On the Influence Factors of Second-hand House Prices in First-tier Cities

—— Empirical Analysis Based on Panel Data

Dong Fan,Zheng Xuefeng

(School of Government Beijing Normal University,Beijing 100875)

Ⅰ.Introduction

From the law of the development of the real estate market in the developed countries such as the United States,the real estate market will undergo a change from the era of incremental housing to the age of the stock.From the current situation of the real estate market in the United States,more than 90% of the real estate market is the stock housing transaction.The proportion of new housing sales to the entire US real estate market is less than 10%.The Real Estate Research Institute of Shanghai University of Finance and Economics shows that in the real estate market of developed countries such as England,France,Germany and Japan,the ratio of second-hand housing to new houses is about 8:1-10:1.China’s second-hand housing market started relatively late,but it developed rapidly.With the gradual liberalization of the secondary housing market,second-hand housing transaction volume and expanding the scale of real estate market,the proportion is increasing gradually.China’s real estate industry is gradually changing from the newly built housing dominated market to the new stage of stock and new housing construction,and will eventually become a market dominated by stock trading.Among them,beijing、shanghai、guangzhou、shenzhen are developing earlier and developing faster,and the new supply will also be less and less in the main urban area.At the same time,most of the real estate demand will also turn from the new housing market to the second-hand housing market due to the price and supporting factors.

In 2015,the volume of second-hand housing turnover in the first tier cities was more obvious than that of the new house.In Beijing,Shanghai,Shenzhen,Guangzhou as an example:the year 2015,Beijing 192251 sets of second-hand housing turnover is 1.85 times the volume of new homes;Shanghai 337300 sets of second-hand housing turnover is 2.77 times the volume of new homes;Shenzhen 126899 sets of second-hand housing turnover is 1.68 times the volume of new housing.Guangzhou city’s new net signed 90488 sets.The second-hand house is over 100 thousand sets.In the 1-11 month of 2016,the number of second-hand housing sales in Beijing was 4.8 times the sales volume of new houses.The ratio of second-hand housing sales to new home sales in Shanghai and Shenzhen was 3.3 and 2.4,respectively.The year 2016,Guangzhou houses net signed 128352 sets,130 thousand sets of second-hand housing transaction volume.Through the above data,it is known that the volume of second-hand housing in Beijing,Shanghai,Shenzhen and Guangzhou is more than the volume of new housing.Shanghai E-House Research Institute released in 2017 “40 City second-hand housing maturity rank”,the report on “housing stock / incremental transactions than the index calculated in Beijing,Xiamen,Shenzhen,Shanghai,Guangzhou,the ratio is greater than 1,the ratio of Urumqi,Harbin,Nanjing,Suzhou,Ningbo for more than 0.8 of the report;the first 5” city housing market first entered the mature stage;5 cities main city after the housing stock is also the first to enter the “era”.In the real estate industry,if the volume of second-hand housing transactions in a city’s real estate market exceeds the volume of new housing transactions,it can be considered that the city has entered the era of stock housing.According to this index,the first tier cities such as North China,Guangzhou and Shenzhen have entered the era of “stock housing”.“Stock room era” is also an inevitable trend of the development of the real estate market.

After the government put forward the goal of “housing is used to live”,the policy of first tier cities has been tightened constantly,and the purchase and loan limit has also been increasing.But this regulation still does not restrain the rise of the house price in the first tier cities.According to the Shanghai E-House Research Institute released the 2016 ranking of the top 50 cities in the national property market,the top three highest transaction prices in 2016 were Shenzhen,Shanghai and Beijing.Along with the first-tier cities of second-hand housing turnover accounted for the real estate market share proportion increased,leading to second-hand housing real estate market mechanism gradually formed.In order to realize the accurate control of the real estate market and realize the housing property of return housing,it is necessary to study the influence factors and the influence mechanism of the second-hand housing price in the first tier cities.But in the existing literature,the research on first-tier cities real estate prices most focused on new housing prices,little attention to factors affecting the price of second-hand housing as well as the impact on the real estate market;and some existing studies are limited to qualitative research,less quantitative analysis.Therefore,to accurately reveal the first-tier cities real estate market price changes,so as to first-tier cities,China’s precise regulation of the real estate market,and promote housing property return,promote the real estate market trend tends to be more rational,to achieve stable development of the real estate market,it is necessary to influence factors of second-hand housing into the scope of the study.

Ⅱ.The selection and analysis of the factors affecting the price of second-hand housing

Looking at the theoretical circles’ research results of the real estate market,it is not difficult to find that there are many factors that affect the price of second-hand housing,but for the first tier cities,the influence of different factors is also very different.This article discusse the factors affecting the price of second-hand housing from the macro economy,new housing supply,land supply,housing lease and other aspects.

1.Macroeconomic fundamentals

The changes in the macroeconomic fundamentals will not only affect the demand of the second-hand housing market,but also have a impact on the supply of second-hand housing.The government has been adjusting the real estate market through the adjustment of macroeconomic policy.The economic fundamentals can be divided into economic growth,inflation level,income level,interest rate and other factors.These factors will impact the supply and demand of the second-hand housing market.

In addition,the change of monetary policy will directly affect the level of market interest rate,which indirectly affects the purchase cost of the demand side of the second-hand housing market.Monetary policy will also affect the change of the financial environment.The financial environment will affect the economic development of the region,it directly affects the enthusiasm of second-hand housing investment and transactions,and further affects the transaction price of second-hand housing.

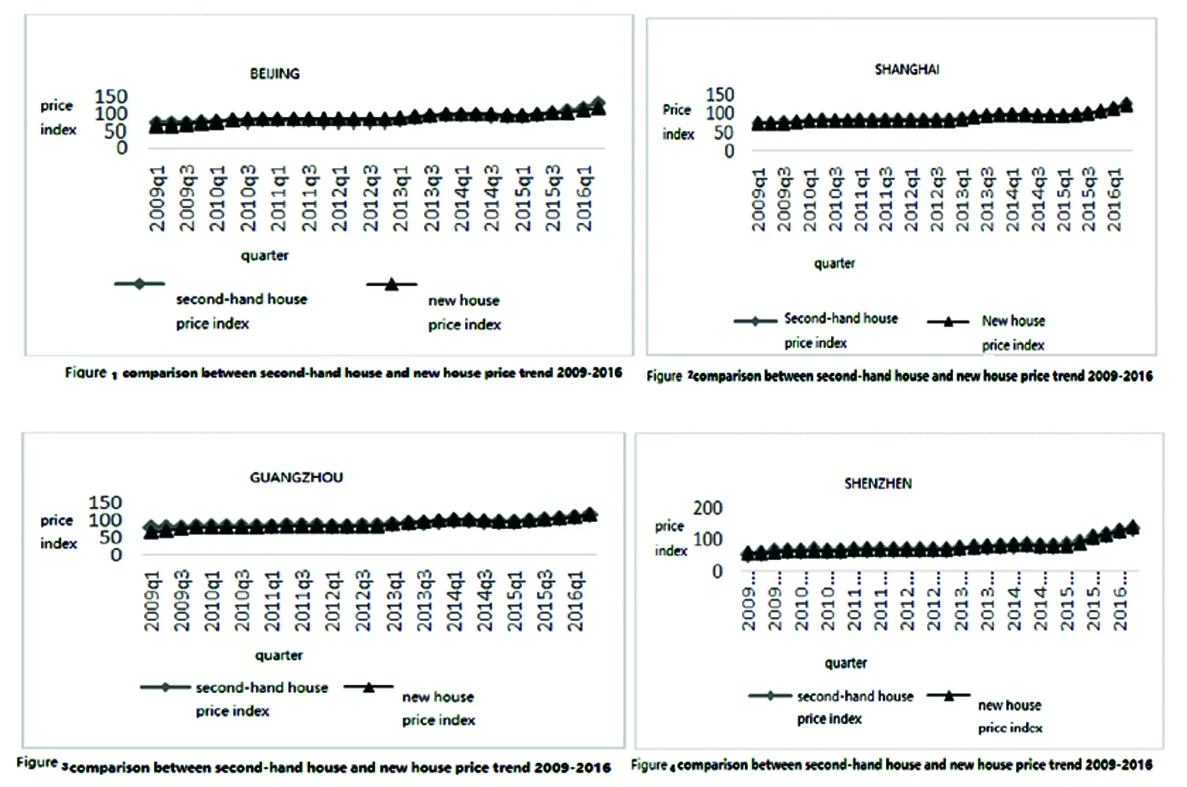

2.New housing supply

The second-hand house and the new house are in the same real estate market,and there is a strong substitution relationship between the two.As the supply of new houses is small in the first-tier cities,the rigid demand is common,which is more obvious.It is because of this substitutable existence that the relationship between second-hand housing and new houses has formed mutual promotion and mutual restriction.Figures 1 to 4 depicts the contrast relationship between the price of second-hand housing and new houses in 2009-2016 tier cities.As you can see from the picture,the price of second-hand housing in the four front-line cities is basically in line with the trend of new housing prices.

3.Land supply factors

When Real estate developers develop real estate,the largest proportion of their purchase costs is the land.As the trend of housing prices in recent years,the land price has also shown a rising trend.Land price is a part of housing construction cost.The rise of land price will lead to the rise of construction cost of real estate,resulting in a driving force for housing prices from cost perspective.Although land supply and land transfer price do not directly affect the second-hand housing market,it will affect the public expectation,and indirectly affect the market price of second-hand housing by anticipating the market transaction price of new houses.Taking Shenzhen as an example,the amount of land sold in the first half of the city is 36 billion 415 million,while the selling area is reduced by nearly 7.Compared with that in 2015,the amount of land sold has been reduced by only 16.4%,and the floor price has reached 24024/m2,which is nearly 3 times that of 2015.In June 8,2016,a commercial and residential land in Guangming New Area was sold by Shenzhen.It was awarded 14 billion 60 million by dragon light for a total price of 159.79%,and the premium rate was 159.79%.The floor price was 27620 /m2,which refreshed the total price of the Kingdom in 2016.According to people in the real estate industry,it is estimated that the price of the project will reach 50 thousand /m2in the future,according to the floor price of 27620/m2.

4.Housing lease factors

From the perspective of use,the consumer buys a house in addition to its own use,it can also rent the house to others.The trading status of the rental market will also affect the transaction price of the second-hand housing market.Yu Huayi and Chen Dong (2009) think:the housing market and the housing rental market are interdependent.If the expected rent return rate is low in the future,it will lead to the increase of the opportunity cost of the house purchase,which will lead to the decrease of speculative house demand and the reduction of house price.If the expected rent return rate is higher in the future,the direction of the impact on housing price will be the opposite direction.From the point of view of demand,the way users get housing is divided into two types:purchase and lease,and there is a certain substitution between the two.Therefore,when the rental demand increases,the demand for housing market will decrease correspondingly,and the price of second-hand housing will decrease correspondingly.Conversely,when the renting demand decreases,the demand for housing market will increase correspondingly,and the price of second-hand housing will rise.

Ⅲ.Empirical test on the factors influencing the price of second-hand housing in the first tier cities

1.Data description

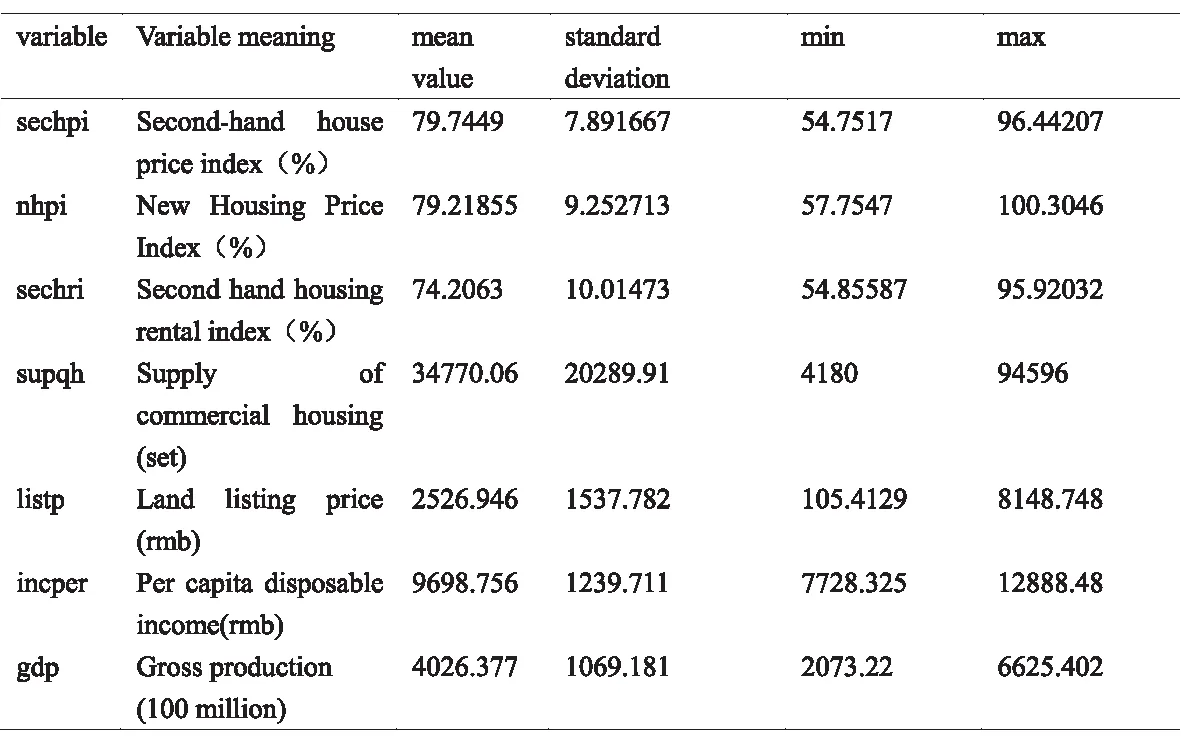

This paper selects the related data of the second-hand housing price index and the new house price index of four front-line cities from 2009 to 2013 in Beijing,Shanghai,Guangzhou and Shenzhen.The data are mainly from the China National Bureau of Statistics,the Guangzhou Statistics Bureau,the Shenzhen Statistics Bureau and the China real estate information network.Second hand housing price and new house price are used for each quarter of the second - hand housing price index (sechpi) and the new house price index (NHPI) respectively.To reflect the influence of second-hand housing rent on the price of second-hand housing,this paper collected monthly data of second-hand housing rent index (sehri) in various cities,and transformed it into quarterly data by a simple weighted average.In order to reflect the impact of land price on the price of second-hand housing,the land listing price (listp) of each city is used as an agent variable.In addition,in order to minimize the omitted variable bias brought to regression analysis,we also selected the second-hand housing prices may affect other variables as control variables,such as the city’s gross domestic product (GDP),the per capita disposable income (incper),commercial housing supply (supqh) etc.The description of the variables and their basic features is shown in Table 1.

Table1Variableanditsbasiccharacteristics

2.Measurement model setting

(1)The standard measurement model set in this paper is as follows

sechpiit=β0+β1nhpiit+β2sechpiit+β3listpit+BXit+μi+εit

Among them,sechpi represents the second-hand housing price index,NHPI shows the new housing price index,sechri expresses second-hand housing rent,and listp indicates the price of land listing.X represents the control variables such as GDP,per capita disposable income and so on,and B is its corresponding coefficient matrix.The subscript i represents the various sections,that is,the cities.The subscript t represents the period,that is,each quarter.It represents the individual effect.

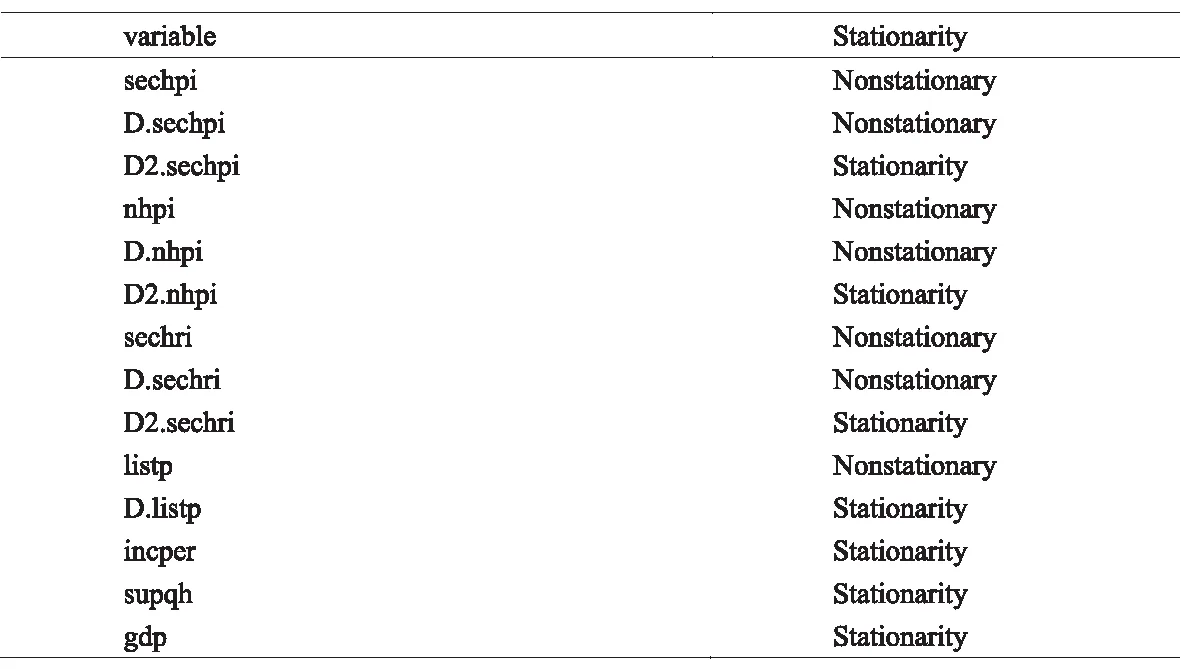

(2)Unit root test

In order to avoid the pseudo regression,the unit root test is needed before the regression of the time characteristic data,that is,the stability test.Because the panel data unit root test is controversial,in order to ensure the reliability of the test results,this paper take a more rigorous way of stationarity test,namely all the time series of each section were tested,the main test methods of ADF test and PP test.The results of the test are shown in Table 2.

Table2Testofvariablestability

As can be seen from table 2,the trend of each variable is more complex.The second hand housing price index sechpi,the new house price index NHPI and the second-hand housing price index sechri are the I (2),that is,the two order single whole process.The price of land listing listp is I (1),the first order single whole process.The sequence of other variables is I (0),that is,the stationary process.

(3)The final regression model is set as follows:

D2.sechpiit=β0+β1D2.nhpiit+β2D2.sechpiit+β3D.listpit+BXit+μi+εit

The second-hand housing price index sechpi,the new house price index NHPI and the second-hand housing price index sechri adopt the two order differential form.The land listing price listp adopts the first order differential form,and the other variables use their horizontal form to enter the regression equation.First order difference and two order difference will make the model more difficult to explain,but it can help us find significant variables that affect the price of second-hand housing.

(4)Regression method and regression results

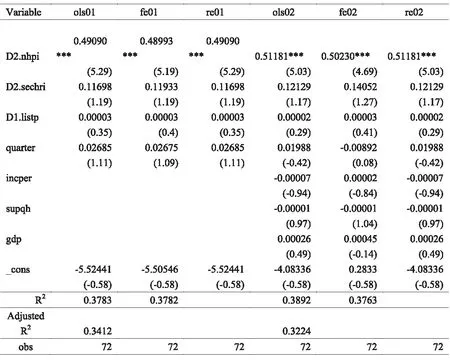

In this paper,mixed OLS,fixed effect model and random effect model were used to carry out regression analysis.According to Wald test and Hausman test,the best choice of mixed OLS is selected.As a contrast,the results of the fixed effect model and the random effect model are presented in Table 3.

Table3Testresultsofcointegrationrelationofvariables

Note:the parenthesis is a robust t statistic adjusted by heteroscedasticity.* * * * * * * (* *) indicated significant levels of 1%,5% and 10% respectively.

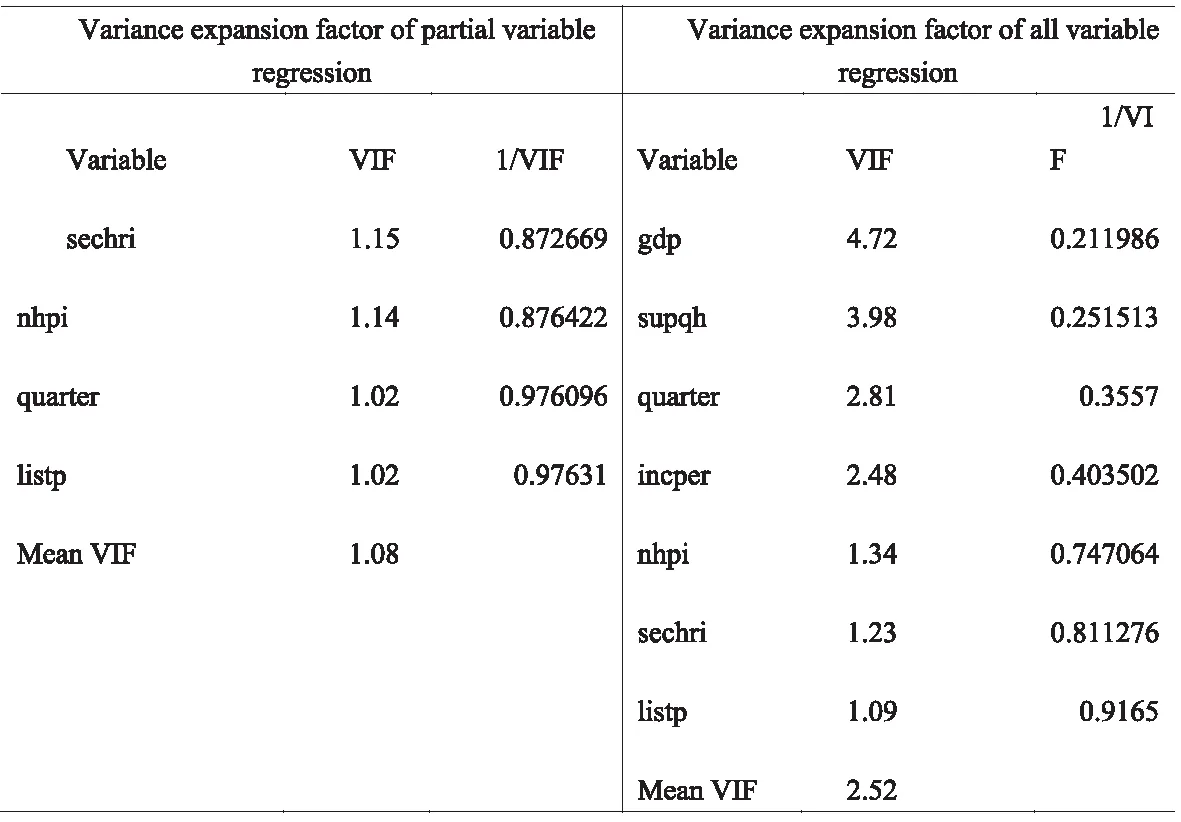

From the regression results,we can see that the other variables are not significant except that the new house price index is not zero.Because the multicollinearity between variables may lead to the variable is not significant.Therefore,the variance expansion factor of the regression variable is calculated to test whether there is serious multicollinearity in the regression model.The results are shown in Table 4.

Table4Variablecollinearitytest

It is known from the value of variance expansion factor that there is no serious problem of multiple collinearity in the regression model.Therefore,the estimation result of the regression model is reliable,that is,in addition to the new house price index will significantly affect the second-hand housing price index,other variables have no significant impact on the second-hand housing price index.

(5)Cointegration Analysis of the second-hand house price index and the new house price index

Due to the two order of second-hand housing price index and the price index above the new regression model are used in the form of difference,therefore,although the launch of the new home price index will significantly affect the second-hand housing price index is still uncertain,but new housing price index specific impact on second-hand housing price index.From the test of stationarity in section (2),we can see that the second-hand housing price index (sechpi) and the new housing price index (NHPI) are all two order single integer processes,which can test whether there is cointegration relationship between the two variables.If there is,you can get a specific impact on the level value of the second-hand house price index by the level of the new housing price index.

In the first quarter of 2009 to the second quarter of 2016 in Beijing,the johans test of time series of second-hand housing and new housing price index is carried out.It is found that there is a cointegration relationship among the two variables.Through the Stata estimation error correction model (VECM),the long-term equilibrium relationship between the second-hand housing price index and the new house price index in Beijing is as follows:

sechpit=-104.11+2.01nhpit

In the same way,we can make a cointegration analysis of the second-hand housing price index and the new house price index in Shanghai.The johans test found that there was a cointegration relationship.The cointegration relationship is as follows:

sechpit=-8.54+0.91nhpit

The long-term equilibrium equation of the second-hand housing price index and the new housing price index in Beijing indicates that the new housing price index of Beijing has increased by one percentage point,which will cause the second-hand housing price index to increase by about 2 percentage points.The long-term equilibrium equation of the second-hand housing price index and the new housing price index in Shanghai indicates that the new housing price index in Shanghai has increased by one percentage point,which will lead to an increase of 0.9 percentage points in the second-hand housing price index.The same method can be used to analyze the price index of second-hand housing and new housing in Guangzhou and Shenzhen,and this article is no longer to be described.

Ⅳ.Conclusions and suggestions

In this paper,from January 2009 to December 2013 period based on the sample data,using panel data cointegration method and analyzes the influencing factors of Chinese first-tier cities of second-hand housing price changes;For the two cities of Beijing and Shanghai,from the first quarter of 2009 to the second quarter of 2016 second-hand housing and new housing price index time series johans test,found there is cointegration relationship between the two variables.The following conclusions can be concluded:

First,from the cointegration analysis results,first-tier cities in the real estate market,the impact of second-hand housing price index of the home price index,second-hand housing rental index,commercial housing supply,land price,per capita disposable income,GDP and other factors,in addition to the new housing price index will significantly affect the second-hand housing the price index,effects of other variables on the second-hand housing price index were not significant.Among them,the supply of housing is not second-hand housing prices have obvious influence of this theory and understanding in demand unchanged,increasing the supply of housing,will lead to the decline in prices,but also to some extent in the regulation of housing supply,regulation and control of the secondary housing market is not obvious.The impact of land prices in the secondary housing market is not significant,which to some extent to the government and society explained:“the most expensive land” and second-hand housing prices soaring Never mind too obvious to some extent;it also explains the relationship between the price of new houses and second-hand housing price mechanism and intermediary variable.“Have the most expensive land”,more reflects the push up prices of new homes,new homes prices directly affect the price of second-hand housing;the price of new homes through the intermediary variables of land price of second-hand housing prices,further analyzes the influence degree of need,to provide a basis for the precise regulation of real estate market.

Second,for the two cities in Beijing and Shanghai,from the first quarter of 2009 to the second quarter of 2016,we tested the time series of second-hand housing and new housing price index,and found that there was a cointegration relationship among the two variables in johans test.The long-term equilibrium relationship between the second-hand housing price index and the new house price index in Beijing is as follows:

sechpit=-104.11+2.01nhpit

The long-term equilibrium relationship between the second-hand housing price index and the new house price index in Shanghai is as follows:

sechpit=-8.54+0.91nhpit

The equilibrium equation of the second-hand housing price index and the new housing price index in Beijing indicates that the new housing price index of Beijing has increased by 1 percentage points,which will cause the second-hand housing price index to rise by about 2 percentage points.The equilibrium equation of the second-hand housing price index and the new housing price index in Shanghai indicates that the new housing price index of Shanghai has increased by 1 percentage points,which will cause the second-hand housing price index to rise by about 0.9 percentage points.Through the equilibrium relationship and equilibrium equation,it can be seen that in the real estate market of the first-tier cities,the price of the new house affects the price of the second-hand house to a certain extent.The first-tier cities are different in terms of their secondary housing rent index,commercial housing supply,land listing price,disposable income per capita and gross domestic product and so on.The impact of new housing prices on second-hand housing prices is also different.But through the co - integration analysis and johans test of two cities in Beijing and Shanghai,it shows that the price of new housing has a more obvious impact on the second-hand housing price.

According to the conclusion of the empirical analysis,we put forward the following suggestions for the accurate control of the real estate market.

First,the “stock housing era” is the main direction to regulate the second-hand housing.With China’s first tier cities and more two or three tier cities entering the “stock room era”,the second-hand housing market will become the leading and future direction of China’s real estate market.The stability of the housing price in the second-hand housing market is directly related to the healthy development of the whole real estate market,and it is also related to the realization of the goal of “the house is used to live”.As the second-hand housing market will become the hot spot of capital chase,the intermediary agencies of the second-hand housing market also have many illegal phenomena such as hype house price,false house and so on.Therefore,China’s real estate market regulation should focus on the secondary housing market,reform the supply side from the secondary housing market,stabilize the real estate market,and promote the return of housing and housing attributes.

Second,the control of the second-hand housing market,in order to regulate the price of new housing as the main direction.In the first-tier cities of the real estate market,this paper selected the variables,only the new housing price index significantly affect the second-hand housing price index,so when first-tier cities second-hand housing market overheating,should first start from the new home sales price regulation,in order to control the influence factors of new home sales price as the starting point,and then the secondary regulation the housing market rose.Although from the empirical analysis,second-hand housing rental index,commercial housing supply,land price,per capita disposable income,GDP and other factors have no significant influence on the price of second-hand housing,but in real life,they are in part a direct impact on the price of new homes,the second-hand housing prices of new homes in the market through indirect conduction.In particular,the supply of commercial housing and the price of land will directly affect the sales price of new houses to a large extent.Therefore,we should also pay attention to these factors when regulating the second-hand housing market.

Third,adhering to the city policy,the regulation policy is different.The same as the first-tier cities,Beijing and Shanghai new home prices on the second-hand housing price level is not the same,which can be seen from the results,compared the influence degree of Beijing new home sales price of second-hand housing prices in Shanghai new home sales prices on the second-hand housing price is more than 2 times (one of the reasons to be detailed investigation and analysis) that,and the degree of influence of different factors on the city of second-hand housing prices are not the same.Therefore,the real estate market regulation should not be “one size fits all”,especially the second-hand housing market,and should be according to local conditions,divide the policy,strengthen the policy pertinence.For example,the implementation of differentiated land supply policy,commercial housing supply,housing or land supply policy in different city credit policy,according to the price of new homes on the second-hand housing prices influence on the new home market,second-hand housing market difference,regional difference of second-hand housing market intervention,so as to ensure the stability and orderly development.

〔1〕Jiang Chengjie,Zhang Zhongyi,Analysis of the factors affecting the optimal real estate price, China prices,2009(5),pp.35-38.

〔2〕Wen Haizhen,Jia Shenghua,Characteristics and characteristics of the second-hand housing price — Based on the analysis of the hedonic price model, Journal of Zhejiang University Engineering Edition,2004(10),pp.1138-1149.

〔3〕Lee J,Kwak S J,List J A.Average Derivative Estimation of Hedonic Price Models, Environmental & Resource Economics,2000,16(1),pp.81-91.

〔4〕Policy Research Center,Ministry of housing and urban rural development,Ping An Bank real estate finance department.Ping An real estate financial report 2016:real estate securitization investment trend research,Beijing:China Financial Publishing House,2016,pp.210-220.

〔5〕Guan Hailing,Beijing real estate price fluctuation and its influencing factors research, price theory and practice,2015(12),pp.74-76.

- 学术界的其它文章

- 中国特色社会主义政治经济学的理论与实践创新

- A Comparative Study of the Translator’s Style

—— A Corpus-based Case Study of Lianghuiwang〔*〕 - 城市治理的差序参与〔*〕

——基于“市民服务热线”的分析视角 - 大都市圈协同治理视角下长三角地方政府事权划分的顶层设计与上海的选择〔*〕

- The Positive Role of Governance in the Way Environmental Policies Impact Technological Innovation

- 日本共产党对马克思主义研究“理论上的突破点”〔*〕