Maize production under risk: The simultaneous adoption of off-farm income diversification and agricultural credit to manage risk

Shoaib Akhtar, Ll Gu-cheng, Adnan Nazir, Amar Razzaq, Raza Ullah, Muhammad Faisal,Muhammad Asad Ur Rehman Naseer, Muhammad Haseeb Raza

1 College of Economics & Management, Huazhong Agricultural University, Wuhan 430070, P.R.China

2 Institute of Agricultural and Resource Economics, University of Agriculture Faisalabad, Faisalabad 38000, Pakistan

Abstract Farmers in Pakistan continue to produce maize under various types of risks and adopt several strategies to manage those risks. This study is the first attempt to investigate the factors affecting the concurrent adoption of off-farm income diversification and agricultural credit which the farmers use to manage the risk to maize production. We apply bivariate and multinomial probit approaches to the primary data collected from four districts of Punjab Province in Pakistan. The results show that strong correlations exist between the off-farm diversification and agricultural credit which indicates that the use of one risk management strategy leads to another. The findings demonstrate that education, livestock number, maize farming experience, perceptions of biological risks and risk-averse nature of the growers significantly encourage the adoption of diversification as a risk management tool while farm size inversely affects the adoption of diversification. Similarly, in the adoption equation of credit, maize farming experience, farm size, perceptions of price and biological risks and risk attitude of farmers significantly enhance the chances of adopting agricultural credit to manage farm risks. These findings are important for the relevant stakeholders who seek to offer carefully designed risk minimizing options to the maize farmers.

Keywords: maize, off-farm diversification, credit, multinomial probit, Pakistan

1. Introduction

Agriculture is a risk prone activity and a large number of farmers in developing countries continue to operate under uncertain and risk conditions (Akcaoz and Ozkan 2005).

These risks include biological risks such as insects, pests and diseases; climatic risks such as droughts and floods;price risks such as uncertainties in input and output prices,and financial risks such as unavailability of timely credit and fluctuations in interest rate, etc. (Saqibet al.2016a;Thiekenet al.2016; Zul fiqaret al.2016). Although farmers only manage some part of the production process, the risk management at farm level is highly important because the inability to cope will result in loss of incomes and livelihoods for millions in the developing countries (Zul fiqaret al.2016).In addition, every other decision maker in the agricultural supply chain has to face risks in their decision-making(Joneset al.2012; Garrettet al.2013). However, currently the farmers in developing countries have a lower capacity to manage agricultural risk at farm levels.

Past research has shown that farmers are very vigilant about the enterprises which involve high investments,high risk in expected output, and demand extra measures to avoid production failures (Adebusuyi 2004; Alderman 2008; Almadani 2014). These farmers adopt a number of risk management strategies to reduce risk. The risk coping strategies adopted by farmers can be divided into two categories: (1) formal strategies (2) informal strategies.The formal strategies are provided by the public institution and these may include agricultural credit, crop insurance schemes, price stabilization policies, information systems,and input subsidies. Informal strategies, on the other hand,are mostly adopted at the farm level and these may include diversification of income, precautionary savings, sellingoff assets, and crop diversification, etc. (Kurukulasuriya and Rosenthal 2003; Santeramoet al.2014; Saqibet al.2016a, b).

Like many other developing countries, agriculture plays a key role in the socio-economic development of Pakistan.However, Pakistani farmers face a variety of agricultural risks, e.g., production risks, market risks, and financial risks (Abdullahet al.2015). The existence of these risks has led the producers to adopt numerous risk management strategies. These strategies include both the ex-ante and ex-post risk management strategies (Walker and Jodha 1986; Barrettet al.2001; Singla and Sagar 2012).

After wheat and rice, maize is the third most important cereal crop in Pakistan. Most of the maize production comes from hybrid maize which has offered significant yield increases to farmers over the past two decades. However,the significant gains in maize production have not translated to increased incomes for farmers in Pakistan. The maize farmers continue to face a variety of risks which include price or market risk (Musser and Patrick 2002; Zul fiqaret al. 2016), climate and biological risk (World Bank 2011),financial risk (Musser and Patrick 2002; Akhtaret al.2018).The price or market risk is a consequence of uncertainty about prices and quantities of inputs and outputs at the time that production decisions are taken (Musser and Patrick 2002; Adnanet al. 2018). Climate risk arises from variability in temperature and rainfall as well as due to extreme events (World Bank 2011). The biological risk is faced by farmers because of pests, diseases and contamination(World Bank 2011). Financial risk is related to the ability of paying back the borrowed funds along with the interest,to have enough finance to continue farming, and to avoid bankruptcy (Musser and Patrick 2002; Akhtaret al.2018).Financial risks stem from insuf ficient credit facilities available to farmers. The small farmers are often forced to get credit from local agents (arthis)who charge very high interest rates on inputs purchased by the farmers. In addition, these informal credit arrangements also bind the farmers to sell their products only to the local agents who offer them lower prices than the market prices.

Among many others, off-farm income diversification is one of the best risk management strategies in agriculture,which is used for managing the production risk and income to ensure the stability of the farmers (Velandiaet al.2009; Pinget al.2016). Himanshuet al. (2011) stated that involvement in off-farm activities that generate more income is necessary for the progress of agriculture and to minimize the production risk, particularly in the countryside areas. To manage the multidimensional risks, agricultural household use income or livelihood diversification techniques at the farm level(Hussein and Nelson 1998), which include working and investing in off-farm jobs and businesses to promote the agriculture (Tangermann 2011). Due to diversi fied income,the farmers might be able to get steady income and avoid selling their product at minimum prices (Ullah and Shivakoti 2014).

Agricultural credit is yet another essential measure to reduce/minimize the agriculture risk. The agricultural credit also has a significant impact on farmer’s production,income, and food security, particularly for those who are vulnerable to heavy rains, thunder storms, pest and insect attacks, and other natural hazards. Several studies have explored the role of agricultural credit in agriculture and livestock production in Pakistan and found that credit plays a significant role in increasing farm productivity as well as livestock production (Romneyet al. 2003; Fayazet al.2006;Akram and Hussain 2008; Burki and Khan 2008; Abedullahet al.2009; Ayazet al.2011).

Due to the existence of heavy risk in maize production,it is important to know how farmers perceive these risks,how they are coping with these risks, and what strategies are the best suited for them. Particularly, it is unknown whether a correlation exists between these risk management decisions. Therefore, this study aims to explore farmers’attitude and perception toward risk and their choice of offfarm income diversification and agricultural credit as the risk management strategies.

2. Data and methods

2.1. Sampling framework and study area

The present study focuses on concurrent adoption of agricultural credit and off-farm income diversification as management strategies to cope with farm-related risk among hybrid maize growers in rural Punjab, Pakistan. Through a farm household survey, primary data were collected between September and November in 2016. The required sample households for data collection were selected using multistage random sampling technique. In the first stage,Punjab Province was purposively selected for the study.The main criteria for selecting Punjab Province as the study area include that: i) Punjab shares 53% of the overall agriculture GDP and 74% for the entire cereal production of the country (Akhtaret al.2018; Abidet al.2015); ii) 81.3% of the total hybrid maize crop, and all of spring hybrid maize is produced in Punjab Province only (GOP 2016b). The main focus of the paper is on maize farming. Maize is grown all over the country, however, major areas include districts of Faisalabad, Okara, Chiniot and Sahiwal. Therefore, these districts were selected purposively in the second stage.In the third stage, one village in each selected district is randomly selected for data collection. In the fourth stage, a total of 400 hybrid maize respondents are randomly selected using the below equation as suggested by Yamane (1967).

Where,n=sample size in each village;N=total number of farming households in a village; e=precision which is set at 15% (0.15).

2.2. Types of risk

Four main types of risk are involved in maize production:

Price riskFluctuation in input and output prices, losses and below average pro fit.

Biological riskRelated to insects, pests, and other biological crop diseases.

Climatic riskRelated to income losses borne by growers due to crop failure, heavy rain, wind, temperature fluctuations, lodging of crops, and low yield of the crop.

Financial riskRelated to the fluctuation of interest rate,unavailability of production loan.

2.3. Management strategy

The study considered two dominant risk management strategies are prevailing in the study area, i.e., off-farm diversification of income and use of agricultural credit.Diversification of off-farm income has been used as a basic approach to managing the risk since mankind started farming (Tangermann 2011). Choice of diversification of off-farm income is the best management strategy for risk managing (Ullah and Shivakoti 2014). By diversifying their income, farm household smoothes their income and minimize the shocks related to farming. In the current study, hybrid maize growers also used off-farm income diversification as a risk management tool. We used the off-farm income diversification as a binary variable in our model (1 if farmers adopt off-farm income diversification as a risk management strategy, and 0 otherwise).

Agricultural credit plays a vital role in rural economy commercialization and in agricultural modernization(Abedullahet al. 2009). Farmers also use agricultural credit as a risk management tool and it has a positive impact on farm production (Skees 1999). The adoption of agriculture credit also has a positive impact on farmers’ income and risk management (Ullah and Shivakoti 2014; Abdullahet al.2015; Saqibet al.2016a). For instance, when the business goes down, the credit is proved to be the best tool to liquidate the business (Anderson 2003). In our model, agricultural credit is used as the dependent variables. Although,agricultural credit may have several uses in the farming sector, yet in this study its value depends on the maize grower’s decision to use credit as a risk management tool.We used agricultural credit as a binary variable in our model(1 if growers adopt agricultural credit as a risk management tool, and 0 otherwise).

2.4. Estimation procedure

Bivariate probit approachThe impacts of various factors on the adoption of the two risk management strategies are assessed using a bivariate probit model. The bivariate probit model is described below:

Where,Yij(j=1, ...,m) represents risk coping options.Here,m=2, i.e., management strategies adopted by theith farmer (i=1, ...,n),xijis a 1×kvector of the observed variable that affects the decision of risk management strategies,βjis ak×1 vector of unobserved parameters which are to be estimated andεijis unknown error term. In this condition,eachYjis a binary variable, and thus eq. (2) is a system ofmequations (m=2) to be estimated (Ullah andShivakoti 2014):

Multinomial probit approachIn addition, the multinomial probit approach was also used to examine the impact of the independent variables on the adoption of a combination of risk management strategies. Four possible combinations of these management strategies are used as dependent variables in the multinomial probit model (Velandiaet al.2009; Ullah andShivakoti 2014). There are four possible combinations: (1) Using no risk management strategy, (2)adopting off-farm income diversification only, (3) adopting agricultural credit only and (4) adopting both strategies concurrently (off-farm income diversification and agriculture credit).

Following model can describe multinomial probit approach:

Where,Yiindicates the risk management strategy combination (Yi=1, ...,m) which theith farmer (i=1, ...,n)chooses;Xiis a 1×kvector of the observed variable that affects the risk managing combinations chosen by hybrid maize growers,βis ak×1 vector of unknown parameters to be estimated, andεiis the error term which is unobserved.To estimate the unidenti fied parameters, maximum likelihood method is applied using eq. (4).

2.5. Variables used in the analysis

Socioeconomic factorsPast research shows that numerous socioeconomic factors in fluence the choice of risk management strategies. For instance, if the age and farming experience of a farmer increases, farmers are more likely to adopt risk management tools (Dadzie and Acquah 2012; Luet al.2012; Abdullahet al.2015; Ullahet al.2015;Saqibet al.2016a). Education has also a substantial impact on the concurrent adoption of off-farm diversification and agricultural credit as a risk management strategy because educated farmers manage the farm related activities more wisely than uneducated farmers (Deressaet al.2010;Kouamé 2011). Likewise, farming experience has a constructive impact on the adoption of risk management strategy (Abedullahet al.2009; Velandiaet al.2009; Saqibet al.2016a). In addition, the number of livestock holding and landholding size also have an impact on the choice of risk management strategies (Iqbalet al.2016).

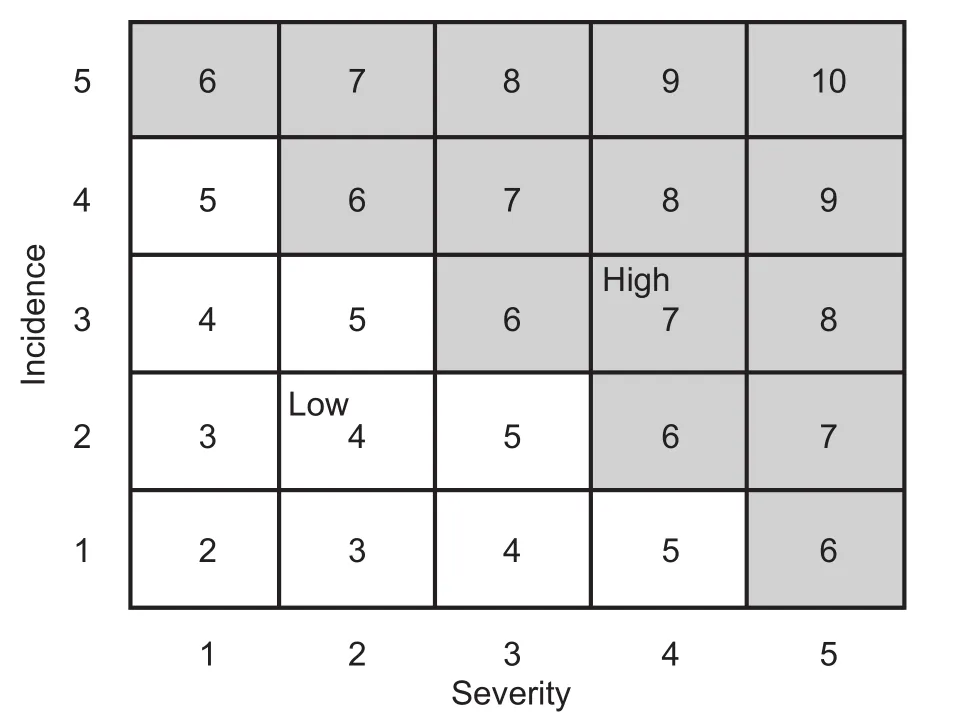

Risk perceptionFarmers face various risks in maize production and these hazards include climatic risk, market risk, biological risk, and financial risk. To measure their risk perception about these four types of risk, farmers were asked to score the severity and incidence of each risk source on a Likert scale of 1–5 (1 being very low and 5 being very high). After that, the risk factor (RF) was calculated by summing the consequence (c) and likelihood (P) (Cooper 2005). Rosenberget al.(1999) and Cooper (2005) framed a risk matrix (Fig. 1) using the risk factor, and this RF score was further classi fied as low if RF score is between 2 and 5, and high if RF score is between 6 and 10 (Ullah and Shivakoti 2014). The variable of risk perceptions thus generated is a binary variable (1 if farmers considered a risk as high for maize crop, and 0 otherwise).

Fig. 1 Risk matrix.

Risk attitudeAn equally likely certainty equivalent (ELCE)model was used to figure out the behavior of farmers toward risks. Certainty equivalents (CEs) were derived for a sequence of risky outcomes and then matched with utility values (Biniciet al. 2003). For example, the farmers were asked to place a monetary value to a certain outcome that made them indifferent for a choice amid two risky outcomes such as total PKR 80 000 (total annual household income)and PKR 0 with same probability (in this example the utility related to PKR 80 000 is 1, and PKR 0 is 0). Suppose that the farmers place a monetary value of PKR 41 000;this is the CE of the farmers for the income level of PKR 80 000 and PKR 0 with equivalent chances. The farmer was once more enquired to state the monetary values of a sure outcome that make him indifferent between the two risky outcomes of PKR 41 000 and PKR 0 with equal probability.This process continued till appropriate data points were identi fied. The parallel process is exercised for the other half of income distribution to get the CE and match them with utility values. The farmer’s response to PKR 41 000 is the CE for uncertain payouts of PKR 80 000 and PKR 0 with equal probabilities (0.5 each) and utility values for this CE is calculated as:

After finding quite a few certainty equivalents and matching them with utility values, a cubic utility function was applied for assessment of the utility of each individual respondent. The equation of cubic utility function is given as:

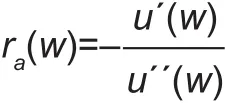

This cubic utility function is related to risk aversion, risk preferring, and risk indifferent attitudes (Biniciet al.2003).The utility is frequently estimated on an ordinary scale,though the shape of utility function on an ordinary scale can be transmuted into a quantitative measure of risk aversion called absolute risk aversion (Arrow 1964; Pratt 1964;Raskin and Cochran 1986). The absolute risk aversion is arithmetically written as:

ra(w) is a parameter of absolute risk aversion,u´ andu´´ are first and second order derivatives of wealth (w),respectively. Following Olarindeet al.(2007), income is substituted for wealth. If the individual is risk averse, then the coef ficient of absolute risk aversion is positive, it is negative if the individual is a risk-taker, and zero if individual is indifferent to risk. The risk attitude of the farmers thus calculated is included in the model as 1 if individual re flects risk-averse nature, and 0 otherwise.

3. Results and discussion

3.1. Descriptive statistics of the variables

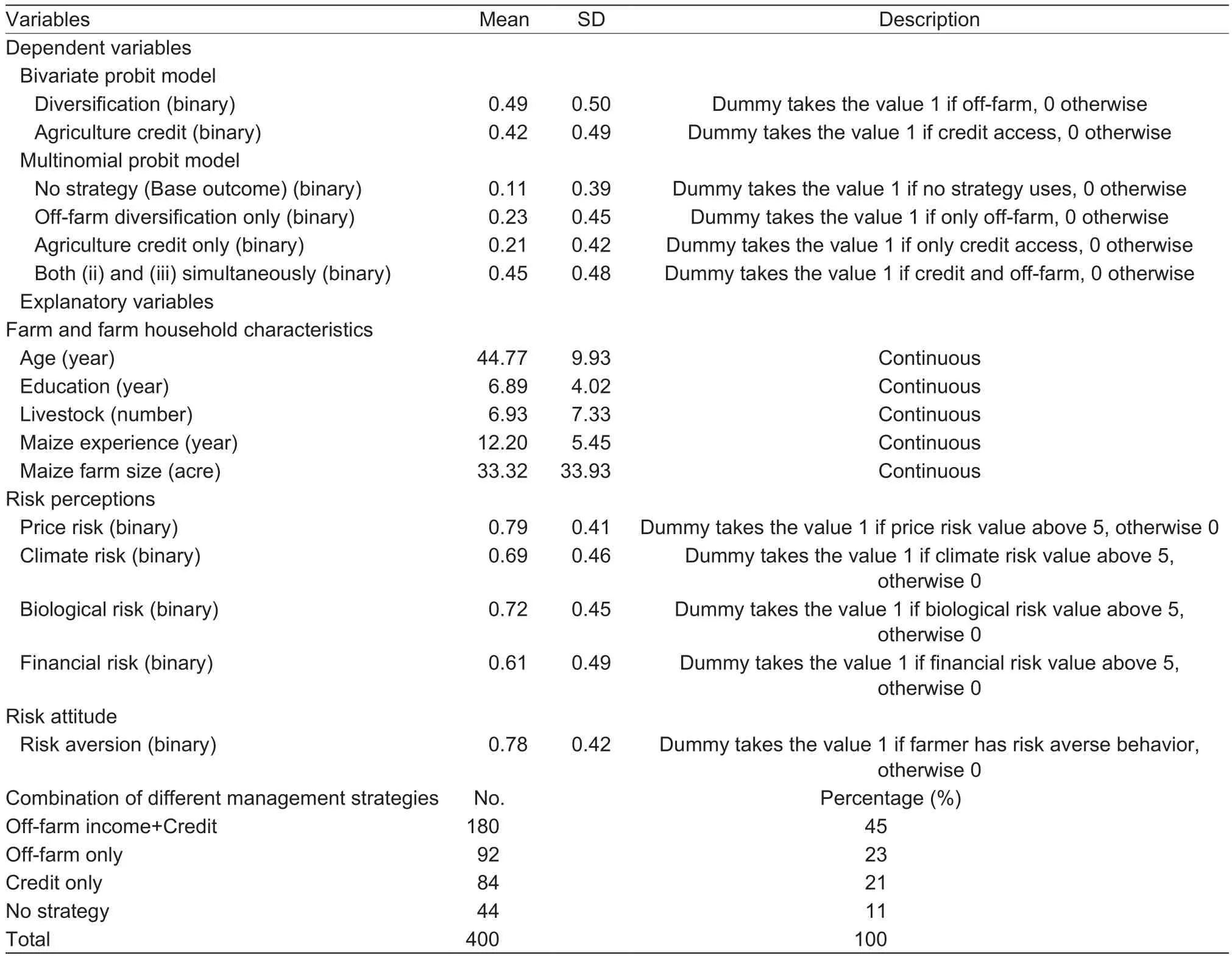

The descriptive statistics of the variables used in the analysis are provided in Table 1. Two types of variables were used in the analysis, i.e., discrete choice dummy variables and the continuous variables. The results divulge that mean age of hybrid maize farmers was 45 years with 7 years of average educational background. On average, farmers had 12 years’ experience of maize farming. The mean farm size in the study area was found to be 33 acres. An average livestock size was 6.93 livestock heads in the study area.Analysis also showed that about 79% of the farmers showed risk-averse behavior as they were not ready to embark upon any type of opportunity that involves any type of risk. Ellis(2000) studied farmers’ decision related to farm production by using income approach and defined risk-averse attitude as, “A person is described as risk averse if he prefers a situation in which a given income is certain to a situation yielding the same expected value for income but which involve uncertainty”. Similar to what is also reported by Dadzie and Acquah (2012), our results indicated that risk of high input prices was the most perceived risk by more thanthree fourth of the hybrid maize farmers while the financial risk was least perceived by hybrid maize farmers. About 69% perceived the climate risk whereas biological risk was perceived by 72% farmers (Table 1).

Table 1 Descriptive statistics of variables used in the analysis

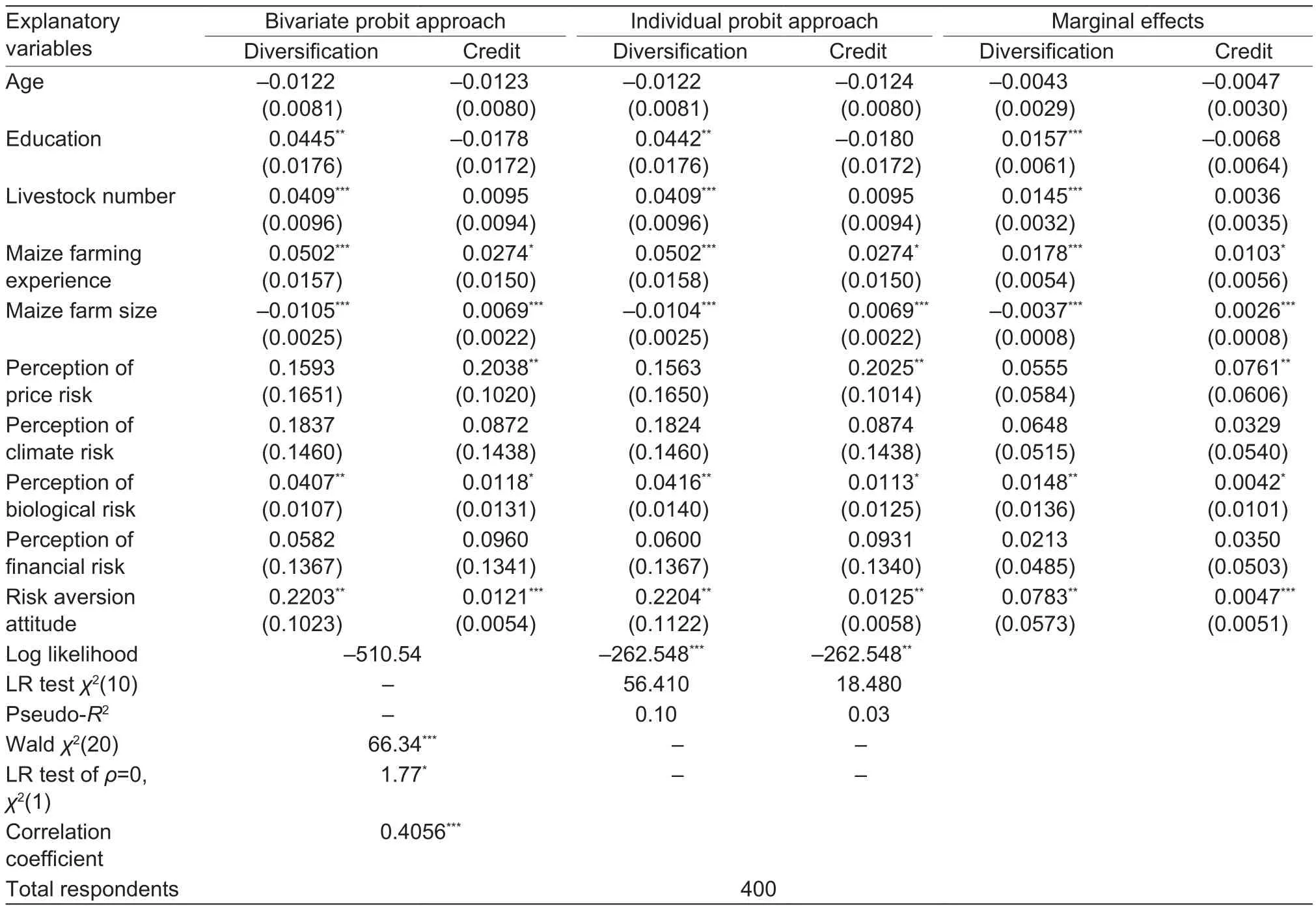

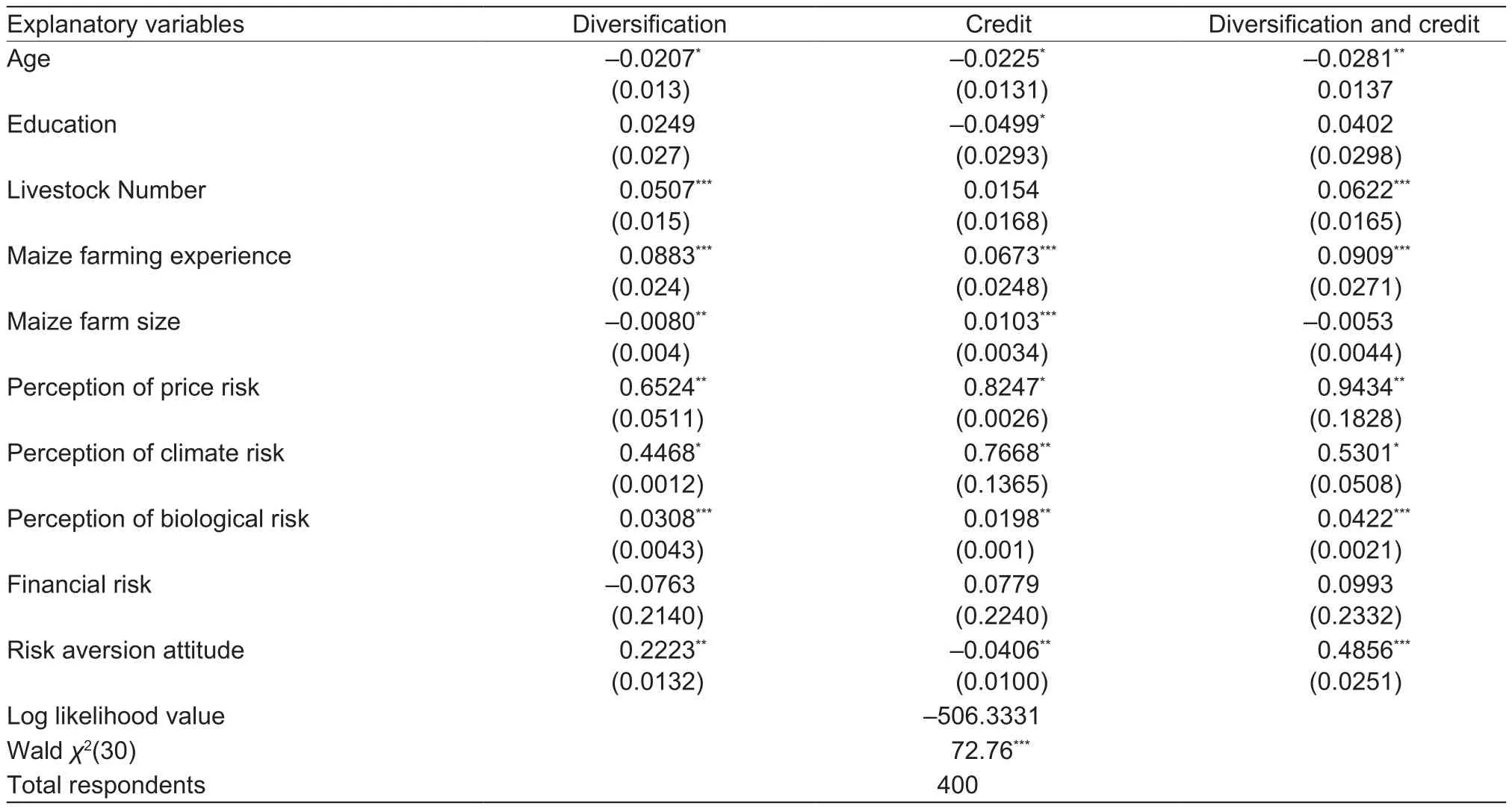

3.2 Estimated parameters of bivariate and individual probit models

The estimated coef ficients of both the bivariate and individual probit models are shown in Table 2 for comparison. The signs and significance of the coef ficients in both models are similar. However, the likelihood ratio test ofρis significant and positive (1.77) with a significant Wald Chi-squared test value (66.34) that allows us to reject theH0of conjoint nullity of the variables included in the estimation. The results show that the factors significantly affecting the adoption of off-farm income diversification as a risk management tool include the education, number of livestock heads at farm, maize farming experience of the farmers, the maize farm size, farmers’perception of biological risk, and the risk aversion attitude of the farmers. Although the variable of farmer’s age is not statistically significant, yet the outcomes of both the bivariate and individual probit model propose that the more aged farmers do not resort to the adoption off-farm income as a promising risk management strategy. The risk aversion may grow with age, and the older farmers may tend to choose less risky investments by adopting more risk management strategies. However, our results indicate otherwise and are in line with other studies (Ashfaqet al. 2008; Mes finet al. 2011; Ullahet al. 2015; Luet al. 2017), where age was found to have a negative effect on the adoption of risk management strategies. Similarly, Jensen and Pope (2004)and Velandiaet al. (2009) found a negative relationship of age with various risk management strategies, i.e., crop insurance, forward contracting, precautionary savings and spreading sales.

The education of farmers has a positive and significant effect on the farmers’ decision to adopt off-farm income diversification as risk management tool. These results are in line with previous studies which also found a positive relationship between education and adoption of risk management strategies (Ashfaqet al. 2008; Kouamé 2011;Ullahet al. 2015; Pinget al. 2016; Saqibet al. 2016a).However, this result is in contrasts with the findings of Mes finet al. (2011) who found that more schooling levels discourage farmers from adopt diversification to manage farm income variability. Farming experience also has a positive and significant impact on the farmers’ choice to adopt off-farm income diversification as risk management tool. This result is in line with Ashfaqet al. (2008) and Ullahet al. (2015), but different from Pinget al. (2016). The results also show that number of livestock heads at the farm has a significant and positive effect on the adoption of off-farm income diversification as a risk management tool. This result might be because the possession of more livestock by a farmer is also an indicator of wealth and socioeconomic status, and being a liquid asset, the livestock can act as a buffer to offset the unexpected weather or climatic shocks.For instance, the farmers who have more livestock at the farm are in a better position to cope with risks experienced on farm and off farm. They can finance their emergency cash needs by selling-off their livestock instantly. Hence,the farmers having more livestock at their farms are more likely to adopt the off-farm income diversification as a risk management tool.

Table 2 Estimated parameter of bivariate probit model for off-farm diversification and credit

The results further indicate that maize farming experience is a key factor that significantly in fluences not only the offfarm income diversification but the credit participation as well. This relationship is positive, and it may be because the more experienced maize farmers are well-aware of the risks they might encounter during maize production. Also,the skilled growers may have more social contacts, and are familiar with the ways to obtain agricultural credit. Finally,the area under hybrid maize cultivation (i.e., the maize farm size) also positively affects the farmers’ decision to adopt off-farm diversification and credit. A similar relationship between these variables was found by Pinget al. (2016). In the context of credit, this result might be because the large farmers must fix the large capital in maize production, and they need funds to cope with the related risks. Therefore,the choice of credit as an ex-post risk management strategy is higher for large farmers as compared to small farmers.

In theory, the perception of all four types of risks considered in this study should encourage an improved adoption of risk management strategies. For instance, the climatic and biological risk may lead to crop failure and have a key impact on the livelihoods of the farmers. These risks alter farmer income and they should encourage the use of off-farm diversification. The financial risk, and the price risk can also lead to reduced incomes for farmers either due to high input prices, or the lower output prices. However,our findings reveal that the perception of biological risk is the most important factor that encourages the adoption of off-farm income diversification as a risk management tool. This implies that perceptions of other types of risk such as price risk, the climate risk are not strong enough to change the behavior of sampled farmers. For the adoption of credit as risk management tool, the significant factors are the perception of price risk and perception of biological risk. Since the price risk is closely related to the financial risk, therefore, this result is plausible in the context of credit adoption. Farmers who perceive price risk are more likely to obtain agricultural credit to manage this type of risk. In addition to the perception of the various type of risks, the risk aversion attitude of farmers has a significant and positive effect on the adoption of offfarm income diversification and agricultural credit as risk management tools. This implies that the more risk averse a farmer is, the more he or she is likely to adopt these risk management strategies. This result is in line with previous studies (Kouamé 2011; Ullah and Shivakoti 2014).The bivariate probit approach allows us to calculate the conditional marginal effects (i.e., marginal effects conditional on the adoption of the other risk management tool) while the individual probit approach does not allow such calculation (Velandiaet al. 2009).

Table 2 indicates the frequency and percentage of farmers using these four risk-reducing combinations. These results show that the most common risk management strategy used by farmers (about 45% farmers) is the combination of off-farm income diversification and credit.

3.3. Parameter estimates of multinomial probit model

There is always the choice that a farmer will use more than one risk management tool or a combination of risk management strategy concurrently. This research considers two risk management tools- off-farm diversification and agricultural credit, therefore, four combinations of risk management tools are possible. Farmers will select only one combination out of the existing four combinations of risk management strategies.

Table 3 shows the estimated coef ficient from the multinomial probit approach for different risk management combinations. The findings of multinomial probit model are different from the bivariate probit results discussed above.This is because in the multinomial model, the focus is on the combinations of the risk management tools, and thus the different results. For instance, the age of the farmer is significantly and negatively related to off-farm diversification in the multinomial probit approach; yet, the effect of this factor is not significant in the bivariate probit approach. Also,the perception of financial risk is negative in the multinomial model while it had a positive impact on the adoption of offfarm diversification in bivariate probit approach. However,similar to the results of the bivariate model, the effect offinancial risk perception is not significant in the multinomial model. Likewise, the coef ficient of farmer’s age is marginally significant (α=10%) in predicting the choice of agricultural credit in the multinomial model, however, it was insignificant in the bivariate probit approach. The risk-averse attitude of farmers has a negative impact on the adoption of agriculture credit in multinomial probit model, while it is positive in the bivariate probit approach.

Table 3 Estimated parameter of multinomial probit model for off-farm diversification and credit

The findings of multinomial probit estimates, especially those related to the combination of off-farm diversification and credit, require further discussion since it is the most common risk management strategy used by most farmers in the study area. According to the results, education, total livestock holding and maize farming experience are the factors that encourage the use of off-farm diversification and agricultural credit concurrently.

In addition, the perception of all risk sources, except for financial risk, have a positive impact of concurrent adoption of off-farm diversification and agricultural credit. The riskaverse behavior also has positive impact on the concurrent adoption of these risk management strategies.

Previous studies have also documented a similar effect of these explanatory variables on grower’s decisions of using risk management strategies in such a combination(Kouamé 2011; Ullah and Shivakoti 2014; Ullahet al.2015;Zul fiqaret al.2016; Luet al. 2017). Substantial perceptions of risk and risk-averse behavior of the hybrid maize growers force them to use sophisticated risk managing strategies to lessen different type of risks related to the maize production.

The use of bivariate and multinomial probit approaches give richer insights and better understanding of the process of decision making regarding risk management at farm level.Using multiple risk management tools at the same time is a common practice among the farming communities. However,there is a dearth of literature on simultaneous adoption of the available risk management tools particularly for hybrid maize farmers. The bivariate probit model provide useful information on the simultaneous adoption of the given risk management tools along with the impacts of independent variables. The multinomial probit approach, on the other hand, provides useful insights into the effects of independent variables on the combinations of risk management tools.The findings revealed that the behavioral factors, i.e., risk perceptions and attitude play key role in farmers’ decisions of adopting risk management tools at farm level and therefore should be given due to consideration in all future studies and in the risk management policies for farmers.

4. Conclusion

The current study uses primary data of 400 hybrid maize growers from rural Punjab in Pakistan to discover the concurrent adoption of off-farm income diversification and agricultural credit. The results indicate that the adoption of one risk management strategy may make it more likely that a farmer will choice the other tool at the same time. In addition, study also investigates the attitude and perception of farmers toward risk. The application of both the bivariate and the multinomial probit model delivers more evidence and a better understanding of farmers’ behavior toward the concurrent choice of risk management tools. The risk management strategies chosen by farmers will not only have a prime importance for farm performance, but will also in fluence the structure of the agriculture sector in the future.Although the study was restricted to just four districts, the findings can be generalized to more areas, mainly where formal/state-owned risk management strategies such as crop insurance are either absent or inef ficient. The findings from the bivariate and multinomial probit models are especially important for policy makers, who should be able to anticipate farmers’ adoption behavior more precisely,and for agricultural extension agents, who can improve their programs by focusing those growers who have higher demand for risk management information.

Acknowledgements

This research work is financially supported by the National Natural Sciences Foundation of China (71473100 and 71461010701).

Journal of Integrative Agriculture2019年2期

Journal of Integrative Agriculture2019年2期

- Journal of Integrative Agriculture的其它文章

- Digital mapping in agriculture and environment

- miR-34c inhibits proliferation and enhances apoptosis in immature porcine Sertoli cells by targeting the SMAD7 gene

- lnhibition of KU70 and KU80 by CRlSPR interference, not NgAgo interference, increases the ef ficiency of homologous recombination in pig fetal fibroblasts

- Protective roles of trehalose in Pleurotus pulmonarius during heat stress response

- Kiwifruit (Actinidia chinensis) R1R2R3-MYB transcription factor AcMYB3R enhances drought and salinity tolerance in Arabidopsis thaliana

- Arbuscular mycorrhizal fungi combined with exogenous calcium improves the growth of peanut (Arachis hypogaea L.) seedlings under continuous cropping