Laundry Detergent in China

China Information Center of Daily Chemical Industry

market current situation

Revenue for the soap, washing powder and synthetic detergent manufacturing industry in China has been increasing at an average annualized rate of 6.5% over the past five years. In 2018, industry revenue is expected to grow 4.0% to $44.8 billion. Industry growth has been driven by rising hygiene awareness in China and the rapid development of synthetic detergents, including laundry detergent and liquid soap. In addition, the growing purchasing power of Chinese consumers has led to a declining sensitivity to product prices. Last, there are over 4,000 manufacturers, distributors and agents nationwide,which has supported the development of the retailing network in suburban and rural areas.

Laundry detergents have increased by nearly 50% in the past year. By analyzing Alibaba data from January 2017 to December 2017, CBNData ranked the top 10 brands of online laundry detergent products according to three comprehensive indicators including sales, repurchase rate and per capita consumption.

Table 1. Top 10 the best-selling liquid laundry detergent brands in 2017

As can be seen from Table 1, brands owned by Unilever and Procter & Gamble have been overtaken by Chinese laundry brands such as Bluemoon, Walch and Chaoneng.Chinese brands are doing a better job than their global rivals because that Chinese brands know more about what Chinese consumers need than foreign brands.

In addition, The Laundress, a high-end laundry detergent brand from the US, and Ever Green, the local technology innovation brand, have also succeeded in ranking among the TOP 10. By contrast, Japan Kao, which is quite popular with Chinese consumers, is obviously far less competitive in laundry detergent than in diapers, paper towels and other category.

The number of the laundry detergent item sold online grew by 2% in 2017, lower than the growth rate of 20%in 2016, but the sales increased nearly 50% in the same year-over-year period. Important sources of growth are an increase in the number of buyers and per capita consumption, and the repurchase rate is still slightly higher than last year. As you can see, the laundry detergent is developing very well online.

Based on the list, Bluemoon and Walch are strongly ranked the first and second respectively, and their sales far exceed other brands.

Although the sales advantage is not obvious, The Laundress ranked eighth on the list due to its higher unit price and repurchase rate.

Post-70s prefer to buy Ariel and Ever Green, post-75s,post-80s and post-85s are relatively more inclined to buy Walch, post-90s and post-95s prefer to buy Bluemoon and Liby.

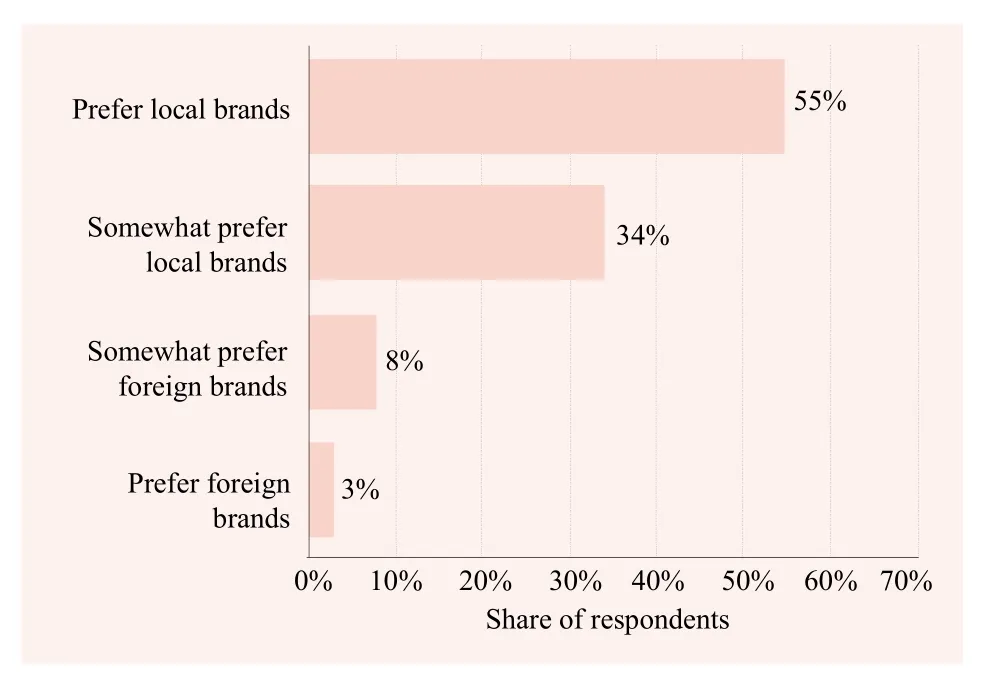

Figure 1. Results of a survey conducted about the local and foreign brand preferences of laundry detergents among Chinese consumers

Figure 1 displays the results of a survey conducted between May and July of 2017 about the local and foreign brand preferences of laundry detergents among consumers in China. During the measured time period, around 55 percent of the Chinese respondents stated that they preferred local brands of laundry detergents over foreign brands.

The reason why domestic companies lead in laundry detergent

There are a number of reasons why domestic companies lead in laundry detergent. First, unlike many global brands,local brands tend to build dominance in one or two subcategories (for example, laundry powder only or laundry powder and soap). This reduced complexity gives them a clear advantage when it comes to sales force execution and activation at the point of sale.

Second, local brands typically were launched before the development of modern trade. As a result, they have built strong distribution networks with third-party distributors that operate throughout the country, such as Liby. Distribution remains a critical competitive advantage for any companies to be successful in China, especially in tier-3 to tier-5 cities, where modern trade has not yet made a strong presence. For example, today Diaopai has a 60%penetration rate in tier-3 to tier-5 cities, compared with OMO’s 30% penetration rate.

Third, Chinese companies typically have more manufacturing plants throughout the country than their foreign counterparts. These plants provide a competitive advantage by making it cost-effective to distribute to remote cities.

And fourth, local brands have been good at exploiting product segments that were not targeted by global brands.For example, Diaopai started by selling laundry detergent in the laundry bar form in 1992, while OMO and Tide entered China focusing on powder. Local brand Bluemoon launched a liquid version of fabric detergent in 2008, a year ahead of Unilever’s OMO and two years before Procter &Gamble’s Tide entered the segment. As a result, Bluemoon has achieved 30% market share and is the leader in laundry liquid today.

China's most influential laundry detergent brands

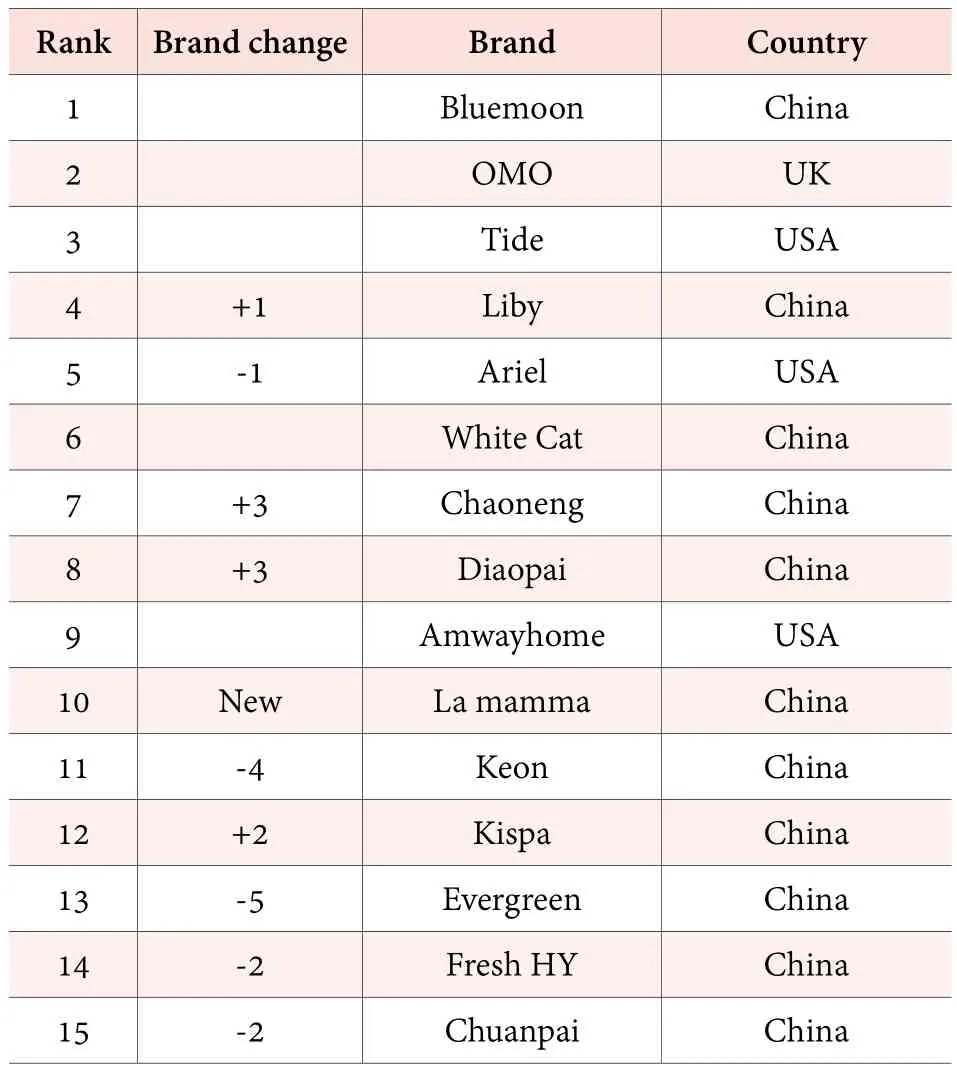

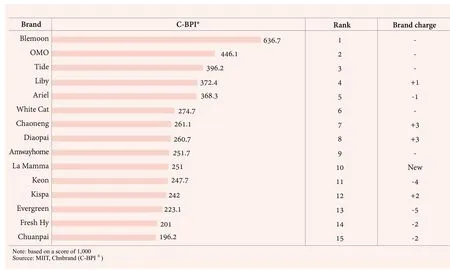

The 2018 China Brand Power Index, or the C-BPI®,consumer survey result was released by Chnbrand (Table 2 and Figure 2), an institution that is funded by the Ministry of Industry and Information Technology and is considered China's most reliable brand evaluation organization.

In the laundry detergent category, Chinese brands performed well, and occupied leading positions. Bluemoon remained stable at No.1 place successively since 2011, and recognized as 2018 C-BPI “Golden Brands”. OMO ranks No.2. Tide is at No.3. Liby moved up one ranks to No.4.While Ariel ranks No.5 dropped one place from 2017.White Cat stays at No. 6. Chaoneng and Diaopai moved up three ranks No.7 and No.8, respectively. Amwayhome ranks No.9. La mamma ranks tenth on the list for the first time. Keon and Evergreen drop out of the top ten,dropping from No.7 and No.8 last year to No.11 and No.13 this year. In the top 15, Chuanpai, Kispa and Fresh Hy are also present.

Table 2. Chnbrand China’s most influential brands in laundry detergent industry, 2018

Figure 2. China’s Top 15 most influential laundry detergent brands (C-BPI ®), 2018

Industry locations

Activity in the soap, washing powder and synthetic detergent manufacturing industry in China is concentrated in Guangdong, Zhejiang, Shandong and Henan provinces, which account for 50.5%, 13.1%,6.0%, and 4.2% of total industry revenue, respectively.Guangdong province employs 34.2% of total industry workers while Henan province accounts for only 6.0%of total industry employment. Guangdong province is home to many of the major players in this industry that benefit from large production facilities and economies of scale. Guangdong province has the most enterprises in this industry with revenue accounting for 50.5% of total industry revenue.

Product function

By reviewing the functions of TOP 10 liquid laundry detergent brands, we can conclude the following key words:natural scent, color-boosting, low-foaming and easyrinsing.

Personal preference is a huge issue in deciding what brand and form of laundry detergent to use.

It can be seen that the function of “color + scent” has become a standard of liquid laundry when buying, while the low-foaming and easy-rinsing are the important indexes to meet the needs of machine washing. Cleaning is not only about stains alone, but also about whiteness, brightness and freshness (Figure 3).

Figure 3. Sales comparison of laundry detergent by function in 2017

According to CBNData’s “2017 Online Laundry Products Consumption Report”, online sales of laundry detergent are dominated by females. It is easy to explain why the liquid laundry detergent, that works efficiently, has a craveworthy fresh scent and superior color protection,became popular.

In a way, female consumers have bought not only laundry detergent, but also a good thing to please themselves.

The Laundress was founded by two fashion aficionados in 2002. The Laundress provides laundry and home cleaning products that takes care of clothes made with wool, silk, jeans and other materials. For fashion lovers, the price of laundry detergent is not a problem if it can take care of clothes.

In addition, consumers not only pay attention to clothes care, but also love and care about themselves a lot. Special laundry detergent for baby clothes and underwear also has proven quite popular among the majority of consumers.According to CBNData’s research report, liquid laundry detergent has gained wide acceptance among female consumers, and the sales increased significantly in 2017.Focusing on consumer health may be a new direction for developing of laundry detergent.

Rising demand for laundry pods

In 2014, laundry detergent pods appeared in China via various e-commerce platforms as one of the biggest changes to laundry products in more than 50 years. In 2017, less than 1% of Chinese households purchased laundry pods.

Price problem

Pods are also more expensive than liquid and powder detergent. Searching with the key word: “laundry pods”on Taobao, you will find that the average price is between 2.5 yuan and 4 yuan per grain. It means that consumers spend 2.5 to 4 yuan each for a wash. At 50 ~ 80 yuan a box,consumer who are accustomed to using bottles of laundry detergent may not be willing to try out.

Lack of publicity

In recent years, each category is becoming increasingly high-end, the more expensive the better selling. Liquid laundry detergent also reveals high-end trends. Why such a high-end laundry pods but there has been no open?

Laundry detergent pods are super concentrated with 70% cleaning ingredients, and more concentrated than laundry detergent (40%~50%). But the concept of concentration has not been well known and understood.Most consumers focus more on the price than the features of the product.

In order to further take root in China, the first problem to be solved for liquid laundry detergent pods is to make pods safer and enhance the product features.

Growth in online retail

E-retailing is the fastest-growing distribution channel in the Chinese liquid detergent market. The biggest players in the online retail market for liquid detergents are Taobao, JD, and Tmall. The growing number of online websites that offer a wide range of liquid detergent products has increased the demand for these products,especially among working parents who seek easy accessibility and convenience. The e-retailing of various products, including liquid detergent, is gaining popularity primarily because of it being a time-saving and costeffective process of purchasing products.

Conclusion

Chinese laundry detergent market is dominated by local brands. The growth of the industry is strong, and competition is also fierce. Both local and foreign brands are committed to retaining more consumers. Consumers are no longer satisfied with just removing the stains. Rather they want the latest and greatest. Targeted functional products are highly sought-after. That is the reason why the online sales of color-protecting and accelerated laundry detergent achieved an overwhelming victory.

China Detergent & Cosmetics2018年3期

China Detergent & Cosmetics2018年3期

- China Detergent & Cosmetics的其它文章

- Tmall Global Encourages Italian Beauty Brands to Enter the Chinese Market

- China Acid-based Surfactant Forum 2018 Held in Changsha

- JD.Com Will Admit Unilever into Its Warehousing, Logistics Networks

- BASF to Establish $10b Site in Guangdong

- Major Industry Events

- China’s makeup supplier Beukay Cosmetics Sets Its Sights on International Markets