越南二次革新即将到来?

□ 文/本刊记者 黎敏

越南二次革新即将到来?

□ 文/本刊记者 黎敏

说到越南的革新开放,很多人会想到中国的改革开放。改革开放给中国带来了翻天覆地的变化,革新开放也照亮了越南的发展之路。从曾经世界上最贫穷的国家,到经济总量排名世界第50的中等收入国家;从封闭落后的国度到外商投资的热土,革新开放30年,越南发展的成就有目共睹。

中国古语有云“三十而立”,意指三十岁左右应有所成就,对于“三十而立”的越南革新开放而言,也正好借此节点,总结过去规划未来。而着眼当下,内需疲软、走出金融危机、调整经济结构依旧是越南发展必须直面的问题,重任在肩,越南的革新开放又将何去何从?

越南的经济结构变得更加合理。

2015年,越南出口额达1600亿美元左右,是1995年的30倍;累计吸收外资项目1.9万个,合同总额约2600亿美元。

黎明前的曙光

时间回到30年前,1986年的越南正酝酿着一次关键性的变革。当时的越南因为长期内外困局,国内经济可谓是满目疮痍,通货膨胀率高达774.7%,人民生活可想而知,这个统一了10年的国家亟待一缕黎明前的曙光照亮前路。

也就是在中国实施改革开放后的8年,越南提出了“革新开放”的主张,翻开了发展的崭新一页。在这一年,越南通过了《2000年前越南经济稳定和发展战略》。这份文件不仅明确提出要在各领域建立商品经济体制,还要在坚持社会主义方向前提下推进革新开放。当时越南提出的目标是,到2000年时越南人均国民生产总值翻一番。转眼三十年,这一目标如今早已实现。

根据越南《经济时报》回顾越南革新开放30年成果的报道来看:革新开放至今,越南经济规模是30年前的7000倍;在1991~1995年期间,越南GDP平均增速一度达到8.2%;人均收入更是达到2200美元以上,较革新之初翻了近6倍。

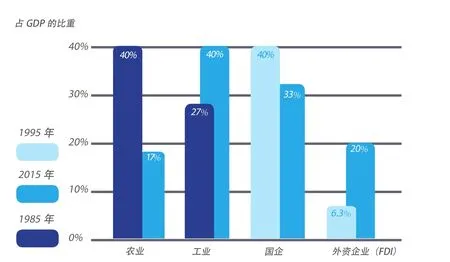

而经济结构也变得更为合理:截止2015年,越南农业占GDP的比重已从1985年的40%降至17%,工业则从27%提高至40%左右;国企对GDP贡献从1995年的40%降至33%,外资企业(FDI)对GDP贡献则由6.3%提高至20%。一降一升间,反映的正是越南经济结构调整的平衡之道。此外,越南的大米、咖啡、胡椒和水产品出口量已跑在了世界的前列。

在政治革新稳步推进之下,开放的春风迎面吹来,越南不仅向世界敞开了合作的大门,也积极融入了世界经济的怀抱。2015年,越南出口额达1600亿美元左右,是1995年的30倍;累计吸收外资项目1.9万个,合同总额约2600亿美元。与此同时,东盟共同体、跨太平洋伙伴关系等多个协定的签订,与中国、东盟国家等传统伙伴的贸易额持续攀升,给越南经济极大的信心,经济增长在2015年创下了近5年来的最高水平。一个个耀眼的数字亦成为了越南革新开放30载最直观的成绩单。

从“特困户”到“新宠儿”

在革新开放之初,越南是人均收入只有100美元的“特困户”,国内经济基础十分薄弱,如何燃起这经济发展的第一星火苗,越南决定通过引进外资向外“借个火”。而最首要的任务,就是要制定一部务实的新外国投资法。

1988年越南新的《外国投资法》应运而生,当年4月,越南就批准了第一个外商投资项目。翻开这部新的《外国投资法》可以看到越南引进外资的诚意:

允许外国企业投资兴办企业,甚至是独资企业;对合资企业征收15~25%的法人所得税,从计算利润开始,两年内免征,其后的两年减半征收;进口原材料和生产设备原则上不征税。一条条法规,意味着越南用法律形式向世界宣布:在越南投资已几乎没有领域限制(具体仍需要审核)、没有投资比例的限制、也没有投资伙伴的限制。

因此,在这之后,外资进入越南的速度明显加快。根据外部环境的变化,越南国会又在1992年和1996年对《外国投资法》进行了两次大的修订,包括在越南政府指定的重要领域逐步增大越南合资方的投资比例;以及将外资企业的经营年限延长至50~70年等内容。法律的日益完善,不仅增添了外商投资的信心,也让世界看到了越南开放的决心,使越南逐渐成为了外商投资的“新宠儿”。

瑞士《新苏黎世报》网站2016年2月24日报道称:眼下越南已经在东南亚国家中引发轰动;越南虽没有印尼的消费潜力,也没有马来西亚的现代化基础设施,但是它现在却显示出改革的意愿,并对外国投资者开放。报道认为,如今要找消除贫困、劳动力可靠或者是地理多样的典范的话,人们会望向越南,因为眼下越南即将出现一波国有企业私有化的浪潮,外国资金和技术将令它们现代化。而且近1亿消费者的市场也十分诱人。

那么对于越南而言,外资到底有多重要呢?来看一组数字:截止2015年,外资企业对越南GDP贡献率达20%,占社会总投资的20%,占越南工业总产值的50%,出口占2/3,为200多万人提供就业。不过,这个相对依赖外资的东盟国家也曾经在亚洲金融危机中饱尝寒意,因此逐步从金融危机中复苏的越南,虽然依旧把引进外资作为开放的重头戏,但也学会了“不把鸡蛋放在一个篮子里”,其未来的革新开放之路或许将越走越宽敞。

酝酿中的二次革新?

在当前的国际经济形势下,各国经济的发展似乎都难以独善其身。越南计划投资部部长裴光荣认为,全球经济衰退对越南影响非常明显,现有的内在结构已经不符合新形势下的发展需要了。通过经济体制改革,打造新的增长动力迫在眉睫。

越南计划投资部副部长阮志勇此前称,越南GDP的增长速度的不稳定,从短期看,是受内需疲软及经济危机的影响;从长期来看,是因为国内经济发展不平衡,依靠投资和劳动密集型的增长模式效率低下;正处于转型期的国内企业还缺乏稳固基础,出口贸易仍依赖于外资企业等原因。那么针对这些问题,越南的革新开放之路又将何去何从呢?

2016年1月,决定越南未来五年发展方向的越南共产党第十二次全国代表大会上,越共中央总书记阮富仲表示,未来5年,越南社会经济的重点任务是集中力量提升经济的增长质量、劳动生产率和竞争力;继续有效开展3项战略性突破;经济结构重组与经济增长革新相结合;加强国家工业化、现代化,注重新农村建设。

此外,会议文件中还首次出现了“私营经济是越南经济发展的重要动力之一”的表述,加之近些年来开始加大对国有企业股份制改革的举措,表明越南已越发重视私营经济在国家经济成分中的重要地位。但是,越南坚持社会主义定向市场经济的总原则不会改变,国有经济依然是经济结构的中流砥柱。

有学者表示,重视发展私营经济是为越南现有经济结构创造更加多元的经济增长动力,促使国有经济在经济结构中更有效率,使得越南可以逐渐适应和加快步伐融入世界经济。

随着越南经济从“量”的积累迈向“质”的提升,外商投资者或许更应该考虑像瑞士《新苏黎世报》网站报道的那样,将目光投向越南国有企业现代化的浪潮中。

“越南革新开放30年来取得了巨大成就,但如今依然面临着经济落后的危机”。正如阮富仲所说,如何破解现有难题,使国家进一步沿着社会主义定向市场经济的原则发展,也许经济上的二次革新十分必要。

联系编辑:

313464302@qq.com

The Textile Industry: Are There Opportunities This Year?

By Araminta Setyawati

T he economic slowdown in 2015 in Indonesia is still having a painful impact on several industries.One of these is the textile and textile products sector (TPT).The performance of this industry is expected to remain sluggish throughout 2016 due to a lack of positive sentiment that might lift it out of its mire.

A global recovery is still elusive along with a domestic economy that has yet to any show sign of improvement.The chairman of the Indonesian Textile Association (API), Ade Sudrajat, is pessimistic about the TPT sector seeing any increased growth in the next year.

The performance of the TPT sector as of October 2015 was far from satisfactory.The Gross Domestic Product(GDP) of the sector has suffered a contraction, or negative growth of 6.1 percent compared to the same period the previous year.This fi gure represents a worse GDP growth rate than that of manufacturing industry as a whole, which stood at 4.3 percent, or the growth of Indonesia’s total GDP of 4.7 percent.

As to the global economic situation, the International Monetary Fund (IMF) has cut its forecast for world economic growth to 3.4 percent from 3.6 percent in 2016.Likewise with the US, economic growth of only 2.6 percent is expected.This affects the Indonesian TPT sector because Indonesian TPT exports are strongly influenced by global economic conditions, particularly those in the US and Europe which represent the sector’s largest markets.

The share of Indonesian TPT exports to the US and Europe generally stand at 31 percent and 16 percent, respectively.This is far greater than exports to ASEAN and Japan, for example.In 2015, the value of TPT exports was estimated to reach US$12 billion, down from the previous year’s fi gure of $12.68 billion, a contraction of about 5.3 percent year-on-year (yoy).

However, as of October last year, Indonesian TPT exports only amounted to $10.2 billion, about 77 percent of the target.Part of the reason for this is that Indonesian export products have to compete with their competitors’ products, especially garments from Vietnam, in the US and European markets.

In Vietnam, production costs are relatively low as they are not unduly burdened by labor costs, which remain fairly cheap.This contrasts somewhat with Indonesia at this time.In addition to the increased cost of raw materials in Southeast Asia’s largest economy, production costs are also burdened by the ever more expensive cost of labor.Add to this the weakening of the rupiah, and it is understandable that many companies --unable to withstand the pressure--have gone out of business.Increasingly high production costs have led to industries, in particular the textile industry, being forced to lay off their employees.

For example, based on the observations of the API, the textile industry centered on four districts in the regency of Bandung retrenched by 6,000 workers during the period from January to May 2015.Imagine how many tens of thousands or even hundreds of thousands of workers would lose their jobs if such layoffs were to take place across the island of Java.According to the API, those industries that generally resort to provisional layoffs are downstream by nature.

In addition, the level of competitiveness of Indonesian TPT products continues to decline.According to the central statistics agency (BPS) data, in 2014 alone there was a drop in the level of competitiveness of Indonesian TPT products in the world market of 1.3 percent.Vietnam, by contrast, saw its level of competitiveness increase by 1.8 percent yoy.Indonesia’s competitiveness decline occurred not only in the world market, but also in the US and European markets, which saw falls of 25 percent and 3 percent, respectively.

Trade Minister Thomas T.Lembong sees Vietnam as a threat in terms of it being Indonesia’s largest competitor in the textile and footwear sector.This is especially true since Vietnam has joined the Trans-Pacific Partnership (TPP).Competition with Vietnam, in the minister’s view, is becoming increasingly keen as the Vietnamese have also now completed negotiations for a free trade agreement (FTA) with the EU.This means that Vietnam will have access to the European market, which is larger even than that of the US, consisting as it does of more than 20 countries.Minister Lembong explained that through the TPP, its 12 member states, led by the US, could soon control 40 percent of the world market.Thus, it is no wonder that Indonesia is eager to join the TPP, which it is expected to do within the next two years.

For an alternative perspective, it is instructive to look to the Investment Coordinating Board (BKPM), which records investment plans, both foreign and domestic, in the textile sector.According to the BKPM, there was a significant increase in investment plans throughout 2015, leading to a positive assessment as to how this might encourage laborintensive investment in 2016.As to the realization of investments across all textile sub-sectors during the first semester of 2015, positive growth was very much in evidence.For example, the textile fiber processing industry posted growth of 213 percent by as much as Rp 2.4 trillion (US$ 176 million) from 82 projects, the textile weaving industry posted growth of 613 percent amounting to Rp 163 billion from 25 projects, the garment industry recorded growth of 16 percent, by as much as Rp 941 billion and the clothing accessories industry recorded growth of 563 percent amounting to Rp 216 billion from 15 projects.

Investment plans, as recorded in the number of principle licenses obtained from the textile sector during 2015, were valued at Rp 13.1 trillion, up 68 percent over the previous year.According to the head of the BKPM, Franky Sibarani, this investment figure in the textile sector included plans for the employment of 101,000 workers.The realization of these investment plans is expected to contribute positively toward the creation of the 2 million jobs targeted by the government in 2016.

Investment data that has been presented by the BKPM indicate that there is still hope for a recovery in the textile industry.However, the industry will recover only if accompanied by effort and support from the government such as national brand development and a logistics base for cotton, which is currently being developed to ensure the availability of the necessary raw materials, continued investment and industrial development will take place as further economic policy packages are rolled out.Moreover, industrial competitiveness as a whole is likely to strengthen, backed by declining gas, electricity and diesel prices.The government is also encouraging the improved performance of this industry, including by stepping up efforts to control imports and securing the domestic market through non-tariff policies.These policies include the compulsory application of Indonesian National Standards (SNI), the use of domestic products in the procurement of goods and services (P3DN), as well as the restructuring of machinery in the textile and footwear industry.

Resource: www.thejakartapost.com

(The writer is an industry analyst at Bank Mandiri.)