Attention: The impact of media attention on market reaction to corporate violations

Chenxi Wang, and Lei Zhou ✉

1School of Management, University of Science and Technology of China, Hefei 230026, China;

2School of Public Affairs, University of Science and Technology of China, Hefei 230026, China

Abstract: Reducing market volatility and achieving high-quality development are important tasks for the Chinese capital market at the present stage.Based on the asset pricing role of media, this study used the event study to empirically examine the impact, as well as the heterogeneity from type and emotional tendency, of media attention on the market reaction to corporate violations from the perspective of limited attention.The results showed that the media’s prior attention to the listed company has a significantly negative impact on the market reaction after the company’s violation.The attention of network media and policy-oriented media has a significantly negative correlation with the market reaction after the company’s violation, while market-oriented media has no significant impact.Compared with neutral media attention, negative and positive media attention trigger more severe negative market reaction after company violations.Furthermore, the negative impact of media attention on the market reaction after corporate violations is mainly manifested in non-state-owned enterprises.The results demonstrate the important role of media attention in asset pricing and have important practical significance for better playing the role of the media, protecting the rights and interests of investors and achieving high-quality development of the capital market.

Keywords: media attention; corporate violations; market reaction

1 Introduction

The impact of corporate violations on market value has always been a focal issue for the government, industry, and academia.Numerous studies have demonstrated that violations of listed companies result in negative market reactions[1-3].Previous research has identified various factors that have significant impacts on the market reaction after a corporate violation, including internal governance and external environmental factors such as the level of social responsibility[4], power structure of senior executives[5], industry characteristics[6], and the level of social trust[7].In the past 30 years,China’s capital market has rapidly developed into an important resource allocation tool and social wealth management platform.However, with the growing number of listed companies and increasingly strict supervision, corporate violations have surfaced more frequently in China’s capital market.These violations have led to abnormal stock price fluctuations and infectious market reactions[8,9], which have greatly damaged companies’ reputations and investors’ interests while also seriously disrupting the normal order and sustainable development of the capital market.As China’s capital market enters a stage of high-quality development, it has become an important strategic task to reduce market volatility and promote the stable operation of the capital market.

As an independent third party in the capital market, the media plays a crucial role in exposing, disseminating, and supervising the violations of listed companies.Extensive media coverage attracts more attention from stakeholders,particularly investors, on corporate violations, which exacerbates the negative fluctuation of a company’s stock price after the fact[10].In the era of information explosion, media not only conveys information to investors but also dominates their attention, influencing their perceptions and investment decisions[11].Limited attention theory reveals that media plays a unique role in allocating investors’ attention resources, which plays a significant role in predicting stock market returns[12,13].Most of the literature examines the impact of media attention on corporate value from the perspective of the media’s information dissemination function[14].However, China’s capital market has more than 200 million individual investors[15],and as an essential channel for these investors to obtain market information, the media is likely to interfere with them,leading to irrational behavior and boosting stock market volatility[16].Moreover, previous studies on the relationship between media and stock price fluctuations have mainly focused on easily identifiable media reports such as market rumors, clarification announcements, and corporate earnings announcements[17-19].Although existing literature has demonstrated the role of after-the-event media coverage in supervising corporate violations from the perspective of external governance, there is still a lack of detailed discussion about the asset pricing role of media’s prior attention in the event of corporate violations[18].Therefore, it is of great theoretical and practical significance to clarify the impact of the media’s prior attention on market reaction after violations.

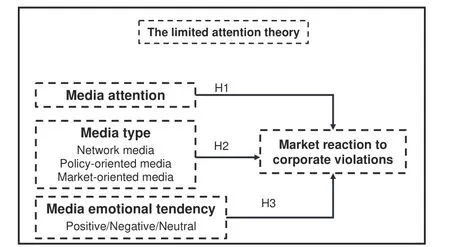

This study employs the event study method to investigate the relationship between the media’s prior attention to listed companies and the market reaction after corporate violations from the perspective of the asset pricing role of media coverage.Compared to prior research, this paper makes several significant contributions.First, while previous literature focuses on the after-the-event reporting and correction effects of media attention on corporate violations from the perspective of external governance, this study systematically examines the impact of media’s prior attention to listed companies on market reaction after corporate violations from the perspective of asset pricing.This study fills a gap in relevant research and deepens the understanding of the role of media attention in capital markets.Second, existing literature mainly utilizes traditional media data, such as newspapers and TV, to study the role of media in capital pricing.However, in recent years,there have been significant changes in the communication mode and operational pattern of the media field, with network media rising rapidly and quickly gaining market share.Therefore, this study incorporates network media data into traditional media data to measure media attention more comprehensively and obtains media attention data through a professional database, effectively avoiding the problems of low sample size, statistical errors, and sample self-selection caused by manual collection in existing studies.Third, existing studies typically utilize a single type of media attention,with relatively simple indicators.In this study, media attention is detailed across multiple dimensions to further explore the effects of different types and emotional tendencies of media attention.The research framework is shown in Fig.1.The results provide a new perspective and richer information for comprehensively understanding the operation of the capital market.

2 Theoretical background

Fig.1.Research model.

The impact of media on asset pricing has been a longstanding topic of interest in academia.Research has consistently demonstrated that media attention can lead to fluctuations in stock prices within the capital market[20].Studies have also shown that media coverage can either initiate or exacerbate fluctuations in a company’s market value[21-23].For example, Mitchell and Mulherin[24]discovered a strong correlation between the number of daily news announcements released by Dow Jones and market activity such as trading volume and returns.Further, both Chan[25]and Tetlock[26]found that negative media coverage resulted in lower stock returns.In another study, Takeda and Yamazaki[27]conducted an event study analysis on Japanese listed companies and identified a significant relationship between a company’s stock price and television coverage.Furthermore, excessive media coverage can result in extreme fluctuations in stock prices[28].

As the main component of market behavior, what is the role of investors in media asset pricing? According to limited attention theory, people have limited capacity to process external information.When faced with vast market information,investors tend to exhibit selective attention behavior[29].Limited attention can significantly affect investors’ judgment of the situation, which is evident in their trading behavior and stock market response[30].The media’s focus on the daily operations of listed companies is an important channel that directs investors’ attention and plays a crucial role in allocating their attention[12].Compared to stocks that lack media attention, stocks that receive widespread coverage have higher trading volumes.The media’s coverage attracts investors’ attention, which affects their trading behavior.This observation further highlights the fact that the media’s impact on the capital market is achieved by influencing investors[31].Attention drives investors to trade, and when significant events occur, investors react more quickly to public information due to the attention they payed[32].Under the constraints of limited attention, the media not only transmits market information but also guides market attention and trading behavior, which may cause temporary price deviations and reversals, leading to further market price fluctuations[33,34].Investors’ insufficient attention to corporate earnings information leads to stock price inertia returns, while their excessive attention to prior information leads to stock price reversal[17].

Due to investors’ limited attention, media attention not only impacts investors’ allocation of attention but also affects their emotions and psychology[35,36].When guided by the media, investors’ focus on a specific company consumes their attention resources.Media reports and emotions reinforce investors’ first impression, risk attitude, and income expectation of the company[37,38].Some studies have shown that media coverage has the power to infect market sentiment, and abnormal media coverage can lead to strong emotional fluctuations that cause the company’s stock price to deviate[39,40].Rodriguez and Garza[41]also confirmed that media sentiment plays a crucial role in investors’ behavioral choices, which in turn affects the stock market’s stability.Negative media reports have a greater impact on stock price volatility[42].When the media reports overly optimistic sentiment, the market’s future expectations will be higher, significantly increasing the probability of extreme volatility in the company’s future stock price[43].Additionally, different types of media have varying reportage amounts and emotional tendencies, resulting in diverse effects on the stock market by affecting investors’ attention and emotions[39].China’s media environment is unique,and there are significant differences between traditional media and Internet media in terms of authority, credibility,and audience[44].Due to their different positions and motivations, various media types have different content emphases and emotional tendencies, leading to varying degrees of attraction and influence on investors[45].

In conclusion, drawing from the limited attention theory,the mechanism of media attention affecting stock price fluctuation can be summarized from two aspects.Firstly, due to investors’ limited time and energy, media attention interferes with the allocation of investors’ attention, resulting in attention deviation towards different companies in trading market,ultimately affecting investors’ behavior and the resulting stock price.Secondly, within the available market information, limited attention leads to investor decisions being influenced by the type of media attention and sentiment in reports,leading to expectation deviation and anchoring effect in the investment process.

3 Hypothesis development

3.1 Media coverage and market reaction to corporate violations

The impact of the media on the capital market is realized by influencing investors’ attention[46].Barber and Odean[31]found that individual investors exhibit attention-driven stock trading behavior.Limited attention theory clearly identifies attention as a scarce cognitive resource, and media reports can disrupt investors’ attention allocation[47].With limited attention,investors focus on one aspect at the expense of another, and therefore, how they allocate their attention affects the importance and acceptance rate of information.In the context of insufficient investor attention, the market may not respond promptly to firm-specific information[17,48].Therefore, market information that attracts investors’ attention can be reflected in stock prices.Due to the media’s aggregation effect, a vast number of media reports attract limited attention from investors, and the stock price of companies that can capture investors’ attention is more prone to fluctuate.Limited attention theory provides a robust explanation for the short-term overreaction of investors in the capital market to new information due to media attention.In empirical research, scholars have discovered that the media can amplify the effect of investors’ attention on stock returns[49,50].Limited attention or over-attention can cause investors to under or over value news about specific company stocks, resulting in stocks deviating from their intrinsic value.This overreaction phenomenon is prevalent in the Chinese capital market[51].

According to the theory of limited attention, the media’s pre-reporting on listed companies exposes them to a wider range of investors compared to companies that lack media attention.When the company’s violations are exposed, more stakeholders participate in the event and react, causing greater fluctuation in stock prices.Moreover, the salience and accessibility of negative information further reinforce its impact on investors[52,53].As a result, investors’ cognitive level and processing speed of relevant information about the listed company significantly increase, making them more sensitive to the company’s violations and more prone to overreaction,ultimately amplifying the stock market’s response to the company’s violations.Hence, Hypothesis 1 (H1) is proposed as follows:

H1: The higher the media prior attention, the stronger the market reaction to corporate violations.

3.2 Media type and market reaction to corporate violations

The impact of media reports on investors is multifaceted, and the effects of different types of media may vary.The attributes of media are an important reference for investors to judge the subtext behind media reports and affect the level of trust that investors have.In China, official media and business media are clearly distinguished[54].Official media, as the mouthpiece of the government, not only plays the role of information transmission but also undertakes the function of political communication.Sponsored by government agencies,policy-oriented media have a semi-official color and play an important role in the market.Policy-oriented media take the lead in issuing relevant policies, laws, and regulations and help to shape the legitimacy of the company.However, policyoriented media may punish companies with high legitimacy more severely for violating stakeholder expectations.Marketoriented media, on the other hand, focus more on the basic information, daily business activities of listed companies, pay more attention to hot current affairs[44], and their content is relatively more independent.Some literature suggests that the credibility of market-oriented media is weak, and they may have loose content review standards, leading to low-quality reports such as false news and empty news.As a result, their influence on investors and companies is limited[55,56].

With the continuous integration of the Internet and media,network media not only has a high efficiency of information dissemination but also contains a wider range of content.The extensive coverage of listed companies by network media attracts more attention and participation from stakeholders.Currently, the role of network media has become increasingly important and even surpassed that of traditional media[57].Previous studies on the impact of different types of media have categorized media into three types: policyoriented media, market-oriented media, and network media.It was found that strengthening the attention of network media and policy-oriented media can effectively improve the quality of internal control of companies, while market-oriented media has no significant impact on the quality of internal control of companies[56,58].Compared to policy-oriented media,network media may have slightly lower credibility, but it compensates with wider audience coverage and a certain influence among investors due to its rich content and efficient dissemination.Policy-oriented media may not be as efficient in communication as network media, but it has inherent advantages in in-depth reporting and attracting more loyal audiences.Additionally, its semi-official nature provides policyoriented media with a head start and authentic endorsement[55,56].Despite the rapid development of network media, the influence of policy-oriented media cannot be overlooked.Due to differences in reporting content, information credibility, and audience coverage, the attention and coverage of different media types toward listed companies before a violation event may have varying effects on investors.Accordingly, Hypothesis 2 (H2) is proposed as follows:

H2: Compared to market-oriented media attention, policyoriented media attention and network media attention have a more significant impact on the market reaction to corporate violations.

3.3 Media’s emotional orientation and market reaction to corporate violations

Financial news affects investor behavior and decisions by influencing their emotions, ultimately impacting the stock market[39].Media reports are often subjectively emotional, and studies have found that the emotional tone of media reports affects investors’ psychology, leading to irrational trading behavior and short-term stock price fluctuations[59].Additionally,the media plays a crucial role in shaping investor expectations[46].The rise and fall of stock prices reflect investor and market expectations, and media reports mainly influence investors by interfering with the formation of their expectations.Investors’ expectation level of future earnings leads to their overreaction and underreaction in the stock market[40].

The investment decision under the constraint of limited attention is prone to distortion after positive or negative media coverage.Compared to neutral reports, positive media reports are more likely to stimulate investors’ optimism and raise future expectations, leading to the “ostrich effect” in which investors ignore negative information and exacerbate their irrationality[43].Among all reports in the media, negative reports are more likely to attract investors’ limited attention and have a more significant impact on their decision-making behavior[55].Therefore, before a company’s violations are exposed, the different emotional tendencies of media reports lead to differences in investors’ psychology and future expectations.

Positive media attention can increase investors’ expectations of a company’s stock returns[46].However, when a subsequent negative event occurs, such as a violation, it strongly deviates from investors’ positive expectations, leading to greater negative emotions and cognitive dissonance among investors.On the other hand, negative media reports can attract investors’ attention, and company violations aggravate investors’ dissatisfaction with the company.Therefore, compared to neutral media attention, both positive and negative media coverage make investors more prone to excessive behavior by influencing investor sentiment and attention, which has an impact on corporate value after violations and exacerbates the degree of market reaction.Hence, Hypothesis 3(H3) is proposed as follows:

H3: Compared to neutral media attention, positive and negative media attention can lead to more significant negative market reactions after corporate violations.

4 Methods

4.1 Selection and data sources

This study uses the event research method and focuses on the violations of A-share non-financial listed companies in China from 2016 to 2020, which were disclosed by the Securities Regulatory Commission and the Shanghai and Shenzhen Stock Exchanges.

This study includes 455 cases of violations based on the following criteria: ① exclusion of samples from listed companies involved in major events affecting stock prices within one year before the violation, such as equity incentives or important contract acquisitions; ② exclusion of samples from companies that have been or are currently ST or ST* during the sample period; ③ exclusion of samples from companies whose stocks were suspended from trading within the event window or whose trading was suspended for more than seven days during the estimated period; ④ exclusion of samples from companies that violated rules multiple times within a year to avoid cross-influence; and ⑤ deletion of samples with missing core data.

The violation data is obtained from the China Stock Market & Accounting Research Database (CSMAR), while the media data is collected from the China Research Data Service Platform (CNRDS).

4.2 Variable definition

4.2.1 Explained variable

To capture the potential impact of violations on the company’s stock market reaction, this study considers the day of the listed company’s violation announcement and the trading day before and after as the event period.The market reaction after a company’s violation is measured using the cumulative abnormal adjusted return (CAR) associated with the violation over a time window of ( - 1,1).Referring to previous literature, choosing 3 days as the time window can capture the possible information leakage before the event and minimize the interference of other events to the CAR except violations[60,61].

Abnormal return is measured by the percentage difference between normal expected return and actual return.Following existing research[61], this study calculates the normal expected return based on the historical data of 128 to 8 trading days before the violation event, which is a total of 120 trading days.The daily volatility of market returns is calculated by using the equal-weighted average method with the SSE Composite Index (index code: 000001) and Shenzhen Component Index(index code: 399001).Individual stock returns and stock market data are obtained from the CSMAR database.Following existing research[50], this study uses the market model to calculate the normal expected return:

In thismodel,Ritis thedailyreturn rate ofindividualstocks on dayt,Rmtis the dailyreturn rate of themarketon dayt,αiis the intercept term, βiis the systematicrisk,and ϵitisthe error term with zero mean.Then, the abnormal return is further calculated as follows:

where ARitis the abnormal return of stockion dayt, and αiand βiare the estimated parameters obtained by ordinary least squares regression.Therefore, the cumulative abnormal return rate of stockiin the time window of ( -1,1) is:

The CARiin Eq.(3) is the explained variable of this paper(the market reaction after the company violates the rules).

4.2.2 Explanatory variables

For the measurement of media attention, the number of media reports is often used as a quantitative index in previous literature[39,62].Li and Shen[40]measured media attention based on the amount of coverage in six major newspapers, such asChina Securities JournalandSecurities Daily.With the development of information technology and digital media, the access channels to media reports have become more diverse.Some studies obtained the news of listed companies directly from databases for research purposes[12,37].To ensure the completeness of the data, this paper includes both network media coverage and newspaper media coverage as the quantitative indices of media attention.Following the practice of Dyck et al.[63]and Wu et al.[64], the total number of media reports about listed companies in the three months before the violations is obtained through the Corporate Financial News Database of CNRDS.The media attention of the company is measured using this method.

For the classification of media types, following previous literature[40,55,56], this study divides media attention into three categories: network media attention, policy-oriented media attention, and market-oriented media attention.The network media attention comes from the CNRDS company’s characteristic database, which includes statistics on financial news from various online sources, such asTencent News,Toutiao,Sina Watch Point,Sohu News Client,Guancha Syndicate.Policy-oriented media attention and market-oriented media attention are manually collected from media reports of eight important newspapers in the full-text database of important Chinese newspapers[45].Specifically, policy-oriented media attention is obtained fromSecurities Times,Securities Daily,China Securities Journal, andShanghai Securities News,while market-oriented media attention is obtained fromChina Business News,Economic Observer,21st Century Business Herald, andChina Business News.

Finally, considering the bias of media coverage, this study categorizes media attention into three types based on the reporting emotional tendencies: negative, positive, and neutral.The objective is to examine whether the emotional tone of media reports has varying effects on the company’s stock market response.

4.2.3 Control variables

To control for data heterogeneity, referring to relevant literature[19,55], this study selects control variables from financial performance and corporate governance levels, which may affect corporate value after corporate violations.These variables include enterprise size (Size), enterprise age (Age),board size (DN), ratio of independent directors (IDR), ownership concentration (Own), regulator (Audit), earnings per share (EPS), financial distress (Loss), financial leverage(Lev), operating performance (ROA), and enterprise growth(Growth).Moreover, we introduce year and industry dummy variables as fixed effects estimators.The detailed definitions of these variables are presented in Table 1.

4.3 Model design

To test the relationship between media coverage and market reaction after listed companies violate regulations, this paper builds a multivariate linear regression model as follows:

Here,iis the listed company, CARiis the cumulative abnormal adjusted return before and after the company’s violation announcement, “Media” is the variable related to media attention,αistheconstant term,β0isthecoefficientof theexplanatoryvariable,and ϵisthe randomdisturbanceterm.“Industry” and “Year” fixed effects are added into the regression model.The explanatory variables are incorporated into the model to test the three sets of hypotheses.

5 Results and analysis

5.1 Descriptive statistics

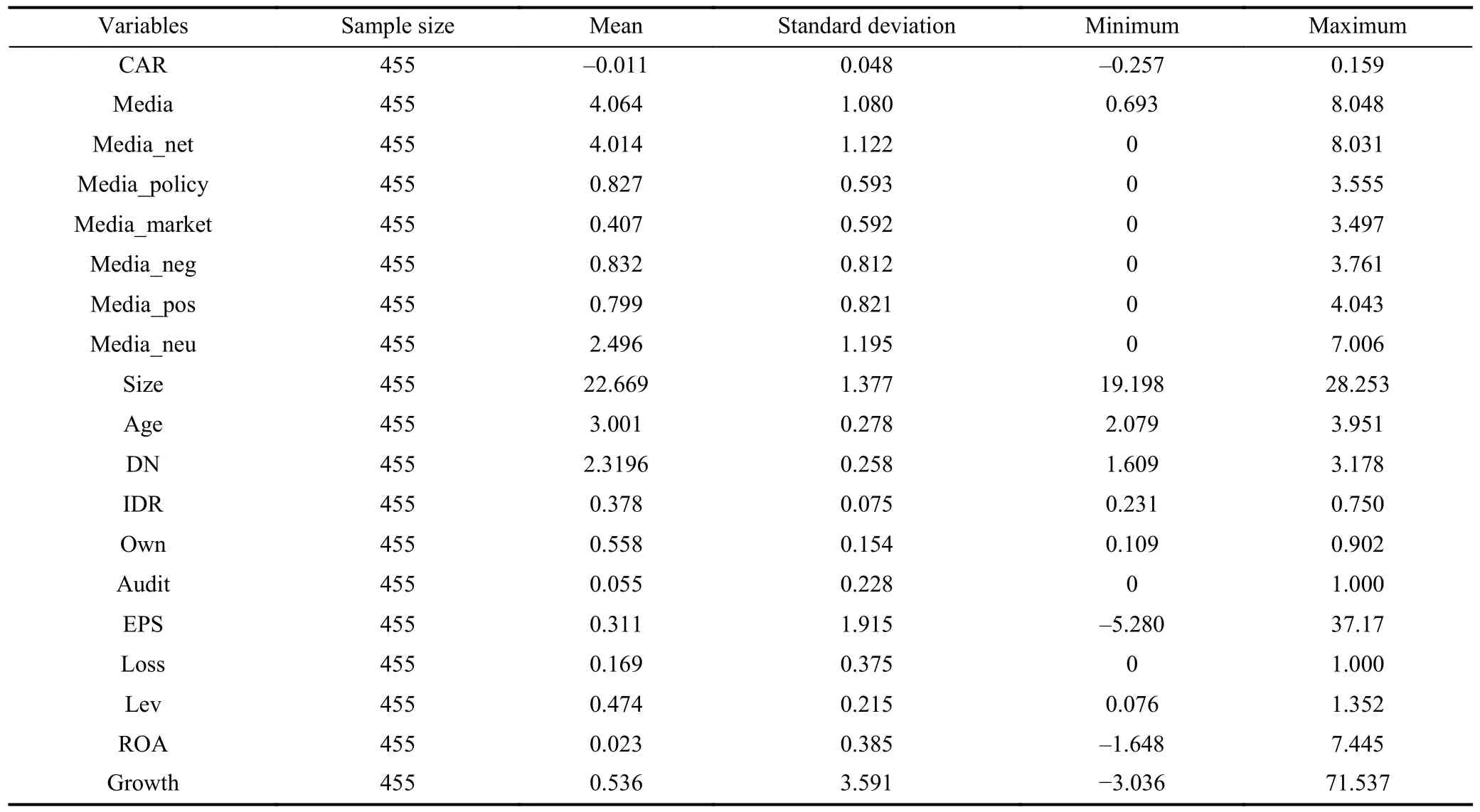

Table 2 shows the descriptive statistics of the main variables.The mean value of CAR is -0.011, indicating a general negative fluctuation in the market reaction after corporate violations.The range of CAR suggests that violation events have varying degrees of impact on the stock market reaction of different companies.The descriptive results of media attention indicate that there are notable variations in media attention to different listed companies prior to the violation.Additionally,there are great differences in media type and emotional tendency of media attention.The standard deviation of some control variables is generally large, which reflects that there are great differences among listed companies in business strategy,governance level, and financial status.

In addition, the variance inflation coefficient of each main variable is calculated by the VIF method.The calculated values of each variable are less than 2, which verifies that there is no serious multicollinearity problem in the model.

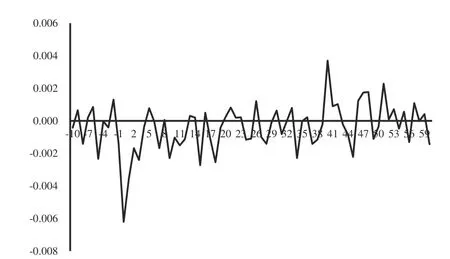

Fig.2 shows the average abnormal earnings (AAR) before and after the announcement of 455 corporate violations during 2016-2020.The ARR fluctuated significantly during the window period ( -1,1).Over time, AAR gradually recovered to positive.The change in the AAR trend confirms that there is indeed an overreaction of investors in the stock market,consistent with bounded rationality theory[61].

5.2 Regression results

5.2.1 Media attention and market reaction to corporate violations

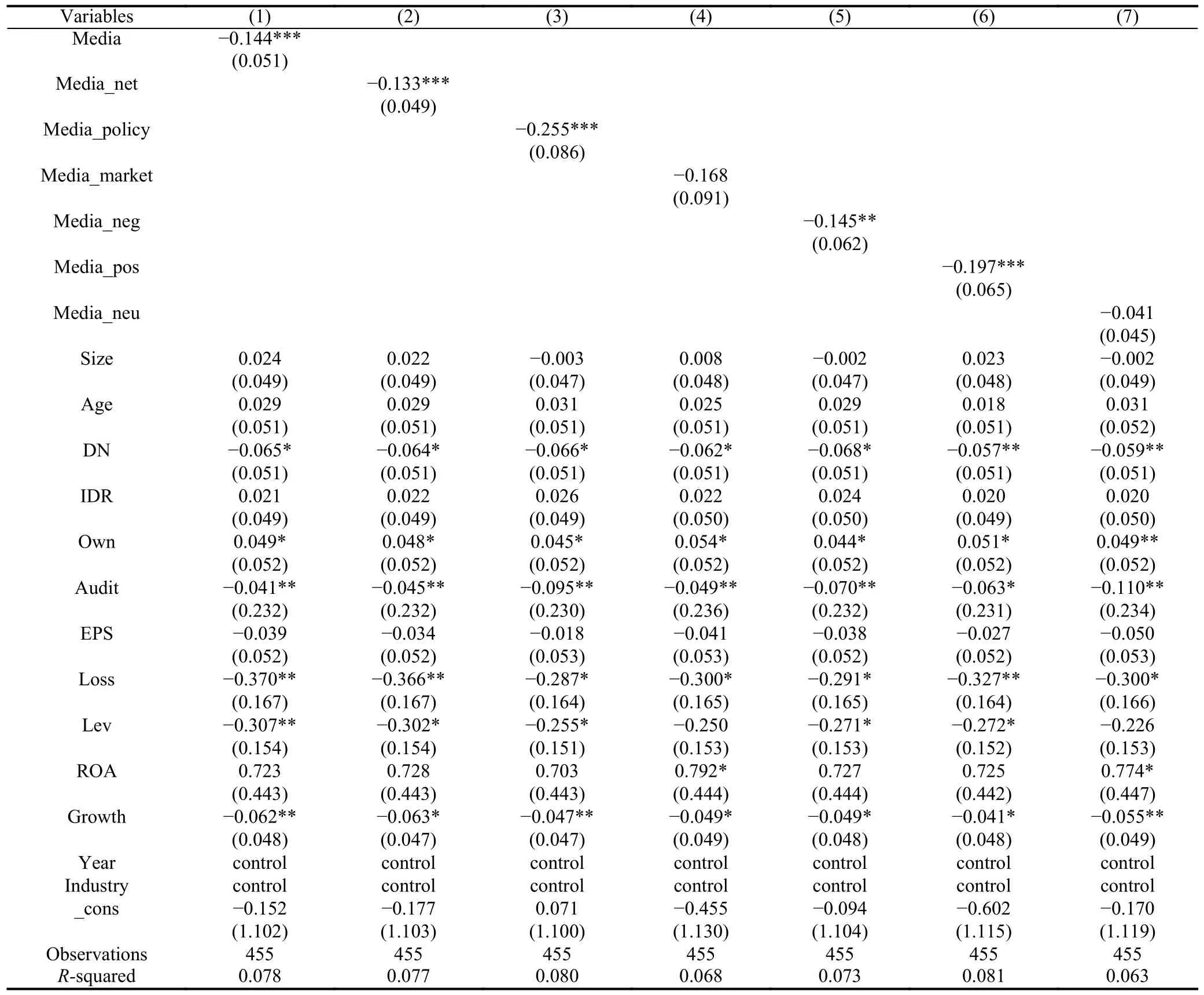

The regression results of the impact of media attention on the market reaction to listed companies’ violations are presented in Table 3.The results of Column (1) show that the regression coefficient of media attention is significantly negative at the 1% confidence level.This finding suggests that higher media attention before the violation of a listed company leads to a lower cumulative abnormal return associated with the violation.In other words, media attention intensifies the negative volatility of the market reaction, thus supporting Hypothesis 1.

5.2.2 Media type and market reaction to corporate violations

Columns (2)-(4) report the impact of different types ofmedia attention on the market reaction of listed companies after violations.The regression results show that both network media attention and policy-oriented media attention significantly and negatively affect the market reaction of listed companies after violations, while the effect of market-oriented media attention is not significant.This suggests that, compared with the extensive coverage of network media and the authority of policy-oriented media, market-oriented media has a weaker appeal and influence on investors.The ability of market-oriented media to influence investors’ decisions and behaviors prior to a company’s violations is limited, making it challenging to trigger a strong market reaction after violations.Therefore, Hypothesis 2 is supported.

Table 1.Variable definition.

Table 2.Descriptive statistics of each variable.

Fig.2.Abnormal return rate after corporate violation.

5.2.3 Media emotional tendency and market reaction to corporate violations

Columns (5)-(7) report the impact of media attention with different emotional tendencies on the market reaction of listed companies after violations.The regression results demonstrate that both negative and positive media attention have a detrimental impact on the market reaction to corporate violations.Conversely, neutral media attention is negative but not significant.This indicates that neutral media attention has no significant impact on the market reaction after the company’sviolation.Hence, Hypothesis 3 is confirmed.

Table 3.Media attention, media type, media emotional tendency, and market reaction to listed companies’ violations.

5.3 Robustness test

We conducted a series of robustness checks to further corroborate our results.

First, we changed the measurement method of the explanatory variable.Referring to Liang et al.[65], we extend the observation range of media’s attention to listed companies and use the number of media reports on the company in the year before the announcement of the company’s violation as a new proxy variable for media attention.The coefficient of media attention is found to be significantly negative, consistent with the empirical results in the previous text.The coefficients and significance of media attention for different media types and emotional tendencies remain unchanged, which is consistent with the previous test results.See Table A1 in Appendix.

Second, we changed the measurement method of the explained variable.In the previous analysis, the market reaction of listed companies after violations was measured by CAR of the day before and after the announcement of the violation.Following relevant literature[64], we calculate the minimum value of the CAR for three consecutive days within a window period of ( -10,60) and remeasure the market reaction of listed companies after violations.We then include this new measurement in the regression model for testing.The test results are consistent with the empirical results presented earlier.See Table A2 in Appendix.

Third, we excluded extreme values to avoid affecting the baseline regression.Following relevant literature[31], all continuous variables are Winsorized with a 5% up-and-down tail.We repeat the regression analysis and find that the test results are consistent with those mentioned earlier.See Table A3 in Appendix.

After the above robustness test, the conclusions have not changed, and the research results in this paper are robust.

5.4 Further exploration

5.4.1 The emotional tendency of different media types and market reaction to corporate violations

To investigate the impact of different media types’ emotional tendencies on the market reaction after listed companies’ violations, this study categorizes network media attention, policyoriented media attention, and market-oriented media attention into three groups based on the emotional tendency of the reports: negative, positive, and neutral.

The regression results in Table 4 show that the negative attention (Net_neg) and positive attention (Net_poc) of network media have a significant negative impact on the market reaction of the company after the violation, whereas the impact of neutral attention (Net_neu) of network media is insignificant.For policy-oriented media attention, negative attention (Policy_neg) and positive attention (Policy_poc) have a significantly negative relationship with the market reaction after violation, but neutral attention (Policy_neu) has no significant relationship.As authoritative media in the capital market, policy-oriented media has more influence and communication power[19,44].Positive reports on listed companies before violations release positive signals to investors and the market.Corporate violations are negative events that affect corporate image and reputation, which contrasts with previous policy-oriented media reports, seriously affecting investor psychology and behavior, thus exacerbating the negative market reaction.

Regarding market-oriented media coverage of companies before violations, only negative attention shows a significant negative correlation with the market reaction following violations.Market-oriented media attention to the daily business activities of listed companies enables investors to obtain relevant information.Compared with positive and neutral reports, negative reports are more likely to affect or predict the future trend of stock prices[55].Therefore, negative reports of market-oriented media are more likely to attract investors sensitive to investment returns, which is reflected in the stock market and intensifies the market reaction of the company after the violation.

5.4.2 The impact of media attention on companies with different ownership natures

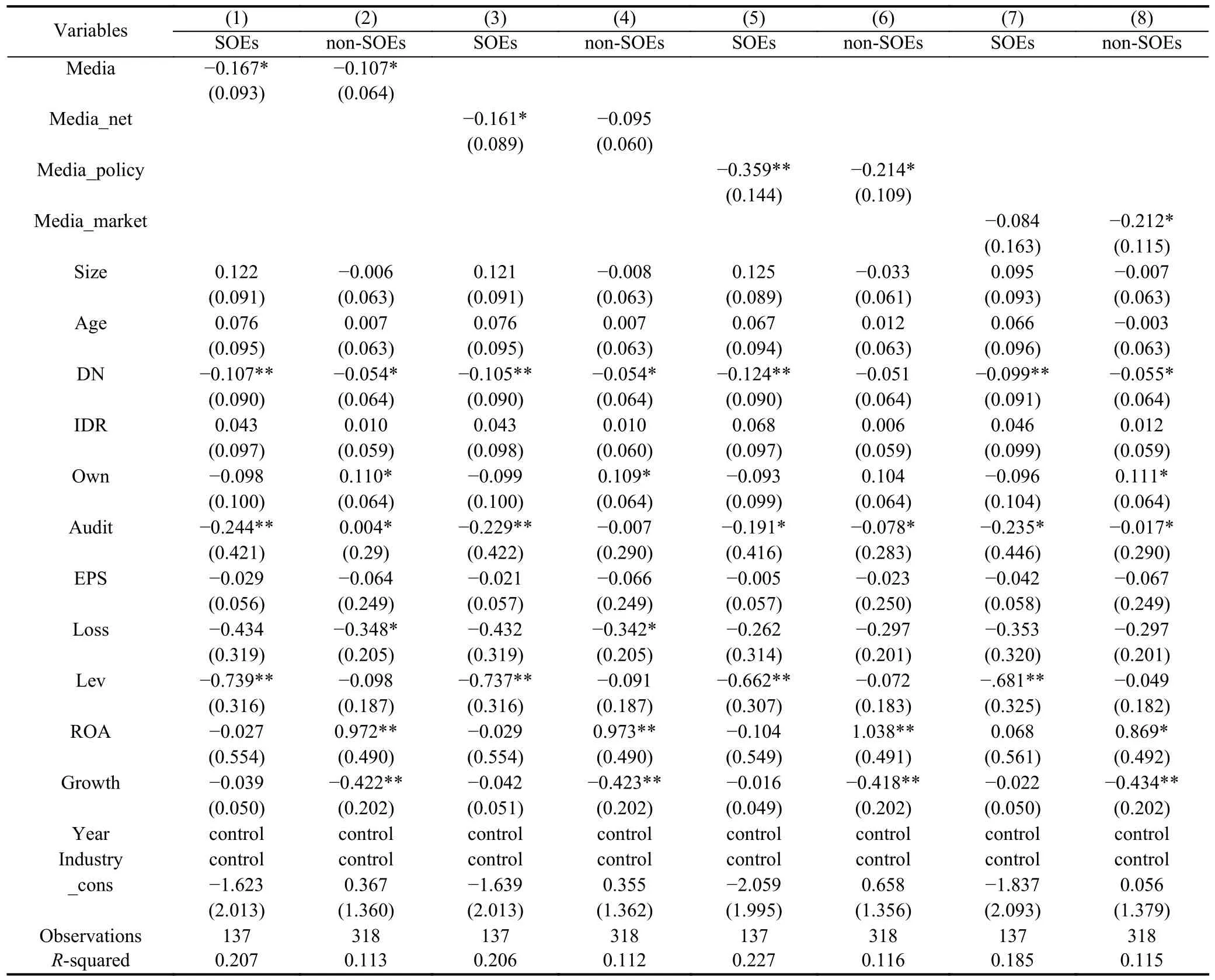

Does the effect of media attention on listed companies vary depending on the nature of their property rights? This study examines whether there is a difference in the impact of media attention on the market reaction to corporate violations for two types of listed companies: state-owned enterprises(SOEs) and non-state-owned enterprises (non-SOEs).The results of the regression analysis are shown in Table 5.

The results indicate that media attention before corporate violations has a significantly negative impact on the market reaction for both SOEs and non-SOEs.However, the effect of media coverage on SOEs and non-SOEs varies.Specifically,for SOEs, the attention from both network media and policyoriented media has a significant negative impact on the market reaction after their violations, whereas market-oriented media attention has no significant effect.For non-SOEs, only market-oriented media attention has a significantly negative relationship with the market reaction after corporate violations, while network and policy-oriented media attention have no significant impact.

This result is in line with the nature of listed companies’property rights.On the one hand, investors not only are influenced by the media, but also have the subjective initiative to choose information sources[45].With the increasing popularity of the Internet, investors find it easier to obtain relevant information about SOEs through network media and policyoriented media.Therefore, they are more inclined to rely on these sources to gather information about SOEs.On the other hand, policy-oriented media reports with semi-officials are more likely to attract the attention of regulators, while network media reports with a wider audience are more likely to influence public opinion.As state-owned listed companies pursue economic profits, they also prioritize their public image.Therefore, compared to market-oriented media, network media and policy-oriented media play a more significant role in the market reaction of SOEs after violations.For non-SOEs, market-oriented media, being industry leaders in professional financial media, provide original and independent reporting.Investors are more likely to seek relevant information about non-SOEs from market-oriented media,which explains why market-oriented media has a moresignificant impact on the market reaction after non-SEOs violate regulations.

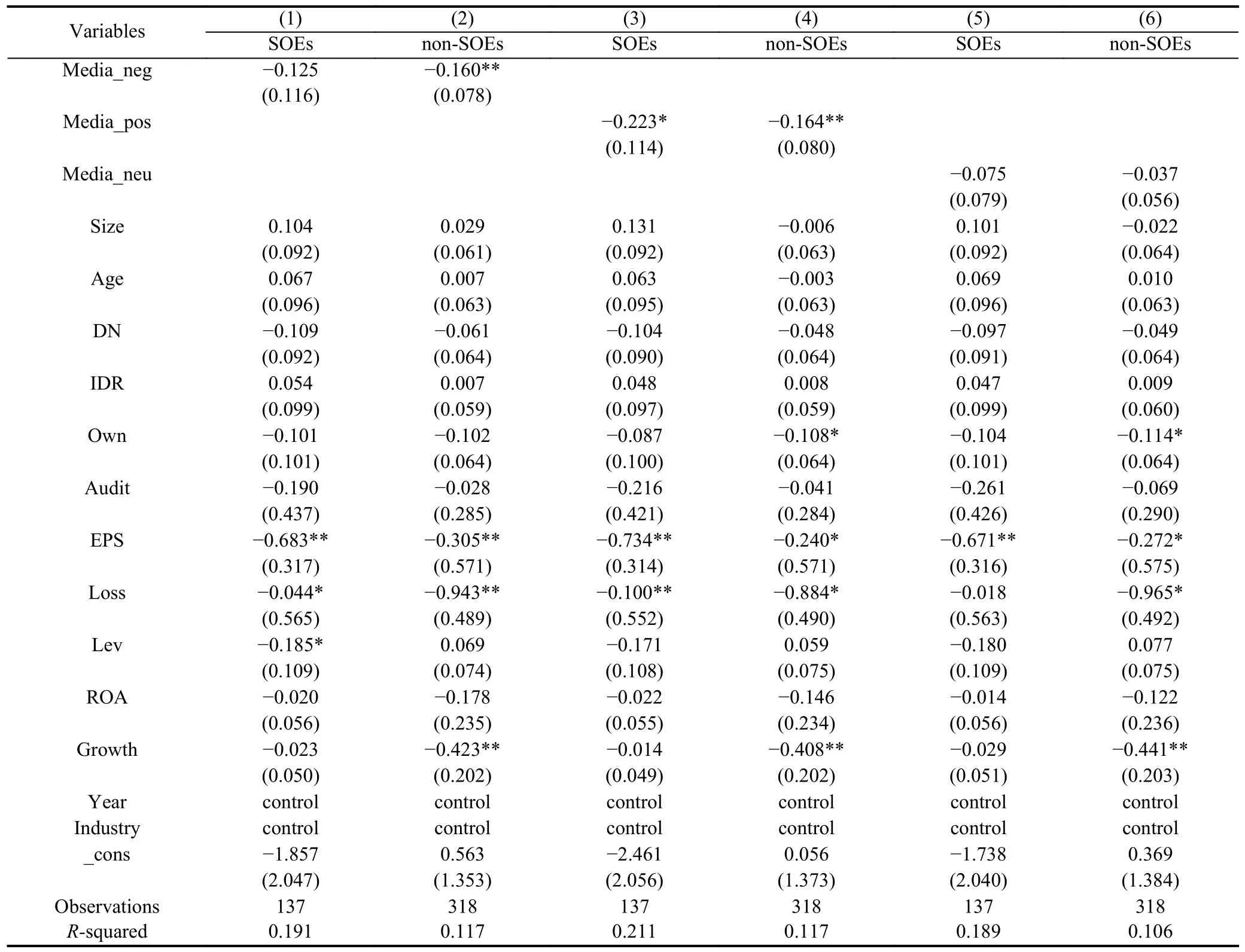

This study also examines the impact of the media’s emotional tendency on the market reaction of corporate violations with different property rights, and the findings are shown in Table 6.The results indicate that for SOEs, positive media coverage before the violation has a significantly negative effect on the market reaction after the violation, while negative and neutral media coverage have no significant impact.Investors tend to have higher expectations for SOEs due to positive coverage, which makes the market reaction after the violation more influenced by positive media attention.In the case of non-SOEs, both negative and positive media coverage significantly exacerbate the negative market reaction after the violation, whereas the effect of neutral media coverage is not significant.

In addition, to ensure the robustness of the results, we conducted inter-group difference tests on the above results.Based on the seemingly unrelated regression, the results of this study show that there are indeed significant differences in the types of media attention and media coverage emotions between SOEs and non-SOEs.See Table A4 in Appendix.

6 Discussion and conclusions

6.1 Conclusions

The market response to corporate violations has drawn increasing attention from academia.In China’s unique market and media landscape, the media plays a crucial role as an observer and promoter of the capital market, and its relationship with the market performance of listed companies is tightly intertwined.However, there is still a lack of detailed analysis and empirical testing on the effect of media attention on the asset prices of companies after violations.Using the eventstudy method, this study empirically examines the correlation between media attention and market reaction to corporate violations, and the results show that prior media attention to a company has a significant negative impact on market reaction following corporate violations.The main research conclusions are as follows.

Table 5.Media attention, media type, and market reaction after the violation of different property rights companies.

First, the higher the media prior attention, the stronger the negative market reaction after the company violates the rules.The higher the media attention given to the listed company before its violations are revealed, the greater the company attracts the attention of investors.Limited attention and excessive attention caused investors to overreact, which aggravated the negative market reaction after the violations.Second, the type of media attention has a varying impact on the market reaction after companies violate regulations.Network media and policy-oriented media attention have significantly led to a negative market reaction after the company’s violations,whereas the impact of market-oriented media is relatively limited.Third, media attention with different emotional tendencies has varying effects on the market reaction following corporate violations.Negative and positive media attention exhibit a significantly negative relationship with the market reaction after corporate violations, whereas neutral media attention has no significant relationship with it.Last, media attention has varying effects on companies with different property rights.SOEs’ market reaction after violating regulations is significantly negatively affected by network media attention and policy-oriented media attention, whereas non-SOEs are primarily negatively affected by market-oriented media attention.In terms of different media emotional tendencies,SOEs’ market reaction after violating regulations is only affected by positive media attention beforehand, while non-SOEs are affected by both negative and positive media attention.

6.2 Theoretical contributions

First, this study provides an empirical analysis of the longterm process of the capital market’s reaction to violations of listed companies by examining the relationship between previolation media attention and market reaction.The asset pricing effect of media is explored, which enriches the relevant theoretical research on violations of listed companies.Previous literature has mainly focused on the media’s external supervision and post-publicity and its governance role inthe violations of listed companies.Less research has been conducted on how the media affects the consequences of corporate violations.Therefore, our results offer empirical support for the price-determining role of media and fill the research gap.

Table 6.Media’s emotional tendency and market reaction after the violation of different property rights companies.

Second, by focusing on the situation of listed companies’violations and applying limited attention theory, this paper empirically examines the negative impact of media coverage on the market reaction after listed companies’ violations.It expands the application scenarios of limited attention theory in financial markets.

Third, this paper decomposes media attention and reveals that heterogeneous media attention has different effects on asset pricing.Our study expands the research scenario to include multidimensional media coverage affecting listed companies’ violations.The results update and deepen the understanding of the role of media coverage in the capital market and provide empirical support for a comprehensive study of the effect of media coverage.

Fourth, the results demonstrate that prior media attention has varying effects on the market value of listed companies with different property rights.Through the lens of behavioral finance, this paper connects the impact of media coverage on corporate value with the inherent attributes of the company,shedding light on the study of the consequences of listed companies’ violations.

6.3 Managerial implications

This paper presents an empirical examination of the impact of prior media attention on stock price volatility after corporate violations from the perspective of asset pricing, which enriches the related research on the role of media in capital markets and market reaction after violations.Based on our research findings, we suggest several practical implications for media, investors, listed companies, and government regulators.

For the media, in today’s highly connected society, the traditional media’s role should not be underestimated, despite being influenced by network media.In particular, policyoriented media holds high authority and credibility, and its quality content attracts investors’ attention, playing an irreplaceable role in the capital market.Thus, it is necessary to improve and strengthen the governance role of media so that listed companies face pressure to preserve corporate value and reduce violations.Considering the varying effects of different types of media on companies with different property rights, policy-oriented media should pay attention to stateowned enterprises, while market-oriented media should focus on private enterprises’ operational trends.This approach maximizes the media’s supervisory and governance functions for listed companies.

For listed companies, in today’s media-driven society, they should be aware of the increased scrutiny and attention they receive.It is crucial for managers and shareholders to learn from the violations of other listed companies and improve their internal governance mechanisms.Compliance with regulations and ethical standards is essential, but it is equally important to manage media and public opinion effectively.Listed companies need to actively manage their public image to maintain and enhance their corporate value, to avoid potential negative market reactions, and to promote long-term sustainable growth.

For investors, it is not always the case that a stock receiving only positive media coverage is a good investment opportunity.In the investment process, investors should enhance their ability to discern between good and bad investments,guard against severe losses from unpredictable events, balance and pay attention to different media reports, and avoid the risks of irrational investment.

For regulators, it is essential to consider media reports as a reference and recognize the impact of media information on the stock market.Simultaneously, regulators should enhance their supervision and punishment of listed companies, guide investors reasonably, and standardize the behavior of listed companies.By doing so, regulators can maintain the order of the capital market and achieve high-quality development in the market.

6.4 Limitations

There are still some shortcomings in this study.First, the measurement of media attention variables in this paper differs from most literature, as it is based on the Chinese Research Data Service Platform.Due to the vast number of reports, this paper does not search news reports of listed companies one by one through news searching.Additionally, the accuracy of emotional judgment on China’s research data service platform has not yet reached 100% (with an accuracy of approximately 85%).Future research will employ a more scientific way to measure the emotional tendency of media coverage to improve the accuracy of the results.Second, this paper does not consider the heterogeneity of research results caused by different types of violations.As various types of violations of listed companies continue to emerge, different types of violations may have varying impacts on investors’psychology and behavior, leading to different market reactions.In future research, we will distinguish between the different types of violations and examine the impact of media attention on stock price volatility after corporate violations.

Acknowledgements

This work was supported by the National Natural Science Foundation of China (72293573, 72104226), the Research Topic of Securities Futures Industry Standard (BZKT-2022-041), and Anhui Province 2022 Annual New Era Education Quality Project (Postgraduate Education) (2022zyxwjxalk003).

Conflict of interest

The authors declare that they have no conflict of interest.

Biographies

Chenxi Wang is a postgraduate student at the School of Management,University of Science and Technology of China.Her research mainly focuses on risk and strategic management.

Lei Zhou is an Associate Professor at the School of Public Affairs,University of Science and Technology of China (USTC).He received his Ph.D.degree from USTC in 2014.His research mainly focuses on risk and strategic management.

Table A1.Robustness test results of changing the measurement of explamatory varibles.

?

Table A2.Robustness test results of changing the measure of the explained variable,

?

Table A3.Robustness test results of exeluding extreme values.

?

Table A4.SUR test results of media attention, media type, and media emotional tendency.

Variables χ2 p-value χ2 p-value χ2 p-value χ2 p-value χ2 p-value χ2 p-value χ2 p-value Media 2.93 0.087*Media_net 2.98 0.084*Media_policy 2.50 0.114 Media_market 3.26 0.071*Media_neg 3.53 0.060*Media_pos 2.36 0.125 Media_neu 3.33 0.068*Size 1.70 0.192 1.70 0.192 3.33 0.068* 1.12 0.291 2.06 0.151 2.31 0.128 1.66 0.198 Age 0.50 0.478 0.50 0.478 0.28 0.596 0.48 0.489 0.33 0.564 0.39 0.531 0.33 0.564 DN 0.29 0.590 0.27 0.601 0.58 0.446 0.21 0.648 0.26 0.609 0.36 0.548 0.24 0.625 IDR 0.15 0.703 0.14 0.710 0.40 0.529 0.13 0.719 0.24 0.626 0.18 0.673 0.18 0.675 Own 3.72 0.054* 3.75 0.053* 3.62 0.057 3.62 0.057* 3.65 0.056* 3.35 0.067* 4.05 0.044**Audit 0.03 0.865 0.02 0.875 0.01 0.924 0.04 0.833 0.00 0.996 0.00 0.963 0.00 0.953 EPS 0.00 0.999 0.00 0.998 0.01 0.916 0.00 0.948 0.03 0.855 0.02 0.889 0.00 0.971 Loss 0.33 0.564 0.33 0.563 0.52 0.472 0.44 0.507 0.61 0.436 0.37 0.543 0.43 0.512 Lev 3.71 0.054* 3.72 0.054* 5.24 0.022** 4.10 0.043** 4.53 0.033** 3.77 0.052 4.53 0.033**ROA 0.55 0.457 0.54 0.461 0.80 0.370 0.70 0.402 1.11 0.293 0.74 0.391 0.45 0.501 Growth 2.31 0.129 2.26 0.133 2.85 0.091* 2.83 0.092* 2.51 0.113 2.77 0.096* 2.66 0.103_cons 0.54 0.462 0.52 0.469 1.48 0.223 0.40 0.529 0.80 0.372 1.19 0.275 0.56 0.452