is too small,we also remove observations in these industries from the SOE sample.After estimating the parameters of the expectations of employee numbers on the basis of model(3),we have the extentof overemployment in SOEs(EL),which equals the difference between the actual employee scale(AL)and expected employee numbers.

Our measure of the degree of marketization(Market)is based on Fan and Wang’s(2010)annual regional market indices:the larger the value,the higher the degree of marketization.As the market indices compiled by Fan and Wang(2010)began only in 2007,we use the market indices for that year.The higher the level of regional unemployment(Layof f),the greater the pressure the government faces to solve local employment problems and hence the stronger the motivation of the government administration to interfere in SOEs(Chen et al.,2009).Accordingly,we expect the regional unemployment rate to be positively related to the size of the redundant workforce.

Chen(2002)shows that local governments have stronger incentives to intervene in business and thus we expect a negative relationship between the number of superfluous employees and the level of government controlling the company(Nature).We hand-collect actual controller information for the 1999-2009 period and then divide the data into central and local government control groups.In line with previous studies,we control for firm size(Du and Zhai,2005;Du and Wang,2007),debt ratio(Harris and Raviv,1991;Du and Wang, 2007),ownership concentration(Petronic and Safieddine,1999),aggregate number of those holding multiple positions(Du and Zhai,2005),proportion of independent directors(Westphal,1996),per capita GDP(Li, 2000)and several other variables.

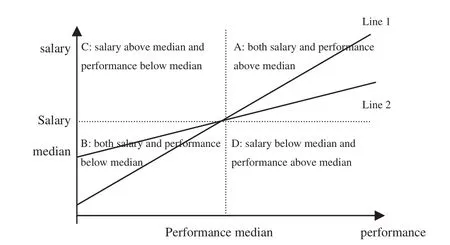

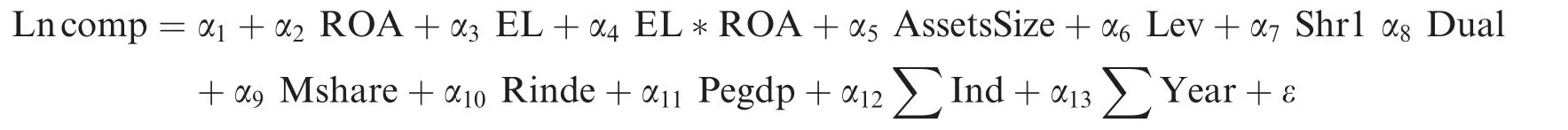

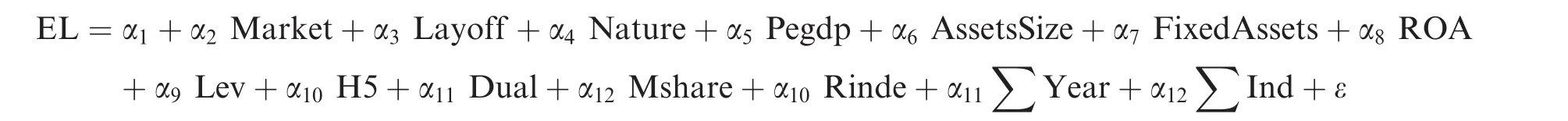

In model(2),we use a dummy variable for PPS.Because the PPS of each company is difficult to quantify, we follow Abowd(1990)and Chen et al.(2010)in employing a dummy variable to differentiate between high and low sensitivity.The specific variables are defined in Fig.1.

Although,in theory,the sensitivity represented by line 1 is stronger than that represented by line 2,the slope and intercept of the two straight lines cannot be measured accurately.Therefore,we can describe the sensitivity only qualitatively through the use of dummy variables.Based on whether PPS is greater or less than the median, we divide it into two groups and form four regions,namely,A,B,C and D.If executive(employee)pay and company performance in period T in zones A and B are higher(lower)than the median of such pay and performance,then we consider the salary to be sensitive(insensitive)to company performance.

The applicability and reliability of our main variable,PPS,are core issues in this paper.However,to render the main body of the text and overall structure of the paper more readable,we relegate our discussion of the related issues to Appendix A.In addition,another important variable is the surplus workforce,and the factors affecting the size of that workforce,such as the degree of marketization,may have some impact on this study. For similar reasons to those mentioned above,we also discuss the relationship between the degree of marketization and the number of superfluous employees and the reliability of our surplus employment estimation in Appendix B.

Fig.1.Definition of PPS.

5.Descriptive statistics

5.1.Main variables

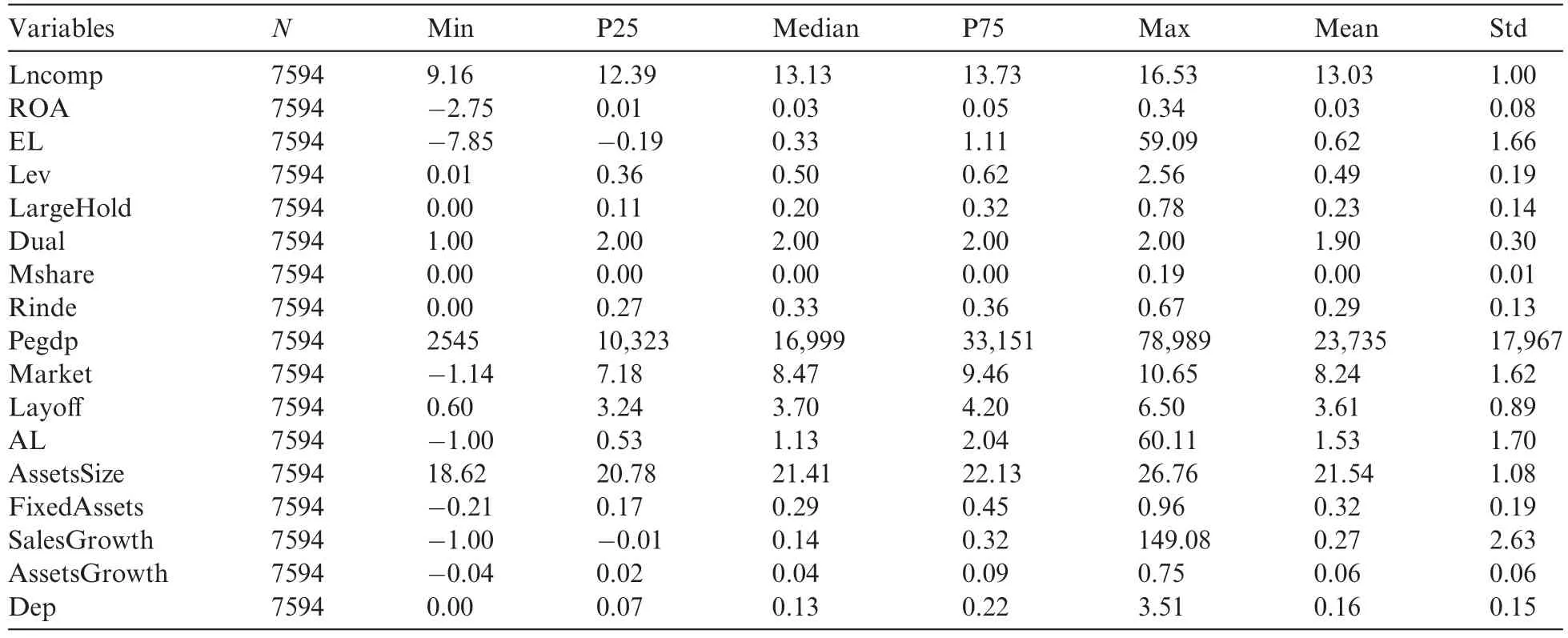

The descriptive statistics presented in Table 4 show an uneven distribution of overemployment.The mean of EL is higher than the median and the sample distribution is obviously skewed to the left.The distribution ofthe other variables,in contrast,is relatively even,with no significant differences between means and medians. As the surplus employment scale differs by year and region,we analyze its size in different years and regions.

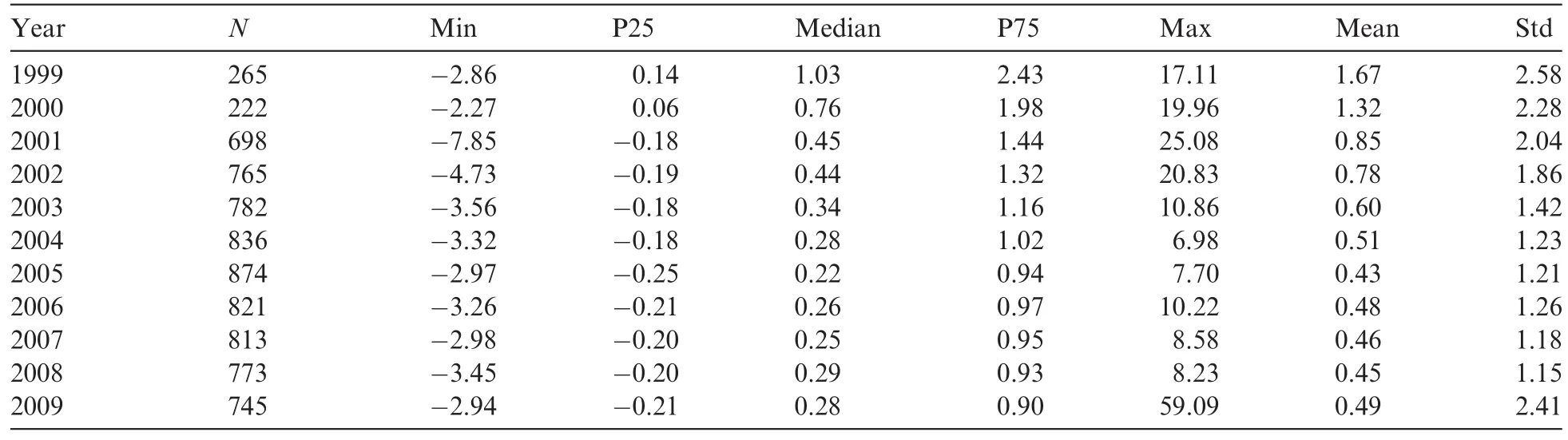

Table 5 provides a more detailed description of overemployment(EL)by year and industry.

If EL is greater than 0 then overemployment exists.In the time series in Table 5,the trend of such employment appears to be declining in both the mean and median.In terms of the median,the phenomenon of a redundant workforce in SOEs is on the decline,especially since 2004.The probable reasons for this decline are the progress of marketization,the deepening of state sector reforms and the weakening of multiple objectives among SOEs,thus strengthening the ability of these enterprises’managers to determine the size of the labor force they employ.However,the number of superfluous employees in state-owned companies has been on the rise since 2008,mostly likely because,following the financial crisis of 2008,the large amount of downsizing in private companies affected the parameters of the employee estimation function.Because of the policy burden placed upon it by the government,the state-owned sector was unable to engage in downsizing to any significant extent,but was rewarded with such measures as tax relief.

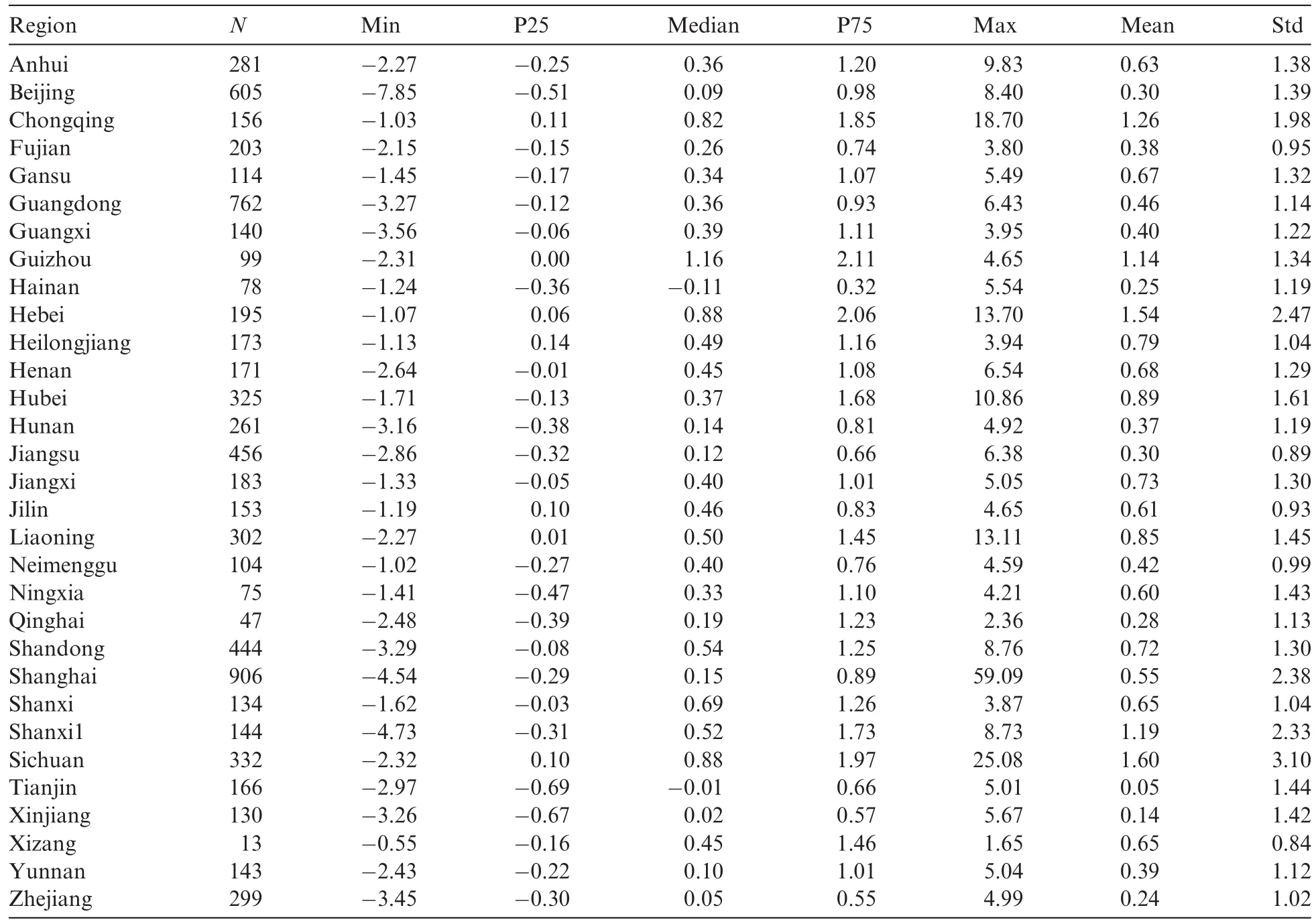

Table 6 presents the regional ranking results sorted by the median of overemployment(EL).Most of the observations with large numbers of surplus employees are distributed in the western regions,such as Guizhou, Hebei,Sichuan,Shanxi and Chongqing.These regions have a lower degree of marketization and thus are more likely to experience government intervention in state-owned companies.

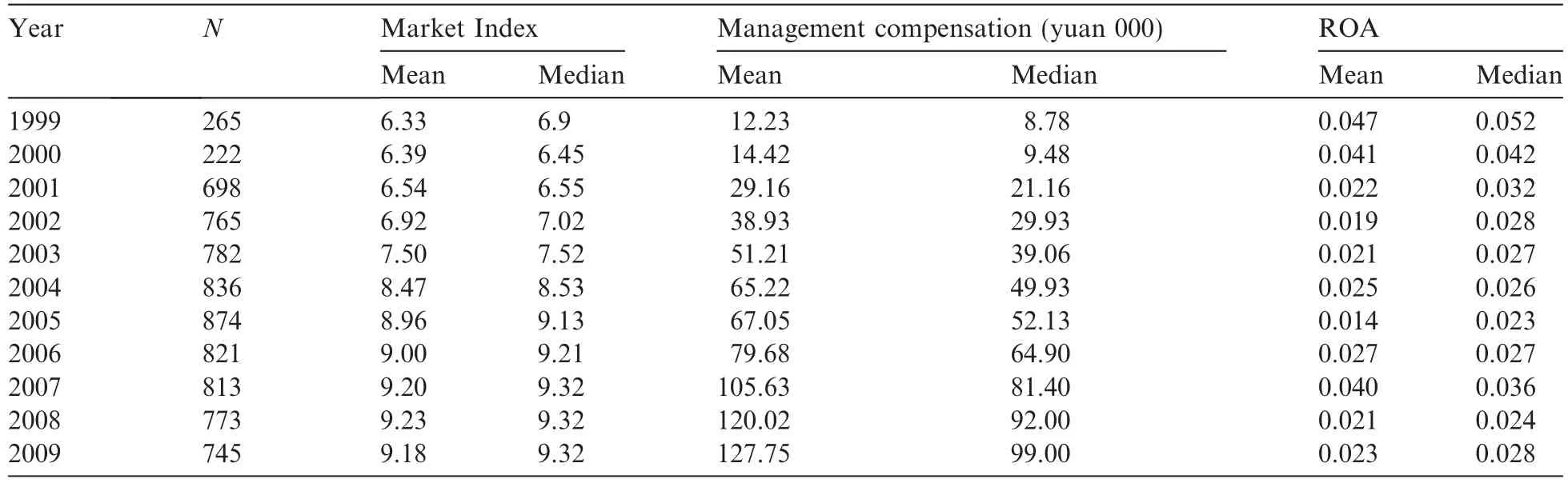

Table 7 presents a time series of the degree of marketization,executive compensation and enterprise performance.

It can be seen from this table that executive compensation(Lncomp)has increased gradually in state-owned listed companies over the sample period in terms of mean and median,with the mean(median)increasing from approximately 122,000 yuan(88,000)in 1999 to 1.3 million yuan(990,000)in 2009.There is no obvious trend in the mean or median in the descriptive statistics for enterprise performance(ROA)in different years, although Table 7 shows a rise in the degree of marketization(Market),which indicates a steady decline in the degree of government intervention.

Table 4Statistical summary of variables.

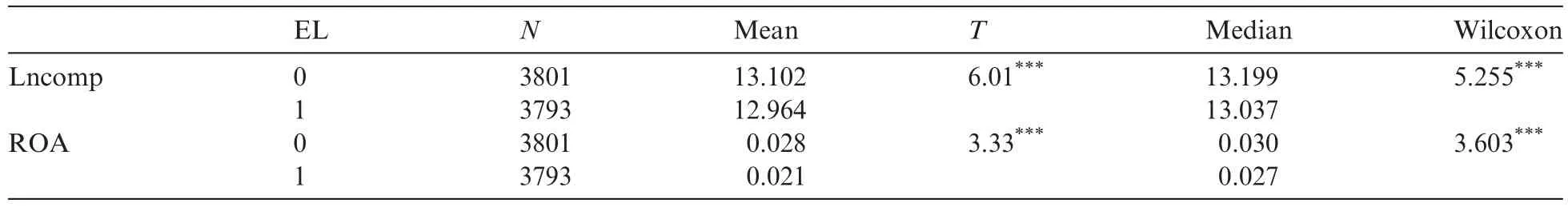

5.2.Univariate analysis

We compare executive compensation with the number of superfluous employees.In terms of executive compensation in the complete sample,the mean(median)for the low and high redundant employment groups is 13.102(13.199)and 12.964(13.037),respectively.The mean and median are significantly different,indicating that executive compensation is lower when the extent of overemployment is greater.In terms of enterpriseperformance(ROA),the low overemployment group is higher than the high overemployment group,and both the mean and median are significantly different.See Table 8 for univariate analysis of the overemployment rate.

Table 5Distribution of overemployment(1999-2009).

Table 6Distribution of overemployment by region.

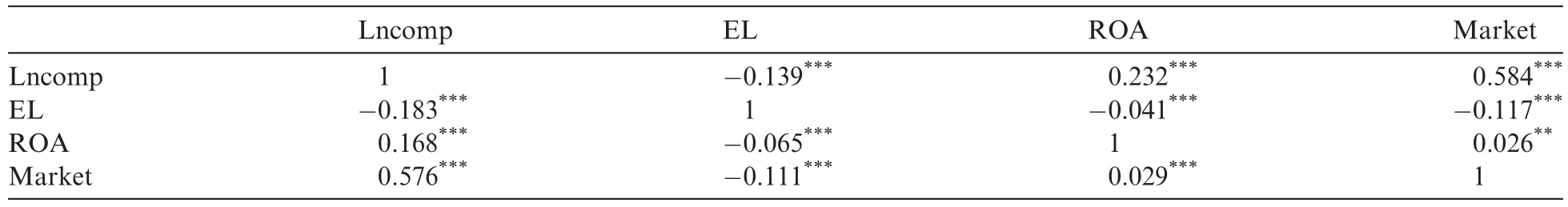

5.3.Correlation analysis of the main variables

Table 9 shows the degree of marketization(Market)to be negatively correlated with overemployment(EL), which supports our hypothesis.In addition,executive compensation(Lncomp)is positively correlated withenterprise performance(ROA),indicating that the pay contracts of SOE executives have a certain motivational function.

Table 7Statistical summary of key variables.

Table 8Univariate analysis of overemployment.

Table 9Correlations.

6.Results

6.1.Hypothesis 1

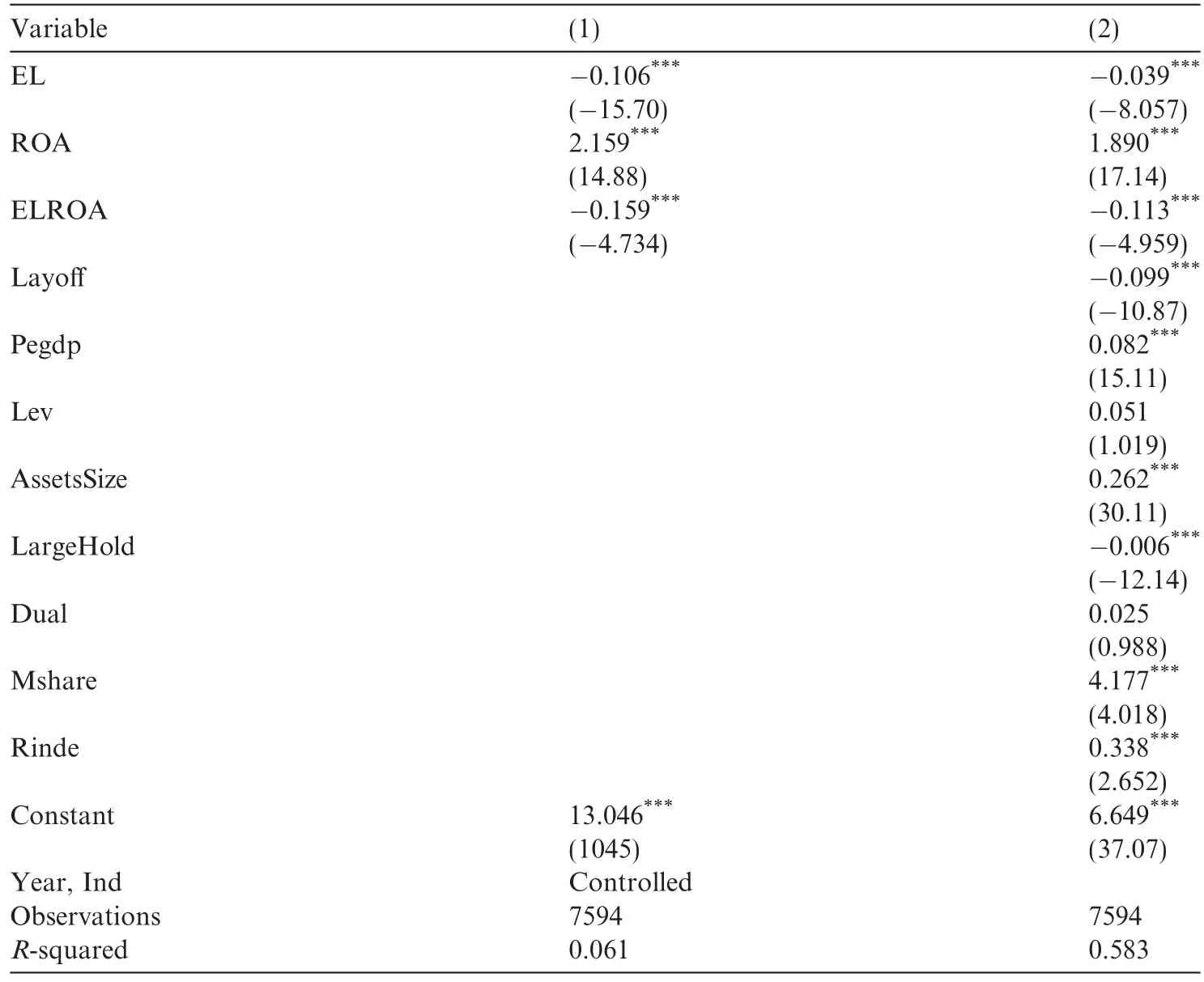

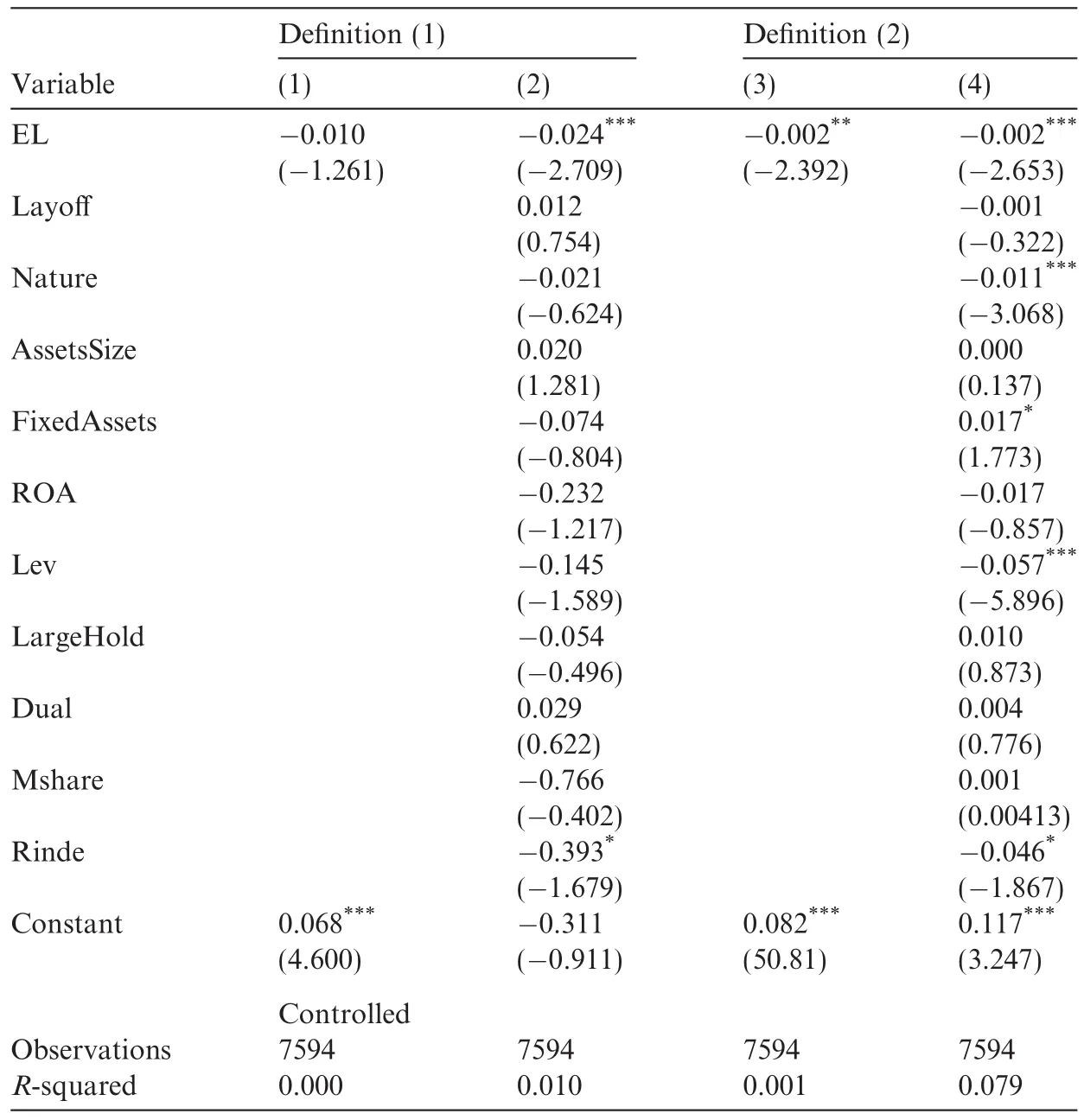

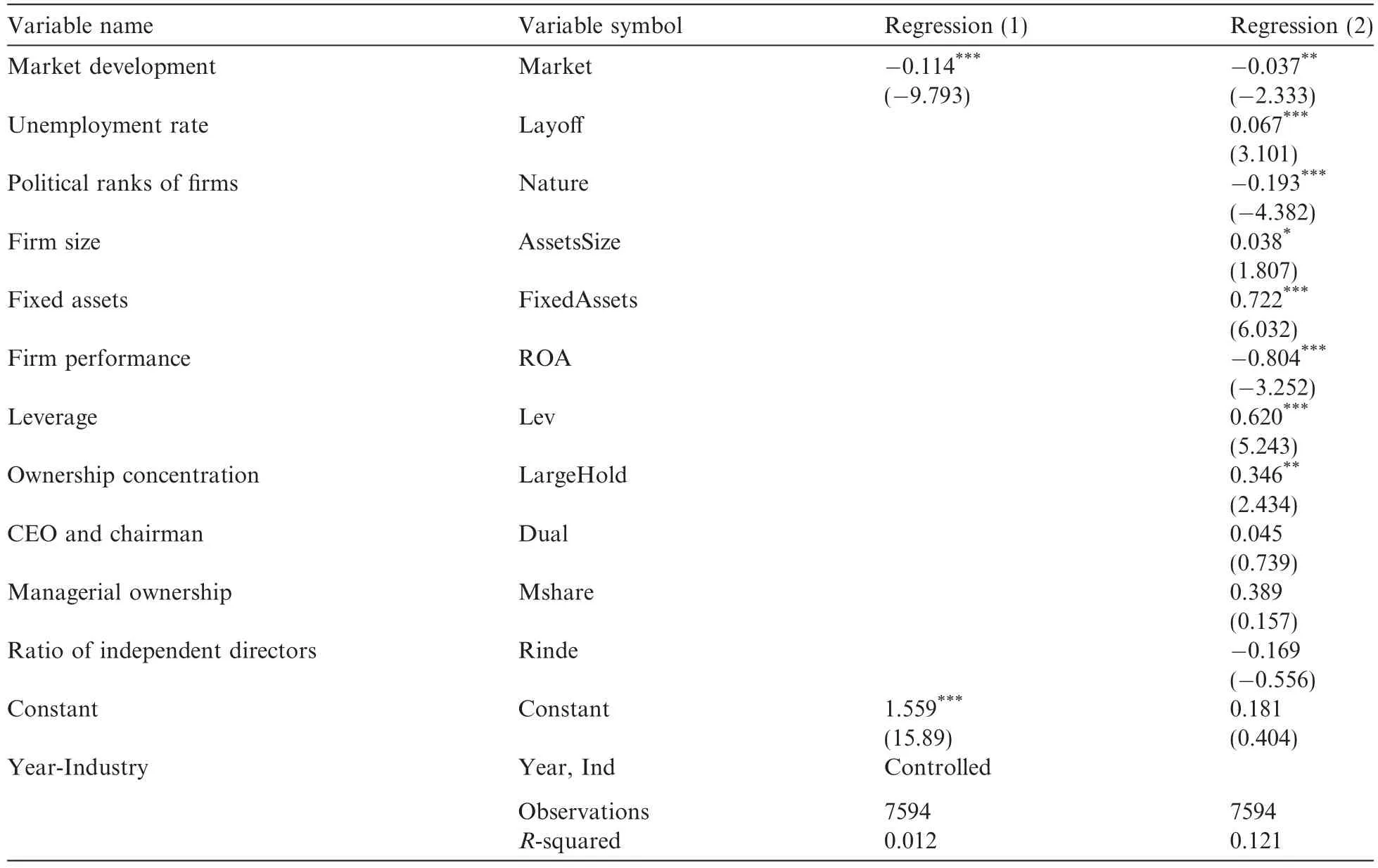

We employ the following OLS regression model to test H1,with the results shown in Table 10. Model(1):

Regression(1)in Table 10 shows that the regression coefficient of the interaction variable ELROA is -0.159 and significantly negative at the 1%level.After controlling for the other variables in regression(2), this coefficient becomes-0.112 and remains significantly negative at the 1%level,which indicates that the presence of a surplus workforce leads to a reduction in the sensitivity of executive compensation to enterpriseperformance,a result consistent with H1.As both the policy burden placed on a company and a reduction in its number of surplus employees may bring benefits,it is difficult for corporate performance to re fl ect the degree of effort exerted by executives.The performance index thus contains government behavior that is difficult to separate out,increasing the amount of noise in evaluating managerial effort.These factors diminish the function of accounting-based performance in executive pay contracts.Hence,the existence of overemployment weakens the relationship between executive compensation and enterprise performance.

The coefficient on ROA is 1.890 and the coefficient on ELROA is-0.112.The economic significance of these results is as follows.If the difference in ROA between two companies is 10%,and EL equals 0,then the difference in pay is e(0.10*1.890)-1=20.80%.After adding the standard deviation(σ=1.66)to EL, the difference in ROA leads to a difference in pay.This difference is e[0.10*(1.890-0.113*1.66)]-1= 18.53%.The 1.27%difference in pay suggests that the economic significance of the sensitivity of executive compensation to enterprise performance caused by overemployment is relatively weak.

Executive compensation increases with an increase in enterprise performance(ROA),the local economic development level(Pegdp)and asset size(AssetsSize),although ownership concentration(LargeHold)is negatively related to the executive compensation level.The implication of these findings is that a lower ownership concentration can increase control capability and supervision motivation while reducing the issue of moral hazard among executives.

6.2.Hypothesis 2

6.2.1.Hypothesis 2(a)

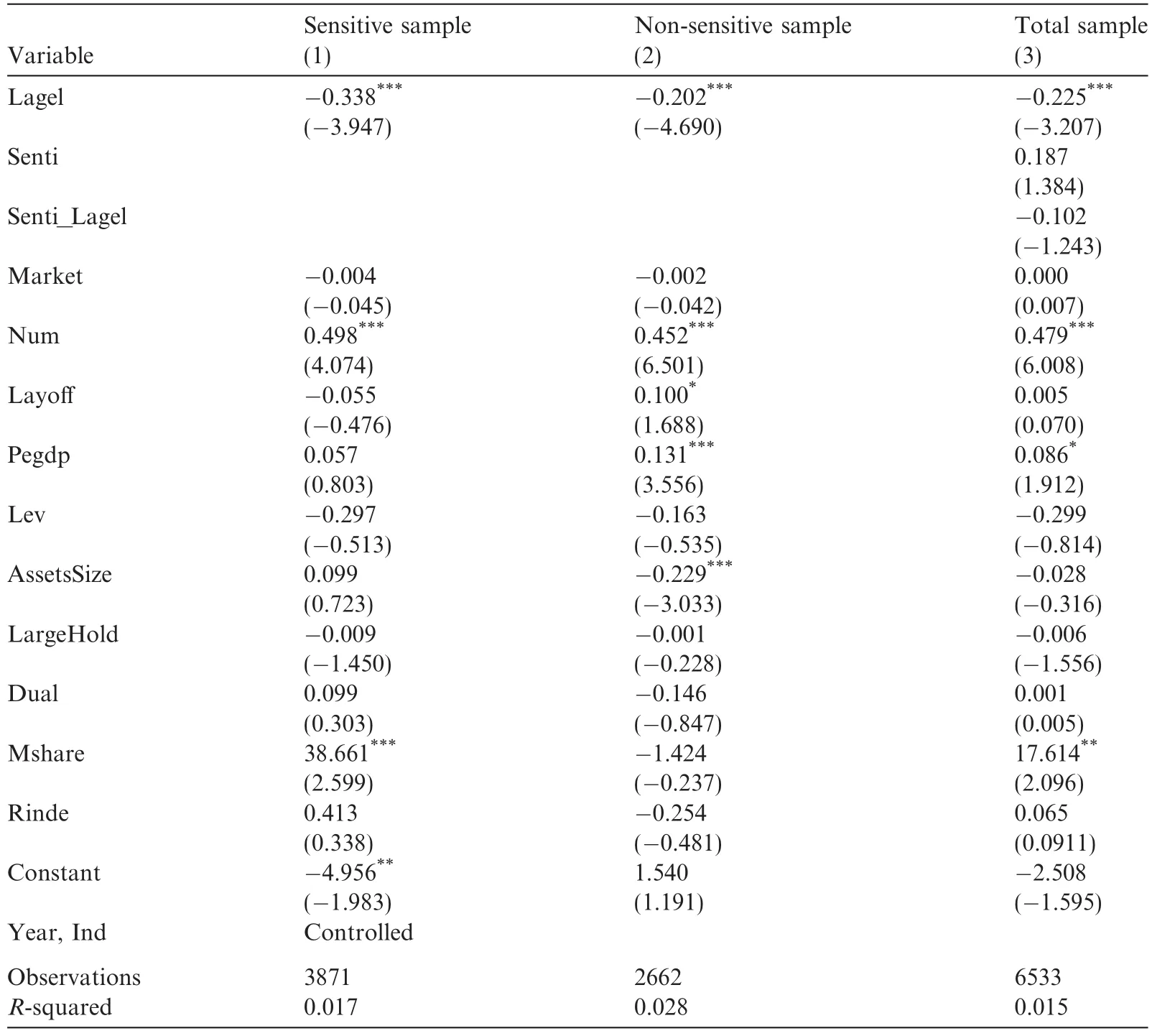

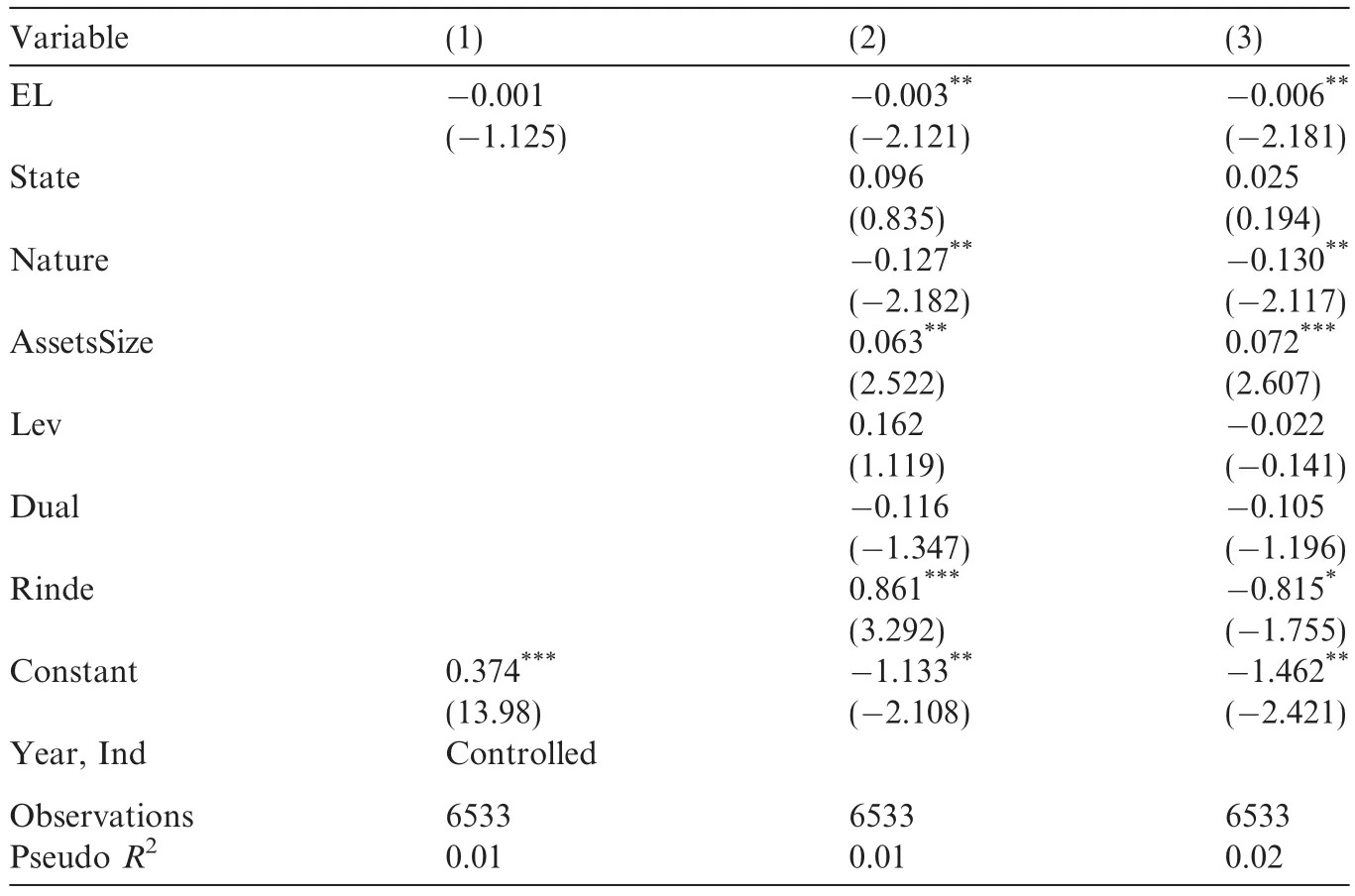

To test the effect of PPS on the number of employees to be hired in the future,we employ the following OLS regression model,with the results shown in Table 11.

Model(2):

Table 11 shows that in the regression in which pay is sensitive to performance,the coefficient on Lagel is -0.338 and significantly negative at the 1%level,which indicates that the number of employees hired in the future will increase more slowly if a greater number of redundant employees were employed in the last term. Hence,executives whose pay is sensitive to performance will be motivated to control hiring in the future to improve firm performance.There are two possible explanations for the relationship between former overemployment and slower-paced employee growth in the future.First,management is likely to lay of fcurrently redundant employees to improve production efficiency.The proportion of layoffs will be greater with a larger surplus workforce.Second,controlling employee numbers in the future can help to control increases in labor costs.The latter explanation may have negative implications for the future development of the company.In companies in which executive compensation is not sensitive to performance,the number of redundant employees maintained in the last term is significantly negatively related to the number of employees to be hired in the future.However,the coefficient on Lagel is-0.202,greater than that in the sample in which executive compensation is sensitive to performance.The implication is that companies in which executive compensation is sensitive to performance will reduce employee growth in the future.The regression intercept of the sensitive sample is-4.956 and significant at the 5%level,whereas that of the insensitive sample is 1.540.Hence,it is clear that after controlling for the other variables,future employee growth remains negative in the sensitive sample,and this sample has a smaller regression intercept than its insensitive counterpart.These results are largely consistent with our hypothesis.

In the complete sample regression,the interaction variable Senti*LagEL is not significant,and the T value is only-1.242,although the direction is in line with our expectations.In a subsequent robustness test using the robustness inference of heteroskedasticity and the cluster regression method,we find the regression coefficient on Senti*LagEL to be significant at the 1%level.

6.2.2.Hypothesis 2(b)

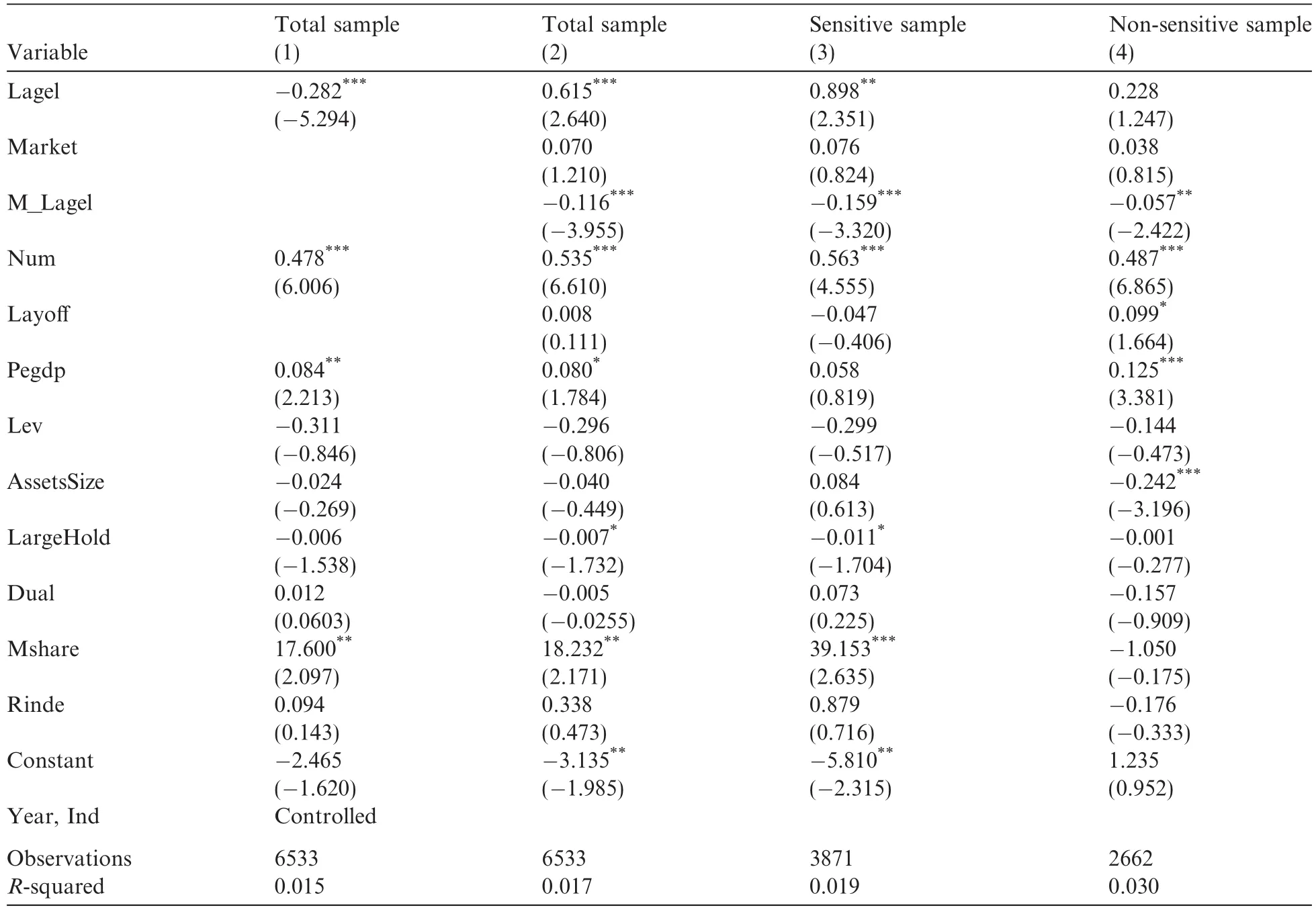

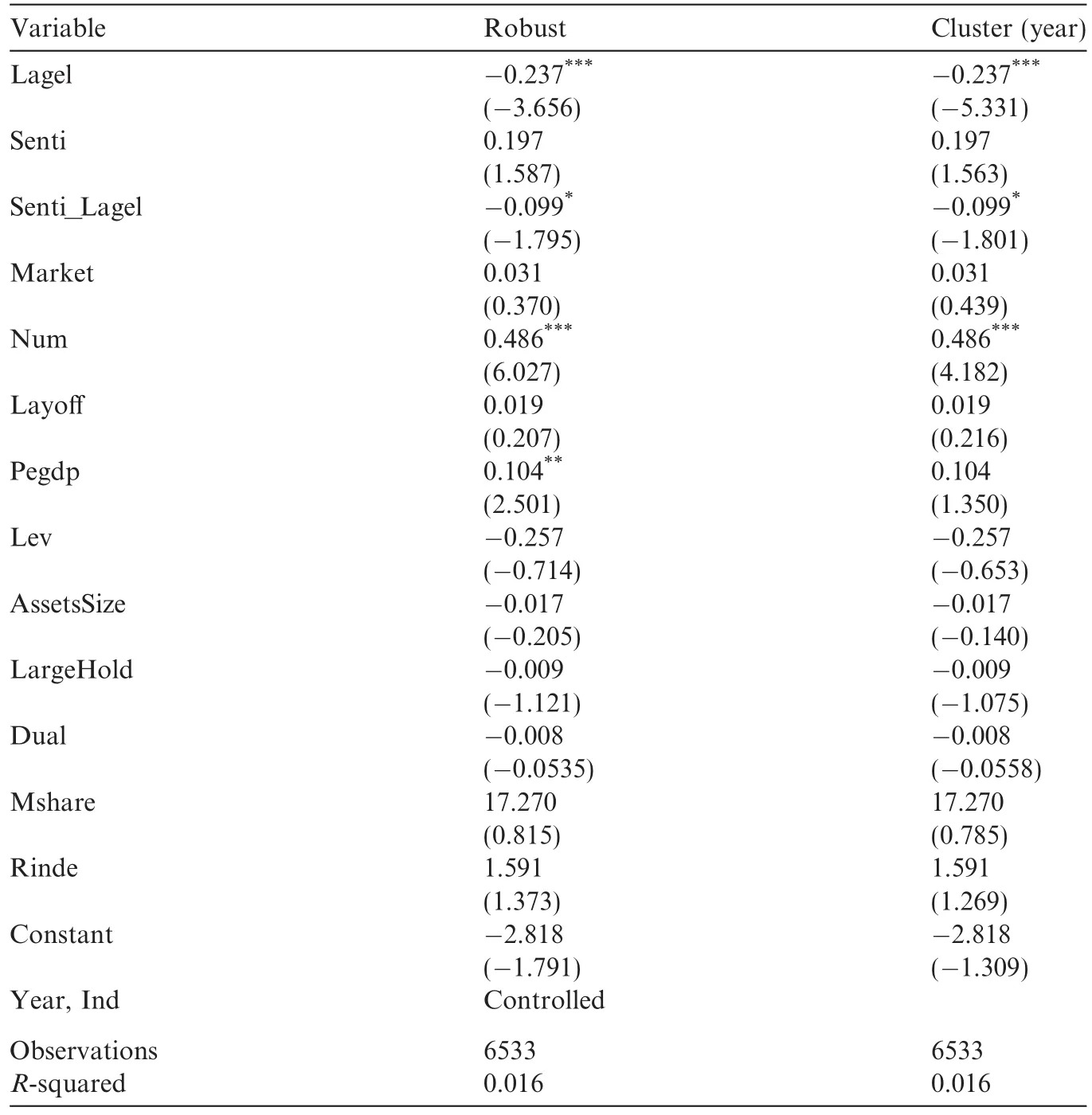

To test the degree of government intervention and the influence of prior-period overemployment on performance,we establish an interactive variable between the degree of marketization and the number of last-termsurplus employees.In addition,to test the effect of PPS on the future increase in employee numbers,we also carry out regression analysis on the sample,the results of which are shown in Table 12.

As regression(1)in Table 12 shows,in the regression that does not include the interaction variable M_Lagel,last-term overemployment is significantly negatively associated with future employee growth,that is,the greater the extent of overemployment in the prior period,the smaller the future increase in workforce size.When the interaction variable M_Lagel is included,the regression coefficient becomes-0.116,significant at the 0.01 level.Hence,the greater the extent of marketization and the greater the number of superfluous employees,the slower the growth in future employee numbers.Regions with a high degree of marketization experience less government intervention and SOE executives have greater power to lay of fredundant employees.The coefficient of Lagel on last-term redundant employment is 0.615.As the model is a nonlinear equation,the influence(the mean of the marketization degree in 0.625-0.116*is 8.24)of Lagel on last-term redundant employment is-0.341,which is still negative and means that if there is a one-unit increase in the number of surplus employees in the previous period,there will be a 0.341-unit decrease in the number of employees hired in the future.Relatively speaking,the redundant workforce variable has a great effect on the size of the future workforce.

Table 10Effect of overemployment on pay for performance.

Table 11OLS regressions of future employment growth on pay for performance.

After dividing the sample in accordance with PPS,we find the coefficient on the interaction term M_Lagel in the PPS sample to be-0.159,which is significant at the 0.01 level.The influence of Lagel,last-term surplus employment,on future employee increases(the mean of the marketization degree in 0.898-0.159*is 8.24)to -0.412,which suggests that if pay is sensitive to performance,then the presence of a redundant workforce has an effect size of-0.412 on the size of the employment increase in the future.In the non-PPS sample,in contrast,the coefficient on the interaction term is-0.057,which is small and significant only at the 0.05 level.The impact of last-term overemployment on the size of the future increase in employee numbers(0.228-0.057*8.24)is-0.242,which is significantly smaller than that in the PPS sample.Similar to the regression in Table 11,in the PPS sample,the intercept is-5.810,significant at the 0.01 level,clearly lower than the intercept of 1.235 in the non-PPS sample.These results are largely supportive of our hypothesis.

We also ran specifications with three-way interactions:marketization degree*sensitivity*last-term overemployment.Because of the existence of strong collinearity,however,we failed to find significant results. Combining the regression results in Tables 11 and 12 allows us to draw the following conclusions.If executive compensation is sensitive to performance,and we assume that managers are driven by the self-interest maximization motivation,then management is more likely to lay of fredundant employees or control the growth in employee numbers to control labor costs and increase efficiency.The less government intervention there is,the larger the degree of power management enjoys to lay of fredundant employees and determine future employee numbers.

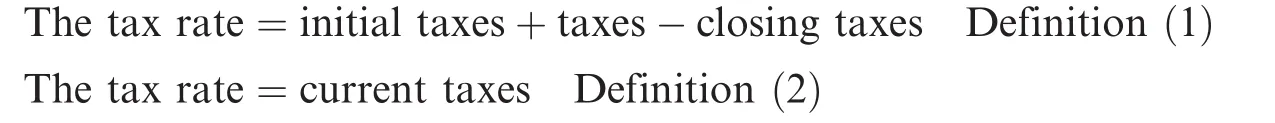

6.3.Additional test:government-imposed policy burden and government gains

In this study,we assume that the existence of a government-imposed policy burden and government gains decrease the efficacy of using accounting performance to evaluate executives.However,the prerequisite forthis assumption is that the government imposes a policy burden and confers preferential treatment at the same time to obtain some government gain.Xue and Bai(2008)find that SOEs in regions with high unemployment retain more surplus employees.As compensation,the government awards them financial subsidies.Accordingly,we test for another possible preferential policy,the tax rate,which we define as follows.

Table 12OLS regressions of future employment on government intervention.

We employ these two definitions because taxes assessed on an accrual basis and realization basis result in different tax rates and actual taxes can differ greatly from accrued taxes.After standardizing the two tax rate calculations by revenue,we perform regression analysis on the size of an enterprise’s redundant workforce. The results are presented in Table 13 and show that the tax rate levied on SOEs is significantly negatively related to the number of redundant employees it retains.These findings constitute evidence that although SOEs are forced to shoulder a government policy burden,they are rewarded for doing so with preferential policies,such as a lower tax rate.

Table 13Regression of policy burden and its benefits.

6.4.Robustness tests

Hypothesis 1 posits that overemployment leads to a decrease in PPS.However,a surplus workforce and PPS are likely to display an endogenous relationship,that is,SOEs with certain company characteristics(such as greater government intervention in their affairs)take on more political responsibilities.Hence,these enterprises retain redundant staf fand profitability is not a key performance indicator by which to measure executive effort,thereby leading to weak PPS.However,in the test of Hypothesis 1,the control variables are those that affect executive pay,not PPS,which may introduce the possibility of endogeneity.To investigate the impact of surplus employees on PPS and the possible endogeneity between them,we add a conservatism test, which adopts the dummy variable for PPS from Abowd(1990)as the dependent variable and overemployment as the main study variable.After consulting the studies carried out by Firth et al.(2006)and Kato and Chery (2004)on the pay of Chinese executives,we also control for the state-owned equity ratio,firm size,the proportion of independent directors and the debt ratio to determine how they affect the sensitivity of the executive compensation variable.After controlling for these variables,if overemployment still has a significant effect on the coefficient regression of the sensitivity variable,then we consider endogeneity not to be a concern and the overemployment variable to be one of the key factors affecting PPS.The regression results are presented in Table 14.

Regressions(2)and(3)in Table 14 show that after controlling for the aforementioned variables,overemployment is significantly negatively related to the dummy variable for PPS,which shows that the existence of redundant staf fdecreases PPS.

ROA is used as the performance index for the tests of Hypothesis 1 and profits in this index include unsustainable profits.To overcome the influence of unsustainable profits on our conclusions,we also use OROA and OROE as the performance index in this test,but the empirical results are largely the same.In addition to replacing the main index,we also carry out a conservatism test on our calculations using a heteroskedasticity-robust inference and year cluster analysis,and the empirical results remain robustness.

Table 14Logistic regression according to Abowd(1990).

Table 15Robustness test of H2.

We also perform a number of robustness tests on Hypothesis 2.For H2(a),the use of a heteroskedasticityrobust inference and year cluster regression analysis show that the interaction term,Senti_LagEL,which was not previously significant,becomes significant at the 0.1 level and remains significant in the sub-sample regression.Similar methods are employed to test H2(b)and the regression results remain largely unchanged.All of these results are presented in Table 15,from which it can be seen that these tests confirm the relative robustness of our empirical results.

7.Conclusion

Drawing on a sample of SOEs listed on the Shanghai and Shenzhen Stock Exchanges during the 1999-2009 period,this study is the first to research the influence of overemployment on PPS.Our findings show the exis-tence of a surplus workforce significantly weakens PPS and the efficacy of accounting measures in assessing performance.A further finding is that the greater the PPS,the greater management’s motivation to lay of fredundant staf fand reduce future growth in employee numbers to maximize its own interests.Further,the lower the degree of government intervention,the greater the control management has over future employee growth.

This paper makes several contributions to our understanding of executive incentives against the institutional background of SOEs in China.Although previous research has considered the influence of government intervention on the PPS of top managers,here government intervention is measured by SOE overemployment, which is shown to affect executive PPS.This study thus extends the literature by considering the economic consequences of PPS.We also identify a type of gambling between executives and the government.In pursuit of personal interest maximization,management gambles with the government according to its level of PPS,laying offa certain number of redundant employees,which reacts with the PPS factors.This finding constitutes one of the main differences between this research on the impact of PPS and similar research carried out abroad.

The study also has several limitations.First,the size of the redundant workforce in this paper is measured following Xue’s(2008)method and thus does not take into account other indices for measuring overemployment.Our calculations may thus fail to reflect reality.We assume that private enterprises shoulder no policy burden and thus employ them to estimate employee numbers in similar enterprises in the state sector.It is possible that systematic differences between the two types of enterprises may have biased our estimation of overemployment.

Second,although monetary rewards are the primary means of motivating executives,our sole use of such rewards may have an impact on our research conclusions.In the special system that prevails in China,executive compensation is controlled to a certain extent and other motivation modes such as on-the-job consumption and opportunities for political promotion may take the place of monetary rewards in certain instances (Chen,2005).The existence of such motivating factors may serve to weaken the effect of monetary incentives. Furthermore,the index of executive pay used in this paper is based on the top three disclosures by listed companies and the exclusion of non-listed personnel may affect our conclusions.

Finally,we employ the degree of marketization index in Fan and Wang(2010)as the measurement index for government intervention.Although the degree of regional marketization may reflect relations between the local government and the market to a certain extent,this index is based on provincial data.Applying this data to reflect government intervention at the firm level inevitably introduces noise that is likely to affect the conclusions of this study.

Acknowledgements

This paper is supported by the National Social Science Foundation(Grant No.08CJY009)and the Philosophical and Social Science Foundation of Education Department of Jiangsu Province(Grant No. 07SJD630016).We also appreciate the support we have received from the IAPHD Project of Nanjing University.We thank the anonymous referees for their constructive suggestions.

Appendix A

Test of Abowd’s(1990)PPS dummy variable.

PPS is an important variable in this study.Here,we explain our use of the variable in greater depth,taking Abowd’s(1990)definition as our example.

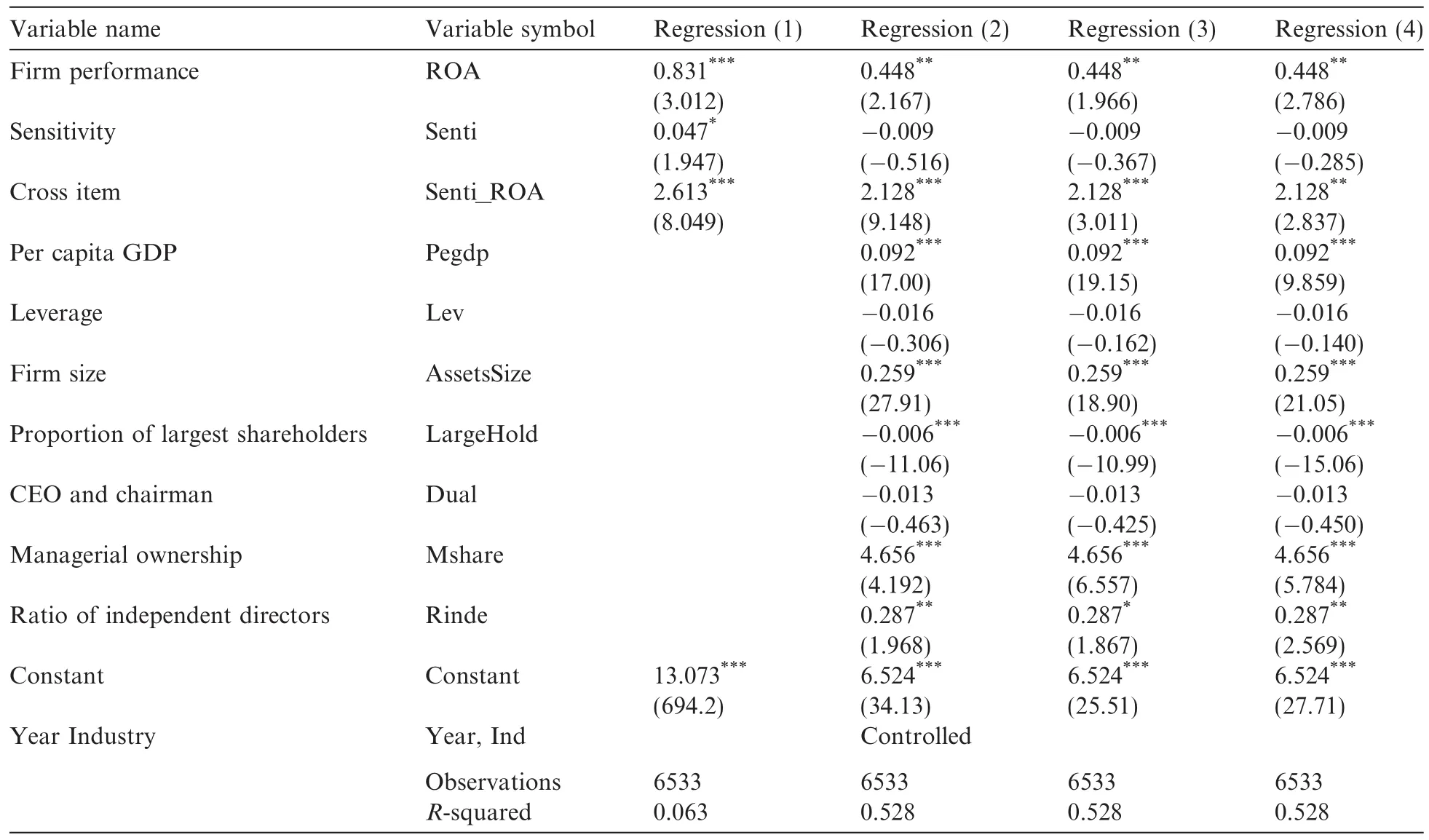

1.Definition reliability.Abowd’s variable is an important indicator of PPS.We test his method of arriving at it and the results are presented in Table A.1.It can be seen that the interaction variable is significant,which indicates that Abowd’s definition largely reflects whether or not salary is sensitive to performance.

2.Endogeneity.If the empirical results support Hypothesis 1 in that currently employed redundant personnel influence current compensation-performance sensitivity,then we consider current PPS to be part of an enterprise’scurrentpolicyburden.Whatwewishtoanalyzefurtheriswhetheroveremployment-influencedcurrent PPS has any effect on the size of an enterprise’s workforce in the future.The current endogenous variable possesses a certain degree of exogeneity relative to the future variable and its endogeneity contrasts withthe variables for the current or prior period.Similar to Abowd(1990),we employ the PPS variable to determine whether the current exogenous salary reacts sensitively to performance as a way of explaining future improvements in enterprise performance to which incentivizing executives in the current period is exogenous.

3.Dynamic characteristics of sensitivity.Determining whether enterprises exhibit stable PPS characteristics is an important issue in this study.The main evidence for PPS sensitivity is whether current salary changes with current performance.Searching for this evidence requires large-sample regression analysis.We can determine what kind of corporation exhibits greater sensitivity between salary and performance,or we can draw conclusions about which factors influence compensation-performance sensitivity.In other words, we take the law as a whole,and the law is whether salaries in the sample corporations are sensitive to performance changes.This concept is similar to accounting conservatism.We adopt Basu’s(1997)model to analyze the overall conservatism of the sample enterprises in the earliest period.However,Khan and Watts (2009)design a firm-year accounting conservatism measure,which demonstrates how corporate conservatism has changed.All of these methods provide indirect support for our Hypothesis.

As we can see from Table A.1,from regression(1)to regression(4),the interaction variable of the dummy variable Senti and ROA is significant,which indicates that the dummy variable for PPS measured by Abowd’s (1990)method is largely able to describe the sensitivity of payment to performance.

Table A.1Results of tests on Abowd’s(1990)method.

Appendix B.Relationship between the degree of marketization and overemployment

To test the reliability of our overemployment estimate and the theoretical influence of the degree of marketization on the size of the redundant workforce,we test the relationship between the two.

In regions with a high degree of marketization,governments afford enterprises a relatively high degree of control for several reasons.The local governments in these regions tend to be more open-minded,better able to use market tools skillfully and to have more market mechanisms at their disposal.In addition,there is generally greater market competition in these regions.These regional conditions compel local governments to exhibit behavior that is closer to market requirements if they are to survive and develop in the face of competition(Chen,2009).In regions with a lower degree of marketization,in contrast,local protectionism and government intervention are stronger and these regions still carry elements of the planned economy(Fan and Wang,2010).SOEs in these regions are thus more likely to experience government intervention and, accordingly,to take on more social responsibilities,such as supporting employment.It is for these reasons that we test the relationship between the degree of marketization and overemployment.

Table A.2OLS regression of overemployment on market development.

As there is no related research on the determining factors of overemployment and our other control variables for testing the degree of marketization are based primarily on the domestic literature discussing policy objectives,excess employees and government intervention in SOEs,we adopt the following model for our test, with the results presented in Table A.2.

It can be seen from this table that regardless of whether we perform single-or multiple-variable regression, the degree of marketization(Market)and the scale of overemployment(EL)are negatively related at the 1% level of significance,which indicates that the higher the degree of marketization,the smaller the size of the redundant workforce.The degree of marketization is a variable that embodies the degree of government intervention.Hence,less government intervention allows SOEs to reduce their multiple objectives and policy tasks such as employment promotion and unemployment reduction.Consequently,the extent of overemployment is reduced.

Abowd,J.M.,1990.Does performance-based managerial compensation affect corporate performance.Industrial and Labor Relation, Review 43(February),52-73.

Bai,C.,Xu,L.,2005.Incentives for CEOs with multi tasks:evidence from Chinese state-owned enterprises.Journal of Comparative Economics 33,517-539.

Bai,C.,Li,D.,Tao,Z.,Wang,Y.,2000.A multitask theory of state enterprise reform.Journal of Comparative Economics 28,716-738.

Bai,C.,Lu,J.,Tao,Z.,2006.The multitask theory of state enterprise reform:empirical evidence from China.American Economic Review 96,353-357.

Banker,R.,Datar,S.,1989.Sensitivity,precision,and linear aggregation of signals for performance evaluation.Journal of Accounting Research 27(1),21-39.

Basu,S.,1997.The conservatism principle and the asymmetric timeliness of earnings.Journal of Accounting and Economics 24,3-37.

Boycko,M.,Shleifer,A.,Vishny,R.W.,1996.A theory of privatization.Economic Journal 106,309-319.

Calomiris,C.W.,Fisman,R.,Wang,Y.X.,2010.Profiting from government stakes in a command economy:evidence from Chinese asset sales.Journal of Financial Economics 96,399-412.

Cao,J.,Pan,L.,Tian,G.,2010.Disproportional Ownership and Pay-Performance Relationship.Working Paper,SSRN.

Chen,D.H.,2002.Local Government,Corporate Governance and Firm Performance.Ph.D.Thesis,Shanghai University of Finance(in Chinese).

Chen,D.H.,2003.A study and analysis on local government,corporate governance:empirical evidence from subsidy in China.The Study of Finance and Economics 9,15-21(in Chinese).

Chen,D.H.,Chen,X.Y.,Wan,H.L.,2005.Regulation and non-pecuniary compensation in Chinese SOEs.Economic Research Journal 2, 92-101(in Chinese).

Chen,X.M.,2009.SOEs Don’t Allow Redundant Employees.Yangcheng Evening News,March 25th(in Chinese).

Chen,Z.,Lu,M.,2003.Theoretical and Empirical Analysis on Adjustments of Ownership Structure in China.Shanxi Economic Press,pp. 88-92(in Chinese).

Chen,X.Y.,Chen,D.H.,Wan,H.L.,Liang,S.K.,2009.The disparity in regions,the regulation of emolument,and the corruption of highranking managers.Management World 11,131-144.

Chen,D.H.,Chen,P.,Shen,Y.J.,You,H.F.,2010.Profit-sharing or Value Maximization:An Analysis of Executive and Employee Pay Performance of Listed Companies in China.Working Paper.

Chongqing Evening News,2008.Chong Qing SOEs Are Strict with Layoffs and Make Sure Wages of Employees Rise by 10%within This Year.Chongqing Evening News,November 20th.

Dewenter,K.L.,Malatesta,P.H.,2001.State owned and privately owned firms:an empirical analysis of profitability,leverage and labor intensity.The American Economic Review 91(1),320-334.

Donahue,J.D.,1989.The Privatization Process.Basic Books,New York.

Du,X.Q.,Wang,L.H.,2007.Empirical research on correlation between compensation schemes of management and the change of performance of public listed companies.Accounting Research 1,73-80(in Chinese).

Du,S.L.,Zhai,Y.L.,2005.An empirical study on determining factors in CEO compensation.Management World 8,59-67(in Chinese).

Fan,G.,Wang,X.L.,2010.Market Index of China—The Relevant Region Process of Market 2009.Economic Science Press,pp.230-353 (in Chinese).

Firth,M.,Fung,P.M.Y.,Rui,O.M.,2006.Corporate performance and CEO compensation in China.Journal of Corporate Finance 12, 693-714.

Friedman,E.,Johnson,S.,Mitton,T.,2003.Propping and tunneling.Journal of Comparative Economics 31,732-750.

Frydman,R.,Gray,C.,Hessel,M.,Rapaczynski,A.,1999.When does privatization work?The impact of private ownership on corporate performance in transition economies.The Quarterly Journal of Economics 114,1153-1192.

Gu,Z.Y.,Wang,K.,Xiao,X.,2010.Government Control and Executive Compensation:Evidence from China.Working Paper,SSRN.

Harris,M.,Raviv,A.,1991.The theory of capital structure.Journal of Finance 45,297-353.

Jensen,M.C.,Meckling,W.H.,1976.Theory of the firm:managerial behavior,agency costs,and ownership structure.Journal of Finance 3,305-350.

Jensen,M.C.,Murphy,K.J.,1990.Performance pay and top management incentives.Journal of Political Economy 98,225-264.

Kato,T.,Chery,L.,2004.Executive Compensation,Firm Performance,and Corporate Governance in China:Evidence from Firms Listed in the Shanghai and Shenzhen Stock Exchanges.Working Paper,SSRN.

Khan,M.,Watts,R.L.,2009.Estimation and empirical properties of a firm-year measure of accounting conservatism.Journal of Accounting and Economics 48,132-150.

Li,Z.Q.,2000.Incentive mechanism and firm performance:an empirical study based on listed companies.Accounting Research 1,77-80 (in Chinese).

Li,D.D.,Liang,M.S.,1998.Causes of the soft budget constraint:evidence on three explanations.Journal of Comparative Economics 26, 104-116.

Lin,Y.F.,Li,Z.,2004.Policy burden,moral hazard and soft budget constraint.Economic Research Journal 2,15-27(in Chinese).

Lin,J.Y.,Tan,G.F.,1999.Policy burdens,accountability and the soft budget constraint.American Economic Review 89(2),426-431.

Lin,Y.F.,Liu,M.X.,Zhang,Q.,2004.Policy burden and enterprise’s soft budgetary binding:a case study from China.Management World 8,34-45(in Chinese).

Liu,X.X.,2001.Reports on China Enterprise Development:1990-2000.Social Science Press,pp.123-145(in Chinese).

Liu,B.,Liu,X.,Li,S.X.,Simmon,H.,2003.An empirical study on the mutual effect between the CEO’s pay and the firm’s performance. Accounting Research 3,99-104(in Chinese).

Liu,F.W.,Sun,Z.,Li,Z.Q.,2007.Government intervention,industry competition,compensation contracts.Management World 9,85-95 (in Chinese).

Murphy,K.J.,1985.Corporate performance pay and managerial remuneration:an empirical analysis.Journal of Accounting and Economics 7,11-42.

Murphy,K.J.,1999.Executive compensation.In:Ashenfelter,O.,Card,D.(Eds.),Handbook of Labor Economics,first ed.,vol.3,pp. 2485-2563(Chapter 38).

Petronic,B.K.,Safieddine,B.,1999.Ownership concentration and sensitivity of insurance pay to accounting performance measure: evidence from publicly and privately-held insurance companies.Journal of Accounting and Economics 7,151-182.

Shleifer,A.,Vishny,R.W.,1994.Politicians and firms.The Quarterly Journal of Economics 109,995-1025.

Tosi,H.L.,Werner,S.,Katz,J.,et al.,2000.How much does performance matter?A meta-analysis of executive compensation studies. Journal of Management,301-339.

Wang,K.,Xiao,X.,2011.Controlling shareholders’tunneling and executive compensation:evidence from China.Journal of Accounting Public Policy 30,89-100.

Watts,R.,Zimmerman,J.,1986.Positive Accounting Theory.Prentice Hall,Englewood Cliffs,NJ,pp.99-121.

Wei,G.,2000.Incentives for top-management and performance of listed companies.Economic Research Journal 3,123-145(in Chinese).

Westphal,J.D.,1996.Cooption and Collaboration?Behavioral and Performance Consequences of Social Ties in the CEO/Board Relationship.Working Paper,SSRN.

Xin,Q.Q.,Tan,W.Q.,2009.Market-oriented reform,firm performance and executive compensation in Chinese state-owned enterprises. Economic Research Journal 11,99-108(in Chinese).

Xin,Q.Q.,Lin,B.,Wang,Y.C.,2007.Government control,executive compensation and capital investment.Economic Research Journal 8,77-89(in Chinese).

Xu,L.X.C.,Zhu,T.,Lin,Y.M.,2005.Politician control,agency problems and ownership reform.Economics of Transition 13(1),1-24.

Xue,Y.K.,Bai,Y.X.,2008.State ownership,redundant employees and firm performance.Management World(10),76-87(in Chinese).

Zeng,Q.S.,2007.Excess employment,equity agency cost and corporate value—evidence from state-owned listed companies.Journal of Shanghai Lixin University of Commerce(1),65-78(in Chinese).

Zeng,Q.S.,Chen,X.Y.,2006.State stockholder,excessive employment and labor cost.Economic Research Journal 5,77-89(in Chinese).

Zhang,J.R.,Zhao,J.W.,Zhang,J.,2003.An empirical study on the association of superior management incentive and listed company performance.Accounting Research 9,109-117(in Chinese).

21 April 2011

*Corresponding author.

E-mail address:shenyongjian2004@yahoo.com.cn(Y.Shen).

China Journal of Accounting Research2012年1期

China Journal of Accounting Research2012年1期

- China Journal of Accounting Research的其它文章

- Accounting standard changes and foreign analyst behavior: Evidence from China

- Controller changes and auditor changes

- Enforcement actions and their effectiveness in securities regulation:Empirical evidence from management earnings forecasts

- Women on boards of directors and corporate philanthropic disaster response