Status quo of China’s dyeing and printing industry in 2018

Production growth slowed down

In 2018, the output of dyeing and printing cloth of enterprises above designated size reached 49.069 billion meters, an increase of 2.63% over the same period last year, and the growth rate dropped by 2.12 percentage points compared with 2017. Under the influence of national industrial policy guidance, industry transformation and upgrading, market demand and other factors, the growth rate of dyeing and printing cloth production has fallen back. In the case of sustained slowdown in production growth, accelerating industrial restructuring and improving quality and efficiency are the key to industrial development.

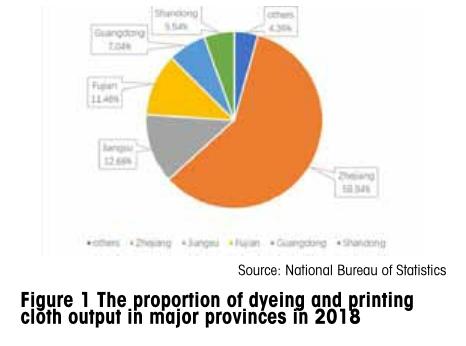

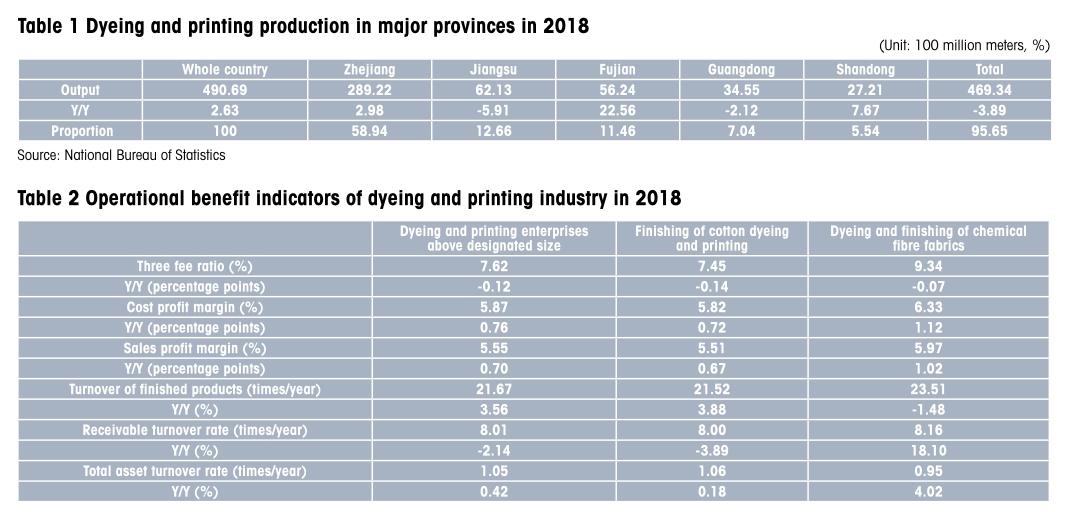

High regional concentration is a remarkable feature of dyeing and printing industry. In 2018, the output of Zhejiang, Jiangsu, Fujian, Guangdong, Shandong and other eastern coastal provinces totaled 46.934 billion meters, accounting for 95.65% of the total. The output of dyeing and printing cloth in Fujian, Shandong and Zhejiang provinces increased by 22.56%, 7.67% and 2.98% respectively, while the output of dyeing and printing cloth in Guangdong and Jiangsu provinces decreased by 2.21% and 5.91% respectively, as shown in Table 1. Zhejiang Province contributes the most to the output of the industry, accounting for 58.94%. Jiangsu, Fujian, Guangdong and Shandong account for 12.66%, 11.46%, 7.04% and 5.54% of the national output respectively. The output of dyeing and printing cloth in other provinces and cities only accounts for 4.36% of the national output, as shown in Figure 1.

Continuous improvement of operation quality and efficiency Operating quality is better

In 2018, the main operating benefit indicators of enterprises above designated size of dyeing and printing industry are shown in Table 2. The proportion of three fees in enterprises above designated size is 7.62%, which is 0.12 percentage points lower than that of the previous year. Among them, cotton dyeing and printing finishing enterprises are 7.45%, chemical fiber finishing enterprises are 9.34%, cost profit margin is 5.87%, which is 0.76 percentage points higher than that of the previous year, Sales profit margin was 5.55%, increased by 0.70 percentage points, higher than 0.4 percentage points in the textile industry, the highest in history.tatistic

Increased profitability

According to the data of the National Bureau of Statistical, in 2018, 1,715 dyeing and printing enterprises above designated size achieved 283.313 billion yuan in revenue from their main business, an increase of 2.98% year-onyear, and the growth rate fell by 3.58 percentage points compared with 2017, the total profit was 15.730 billion yuan, an increase of 17.93%, an increase of 6.29 percentage points compared with 2017, and the cost of their main business was 246.456 billion yuan, an increase of 2.79% year-on-year. The profitability of the industry has been improved, but the cost burden of the enterprise is still heavy. The proportion of the main business cost to the main business income is as high as 86.99%. The growth rate of profit is higher than that of the main business income by nearly 15 percentage points.

In 2018, the export delivery value of dyeing and printing enterprises above designated size was 43.561 billion yuan, a decrease of 1.6% year-on-year. Domestic sales accounted for 84.62% of the sales output value, which was 2.66 percentage points lower than in 2017, and the growth rate of domestic sales slowed down.

In 2018, there were 303 loss-making enterprises in dyeing and printing enterprises above designated size, accounting for 17.67%, an increase of 3.81 percentage points compared with 2017. The total loss of loss-making enterprises was 1.699 billion yuan, down 11.48% from the same period last year, and the growth rate was 23.49 percentage points lower than that in 2017.

Overall, the profits of the dyeing and printing industry increased rapidly in 2018, mainly due to the deepening of supply-side structural reform, the effective implementation of policies such as eliminating backward production capacity, upgrading product structure and optimizing resource allocation, the accelerated pace of structural adjustment, transformation and upgrading, and the industry moving towards high-quality development.

Good performance of export market

In 2018, the total import and export volume of eight major categories of dyeing and printing products was 26.582 billion U.S. dollars, an increase of 6.65% year-on-year, an increase of 6.85 percentage points over 2017, the trade surplus was 22.774 billion U.S. dollars, an increase of 8.53% year-on-year, and an increase of 8.02 percentage points over 2017.

Continued decrease in imports

In 2018, the number of imports of eight major categories of dyeing and printing products was 998 million meters, a decrease of 4.22% year-on-year, and the growth rate dropped by 2.33 percentage points compared with 2017, the amount of imports was 1.904 billion U.S. dollars, a decrease of 3.35% year-on-year, and the growth rate increased by 0.44 percentage points over 2017, the average unit price of imports was 1.91 U.S. dollars per meter, an increase of 1.06% year-on-year, and the growth rate increased by 3.00 percentage points over 2017.

Maintaining export growth

In 2018, the export volume of eight major categories of dyeing and printing products was 23.288 billion meters, an increase of 2.70% year-on-year, and the growth rate dropped by 2.51 percentage points compared with 2017, the export amount was 24.678 billion U.S. dollars, an increase of 7.51% year-onyear, and the growth rate increased by 7.39 percentage points over 2017, the average unit price of exports was 1.06 U.S. dollars per meter, an increase of 4.95% year-on-year, and the growth rate increased by 9.79 percentage points over 2017. From 2011 to 2018, the export volume of eight major categories of dyeing and printing products increased year by year, and the average unit price of export fluctuated. In 2018, the volume and price of dyeing and printing products increased simultaneously, and the export situation was good.

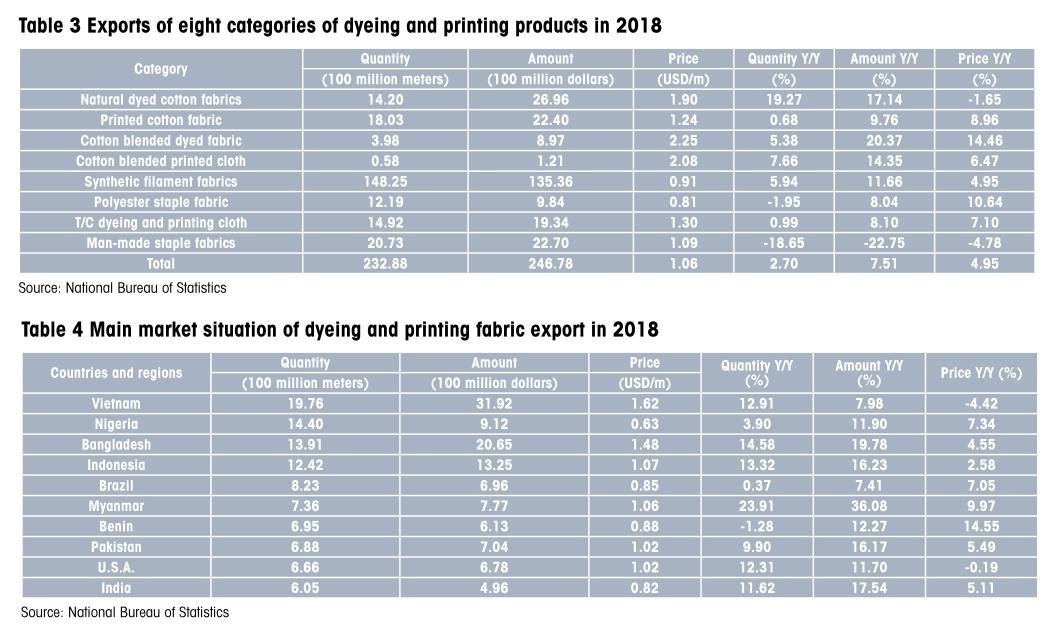

Export of eight categories of dyeing and printing products

In 2018, the export quantity and amount of cotton dyed fabrics increased by 19.27% and 17.14% respectively, but the average unit price of exports decreased by 1.65%. The export quantity and amount of man-made staple fabrics decreased by 18.65% and 22.75% respectively, and the average unit price of exports decreased by 4.78%. Apart from the decrease in the average unit price of cotton dyed fabrics and man-made staple fabrics, the average unit price of the other six categories of products increased in varying degrees, including cotton blended dyed fabrics increased by 14.46% and polyester staple fabrics increased by 10.64% over the same period. As shown in Table 3.

Major export markets

In 2018, Vietnam, Nigeria, Bangladesh, Indonesia, Brazil, Myanmar, Benin, Pakistan, the United States and India ranked the top ten export markets in eight categories, as shown in Table 4. The top 10 market exports totaled 10.262 billion meters, accounting for 44.07% of the total, the export amount is 11.458 billion U.S. dollars, accounting for 46.43% of the total. Southeast Asian countries have become the main export market of dyeing and printing cloth in China.

Traditional export market

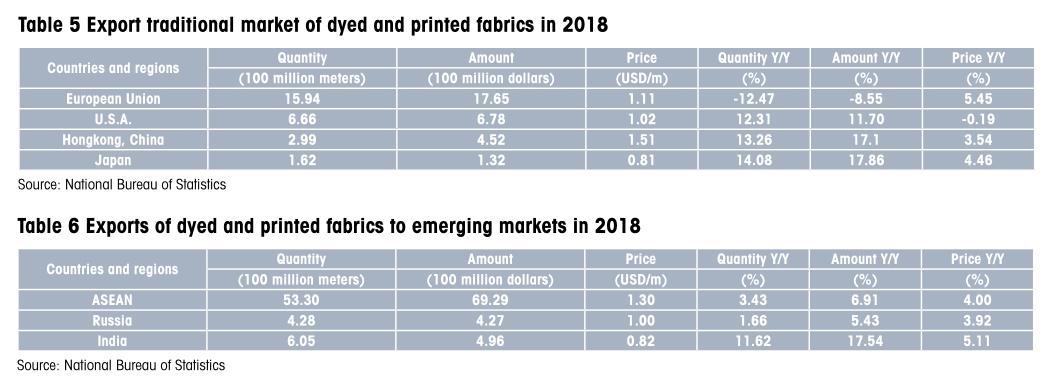

In 2018, eight categories of dyeing and printing products showed different performances in traditional export markets, as shown in Table 5. Exports to the EU market amounted to 1.594 billion meters, a decrease of 12.47% year-on-year, with an export value of 1.765 billion U.S. dollars, a decrease of 8.55% year-on-year, which changed the trend of annual increase in the proportion of exports to the EU market since 2012. Despite the escalating trade frictions between China and the United States in 2018, the export of eight major categories of dyeing and printing products to the United States market did not decline but increased, indicating that the trade frictions between China and the United States have not yet had a significant impact on the dyeing and printing industry, but because of the increasing uncertainty of the export environment, it has a negative impact on relevant international purchase orders, dyeing and printing enterprises orders, raw material procurement, etc. Japan is the main export market of textiles and apparel in China. In 2018, the export of dyeing and printing cloth to Japan has warmed up. The export vol- ume and amount increased by 14.08% and 17.86% respectively compared with the same period last year. The challenge facing Chinas dyeing and printing products in Japan is not to expand market share, but to provide deep-processed, high-quality products, enhance product added value and brand services.

Exports to emerging markets

In 2018, dyeing and printing fabrics exported well to emerging markets such as ASEAN, as shown in Table 6. The main reason why the export of dyeing and printing products to ASEAN keeps growing is that bilateral economic growth is good and bilateral trade growth is boosted by deepening cooperation. In 2018, Russias economic growth rate increased. The export volume of eight categories of dyeing and printing products to Russia increased by 1.66% and the export amount increased by 5.43%. Indias better economy and better demand environment boost Chinas exports to India, although India raised the tariff rate of import of more than 300 textiles to 20% to protect its textile manufacturers from the impact of imported textiles, its domestic products can not meet the consumption demand at present. In 2018, the export volume and export amount of eight categories of products to India increased significantly.

Main problems in dyeing and printing industry in 2018

Cost pressures continue to rise

At present, the rising cost has become the main problem of enterprise production and operation at this stage. In 2018, due to the continuous growth of financing, employment, taxation, environmental protection investment and the rising price of dyes and chemicals, the comprehensive operation cost of enterprises has been further increased. Since 2018, the price of dye raw material intermediates has been at a high level, which has pushed up the price of dyes. The price of main disperse dyes has risen by 70% - 80%, and the price of reactive dyes has risen by 40% - 50%. However, dyeing and printing processing fees are difficult to increase synchronously, which has increased the operating pressure of dyeing and printing enterprises. In addition, with the continuous promotion of industry transformation and upgrading, the investment in technological transformation and innovation is increasing. At the same time, with the deepening of the national environmental protection policy, the requirement of wastewater and exhaust gas treatment in dyeing and printing industry has been constantly improved, which has led to the increasing investment and operation cost of environmental protection facilities. The pressure brought by the rising cost of industry is becoming increasingly prominent.

Increased competition in the international market

At present, the international market competition of textile industry is intensifying. Dyeing and printing industry, as an important part of the textile industry to reflect the core competitiveness of the industrial chain, is also increasingly affected by the pressure of international competition. In terms of output, from 2016 to 2018, the output of dyeing and printing cloth showed a declining trend year by year. In terms of export, from 2015 to 2017, the export amount of eight major categories of dyeing and printing products decreased year by year. Although it rebounded in 2018, compared with the “Twelfth Five-Year Plan” period, the export has shrunk considerably. In recent years, Vietnam, Bangladesh and India and other Southeast Asian countries continue to increase their share in the three major textile markets of the United States, Japan and Europe. With the escalation of Sino-U.S. trade frictions in 2018, more orders have flowed to Southeast Asia and other regions with advantages of labor costs and tariff policies, thus weakening the export competitiveness of Chinas textiles and clothing.

Development trend and key direction of dyeing and printing industry in 2019

The impact of domestic and foreign situation on dyeing and printing industry

At the international level, the external environment is still complex, the unfavorable factors to the export growth of the industry have increased significantly, the growth of the world economy has slowed down, trade frictions between China and the United States persist, Britains separation from the European Union has not yet been settled, trade protectionism and unilateralism are rampant, and the international financial market is full of uncertainty, which will affect the export of textiles and clothing and further aggravate the domestic textile and clothing market competition, coupled with the slow growth of terminal consumption demand, dyeing and printing enterprises around the country have improved their technology and equipment, and makes the market competition more intense.

From the domestic level, at present, production and living consumption continue to upgrade, consumption structure will be further optimized, and high-end consumption has become a new economic growth point that our country focuses on cultivating. The traditional production mode of the industry has been unable to meet the growing demand. Accelerating the transformation and upgrading, restructuring and promoting the industry to move towards the middle and high-end is the key to the development of the industry in the future.

Grasp strategic opportunities and rebuild new competitive advantages of the industry

In the environment of weak international demand and fierce international trade competition, there is still a great uncertainty about how Sino-U.S. trade friction will move. But on the whole, it also provides opportunities for Chinas dyeing and printing industry to develop diversified markets. The industry can take this opportunity to exchange speed for space for structural adjustment, expand sales and emerging markets, and strive to create new international competitive advantages of the industry. On the one hand, we should optimize the existing market and product export structure, transform the export growth mode, and focus on improving the quality and efficiency of export growth. On the other hand, under the background of “Belt and Road” Initiative, enterprises should do a good job in market planning, strengthen the development of emerging markets along the road, and reduce the risks caused by the reduction of orders due to trade friction.

Accelerating transformation and upgrading to promote high-quality development of the industry

First, we should strengthen scientific and technological innovation and break through key technologies in the industry. Focus on the development of high-quality dyeing and printing product design and manufacturing technology, including functional textile dyeing and finishing technology, multi-component textile dyeing and finishing technology, high color fastness textile dyeing and finishing technology, new fiber dyeing and finishing technology, to provide technical basis for the development of high-quality, multi-functional, differentiated and high value-added products, make textile fabrics develop in the direction of comfort, fashion, environmental protection, diversification, multi-function and intellectualization, and improve the core competitiveness of products. The second is to speed up the adjustment of product and market structure and realize the transformation from scale and quantity type to quality and benefit type. Thirdly, improve the level of industry management, and realize the traditional industry management from “extensive” to “refined”.

- China Textile的其它文章

- World-class textile technology in ShanghaiTex 2019

- Economic operation of China’s industrial textiles industry in 2018

- Operation analysis of China’s chemical fiber industry in 2018 and operation forecast in 2019

- Status quo of China’s textile machinery industry in 2018

- Lanyin Fashion Town

- Give full play to the“three major”advantages and draw a new blueprint for high-quality economic development