A Review of the Renminbi in 2019

By Guan Tao

There was a basic equilibrium in China’s foreign exchange market over the first three quarters of 2019,despite the fluctuations of the Chinese currency.

T he renminbi slid through the psychological barrier of seven to one US dollar this year but that failed to create panic in the market. Instead there was basic equilibrium. This article takes a look at the currency’s trajectory over much of the year and seeks to explain what happened and why.

The renminbi traced an uncertain path over much of 2019, at times falling through the key level of seven to one US dollar, and at times making convincing gains. The central parity rate against the US dollar rose a cumulative 2.0% in the first four months of the year, reaching 6.70 to the dollar at the end of February. However, the mid-rate lost 2.5% in May amid negative market sentiment, offsetting the gains of the previous months. The market rate weakened to more than 6.90 to the US unit and then lost ground again in June and July reflecting a volatile US dollar index and the restart of Sino-US trade talks after the meeting of the two countries’ presidents.

Yet, the US tactic of applying “maximum pressure” after the 12thround of trade negotiations helped weaken the renminbi again in August.The trading price and the mid-rate of the onshore renminbi against the US dollar slipped below seven to one. As of the end of the third quarter,the central parity rate was 7.0729 to the dollar and the closing market price was 7.1381. There had been a fall of 2.8% in the market rate from August 2 and a decline of 3.0% from the end of last year. As this article went to print in late November, the currency was still weaker than seven to the dollar.

Market Forces

But statistics show that the renminbi’s depreciation was the consequence of market forces and not a deliberate weakening of the currency by authorities to gain a competitive trade advantage. The US dollar index had risen 3.5% over the first three quarters of 2019. In that same period there was a drop of 2,097 basis points in the renminbi mid-rate. This should have decreased the renminbi central parity by more than one yuan, even without the weakness of the renminbi against the US dollar as implied in China’s central parity quotation mechanism(the central parity = the previous day’s closing price +the exchange rates of a basket of currencies + countercyclical factors). In fact, the mid-rate fell only about 0.2 yuan. Data from the China Foreign Exchange Trade System (CFETS) showed a 1.9% decline in the renminbi index after a rise over the first three quarters.

Supply and demand in the onshore retail foreign exchange market can be reflected by the banks’ spot and forward settlements and sales of foreign exchange —with options included. There was a combined surplus of US$18.3 billion in the transactions over the first three quarters of 2019, compared with a US$5.9 billion deficit in the same period last year. The deficit from spot settlements and sales of foreign exchange was US$48.2 billion, up 72% year on year.

Compared with the end of last year, net forward foreign exchange purchases by banks on behalf of customers decreased by US$76.2 billion, while the net options purchases with delta adjusted exposure on behalf of bank customers increased by US$9.7 billion.The two tallies of derivatives transactions raised foreign exchange supply by US$66.5 billion, up 200% from the same period last year.

Looking at spot settlements and sales without considering derivatives transactions would result in a misinterpretation of foreign exchange supply and demand. For example, in the third quarter of 2019,when the renminbi rate broke the seven to the dollar threshold, forward settlements and sales of foreign exchange (including options) by banks turned from a surplus of US$6.6 billion the previous quarter to a deficit of US$4.9 billion. The deficit of spot foreign exchange settlements and sales was US$15 billion, down 38% on a month on month basis. And the cumulative gain of the spot foreign exchange supply by forwards and options was US$10.1 billion, down 67% month on month (See Chart 1). It can be seen once again that after China's currency breached the seven to the dollar level,although demand for foreign exchange went up in the spot market due to increased hedging against forward purchases, there was still a basic equilibrium in the market.

Balance of Payments

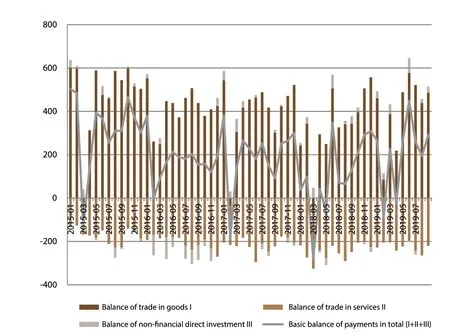

In the first three quarters of 2019 there was an increase in the balance of payments surplus. Exports fell 0.1%and imports slid 5.0% in dollar terms in the ninemonth period, according to customs data. There was a surplus of US$298.4 billion,up 36.1%, 3.3 percentage points higher than the growth rate in the first half of the year. The services trade deficit was US$129.1 billion,an estimated drop of 8%.Over the same period, the non-financial sector utilized US$100.8 billion in actual foreign direct investment, up 2.9% from the year before.Data from the Ministry of Commerce indicated that despite economic and trade frictions, China was still a hot spot for foreign investment.

Chinese enterprises also remained keen on “going global” despite growing protectionism. Outbound direct investment reached US$81 billion in the first nine months of the year,down only 1.5% from a year earlier. There was a surplus of US$19.8 billion in nonfinancial direct investment,up 52% year on year, though this was 27.9 percentage points lower than in the first half of the year.

The surplus on the basic balance of payments — the balance of trade in goods and services combined with the surplus of direct investment— was US$183.6 billion, an increase of 302% year on year.In the third quarter alone,the basic balance of payments surplus was US$74.6 billion,up 8% month on month and 182% year on year. This ensured that China’s foreign exchange market quickly regained stability after the renminbi breached the seven to the dollar level (See Chart 2).

Foreign Investment in Renminbi Financial Assets

In the first three quarters of 2019, foreign institutions increased their holdings of renminbi financial assets,but there was considerable volatility in stock market investments. Under the Stock Connect Program, which most importantly links mainland bourses with the Hong Kong stock exchange, China had net capital outflows for five months, and net capital inflows for the four months of January, February, June and September. In the first nine months of 2019 there was a cumulative net inflow of 28 billion yuan, though that was down 82.5% from the same period last year. As for bond investments, crossborder capital flows were stable. In all months except February and April, overseas institutions continued to increase their investments in renminbi fixed income products, raising their holdings of renminbi treasury bonds by 186.8 billion yuan,inter-bank certificates of deposit by 54 billion yuan and policy bank bonds by 168 billion yuan.

Chart 1 Supply and demand in the onshore foreign exchange market (Unit: US$100 million)

Chart 2 The balance of trade in goods and services and the balance of non-financial direct investment (Unit: 100 million US dollars)

The total net inflow hit 408.8 billion yuan, down 23.5% year on year. The total net inflow under the Stock Connect and Hong Kong-mainland Bond Connect programs was a combined 436.8 billion yuan, down 37.1% from the year before. The net inflow of each quarter was 193.5 billion yuan in the first quarter followed by 76.3 billion and 167 billion yuan in the second and third quarters, respectively. This showed that despite the great fluctuations in cross-border securities investments,foreign investors were still interested in acquiring renminbi assets even when the currency broke through the seven to the dollar level.

In the first three quarters,the rate of foreign exchange receipts and settlements by banks on behalf of customers was 65.0%, and the foreign exchange payment/purchase rate was 67.3%. When the central parity rate of the renminbi against the US dollar depreciated by 2.5% from the last quarter to 6.9872 yuan to one US dollar on average in the third quarter, the rate of foreign exchange receipts and settlements by banks on behalf of customers was 68.0%, and the foreign exchange payments and purchases rate was 68.2%, up 1.7% and down 0.8% month on month, respectively. This demonstrated that when the renminbi rate breached the seven to one US dollar level,the market’s willingness to settle foreign exchange rose and the motivation to purchase foreign exchange declined. But neither panic buying nor speculative hoarding of foreign exchange was evident. In the first three quarters, domestic foreign exchange deposits of residents and non-financial enterprises decreased by US$5.6 billion and US$27.3 billion, respectively. And the third quarter saw a drop of US$3.9 billion and US$22.1 billion respectively, though with increases of 55% and 150% respectively on a quarter on quarter basis.

Cross-border Capital Flows

Cross-border capital flows were orderly, with a trend of slightly increased pressure from outflows.Renminbi overseas receipts and payments by banks on behalf of customers in the first three quarters showed a net outflow of US$5.3 billion,down 86% year on year. Thus,the surplus in the bank’s foreign exchange receipts and payments widened from US$2.6 billion to US$7.9 billion, while the same period last year saw a deficit of US$56.5 billion and US$17.4 billion.

The deficit in the foreign exchange settlements and sales of banks on behalf of customers was US$38 billion,US$45.9 billion less than the receipts and payments of foreign exchange, compared with the positive US$34.2 billion gap between the two last year.

Expectations that the current account surplus would coexist alongside a net inflow under the capital account was outdated and not in line with the reforms promoting exchange rate liberalization. In fact, China’s capital outflows improved after the renminbi rate breached the seven to one US dollar level. The deficit of foreign exchange settlements and sales by banks on behalf of customers then was US$13.2 billion, US$4.5 billion less than the foreign exchange receipts and payments of US$17.7 billion,compared with a negative US$14.6 billion gap between the two last quarters.

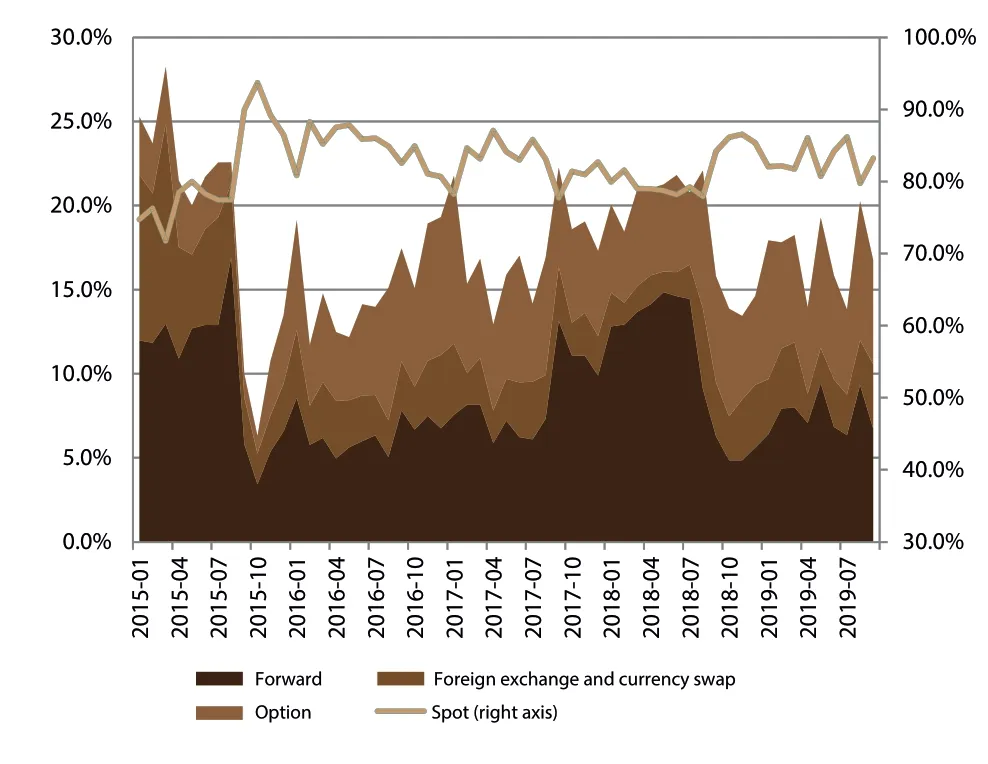

Chart 3 Composition of foreign exchange transactions between domestic banks and their customers (Unit: %)

Chart 4 Hedge ratio of domestic forward foreign exchange settlements and sales to overseas foreign exchange receipts and payments

Insufficient Hedging Against Currency Risk

The sharp fall in the renminbi did not cause market panic, but the insufficient hedging against currency risk requires attention. According to trading data of the foreign exchange market, the volume of transactions between banks and their customers was US$3.09 trillion in the first three quarters, down 3.7% year on year. The contribution of spot trading rose 3.2 percentage points year on year to 82.8% of transactions, while that of foreign exchange derivatives trading declined.

In August and September, when the renminbi rate breached the seven to the dollar level, the proportion of spot trading was 79.7% and 83.2% respectively, down 6.4 percentage points and up 3.5 percentage points on a month-on-month basis. In the same periods, forward trading accounted for 9.3% and 6.7%, up 3.0 percentage points and down 2.6 percentage points month on month, respectively. And the share of options trading was 8.3% and 6.2%, up 3.2 percentage points and down 2.1 percentage points on a month on month basis (See Chart 3). This demonstrates that the market lagged in its reaction to currency risk, even with a sign of reversal in September.

This was further indicated in the ratio of the amount of agreements of forward settlements and sales of foreign exchange to the overseas foreign exchange receipts and payments by banks on behalf of customers.In the first three quarters of 2019, the hedge ratio of forward foreign exchange settlements was 8.9%, down 0.2 percentage point in yearon-year terms and that of forward foreign exchange sales was 3.3%, down 7.7 percentage points. In August and September, the hedge ratio of forward foreign exchange settlement was 8.9% and 8.5%, respectively,a 0.2 percentage point and a 0.4 percentage point monthly drop. The hedging ratio of forward foreign exchange sales grew 0.9 percentage point and 0.4 percentage point, respectively, from the month before to 3.7% and 4.1%. That was far lower than the 13.8% reached in July 2015 (See Chart 4) –just ahead of a currency devaluation.

Yet, despite the rising hedging ratio of forward foreign exchange purchases,the negative impact on supply and demand in the foreign exchange market was limited.As of the end of September 2019, the balance of the net non-matured forward foreign exchange settlements by banks on behalf of customers totaled US$200 million,compared with the net purchases of US$4.1 billion in July, on the eve of when the renminbi breached the seven to the dollar level.