Operation analysis of China’s chemical fiber industry in 2018 and operation forecast in 2019

In 2018, the world economy recovered and the domestic economy remained stable, which created a relatively favorable market environment for Chinas textile and chemical fiber industry and supported the overall smooth operation of the industry. However, the international situation is complex and changeable, the oil price fluctuates greatly, the trade friction between China and the United States escalates gradually, the devaluation of RMB and other factors increase the risk of operation of the industry. Especially in the polyester industry, affected by crude oil prices and PTA futures, the industry fluctuated unsteadily in the second half of the year. Except for the fourth quarter, overall, the production of the chemical fiber industry has maintained a good growth, and the economic growth rate has been stable in a higher range, which has become an important support for the economic growth of the textile industry. However, the operation of various sub-industries has been differentiated. The overall performance of polyester and nylon industries is good, while the operation of viscose, acrylic and spandex industries is more difficult. There are also differences among enterprises, and resources are further concentrated to the dominant enterprises.

Basic operation of chemical fiber industry in 2018

Production

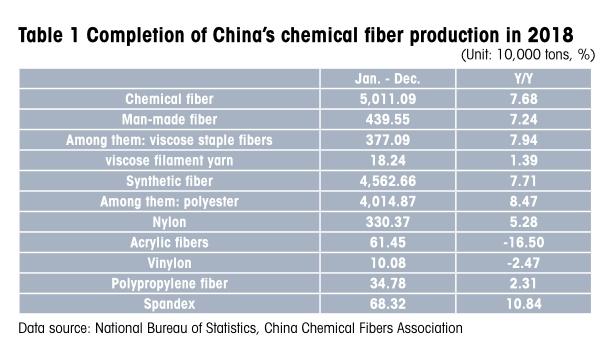

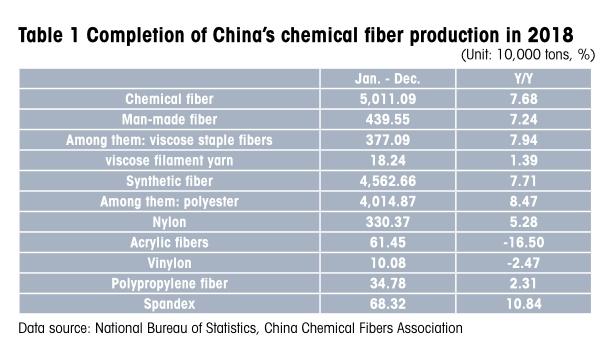

According to the statistics of National Bureau of Statistics, the output of chemical fibers in 2018 was 50.1109 million tons, an increase of 7.68% year on year. Among them, the output of polyester fiber was 40.1487 million tons, an increase of 8.47%, that of nylon fiber was 3.3037 million tons, an increase of 5.28%, and that of viscose staple fiber was 3.7709 million tons, an increase of 7.94%.

The chemical fiber industry has entered the “new normal” since 2012, with slower output growth and faster elimination of backward production capacity. After entering the 13th Five-Year Plan, the chemical fiber industry continued to promote supply-side structural reform, while expanding the industry, it continued to be accompanied by the elimination of backward production capacity. From 2012 to 2018, the average annual growth rate of chemical fiber production was 4.55%, which was less than half of the peak year of output growth.

The production and marketing of polyester and nylon industries are booming, and the average operating rate of the industry is at a relatively high level in recent two years. Among them, the operating rate of polyester filament industry remains high, especially in the peak season of direct spinning filament more than 90%, and in the off-season, the operating rate is also maintained at more than 80%. Due to the release of a large number of new capacity, the output of the spandex industry has increased significantly year on year. The operating rate of viscose industry and acrylic fiber industry is significantly lower than that in 2017. The average operating rate of acrylic fiber industry is about 60%. The operating rate of both industries is at a relatively low level in recent two years.

Import and export

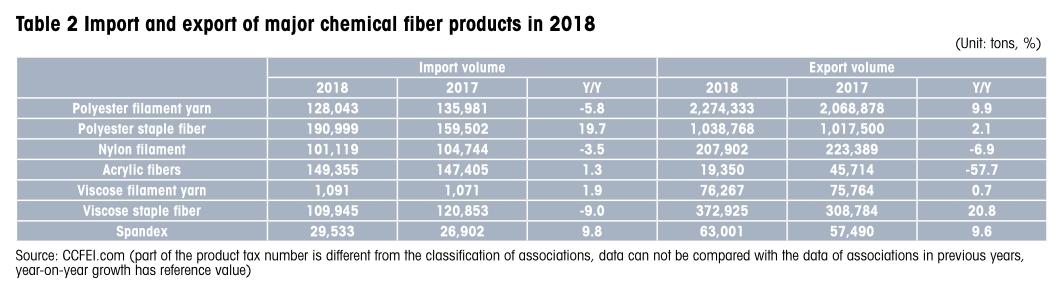

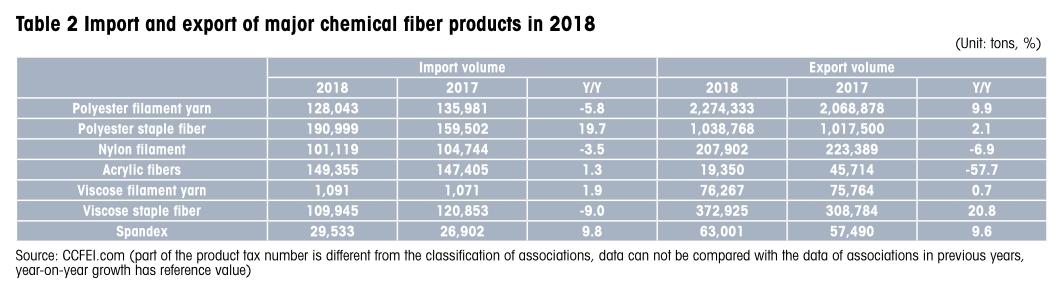

Due to the problem of data sources, there is no accurate import and export data for the whole chemical fiber industry. According to the associations calculation, the import volume of chemical fibers in 2018 was about 940,000 tons, an increase of about 2% over the same period last year. Imports of polyester staple fibers need to be paid attention to. The import volume increased by nearly 20% year-on-year, which should be related to the limitation of domestic regenerated raw materials to make up for the shortage of the output of regenerated fibers. Moreover, the original and regenerated products of polyester staple fibers can not be distinguished by tax number. It is known that a considerable part of the increase in imports of polyester staple fibers is regenerated polyester staple fibers.

The export volume of chemical fibers increased by about 6%, and the export volume was about 4.3 million tons. The impact of Sino-U.S. trade frictions has not yet fully emerged, and the export volume of three major products, polyester filament, polyester staple and viscose staple, has maintained a good growth rate.

Market

The synthetic fiber market is affected by oil price fluctuation, and the price focus is higher than that in 2017 under the push of cost. Especially in the polyester industry, affected by crude oil prices, more affected by PTA futures, the industry in the second half of the year saw a big ups and downs. The nylon market is relatively stable. The viscose staple fiber market is generally in a weak position because of the price depression of cotton and the release of increased production capacity.

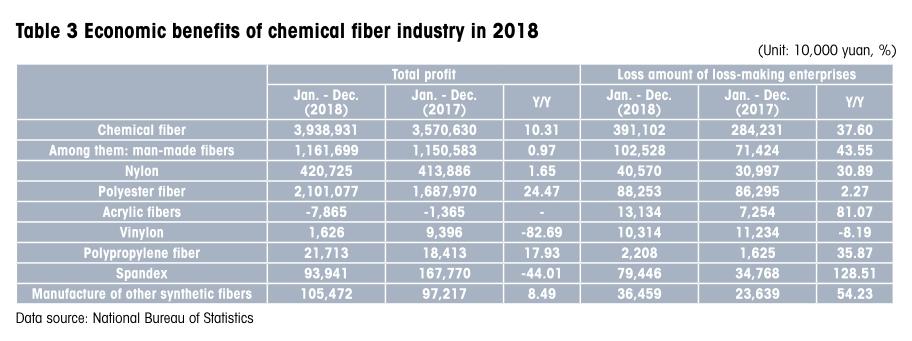

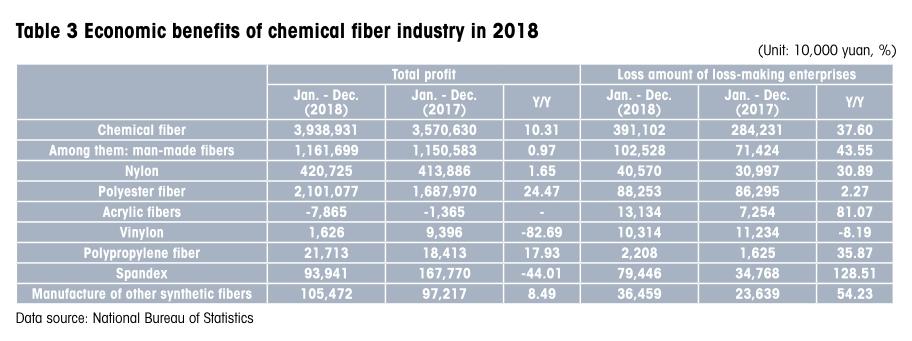

Quality and effectiveness

In 2018, the added value of Chinas chemical fiber industry increased by 7.6% year-on-year, 1.8 percentage points faster than in 2017, the main business income reached 798.958 billion yuan, an increase of 12.42% year-on-year, and the total profit reached 39.389 billion yuan, an increase of 10.31% year-on-year. Chemical fiber industry has become an important support for the economic growth of textile industry. the percentage of loss-making enterprises is 18.23%, which is 5.21 percentage points larger than that of 2017. The loss amount of loss-making enterprises also increased by 37.6% year-on-year, reflecting the continued polarization of the profitability of enterprises.

The operation quality of chemical fiber industry in 2018 is generally good, but it is lower than that in 2017. The profit margin of the main business is 4.93%, which is 0.09 percentage points lower than that of the previous year. The turnover rate of total assets is basically the same as that of 2017, but the turnover rate of finished products is declining. The proportion of sales expenses and financial expenses among the three expenses is reduced. From the market, the increase of industry profits is mainly attributed to the rise of product prices and the follow-up of downstream demand, but its essence is that the supply-side structural reform has achieved certain results, the supplydemand relationship has improved, and the development of new products is also accelerating, with the improvement of brand, quality and variety.

Main factors affecting the operation of chemical fiber industry

International oil prices

In 2018, in addition to the impact of supply and demand fundamentals, international oil prices are deeply affected by political events. International oil prices rose slowly in the first nine months, reaching new highs, and fell sharply in the last three months.

It is expected that the global economic growth will slow down in 2019, the oil demand will be insufficient, and the pace of U.S. oil production increase will not slow down, which will lead to a moderate easing of crude oil supply and demand. If OPEC does not increase the intensity of production reduction, it is difficult for oil prices to rise substantially. In the geopolitical arena of 2019, the Trump government will continue to be a major producer of uncertainties in the oil market. Incidents such as Britains withdrawal from the EU, sanctions on Iranian for its nuclear program and regional conflicts in the Middle East may become problems, leading to fluctuations in crude oil prices.

Futures market

PTA futures market in 2018 has a great impact on the operation of the polyester industry. The financial attributes and speculation of futures magnify the fluctuation of the market. At the end of 2018, PTA was introduced to foreign traders and MEG futures were successfully listed, so the market risk of polyester raw materials in 2019 was further increased. The risk control of chemical fiber enterprises, especially private enterprises, is still not perfect. It is suggested that chemical fiber enterprises should stay away from futures speculation. From the historical experience and a long time, the participation of chemical fiber enterprises in futures trading has no positive impact on the profitability of enterprises. On the contrary, there are always enterprises that lose or even fail due to excessive speculation. Futures speculation also polarizes the industry, leading to irrational competition.

Investment

In 2018, the growth rate of fixed assets investment in chemical fiber industry continued to rebound, reaching 29.0%. According to incomplete statistics, polyester production capacity increased by nearly 5 million tons in 2018 (including 1.1 million tons of flakes). In 2019, it is expected that more than 3 million tons of polyester will be added to the production capacity, and there is still a long way to go to prevent overcapacity.

New capacity release, backward capacity withdrawal, the industry is in the throes of changing. Among them: the new capacity of polyester industry is mainly dominated by large enterprises, the degree of concentration is further improved, and the trend of “refining and chemical integration” is obvious, polyester staple fibers benefit from the market of regenerated fibers, nylon spinning speed is lower than raw materials, and the operation of nylon industry is better, viscose staple fibers and spandex industries have greater impact on the market and the operation of the industry is difficult.

Exchange rate

In 2018, the RMB exchange rate fell from 6.5 to 6.86, with a depreciation of 5.4%. Although RMB depreciation can hedge the adverse effects of some trade frictions, the proportion of chemical fiber direct export is still low, and chemical fiber industry is an industry with high dependence on raw material import. PX, MEG and wood pulp all maintain more than 50% dependence on import, so RMB depreciation will increase the cost of chemical fiber raw material import.

Sino-U.S. trade frictions

Sino-U.S. trade frictions escalated in 2018. In the short run, the direct impact on Chinas chemical fiber import and export is generally small, and it has a greater impact on some products in some industries, especially the concern about taxation is the crux of the real impact on the textile and chemical fiber industry, seriously affecting the confidence of enterprises. In the long run, the import transfer of the United States may accelerate the development of competing countries and affect the international competitiveness of Chinas chemical fiber industry.

The international situation is still complex in 2019. Although the negotiations between China and the United States are progressing smoothly and the U.S. tariff imposed on Chinese products has not yet increased to 25%, we can not be blindly optimistic. The Sino-U.S. trade war may be a protracted one that stops and stops.

Operation forecast of chemical fiber industry in 2019

Background of industry operation

In 2019, although the global economy will continue to expand, the risks are rising and the momentum of growth will weaken. Chinas economic operation is also facing downward pressure. It is expected that Chinas economy will continue to grow steadily, and the growth rate may be slightly lower than last year.

Under the pressure, it is expected that the growth rate of the main operating indicators of the textile in- dustry will be lower than that in 2018, and the pressure of export growth is particularly prominent. The inherent demand of textile industry to promote high-quality development is more urgent. We must focus on improving production efficiency and risk-resistant ability, in order to maintain a stable development trend.

Against the background of slowing global economic growth, the growth of oil demand is weak, while the supply side of crude oil is still moderately loose, but the current oil price is low, lacking the power to rise and fall sharply. The crude oil market is increasingly affected by geopolitical factors. There is a possibility that oil prices will rebound periodically due to geopolitical factors. The overall volatility is not expected to exceed 2018.

Operation forecast of chemical fiber industry

In 2019, the chemical fiber industry, especially the polyester industry, is still at the peak of production. With the increase of supply, the contradiction between supply and demand in the market in 2019 will gradually become prominent. At the same time, due to the larger base in 2018, the growth rate of some operational indicators will slow down in 2019.

However, considering the current high degree of industrial concentration, the remarkable increase in the voice of large enterprises and the weakening of disorderly competition in the market, the decline rate of various indicators in the industry is relatively limited. We can not exclude the stimulating demand of stages due to the ease of the Sino-U.S. trade dispute, the launch of the second round of environmental protection inspection in 2019, the transfer of textile, dyeing and printing to the central region of China and other incidents.

It is expected that in 2019, the average operating rate of the chemical fiber industry will be lower than in 2018, and the output will continue to grow at a rate of about 5% in recent years, the export volume will increase slightly further, and the economic benefit will be weaker than in 2018. The gap between enterprises competitiveness is widened further, and the head effect and subdivision effect continue to appear.

- China Textile的其它文章

- Status quo of China’s textile machinery industry in 2018

- Made in China is gaining global recognition

- CHTC:Group displaying worth expectations

- Give full play to the“three major”advantages and draw a new blueprint for high-quality economic development

- Lanyin Fashion Town

- Status quo of China’s dyeing and printing industry in 2018