Regional Redistribution Effects of Renewable Energy Subsidies

Alessandro Sapio

Department of Business and Economics,Parthenope University of Naples,Naples,Italy

Keywords Renewable energy Subsidies Redistribution Regions Pecuniary externality

Abstract Through a theoretical model of subsidies for renewable energy(RE),the paper shows that regions characterised by high energy demand and low RE endowments contribute disproportionately to the green energy budget.Such a pattern is emphasised if subsidies are tied to wholesale electricity prices,because the merit order effect associated with renewables,by depressing the electricity price,justifies higher subsidies to RE generators.Due to a pecuniary externality,interconnection between regions allows the region with a lower income and richer RE production to partly shift the burden of RE support on the other region.These spatial patterns can be overturnedif RE ownershipis distributed across zones,and under some parameter sets in which market integration implies a heavier unit burden of RE support.

1 Introduction

There is a widespread consensus on the need for a greener economy,yet not enough thinking has been devoted to the distributional effects of the green transition.

In general terms,technology diffusion(Rogers,1983)is a welcome driver of economic growth in the longrun,yet,it is deemed responsible for the rising personal income inequality as it is with skill-biased technical change(Acemoglu,2002).While inequality reduction is tackled through specific public policies,policy-makers often target the symptom without taking care of the origin of the disease.For example,in some cases inequality is induced by technology diffusion which is itself receiving public support.Technical change and diffusion are encouraged through policy measures when targeted to key societal goals and when market incentives alone are not enough to induce the societal optimum speed of diffusion,owing to externalities.Ecological innovation(Kemp,2010)in the fight against global warming is a case in point,as discussed since Nordhaus(1993).A-mong the main tools in climate policy,subsidies to renewable energy(RE)sources have been motivated by the existence of a gap in levelized costs between renewables and conventional energy sources,since the thermal efficiency of RE has historically been relatively low(Joskow,2011;Borenstein 2012).

The diffusion of RE technologies could affect inequality too,but with its own specificities.Energy generation is capital intensive,hence the skill bias associated to it is probably negligible.Income inequality can be mitigated as long as RE technologies come in the form of distributed generation facilities,which allow energy consumers to turn into prosumers and hence reach self-sufficiency in energy consumption and generate their own incomes from selling energy in excess of their personal needs(see Anaya and Pollitt,2015).Perhaps a most relevant distributional effect of renewables can be identified in spatial or regional inequality.The increasing penetration of RE can go to the advantage of citizens in some regions and to the detriment of those located in other regions,depending on the spatial concentration of energy consumption points and of RE producing sites.In fact,spatial heterogeneity in the availability of renewable energy sources is rooted in the very nature of wind power and solar power technologies,which exploit local meteorological conditions(insolation,wind speed,wind direction).Regions also differ in terms of preferences or attitudes towards the environment(Lin,2016),which affect the availability to pay for RE production and to install new photovoltaic panels and wind turbines.Relatedly,imperfections in local credit markets can severely limit one region’s progress along the RE diffusion curve(Rodriguez et al.,2015).This is a relevant issue for Italy,which is characterised by North-South gaps in economic development.

Spatial inequality is a politically sensitive issue in that it can be emphasised by public policies promoting the diffusion of RE.RE subsidies may end up being disproportionately financed through taxes levied on citizens in specific regions,e.g.those richer in income and with lower endowments in renewables.Redistribution caused by renewable energy subsidies can foster opposition to RE and shift votes to pro-carbon parties in some regions.The design of policies to support RE needs to internalise these effects.

This paper aims to address the following research questions.Under which conditions does the RE support system redistribute resources across regions?How do such effects change under different subsidy schemes?How are the redistributive effects tuned by related policies,such as the physical interconnection of regional markets?

In order to provide answers,a theoretical model of the green energy budget is proposed.In the model,final energy users are levied taxes in proportion to their energy consumption;such taxes are collected to subsidise RE producers.Energy users and RE producers are spread across different regions,North and South for simplicity.The model focuses on subsidies and taxes at the regional aggregate level,allowing to compute,for each region,the net contribution to the national’green energy’budget.The model is analysed under different scenarios,assuming different subsidy schemes( fixed or tied to wholesale electricity prices)and different levels of interconnections between regions(zonal separation vs.zonal integration).

The model shows that,if RE facilities are completely owned by residents and zones are physically separated the North(characterised by high energy demand and low RE production)contributes disproportionately to the green energy budget under the fixed subsidy rule.Such a pattern is emphasised in the market-based subsidy scheme,because the merit order effect associated with renewables,by depressing the electricity price,justifies higher subsidies to RE generators.Zonal integration gives rise to pecuniary externalities,since a larger RE production in one zone affects the net contribution of the other through its effect on the national electricity price.Despite such externalities,the North is still contributing more than the South,and any new RE installation in the South implies a burden-shifting effect.However,this pattern-North subsidising the South-can be overturned if RE ownership is distributed across zones.Finally,if a balanced budget rule is imposed,market integration can imply an increase in the unit burden of RE support.

The paper is structured as follows.The next section(Section 2)describes the system of incentives to renewable energy sources in Italy.Section 3 outlines a model of the green energy budget,based on the institutional features previously described.The analysis of the model,under various assumptions and extensions,is performed in Section 4,whereas Section 5 extends the model.The concluding Section 6 discusses the results in light of policy-making goals and identifies routes for future research.

2 The green energy budget in Italy

In Italy,renewable energy sources are subsidised by Gestore Servizi Energetici(GSE),a State-owned company.The main financial source for RE subsidies is the so-called A3 component in the retail energy bill.The A3 component for each energy user is increasing in the user’s energy consumption,with parameters that depend on the user category(residential,commercial)and the installed capacity.In principle,each energy user can also be receiving subsidies if a RE plant is installed in her household or commercial facility.Hereby the incoming and outgoing financial flows managed by GSE to subsidise renewables will be called the green energy budget.

By aggregating among users in the same region,one can compute the net contribution of each region to the green energy budget.Although support rules are uniform across regions,North-South patterns in the regional net contributions to the green energy budget are expected.Indeed,there are regional differences in wind and solar power production,in environmental preferences and attitudes,as well as in per capita incomes and in industrial density.More specifically,it makes sense to expect Southern regions to be subsidised by the Northern ones.Average insolation and wind speeds are higher in the South,making them more favourable locations for new RE instalments.At the same time,Southern regions are characterised by lower per capita GDP,implying that electricity demand is also lower.

The outlined North-South pattern begs the question whether it is politically acceptable for the Northern regions to subsidise the Southern ones,also in light of the strength of regional parties,such as the Northern League,proposing federalist reforms if not a secession,and the allegations that a share of subsidies be seized by organised crime rooted in the South,such as ma fia(see Caneppele et al.,2013).

Such a geographical pattern,however,may have been blurred or emphasised by recent changes in the regulatory setting and by the completion of some long awaited infrastructural projects.For one, fixed feed-in tariffs and green certificates have been replaced with incentives tied to wholesale(day-ahead)zonal electricity market prices(MD 6 July 2012;MD 23 June 2016).More specifically,the energy market regulatory authority,ARERA,sets a minimal tariff to be guaranteed to REsuppliers running plants above a certain capacity,such that whenever the zonal price falls below it,a subsidy equal to the difference between the minimal tariff and the zonal price is awarded.No subsidies are paid if the zonal price is above the minimal tariff.

Hence,RE plants located in congested zones may not receive subsidies exactly in those hours when zonal separation leads to price peaks.Sicily and Sardinia have historically been prone to congestion and rich in RE at the same time(Sapio,2015,Sapio and Spagnolo,2016).However,the inauguration of the Sardinian cable(SAPEI)in March 2011 and the doubling of the Sicilian cable(Sorgente-Rizziconi)in May 2016 may have smoothed out the differences in wholesale prices(in unit subsidies)across regions.Finally,the progressiveness of the A3 component has been reduced(Energy Authority deliberation 582/2015/R/eel).Therefore,regional differentials in energy demand should weight less in determining cross-regional gaps in green budget contributions.

3 Model

3.1 Electricity market zones

Let z denote the generic market zone or regionaThe terms zone and region will hereby be treated as interchangeable,although market zones in Italy can include more than a region..To explore the North-South pattern mentioned above,we will assume that z can take either of these two values:n(North)and s(South).Dzis zonal demand,assumed to be short-run price-inelastic and exogenous,a stylised fact in the empirical literature on electricity markets.Rzis the zonal generation of renewable energy,short-run price-inelastic and exogenous as well,and offered in the wholesale market at a null price.Here a simplistic assumption is made,to be relaxed later in the paper,that RE plants in a market zone are fully owned by residents of the same zone.The zonal electricity supply Szis the sum of price-inelastic RE supply and of electricity supply from other,conventional sources.Supply from conventional sources is assumed to be increasing in the zonal market price pz:

whereσ′(.)> 0(see Carmona and Coulon(2014)for a review of structural modelling of electricity prices).

Zonal prices are determined by the crossing of demand and supply,a physical necessity in the electricity industry due to the shortage of viable storage facilities(see,however,Fumagalli(2016)on the recent evolution of storage technologies).

If each market zone clears independently(separated market zones,i.e.if no transmission capacity is available),then Sz=Dz,hence:

where pz(.)is the inverse of the supply function σ(.),with(.)>0.

Instead,with fully integrated zones,namely when a transmission line is available and never congested,Sn+Ss=Dn+Ds,implying that the zonal price depends on demand and renewable supply from both the Northern and the Southern zone-or,in other words,on the national demand and renewable supply of electricity,according to a function p:

with p′(.)> 0.

Let us now recall the merit order effect,a stylised fact which will be useful in the analysis of the model.As shown in several papers,from Sensfuss et al.(2008)to Clò et al.(2015),in the short run a larger renewable energy in-feed translates into lower wholesale market prices for electricity.The reason is that high-cost fossilfueled units are displaced by the additional RE generation,which is offered at zero.Another recent and perhaps less established result shows that the merit order effect is milder after zonal integration(e.g.evidence in Ketterer(2014)on Germany)or in market sessions when a zone is not congested(Sapio,2015 on Italy).

In the above equations,forpz,the merit order effect is given by the partial derivative ofwith respect to RE production,namely in the zonal separation case,-p′in the zonal integration one.

3.2 Green incentives

Let Izdenote the total incentive or subsidy cashed in by renewable energy producers in zone z.In Italy,this has been determined in two alternative ways:

•Fixed regime:RE producers receive a fixed incentiveπper unit of RE,hence the zonal incentive reads:

•Market-based regime:RE producers are awarded the difference between the zonal market price and a

minimum tariffπif the zonal price is below it,i.e.

per unit of RE,hence

if pz<π,0 otherwise.

The market-based regime has replaced the fixed regime in Italy in two steps between 2012 and 2016.It is worth noting that while subsidies are formulated in a uniform way across the country,authorisation procedures and competences differ across regions,so that new RE capacity authorisations in a region cannot be prevented by other regions.

Subsidies are financed by final(industrial and household)users through the so-called A3 component,whose zonal aggregate reads:

withαz(0)>0( fixed part),≥0.

This is mimicking and generalising the subsidy profiles used by GSE,which are typically piece-wise linear and nondecreasing(e.g.in one case they are constant).bThis is a highly simplified model of the green energy budget,as it overlooks policy tools such as green certificates,feed-in premia,and the stratification of RE technology vintages to which different subsidy schemes were associated.

Importantly,we assume that no obligation exists to balance the green energy budget,as in reality additional public resources are allocated whenever the forecasted amount of gross subsidies turns out to be insufficient to cover the actual applications for funding received.Section 5 will analyze the model under a budget balance rule.

4 Model analysis

Let us now analyse the model.Four scenarios will be compared,namely the two incentive regimes( fixed,market-based)under different infrastructural conditions(zonal separation,full zonal integration).Extensions of the model will be presented in Section 5.

4.1 Net zonal contributions-with zonal separation

In the fixed regime,the net contribution of zone z to the green energy budget is equal to

This highlights a positive effect of demand and a negative effect of RE.Therefore,zones with higher energy use and less renewables,such as the North,contribute more to the green energy budget.

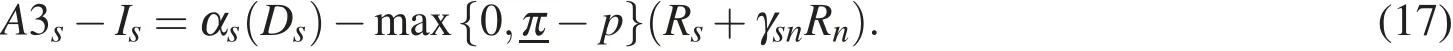

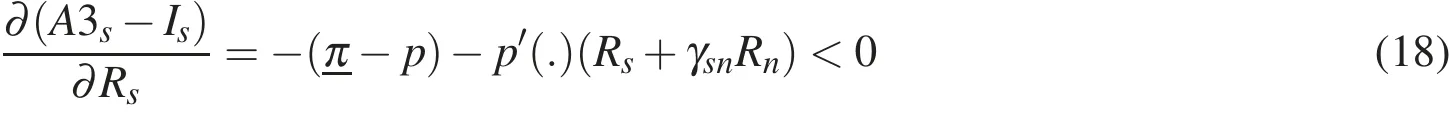

In the market-based regime,the incentive received by RE producers in a zone depends on the zonal market price pz,provided that it is below the minimal tariffπ,hence the net contribution of zone z reads

Based on the equation above,zones with higher demand provide a larger gross contribution.Higher demand translates also into a higher zonal electricity price,so that RE producers located in that zone receive lower incentives,or none at all whenever the zonal price is above the minimal tariff.Zones with higher RE generation receive more subsidies,provided that the zonal price is below the minimum tariff,and even more are implied by the merit order effect(downward pressure on the zonal price).Indeed,more RE in-feed pushes the zonal price down,widening the gap between the minimum tariff and the zonal price and inducing a higher unit subsidy multiplied by a larger RE production.

To put it differently,the market-based regime widens the gap between North and South in terms of regional contributions to the green energy budget,to the detriment of the Northern zone.

More formally,the first derivatives of the net zonal contribution with respect to zonal electricity demand and RE outputs are the following:

and

In both equations,the second addendum on the right-hand side captures the effect mediated by market prices,which strengthen the redistributive effects.

4.2 Net zonal contributions-with full integration

Suppose the North and South are fully integrated.Hence,the electricity price is the same across zones(p=pn=ps,see Eq.3)since there is no congestion,and the formula for A3zis unchanged,but now

i.e.net revenues for zone zdepend,through the national price p,on both its own and the neighbour’s electricity demand and renewables generation.No such effect would follow in a fixed incentive regime(Eq.8 still holds).

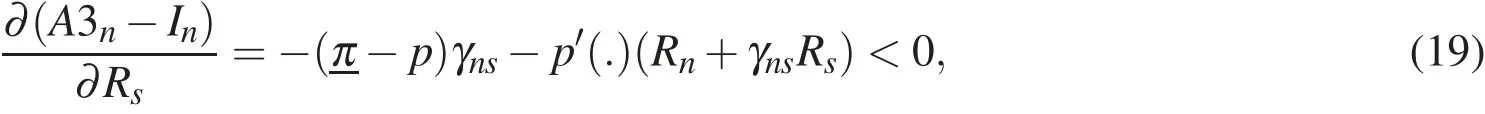

A marginal increase in Southern renewables yields

as before,but now there is also a pecuniary externality:a change in RE production in one zone affects the other zone’s net contribution to the green energy budget by in fluencing the common wholesale electricity price.Formally:

It is worth noting that the marginal effect of an increase in Southern renewables is larger in magnitude than that associated to Northern renewables,namely

ifπ-p>0,except in the empirically false case in which RE production in the South,Rs,is more limited than in the North,Rn.

By generating more RE,zone s depresses the common electricity price,therefore widening the gap between the price and the minimum tariff.This allows increasing its own as well as its neighbour’s incentive.Yet,the incentive received by zone s increases more because only its RE output has grown,and the gross zonal contributions A3s,A3nare given.Overall,the North ends up with a proportionally higher net contribution to the national green energy budget.This could be called relative burden shifting.

5 Extending the model

The above simple model of the green energy budget is hereby extended in two directions:(i)allowing for distributed ownership of RE facilities,(ii)imposing a balanced budget rule.

5.1 Ownership patterns

Spatial concentration in profit claims was a restrictive assumption.It is indeed more realistic to posit that the ownership of the RE facilities can only partially traced back to the citizens of the regions were the facilities are located.Most often,RE plants are commissioned and managed by large energy producers,in most cases listed on stock markets.

Therefore,profits generated by RE plants in those cases accrue to shareholders located across the country and even across national borders.

Formally,suppose RE plants in s are partly owned by citizens in n.If the aggregate share held by northern citizens in RE plants located in the South isγns∈ (0,1]and,vice versa,γsn∈ (0,1],the net zonal contributions can now be reformulated as follows:

and

Taking first derivatives of both net contributions with respect to Rsand assumingπ-p>0 shows,as before,that a marginal increase in Southern renewables exercises a downward pressure on both(pecuniary externality):

and

but interestingly,the pecuniary externality measured by Eq.19 is also a function of the ownership shares.

Because of this,the relative burden-shifting effect previously examined is now less clear in its magnitude and direction.In particular,whether one zone or another benefits most from the lower net contribution depends on the relative RE production,on the pattern of RE plant cross-ownership in the two zones,and on the merit order effect.

A further exercise on ownership patterns assumes that RE plants can be owned by foreign companies as well.In one extreme case of theoretical interest,albeit not empirically sound,RE plants are fully owned by foreigners.The implied net contribution of each zone to the green energy budget is simply

showing that when RE facilities are fully in foreign hands,the zone with higher energy demand(the North in our model)is the one that contributes the most to the green energy budget.However,its relative contribution no longer depends on RE authorisation choices made in other regions.

Oneready implication isthat northern energy users mayoppose policies that favour thepenetration offoreign companies in the national industrial sector.

5.2 Balanced budget and the unit cost of RE support

In a final piece of analysis,we need to tackle an issue so far ignored:budget balance.At this point,it has been assumed that budget losses would be covered through other public resources.The questions asked here are:what subsidy parameters would guarantee a balanced green energy budget?How should these parameters be revised in response to increasing penetration of renewables?Finally,what would the implications be for regional redistribution patterns?

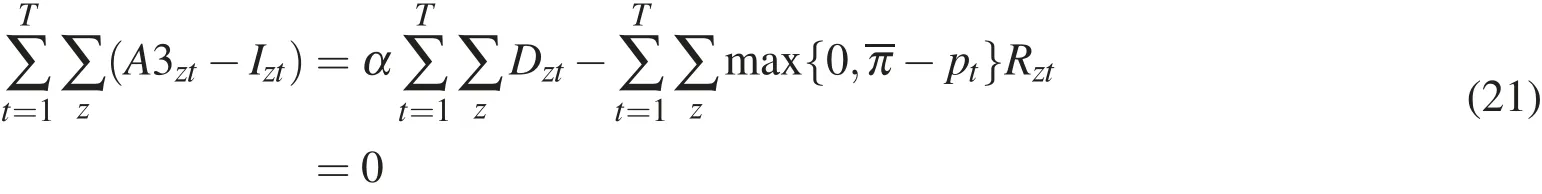

Suppose that the A3 component is defined as A3zt=αDzt,where t denotes a time period.The question then is,in operational terms,whichαwould ensure a balanced green budget on a given time horizon T?

Aggregating Iztand A3ztacross(integrated)zones and periods and equating to 0,yields the following expression:

where max{0,π-pt}>0 for at least one period t.

From this,one can derive the A3 parameterα∗that guarantees a balanced green budget:

This is increasing in renewables and decreasing in demand.

In other words,when REgeneration increases in a zone,keeping the green budget balanced requires a higher αparameter:

The above results can find an interesting interpretation in light of the merit order effect when markets are integrated.As shown by Ketterer(2014)among others,market integration is one factor weakening the merit order effect.Thus,without market integration(that is,with zonal separation),the numerator of the expression forα∗would be onlyπ-pst+,butwould be higher(due to a stronger merit order effect).

As an implication,the integration of market zones under certain conditions implies a higher unit cost of RE support.This could be seen as a hidden cost of market integration.Since market integration pushes wholesale prices down,more public resources are needed in order to support the green energy sources.On the other hand,integration also neutralises the merit order effect of renewables.Therefore,if this effect is strong enough,the subsidy burden could be relieved by integration.

6 Conclusion

The proposed model of RE subsidies shows that the region with higher income and lower RE endowments(the North in Italy)contributes disproportionately to the “green energy budget”.Then,the redistributive effect is emphasised by a support regime that ties the subsidies to wholesale electricity prices,because of the merit order effect associated to renewables,which justifies higher subsidies to RE generators by depressing the electricity price.When regions are physically integrated,one region’s increase in REproduction affects the net contribution of the other region as well,through its effect on the national electricity price.Despite such externalities,the North is still contributing more than the South,and any new RE installation in the South implies a burdenshifting effect.However,this pattern-North subsidising the South-is blurred if RE ownership is distributed across zones.Finally,considering a balanced budget rule shows that in the market-based subsidy regime,the unit burden on taxpayers is made heavier by market integration,because it mitigates the national electricity price and hence,more financial resources are absorbed by the subsidy system.

These results are relevant with respect to the on-going debate on the decentralization of regional energy policies during the green economy transition.As one learns from the literature on climate change negotiations,international action against climate change involves solving a coordination problem among sovereign entities.This is a challenge nearly as hard even within countries whenever energy policies are decentralized,as with regional energy plans in Italy.Indirect evidence of a need for regional coordination in energy policy actions comes from empirical works.In Sapio(2015),one argues that congestion induced by renewables is not accounted for in local authorization procedures for new RE plants.Gianfreda et al.(2016)propose a similar argument based on a sample of European countries.In light of the results illustrated in this paper,coordination among regions should be aimed at preserving redistribution only if equitable.One way to accomplish this goal could entail differentiated subsidy parameters.Indeed,because of heterogeneity in locations and environmental preferences there may be little reason for uniform support means,as claimed by Lin(2016)based on evidence of spatial misallocation of wind farms in the US.

Future research will extend the model to account for dynamic and stochastic relationships.Following Figueiredo et al.(2016),a new extension of the model should account for positive correlation between wind chill and electric heating demand.Due to such correlation,higher subsidies accruing to a region could be partly offset by a higher gross contribution to the green energy budget.Common components in RE generation dynamics across regions would also be interesting to explore,as burden-shifting effects may be blurred in those cases.Secondly,the redistributive patterns studied in this paper should be assessed in light of the environmental benefits implied by intensified investments in green technologies.Even if a region ends up as a net contributor to the green energy budget,its citizens may support incentives to renewables because of non-monetary benefits,such as access to clear air and health safety.A final insight for future research is empirical in nature and involves building a dataset including prices and demand(from GME,the wholesale electricity market operator),tariffs from ARERA(Energy Authority),transmission capacity and renewables from Terna,as well as ownership data.

Acknowledgment

The author would like to thank 2 anonymous references,Antoine Mandel,and the audiences in Milan(1st symposium of the Italian Association of Energy Economists,December 2nd2016)and Turin(seminar at the Department of Economics and Statistics,February 1st2017)for their useful comments and suggestions.Financial support by Parthenope University of Naples,Bando di sostegno alla ricerca individuale per il triennio 2015-2017,annualita’2016,is gratefully acknowledged.Any remaining error is solely the author’s responsibility.

Journal of Environmental Accounting and Management2018年4期

Journal of Environmental Accounting and Management2018年4期

- Journal of Environmental Accounting and Management的其它文章

- Light Fertilization Affects Growth and Photosynthesis in Mung Bean(Vigna radiata)Plants

- Capture Rate of Selected Heavy Metals In Q.Ilex L.Leaves Collected At Two Sites With Different Land Uses

- Impact of Biochar Amendment on Soil Quality and Crop Yield in a Greenhouse Environment

- Phytotoxic Extracts as Possible Additive in Subsurface Irrigation Drip for Organic Agriculture

- Ecotoxicological Assessment of Virgin Plastic Pellet Leachates in Freshwater Matrices

- Uptake of Micro and Macronutrients in Relation to Increasing Mn Concentrations in Cistus salvifolius L.Grown in Hydroponic Cultures