Encouraged Areas for Foreign Investment

By Li Dawei

China has been moving aggressively to improve its foreign investment environment.

I n June, China's National Development and Reform Commission (NDRC) and the Ministry of Commerce jointly issued three documents to encourage foreign investment, reducing the scope of sectors barred to foreigners and expanding areas where investment is encouraged. The three policy documents -- the Special Administrative Measures (Negative List) for Foreign Investment Access (2019 Edition), the Special Administrative Measures (Negative List) for Foreign Investment Access to the China (Shanghai) Pilot Free Trade Zone (2019 Edition), and the Catalogue of Encouraged Industries for Foreign Investment (2019 Edition) -- all took effect on July 30, 2019.

The latest Negative List - which denotes areas where foreigners cannot legally invest - has been made considerably shorter than in the past, while the Encouraged Catalogue, which covers areas where the government promotes foreign participation in the economy, has been expanded.

Improved Regulatory Framework

Prior to the 18th National Congress of the Communist Party of China in November 2012, foreign investment in China was regulated under the Catalogue of Industries for Guiding Foreign Investment. The Catalogue set out three broad categories for foreign investment: encouraged, restricted and prohibited. In the following year a new approach was adopted for the regulation of foreign investment; foreigners seeking to invest in China were given national treatment before their projects were formally considered for approval. Meanwhile, a negative list was drawn up, meaning that foreign investment was barred only in areas specifically designated as off-limits. Industries previously designated as restricted or prohibited areas were initially made part of the Special Administrative Measures (Negative List) for Foreign Investment Access in 2017. Since the creation of the negative list, the areas barred to foreigners have been gradually whittled down. “Encouraged industries” received similar treatment as in the past. This general approach has been called “pre-establishment national treatment plus a negative list.” The issuance of the latest documents has refined this overall approach, relaxing controls on market access to foreign capital and encouraging foreign investors to enter the Chinese market.

Fewer Restricted Sectors

China took measures to ease restrictions on foreign investment in 2013, 2015, 2017 and again in 2018. The number of items on the national Negative List (or under the restricted or prohibited categories) was reduced from 119 in 2013 to 48 in 2018, and those for free trade zones were cut from 122 to 45 over the same period. The 2019 negative list items have been reduced further to 40 nationally and 37 in the free trade zones (See Chart 1).

Chart 1: Number of Items in National Negative Lists from 2013-2019

The latest Negative Lists further open up the agriculture, manufacturing, services and infrastructure construction sectors. In agriculture, there is no longer a provision stating that “foreign investment in the exploitation of wildlife resources originally produced in China and protected by the country shall be prohibited.” In the mining and minerals sector, the exploitation and development of oil and natural gas is no longer limited to joint ventures or cooperative projects. Additionally, the restrictions on foreign investment in the mining and processing of molybdenum, tin, and antimony have been abolished. In manufacturing, foreign investment has been allowed in the production of xuan paper and ink blocks. In services, China has lifted restrictions on domestic shipping agents, cinemas and agencies for performers. The 50% ownership limit on foreign stakes in communications, call centers and storage has also been abolished. In infrastructure construction, the construction and operation of gas and heating networks in cities with populations of over 500,000 no longer need to be controlled by Chinese interests. Moreover, in the free trade zones fishing, printing and publishing have been opened up.

More Encouraged Industries

China has learned from the experience of other nations, particularly developing countries, in making use of foreign capital. The most commonly used formula is to implement policies that promote foreign investment under the general principle of applying equal treatment to domestic and foreign investors. The 2019 Foreign Investment Encouraged Catalogue consists of two subcatalogues — one applies to the whole country and one is applicable to the 22 provinces in China's central and western regions.

The total of encouraged industries is 1,108. Nationwide, the number of encouraged industries has increased to 415, with 67 items added and 45 items revised, compared with the 2017 Edition. On a regional basis, the sub-catalogue of China's 22 central and western provinces has added 54 encouraged items and revised 165 items, compared with the 2017 edition of the lists.

Foreign investment is especially welcome in advanced manufacturing and production-related services. In the field of manufacturing, the newly added or revised items cover core components for 5G communications, etchers for integrated circuits, chip packaging equipment, cloud computing equipment, industrial robots, new energy vehicles, key components for smart cars, key raw materials for cell therapy drugs, large-scale cell culture products, new aerospace materials, monocrystalline silicon, and large-size silicon wafers. In the service sector, items were added or modified in the areas of engineering consulting, accounting, taxation, inspection and certification services, cold chain logistics, e-commerce, dedicated rail lines, artificial intelligence services, cleaner production services, carbon capture services, and circular economy services.

China is also encouraging foreign investors to shift their focus to central and western parts of the country for labor-intensive industries, industries making use of advanced technology, and related equipment. At the same time, some items specific to certain provinces have been added to the encouraged list based on local advantages. For example, for Yunnan, Inner Mongolia and Hunan, there are changes affecting agricultural processing. For Anhui, Sichuan and Shaanxi, where adequate electric power is a key concern, there are changes related to items on general integrated circuits, tablet computers and communications terminals. For Henan and Hunan, which are in need of transport and logistics networks, items on logistics storage facilities and gas stations were added.

China has made great achievements in utilizing foreign investment since its opening to the outside world in 1978.

The adjustments on the two Negative Lists and the Encouraged Catalogue are expected to help create a more balanced and sustainable economy.

Meeting the New Needs of China

In a report issued following the Communist Party's 19th National Congress in 2017, a key challenge for the country was “the contradiction between unbalanced and inadequate development and the people's ever-growing needs for a better life.” China's companies are weak in advanced manufacturing such as new energy, new materials, biomedicine and chip manufacturing. They are weaker in services such as finance, logistics, medical treatment, education and culture. China has been expanding access to foreign investors in order to meet domestic demand for these higher end goods and services.

The 2019 Negative Lists and the Encouraged Catalogue have focused on advanced manufacturing and modern services. Multinational corporations can significantly improve the quality of goods and services in China. Meanwhile, the spillover of technology of these corporations to upstream and downstream industries can help improve the quality of goods and services supplied by Chinese domestic companies. For instance, the three documents have lifted the restrictions on foreign investment in the fields of transportation (i.e. shipping agents) and valueadded telecommunications, and encouraged foreign investment on accounting, taxation and cold-chain logistics. The move will obviously improve producer services in China and push the integration of services and manufacturing. In addition, the exploitation and development of oil and natural gas has not been limited, either. The advantage of related multinational companies in shale gas exploitation can play a big role in helping China improve its structure of energy and chemical industries. China also encourages foreign capital flow into new high-tech industries such as 5G, artificial intelligence, IC etchers and industrial robots.

Adapting to a Changing Global Value Chain

In the future, cross-border flows of services, information and people will be more common than flows of commodities, thanks to the ease of such interaction and new forms of production technologies. As a result, there will be new models of economic arrangements - work will be more decentralized but networked. There will be greater cross-border flows of capital, technology and talent. China's 2019 Encouraged Catalogue includes new and emerging types of information technology services as well as biomedicine and professional services. There will be more cooperation between Chinese and foreign companies, and that will be conducive to creating a more efficient, flexible and equitable global value chain.

Balancing China's Regional Development

China has made great achievements in utilizing foreign investment since its opening to the outside world in 1978. However, there has been an undeniable imbalance in development with the eastern regions racing ahead and the central and western regions lagging behind. The eastern seaboard has been the destination of over 70% of the foreign investment in China. Yet, the western region presently attracts only about 10%, and in some provinces the percentage is actually declining. Some areas such as Chongqing and Sichuan province have made considerable progress in developing their infrastructure. They are a good alternative for multinational companies that are concerned about rising costs of land and labor in the more developed eastern provinces. The 2019 Encouraged Catalogue has tried to address this problem. Additionally, the policy guidelines aim to attract funds in agricultural processing and logistics and warehousing facilities in these less developed areas.

Globalization

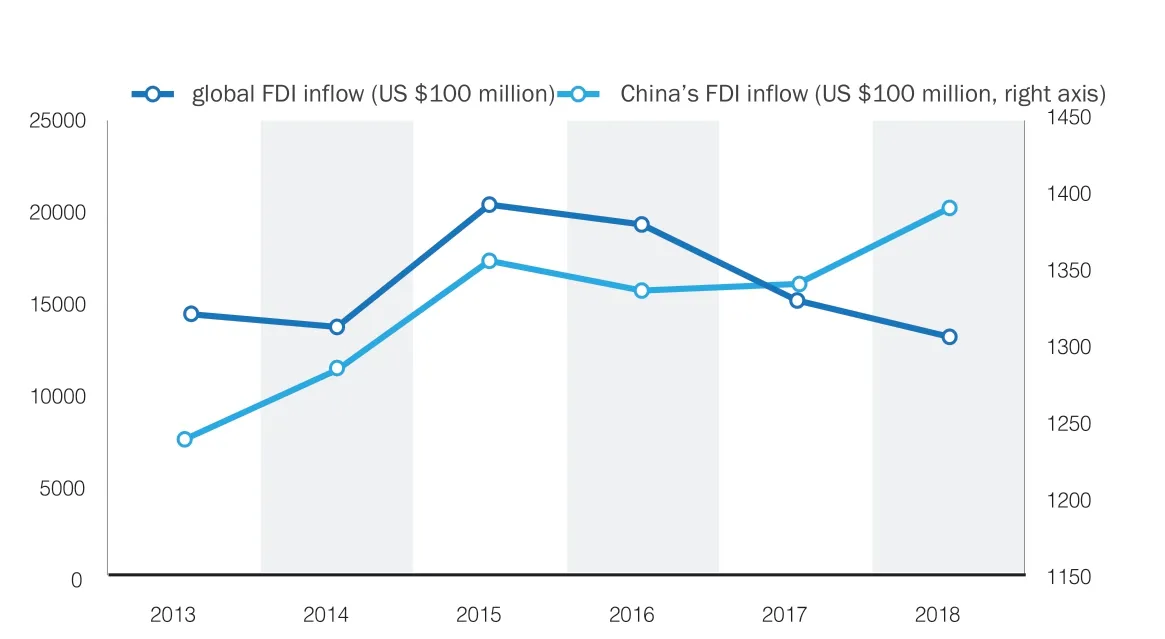

There has been a slowdown in cross-border direct investment in recent years. One reason is the decreasing effect of the “dividends” from scientific and technological breakthroughs. Another is protectionist measures, such as tariffs and security reviews by the US and some other developed countries. This has seriously affected the investment confidence of transnational corporations worldwide. According to the 2019 World Investment Report issued by the United Nations Conference on Trade and Development in June of this year, global foreign direct investment in 2018 was down 13% to US$1.3 trillion, the lowest level since the international financial crisis in 2008. There have been three consecutive years of decline (See Chart 2).

Faced with a rise of trade and investment protectionism, China has adhered to the general principle of promoting the construction of a community of human destiny and sharing domestic development opportunities with the rest of the world by expanding access to foreign capital. Foreign investment in China overall has shown a steady growth. The shortened Negative Lists and the extended Encouraged Category represent China's response to protectionism. China is striving for trade and investment liberalization as part of a transparent, effective and equitable cooperation model on a path towards creating a global community with a shared future.

Policy Needs

Related policies, both national and regional, should be amended to correspond with the new Negative Lists and the Encouraged Category. Additionally, the supervisory mechanisms for the implementation of these regulations should be improved, and there should be incentives for compliance with the regulations and punitive measures for violations.

Chart 2: Global and China's FDI inflow

Greater openness is needed in medical treatment, education and telecommunication. Overall, this would be positive for China's economy, giving greater convenience and support to foreign investors, and stimulating consumption. As for possible risk, regulators can build defences by means of appropriate inspection reviews and other measures. It is suggested that restrictions should be loosened on foreign equity stakes and the scope of business in related fields in the free trade zones, and to extend these policies nationwide when appropriate.

Lastly, looking to the future, China must continue to improve the domestic business environment. It should strive to meet the standards of the annual business environment report by the World Bank. It should step up the pace of reform and address existing problems with the issuance of construction permits, access to credit, and bankruptcy procedures. Better protection of intellectual property - long a source of complaint by foreign investors - is also a must. And bureaucratic procedures for residence permits, education and medical care need to be improved in order to attract more foreign talent.

- China Forex的其它文章

- Anti Money Laundering Efforts in Trade Finance

- China's Foreign Exchange Policies

- New Policy on Managing Cross-border Funds in Local and Foreign Currencies

- Monetary Policy Making and the Jackson Hole Symposium

- Will Libra Usher in an Era of Digital Currencies?

- Foreign Investment Steady Despite Sino-US Trade Row