Sino-US Trade Friction– Can China Cope with Industrial Transfers

By staff reporter Wang Yaya

China is now feeling the sting of an industrial shift that reflects market and non-market factors. It is already taking steps to cope with this changing environment. The following article looks at these efforts.

A mid the rise of protectionism and Sino-US trade friction,China’s manufacturing sector has come under substantial pressure. Once a beneficiary of industry shift,China is now on the receiving end of the transfer of production and jobs. Economists have even raised fears of a hollowing out of the nation’s manufacturing sector and questioned whether the nation is on the cusp of seeing its role in global production replaced by Southeast Asia. In order to answer these questions, China Forex asked a group of industrial experts and scholars about their views on these developments. The following is an edited version of the interview.

Industrial Shifts in Global Perspective

Industrial shifts are the transfer of manufacturing industries due to changing costs of production in different countries and areas, according to Huang Hanquan, director of the Institute of Industrial Economy and Technological Economy at the National Development and Reform Commission(NDRC). Huang noted that international capital is always looking for opportunities in places where resource costs are lower and there are comparative advantages.This results in the international division of labor changes and creates the reorganization of industry in what we call industrial shifts or transfers.

Generally speaking, there are three ways to effect industrial shifts or transfers. An enterprise can reduce production capacity in the place in which production costs have risen or relocate its production. This is called production shrinkage. An enterprise can also expand capacity in a new place while keeping the same production scale in the previous one and it can also choose global manufacturing operations under a globalization strategy. Among the three methods, production shrinkage is the current focus as it usually has the biggest impact on the original place of production.

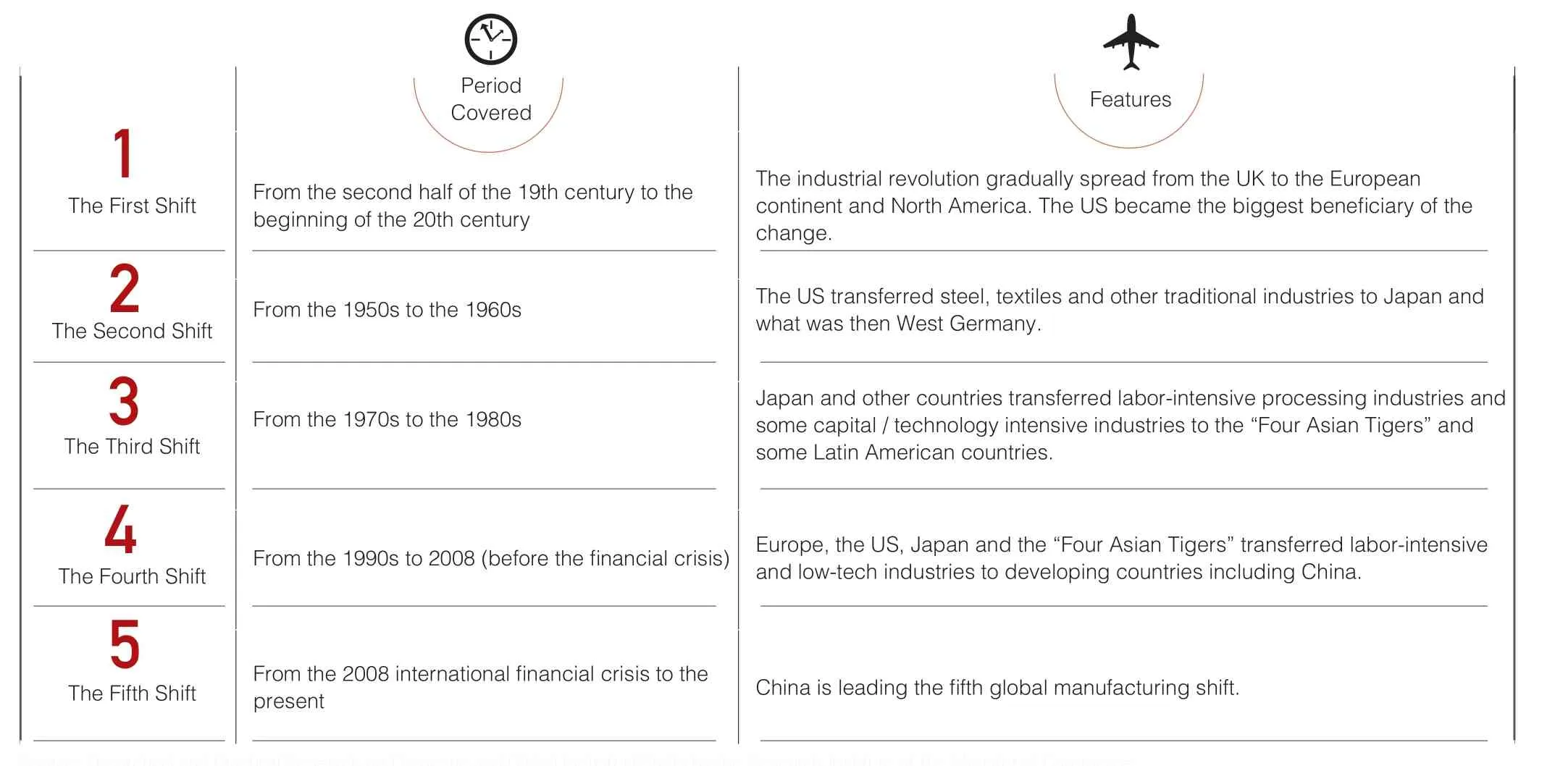

Industrial shifts are hardly new,with the first modern era trend appearing in the second half of the 19th century. He Manqing, director and researcher of the Research Center for Multinational Companies at the Ministry of Commerce’s Research Institute, said that China has come under the global spotlight in the current industrial shift, the fifth such wave of relocations. Some manufacturing and service firms in China’s coastal areas have been moving to neighboring countries as a result of rising manufacturing,operating and living costs since 2008,due to the new Labor Law and higher housing prices. Other reasons include overcapacity in some industries and pressure for industrial upgrading.

Some scholars note that small and medium-sized manufacturers in labor-intensive industries, which rely mainly on exports or contract manufacturing, are moving from China to Vietnam, Myanmar, India,Indonesia and other emerging economies to take advantage of cheaper labor and other resources.At the same time, some higher-end manufacturing companies are moving back to developed countries including the US and Europe.

In Huang Hanquan’s opinion,the fourth and fifth industrial shifts converged. Industry in Europe,the US, Japan and the four “Asian tiger economies” is shifting to China and Southeast Asia, still hot spots for international investment.Meanwhile, some manufacturers in China are transferring production to other emerging markets, including Vietnam, owing to the rising production costs at home. The coexistence of the two investment flows is a primary feature of the current global industrial shift.Data published by China’s Ministry of Commerce in October 2019 has demonstrated Huang’s assertions.From January to September this year,30,871 foreign-funded enterprises were set up in China. Over the same period the actual use of foreign investment capital grew 2.9% year on year to US$100.78 billion.

China had total foreign capital inflows of US$139 billion in 2018, up 3% over the previous year. That was despite a 13% drop in global crossborder investment to US$1.3 trillion that year. Moreover, total global investment has been down for three successive years.

The World Investment Report 2019 issued by the United Nations Conference on Trade and Development in June 2019 echoed the view that China continues to show long-term attractiveness to international investors.

At the same time, there has been rapid growth in China’s overseas direct investment in recent years.Data from the Ministry of Commerce show that China’s outbound investment reached about US$124.6 billion in 2017 and US$130 billion in 2018. Outbound investment totaled US$87 billion in the first nine months of this year. It can be seen that China acts as both an international investment destination and an active supplier of capital for the rest of the world.

Industrial Shifts from China

China’s industrial shifts began when the country was changing its pattern of economic development.The NDRC’s Huang argues that the shifts can be traced back to around 2012. At that point China’s economy entered a “new normal” stage in which the previous pattern of growth driven by low-cost resources was being transformed. Increasing costs of land and human resources, as well as restrictions on production due to environmental protection efforts,have made it harder to continue some types of production. This has convinced many companies to shift some types of manufacturing away from China.

A company generally bases its investment considerations on a number of cost factors, and in China that usually is the cost of labor.Another aspect is the business environment. Furthermore, the support capabilities of local industry and available talent are another important consideration. Companies must take into account whether the production location is near the target market. China’s early industrial shifts were pressured by soaring labor costs initially but now all of these factors are contributing to decisions on where to locate production.

Many of the companies shifting overseas are from the Pearl and Yangtze River Deltas. The Pearl River Delta in Guangdong province was previously a key hub for foreign-funded enterprises in the processing trade. But some laborintensive industries are moving away from parts of China far away from the higher cost eastern coast.Southwestern China is also a source of outbound investment as it is close to parts of Southeast Asia, and there are convenient logistics channels that allow these companies to supply the home market.

在当今的时代不断发展的过程中,我国的经济也实现了进一步的发展,因此知识对于当今的经济发展过程而言至关重要。因此,要想适应当今时代发展的需求,就应该将专业知识和社会实践实现进一步的有效结合,因此,我国的学校以及社会之间也就形成了越来越密切的联系。在这一过程中,再继续应用传统的教学模式进行教学就会很难跟上时代发展的步伐,所以,实践教学是当今最为适用的一种教学形式。因为实践教学要依托实训室进行,但是很多学校的实训室仅仅在实践教学的过程中才对学生开放,其余的时间不允许学生进入到实训室之中进行学习[1]。

Often it is the leading companies of an industry that drive the outbound investment trend, with supporting firms in the industrial chain following suit. In the aspect of a company’s ownership, those moving away are mainly foreign-funded and private companies. “That is normal.After all, these kinds of enterprises are more profit-driven,” Huang said.

Other features of the industrial shift from China have been observed by the Institute of World Economy and Politics at the Chinese Academy of Social Sciences. The institute launched a survey after the Sino-US trade spat erupted in 2018.During the study in places including Shenzhen, Taizhou of Zhejiang, and Xiamen in Fujian province, “it is found that there are indeed industrial shifts from China. But today, the immediate concern of the companies moving away is not shrinking production costs,” said Zhang Lin of the Institute’s International Trade Research Office. “Some labor-intensive companies began transferring production to Southeast Asia and other places some years ago.The companies which are considering setting up factories abroad now possibly have no other choice.”

Zhang Lin illustrates her point with an example of a firm we’ll call Company A, a Taiwanese-owned original equipment manufacturer that is a major manufacturer of bathroom products and relies on the US for about 70% of its orders. Upon the outbreak of Sino-US trade friction, its US customers called on Company A to transfer its production to Vietnam.

“The customers stated that if the company set up a factory in Vietnam, they would increase their orders. But orders would be canceled if the company kept its production in mainland China”. The company was faced with a dilemma. On the one hand, it had already upgraded its production lines in China,introducing advanced robotics to replace manual production. On the other hand, the company had to meet the requirement of its US customers.Ultimately, the company chose to move its older equipment to Vietnam and set up a smaller production line there.

Similarly, another company we’ll call Company B, a manufacturer for an internationally renowned brand of luggage, was forced to shift production at the request of its US customers. The company was told it would see an increase of 60% in orders on the condition that the goods were shipped from Vietnam.If the production remained in China,orders would be cancelled.

Zhang Lin of the Chinese Academy of Social Sciences said: “A few traditional OEM (original equipment manufacturers) have transformed from labor-intensive production to capital-intensive and higher-tech output. They do not really want to move from China.” This is the case for both companies A and B. It is not the market factors that have driven them to set up factories in Vietnam.

“It is unreasonable to attribute all industrial shifts to issues about China’s manufacturing environment,”said the NDRC’s Huang, who puts much of the blame on US-China trade friction. “There are shifts of orders and production. At the same time,China’s domestic industrial shift from its eastern regions to the central and western ones has been disrupted.”

Dishang Group Co, Ltd is an example of a company choosing the globalization formula. This largesized company has a diversified business with garment production at its core. “Transferring the production base to Southeast Asia was an important part of the company’s globalization strategy. Related arrangements were made eight years ago,” Dishang’s general director Zhu Lihua said in an interview. “Presently we have plants and processing bases in Cambodia, Myanmar and Bangladesh. And a garment industrial park is under construction in Myanmar. We will expand production in these places and more orders will be filled there.” Nevertheless,offshore production accounts for less than one -tenth of Dishang’s overall production, which is largely in China.

Sino-US Trade Friction

Sino-US trade friction has placed pressure on China’s exports but the“effect of this trade pressure so far has been kept under control,” Huang said.

First, enterprises are making efforts to offset the effect of surging costs of labor. Those in China’s coastal areas, which have suffered from rising costs and suffered from labor shortages, are replacing manual production with robots. For instance,the above-mentioned Company A introduced a complete robotic production line in 2018. Meanwhile,company officials said capital flows into Southeast Asia will lift the costs of labor there.

Moreover, the move of laborintensive, low-tech industries will make room and free up resources for emerging and high-tech industries.Take Adidas (China) Ltd as an example. It shut a factory in Suzhou in Jiangsu province in 2012. At the same time, it invested heavily in Tianjin to build its Northern Logistics Distribution Center. This demonstrates the coexistence of industrial shifts and upgrading in China.

Third, there is further potential in non-US markets that China’s exporters can tap. According to China’s Customs’ statistics, the European Union became the biggest trade partner of China, taking up 15.5% of the country’s foreign trade from January to October this year. Another 13.8% of the nation’s foreign trade was taken up by the member states of the Association of Southeast Asian Nations (ASEAN),now China’s second biggest trade partner. It is practical for Chinese exporters to expand exports to these areas.

A maker of bathroom supplies for other brands — and with 90% of its final customers in the US — chose to build its own brand in the European market to offset existential problems in its key market. And the company,based in Taizhou, has already made significant progress, according to Zhang Lin.

Finally, China is able to support various industries, with a complete industrial chain. At the same time it has a huge domestic market with a population of 1.4 billion. “No other country all of these advantages,”said Huang of the NDRC.

Chinese Customs statistics demonstrate these advantages.China’s foreign trade in goods amounted to 25.63 trillion yuan in the first 10 months of 2019, a 2.4%year-on-year growth. Exports over that period rose 4.9% while imports fell 0.4%. China enjoyed a trade surplus of 2.35 trillion yuan.

In conclusion, industrial shifts from China coincide with the country’s industrial transformation and upgrading. Even though the situation has become more complicated as a result of Sino-US trade friction, China remains attractive to foreign investors. At the same time, industrial shifts driven by healthy competition can force China’s manufacturing to accelerate their technical upgrading, which will ultimately offset the negative effects of industrial shifts.