Markov链利率下再保险模型的破产概率上界

牛祥秋

摘 要 研究了如何确定离散时间情况下再保险模型破产概率上界的问题.为了降低自身的破产风险,保险公司常常对部分乃至全部资产进行再保险.假定索赔间隔时间和索赔额具有一阶自回归结构,假定利率过程为取值于可数状态空间的Markov链.建立了其比例再保险模型,分别用递归更新技巧和鞅方法得到模型的破产概率上界.该破产概率上界作为评估再保险公司偿付能力和风险控制能力的重要指标,对于它的研究成果能为再保险人做出重大决策提供重要的依据,具有较为重要的理论和现实意义.

关键词 概率论; 上界; 鞅; 比例再保险; 破产概率; Markov链利率

中图分类号 O211.9 文献标识码 A

Abstract Upper bounds for the ruin probability of reinsurance were studied in a discrete time risk model. To reduce the risk, there is a possibility to reinsure a part or the whole reserve. In the model, the time between the occurrence of the claims and the claims were assumed to be the AR(1) structure, the interest rates followed a Markov chain with a denumerable state space. The risk model of proportional reinsurance was considered. The upper bounds for the ruin probability were derived both by renewal recursive technique and martingale method. As an important indicator of the abilities of solvency and risk management, the research of the ruin probability can provide an important basis for reinsurer's major decisions, so it has important theoretical and practical significance.

Key words probability theory; upper bound ; Martingale; proportional reinsurance; Markov chain interest rate

1 引 言

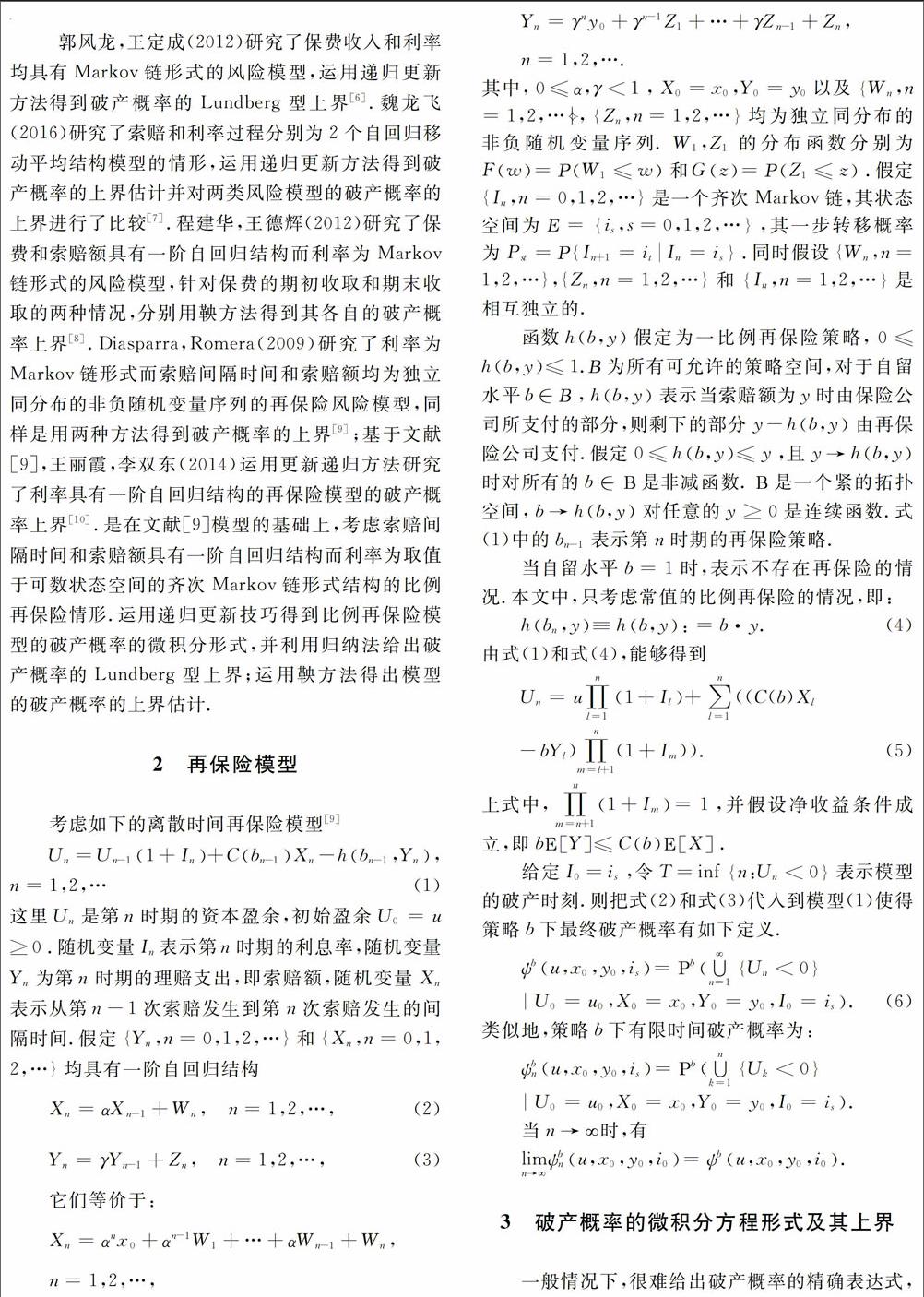

破产概率是风险研究的内容之一.保险公司为了降低破产风险而倾向于把部分甚至是全部资产进行再保险,因此对再保险破产概率的研究很具有现实意义. Cai(2002a)研究了利率为独立同分布的随机变量情形的离散时间风险模型破产概率上界估计[1];Cai(2002b)研究了利率为一阶自回归情形的离散时间风险模型破产概率上界估计[2].Cai,Dickson(2004)考虑了利率为Markov链形式的风险模型,并且分别用递归方法和鞅方法得出了破产概率的上界[3]; Yang,Zhang(2003)研究了保费和索赔额具有一阶自回归结构的常利率风险模型,得到破产概率的指数型和非指数型上界[4]; Lin,Wang(2006)研究了净损失额(索赔额减去保费)具有一阶自回归结构,利率为Markov链形式的风险模型,并且分别用归纳法和鞅方法得出了破产概率的上界[5];郭风龙,王定成(2012)研究了保费收入和利率均具有Markov链形式的风险模型,运用递归更新方法得到破产概率的Lundberg型上界[6].魏龙飞(2016)研究了索赔和利率过程分别为2个自回归移动平均结构模型的情形,运用递归更新方法得到破产概率的上界估计并对两类风险模型的破产概率的上界进行了比较[7].程建华,王德辉(2012)研究了保费和索赔额具有一阶自回归结构而利率为Markov链形式的风险模型,针对保费的期初收取和期末收取的两种情况,分别用鞅方法得到其各自的破产概率上界[8].Diasparra,Romera(2009)研究了利率为Markov链形式而索赔间隔时间和索赔额均为独立同分布的非负随机变量序列的再保险风险模型,同样是用两种方法得到破产概率的上界[9];基于文献[9],王丽霞,李双东(2014)运用更新递归方法研究了利率具有一阶自回归结构的再保险模型的破产概率上界[10].是在文献[9]模型的基础上,考虑索赔间隔时间和索赔额具有一阶自回归结构而利率为取值于可数状态空间的齐次Markov链形式结构的比例再保险情形.运用递归更新技巧得到比例再保险模型的破产概率的微积分形式,并利用归纳法给出破产概率的Lundberg型上界;运用鞅方法得出模型的破产概率的上界估计.

5 结 论

随着中国的保险市场逐步与国际接轨,各保险公司越来越重视到再保险的重要性.保险公司通过再保险旨在分散和控制风险以达到降低破产发生的概率.而索赔间隔时间,索赔额,利率以及分保费比例等因素直接影响到破产发生的概率.基于此,论文考虑了利率、索赔额和索赔的时间间隔的相依情形对比例再保险模型破产概率的影响.分别运用了更新递归技巧和鞅方法两种方法得到模型的两种破产概率的上界估计.由此来分析各因素的变化对再保险模型破产概率的影响,具有重要的现实意义.

对于再保险的研究主要分为比例再保险和超额损失再保险两个方向.文中仅考虑了比例再保险的情形,未有涉及超额损失再保险情形.接下来会对超额损失再保险作进一步研究.endprint

参考文献

[1] J CAI. Discrete time risk models under rates of interest [J]. Probability in the engineering and informational sciences,2002,16(3):309-324.

[2] J CAI. Ruin probabilities with dependent rates of interest [J]. Journal of Applied Probability.2002,39(2): 312-323.

[3] J CAI, D DICKSON. Ruin probabilities with a Markov chain interest model [J]. Insurance Mathematics & Economics.2004,35(3):513-525.

[4] H L YANG, L H ZHANG. Martingale method for ruin Probability in an autoregressive model with constant interest Rate[J]. Probability in the Engineering & Informational Sciences,2003, 17(2):183-198.

[5] L XU, R M WANG. Upper bounds for ruin probabilities in an autoregressive risk model with a Markov chain interest rate [J].Journal lf industrial and management optimization,2006,2(2):165-175.

[6] 郭风龙,王定成. 考虑Markov保费和利率的离散时 间风险模型的破产概率[J].数学的实践与认识, 2012, 42(12):136-140.

[7] 魏龙飞. 具有相依结构离散时间模型破产概率的上界[J]. 经济数学, 2016, 33(1):88-92.

[8] 程建华,王德辉. Markov链利率下相依风险模型破产概率的上界[J].吉林大学学报:理学版,2012,50(2):173-178.

[9] M DIASPARRA, R ROMERA. Inequalities for the ruin probability in a controlled discrete-time risk process[J]. European Journal of Operational Research. 2009, 204(3): 496-504.

[10]王丽霞,李双东.相依利率下离散时间再保险模型的破产问题[J].应用概率统计,2014,30(3):279-288.

[11]D LAMBERTON, B LAPEYRE. Introduction to stochastic calculus applied to finance[M]. London: Chapman & Hall,1996.endprint