Global Economic Momentum:This Time It"s Different

By Wu Ge

Where does the momentum come from in this global recovery?What will the recovery look like in the future?

C hina has been an important driver of the global economy for some time. But more recently there have been changes from global recoveries of the past. Since the end of 2015,China"s growth in domestic demand has been declining and external demand has taken a more prominent role. So where does the momentum come from in this global recovery?What will it look like in the future?This will have a direct impact on China"s economic development.

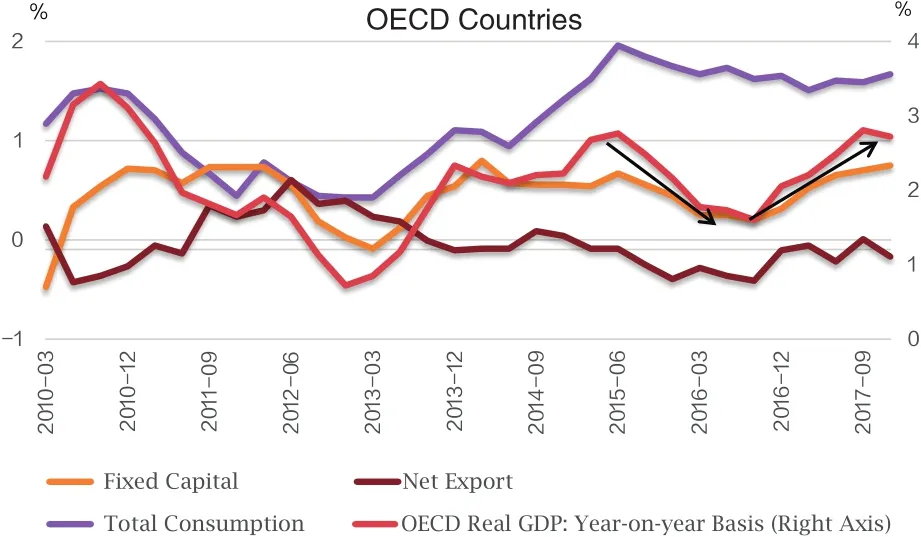

From a global perspective,investment plays a leading role in the current economic recovery.Data from the 35 member states of the Organization for Economic Cooperation and Development (OECD)is used as an approximate indicator of global economic growth, as OECD economic aggregates account for about two-thirds of global volume.The growth rate of world gross domestic product correlates closely with this growth level, having a high coef fi cient of 0.94. Historically,investment has a greater impact on economic growth than consumption and net exports and this maintains a higher degree of consistency with the overall GDP growth trend (see Figure 1). Over the last 10 quarters,the correlation coef fi cient between the increase in investment and GDP has been as high as 0.97, which shows that investment has largely led the recovery in this round of global economy.

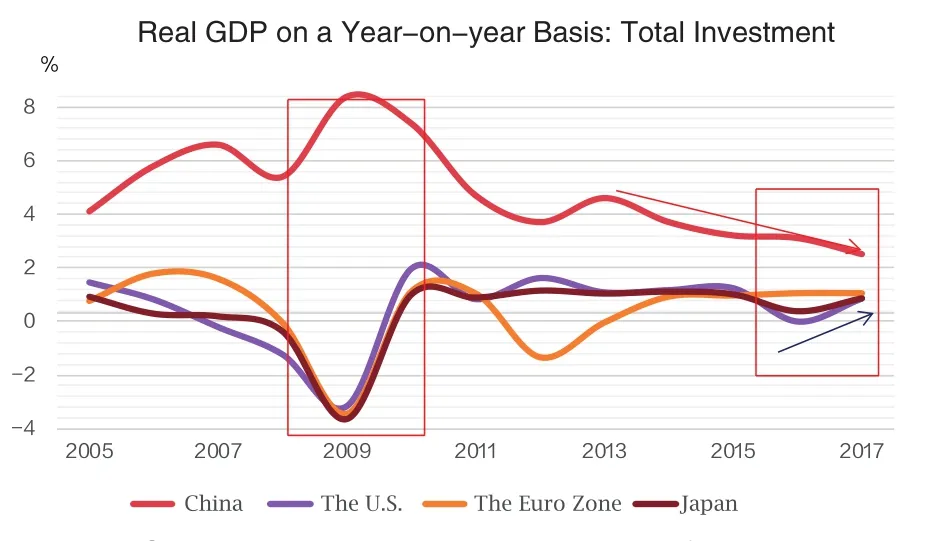

US investment has played a more obvious role in the current global economic recovery, while China"s investment growth has shown a weaker trend (see Figure 2). Although the longterm investment growth in China is much higher than in the US, Europe,Japan and other major economies,due to factors such as excess domestic production capacity, real estate regulation and debt problems, China"s investment growth has weakened.Therefore, from the perspective of marginal changes, China is no longer the main contributor to the global recovery. Changes in US investment have better demonstrated the trend in the global economy over the past two years. Japan’s economy has apparently rebounded, but its global in fl uence is much less than that of the US in terms of economic volume. It is worth noting that, although rising prices caused by the elimination of excess production capacity in China may have a positive impact on halting de fl ationary expectations, US investment is still the main engine in the global recovery.

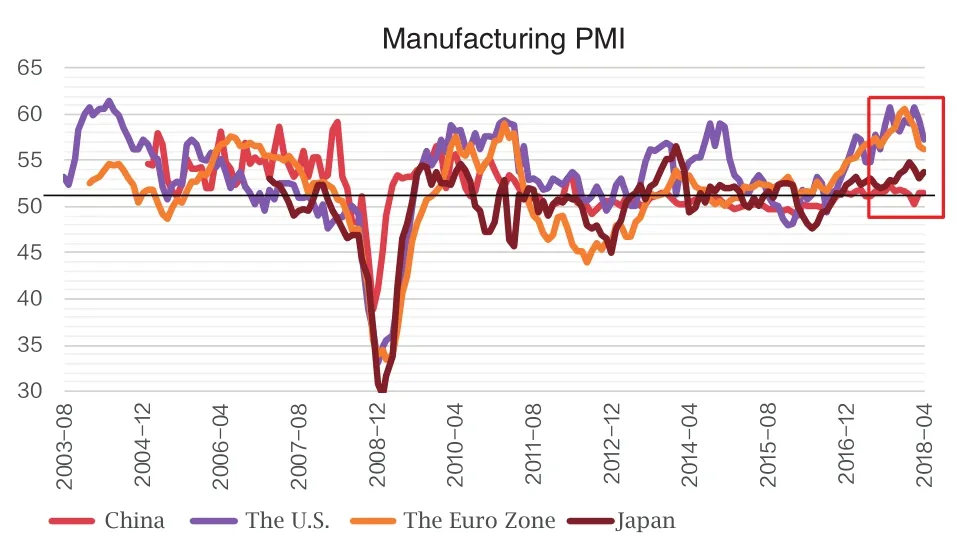

How will global economic momentum evolve in the future?Since the fi rst quarter of this year, the purchasing managers" index (PMI) of major economies such as the US have fallen (see Figure 3), which has raised concerns about the exhaustion of global economic momentum in the future. Based on the above analysis, it is believed that predicting the future trend of global investment is crucial to grasping macroeconomic direction.The future changes in US investment, a key indicator of current global recovery,may be able to re fl ect the economic development of the US and even the global economy to a large extent.

Figure 1 An Investment rebound is crucial to this round of global economic recovery Source: collected by the author based on data from OECD

Figure 2 US investment becomes the main engine of the current global recovery Source: collected by the author based on data from WIND and OECD Note: For the sake of consistency, total capital formation (total gross fixed capital formation + inventory changes) is selected here as investment

Figure 3 The recent economic downturn in the US and other major economies Source: collected by the author based on data from WIND

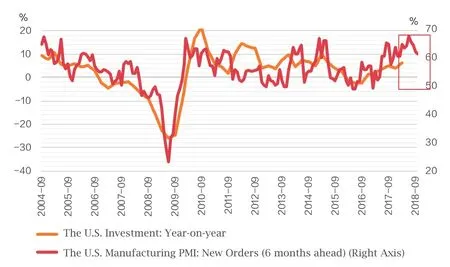

Figure 4 Leading investment in manufacturing new orders for about half a year, US investment remains resilient Source: collected by the author based on data from WIND

Chart 5 Crude oil prices have led investment higher for about 12 months; US investment is likely to climb further.Source: collected by the author based on data from WIND

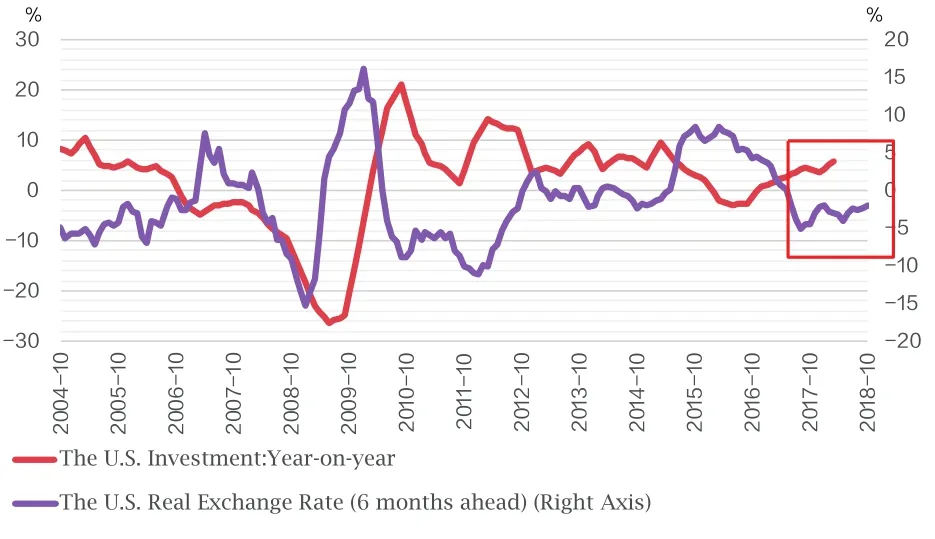

Chart 6 Real interest rates lead investment for half a year, and it is expected that US investment will be supported in the future.Source: collected by the author based on data from WIND Note: real US interest rates = US federal funds rate - US PPI

For clarity, the US investments mentioned here refer to domestic private investment. US investment growth hit bottom in mid-2016 and steadily increased in 2017. Investment in new equipment accounted for about 35% to 40% of total investment, higher than residential and construction investment, and it had the highest correlation with overall investment.Judging from various current leading indicators, US investment is expected to gain more traction in the near term.

The manufacturing PMI sub-index for new orders indicates that US investment growth in the next one or two quarters will remain resilient (see Figure 4). The continuous expansion of new orders in manufacturing re fl ects positive changes in demand, and that is a signal for companies to expand investment.Despite the recent decline in new order indicators, taking into account the leading relationship between orders and investment, it is expected that US investment growth may remain at high levels in the coming one or two quarters at least.

The recovery of crude oil prices suggests that US investment is expected to continue to grow for some time (see Figure 5). With the impetus of shale oil technology, US crude oil production has been increasing year by year. Since 2012, crude oil prices have become a leading indicator of domestic private investment in the US. Affected by supply shocks, international crude oil prices fell below US$30 a barrel in early 2016. Since then, they have climbed in a fairly steady fashion, fi nally exceeding US$70 in April 2018. That represents price growth of more than 100% in two years, and this has greatly boosted the domestic energy sector. Judging from the leading role of oil prices in US investment, growth may remain high in the coming year.

Lower real interest rates will support US investment in the future (see Figure 6). Although the Federal Reserve has been raising interest rates since the end of 2015, the pace and the magnitude of increases in nominal interest rates has not kept up with the rise in oil and other international commodity prices amid a recovery of the global economy.As a result, real interest rates in the US fell back into negative territory in early 2017. Actual corporate fi nancing costs decreased, and the optimization of capital provided support for the expansion of private investment. In May,US unemployment fell to its lowest level in 18 years, while previously sluggish wage growth began to pick up. It is expected that US domestic in fl ation will face greater upward pressure in the future. However, market expectations for the pace of rate hikes by the Fed this year have not changed considerably.Real US interest rates will continue to fl uctuate at a high level for the coming period.

In summary, although the PMI indexes of major countries such as the US have declined since the fi rst quarter of this year, they are still relatively high as compared with levels in the same period over the past fi ve years. At this stage, there is still evidence of global economic resilience. Meanwhile, the global economy will continue to show a high degree of volatility for some time to come.

The resilience of global economic fundamentals helps create favorable conditions for China amid the stability of external demand and domestic economic development. In April 2018,China’s goods exports grew by 12.9%year-on-year in US dollar terms while imports increased 21.5%. China"s exports grew 13.7% year-on-year in the fi rst four months of this year. If the monthly average growth of exports for the remaining eight months maintains a rate of around 5.5%, annual growth will be a solid 7.9% - equal to last year’s pace. Nevertheless, the solid appreciation of the renminbi in the past year will gradually affect Chinese export growth this year. A possible trade war between China and the US as well as volatility on international fi nancial markets may mean greater uncertainties over the global economy’s growth momentum. That in turn could affect external demand for China and this needs to be closely monitored.

The author is chief economist of Huarong Securities.

- China Forex的其它文章

- Preventing Money Laundering Risks in Cross-border Mergers and Acquisitions

- Electronic Payments Boost Renminbi Business

- How a Trade Dispute Between China and the United States Might Evolve

- Sino-US Trade Disputes and US Protectionism

- Can We Minimize the Impact of a Trade War?

- Exchange Rate Choices and China"s Managed Float