The impact of macroprudential cross-border capital flow management on the linkage of domestic and foreign bond markets

Pengwei Zhao, and Xiao Wang ✉

International Institute of Finance, School of Management, University of Science and Technology of China, Hefei 230031, China

Abstract: Cross-border financing activities in China have increased significantly in recent years, and the inflow of capital may lead to accumulated financial risks.To mitigate financial risks and promote the opening of financial markets, macroprudential management policies for cross-border financing have been implemented since 2016.This paper examines the effectiveness of macroprudential management policies in opening financial markets and managing foreign financial risks.We employ a time-varying parameter vector autoregressive (TVP-VAR) model to quantitatively analyze changes in the spillover effects between Chinese bond market and foreign bond markets under different implementation stages of crossborder financing macroprudential policies.Our analysis reveals that the implementation of macroprudential management of cross-border financing has increased the total spillover effect between different bond markets, as well as the spillover effect from other bond indices to the Chinese RMB Bond Index and the spillover effect from other indices to the Chinese USD index.Moreover, our findings indicate that macroprudential management has reduced the total volatility spillover effect and the volatility spillover effect from other indices to the Chinese RMB Bond Index.These results highlight the importance of preventing external risk transmission when China’s financial market is opening to the world.

Keywords: macroprudential policy; TVP-VAR; Chinese RMB Bond Index; spillover

1 Introduction

China has entered a stage of comprehensive financial openingup since the 2010s.The cross-border financing activities of enterprises are becoming increasingly frequent, and an increasing number of enterprises are issuing foreign currency bonds instead of RMB bonds.However, the inflow of capital also brings financial risks.Thus, the People’s Bank of China(PBC),as a central bank, implements full-coverage macroprudential management of cross-border financing (hereinafter referred to as macroprudential management) since 2016.Macroprudential management encourages enterprises to borrow from the international market and further makes Chinese RMB bond market more connected with the international bond market.

Macroprudential management of cross-border financing involves policies that use prudential tools to limit systemic risks in cross-border financing, with the aim of preventing systemic financial risks and stabilizing financial markets.The timeline of the policy stages is as follows.On January 22,2016, the PBC issued theNotice on Expanding the Pilot Program of Comprehensive Macroprudential Regulation of Cross-border Financing.This notice stipulated that the cross-border financing limit of banks, financial institutions,and nonfinancial enterprises is (the entity’s net assets)×(crossborder financing leverage ratio)×(macroprudential adjustment parameter), where the cross-border financing leverage ratio of nonfinancial enterprises is 1 and that of financial enterprises is 0.8, and the macroprudential adjustment parameter is 1 for all enterprises.From April 30, 2016, the PBC officially implemented macroprudential management nationwide.On January 13, 2017, the PBC further relaxed the upper limit of cross-border financing for enterprises, raised the cross-border financing leverage ratio of nonfinancial enterprises to 2, and expanded the target enterprise from Chinesefunded enterprises to all kinds of enterprises.On March 12,2020, the macroprudential adjustment parameter was raised from 1 to 1.25.On December 11, 2020, the macroprudential adjustment parameter decreased from 1.25 to 1.Upon meticulous research into the granular details of macroprudential management across different periods, we identified January 2016, April 2016, and January 2017 as the three pivotal junctures exerting the most substantial impact.Consequently, our empirical analysis primarily concentrates on the above three time points.Additionally, policy effects tend to materialize rapidly within a short time frame, and we will assess their influences by analyzing changes in spillover effects within a few months surrounding the crucial time points.

Under macroprudential management, enterprises broaden their sources of funds through cross-border financing and then affect Chinese bond market.Thus, this paper tries to answer the following question: Triggered by the implication of macroprudential management, would the linkage between Chinese bond market and the international bond market be closer? Based on the domestic and foreign bond market indices, we study the relationship between China’s and international bond markets in terms of index spillover and volatility spillover to answer this question.

Specifically, our main work is to gauge the spillover effects between Chinese bond markets and other major bond markets after the implication of macroprudential management by leveraging the methodology of time-varying parameter vector autoregression (TVP-VAR)[1-3].We find that:(i) Macroprudential management increased the total spillovers among different bond markets, the spillovers from other indices to the Chinese RMB Bond Index, and the spillovers from other indices to the Chinese USD Bond Index.(ii) The implementation and improvement of macroprudential management have reduced the total volatility spillovers between different bond indices and the volatility spillovers from other indices to the Chinese RMB Bond Index.

In the sample period, apart from cross-border financing macroprudential management, other significant international events also exerted influence on spillover effects.Notable examples include the RMB exchange rate reform in 2015 and the depreciation of the USD in 2017.However, our primary focus is on the impact of macroprudential management.The influences of the mentioned international events serve as supplementary aspects to our findings, rather than constituting the central conclusions of our study.Fortuitously, these international events occurred with considerable temporal distance from macroprudential management, and their impacts manifested rapidly.As a result, we can deduce that changes in spillover effects before and after macroprudential management were primarily governed by macroprudential management.

The remainder of this paper is arranged as follows.Section 2 reviews the literature and points out our contribution.Section 3 specifies the econometric model.Section 4 describes the data and sample construction.Section 5 displays the empirical analysis results.Finally, Section 6 concludes.

2 Literature review and contribution

We conduct a literature review from three aspects: policy research methods, the linkage of domestic and foreign bond markets, and the impact of macroprudential management.

Scholars have employed various research methods for the macroprudential management of cross-border financing.Diebold and Yilmaz[1-3]proposed unbiased estimation methods to calculate price volatility and spillover effects between vector autoregressive (VAR) models.Akhtaruzzaman et al.[4]used a VAR model to study the correlation between stock markets during the COVID-19 pandemic.Corbet et al.[5]extended the model to study the diversification options provided by cryptocurrencies.Antonakakis et al.[6]proposed a timevarying parameter VAR model to remove the influence of time effects on parameter estimation.Based on the above literature, the TVP-VAR model is an effective model for capturing the impact of macroeconomic policies, and analyzing policies from the index level and index volatility can improve the accuracy and comprehensiveness of the results.

In terms of the linkage between domestic and foreign financial markets, most of the literature studies the impact of corporate foreign debt issuance at the firm level.For example,Cortina J et al.[7]found that the crisis promoted firms to shift their financing activities between domestic and international syndicated loans and corporate bonds.At the aggregate level,the majority of literature primarily focuses on examining the linkages among various domestic financial markets.Luo et al.[8]believed that the revision of the rules for the subscription of convertible bonds will increase the linkage between the convertible bond market and the stock market, resulting in a two-way spillover effect.Meng et al.[9]found that the stock market and bond market are more affected by external risks than other financial markets, and major events in the current period will affect the risk spillovers between financial markets.While some studies have examined the spillover effects between domestic and foreign bond markets, little attention has been given to the transmission of bond market risks.For instance, Fei and Liu[10]discovered a significant volatility spillover effect of global financial risks on Chinese bond market, with the spillover effect being notably higher for longterm treasury bonds than for short-term treasury bonds.Zhao et al.[11]employed a comprehensive selection of risk indicators from five different levels to calculate the systemic risk level of the bond market in our country for the period spanning 2018 to 2021.Although the findings revealed a discernible overall upward trend in the systemic risk level of our country’s bond market, the study did not examine the impact of macroprudential management on risk transmission.Wu et al.[12]identified strong short-term self-inertia characteristics in the bond market but highlighted its susceptibility to influences from the foreign exchange market and the domestic economy.However, these studies rarely establish a connection between macroprudential management and the interplay between domestic and foreign financial markets.Consequently, we pioneer the integration of macroprudential management and the linkage between domestic and foreign bond markets.From the perspective of macroprudential management, we analyze changes in bond market linkages and examine spillover effects from both market indices and market risk perspectives.

In the research on the impact of macroprudential management of cross-border financing, the literature predominantly concentrates on examining the domestic effects of China’s macroprudential policies while neglecting the analysis of spillover effects between China and the international market.Zhang et al.[13]employed a TVP-VAR model to investigate the impact of macroprudential policies on systemic risk in domestic financial markets and observed that these policies are effective in reducing systemic risk in the long run.Similarly,Huang et al.[14]constructed a TVP-VAR network to examine the relationship between various economic indicators, revealing that real estate and stocks exert a significant influence on the financial market, while exchange rates and money supply have a relatively weaker impact.Furthermore, Chen et al.[15]utilized a TVP-VAR model and established that macroprudential policies have restrained credit expansion in China’s real estate sector.Hence, the objective of this study is to utilize the TVP-VAR model to analyze the effects of macroprudential management between domestic and foreign markets, aiming to fill the existing research gaps.

Based on the above literature research and our content, we define our main contributions as follows.(i) Since the above literature fails to adequately address the impact of macroprudential policies on the linkage between domestic and foreign bond markets[13,15], we estimate the changes in the spillover effect before and after the implementation of the macroprudential management of cross-border financing to measure the impacts of the policy and quantitatively analyze whether the linkage between the Chinese bond market and the international bond market has improved.(ii) In the context of current global market risk growth, it is increasingly important to study the impact of macroprudential management on risk transmission between different bond markets[10-12].The literature fails to elucidate the role of macroprudential management in the transmission of bond market risk.Our study provides a crucial supplement to this area of inquiry.We estimate the volatility spillover effect between bond indices to analyze cross-border financing volatility.We examine the impact of macroprudential management of cross-border financing on the risk of the RMB bond market and explore the changes in bond market risk in the context of the gradual opening of the financial market.(iii) It is rare to employ a TVP-VAR model to explore the impact of macroprudential management on domestic and foreign bond markets[14].After a comprehensive comparison of three different methods, we chose to employ the TVP-VAR model for our analysis.TVPVAR avoids the influence of the rolling window length and variable order in the traditional VAR model on the results.The coefficients in TVP-VAR fully absorb the effect of the policy, and the results are more accurate and reliable.

3 Model

3.1 Baseline model

Following the onset of the 2008 economic crisis, extensive literature emerged with the objective of exploring the formulation of macroprudential policies and their time-varying influence on financial markets.For example, Chari et al.[16]demonstrated that ex ante macroprudential management can amplify the effects of global risk shocks on financial markets,with varying degrees of amplification observed across different time periods.Our research aims to investigate the timevarying impact of macroprudential policies on the bond market.To accomplish this objective, scholars commonly employ econometric methodologies such as vector autoregression (VAR), generalized autoregressive conditional heteroscedasticity (GARCH), and copula models to examine dynamic spillover effects.For instance, Meng et al.[9]employed the TVP-VAR model to construct a risk contagion network in financial markets, Wang et al.[17]constructed the BEKKMGARCH spillover effect index for crude oil, and Zhou and Han[18]measured the financial relationship between China and Hong Kong by constructing the GARCH-copula-CoVaR spillover effect index for market interdependencies.These three econometric models possess their respective advantages and disadvantages.The TVP-VAR model allows for dynamic responses to time-varying spillover effects, but rapid changes in results may introduce distortions.The GARCH model exhibits superior fitting capabilities, although it is primarily suitable between two variables.The copula model boasts a wide range of applications but necessitates substantial sample requirements.Due to the multiple bond markets and distinct volatility patterns, the TVP-VAR model is better for our study.Furthermore, since Diebold and Yilmaz[1-3]pioneered the investigation of market interconnectedness, VAR has become a widely utilized model.Especially after the work of Antonakakis et al.[6], TVP-VAR replaced VAR as a common framework for analyzing the spillover effects of macroeconomic indicators.Bekiros and Paccagnini[19]found that TVPVAR has the best short-term prediction effect among all VAR models.The TVP-VAR model enhances traditional analytical approaches by obviating the need for fixed rolling window sizes and mitigating the loss of observation values.Additionally, the time-varying parameters facilitate improved measurement of dynamic changes.

First, we construct a TVP-VAR model:Xtis anndimensional variable; each component ofXtrepresents a bond index.Γptis the parameter matrix ofXt-p, wherepis the lag order.µtis then- dimensional random perturbation column vector; µtis independent and identically distributed with the expectation as 0 and the covariance matrix as Σt.The TVP-VAR model of thep-order lag at any timetis

Second, after building the baseline model, we need to perform a variance decomposition to calculate the spillover effects of this model.The variance decomposition is divided into two steps.The first step is to rewrite the model into an infinite-order vector moving average (VMA) model.The purpose of this step is to calculate the normalized impact of a component on any other component.

After variance decomposition, we calculate the contribution proportion of the normalized shock of thelth variable to the mean square error of theXt+H,jprediction attand define it as thelth component attto thejth component spillovers.

Thelargerthespillovereffectθjl,t(H) is, thestronger the eff ectis.After calculatingthe spillover effectofeachbond index on any other bond index, we first normalize the spillover effect θjl,t(H), calculate the overall spillover effectSt(H) and the directional spillover effectsS j·,t(H) andS·j,t(H), and finally calculate the net pairwise spillover effectNi j,t.

We fir st perform row normalization on θjl,t(H):

Then, calculate the total spillover effect:

Calculate directional spillovers:

Calculate net pairwise spillovers:

Among them, the total spillover effectSt(H) represents the comovement among all markets,S j·,t(H) andS·l,t(H) represent the directional spillover effect, andNi j,trepresents the spillover effect between any two bond indices.The directional spillover effects of any bond market A are divided into two categories, namely, the spillover effect received by A and the spillover effect imposed by A.

3.2 Calculation of bond index volatility

This investigation delves into the implications of macroprudential management for index spillover and volatility spillover in the realm of bond markets.Our analysis focuses on the modifications in volatility spillovers that occur between domestic and foreign bond markets, as gauged by the volatility of the bond index.

To calculate bond index volatility, we follow the method proposed by Alizadeh et al.[20]and compute weekly volatility.Specifically, we estimate volatility as follows:

whereHtrepresents the highest price of the week,Ltrepresents thelowestpriceoftheweek,Otrepresentsthe opening priceon Monday, andCtrepresentstheclosing price on Friday.According to Ref.[20], this formula removes the influence of high-frequency trading and discontinuous trading time on estimation, each coefficient is the optimal solution on the analysis scale, and the coefficient does not change with the parameter change.Thus, the calculated volatility is invariant on the analytical scale.

3.3 Estimation of lag order and spillover effect of TVPVAR

Considering the possibility of structural changes on April 30,2016, we selected that day as a demarcation point to estimate the lag order before and after the implementation of macroprudential policies.In addition, the lag orders for all robustness tests are also determined in this way.The obtained results are presented in Tables A1 and A2 in Appendix.According to the Akaike information criterion (AIC), Bayesian information criterion (BIC), and Hannan-Quinn criterion(HQC), the optimal lag order of the TVP-VAR model at the comprehensive judgment index level is 8, while optimal lag order of the TVP-VAR model for the volatility spillover is 2.

4 Sample construction

To fully appreciate the impact of cross-border financing macroprudential management across distinct stages, our dataset encompasses daily data from January 1, 2015 to December 31, 2017.This temporal span comprehensively covers the pilot, implementation, and improvement of macroprudential management, thereby facilitating an effective examination of the policy’s ramifications.According to previous studies by Livingston et al.[21]and Chesney et al.[22], the ChinaBond Index and FTSE US Treasury Index have been identified as representative indices for the bond markets of China and the United States, respectively.Furthermore, Jiang and Zhao[23]discovered a substantial growth in the issuance volume of Chinese USD bonds, indicating that Chinese companies have increasingly turned to issuing USD bonds to hedge risks.Presently, Chinese USD bonds have emerged as a crucial avenue for Chinese firms to raise funds overseas.Therefore, we incorporate the Chinese USD Bond Index into our analysis.Moreover, based on the research of Ferreira and Miguel[24], the HK bond market demonstrates a highly developed and significantly large investment in foreign currency bonds, positioning it prominently in the global dollar bond market.The inclusion of the Hong Kong USD Bond Index allows for a comprehensive depiction of the global bond market.Additionally,Zhou et al.[25]indicated a one-way spillover effect between offshore RMB bonds, and they suggested that the level of openness of onshore RMB could mitigate this effect.Hence,the HK offshore RMB bond index enables us to capture new trends in RMB bond issuance.Therefore, these five bond markets can be divided into three parts.One is Chinese bond markets, including the Chinese RMB bond market and Chinese USD bond market; one is HK’s bond markets, including the HK USD bond market and HK Offshore RMB bond market; and another is the FTSE US bond market,which represents the international market.

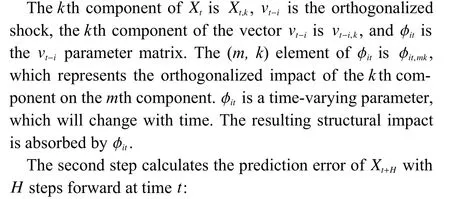

We select 6 representative bond indices, namely, the ChinaBond Index (index code: CBA00203.CS; here it is called Chinese RMB Bond Index, and its abbreviation is CH), iBoxx USD Asia ex-Japan China Index (GB00BTKFSZ82.IHS;Chinese USD Bond Index, CHUSD), iBoxx USD Asia ex-Japan Hong Kong Index (GB00BTKFXK82.IHS; HK USD Bond Index, HKUSD), Hang Seng Markit iBoxx Offshore RMB Bond Index (IBXX001P.HI; HK Offshore RMB Bond Index, CNH), FTSE US Treasury Index (CFIIUSL Index;FTSE Russell US Bond Index, FRUS), and FTSE MTS Eurozone Government Bond Index (EMTXGO Index; FTSE Russell EU Bond Index, FREU).Data come from Wind and Bloomberg.Table 1 shows the statistics of all bond indices.

In our study, ︿ θA,B,t(H) means the spillover effect that A received from B (hereinafter referred to as the spillover effect from B to A).A and B represent the bond indices of any given market.For instance, ︿ θCH,FRUS,t(H) indicates the spillover effect from FRUS to CH.Eq.(6) changes to

whereSCH·,t(H) represents the spillover of CH from others.Similarly,

whereS·CH,t(H) represents the spillover of CH to others.

From the above two definitions, we can also define the directional volatility spillover.The total spillover can be rewritten as:

5 Empirical analysis

5.1 Bond index spillover

We set five bond indices listed in Table 1 as the index vectorXtand estimate the TVP-VAR model as in Eq.(1) by orthogonalizingXtand reshaping the model into a VMA model as in Eq.(2) to calculate total, directional and net pairwise spillovers as in Eqs.(5)-(8).

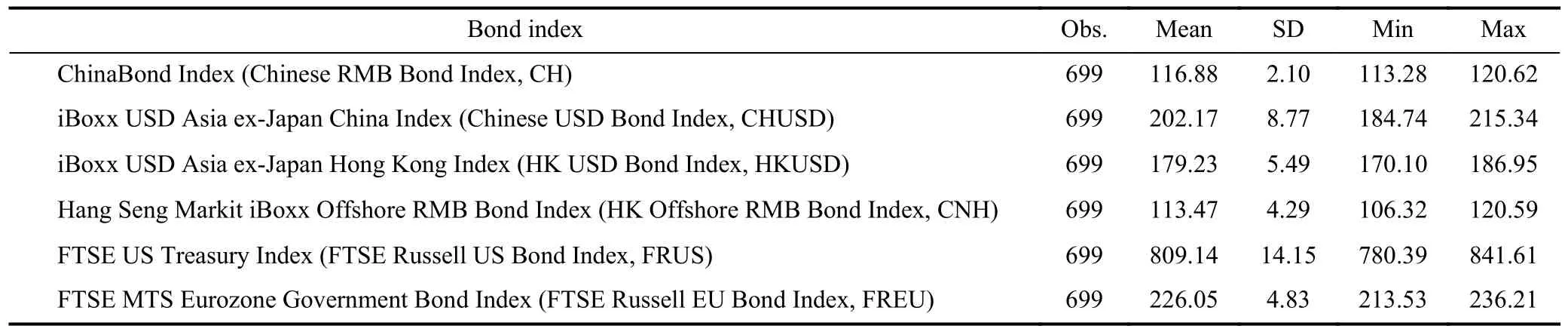

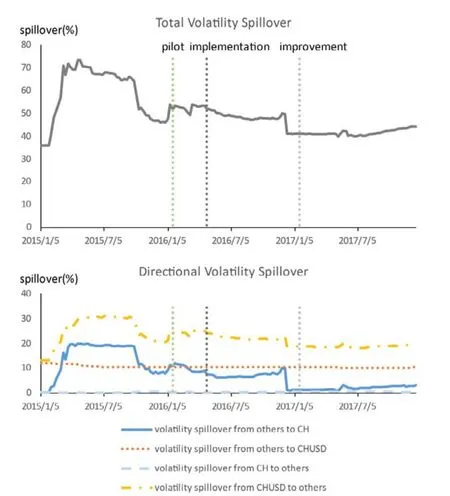

Fig.1 shows the total spillover and directional spillover among the five indices.Specifically, after the pilot of macroprudential management in January 2016, the total spillover effect increased steadily within four months.The implementation of macroprudential management in April 2016 further amplified the total spillover effect by an additional 4%.The improvement of macroprudential management launched in January 2017 swiftly exacerbated the total spillover effect,marking an increase of 8% within a mere ten-day span following the policy’s inauguration.In summary, the pilot and implementation of macroprudential management of crossborder financing have significantly strengthened the total spillover.

We gathered a comprehensive dataset encompassing all policies that may have an impact on the bond market between 2015 and 2017 (Table A4 in Appendix).These include monetary policy, exchange rate policy, credit policy, and macroprudential policy.Given the above policy list, alterations in spillover effects adjacent to various policies can be discerned from the spillover effect figure.While we cannot disregard potential disruptions from other policies, their impact would be largely negligible without the implementation of macroprudential management.Essentially, the effects of other policies are based on the effect of macroprudential management, which is the primary determinant of spillover effects.

Our investigation extends to directional spillover effects between Chinese bond markets and other bond markets.Consequently, we scrutinize the directional spillover effect of the Chinese RMB Bond Index and the Chinese USD Bond Index.Our results indicate that the spillover effect from the Chinese RMB bond market to other bond markets and the spillover effect from other bond markets to the Chinese RMB bond market remained stable from 2015 to 2017, as shown in Fig.1.The implementation of macroprudential management in April 2016 significantly escalated the spillover effect from other markets to the Chinese USD bond market, witnessing a surge from 10% to 12.7%.After the improvement of the macroprudential management of cross-border financing in January 2017, the spillover effect from other markets to the Chinese RMB bond market increased by 2%.The improvement of macroprudential management in January 2017 also inflated the spillover effect from other markets to the Chinese USD bond market from 12% to 17%.In summary, the macroprudential management of cross-border financing has enhanced the spillover effect from other markets to the Chinese RMB bond market and the spillover effect from othermarkets to the Chinese USD bond market.

Table 1.Statistics of the bond indices.

Fig.1.Total spillover and directional spillover.The total spillover effect equals 1- (Σ the spillover effect from A to A), where A represents any bond market.The spillover effect from others to CH means that the Chinese RMB bond market received spillover effects from other bond markets.The spillover effect from CH to others means that the Chinese RMB bond market imposes a spillover effect on other bond markets.The spillover effect of CHUSD is the same as that of CH.

Fig.1 also depicts substantial oscillations in spillover effects during 2017, attributable to a confluence of domestic policy modifications and international exchange rate fluctuations.In the early months of 2017 (January to April), the USD exchange rate exhibited stability, engendering a stable pattern in market spillover effects.The principal driving force behind these spillover effects during this period was the enactment of enhanced macroprudential management measures introduced in January 2017.

After April 2017, the USD underwent a marked depreciation (refer to Fig.A1 in Appendix), constraining market activities within Chinese USD bond market and causing directional spillover effects to diminish rapidly.During this period, the RMB displayed a sustained appreciation trend.This trend became particularly pronounced after May 2017 when the PBC initiated the inclusion of a countercyclical factor in RMB valuation, prompting increasingly positive market expectations for the currency.As a result, both total and directional spillover effects experienced an upsurge, culminating in a peak during August 2017.

From August 2017 onwards, the PBC actively intervened to temper the RMB’s appreciation trajectory, causing the exchange rate to revert to a more fluctuating pattern.This led to diminished market confidence in RMB, and as a result of the ensuing exchange rate oscillations, the spillover effects in Chinese USD bond market contracted significantly, exhibiting a persistently unstable tendency.In summary, in January 2017, with other factors remaining stable, macroprudential management assumed a dominant role.The fluctuations in spillover effects observed after April 2017 were influenced by a multitude of factors and cannot be attributed to any single element.In contrast, during January and April 2016, international factors such as the USD remained stable, and domestic policy was limited to macroprudential management.Consequently, changes in spillover effects during January and April 2016 can be ascribed to the impact of macroprudential management.

The improvement of macroprudential management in January 2017 represents a significant policy shift.This updated policy extended the purview of macroprudential management to include all financial institutions and enterprises, instead of just Chinese-funded ones.In addition, in contrast with the implementation of macroprudential management in April 2016,it established regulations on the scale of foreign debt for foreign-invested enterprises, relaxed capital inflows, and exerted an impact consistent with the 2016 policy promotion,substantially invigorating the bond market.Simultaneously,the PBC tightened capital outflows in January 2017, leading to declines in equity and bond markets.Overall, the policies in 2017 were characterized by relaxed capital inflows and constricted capital outflows.The restrictive measures on capital outflows limited trading activity in the bond market, leading to reductions in total and directional spillover effects,while the liberalization of capital inflows heightened spillover effects between bond markets.As observed in Fig.1,spillover effects in January 2017 exhibited an upward trend,indicating that the influence of macroprudential management’s relaxation of capital inflows outweighed the impact of tightened capital outflows.Consequently, it can be deduced that macroprudential management played a decisive role in shaping spillover effect fluctuations in January 2017, and macroprudential management significantly impacted the Chinese bond market.

According to the above analysis, the implementation and improvement of macroprudential management of crossborder financing has enhanced the linkage between different bond markets and significantly increased the spillover effect from other markets to the Chinese RMB bond market and Chinese USD bond market.Macroprudential management speeds up the internationalization process of the Chinese RMB bond market.

5.2 Net pairwise bond index spillover

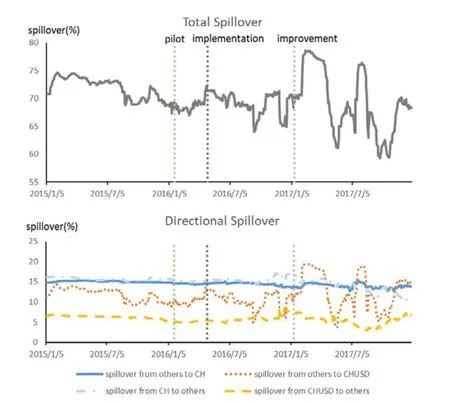

We estimate the spillover effect between each index in the same way as for the total and directional spillover effects, and then we obtain the net pairwise spillover effect between any two indices.We focus on four pairs to explore the net pairwise spillovers: the Chinese RMB Bond Index and FTSE Russell US Bond Index, the Chinese USD Bond Index and FTSE Russell US Bond Index, the HK USD Bond Index and FTSE Russell US Bond Index, and the HK Offshore RMB Bond Index and FTSE Russell US Bond Index.We draw the spillover effects during the sample time span in Fig.2.

Fig.2 presents the net pairwise spillover effects between the Chinese RMB Bond Index, Chinese USD Bond Index,and FTSE Russell US Bond Index.The results reveal that the implementation of macroprudential management has a significant impact on the spillover effect from the Chinese RMB bond market to the FTSE US bond market.Specifically,after the implementation of macroprudential management in April 2016, the spillover effect from the Chinese RMB bond market to the FTSE US bond market increased significantly.This trajectory persisted following the improvement of macroprudential management in January 2017, suggesting the policy’s efficacy in increasing the market influence of the Chinese RMB bond market.

Fig.2.Net pairwise spillover.Note: Taking the first picture as an example, a positive net paired spillover effect means that the spillover effect from the Chinese USD Bond Index to the FTSE Russel US Bond Index is greater than the spillover effect from the FTSE Russel US Bond Index to the Chinese USD Bond Index.

Additionally, the net pairwise spillover effect from the Chinese USD bond market to the FTSE US bond market is positive, indicating that the spillover effect from the Chinese USD bond market to the FTSE US bond market is greater than the spillover effect from the FTSE US bond market to the Chinese USD bond market.

In summary, the findings indicate that the implementation of macroprudential management has played a crucial role in enhancing the spillover effects among different bond markets and strengthening the international influence of the Chinese RMB bond market.

5.3 Volatility spillover effects

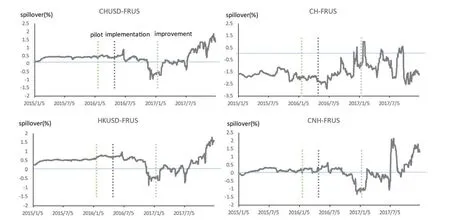

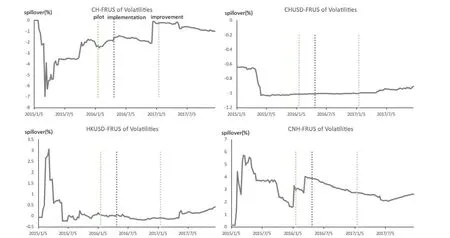

First, we estimate the volatilities of all bond indices.The five bond index volatilities are calculated according to Eq.(9).Then, we estimate the volatility spillover effect for each index according to Eqs.(5)-(8) and calculate the total spillover and directional spillover (Table A3 in Appendix).Fig.3 shows the above results.

From Fig.3 , the results show that the total volatility spillover effect among the five bond markets declined gradually and remained at approximately 50% in 2017.

Examining the directional volatility spillover effects, we find that the volatility spillover effect from other bond markets to the Chinese USD bond market remained steady.Conversely, the volatility spillover effect from other bond markets to the Chinese RMB Bond Index exhibited a consistent downward trend.This trend indicates that macroprudential management has effectively mitigated risk transmission from international markets to the Chinese RMB bond market.As a result, the Chinese RMB bond market demonstrates decreased susceptibility to the volatilities and risk factors present in international markets.

After the pilot and implementation of macroprudential management in January and April 2016, the volatility spillover effect from other bond markets to the Chinese RMB bond market dropped significantly from 11.5% to 8.6%.This significant reduction in volatility spillover from other bond markets to the Chinese RMB bond market testifies to the efficacy of macroprudential management in mitigating the impact of international bond market volatilities on the Chinese RMB bond market, consequently reducing risk transmission.

Fig.3.Total and directional volatility spillover.

However, after the pilot of macroprudential management,the volatility spillover effect from Chinese USD bonds to other bond markets increased.The relaxation of corporate foreign debt leads to rising risk transmission, as shown by the amplified risk transmission from the Chinese USD bond market to other markets after the implementation of macroprudential management in January and April 2016.Finally,the increased risk transmission from Chinese USD bond market gradually diminished, and the volatility spillover returned to 20%, the spillover level before the policy change, as shown in Fig.3.

Another phenomenon in Fig.3 is the obvious change in the volatility spillover effect in both August 2015 and November 2016.The total volatility spillover, the volatility spillover from CHUSD to others, and the volatility spillover from others to CH experienced a sharp decline in September 2015.This can be attributed to an important foreign exchange reform implemented by the People’s Bank of China in August 2015, which altered the pricing mechanism of the RMB, rendering it more market-oriented.This reform marked a significant event in the evolution of the RMB, leading to considerable fluctuations in its exchange rate following implementation.Influenced by these RMB exchange rate oscillations,market activities between the Chinese bond market and international bond markets weakened, causing a reduction in total volatility spillover, as well as the volatility spillover from CHUSD to others and the volatility spillover from others to CH.

From Fig.3 , after November 2016, the total volatility spillover, the volatility spillover from others to CH, and the volatility spillover from CHUSD to others decreased.This decline resulted from the PBC’s partial relaxation of restrictions on overseas lending by domestic enterprises in November 2016.The policy change led to a dampening of trading activities in the Chinese bond market, subsequently causing these risk spillover effects to diminish.

In summary, macroprudential management has significantly reduced the total spillover effect among all bond markets in terms of volatility.The pilot and implementation of macroprudential management reduced the risk transmission from the international market to the Chinese RMB bond market.

5.4 Net pairwise bond volatility spillover effects

From Fig.4, the pilot and implementation of macroprudential management in January and April 2016 precipitated a rise in the volatility spillover effect from the Chinese RMB bond market to the FTSE US bond market, from an initial value of-2.38 up to -1.97.Furthermore, the improvement of macroprudential management in January 2017 resulted in consequential shifts in the volatility spillover between the Chinese RMB Bond Index and the FTSE US Bond Index.While the volatility spillover effect between the FTSE US bond and Chinese RMB bond was originally driven predominantly by the U.S.bond market, the transmission of risk from the U.S.bond market to the Chinese RMB bond market has seen a gradual decrease.For all other three pairs of Chinese USD bonds, Hong Kong USD bonds, and offshore RMB bonds with FTSE US bonds, the net pairwise volatility spillovers have demonstrated general stability subsequent to the implementation of macroprudential management.The volatility spillover effect between the FTSE US bond market and the Chinese RMB bond market has evolved from a unilateral propagation to a bidirectional interaction.The capacity of the Chinese RMB bond market to exert an influence on the volatility spillover effect within the FTSE US bond market is increasingly pronounced.

Fig.4.Net pairwise volatility spillover.Taking the first figure as an example, a positive net pairwise spillover effect means that the spillover effect from Chinese RMB Bond Index volatility to US Bond Index volatility is greater than the spillover effect from US Bond Index volatility to Chinese RMB Bond Index volatility; net pairwise spillovers.

In summary, the implementation of macroprudential management played a positive role in increasing volatility spillover effects from the Chinese RMB bond market to the FTSE US bond market.This has been particularly evident since the implementation of macroprudential management in April 2016.Overall, these measures ensure the influence of China’s financial market in the integration of global financial markets.

5.5 Index spillover robustness check

Our index spillover robustness checks are divided into two tests.The first test is to change the FTSE US Bond Index to the FTSE EU Bond Index to replicate the result (Table A5 in Appendix).The second test is to replace the TVP-VAR model with the VAR model to replicate the result.

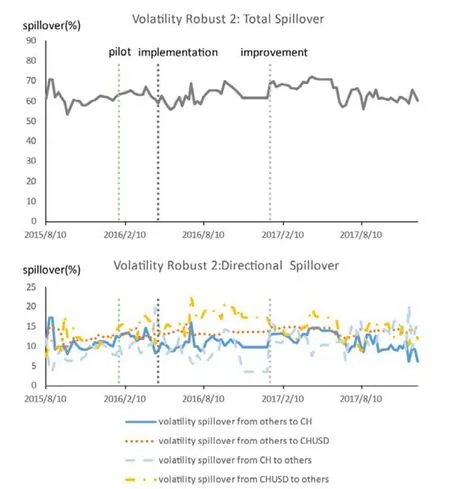

From Fig.5, the implementation and improvement of the macroprudential policy for cross-border financing have led to a reduction in the total spillover effect.The total spillover effect decreased by 4% within three months after the implementation of the policy in April 2016 and by 16% within three months after the improvement of the policy in January 2017.All changes in spillover effects are consistent with those in the original model.In summary, macroprudential management has played a significant role in maintaining the stability of the Chinese RMB bond market.

Fig.5.Index robust 1: FRUS change to FREU.

Fig.6 illustrates that the total spillover effect among bond markets remained stable over time, and there was a slight increase of 5%-8% in the total spillover effect after the implementation of macroprudential management in April 2016 and the improvement of these policies in January 2017.These findings are consistent with the original model.In parallel, the directional spillover effect also demonstrated overall stability,yet after April 2016, an increase ranging between 5% and 10% was observed in all directional spillover effects.Furthermore, after January 2017, the spillover effect from other bond markets to the Chinese RMB bond market and from the Chinese USD bond market to other markets witnessed an increase of 9%.These empirical outcomes lend support to the notion that the implementation and improvement of macroprudential management have indeed bolstered the interconnections within bond markets.

5.6 Volatility robustness check

Our volatility robustness checks are also divided into two tests.The first test is to change the volatility of the FTSE US Bond Index to the volatility of the FTSE EU Bond Index to replicate the result (Table A6 in Appendix).The second test is to replace the TVP-VAR model with the VAR model to replicate the result.

Fig.6.Index robust 2: TVP-VAR change to VAR.

Fig.7.Volatility robust 1: FRUS change to FREU.

Fig.7 illustrates that both the total volatility spillover effect and the directional volatility spillover effect underwent a consistent decline, and the trends are in harmony with those presented by the original model.After the implementation and improvement of macroprudential management, a significant decrease was observed in the total volatility spillover effect, signifying that macroprudential management has indeed reduced the transmission of risk between bond markets.In particular, the volatility spillover effects from other bond markets to the Chinese RMB bond market decreased significantly by 5% after the implementation of macroprudential management.These results suggest that macroprudential management is instrumental in mitigating the transmission of international risks to the Chinese RMB bond market.

Fig.8 shows that the total volatility spillover effect remained stable, but the directional volatility spillover effect displayed significant oscillations.Both the total and directional volatility spillover effects are consistent with the original model.After the implementation of macroprudential management, a decrease of 6.5% was observed in the total volatility spillover effect within a span of three months.Moreover, after the improvement of the macroprudential policy, the volatility spillover effect from the Chinese RMB Bond Index to others decreased by 7% within three months, and the volatility spillover effect from Chinese USD bonds to others also decreased by 7%.These findings collectively suggest that the implementation and improvement of macroprudential policy measures have effectively curtailed risk transmission among international bond markets, thereby mitigating the impact of international shocks.

6 Conclusions

Within the scope of this study, we have deployed a TVPVAR model as a tool to gauge the linkages between significant bond markets domestically and globally.In doing so, we have constructed total spillover and directional spillover effects at both index and volatility dimensions.Based on the above analysis, we arrive at the following conclusions:

Fig.8.Volatility robust 2: TVP-VAR change to VAR.

(Ⅰ) Since existing studies have predominantly investigated the linkages between domestic and foreign bond markets at the firm level[7]and the spillover effects between domestic financial markets at the aggregate level[8,9], our study fills this knowledge gap by examining the spillover effects between domestic and foreign bond markets at the aggregate level.Macroprudential management has increased the total spillover effect among different bond markets, the spillover effect from other bond markets to the Chinese RMB bond market, and the spillover effect from other bond markets to the Chinese USD market.Macroprudential management has strengthened the influence of foreign bond markets on Chinese bond markets,which is conducive to the internationalization process of Chinese bond market.

(Ⅱ) Despite existing research delving into the volatility spillover effects in the bond market landscape[13], the integral role of macroprudential management in the risk transmission of the bond market remains inadequately elucidated.Our study offers a crucial and scholarly supplement to this sphere of inquiry.We find that macroprudential management has reduced the total volatility spillover effect and the volatility spillover effect from other bond markets to the Chinese RMB bond market.These results indicate that the policy has improved the risk resistance of Chinese bond market and reduced the risk transmission from foreign bond markets to Chinese bond market.

On a comprehensive scale, the macroprudential management of cross-border financing has played a pivotal role in augmenting the internationalization of the Chinese RMB bond market as well as the Chinese USD bond market.After the implementation of macroprudential management, there was a notable increase in the spillover effect from other bond markets to the Chinese RMB bond market and the Chinese USD bond market.Concurrently, the volatility spillover effect within these five bond markets either maintained constancy or exhibited a decline.This observation points toward a rise in these markets’ internationalization, achieving an uptick in associated risk.Thus, the policy exerts a salutary influence on the progression toward global financial openness.Our study provides a novel approach to analyzing macroprudential management policies.However, there are some deficiencies, such as insufficient significance testing, and a relatively macrolevel analysis framework that is not detailed to specific indicators.Our next step will focus on specific micro variables and transmission pathways of macroprudential management.

Acknowledgements

This work was supported by the National Natural Science Foundation of China (72003181).

Conflict of interest

The authors declare that they have no conflict of interest.

Biographies

Pengwei Zhao is a graduate student under the tutelage of Prof.Xiao Wang at the University of Science and Technology of China.His research mainly focuses on international finance and corporate finance.

Xiao Wang is a Professor in the School of Management and an Assistant Dean of International Institute of Finance at the University of Science and Technology of China.She received her Ph.D.degree in Economics from University of Wisconsin-Madison in 2011, M.A.in Economics in 2005, and B.A.in Economics in 2003 from Peking University.Her research mainly focuses on international finance, international trade,and applied econometrics.Her work has appeared in some leading economics and finance journals, such asJournal of International EconomicsandJournal of Banking and Finance.In 2016, she received the Pushan Academic Award for Excellent Papers on International Economics.

Table A1.Index optimal lag order.

* means the optimal lag order.Same as below.

Before macroprudential management After macroprudential management Lag FPE AIC HQC BIC FPE AIC HQC BIC 6 6.10E-31 -55.38 -55.15 -54.77 6.40E-31 -55.33 -55.10 -54.72 7 6.00E-31 -55.40 -55.14 -54.70 6.30E-31 -55.35 -55.09 -54.65 8 6.00E-31* -55.41* -55.11 -54.60 6.30E-31* -55.36* -55.06 -54.56 9 6.00E-31 -55.39 -55.05 -54.49 6.30E-31 -55.35 -55.01 -54.45

Table A2.Volatility optimal lag order.

Before macroprudential management After macroprudential management Lag FPE AIC HQC BIC FPE AIC HQC BIC 1 5.50E-57 -115.36 -113.94 -114.27 2.70E-56 -113.75 -113.56 -113.30 2 9.40E-57* -115.96* -114.19* -112.95 1.30E-56* -114.46* -113.97* -113.46*3 8.50E-57 -114.90 -113.77 -111.98 1.40E-56 -114.44 -113.95 -113.26 4 1.30E-56 -114.73 -113.25 -110.90 1.60E-56 -114.28 -113.81 -112.87

Table A3.Statistics of the bond volatility.

Variable Obs.Mean SD Min Max Chinese RMB Bond Index volatility 148 8.67E-07 1.82E-06 3.10E-09 1.44E-05 Chinese USD Bond Index volatility 148 3.33E-06 4.62E-06 7.52E-08 3.17E-05 HK USD Bond Index volatility 148 2.70E-06 2.99E-06 2.56E-08 1.60E-05 HK Offshore RMB Bond Index volatility 148 3.64E-07 7.71E-07 7.94E-10 5.11E-06 FTSE Russell US Bond Index volatility 148 6.59E-06 6.80E-06 1.34E-07 4.06E-05 FTSE Russell EU Bond Index volatility 148 1.12E-05 2.56E-05 4.77E-08 2.49E-04

Table A4.All effective policies in 2015-2017.

Date Type Policy 2015-05-28 Credit Connection between services and poverty alleviation 2015-08-11 Exchange rate Exchange rate reform to make RMB marketization 2016-02-16 Credit Financial support for industry to stabilize growth 2016-03-30 Credit Increase financial support for new consumer sectors 2016-04-30 Macroprudential Implement macroprudential management 2016-09-23 Monetary Improve the issurance of financial bonds 2016-09-30 Monetary Establish a market-making support for government bonds 2017-01-13 Macroprudential Improve macroprudential management 2017-04-10 Credit Innovative financial support and services 2017-06-21 Macroprudential Mainland and Hong Kong bond market connect

Table A5.Optimal lag order in index robust 1.

Before macroprudential management After macroprudential management Lag FPE AIC HQC BIC FPE AIC HQC BIC 2 4.60E-30* -53.36 -53.09* -52.68* 2.00E-31* -56.48* -56.26* -55.93*3 4.80E-30 -53.32 -52.93 -52.33 2.10E-31 -56.46 -56.14 -55.65 4 4.60E-30 -53.35* -52.84 -52.06 2.10E-31 -56.47 -56.04 -55.40 5 4.80E-30 -53.33 -52.69 -51.72 2.10E-31 56.44 -55.91 -55.12

Table A6.Optimal lag order in volatility robust 1.

Before macroprudential management After macroprudential management Lag FPE AIC HQC BIC FPE AIC HQC BIC 1 4.20E-55 -111.02 -110.59 -109.92 4.80E-56 -113.19 -113.01 -112.73*2 6.70E-55 -110.24 -109.81 -108.57 3.90E-56 -113.39 -113.13* -112.64 3 9.90E-55* -110.58* -109.12 -107.33 3.60E-56* -113.46* -112.90 -112.19 4 1.10E-55 -110.22 -108.74 -106.39 4.10E-56 -113.34 -112.71 -111.77

Fig.A1.RMB exchange rate in 2017.