Influence of consumer information investment on supply chain advertising and pricing strategies

Shen Yue Zhong Weijun Mei Shu’e

(School of Economics and Management,Southeast University,Nanjing 211189,China)

Abstract:A game theory model is established to explore equilibrium strategies and profits of the manufacturer and the retailer and to analyze the influence of consumer information investment on these equilibrium results.Equilibrium strategies and profits of different cost-sharing modes are compared to study the effect of different modes on the manufacturer and the retailer.The results show that the effectiveness of consumer information investment depends on the relative impact of advertising and retail price on market demand.Investing in consumer information will reduce profits of the manufacturer and retailer if the impact of advertising is much smaller than that of price.Furthermore,the manufacturer will transfer the information expense to the retailer by increasing the wholesale price even if it commits to sharing the consumer information investment.In addition,the manufacturer chooses a higher wholesale price,and the retailer sets a higher price when the two companies cooperate in advertising than when they do not.Meanwhile,the retailer prefers non-cooperative advertising to cooperative advertising,while the manufacturer prefers cooperative advertising when considering consumer information investment.

Key words:consumer information investment; advertising strategy; pricing strategy; supply chain

The rapid development of big data technology allows companies to use consumer information for consumer profiling and conduct precise marketing (e.g.,targeted advertising).Research has shown that digital targeting meaningfully improves the response to advertisements and that ad performance declines when marketers’ access to consumer data is reduced[1].Companies are increasingly recognizing the importance of consumer information in marketing.

Although consumer information can improve marketing efficiency,collecting consumer information is costly.How to balance the benefits and the costs of consumer information is a pressing issue for companies.As for supply members,how to share the cost is also something to consider.Research has shown that the cost-sharing modes of consumer information investment vary in different supply chains[2].Many companies are not sure which cost-sharing mode is beneficial to them.In addition,how to conduct the advertising and pricing strategies when considering consumer information investment is a concern for companies.

Supply chain advertising and pricing strategies have been of interest to researchers and managers.Huang and Li[3]compared three cooperative advertising models and found that every Pareto cooperative advertising can maximize the system profit.Yue et al.[4]believed that if the manufacturer provided the retailer with the same portion of the local advertising allowance as the price deduction that he offered to consumers,the retailer would increase advertisement.Li et al.[5]analyzed the influence of the interrelationship between the O2O channels on supply chain members’ decisions regarding advertisement levels and participation.Xu et al.[6]studied the pricing strategies of cross-regional dual-channel supply chains when the manufacturer is the leader.Wang et al.[7]analyzed the influence of power imbalance and supply chain competition on pricing strategies.Few studies have considered the effects of consumer information on supply chain advertising and pricing strategies.

Most existing studies on the impact of consumer information on advertising and pricing strategies have only considered companies’ own behaviors.Esteban and Hernandez[8]found that consumer information can drive companies to intensify their advertising effort.Zhao and Xue[9]believed that information advantage did not save the advertising cost but is beneficial for companies to gain more profits.Some empirical studies analyzed the influence of different consumer information on company advertising strategies,such as shopping cart characteristics[10],users’ engagement level[11],and consumer search behavior and purchase capacity[12].Esteves investigated that the pricing for perceived loyal consumers had an inverse U-shaped relationship with the signal’s accuracy[13].Miettinen and Stenbacka[14]compared the pricing strategies with different consumer information and found that personalized pricing would damage consumer surplus and social welfare.None of them have discussed the effect of consumer information on the marketing strategies of upstream and downstream firms in the supply chain.

A game theory model is established to explore the equilibrium strategies and profits of the manufacturer and the retailer and to analyze the influence of consumer information investment on these equilibrium results.In addition,four cost-sharing modes are considered.Equilibrium strategies and profits of different cost-sharing modes are compared to study the effect of different modes on the manufacturer and the retailer.

1 Model and Assumption

Consider a distribution channel with one manufacturer and one retailer in which the manufacturer sells products through the retailer.Market demand for products depends on the price and the level of advertising effort devoted by the retailer.Assuming that advertising efficiency is influenced by consumer information investment,the demand function is

D=T-ep+(1+m)βa

(1)

whereTis the market demand if there is no advertising and pricing;estands for price influence coefficient;pis the retail price;βis the effectiveness of advertising;ais the level of advertising effort;mstands for consumer information investment.For simplicity,in the subsequent analysis,it is assumed thatT=1 andβ=1.Because the aim of this paper is to investigate the effect of consumer information investment on supply chain advertising and pricing strategies,it is necessary to ensure that the manufacturer and the retailer will invest in consumer information and advertising,that is,to ensure that the equilibrium profits of the manufacturer and the retailer is not less than 0.Therefore,it is assumed thate>3/4.The cost corresponding to the advertising effortaisa2/2.Research shows that consumer information can improve advertising efficiency[19-20].Assuming that the effect of consumer information investment on advertising efficiency is linear,minvestment can increase the advertising conversion rate to 1+m.

Four cost-sharing modes are considered: 1) Mode Ⅰ.Both consumer information investment and advertising cost are borne by the retailer.2) Mode Ⅱ.Consumer information investment is shared between two companies,while advertising cost is borne by the retailer.3) Mode Ⅲ.Consumer information investment is borne by the retailer,while advertising cost is shared between two companies.4) Mode Ⅳ.Both consumer information investment and advertising cost are shared between the manufacturer and the retailer.

2 Analysis

The equilibrium results of four cost-sharing modes are compared and analyzed in this part,including the equilibrium wholesale price,retail price,advertising effort,manufacturer’s revenue,and retailer’s revenue.In addition,the influence of consumer information investment on these equilibrium results is discussed.

2.1 Equilibrium analysis

2.1.1 Equilibrium of Mode Ⅰ

When both consumer information investments and advertising costs are borne by the retailer,the profits for the manufacturer and retailer are

π1M=Dw

(2)

(3)

whereDdenotes the market demand;wis the wholesale price; subscript 1 indicates the first cost-sharing mode; subscript M denotes the manufacturer; subscript R indicates the retailer.The manufacturer and the retailer play a Stackelberg game.The timing of the game is as follows: firstly,the manufacturer decides the wholesale pricew; then,the retailer decides the level of advertising effortaand retail pricep.The equilibrium results are derived according to the standard backward induction,as shown in Proposition 1.

(a)

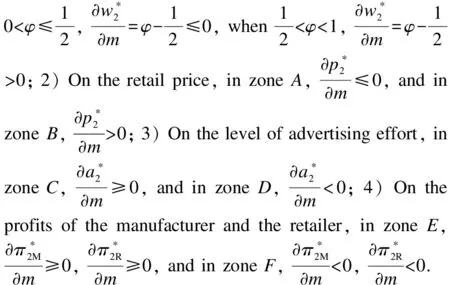

With an increase in consumer information investment,the manufacturer lowers the wholesale price to relieve the cost pressure on the retailer and prevent the retailer from raising the selling price or lowering the advertising effort,which will reduce the market demand.

When the consumer information investment is high,the retailer lowers the selling price.Asmincreases andpdecreases,the market demand increases while the unit profit decreases,but the growth rate of market demand is greater than that of unit profit; hence,the retailer cuts down the price.When consumer information investment is not very high,the retailer raises the selling price with an increase in investment.The impact of advertising increases with an increase ofmwhen the difference between the impact of the product price and advertising on the market demand is small.Increasing the selling price does not have a significant impact on market demand but increases the unit profit; hence,the retailer raises the price.When the impact of price on market demand is larger than that of advertising,the growth rate of unit profit is greater than that of market demand with an increase in consumer information investment; hence,the retailer raises the price.

The impact of advertising is enhanced with an increase in consumer information investment when the difference between the impact of price and advertising on the market demand is small; the retailer can obtain more profits by increasing the advertising effort; hence,the retailer chooses to increase the advertising effort.However,when the effect of price is greater than that of advertising,increasing advertising efforts has a slight impact on market demand but increases advertising costs; hence,the retailer will cut down the advertising expense.

When the impact of advertising on market demand is greater than that of price,the market demand increases with an increase in consumer information investment,with no cost to bear; hence,the manufacturer’s profit increases.When the impact of price is greater than that of advertising,the profit of the manufacturer decreases with consumer information investment increasing,because the retailer will raise the selling price or reduce the advertising effort to offset the information expenses,which leads to a lower market demand.

The retailer’s profit increases with an increase in consumer information investment when the impact of advertising on market demand is greater than that of price.The growth rate of the demand market is greater than that of the unit profit; hence,the retailer obtains more profits with consumer information expense increasing.When the impact of price is greater than that of advertising,investing more in consumer information has a slight impact on market demand but increases the cost; hence,the profit of the retailer decreases.

2.1.2 Equilibrium of Mode Ⅱ

When consumer information investment is shared by two companies while the advertising cost is borne by the retailer,the profits for the manufacturer and retailer are

π2M=D(w-φm)

(4)

(5)

where subscript 2 indicates the second cost-sharing mode,andφ(0≤φ<1) is the proportion of consumer information investment borne by the manufacturer.Similar to Mode Ⅰ,the manufacturer and the retailer play a Stackelberg game.The timing of the game is as follows: first,the manufacturer decides the wholesale pricewand the participation rate of consumer information investmentφ; then,the retailer decides the level of advertising effortaand retail pricep.The equilibrium results are derived according to the standard backward induction,as shown in Proposition 2.

Proposition 2 shows the wholesale price increase with an increase in the participation rate.The manufacturer transfers the cost to the retailer by increasing the wholesale price,even if it commits to sharing the information expense.

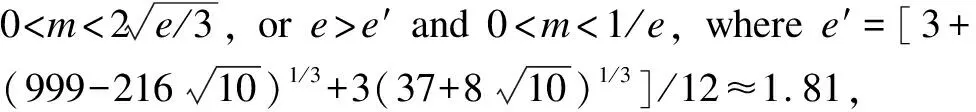

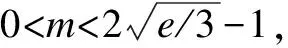

Corollary 2 presents the impact of consumer information investment on the equilibrium results.Except for the wholesale price,other equilibrium results are the same as Mode I.Hence,Fig.1 is used to depict the region of various values ofeandm.

When the manufacturer’s participation rateφis not high,the manufacturer cuts down the wholesale price to relieve the cost pressure on the retailer and prevent the retailer from raising the selling price or lowering advertising effort,which will reduce the market demand.When the manufacturer’s participation rateφis high,the manufacturer raises the wholesale price to offset the information expense.The influence of consumer information investment on equilibrium retail price,advertising effort,and the profits of manufacturers and retailers is similar to that with Mode I; therefore,it will not be explained here.

2.1.3 Equilibrium of Mode Ⅲ

When consumer information investment is borne by the retailer while the advertising cost is shared by two companies,the profits for the manufacturer and retailer are

(6)

(7)

where subscript 3 indicates the third cost-sharing mode andt(0≤t<1) is the proportion of advertising cost borne by the manufacturer.Like the previous modes,the manufacturer and the retailer play a Stackelberg game,with the timing of the game as follows: first,the manufacturer decides the wholesale pricewand the participation rate of advertising costt; then,the retailer decides the level of advertising effortaand retail pricep.The equilibrium results are derived according to the standard backward induction,as shown in Proposition 3.

The manufacturer’s participation rate of advertising cost is not affected by the information expense,and it is the same as that with no consumer information investment.The manufacturer’s participation decision of advertising cost is independent of advertising effectiveness when there is no consumer information[21]; hence,the manufacturer’s participation rate remains unchanged,and even the consumer information investment can improve the effectiveness of advertising.

(a)

The retailer will increase the advertising effort to gain more market demand when the impact of advertising effort on market demand is greater than that of price; hence,the manufacturer increases the wholesale price to offset the advertising cost.On the other hand,when the impact of price on market demand is greater than that of advertising,the manufacturer cuts down the wholesale price to relieve the cost pressure on the retailer and prevent the retailer from raising the selling price or lowering the advertising effort,which will reduce the market demand.

When the impact of price on the market demand is moderate while the investment of consumer information is high,the retailer will reduce the selling price because the growth rate of market demand is greater than that of unit profit.When the impact of advertising effort on market demand is greater than that of price while consumer information investment is not very high,increasing the selling price does not have a significant impact on market demand but increases the unit profit; hence,the retailer raises the price with an increase of consumer information investment.The growth rate of unit profit is greater than that of market demand when the impact of price on market demand is larger than that of advertising while the consumer information investment is high; hence,the retailer raises the price with an increase of consumer information investment.

When the difference between the impact of advertising and price on market demand is small,increasing the consumer information investment can enhance the impact of advertising; meanwhile,the manufacturer commits to sharing a portion of the advertising cost; hence,the retailer will increase the advertising effort.However,when the effect of the price is greater,increasing advertising efforts has a slight impact on market demand but increases advertising costs; hence,the retailer will reduce the payment of advertising.

The profit of the manufacturer increases with an increase in consumer information investment when the impact of advertising on market demand is greater than that of the selling price.As increasing consumer information investment can improve advertising effectiveness,it can increase market demand.Although the advertising cost increases,the increment of revenue is higher than the increase rate of advertising cost; hence,the manufacturer obtains more profits.Consumer information investment can improve advertising effectiveness but has a slight influence on market demand when the impact of retail price on the market demand is greater than that of advertising.If the rate of decline of the unit profit is higher than the increase rate of market demand,the profit of the manufacturer decreases.

With an increase in consumer information,the profit of the retailer decreases.When the impact of advertising on market demand is greater than that of price,the manufacturer raises the wholesale price,and the retailer increases the advertising effort; the retailer’s profit decreases.When the impact of retail price on market demand is greater than that of advertising,the decline rate of the unit profit is higher than the increase rate of market demand with an increase in consumer information investment; hence,the retailer’s profit decreases.

2.1.4 Equilibrium of Mode Ⅳ

When both consumer information investment and the advertising cost are shared by the two companies,the profits for the manufacturer and retailer are

(8)

(9)

where subscript 4 indicates the fourth cost-sharing mode.Again,the manufacturer and the retailer play a Stackelberg game.The timing of the game is as follows: first,the manufacturer decides the wholesale pricew,the participation rate of advertising costt,and consumer information investmentφ; then,the retailer decides the level of advertising effortaand retail pricep.The equilibrium results are derived according to the standard backward induction,as shown in Proposition 4.

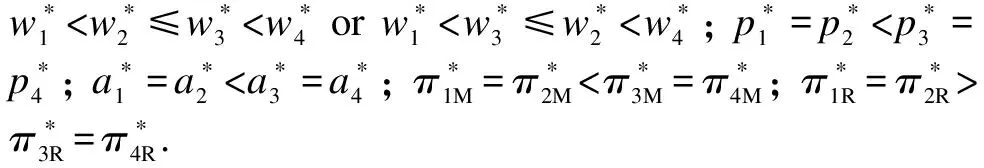

Proposition 4 shows the wholesale price increase with an increase in participation rate.The manufacturer transfers the cost to the retailer by increasing the wholesale price,even if it commits to sharing the information expense.Hence,the retailer’s advertising and pricing decisions are not affected byφ.The manufacturer’s advertising participation rate is the same as that of Mode Ⅲ,which is independent of the consumer information investment.

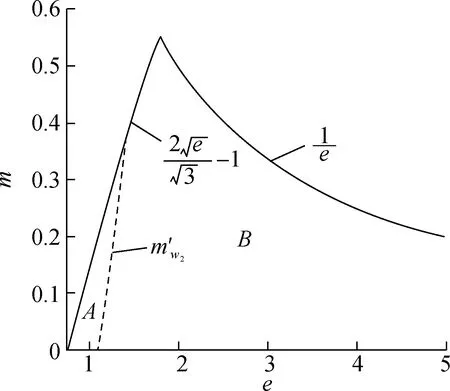

Corollary 4 presents the impact of consumer information investment on the equilibrium results.Except for the wholesale price,other equilibrium results are similar to those of Mode Ⅲ; hence,Fig.2 is used to depict the region of various values ofeandm.

As shown in Corollary 4,when the impact of advertising on market demand is greater than that of price,the manufacturer raises the wholesale price with an increase in consumer information investment.When the impact of price on market demand is greater than that of advertising if the manufacturer’s participation rate of consumer investment is high,the manufacturer raises the wholesale price to offset the information expense; if its participation rate is low,the manufacturer cuts down the wholesale price to relieve the cost pressure on the retailer and prevent the retailer from raising the price or lowering the advertising effort,which will reduce the market demand.The influence of consumer information investment on the equilibrium retail price,advertising effort,and the profits of the manufacture and the retailer is similar to Mode Ⅲ; hence it is no longer explained here.

2.2 Comparative analysis

The equilibrium results explained above are compared in this part,with the comparison results presented in Proposition 5.

As shown in Proposition 5,when the consumer information investment and the advertising cost are borne by the retailer,the manufacturer sets the lowest wholesale price because it does not have to bear any costs.The manufacturer sets the highest wholesale because of the information investment and advertising cost when both the consumer information and advertising cost are shared by the two companies.Comparing the equilibrium wholesale prices of Modes Ⅱ and Ⅲ,the relationship between them depends on the manufacturer’s participation rate of consumer information investment.When the participation rate is low,the wholesale price of Mode Ⅲ is higher; if the participation rate is high,the wholesale price of Mode Ⅱ is higher.

The retailer sets a higher price when the two companies do cooperative advertising regardless of whether the manufacturer commits to a portion of consumer information investment.

The retailer chooses a higher advertising effort when the manufacturer shares a part of advertising cost regardless if the manufacturer commits to a portion of consumer information investment.

Regardless of whether the two companies share the consumer information investment,the manufacturer prefers cooperative advertising to non-cooperative advertising.On the other hand,the retailer prefers non-cooperative advertising.These findings differ from those of existing studies on cooperative advertising,which believe that cooperative advertising is beneficial to both the manufacturer and the retailer.Compared with non-cooperative advertising,the retailer chooses to invest more in advertising efforts,which increases not only the advertising cost but also the information expense; hence,the profit of the retailer is damaged.

3 Conclusions

1) A comparison of the equilibrium wholesale prices of the four cost-sharing modes shows that the manufacturer will set a higher wholesale price when it commits to sharing the consumer information investment.It will transfer the information expense to the retailer,who will bear the full cost of the information investment.

2) Comparing the wholesale and retail prices of the four cost-sharing modes,it is shown that both manufacturers and retailers will choose a higher price when they cooperate in advertising than when they do not.

3) Comparing the level of advertising effort of the four cost-sharing modes,it is found that cooperative advertising will encourage the retailer to increase the advertising effort.

4) The manufacturer prefers cooperative advertising,while the retailer prefers non-cooperative advertising.

Journal of Southeast University(English Edition)2023年3期

Journal of Southeast University(English Edition)2023年3期

- Journal of Southeast University(English Edition)的其它文章

- Analysis on the visual recognition effect of Tibetan-Chinese bilingual guide signs

- Analysis of factors affecting injury severity of shared electric bike riders

- Influence of mineral admixtures on the mechanical property and durability of waste oyster shell mortar

- Poisoning attack detection scheme based on data integrity sampling audit algorithm in neural network

- Integrity analysis and inverse Deng’s grey relational analysis model

- A multilayer network model of the banking system and its evolution