Economic operation of China’s industrial textiles industry in 2018

In 2018, Chinas industrial textile industry has maintained a relatively rapid growth throughout the year, and the quality and efficiency of the operation of the industry is in a stable range. According to the data of the National Bureau of Statistics, the industrial added value of enterprises above designated size increased by 8.6% year-on-year, 4.6 percentage points higher than in 2017. The recovery of the growth rate of industrial added value shows that the overall benefit of the industry has improved significantly. According to the survey of China Nonwovens & Industrial Textile Association, the prosperity index of industry enterprises in 2018 is 75.4, which is lower than that of the whole year, but still in a relatively high prosperity range.

Steady growth of production

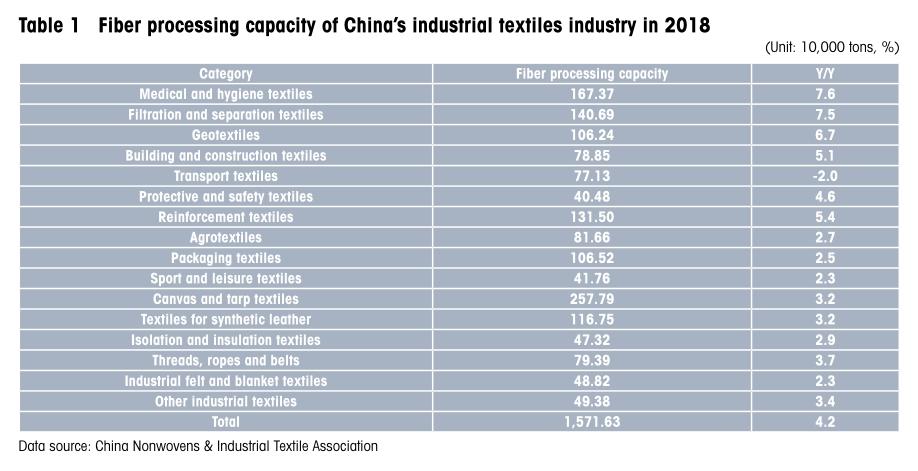

Since the Twelfth Five-Year Plan period, Chinas industrial textile industry has maintained a rapid growth in production. The total amount of fiber processing in- creased from 9.1 million tons in 2011 to 15.08 million tons in 2017, with an average annual growth of 7.5%. It has become the largest producer, trader and consumer of industrial textiles in the world. In 2018, Chinas industrial textile industry is facing a more complex development environment. The growth rate of production is basically the same as that in 2017, with an increase of 4.2% year on year. The total annual fiber processing volume is 15.7163 million tons. The production of medical and hygiene textiles, filtration and separation textiles, geotextiles, building and construction textiles and reinforcement textiles continued to grow at a relatively high rate. (Table 1)

Good economic benefits

According to the data of the National Bureau of Statistics, in 2018, the total revenue and profits of enterprises above designated size of the industrial textile industry reached 241.993 billion yuan and 13.04 bil- lion yuan respectively, increasing by 6.75% and 5.52% respectively. The average profit margin of the industry is 5.39%, which is 0.06 percentage points lower than that of the previous year. The percentage of loss-making enterprises is 11.84%, and the loss of loss-making enterprises is 702 million yuan, which is 33.84% higher than that of the previous year. According to the statistics of 200 member enterprises, the main business income and total profit of sample enterprises increased by 9% and 16.02% respectively, and the profit margin was 6.85%, which was higher than the average level of the whole industry.

Maintaining active investment

Enterprises are optimistic about the development of the industry. Key enterprises continue to increase investment. The focus of investment is mainly focused on the introduction of advanced equipment to increase production capacity, as well as the intelligent upgrading and energy-saving transformation of existing equipment, so as to improve quality and reduce costs. Investment in nonwovens continues to be very strong, especially in spunbonded, spunlaced and needle punched nonwovens. According to incomplete statistics, 65 spunbonded non- wovens production lines, 52 spunlaced production lines and 193 needle-punched production lines were added in 2018.

Exports continue to pick up

As a result of Sino-U.S. trade friction, most industrial textiles are within the scope of the second round of tax increase in the United States, which has brought greater pressure to the industrys exports to the United States. According to the data of China Customs, in 2018, China exported 23.22 billion U.S. dollars of various industrial textiles (due to the change of China Customs data, the export statistics of industrial textiles industry changed in 2018. In order to facilitate comparison, this report adjusted the export data of 2017 according to the statistics of 2018), which increased by 7.92% year on year, and nearly 2 percentage points higher than that in 2017. At the same time, the increase of export volume and export price jointly promoted the growth of export volume and further consolidated the recovery of industry exports.

Major products

In 2018, the export of the main products of the textile industry in the industrial park showed a relatively high growth rate. Industrial coated fabrics are the largest export products in the industry, with export volume increasing by 12.51%, felts, tents and other traditional products by 10.74%, and cord fabrics by 12.93%. The export volume of nonwovens and related products also maintained a relatively high growth rate, with coil exports of 2.954 billion U.S. dollars, an increase of 13.11%, disposable sanitary goods exports of 1.78 billion U.S. dollars, an increase of 11.88%, nonwovens protective clothing exports of 927 million U.S. dollars, an increase of 7.42%, and Chinas nonwovens and products still maintain a strong global competitiveness. (Table 2)

Major export markets

Due to incomplete export data, we only analyze the main export markets of nonwovens. The European Union, Japan, South Korea, the United States and Vietnam are the main export markets of Nonwovens in China. Except for the Japanese market in 2018, the rest regions have increased considerably. (Table 3)

Development of key industry areas in 2018

Medical and hygiene textiles

Medical and hygiene textiles are widely used in industrial textile industry. Taking disposable sanitary products as an example, the market of womens sanitary napkins has been relatively mature with high penetration rate, and maintains a natural growth rate of about 5% every year. Baby diapers are still a fast-growing market, growing at about 12%. And adult incontinence products are still in the market cultivation period, with great potential, increasing by more than 20% annually. Wipe products (dry and wet towels) are another fast-growing market, growing by more than 10%.

In 2018, investment and production of spunlaced nonwovens and spunbonded nonwovens for sanitary materials continued to grow in double-digit in 2018. The export of diapers and sanitary napkins reached 1.798 billion U.S. dollars in 2018, an increase of 11.88% over the same period of last year. Among them, the export of adult incontinence products reached 287 million U.S. dollars.

The development of medical textile industry is relatively stable, the concentration of industry is relatively high, and the export proportion of key enterprises in the industry is relatively large. In 2018, China exported 927 million U.S. dollars of disposable nonwovens protective clothing, an increase of 7.42% over the same period last year, and 992 million U.S. dollars of medical dressings such as gauze and bandage, an increase of 5.37% over the same period last year.

Geotechnical and construction textiles

In 2018, Chinas fixed assets in railway, highway, airport and port infrastructure areas continued to maintain a high scale and growth, providing a huge market for the development of geotextiles. Geotechnical industry also actively develops the market of environmental engineering, and has achieved good results in landfill, tailings treatment, petroleum exploration, industrial seepage control and ecological slope protection. Various products adapted to environmental protection have become new growth points of geotechnical materials industry.

Polypropylene filament nonwovens developed by key enterprises in the industry in 2018 have excellent performance, breaking the monopoly of multinational companies in this field, and the products have been applied in key national projects. On the whole, the demand of geotextile industry is relatively sufficient, and the order situation of enterprises is relatively good. According to the survey and calculation of key enterprises by the association, the main business income and total profit of the industry increased by 11.6% and 8.47% respectively in 2018.

Although the overall development situation of the industry is relatively good, the production of small enterprises in the industry is affected by the national environmental protection policy. Rising raw material prices and long engineering accounts also bring certain risks to the operation of enterprises.

Transport textiles

Transport textiles are an important field of industrial textiles. Firstly, compared with traditional materials, textile materials have strong advantages in weight, sound insulation, thermal insulation, comfort and environmental protection, and the trend of replacing traditional materials is obvious. Secondly, the application of new textile materials in vehicles is expanding. For example, super-fiber materials are more widely used in automobile seats, door panels and other parts. High-performance fiber composites are gradually applied in new energy vehicles. With the maturity of technology and the reduction of cost, the application of fiber composites in automobiles will be more extensive. In addition to automobiles, textile materials are also widely used in high-speed rail and aircraft, including not only traditional seat fabrics, but also some new honeycomb materials, door panels, filter materials and so on. Thirdly, the automotive textile industry has a relatively high technical threshold and a relatively long entry period. Therefore, enterprises can form a relatively stable cooperative relationship with automobile manufacturers. There are many large enterprises in the industry, and the degree of concentration is relatively high.

Filtration and separation textiles

In 2018, the state continued to intensify efforts to improve the atmospheric environment. Chinas air quality has been significantly improved. Filtration and separation textiles enterprises have played an important role, and the industry has ushered in a rare opportunity for development. Bag dust collector has the characteristics of high efficiency purification of fine particulate matter, wide range of air handling and small impact of dust properties. Bag dust collector has become the mainstream dust collector at present. It is widely used in industry and its application proportion is increasing year by year. The reality shows that bag filter has become the mainstream equipment for efficient purification of particulate matter, and bag filter has become the main force for realizing ultra-low emission and revamping. According to the associations survey, the main business income and total profit of the key enterprises in the industry increased by 13.7% and 11.5% respectively in 2018, and the profit margin was about 10%.

Protective and safety textiles

The market of protective and safety textiles in our country is very large. First-line workers such as firefighting, petroleum and petrochemical, coal, iron and steel metallurgy need high-quality products to ensure safety. However, compared with the rapid development of medical and hygiene textiles, filtration and separation textiles and other fields, the development speed of this field is slower. According to the survey conducted by the Association, the main business income and total profit of key enterprises increased by 5.42% and 7.56% respectively in 2018.

Industry development forecast in 2019

In 2019, Chinas industrial textile industry is facing a more complex environment, and the challenge of highquality development of the industry is greater. Chinas macroeconomic downward pressure is increasing, and the domestic demand for industrial textiles is facing greater uncertainty, trade protectionism is rising, major countries around the world have lowered their growth expectations, and the impact of Sino-U.S. trade friction on the industry will gradually emerge, the fluctuation of raw material prices and the intensification of industry competition brought by the rapid growth of investment have squeezed the profit space of enterprises.

However, the positive factors that promote the continuous growth of industrial textile industry have not changed. China is still the largest and most dynamic domestic demand market in the world. The market demand released by infrastructure construction, consumption upgrading, urbanization and civil-military integration development is huge. The state firmly supports the implementation of the policy of real economic development, and the business environment of enterprises will be further optimized. The countries and regions along the “Belt and Road” have strong demand for disposable sanitary materials, nonwovens, coated fabrics, geotextiles and filtering materials.

Chinas industrial textile industry has strong competitiveness in the world. It is not only the largest in scale, but also has made great progress in professional training, special equipment and raw material support. It has the competitive advantage of the whole industry chain. The gap between Chinas industrial textile industry and developed countries in scientific and technological innovation, new product development, fine management and product quality has gradually narrowed. Many achievements have been made in intelligent manufacturing and green manufacturing, and the strength of key enterprises has been strengthened.

- China Textile的其它文章

- Status quo of China’s textile machinery industry in 2018

- Made in China is gaining global recognition

- CHTC:Group displaying worth expectations

- Give full play to the“three major”advantages and draw a new blueprint for high-quality economic development

- Lanyin Fashion Town

- Status quo of China’s dyeing and printing industry in 2018