Sino-US Trade Disputes and US Protectionism

By Xue Wei and Zhang Ming

S ince Donald Trump took of fi ce last year, protectionism has gained momentum in the United States. In recent months, Trump has announced plans for a series of trade sanctions against China, calling for tariffs on US$50 billion worth of imports followed by tariffs on another US$100 billion of goods. He also has called for restrictions on investments and acquisitions in the United States by Chinese companies. The potential for a trade war has already become a serious impediment to economic globalization and this could signi fi cantly affect the global economic recovery. Developments are being watched closely around the world.

The history of trade barriers can be traced back to the 15th and 16th centuries as mercantilism was promoted. Although mercantilist policies have long been abandoned by major powers, protectionist measures have never really disappeared.

The onset of the Great Depression prompted the United States and European countries to erect trade barriers to protect their own economies, and that in turn ampli fi ed the economic damage. In the 1970s,there were bitter trade disputes involving the US and Europe over agricultural products as well as iron and steel. Both sides turned to legal challenges such as anti-dumping and countervailing duties under the framework of General Agreement on Tariffs and Trade(GATT). These were in fact disguised duty increases,which appeared to be more acceptable than the simple measure of raising import duties. In the 1990s,the Americans and the Europeans made use of local content requirements and local procurement priorities,further expanding the arsenal for fi ghting trade wars.At the beginning of this century, against a global background of excess production capacity in steel,the US and Europe engaged in a trade confrontation over steel. The US conducted investigations into trade practices of the European Union and Japan under the provisions of domestic trade laws, and imposed import quotas and import licensing requirements. The EU reacted with counter-measures of its own - import quotas and increased import tariffs on US-made steel.It also fi led trade complaints with the WTO against the US.

It can be seen clearly that the US, the EU and other Western countries have honed their skills in trade disputes. While it was dif fi cult to extend those simple tariff barriers under the framework of the WTO,protectionists have managed to turn to anti-dumping and countervailing duties, along with an array of other measures such as quotas, licenses, local content requirements, special investigations and sanctions under domestic law.

The trade disputes between the US and Japan in the 1980s can be viewed as classic cases in the annals of trade history. After World War Two, the US and the Soviet Union wrestled for global hegemony.Japan, as an American ally in the political rivalry with the Soviet Union, received a great deal of American policy bene fi ts. However, with the collapse of the Soviet economy in the 1980s, Japan’s role was greatly weakened. Japan’s strong economic growth brought unprecedented pressure on the American economy,prompting Washington to train its political might on Japan to push its ally to reduce its trade surplus with the US. Dispute between the two countries was inevitable.

Table 1 Comparisons of trade disputes between the US and Europe before and after World War II

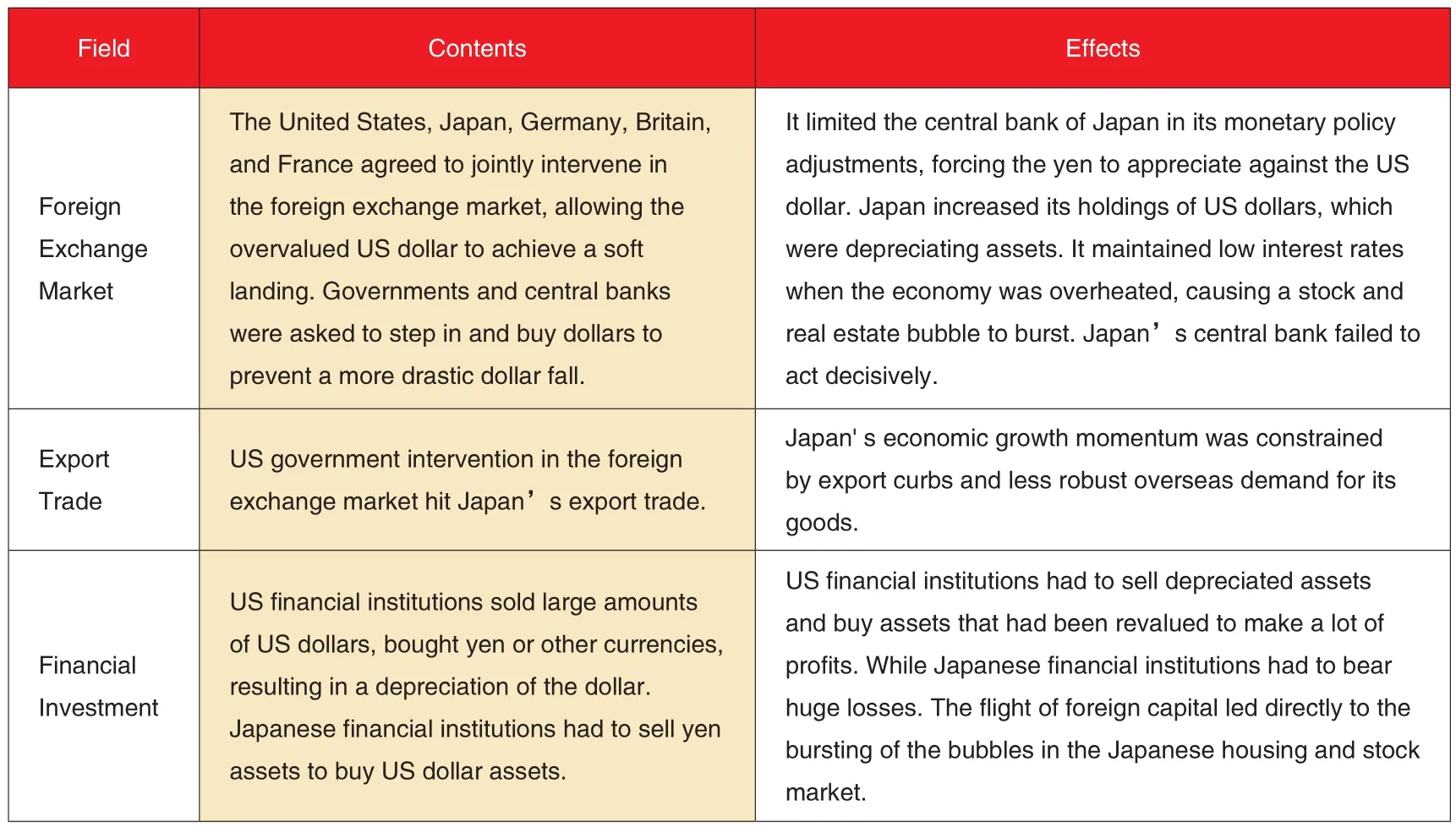

Table 2 The Plaza Accord and its Effects

The most noteworthy area of dispute was the auto sector. At that time, Japan’s inexpensive autos became the new darling of the European and the US markets. However, Japan did not completely open its domestic market, making the US and Japanese shares of each other’s auto markets seriously imbalanced. Although the US imposed import quotas on Japanese autos, parts and components in the early 1980s, forcing Japan to promote the opening of its domestic market in the early 1990s, success was limited. Japanese manufacturers set up factories in the US through direct investment and the Japanese share of the US auto market continued to increase.After Bill Clinton became the American president,he continued to exert pressure on Japan. European countries were similarly troubled by the big market share of Japan’s automakers, so they applied similar restrictions on Japanese cars. Japan could only react by fi ling complaints at the WTO. In the end, the US and Japan reached an agreement in 1995 under which Japan promised to increase imports of US autos and parts, expanding direct investment in the US and signi fi cantly liberalize its own domestic market.

Japan made trade concessions under continuing pressure from the US and coordinated actions by Europe, and in September 1985, it joined the United States, Britain, France and Germany in signing the Plaza Accord. That agreement, which sought to adjust interest rates to guide a depreciation of the dollar, may have played a greater role in facilitating the dramatic reversal of Japan’s policies. The objective of the agreement was to increase the export competitiveness of US products, which had been hit hard by a much stronger dollar. However, Japan was overly dependent on exports and investment, and it saw a signi fi cant decline in export growth and its trade surplus after signing the Plaza Accord. Although the economy was stimulated by a loose monetary policy, the continuing appreciation of the yen and the rise in the housing market attracted a large in fl ux of international capital.Japan witnessed an investment and stock market bubble. The Japanese government did not realize the potential risks at that time. Again, under the constraints of the Plaza Accord, there was little room for Japan’s central bank to conduct monetary policy adjustments. When foreign capital withdrew and the fi nancial bubble burst, the Japanese economy fell into a long-term decline, which eventually became known as the two lost decades.

It can be seen that the Plaza Accord brought signi fi cant strategic advantages to the US. Under the framework of the agreement, the Japanese government lacked room for policy adjustment which put it in a very disadvantaged position. In its trade disputes, Japan had suf fi cient economic clout but it had few weapons at its disposal, relying on the relatively mild countermeasures of trade complaints.Eventually it sacri fi ced economic growth. The US,relying on its national strength, launched a multidimensional assault that covered trade, fi nance and exchange rates, accompanied by diplomatic and political pressure. The outcomes of trade wars are determined by national strength, relevant experience,an ability to make and carry out bold decisions as well as government willpower. Japan was at a disadvantage in these areas.

The US trade con fl icts of the past are of great reference value for China. Beijing needs to take them under consideration and avoid falling into three major traps.

Judging from the history of Sino-US trade disputes, the US has mostly been on the offensive side while China has mostly been on the defensive.Before 2010, due to a lack of familiarity with WTO rules, China’s trade countermeasures were relatively simple, though since then, they have become more varied. However, it is worth noting that this round of trade disputes between China and the US is different from previous ones. To put it simply, in the past, the US government provoked trade frictions mainly to hit China in the course of "engagement." In the current round of trade friction, the US is using trade as a tool to “contain”China in a systematic manner.

Although the probability of a broad escalation of the trade con fl ict between China and the US appears to be limited in the near term, there are concerns over the longer term. Given that grassroots support for Trump in the United States has increased and the elites have gradually come around to a consensus on the need to sacri fi ce their own short-term interests by containing China in order to maintain their long-term interests. China should be prepared for a complex long-term contest with the US.

Judging from previous Sino-US trade disputes,the overall level of the trade dispute is relatively low and still con fi ned to a relatively small scope. But the strategic thinking in the U.S today is very different from that of the past. Therefore, the past as far as Sino-US disputes are concerned, has limited value as a reference. In contrast, previous trade spats involving the US, Europe and Japan may provide a better reference for China.

If we compare the trade con fl icts between the US and Europe with those between the US and Japan in the 1980s, it can be seen that the targeted measures used by Europe in the trade fi eld were better than the blind compromises of Japan. Although Europe"s rapid response and tough countermeasures brought signi fi cant short-term impacts to itself, the outcomes of previous trade wars proved that Europe did not suffer such signi fi cant losses and that the impact could be successfully transferred to third parties. That was particularly the case in the agricultural trade disputes between Europe and the US in the 1970s. Japan"s temporary compromises and concessions, which helped avoid short-term shocks and more signi fi cant trade confrontations, increased the chances of trade wars in the long run, especially in dealing with the US which possessed mature means of protection and excelled in multi-dimensional contests.

Therefore, in the face of aggressive US initiatives to upgrade trade disputes, China should not immediately adopt a similarly ruthless attitude. This does not mean China will allow absolute compromises and concessions. The best option for China is to stick to its own bottom line on the basis of active negotiation by adopting targeted countermeasures in key areas,such as aircraft and automobiles. At the same time, it is necessary for China to make all preparations necessary against a multi-dimensional offensive by the US. These would include strengthened fi nancial supervision,accelerated industrial restructuring and upgrading,and improved ef fi ciency in training domestic talent.

In addition, the Japanese government"s lack of experience and miscalculations contributed to its failures on the trade front in the past. While increasing its vigilance, China should systematically review the lessons learned from the trade confrontations of the past and avoid falling into three major traps.

Trap 1. Domestic structural reforms and systemic risk prevention should not be interrupted by an escalation of trade disputes. In this regard, it is particularly necessary to avoid repeating the mistake of the four-trillion-yuan-stimulus-package. After the outbreak of the global fi nancial crisis in 2008,the Chinese government invested four trillion yuan in fi scal stimulus with a loose money policy. This was due to its overestimation of the severity of the crisis and its possible impact on China. With a fourtrillion-yuan-stimulus-package, the Chinese economy quickly rebounded after hitting bottom. The price was stagnation afterwards, the reversal of structural reforms and soaring asset prices. Such side-effects need to be avoided in future. The author’s concern is that fears of signi fi cant damage to economic growth will result in policies that disrupt domestic structural reform and prevent control of fi nancial risks. If China uses a new round of credit growth to stimulate infrastructure and real estate, that would certainly make the situation worse. In this regard, the Chinese government should maintain its convictions by tolerating a moderate decline in economic growth.That would avoid a return to the old method of boosting economic growth through credit growth and investment.

Trap 2: China needs to avoid making major concessions on the exchange rate and reducing the bilateral trade surplus through appreciation of the renminbi against the US dollar. Japan"s most painful lesson learned from the trade dispute with the US in the 1980s was from the signing of the Plaza Accord.The change in Japan"s national fate was due to the mishandling of the US trade dispute rather than the bursting of the stock and property bubbles in the early 1990s. The Chinese government should learn from Japan"s experience. The future exchange rate of the renminbi should be determined by market supply and demand. The government can only limit the currency"s over-adjustments rather than arti fi cially create a oneway trend.

Trap 3: There is a need to avoid trying to put pressure on the US government by substantially reducing China"s holdings of US Treasury securities.Considering that China"s central bank still holds trillions of dollars in US Treasury securities, some observers argue that Beijing can exert pressure on the US through large-scale reduction of its holdings. That would force the US government to make concessions in any trade war, according to this argument. Those who support this view contend that such large-scale reductions would lead to a signi fi cant rise in longterm US interest rates, which would weigh on the US bond and stock markets. That would also affect the US economy through a negative wealth effect. At the same time, this would increase long-term fi nancing costs in the US and drive down investment growth,according to the proponents of this strategy. However,this ignores the following risks. First, it is impossible for China to sell all its US Treasury securities at once.Second, the US government can take special measures to hedge against this kind of scenario. Third, the US government can fully accuse the Chinese government of launching a fi nancial war, thereby directly freezing US Treasuries held by the Chinese government,or announcing targeted defaults on US Treasury securities held by Chinese investors. In other words,the Chinese government has lent trillions of US dollars to the US government but it is very dif fi cult for China to threaten the US by selling the bonds it is holding.Therefore, under the background that the Trump administration has signi fi cantly lowered the bottom line of the US government’s behavior, the Chinese government should try not to do anything that will put itself in an unfair and disadvantaged position.

In general, regardless of how the Sino-US trade dispute evolves in the future, the impact on China"s economy will ultimately be limited. It will neither change the trend of China"s continuing economic growth nor reverse the pattern of China"s overall rise in the world. China should stick fi rmly to its policies and handle trade disputes with the US without unnecessary alarm.

Xue Wei is a macroeconomic researcher at Ping An Securities Zhang Ming is a researcher at the Institute of World Economy and Politics, Chinese Academy of Social Sciences

- China Forex的其它文章

- Preventing Money Laundering Risks in Cross-border Mergers and Acquisitions

- Electronic Payments Boost Renminbi Business

- How a Trade Dispute Between China and the United States Might Evolve

- Can We Minimize the Impact of a Trade War?

- Exchange Rate Choices and China"s Managed Float

- Global Economic Momentum:This Time It"s Different