New Policy on Managing Cross-border Funds in Local and Foreign Currencies

By Liu Wei

C ross-border flows of funds in domestic and foreign currencies affect the national economy in different ways. In the past, separate accounts were maintained for local and foreign currencies under a program for centralized pooling of funds and cross-border fund movements. Local and foreign currency policies were managed by different regulatory departments. But the State Administration of Foreign Exchange (SAFE) recently issued its Regulations on the Centralized Operation of Multinational Enterprise Group Funds [SAFE Document No. 7 (2019)] and for the first time, the regulator proposed multi-currency accounts, including renminbi funds. That groundbreaking document suggests that there eventually will be a merging of the management responsibilities for cross-border domestic and foreign currencies.

The Notice of the People's Bank of China on the Relevant Matters Concerning the Centralized Operation of Cross-border Renminbi Funds by Multinational Enterprise Groups [PBOC Document No. 324 (2014)], currently serves as the policy foundation for the centralized cross-border collection and payment business in renminbi under the current account. The Notice of the People's Bank of China on Further Facilitating Multinational Enterprise Groups to Launch Cross-border Two-way Renminbi Fund Pooling Business [PBOC Document No.279 (2015)] serves as the policy basis for cross-border twoway renminbi fund pooling while Document 7 also governs foreign currencyrelated cross-border fund management business.

Multinationals and Foreign Currency Fund Pooling

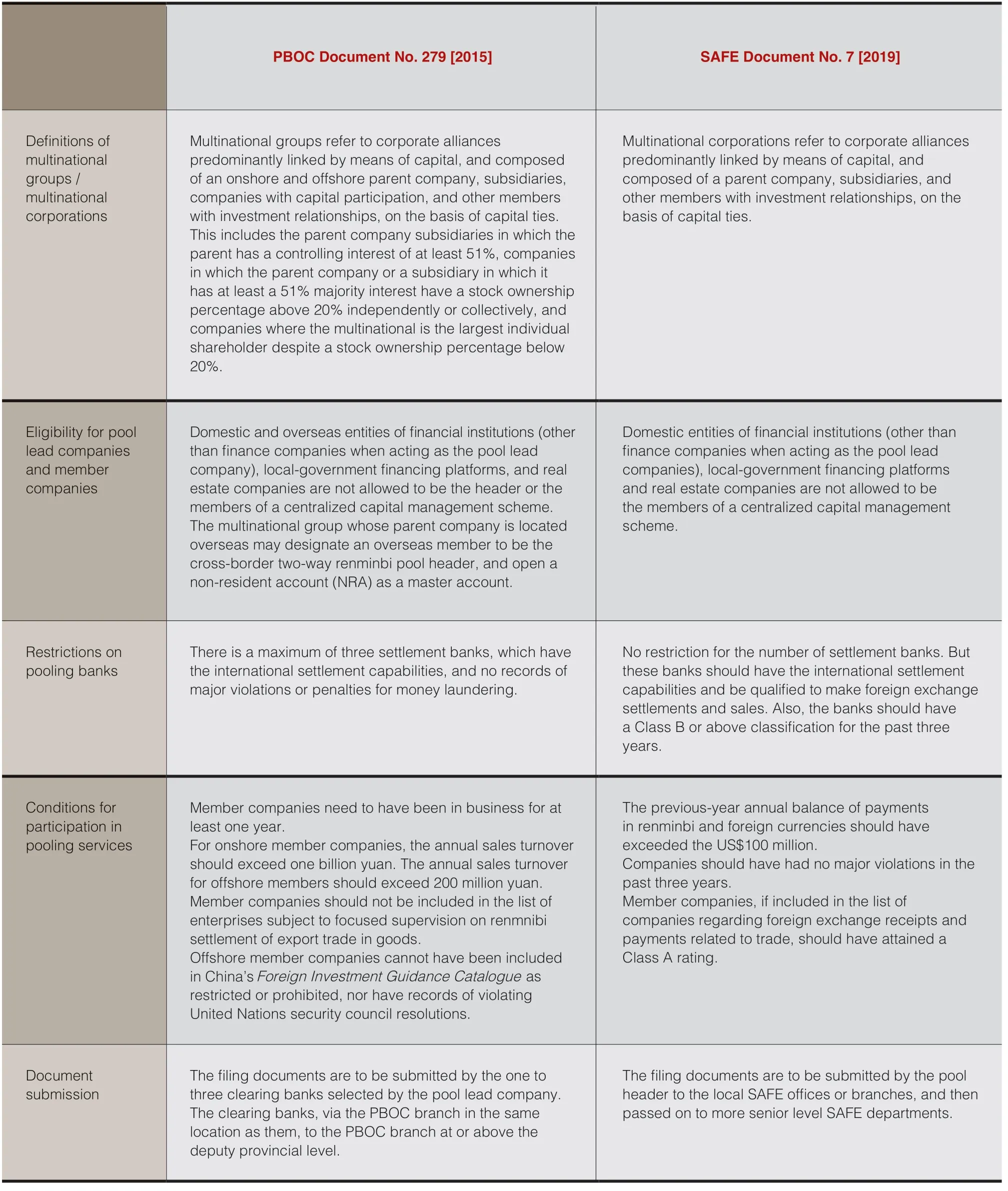

There are regulatory differences between the multinational enterprise groups' local currency and foreign currencies fund pools in terms of entry barriers, quota management and risk controls.

One area where there are policy changes thanks to the new regulations is in the qualifications for group member companies. The member companies participating in the crossborder two-way renminbi fund pooling must be companies linked to group holding companies. They need to have a clear equity relation to the group in the calculation of overall equity for cross-border two-way renminbi fund pooling. Document 7 offers a broader scope for determining the qualifications of member enterprises for fund pooling covering foreign currencies.

Cross-border two-way renminbi fund pooling requires domestic and foreign member enterprises to have been in operation for more than one year. The total annual operating revenue of the domestic member companies should be at least one billion yuan and the annual operating revenue of overseas member companies should be at least 200 million yuan. Document 7 requires that domestic member companies must have international settlements in domestic and foreign currencies of over US$100 million. Moreover, a member company is barred from this business if it is demoted from a Class A rating under the government classification system that offers greater regulatory convenience for greater regulatory compliance.

Provisions about fund pooling in regulations of centralized operation and management of cross-border funds

?

Cooperating Banks

In previous two-way cross-border renminbi fund pools, the main enterprises could not have more than three partner banks, but Document 7 removes this restriction.Both Document 279 and Document 7 require onetime filing. In addition to requiring basic information on the group company and its shareholders, Document No. 7 asks the companies to prepare materials for centralized management on external borrowing quotas, overseas lending quotas, and payment of current account funds and net settlements.

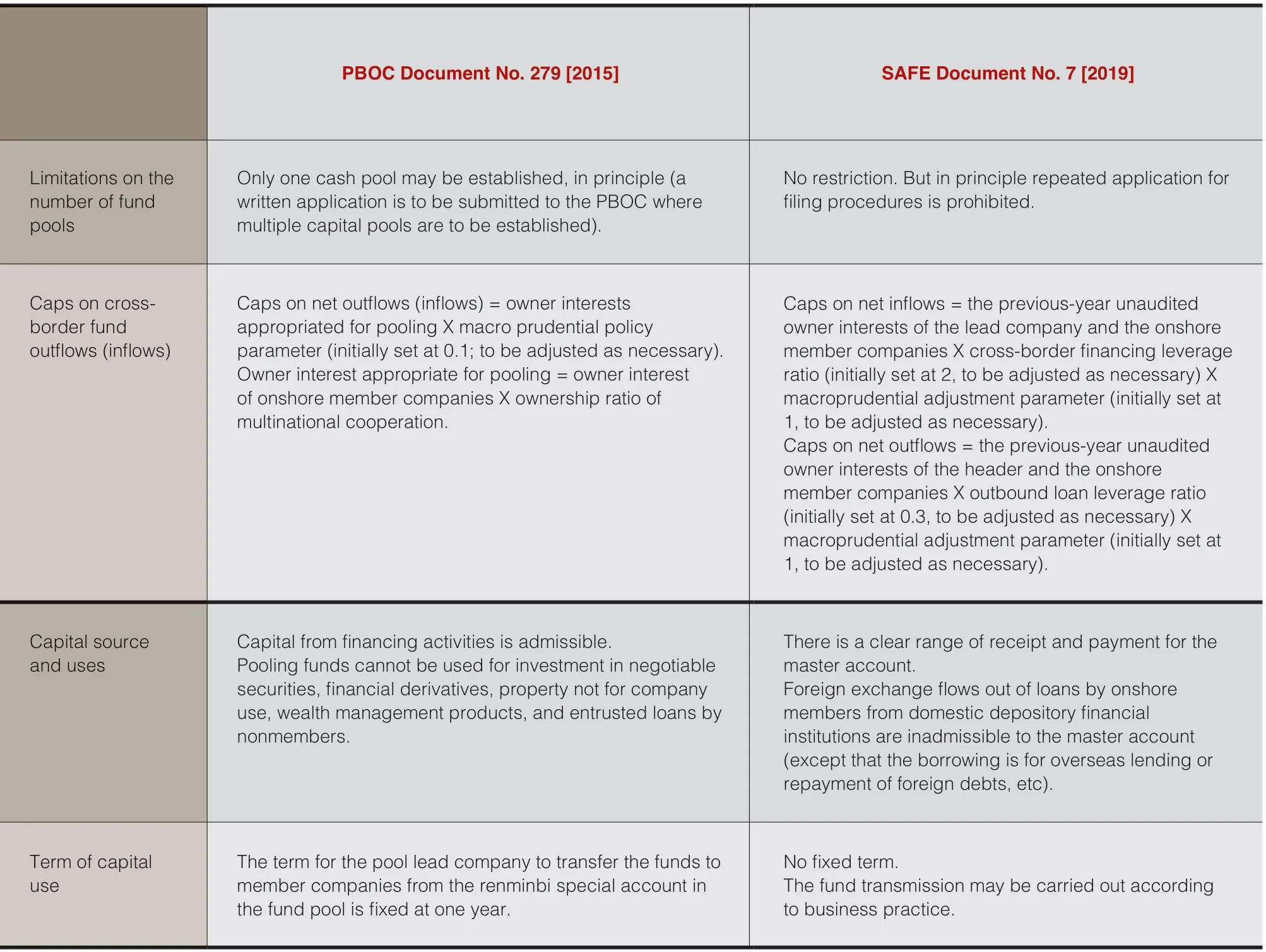

Document 279 states that multinational corporations can set up only one cross-border twoway renminbi fund pool. Document 7 states that multinational corporation sponsors and member companies must not apply for duplicate record filing. In terms of account usage, Document 7 stipulates that multinational corporations set up only one main account in China without any main accounts opened abroad. Foreign exchange loans borrowed by domestic member companies from domestic deposit-taking financial institutions may not be placed in the main account, except for repayment of foreign debts and overseas borrowings. Document 279 does not bar funds from these institutions from being placed in the main account, but funds must not be invested in securities, financial derivatives or property that is not for the group's own use. Funds also cannot be used to purchase wealth management products or for issuing entrusted loans to non-member companies. In addition, Document 279 also requires funds transferred from member companies to domestic and foreign member companies to be returned within one year, while Document 7 sets no clear time limit for transferring funds between member companies.

Document 7 states that multinational corporations can handle the centralized collection and payment of current account funds or the net settlement of the difference by the main group company according to operating needs. Centralized fund collection and payment under the current account means that the main company handles the current account income and expenditures through the primary account for domestic funds for the local group members. In terms of the net difference settlement under the current account, the main company must centrally audit the accounts payable and receivable of the domestic and foreign group members through the main account for domestic funds. Also, it shall merge all operational modes of the single transaction concerning the collection and payment of a certain period of time. In principle, the net amount of each natural monthly rolling balance shall be settled not less than once a month. At present, Document 324 serves as the policy basis for the centralized collection and payment under the current account, which is basically consistent with Document 7.

A comparison of specific businesses under the current regulations shows that the general policy direction for local and foreign currencies is similar. This lays the foundation for the future integration of the two.

Capital Flows

The implementation of Document 7 is unlikely to have a significant impact on cross-border capital flows in the near term. Document 7 requires that companies that participate in funding pools need to clarify their original creditor-debt relations. Companies are eligible to become group companies only when overseas borrowings are repaid and overseas loans are recovered. This means many companies will likely need to delay participation for some time. Document 7 also has more documentation requirements. There is still a certain threshold for participating multinational corporations. It says the balance of international and foreign currency expenditures must have exceeded US$100 million in the previous year and there needs to be a record of no major illegal conduct over the past three years. Member companies on the foreign exchange revenue and expenditure list must be Class A enterprises according to the government regulatory classification system. Moreover, enterprises participating in the group foreign debt or lending must not engage in foreign borrowing or lending themselves. Therefore, the number of multinational conglomerates that have completed filings and added cross-border fund pools in the short term should be limited. In addition, Document 7 has adjustment mechanisms such as a crossborder financing leverage ratio, overseas lending leverage ratio and macroprudential adjustment coefficient, in order to prevent risks to cross-border capital flows along with the development of centralized operation management business concerning the cross-border funds

Document 7 presents new challenges for regulatory supervision. It requires companies to prepare corresponding materials for foreign exchange offices at or above the provincial level. This means that local foreign exchange management departments need to guide companies in preparing the required materials. Regulatory departments also need to review the materials, verify the scale of financing and conduct follow-up supervision and evaluation. Document 7 does not specify a time for annual business evaluation, which means that it is necessary to create a mechanism for the timely sharing and transmission of information within the foreign exchange management system to enable the companies to carry out centralized operation of cross-border funds.