Preventing Money Laundering Risks in Cross-border Mergers and Acquisitions

By Yao Ying

China"s foreign exchange management for capital account items calls for examination and approval as well as registration.

W ith the acceleration of economic and fi nancial globalization,more and more Chinese corporations have acquired overseas companies in order to improve their overall competitiveness in the international market. At the same time this trend has been driven by the government’s drive to transform the economy and upgrade domestic industry.According to statistics from Thomson Reuters, there were 866 cross-border mergers and acquisitions involving Chinese companies in 2017 with the transaction volume reaching US$141.9 billion.

China has become the largest player in cross-border mergers and acquisitions in the global arena.Moreover, private enterprises have taken a more prominent role in these transactions. Listed nonstate enterprises have signi fi cantly increased their stakes in quality offshore assets as part of a national policy that encourages companies to "go global." At present, China"s foreign exchange management for capital account items calls for examination and approval as well as registration. The regulatory system is relatively comprehensive,but in some cases there is money laundering, terrorist fi nancing, or tax evasion, and these activities may be disguised as legitimate cross-border fl ows of funds. This poses a threat to normal fi nancial transactions and the collection of taxes as well as China"s macroeconomic environment. Effectively identifying money-laundering risks in crossborder mergers and acquisitions and conducting comprehensive monitoring and effective supervision are of great importance in maintaining national fi nancial security.

Case Analysis

In general, cross-border mergers and acquisitions are relatively large transactions, and frequently involve cash payments. Some illegal organizations use less supervised channels or engage in money laundering in the name of crossborder mergers and acquisitions.The following case of money laundering in a cross-border acquisitions serves an example.(The the companies involved have not been identi fi ed by name).

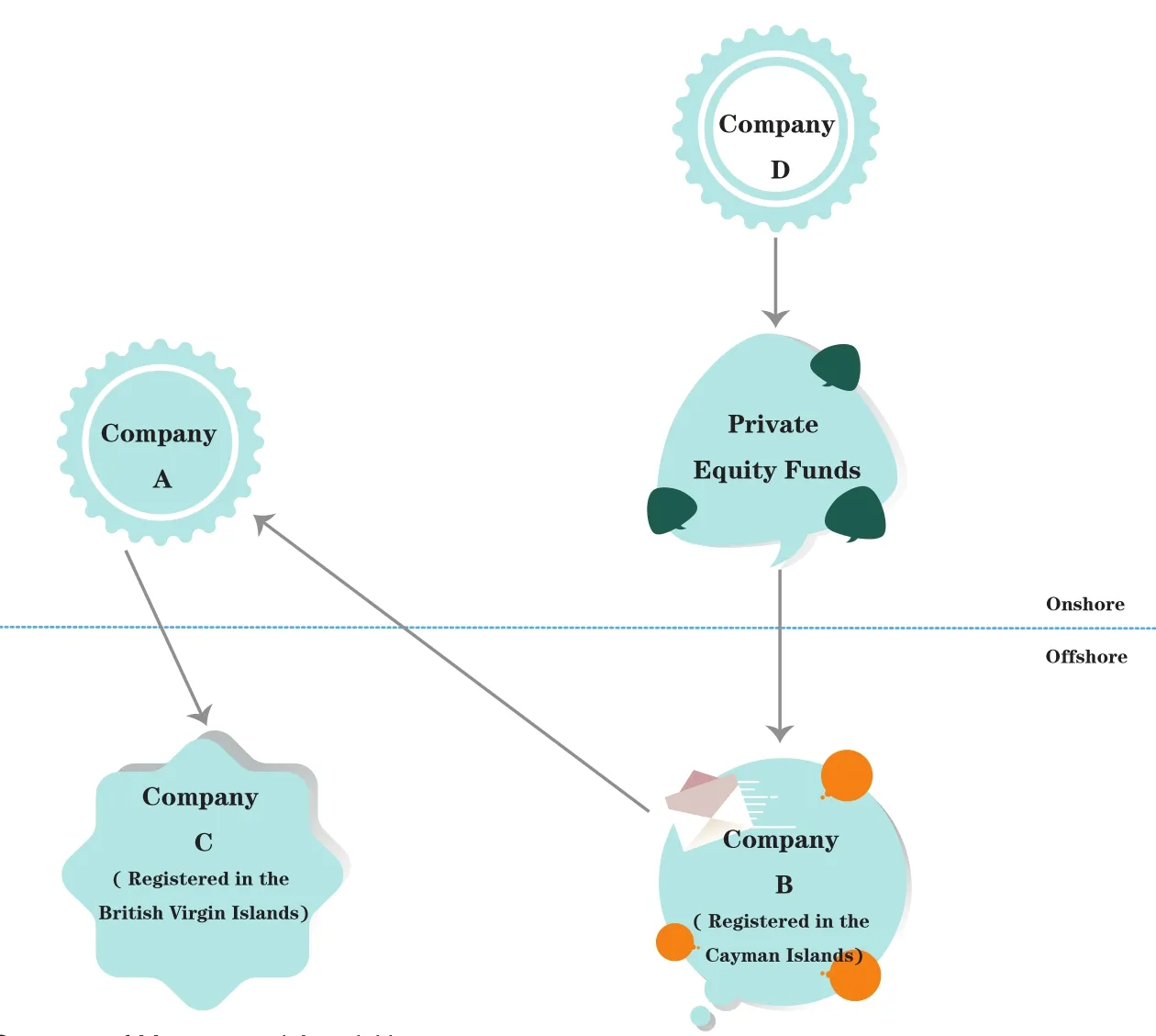

Company A is a domestic manufacturer of new materials.Company B, registered in the Cayman Islands, and Company C, registered in the British Virgin Islands, are wholly-owned subsidiaries of Company A.Company B is an overseas raw materials procurement center that supplies raw materials to Company A. Company C is a downstream company in the industrial chain.50% of Company A’s products are exported to Company C. There are a few account receivables between Company C and Company A, but most of the business is conducted in cash.

Structure of Mergers and Acquisitions

Company A intends to sell its 100% equity stake in Company B due to cash fl ow needs. However,according to available fi nancial data,Company B’s registered capital is only 30 million yuan, sales were 150 million yuan and it had a net loss.The valuation should not have been high but surprisingly, Company D,a limited partnership that invests in private equity funds, offered US$30 million (equivalent to 189 million yuan when calculated at the exchange rate of 6.3 yuan to US$1). That was fi ve times Company B’s registered capital, a substantial premium for this company. Due diligence uncovered hidden contracts between Company D and Company A. It was suspected that the premium in the acquisition actually included some funds that represented capital fl ight. At the same time, Company A registered a number of shell companies that had complex interlocking relations with each other in many tax havens,such as the Cayman Islands and the British Virgin Islands. There were related-party transactions that appeared to be merely for the movement of capital and money laundering (See the chart below for the structure of the acquisition).

In the above case, the valuation of the target company is the core of the acquisition. In the bidding process of cross-border mergers and acquisitions, if the seller’s valuation far exceeds a fair market price, and the buyer is still willing to pay in cash with no bank fi nancing,there is often a risk of money laundering. In addition, bypassing overseas direct investment review by designing a complex transaction using tax havens is often a means of laundering money. The tax haven attracted foreign capital through low-tax or zero-tax policies accompanied by loose regulations.These countries and territories often establish strict bank secrecy systems, making it dif fi cult to learn the source of the external funds.

Risk Characteristics

Money laundering channels in cross-border mergers and acquisitions include cash smuggling, alternative remittances,transactions under the current account, investment under the capital account, cash out fl ows from credit cards, offshore fi nancial centers, direct overseas receipts, and the transfer of funds through speci fi c relationships abroad. Cross-border mergers and acquisitions are an important tool used by unscrupulous institutions to launder money by means of investment under the capital account. If a cross-border M&A transaction displays one or more of the following characteristics, it is necessary for the bank involved in the transaction to conduct a detailed anti-money laundering due diligence investigation.

First, cross-border mergers and acquisitions require a high degree of con fi dentiality, which often means full cash delivery. Thus it is necessary to conceal the true source of funds and the ultimate controller of a company. At the same time, the transactions must be completed quickly to facilitate the rapid fl ow of illegal funds. Moreover, there are over-valuations and so-called blackbox operations.

Second, the stated value of the acquisition target is problematic. In China, the pricing and evaluation mechanism of equity acquisitions are vague and lacking in reasonable and objective assessment criteria.Cross-border premium mergers and acquisitions have great fl exibility.The actual transaction price can be much higher than the target’s net equity value, which can help move capital and facilitate money laundering.

Third, cross-border mergers and acquisitions transactions can be highly complex, often using a multi-tiered structure to avoid taxes. Offshore fi nancial centers are also commonly used to transfer assets abroad. There are generally two steps - the fi rst being to set up a shell company in the offshore center. The second is the domestic company buys raw materials,equipment or other items at high prices from the offshore company.Later the domestic company sells the goods at a low price to the offshore company or a domestic exporter sells the goods to the same company, thus creating a large volume of account receivables.When assets are transferred overseas, another anonymous offshore company is registered to use a small portion of the assets for the acquisition, thereby disguising the laundering of funds.

Fourth, companies with strong cash recovery abilities, such as trading companies, sports clubs,fi lm studios, real estate and hotels are prime targets for money laundering through cross-border mergers and acquisitions. In recent years, some companies have made frequent large-scale acquisitions in these areas. Some of the apparently irrational overseas investment activities may be related to such asset transfers and money laundering.

The aforementioned risk characteristics provide a theoretical basis for effectively identifying money laundering risks in crossborder mergers and acquisitions transactions.

Precautions

When dealing with crossborder renminbi pools, foreign exchange settlements, and the fi nancing of cross-border mergers and acquisitions, banks must strengthen the identi fi cation of the risk characteristics of money laundering and adopt measures to prevent this kind of illegal activity.

First, banks should ensure that approval procedures for crossborder mergers and acquisitions are in place. Cross-border mergers and acquisitions need the approval of the overseas investment department of the National Development and Reform Commission and the Ministry of Commerce, as well as foreign exchange authorities. The National Development and Reform Commission is a key department for overseas investment review.Cross-border mergers and acquisitions undertaken directly by domestic parties need to be registered if not approved before implementation. For cross-border merger and acquisition projects that fall within the scope of approval and fi ling requirements,foreign exchange management procedures cannot be undertaken without the completion of these requirements. Banks also cannot begin related fund settlement and fi nancing procedures until these preliminary steps are completed.

Second, banks need to strengthen their ability to conduct veri fi cation of the transaction and legal compliance. Banks need to focus on reviewing whether the acquisition target complies with management regulations, and verify whether the funds are used to pay for the stated transaction.Funds should not be used for other purposes. Funds cannot be used for arbitrage or other forms of speculative trading. In addition,in the process of foreign direct investment registrations and fund remittances for customers, banks should require customers to submit relevant supporting documents.

Third, banks need to strengthen the management of their system for reporting large or suspicious transactions. Banks should,in accordance with relevant regulations, report to authorities single or accumulated transactions of more than 50,000 yuan or foreign currencies of more than US$10,000 on a single day. This applies to cash deposits and withdrawals,foreign exchange settlements and exchanges, remittances, bill settlements and other forms of cash payments and receipts. At the same time, banks should independently establish and improve transaction monitoring standards and actively carry out their anti-money laundering supervision responsibilities. For large cross-border cash transfers involving Chinese companies investing in foreign companies,banks should require companies to submit detailed investment purchase contracts and other related materials. For a free trade account set up in a free trade zone,banks need to understand the business model and examine the investment certi fi cate and other company documents. Any large cross-border cash transfer that fails to provide evidence of a legal source of funding and the actual use of the funds offshore should be scrutinized.

Fourth, banks should prudently intervene in offshore mergers and acquisitions projects in cyclical industries. They should consider the credit status, management capabilities, market prospects,fi nancial soundness, self- fi nancing capacity of the parties, market prospects, future pro fi tability and national risks. In addition,the trading operation risks and business integration risks should be fully considered. Moreover, when supporting Chinese enterprises going global, banks should strengthen management in terms of credit risk, country risk, and compliance risk, in order to improve their cross-border fi nancial service capabilities.

Policy Suggestions

After years of development,China’s anti-money laundering supervision has basically achieved full coverage in banking,securities, insurance, and non-bank payment institutions. Signi fi cant results have been made in assisting anti-money-laundering campaigns. However, increasingly sophisticated money laundering practices pose severe challenges to China’s anti-money-laundering efforts. The cooperation of all segments of society at large have a role to play in enhancing antimoney-laundering efforts.

First, it is necessary to improve the regulatory model. The deterrence of money-laundering requires the continuous expansion of supervision and improved methodologies. At the corporate headquarters level, it is necessary to strengthen the anti-moneylaundering responsibilities of directors, supervisors, and senior management members. Selfmanagement needs to be enhanced.Effective prevention and control measures need to be taken based on relative risk levels.

Second, it is necessary to is to strengthen coordination among the various regulatory agencies and fi nancial institutions. Regulators should take the lead in supervisory management, strengthen daily compliance supervision of antimoney-laundering efforts,include anti-money-laundering requirements in industry regulatory rules, and build a comprehensive supervisory chain. Financial institutions must implement the requirements of regulatory authorities and continue to carry out special actions to prevent and crack down on illegal money transfers by offshore companies and underground banks. Supervisory departments and fi nancial institutions should coordinate with each other and work together to carry out intensive, in-depth, efforts to control criminal activities in this area.

Third, it is necessary to strengthen anti-moneylaundering monitoring and analysis. It is essential to improve investigation procedures and strengthen analysis of the various types of money laundering. At the same time, it is necessary to strengthen communication and coordination among law enforcement agencies, improve the cooperation mechanism for suspicious transactions and establish a smooth channel for the sharing of intelligence information.It is necessary to strengthen the investigation, prosecution, and judgment of money laundering and terrorist fi nancing crimes in accordance with the law, and step up the ability to con fi scate all kinds of criminal assets, proceeds and tools.

Fourth, it is necessary to improve the anti-money-laundering data sharing mechanism. More attention should be given to researching anti-money-laundering sharing standards, and relevant departments need to be aware of their own responsibilities in data sharing. Electronic networks need to be in place to process data in a con fi dential manner. Data collected needs to be put to good use in macroeconomic management as well as law enforcement. The establishment of a statistical monitoring index is needed.

Fifth, it is necessary to strengthen the culture of compliance. Chinese enterprises and fi nancial institutions need to strictly abide by anti-moneylaundering laws and international standards as they seek to go global. In some developed countries, such anti-moneylaundering efforts have had a signi fi cant head start. Their legal systems were in place before

China began its own campaign and they have considerably heavier penalties. In recent years,many multinational banks have been subjected to substantial penalties for violating such laws.As a latecomer to the international fi nancial market, Chinese fi nancial institutions should keep these lessons in mind and ensure they help in anti-money laundering efforts as well as the thwarting of terrorist fi nancing and tax evasion.We also need to foster the culture of compliance and fi rmly hold on to the bottom line of anti-moneylaundering risk prevention.

Cross-border anti-moneylaundering regulation is an important national responsibility.It has a strategic role in deterring economic crimes, safeguarding the economic and fi nancial order,and ensuring social stability. At the same time, as a responsible national power, it is necessary for China to actively shoulder its responsibilities in international antimoney-laundering efforts. In crossborder mergers and acquisitions,precautions against money laundering risks need to be taken to safeguard national fi nancial security and ensure successful foreign exchange management.

The author is from the Investment Banking Department of the Head Of fi ce of Industrial and Commercial Bank of China

- China Forex的其它文章

- Electronic Payments Boost Renminbi Business

- How a Trade Dispute Between China and the United States Might Evolve

- Sino-US Trade Disputes and US Protectionism

- Can We Minimize the Impact of a Trade War?

- Exchange Rate Choices and China"s Managed Float

- Global Economic Momentum:This Time It"s Different